Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - OLIN Corp | form8kasmresultbarclays50312.htm |

1

Barclays Capital

Chemical ROC Stars Conference

May 3, 2012

May 3, 2012

Exhibit 99.1

2

Company Overview

All financial data are for the quarter ended March 31, 2012, and the years ending December 31, 2011 and December 31, 2010. Data are

presented in millions of U.S. dollars except for earnings per share. 2011 results include a pretax $181 million gain associated with the

remeasurement of Olin’s SunBelt interest, or $1.30 per share. Additional information is available at www.olin.com.

presented in millions of U.S. dollars except for earnings per share. 2011 results include a pretax $181 million gain associated with the

remeasurement of Olin’s SunBelt interest, or $1.30 per share. Additional information is available at www.olin.com.

Winchester

Chlor Alkali

Third Largest North American Producer of

Chlorine and Caustic Soda

Chlorine and Caustic Soda

Q1 2012 FY 2011 FY 2010

Revenue: $ 360 $ 1,389 $ 1,037

EBITDA: $ 96 $ 331 $ 192

Income: $ 74 $ 245 $ 117

A Leading North American Producer of Small

Caliber Ammunition

Caliber Ammunition

Q1 2012 FY 2011 FY 2010

Revenue: $ 148 $ 572 $ 549

EBITDA: $ 14 $ 49 $ 73

Income: $ 11 $ 38 $ 63

Revenue: $ 507 $ 1,961 $ 1,586

Pretax Income: $ 61 $ 380 $ 77

EPS (Diluted): $ .48 $ 2.99 $ .81

Q1 2012 FY 2011 FY 2010

Olin Corporation

3

Investment Rationale

• Leading North American producer of Chlor-Alkali

• Leading producer of industrial bleach with additional growth

opportunities

opportunities

• Leading producer of burner grade hydrochloric acid

• Favorable industry dynamics for both businesses

• Winchester’s leading industry position

• Significant cost reduction program underway

• Strong balance sheet, positive earnings outlook

• 342nd consecutive quarterly dividend declared

4

Improving EBITDA

• Since 2000, net chlor alkali capacity

has been reduced in North America

by approximately 7%

has been reduced in North America

by approximately 7%

• The North American chlor alkali

industry has consolidated

industry has consolidated

• Olin’s acquisitions have been

immediately accretive to earnings

immediately accretive to earnings

• Downstream bleach and HCl growth

has increased earnings and margins

has increased earnings and margins

• Winchester post surge profits are

greater than pre-surge profits

greater than pre-surge profits

• Centerfire relocation to MS will

increase Winchester EBIT by $30

million per year when complete

increase Winchester EBIT by $30

million per year when complete

• Q1 2012 EBITDA is the highest Q1

EBITDA in the Company’s history

EBITDA in the Company’s history

Olin Adjusted EBITDA

5

Chlor Alkali Process

ECU = Electrochemical Unit; a unit of measure reflecting the chlor alkali process outputs

of 1 ton of chlorine, 1.13 tons of 100% caustic soda and .03 tons of hydrogen.

of 1 ton of chlorine, 1.13 tons of 100% caustic soda and .03 tons of hydrogen.

North

American

Position

American

Position

Percent

of 2011

Revenue

of 2011

Revenue

#2

#3

#1

Industrial

Industrial

#1

Merchant

Merchant

#1

Burner

Grade

Burner

Grade

50%

10%

4%

9%

26%

1%

Raw Materials

BRINE + ELECTROLYSIS = PRODUCTS

Caustic Soda - 1.13 Tons

(Sodium Hydroxide)

(Potassium Hydroxide)

Bleach

(Sodium Hypochlorite)

Chlorine - 1 Ton

Potassium Chloride

or

Sodium Chloride

KOH - 1.59 Tons

HCl

(Hydrochloric Acid)

Hydrogen Gas - .03 Tons

KOH

or

Caustic Soda

Chlorine

Hydrogen

6

Integrated Vinyls Producers

7

Mercury Transition Plan

• Olin currently operates 2 mercury cell plants representing

approximately 360,000 ECUs or 17% of our total capacity

approximately 360,000 ECUs or 17% of our total capacity

• By the end of 2012, Olin expects to convert 200,000 ECUs

of mercury cell technology to membrane technology and will

shutdown the remaining 160,000 ECUs

of mercury cell technology to membrane technology and will

shutdown the remaining 160,000 ECUs

• This project will right size our capacity in the region, service

our local customers with the latest technology, reduce our

electricity costs, and close our highest cost chlor alkali plant

our local customers with the latest technology, reduce our

electricity costs, and close our highest cost chlor alkali plant

• Estimated capital expenditures of $160 million are expected

over 2011 and 2012, aided by $41 million of low-cost

Tennessee-sponsored tax-exempt financing

over 2011 and 2012, aided by $41 million of low-cost

Tennessee-sponsored tax-exempt financing

8

Capacity Rationalization

Favorable Industry Dynamics

Acquisition

Date

Date

Position

Source: CMAI.

Industry Consolidation

1.26 million

tons of capacity

rationalized;

7.3% of 2000

7.3% of 2000

capacity

16,040

17,300

2007

2004

• Acquired by Olin

• 725,000 Short Tons ECU Capacity

• 4.7% of North American capacity

• Acquired by OxyChem

• 859,000 Short Tons ECU Capacity

• 5.5% of North American capacity

Pioneer

Vulcan

2010

• Acquired by Cydsa/Iquisa

• 45,000 Short Tons ECU Capacity

Mexichem

2011

• Olin acquired PolyOne’s 50%

ownership in the SunBelt JV

ownership in the SunBelt JV

• 176,000 Short Tons ECU Capacity

PolyOne

2011

• Acquired by PPG

• 70,000 Short Tons ECU Capacity

Equa-Chlor

9

Diverse Customer Base

Chlorine

Caustic Soda

North American Industry

Olin Corporation

Source: CMAI and Olin 2011 demand. Includes sales of SunBelt.

Chlorine: “Organics” includes: Propylene oxide, epichlorohydrin, MDI, TDI, polycarbonates. “Inorganics” includes: Titanium dioxide and bromine.

Caustic Soda: “Organics” includes: MDI, TDI, polycarbonates, synthetic glycerin, sodium formate, monosodium glutamate. “Inorganics” includes: titanium dioxide, sodium silicates, sodium cyanide.

10

Bleach Plants

39

Tacoma, WA

Tracy, CA

Santa Fe Springs, CA

Henderson, NV

St. Gabriel, LA

Augusta, GA

Charleston, TN

Niagara Falls, NY

Becancour,

Quebec

Olin’s Geographic Advantage

|

Location

|

Chlorine Capacity

(000s Short Tons)

|

|

McIntosh, AL

|

426 Diaphragm

|

|

McIntosh, AL - SunBelt

|

352 Membrane

|

|

Becancour, Quebec

|

297 Diaphragm

65 Membrane

|

|

Niagara Falls, NY

|

300 Membrane

|

|

Charleston, TN (1)

|

226 Mercury

|

|

St. Gabriel, LA

|

246 Membrane

|

|

Henderson, NV

|

153 Diaphragm

|

|

Augusta, GA (1)

|

75 Mercury

|

|

Total

|

2,140

|

• Access to regional customers including bleach and water treatment

• Access to alternative energy sources

– Coal, hydroelectric, natural gas and nuclear

(1) Announced the conversion of 200,000 tons of mercury cell technology to membrane cell technology at the Charleston, TN facility

and the closure of the mercury cell facility in Augusta, GA, both are expected to be completed by 12/31/12.

11

Industrial Bleach

• Olin is the leading North American bleach producer with 18% market

share and planned capacity additions will provide Olin the ability to

double market share by 2013

share and planned capacity additions will provide Olin the ability to

double market share by 2013

• Bleach utilizes both chlorine and caustic soda in an ECU ratio

• Bleach commands a premium price over an ECU

• Demand is seasonal, but not cyclical

• Regional nature of the bleach business benefits Olin’s geographic

diversity, further enhanced by Olin’s proprietary railcar technology

diversity, further enhanced by Olin’s proprietary railcar technology

• In 2012, 3 new HyPure® Bleach investments will add 50% more bleach

capacity to the Olin system, extend shelf life and lower freight costs

capacity to the Olin system, extend shelf life and lower freight costs

• Q1 2012 bleach shipments increased 8% over Q1 2011 levels and we

now have the capacity to convert 12% of our ECUs into bleach

now have the capacity to convert 12% of our ECUs into bleach

12

Bleach Growth is a Key Objective

• Olin bleach volume delivers steady growth

• Key bleach target segments include water

treatment, consumer products, food, farming

and pool chemicals

treatment, consumer products, food, farming

and pool chemicals

• Increased stability and shelf life

• Reduced transportation costs

• Larger shipping radius

• Proprietary Olin advantages

• Potential new category of consumer products

OLIN HYPURE® BLEACH

AND RAILCAR DELIVERY WILL

IMPROVE ACCESS TO THE MARKET

13

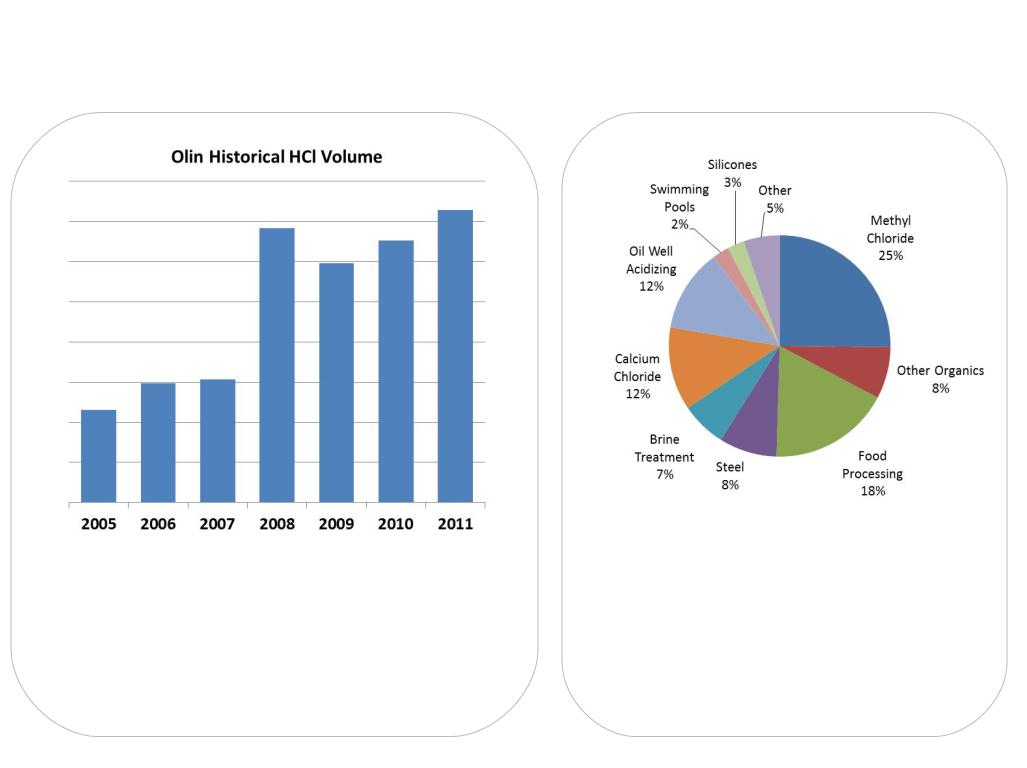

Hydrochloric Acid

• HCl demand is strong, primarily from oil and gas exploration,

resulting in Q1 2012 volumes up 10% over Q1 2011 levels

resulting in Q1 2012 volumes up 10% over Q1 2011 levels

• Demand for HCl is currently higher than supply

• By-product HCl accounts for 75% of the market supply, but

availability is subject to urethane and fluorocarbon demand

availability is subject to urethane and fluorocarbon demand

• Currently 25% of HCl market supply is “Burner-grade” or “on-

purpose” HCl

purpose” HCl

• Burner grade HCl is a reliable source, and while a small cost

component in oil and gas exploration, is critical to the process

component in oil and gas exploration, is critical to the process

• Olin has the ability to convert 8% of our capacity into HCl sales

• Favorable HCl pricing and volumes contributed approximately

$9 million more in EBIT during Q1 2012 over Q1 2011

$9 million more in EBIT during Q1 2012 over Q1 2011

14

Growing HCl Demand

North American HCl Supply

• Burner acid is the only growing HCl supply source

• 75% of HCl is supplied by Gulf byproduct producers

• Byproduct HCl availability is less reliable than burner

• Olin is ideally positioned to serve the West & North

North American HCl Demand

• Oil & Gas demand has outstripped supply

• U.S. steel industry demand is recovering

• Diverse demand segments grow with GDP

• 2011 supply shortages upset the market

Source: CEH 2009

15

Chlor-Alkali Outlook

• Q1 2012 ECU netbacks of $585 were down slightly from Q4 2011 levels

• At this time, the success of the Q1 price announcements of $40 for chlorine

and $45 for caustic soda remain uncertain

and $45 for caustic soda remain uncertain

• Q1 2012 operating rates increased to 80% and we expect our system operating

rates to be in the mid-80% range in Q2 reflecting higher bleach demand

rates to be in the mid-80% range in Q2 reflecting higher bleach demand

• Q1 2012 bleach shipments increased 8% over Q1 2011 levels marking the 17th

consecutive year-over-year quarterly increase

consecutive year-over-year quarterly increase

• During Q1, the new HyPure® Bleach facility in McIntosh, AL was completed

and two more facilities are scheduled for completion in 2012 which will

increase our bleach capacity by 50% over 2011 levels

and two more facilities are scheduled for completion in 2012 which will

increase our bleach capacity by 50% over 2011 levels

• 2011 HCl sales increased 12% over 2010 levels and Q1 2012 levels are 8%

higher than Q1 2011 levels adding $9 million of incremental EBIT to the

current quarter results

higher than Q1 2011 levels adding $9 million of incremental EBIT to the

current quarter results

(1)

(1) ECU netback = Price of 1 ton of Chlorine + 1.1 x price of 1 ton of Caustic Soda - Freight cost

16

Winchester Segment

Winchester Strategy

• Cost Reduction

– Centerfire relocation

– Once complete, we

expect $30 million

lower operating costs

expect $30 million

lower operating costs

– Meaningful savings

begin in 2013

begin in 2013

• New Product Development

– Continue to develop

new product offerings

new product offerings

– Maintain reputation as a

new product innovator

new product innovator

• Provide returns in excess of

cost of capital

cost of capital

|

|

Hunters & Recreational Shooters

|

|

|

|

||

|

Products

|

Retail

|

Distributors

|

Mass

Merchants |

Law

Enforcement |

Military

|

Industrial

|

|

Rifle

|

ü

|

ü

|

ü

|

ü

|

ü

|

N/A

|

|

Handgun

|

ü

|

ü

|

ü

|

ü

|

ü

|

N/A

|

|

Rimfire

|

ü

|

ü

|

ü

|

ü

|

ü

|

ü

|

|

Shotshell

|

ü

|

ü

|

ü

|

ü

|

ü

|

ü

|

|

Components

|

ü

|

ü

|

ü

|

ü

|

ü

|

ü

|

Brands

17

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

U.S. Commercial Ammunition

Manufacturer Shipments2

U.S. Firearms Production3

U.S. Gun Sale

Background Checks (NICS)1

Data Correlations

•NICS Checks & U.S. Firearms Production: +94%

•U.S. Commercial Ammunition Mfr. Shipments & U.S. Firearms Production: +94%

•U.S. Commercial Ammunition Mfr. Shipments & NICS Checks: +88%

1Reflect the FBI’s National Instant Criminal background check System statistics (NICS).

2Estimated based on NSSF Trade Statistics Program Ammunition Manufacturer Surveys, Department of Commerce U.S. Import Statistics, and internal Winchester estimates.

3Reflects production reported on Bureau of Alcohol, Tobacco, Firearms and Explosives’ Annual Firearms Manufacturing and Export Reports.

Strong Correlation Between

Firearm and Ammunition Sales

Firearm and Ammunition Sales

18

Winchester

• Q1 2012 earnings down from Q1 2011 due to higher commodity and

transition costs associated with the Oxford, MS relocation

transition costs associated with the Oxford, MS relocation

• Commercial sales were strong in Q1 2012 and commercial backlogs

increased over $100 million during the quarter

increased over $100 million during the quarter

• During 2012, we expect that the relocation efforts in moving centerfire

operations from East Alton, IL to Oxford, MS will transition from

incremental costs to operational savings

operations from East Alton, IL to Oxford, MS will transition from

incremental costs to operational savings

• In January, U.S. Munitions, a joint venture between Winchester and

BAE Systems, submitted a bid to operate the U.S. Army’s Lake City

munitions plant for 10 years; a decision is expected October, 2012

BAE Systems, submitted a bid to operate the U.S. Army’s Lake City

munitions plant for 10 years; a decision is expected October, 2012

• In March, the U.S. Army awarded 9mm NATO and shotshell contracts

to Winchester estimated to be worth approximately $20 million

to Winchester estimated to be worth approximately $20 million

• We expect Q2 2012 earnings to be comparable with Q2 2011 results

19

Centerfire Relocation

• The decision to relocate Winchester’s centerfire operations,

including 1,000 jobs, was made on November 3, 2010

including 1,000 jobs, was made on November 3, 2010

• The controlled relocation process is expected to take up to 5 years

to complete, assuring high quality product is available for our

customers throughout the transition

to complete, assuring high quality product is available for our

customers throughout the transition

• The new 500,000 square foot facility was opened in October

2011 and equipment relocation began in Q3 2011

2011 and equipment relocation began in Q3 2011

• During Q1, about 2/3rds of pistol rounds were made in Oxford

• Annual operating costs are expected to be reduced by $30 million

once the move is completed, meaningful cost savings are

expected to be realized in second half of 2013

once the move is completed, meaningful cost savings are

expected to be realized in second half of 2013

• The net project cost is estimated to be $80 million, of which

approximately $50 million is related to capital expenditures

approximately $50 million is related to capital expenditures

• In addition to $31 million of grants from MS, $42 million of low-

cost MS tax-exempt debt was made available to Olin

cost MS tax-exempt debt was made available to Olin

20

Strong Balance Sheet

• The 3/31/12 cash balance of $255 million reflects:

• Normal seasonal working capital growth of $71 million;

• $76 million of capital spending associated with mercury conversion

project, construction of 3 HyPure® bleach plants and the centerfire

relocation to Oxford, MS; and

project, construction of 3 HyPure® bleach plants and the centerfire

relocation to Oxford, MS; and

• $17 million returned to shareholders

• No material debt maturities until 2016 and no debt towers in

excess of $150 million

excess of $150 million

• The Olin pension plans remain fully funded with no

contributions expected until at least 2014

contributions expected until at least 2014

• 2012 CAPEX is forecast to be in the $215 to 245 million

range which includes:

range which includes:

• completion of the mercury conversion projects in TN and GA;

• construction of three new HyPure® Bleach facilities; and

• continued progress on the Winchester centerfire relocation project

21

• Q1 2012 Chlor Alkali earnings were almost $75 million and

Winchester earned almost $12 million contributing to the

highest level of EBIDTA in the Company’s long history

Winchester earned almost $12 million contributing to the

highest level of EBIDTA in the Company’s long history

• Operating rates are projected to be in the mid-80% range in

the Q2 reflecting the normal pick-up in bleach demand

the Q2 reflecting the normal pick-up in bleach demand

• Bleach sales continue to realize year over year growth

• The 3 new HyPure® plants this year will provide Olin the

ability to convert over 15% of our ECUs into bleach

ability to convert over 15% of our ECUs into bleach

• HCl demand and volumes are strong resulting in $9 million of

incremental EBIT in Q1 2012 as compared to Q1 2011

incremental EBIT in Q1 2012 as compared to Q1 2011

• Q1 2012 Winchester commercial volumes are starting strong

with backlog building over $100 million

with backlog building over $100 million

• The Oxford centerfire relocation project is on schedule

toward the goal of reducing annual expenses by $30 million

toward the goal of reducing annual expenses by $30 million

Profit Outlook

22

Forward-Looking Statements

This presentation contains estimates of future

performance, which are forward-looking statements

and actual results could differ materially from those

anticipated in the forward-looking statements. Some

of the factors that could cause actual results to differ

are described in the business and outlook sections of

Olin’s Form 10-K for the year ended December 31,

2011 and in Olin’s First Quarter 2012 Form 10-Q.

These reports are filed with the U.S. Securities and

Exchange Commission.

performance, which are forward-looking statements

and actual results could differ materially from those

anticipated in the forward-looking statements. Some

of the factors that could cause actual results to differ

are described in the business and outlook sections of

Olin’s Form 10-K for the year ended December 31,

2011 and in Olin’s First Quarter 2012 Form 10-Q.

These reports are filed with the U.S. Securities and

Exchange Commission.