Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - ECO SCIENCE SOLUTIONS, INC. | Financial_Report.xls |

| EX-3 - AMENDED ARTICLES OF INCORPORATION - ECO SCIENCE SOLUTIONS, INC. | exhibit34.htm |

| EX-31 - SOX SECTION 302(A) CERTIFICATION OF THE CEO & CFO - ECO SCIENCE SOLUTIONS, INC. | exhibit311.htm |

| EX-32 - SOX SECTION 906 CERTIFICATION OF THE CEO & CFO - ECO SCIENCE SOLUTIONS, INC. | exhibit321.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

|

[X] |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

For the fiscal year ended |

January 31, 2012 |

|

|

[ ] |

TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

For the transition period from |

[ ] to [ ] |

|

|

Commission file number |

333-166487 |

|

|

PRISTINE SOLUTIONS INC. |

|

(Exact name of registrant as specified in its charter) |

|

Nevada |

|

N/A |

|

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

Stettin Albert Town, Trelawny, Jamaica |

|

N/A |

|

(Address of principal executive offices) |

|

(Zip Code) |

|

Registrant's telephone number, including area code: |

|

(876) 572-4681 |

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class |

|

Name of Each Exchange On Which Registered |

|

N/A |

|

N/A |

Securities registered pursuant to Section 12(g) of the Act:

|

N/A |

|||||||

|

(Title of class) |

|||||||

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 the Securities Act. |

|||||||

|

|

Yes ◻ No ☒ |

||||||

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act |

|||||||

|

|

Yes ◻ No ☒ |

||||||

|

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the last 90 days. |

|||||||

|

|

Yes ☒ No ◻ |

||||||

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-K (§229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). |

|||||||

|

|

Yes ◻ No ◻ |

||||||

|

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. |

|||||||

|

|

◻ |

||||||

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

|||||||

|

Large accelerated filer |

◻ |

Accelerated filer |

◻ |

||||

|

Non-accelerated filer |

◻ |

Smaller reporting company |

☒ |

||||

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). |

|||||||

|

|

Yes ◻ No ☒ |

||||||

The aggregate market value of Common Stock held by non-affiliates of the Registrant on July 31, 2011 was $Nil based on a $Nil average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

|

Indicate the number of shares outstanding of each of the registrant’s classes of common stock as of the latest practicable date: |

|

|

418,000,686 as of April 27, 2012 |

|

DOCUMENTS INCORPORATED BY REFERENCE

None.

2

TABLE OF CONTENTS

| Item 1. | Business | 4 |

| Item 1A. | Risk Factors | 12 |

| Item 1B. | Unresolved Staff Comments | 17 |

| Item 2. | Properties | 17 |

| Item 3. | Legal Proceedings | 17 |

| Item 4. | Mine Safety Disclosures | 17 |

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 17 |

| Item 6. | Selected Financial Data | 18 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 18 |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 24 |

| Item 8. | Financial Statements and Supplementary Data | 24 |

| Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 25 |

| Item 9A. | Controls and Procedures | 25 |

| Item 9B. | Other Information | 26 |

| Item 10. | Directors, Executive Officers and Corporate Governance | 26 |

| Item 11. | Executive Compensation | 29 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 30 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence | 31 |

| Item 14. | Principal Accounting Fees and Services | 32 |

| Item 15. | Exhibits, Financial Statement Schedules | 32 |

3

PART I

Item 1. Business

This annual report contains forward-looking statements. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors”, that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are stated in United States Dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles.

In this annual report, unless otherwise specified, all dollar amounts are expressed in United States dollars and all references to “common shares” refer to the common shares in our capital stock.

As used in this annual report, the terms we", "us", "our" and "our company" mean Pristine Solutions Inc., and our wholly-owned subsidiary, Pristine Solutions Limited, a Jamaica company, unless otherwise indicated.

Corporate Overview

We were incorporated on December 8, 2009 under the laws of the State of Nevada. We have a wholly-owned subsidiary, Pristine Solutions Limited, incorporated under the laws of Jamaica. Our principal executive offices are located at Stettin Albert Town, Trelawny, Jamaica. Our telephone number is (876) 572-4681. Our fiscal year end is January 31.

On February 27, 2012, our company authorized an increase to the authorized number of shares of common stock from 100,000,000 shares to 650,000,000 shares and a decrease to the authorized preferred stock from 100,000,000 shares to 50,000,000 shares. Our company also effected a 6-for-1 forward stock split of the issued and outstanding shares of common stock on February 27, 2012.

Our Current Business

We are a start up, development stage company. We have only recently begun operations and we have relied upon the sale of our securities and proceeds from debt to fund those operations as we have only generated limited revenues from the sale of our products. We intend on developing a network of sales points for the sale and service of tankless water heaters in Jamaica. We aim to be the first tankless water heater company specializing in tankless-only products to enter the Jamaican market and the only company in the Jamaican market offering solar powered tankless water heater products.

4

On December 30, 2009, we entered into a distribution agreement with the manufacturer of the tankless hot water heaters which we hope to sell in Jamaica: Zhongshan Guangsheng Industry Co., Ltd., of China. Zhongshan currently manufactures the tankless hot water heaters under the brand Gleamous Electric Appliances. Zhongshan is part of an international enterprise that also owns an R&D group, factory, and sales group and is looking to expand into other markets. Our management hopes that we can expand the Gleamous brand into the Jamaican market and the rest of the Caribbean. Pursuant to the terms of this agreement, we acquired 52 units of Zhongshan’s various Gleamous tankless water heaters of which we were required to purchase 50 within the first 6 months of the agreement. As consideration, we were granted the exclusive license to distribute the products within Jamaica. The term of the agreement was 1 year and may be terminated by either party with 30 days written notice.

On March 18, 2011 we entered into a new license agreement with Zhongshan for an additional six months. According to the terms of the agreement, our company will purchase no less than 150 products within six months from the date of the agreement. As of January 31, 2012, 172 units of water heaters were ordered, of which 52 units were received by our company. Full payment has been made on all of the units.

Products and Services

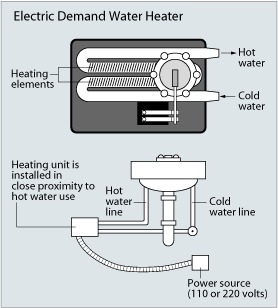

Tankless water-heaters, also called Instantaneous or Demand Water Heaters, provide hot water only as it is needed. Traditional storage water heaters produce standby energy losses that cost consumers money even when they are not being used. A tankless water heater is used only when there is a demand for hot water. With a sufficient amount of heaters attached to the hot water appliances in a customer’s home, our products could provide hot water for the entire household. However, the tankless water heaters we will initially be distributing, and which we list below, are not, on their own, capable of supplying sufficient hot water to meet an entire household’s hot water requirements. These heaters are intended for specific usage for one appliance which requires hot water.

The tankless water heater process is as follows:

5

|

|

A hot water tap is opened. |

|

|

The water enters the heater. |

|

|

A water flow sensor detects the water flow. |

|

|

The computer automatically ignites the burner. |

|

|

The water circulates through the heat exchanger (coil). |

|

|

The heat exchanger instantly heats the water at the designated temperature (this takes only 5 seconds). |

|

|

The heater can provide you with endless hot water continuously so no more running out of hot water in the middle of a shower. |

|

|

When the hot water tap is turned off, the unit shuts down automatically. |

When a hot water tap is turned on, cold water travels through a pipe into the unit. In an electric tankless water heater, an electric element heats the water. In a traditional gas-fired tankless water heater a gas burner heats the water. As a result, tankless water heaters deliver a constant supply of hot water. Typically, tankless water heaters provide hot water at a rate of 2 – 5 gallons (7.6 – 15.2 liters) per minute. Typically, traditional gas-fired tankless water heaters will produce higher flow rates than electric tankless water heaters. However, some smaller tankless water heaters, such as the ones we will be offering initially, cannot supply enough hot water for simultaneous, multiple uses in large households.

For example, taking a shower and running the dishwasher at the same time can stretch a tankless water heater to its limit. To overcome this problem, one can install a “whole house” type tankless water heater or install two or more tankless water heaters, connected in parallel for simultaneous demands of hot water. One can also install separate tankless water heaters for appliances—such as a clothes washer or dishwasher—that use a lot of hot water in homes. Offering a “whole house” solution is not our current focus, but once we are better established, we hope to provide a “whole house” option to the residents of Jamaica. Initially, we anticipate offering the following 3 types of tankless water heaters:

6

DSK Series Instant Water-Heater

This series of tankless water heaters has proven to the most popular in other markets for Zhongshan, so we anticipate marketing this series most aggressively in Jamaica as well.

The features of the DSK series include:

| * | LED monitor displays the water heater’s working conditions |

| * | ABS splash proof casing |

| * | Stainless steel heater tank withstands rust and rupture. |

| * | Stepless power regulation with the turning knob |

| * | Function key for manual creepage test which makes the tank safer to use. |

| * | Safety protection: protection against dry heating and overheating; ELCB test device to prevent electric leakage; Flow switch as safety device; Automatic malfunction checking. |

DSL Series Fast Water-Heater

This is a premium series of water heaters which allows for quicker heating of water with higher water temperatures. We anticipate marketing this series to Jamaican customers, but do not anticipate this to be our highest selling product due to its premium price point.

The features of the DSL series include:

| * | Digital display screen; displaying the temperature of outlet water. |

| * | Thermal cut-off protects heating element from damage |

| * | Adjustable thermostat allows temperature adjustment from OFF to 95°C (Low- -High) with safety cut-out at 98°C |

| * | Stainless steel heater tank withstands rust and rupture. |

| * | Built-in ELCB; reliable test device to prevent electric leakage. |

7

| * | Available for single point or multi-points of water supply. |

| * | Unique design & splash proof casing. |

| * | Automatic malfunction checking. |

Kitchen Water-Heaters

This series of heaters is intended for kitchen use. The features of this series are as follows:

| * | LED monitor displays its working conditions |

| * | ABS splash proof casing |

| * | Stainless steel heater tank withstands rust and rupture. |

| * | Easy to adjust water flow and temperature by turn of a knob. |

| * | Instant generation of hot water |

| * | Save space with compact & slim design, suitable for use in Kitchen |

| * | Safety protection: protection against dry heating and overheating; ELCB test device to prevent electric leakage; Flow switch as safety device; Automatic malfunction checking. |

Market, Customers and Distribution Methods

We plan on testing the market first with the DSK series of products as they offer the Jamaican market the most competitively priced product. Conducting a test and market analysis will allow us to better understand our target markets and to better outline our marketing plan and sales strategies. Our initial plan and offering will be to market to residents, businesses, governments, contractors, builders, and related supply stores. This will also allow us to market and target to a larger audience and thus eliminate dependence on one or a few major customers.

8

In marketing our products, we anticipate relying on the following channels:

| * | Telephone solicitations –We anticipate hiring in-house sales representatives who will contact potential clients directly through the telephone. Our management believes that telephone solicitation will be an effective marketing tool in Jamaica for direct sales of our products. |

| * | Direct mail –We anticipate also contacting potential customers through direct mail with advertising in the form of brochures and information leaflets. We may include coupons, direct sales offers, selecting the audience by name, and set whatever distribution schedule is most desirable, without being constrained by the publication or broadcast schedules of the major media. |

| * | Direct marketing by sales representatives- Transportation vehicles will be utilized for the sole use of the sales representatives to visit potential customers at their homes. We believe that will allow for efficiency, smooth operation, and put us in direct contact with the clients and major decision-makers. |

| * | Website –We expect to develop a website to act as a major source of information and sales. Use of the Internet is growing in Jamaica and more and more people are using it in place of the traditional methods to look for services and even to do their shopping. |

| * | Traditional Advertising –Magazine and newspaper advertising is an effective way of reaching an audience that is interested in low-energy consumption products. |

| * | Distribution Channels –We will attempt to enter into agreements with existing Jamaican retailers who have already established a clientele. Complementary product channels will be targeted such as plumbing stores, plumbing suppliers, building contractors, local and federal governments and bathroom accessory companies. |

Once a tankless water heater is purchased by the consumer, we expect that the consumer will be able to install it by themselves as the installation process is a relatively simple one. However, we do plan on engaging employees who will be responsible to respond to technical questions and minor repairs of the equipment if we have sufficient funding to do so.

We provide a competitive warranty replacement and repair service for our products. Zhongshan will be responsible for all eventual costs of warranty repair or replacement, however in order to provide effective customer service we will incur the initial costs of these services and receive reimbursement from Zhongshan. It is possible that reimbursement from Zhongshan may be delayed or declined. If we are obligated to repair or replace any of our products, our operating costs could increase if the actual costs differ materially from our estimates, which could prevent us from becoming profitable.

Competition

We face competition from various traditional water heater retailers, but no companies are currently selling tankless water heaters. We believe this gives us a competitive advantage due to the inherent design of our product.

Many of our competitors have longer operating histories, better brand recognition and greater financial resources than we do. In order for us to successfully compete in our industry we will need to:

| * | establish our products’ competitive advantage with retailers and customers; |

| * | develop a comprehensive marketing system; and |

| * | increase our financial resources. |

However, there can be no assurance that even if we do these things, we will be able to compete effectively with the other companies in our industry.

9

We believe that we will be able to compete effectively in our industry because of a competitive advantage offered by our product in terms of water consumption and energy use. We will attempt to inform our potential customers of these competitive advantages and establish a developed distribution network based on various marketing techniques and positive word of mouth advertising. We believe that our products have cost related competitive advantages over other products in the marketplace due to lower cost of acquisition and more efficient usage of energy. Conventional hot water tanks cost approximately $500 to $1,000 depending on size and features, while our products will be significantly less expensive. Additionally, given the on demand nature of our tankless water heaters, we believe that our customers will also be able to use energy more efficiently as the customers will not have to constantly heat water which they are not using as with conventional hot water heaters.

However, as we are a newly-established company, we face the same problems as other new companies starting up in an industry, such as lack of available funds. Our competitors may be substantially larger and better funded than us, and have significantly longer histories of research, operation and development than us. In addition, they may be able to provide more competitive products than we can and generally be able to respond more quickly to new or emerging technologies and changes in legislation and regulations relating to the industry. Additionally, our competitors may devote greater resources to the development, promotion and sale of their products or services than we do. Increased competition could also result in loss of key personnel, reduced margins or loss of market share, any of which could harm our business.

Our products also have some inherent competitive weaknesses which may affect our ability to market them and generate sales. These are as follows:

| 1) | Our tankless water heaters are not sufficiently large to provide hot water supply for an entire household; |

| 2) | Our end customer may experience an increase in their water and fuel bill due to the endless amount of hot water available as the fact that hot water is constantly available may encourage increased usage; |

| 3) | There is a heating up period for our products during which hot water is not available; and |

| 4) | It may take time to gain market acceptance for tankless products compared to the conventional hot water tanks. |

Intellectual Property

We have not filed for any protection of our trademark, and we do not have any other intellectual property. Our website is www.thepristinesolution.com.

Research and Development

We did not incur any research and development expenses during the period from December 8, 2009 (inception) to January 31, 2012.

Purchase of Significant Equipment

We do not intend to purchase any significant equipment over the twelve months ending January 31, 2013.

Compliance with Government Regulation

We are not aware of any government regulations which will have a material impact on our operations.

Environmental Regulations

We are not aware of any material violations of environmental permits, licenses or approvals that have been issued with respect to our operations. We expect to comply with all applicable laws, rules and regulations relating to our business, and at this time, we do not anticipate incurring any material capital expenditures to comply with any environmental regulations or other requirements.

10

While our intended projects and business activities do not currently violate any laws, any regulatory changes that impose additional restrictions or requirements on us or on our potential customers could adversely affect us by increasing our operating costs or decreasing demand for our products or services, which could have a material adverse effect on our results of operations.

Subsidiaries

We have a wholly-owned subsidiary, Pristine Solutions Limited, incorporated under the laws of Jamaica.

Employees

As of April 27, 2012, we had no employees other than our sole director and officer who contributes approximately 50% of her time to our company.

We currently engage independent contractors in the areas of accounting and legal services. We plan to engage independent contractors in the areas of marketing, bookkeeping, investment banking and other services including at least 3 part time consultants who will each focus on sales and marketing, business development and investor relations.

Intellectual Property

We do not own, either legally or beneficially, any patent or trademark.

REPORTS TO SECURITY HOLDERS

We are required to file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission and our filings are available to the public over the internet at the Securities and Exchange Commission’s website at http://www.sec.gov. The public may read and copy any materials filed by us with the Securities and Exchange Commission at the Securities and Exchange Commission’s Public Reference Room at 100 F Street N.E. Washington D.C. 20549. The public may obtain information on the operation of the Public Reference Room by calling the Securities and Exchange Commission at 1-800-732-0330. The SEC also maintains an Internet site that contains reports, proxy and formation statements, and other information regarding issuers that file electronically with the SEC, at http://www.sec.gov.

Item 1A. Risk Factors

Risks Related to Our Business

Investors may not be able to adequately evaluate our business due to our short operating history, lack ofsignificantrevenues and no customers. We may not be successful in developing a market for our products and the value of your investment could decline.

We are a development stage company with no substantial tangible assets in a highly competitive industry. We have limited operating history, customers and revenues. This makes it difficult to evaluate our future performance and prospects. Our Prospects must be considered in light of the risks, expenses, delays and difficulties frequently encountered in establishing a new business in an emerging and evolving industry, including the following factors:

| * | our business model and strategy are still evolving and are continually being reviewed and revised; |

| * | we may not be able to raise the capital required to develop our initial client base and reputation; and |

| * | we may not be able to successfully develop our planned products and services. |

There is no assurance our future operations will be profitable. If we cannot generate sufficient revenues to operate profitably, we may suspend or cease operations. We cannot be sure that we will be successful in meeting these

11

challenges and addressing these risks and uncertainties. If we are unable to do so, our business will not be successful and the value of any investment in us will decline.

We require approximately$470,000 in additional funding to continue our operations over the next 12months. If we do not secure additional funding, we may not be able to distribute our products, which will affect our ability to generate revenues and achieve profitability.

Our failure to raise additional capital or generate the cash flows necessary to finance our business could force us to limit or cease our operations. Our business plan contemplates that we will expand our distribution throughout Jamaica. Accordingly, we will need to raise approximately $470,000 in additional funds, and we may not be able to obtain additional debt or equity financing on favorable terms, if at all. If we raise additional equity financing, our stockholders may experience significant dilution of their ownership interests, and the per-share value of our common stock could decline. If we engage in debt financing, we may be required to accept terms that restrict our ability to incur additional indebtedness and force us to maintain specified liquidity or other ratios. If we need additional capital and cannot raise it on acceptable terms, we may not be able to, among other things, distribute and market our products, which would negatively impact our business and our ability to generate revenues and achieve profitability.

The loss of Christine Buchanan-Mckenzie, our President, Chief Executive Officer, Chief Financial Officer, Secretary andsoleDirector,would harm our business and decrease our ability to operate profitably.

We will rely heavily on Christine Buchanan-Mckenzie to conduct our operations and the loss of this individual could significantly disrupt our business. Virtually all material decisions concerning the conduct of our business are made or are significantly influenced by Christine Buchanan-Mckenzie. Although we have a management agreement with this individual, the agreement has a term of only 1 year and provides for early termination with notice. As such, she may resign from her positions with us at any time. While we believe that, in the future, we may be able to enter into executive services agreements with Christine Buchanan-Mckenzie, we cannot assure you that we will be able to enter into such agreements in the near future, if at all. Should we fail to enter into acceptable agreements with Christine Buchanan-Mckenzie, we may not be able to maintain the visibility in the industry that is necessary to maintain and extend our production, financing and distribution agreements which will lead to a loss of revenues and profitability.

We may not succeed in effectively marketing Gleamous tankless water heaters, which could prevent us from acquiring customers and achieving significant revenues.

A significant component of our business strategy is the development of a market for the Gleamous products in Jamaica and the Caribbean. Due to the competitive nature of the retail industry, if we do not market the Gleamous tankless water heaters effectively, we may fail to attract customers or achieve significant revenues. Promoting the Gleamous tankless water heaters will depend largely on the efforts of our marketing personnel and targeting the appropriate merchandising outlets. In order to be successful in this, we expect to incur substantial expenses in the next 12 months related to advertising and other marketing efforts. Currently, we do not have sufficient funds to carry out all our anticipated advertising and marketing efforts and there can be no assurance that we will be able to raise the required funds.

Our ability to market our product successfully is also dependent on external factors over which we may have little or no control, including the performance of our suppliers, third-party carriers and networking vendors. We also rely on third parties for information, including product characteristics that we present to consumers, which may, on occasion, be inaccurate. Our failure to provide our customers with a product that meets their expectations, for any reason, could substantially harm our reputation and prevent us from developing Gleamous as a trusted brand. The failure of our brand promotion activities could adversely affect our ability to attract new customers and maintain customer relationships and, as a result, substantially harm our business and results of operations.

12

Competition from appliance companies with greater brand recognition and resources may result in our inability to continue with our operations or prevent us from achieving significant revenues.

The appliance industry is highly competitive and new brands and products are being launched all the time. The competitive nature of the retail industry as a whole means that we have to establish our product at the right price, ensure that the packaging is appealing and ensure that our product is distributed through the appropriate channels. It is very likely that we will be subjected to price pressure on our product and this could result in reduced gross margins, which in turn could substantially harm our business and results of operations. Current and potential competitors include independent or online appliance retailers which offer competitive products, or which may see a market to develop a product similar to ours.

In addition, we may face competition from the supplier of our products may illegally circumvent the distribution agreement we have with them, and decide to sell directly to consumers, either through physical retail outlets or through an online store.

Many appliance retailers have advantages over us, including longer operating histories, greater brand recognition, existing customer and supplier relationships, and significantly greater financial, marketing and other resources. Some of these retailers may be able to devote substantially more resources to developing new products, or they may have contacts with other companies that devote themselves full time to developing new products. In addition, larger, more established and better capitalized entities may acquire, invest or partner with traditional and online competitors as use of the Internet and other online services increases.

As our business assets and oursoledirector and officer are located in Jamaica; investors may be limited in their ability to enforce US civil actions against our assets or oursoledirector and officer. You may not be able to receive compensation for damages to the value of your investment caused by wrongful actions by our director.

Our business assets are located in Jamaica and Christine Buchanan-Mckenzie, our sole director and officer, is a resident of Jamaica. Consequently, it may be difficult for United States investors to affect service of process upon our assets or our sole director or officer. It may also be difficult to realize upon judgments of United States courts predicated upon civil liabilities under U.S. Federal Securities Laws. A judgment of a U.S. court predicated solely upon such civil liabilities may not be enforceable in Jamaica by a Jamaican court if the U.S. court in which the judgment was obtained did not have jurisdiction, as determined by the Jamaican court, in the matter. There is substantial doubt whether an original action could be brought successfully in Jamaica against any of our assets or our sole director or officer predicated solely upon such civil liabilities. You may not be able to recover damages as compensation for a decline in your investment.

Our management beneficially owns approximately 57% of the shares of common stock and their interest could conflict with the investors which could cause the investor to lose all or part of the investment.

Christine Buchanan-Mckenzie, our sole director, President, Chief Executive Officer and Chief Financial Officer owns, or has control over, approximately 57% of our issued and outstanding common stock. As such, Ms. Buchanan-Mckenzie is able to substantially influence all matters requiring stockholder approval, including the election of directors and approval of significant corporate transactions. Such concentration of ownership may also have the effect of delaying or preventing a change in control, which may be to the benefit of our management but not in the interest of the shareholders. This beneficial ownership and potential effective control on all matters relating to our business and operations could eliminate the possibility of shareholders changing the management in the event that the shareholders did not agree with the conduct of the officers and directors. Additionally, the shareholders would potentially not be able to obtain the necessary shareholder vote to affect any change in the course of our business. This lack of shareholder control could prevent the shareholders from removing from the Board of Directors any directors who are not managing the company with sufficient skill to make it profitable,which could prevent us from becoming profitable.

13

Since our sole officer and director does not have significant training or experience in the retail appliance industry, our business could suffer irreparable harm as a result of her decisions and choices and you could lose your entire investment.

Though, as our sole director and officer, Christine Buchanan-Mckenzie, is indispensible to our operations, she does not have any significant training or experience in the sales of household appliances and bringing such new products to market. Without such direct training or experience, she may not be fully aware of many of the specific requirements related to working within this environment. Our sole officer and director’s decisions and choices may therefore fail to take into account standard technical or managerial approaches which other companies in the appliance business commonly use. Consequently, our operations, earnings, and ultimately our ability to carry on business could suffer irreparable harm, which could result in the total loss of your investment.

The costs associated with any warranty repair or replacement or any product recall could increase our operating costs and prevent us from becoming profitable.

We have implemented warranty coverage on our products based on our best estimate of what will be required to settle any product defect claims or issues. However, we may be forced to incur costs above this amount if our estimates are incorrect or if we, our suppliers or government regulators decide to recall a product or input because of a known or suspected performance issue, even if we are only required to participate voluntarily in the recall. Once we begin distributing our tankless water heaters, we may also incur liability related to any manufacturing defects that our products contain. If we are obligated to repair or replace any of our products, our operating costs could increase if the actual costs differ materially from our estimates, which could prevent us from becoming profitable.

Our success depends in part on our ability to attract and retain key skilled professionals, which we may not be able to do. Our failure to do so could prevent us from achieving our goals or becoming profitable.

We plan to engage independent contractors in the areas of marketing, bookkeeping, investment banking and other services including at least three part time consultants who will each focus on sales and marketing, business development and investor relations. However, competition for qualified skilled professionals is intense, and we may be unable to attract and retain such key personnel. Additionally, as of April 27, 2012 we did not have sufficient funds to hire any of these consultants and there can be no assurance that we will be able to secure the required financing. This could prevent us from achieving our goals or becoming profitable.

We may indemnify our directors and officers against liability to us and our stockholders, and such indemnification could increase our operating costs.

Our Bylaws allow us to indemnify our directors and officers against claims associated with carrying out the duties of their offices. Our Bylaws also allow us to reimburse them for the costs of certain legal defenses. Insofar as indemnification for liabilities arising under the Securities Act of 1933, as amended (the “Securities Act”), may be permitted to our directors, officers or control persons, we have been advised by the SEC that such indemnification is against public policy and is therefore unenforceable.

Since our sole officer and director is aware that she may be indemnified for carrying out the duties of her offices, she may be less motivated to meet the standards required by law to properly carry out such duties, which could increase our operating costs. Further, if our sole officer and director files a claim against us for indemnification, the associated expenses could also increase our operating costs.

We are exposed to currency exchange risk which could cause our reported earnings or losses to fluctuate.

Although we report our financial results in US dollars, a portion of our sales and operating costs may be denominated in Jamaican dollars. In addition, we are exposed to currency exchange risk on any of our assets that are denominated in Jamaican dollars. Since we present our financial statements in US dollars, any change in the value of the Jamaican dollar relative to the US dollar during a given financial reporting period would result in a foreign

14

currency loss or gain on the translation of our Jamaican dollar transactions into US dollars. Consequently, our reported earnings or losses could fluctuate materially as a result of foreign exchange translation gains or losses.

We have only one supplier of the tankless water heaters we intend to distribute in our target market. If our agreement with our supplier is terminated, we may not be able to secure additional products and our ability to generate revenues may suffer.

On December 30, 2009, as amended on March 18, 2011, we entered into a distribution agreement with Zhongshan to acquire and distribute their Glameous line of tankless water heaters. The agreement with Zhongshan contains termination provisions and additionally, Zhongshan could unilaterally terminate their supply of product to us outside of the terms of the agreement. If this was to occur, we would be forced to find an alternative supplier of tankless water heaters. If we are not able to secure such supply, we may not have sufficient product to sell to our intended market and consequently, our ability to generate revenues may suffer.

Risks Related to the Ownership of Our Stock

The continued sale of our equity securities will dilute the ownership percentage of our existing stockholders and may decrease the market price for our common stock.

Given our lack of significant revenues and the doubtful prospect that we will earn significant revenues in the next several years, we will require additional financing of $470,000 for the next 12 months, which will require us to issue additional equity securities or incur additional debt. We expect to continue our efforts to acquire financing to fund our planned development and expansion activities, which will result in dilution to our existing stockholders. In short, our continued need to sell equity will result in reduced percentage ownership interests for all of our investors, which may decrease the market price for our common stock.

We do not intend to pay dividends and there will thus be fewer ways in which you are able to make areturnon your investment.

We have never paid dividends and do not intend to pay any dividends for the foreseeable future. To the extent that we may require additional funding currently not provided for in our financing plan, our funding sources may prohibit the declaration of dividends. Because we do not intend to pay dividends, any return on your investment will need to result from an appreciation in the price of our common stock. Therefore, there will be fewer ways in which you are able to make a return on your investment.

Because the SEC imposes additional sales practice requirements on brokers who deal in shares of penny stocks, some brokers may be unwilling to trade our securities. This means that you may have difficulty reselling your shares, which may cause the value of your investment to decline.

Our shares are classified as penny stocks and are covered by Section 15(g) of the Securities Exchange Act of 1934 (the “Exchange Act”) which imposes additional sales practice requirements on brokers-dealers who sell our securities in this offering or in the aftermarket. For sales of our securities, broker-dealers must make a special suitability determination and receive a written agreement from you prior to making a sale on your behalf. Because of the imposition of the foregoing additional sales practices, it is possible that broker-dealers will not want to make a market in our common stock. This could prevent you from reselling your shares and may cause the value of your investment to decline.

Financial Industry Regulatory Authority (FINRA) sales practice requirements may limit your ability to buy and sell our common stock, which could depress the price of our shares.

FINRA rules require broker-dealers to have reasonable grounds for believing that an investment is suitable for a customer before recommending that investment to the customer. Prior to recommending speculative low-priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information

15

about the customer’s financial status, tax status and investment objectives, among other things. Under interpretations of these rules, FINRA believes that there is a high probability such speculative low-priced securities will not be suitable for at least some customers. Thus, FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our shares, have an adverse effect on the market for our shares, and thereby depress our share price.

Our security holders may face significant restrictions on the resale of our securities due to state “blue sky” laws.

Each state has its own securities laws, often called “blue sky” laws, which (i) limit sales of securities to a state’s residents unless the securities are registered in that state or qualify for an exemption from registration, and (ii) govern the reporting requirements for broker-dealers doing business directly or indirectly in the state. Before a security is sold in a state, there must be a registration in place to cover the transaction, or the transaction must be exempt from registration. The applicable broker must be registered in that state.

We do not know whether our securities will be registered or exempt from registration under the laws of any state. A determination regarding registration will be made by those broker-dealers, if any, who agree to serve as the market-makers for our common stock. There may be significant state blue sky law restrictions on the ability of investors to sell, and on purchasers to buy, our securities. You should therefore consider the resale market for our common stock to be limited, as you may be unable to resell your shares without the significant expense of state registration or qualification.

Item 1B. Unresolved Staff Comments

As a “smaller reporting company” we are not required to provide the information required by this Item.

Item 2. Properties

Executive Offices

Our principal offices are located at Stettin Albert Town, Trelawny, Jamaica. Our telephone number at our principal office is 876.572.4681. Our office space is provided to us at no cost by our president.

Item 3. Legal Proceedings

We know of no material, existing or pending legal proceedings against our company, nor are we involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which any of our directors, officers or affiliates, or any registered or beneficial stockholder, is an adverse party or has a material interest adverse to our interest.

Item 4. Mine Safety Disclosures

Not applicable.

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our common stock is quoted on the OTC Bulletin Board under the Symbol "PRTN". Our common stock was listed for quotation on February 3, 2011. Since the listing of our common stock for trading, there have been no trades or bid prices.

As of April 27, 2012, there were approximately 37 holders of record of our common stock. As of such date, 418,000,686 common shares were issued and outstanding.

16

Dividend Policy

We have not paid any cash dividends on our common stock and have no present intention of paying any dividends on the shares of our common stock. Our current policy is to retain earnings, if any, for use in our operations and in the development of our business. Our future dividend policy will be determined from time to time by our board of directors.

Recent Sales of Unregistered Securities; Use of Proceeds from Registered Securities

We did not sell any equity securities which were not registered under the Securities Act during the year ended January 31, 2012 that were not otherwise disclosed in our registration statement on Form S-1, quarterly reports on Form 10-Q or our current reports on Form 8-K filed during the year ended January 31, 2012.

Equity Compensation Plan Information

Except as disclosed below, we do not have a stock option plan in favor of any director, officer, consultant or employee of our company.

Purchase of Equity Securities by the Issuer and Affiliated Purchasers

We did not purchase any of our shares of common stock or other securities during our fiscal year ended January 31, 2012.

Item 6. Selected Financial Data

As a “smaller reporting company” we are not required to provide the information required by this Item.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion should be read in conjunction with our audited consolidated financial statements and the related notes for the year ended January 31, 2012 and the period ended January 31, 2011 that appear elsewhere in this annual report. The following discussion contains forward-looking statements that reflect our plans, estimates and beliefs. Our actual results could differ materially from those discussed in the forward looking statements. Factors that could cause or contribute to such differences include, but are not limited to those discussed below and elsewhere in this annual report, particularly in the section entitled "Risk Factors" beginning on page 12of this annual report.

Our audited consolidated financial statements are stated in United States Dollars and are prepared in accordance with United States Generally Accepted Accounting Principles.

Plan of Operations

Cash Requirements

We anticipate that we will meet our ongoing cash requirements through equity or debt financing. We estimate that our expenses over the next 12 months will be approximately $470,000 as described in the table below. These estimates may change significantly depending on the nature of our future business activities and our ability to raise capital from shareholders or other sources.

|

Description |

Estimated

|

|

Legal and accounting fees |

80,000 |

|

Product acquisition, testing and servicing costs |

80,000 |

|

Marketing and advertising |

75,000 |

|

Investor relations and capital raising |

20,000 |

|

Management and operating costs |

40,000 |

|

Salaries and consulting fees |

50,000 |

|

Fixed asset purchases for distribution centers |

60,000 |

|

General and administrative expenses |

65,000 |

|

Total |

$470,000 |

17

We intend to meet our cash requirements for the next 12 months through a combination of debt financing and equity financing by way of private placements. We currently do not have any arrangements in place to complete any private placement financings and there is no assurance that we will be successful in completing any such financings on terms that will be acceptable to us.

If we are not able to raise the full $470,000 to implement our business plan as anticipated, we will scale our business development in line with available capital. Our primary priority will be to retain our reporting status with the SEC which means that we will first ensure that we have sufficient capital to cover our legal and accounting expenses. Once these costs are accounted for, in accordance with how much financing we are able to secure, we will focus on product acquisition, testing and servicing costs as well as marketing and advertising of our products. We will likely not expend funds on the remainder of our planned activities unless we have the required capital.

If we are able to raise the required funds to fully implement our business plan, we plan to implement the below business actions in the order provided below. If we are not able to raise all required funds, we will prioritize our corporate activities as chronologically laid out below because the activity which needs to be undertaken in the initial months is prerequisite for future operations. We anticipate that the implementation of our business will occur as follows:

February 2012to January 2013

| * | Website has been designed and once the Company invests in more inventory, it will design and have a shopping cart added to it for online sales. |

| * | Market products to large retailers and distributors |

| * | Testing of the units have been successful, and additional purchase orders have been placed from Zhongshan, the manufacturer |

| * | Review opportunities for establishment of retail locations |

| * | Attend trade shows |

| * | Market products to hotels, resorts, and real estate developers |

| * | Hire personnel to market and service our products |

| * | Purchase additional assets, such as additional delivery vehicles, that can be used to service and market different regions. |

| * | Raise additional capital for inventory and marketing |

Personnel Plan

We do not expect any material changes in the number of employees over the next 12 month period (although we may enter into employment or consulting agreements with our officer and director). We do and will continue to outsource contract employment as needed.

We currently engage independent contractors in the areas of accounting and legal services. We plan to engage independent contractors in the areas of marketing, bookkeeping, investment banking and other services, including at

18

least 3 part time consultants who will each focus on sales and marketing, business development and investor relations.

Off-Balance Sheet Arrangements

There are no off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures or capital resources that is material to investors.

Our principal capital resources have been through the subscription and issuance of common stock, although we have also utilized a loan and advances from related parties.

Results of Operations for the Years Ended January 31, 2012 and 2011

The following summary of our results of operations should be read in conjunction with our audited financial statements for the year ended January 31, 2012 and the period ended January 31, 2011.

Our operating results for the periods ended January 31, 2012 and 2011 are summarized as follows:

|

|

|

|

Period Ended |

|

|||

|

|

|

|

January 31 |

|

|||

|

|

|

|

2012 |

|

|

2011 |

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

569 |

|

$ |

3,674 |

|

|

|

Cost of Goods Sold |

$ |

221 |

|

$ |

1,207 |

|

|

|

Total Operating Expenses |

$ |

29,250 |

|

$ |

48,795 |

|

|

|

Net Loss |

$ |

(26,445) |

|

$ |

(46,436) |

|

Revenuesand Cost of Goods Sold

We earned revenues of $569 during the year ended January 31, 2012 compared to $3,674 for the period ended January 31, 2011. We incurred cost of goods sold of $221 during the year ended January 31, 2012, compared to $1,207 for the period ended January 31, 2011.

Operating Expenses

Our operating expenses for the year ended January 31, 2012 and the period ended January 31, 2011 are outlined in the table below:

|

|

|

|

Period Ended |

|

|||

|

|

|

|

January 31 |

|

|||

|

|

|

|

2012 |

|

|

2011 |

|

|

|

Foreign exchange loss (gain) |

$ |

(2,457) |

|

$ |

108 |

|

|

|

Depreciation and amortization |

$ |

1,303 |

|

$ |

814 |

|

|

|

General and administrative |

$ |

27,947 |

|

$ |

47,981 |

|

The decrease in operating expenses for the year ended January 31, 2012, compared to the same period in fiscal 2011, was mainly to a foreign exchange gain and decreased general and administrative expenses.

19

Liquidity and Financial Condition

As of January 31, 2012, our total current assets were $6,681 and our total current liabilities were $39,457 resulting in a working capital deficit of $32,776. We had a net loss of $26,445 for the year ended January 31, 2012, and $77,577 for the period from December 8, 2009 (date of inception) to January 31, 2012.

We have suffered recurring losses from operations. The continuation of our company is dependent upon our company attaining and maintaining profitable operations and raising additional capital as needed. In this regard we have raised additional capital through private placement of equity and loan transactions.

|

|

Cash Flows |

|

Period Ended |

|

|||

|

|

|

|

January 31, |

|

|||

|

|

|

|

2012 |

|

|

2011 |

|

|

|

|

|

|

|

|

|

|

|

|

Net Cash Used in Operating Activities |

$ |

(20,832) |

|

$ |

(50,486) |

|

|

|

Net Cash Used in Investing Activities |

$ |

Nil |

|

$ |

(7,816) |

|

|

|

Net Cash Provided from Financing Activities |

$ |

19,490 |

|

$ |

9,985 |

|

|

|

Increase (Decrease) In Cash |

$ |

(1,342) |

|

$ |

(48,317) |

|

We had cash in the amount of $201 as of January 31, 2012 as compared to $1,543 as of January 31, 2011. We had a working capital deficit of $32,776 as of January 31, 2012 compared to working capital deficit of $7,634 as of January 31, 2011.

Future Financings

We will require additional funds to implement our growth strategy in our new business. These funds may be raised through equity financing, debt financing, or other sources, which may result in further dilution in the equity ownership of our shares.

There can be no assurance that additional financing will be available to us when needed or, if available, that it can be obtained on commercially reasonable terms. If we are not able to obtain the additional financing on a timely basis should it be required, or generate significant material revenues from operations, we will not be able to meet our other obligations as they become due and we will be forced to scale down or perhaps even cease our operations.

Contractual Obligations

As a “smaller reporting company”, we are not required to provide tabular disclosure obligations.

Going Concern

The accompanying consolidated financial statements have been prepared on a going concern basis, which assumes our company will continue to realize its assets and discharge its liabilities in the normal course of business. The continuation of our company as a going concern is dependent upon the continued financial support from our shareholders, the ability of our company to obtain necessary financing and the attainment of profitable operations. As of January 31, 2012, our company has incurred losses totaling $77,577 since inception, and has not yet generated significant revenue from operations. These factors raise substantial doubt regarding our company’s ability to continue as a going concern.

If we are able to raise additional funds and our operations and cash flow improve, management believes that we will be able to continue to operate. However, no assurance can be given that management's actions will result in profitable operations or an improvement in our liquidity. The uncertainty regarding our ability to continue as a going concern will cease when our revenues have reached a level able to sustain our business operations.

20

Critical Accounting Policies

The discussion and analysis of our financial condition and results of operations are based upon our consolidated financial statements, which have been prepared in accordance with the accounting principles generally accepted in the United States of America. Preparing financial statements requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue, and expenses. These estimates and assumptions are affected by management’s application of accounting policies. We believe that understanding the basis and nature of the estimates and assumptions involved with the following aspects of our financial statements is critical to an understanding of our financial statements.

Basis of Presentation

These consolidated financial statements of our company have been prepared in accordance with generally accepted accounting principles in the United States and are expressed in US dollars. Our company’s fiscal year end is January 31.

Principal of Consolidation

The consolidated financial statements include the accounts of Pristine Solutions Inc. and its 100% owned subsidiary. All significant intercompany balances and transactions have been eliminated in consolidation.

Use of Estimates

The preparation of consolidated financial statements in conformity with United States generally accepted accounting principles requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. Our company regularly evaluates estimates and assumptions related to long-lived assets and deferred income tax asset valuation allowances. Our company bases its estimates and assumptions on current facts, historical experience and various other factors that it believes to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities and the accrual of costs and expenses that are not readily apparent from other sources. The actual results experienced by our company may differ materially and adversely from our company’s estimates. To the extent there are material differences between the estimates and the actual results, future results of operations will be affected.

Cash and Cash Equivalents

Our company considers all highly liquid instruments with maturity of three months or less at the time of purchase to be cash equivalents.

Receivables

Our company uses the allowance method to account for uncollectible accounts receivable. Accounts receivable are presented net of an allowance for doubtful accounts of $Nil at January 31, 2012, and 2011.

Inventory

Inventories, consisting of electric water heaters, are stated at the lower of cost or market. Cost is determined on a standard cost basis that approximates the first-in, first-out (FIFO) method. Market is determined based on net realizable value. Appropriate consideration is given to obsolescence, excessive levels, deterioration, and other factors in evaluating net realizable value. As of January 31, 2011 and January 31, 2012, an allowance of $Nil and $Nil was recognized to mark our company’s inventory to the lower of cost or market.

21

Property and Equipment

Property and equipment consists of a vehicle which is recorded at cost. The vehicle is being depreciated on a straight-line basis over 6 years.

Financial Instruments

Our company’s financial instruments consist principally of cash, accounts receivable, accounts payable, loans payable and related party payables. Our company believes that the recorded values of our company’s financial instruments approximate their current fair values because of their nature and respective relatively short maturity dates or durations.

Our company’s operations are in the United States and Jamaica, which results in exposure to market risks from changes in foreign currency rates. The financial risk is the risk to our company’s operations that arise from fluctuations in foreign exchange rates and the degree of volatility of these rates. Currently, our company does not use derivative instruments to reduce its exposure to foreign currency risk.

Revenue Recognition

Sales are recorded when products are shipped to customers. Provisions for discounts and rebates to customers, estimated returns and allowances, and other adjustments are provided for in the same period the related sales are recorded. No provision for discounts or rebates to customers, estimated returns and allowances or other adjustments were recognized during the years ended January 31, 2012 and 2011. In instances where products are configured to customer requirements, revenue is recorded upon the successful completion of our company’s final test procedures and the customer’s acceptance. No revenues were deferred due to products being configured to customer requirements during the years ended January 31, 2012 and 2011.

Product Warranty

Our company provides a one year warranty on all products sold. Our company’s policy is to accrue a warranty liability equal to 2% of sales based on the manufacturer’s past experience. Spare parts equal to 1% of each order are provided to our company free of charge from the manufacturer. During the year ended January 31, 2012, our company recognized $11 (2011 - $73) of warranty expenses in accrued liabilities and cost of goods sold. Our company did not have any warranty claims during the years ended January 31, 2012 and 2011. Our company will continue to evaluate its warranty policy based on actual products returned and costs incurred.

Our company’s warranty accrual is based on our company’s best estimates of product failure rates and unit costs to repair. However, our company plans to release new products. As a result, it is at least reasonably possible that products could be released with certain unknown quality and/or design problems. Such an occurrence could result in materially higher than expected warranty and related costs, which could have a materially adverse effect on our company’s results of operations and financial condition.

Shipping and Handling Activities

Shipping and handling costs of approximately $Nil during the year ended January 31, 2012 (2011 - $1,600) are included in selling, general and administrative expenses.

22

Earnings (Loss) Per Share

Basic EPS is computed by dividing net income (loss) available to common shareholders (numerator) by the weighted average number of shares outstanding (denominator) during the period. Diluted EPS gives effect to all dilutive potential common shares outstanding during the period using the treasury stock method and convertible preferred stock using the if-converted method. In computing Diluted EPS, the average stock price for the period is used in determining the number of shares assumed to be purchased from the exercise of stock options or warrants. Diluted EPS excludes all dilutive potential shares if their effect is anti-dilutive. At January 31, 2012, our company had no potentially dilutive securities outstanding.

Foreign Currency Translation

Monetary assets and liabilities denominated in foreign currencies are translated using the exchange rate prevailing at the balance sheet date. Gains and losses arising on settlement of foreign currency denominated transactions or balances are included in the determination of income. Foreign currency transactions are primarily undertaken in Jamaican dollars. Our company has not, to the date of these financial statements, entered into derivative instruments to offset the impact of foreign currency fluctuations. The United States dollar is the functional and reporting currency.

Income Taxes

Our company accounts for income taxes using the asset and liability method. Under this method, deferred tax assets and liabilities are recognized for the expected future tax consequences of temporary differences between the financial reporting and tax bases of assets and liabilities, and for operating loss and tax credit carryforwards. Deferred tax assets and liabilities are measured using the currently enacted tax rates and laws that will be in effect when the differences are expected to reverse. Our company records a valuation allowance to reduce deferred tax assets to the amount that is believed more likely than not to be realized. At January 31, 2012 the deferred tax asset related to our company’s net operating loss carry forward has been fully reserved and no benefit has been recognized in our company’s consolidated financial statements.

Recent Accounting Pronouncements

Our company has implemented all new accounting pronouncements that are in effect and that may impact its consolidated financial statements and does not believe that there are any other new accounting pronouncements that have been issued that might have a material impact on their financial position or results of operations.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

As a “smaller reporting company” we are not required to provide the information required by this Item.

Item 8. Financial Statements and Supplementary Data

23

Pristine Solutions Inc.

(A Development Stage Company)

Consolidated Financial Statements

January 31, 2012

| Index | |

| Report of Independent Registered Public Accounting Firm | F-1 |

| Consolidated Balance Sheets | F-2 |

| Consolidated Statements of Operations | F-3 |

| Consolidated Statement of Stockholders’ Equity (Deficit) | F-4 |

| Consolidated Statements of Cash Flows | F-5 |

| Notes to the Consolidated Financial Statements | F-6 |

24

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Stockholders

Pristine Solutions Inc.

(A Development Stage Company)

Trelawny, Jamaica

We have audited the accompanying consolidated balance sheets of Pristine Solutions Inc. (the Company”) as of January 31, 2012 and 2011, and the related consolidated statements of operations, stockholders’ equity (deficit), and cash flows for the years then ended and for the period from December 8, 2009 (Inception) to January 31, 2012. These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance whether the consolidated financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the consolidated financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall consolidated financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects the consolidated financial position of Pristine Solutions Inc. as of January 31, 2012 and 2011, and the consolidated results of their operations and their cash flows for the year ended January 31, 2012 and 2011 and for the period from December 8, 2009 (Inception) to January 31, 2012 in conformity with accounting principles generally accepted in the United States of America.

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 1 to the consolidated financial statements, the Company has incurred losses since inception, and has not yet generated significant revenue from operations. These factors raise substantial doubt about the Company’s ability to continue as a going concern. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ GBH CPAs, PC

GBH CPAs, PC

www.gbhcpas.com

Houston, Texas

April 30, 2012

F-1

Pristine Solutions Inc.

(A Development Stage Company)

Consolidated Balance Sheets

|

|

January 31, 2012 |

January 31, 2011 |

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

|

Current Assets |

|

|

|

|

|

|

|

Cash |

$ 201 |

$ 1,543 |

|

Accounts receivable |

– |

2,985 |

|

Inventory |

6,480 |

1,050 |

|

|

|

|

|

Total Current Assets |

6,681 |

5,578 |

|

|

|

|

|

Property and equipment, net |

5,699 |

7,002 |

|

Total Assets |

$ 12,380 |

$ 12,580 |

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ DEFICIT |

|

|

|

|

|

|

|

Current Liabilities |

|

|

|

|

|

|

|

Accounts payable and accrued liabilities |

$ 7,666 |

$ 1,172 |

|

Loans payable |

29,475 |

9,985 |

|

Related party payables |

2,316 |

2,055 |

|

|

|

|

|

Total Liabilities |

39,457 |

13,212 |

|

|

|

|

|

|

|

|

|

Contingencies and Commitments |

– |

– |

|

|

|

|

|

Stockholders’ Deficit |

|

|

|

|

|

|

|

Preferred stock, 50,000,000 shares authorized, $0.001 par value; no shares issued and outstanding |

– |

– |

|

|

|

|

|

Common stock, 650,000,000 shares authorized, $0.0001 par value; 418,000,686 shares issued and outstanding |

41,800 |

41,800 |

|

|

|

|

|

Additional paid-in capital |

8,700 |

8,700 |

|

|

|

|

|

Deficit accumulated during the development stage |

(77,577) |

(51,132) |

|

|

|

|

|

Total Stockholders’ Deficit |

(27,077) |

(632) |

|

|

|

|

|

Total Liabilities and Stockholders’ Deficit |

$ 12,380 |

$ 12,580 |

|

|

|

|

F-2

Pristine Solutions Inc.

(A Development Stage Company)

Consolidated Statements of Operations

|

|

For the Year Ended January 31, 2012 |

|

For the Year Ended January 31, 2011 |

|

From December 8, 2009 (Inception) to January 31, 2012 |

|

|

|

|

|

|

|

|

Sales, net of returns |

$ 569 |

|

$ 3,674 |

|

$ 4,243 |

|

Cost of Goods Sold |

(221) |

|

(1,207) |

|

(1,428) |

|

Gross Margin |

348 |

|

2,467 |

|

2,815 |

|

|

|

|

|

|

|

|

Operating Expenses |

|

|

|

|

|

|

Depreciation and amortization |

1,303 |

|

814 |

|

2,117 |

|

General and administrative |

27,947 |

|

47,981 |

|

79,991 |

|

|

|

|

|

|

|

|

Total Operating Expenses |

29,250 |

|

48,795 |

|

82,108 |

|

|

|

|

|

|

|

|

Loss from Operations |

(28,902) |

|

(46,328) |

|

(79,293) |

|

|

|

|

|

|

|

|

Other Income (Expense) |

|

|

|

|

|

|

Foreign exchange gain (loss) |

2,457 |

|

(108) |

|

1,716 |

|

|

|

|

|

|

|

|

Net Loss |

$ (26,445) |

|

$ (46,436) |

|

$ (77,577) |

|

|

|

|

|

|

|

|

Net Loss Per Share – Basic and Diluted |

$ (0.00) |

|

$ (0.00) |

|

|

|

|

|

|

|

|

|

|

Weighted Average Shares Outstanding – Basic and Diluted |

418,000,686 |

|

418,000,686 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

F-3

Pristine Solutions Inc.

(A Development Stage Company)

Consolidated Statement of Stockholders’ Equity (Deficit)

From December 8, 2009 (Inception) to January 31, 2012

|

|

Common Stock |

Amount |

Additional Paid-in Capital |

Deficit Accumulated During the Development Stage |

Total |

|

|

|

|

|

|

|

|