Attached files

| file | filename |

|---|---|

| EX-1.1 - FORM OF UNDERWRITING AGREEMENT - Rib-X Pharmaceuticals, Inc. | d255425dex11.htm |

| EX-5.1 - OPINION OF MINTZ,LEVIN,COHN,FERRIS,GLOVSKY AND POPEO, P.C. - Rib-X Pharmaceuticals, Inc. | d255425dex51.htm |

| EX-3.1.2 - CERTIFICATE OF AMENDMENT - Rib-X Pharmaceuticals, Inc. | d255425dex312.htm |

| EX-23.1 - CONSENT OF PRICEWATERHOUSECOOPERS LLP - Rib-X Pharmaceuticals, Inc. | d255425dex231.htm |

Table of Contents

As filed with the Securities and Exchange Commission on May 1, 2012

Registration No. 333-178188

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Amendment No. 6

To

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Rib-X Pharmaceuticals, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 2834 | 06-1599437 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(IRS Employer Identification No.) |

300 George Street, Suite 301

New Haven, Connecticut 06511

(203) 624-5606

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Mark Leuchtenberger

President and Chief Executive Officer

Rib-X Pharmaceuticals, Inc.

300 George Street, Suite 301

New Haven, Connecticut 06511

(203) 624-5606

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

| Jonathan L. Kravetz, Esq. Daniel H. Follansbee, Esq. Megan N. Gates, Esq. John T. Rudy, Esq. Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C. One Financial Center Boston, Massachusetts 02111 (617) 542-6000 |

Michael D. Maline, Esq. Edward A. King, Esq. Goodwin Procter LLP 620 Eighth Avenue New York, NY 10018 (212) 813-8800 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If any of the securities being registered on this Form are being offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | x (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell securities, and we are not soliciting offers to buy these securities, in any state where the offer or sale is not permitted.

Subject to Completion, Dated May 1, 2012

| PRELIMINARY PROSPECTUS |

5,770,000 Shares

Common Stock

This is the initial public offering of shares of the common stock of Rib-X Pharmaceuticals, Inc. We are offering shares of our common stock. We anticipate the initial public offering price will be between $12.00 and $14.00 per share. We have applied to list our common stock on the NASDAQ Global Market under the symbol “RIBX.”

We are an “emerging growth company” under applicable Securities and Exchange Commission rules and will be subject to reduced public company reporting requirements. Investing in our common stock involves risks. See “Risk Factors” beginning on page 12.

Neither the Securities and Exchange Commission nor any other state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

We have granted the underwriters the right to purchase up to 865,500 additional shares of common stock to cover over-allotments.

Certain of our existing stockholders and their affiliated entities have indicated an interest in purchasing up to approximately $20.0 million in shares of our common stock in this offering at the initial public offering price. However, because indications of interest are not binding agreements or commitments to purchase, the underwriters could determine to sell more, less or no shares to any of these existing stockholders and any of these existing stockholders could determine to purchase more, less or no shares in this offering.

The underwriters expect to deliver the shares on , 2012.

Deutsche Bank Securities

William Blair & Company

Lazard Capital Markets

Needham & Company

The date of this prospectus is , 2012

Table of Contents

ABOUT THIS PROSPECTUS

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus. We are offering to sell, and seeking offers to buy, shares of common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of common stock.

Until , 2012 (25 days after the date of this prospectus), all dealers that buy, sell or trade our common stock, whether or not participating in this offering, may be required to deliver a prospectus. This delivery requirement is in addition to the obligation of dealers to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

This prospectus includes estimates, statistics and other industry and market data that we obtained from industry publications, research, surveys and studies conducted by third parties and publicly available information. Such data involves a number of assumptions and limitations and contains projections and estimates of the future performance of the industries in which we operate that are subject to a high degree of uncertainty. This prospectus also includes data based on our own internal estimates. We caution you not to give undue weight to such projections, assumptions and estimates.

Table of Contents

This summary provides an overview of selected information contained elsewhere in this prospectus and does not contain all of the information you should consider before investing in our common stock. You should carefully read this prospectus and the registration statement of which this prospectus is a part in their entirety before investing in our common stock, including the information discussed under “Risk Factors” and our financial statements and related notes appearing elsewhere in this prospectus. Unless otherwise indicated herein, the terms “we,” “our,” “us,” or “the Company” refer to Rib-X Pharmaceuticals, Inc.

Overview

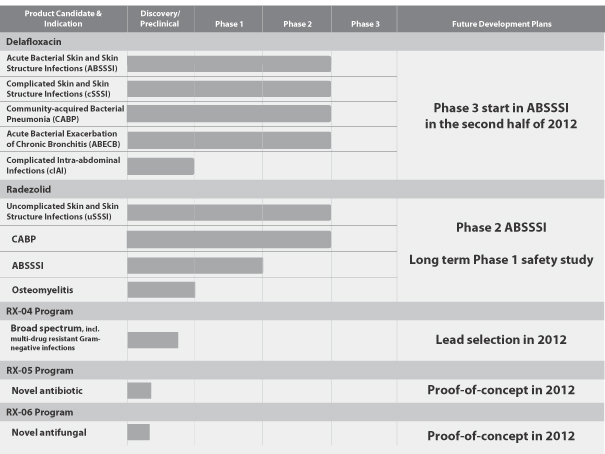

We are a biopharmaceutical company developing new antibiotics to provide superior coverage, safety and convenience for the treatment of serious and life-threatening infections. Our proprietary drug discovery platform, which is based on Nobel Prize-winning science, provides an atomic-level, three-dimensional understanding of interactions between drug candidates and their bacterial targets and enables us to systematically engineer antibiotics with enhanced characteristics. Our most advanced product candidate, delafloxacin, is intended for use as an effective and convenient first-line therapy primarily in hospitals prior to the availability of a specific diagnosis. Unlike currently available first-line treatments, delafloxacin has the potential to offer broad-spectrum coverage as a monotherapy for serious Gram-negative and Gram-positive bacterial infections, including for methicillin-resistant Staphylococcus aureus, or MRSA, with both intravenous and oral formulations. Most bacteria are broadly categorized as either Gram-positive, meaning that they possess a single membrane and a thick cell wall and turn dark-blue or violet when subjected to a laboratory staining method known as Gram’s method, or Gram-negative, meaning that they have two membranes with a thin cell wall and, when subjected to Gram’s method of staining, lose the stain or are decolorized. Delafloxacin has completed four Phase 2 clinical trials, including a Phase 2b clinical trial for the treatment of acute bacterial skin and skin structure infections, or ABSSSI. We received results from this Phase 2b trial in December 2011 and plan to commence the first of two planned Phase 3 trials for the treatment of ABSSSI in the second half of 2012. The timing of our second planned Phase 3 clinical trial will depend upon obtaining additional funding beyond the proceeds of this contemplated offering. Based on our current expectations regarding the availability of such funding and subject to the results of these two trials, we anticipate submitting a New Drug Application for delafloxacin for the treatment of ABSSSI as early as the fourth quarter of 2014 and for additional indications thereafter. Our second product candidate, radezolid, is a next-generation, IV/oral oxazolidinone designed to be a potent antibiotic with a safety profile permitting long-term treatment of resistant infections, including those caused by MRSA. We have completed two Phase 2 clinical trials of radezolid. We are also pursuing development of RX-04, our preclinical program partnered with Sanofi, S.A., which has produced new classes of antibiotics that attach to a location on the bacterial ribosome to which no other approved class of antibiotics bind and are designed to combat the most difficult-to-treat, multi-drug resistant Gram-positive and Gram-negative bacteria. Because its protein building function is essential for the life of infection-causing bacteria, the bacterial ribosome is the target of most marketed antibiotics, which work by binding to the ribosome and inhibiting its function. In addition, our pipeline includes RX-05, an antibacterial discovery program, and RX-06, an antifungal discovery program, both of which target newly discovered binding sites within ribosomes.

We believe one of our key competitive advantages is our focus on the three-dimensional properties of antibiotics, which is enabled by our proprietary drug discovery platform. Unlike traditional approaches to antibiotic discovery, which generally rely on random screening of chemical libraries to identify potential compounds, our discovery team utilizes sophisticated, customized computer software to simulate and predict in three-dimensions both inter- and intra-

1

Table of Contents

molecular reactions and resulting properties of compounds including absorption, distribution, metabolism, excretion and toxicology. We combine these exclusive computational tools with our patent-protected, atomic-level insights into the structure of the ribosome to systematically engineer novel antibiotics to avoid resistance and optimize potency, spectrum, efficacy and safety. As a result, we have created a highly efficient and productive drug development engine based on our unique design strategy that effectively leverages structure-based drug design, preparative medicinal chemistry, ribosome biochemistry, molecular biology and pharmacology.

According to Datamonitor, in the seven major pharmaceutical markets, which consist of the United States, Japan, the United Kingdom, Germany, France, Italy and Spain, antibiotic product sales totaled approximately $20 billion in 2009 and, within the hospital market, approximately $8 billion was generated from antibiotic sales in 2006. Staphylococcus skin and soft tissue infections in the United States alone accounted for on average nearly 12 million physician and emergency department visits annually in the years from 2001 to 2003 according to the Centers for Disease Control, or CDC. In addition, the Infectious Disease Society of America, or IDSA, estimated in 2004 that nearly two million infections are developed in the hospital setting annually in the United States, resulting in the deaths of 90,000 patients each year. Of these infections, 70% are caused by bacteria that are resistant to one or more antibiotics used to treat them, including those caused by MRSA. The CDC estimated that MRSA alone caused 94,000 life-threatening infections and almost 19,000 deaths in 2005 in the United States, exceeding the number of deaths caused by HIV/AIDS in that year. Based on data provided by GlobalData for the U.S. pharmaceutical market and the global pharmaceutical market, we estimate that the use of antibiotics to treat MRSA has increased at a compounded annual growth rate of 18% for the years from 2005 to 2010 and is forecasted to continue growing through 2017.

The three major branded antibiotics used for the treatment of serious infections, Zyvox (linezolid), Cubicin (daptomycin) and Tygacil (tigecycline), generated U.S. sales in 2011 of $640 million, $699 million and $148 million, respectively. In addition, there were over four million courses of vancomycin, a generic drug used to treat serious infections caused by resistant Gram-positive bacteria like MRSA, dosed in 2009.

According to the Joint Commission, formerly the Joint Commission on Accreditation of Healthcare Organizations, hospitals are generally required to begin administering antibiotics to patients with serious infections within six hours of presentation to the hospital, well in advance of the up to 48 hours required to diagnose the particular bacteria causing the infection. As a result, this first-line antibiotic therapy needs to offer a broad spectrum of antibacterial coverage that includes MRSA. Because there is no single broad-spectrum antibiotic available that is safe for first-line use and also has potency against MRSA, according to Datamonitor, the current first-line standard of care for serious infections is an antibiotic cocktail consisting of the twice-daily intravenous, or IV, administration of vancomycin for MRSA coverage, and one or more additional antibiotics to broaden the overall spectrum of coverage. The use of vancomycin, a narrow-spectrum Gram-positive treatment, may be increasingly limited due to its risk of adverse side effects and the rise of vancomycin-resistant bacterial strains in recent years. According to Datamonitor, these limitations often require the use of a second-line treatment, such as Cubicin or Zyvox, for MRSA and other resistant Gram-positive bacteria. However, as indicated in its prescribing information, Cubicin is only available in an IV form and requires laboratory monitoring at least weekly for toxic side effects. Although Zyvox has an available oral form, as indicated in its prescribing information, it requires active monitoring for use beyond two weeks due to the potential for significant adverse side effects, including bone marrow suppression, or myelosuppression, and nerve damage, or neurotoxicity. In addition, studies published in The New England Journal of Medicine and Antimicrobial Agents and Chemotherapy have found that Cubicin and Zyvox have also been associated with increasing drug resistance. As indicated

2

Table of Contents

in its prescribing information, Tygacil, a broad-spectrum antibiotic, is generally utilized as a third- or fourth-line antibiotic due to its greater risk of mortality as compared to the active comparators in its clinical studies, and the high rates of vomiting and nausea.

We believe that antibiotic resistance has eroded the efficacy and exacerbated the limitations of current treatments, creating significant unmet needs for new antibiotics that represent new treatment paradigms. In particular, these include:

| • | the need for an effective and convenient first-line, broad-spectrum antibiotic with coverage of MRSA that can be administered as a single treatment, or monotherapy, primarily in hospitals during the critical early period of a patient’s care when a specific diagnosis is not yet available; |

| • | the need for a potent antibiotic with a safety profile permitting long-term treatment of resistant infections, including MRSA; |

| • | the need for drugs that treat multi-drug resistant bacteria, which are generally the most difficult to treat; and |

| • | the ongoing need for new drugs to combat the continuing problem of drug resistance. |

Our unique drug discovery approach serves as the foundation for our pipeline of clinical and earlier-stage product candidates, set forth below, that we believe can address these unmet needs for the treatment of serious infections.

3

Table of Contents

Delafloxacin. Delafloxacin is intended for use as an effective and convenient first-line antibiotic primarily in hospitals prior to the availability of a specific diagnosis. Unlike current first-line treatments, delafloxacin has the potential to offer broad-spectrum coverage as a monotherapy, including for MRSA, with both IV and oral formulations. In addition to strong Gram-positive potency, delafloxacin has shown excellent in vitro activity against most Gram-negative bacteria commonly found in the hospital setting. We are developing both IV and oral formulations of delafloxacin to enable patients who begin IV treatment in the hospital setting to transition to oral dosing for home-based care, offering the potential to increase patient convenience, lower the overall cost of treatment and reduce the length of hospital stays. We believe that these attributes, combined with delafloxacin’s safety profile and reduced probability of resistance, demonstrate the potential of delafloxacin to become a new standard of care for first-line treatment of serious infections and thereby reduce the need to switch to second-line, narrow-spectrum antibiotics.

We have received results from our Phase 2b clinical trial designed to compare the efficacy of delafloxacin for the treatment of ABSSSI, including infections caused by MRSA, to Zyvox (linezolid), with and without aztreonam, and vancomycin, with and without aztreonam. Delafloxacin met primary and secondary efficacy endpoints evaluated to date. Of note, although this Phase 2b trial was not designed to demonstrate statistical significance, for the primary endpoint of Investigators’ Global Assessment of Cure, delafloxacin demonstrated a statistically significant efficacy advantage as compared to vancomycin. Additionally, delafloxacin demonstrated numerical benefit over both Zyvox (linezolid) and vancomycin in the secondary endpoint, cessation of lesion spread and absence or resolution of fever at 48 to 72 hours. Based on this analysis and other data, we believe delafloxacin has demonstrated a level of efficacy that strongly supports our planned initiation of a Phase 3 study of delafloxacin in the second half of 2012.

Radezolid. Radezolid is a next-generation oxazolidinone designed to meet the need for a potent antibiotic with both IV and oral formulations and a safety profile suitable for the treatment of serious infections, including ABSSSI and severe community-acquired bacterial pneumonia, or CABP, and those caused by MRSA, as well as long-term treatment of underserved serious infections, such as osteomyelitis and prosthetic and joint infections. Radezolid has several attributes allowing it to overcome known oxazolidinone resistance mechanisms and has shown excellent in vitro activity against resistant Streptococcus pneumoniae and MRSA. Unlike Zyvox and tedizolid, radezolid has also shown in vitro activity against Haemophilus influenzae, Legionella pneumophila and Moraxella catarrhalis, and other common causes of CABP. We believe that the demonstrated broad-spectrum of coverage, potency and potential long-term safety profile of radezolid give it the potential to become the antibiotic of choice for multiple resistant infections and for treatment in populations, such as the elderly and children, that might be vulnerable to myelosuppression caused by other oxazolidinone treatments.

RX-04 Program. Our most advanced preclinical program, the RX-04 program, is focused on using one novel binding site within the ribosome to design and develop new classes of antibiotics to treat some of the most deadly and difficult-to-treat, multi-drug resistant Gram-positive and Gram-negative infections. We also are designing candidates through the RX-04 program to have lower potential for resistance, lower potential for toxicity and potential for IV-to-oral dosing. Using our proprietary drug discovery platform, we have developed three novel classes of antibiotics in less than three years that bind to this ribosomal site.

4

Table of Contents

In June 2011, we entered into a collaboration and license agreement with Sanofi related to our RX-04 program. Under this agreement, Sanofi has the right to license an unlimited number of product candidates targeting this discrete binding site within the ribosome. We retain all rights pertaining to our proprietary drug discovery platform, including all other binding sites within the ribosome and all future programs, as well as to any RX-04 compound that Sanofi does not exercise its option to develop during the three-year term of the collaboration. We have received $22.0 million through March 31, 2012 in upfront and milestone payments under the collaboration, including the receipt of a payment of $3.0 million from Sanofi in January 2012 for the achievement of a research milestone. For each RX-04 product developed by Sanofi, we are eligible for up to $9.0 million in potential research milestone payments, up to $27.0 million in potential development milestone payments relating to initiation of Phase 1, 2 and 3 clinical trials, up to $50.0 million in potential regulatory milestone payments relating to approvals in various jurisdictions including the United States, the European Union and Japan, up to $100.0 million in potential commercial milestone payments, and tiered percentage royalties of up to 10% on sales from products commercialized under the agreement, if any. We also have the right under the collaboration to co-commercialize one RX-04 product of our choosing with Sanofi in the United States. We are currently collaborating with Sanofi on ongoing preclinical development and lead generation and, as part of a comprehensive safety assessment, we have just completed in vitro and in vivo profiling of the first cohort of leads from the RX-04 program that demonstrated strong potency and efficacy. These results have informed the next iteration of design and optimization. We expect the results of this optimization round to inform the selection of a lead compound in 2012 for toxicology studies followed by Phase 1 studies in humans.

Our Strategy

Our objective is to discover, develop and commercialize best-in-class and new classes of anti-infectives with superior coverage, safety and convenience to provide new standards of care for patients with serious and life-threatening infections. The critical components of our business strategy are:

| • | Complete the clinical development of delafloxacin. We plan to commence the first of two planned Phase 3 trials for the treatment of ABSSSI in the second half of 2012. The timing of our second planned Phase 3 clinical trial will depend upon obtaining additional funding beyond the proceeds of this contemplated offering. Based on our current expectations regarding the availability of such funding and subject to the results of these two trials, we anticipate submitting applications for marketing approval to the U.S. Food and Drug Administration and European Medicines Agency as early as the fourth quarter of 2014. We also intend to seek approval for additional indications for delafloxacin, including CABP and cIAI. |

| • | Opportunistically seek partners for the development and commercialization of our drug candidates outside of the United States. We have retained worldwide rights to our drug discovery platform and all of our drug discovery and development programs other than the RX-04 program, where we maintain U.S. co-commercialization rights for one product candidate of our choosing. Outside of the United States, we expect to seek strategic partnerships for the further development and commercialization of our product candidates, including delafloxacin and radezolid. We also intend to explore additional funded collaborations leveraging our drug discovery platform. |

| • | Advance the development of multiple product candidates from our RX-04 program through our collaboration with Sanofi. We intend to work with Sanofi under our collaboration agreement to identify and develop multiple RX-04 product |

5

Table of Contents

| candidates. In addition to the development and commercial milestone payments for which we are eligible for each RX-04 product candidate, we intend to exercise our right to co-commercialize one RX-04 product of our choosing in the United States. We expect that the product candidates that emerge from the RX-04 program will target a variety of uses, including the treatment of the most deadly and difficult-to-treat, multi-drug resistant Gram-positive and Gram-negative pathogens. |

| • | Leverage our discovery platform to continue to expand our pipeline of anti-infective product candidates. We intend to continue to pursue active discovery programs using our proprietary platform to identify new binding sites within the ribosome and additional product candidates with broad-spectrum efficacy and safety to combat resistance mechanisms. In particular, we intend to demonstrate evidence of potency enabling lead identification and optimization in our RX-05 antibiotic program and our RX-06 antifungal program in 2012. |

| • | Advance the clinical development of radezolid. We have successfully completed Phase 2 studies with an oral formulation of radezolid in uncomplicated skin and skin structure infections, or uSSSI, and in CABP. Subject to obtaining sufficient additional funding beyond the proceeds of this contemplated offering, we intend to initiate a Phase 2 study for the treatment of ABSSSI and a Phase 1 long-term safety study in humans to demonstrate what we believe is a long-term safety advantage over Zyvox. Following these studies, we also intend to perform additional clinical trials of radezolid in ABSSSI and CABP and for indications that require long-term treatment, such as osteomyelitis and prosthetic and joint infections, including as a result of orthopedic surgery. |

Risks Relating to Our Business

We are an early-stage biopharmaceutical company, and our business and ability to execute our business strategy are subject to a number of risks of which you should be aware before you decide to buy our common stock. In particular, you should consider the following risks, which are discussed more fully in “Risk Factors”:

| • | we have never been profitable, have no products approved for commercial sale and may never achieve profitability; |

| • | we will need to obtain substantial additional funding beyond this contemplated offering to complete the development and commercialization of delafloxacin and to continue to advance the development of radezolid and our other product candidates; |

| • | we have never conducted a Phase 3 clinical trial for any of our product candidates and cannot be certain that delafloxacin or any of our other product candidates will receive regulatory approval for commercial sale; |

| • | we may be subject to delays in our clinical trials, which could result in increased costs and delay or limit our ability to obtain regulatory approval for our product candidates; |

| • | because the results of earlier studies and clinical trials of our product candidates may not be predictive of future clinical trial results, our product candidates may not have favorable results in future clinical trials, which would delay or limit their future development; |

| • | we may be unable to successfully identify, develop, license or commercialize any product candidates under our collaboration with Sanofi, or to establish other |

6

Table of Contents

| development and commercialization collaborations for delafloxacin and radezolid, which would adversely affect our ability to realize the expected benefits of such collaborations and further develop our product candidates; |

| • | we may be unable to maintain and protect our proprietary intellectual property assets, which could impair our drug discovery platform and commercial opportunities; and |

| • | we have incurred significant losses since our inception resulting in an accumulated deficit of $244.3 million as of December 31, 2011 and expect to incur losses for the foreseeable future, which, among other things, raises substantial doubt about our ability to continue as a going concern. |

Corporate Information

We were incorporated in Delaware in October 2000 under the name Rib-X Designs, Inc. and changed our name to Rib-X Pharmaceuticals, Inc. in December 2000. Our primary executive offices are located at 300 George Street, Suite 301, New Haven, CT 06511-6663, and our telephone number is (203) 624-5606. Our website address is http://www.rib-x.com. The information contained on, or that can be accessed through, our website is not part of this prospectus.

“Rib-X,” “Rib-X Pharmaceuticals Antibiotics in Three Dimensions,” and the Rib-X Pharmaceuticals logo are trademarks or registered trademarks of Rib-X Pharmaceuticals, Inc. Other trade names, trademarks and service marks appearing in this prospectus are the property of their respective owners. Solely for convenience, the trademarks, service marks and trade names in this prospectus are referred to without the ® and TM symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto.

7

Table of Contents

THE OFFERING

| Common stock offered by us |

5,770,000 shares |

| Common stock to be outstanding after this offering |

15,664,597 shares |

| Use of proceeds |

We estimate that our net proceeds from the sale of 5,770,000 shares of common stock in this offering will be approximately $66.2 million after deducting estimated offering expenses and underwriting discounts and commissions and assuming an initial public offering price per share of $13.00, the mid-point of the price range set forth on the cover of this prospectus. We intend to use the net proceeds of this offering to fund the estimated cost of our first planned Phase 3 clinical trial of delafloxacin, fund ongoing research and development activities for our RX-04, RX-05 and RX-06 programs, pay scheduled principal and interest on our borrowings, and other general corporate purposes. See “Use of Proceeds.” |

| Proposed NASDAQ Global Market symbol |

RIBX |

The information above is based on 9,894,597 shares of our common stock outstanding as of March 31, 2012, and assumes and gives effect to:

| • | the issuance of 65,333 shares of our common stock upon the conversion of all outstanding shares of our convertible preferred stock and accumulated dividends thereon, assuming that such conversion occurs on May 8, 2012; |

| • | the issuance of 9,827,456 shares of our common stock upon the conversion of all outstanding principal and interest accrued on our senior convertible demand promissory notes, senior subordinated convertible demand promissory notes and subordinated convertible promissory notes, which we refer to collectively as our convertible notes, assuming an initial public offering price per share of $13.00, the mid-point of the price range set forth on the cover page of this prospectus, and that such conversion occurs on May 8, 2012; |

| • | the adoption of our restated certificate of incorporation and restated by-laws in connection with the consummation of this offering; |

| • | a 1-for-5,670.66 reverse stock split of our common stock which became effective on May 1, 2012; and |

| • | no exercise of the underwriters’ over-allotment option. |

It does not include:

| • | 3,857 shares and 26 shares of our common stock issuable upon the exercise of stock options outstanding as of March 31, 2012 under our 2001 Stock Option and Incentive Plan and our 2011 Equity Incentive Plan, respectively, at a combined weighted average exercise price of $637.96 per share; |

8

Table of Contents

| • | 653,826 shares of our common stock issuable upon the vesting of restricted stock units granted under our 2011 Equity Incentive Plan pursuant to our Bonus Plan in connection with this offering, assuming an initial public offering price per share of $13.00, the mid-point of the price range set forth on the cover page of this prospectus; |

| • | 16,346 shares of our common stock issuable upon the vesting of restricted stock units granted under our 2011 Equity Incentive Plan pursuant to our Non-Employee Director Bonus Plan in connection with this offering, assuming an initial public offering price per share of $13.00, the mid-point of the price range set forth on the cover page of this prospectus; |

| • | 3,672 additional shares of our common stock that were available for future issuance as of March 31, 2012 under our 2011 Equity Incentive Plan, which excludes the 156,768 shares of our common stock issuable upon the exercise of options to purchase common stock to be granted in connection with this offering under our 2011 Equity Incentive Plan pursuant to a letter agreement we entered into with our new Chief Development Officer in April 2012, assuming an initial public offering price per share of $13.00, the mid-point of the price range set forth on the cover page of this prospectus, and that the conversion of our preferred stock and dividends thereon and our convertible notes and accrued interest thereon occurs on May 8, 2012, and which further excludes 1,669,362 additional shares reserved for issuance under our 2011 Equity Incentive Plan following the approval by our board of directors and stockholders in April 2012 of our amended 2011 Equity Incentive Plan, which reserves an aggregate of 2,500,000 shares of our common stock for issuance under our 2011 Equity Incentive Plan; |

| • | 160,000 shares of our common stock that will be available for future issuance under our 2012 Employee Stock Purchase Plan; and |

| • | 8,230 shares of our common stock issuable upon the exercise of warrants outstanding as of March 31, 2012 at a weighted average exercise price of $869.54 per share. |

Unless otherwise indicated, all information contained in this prospectus assumes and reflects the above.

Certain of our existing stockholders and their affiliated entities have indicated an interest in purchasing up to approximately $20.0 million in shares of our common stock in this offering at the initial public offering price. However, because indications of interest are not binding agreements or commitments to purchase, the underwriters could determine to sell more, less or no shares to any of these existing stockholders and any of these existing stockholders could determine to purchase more, less or no shares in this offering. Any shares purchased by these existing stockholders will be subject to lock-up restrictions described in “Shares Eligible for Future Sale.”

9

Table of Contents

Summary Financial Data

You should read this summary financial data together with our audited financial statements and the related notes thereto included elsewhere in this prospectus and the information under “Selected Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” We derived the statement of operations data for the years ended December 31, 2009, 2010 and 2011, and the balance sheet data as of December 31, 2011, from our audited financial statements included elsewhere in this prospectus.

| Years Ended December 31, | ||||||||||||

| 2009 | 2010 | 2011 | ||||||||||

| (in thousands, except share and per share amounts) |

||||||||||||

| Statement of Operations Data: |

||||||||||||

| Revenues: |

||||||||||||

| Contract revenues |

$ | — | $ | — | $ | 2,705 | ||||||

| Operating expenses: |

||||||||||||

| Research and development |

17,592 | 12,422 | 31,206 | |||||||||

| General and administrative |

3,888 | 5,152 | 5,723 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total operating expenses |

21,480 | 17,574 | 36,929 | |||||||||

|

|

|

|

|

|

|

|||||||

| Loss from operations |

(21,480 | ) | (17,574 | ) | (34,224 | ) | ||||||

| Other income (expense): |

||||||||||||

| Interest income |

68 | 11 | 14 | |||||||||

| Interest expense |

(6,952 | ) | (10,290 | ) | (19,497 | ) | ||||||

| Other income |

160 | 1,098 | 246 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total other income (expense) |

(6,724 | ) | (9,181 | ) | (19,237 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Net loss |

(28,204 | ) | (26,755 | ) | (53,461 | ) | ||||||

| Convertible preferred stock dividends |

(14,180 | ) | (15,314 | ) | (16,540 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Net loss attributable to common stockholders |

$ | (42,384 | ) | $ | (42,069 | ) | $ | (70,001 | ) | |||

|

|

|

|

|

|

|

|||||||

| Net loss per share, basic and diluted |

$ | (23,704.70 | ) | $ | (23,281.13 | ) | $ | (38,717.37 | ) | |||

|

|

|

|

|

|

|

|||||||

| Weighted average shares outstanding, basic and diluted |

1,788 | 1,807 | 1,808 | |||||||||

|

|

|

|

|

|

|

|||||||

| Pro forma net loss per share, basic and diluted (unaudited) (1) |

$ | (4.63 | ) | |||||||||

|

|

|

|||||||||||

| Weighted average shares used in computing pro forma net loss per share, basic and diluted (unaudited) (1) |

7,402,239 | |||||||||||

|

|

|

|||||||||||

| (1) | The pro forma net loss per share and weighted average shares have been calculated to give effect to the (i) issuance of shares of common stock upon conversion of all outstanding shares of our convertible preferred stock and accumulated dividends thereon and upon conversion of all outstanding principal and accrued interest on the convertible notes payable assuming an initial public offering price per share of $13.00, the mid-point of the range set forth on the cover page of this prospectus, (ii) settlement of the put rights upon the conversion of the convertible notes payable, (iii) conversion of the preferred stock warrants into common stock warrants and (iv) elimination of the common stock warrant exercise price protection term, in all cases, assuming each had occurred on the later of January 1, 2011 or where applicable, the issuance date of the convertible notes payable. See Note 2 to our financial statements included elsewhere in the prospectus. |

10

Table of Contents

The summary unaudited pro forma balance sheet as of December 31, 2011 has been prepared to give effect to the (i) issuance of shares of common stock upon conversion of all outstanding shares of our convertible preferred stock and accumulated dividends thereon and upon conversion of all outstanding principal and accrued interest on the convertible notes payable, in each case, assuming an initial public offering price per share of $13.00 , the mid-point of the range set forth on the cover page of this prospectus, (ii) settlement of the put rights upon the conversion of the convertible notes payable, (iii) conversion of the preferred stock warrants into common stock warrants, and (iv) elimination of the common stock warrant exercise price protection term, assuming in all cases, as if each had occurred on December 31, 2011. The summary unaudited pro forma as adjusted balance sheet as of December 31, 2011 has been prepared to give effect to the foregoing items (i) through (iv) and the sale of shares of common stock in this offering after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us at an assumed initial public offering price per share of $13.00, the mid-point of the range set forth on the cover page of this prospectus, assuming in all cases, as if each had occurred on December 31, 2011. The summary unaudited pro forma and pro forma as adjusted balance sheet is for informational purposes only and does not purport to indicate balance sheet information as of any future date.

| As of December 31, 2011 | ||||||||||||

| Actual | Pro Forma (4) | Pro Forma as Adjusted (5) |

||||||||||

| (unaudited) | (unaudited) | |||||||||||

| (in thousands) | ||||||||||||

| Balance Sheet Data: (1) | ||||||||||||

| Cash and cash equivalents |

$ | 8,019 | 8,019 | 74,515 | ||||||||

| Total assets |

11,690 | 11,515 | 76,160 | |||||||||

| Convertible notes payable (2) |

62,143 | — | — | |||||||||

| Accrued interest on convertible notes payable (2) |

14,182 | — | — | |||||||||

| Put rights |

28,223 | — | — | |||||||||

| Deferred revenue, net of current portion (3) |

9,997 | 9,997 | 9,997 | |||||||||

| Convertible preferred stock |

122,428 | — | — | |||||||||

| Accumulated equity (deficit) |

(244,264 | ) | (244,264 | ) | (244,264 | ) | ||||||

| Total stockholders’ equity (deficit) |

(239,297 | ) | (12,429 | ) | 53,830 | |||||||

| (1) | The balance sheet data does not reflect the impact of $15,000 we borrowed under a loan and security agreement entered into in February 2012. As a result, our cash and cash equivalents balance as of March 31, 2012 was $14,276. The aggregate principal amount outstanding under the loan and security agreement as of March 31, 2012 was $15,000. See Note 17 to our audited financial statements included elsewhere in this prospectus for further details regarding this loan and security agreement. |

| (2) | Convertible notes payable and accrued interest on convertible notes payable were current liabilities as of December 31, 2011. |

| (3) | Deferred revenue is related to our collaboration and license agreement with Sanofi. See Note 3 to our financial statements included elsewhere in this prospectus. |

| (4) | The pro forma balance sheet data in the table above gives effect to the elimination of $175 of unamortized debt issuance costs upon conversion of the convertible notes payable to stockholders as described in the paragraph above. |

| (5) | The pro forma as adjusted balance sheet data in the table above gives effect to the reclassification of $1,851 of deferred initial public offering costs recognized as of December 31, 2011 that will be charged to additional paid-in capital as a reduction of proceeds received in connection with this offering. As of December 31, 2011, we had made payments totaling $237 and had accrued $1,614 related to these costs. |

11

Table of Contents

Investing in our common stock involves a high degree of risk. You should carefully consider the following risk factors, as well as the other information in this prospectus, including our financial statements and related notes, before deciding whether to invest in shares of our common stock. The occurrence of any of the following adverse developments described in the following risk factors could materially and adversely harm our business, financial condition, results of operations or prospects. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Relating Our Financial Position and Need for Additional Capital

We have never been profitable. Currently, we have no products approved for commercial sale, and to date we have not generated any revenue from product sales. As a result, our ability to reduce our losses and reach profitability is unproven, and we may never achieve or sustain profitability.

We have never been profitable and do not expect to be profitable in the foreseeable future. We have incurred net losses in each year since our inception, including net losses of $28.2 million, $26.8 million and $53.5 million for 2009, 2010 and 2011, respectively. As of December 31, 2011, we had an accumulated deficit of $244.3 million. We have devoted most of our financial resources to research and development, including our preclinical development activities and clinical trials. We have not completed development of any product candidate and we have therefore not generated any revenues from product sales. We expect to incur increased expenses if and as we commence Phase 3 development of delafloxacin, satisfy our obligations under our agreement with Sanofi, advance our other product candidates and expand our research and development programs. We also expect an increase in our expenses associated with seeking regulatory approvals and preparing for commercialization of our product candidates, and adding infrastructure and personnel to support our product development efforts and operations as a public company. As a result of the foregoing, we expect to continue to experience net losses and negative cash flows for the foreseeable future. These net losses and negative cash flows have had, and will continue to have, an adverse effect on our stockholders’ equity and working capital.

Because of the numerous risks and uncertainties associated with pharmaceutical product development, we are unable to accurately predict the timing or amount of increased expenses or when, or if, we will be able to achieve profitability. In addition, our expenses could increase if we are required by the United States Food and Drug Administration, or FDA, to perform studies in addition to those currently expected, or if there are any delays in completing our clinical trials or the development of any of our product candidates. The amount of future net losses will depend, in part, on the rate of future growth of our expenses and our ability to generate revenues. To date, our only source of revenue has been our collaboration and license agreement with Sanofi. Future payments from Sanofi under this collaboration are uncertain because Sanofi may choose not to continue research or development of activities for one or more potential RX-04 product candidates under the collaboration, we may not achieve milestones under the agreement with Sanofi, Sanofi may not exercise its option to license any RX-04 product candidates, and RX-04 product candidates may not be approved or, if they are approved, may not be accepted in the market. If we are unable to develop and commercialize one or more of our product candidates, either alone or with collaborators, or if revenues from any such collaboration product candidate that receives marketing approval are insufficient, we will not achieve profitability. Even if we do achieve profitability, we may not be able to sustain or increase profitability.

12

Table of Contents

If we are unable to raise capital when needed, we would be forced to delay, reduce or eliminate our product development programs.

Developing pharmaceutical products, including conducting preclinical studies and clinical trials, is expensive. We expect to incur increased expenses as we commence Phase 3 development of delafloxacin, satisfy our obligations under our agreement with Sanofi, advance our other product candidates and expand our research and development programs. Moreover, proceeds from this offering will not be sufficient to complete the development and commercialization of our lead product candidate, delafloxacin, or to continue the development of radezolid. For instance, to complete Phase 3 development of delafloxacin, we estimate that our two planned ABSSSI Phase 3 studies will each cost approximately $33.0 million. Accordingly, we will need to obtain additional funding beyond the proceeds of this contemplated offering to complete the development and commercialization of delafloxacin as well as to continue to advance the development of radezolid and our other clinical and preclinical candidates. If the FDA requires that we perform additional studies beyond those that we currently believe will be required, our expenses would further increase beyond what we currently anticipate and the anticipated timing of any potential product approvals may be delayed. Under our collaboration and license agreement with Sanofi, we are required to use personnel and other resources in the conduct of a joint development plan directed toward identifying and optimizing product candidates thereunder meeting mutually agreed target product profiles. We currently have no commitments or arrangements to fund our research and development programs other than future contingent milestone or royalty payments from Sanofi, which require the successful development, regulatory approval and commercialization of one or more product candidates thereunder and may not be received for several years. We believe that the net proceeds from this offering, together with amounts we anticipate receiving under our collaboration with Sanofi and existing cash and cash equivalents and interest thereon, will be sufficient to fund our projected operating requirements through the first quarter of 2014.

Our future funding requirements, both short-term and long-term, will depend on many factors, including, but not limited to:

| • | the initiation, progress, timing, costs and results of preclinical studies and clinical trials for our product candidates and potential product candidates, including initiation of Phase 3 development for delafloxacin; |

| • | the success of our collaboration with Sanofi and receipt of milestones and royalty payments, if any, thereunder; |

| • | the number and characteristics of product candidates that we pursue; |

| • | the outcome, timing and costs of regulatory approvals; |

| • | the amount and timing of any payments we may be required to make, or that we may receive, in connection with the licensing, filing, prosecution, defense and enforcement of any patents or other intellectual property rights; |

| • | the costs and timing of completion of commercial-scale outsourced manufacturing activities; |

| • | the costs of establishing sales, marketing and distribution capabilities for any product candidates for which we may receive regulatory approval; |

| • | the timing, receipt and amount of any sales, or royalties on, our product candidates, if any; and |

| • | the terms and timing of any future collaborative, licensing or other arrangements that we may establish. |

13

Table of Contents

Unless and until we can generate a sufficient amount of revenue from our product candidates, we expect to finance future cash needs through public or private equity offerings, debt financings or regional collaborations and licensing arrangements. Additional funds may not be available when we need them on terms that are acceptable to us, or at all. If adequate funds are not available, we may be required to delay, reduce the scope of or eliminate one or more of our research or development programs or our commercialization efforts. To the extent that we raise additional funds by issuing equity securities, our stockholders may experience additional dilution, and debt financing, if available, may involve restrictive covenants. To the extent that we raise additional funds through collaborations and licensing arrangements, it may be necessary to relinquish some rights to our technologies or our product candidates or grant licenses on terms that may not be favorable to us. We may be required to access the public or private capital markets from time to time when conditions are unfavorable, or we may seek to access them when conditions are favorable even if we do not have an immediate need for additional capital.

We have a limited operating history and we expect a number of factors to cause our operating results to fluctuate on a quarterly and annual basis, which may make it difficult to predict our future performance.

Our operations to date have been primarily limited to developing our technology and undertaking preclinical studies and clinical trials of our product candidates. We have not yet obtained regulatory approvals for any of our product candidates. Consequently, any predictions made about our future success or viability may not be as accurate as they could be if we had a longer operating history or approved products on the market. Our financial condition and operating results have varied significantly in the past and are expected to continue to significantly fluctuate from quarter-to-quarter or year-to-year due to a variety of factors, many of which are beyond our control. Factors relating to our business that may contribute to these fluctuations include:

| • | our ability to obtain additional funding to develop our product candidates; |

| • | the need to obtain and maintain regulatory approval in the United States as well as other significant non-U.S. markets for delafloxacin, radezolid, or any of our other product candidates; |

| • | delays in the commencement, enrollment and timing of clinical trials; |

| • | the success of our clinical trials through all phases of clinical development, including our Phase 3 clinical trials of delafloxacin; |

| • | any delays in regulatory review and approval of product candidates in clinical development; |

| • | potential side effects of our product candidates that could delay or prevent commercialization or cause an approved drug to be taken off the market; |

| • | our ability to identify and develop additional product candidates; |

| • | market acceptance of our product candidates; |

| • | our ability to establish an effective sales and marketing infrastructure; |

| • | competition from existing products or new products that may emerge; |

| • | the ability of patients or healthcare providers to obtain coverage or sufficient reimbursement for our products; |

| • | our dependency on third-party manufacturers to manufacture our products or key ingredients; |

14

Table of Contents

| • | our ability to establish or maintain collaborations, licensing or other arrangements; |

| • | the costs to us, and our ability and a third party’s ability to obtain, maintain and protect intellectual property rights; |

| • | costs related to and outcomes of potential intellectual property litigation; |

| • | our ability to adequately support future growth; |

| • | our ability to attract and retain key personnel to manage our business effectively; |

| • | our ability to build our finance infrastructure and improve our accounting systems and controls; |

| • | potential product liability claims; |

| • | potential liabilities associated with hazardous materials; and |

| • | our ability to maintain adequate insurance policies. |

Accordingly, the results of any quarterly or annual periods should not be relied upon as indications of future operating performance.

The timing of milestone, royalty and other payments we are required to make under our license agreements are uncertain and could adversely affect our cash flows and results of operations.

We are obligated, including pursuant to an exclusive license and supply agreement with CyDex Pharmaceuticals, Inc. (now a wholly owned subsidiary of Ligand Pharmaceuticals Incorporated, both hereafter referred to as Ligand), an exclusive license agreement with Wakunaga Pharmaceutical Co., Ltd., or Wakunaga, and an exclusive license agreement with Yale University, to make milestone payments and pay royalties and other fees in connection with the development and commercialization of our product candidates. The timing of our achievement of these milestones and the corresponding milestone payments is subject to factors relating to the clinical and regulatory development and commercialization of our product candidates, which are difficult to predict and for which many are beyond our control. We may become obligated to make a milestone or other payment at a time when we do not have sufficient funds to make such payment, which could result in the loss of required intellectual property rights to further develop or commercialize one or more of our product candidates, or at a time that would otherwise require us to use funds needed to continue to operate our business, which could delay our clinical trials, curtail our operations, scale back our commercialization and marketing efforts or seek funds to meet these obligations on terms unfavorable to us. In addition, disputes with a licensor regarding compliance with the requirements of our agreements could result in our making milestone, royalty or other payments when we do not believe they are due to avoid potentially expensive litigation. If we are unable to make any payment when due or if we fail to use commercially reasonable efforts to achieve certain development and commercialization milestones within the timeframes required by these agreements, the other party may have the right to terminate the agreement and all of our rights to develop and commercialize product candidates using the applicable technology.

Our independent registered public accounting firm has expressed doubt about our ability to continue as a going concern.

Based on our cash balances, recurring losses, net capital deficiency, and significant debt outstanding as of December 31, 2011 and our projected spending in 2012, which raise substantial doubt about our ability to continue as a going concern, our independent registered

15

Table of Contents

public accounting firm has included an explanatory paragraph in its report on our financial statements as of and for the year ended December 31, 2011 regarding this uncertainty. We believe that the net proceeds from this offering, together with proceeds of $15.0 million from a loan agreement entered into in February 2012 and amounts we have received and anticipate receiving under our collaboration with Sanofi and existing cash and cash equivalents and interest thereon, will be sufficient to fund our projected operating requirements through the first quarter of 2014. However, if we are unable to continue as a going concern, we might have to liquidate our assets and the values we receive for our assets in liquidation or dissolution could be significantly lower than the values reflected in our financial statements. Amounts due under the February 2012 loan agreement may become immediately due and payable upon the occurrence of a material adverse change, as defined under the loan agreement. Under the terms of the loan agreement, we are subject to operational covenants, including limitations on our ability to incur liens or additional debt, pay dividends, redeem stock, make specified investments and engage in merger, consolidation or asset sale transactions, among other restrictions. In addition, the inclusion of a going concern statement by our auditors, our lack of cash resources and our potential inability to continue as a going concern may materially adversely affect our share price and our ability to raise new capital or to enter into critical contractual relations with third parties.

Risks Relating to Regulatory Review and Approval of Our Product Candidates

We cannot be certain that delafloxacin, radezolid, our RX-04 product candidates or any of our other product candidates will receive regulatory approval, and without regulatory approval we will not be able to market our product candidates.

We have invested a significant portion of our efforts and financial resources in the development of our most advanced product candidates, especially delafloxacin. Our ability to generate revenue related to product sales, if ever, will depend on the successful development and regulatory approval of these product candidates.

While it is not required, we plan to request a special protocol assessment, or SPA, for our clinical protocol for each of our planned Phase 3 clinical trials of delafloxacin for the treatment of ABSSSI from the FDA. An SPA is intended to provide assurance that if the agreed upon clinical trial protocols are followed, the clinical trial endpoints are achieved, and there is a favorable risk-benefit profile, the data may serve as the primary basis for an efficacy claim in support of an NDA. However, SPA agreements are not a guarantee of an approval of a product candidate or any permissible claims about the product candidate. In particular, SPAs are not binding on the FDA if previously unrecognized public health concerns arise during the performance of the clinical trial, other new scientific concerns regarding product candidate safety or efficacy arise or if the sponsoring company fails to comply with the agreed upon clinical trial protocols. We cannot predict whether we will be able to reach agreement with the FDA on an SPA or, if we do reach agreement, whether any issues will arise during the clinical trial that would negate that agreement. In addition, we do not know how the FDA will interpret the commitments under the agreed upon SPA and how it will interpret the data and results.

We currently have no products approved for sale and we cannot guarantee that we will ever have marketable products. The development of a product candidate and issues relating to its approval and sale are subject to extensive regulation by the FDA in the United States and regulatory authorities in other countries, with regulations differing from country to country. We are not permitted to market our product candidates in the United States until we receive approval of an NDA from the FDA. We have not submitted an NDA for any of our product candidates. An NDA must include extensive preclinical and clinical data and supporting

16

Table of Contents

information to establish the product candidate’s safety and effectiveness for each desired indication. The NDA must also include significant information regarding the chemistry, manufacturing and controls for the product. Obtaining approval of an NDA is a lengthy, expensive and uncertain process, and may not be obtained. The FDA review process typically takes years to complete and approval is never guaranteed. If we submit an NDA to the FDA, the FDA must decide whether to accept or reject the submission for filing. We cannot be certain that any submissions will be accepted for filing and review by the FDA. Even if a product is approved, the FDA may limit the indications for which the product may be marketed, include extensive warnings on the product labeling or require expensive and time-consuming post-approval clinical trials or reporting as conditions of approval. Foreign regulatory authorities also have requirements for approval of drug candidates with which we must comply prior to marketing. Obtaining regulatory approval for marketing of a product candidate in one country does not ensure that we will be able to obtain regulatory approval in other countries. In addition, delays in approvals or rejections of marketing applications in the United States or foreign countries may be based upon many factors, including regulatory requests for additional analyses, reports, data and studies, regulatory questions regarding or different interpretations of data and results, changes in regulatory policy during the period of product development and the emergence of new information regarding our product candidates or other products. Also, regulatory approval for any of our product candidates may be withdrawn. If delafloxacin, radezolid or any of our other product candidates do not receive regulatory approval, we may not be able to generate sufficient revenue to become profitable or to continue our operations.

Delays in the commencement, enrollment and completion of clinical trials could result in increased costs to us and delay or limit our ability to obtain regulatory approval for our product candidates.

Delays in the commencement, enrollment and completion of clinical trials could increase our product development costs or limit the regulatory approval of our product candidates. We plan to commence the first of two planned Phase 3 trials of delafloxacin for the treatment of ABSSSI in the second half of 2012. However, the timing of the second planned Phase 3 clinical trial will depend upon obtaining additional funding beyond the proceeds of this offering. We may be unable to initiate or complete such development on schedule, if at all. In addition, we do not know whether any future trials or studies of our other product candidates will begin on time or will be completed on schedule, if at all. The commencement, enrollment and completion of clinical trials can be delayed for a variety of reasons, including:

| • | inability to obtain sufficient funds required for a clinical trial; |

| • | inability to reach agreements on acceptable terms with prospective clinical research organizations, or CROs, and trial sites, the terms of which can be subject to extensive negotiation and may vary significantly among different CROs and trial sites; |

| • | clinical holds, other regulatory objections to commencing a clinical trial or the inability to obtain regulatory approval to commence a clinical trial in those countries that require such approvals; |

| • | inability to identify and maintain a sufficient number of trial sites, many of which may already be engaged in other clinical trial programs, including some that may be for the same indication as our product candidates; |

| • | inability to obtain approval from institutional review boards, or IRBs, to conduct a clinical trial at their respective sites; |

| • | severe or unexpected drug-related adverse effects experienced by patients; |

| • | inability to timely manufacture sufficient quantities of the product candidate required for a clinical trial; |

17

Table of Contents

| • | difficulty recruiting and enrolling patients to participate in clinical trials for a variety of reasons, including meeting the enrollment criteria for our study and competition from other clinical trial programs for the same indication as our product candidates; and |

| • | inability to retain enrolled patients after a clinical trial is underway. |

Changes in regulatory requirements and guidance may also occur and we or any of our partners may need to amend clinical trial protocols to reflect these changes with appropriate regulatory authorities. Amendments may require us or any of our partners to resubmit clinical trial protocols to IRBs for re-examination, which may impact the costs, timing or successful completion of a clinical trial. In addition, a clinical trial may be suspended or terminated at any time by us, our current or future partners, the FDA or other regulatory authorities due to a number of factors, including:

| • | failure to conduct the clinical trial in accordance with regulatory requirements or our clinical protocols; |

| • | unforeseen safety issues or any determination that a clinical trial presents unacceptable health risks; |

| • | lack of adequate funding to continue the clinical trial due to unforeseen costs or other business decisions; and |

| • | upon a breach or pursuant to the terms of any agreement with, or for any other reason by, current or future partners that have responsibility for the clinical development of any of our product candidates, including Sanofi upon exercise of its rights to develop and commercialize any RX-04 compounds. |

In addition, if we or any of our partners are required to conduct additional clinical trials or other testing of our product candidates beyond those contemplated, our ability to obtain regulatory approval of these product candidates and generate revenue from their sales would be similarly harmed.

Clinical failure can occur at any stage of clinical development and we have never conducted a Phase 3 trial or submitted an NDA before. The results of earlier clinical trials are not necessarily predictive of future results and any product candidate we, Sanofi or our potential future partners advance through clinical trials may not have favorable results in later clinical trials or receive regulatory approval.

Clinical failure can occur at any stage of our clinical development. Clinical trials may produce negative or inconclusive results, and we or our partners may decide, or regulators may require us, to conduct additional clinical or preclinical testing. In addition, data obtained from tests are susceptible to varying interpretations, and regulators may not interpret our data as favorably as we do, which may delay, limit or prevent regulatory approval. Success in preclinical testing and early clinical trials does not ensure that subsequent clinical trials will generate the same or similar results or otherwise provide adequate data to demonstrate the efficacy and safety of a product candidate. Frequently, product candidates that have shown promising results in early clinical trials have suffered significant setbacks in subsequent clinical trials. In addition, the design of a clinical trial can determine whether its results will support approval of a product and flaws in the design of a clinical trial may not become apparent until the clinical trial is well advanced. We have limited experience in designing clinical trials and may be unable to design and execute a clinical trial to support regulatory approval. Further, clinical trials of potential products often reveal that it is not practical or feasible to continue development efforts. If delafloxacin, radezolid or our other product candidates are found to be unsafe or lack efficacy, we will not be able to obtain regulatory approval for them and our

18

Table of Contents

business would be harmed. For example, if the results of our planned Phase 3 clinical trials of delafloxacin do not achieve the primary efficacy endpoints or demonstrate expected safety, the prospects for approval of delafloxacin would be materially and adversely affected. A number of companies in the pharmaceutical industry, including those with greater resources and experience than us, have suffered significant setbacks in Phase 3 clinical trials, even after seeing promising results in earlier clinical trials.

In some instances, there can be significant variability in safety and/or efficacy results between different trials of the same product candidate due to numerous factors, including changes in trial protocols, differences in size and type of the patient populations, adherence to the dosing regimen and other trial protocols and the rate of dropout among clinical trial participants. We do not know whether any Phase 2, Phase 3 or other clinical trials we or any of our partners may conduct will demonstrate consistent or adequate efficacy and safety to obtain regulatory approval to market our product candidates.

Our product candidates may have undesirable side effects which may delay or prevent marketing approval, or, if approval is received, require them to be taken off the market, require them to include safety warnings or otherwise limit their sales.

We refer to those adverse events observed in our clinical trials with an incidence rate equal to or greater than 5% of the subjects in a clinical trial as common adverse events. The common adverse events observed in clinical trials of delafloxacin were nausea, diarrhea, vomiting, pruritus, fatigue, headache, dizziness, infusion site pain, insomnia, constipation, rhinitis and dry mouth. The common adverse events observed in clinical trials of radezolid were nausea, diarrhea, headache, dizziness and fungal infection. Three patients receiving delafloxacin in our clinical trials have had serious adverse events that were thought by the investigator to be possibly related to delafloxacin therapy. One patient with a previously non-disclosed recent onset seizure disorder had a further seizure on delafloxacin. One patient with a complicated medical history was hospitalized with abdominal pain and diarrhea. A third patient had a single episode of mouth swelling and shortness of breath. Two patients receiving radezolid in our clinical trials have had serious adverse events that were thought by the investigator to be possibly related to radezolid therapy. One patient with lung cancer had a pneumonia that did not respond to radezolid therapy. A second patient with prior peptic ulcer disease discontinued ulcer therapy prior to enrolling in a radezolid trial and had a recurrent ulcer with perforation. Additional or unforeseen side effects from these or any of our other product candidates could arise either during clinical development or, if approved, after the approved product has been marketed. Our product candidates are being developed for the systemic treatment of multi-drug resistant and extremely-drug resistant infections caused by Gram-positive and Gram-negative bacteria and are still in the early stages of clinical development. The range and potential severity of possible side effects from systemic therapies is significant. The results of future clinical trials may show that our product candidates cause undesirable or unacceptable side effects, which could interrupt, delay or halt clinical trials, and result in delay of, or failure to obtain, marketing approval from the FDA and other regulatory authorities, or result in marketing approval from the FDA and other regulatory authorities with restrictive label warnings.

If any of our product candidates receives marketing approval and we or others later identify undesirable or unacceptable side effects caused by such products:

| • | regulatory authorities may require the addition of labeling statements, specific warnings, a contraindication or field alerts to physicians and pharmacies; |

| • | we may be required to change the way the product is administered, conduct additional clinical trials or change the labeling of the product; |

| • | we may be subject to limitations on how we may promote the product; |

19

Table of Contents

| • | sales of the product may decrease significantly; |

| • | regulatory authorities may require us to take our approved product off the market; |

| • | we may be subject to litigation or product liability claims; and |

| • | our reputation may suffer. |

Any of these events could prevent us, Sanofi or our potential future partners from achieving or maintaining market acceptance of the affected product or could substantially increase commercialization costs and expenses, which in turn could delay or prevent us from generating significant revenues from the sale of our products.

Reimbursement decisions by third-party payors may have an adverse effect on pricing and market acceptance. If there is not sufficient reimbursement for our products, it is less likely that our products will be widely used.

Market acceptance and sales of delafloxacin, radezolid, or any other product candidates that we develop will depend on reimbursement policies and may be affected by future healthcare reform measures. Government authorities and third-party payors, such as private health insurers and health maintenance organizations, decide which drugs they will cover and establish payment levels. We cannot be certain that reimbursement will be available for delafloxacin, radezolid, or any other product candidates that we develop. Also, we cannot be certain that reimbursement policies will not reduce the demand for, or the price paid for, our products. If reimbursement is not available or is available on a limited basis, we may not be able to successfully commercialize delafloxacin, radezolid, or any other product candidates that we develop.

In the United States, the Medicare Prescription Drug, Improvement, and Modernization Act of 2003, also called the Medicare Modernization Act, or MMA, changed the way Medicare covers and pays for pharmaceutical products. The legislation established Medicare Part D, which expanded Medicare coverage for outpatient prescription drug purchases by the elderly but provided authority for limiting the number of drugs that will be covered in any therapeutic class. The MMA also introduced a new reimbursement methodology based on average sales prices for physician-administered drugs.