Attached files

| file | filename |

|---|---|

| 8-K - UIL HOLDINGS CORPORATION 8-K 5-3-2012 - UIL HOLDINGS CORP | form8k.htm |

| EX-99.1 - EXHIBIT 99.1 - UIL HOLDINGS CORP | ex99_1.htm |

1Q 2012 Earnings Presentation

May 4, 2012

Exhibit 99.2

2

Note to Investors

Certain statements contained herein, regarding matters that are not historical facts, are forward-looking statements (as defined in the

Private Securities Litigation Reform Act of 1995). These include statements regarding management’s intentions, plans, beliefs,

expectations or forecasts for the future. Such forward-looking statements are based on UIL Holdings’ expectations and involve risks

and uncertainties; consequently, actual results may differ materially from those expressed or implied in the statements. Such risks and

uncertainties include, but are not limited to, general economic conditions, legislative and regulatory changes, changes in demand for

electricity, gas and other products and services, unanticipated weather conditions, changes in accounting principles, policies or

guidelines, and other economic, competitive, governmental, and technological factors affecting the operations, markets, products and

services of UIL Holdings’ subsidiaries, The United Illuminating Company, The Southern Connecticut Gas Company, Connecticut

Natural Gas Corporation and The Berkshire Gas Company. The foregoing and other factors are discussed and should be reviewed in

UIL Holdings’ most recent Annual Report on Form 10-K and other subsequent periodic filings with the Securities and Exchange

Commission. Forward-looking statements included herein speak only as of the date hereof and UIL Holdings undertakes no obligation

to revise or update such statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated

events or circumstances.

James Torgerson

President and Chief Executive Officer

Richard Nicholas

Executive Vice President and Chief Financial Officer

1Q 2012 Earnings Highlights

q Consolidated net income in 1Q ‘12 of $47.1M or $0.92 per diluted earnings per share -

a decrease of $4.9M or $0.10 per diluted share for the same time period in 2011 due to

lower net income at the gas companies

a decrease of $4.9M or $0.10 per diluted share for the same time period in 2011 due to

lower net income at the gas companies

§ Net income from the gas companies declined $8.9M or $0.18 per diluted share in 2012 compared to

2011 primarily due to weather

2011 primarily due to weather

q Decreased margin partially offset by weather insurance

§ 1Q ‘12 heating degree days were 20% below normal, 23% below the heating degree days in 1Q ‘11

§ Full revenue decoupling mechanism is in place for electric distribution - no weather impact

q GenConn earnings increased $2.4M in 1Q ‘12 compared to 1Q ’11

§ Middletown plant became fully operational in June ’11

q Continue to invest in the Connecticut portion of the New England East West Solution

projects

projects

§ Invested $13M through April 30, 2012

q Continued progress on gas conversion growth initiative

§ Converted 28% more customers in the 1Q ‘12 compared to the 1Q ‘11

3

Gas Conversions

q Converted 2,797 customers as of mid-April ’12 - 29% increase over the same period in ‘11

q 2012 goal is to convert approximately 10,200 customers to natural gas heat, a 50% increase

over 2010 levels of 6,800 additions

over 2010 levels of 6,800 additions

§ Converted approximately 8,300 customers in 2011 - 22% above the 2010 level

§ Target is to convert 30,000-35,000 gas heating customers for the period 2011-2013

4

As of April 2012 -

30% ahead of 2011

customer conversions

pace

30% ahead of 2011

customer conversions

pace

Gas Conversions - cont.

q Consumer interest in converting remains strong

§ Financing options have been expanded to assist customers with up-front conversion

costs

costs

§ Natural gas supply prices are low and projected to remain low for the foreseeable

future

future

§ Delivered natural gas price for heating customers is approximately half the cost of

heating oil on an equivalent basis

heating oil on an equivalent basis

q Each new residential customer is anticipated to generate approximately $280-

$315 of distribution net operating income annually

$315 of distribution net operating income annually

5

State Regulatory Update

6

Utility Company Storm Response

q Investigation of Public Service Companies’

response to 2011 Storms (DN 11-09-09)

response to 2011 Storms (DN 11-09-09)

q Hearings for Electric - 4/23/12 - 5/4/12

q Draft decision expected 6/12/12, final decision

expected 6/27/12

expected 6/27/12

Renewable Energy

q On 1/18/12, UI filed proposal with PURA

outlining framework for approval of UI’s

renewable connections program under which UI

would develop up to 10MW of renewable

generation for recovery on a cost of service basis

outlining framework for approval of UI’s

renewable connections program under which UI

would develop up to 10MW of renewable

generation for recovery on a cost of service basis

q UI expects PURA to issue a final decision in the

third quarter of 2012

third quarter of 2012

UI Electric Distribution Rate Case

q Evaluating timing of distribution rate case to

reflect significant investments in distribution

infrastructure

reflect significant investments in distribution

infrastructure

Berkshire Gas Rate Plan

q 10-yr rate plan expired on 1/31/12

q Current rates remain in effect

UI Electric Decoupling

q On 4/2/12, UI filed the results of the decoupling

rider for the 2011-2012 rate year

rider for the 2011-2012 rate year

q Approximately $5.1M owed by customers

q UI’s decoupling mechanism is allowed to

operate under its current structure until a PURA

decision in UI’s next rate case proceeding

operate under its current structure until a PURA

decision in UI’s next rate case proceeding

q On 4/24/12, Governor Malloy nominated Arthur

House(D) as a director of PURA

House(D) as a director of PURA

§ House recently served as Chief of the Communications

Group for National Geospatial-Intelligence Agency

Group for National Geospatial-Intelligence Agency

§ Replaces position held by Anna Ficeto(D), who was

recently sworn in as a Superior Court judge

recently sworn in as a Superior Court judge

q On 4/25/12, Governor Malloy re-nominated Jack

Betkoski(D) as a director of PURA

Betkoski(D) as a director of PURA

q Kevin DelGobbo(R) declined the Governor’s offer

for re-nomination as a PURA director and will

leave on 5/11/12

for re-nomination as a PURA director and will

leave on 5/11/12

Pubic Utilities Regulatory Authority

State Legislative Update

as of May 1, 2012

as of May 1, 2012

q CT legislative session ends May 9th

§ Various bills have moved through Energy & Technology Committee dealing with utility storm

performance, system reliability and resiliency, renewable energy and expansion of gas

infrastructure

performance, system reliability and resiliency, renewable energy and expansion of gas

infrastructure

q Senate Bill (SB) 23 - An Act Enhancing Emergency Preparedness and Response

§ Governor Malloy’s bill in response to 2011 weather events

§ Requires PURA to establish minimum standards of performance for utilities in storm emergency

preparation & response

preparation & response

§ Requires a request for proposal for micro-grid pilots, including electric distribution company

participation

participation

q Bills dealing primarily with gas expansion opportunities

§ SB 450 - An Act Concerning Energy Conservation and Renewable Energy

q Requires Department of Energy and Environmental Protection to study opportunities for natural gas line

extensions

§ SB 451 - An Act Concerning the Establishment of a Heating Furnace and Boiler Replacement Program

q This bill requires each electric distribution company to establish and administer a loan program to help

consumers finance higher efficiency furnace or boiler replacements. The costs of the loans would be

recovered on the customer's electric bill. The electric distribution company’s cost for administering

the program is recovered through the Systems Benefits Charge.

7

Economic Update

8

q State’s unemployment rate decreased for the eighth consecutive month - the

lowest rate in three years (1)

lowest rate in three years (1)

q Seasonally adjusted unemployment rates as of March 2012(2)

§ CT - 7.7%

§ MA - 6.5%

§ National - 8.2%

q Unemployment rates in the largest service areas and cities as of March 2012(3)

§ Bridgeport labor market areas (LMAs) 7.6%, (City of Bridgeport 12.4%)

§ New Haven LMAs 8.5%, (City of New Haven 11.9%)

§ Hartford LMAs 8.1%, (City of Hartford 14.7%)

(1) State of Connecticut website

(2) U.S. Bureau of Labor Statistics

(3) CT Department of Labor

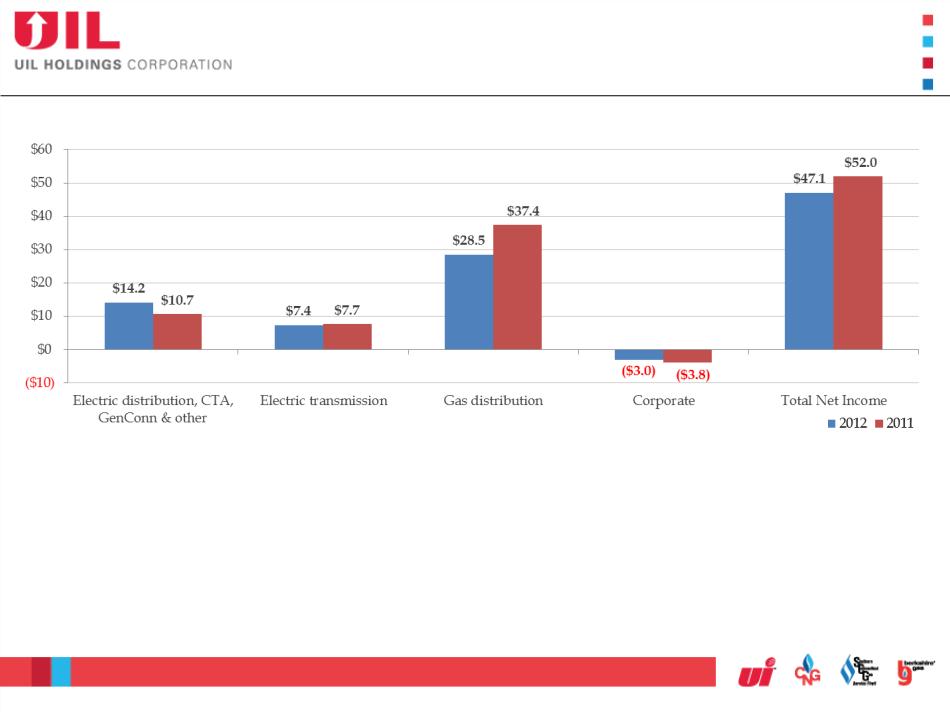

1Q 2012 Financial Results by Business

Net Income ($M)

Net Income ($M)

9

1Q ‘12 vs. 1Q ‘11

1Q 2012 Financial Results - Details

10

Electric distribution, CTA, GenConn & Other

q 32% increase in 1Q ‘12 net income over the same period in 2011

§ GenConn contributed pre-tax earnings of $4.5M to UIL for the 1Q ‘12 compared to $2.1M for the same

period in 2011 - Middletown plant became fully operational in June 2011

period in 2011 - Middletown plant became fully operational in June 2011

q Average D & CTA ROE as of 3/31/12: 8.88%

Electric transmission

q Net income of $7.4M in 1Q ‘12, compared to $7.7M in 1Q ‘11

Gas distribution

q 23% decrease in 1Q ‘12 net income over the same period in 2011

§ Decline primarily due to warmer than normal weather, which was only partially offset by weather

insurance

insurance

§ $14.6M decrease in margin, offset by $3.5M of weather insurance - resulting in pre-tax weather impact

of $11.1M in the 1Q ‘12

of $11.1M in the 1Q ‘12

§ 1Q ‘12 impact due to warmer weather - ($0.13) per diluted share compared to 1Q ‘11, ($0.10) per

diluted share compared to normal weather, both partially offset by weather insurance

diluted share compared to normal weather, both partially offset by weather insurance

q Preliminary average ROEs as of 3/31/12: SCG 4.80%-5.00%, CNG 6.85%-7.05%

q Preliminary average weather normalized ROEs as of 3/31/12: SCG 6.75%-6.95%, CNG 9.65%-

9.85%

9.85%

Corporate

q 1Q ‘12 after-tax costs of $3M compared to $3.8M in 1Q ‘11

§ The reduction of costs were due to a decrease in interest expense resulting from lower short-term

borrowings

borrowings

CapEX

q 2012 CapEx projections reduced by $25M, mainly in electric distribution

Debt Maturities, Liquidity & Credit Ratings

11

|

Issuer

|

S&P

|

Moody’s

|

|

UIL

Holdings |

BBB

(Stable) |

Baa3

(Stable) |

|

United

Illuminating |

BBB

(Stable) |

Baa2

(Stable) |

|

SCG

|

BBB

(Stable) |

Baa2

(Stable) |

|

CNG

|

BBB

(Stable) |

Baa1

(Stable) |

|

Berkshire

|

BBB

(Stable) |

Baa2

(Stable) |

Based on current plans - expect no need for

external equity at least through 2013

external equity at least through 2013

*

Available Liquidity

* Completed 2/1/12

Debt Maturities ($M)

Credit Ratings

Amounts may not add due to rounding.

Does not include $100M long-term debt priced in January 2012, which closed in

early April

early April

12

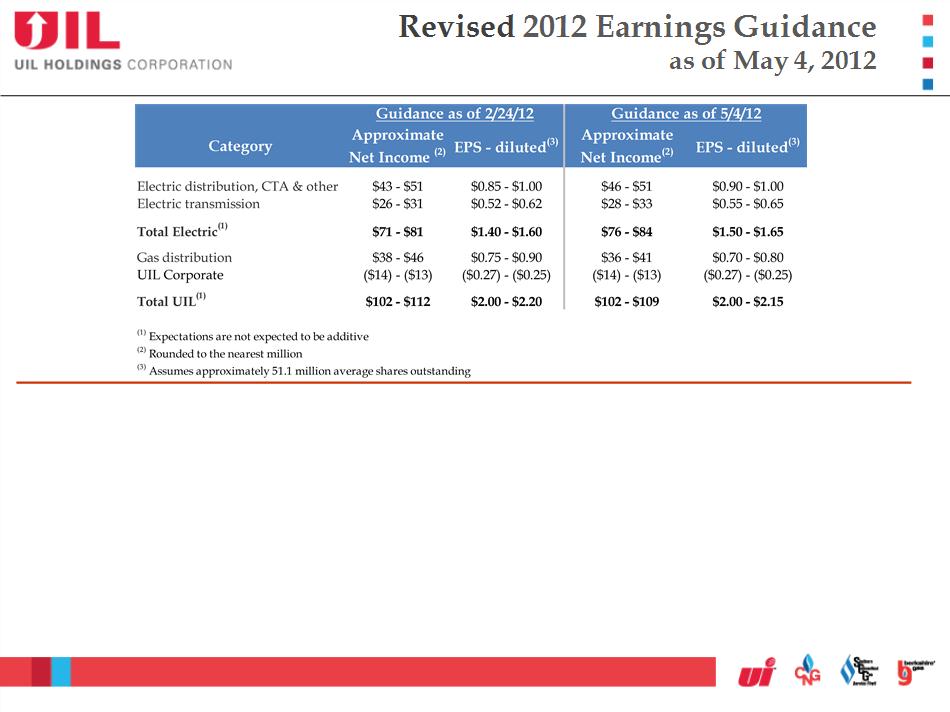

q Consolidated earnings guidance of $2.00-$2.15 per diluted share

§ Primarily due to warmer than normal weather during the winter heating season, which significantly

impacted gas distribution earnings

impacted gas distribution earnings

q Electric company earnings guidance of $1.50-$1.65 per diluted share

§ Increased the low end of the range for electric distribution, CTA & other to $0.90-$1.00 per diluted share

§ Increased transmission guidance to $0.55-$0.65 per diluted share

q Revised gas distribution range to $0.70-$0.80 per diluted share

q Earnings guidance for UIL Corporate remains unchanged

Q&A

Appendix

Segmented 1Q ‘12 Earnings

Information

Information

15

2011-2016 Average Rate Base

GenConn Equity Investments:

Rate Base $M (Excluding GenConn Equity Investments):

$2,062

$2,235

$2,388

$2,535

$2,731

1%

41%

22%

36%

40%

22%

38%

40%

22%

38%

38%

24%

38%

Amounts may not add due to rounding.

16

2011-2016

CAGR 6.9%

Gas

Distribution:

3.6%

Electric

Transmission:

10.2%

Electric

Distribution:

11.1%

2%

43%

22%

33%

4%

42%

21%

33%

$1,956