Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - HOLOGIC INC | d343258d8k.htm |

| EX-2.1 - AGREEMENT AND PLAN OF MERGER DATED APRIL 29, 2012 - HOLOGIC INC | d343258dex21.htm |

| EX-10.1 - COMMITMENT LETTER DATED APRIL 29, 2012 - HOLOGIC INC | d343258dex101.htm |

Creating a Leading Diagnostics Franchise Focused

on Women’s Health

April 30, 2012

Exhibit 99.1 |

Forward-Looking Statements

This presentation contains forward-looking information that involves risks and

uncertainties, including statements about Hologic’s and

Gen-Probe’s plans, objectives, expectations and intentions. Such statements include, without limitation,

statements about the timing of the completion of the transaction, the anticipated

benefits thereof, including anticipated future financial and operating

results of the combined company, the expected permanent financing for the transaction,

other of Hologic’s and Gen-Probe’s plans, objectives, expectations

and intentions, and other statements that are not historical

facts.

Forward-looking

statements

may

contain

words

such

as

“expect,”

“believe,”

“may,”

“can,”

“should,”

“will,”

“forecast,”

“anticipate,”

or similar expressions (including their use in the negative), and include

assumptions that underlie such statements. These

forward-looking statements are subject to known and unknown risks and

uncertainties that could cause actual results to differ materially from those

expressed or implied by such statements, including but not limited to: the

ability of the parties to consummate the proposed merger in a timely manner or at all;

satisfaction of the conditions precedent to consummation of the proposed merger,

including the ability to secure regulatory approvals in a timely manner or

at all, and approval by Gen-Probe’s stockholders; the possibility of litigation

(including related to the merger itself); successful completion of anticipated

financing arrangements; Hologic’s ability to successfully and timely

integrate Gen-Probe’s operations, product lines, technologies and employees, and realize

synergies

from

the

proposed

transaction;

unknown,

underestimated

or

undisclosed

commitments

or

liabilities;

effects

of

purchase

accounting

that

may

be

different

from

expectations;

the

level

of

demand

for

the

combined

company’s

products; the ability of the combined company to develop, deliver and support a

broad range of products, develop new products,

expand

its

markets

and/or

develop

new

markets;

and

the

ability

of

the

combined

company

to

attract,

motivate

and retain key employees. Moreover, the combined business may be adversely

affected by future legislative, regulatory, or tax changes as well as other

economic, business and/or competitive factors. The risks included above are

not exhaustive. Other factors that could adversely affect the combined

company’s business and prospects are described in the combined

company’s filings with the Securities and Exchange Commission. The companies expressly

disclaim any obligation or undertaking to release publicly any updates or revisions

to any such statements presented herein to reflect any change in

expectations or any change in events, conditions or circumstances on which any such

statements are based.

2 |

Use

of Non-GAAP Financial Measures Hologic, Inc. (the “Company”)

has presented the following non-GAAP financial measures in this presentation : adjusted net income

and adjusted EBITDA of each of Hologic and Gen-Probe, and pro forma adjusted

net income, adjusted EPS and adjusted EBITDA of the combined company.

The Company defines its non-GAAP adjusted net income and adjusted EPS to exclude the non-cash

amortization of intangible assets, other acquisition-related charges, such

changes for contingent consideration, transaction costs and charges

associated with the write-up of acquired inventory to fair value, non-cash interest expense related to amortization of

the debt discount for convertible debt securities, divestiture and restructuring

charges, non-cash loss on exchange of convertible notes, and

one-time, nonrecurring, unusual or unanticipated charges, expenses or gains. The Company’s non-GAAP adjusted

EBITDA

excludes

from

its

GAAP

net

income:

(i)

the

items

excluded

in

its

calculation

of

non-GAAP

adjusted

net

income;

(ii)

interest

expense, net, not otherwise excluded in calculating its non-GAAP adjusted net

income; (iii) provision for income taxes; and (iv) depreciation

expense. The reconciliations of these historical non-GAAP measures to

each of Hologic’s and Gen-Probe’s GAAP financial measures for

the periods presented, are set forth on slide 22. Future GAAP EPS may be affected

by changes in ongoing assumptions and judgments relating to the combined

company’s businesses, and may also be affected by nonrecurring, unusual or unanticipated

charges, expenses or gains, all of which are excluded in the calculation of

non-GAAP adjusted net income, adjusted EPS and adjusted EBITDA as

described in this presentation. It is therefore not practicable to reconcile this non-GAAP guidance to the most

comparable GAAP measure.

The

Company

believes

the

use

of

these

non-GAAP

metrics

are

useful

to

investors

in

comparing

the

results

of

operations

for

comparable periods by eliminating certain of the more significant effects of its

acquisitions and related activities, non-cash charges resulting from

changes in GAAP, and litigation settlement, divestiture and restructuring. These measures also reflect how the

Company manages the business internally. In addition to the adjustments included in

the calculation of the Company’s non-GAAP adjusted EBITDA

eliminates the effects of financing, income taxes and the accounting effects of capital spending. As with the

items eliminated in its calculation of non-GAAP adjusted net income, these

items may vary for different companies for reasons unrelated to the overall

operating performance of a company’s business. When analyzing the Hologic’s, Gen-Probe’s and the pro

forma combined company’s operating performance, investors should not consider

these non-GAAP financial measures as a substitute for net income

prepared in accordance with GAAP. .

3 |

Agenda

4

Transaction Summary

Strategic Rationale

Financial Highlights

Roadmap to Completion |

Combination of Leading

Diagnostics Franchises

5

Combines Best-in-Class Technologies

Strengthens Molecular Diagnostics Franchise

Comprehensive Cervical Cancer Screening Solution

Complementary Sales Force and Product Offering

Opportunity to Accelerate International Expansion

Strong Growth and Margin Profile

Immediate Accretion Expected with Continued Strong Earnings Momentum

|

Transaction Summary

6

Hologic will acquire all of the outstanding shares of

Gen-Probe for $82.75 per share for total enterprise value

of $3.7 billion

100% cash transaction funded through available cash and

additional financing of term loans and high yield securities

Requires approvals by Gen-Probe shareholders,

regulatory authorities and other customary closing

conditions

Transaction targeted to close second half of calendar 2012

Structure

Considerations

Approvals

Closing |

Agenda

7

Transaction Summary

Strategic Rationale

Financial Highlights

Roadmap to Completion |

Hologic’s Best-in-Class Technologies

Gen-Probe’s Products Are Highly Complementary

8

Complementary

technologies &

markets…

…with a focus on

R&D to drive

future growth

Breast Health

Surgical

Diagnostics |

Class

Leading Cervical Cancer Screening Solutions Flexible Depending on Market

Need Type of Lab

9

Combined Cervical

Cancer Screening

Offerings:

APTIMA

Cervista

Genotyping

TPPT & Imaging |

Combined Menu & Sales Force Infrastructures

Combined Company

Menu

•

HPV

-

APTIMA

-

Cervista

-

Genotyping

•

CT / NG

•

Trichomonas

•

TPPT & Imaging

•

fFn

10

Combined Sales

Call Point

•

Molecular Lab

•

Cytology Lab

•

Physician

•

Drive Test Utilization

•

Drive Compliance

•

Communicate Guidelines

•

Portfolio Sales |

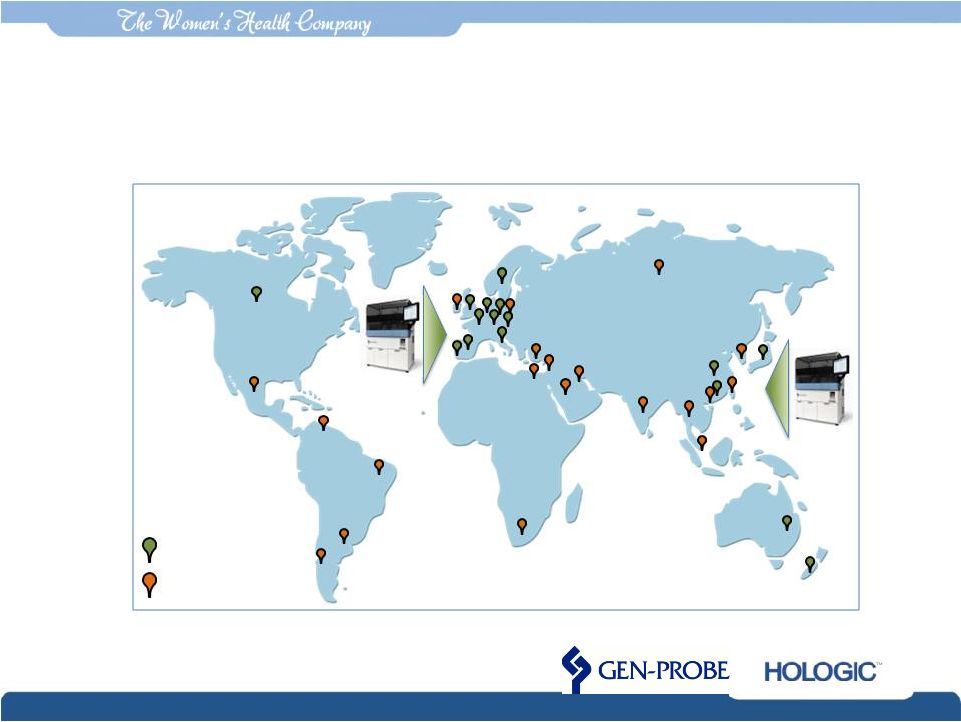

International Expansion:

Combining Hologic’s Worldwide Direct Sales Force & Distribution

Partners with Gen-Probe’s Assays & Platforms

•

Use

Hologic’s

International

Direct

Sales

Force

to

Accelerate

Global

Adoption

of

Gen-Probe’s

Automation & Assays

•

Further Round Out Hologic’s International Portfolio

Direct Sales

Distribution Partner

11 |

Agenda

12

Transaction Summary

Strategic Rationale

Financial Highlights

Roadmap to Completion |

Financial Highlights

13

Strong Financial Profile and Immediate EPS Accretion

Accelerates Top and Bottom-Line Growth

Diversified Revenue Mix in Women’s Health

Significant Synergies

Disciplined Balance Sheet Approach

Poised to Create Significant Long-Term Shareholder Value

Poised to Create Significant Long-Term Shareholder Value

|

Strong Financial Profile and

Immediate EPS Accretion

14

Estimated to be $0.20 Accretive to Adjusted EPS

For First Full Year After Close

LTM as of

31-Mar-2012

Revenue

($mm)

$1,862

$587

Adjusted EBITDA

($mm)

$634

$188

% Margins

34%

32%

Pro Forma

$2,449

$822

34% |

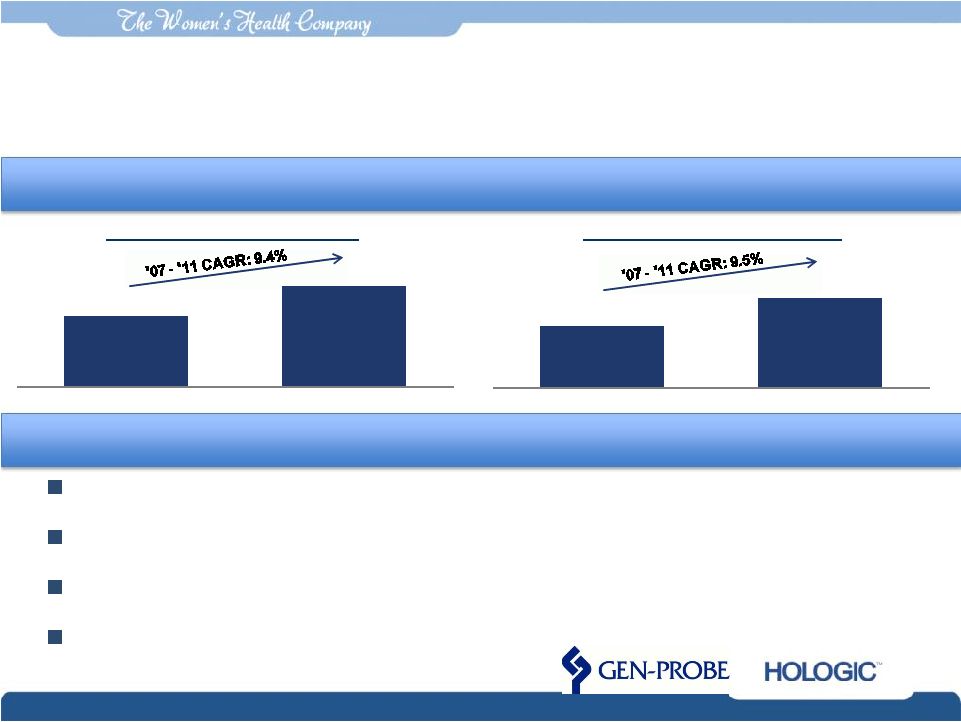

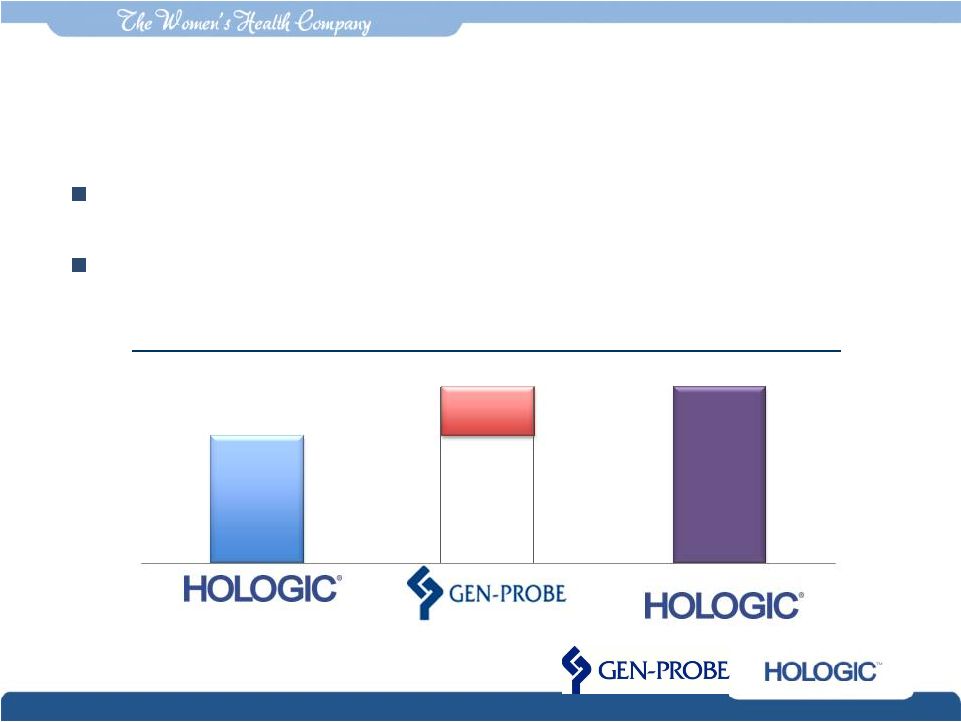

Accelerates Top and Bottom-Line Growth

15

Combination Poised for Sustained Growth

Combination Poised for Sustained Growth

Strength of Current Growth Portfolio (Tomo, Myosure, CT/NG, HPV,

Trich)

International Infrastructure Provides Expansion Opportunity

Incremental Upside from Cross-Selling Opportunities

Continued R&D Investment to Drive Innovation

Gen-Probe’s Consistent Track Record of Growth

Gen-Probe’s Consistent Track Record of Growth

Revenue

Adjusted EBITDA

($ in millions)

$ 403

$ 576

2007

2011

$ 133

$ 191

2007

2011 |

Diversified Revenue Mix In Women’s Health

16

17%

Surgical

5%

Skeletal

46%

Breast Health

32%

Diagnostics

61%

Diagnostics

35%

Blood

Screening

4%

Other

50%

Diagnostics

($1.2bn)

38%

Women’s

Imaging

($0.9bn)

12%

Surgical

($0.3bn)

86% Women’s Health Focus |

Significant Synergies

17

$75 million of projected annual cost savings within 3 years

Cross-selling provides potential for meaningful revenue synergies

—

Alignment

of

assets

to

maximize

efficiencies

—

Overhead

consolidation

$40 Million in Cost Synergies Anticipated in Year One

$40 Million in Cost Synergies Anticipated in Year One

|

Disciplined Balance Sheet Approach

18

Pro forma LTM net leverage of 5.3x*

expected to be below 5.0x by fiscal year-

end

Robust cash flow expected to provide ability to return to pre-transaction

leverage level within 3 years

Operating Cash Flow (LTM, March 31, 2012)

Pro Forma

* Including synergies

$ 452m

$ 173m

$ 625m |

Agenda

19

Transaction Summary

Strategic Rationale

Financial Highlights

Roadmap to Completion |

Roadmap to Completion

20

Integration teams to report to CEOs

Intention to retain Gen-Probe senior management team and San Diego

presence

Well-recognized Gen-Probe brand will be maintained

Regulatory authorities approvals

Gen-Probe shareholder vote

Expected close second half of calendar 2012

Management Team Focused on Seamless Integration

Management Team Focused on Seamless Integration |

Combination of Leading

Diagnostics Franchises

21

Combines Best-in-Class Technologies

Strengthens Molecular Diagnostics Franchise

Comprehensive Cervical Cancer Screening Solution

Complementary Sales Force and Product Offering

Opportunity to Accelerate International Expansion

Strong Growth and Margin Profile

Immediate Accretion Expected with Continued Strong Earnings Momentum

|

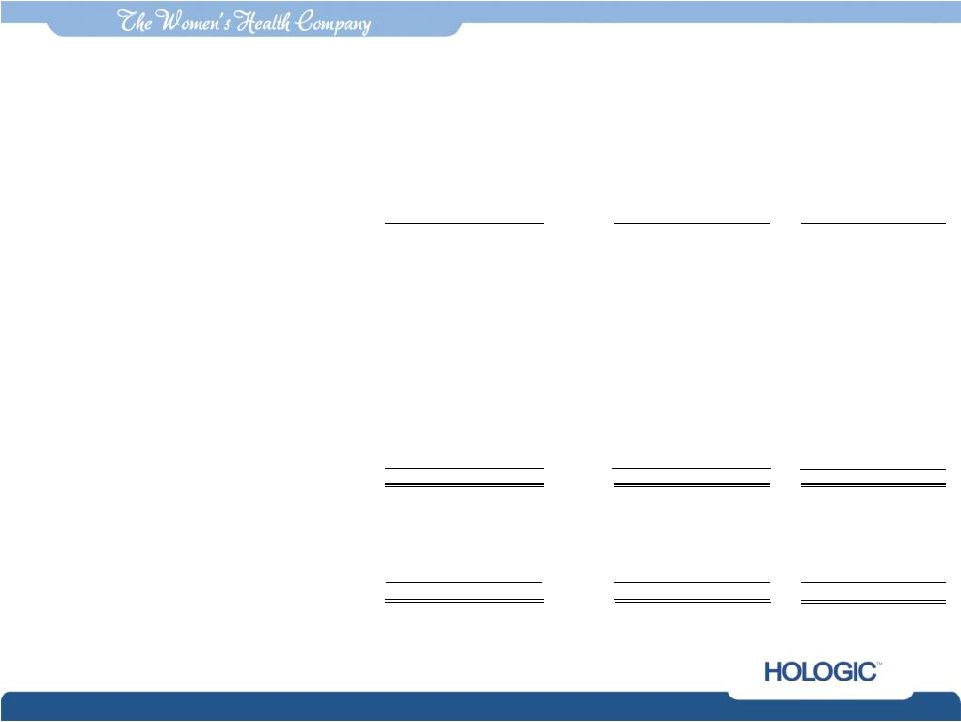

Reconciliation of GAAP Net Income to Non-GAAP

Adjusted Net Income and Pro Forma EBITDA

22

Hologic

Gen-Probe

Twelve Months ended

March 24, 2012

Twelve Months ended

March 31, 2012

Pro Forma Combined

NET INCOME

GAAP net income

44,304

$

49,307

$

93,611

$

Adjustments:

Amortization of intangible assets

242,124

11,015

253,139

Non-cash interest expense relating to convertible notes

73,598

-

73,598

Non-cash loss on convertible notes exchange

42,347

-

42,347

Contingent consideration

91,978

-

91,978

Gain on sale of intellectual property, net

(12,424)

-

(12,424)

Adiana closure charges

18,284

-

18,284

Litigation settlement charges

760

-

760

Restructuring and divestiture (excludes Adiana items)

282

2,646

2,928

Acquisition-related costs and other charges

2,924

2,546

5,470

Other-than-temporary impairment of investment

-

39,842

39,842

Goodwill and asset impairment charges

-

12,746

12,746

Income tax effect of reconciling items

(152,226)

(6,410)

(158,636)

Non-GAAP adjusted net income

351,951

$

111,692

$

463,643

$

EBITDA

Non-GAAP adjusted net income

351,951

$

111,692

$

463,643

$

Interest expense, net, not

adjusted above 39,374

(8,103)

31,271

Provision for income taxes

175,248

48,989

224,237

Depreciation

67,571

35,657

103,228

Adjusted EBITDA

634,144

$

188,235

$

822,379

$

|