Attached files

| file | filename |

|---|---|

| EX-31.1 - CERTIFICATION OF THE PRINCIPAL EXECUTIVE OFFICER - Pendrell Corp | d340221dex311.htm |

| EX-31.2 - CERTIFICATION OF THE PRINCIPAL ACCOUNTING AND FINANCIAL OFFICER - Pendrell Corp | d340221dex312.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(AMENDMENT NO. 1)

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2011

Or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-33008

PENDRELL CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 98-0221142 | |

| (State or other jurisdiction of incorporation or organization) |

(IRS Employer Identification No.) |

2300 Carillon Point, Kirkland, Washington 98033

(Address of principal executive offices including zip code)

(425) 278-7100

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Class A common stock, par value $0.01 per share | The Nasdaq Global Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x.

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨.

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer, accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | x | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x.

As of June 30, 2011, the aggregate market value of common stock held by non-affiliates of the registrant was approximately $465,721,460.

As of April 25, 2012, the registrant had 207,464,324 shares of Class A common stock and 53,660,000 shares of Class B common stock outstanding.

EXPLANATORY NOTE

Pendrell Corporation (“Pendrell” or the “Company”), is filing this Amendment No. 1 to our Form 10-K (the “Amendment”) for the fiscal year ended December 31, 2011, originally filed with the Securities and Exchange Commission (the “SEC”) on March 9, 2012. This Amendment hereby amends the cover page, Part II, Item 5 and Part III, Items 10-14. We have also included as exhibits the certifications required under Section 302 of The Sarbanes-Oxley Act of 2002. Because no financial statements are contained within this Amendment, we are not including certifications pursuant to Section 906 of The Sarbanes-Oxley Act of 2002.

Except as otherwise expressly stated herein, this Amendment does not reflect events occurring after the date of the Form 10-K, nor does it modify or update the disclosure contained in the Form 10-K in any way other as required to reflect the amendments discussed above and reflected below. Accordingly, this Amendment should be read in conjunction with the Form 10-K and the Company’s other filings made with the SEC on or subsequent to March 9, 2012.

2

PENDRELL CORPORATION

2011 ANNUAL REPORT ON FORM 10-K/A

INDEX

3

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. |

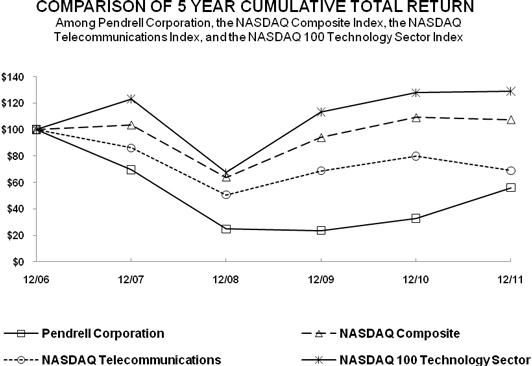

Performance Measurement Comparison

The following graph shows the total stockholder return as of the dates indicated of an investment of $100 in cash on December 31, 2006 for: (i) the Company’s Class A common stock; (ii) the NASDAQ composite Index, (iii) the NASDAQ Telecommunications Index, and (iv) the NASDAQ 100 Technology Sector Index. All values assume reinvestment of the full amount of any dividends; however, no dividends have been declared on our Class A common stock to date.

The Company previously utilized the NASDAQ Telecommunications Stock Index, but has changed to the NASDAQ 100 Technology Sector Index as the published industry index, as this index represents companies more comparable to the Company’s current line of business. The NASDAQ Telecommunications Stock Index is also represented on the following graph, as applicable regulations require both the new and old index be shown if the graph shows a different index from that utilized in the preceding year.

The stock price performance graph below is not necessarily indicative of future performance.

| 12/06 | 12/07 | 12/08 | 12/09 | 12/10 | 12/11 | |||||||||||||||||||

| Pendrell Corporation |

100.00 | 69.58 | 24.73 | 23.63 | 32.82 | 56.02 | ||||||||||||||||||

| NASDAQ Composite |

100.00 | 103.64 | 63.99 | 94.09 | 109.22 | 107.73 | ||||||||||||||||||

| NASDAQ Telecommunications |

100.00 | 86.13 | 50.65 | 68.86 | 80.07 | 69.03 | ||||||||||||||||||

| NASDAQ 100 Technology Sector |

100.00 | 123.16 | 67.52 | 113.36 | 127.97 | 129.06 | ||||||||||||||||||

The graph and other information furnished under this Part II, Item 5 of this Amendment shall not be deemed to be “soliciting material” or to be “filed” with the SEC or subject to Regulation 14A or 14C, or to the liabilities of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The stock price performance included in the above graph is not necessarily indicative of future stock performance.

4

| Item 10. | Directors, Executive Officers and Corporate Governance. |

Controlled Company Status and Directors

Controlled Company Status. Eagle River controls approximately 65.1% of the voting power of our outstanding common stock as of April 16, 2012. As a result, we are a “controlled company” within the meaning of the NASDAQ Global Select Market (“NASDAQ”) corporate governance rules. In accordance with a provision in NASDAQ rules for controlled companies, the Company is not required to comply with certain NASDAQ corporate governance requirements, including (1) the requirement that a majority of the Board of Directors consist of independent directors, (2) the requirement that the compensation of officers be determined, or recommended to the Board of Directors for determination, by a majority of the independent directors or a compensation committee comprised solely of independent directors, and (3) the requirement that director nominees be selected, or recommended for the Board of Directors’ selection, by a majority of the independent directors or a nominating committee comprised solely of independent directors with a written charter or Board of Directors resolution addressing the nomination process. We do not currently rely on any of these exemptions, but reserve the right to do so in the future. If we choose to do so, our stockholders may not have the same protections afforded to stockholders of companies that are subject to all of the NASDAQ corporate governance requirements.

Our Directors. The name and certain background information regarding each of our directors, as of April 16, 2012, are set forth below. There are no family relationships among directors or executive officers of Pendrell. In addition to the information presented below regarding each director’s specific experience, qualifications, attributes and skills that led the Board of Directors to conclude that he is qualified to serve as a director of the Company, each of our directors has demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment to Pendrell and our Board of Directors as demonstrated by his past service.

| Name |

Age |

Principal Occupation/ Position Held with the Company | ||

| Richard P. Emerson |

50 | Director | ||

| Richard P. Fox |

64 | Director | ||

| Nicolas Kauser |

72 | Director | ||

| Craig O. McCaw |

62 | Chair of the Board of Directors | ||

| R. Gerard Salemme |

58 | Chief Strategy Officer and Executive Vice President; Director | ||

| Stuart M. Sloan |

68 | Director | ||

| H. Brian Thompson |

73 | Director | ||

| Benjamin G. Wolff |

43 | President, Chief Executive Officer and Director |

Richard P. Emerson

Became Director: October 2010

Mr. Emerson has spent his entire career in investment banking and corporate finance. Most recently, from 2004 through 2008, he was Senior Managing Director of Evercore Partners Inc., a public investment banking advisory firm providing advisory services to multinational corporations and financial sponsors on significant mergers, acquisitions, divestitures, restructurings, and other strategic transactions. Mr. Emerson opened and ran the west coast office for Evercore. From 2000 through 2003, Mr. Emerson served as Senior Vice President for Microsoft Corporation, reporting directly to the Chief Executive Officer and serving on the executive leadership team, with responsibility for all acquisitions, investments and corporate strategy. Mr. Emerson joined Microsoft from investment bank Lazard Ltd., where as a Senior Managing Director, he advised telecom and technology clients on significant mergers, acquisitions and related financial transactions from 1994 to 2000, and opened and ran the west coast office. Prior to Lazard, Mr. Emerson held senior roles with The Blackstone Group and Morgan Stanley Smith Barney (formerly, Morgan Stanley & Company). Mr. Emerson previously served on the Board of Directors of Clearwire Corporation from 2003 through 2008, where he also served on the Audit Committee.

Qualifications and Skills: With a career dedicated to corporate finance and mergers and acquisitions, Mr. Emerson is well suited to assist the Company with future financing and investment opportunities. In addition, in his role as a former member of the Audit Committee for Clearwire and the Board of Trustees of California Academy of Science, he provides oversight and review of financial policy and reporting of the type required of the Company’s Audit Committee. As such, the Board of Directors has appointed Mr. Emerson to serve as a member of its Audit Committee.

5

Richard P. Fox

Became Director: October 2010

Since 2001, Mr. Fox has been an independent consultant with both public and private companies, and he specializes in financial reporting. For more than 28 years, Mr. Fox served in various roles with Ernst & Young, a major international accounting firm, including partner-in-charge of the audit department in Seattle from 1989 through 1995, and managing partner of Ernst & Young’s Seattle office from 1995 to 1997. Thereafter, he served as Senior Vice President of PACCAR, Incorporated, with responsibility for the accounting, treasury, and information systems functions. In April 1998, he joined Wall Data, Incorporated as its Chief Financial Officer and director, where he initiated a study of strategic alternatives that led to the sale of the company in early 2000. Following the sale of Wall Data, Mr. Fox became President and Chief Operating Officer of CyberSafe Corporation, a role that he held until launching an independent consulting practice in late 2001. Mr. Fox also served on the Boards of Directors and Audit Committees for Shurgard Storage Centers Inc. from 2004 to 2006 and aQuantive Inc. from 2003 to 2007. He continues to serve on the Boards of Directors and Audit Committees of Flow International Corporation and other private companies.

Qualifications and Skills: With more than 40 years of experience reviewing, auditing and implementing financial systems and financing structures, Mr. Fox will be instrumental in assisting the Company with its financial planning and future investment opportunities. Moreover, his experience with financial reporting systems and accounting functions qualifies him as an “audit committee financial expert,” as defined in the applicable rules of the SEC and applicable NASDAQ listing standards. As such, the Board of Directors has appointed Mr. Fox to serve as chair of the Audit Committee. The Board of Directors has also appointed Mr. Fox to serve as a member of the Compensation Committee.

Nicolas Kauser

Became Director: December 2008 (also served from May 2000 through May 2004)

Mr. Kauser has spent over 40 years in the communications industry, including as President of Clearwire International LLC, and CTO of Clearwire, EVP and CTO for AT&T Wireless Services, Inc. (formerly McCaw Cellular Communications, Inc.), Sr. VP of Operations and VP of Engineering of Cantel, Inc., and spent 20 years in Venezuela where he first worked for the National Telephone Co. and subsequently co-founded two companies in the communications industry. Mr. Kauser serves on the Board of Directors of TriQuint Semiconductor, Inc., where he also chairs the Nominating and Governance Committee and serves on the Audit Committee. In 1998, Mr. Kauser received the prestigious Gold Prize awarded by The Carnegie Mellon Institute and American Management Systems for excellence in the application of information technology.

Qualifications and Skills: Mr. Kauser was a director with Pendrell from 2000 to 2004 and is familiar with our operations and history. He has been involved in the technology industry for many years and has particular experience with communications companies. In addition, Mr. Kauser’s experience as a senior officer at Clearwire and AT&T provides him with the management experience to assist in the oversight of our operations and strategic objectives. He has served on the Boards of Directors of a number of companies, including TriQuint Semiconductors, Inc. and private companies. As such, the Board of Directors has appointed Mr. Kauser to serve as Chair of the Nominating and Governance Committee.

Craig O. McCaw

Became Director: May 2000; Chair of the Board of Directors since June 2011 (also served as Board of Directors Chair from 2000 until 2009)

Since 1993, Mr. McCaw has been Chairman, Chief Executive Officer, and the beneficial member of the Eagle River group of investment companies which focus on strategic investments in the telecommunications industry. Mr. McCaw served as a director and Chairman of DBSD North America, Inc. from September 2005 through December 16, 2008. Mr. McCaw founded Clearwire in October 2003 and served as its Chairman of the Board of Directors from October 2003 to December 31, 2010. Mr. McCaw was a director of Nextel Communications, Inc. (acquired by Sprint Corporation in 2005), from July 1995 until December 2003, and a director of XO Communications, Inc. (formerly known as NEXTLINK Communications, Inc.) (“XO” or “XO Communications”), from January 1997 until January 2002. From September 1994 to July 1997, he was also XO’s Chief Executive Officer. From 1974 to September 1994, Mr. McCaw served as Chairman and Chief Executive Officer of McCaw Cellular Communications, Inc., which he built into the nation’s leading provider of cellular services in more than 100 U.S. cities, until the company was sold to AT&T in August 1994.

Qualifications and Skills: Mr. McCaw brings to our Board of Directors demonstrated leadership skills and operating experience, including those acquired during more than 30 years of serving as a senior executive and director of Clearwire, XO, Nextel and McCaw Cellular Communications. As a former director of public and private companies in the telecommunications industry, Mr. McCaw also brings to the Company broad-based business experience and financial acumen.

6

R. Gerard Salemme

Became Director: June 2010 (also served from May 2002 through December 2008)

Mr. Salemme has served as our Chief Strategy Officer and Executive Vice President since March 2011. Mr. Salemme has 30 years of experience in business and government, having served as a senior leader for strategy and business development for public corporations and private investment firms. As an executive with Craig McCaw from 1997 until July 2011 in Eagle River, a private investment firm, Mr. Salemme was a founding shareholder of Clearwire Corporation and senior executive at XO Communications. At Clearwire Corporation, Mr. Salemme was an Executive Vice President responsible for transactions valued at over $10 billion that resulted in Clearwire becoming the largest holder of spectrum in the United States and a leader in the wireless broadband industry. Prior to his work with Clearwire, Mr. Salemme served as an executive at AT&T and McCaw Cellular Communications. He also held the position of Senior Telecommunications Policy Analyst for the U.S. House of Representatives Subcommittee on Telecommunications and Finance (1987-1991) and served as Chief of Staff to Congressman Ed Markey of Massachusetts (1976-1984). From 1982-1984, he taught Economics at the University of Massachusetts, Salem and held key management positions in national political campaigns.

Qualifications and Skills: Mr. Salemme brings to our Board of Directors significant experience in business and government, including experience gained as a senior executive officer with Clearwire, XO and AT&T, which provides him with the management experience to assist in the oversight of our operations and strategic objectives. He is familiar with our operations and history, having served on our Board of Directors from 2002 to 2008. He has also served on the Boards of Directors of a number of private companies.

Stuart M. Sloan

Became Director: October 2010

Since 1994, Mr. Sloan has been a principal of Sloan Capital Companies LLC, a private investment company that serves as general partner in the redevelopment of University Village, a nationally recognized regional center for upscale shopping in Seattle, Washington. From 1986 through 1999, Mr. Sloan was an owner and executive officer of Quality Food Centers, Inc. (“QFC”), which was acquired by Fred Meyer in 1997. Prior to QFC, from 1967 until 1984, Mr. Sloan owned in part and operated Schuck’s Auto Supply, Inc., which was sold to Pay ‘n Save Corp in 1984. Mr. Sloan currently serves as a director of Anixter International, Inc. From September 2003 until March 2011, Mr. Sloan served as a director of J. Crew Group, Inc. He also serves on the Board of The Ohio State University Medical Center and is active, both personally and through his private foundation, in numerous civic, cultural, educational and other philanthropic activities.

Qualifications and Skills: Mr. Sloan’s extensive management experience, along with his service on numerous Boards of Directors, provides him with the experience to assist in the oversight of our operations and strategic objectives. For this reason, the Board of Directors has appointed Mr. Sloan to serve as a member of the Nominating and Governance Committee. His direct involvement, over the span of decades, with management of franchise operations, personnel management and employee incentives makes him particularly well suited to assist with compensation issues and other human resource matters. As such, the Board of Directors has appointed Mr. Sloan to serve as a member of the Compensation Committee.

H. Brian Thompson

Became Director: May 2007

Since 2006, Mr. Thompson has been Executive Chairman of Global Telecom & Technology, a global telecommunications carrier and network integrator serving the data communications needs of large enterprise, government and carrier clients in over 80 countries from its headquarters in the Washington, DC metro region and offices in London, Dusseldorf and Denver. Mr. Thompson continues to head his own private equity investment and advisory firm, Universal Telecommunications, Inc. From December 2002 to June 2007, Mr. Thompson was Chairman of Comsat International, one of the largest independent telecommunications operators serving all of Latin America. Mr. Thompson was Chairman and Chief Executive Officer of LCI International from 1991 until its merger with Qwest Communications International Inc. in June 1998. Mr. Thompson became Vice Chairman of the Board of Directors for Qwest until his resignation in December 1998. Mr. Thompson previously served as Executive Vice President of MCI Communications Corporation from 1981 to 1990, and prior to MCI was a management consultant with the Washington, DC offices of McKinsey & Company for nine years, where he specialized in the management of telecommunications. He currently serves as a member of the Board of Directors of Axcelis Technologies, Inc., Penske Automotive Group, and Sonus Networks, Inc. He serves as a member of the Irish Prime Minister’s Ireland-America Economic Advisory Board, and from January-March 1999, he served as Non-Executive Chairman of Telecom Eireann, Ireland’s incumbent telephone company. Mr. Thompson received his M.B.A. from Harvard’s Graduate School of Business and holds an undergraduate degree in chemical engineering from the University of Massachusetts.

Qualifications and Skills: Mr. Thompson brings to our Board of Directors significant experience in the telecommunications industry, including experience as an Executive Chairman at Global Telecom & Technology and Chairman at Comsat International. His executive officer experience at LCI International and MCI Communications Corporation provides him with the management experience to assist in the oversight of our operations and strategic objectives. He has served on the Board of Directors of a number of companies, including Axcelis Technologies, Inc. and Sonus Networks, Inc. As such, the Board of Directors has appointed Mr. Thompson to serve as chair of the Compensation Committee.

7

Benjamin G. Wolff

Became Director: December 2009 (also served as Chairman from December 2009 to June 2011 and as a director from 2005 to 2008)

Mr. Wolff has served as our President and Chief Executive Officer since January 2010. Mr. Wolff was a Co-Founder of Clearwire Corporation, where he served in a variety of capacities, including as a member of the Board of Directors, Executive Vice President, President, Co- Chief Executive Officer, Chief Executive Officer and finally Co-Chairman, a position he held until March 2009. Mr. Wolff again served on the Clearwire Board of Directors as the designated representative of Eagle River from January 2011 until October 2011. Mr. Wolff also served as the President of Eagle River from April 2004 until July 2011, a position from which he resigned in connection with his full-time engagement with the Company. He continues to serve on the Boards of Directors of some of Eagle River’s privately held portfolio companies. From January 1994 until April 2004, Mr. Wolff was a lawyer with Davis Wright Tremaine LLP, where he became a partner in 1998. Mr. Wolff’s practice focused on mergers and acquisitions, corporate finance, intellectual property licensing, and strategic alliance transactions. He also co-chaired the firm’s Business Transactions department and served on the firm’s Executive Committee.

Qualifications and Skills: Mr. Wolff brings to our Board of Directors extensive senior management, finance and industry experience, in addition to having served on our Board of Directors from 2005 to 2008 and since December 2009. In particular, having served as our President, Chief Executive Officer and Board of Directors Chair, and previously as Co-Chairman and Chief Executive Officer of Clearwire Corporation, Mr. Wolff possesses the operational, financial, strategic and governance experience needed to make significant contributions to our Board of Directors.

Information Concerning Executive Officers

Background information as of April 16, 2012, about each of Pendrell’s executive officers, including all positions and offices held by each such person and each such person’s business experience during at least the past five years, is provided below.

| Name |

Age |

Position Held with the Company | ||

| Benjamin G. Wolff |

43 | Director; President and Chief Executive Officer | ||

| Thomas J. Neary |

52 | Vice President and Chief Financial Officer | ||

| R. Gerard Salemme |

58 | Director; Executive Vice President and Chief Strategy Officer | ||

| Joseph K. Siino |

48 | Chief IP Officer | ||

| Timothy M. Dozois |

49 | Acting General Counsel, Corporate Counsel and Corporate Secretary |

Set forth below is information concerning the persons listed above (other than information concerning Mr. Wolff and Mr. Salemme, which has been provided under “Our Directors,” in the section above).

Thomas J. Neary

Mr. Neary has served as our Vice President and Chief Financial Officer since July 2011. From January 2009 to December 2010, Mr. Neary served as Chief Financial Officer and Chief Operating Officer for Coast Crane Corporation, a company specializing in the sales, rental and services of construction cranes. From February 2007 to January 2009, Mr. Neary served as a Chief Financial Officer consultant at CFO Selections, a provider of financial management consulting services. From May 2005 to February 2007, Mr. Neary served as Chief Financial Officer for Marketrange Corporation, the parent corporation of PerfectMatch.com, a subscription-based online lifestyle community. From 1992 to 2005, Mr. Neary served in various finance, operations, marketing, business development, and international roles for Microsoft Corporation.

Joseph K. Siino

Mr. Siino was appointed our Chief IP Officer in June, 2011, following Pendrell’s acquisition of Ovidian Group, LLC, an IP services company which Mr. Siino founded in March 2009 and thereafter served as its Chief Executive Officer. Prior to founding Ovidian, Mr. Siino served as Yahoo!’s Senior Vice President of Intellectual Property from February 2005 to February 2009. Before joining Yahoo!, Mr. Siino was a partner at Brobeck, Phleger & Harrison, where he led the IP strategy and technology transactions practice.

Timothy M. Dozois

Mr. Dozois was engaged as a consultant and appointed our Acting General Counsel and Corporate Secretary in May 2010. In July 2011, he accepted a full-time position as Corporate Counsel. Prior to July 2011, during his consultancy with us, Mr. Dozois was a partner at the law firm Zupancic Rathbone Law Group, Inc. From 1996 until March 2010, Mr. Dozois was a partner at Davis Wright Tremaine LLP, specializing in securities and transactional work. Mr. Dozois is a member of the Oregon State Bar Association.

8

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our executive officers, directors and ten percent stockholders to file reports of ownership and changes in ownership with the SEC. The same persons are required to furnish us with copies of all Section 16(a) forms they file. Based solely on our review of such forms furnished to us during the most recent fiscal year, we believe that all of our executive officers, directors and ten percent stockholders complied with the applicable filing requirements.

Code of Conduct and Ethics

The Company has adopted a Code of Conduct and Ethics that applies to all officers, directors and employees. The Code of Conduct and Ethics is available on the Company’s website at www.pendrell.com. If the Company makes any substantive amendments to the Code of Conduct and Ethics or grants any waiver from a provision of the Code of Conduct and Ethics to any executive officer or director, the Company will promptly disclose the nature of the amendment or waiver on its website.

Nomination Process

In December 2011, the Board of Directors adopted a Nominating and Governance Committee comprised solely of independent directors and a corresponding charter. The Nominating and Governance Committee was established to: (i) develop qualification criteria for selecting director candidates; (ii) identify and screen potential director candidates; (iii) consult with the Board of Directors regarding potential director candidates; (iv) after consultation with the Board of Directors Chair, recommend to the Board of Directors nominees for election or re-election at each annual stockholder meeting, or to fill Board of Directors vacancies; (v) periodically review and make recommendations to the Board of Directors regarding the Company’s charter or bylaws, or the governing documents of Company subsidiaries; (vi) establish procedures for, and periodically conduct performance evaluations of Board of Directors members and members of Board of Directors committees; (vii) identify, monitor and evaluate emerging corporate governance issues and trends and make related recommendations to the Board of Directors as appropriate; (viii) monitor compliance with the Company’s Code of Conduct and Ethics; (ix) periodically review and assess the adequacy of the committee’s charter; and (vii) perform such other duties and fulfill such other responsibilities as the Board of Directors delegates to the Nominating and Governance Committee from time to time. During the year ended December 31, 2011, there were no changes to the procedures by which stockholders may nominate directors or recommend nominees to our Board of Directors.

Audit Committee

We have a separately designated standing Audit Committee established in accordance with Section 3(a)(58)(A) of the Exchange Act, and Nasdaq Marketplace Rule 4350(d). The Board of Directors has determined that each member of the Audit Committee is independent (under the independence requirements of NASDAQ and the SEC). In addition, the Board of Directors has determined that Richard P. Fox qualifies as an Audit Committee “financial expert” as defined by the SEC rules.

| Item 11. | Executive Compensation. |

Compensation Discussion and Analysis

This compensation discussion and analysis provides information regarding the compensation program for our “named executive officers”. Our named executive officers for 2011 were Mr. Wolff, our Chief Executive Officer; Mr. Neary, our Chief Financial Officer; Mr. Leybold, our former interim Chief Financial Officer; and Mr. Salemme, Mr. Siino and Mr. Dozois, our three other most highly compensated executive officers. This section includes information regarding the overall objectives of our compensation program and each element of compensation that we provide. This compensation discussion and analysis is limited to a discussion of compensation and other benefits earned by the named executive officers for their performance in fiscal year 2011.

9

Overview of Executive Compensation Program

Compensation Philosophy and Objectives

Pendrell believes that the skill, talent, judgment and dedication of its executive officers are critical factors affecting the long-term value of our Company. Therefore, the primary goals for our executive compensation program are to attract and retain qualified executives who are well suited to lead the Company as it evolves and that are able to contribute to our long-term success, induce performance consistent with clearly defined corporate and individual performance goals, and align our executives’ long-term interests with those of our stockholders. We believe our executive compensation program provides a solid framework for implementing and maintaining a balanced approach to compensation, has been instrumental in helping us accomplish our business objectives, and is strongly aligned with the long-term interests of our stockholders. In more detail, our compensation program is designed to:

| • | provide effective Board of Directors and Compensation Committee oversight; |

| • | avoid rigid or formulaic incentives that could create unintended consequences; |

| • | offer compensation to attract, retain and develop individuals with the leadership abilities and skills to successfully execute our business strategy and build long-term stockholder value; |

| • | encourage and reward outstanding initiative, achievement and teamwork; |

| • | motivate individuals to perform at their highest level; |

| • | provide compensation and incentive packages to our executives that are competitive with our current and anticipated peer companies; |

| • | emphasize performance-based pay that aligns incentives with the strategic objectives of the Company; and |

| • | provide a meaningful ownership stake in the Company to appropriately align executive interests with stockholder interests. |

Elements of Compensation

Our executive compensation program consists of the following primary elements: base salary, annual cash bonuses and equity-based compensation awards. Each element is designed to achieve one or more of our Company’s performance, retention and alignment goals as described below.

| Compensation Element |

Designed to Reward |

Relationship to Compensation Philosophy | ||

| Base Salary |

Executive officer’s experience, responsibilities, and contributions to the Company | Attract and retain talented executives through competitive pay programs | ||

| Annual Cash Bonuses |

Achievement of discretionary corporate and individual performance goals | Motivate executives to achieve and exceed annual business and personal objectives | ||

| Long-term Equity Incentives (options and stock awards) |

Increased stockholder value through achievement of long-term strategic goals such as revenue growth, return on invested capital and stock price appreciation | Align executive and stockholder interests to optimize stockholder return

Motivate executives to achieve and exceed business objectives | ||

Addressing Risk-Taking

We recognize that incentive-based compensation arrangements may encourage risk-taking by senior management. For this reason, the Compensation Committee regularly assesses our executive compensation program to ensure that our executives’ incentive compensation and performance-based compensation does not encourage excessive risk-taking. The Compensation Committee manages this concern by monitoring compliance with our code of ethics, structuring executives’ pay to include both fixed and variable compensation, and retaining broad discretion over the award of annual cash bonuses. Through application of these checks and balances, the Compensation Committee has determined that our compensation arrangements do not lend themselves to unnecessary or excessive risk-taking.

10

Executive Compensation Decision-Making Process

Say on Pay Feedback from Stockholders

At the 2011 annual meeting of stockholders, our stockholders approved, on an advisory basis, the compensation of our named executive officers. The advisory vote received over 82% favorable votes from our stockholders. The Compensation Committee reviewed the vote of the stockholders and, given the significant level of stockholder support, made no changes to our executive compensation policies or decisions as a result of the vote. At the 2011 annual meeting, our stockholders also approved, on an advisory basis, our recommendation for an advisory vote on executive compensation of our named executive officers on an annual basis. Consistent with our recommendation and the approval by our stockholders, on an advisory basis, we have determined to hold an advisory vote on executive compensation of our named executive officers on an annual basis.

Determining Compensation for Chief Executive Officer and Other Named Executive Officers

At the beginning of 2011 and again at mid-year when the majority of our executives were hired, Mr. Wolff and our Compensation Committee jointly developed a set of objectives for Pendrell and its executive officers. These objectives were derived largely from financial and strategic planning sessions, during which in-depth reviews of the Company’s opportunities were analyzed and goals then established for the upcoming year. The resulting objectives include both quantitative financial measurements and qualitative strategic and operational considerations that are evaluated subjectively, without any formal weightings, and are focused on factors that our Compensation Committee and our Board of Directors believe create long-term stockholder value.

360 Degree Performance Evaluation Process

At year-end, our Compensation Committee members interviewed each executive team member and reviewed a self-assessment of their performance, their assessment of the Chief Executive Officer’s performance, and an assessment of the performance of the other members of our executive team. The Compensation Committee evaluated these assessments along with peer Company data. The Compensation Committee then met with the Chief Executive Officer and received his assessment of executive performance (other than his own performance). After reviewing the performance evaluations, the data and the Chief Executive Officer’s recommendations, members of the Compensation Committee then met with our Chief Executive Officer and with our chief people officer to assess the performance of, and determine the compensation of, our executives. The Chief Executive Officer worked closely with the Compensation Committee in this process, but did not participate in determining his own compensation. We believe this “360 Degree” review process was effective for 2011, and expect that it will therefore be utilized for future performance evaluations.

Role of Compensation Consultant

From time to time, the Compensation Committee has sought the views of Barney & Barney regarding compensation trends and our compensation programs. In 2011, the Compensation Committee did not request an opinion from Barney & Barney on the amount of compensation paid to our executives, but did obtain its views on the appropriateness of our peer groups, general market practices relating to compensation and benefits for executive officers of public companies. Barney & Barney’s services are provided to our Compensation Committee under hourly fee arrangements and not pursuant to a standing engagement.

Peer Companies and Benchmarking

In determining compensation for our named executive officers in 2011, the Compensation Committee compared each compensation component (salary, bonus, and equity), to the components paid to executives in similar positions within certain peer companies, which are determined based on the criteria indicated below.

Named Executive Officer Compensation, Other than Chief Executive Officer. The peer companies used for comparison of the compensation of our named executive officers, other than our Chief Executive Officer, include companies from the Radford Global Technology Survey, referred to as the Radford Survey. For establishing and changing 2011 compensation of our named executive officers (other than the Chief Executive Officer), including Gerry Salemme’s full-time compensation adjustment in July, the Compensation Committee considered Radford Survey data for technology companies with revenues between $200 million and $500 million. The Compensation Committee chose this revenue range because of its belief that we typically compete with companies at or above this revenue range with respect to the recruiting and retention of employees.

11

Chief Executive Officer Compensation. When establishing our Chief Executive Officer’s full-time compensation commencing July 2011, the Compensation Committee compared data from several sources, relying principally on data from a group of companies within the technology, intellectual property and publicly held private equity industries. Our chief people officer and Compensation Committee selected these companies based on a number of factors, including revenues, stage of development, and market capitalization. The group consisted of:

| Acacia Research Corporation | Arbitron Inc. | |

| Boston Private Financial Holdings, Inc. | Constant Contact, Inc. | |

| DG FastChannel | Dice Holdings, Inc. | |

| Evercore Partners Inc. | Fortress Investment Group LLC | |

| Hercules Technology Growth Capital | InterDigital, Inc. | |

| iStar Financial Inc. | LogMeIn, Inc. | |

| NewStar Financial, Inc. | PacWest Bancorp | |

| Rambus Inc. | Silicon Image, Inc. | |

| Sonus Networks, Inc. | Tekelec | |

| Tessera Technologies, Inc. | TiVO Inc |

At year-end, with Pendrell’s primary operating subsidiary established as a fully-integrated IP investment and advisory firm, our Compensation Committee refined the list of peer companies to include those of comparable size and similar focus. Therefore, when reviewing our Chief Executive Officer’s 2011 performance in February 2012, our Compensation Committee reviewed data from the following companies:

| Acacia Research Corporation |

Dolby Laboratories, Inc. | |

| Dynamic Technology Systems, Incorporated |

Immersion Corporation | |

| InterDigital, Inc. |

Rambus Inc. | |

| Rovi Corporation |

RPX Corporation | |

| Tessera Technologies, Inc. |

TiVO Inc. | |

| VirnetX Holding Corporation |

In order to retain the best talent, and to reward superior performance, our Compensation Committee does not rigidly apply competitive compensation data. Instead, the Compensation Committee generally targets median cash compensation for executives at the 50th percentile of the cash compensation paid to executives at peer companies. Actual cash compensation paid may be above or below the targeted range due to a number of factors, including but not limited to: Company and individual performance, differences in responsibilities between executives at peer companies, executives’ experience and tenure with the Company, executives’ performance, and contributions relative to other executives at the Company. The Compensation Committee also targets median equity compensation for executives at the 50th percentile of the equity compensation paid to executives at peer companies. As with cash compensation, the value of equity compensation grants to particular executives may be above or below the targeted range due to the factors listed above, as well as the following additional factors: perceived limitations in the compensation survey data as it relates to equity compensation, executives’ potential future contributions to the Company, executives’ expected tenure, and the retention value, or holding power, of existing equity compensation grants.

Executive Compensation Decisions for 2011

General Considerations

In reviewing named executive officers’ performance and determining cash and equity compensation bonus awards, the Compensation Committee noted the terms of employment for each named executive officer as set forth in their respective employment letters or agreements, if any, and then focused on the named executive officer’s individual responsibilities and performance, as well as the Company’s overall performance. The Compensation Committee did not adopt formal guidelines for assessing performance; nor did the Compensation Committee apply formulae to determine the relative mix of compensation elements. As such, the mix of compensation elements may vary from individual to individual.

During its annual performance review in February 2012, the Compensation Committee evaluated executive performance based upon fulfillment of responsibilities, demonstrated leadership, management experience and effectiveness, and Company performance. Specific factors affecting compensation decisions for the Company’s named executive officers included:

| • | achievement of strategic objectives such as the development and expansion of our IP investment and advisory business; |

| • | achievement of specific operational goals for the Company, including sustained progress in furtherance of our IP investment and advisory business; |

| • | growth in the value of the Company, as demonstrated by increased stock price; |

| • | demonstrated leadership through the establishment and maintenance of productive and effective working relationships with other employees of the Company; and |

| • | resolution of issues related to our legacy satellite operations and assets, including successful disposition of satellite assets and progress in the ongoing litigation with Boeing. |

12

The following describes the primary components of our executive compensation program for each of our named executive officers during 2011.

Base Salaries

We provide base salary as a fixed source of compensation for our executives to mitigate the risks associated with variable cash bonuses and stock-based incentive compensation. Our Compensation Committee recognizes the importance of base salary as a tool to attract, retain and reward our named executive officers. This was particularly evident in 2011; a year in which Mr. Wolff and Mr. Salemme agreed to relinquish significant roles with and compensation from Eagle River in order to devote full time efforts to Pendrell, and in which all of our other named executive officers (other than Mr. Leybold, our former interim Chief Financial Officer) were hired as employees. As such, all of our executives’ base salary determinations were established through arm’s-length negotiation at the time of hire or full-time transition.

The annualized base salaries of our current named executive officers at the end of 2011 are set forth below. Actual base salaries earned for our named executive officers in 2011 are reflected under the section “Executive Compensation – Summary Compensation.”

| Named Executive Officer and Principal Position |

2011 Annualized Base Salary* (as of year-end) ($) |

2010 Annualized Base Salary (as of year-end) ($) |

||||||

| Benjamin G. Wolff, President and Chief Executive Officer |

750,000 | * | 500,000 | |||||

| Thomas J. Neary, Chief Financial Officer |

250,000 | — | ||||||

| R. Gerard Salemme, Chief Strategy Officer |

400,000 | * | — | |||||

| Joseph K. Siino, Chief IP Officer |

400,000 | — | ||||||

| Timothy M. Dozois, Acting General Counsel and Corporate Counsel |

250,000 | — | ||||||

| * | Mr. Wolff’s base salary at the commencement of 2011 was $500,000 and Mr. Salemme’s base salary upon commencement of his employment was $300,000. Their salaries were adjusted upward in July 2011 in connection with their commitment to devote full time efforts to Pendrell. |

Annual Cash Bonuses

The Compensation Committee has not adopted formal guidelines for determining annual cash bonuses, but is instead guided by each named executive officers’ employment letters and an assessment of the individual’s performance against stated objectives. All cash bonuses are discretionary, determined by the Compensation Committee based on subjective assessment of individual and Company performance as determined through the 360 Degree evaluation process referenced above. Given the early stage of development our new business initiatives, it was not practical for the Compensation Committee to establish quantitative or formulaic Company-wide performance objectives for 2011. Instead, the Compensation Committee evaluated Pendrell’s overall performance against the following qualitative objectives that were established in early 2011:

| • | secure sufficient capital to fund operations; |

| • | improve the Company’s year over year net cash position; |

| • | pursue a successful resolution of the Boeing litigation and establish plans for use of proceeds, if any; |

| • | ensure the protection of the Company’s tax assets; and |

| • | divest legacy satellite business while preserving related assets. |

Upon the completion of the $325 million sale of our bankrupt subsidiary, DBSD North America, Inc. (“DBSD”) to DISH Network Corporation (“DISH Network”) in March 2011, the Compensation Committee established these additional Company objectives:

| • | develop a strategic plan that preserves, enhances and increases value by leveraging the Company’s remaining assets; |

| • | assemble a highly skilled management team; |

| • | re-position the Company to distance it from its legacy business; and |

| • | complete a transaction consistent with the strategic plan. |

To determine cash bonuses, the Compensation Committee then assessed executive performance as a function of: (i) the performance objectives indicated above, (ii) the executive’s individual objectives for the year, (iii) our Company’s major accomplishments, and (iv) successful implementation of our strategic plan.

13

The resulting cash bonuses for 2011 ranged from 80% of target to 114% of target (with targets established in our named executives’ employment letters). The variances in the bonus payments resulted from the Compensation Committee’s subjective determinations regarding the extent to which each executive officer contributed to the accomplishment of the Company’s stated objectives. In particular, with respect to Mr. Siino, the Compensation Committee considered his important role in assisting to establish the Company’s IP business operations.

In addition to the bonuses contemplated by our executives’ employment letters, the Compensation Committee approved special one-time bonuses to Ben Wolff and Gerry Salemme for their efforts in connection with the Company’s sale of DBSD to DISH Network, which yielded proceeds to the Company of approximately $325 million. In granting this unique, one-time award, the Compensation Committee noted the extraordinary impact of the DISH transaction on the Company and its future prospects.

The discretionary cash bonuses awarded to our named executive officers (other than Mr. Leybold, our former interim Chief Financial Officer, who did not receive a cash bonus) for 2011 were as follows:

| Named Executive Officer |

2011 Annualized Target Bonus ($)(1) |

2011 Prorated Target Bonus ($)(2) |

2011 Actual Bonus ($) |

|||||||||

| Mr. Wolff |

750,000 | 750,000 | 1,250,000 | (3) | ||||||||

| Mr. Neary |

125,000 | 55,822 | 55,822 | |||||||||

| Mr. Salemme |

400,000 | 353,973 | 707,946 | (3) | ||||||||

| Mr. Siino |

300,000 | 161,918 | 185,000 | |||||||||

| Mr. Dozois |

82,500 | 40,459 | 32,367 | |||||||||

| (1) | Reflects target bonuses in effect at the end of 2011 pursuant to each of the executive’s employment letters. Mr. Wolff’s target bonus at the commencement of 2011 was $500,000 and Mr. Salemme’s target bonus upon commencement of his employment was $150,000. Their target bonuses were adjusted upward in July 2011 in connection with their commitment to devote full time efforts to Pendrell. |

| (2) | Reflects prorated target bonuses for each executive officer’s partial year of service, based on their annualized base salary in effect at the end of 2011. |

| (3) | Reflects bonus paid at 100% of target plus the one-time special bonus for completing the DISH transaction. |

Long-Term Equity Incentive Compensation

Our long-term incentive program is designed to attract a talented executive team, encourage long-term retention of executive officers and enable us to recognize efforts put forth by executives who contribute to stock price appreciation and development. The periodic vesting of long-term incentive compensation, which is contingent upon continued employment, directly aligns executive officer interests with our stockholders’ interests by rewarding creation and preservation of long-term stockholder value.

Stock Options. A stock option is the right for a recipient to purchase a specified number of shares of our Class A common stock at a price designated on the date of grant. Stock options have value only to the extent the price of our stock on the date of exercise exceeds the stock price on the grant date. We believe this factor motivates our executive officers to improve and maintain Company performance, which in turn may drive stock price and increase the value of any unexercised stock options.

Time-Based Restricted Stock Awards. An award of restricted stock, or RSA, entitles the recipient to receive a specified number of shares of our Class A common stock, at no cost to the recipient, if the recipient remains employed with us when the restricted stock vests. We believe restricted stock awards directly link executive officer interests with those of our stockholders because restricted stock value is tied to the market value of our common stock.

Performance-Based Restricted Stock Awards. The Compensation Committee believes that achievement of key corporate goals should directly and materially impact the total compensation opportunity for our named executive officers. As a result, while a small percentage of the RSAs that we issued in 2011 vest over time, more than 92% of the RSAs issued to executives in 2011 vest only upon achievement of ambitious net income and stock price goals.

Stock Appreciation Rights. As a general rule, the Compensation Committee prefers non-cash equity incentives to equity incentives that are settled in cash, and therefore typically does not grant stock appreciation rights, or SARs, to executives. However, in connection with our acquisition of Ovidian Group and the corresponding engagement of Joe Siino as our chief IP officer, Mr. Siino was granted stock appreciation rights that entitle him to additional cash compensation only if both of the following occur: (i) our intellectual property, innovation and technology businesses achieve ambitious net income goals, and (ii) our Class A common stock price exceeds $6.00 per-share and $10.00 per-share price goals. The Compensation Committee views Mr. Siino’s stock appreciation rights as a unique benefit that was ancillary to the purchase of Ovidian Group, that will be payable only if our team of IP professionals drive significant business growth.

14

The Compensation Committee awarded the following long-term equity incentive awards to our current named executive officers in 2011 pursuant to the executive officer’s employment letter and, in February 2012, in connection with the 2011 annual performance review cycle as described above:

| Employment Letter Awards | July 2011 | Annual Review | ||||||||||||||||||||||||||||||

| Named Executive Officer |

Option Time-Based |

RSA Time-Based |

RSA Performance |

SAR Performance |

Option Time-Based |

RSA Performance |

Option Time-Based |

RSA Time-Based |

||||||||||||||||||||||||

| Mr. Wolff |

950,000 | 950,000 | 75,000 | 150,000 | ||||||||||||||||||||||||||||

| Mr. Neary |

150,000 | 150,000 | 30,000 | 50,000 | ||||||||||||||||||||||||||||

| Mr. Salemme |

400,000 | 250,000 | 700,000 | 700,000 | 50,000 | 100,000 | ||||||||||||||||||||||||||

| Mr. Siino |

1,000,000 | 850,000 | 50,000 | 100,000 | ||||||||||||||||||||||||||||

| Mr. Dozois |

150,000 | 150,000 | 10,000 | 20,000 | ||||||||||||||||||||||||||||

Compensation Mix

For 2011, the mix of the total compensation elements for each of our named executive officers (other than Mr. Leybold, our former interim Chief Financial Officer, who received only a base salary) is as follows:

Percent of Total Compensation*

| Named Executive Officer |

Base Salary and Other Compensation |

Annual Bonus and Non-Equity Incentive Compensation |

Equity and Long-Term Incentive Awards |

|||||||||

| Mr. Wolff |

20.2 | % | 38.8 | % | 41.0 | % | ||||||

| Mr. Neary |

31.3 | % | 15.8 | % | 52.9 | % | ||||||

| Mr. Salemme |

10.3 | % | 22.5 | % | 67.2 | % | ||||||

| Mr. Siino |

7.7 | % | 6.6 | % | 85.7 | % | ||||||

| Mr. Dozois |

30.2 | % | 9.4 | % | 60.4 | % | ||||||

| * | The percentage of compensation is determined based on the amounts reported in the “Summary Compensation” table below. |

The allocation of a majority of compensation in the form of equity incentive awards reflects the principle that a substantial portion of total compensation should be delivered in the form of contingent compensation to align the interests of our named executive officers with those of our stockholders.

Other Compensation

Employment, Severance and Change in Control Arrangements

Each named executive officer is employed at will. We issued employment letters to each of our named executive officers when they were hired that provide for general employment terms and, in the case of Mr. Wolff, Mr. Salemme and Mr. Dozois, certain benefits payable in connection with a termination of employment under certain circumstances, such as termination without “cause,” as specified in their employment letters. The terms of these arrangements are described in further detail in the section below titled “Potential Payments upon Termination or Change in Control.” These severance benefits are intended to ensure that key executives are focused on the Company’s goals and objectives, as well as the interests of our stockholders, by removing uncertainties related to unexpected termination of employment.

In addition, all equity grants made to our named executive officers and non-executive employees under our 2000 Stock Incentive Plan, as Amended and Restated (the “2000 Stock Incentive Plan”) provide for 100% acceleration in the event that we are subject to a change in control and the equity obligation is not assumed by the acquiring Company.

Health and Welfare Benefits

Our executive officers receive the same health and welfare benefits offered to other employees including medical, dental, vision, life, accidental death and dismemberment, and disability insurance; and holiday pay. The same contribution amounts, percentages and plan design provisions are applicable to all employees.

Retirement Programs

The executive officers may participate in the same tax-qualified, employee-funded 401(k) plan offered to all other employees, through which we offered up to $4,083 in an annual matching contribution for the 2011 plan year that commenced August 1, 2011. We have no defined benefit pension plans or supplemental retirement plans for executives.

15

Perquisites and Personal Benefits

We do not provide special benefits or other perquisites to any of our named executive officers.

Taxation of “Parachute” Payments and Deferred Compensation

Sections 280G and 4999 of the Internal Revenue Code (the “Code”) provide that executive officers and directors who hold significant equity interests and certain other service providers may be subject to an excise tax if they receive payments or benefits in connection with a change in control that exceeds certain prescribed limits, and that we, or a successor, may forfeit a deduction on the amounts subject to this additional tax. Section 409A of the Code (“Section 409A”) also imposes additional significant taxes on the individual in the event that an executive officer, director or other service provider receives “deferred compensation” that does not meet the requirements of Section 409A. We do not provide any executive officer, including any named executive officer, with a “gross-up” or other reimbursement payment for any liability that he or she might owe as a result of the application of Sections 280G or 4999 of the Code. The employment letters with Mr. Wolff and Mr. Salemme allow the Company to accelerate severance payments to the extent necessary to comply with Section 409A and Mr. Wolff’s employment letter provides for a gross up for all taxes or other payments that may be due pursuant to Section 409A.

Other Policies and Considerations

Assessment of Risk in our Compensation Program

The Compensation Committee believes that the annual and long-term equity incentive compensation programs for our executive officers appropriately focus these individuals on our current and future business needs, without encouraging undue risk-taking. The Compensation Committee periodically assesses the Company’s compensation program to monitor and mitigate risk. This ongoing assessment includes consideration of the primary design features of the compensation plans and the process to determine incentive compensation eligibility and grant awards for employees. We believe that our compensation policies and practices for all employees, including named executive officers, do not create risks that are reasonably likely to have a material adverse effect on the Company.

Stock Ownership Guidelines

Given the early stage of Pendrell’s new business initiatives and the high percentage of executive equity holdings that are not yet vested, we currently do not require our executive officers to own a particular amount of our stock. The Compensation Committee is satisfied that stock and other equity holdings among our executive officers are sufficient at this time to provide appropriate motivation and to align this group’s long-term interests with those of our stockholders. However, we may in the future require our executive officers to own a particular amount of our stock, particularly as existing unvested performance based awards begin to vest.

Policies Regarding Granting of Equity Awards

During 2011, equity awards were granted to the Chief Executive Officer and individuals reporting directly to the Chief Executive Officer, during meetings of the Compensation Committee. The grant date for the awards was either (a) the individual’s employment start date or (b) the 15th day of the month following the individual’s employment start date, as determined by the Compensation Committee.

Our Board of Directors has authorized our Chief Executive Officer, who is also a member of our Board of Directors, to grant stock options and restricted stock awards to certain newly hired employees and consultants, subject to certain limitations, as follows:

| • | the awards will be granted on the 15th day of each month following an individual’s employment start date; |

| • | the individual cannot report directly to the Chief Executive Officer or be subject to Section 16 reporting requirements; |

| • | the total number of shares granted under all awards to an individual during a single period may not exceed certain levels, as approved in advance by the Compensation Committee; and |

| • | the total number of shares granted under all awards by the Chief Executive Officer during a calendar year may not exceed 1,000,000 shares. |

Each stock option must have an exercise price equal to the closing share price on the date of grant. We do not have either a policy or practice in place to grant equity awards that are timed to precede or follow the release or withholding of material nonpublic information.

Tax Deductibility of Executive Compensation

Section 162(m) of the Code (“Section 162(m)”) generally disallows an income tax deduction to publicly traded companies for compensation over $1.0 million paid to the Chief Executive Officer or any of the Company’s other four most highly compensated

16

executive officers. Under Section 162(m), the Company may deduct compensation in excess of $1 million if it qualifies as “performance-based compensation,” as defined in Section 162(m). Stock options granted under the Company’s 2000 Stock Incentive Plan will qualify as performance-based compensation and be exempt from the Section 162(m) deductibility limit provided these stock options are approved by the Compensation Committee and granted in compliance with the requirements of Section 162(m). The Compensation Committee believes that in certain circumstances factors other than tax deductibility take precedence when determining the forms and levels of executive compensation most appropriate and in the best interests of the Company and its stockholders. Given the Company’s changing focus and its tax assets, as well as the competitive market for outstanding executives, the Compensation Committee believes that it is important for it to retain the flexibility to design compensation programs consistent with the Company’s overall executive compensation program, even if some executive compensation is not fully deductible by the Company. Accordingly, the Compensation Committee may from time to time approve elements of compensation for certain officers that are not fully deductible by the Company, and reserves the right to do so in the future when appropriate.

Policies on Hedging Economic Risk

No director or officer designated by our Board of Directors as a “reporting person or insider,” and no employee working in any of our corporate offices, may engage in any transaction involving the Company’s securities or securities of certain companies with whom we transact business (including a stock plan transaction such as an option exercise, a gift, a loan or pledge or hedge, a contribution to a trust, or any other transfer), without first obtaining pre-clearance of the transaction from our legal department.

Recovery of Incentive-Based Compensation

We recognize that our compensation program will be subject to the forthcoming rules and regulations to be promulgated by SEC as a result of Section 954 of the Dodd-Frank Act, which directs the SEC to issue rules prohibiting the listing on any national securities exchange of companies that do not adopt a policy providing for the recovery from any current or former executive officer of any incentive-based compensation (including stock options) awarded during the three-year period prior to an accounting restatement resulting from material noncompliance of the issuer with financial reporting requirements. We intend to adopt such a “clawback” policy which complies with all applicable standards when such rules become available.

17

EXECUTIVE COMPENSATION

Summary Compensation

The following table sets forth information regarding compensation earned by our named executive officers for service to us during 2011 and, if applicable, 2010, whether or not such amounts were paid in such year. None of the individuals served as a named executive officer during 2009.

| Name and Principal Position |

Year(1) | Salary ($) |

Bonus ($)(2) |

Stock Awards ($)(3) |

Option Awards ($)(3) |

All Other Compensation ($)(4) |

Total ($) |

|||||||||||||||||||||

| Benjamin G. Wolff |

2011 | 621,609 | 1,250,000 | — | 1,320,500 | 30,000 | 3,222,109 | |||||||||||||||||||||

| President and Chief Executive Officer |

2010 | 500,000 | 500,000 | 2,320,000 | 2,040,000 | 30,000 | 5,390,000 | |||||||||||||||||||||

| Thomas J. Neary(5) |

2011 | 110,953 | 55,822 | — | 187,500 | — | 354,275 | |||||||||||||||||||||

| Vice President, Chief Financial Officer |

||||||||||||||||||||||||||||

| Timothy P. Leybold(6) |

2011 | 283,371 | — | — | — | — | 283,371 | |||||||||||||||||||||

| Former Interim Chief Financial Officer |

2010 | 378,022 | — | — | — | — | 378,022 | |||||||||||||||||||||

| R. Gerard Salemme(7) |

2011 | 294,680 | 707,946 | 482,500 | 1,637,000 | 30,000 | 3,152,126 | |||||||||||||||||||||

| Chief Strategy Officer, Executive Vice President |

||||||||||||||||||||||||||||

| Joseph K. Siino(8) |

2011 | 213,846 | 185,000 | — | 2,390,000 | — | 2,788,846 | |||||||||||||||||||||

| Chief IP Officer |

||||||||||||||||||||||||||||

| Timothy M. Dozois(9) |

2011 | 104,166 | 32,367 | — | 208,500 | — | 345,033 | |||||||||||||||||||||

| Acting General Counsel, Corporate Counsel |

||||||||||||||||||||||||||||

| (1) | Compensation is provided only for years for which each individual was a named executive officer. |

| (2) | Reflects discretionary cash bonuses paid in February 2012 to our named executive officers for 2011 performance. These bonuses are described under “Compensation Discussion and Analysis” above. |

| (3) | Reflects the grant date fair value computed in accordance with applicable accounting guidance for stock and option awards granted during each year. These equity grants are described under “Compensation Discussion and Analysis” above or in the “Grants of Plan-Based Awards in 2011” or “Outstanding Equity Awards at 2011 Year-End” tables below. |

Values not included in the table: In 2011, the Compensation Committee approved awards to the executives listed below with vesting tied to Company performance. On the grant date, achievement of the conditions was not deemed probable, and accordingly, pursuant to the SEC’s disclosure rules, no value is included in the table for these awards. Below are the fair values of such awards at grant date assuming achievement of the highest level of performance condition.

| Name |

2011

Performance Based Restricted Stock Awards ($) |

2011

Performance Based Stock Appreciation Awards ($) |

||||||

| Benjamin G. Wolff |

2,641,000 | — | ||||||

| Thomas J. Neary |

384,000 | — | ||||||

| R. Gerard Salemme |

1,946,000 | — | ||||||

| Joseph K. Siino |

— | 1,826,000 | ||||||

| Timothy M. Dozois |

417,000 | — | ||||||

We have disclosed the assumptions made in the valuation of the restricted stock and option awards under Note 8 to the Consolidated Financial Statements included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2011. The amounts reported do not reflect the compensation actually received by our named executive officers. There can be no assurance that stock options will be exercised (in which case no value will be realized by the individual) or that the value on vesting of exercise will approximate the compensation expense recognized by the Company.

| (4) | Our named executive officers did not receive any other compensation from us during 2011 that was not provided to all employees generally, and the aggregate of which did not exceed $10,000. Mr. Wolff and Mr. Salemme were each paid $30,000 annually in connection with their service as a Board of Directors member of DBSD North America, Inc., our former subsidiary. |

| (5) | Mr. Neary joined us as our Chief Financial Officer in July 2011. His annualized base salary for 2011 was $250,000. |

| (6) | Mr. Leybold served as our former interim Chief Financial Officer under the terms of a consulting agreement with Tatum, LLC until Mr. Neary joined us in July 2011. |

| (7) | Mr. Salemme joined us as our Chief Strategy Officer in March 2011. His annualized base salary at the end of 2011 was $400,000. |

| (8) | Mr. Siino joined us as our Chief IP Officer in June 2011. His annualized base salary for 2011 was $400,000. |

| (9) | Mr. Dozois joined us as Corporate Counsel in July 2011. His annualized base salary for 2011 was $250,000. |

18

Grants of Plan-Based Awards in 2011

The following table provides information concerning the long-term incentive awards made in 2011 to each of the named executive officers under our 2000 Stock Incentive Plan, with the exception of Mr. Leybold, our former interim Chief Financial Officer, who did not receive any awards during 2011.

| Estimated Future Payouts Under Equity Incentive Plan Awards(2) |

All Other Stock Awards: |

All Other Option Awards: |

||||||||||||||||||||||||||||||||

| Name |

Grant Date |

Committee Action Date(1) |

Threshold ($) |

Target ($) |

Maximum ($) |

Number of Shares of Stock or Units (#)(3) |

Number of Securities Underlying Options (#)(4) |

Exercise or Base Price of Option Awards ($/Sh)(5) |

Grant Date Fair Value of Stock and Option Awards ($)(6) |

|||||||||||||||||||||||||

| Benjamin G. Wolff |

07/05/11 | 950,000 | 950,000 | 0 | ||||||||||||||||||||||||||||||

| 07/15/11 | 07/05/11 | 950,000 | $ | 2.78 | 1,320,500 | |||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

| Thomas J. Neary |

07/21/11 | 150,000 | 150,000 | 0 | ||||||||||||||||||||||||||||||

| 08/15/11 | 07/18/11 | 150,000 | $ | 2.56 | 187,500 | |||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

| R. Gerard Salemme |

03/04/11 | 02/11/11 | 250,000 | 482,500 | ||||||||||||||||||||||||||||||

| 03/04/11 | 02/11/11 | 400,000 | $ | 1.93 | 664,000 | |||||||||||||||||||||||||||||

| 07/05/11 | 700,000 | 700,000 | 0 | |||||||||||||||||||||||||||||||

| 07/15/11 | 07/05/11 | 700,000 | $ | 2.78 | 973,000 | |||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

| Joseph K. Siino |

06/17/11 | 06/14/11 | 1,000,000 | $ | 2.81 | 2,390,000 | ||||||||||||||||||||||||||||

| 06/17/11 | 06/14/11 | 500,000 | (7) | $ | 6.00 | (7) | 0 | |||||||||||||||||||||||||||

| 06/17/11 | 06/14/11 | 350,000 | (7) | $ | 10.00 | (7) | 0 | |||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

| Timothy M. Dozois |

07/05/11 | 150,000 | 150,000 | 0 | ||||||||||||||||||||||||||||||

| 07/15/11 | 07/05/11 | 150,000 | $ | 2.78 | 208,500 | |||||||||||||||||||||||||||||

| (1) | The equity awards were approved by the Compensation Committee prior to the executive officer’s start date; the grant dates for these awards were the later of (a) the approval date; (b) the employment start date; or (c) such later date as determined by the Compensation Committee. |

| (2) | These performance-based restricted stock awards may vest in four (4) 25% increments following the one year anniversary of the grant date, upon achievement of four (4) different performance targets, each of which independently triggers a vesting event as to 25% of the restricted shares. If any one of, or all of, the performance targets are not met within seven years, the unvested awards will be forfeited. |

| (3) | Mr. Salemme’s restricted stock award vests in four equal annual installments beginning March 4, 2012. |

| (4) | The stock options awarded to Mr. Wolff, Mr. Salemme, Mr. Siino and Mr. Dozois vest in four equal annual installments beginning June 17, 2012; Mr. Neary’s stock option vests in four equal annual installments beginning July 21, 2012. |

| (5) | The exercise price is the closing sales price of our common stock on NASDAQ on the grant date. |

| (6) | Reflects the grant date fair value computed in accordance with applicable accounting guidance for the stock and option awards. See footnote (1) to the “Summary Compensation” table above for further information on the performance based restricted stock awards and stock appreciation rights granted in 2011. |

| (7) | The stock appreciation rights granted to Mr. Siino were awarded at a substantially higher base price than our current stock price, and will only vest in the event the Company achieves certain net income goals for a period of two consecutive calendar years and can be settled only in cash. As such, these stock appreciation rights do not diminish the shares available for issuance under our 2000 Stock Incentive Plan. In order for Mr. Siino to realize any value from the awards upon achievement of the net income goals, the Company’s stock price will need to be in excess of the $6.00 and $10.00 base price of each award. If the performance conditions are not met within seven (7) years or if the Company’s stock price is not in excess of the respective base price at the time such net income goals are achieved, the awards will be forfeited. |

19

Outstanding Equity Awards

The following table shows certain information regarding outstanding equity awards at December 31, 2011, for the named executive officers (with the exception of Mr. Leybold, our former interim Chief Financial Officer, who did not have outstanding equity awards).

| Option Awards | Stock Awards | |||||||||||||||||||||||||||||||||||

| Name |

Number of Securities Underlying Unexercised Options (#) Exercisable |

Number of Securities Underlying Unexercised Options (#) Unexercisable |

Equity Incentive Plan Awards: Number of Securities Underlying Unexercised Unearned Options (#) |

Option Exercise Price ($) |

Option Expiration Date |

Number of Shares of Stock That Have Not Vested (#) |

Market Value of Shares of Stock That Have Not Vested ($)(12) |

Equity Incentive Plan Awards: Number of Unearned Shares That Have Not Vested (#) |

Equity Incentive Plan Awards: Market Value of Unearned Shares That Have Not Vested ($)(12) |

|||||||||||||||||||||||||||

| Mr. Wolff |

30,000 | (1) | 0 | 4.25 | 11/14/15 | |||||||||||||||||||||||||||||||

| 30,000 | (1) | 0 | 5.85 | 10/01/16 | ||||||||||||||||||||||||||||||||

| 30,000 | (1) | 0 | 3.50 | 10/01/17 | ||||||||||||||||||||||||||||||||

| 22,500 | (1) | 7,500 | 1.01 | 10/01/18 | ||||||||||||||||||||||||||||||||

| 500,000 | (2) | 1,500,000 | 1.16 | 02/15/20 | ||||||||||||||||||||||||||||||||

| 0 | (3) | 950,000 | 2.78 | 07/15/21 | ||||||||||||||||||||||||||||||||