Attached files

| file | filename |

|---|---|

| 8-K - HIGHER ONE HOLDINGS INC 8-K 5-1-2012 - Higher One Holdings, Inc. | form8k.htm |

| EX-99.1 - EXHIBIT 99.1 - Higher One Holdings, Inc. | ex99_1.htm |

EXHIBIT 99.2

Higher One Holdings, Inc.

Q1’12 Earnings Results

Q1’12 Earnings Results

May 1, 2012

®

©2012 Higher One Holdings, Inc. Higher One and CASHNet are registered trademarks

of Higher One, Inc. All other marks are owned by their respective owners.

of Higher One, Inc. All other marks are owned by their respective owners.

2

Forward-Looking Statements

This presentation includes forward-looking statements, as defined by the Securities and Exchange

Commission. Management’s projections and expectations are subject to a number of risks and

uncertainties that could cause actual performance to differ materially from that predicted or implied.

These statements speak only as of the date they are made, and the company does not intend to update or

otherwise revise the forward-looking information to reflect actual results of operations, changes in

financial condition, changes in estimates, expectations or assumptions, changes in general economic or

industry conditions or other circumstances arising and/or existing since the preparation of this

presentation or to reflect the occurrence of any unanticipated events. The forward-looking statements in

this presentation do not include the potential impact of any acquisitions or divestitures that may be

announced and/or completed after the date hereof. Information about the factors that could affect future

performance can be found in our recent SEC filings, available on our website at http://ir.higherone.com/.

Commission. Management’s projections and expectations are subject to a number of risks and

uncertainties that could cause actual performance to differ materially from that predicted or implied.

These statements speak only as of the date they are made, and the company does not intend to update or

otherwise revise the forward-looking information to reflect actual results of operations, changes in

financial condition, changes in estimates, expectations or assumptions, changes in general economic or

industry conditions or other circumstances arising and/or existing since the preparation of this

presentation or to reflect the occurrence of any unanticipated events. The forward-looking statements in

this presentation do not include the potential impact of any acquisitions or divestitures that may be

announced and/or completed after the date hereof. Information about the factors that could affect future

performance can be found in our recent SEC filings, available on our website at http://ir.higherone.com/.

This presentation includes certain metrics presented on a non-GAAP basis, including non-GAAP adjusted

EBITDA, non-GAAP adjusted EBITDA margin, non-GAAP adjusted net income, non-GAAP adjusted diluted

EPS, and non-GAAP Free Cash Flow. We believe that these non-GAAP measures, which exclude

amortization of intangibles, stock-based compensation, and certain non-recurring or non-cash impacts to

our results, all net of taxes, provide useful information regarding normalized trends relating to the

company’s financial condition and results of operations. Reconciliations of these non-GAAP measures to

their closest comparable GAAP measure are included in the appendix of this presentation.

EBITDA, non-GAAP adjusted EBITDA margin, non-GAAP adjusted net income, non-GAAP adjusted diluted

EPS, and non-GAAP Free Cash Flow. We believe that these non-GAAP measures, which exclude

amortization of intangibles, stock-based compensation, and certain non-recurring or non-cash impacts to

our results, all net of taxes, provide useful information regarding normalized trends relating to the

company’s financial condition and results of operations. Reconciliations of these non-GAAP measures to

their closest comparable GAAP measure are included in the appendix of this presentation.

®

©2012 Higher One Holdings, Inc. Higher One and CASHNet are registered trademarks

of Higher One, Inc. All other marks are owned by their respective owners.

of Higher One, Inc. All other marks are owned by their respective owners.

3

Key Metrics

• Number of students receiving refunds at clients that were launched for at

least a year down slightly...

least a year down slightly...

o Believe this indicates enrollment flat to slightly down at client institutions

o Enrollment at client institutions up over 3% in 2010/2011 school year, up over

9% in ‘09/’10

9% in ‘09/’10

• Average disbursement size flat

• Dollars disbursed into OneAccounts grew 11%, essentially in line with

Account Revenue growth

Account Revenue growth

o Indicates consistent spending patterns

• OneAccount election rates remain stable

• Revenue per account down 8%

o Higher percent of OneAccounts generated by newly launched schools receive

refunds than at more mature clients (due to churn)

refunds than at more mature clients (due to churn)

• Leads to higher revenue/account for accounts generated by newly launched schools

o 7% of accounts this quarter from schools launched in past 12 months

compared to 14% the year before

compared to 14% the year before

o Schools launching in fall 2012 expected to be about 50% higher than 2011

®

©2012 Higher One Holdings, Inc. Higher One and CASHNet are registered trademarks

of Higher One, Inc. All other marks are owned by their respective owners.

of Higher One, Inc. All other marks are owned by their respective owners.

4

Q1’12 Highlights

• Revenue up 12% due to solid OneDisburse sales, offset by near-

term enrollment headwinds, lower percentage of cards from newly

launched schools

term enrollment headwinds, lower percentage of cards from newly

launched schools

• 161,000 increase in OneDisburse SSE in the quarter from new sales

o 431,000 SSE currently in implementation (compared to 227,000 at the

end of Q1’11)

end of Q1’11)

o Pipeline robust

• Student adoption rate of OneAccounts remains consistent

• Revenue diversification continues

o CASHNet sales increased sharply, adding 160,000 SSE

o Broad launch of Premier and Flex as planned, non-refund deposits up

~30%

~30%

• Average refund size, spending patterns, and economics per student

receiving refunds remain consistent with historical levels

receiving refunds remain consistent with historical levels

• Annual guidance reduced to account for continued enrollment

headwinds

headwinds

®

©2012 Higher One Holdings, Inc. Higher One and CASHNet are registered trademarks

of Higher One, Inc. All other marks are owned by their respective owners.

of Higher One, Inc. All other marks are owned by their respective owners.

5

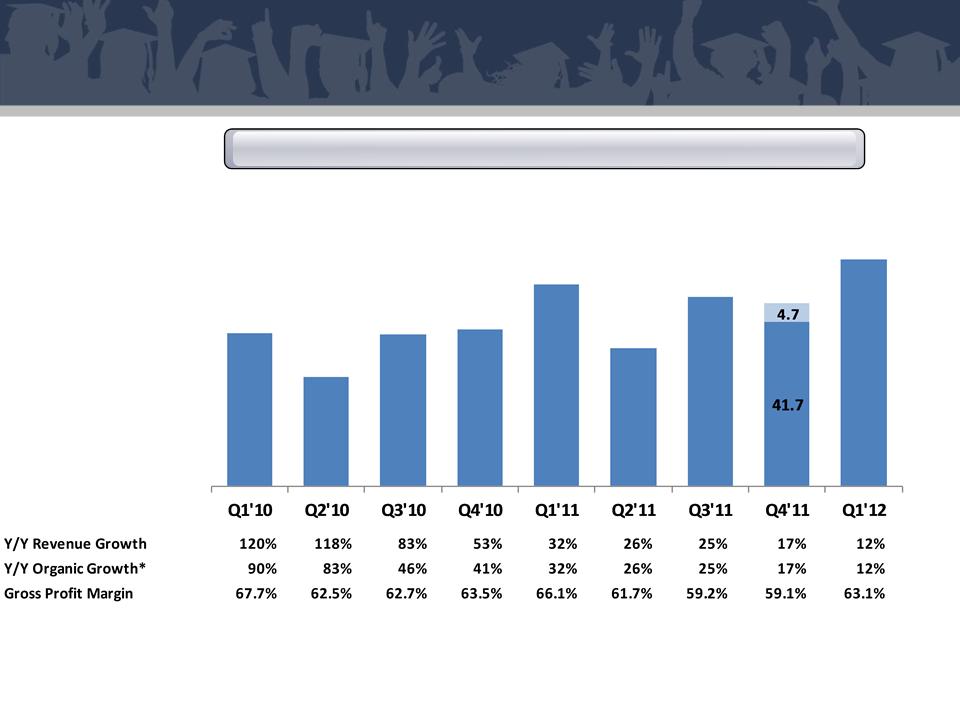

*Calculation of organic revenue growth is included in the appendix of this presentation

**Excluding $4.7 million impact of credit project, Q4’11 gross margin would have been 63.2%

Revenue

(in $ millions)

Continued revenue growth in difficult environment

38.9

27.8

38.6

39.8

51.4

35.1

48.1

46.5

**

**

57.8

®

©2012 Higher One Holdings, Inc. Higher One and CASHNet are registered trademarks

of Higher One, Inc. All other marks are owned by their respective owners.

of Higher One, Inc. All other marks are owned by their respective owners.

6

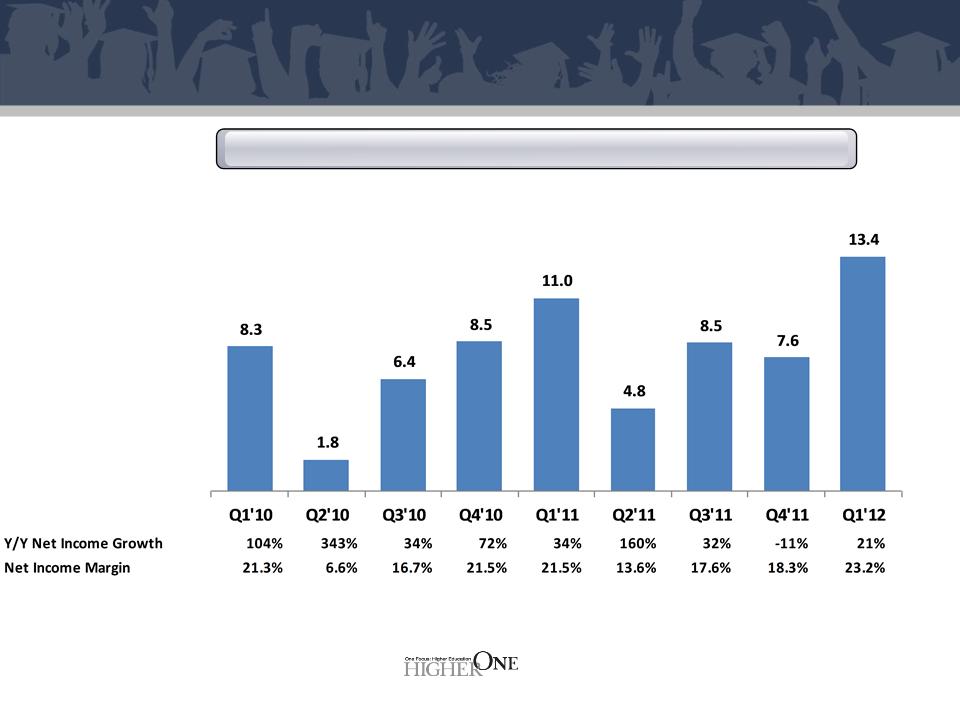

GAAP Net Income

Net Income

(in $ millions)

®

©2012 Higher One Holdings, Inc. Higher One and CASHNet are registered trademarks

of Higher One, Inc. All other marks are owned by their respective owners.

of Higher One, Inc. All other marks are owned by their respective owners.

7

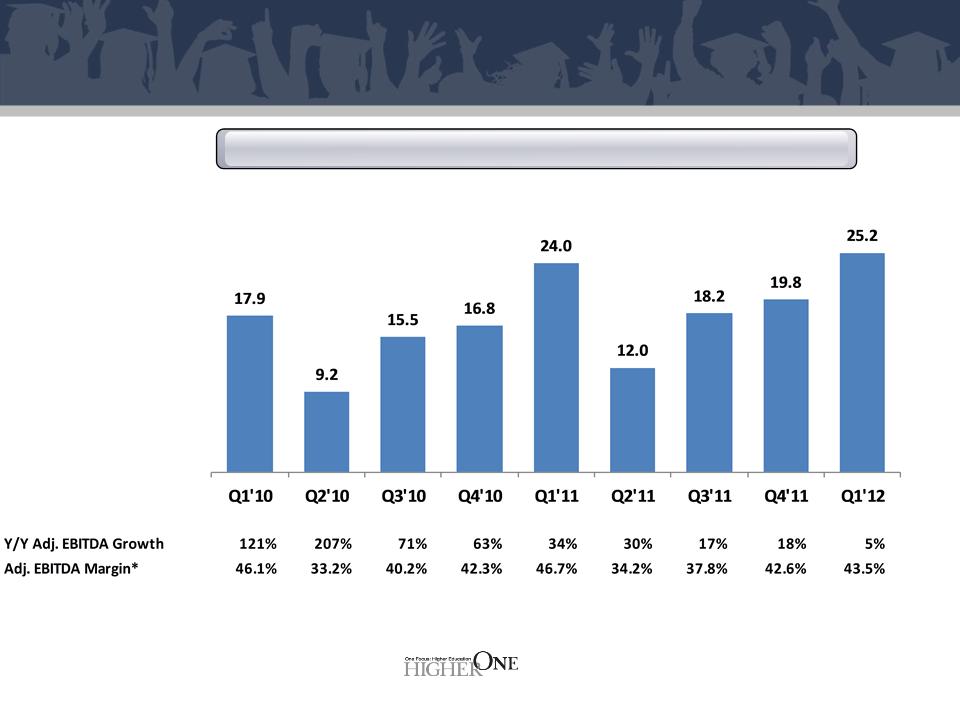

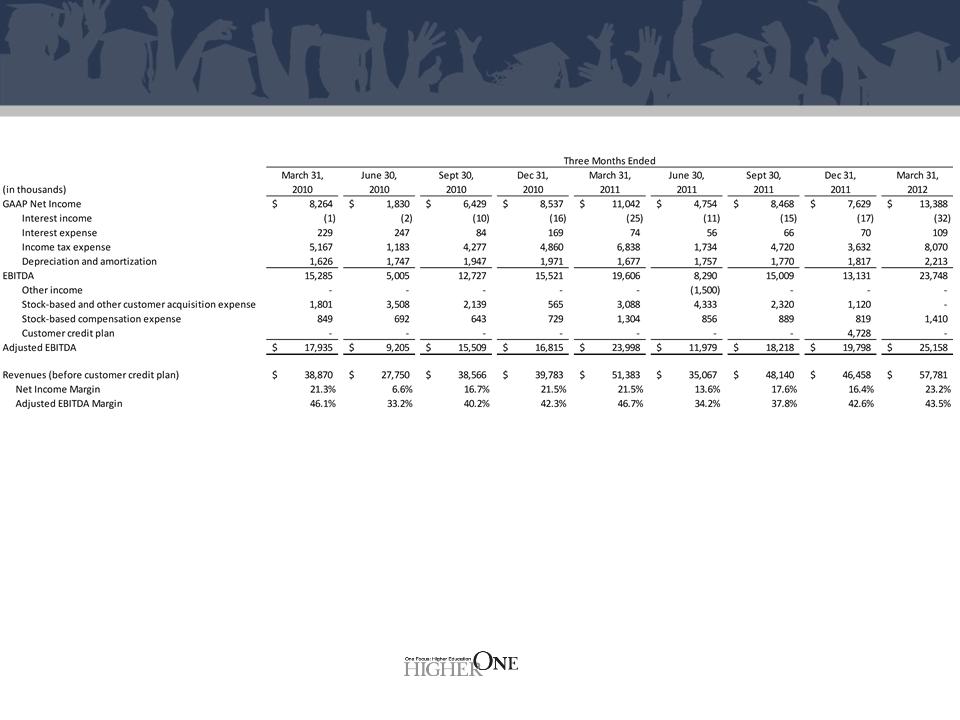

Adj. EBITDA margin impacted by gross margin decline

*Calculation of Adj. EBITDA and Adj. EBITDA Margin is included in the appendix of this presentation

Adj. EBITDA*

(in $ millions)

®

©2012 Higher One Holdings, Inc. Higher One and CASHNet are registered trademarks

of Higher One, Inc. All other marks are owned by their respective owners.

of Higher One, Inc. All other marks are owned by their respective owners.

8

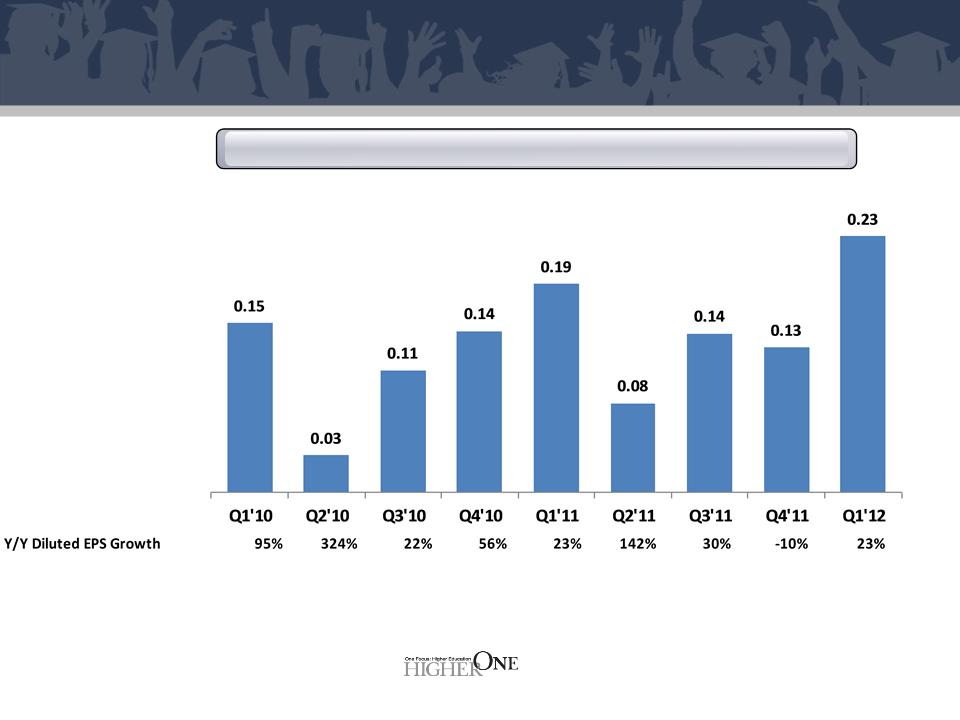

GAAP Diluted EPS

GAAP Diluted EPS

(in $)

®

©2012 Higher One Holdings, Inc. Higher One and CASHNet are registered trademarks

of Higher One, Inc. All other marks are owned by their respective owners.

of Higher One, Inc. All other marks are owned by their respective owners.

9

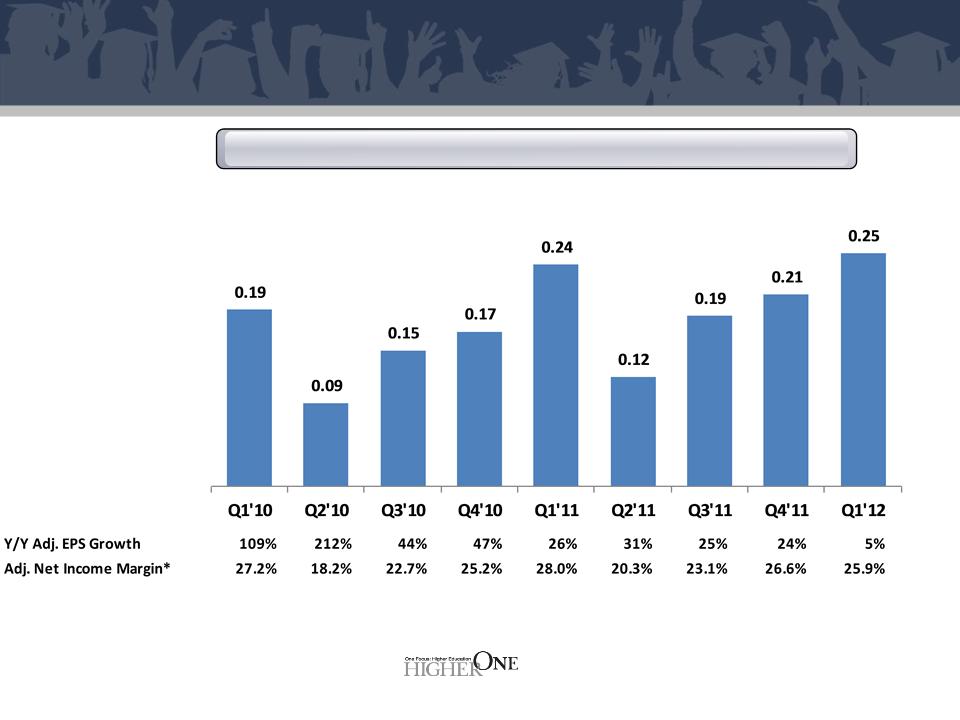

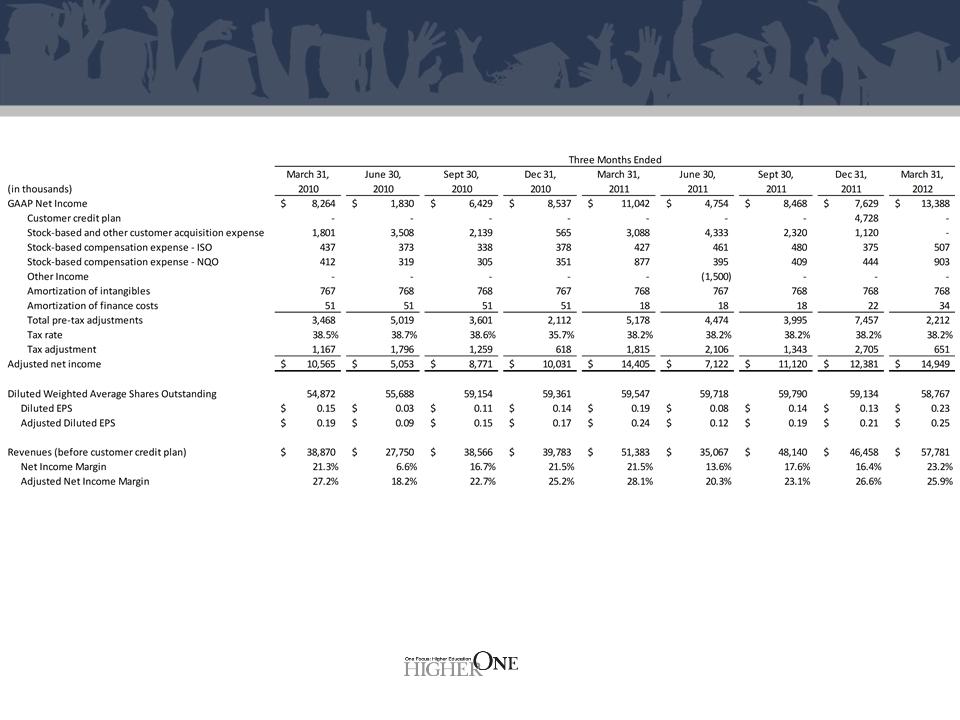

Adj. EPS growth impacted by lower margins

*Calculation of Adj. EPS and Adj. Net Income Margin is included in the appendix of this presentation

Adjusted Diluted EPS

(in $)

®

©2012 Higher One Holdings, Inc. Higher One and CASHNet are registered trademarks

of Higher One, Inc. All other marks are owned by their respective owners.

of Higher One, Inc. All other marks are owned by their respective owners.

10

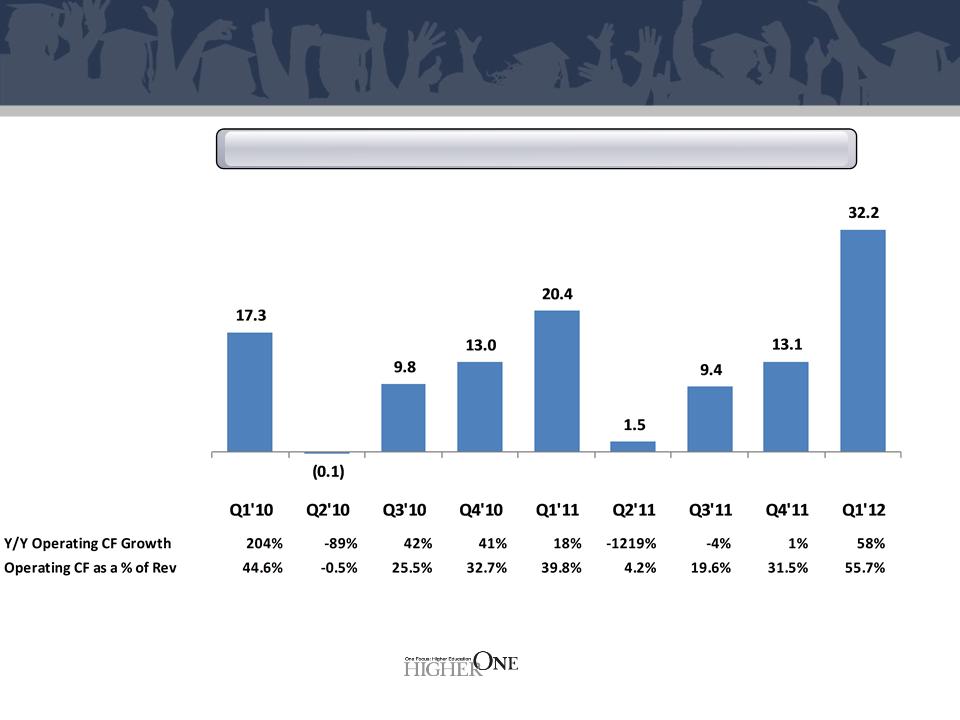

Operating Cash Flow

Operating Cash Flow

(in $ millions)

®

©2012 Higher One Holdings, Inc. Higher One and CASHNet are registered trademarks

of Higher One, Inc. All other marks are owned by their respective owners.

of Higher One, Inc. All other marks are owned by their respective owners.

11

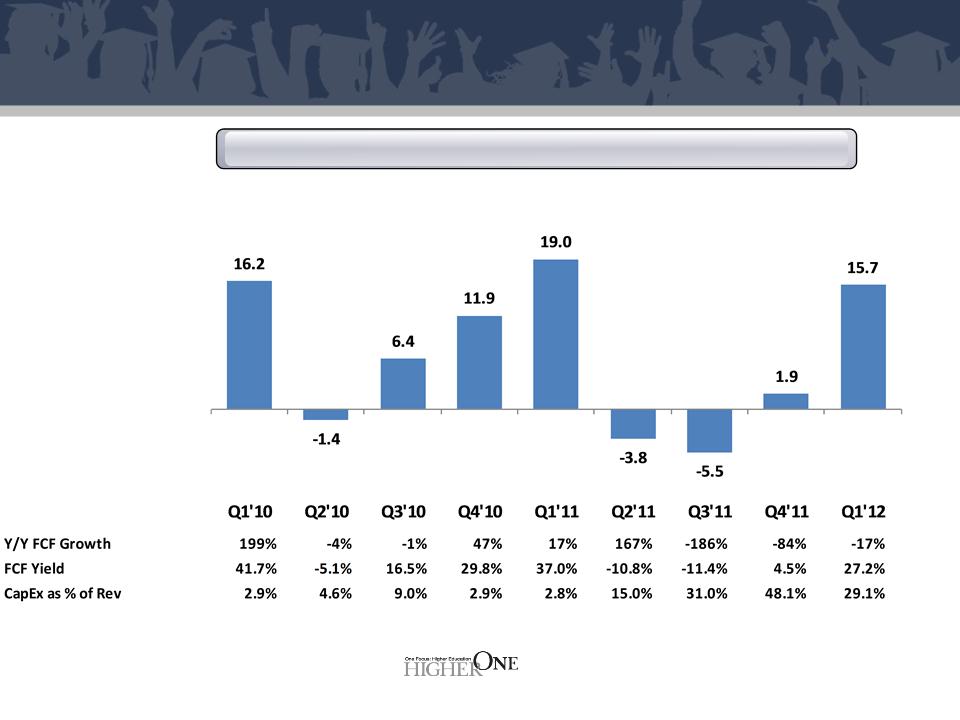

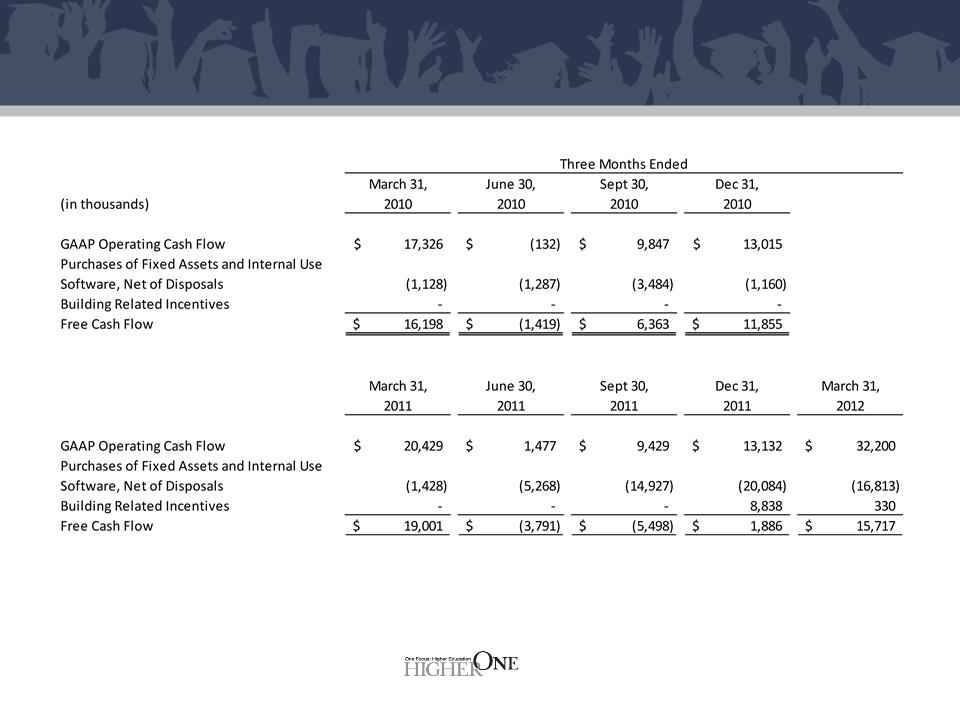

*Calculation of Free Cash Flow is included in the appendix of this presentation

Free Cash Flow

(in $ millions)

FCF strong despite significant capital investments

®

©2012 Higher One Holdings, Inc. Higher One and CASHNet are registered trademarks

of Higher One, Inc. All other marks are owned by their respective owners.

of Higher One, Inc. All other marks are owned by their respective owners.

12

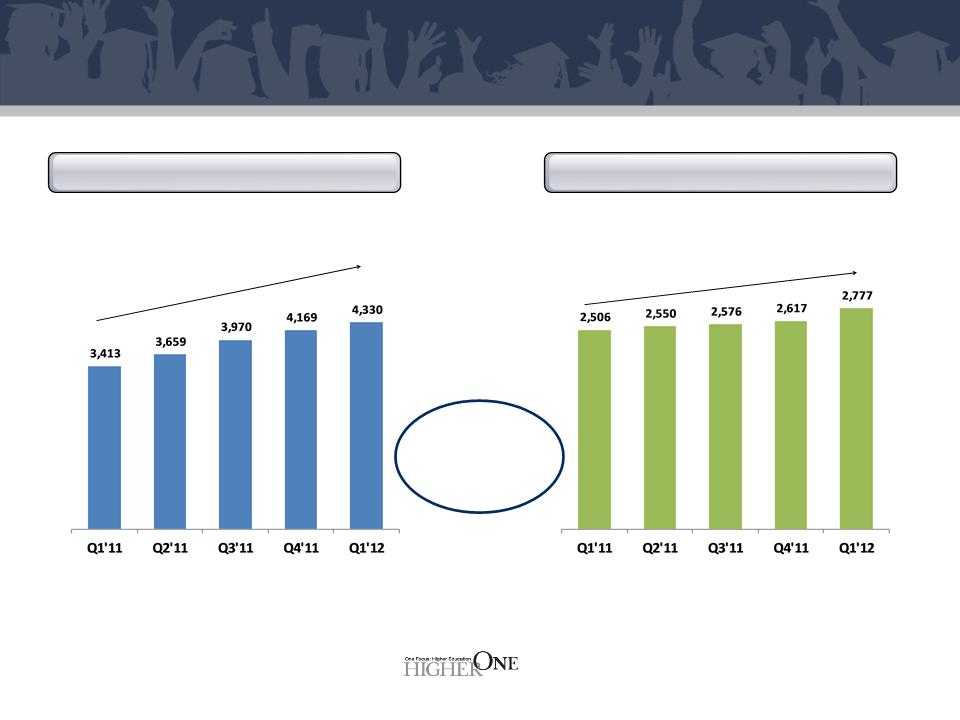

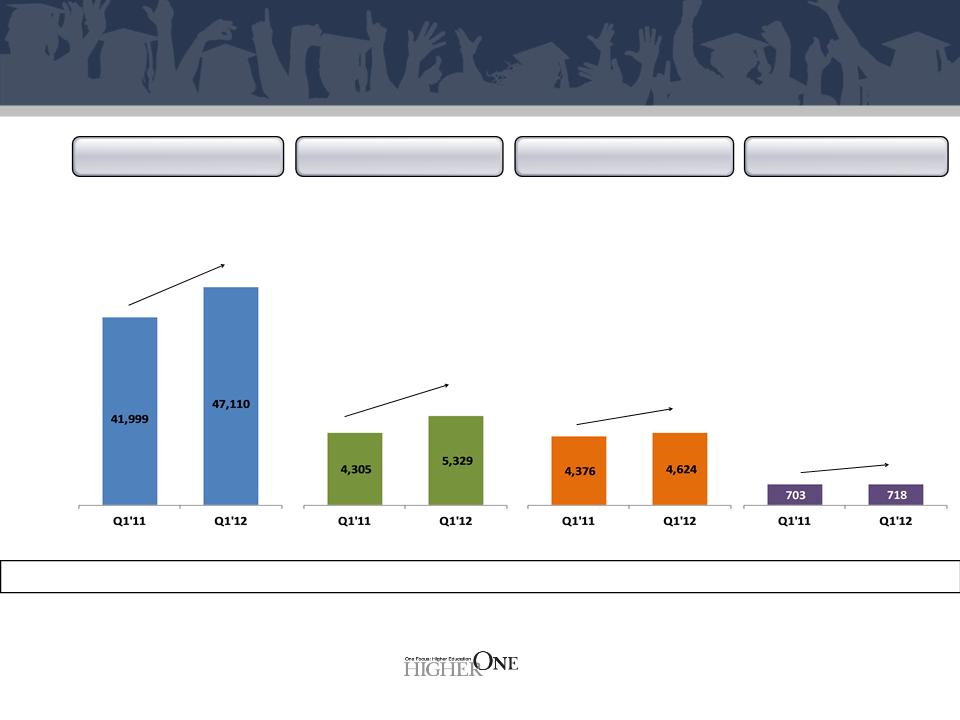

Strong signings, increased cross-penetration

*SSE stands for Signed School Enrollment, and is recorded each quarter as the total student enrollment at all schools that are contracted at

quarter-end for either our OneDisburse or at least one of our CASHNet® payment suite of products, as of the date the contract is signed (using

the most up-to-date IPEDS data at that point in time).

quarter-end for either our OneDisburse or at least one of our CASHNet® payment suite of products, as of the date the contract is signed (using

the most up-to-date IPEDS data at that point in time).

OneDisburse SSE*

CASHNet Suite SSE*

+27%

+11%

(in thousands)

(in thousands)

15% client

overlap

overlap

®

©2012 Higher One Holdings, Inc. Higher One and CASHNet are registered trademarks

of Higher One, Inc. All other marks are owned by their respective owners.

of Higher One, Inc. All other marks are owned by their respective owners.

13

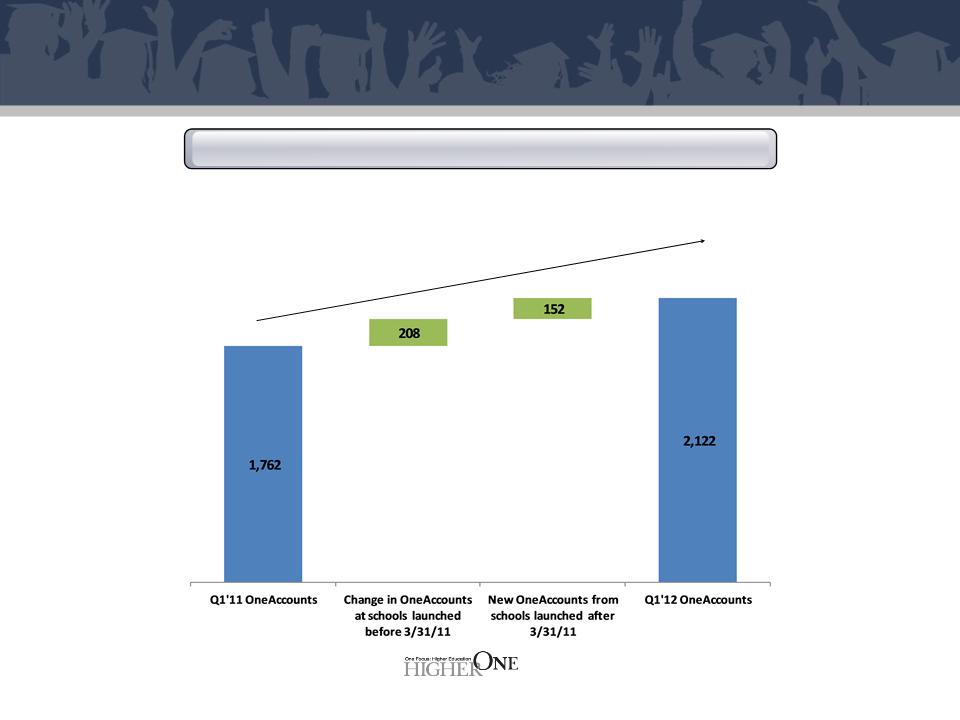

Adoption increases drive OneAccount growth

OneAccount Growth

+20%

(in thousands)

®

©2012 Higher One Holdings, Inc. Higher One and CASHNet are registered trademarks

of Higher One, Inc. All other marks are owned by their respective owners.

of Higher One, Inc. All other marks are owned by their respective owners.

14

Continued growth in major revenue streams

As a % of total

revenue

revenue

Account

(in $ thousands)

Payment Trxn

(in $ thousands)

Higher Ed. Institution

(in $ thousands)

Other

(in $ thousands)

82%

82%

8%

9%

9%

8%

1%

1%

+12%

+24%

+6%

+2%

®

©2012 Higher One Holdings, Inc. Higher One and CASHNet are registered trademarks

of Higher One, Inc. All other marks are owned by their respective owners.

of Higher One, Inc. All other marks are owned by their respective owners.

15

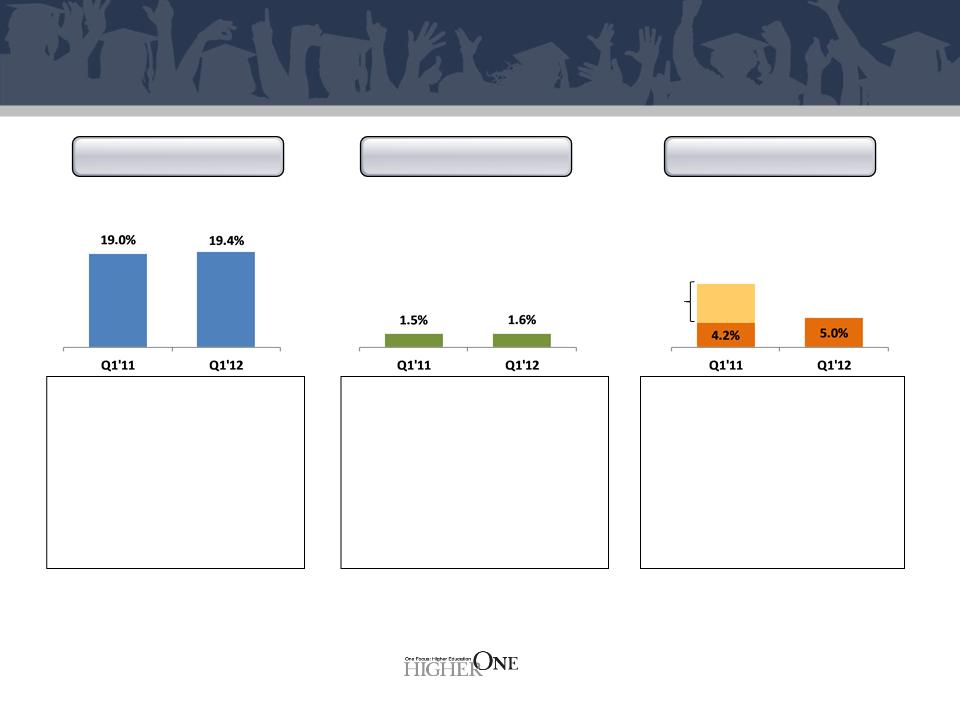

Spending wisely to grow and scale the business

• Overall facilities costs up due to

incremental expenses related to

new headquarters, other offices,

data centers… will be a source of

leverage from scale in the future

incremental expenses related to

new headquarters, other offices,

data centers… will be a source of

leverage from scale in the future

• IT related transition/overlap

expense

expense

• Continue to invest in projects to

increase product development

flexibility, grow revenue, and

manage costs

increase product development

flexibility, grow revenue, and

manage costs

• Increased marketing expenses from

consumer branding initiatives and

broad launch of Premier and Flex

consumer branding initiatives and

broad launch of Premier and Flex

• Earn-out resulting in stock-based and

other M&A related expense expired in

2011

other M&A related expense expired in

2011

G&A

(as a % of rev)

PD

(as a % of rev )

Adj. S&M*

(as a % of rev)

10.6%

*The Adjusted Sales and Marketing Expense graph shows both total Sales & Marketing as a percent of revenue as well as Sales & Marketing as a percent of revenue

excluding stock-based and other acquisition expense, which is related to the vesting of certain shares issued in connection with the acquisition of EduCard and CASHNET.

Stock-based and other acquisition expense is recognized in the quarter as a function of sales and average share price.

excluding stock-based and other acquisition expense, which is related to the vesting of certain shares issued in connection with the acquisition of EduCard and CASHNET.

Stock-based and other acquisition expense is recognized in the quarter as a function of sales and average share price.

Stock-based and

other M&A

related expense

other M&A

related expense

®

©2012 Higher One Holdings, Inc. Higher One and CASHNet are registered trademarks

of Higher One, Inc. All other marks are owned by their respective owners.

of Higher One, Inc. All other marks are owned by their respective owners.

16

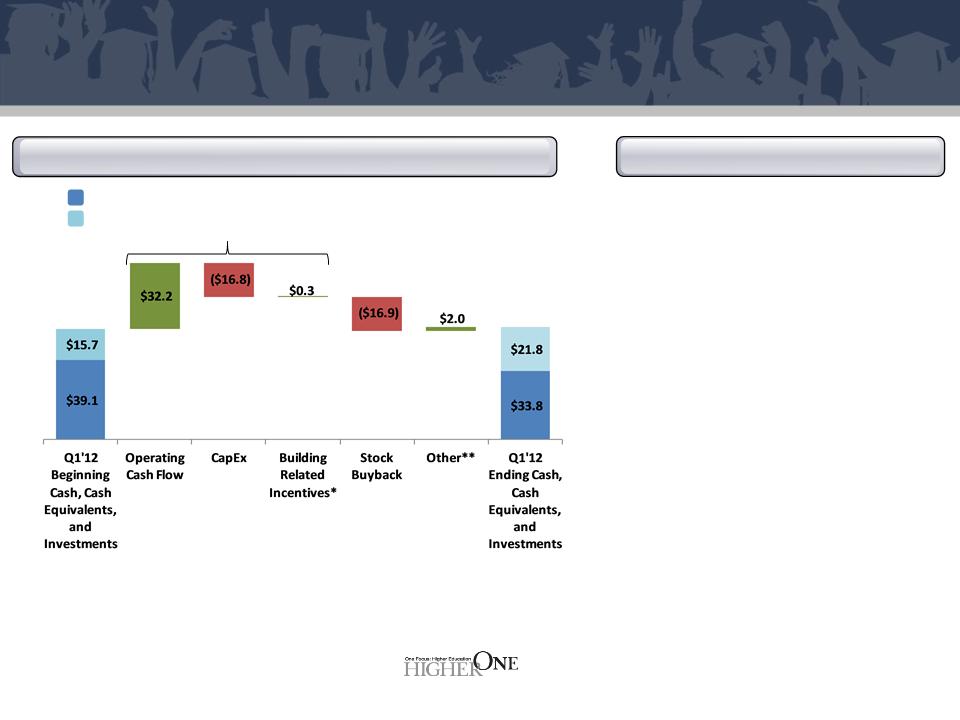

Capital allocation creating value for shareholders

• Fully liquid assets total $55.6M

• $15.7M in FCF

• Capital spending on building project, IT

infrastructure project

infrastructure project

• $6.0 million reduction to income tax

receivable, $0.3 in additional subsidies,

credits, and construction cost offsets

related to building project in Q1

receivable, $0.3 in additional subsidies,

credits, and construction cost offsets

related to building project in Q1

• To date, $15.1 million in total subsidies,

credits, and construction cost offsets

related to our building renovation project

credits, and construction cost offsets

related to our building renovation project

• ($16.9) million on repurchasing

1,111,128 shares at an average price of

$15.21 in Q1

1,111,128 shares at an average price of

$15.21 in Q1

• Since start of buyback program, $33.1

million of shares repurchased at an

average price of $15.25/share

million of shares repurchased at an

average price of $15.25/share

*Reductions to income tax receivable related to building renovation project reflected in Operating Cash Flow. Other subsidies, credits, and

construction cost offsets related to our building project reflected in Building Related Incentives.

construction cost offsets related to our building project reflected in Building Related Incentives.

**Other primarily includes proceeds and tax benefits from options exercises

Cash & Investment Balance/Flows

(in millions)

FCF/Other Movements

$54.8

FCF

Cash and cash equivalents

Investments in available for sale securities

$55.6

®

©2012 Higher One Holdings, Inc. Higher One and CASHNet are registered trademarks

of Higher One, Inc. All other marks are owned by their respective owners.

of Higher One, Inc. All other marks are owned by their respective owners.

17

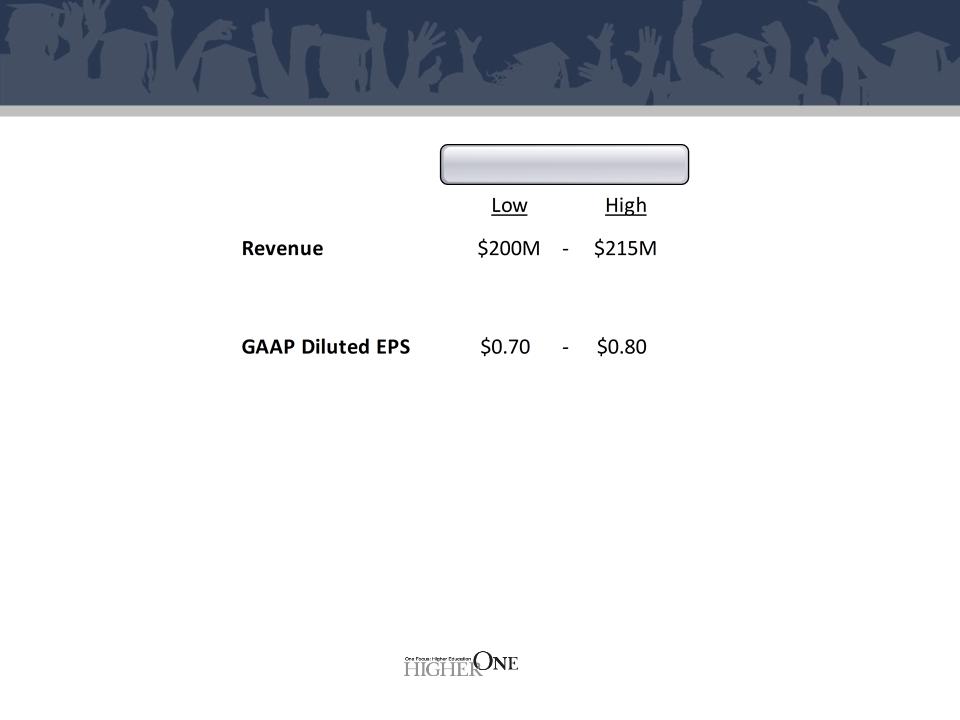

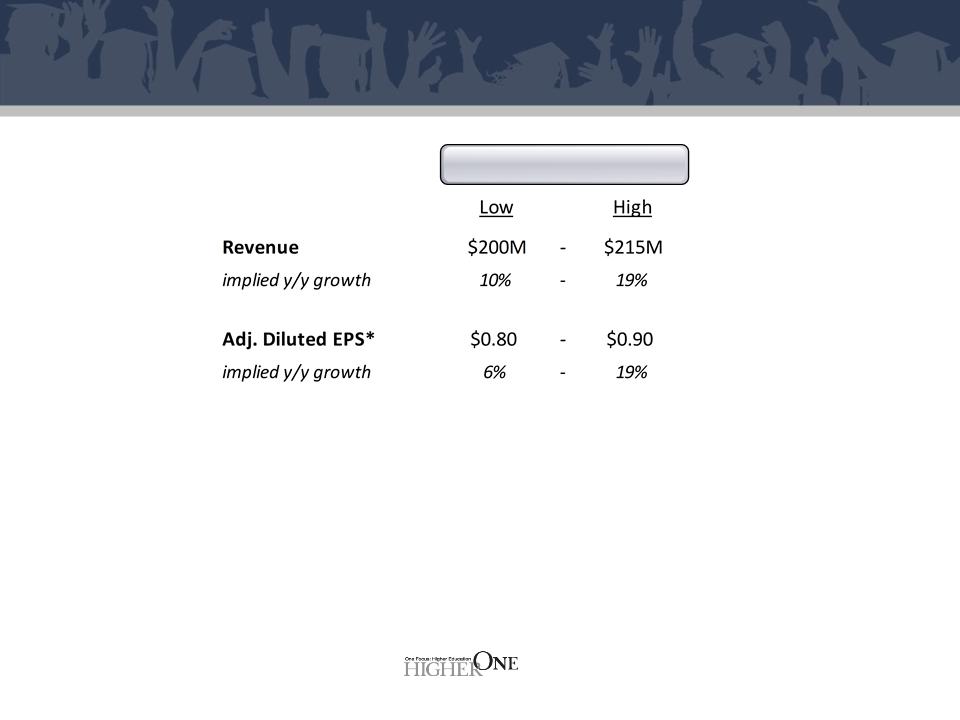

GAAP Guidance Update

FY’12

®

©2012 Higher One Holdings, Inc. Higher One and CASHNet are registered trademarks

of Higher One, Inc. All other marks are owned by their respective owners.

of Higher One, Inc. All other marks are owned by their respective owners.

18

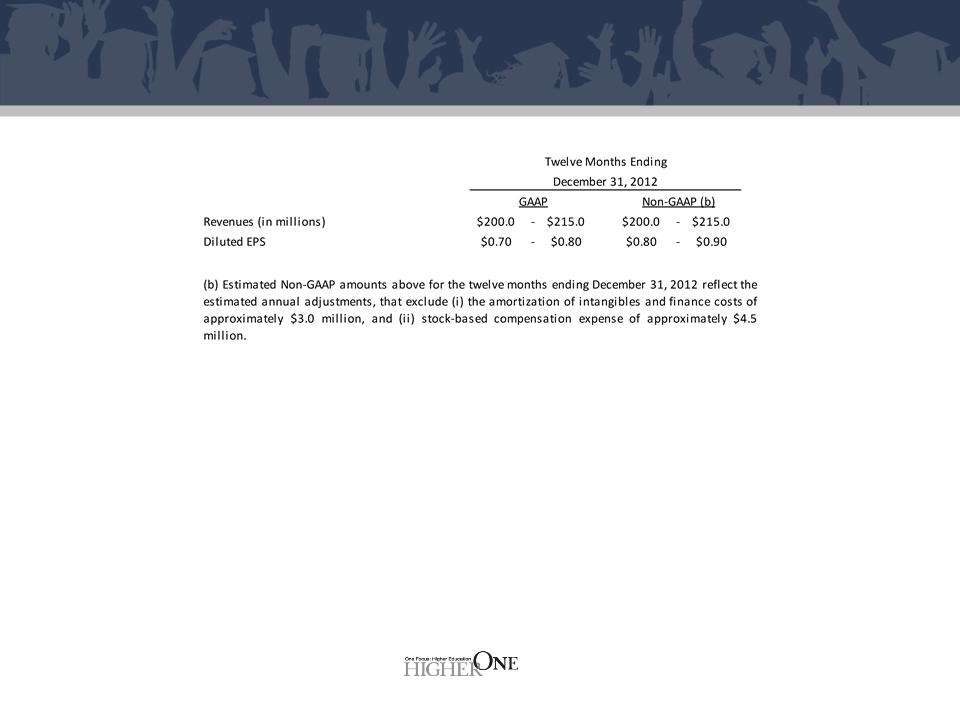

Non-GAAP Guidance Update

*Calculation of Adjusted Diluted EPS is included in the appendix of this presentation

FY’12

• Midpoint of guidance implies flat enrollment growth, minimal uptake

of Flex and Premier

of Flex and Premier

• 431,000 SSE currently in implementation, most should be launched

by Fall ‘12 semester, along with additional sales made in Q2

by Fall ‘12 semester, along with additional sales made in Q2

• Light Q1 disbursements, Pell changes could impact Q2’12

®

©2012 Higher One Holdings, Inc. Higher One and CASHNet are registered trademarks

of Higher One, Inc. All other marks are owned by their respective owners.

of Higher One, Inc. All other marks are owned by their respective owners.

19

Q1’12 Summary

• Growth initiatives progressing well

• Large backlog of schools currently in

implementation

implementation

• Solid growth in OneDisburse and CASHNet SSE

• Metrics gauging long-term health of the business

consistent with historical trends

consistent with historical trends

• Near-term enrollment headwinds impacting

revenue growth

revenue growth

o Industry experts expect enrollment to return to more

normalized growth patters in ‘12/’13 school year

normalized growth patters in ‘12/’13 school year

®

©2012 Higher One Holdings, Inc. Higher One and CASHNet are registered trademarks

of Higher One, Inc. All other marks are owned by their respective owners.

of Higher One, Inc. All other marks are owned by their respective owners.

20

Q & A

®

©2012 Higher One Holdings, Inc. Higher One and CASHNet are registered trademarks

of Higher One, Inc. All other marks are owned by their respective owners.

of Higher One, Inc. All other marks are owned by their respective owners.

21

Appendix

®

©2012 Higher One Holdings, Inc. Higher One and CASHNet are registered trademarks

of Higher One, Inc. All other marks are owned by their respective owners.

of Higher One, Inc. All other marks are owned by their respective owners.

22

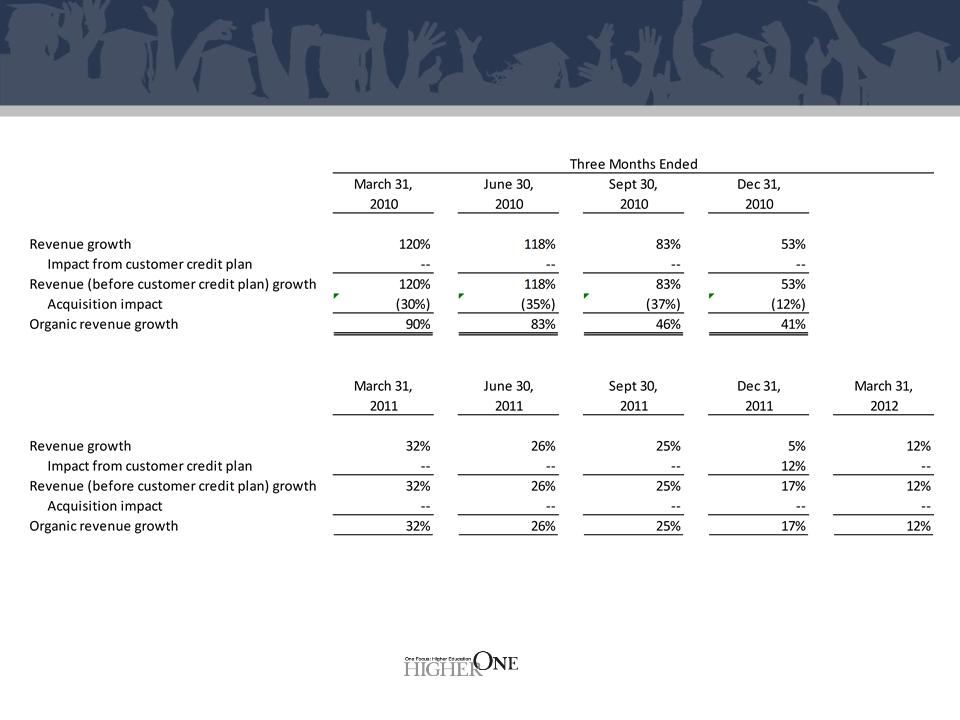

Calculation of Organic Gross Revenue*

*Organic revenue calculation excludes the entire revenue impact from the current and prior year quarter for all acquisitions made within 15

months of a given quarter’s end

months of a given quarter’s end

®

©2012 Higher One Holdings, Inc. Higher One and CASHNet are registered trademarks

of Higher One, Inc. All other marks are owned by their respective owners.

of Higher One, Inc. All other marks are owned by their respective owners.

23

Calculation of Free Cash Flow

®

©2012 Higher One Holdings, Inc. Higher One and CASHNet are registered trademarks

of Higher One, Inc. All other marks are owned by their respective owners.

of Higher One, Inc. All other marks are owned by their respective owners.

24

Calculation of Adjusted EBITDA

®

©2012 Higher One Holdings, Inc. Higher One and CASHNet are registered trademarks

of Higher One, Inc. All other marks are owned by their respective owners.

of Higher One, Inc. All other marks are owned by their respective owners.

25

Calculation of Adjusted Diluted EPS

®

©2012 Higher One Holdings, Inc. Higher One and CASHNet are registered trademarks

of Higher One, Inc. All other marks are owned by their respective owners.

of Higher One, Inc. All other marks are owned by their respective owners.

26

Reconciliation of GAAP to non-GAAP Guidance