Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BlueLinx Holdings Inc. | d345733d8k.htm |

| EX-99.1 - EX-99.1 - BlueLinx Holdings Inc. | d345733dex991.htm |

Exhibit 99.2

| BlueLinx Quarterly Review 1st Quarter 2012 |

| BlueLinx Holdings Inc. Forward-Looking Statement Safe Harbor - This presentation includes "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. All of these forward-looking statements are based on estimates and assumptions made by our management that, although believed by us to be reasonable, are inherently uncertain. Forward-looking statements involve risks and uncertainties, including, but not limited to, economic, competitive, governmental and technological factors outside of our control, that may cause our business, strategy or actual results to differ materially from the forward-looking statements. These risks and uncertainties may include, among other things: changes in the supply and/or demand for products which we distribute, especially as a result of conditions in the residential housing market; general economic and business conditions in the United States; the activities of competitors; changes in significant operating expenses; changes in the availability of capital; the ability to identify acquisition opportunities and effectively and cost-efficiently integrate acquisitions; adverse weather patterns or conditions; acts of war or terrorist activities; variations in the performance of the financial markets; and other factors described in the "Risk Factors" section in our Annual Report on Form 10-K for the fiscal year ended December 31, 2011, and in our other periodic reports filed with the SEC. In addition, the statements in this presentation are made as of May 3, 2012. We undertake no obligation to update any of the forward-looking statements made herein, whether as a result of new information, future events, changes in expectation or otherwise. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to May 3, 2012. Use of Non-GAAP and Adjusted Financial Information - To supplement GAAP financial information, we use adjusted measures of operating results which are non-GAAP measures. This non-GAAP adjusted financial information is provided as additional information for investors. These adjusted results exclude certain costs, expenses, gains and losses, and we believe their exclusion can enhance an overall understanding of our past financial performance and also our prospects for the future. These adjustments to our GAAP results are made with the intent of providing both management and investors a more complete understanding of our operating performance by excluding non-recurring, infrequent or other non-cash charges that are not believed to be material to the ongoing performance of our business. The presentation of this additional information is not meant to be considered in isolation or as a substitute for GAAP measures of net earnings, diluted earnings per share or net cash provided by (used in) operating activities prepared in accordance with generally accepted accounting principles in the United States. |

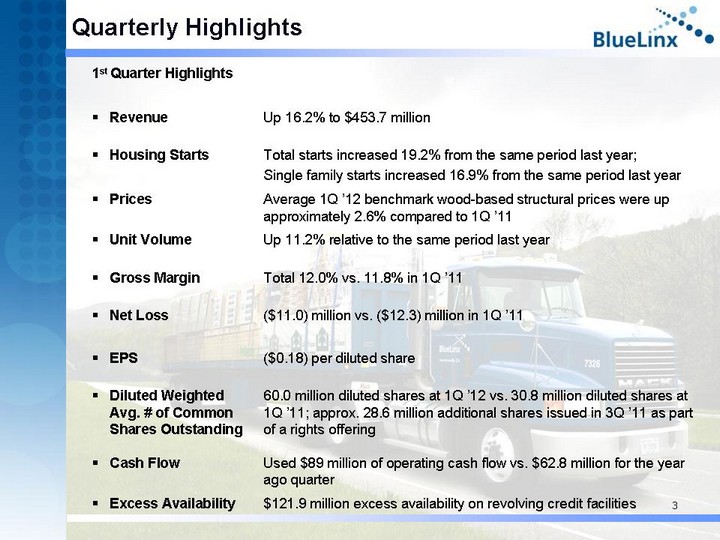

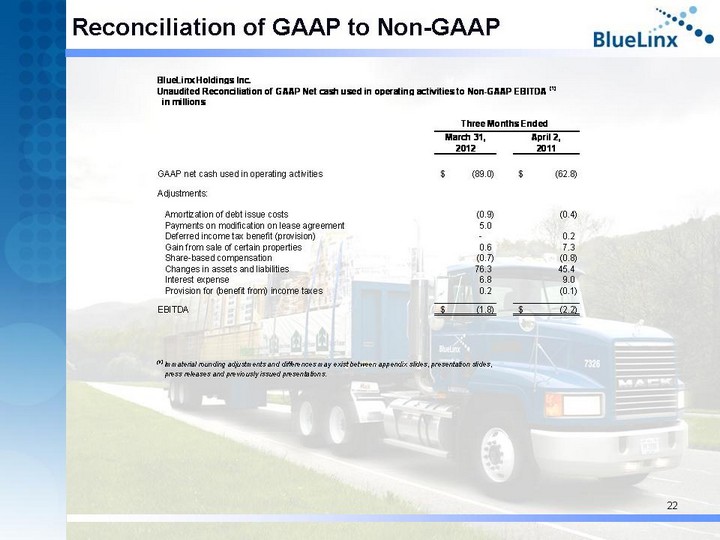

| 1st Quarter Highlights 1st Quarter Highlights Revenue Up 16.2% to $453.7 million Up 16.2% to $453.7 million Housing Starts Total starts increased 19.2% from the same period last year; Single family starts increased 16.9% from the same period last year Total starts increased 19.2% from the same period last year; Single family starts increased 16.9% from the same period last year Prices Average 1Q '12 benchmark wood-based structural prices were up approximately 2.6% compared to 1Q '11 Average 1Q '12 benchmark wood-based structural prices were up approximately 2.6% compared to 1Q '11 Unit Volume Up 11.2% relative to the same period last year Up 11.2% relative to the same period last year Gross Margin Total 12.0% vs. 11.8% in 1Q '11 Total 12.0% vs. 11.8% in 1Q '11 Net Loss ($11.0) million vs. ($12.3) million in 1Q '11 ($11.0) million vs. ($12.3) million in 1Q '11 EPS ($0.18) per diluted share ($0.18) per diluted share Diluted Weighted Avg. # of Common Shares Outstanding 60.0 million diluted shares at 1Q '12 vs. 30.8 million diluted shares at 1Q '11; approx. 28.6 million additional shares issued in 3Q '11 as part of a rights offering 60.0 million diluted shares at 1Q '12 vs. 30.8 million diluted shares at 1Q '11; approx. 28.6 million additional shares issued in 3Q '11 as part of a rights offering Cash Flow Used $89 million of operating cash flow vs. $62.8 million for the year ago quarter Used $89 million of operating cash flow vs. $62.8 million for the year ago quarter Excess Availability $121.9 million excess availability on revolving credit facilities $121.9 million excess availability on revolving credit facilities Quarterly Highlights |

| Doug Goforth Chief Financial Officer and Treasurer Quarterly Review |

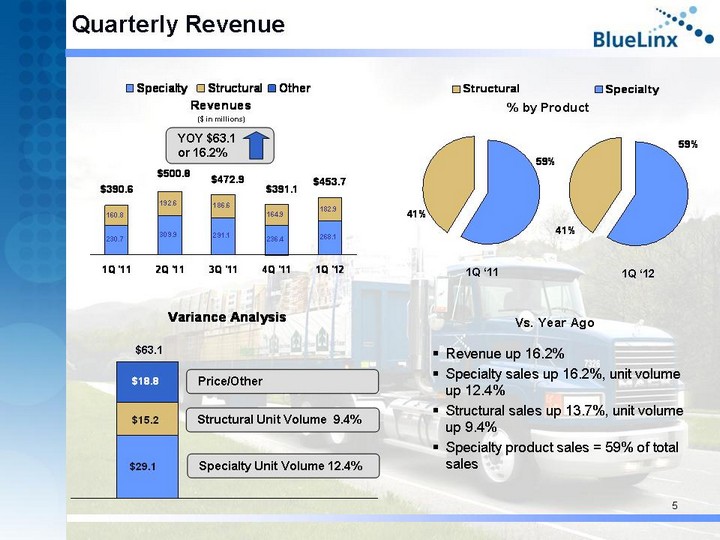

| Quarterly Revenue 1Q '11 2Q '11 3Q '11 4Q '11 1Q '12 Specialty 230.7 309.9 291.1 236.4 268.1 Structural 160.8 192.6 186.6 164.9 182.9 Other -0.9 -1.7 -4.8 -10.2 2.7 Specialty Unit Volume 12.4% YOY $63.1 or 16.2% Structural Unit Volume 9.4% Price/Other $63.1 4Q '11 Specialty 240.7 Structural 165.7 1Q '11 1Q '12 4Q '10 Specialty 221.4 Structural 154.779 Vs. Year Ago Revenue up 16.2% Specialty sales up 16.2%, unit volume up 12.4% Structural sales up 13.7%, unit volume up 9.4% Specialty product sales = 59% of total sales % by Product 4Q '05 1Q '06 2Q '06 3Q '06 4Q '06 1Q '07 2Q '07 3Q '07 4Q '07 1Q '08 2Q '08 3Q '08 4Q '08 1Q '09 2Q '09 3Q '09 4Q '09 1Q '10 2Q '10 3Q '10 4Q '10 Specialty 539.5 580 603.3 553.5 460 456.5 500.8 462.9 381.5 354 402.8 375.9 278.7 233.9 250 257.9 206.2 233.1 286 264.3 221.4 Structural 815.2 813.4 798.7 666.6 509.2 518.9 598.1 571.4 409.6 373 442.4 365.8 240.9 182.5 183 202.1 171 203.7 265.4 213.9 154.8 Other -25.4 -16.8 -23 -16.6 -28.9 -18.3 -16.9 -18.4 -12.2 -10.2 -10.5 -14.9 -18.1 -9.3 -9.5 -10.6 -11.1 -5.7 -10.62 -13.5 -8.3 |

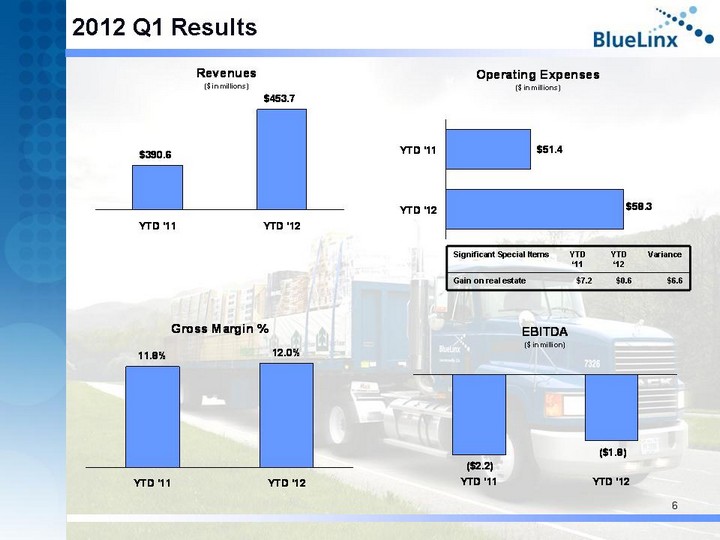

| 2012 Q1 Results revenue YTD '11 390.604 YTD '12 453.708 YTD '11 YTD '12 GM % 0.118 0.12 Operating Expense YTD '11 51.4 YTD '12 58.3 YTD '11 YTD '12 EBITDA -2.2 -1.8 Significant Special Items YTD '11 YTD '12 Variance Gain on real estate $7.2 $0.6 $6.6 |

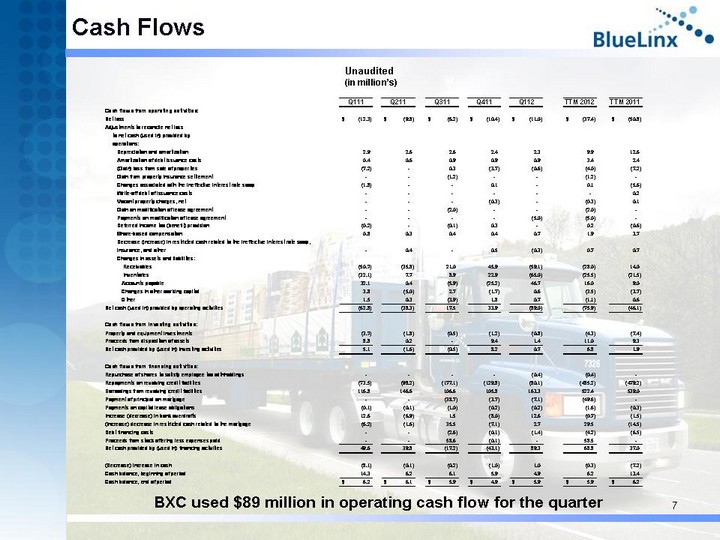

| Cash Flows BXC used $89 million in operating cash flow for the quarter Unaudited (in million's) (in million's) (in million's) |

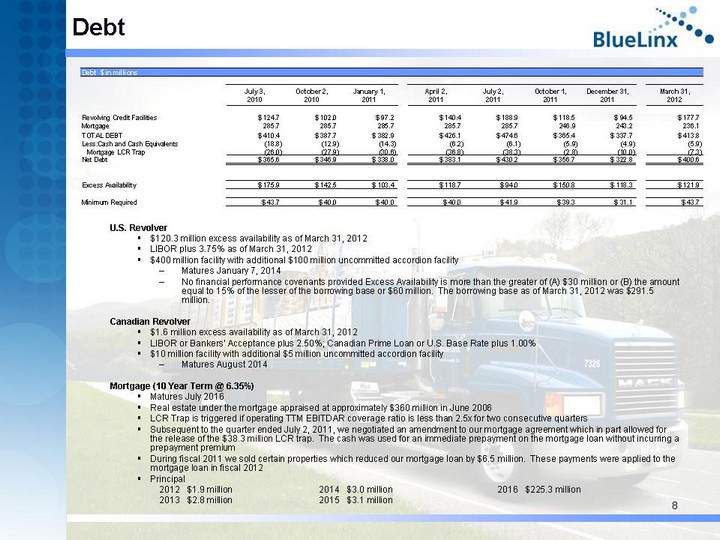

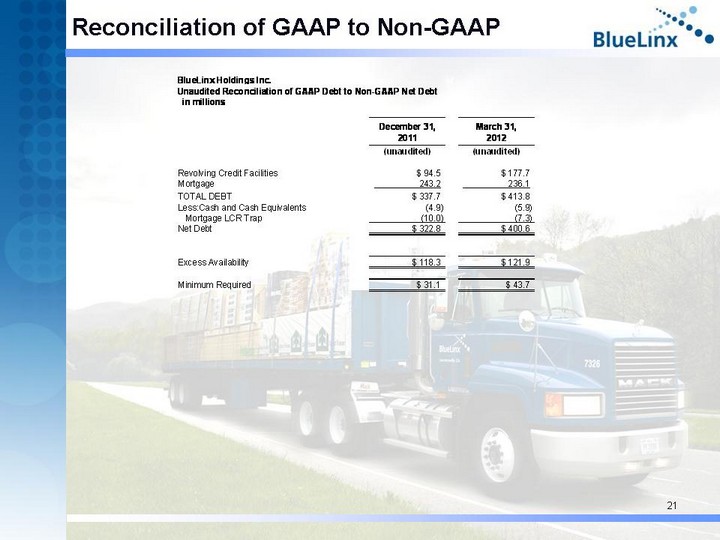

| Debt U.S. Revolver $120.3 million excess availability as of March 31, 2012 LIBOR plus 3.75% as of March 31, 2012 $400 million facility with additional $100 million uncommitted accordion facility Matures January 7, 2014 No financial performance covenants provided Excess Availability is more than the greater of (A) $30 million or (B) the amount equal to 15% of the lesser of the borrowing base or $60 million. The borrowing base as of March 31, 2012 was $291.5 million. Canadian Revolver $1.6 million excess availability as of March 31, 2012 LIBOR or Bankers' Acceptance plus 2.50%; Canadian Prime Loan or U.S. Base Rate plus 1.00% $10 million facility with additional $5 million uncommitted accordion facility Matures August 2014 Mortgage (10 Year Term @ 6.35%) Matures July 2016 Real estate under the mortgage appraised at approximately $360 million in June 2006 LCR Trap is triggered if operating TTM EBITDAR coverage ratio is less than 2.5x for two consecutive quarters Subsequent to the quarter ended July 2, 2011, we negotiated an amendment to our mortgage agreement which in part allowed for the release of the $38.3 million LCR trap. The cash was used for an immediate prepayment on the mortgage loan without incurring a prepayment premium During fiscal 2011 we sold certain properties which reduced our mortgage loan by $6.5 million. These payments were applied to the mortgage loan in fiscal 2012 Principal 2012 $1.9 million 2014 $3.0 million 2016 $225.3 million 2013 $2.8 million 2015 $3.1 million 2013 $2.8 million 2015 $3.1 million 2013 $2.8 million 2015 $3.1 million 2013 $2.8 million 2015 $3.1 million 2013 $2.8 million 2015 $3.1 million 2013 $2.8 million 2015 $3.1 million 2013 $2.8 million 2015 $3.1 million 2013 $2.8 million 2015 $3.1 million 2013 $2.8 million 2015 $3.1 million 2013 $2.8 million 2015 $3.1 million 2013 $2.8 million 2015 $3.1 million 2013 $2.8 million 2015 $3.1 million 2013 $2.8 million 2015 $3.1 million 2013 $2.8 million 2015 $3.1 million 2013 $2.8 million 2015 $3.1 million 2013 $2.8 million 2015 $3.1 million 2013 $2.8 million 2015 $3.1 million 2013 $2.8 million 2015 $3.1 million 2013 $2.8 million 2015 $3.1 million 2013 $2.8 million 2015 $3.1 million 2013 $2.8 million 2015 $3.1 million 2013 $2.8 million 2015 $3.1 million 2013 $2.8 million 2015 $3.1 million 2013 $2.8 million 2015 $3.1 million 2013 $2.8 million 2015 $3.1 million 2013 $2.8 million 2015 $3.1 million 2013 $2.8 million 2015 $3.1 million 2013 $2.8 million 2015 $3.1 million |

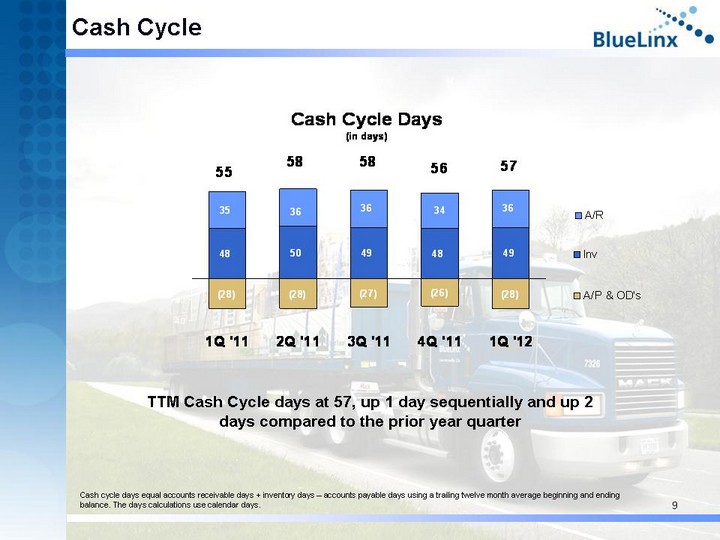

| Cash Cycle TTM Cash Cycle days at 57, up 1 day sequentially and up 2 days compared to the prior year quarter 3Q '07 4Q '07 1Q '08 2Q '08 3Q '08 4Q '08 1Q '09 2Q '09 3Q '09 4Q '09 1Q '10 2Q '10 3Q '10 4Q '10 1Q '11 2Q '11 3Q '11 4Q '11 1Q '12 Inv 45.8 44.7 46.3 46.3 45.3 43.9 44 44.7 45.1 43.9 43.9 43.2 44.2 45 48 50 49 48 49 A/R 34.7 32.9 34.5 35.3 34.7 32.4 33 35.6 35.9 32.6 34.4 34 33.9 32 35 36 36 34 36 A/P & OD's -28.7 -27.3 -28.3 -28.8 -27.8 -26.4 -27 -28.4 -28.9 -28 -28.7 -28 -27.2 -25 -28 -28 -27 -26 -28 Cash cycle days equal accounts receivable days + inventory days - accounts payable days using a trailing twelve month average beginning and ending balance. The days calculations use calendar days. |

| George Judd Chief Executive Officer Business Review |

| Remarks 1st Quarter focus Specialty growth Gross margin Customer care Long term strategic objectives: Profitably grow specialty revenues to 60+% of total sales Profitably manage structural Profitably outgrow the market over the long term |

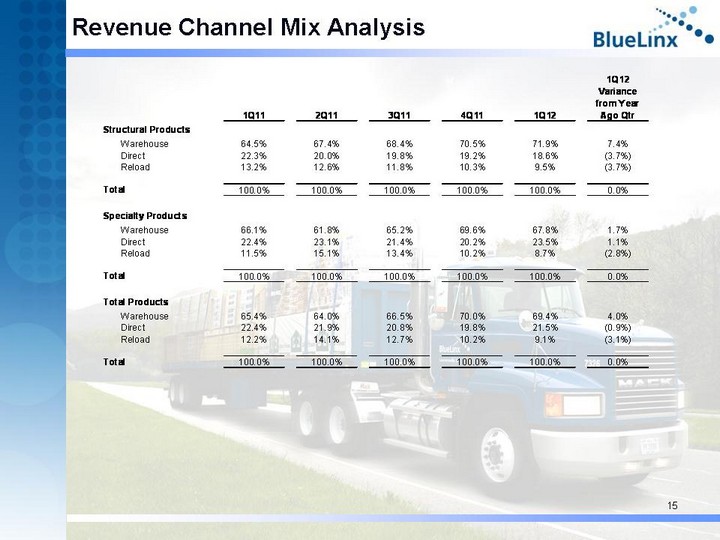

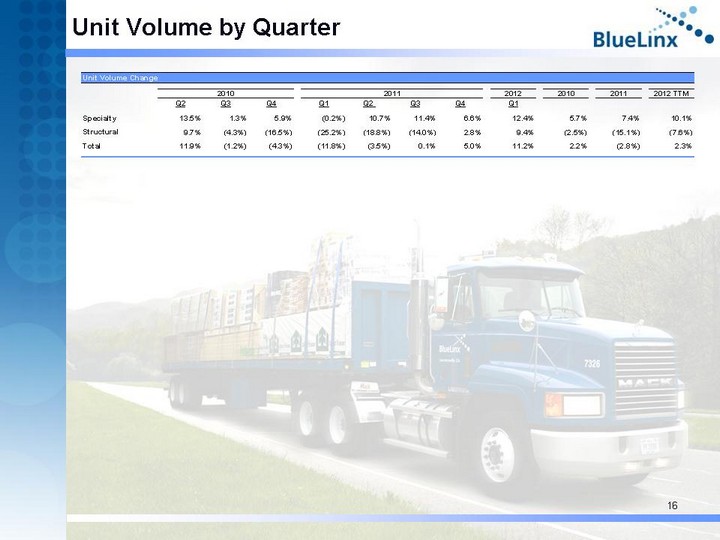

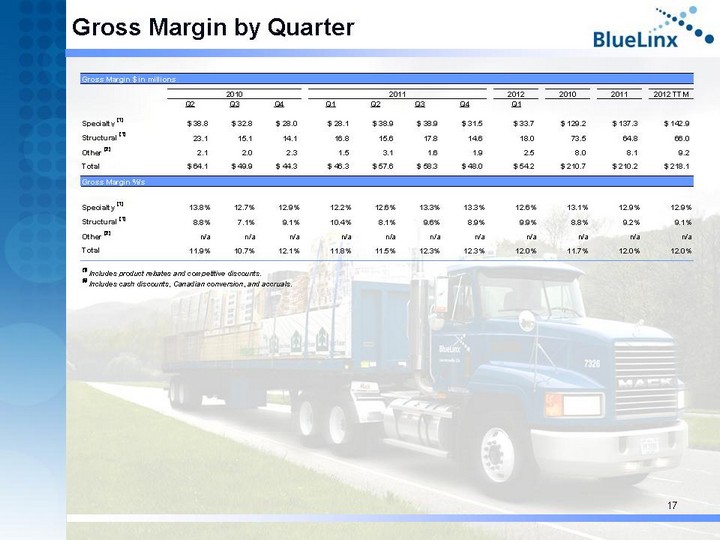

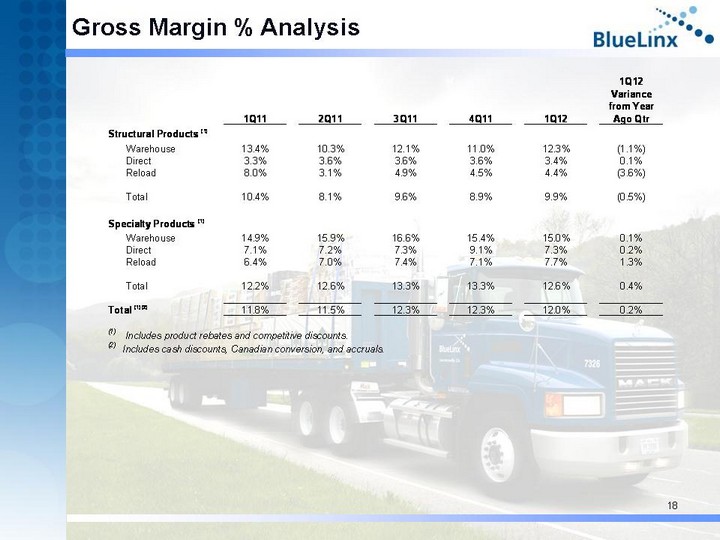

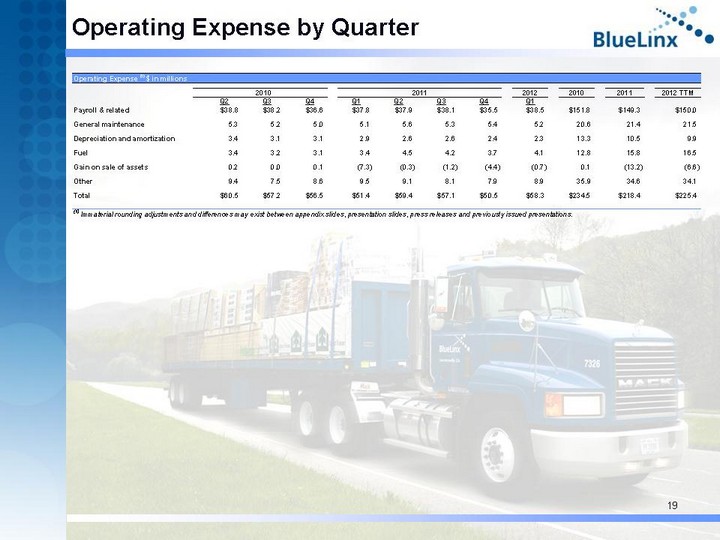

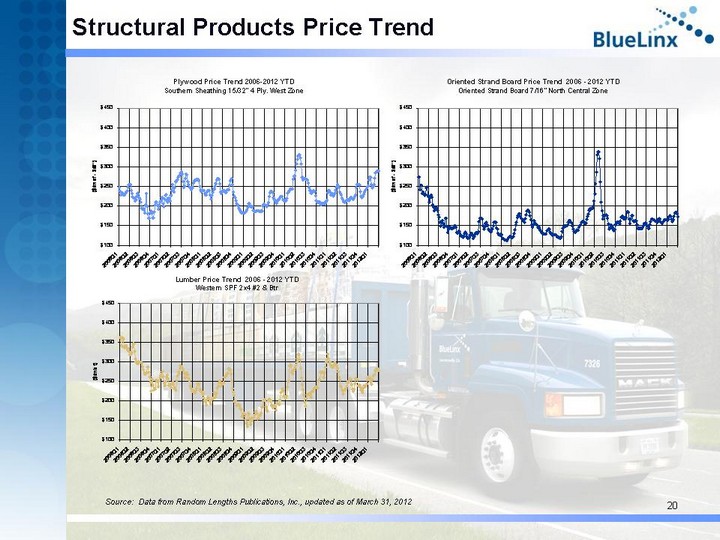

| Appendix TOPIC PAGE Profit and Loss Statement by Quarter 13 Revenues by Quarter 14 Channel Mix Analysis 15 Unit Volume by Quarter 16 Gross Margin by Quarter 17 Gross Margin % Analysis 18 Operating Expense by Quarter 19 Structural Product Price Trends 20 Reconciliation of GAAP Debt to Non-GAAP Net Debt 21 Reconciliation of GAAP Net cash used in operating activities to Non-GAAP EBITDA 22 |

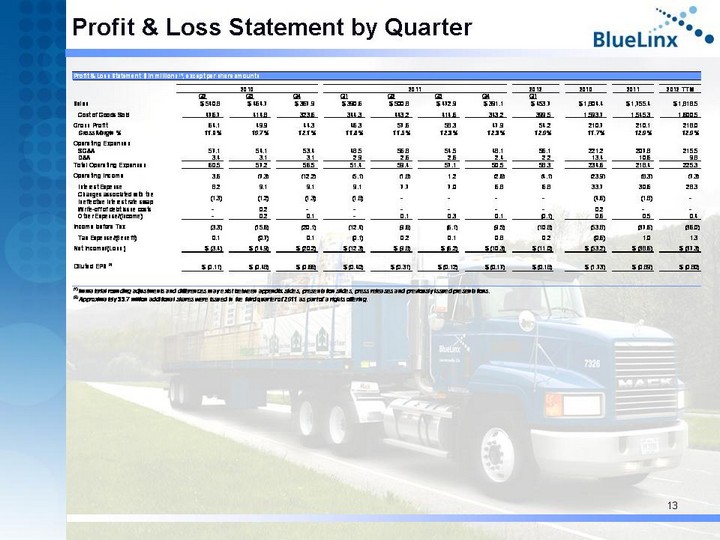

| Profit & Loss Statement by Quarter Profit & Loss Statement by Quarter |

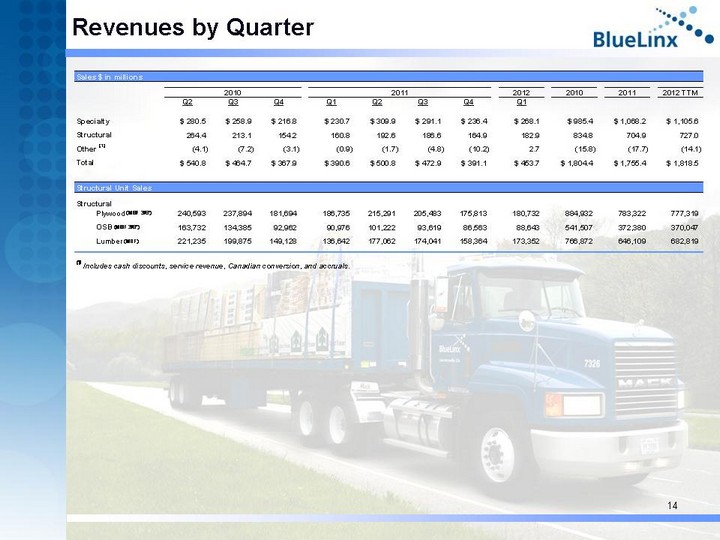

| Revenues by Quarter Revenues by Quarter |

| Revenue Channel Mix Analysis Revenue Channel Mix Analysis |

| Unit Volume by Quarter Unit Volume by Quarter |

| Gross Margin by Quarter Gross Margin by Quarter |

| Gross Margin % Analysis Gross Margin % Analysis |

| Operating Expense by Quarter Operating Expense by Quarter |

| Structural Products Price Trend Source: Data from Random Lengths Publications, Inc., updated as of March 31, 2012 Source: Data from Random Lengths Publications, Inc., updated as of March 31, 2012 Source: Data from Random Lengths Publications, Inc., updated as of March 31, 2012 Source: Data from Random Lengths Publications, Inc., updated as of March 31, 2012 |

| Reconciliation of GAAP to Non-GAAP Reconciliation of GAAP to Non-GAAP |

| Reconciliation of GAAP to Non-GAAP Reconciliation of GAAP to Non-GAAP |

| www.BlueLinxco.com |