Attached files

| file | filename |

|---|---|

| 8-K - 8-K - EQUITY ONE, INC. | d342182d8k.htm |

| EX-99.1 - EX-99.1 - EQUITY ONE, INC. | d342182dex991.htm |

Exhibit 99.2

Equity One, Inc.

Supplemental Information Package

March 31, 2012

Equity One, Inc.

1600 N.E. Miami Gardens Drive

North Miami Beach, Florida 33179

Tel: (305) 947-1664 Fax: (305) 947-1734

www.equityone.net

| Equity One, Inc. |

|

| SUPPLEMENTAL INFORMATION March 31, 2012 (unaudited) |

| TABLE OF CONTENTS | ||||

| Page | ||||

| Overview |

||||

| Disclosures |

3 | |||

| Summary Financial Results and Ratios |

4 | |||

| Assets, Liabilities, and Equity |

||||

| Condensed Consolidated Balance Sheets |

5 | |||

| Market Capitalization |

6 | |||

| Income, EBITDA, and FFO |

||||

| Condensed Consolidated Statements of Income |

7 | |||

| Pro Forma Financial Information for Discontinued Operations |

8 | |||

| Net Operating Income |

9 | |||

| Adjusted EBITDA |

10 | |||

| Consolidated Statements of Funds from Operations |

11 | |||

| Additional Disclosures |

12 | |||

| Leasing Data |

||||

| Tenant Concentration - Top Twenty Five Tenants |

13 | |||

| Recent Leasing Activity |

14 | |||

| Shopping Center Lease Expiration Schedule |

15 | |||

| Property Data |

||||

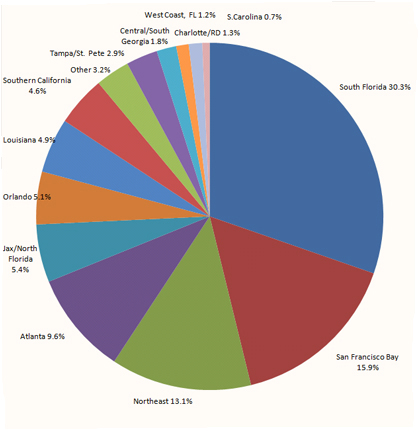

| Annual Minimum Rent of Operating Properties by Metro/Region |

16 | |||

| Property Status Report |

17-24 | |||

| Real Estate Acquisitions and Dispositions |

25 | |||

| Real Estate Developments and Redevelopments |

26 | |||

| Debt Schedules |

||||

| Debt Summary |

27 | |||

| Consolidated Debt Maturity Schedule |

28 | |||

| Consolidated Debt Summary - Property Mortgage Detail |

29 | |||

| Consolidated Debt Summary - Unsecured Notes, Lines of Credit, and Total |

30 | |||

| Joint Venture Supplemental Data |

31-33 | |||

| EQUITY ONE, INC. DISCLOSURES As of March 31, 2012 |

| |

|

| ||

Forward Looking Statements

Certain information contained in this Supplemental Information Package constitutes forward-looking statements within the meaning of the federal securities laws. Although Equity One believes that the expectations reflected in such forward-looking statements are based upon reasonable assumptions, it can give no assurance that these expectations will be achieved. Factors that could cause actual results to differ materially from current expectations include changes in macro-economic conditions and the demand for retail space in the states in which Equity One owns properties; the continuing financial success of Equity One’s current and prospective tenants; the risks that Equity One may not be able to proceed with or obtain necessary approvals for development or redevelopment projects or that it may take more time to complete such projects or incur costs greater than anticipated; the availability of properties for acquisition; the extent to which continuing supply constraints occur in geographic markets where Equity One owns properties; the success of its efforts to lease up vacant space; the effects of natural and other disasters; the ability of Equity One to successfully integrate the operations and systems of acquired companies and properties; changes in Equity One’s credit ratings; and other risks, which are described in Equity One’s filings with the Securities and Exchange Commission.

Basis of Presentation

The information contained in the Supplemental Information Package does not purport to disclose all items required by GAAP and is unaudited information. The Company’s Form 10-K for the year ended December 31, 2011 and Form 10-Q for the period ended March 31, 2012, should be read in conjunction with this Supplemental Information Package. The results of operations of any property acquired are included in our financial statements since the date of its acquisition, although such properties may be excluded from certain metrics disclosed in this Supplemental Information Package. When presenting the balance sheet and income statement of unconsolidated joint ventures we exclude variable interest entities required to be consolidated under GAAP for which the joint venture does not hold title to the underlying property.

EBITDA is a widely used performance measure and is provided as a supplemental measure of operating performance. We compute EBITDA as the sum of net income before extraordinary items, depreciation and amortization, income taxes, interest expense, gain (loss) on disposal of income producing properties, gain (loss) on debt extinguishment, gain (loss) on sale of securities, acquisition and disposition costs, bargain purchase gain and impairment of real estate. Given the nature of our business as a real estate owner and operator, we believe that the use of EBITDA as opposed to earnings in various financial ratios is helpful to investors as a measure of our operational performance because EBITDA excludes various items included in earnings that do not relate to or are not indicative of our operating performance, such as gains and losses on sales of real estate and real estate related depreciation and amortization, and includes the results of operations of real estate properties that were sold or classified as real estate held for sale either during or subsequent to the end of a particular reporting period, which are included in earnings on a net basis. Accordingly, we believe that the use of EBITDA as opposed to earnings in various ratios provides a meaningful performance measure as it relates to our ability to meet various coverage tests for the stated periods.

EBITDA should not be considered as an alternative to earnings as an indicator of our financial performance, or as an alternative to cash flow from operating activities as a measure of our liquidity. Our computation of EBITDA may differ from the methodology utilized by other companies to calculate EBITDA. Investors are cautioned that items excluded from EBITDA are significant components in understanding and assessing the Company’s financial performance.

Use of Funds from Operations as a Non-GAAP Financial Measure

We believe Funds from Operations (FFO) (combined with the primary GAAP presentations) is a useful supplemental measure of our operating performance that is a recognized metric used extensively by the real estate industry, particularly REITs. NAREIT stated in its April 2002 White Paper on FFO, “Historical cost accounting for real estate assets implicitly assumes that the value of real estate assets diminishes predictably over time. Since real estate values have historically risen or fallen with market conditions many industry investors have considered presentations of operating results for real estate companies that use historical cost accounting to be insufficient by themselves.” FFO, as defined by NAREIT, is net income (computed in accordance with GAAP), excluding (gains or losses) from sales of, or any impairment charges related to, depreciable operating properties, plus depreciation and amortization, and after adjustments for unconsolidated partnerships and joint ventures. Adjustments for unconsolidated partnerships and joint ventures will be calculated to reflect funds from operations on the same basis. In October 2011, NAREIT clarified that FFO should exclude the impact of impairment losses on depreciable operating properties, either wholly owned or in joint ventures. We have calculated FFO for all periods presented in accordance with this clarification.

We believe that financial analysts, investors and stockholders are better served by the presentation of comparable period operating results generated from our FFO measure. Our method of calculating FFO may be different from methods used by other REITs and accordingly, may not be comparable to such other REITs. FFO is presented to assist investors in analyzing our operating performance. FFO (i) does not represent cash flow from operations as defined by GAAP, (ii) is not indicative of cash available to fund all cash flow needs, including the ability to make distributions, (iii) is not an alternative to cash flow as measure of liquidity, and (iv) should not be considered as an alternative to net income (which is determined in accordance with GAAP) for purposes of evaluating our operating performance. We believe net income is the most directly comparable GAAP measure to FFO.

Page 3

| EQUITY ONE, INC. SUMMARY FINANCIAL RESULTS AND RATIOS For the three months ended March 31, 2012 and 2011 (in thousands, except per share data) |

| |

|

| ||

| For the three months ended | ||||||||

| March 31, 2012 |

March 31, 2011 |

|||||||

| Summary Financial Results |

||||||||

| Total revenues* |

$ | 83,067 | $ | 86,789 | ||||

| Adjusted EBITDA (see page 10) |

$ | 50,314 | $ | 51,361 | ||||

| Property net operating income (see page 9) |

$ | 59,581 | $ | 61,480 | ||||

| General & administrative expenses (G&A)* - Adjusted(1) |

$ | 10,128 | $ | 9,026 | ||||

| Net income attributable to Equity One |

$ | 18,982 | $ | 34,994 | ||||

| Net income per diluted share |

$ | 0.16 | $ | 0.32 | ||||

| Funds from operations (FFO) |

$ | 33,242 | $ | 61,040 | ||||

| FFO per diluted share |

$ | 0.27 | $ | 0.52 | ||||

| Total dividends paid per share |

$ | 0.22 | $ | 0.22 | ||||

| Weighted average diluted shares used in EPS computations |

112,820 | 117,258 | ||||||

| Weighted average diluted shares used in FFO computations(2) |

124,178 | 117,258 | ||||||

| Summary Operating and Financial Ratios |

||||||||

| Core shopping center portfolio occupancy at end of period (see pages 17-24) |

91.2 | % | 90.3 | % | ||||

| Same-property shopping center portfolio occupancy at end of period(3) |

90.8 | % | 90.9 | % | ||||

| Same-property NOI growth - cash basis (see page 9) |

4.5 | % | 0.3 | % | ||||

| NOI margin (see page 9) |

72.4 | % | 71.2 | % | ||||

| Expense recovery ratio* |

79.3 | % | 74.2 | % | ||||

| New, renewal and option rent spread - cash basis (see page 14) |

3.5 | % | -4.3 | % | ||||

| Adjusted G&A expense to total revenues(1) |

12.2 | % | 10.4 | % | ||||

| Net debt to total market capitalization (see page 6) |

35.3 | % | 39.9 | % | ||||

| Net debt to Adjusted EBITDA (see page 10) |

6.8 | 7.2 | ||||||

| Adjusted EBITDA to interest expense* (see page 10) |

2.8 | 2.4 | ||||||

| Adjusted EBITDA to fixed charges* (see page 10) |

2.5 | 2.0 | ||||||

| * | The indicated line item includes amounts reported in discontinued operations. |

| (1) | G&A expense for the three months ended March 31, 2012 deducts $1.3 million for external costs associated with acquisition and disposition related expenses during the period, as well as depreciation & amortization amounts included in G&A. G&A expense for the three months ended March 31, 2011 deducts $2.3 million for external costs associated with acquired properties and acquisition related expenses during the period, $0.5 million in severance costs, as well as depreciation & amortization amounts included in G&A. |

| (2) | Weighted average diluted shares for the three months ended March 31, 2012 are higher than the GAAP diluted weighted average shares as a result of the 11.4 million units held by Liberty International Holdings, Ltd. which are convertible into our common stock. These convertible units are not included in the diluted weighted average share count for GAAP purposes because their inclusion is antidilutive. |

| (3) | Information provided on a same property basis is provided for only those properties that were owned and operated for the entirety of both periods being compared, excludes properties that were redeveloped, expanded or under development and properties purchased or sold at any time during the periods being compared. |

Page 4

| EQUITY ONE, INC. CONDENSED CONSOLIDATED BALANCE SHEETS As of March 31, 2012 and December 31, 2011 and 2010 (unaudited) (in thousands) |

| |

|

| ||

| Mar 31, 2012 | Dec 31, 2011 | Dec 31, 2010 | ||||||||||

| Assets |

||||||||||||

| Properties: |

||||||||||||

| Income producing |

$ | 3,106,668 | $ | 2,955,605 | $ | 2,117,245 | ||||||

| Less: accumulated depreciation |

(309,214 | ) | (299,106 | ) | (248,528 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Income producing properties, net |

2,797,454 | 2,656,499 | 1,868,717 | |||||||||

| Construction in progress and land held for development |

125,199 | 104,792 | 74,402 | |||||||||

| Properties held for sale or properties sold in a disposal group |

11,901 | 46,655 | 513,230 | |||||||||

|

|

|

|

|

|

|

|||||||

| Properties, net |

2,934,554 | 2,807,946 | 2,456,349 | |||||||||

| Cash and cash equivalents |

17,326 | 103,524 | 38,333 | |||||||||

| Accounts and other receivables, net |

8,777 | 17,790 | 12,559 | |||||||||

| Investments in and advances to unconsolidated joint ventures |

54,963 | 50,158 | 59,736 | |||||||||

| Mezzanine loans receivable, net |

64,710 | 45,279 | — | |||||||||

| Goodwill |

8,401 | 8,406 | 9,561 | |||||||||

| Other assets |

208,782 | 189,468 | 104,024 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total Assets |

$ | 3,297,513 | $ | 3,222,571 | $ | 2,680,562 | ||||||

|

|

|

|

|

|

|

|||||||

| Liabilities and stockholders’ equity |

||||||||||||

| Liabilities: |

||||||||||||

| Mortgage notes payable |

$ | 468,485 | $ | 471,754 | $ | 354,379 | ||||||

| Unsecured senior notes payable |

681,136 | 691,136 | 691,136 | |||||||||

| Term loan |

200,000 | $ | — | $ | — | |||||||

| Unsecured revolving credit facilities |

42,000 | 138,000 | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Total debt |

1,391,621 | 1,300,890 | 1,045,515 | |||||||||

| Unamortized premium (discount) on notes payable, net |

7,384 | 8,181 | (1,805 | ) | ||||||||

|

|

|

|

|

|

|

|||||||

| Total notes payable |

1,399,005 | 1,309,071 | 1,043,710 | |||||||||

| Accounts payable and other liabilities |

238,522 | 223,198 | 115,166 | |||||||||

| Liabilities associated with assets held for sale or sold in a disposal group |

— | 27,587 | 181,458 | |||||||||

| Deferred tax liability |

14,608 | 14,709 | 46,523 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total liabilities |

1,652,135 | 1,574,565 | 1,386,857 | |||||||||

| Redeemable noncontrolling interests |

22,726 | 22,804 | 3,864 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total stockholders’ equity of Equity One, Inc. |

1,414,696 | 1,417,316 | 1,285,907 | |||||||||

|

|

|

|

|

|

|

|||||||

| Noncontrolling interests |

207,956 | 207,886 | 3,934 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total Liabilities and Stockholders’ Equity |

$ | 3,297,513 | $ | 3,222,571 | $ | 2,680,562 | ||||||

|

|

|

|

|

|

|

|||||||

Page 5

| EQUITY ONE, INC. MARKET CAPITALIZATION As of March 31, 2012 and December 31, 2011 and 2010 (in thousands, except share data) |

| |

|

| ||

| Mar 31, 2012 | Dec 31, 2011 | Dec 31, 2010 | ||||||||||

| Closing market price of common stock |

$ | 20.22 | $ | 16.98 | $ | 18.18 | ||||||

| Common stock shares |

||||||||||||

| Basic common shares |

112,692.009 | 112,599.355 | 102,326.818 | |||||||||

| Diluted common shares |

||||||||||||

| Unvested restricted common shares |

182.336 | 107.888 | 149.980 | |||||||||

| DownREIT units (convertible into shares) |

93.656 | 93.656 | 93.656 | |||||||||

| Common stock options (treasury method, closing price) |

223.540 | 114.575 | 124.506 | |||||||||

| Long term incentive plan performance awards |

— | — | 356.516 | |||||||||

| Convertible CapCo Partnership Units |

11,357.837 | 11,357.837 | — | |||||||||

|

|

|

|

|

|

|

|||||||

| Diluted common shares |

124,549.378 | 124,273.311 | 103,051.476 | |||||||||

|

|

|

|

|

|

|

|||||||

| Equity market capitalization |

$ | 2,518,388 | $ | 2,110,161 | $ | 1,873,476 | ||||||

|

|

|

|

|

|

|

|||||||

| Total debt (excluding unamortized/unaccreted premium/(discount))(1) |

$ | 1,391,621 | $ | 1,328,174 | $ | 1,224,796 | ||||||

| Cash and equivalents |

(17,326 | ) | (103,524 | ) | (38,333 | ) | ||||||

|

|

|

|

|

|

|

|||||||

| Net debt(1) |

1,374,295 | 1,224,650 | 1,186,463 | |||||||||

| Equity market capitalization |

2,518,388 | 2,110,161 | 1,873,476 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total market capitalization |

$ | 3,892,684 | $ | 3,334,811 | $ | 3,059,939 | ||||||

|

|

|

|

|

|

|

|||||||

| Net debt to total market capitalization at current market price |

35.3 | % | 36.7 | % | 38.8 | % | ||||||

| Net debt to total market capitalization at constant share price of $16.98 |

39.4 | % | 36.7 | % | 40.4 | % | ||||||

|

|

|

|

|

|

|

|||||||

| Gross real estate and securities investments |

$ | 3,243,768 | $ | 3,107,052 | $ | 2,704,877 | ||||||

| Net debt to gross real estate and securities investments |

42.4 | % | 39.4 | % | 43.9 | % | ||||||

| (1) | Includes $27.3 million and $179.3 million of secured mortgage debt related to assets held for sale as of December 31, 2011 and December 31, 2010, respectively. |

Page 6

| EQUITY ONE, INC. CONDENSED CONSOLIDATED STATEMENTS OF INCOME For the three months ended March 31, 2012 and 2011 (unaudited) (in thousands, except per share amounts) |

| |

|

| ||

| Three months ended | Percent Change |

|||||||||||

| March 31, 2012 |

March 31, 2011 |

|||||||||||

| REVENUE: |

||||||||||||

| Minimum rent |

$ | 60,818 | $ | 53,171 | ||||||||

| Expense recoveries |

17,939 | 15,748 | ||||||||||

| Percentage rent |

1,954 | 1,454 | ||||||||||

| Management and leasing services |

804 | 466 | ||||||||||

|

|

|

|

|

|

|

|||||||

| Total revenue |

81,515 | 70,839 | 15.1 | % | ||||||||

|

|

|

|

|

|

|

|||||||

| COSTS AND EXPENSES: |

||||||||||||

| Property operating |

22,130 | 20,574 | ||||||||||

| Rental property depreciation and amortization |

21,715 | 18,766 | ||||||||||

| General and administrative |

11,560 | 11,977 | ||||||||||

|

|

|

|

|

|

|

|||||||

| Total costs and expenses |

55,405 | 51,317 | 8.0 | % | ||||||||

|

|

|

|

|

|

|

|||||||

| INCOME BEFORE OTHER INCOME AND EXPENSE, TAX AND DISCONTINUED OPERATIONS |

26,110 | 19,522 | ||||||||||

| OTHER INCOME AND EXPENSE: |

||||||||||||

| Investment income |

1,445 | 693 | ||||||||||

| Other income |

141 | 129 | ||||||||||

| Interest expense |

(17,369 | ) | (17,551 | ) | ||||||||

| Amortization of deferred financing fees |

(593 | ) | (539 | ) | ||||||||

| Equity in (loss) income of unconsolidated joint ventures |

(188 | ) | 366 | |||||||||

| (Loss) gain on extinguishment of debt |

(93 | ) | 42 | |||||||||

| Gain on bargain purchase |

— | 30,561 | ||||||||||

|

|

|

|

|

|||||||||

| INCOME FROM CONTINUING OPERATIONS BEFORE TAX AND DISCONTINUED OPERATIONS |

9,453 | 33,223 | ||||||||||

| Income tax benefit of taxable REIT subsidiaries |

46 | 133 | ||||||||||

|

|

|

|

|

|

|

|||||||

| INCOME FROM CONTINUING OPERATIONS |

9,499 | 33,356 | -71.5 | % | ||||||||

|

|

|

|

|

|

|

|||||||

| DISCONTINUED OPERATIONS: |

||||||||||||

| Operations of income producing properties sold or held for sale |

(141 | ) | 3,589 | |||||||||

| Gain on disposal of income producing properties |

14,269 | — | ||||||||||

| Impairment loss on income producing properties sold or held for sale |

(1,932 | ) | — | |||||||||

| Income tax benefit of taxable REIT subsidiaries |

— | 432 | ||||||||||

|

|

|

|

|

|||||||||

| INCOME FROM DISCONTINUED OPERATIONS |

12,196 | 4,021 | ||||||||||

|

|

|

|

|

|||||||||

| NET INCOME |

21,695 | 37,377 | -42.0 | % | ||||||||

|

|

|

|

|

|

|

|||||||

| Net income attributable to noncontrolling interests - continuing operations |

(2,713 | ) | (2,400 | ) | ||||||||

| Net loss attributable to noncontrolling interests - discontinued operations |

— | 17 | ||||||||||

|

|

|

|

|

|||||||||

| NET INCOME ATTRIBUTABLE TO EQUITY ONE, INC. |

$ | 18,982 | $ | 34,994 | -45.8 | % | ||||||

|

|

|

|

|

|

|

|||||||

| EARNINGS PER COMMON SHARE - BASIC: |

||||||||||||

| Continuing operations |

$ | 0.06 | $ | 0.29 | ||||||||

| Discontinued operations |

0.11 | 0.04 | ||||||||||

|

|

|

|

|

|||||||||

| NET INCOME |

$ | 0.16 | * | $ | 0.33 | -51.5 | % | |||||

|

|

|

|

|

|

|

|||||||

| EARNINGS PER COMMON SHARE - DILUTED: |

||||||||||||

| Continuing operations |

$ | 0.06 | $ | 0.28 | ||||||||

| Discontinued operations |

0.11 | 0.03 | ||||||||||

|

|

|

|

|

|||||||||

| NET INCOME |

$ | 0.16 | * | $ | 0.32 | * | -50.0 | % | ||||

|

|

|

|

|

|

|

|||||||

| Weighted average shares outstanding |

||||||||||||

| Basic |

112,649 | 106,254 | ||||||||||

|

|

|

|

|

|||||||||

| Diluted |

112,820 | 117,258 | ||||||||||

|

|

|

|

|

|||||||||

*Note: Basic EPS for the three months ended March 31, 2012 and Diluted EPS for the three months ended March 31, 2012 and 2011 do not foot due to the rounding of the individual calculations.

Page 7

| EQUITY ONE, INC. PRO FORMA FINANCIAL INFORMATION FOR DISCONTINUED OPERATIONS For the three months ended March 31, 2012 and 2011 (unaudited) (in thousands) |

| |

|

| ||

| Three months ended March 31, 2012 |

Three months ended March 31, 2011 |

|||||||||||||||||||||||

| As Reported |

Disc. Ops | Pre Disc. Ops |

As Reported |

Disc. Ops | Pre Disc. Ops |

|||||||||||||||||||

| REVENUE: |

||||||||||||||||||||||||

| Minimum rent |

$ | 60,818 | $ | 1,251 | $ | 62,069 | $ | 53,171 | $ | 13,260 | $ | 66,431 | ||||||||||||

| Expense recoveries |

17,939 | 51 | 17,990 | 15,748 | 2,678 | 18,426 | ||||||||||||||||||

| Percentage rent |

1,954 | 250 | 2,204 | 1,454 | 12 | 1,466 | ||||||||||||||||||

| Management and leasing services |

804 | — | 804 | 466 | — | 466 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total revenue |

81,515 | 1,552 | 83,067 | 70,839 | 15,950 | 86,789 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| COSTS AND EXPENSES: |

||||||||||||||||||||||||

| Property operating |

22,130 | 552 | 22,682 | 20,574 | 4,269 | 24,843 | ||||||||||||||||||

| Rental property depreciation and amortization |

21,715 | 84 | 21,799 | 18,766 | 4,328 | 23,094 | ||||||||||||||||||

| General and administrative |

11,560 | 13 | 11,573 | 11,977 | 16 | 11,993 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Total costs and expenses |

55,405 | 649 | 56,054 | 51,317 | 8,613 | 59,930 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| INCOME BEFORE OTHER INCOME AND EXPENSE, TAX AND DISCONTINUED OPERATIONS |

26,110 | 903 | 27,013 | 19,522 | 7,337 | 26,859 | ||||||||||||||||||

| OTHER INCOME AND EXPENSE: |

||||||||||||||||||||||||

| Investment income |

1,445 | 1 | 1,446 | 693 | — | 693 | ||||||||||||||||||

| Other income |

141 | — | 141 | 129 | 2 | 131 | ||||||||||||||||||

| Interest expense |

(17,369 | ) | (327 | ) | (17,696 | ) | (17,551 | ) | (4,014 | ) | (21,565 | ) | ||||||||||||

| Amortization of deferred financing fees |

(593 | ) | (2 | ) | (595 | ) | (539 | ) | (4 | ) | (543 | ) | ||||||||||||

| Equity in income (loss) of unconsolidated joint ventures |

(188 | ) | — | (188 | ) | 366 | 268 | 634 | ||||||||||||||||

| Gain on sale of real estate |

— | 14,269 | 14,269 | — | — | — | ||||||||||||||||||

| Gain (loss) on extinguishment of debt |

(93 | ) | (716 | ) | (809 | ) | 42 | — | 42 | |||||||||||||||

| Gain on bargain purchase |

— | — | — | 30,561 | — | 30,561 | ||||||||||||||||||

| Impairment loss |

— | (1,932 | ) | (1,932 | ) | — | — | — | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| INCOME FROM CONTINUING OPERATIONS BEFORE TAX AND DISCONTINUED OPERATIONS |

9,453 | 12,196 | 21,649 | 33,223 | 3,589 | 36,812 | ||||||||||||||||||

| Income tax benefit of taxable REIT subsidiaries |

46 | — | 46 | 133 | 432 | 565 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| INCOME FROM CONTINUING OPERATIONS |

9,499 | 12,196 | 21,695 | 33,356 | 4,021 | 37,377 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| DISCONTINUED OPERATIONS: |

||||||||||||||||||||||||

| Operations of income producing properties sold or held for sale |

(141 | ) | 141 | — | 3,589 | (3,589 | ) | — | ||||||||||||||||

| Gain on disposal of income producing properties |

14,269 | (14,269 | ) | — | — | — | — | |||||||||||||||||

| Impairment loss on income producing properties sold or held for sale |

(1,932 | ) | 1,932 | — | — | — | — | |||||||||||||||||

| Income tax (expense) benefit |

— | — | — | 432 | (432 | ) | — | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| INCOME FROM DISCONTINUED OPERATIONS |

12,196 | (12,196 | ) | — | 4,021 | (4,021 | ) | — | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Net income attributable to noncontrolling interests - continuing operations |

(2,713 | ) | — | (2,713 | ) | (2,400 | ) | 17 | (2,383 | ) | ||||||||||||||

| Net loss attributable to noncontrolling interests - discontinued operations |

— | — | — | 17 | (17 | ) | — | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| NET INCOME ATTRIBUTABLE TO EQUITY ONE, INC. |

$ | 18,982 | $ | — | $ | 18,982 | $ | 34,994 | $ | — | $ | 34,994 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Page 8

| EQUITY ONE, INC. NET OPERATING INCOME For the three months ended March 31, 2012 and 2011 (in thousands) |

| |

|

| ||

| Three months ended | Percent Change |

|||||||||||

| March 31, 2012 |

March 31, 2011 |

|||||||||||

| Total net operating income(1) |

||||||||||||

| Total rental revenue |

$ | 82,263 | $ | 86,323 | (4.7 | %) | ||||||

| Property operating expenses |

22,682 | 24,843 | (8.7 | %) | ||||||||

|

|

|

|

|

|||||||||

| Net operating income |

$ | 59,581 | $ | 61,480 | (3.1 | %) | ||||||

|

|

|

|

|

|||||||||

| NOI margin (NOI / Total rental revenue) |

72.4 | % | 71.2 | % | ||||||||

| Same-property cash NOI(2)(4) |

||||||||||||

| Total rental revenue |

$ | 60,678 | $ | 59,547 | 1.9 | % | ||||||

| Property operating expenses(3) |

18,073 | 18,771 | (3.7 | %) | ||||||||

|

|

|

|

|

|||||||||

| Net operating income |

$ | 42,605 | $ | 40,776 | 4.5 | % | ||||||

|

|

|

|

|

|||||||||

| Growth in same property NOI |

4.5 | % | ||||||||||

| Number of properties included in analysis(4) |

132 | |||||||||||

| (1) | Amounts included in discontinued operations have been included for purposes of this presentation of net operating income. NOI presented on a GAAP basis. |

| (2) | Excludes the effects of straight-line rent, above/below market rents, lease termination fees, and prior year expense recovery adjustments, if any. |

| (3) | Property operating expenses include intercompany management fee expense. |

| (4) | The same-property pool includes only those properties that were owned and operated for the entirety of both periods being compared and excludes developments and redevelopments, unconsolidated joint venture properties, and any properties purchased or sold during the periods being compared. |

Page 9

| EQUITY ONE, INC. EARNINGS BEFORE INTEREST, TAXES, DEPRECIATION and AMORTIZATION - (ADJUSTED EBITDA) For the three months ended March 31, 2012 and 2011 (in thousands) |

| |

|

| ||

| Three months ended | ||||||||

| March 31, 2012 |

March 31, 2011 |

|||||||

| Net income attributable to Equity One, Inc. |

$ | 18,982 | $ | 34,994 | ||||

| Rental property depreciation and amortization* |

21,799 | 23,094 | ||||||

| Other depreciation and amortization* |

178 | 158 | ||||||

| Interest expense* |

17,696 | 21,565 | ||||||

| Amortization of deferred financing fees* |

595 | 543 | ||||||

| Loss (gain) on extinguishment of debt* |

809 | (42 | ) | |||||

| Acquisition/Disposition costs(1) |

1,267 | 2,809 | ||||||

| Impairment loss* |

1,932 | — | ||||||

| Gain on sale of depreciable real estate* |

(13,086 | ) | — | |||||

| Income tax benefit of taxable REIT subsidiaries* |

(46 | ) | (565 | ) | ||||

| Gain on bargain purchase |

— | (30,561 | ) | |||||

| Equity in loss (income) of unconsolidated joint ventures* |

188 | (634 | ) | |||||

|

|

|

|

|

|||||

| Adjusted EBITDA |

$ | 50,314 | $ | 51,361 | ||||

|

|

|

|

|

|||||

| Interest expense* |

$ | 17,696 | $ | 21,565 | ||||

|

|

|

|

|

|||||

| Adjusted EBITDA to interest expense* |

2.8 | 2.4 | ||||||

| Fixed charges |

||||||||

| Interest expense* |

$ | 17,696 | $ | 21,565 | ||||

| Scheduled principal amortization (2) |

2,220 | 3,986 | ||||||

|

|

|

|

|

|||||

| Total fixed charges |

$ | 19,916 | $ | 25,551 | ||||

|

|

|

|

|

|||||

| Adjusted EBITDA to fixed charges* |

2.5 | 2.0 | ||||||

| Net debt to Adjusted EBITDA (3) |

6.8 | 7.2 | ||||||

| Total market capitalization (see page 6) |

$ | 3,892,684 | $ | 3,694,949 | ||||

|

|

|

|

|

|||||

| * | The indicated line item includes amounts reported in discontinued operations. |

| (1) | Amounts include external costs associated with acquired and disposed properties and acquisition/disposition related expenses during the period. For the three months March 31, 2012 and 2011, amounts include $0.04 million and $0.5 million, respectively, in severance costs. |

| (2) | Excludes balloon payments upon maturity. |

| (3) | Adjusted EBITDA for the period has been annualized. |

Page 10

| EQUITY ONE, INC. CONSOLIDATED STATEMENTS OF FUNDS FROM OPERATIONS For the three months ended March 31, 2012 and 2011 (in thousands, except per share data) |

| |

|

| ||

| Three months ended | ||||||||

| March 31, 2012 |

March 31, 2011 |

|||||||

| Net income attributable to Equity One, Inc. |

$ | 18,982 | $ | 34,994 | ||||

| Adjustments: |

||||||||

| Rental property depreciation and amortization, including discontinued operations, net of noncontrolling interest |

21,758 | 23,020 | ||||||

| Net adjustment for unvested shares and noncontrolling interest(1) |

2,499 | 2,415 | ||||||

| Impairments of depreciable real estate, net of tax(2) |

1,932 | — | ||||||

| Gain on disposal of depreciable real estate, net of tax |

(13,086 | ) | — | |||||

| Pro rata share of real estate depreciation from unconsolidated JV’s |

1,157 | 611 | ||||||

|

|

|

|

|

|||||

| Funds from operations |

$ | 33,242 | $ | 61,040 | ||||

|

|

|

|

|

|||||

| Earnings per diluted share attributable to Equity One, Inc. |

$ | 0.16 | $ | 0.32 | ||||

| Adjustments: |

||||||||

| Rental property depreciation and amortization, including discontinued operations, net of noncontrolling interest |

0.18 | 0.20 | ||||||

| Net adjustment for unvested shares and noncontrolling interest(1) |

0.01 | (0.01 | ) | |||||

| Impairments of depreciable real estate, net of tax(2) |

0.02 | — | ||||||

| Gain on disposal of depreciable real estate, net of tax |

(0.11 | ) | — | |||||

| Pro rata share of real estate depreciation from unconsolidated JV’s |

0.01 | 0.01 | ||||||

|

|

|

|

|

|||||

| Funds from operations per diluted share |

$ | 0.27 | $ | 0.52 | ||||

|

|

|

|

|

|||||

| Weighted average diluted shares(3) |

124,178 | 117,258 | ||||||

|

|

|

|

|

|||||

| (1) | Includes net effect of: (a) distributions paid with respect to unissued shares held by a noncontrolling interest which have already been included for purposes of calculating earnings per diluted share for the three months ended March 31, 2012 and 2011; and (b) an adjustment to compensate for the rounding of the individual calculations. |

| (2) | Effective in the fourth quarter of 2011, NAREIT clarified the definition of FFO to exclude impairment write downs of depreciable real estate. We have calculated FFO for all periods presented in accordance with this clarification. |

| (3) | Weighted average diluted shares for the three months ended March 31, 2012 are higher than the GAAP diluted weighted average shares as a result of the 11.4 million units held by Liberty International Holdings, Ltd. which are convertible into our common stock. These convertible units are not included in the diluted weighted average share count for GAAP purposes because their inclusion is antidilutive. |

Page 11

| EQUITY ONE, INC. ADDITIONAL DISCLOSURES For the three months ended March 31, 2012 and 2011 (in thousands) |

|

| Three months ended | ||||||||

| March 31, 2012 |

March 31, 2011 |

|||||||

| Certain non-cash items: |

||||||||

| Amortization of deferred financing fees |

$ | 595 | $ | 543 | ||||

| Accretion of below market lease intangibles |

(2,948 | ) | (2,043 | ) | ||||

| Share-based compensation expense |

2,062 | 1,635 | ||||||

| Straight line rent |

(1,024 | ) | (902 | ) | ||||

| Capitalized interest |

(1,143 | ) | (498 | ) | ||||

| Amortization of discount on notes payable, net |

(784 | ) | 236 | |||||

| Certain capital expenditures: |

||||||||

| Tenant improvements |

$ | (2,947 | ) | $ | (2,374 | ) | ||

| Leasing commissions and costs |

(1,365 | ) | (1,266 | ) | ||||

| Redevelopments and expansions |

(20,176 | ) | (3,347 | ) | ||||

| Maintenance capital expenditures |

(2,676 | ) | (1,394 | ) | ||||

|

|

|

|

|

|||||

| Total tenant improvements and leasing costs |

$ | (27,164 | ) | $ | (8,381 | ) | ||

|

|

|

|

|

|||||

| March 31, 2012 |

Dec 31, 2011 |

|||||||

| Other assets : |

||||||||

| Lease intangibles, net |

$ | 95,978 | $ | 92,559 | ||||

| Lease commissions, net |

30,396 | 28,755 | ||||||

| Straight-line rent receivable, net |

18,290 | 17,270 | ||||||

| Deposits and mortgage escrow |

37,522 | 34,567 | ||||||

| Deferred financing costs, net |

10,012 | 8,676 | ||||||

| Prepaid and other expenses |

10,093 | 2,178 | ||||||

| Furniture and fixtures, net |

2,342 | 2,234 | ||||||

| Deferred tax asset |

3,174 | 3,229 | ||||||

| Fair value of interest rate swap |

975 | — | ||||||

|

|

|

|

|

|||||

| Total other assets |

$ | 208,782 | $ | 189,468 | ||||

|

|

|

|

|

|||||

| Accounts payable and other liabilities: |

||||||||

| Above/below market rents, net |

$ | 178,513 | 156,495 | |||||

| Prepaid rent and deferred income |

7,789 | 6,882 | ||||||

| Accounts payable and other |

52,220 | 59,821 | ||||||

|

|

|

|

|

|||||

| Total accounts payable and other liabilities |

$ | 238,522 | $ | 223,198 | ||||

|

|

|

|

|

|||||

| Liquidity as of 3/31/12: |

||||||||

| Cash and Cash Equivalents |

$ | 15,610 | ||||||

| Available under Lines of Credit |

442,835 | |||||||

|

|

|

|||||||

| Total Available Funds |

$ | 458,445 | ||||||

|

|

|

|||||||

Page 12

| EQUITY ONE, INC. TENANT CONCENTRATION SCHEDULE - TOP TWENTY-FIVE TENANTS CONSOLIDATED PROPERTIES As of March 31, 2012 |

|

| Tenant |

Number of stores |

Credit Rating S&P/ |

Square feet |

% of total square feet |

Annualized minimum rent |

% of total annualized minimum rent |

Average annual minimum rent per square foot |

Average remaining term of AMR(2) |

||||||||||||||||||||||

| Top twenty-five tenants |

||||||||||||||||||||||||||||||

| Publix |

43 | NA | 1,881,970 | 10.4 | % | $ | 14,801,898 | 6.4 | % | $ | 7.87 | 6.9 | ||||||||||||||||||

| Supervalu |

6 | B+ / B1 | 398,625 | 2.2 | % | 8,995,251 | 3.9 | % | 22.57 | 4.4 | ||||||||||||||||||||

| Kroger |

10 | BBB / Baa2 | 573,686 | 3.2 | % | 4,233,263 | 1.8 | % | 7.38 | 5.1 | ||||||||||||||||||||

| TJ Maxx Companies |

11 | A / A3 | 322,879 | 1.8 | % | 4,198,079 | 1.8 | % | 13.00 | 3.5 | ||||||||||||||||||||

| L.A. Fitness |

5 | NA | 234,897 | 1.3 | % | 4,077,401 | 1.8 | % | 17.36 | 11.2 | ||||||||||||||||||||

| Bed Bath & Beyond |

9 | BBB+ / NA | 306,332 | 1.7 | % | 3,811,537 | 1.6 | % | 12.44 | 4.2 | ||||||||||||||||||||

| Costco |

1 | A+ / A1 | 148,295 | 0.8 | % | 3,029,252 | 1.3 | % | 20.43 | 2.4 | ||||||||||||||||||||

| Winn Dixie |

9 | NA | 398,128 | 2.2 | % | 2,937,815 | 1.3 | % | 7.38 | 3.9 | ||||||||||||||||||||

| CVS Pharmacy |

13 | BBB+ / Baa2 | 150,999 | 0.8 | % | 2,447,511 | 1.1 | % | 16.21 | 6.9 | ||||||||||||||||||||

| Goodwill |

14 | NA | 217,873 | 1.2 | % | 2,419,535 | 1.0 | % | 11.11 | 8.4 | ||||||||||||||||||||

| Staples |

6 | BBB / Baa2 | 120,529 | 0.7 | % | 2,371,378 | 1.0 | % | 19.67 | 3.8 | ||||||||||||||||||||

| Office Depot |

8 | B- / B2 | 195,777 | 1.1 | % | 2,344,457 | 1.0 | % | 11.98 | 4.4 | ||||||||||||||||||||

| Walmart |

3 | AA / Aa2 | 230,217 | 1.3 | % | 2,150,075 | 0.9 | % | 9.34 | 5.7 | ||||||||||||||||||||

| Best Buy |

4 | BBB- / Baa2 | 142,831 | 0.8 | % | 2,104,708 | 0.9 | % | 14.74 | 4.2 | ||||||||||||||||||||

| Kmart |

5 | NA | 439,558 | 2.4 | % | 1,939,705 | 0.8 | % | 4.41 | 3.3 | ||||||||||||||||||||

| Target |

1 | A+ / A2 | 160,346 | 0.9 | % | 1,924,152 | 0.8 | % | 12.00 | 6.3 | ||||||||||||||||||||

| Walgreens |

6 | A / A3 | 96,562 | 0.5 | % | 1,824,815 | 0.8 | % | 18.90 | 24.5 | ||||||||||||||||||||

| Sports Authority |

2 | B- / B3 | 58,500 | 0.3 | % | 1,772,500 | 0.8 | % | 30.30 | 4.6 | ||||||||||||||||||||

| Dollar Tree |

19 | NA | 210,050 | 1.2 | % | 1,763,590 | 0.8 | % | 8.40 | 2.9 | ||||||||||||||||||||

| Whole Foods |

2 | BB+ / NA | 85,907 | 0.5 | % | 1,746,911 | 0.8 | % | 20.33 | 12.7 | ||||||||||||||||||||

| Stop & Shop |

1 | NA | 59,015 | 0.3 | % | 1,685,484 | 0.7 | % | 28.56 | 12.8 | ||||||||||||||||||||

| JP Morgan Chase |

11 | A / Aa3 | 51,316 | 0.3 | % | 1,596,436 | 0.7 | % | 31.11 | 5.1 | ||||||||||||||||||||

| Trader Joe’s |

4 | NA | 42,958 | 0.2 | % | 1,463,177 | 0.6 | % | 34.06 | 8.9 | ||||||||||||||||||||

| Loehmann’s |

1 | NA | 56,870 | 0.3 | % | 1,400,000 | 0.6 | % | 24.62 | 4.0 | ||||||||||||||||||||

| Wells Fargo |

13 | A+ / A2 | 47,714 | 0.3 | % | 1,367,212 | 0.6 | % | 28.65 | 2.2 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

| Total top twenty-five tenants |

207 | 6,631,834 | 36.6 | % | $ | 78,406,142 | 33.8 | % | $ | 11.82 | 6.2 | |||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

Note: The above schedule includes properties under development/redevelopment and excludes non-retail properties and properties held in unconsolidated joint ventures.

| (1) | Ratings as of March 31, 2012. Source: Moody’s/S&P. |

| (2) | In years, excluding tenant renewal options. |

Page 13

| EQUITY ONE, INC. RECENT LEASING ACTIVITY For the three months ended March 31, 2012 |

|

| Category |

Total Leases |

Total Sq. Ft. |

Same Space Sq. Ft. |

Prior Rent PSF |

New Rent PSF |

Rent Spread |

Same Space TIs PSF(2) |

|||||||||||||||||||||

| New Leases(1) |

48 | 143,765 | 141,840 | $ | 16.96 | $ | 16.54 | -2.5 | % | $ | 11.75 | |||||||||||||||||

| Renewals & Options |

74 | 303,194 | 303,194 | 14.14 | 15.10 | 6.8 | % | 0.25 | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Total New, Renewals & Options |

122 | 446,959 | 445,034 | $ | 15.04 | $ | 15.56 | 3.5 | % | $ | 3.91 | |||||||||||||||||

Note: Prior rent and new rent are presented on a “cash basis”, not on a straight-line basis. Excludes unconsolidated joint venture properties, non-retail properties, and developments/redevelopments.

| (1) | Rent spreads for new leases reflect same-space leasing where amount of rent paid by prior tenant is available regardless of the amount of time the space has been vacant. |

| (2) | Amount includes tenant allowance and landlord work. |

Page 14

| EQUITY ONE, INC. SHOPPING CENTER LEASE EXPIRATION SCHEDULE As of March 31, 2012 |

|

| ANCHOR TENANTS (SF >= 10,000) |

SHOP TENANTS (SF < 10,000) | TOTAL TENANTS | ||||||||||||||||||||||||||||||||||||||||||||||

| Year |

# of leases |

Square Feet |

% of Total SF |

Average Annual Minimum Rent PSF at Expiration |

# of leases |

Square Feet |

% of Total SF |

Average Annual Minimum Rent PSF at Expiration |

# of leases |

Square feet |

% of Total SF |

Average Annual Minimum Rent PSF at Expiration |

||||||||||||||||||||||||||||||||||||

| M-T-M |

1 | 15,000 | 0.1 | % | $ | 28.00 | 115 | 245,046 | 4.2 | % | $ | 17.36 | 116 | 260,046 | 1.6 | % | $ | 17.97 | ||||||||||||||||||||||||||||||

| 2012 |

31 | 756,629 | 7.1 | % | 9.52 | 363 | 764,409 | 13.0 | % | 20.52 | 394 | 1,521,038 | 9.2 | % | 15.05 | |||||||||||||||||||||||||||||||||

| 2013 |

31 | 942,448 | 8.9 | % | 9.29 | 372 | 807,022 | 13.7 | % | 21.56 | 403 | 1,749,470 | 10.6 | % | 14.95 | |||||||||||||||||||||||||||||||||

| 2014 |

41 | 1,226,225 | 11.5 | % | 8.47 | 375 | 802,723 | 13.6 | % | 21.49 | 416 | 2,028,948 | 12.3 | % | 13.62 | |||||||||||||||||||||||||||||||||

| 2015 |

38 | 1,120,580 | 10.5 | % | 7.65 | 262 | 656,074 | 11.1 | % | 23.19 | 300 | 1,776,654 | 10.7 | % | 13.39 | |||||||||||||||||||||||||||||||||

| 2016 |

44 | 1,598,695 | 15.0 | % | 12.80 | 236 | 590,607 | 10.0 | % | 23.73 | 280 | 2,189,302 | 13.2 | % | 15.75 | |||||||||||||||||||||||||||||||||

| 2017 |

26 | 830,705 | 7.8 | % | 14.73 | 121 | 309,190 | 5.3 | % | 25.48 | 147 | 1,139,895 | 6.9 | % | 17.64 | |||||||||||||||||||||||||||||||||

| 2018 |

14 | 570,405 | 5.4 | % | 12.17 | 27 | 95,813 | 1.6 | % | 31.93 | 41 | 666,218 | 4.0 | % | 15.01 | |||||||||||||||||||||||||||||||||

| 2019 |

11 | 520,779 | 4.9 | % | 8.56 | 24 | 74,380 | 1.3 | % | 29.15 | 35 | 595,159 | 3.6 | % | 11.13 | |||||||||||||||||||||||||||||||||

| 2020 |

18 | 555,872 | 5.2 | % | 13.07 | 25 | 83,238 | 1.4 | % | 27.94 | 43 | 639,110 | 3.9 | % | 15.01 | |||||||||||||||||||||||||||||||||

| 2021 |

14 | 344,882 | 3.2 | % | 12.35 | 26 | 70,518 | 1.2 | % | 45.15 | 40 | 415,400 | 2.5 | % | 17.92 | |||||||||||||||||||||||||||||||||

| Thereafter |

54 | 1,930,686 | 18.1 | % | 12.92 | 47 | 173,512 | 3.0 | % | 35.47 | 101 | 2,104,198 | 12.7 | % | 14.78 | |||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| Sub-total / Avg. |

323 | 10,412,906 | 97.7 | % | 11.13 | 1,993 | 4,672,532 | 79.4 | % | 23.24 | 2,316 | 15,085,438 | 91.2 | % | 14.88 | |||||||||||||||||||||||||||||||||

| Vacant |

11 | 247,471 | 2.3 | % | NA | 607 | 1,210,940 | 20.6 | % | NA | 618 | 1,458,411 | 8.8 | % | NA | |||||||||||||||||||||||||||||||||

| Total / Avg. |

334 | 10,660,377 | 100.0 | % | NA | 2,600 | 5,883,472 | 100.0 | % | NA | 2,934 | 16,543,849 | 100.0 | % | NA | |||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

Note: The above schedules exclude properties under development/redevelopment, non-retail properties, and properties held in unconsolidated joint ventures.

Page 15

| EQUITY ONE, INC. ANNUAL MINIMUM RENT OF OPERATING PROPERTIES BY METRO/REGION As of March 31, 2012 |

|

Note: The above schedules exclude properties under development/redevelopment, non-retail properties, and properties held in unconsolidated joint ventures.

Page 16

| EQUITY ONE, INC. PROPERTY STATUS REPORT As of March 31, 2012 |

|

| City |

Year Built / Renovated |

Total Sq. Ft. Owned |

Percent Leased |

Number | Supermarket anchor | Other anchor tenants |

Average base rent per leased SF |

|||||||||||||||||||||||||||||

| of tenants | Owned sq. ft. |

Name |

Expiration Date |

|||||||||||||||||||||||||||||||||

| Property |

Leased | Vacant | ||||||||||||||||||||||||||||||||||

| NORTH FLORIDA (31) |

|

|||||||||||||||||||||||||||||||||||

| Orlando / Central Florida (8) |

|

|||||||||||||||||||||||||||||||||||

| Alafaya Commons |

Orlando | 1987 | 126,333 | 84.7 | % | 21 | 9 | 54,230 | Publix | 11/30/13 | $ | 13.68 | ||||||||||||||||||||||||

| Alafaya Village |

Orlando | 1986 | 38,118 | 87.3 | % | 14 | 2 | $ | 21.19 | |||||||||||||||||||||||||||

| Eastwood, Shoppes of |

Orlando | 1997 | 69,037 | 98.1 | % | 12 | 1 | 51,512 | Publix | 11/01/17 | $ | 12.40 | ||||||||||||||||||||||||

| Kirkman Shoppes |

Orlando | 1973 | 88,820 | 63.6 | % | 22 | 8 | $ | 22.20 | |||||||||||||||||||||||||||

| Lake Mary Centre |

Orlando | 1988 / 2001 | 340,434 | 95.8 | % | 56 | 10 | 63,139 | Albertsons | 06/30/12 | Kmart / Lifestyle Fitness Center / Office Depot | $ | 13.34 | |||||||||||||||||||||||

| Park Promenade |

Orlando | 1987 /2000 | 128,848 | 72.4 | % | 14 | 9 | Beauty Depot / Dollar General | $ | 6.91 | ||||||||||||||||||||||||||

| Town & Country |

Kissimmee | 1993 | 75,181 | 92.0 | % | 10 | 4 | 52,883 | Albertsons* (Ross Dress For Less) | 10/31/18 | $ | 7.78 | ||||||||||||||||||||||||

| Unigold Shopping Center |

Winter Park | 1987 | 117,527 | 80.5 | % | 20 | 6 | 52,500 | Winn-Dixie | 04/30/12 | $ | 11.50 | ||||||||||||||||||||||||

| Jacksonville / North Florida (8) |

|

|||||||||||||||||||||||||||||||||||

| Beauclerc Village |

Jacksonville | 1962 / 1988 | 68,846 | 89.6 | % | 7 | 4 | Big Lots / Goodwill / Bealls Outlet | $ | 8.58 | ||||||||||||||||||||||||||

| Forest Village |

Tallahassee | 2000 | 71,526 | 80.7 | % | 10 | 6 | 37,866 | Publix | 04/30/20 | $ | 10.58 | ||||||||||||||||||||||||

| Ft. Caroline |

Jacksonville | 1985 / 1995 | 71,816 | 86.8 | % | 6 | 6 | 45,500 | Winn-Dixie | 05/31/15 | Citi Trends | $ | 6.86 | |||||||||||||||||||||||

| Mandarin Landing |

Jacksonville | 1976 | 139,580 | 84.4 | % | 20 | 10 | 50,000 | Whole Foods | 12/31/23 | Office Depot / Aveda Institute | $ | 17.35 | |||||||||||||||||||||||

| Medical & Merchants |

Jacksonville | 1993 | 156,153 | 97.0 | % | 11 | 2 | 55,999 | Publix | 02/10/13 | Memorial Hospital / Planet Fitness | $ | 13.02 | |||||||||||||||||||||||

| Oak Hill |

Jacksonville | 1985 / 1997 | 78,492 | 100.0 | % | 17 | — | 39,795 | Publix | 03/11/15 | Planet Fitness | $ | 8.20 | |||||||||||||||||||||||

| Pablo Plaza |

Jacksonville | 1974 /1998 /2001 /2008 | 151,238 | 86.3 | % | 21 | 9 | 34,400 | Publix* (Office Depot) | 11/30/13 | Marshalls / HomeGoods | $ | 11.67 | |||||||||||||||||||||||

| South Beach |

Jacksonville Beach | 1990 / 1991 | 303,856 | 87.0 | % | 34 | 15 | Ross / Bed Bath & Beyond / Home Depot / Stein Mart / Staples | $ | 12.31 | ||||||||||||||||||||||||||

| Tampa / St. Petersburg / Venice / Cape Coral / Naples (10) |

|

|||||||||||||||||||||||||||||||||||

| Charlotte Square |

Port Charlotte | 1980 | 96,626 | 69.9 | % | 12 | 13 | Seafood Buffet / American Signature Furniture | $ | 5.49 | ||||||||||||||||||||||||||

| Glengary Shoppes |

Sarasota | 1995 | 99,182 | 100.0 | % | 6 | — | Best Buy / Barnes & Noble | $ | 18.18 | ||||||||||||||||||||||||||

| Lutz Lake |

Lutz | 2002 | 64,985 | 92.0 | % | 11 | 3 | 44,270 | Publix | 05/31/22 | $ | 12.55 | ||||||||||||||||||||||||

| Mariners Crossing |

Spring Hill | 1989 / 1999 | 97,812 | 93.7 | % | 17 | 1 | 48,315 | Sweet Bay | 08/15/20 | $ | 10.74 | ||||||||||||||||||||||||

| Regency Crossing |

Port Richey | 1986 / 2001 | 85,864 | 80.5 | % | 12 | 13 | 44,270 | Publix | 02/28/21 | $ | 10.37 | ||||||||||||||||||||||||

Page 17

| EQUITY ONE, INC. PROPERTY STATUS REPORT As of March 31, 2012

|

|

| City |

Year Built / Renovated |

Total Sq. Ft. Owned |

Percent Leased |

Number | Supermarket anchor | Other anchor tenants |

Average base rent per leased SF |

|||||||||||||||||||||||||||||

| of tenants | Owned sq. ft. |

Name |

Expiration Date |

|||||||||||||||||||||||||||||||||

| Property |

Leased | Vacant | ||||||||||||||||||||||||||||||||||

| Seven Hills |

Spring Hill | 1991 | 72,590 | 90.6 | % | 14 | 4 | 48,890 | Publix | 09/25/16 | $ | 10.18 | ||||||||||||||||||||||||

| Shoppes of North Port |

North Port | 1991 | 84,705 | 88.0 | % | 15 | 6 | Bealls Outlet / Goodwill | $ | 9.19 | ||||||||||||||||||||||||||

| Sunlake |

Tampa | 2008 | 94,397 | 91.3 | % | 19 | 6 | 45,600 | Publix | 12/31/28 | $ | 17.69 | ||||||||||||||||||||||||

| Sunpoint Shopping Center |

Ruskin | 1984 | 132,374 | 68.2 | % | 16 | 8 | Goodwill / Ozzie’s Buffet / Big Lots / Chapter 13 Trustee | $ | 8.50 | ||||||||||||||||||||||||||

| Walden Woods |

Plant City | 1985 / 1998 / 2003 | 72,950 | 88.7 | % | 11 | 4 | Dollar Tree / Aaron Rents / Dollar General | $ | 7.47 | ||||||||||||||||||||||||||

| Florida Treasure / Northeast Coast (5) |

||||||||||||||||||||||||||||||||||||

| New Smyrna Beach |

New Smyrna Beach | 1987 | 118,451 | 94.4 | % | 32 | 2 | 42,112 | Publix | 09/23/17 | Bealls Outlet | $ | 12.08 | |||||||||||||||||||||||

| Old King Commons |

Palm Coast | 1988 | 84,759 | 83.5 | % | 13 | 5 | Wal-Mart | $ | 7.93 | ||||||||||||||||||||||||||

| Ryanwood |

Vero Beach | 1987 | 114,925 | 88.3 | % | 25 | 7 | 39,795 | Publix | 03/23/17 | Bealls Outlet / Books-A-Million | $ | 11.31 | |||||||||||||||||||||||

| South Point Center |

Vero Beach | 2003 | 64,790 | 95.7 | % | 13 | 2 | 44,840 | Publix | 11/30/23 | $ | 15.56 | ||||||||||||||||||||||||

| Treasure Coast |

Vero Beach | 1983 | 133,781 | 95.8 | % | 20 | 3 | 59,450 | Publix | 07/31/26 | TJ Maxx | $ | 12.61 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| TOTAL SHOPPING CENTERS NORTH FLORIDA (31) |

3,443,996 | 87.6 | % | 531 | 178 | 955,366 | $ | 12.03 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| SOUTH FLORIDA (37) |

||||||||||||||||||||||||||||||||||||

| Miami-Dade / Broward / Palm Beach (34) |

||||||||||||||||||||||||||||||||||||

| Aventura Square(1) |

Aventura | 1991 | 143,250 | 100.0 | % | 10 | — | Babies R Us / Jewelry Exchange / Old Navy / Bed, Bath & Beyond / DSW | $ | 24.15 | ||||||||||||||||||||||||||

| Bird Ludlum |

Miami | 1988 / 1998 | 192,274 | 94.3 | % | 43 | 4 | 44,400 | Winn-Dixie | 12/31/12 | CVS Pharmacy / Goodwill | $ | 19.02 | |||||||||||||||||||||||

| Bluffs Square |

Jupiter | 1986 | 123,917 | 78.4 | % | 19 | 12 | 39,795 | Publix | 10/22/16 | Walgreens | $ | 12.75 | |||||||||||||||||||||||

| Chapel Trail |

Pembroke Pines | 2007 | 56,378 | 100.0 | % | 4 | — | LA Fitness | $ | 21.58 | ||||||||||||||||||||||||||

| Coral Reef Shopping Center |

Palmetto Bay | 1968 / 1990 | 76,632 | 91.0 | % | 14 | 4 | Office Depot / Walgreens | $ | 25.69 | ||||||||||||||||||||||||||

| Countryside Shops |

Cooper City | 1986 / 1988 / 1991 | 179,561 | 87.0 | % | 36 | 10 | 39,795 | Publix | 12/04/15 | Stein Mart | $ | 14.41 | |||||||||||||||||||||||

| Crossroads Square |

Pembroke Pines | 1973 | 81,587 | 79.9 | % | 15 | 9 | CVS Pharmacy / Goodwill | $ | 17.06 | ||||||||||||||||||||||||||

| CVS Plaza |

Miami | 2004 | 18,214 | 100.0 | % | 6 | — | $ | 22.67 | |||||||||||||||||||||||||||

| El Novillo |

Miami Beach | 1970 / 2000 | 10,000 | 100.0 | % | 1 | — | Sakura Japanese Buffet | $ | 17.00 | ||||||||||||||||||||||||||

| Greenwood |

Palm Springs | 1982 / 1994 | 133,339 | 91.0 | % | 31 | 7 | 50,032 | Publix | 12/05/14 | Bealls Outlet | $ | 13.08 | |||||||||||||||||||||||

| Hammocks Town Center |

Miami | 1987 / 1993 | 260,807 | 94.9 | % | 32 | 6 | 39,795 | Publix | 06/24/17 | Metro Dade Library / CVS Pharmacy / Porky’s Gym / Kendall Ice | $ | 9.12 | |||||||||||||||||||||||

Page 18

| EQUITY ONE, INC. PROPERTY STATUS REPORT As of March 31, 2012

|

|

| City |

Year Built / Renovated |

Total Sq. Ft. Owned |

Percent Leased |

Number | Supermarket anchor | Other anchor tenants |

Average base rent per leased SF |

|||||||||||||||||||||||||||||

| of tenants | Owned sq. ft. |

Name |

Expiration Date |

|||||||||||||||||||||||||||||||||

| Property |

Leased | Vacant | ||||||||||||||||||||||||||||||||||

| Jonathan’s Landing |

Jupiter | 1997 | 26,820 | 69.9 | % | 9 | 3 | $ | 21.12 | |||||||||||||||||||||||||||

| Lago Mar |

Miami | 1995 | 82,613 | 82.7 | % | 14 | 8 | 42,323 | Publix | 09/13/15 | $ | 13.57 | ||||||||||||||||||||||||

| Lantana Village |

Lantana | 1976 / 1999 | 181,780 | 97.5 | % | 23 | 2 | 39,473 | Winn-Dixie | 02/15/16 | Kmart / Rite Aid* (Family Dollar) | $ | 7.54 | |||||||||||||||||||||||

| Magnolia Shoppes |

Fort Lauderdale | 1998 | 114,118 | 91.3 | % | 13 | 5 | Regal Cinemas / Deal$ | $ | 11.74 | ||||||||||||||||||||||||||

| Meadows |

Miami | 1997 | 75,524 | 94.2 | % | 16 | 4 | 47,955 | Publix | 07/09/17 | $ | 14.01 | ||||||||||||||||||||||||

| Shoppes of Oakbrook |

Palm Beach Gardens | 1974 / 2000 / 2003 | 199,633 | 96.6 | % | 25 | 5 | 44,400 | Publix | 11/30/20 | Stein Mart / Homegoods / CVS / Basset Furniture / Duffy’s | $ | 14.39 | |||||||||||||||||||||||

| Oaktree Plaza |

North Palm Beach | 1985 | 23,745 | 63.6 | % | 11 | 9 | $ | 16.88 | |||||||||||||||||||||||||||

| Plaza Alegre |

Miami | 2003 | 88,411 | 93.7 | % | 17 | 3 | 44,271 | Publix | 03/14/23 | Goodwill | $ | 15.50 | |||||||||||||||||||||||

| Point Royale |

Miami | 1970 / 2000 | 174,875 | 97.0 | % | 20 | 4 | 45,350 | Winn-Dixie | 02/15/15 | Best Buy / Pasteur Medical | $ | 10.78 | |||||||||||||||||||||||

| Prosperity Centre |

Palm Beach Gardens | 1993 | 122,014 | 100.0 | % | 10 | — | Office Depot / CVS / Bed Bath & Beyond / TJ Maxx | $ | 17.40 | ||||||||||||||||||||||||||

| Ridge Plaza |

Davie | 1984 / 1999 | 155,204 | 94.9 | % | 20 | 7 | Ridge Cinema / Kabooms / United Collection / Round Up / Goodwill | $ | 11.27 | ||||||||||||||||||||||||||

| Riverside Square |

Coral Springs | 1987 | 103,241 | 80.6 | % | 22 | 11 | 39,795 | Publix | 02/18/17 | $ | 11.74 | ||||||||||||||||||||||||

| Sawgrass Promenade |

Deerfield Beach | 1982 / 1998 | 107,092 | 84.8 | % | 20 | 5 | 36,464 | Publix | 12/15/14 | Walgreens / Dollar Tree | $ | 10.85 | |||||||||||||||||||||||

| Sheridan Plaza |

Hollywood | 1973 / 1991 | 508,455 | 98.8 | % | 60 | 3 | 65,537 | Publix | 10/09/16 | Kohl’s / Ross / Bed Bath & Beyond / Pet Supplies Plus / LA Fitness / Office Depot / Assoc. in Neurology | $ | 15.39 | |||||||||||||||||||||||

| Shoppes of Andros Isles |

West Palm Beach | 2000 | 79,420 | 82.4 | % | 9 | 8 | 51,420 | Publix | 02/29/20 | $ | 12.17 | ||||||||||||||||||||||||

| Shoppes of Silverlakes |

Pembroke Pines | 1995 / 1997 | 126,789 | 88.1 | % | 28 | 7 | 47,814 | Publix | 06/14/15 | Goodwill | $ | 15.49 | |||||||||||||||||||||||

| Shops at Skylake |

North Miami Beach | 1999 / 2005 / 2006 | 287,077 | 96.0 | % | 45 | 4 | 51,420 | Publix | 07/31/19 | TJMaxx / LA Fitness / Goodwill | $ | 18.50 | |||||||||||||||||||||||

| Tamarac Town Square |

Tamarac | 1987 | 124,585 | 75.4 | % | 25 | 14 | 37,764 | Publix | 12/15/14 | Dollar Tree | $ | 10.88 | |||||||||||||||||||||||

| Waterstone |

Homestead | 2005 | 61,000 | 89.3 | % | 8 | 2 | 45,600 | Publix | 07/31/25 | $ | 13.63 | ||||||||||||||||||||||||

| West Bird |

Miami | 1977 / 2000 | 99,864 | 87.7 | % | 23 | 5 | 37,949 | Publix | 08/31/20 | CVS Pharmacy | $ | 13.36 | |||||||||||||||||||||||

| West Lakes Plaza |

Miami | 1984 / 2000 | 100,747 | 100.0 | % | 27 | — | 46,216 | Winn-Dixie | 05/22/16 | Navarro Pharmacy | $ | 13.94 | |||||||||||||||||||||||

| Westport Plaza |

Davie | 2002 | 49,533 | 100.0 | % | 8 | — | 27,887 | Publix | 11/30/22 | $ | 17.65 | ||||||||||||||||||||||||

| Young Circle |

Hollywood | 1962 / 1997 | 65,834 | 98.1 | % | 9 | 1 | 23,124 | Publix | 11/30/16 | Walgreens | $ | 14.59 | |||||||||||||||||||||||

Page 19

| EQUITY ONE, INC. PROPERTY STATUS REPORT As of March 31, 2012

|

|

| City |

Year Built / Renovated |

Total Sq. Ft. Owned |

Percent Leased |

Number | Supermarket anchor | Other anchor tenants |

Average base rent per leased SF |

|||||||||||||||||||||||||||||

| of tenants | Owned sq. ft. |

Name |

Expiration Date |

|||||||||||||||||||||||||||||||||

| Property |

Leased | Vacant | ||||||||||||||||||||||||||||||||||

| Florida Treasure / Northeast Coast (3) |

||||||||||||||||||||||||||||||||||||

| Cashmere Corners |

Port St. Lucie | 2001 | 89,234 | 93.7 | % | 13 | 3 | 59,448 | Albertsons | 04/30/25 | $ | 8.49 | ||||||||||||||||||||||||

| Salerno Village |

Stuart | 1987 | 82,477 | 90.8 | % | 14 | 6 | 45,802 | Winn-Dixie | 03/23/24 | CVS Pharmacy | $ | 10.53 | |||||||||||||||||||||||

| Shops at St. Lucie |

Port St. Lucie | 2006 | 19,361 | 74.2 | % | 7 | 3 | $ | 22.60 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| TOTAL SHOPPING CENTERS SOUTH FLORIDA (37) |

4,425,405 | 92.4 | % | 707 | 174 | 1,093,829 | $ | 14.44 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| SOUTHEAST (49) |

||||||||||||||||||||||||||||||||||||

| ALABAMA(1) |

||||||||||||||||||||||||||||||||||||

| Madison Centre |

Madison | 1997 | 64,837 | 98.1 | % | 12 | 1 | 37,912 | Publix | 06/01/17 | Rite Aid | $ | 9.45 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| TOTAL SHOPPING CENTERS ALABAMA(1) |

64,837 | 98.1 | % | 12 | 1 | 37,912 | $ | 9.45 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| FLORIDA (1) |

||||||||||||||||||||||||||||||||||||

| Middle Beach Shopping Center |

Panama City Beach | 1994 | 69,277 | 82.2 | % | 2 | 7 | 56,077 | Publix* | 09/30/14 | $ | 8.53 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| TOTAL SHOPPING CENTERS FLORIDA(1) |

69,277 | 82.2 | % | 2 | 7 | 56,077 | $ | 8.53 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| GEORGIA (22) |

||||||||||||||||||||||||||||||||||||

| Atlanta (18) |

||||||||||||||||||||||||||||||||||||

| BridgeMill |

Canton | 2000 | 89,102 | 91.9 | % | 25 | 4 | 37,888 | Publix | 01/31/20 | $ | 15.83 | ||||||||||||||||||||||||

| Buckhead Station |

Atlanta | 1996 | 233,739 | 100.0 | % | 15 | 1 | Bed Bath & Beyond / TJ Maxx / Old Navy / Toys R Us / DSW / Ulta 3 / Nordstrom Rack | $ | 21.38 | ||||||||||||||||||||||||||

| Butler Creek |

Acworth | 1990 | 95,597 | 94.2 | % | 18 | 3 | 59,997 | Kroger | 01/31/18 | $ | 9.83 | ||||||||||||||||||||||||

| Chastain Square |

Atlanta | 1981 / 2001 | 91,637 | 97.1 | % | 23 | 3 | 37,366 | Publix | 05/31/24 | $ | 17.89 | ||||||||||||||||||||||||

| Douglas Commons |

Douglasville | 1988 | 97,027 | 95.0 | % | 15 | 3 | 59,431 | Kroger | 08/31/13 | $ | 10.91 | ||||||||||||||||||||||||

| Fairview Oaks |

Ellenwood | 1997 | 77,052 | 95.7 | % | 12 | 2 | 54,498 | Kroger | 09/30/16 | $ | 10.37 | ||||||||||||||||||||||||

| Grassland Crossing |

Alpharetta | 1996 | 90,906 | 94.6 | % | 12 | 2 | 70,086 | Kroger | 06/30/16 | $ | 9.06 | ||||||||||||||||||||||||

| Hairston Center |

Decatur | 2000 | 13,000 | 84.6 | % | 6 | 2 | $ | 9.26 | |||||||||||||||||||||||||||

| Hamilton Ridge |

Buford | 2002 | 90,996 | 85.1 | % | 14 | 7 | 54,166 | Kroger | 11/30/22 | $ | 11.45 | ||||||||||||||||||||||||

| Hampton Oaks |

Fairburn | 2009 | 20,842 | 17.3 | % | 2 | 10 | $ | 12.12 | |||||||||||||||||||||||||||

| Mableton Crossing |

Mableton | 1997 | 86,819 | 98.1 | % | 15 | 1 | 63,419 | Kroger | 08/31/17 | $ | 10.35 | ||||||||||||||||||||||||

| Macland Pointe |

Marietta | 1992-93 | 79,699 | 92.8 | % | 14 | 3 | 55,999 | Publix | 12/29/12 | $ | 10.20 | ||||||||||||||||||||||||

Page 20

| EQUITY ONE, INC. PROPERTY STATUS REPORT As of March 31, 2012

|

|

| City |

Year Built / Renovated |

Total Sq. Ft. Owned |

Percent Leased |

Number | Supermarket anchor | Other anchor tenants |

Average base rent per leased SF |

|||||||||||||||||||||||||||||

| of tenants | Owned sq. ft. |

Name |

Expiration Date |

|||||||||||||||||||||||||||||||||

| Property |

Leased | Vacant | ||||||||||||||||||||||||||||||||||

| Market Place |

Norcross | 1976 | 73,686 | 96.0 | % | 19 | 4 | Galaxy Cinema | $ | 10.97 | ||||||||||||||||||||||||||

| Piedmont Peachtree Crossing |

Buckhead | 1978 / 1998 | 152,239 | 97.7 | % | 25 | 3 | 55,520 | Kroger | 02/28/15 | Cost Plus Store / Binders Art Supplies | $ | 18.15 | |||||||||||||||||||||||

| Powers Ferry Plaza |

Marietta | 1979 / 1987 / 1998 | 86,401 | 84.7 | % | 18 | 6 | Micro Center | $ | 9.80 | ||||||||||||||||||||||||||

| Shops of Westridge |

McDonough | 2006 | 66,297 | 71.0 | % | 7 | 11 | 38,997 | Publix | 04/30/26 | $ | 12.39 | ||||||||||||||||||||||||

| Wesley Chapel |

Decatur | 1989 | 164,153 | 83.5 | % | 16 | 12 | Everest Institute / Little Giant/ Deal$ / Planet Fitness | $ | 8.13 | ||||||||||||||||||||||||||

| Williamsburg @ Dunwoody |

Dunwoody | 1983 | 44,928 | 60.4 | % | 19 | 9 | $ | 22.31 | |||||||||||||||||||||||||||

| Central / South Georgia(4) |

||||||||||||||||||||||||||||||||||||

| Daniel Village |

Augusta | 1956 / 1997 | 171,932 | 87.1 | % | 31 | 8 | 45,971 | Bi-Lo | 03/25/22 | St. Joseph Home Health Care | $ | 8.79 | |||||||||||||||||||||||

| McAlpin Square |

Savannah | 1979 | 173,952 | 95.9 | % | 21 | 3 | 43,600 | Kroger | 08/31/15 | Big Lots / Post Office / Habitat for Humanity | $ | 7.79 | |||||||||||||||||||||||

| Spalding Village |

Griffin | 1989 | 235,318 | 60.9 | % | 16 | 12 | 59,431 | Kroger | 05/31/14 | Fred’s Store / Goodwill | $ | 7.10 | |||||||||||||||||||||||

| Walton Plaza |

Augusta | 1990 | 43,460 | 91.7 | % | 5 | 3 | Gold’s Gym | $ | 7.10 | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| TOTAL SHOPPING CENTERS GEORGIA (22) |

2,278,782 | 87.8 | % | 348 | 112 | 736,369 | $ | 12.19 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| LOUISIANA(12) |

||||||||||||||||||||||||||||||||||||

| Ambassador Row |

Lafayette | 1980 /1991 | 187,678 | 98.3 | % | 24 | 2 | Conn’s Appliances / Big Lots / Chuck E Cheese / Planet Fitness / JoAnn Fabrics |

$ | 9.22 | ||||||||||||||||||||||||||

| Ambassador Row Courtyard |

Lafayette | 1986 / 1991 / 2005 | 146,697 | 96.7 | % | 21 | 2 | Bed Bath & Beyond / Marshall’s / Hancock Fabrics / Unitech Training Academy / Tuesday Morning | $ | 9.72 | ||||||||||||||||||||||||||

| Bluebonnet Village |

Baton Rouge | 1983 | 101,623 | 96.8 | % | 21 | 5 | 33,387 | Matherne’s | 11/30/15 | Office Depot | $ | 11.50 | |||||||||||||||||||||||

| Boulevard |

Lafayette | 1976 / 1994 | 68,012 | 93.2 | % | 13 | 2 | Piccadilly / Harbor Freight Tools / Golfballs.com | $ | 9.13 | ||||||||||||||||||||||||||

| Country Club Plaza |

Slidell | 1982 / 1994 | 64,686 | 94.6 | % | 9 | 1 | 33,387 | Winn-Dixie | 01/31/13 | $ | 6.60 | ||||||||||||||||||||||||

| Crossing |

Slidell | 1988 / 1993 | 114,806 | 98.3 | % | 14 | 2 | 58,432 | Save A Center | 09/28/39 | A-1 Home Appliance / Piccadilly | $ | 5.39 | |||||||||||||||||||||||

| Elmwood Oaks |

Harahan | 1989 | 120,515 | 91.2 | % | 8 | 1 | Academy Sports / Dollar Tree / Home Décor | $ | 9.83 | ||||||||||||||||||||||||||

| Plaza Acadienne |

Eunice | 1980 | 59,419 | 97.5 | % | 6 | 1 | 28,092 | Super 1 Store | 06/30/15 | Fred’s Store | $ | 4.35 | |||||||||||||||||||||||

| Sherwood South |

Baton Rouge | 1972 / 1988 / 1992 | 77,107 | 81.3 | % | 7 | 2 | Burke’s Outlet / Harbor Freight Tools / Fred’s Store | $ | 6.09 | ||||||||||||||||||||||||||

| Siegen Village |

Baton Rouge | 1988 | 170,416 | 98.9 | % | 19 | 1 | Office Depot / Big Lots / Dollar Tree / Stage / Party City | $ | 9.42 | ||||||||||||||||||||||||||

| Tarpon Heights |

Galliano | 1982 | 56,605 | 100.0 | % | 9 | — | Stage / Dollar General | $ | 5.86 | ||||||||||||||||||||||||||

| Village at Northshore |

Slidell | 1988 | 144,638 | 96.7 | % | 13 | 2 | Marshalls / Dollar Tree / Kirschman’s* / Bed Bath & Beyond / Office Depot | $ | 7.32 | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| TOTAL SHOPPING CENTERS LOUISIANA (12) |

1,312,202 | 95.8 | % | 164 | 21 | 153,298 | $ | 8.32 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

Page 21

| EQUITY ONE, INC. PROPERTY STATUS REPORT As of March 31, 2012

|

|

| City |

Year Built / Renovated |

Total Sq. Ft. Owned |

Percent Leased |

Number | Supermarket anchor | Other anchor tenants |

Average base rent per leased SF |

|||||||||||||||||||||||||||||

| of tenants | Owned sq. ft. |

Name |

Expiration Date |

|||||||||||||||||||||||||||||||||

| Property |

Leased | Vacant | ||||||||||||||||||||||||||||||||||

| MISSISSIPPI (1) |

||||||||||||||||||||||||||||||||||||

| Shipyard Plaza |

Pascagoula | 1987 | 66,857 | 100.0 | % | 8 | — | Big Lots / Buffalo Wild Wings | $ | 7.29 | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| TOTAL SHOPPING CENTERS MISSISSIPPI(1) |

66,857 | 100.0 | % | 8 | — | — | $ | 7.29 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| NORTH CAROLINA (8) |

||||||||||||||||||||||||||||||||||||

| Brawley Commons |

Charlotte | 1997 / 1998 | 119,189 | 71.3 | % | 20 | 18 | 42,142 | Lowe’s Foods | 05/13/17 | Rite Aid | $ | 11.68 | |||||||||||||||||||||||

| Centre Pointe Plaza |

Smithfield | 1989 | 163,642 | 94.7 | % | 21 | 3 | Belk’s / Dollar Tree / Aaron Rents / Burkes Outlet Stores | $ | 6.05 | ||||||||||||||||||||||||||

| Chestnut Square |

Brevard | 1985 / 2008 | 34,260 | 82.9 | % | 4 | 4 | Walgreens | $ | 15.69 | ||||||||||||||||||||||||||

| Galleria |

Wrightsville Beach | 1986 / 1990 | 92,114 | 37.9 | % | 24 | 13 | $ | 9.99 | |||||||||||||||||||||||||||

| Riverview Shopping Center |

Durham | 1973 / 1995 | 128,498 | 92.4 | % | 11 | 5 | 53,538 | Kroger | 12/31/14 | Upchurch Drugs / Riverview Galleries | $ | 8.03 | |||||||||||||||||||||||

| Stanley Market Place |

Stanley | 2007 | 53,228 | 94.1 | % | 5 | 2 | 34,928 | Food Lion | 05/15/27 | Family Dollar | $ | 9.81 | |||||||||||||||||||||||

| Thomasville Commons |

Thomasville | 1991 | 148,754 | 88.3 | % | 8 | 6 | 32,000 | Ingles | 09/29/12 | Kmart | $ | 5.33 | |||||||||||||||||||||||

| Willowdaile Shopping Center |

Durham | 1986 | 95,601 | 91.3 | % | 17 | 5 | Hall of Fitness / Ollie’s Bargain Outlet | $ | 8.37 | ||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| TOTAL SHOPPING CENTERS NORTH CAROLINA (8) |

835,286 | 82.7 | % | 110 | 56 | 162,608 | $ | 8.11 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| SOUTH CAROLINA (3) |

||||||||||||||||||||||||||||||||||||

| North Village Center |

North Myrtle Beach | 1984 | 60,356 | 68.2 | % | 5 | 8 | Dollar General / Goodwill | $ | 8.02 | ||||||||||||||||||||||||||

| Windy Hill |

North Myrtle Beach | 1968 / 1988 / 2006 | 68,465 | 100.0 | % | 5 | — | Rose’s Store / Citi Trends | $ | 6.11 | ||||||||||||||||||||||||||

| Woodruff |

Greenville | 1995 | 68,055 | 100.0 | % | 10 | — | 47,955 | Publix | 08/06/15 | $ | 10.52 | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| TOTAL SHOPPING CENTERS SOUTH CAROLINA (3) |

196,876 | 90.2 | % | 20 | 8 | 47,955 | $ | 8.24 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| VIRGINIA (1) |

||||||||||||||||||||||||||||||||||||

| Smyth Valley Crossing |

Marion | 1989 | 126,841 | 98.0 | % | 13 | 1 | 32,000 | Ingles | 09/25/15 | Wal-Mart | $ | 6.06 | |||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| TOTAL SHOPPING CENTERS VIRGINIA (1) |

126,841 | 98.0 | % | 13 | 1 | 32,000 | $ | 6.06 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| TOTAL SHOPPING CENTERS SOUTHEAST (49) |

4,950,958 | 89.7 | % | 677 | 206 | 1,226,219 | $ | 9.97 | ||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

| NORTHEAST (16) |

||||||||||||||||||||||||||||||||||||

| CONNECTICUT (6) |

||||||||||||||||||||||||||||||||||||

| Brookside Plaza |

Enfield | 1985 / 2006 | 213,274 | 95.6 | % | 22 | 4 | 59,648 | Wakefern Food | 08/31/15 | Bed Bath & Beyond / Walgreens / Staples /Petsmart / Hibachi Grill | $ | 12.33 | |||||||||||||||||||||||

| Compo Acres(1) |

Westport | 1960/2011 | 43,107 | 90.7 | % | 13 | 2 | Trader Joe’s | $ | 45.01 | ||||||||||||||||||||||||||

Page 22

| EQUITY ONE, INC. PROPERTY STATUS REPORT As of March 31, 2012

|

|

| City |

Year Built / Renovated |

Total Sq. Ft. Owned |

Percent Leased |

Number | Supermarket anchor | Other anchor tenants |

Average base rent per leased SF |

|||||||||||||||||||||||||||