Attached files

| file | filename |

|---|---|

| EX-21 - SUBSIDIARIES - PRIME GLOBAL CAPITAL GROUP Inc | prime_ex21.htm |

| EX-32.2 - CERTIFICATION - PRIME GLOBAL CAPITAL GROUP Inc | prime_ex3202.htm |

| EX-31.1 - CERTIFICATION - PRIME GLOBAL CAPITAL GROUP Inc | prime_ex3101.htm |

| EX-31.2 - CERTIFICATION - PRIME GLOBAL CAPITAL GROUP Inc | prime_ex3102.htm |

| EX-32.1 - CERTIFICATION - PRIME GLOBAL CAPITAL GROUP Inc | prime_ex3201.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

Amendment No . 2

ý ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended October 31, 2011

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to ____________

Commission file number: 333-158713

PRIME GLOBAL CAPITAL GROUP INCORPORATED

(Exact name of registrant as specified in its charter)

|

NEVADA

|

26-4309660

|

|

|

(State or other jurisdiction of

|

(I.R.S. Employer

|

|

|

incorporation or organization)

|

Identification No.)

|

|

|

11-2, Jalan 26/70A, Desa Sri Hartamas

50480 Kuala Lumpur, Malaysia

|

N/A

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: + 603 6201 3198

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant to Section 12(g) of the Act: Common Stock, par value $0.001

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.Yes o No S

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act.Yes o No S

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes S No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes S No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. S

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o Accelerated filer S

Non-accelerated filer o (Do not check if a smaller reporting company) Smaller reporting company S

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).Yes o No S

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

|

Common Stock

|

Outstanding at March 30, 2012

|

|

|

Common Stock, $.001 par value per share

|

501,854,393 shares

|

The aggregate market value of Prime Global Capital Group Incorporated common stock held by non-affiliates as of March 30, 2012, was $1,296,787,059 based on the closing sale price of $2.85 per common share.

DOCUMENTS INCORPORATED BY REFERENCE: None

TABLE OF CONTENTS

|

Page

|

||

|

Part I

|

||

|

Item 1

|

Business

|

1

|

|

Item 1A

|

Risk Factors

|

12

|

|

Part II

|

||

|

Item 7

|

Management’s Discussion and Analysis of Financial Condition and Results of Operation

|

20

|

|

Part III

|

||

|

Item 13

|

Certain Relationships and Related Transactions, and Director Independence.

|

33

|

|

Part IV

|

||

|

Item 15

|

Exhibits, Financial Statement Schedules

|

35

|

|

Signatures

|

37 |

EXPLANATORY NOTE

This Amendment No. 2 is being filed for the purpose of updating the information included in the facing page and in Items 1, 1A, 7, 13 and 15 of this Form 10-K. No other changes or additions are being made hereby to this Form 10-K. This Amendment No. 2 to the Form 10-K does not reflect events that may have occurred subsequent to October 31, 2011, and does not modify or update in any way the disclosures made in the original Form 10-K as amended by Amendment No. 1 filed with the Securities and Exchange Commission on February 1, 2012.

PART I

Forward Looking Statements

This Form 10-K contains “forward-looking” statements including statements regarding our expectations of our future operations. For this purpose, any statements contained in this Form 10-K that are not statements of historical fact may be deemed to be forward-looking statements. Without limiting the foregoing, words such as “may,” “will,” “expect,” “believe,” “anticipate,” “estimate,” or “continue” or comparable terminology are intended to identify forward-looking statements. These statements by their nature involve substantial risks and uncertainties, and actual results may differ materially depending on a variety of factors, many of which are not within our control.

These risks and uncertainties include international, national, and local general economic and market conditions; our ability to sustain, manage, or forecast growth, our ability to successfully make and integrate acquisitions, new product development and introduction, existing government regulations and changes in, or the failure to comply with, government regulations, adverse publicity, competition, the loss of significant customers or suppliers, fluctuations and difficulty in forecasting operating results, change in business strategy or development plans, business disruptions, the ability to attract and retain qualified personnel, and the risk of foreign currency exchange rate. Although the forward-looking statements in this report reflect the good faith judgment of our management, such statements can only be based on facts and factors currently known by them. In light of these risks and uncertainties, you are cautioned not to place undue reliance on these forward-looking statements. Except as required by law, we undertake no obligation to announce publicly revisions we make to these forward-looking statements to reflect the effect of events or circumstances that may arise after the date of this report. All written and oral forward-looking statements made subsequent to the date of this report and attributable to us or persons acting on our behalf are expressly qualified in their entirety by this section.

ITEM 1. DESCRIPTION OF BUSINESS.

History

We were incorporated in the state of Nevada on January 26, 2009, to serve as a holding company for our former smart home business, which was conducted through our former subsidiary, Home Touch Limited, a Hong Kong Special Administrative Region of China corporation, or HTL. On January 26, 2009, we acquired HTL through a share exchange transaction in which we exchanged 40,000,000 shares of our Common Stock for 10,000 shares of HTL common stock. HTL was originally organized under the name Lexing Group Limited in July 2004 and was renamed Home Touch Limited in 2005.

On July 15, 2010, we effectuated a 1-for-20 reverse stock split, or the Reverse Split, of all issued and outstanding shares of the Company's Common Stock in connection with our plans to attract additional financing and potential business opportunities. As a result of the Reverse Split, our issued and outstanding shares decreased from 40,000,000 to 2,000,000.

On September 27, 2010, we filed a report on Form 8-K disclosing the sale to certain accredited investors on September 21, 2010, of an aggregate of 1,500,000 shares of our Common Stock at a per share price of $0.10, or $150,000 in the aggregate, in accordance with the terms and conditions of certain subscription agreements made with such investors. The Company received net proceeds of approximately $145,000 from the sale of the shares which were used for general corporate purposes. The shares were sold pursuant to the exemption provided by Section 4(2) of the Securities Act of 1933, as amended, and Regulation D promulgated thereunder. Weng Kung Wong, who was appointed our Chief Executive Officer and director on November 15, 2010, purchased 375,000 shares of our Common Stock in this transaction.

1

Change in Control, Disposition of Smart Home Business, Acquisition of UHT and Name Change

On November 15, 2010, we consummated the sale to certain accredited investors of an aggregate of 80,000,000 shares of our Common Stock at a per share price of $0.01, or $800,000 in the aggregate, in accordance with the terms and conditions of certain subscription agreements made with such investors. The Company received net proceeds of approximately $795,000 from the sale of the shares which were used for general corporate purposes. The shares were sold pursuant to the exemption provided by Section 4(2) of the Securities Act of 1933, as amended and Regulation D promulgated thereunder. Weng Kung Wong, our Chief Executive Officer and director, purchased an additional 12,750,000 shares of our Common Stock in this transaction.

A change of control occurred in connection with the sale of such shares. David Ng and Stella Wai Yau resigned from their positions as President and Chief Executive Officer of the Company, and as Chief Financial Officer, Chief Operating Officer and Secretary of the Company effective November 15, 2010. The following individuals were appointed to serve as executive officers and directors of the Company:

|

Name

|

Office

|

|

|

Weng Kung Wong

|

Chief Executive Officer, Director

|

|

|

Liong Tat Teh

|

Chief Financial Officer, Director

|

|

|

Sek Fong Wong

|

Secretary, Director

|

On December 6, 2010, we consummated a share exchange, or the Share Exchange, pursuant to which Wooi Khang Pua and Kok Wai Chai, or the UHT Shareholders, transferred to us all of the issued and outstanding shares of Union Hub Technology Sdn. Bhd., or UHT, a company organized under the laws of Malaysia and engaged in the design, development and operation of technologies to enable a community of users to engage in social networking, research and e-commerce on a mobile platform, in exchange for the issuance of 16,500,000 shares of our common stock, par value $0.001 per share, or the Common Stock. As a result of our acquisition of UHT, we became involved in the m-commerce business. The Share Exchange was made pursuant to the terms of a Share Exchange Agreement, or the Exchange Agreement, by and among, and the Company, the UHT Shareholders and UHT. As result of the Share Exchange, UHT became our wholly owned subsidiary. We relied on the exemption from registration pursuant to Section 4(2) of, and Regulation D and/or Regulation S promulgated under, the Securities Act of 1933, as amended, or the Securities Act, in issuing the UHT Shares. Messrs. Pua and Chai are directors of UHT, and each beneficially owns 4.98% of our issued and outstanding common stock.

Concurrently with the Share Exchange, we sold to Up Pride Investments Limited, a British Virgin Islands limited liability company owned by David Gunawan Ng, and Magicsuccess Investments Limited, a British Virgin Islands limited liability company owned by Stella Wai Yau, all of the issued and outstanding securities of HTL for cash consideration of $20,000. In connection with the sale, Mr. Ng and Ms. Yau, our former founders and executive officers, resigned from their positions on our board of directors. Our smart home business was conducted through HTL, and as result of the sale, we ceased our smart home business operations. The sale of HTL securities was made pursuant to the terms of a Common Stock Purchased Agreement, or the Common Stock Purchase Agreement, by and among the Company, HTL, Up Pride Investments Limited and Magicsuccess Investments Limited. We relied on the exemption from registration pursuant to Section 4(2) of, and Regulation D and/or Regulation S promulgated under, the Securities Act of 1933, as amended, or the Securities Act, in selling the HTL securities.

The foregoing descriptions of the Exchange Agreement and Common Stock Purchase Agreement are qualified in their entirety by reference to such agreements which are filed as Exhibits 2.2 and 10.1 to this Annual Report, respectively, and are incorporated herein by reference.

2

On January 25, 2011, we changed our name to Prime Global Capital Group Incorporated and increased our authorized capital to 1,000,000,000 shares of common stock and 100,000,000 shares of preferred stock.

On July 13, 2011 and September 1, 2011, we established Power Green Investments Limited and PGCG Properties Investment Limited, respectively, in British Virgin Islands (BVI) with paid-in capital of $1 each. Both companies are registered as a limited liability company for investment holding purpose. Currently, both companies are inactive.

Transition to Accelerated Filer Status and Approval to Initiate Uplisting Process

As of October 31, 2011, we became an accelerated filer. We elected to provide the optional scaled disclosure allowed for smaller reporting companies in this Form 10-K to provide us with sufficient time to transition into the fuller reporting standard.

On December 12, 2011, our board of directors approved, authorized and directed our officers to initiate the process for listing shares of the Company’s common stock on one or more U.S. national securities exchanges including the NYSE Amex Equities Exchange.

Current Business Operations

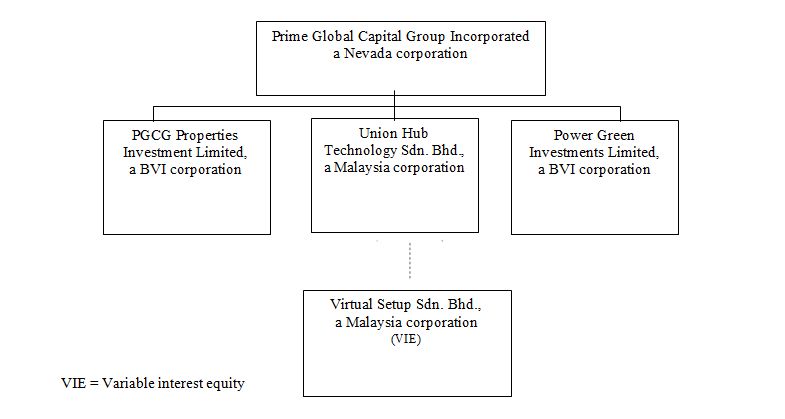

Current Corporate Structure

A chart of our current corporate structure is set forth below:

During fiscal year 2011, we operated in the following three business segments: (i) the design, development and operation of one or more technologies to enable a community of users to engage in social networking, research and e-commerce on a mobile platform, or the m-commerce business; (ii) the periodic distribution of consumer products; and (iii) our oilseeds business. Our m-commerce and consumer distribution products businesses are operated through UHT. Our oilseeds business is operated through Virtual Setup Sdn. Bhd., or VSSB, our VIE.

Description of Our M-Commerce and Consumer Goods Distribution Businesses

Our initial m-commerce business plan broadly encompassed the development, distribution and operation of mobile and online social networking, ecommerce and search products and services. In the course of developing of our products and services, we took advantage of opportunities as they arose to generate revenue for working capital purposes. In July 2010, we began providing IT consulting, programming and website development services to related and unrelated third customers located in Malaysia and one customer in Singapore, all of whom were generated through the personal relationships of our executive officers. We did not launch our m-commerce platform in fiscal year 2011 and, excluding the provision of IT, programming and web development services, did not generate any revenue from our m-commerce business. Our IT consulting, programming and website development services accounted for approximately 77% of our revenues during fiscal year ended October 31, 2011.

3

To generate revenue, we also sold consumer goods to Legend Venture Pte. Ltd., a related party located in Singapore. This one-time sale accounted for approximately 20% of our net revenues for fiscal year ended October 31, 2011. In fiscal year ended October 31, 2011, we did not make any significant investments in our consumer goods business and relied on the personal relationships of our executive officers and directors to generate sales. We expect that on a going forward basis, we will continue to rely on the personal relationships of our executive officers and director to generate sales, if any, as such opportunities may arise.

Our New Oilseeds Business; Scale Back of M-Commerce and Consumer Goods Operations

As a result of the challenges we experienced in implementing our m-commerce business plan, we began actively seeking business opportunities in the oilseeds industry in fiscal year 2011. In July 2011, Virtual Setup Sdn. Bhd., a company organized under the laws of Malaysia, or VSSB, obtained the right to purchase and operate a mature palm oil plantation located in Malaysia pursuant to the terms of a Sale and Purchase Agreement, or Land Purchase Agreement, and an Agreement for Rental of Oil Palm Land, or Rental Agreement. In August 2011, we entered into a binding Memorandum of Understanding, or MOU, to acquire VSSB upon VSSB’s consummation of the Land Purchase Agreement. VSSB is owned by PGCG Plantations Sdn. Bhd., which is owned in equal parts by Messrs. Wong, our Chief Executive Officer and director, and Chai, UHT’s director. VSSB is considered a variable interest entity of the Company and has been consolidated into our financial statements. Messrs. Wong and Chai serve as directors of VSSB. We expect the consummation of the Land Purchase Agreement to occur by the third quarter of 2012.

On December 8, 2011, we entered into a Memorandum of Understanding, or the Thailand MOU, with Mr. Wichai Samphantharat, Chief District Officer of Srira Cha province, Thailand, pursuant to which the Srira Cha province government agreed to allocate to the Company 20 Rai (approximately 8 acres) of land to plant castor seeds on a trial basis. We agreed to provide castor seeds for cultivation by contract farmers and purchase the castor beans cultivated at the trial planting site. We hope to commence trial planting by the third quarter of 2012.

Upon the satisfaction of the provincial government and the farmers with the trial planting, the provincial government will allocate additional lands with a goal of reaching 500,000 Rai over a period of five years and promote and support the cultivation of castor among independent farmers. Once a planting area of 4,000 Rai has been achieved, the Company intends to obtain the government’s approval to build and operate a castor processing plant with the goal of building and operating two castor processing plants over such five year period. Similar to the trial planting, we intend to purchase the castor beans cultivated by the contract farmers on the allocated land.

The foregoing descriptions of the MOU, Land Purchase Agreement, Rental Agreement and Thailand MOU are qualified in their entirety by reference to such agreements which are filed as Exhibits 10.6, 10.7, 10.8 and 10.9 to this Annual Report, respectively, and are incorporated herein by reference.

We will require approximately $7.2 million to consummate the purchase of our palm oil plantation and US$ 10,000 to initiate trial planting of castor plants. Our cash balance as of October 31, 2011, was approximately $2.6 million thus resulting in our auditor including a statement in its report to the effect that there is a substantial doubt about our ability to continue as a going concern in light of our capital commitments in comparison to our available cash resources. Consistent with past practice, we hope to obtain the necessary additional financing from our shareholders, executive officers and directors or through external financing. We are currently conducting internal discussions to obtain the necessary financing, however, there can be no assurance that we will be able to obtain sufficient funds on acceptable terms to timely meet our obligations.

In light of the opportunities presented by our oilseeds business, our management elected to seek additional business opportunities in the castor oil and palm oil industries with a focus on the acquisition, lease or management of existing castor oil and palm oil plantations located in Asia. Except for agreements and commitments described in the MOU, Land Purchase Agreement, Rental Agreement and Thailand MOU, we are not parties to any other binding agreements or commitments regarding any such disposition, acquisition or business venture, and there can be no assurance that we will be able to successfully consummate such disposition, acquisition or business venture.

4

We also intend to scale back our m-commerce business by ceasing our m-commerce activities except for the provision of IT consulting, programming and website development services and only as such opportunities may arise from time to time. Similarly, we expect to continue distributing consumer goods only if such opportunities become readily available. We do not expect to invest significantly in our software and consumer product distribution operations and, accordingly, do not anticipate such operations to generate significant revenue during the next fiscal year.

Anticipated Real Estate Purchases

We are also in discussions to purchase commercial real estate located in Kuala Lumpur, Malaysia. While we have not entered into any binding agreements or commitments regarding any such acquisition, we do anticipate making one or more real estate acquisitions in the very near future. There can be no assurance, however, that we will be able to successfully consummate such acquisition in the near future.

Description of Our Oilseeds Business

Palm Oil Plantation

Palm oil is an edible vegetable oil obtained by crushing the fruit of the palm oil tree, commonly referred to as fresh fruit bunches. Palm oil is one of seventeen major oils traded in the global edible oils and fats market and has broad commercial and industrial uses. According to Oil World, 2011, palm oil accounted for approximately 27%, or approximately 47,520,000 tons, of the world’s annual consumption of 176 million tons of the 17 primary edible oils and fats in 2010/2011. Global consumption of palm oil increased significantly from approximately 11,398,000 tons in 1990/1991 to approximately 47,520,000 tons in 2010/2011.

Crude palm oil (CPO) is extracted through a process of sterilizing and pressing of the palm oil tree’s fresh fruit bunches (FFB). Each FFB can contain over a thousand individual fruits. During the extraction process, seeds are separated from the fruit, and upon cracking the seed’s shell, the kernel inside is separated for further processing to yield palm kernel oil (PKO). Derivatives of CPO and PKO are used throughout the world for many food and non-food applications including cooking oil, margarine, ice cream, non dairy creamer, soaps, detergents, animal feed, cosmetics and industrial lubricants.

Palm oil is one of the few perennial crops that is harvested all year round. Palm oil trees require constant rain throughout the year and are limited to tropical environments located in the ten-degree belt around the equator such as South East Asia, West Africa and South America. The largest producers of palm oil are Malaysia and Indonesia, which account for approximately 85 percent of annual global palm oil production.

The commercial life span of a palm oil tree is estimated to be up to 25 years. Palm oil is recognized as being significantly more productive due to its high oil yield per hectare compared to other edible oil sources, such as soybeans and rapeseed. Palm oil, due to its high edible oil productivity per hectare, is one of the world’s most efficient crops for the production of edible oils, which is an important component of the human food supply. Palm oil can yield ten to fifteen times more edible oil per hectare than the leading alternatives such as soya, rapeseed, canola or corn.

We believe the palm oil industry is well positioned in the years ahead for the following reasons:

|

·

|

Demand for CPO, in common with other vegetable oils, has remained relatively robust, even through the current global economic turbulence. We believe that this is being driven by growing demand from the food industry which is anticipated to increase in line with expectations of higher GDP growth from the three key consuming/buying markets: China, India and the EU. We believe that demand for vegetable oils is accelerating, due largely to income growth in populous regions and the influence of biodiesel programs.

|

|

·

|

We believe that per capita vegetable oil consumption in developing Asian countries remains low relative to other more developed nations. As per capita income increases in these developing nations, we expect that the demand for palm oil will increase, as the population is able to consume more foods that use palm oil (especially packaged foods such as chocolates, creamers and fast food).

|

|

·

|

Environmental concerns and the increasing price of crude mineral oils have resulted in a worldwide trend to utilize vegetable oils such as rapeseed oil, soybean oil and palm oil for the production of biofuels and electricity. We believe that the growth in the production of biodiesel will be particularly pronounced in Asia. In addition, biofuel initiatives in Europe, such as the edible oil requirement for food, are causing an increase in demand for vegetable oils, primarily rapeseed, by biofuel producers. In turn, we anticipate that Europe’s demand for palm oil will increase in food processing, as locally produced oil crops are diverted for biofuel usage.

|

|

·

|

We also expect industrial palm oil use to grow given its increasing use as an oleo chemical and biodiesel feedstock.

|

5

VSSB, our VIE, manages and operates our palm oil plantation in Malaysia. Our plantation cultivates and distributes FFBs to third party oilseed processors located in Malaysia that extract, refine and resell palm oil. The byproducts of the refinery process are sold to other manufacturers further downstream to produce various derivative products.

As our cultivation operations expand, we anticipate building or acquiring one or more oil mills to extract CPO and PKO from FFB cultivated on our own plantation and on smaller local plantations. The CPO and PKO will be sold to third party refineries and other market participants in bulk.

Farming of Castor Crops

Castor oil is a non-edible fatty oil extracted from seeds of castor crops by pressing followed by solvent extraction. A broad range of innovative chemicals and end use products are generated from castor oil. These chemicals and products have widespread applications in agricultural, cosmetics, electronics and telecommunications, food, lubricant, paper and ink, perfume, paints and adhesive, pharmaceutical, plastics, polymers and rubber industries.

India is by far the largest producer and exporter of castor oil, followed by China and Brazil. However, many other countries – especially from South East Asia, Africa and South America - are showing significant interest in being large-scale producers of castor crop, castor oil and castor chemicals. The largest importers of castor oil are China, Europe and the United States.

Compared to many other crops, castor crop requires relatively fewer inputs such as water, fertilizers and pesticide and can be grown on marginal land. At the same time, crop yields can be significantly improved through application of proper procedures during sowing and maintenance and use of high-yield hybrid varieties.

Prime Global Capital Group Incorporated plans to manage and operate castor seed operations. On December 8, 2011, we entered into a MOU to commence trial planting of castor crops with independent contract farmers on 20 Rai (approximately 8 acres) of land in Srira Cha province, Thailand. We expect to commence trial planting in Srira Cha province, Thailand, by the third quarter of 2012.

Our farming model offers the following features:

|

·

|

Sales of specific species of castor seeds to farmers for cultivation;

|

|

·

|

Provide necessary technical and operational assistance on better cropping practices;

|

|

·

|

Organizing farmers' rallies and visits to demonstration plots;

|

|

·

|

Post-harvesting support of threshing, weighing, packing, transportation of the output procured from farmers;

|

|

·

|

Guaranteed purchase of harvest at assured procurement price ahead of the actual cropping season, thereby mitigating the downside risks of the farmers with respect to market fluctuations; and

|

|

·

|

Prompt cash payment to farmers at the time of procurement.

|

Upon a successful trial planting, we hope to contract up to 500,000 Rai of land in Srira Cha over a period of five years. Once we contract 4,000 Rai of land, we hope to build and operate one or more castor processing plants during such five year period.

6

Oil Seeds Pricing

CPO, PKO and castor oils are commodities traded in a worldwide competitive market with high pricing volatility. Factors affecting pricing of these commodities (which in turn affect the prices for FFBs and castor seeds) include:

|

·

|

Estimated output based on the acreage, weather conditions and pest infestation etc.;

|

|

·

|

Shifting cropping patterns in producing countries;

|

|

·

|

Leftover stocks from the previous years’ production after meeting the demand;

|

|

·

|

Consumption and export pattern;

|

|

·

|

Energy prices; and

|

|

·

|

Government policies and intervention.

|

If energy prices remain high with crude oil prices being maintained at US$100 per barrel, we believe that prices of all vegetable oils are likely to increase as vegetable oil prices are expected to remain linked to prices in the fuel sector. We further believe that the current financial crisis and the growing nexus between crude oil prices and vegetable oil prices brought on by the increased reliance on oils for biofuels will exacerbate the pricing volatility and uncertainty already inherent in our industry.

Because we do not exert significant pricing power over our products, we expect margin expansion to occur through more cost effective manufacturing processes or by way of value addition, branding and retail packaging. We do not, however, have any current plans to brand our products or seek retail customers.

Distribution

Our consumer goods are sold to customers generated from the personal relationships of our executive officers which may be located outside of Malaysia.

Customers of our oilseeds business principally consist of oilseed processors, refineries and oilseed product manufacturers. Our products are distributed in bulk from our plantations directly to our customers’ facilities. Initially, we intend to transport our products through third party transportation systems. As our oilseeds business expands, we may explore developing our own transportation system by acquiring or leasing trucks, trailers, railroad tank and hopper cars.

Marketing, Sales and Support

We do not intend to engage in marketing efforts with respect to our software and consumer goods distribution operations. We intend to rely on the personal relationships of our executive officers in effecting any sales of our IT services and consumer goods. Our former m-commerce and product distribution sales and support staff now focus on identifying land for the cultivation of our oil seeds.

We do not and have no immediate plans to engage in marketing activities as our FFBs are sold in bulk to extractors and processors.

7

Major Customers

We generated net revenues of $3,753,063 during the fiscal year ended October 31, 2011. We derived approximately 77%, 20% and 3% of our revenues from the provision of software products and services, the distribution of consumer products, and plantation sales respectively, to our customers located in Malaysia and Singapore. We are not a party to any long-term agreements with our customers. During the fiscal year ended October 31, 2011, the following three customers accounted for 10% or more of our total net revenues:

|

Name of Customer

|

Business Segment

|

Amount of

Net Revenues

|

Percentage of Total Net Revenues

|

||||

|

Ideahom Centre

|

Software

|

$

|

2,005,140

|

53%

|

|||

|

Legend Venture Pte. Ltd.*

|

Product Distribution

|

756,133

|

20%

|

||||

|

Crystal Dimension Pte. Ltd.*

|

Software

|

490,094

|

13%

|

||||

|

Total

|

$

|

3,251,367

|

86%

|

||||

During the seven months ended October 31, 2010, the following three customers accounted for 10% or more of our total net revenues:

|

Name of Customer

|

Business Segment

|

Amount of

Net Revenues

|

Percentage of Total Net Revenues

|

||||

|

Legend Venture Pte. Ltd.*

|

Product Distribution

|

$

|

246,759

|

46%

|

|||

|

Tasystems Sdn. Bhd.*

|

Software

|

144,332

|

27%

|

||||

|

Magic Multimedia Sdn. Bhd.

|

Software

|

72,022

|

13%

|

||||

|

Total

|

$

|

463,113

|

86%

|

||||

*Legend Venture Pte. Ltd., Crystal Dimension Pte. Ltd. and Tasystems Sdn. Bhd. are affiliated entities. Each of the two directors of Legend Venture Pte. Ltd. beneficially own 4.8% and 4.7%, respectively, of our issued and outstanding common stock, or 9.5% in the aggregate. Each of the three directors of Crystal Dimension Pte. Ltd. beneficially owns 4.8%, 4.7% and 0.8%, respectively, of our issued and outstanding common stock, or 10.3% in the aggregate. Each of the two directors of Tasystems Sdn. Bhd. beneficially own 0.16% and 0.87%, respectively, of our issued and outstanding common stock, or 1.03% in the aggregate.

Except for Legend Venture Pte. Ltd. and Crystal Dimension Pte. Ltd., which are located in Singapore, all of our major customers are located in Malaysia.

Key Vendors

All of our key vendors are located in Malaysia. We are not parties to long-term agreements with our major vendors. In light of our decreased emphasis on our software and consumer goods business segments, we expect to engage the services of these vendors on a limited basis in the future. We do not anticipate difficulties in locating alternative developers and other vendors as needed.

During the fiscal year ended October 31, 2011, three vendors accounted for 10% or more of our purchases:

|

Vendor

|

Business Segment

|

Amount of

Net Revenues

|

Percentage of Total Net Revenues

|

||||

|

WataTime

|

Product Distribution

|

$

|

445,646

|

54%

|

|||

|

Cheong Lei

|

Product Distribution

|

150,419

|

18%

|

||||

|

Gaeawave Sdn. Bhd. *

|

Software

|

104,147

|

13%

|

||||

|

Total

|

$

|

700,212

|

85%

|

||||

During the seven months ended October 31, 2010, three vendors accounted for 10% or more of our purchases:

|

Vendor

|

Business Segment

|

Amount of

Net Revenues

|

Percentage of Total Net Revenues

|

||||

|

MWPAY Sdn. Bhd. *

|

Software

|

$

|

172,165

|

47%

|

|||

|

Liew Choon Fook

|

Product Distribution

|

112,690

|

30%

|

||||

|

Tong Hei

|

Product Distribution

|

82,542

|

22%

|

||||

|

Total

|

$

|

367,397

|

99%

|

||||

*Gaeawave Sdn. Bhd. and MW Pay Sdn. Bhd. are affiliated entities. Mr. Chai, UHT’s director, served as a director of Gaeawave Sdn. Bhd. until December 21, 2011, and beneficially owns 4.98% of our issued and outstanding common stock. The remaining former director of Gaeawave Sdn. Bhd. served as a director until December 21, 2011, and beneficially owns 4.94% of our issued and outstanding common stock. Mr. Wong, our Chief Executive Officer and director, is a director of MW Pay Sdn. Bhd. and beneficially owns 9.1% of our issued and outstanding common stock. The remaining director of MW Pay Sdn. Bhd. owns 0.8% of our issued and outstanding common stock.

8

Competition and Market Position

Software Operations

Our software business is characterized by intense competition and rapidly changing and converging, as well as new and disruptive, technologies. We face formidable competition in every aspect of our software business. Our competitors may be local or international enterprises and may have financial, technical, sales, marketing and other resources greater than ours. These companies may also compete with us in recruiting and retaining qualified personnel and consultants.

Our competitive position will depend on our ability to attract and retain qualified engineers and other personnel, develop effective proprietary products and solutions, the personal relationships of our executive officers and directors, and our ability to secure adequate capital resources. We compete to attract and retain customers of our services. We expect to compete in this area on the basis of price, usefulness, availability, and ease of use of our services.

Consumer Goods

Our consumer goods business is characterized by intense competition and foreign currency risks. Our competitors are small-scale to medium size operators that may have greater financial, technical, sales, marketing and other resources than us.

Our competitive position will depend on our ability to identify and deliver desirable goods at attractive price points. We compete to attract customers for goods that we source. We expect to compete in these areas on the basis of price, product availability and vendor relationships.

Oilseeds Business

Our oilseeds business is characterized by intense competition, pricing volatility and foreign currency risks. Our competitors range from small-scale operators to fully integrated multinational enterprises with significant financial, technical, sales, marketing and other resources. In addition to palm oil and castor oil producers, our competitors also include producers of alternative vegetable oils such as soybean, rapeseed, cottonseed, peanut, sunflower seed and corn oils.

Market fundamentals that affect supply and demand of our products include land shortages, water constraints, climate change, global warming, low operating margin, inadequate quality control and quality assurance mechanisms leading to adulteration, food laws and poor implementation and low depth liquidity in futures markets. Non-fundamental factors include politics, inflation, investor interest, government policies and liquidity.

Multinational corporations are able to take advantage of economies of scale that allow them to command high quality with lower costs, access cheaper credit, minimize losses and decrease input costs. Multinational corporations also tend to have a greater ability to absorb volatility in production and pricing and respond to uncertainty. We believe that the current financial crisis, global volatility in commodity prices and the growing nexus between crude oil prices and vegetable oil prices brought on by the increased reliance on oils for biofuels have only served to exacerbate the volatility and uncertainty already inherent in our industry.

9

We believe that our competitive position will depend on our ability to mitigate volatility and uncertainty in our industry. We hope to achieve this by obtaining economies of scale, implementing development plans, obtaining and maintaining protection of our intellectual property, recruiting and retaining qualified personnel and securing adequate capital resources. While we expect to compete primarily on the basis of pricing, we believe that the diversion of vegetable oil for use as biofuels will offer us an opportunity to achieve and sustain an acceptable margin of return for the foreseeable future.

Intellectual Property

We attach great importance to protecting our investment in the research and development of our products and technologies. We intend to seek the widest possible protection for significant product and process developments in our major markets through a combination of trade secrets, trademarks, copyrights and patents, if applicable. We anticipate that the form of protection will vary depending upon the level of protection afforded by the particular jurisdiction. Currently, our revenue is derived principally from our operations in Malaysia where intellectual property protection may be limited and difficult to enforce. In such instances, we may seek protection of our intellectual property through measures taken to increase the confidentiality of our findings.

We intend to register trademarks as a means of protecting the brand names of our companies and products. We intend protect our trademarks against infringement and also seek to register design protection where appropriate.

We rely on trade secrets and unpatentable know-how that we seek to protect, in part, by confidentiality agreements. Our policy is to require some of our employees to execute confidentiality agreements upon the commencement of employment with us. These agreements provide that all confidential information developed or made known to the individual during the course of the individual’s relationship with us is to be kept confidential and not disclosed to third parties except in specific limited circumstances. The agreements also provide that all inventions conceived by the individual while rendering services to us shall be assigned to us as the exclusive property of our company. There can be no assurance, however, that all persons who we desire to sign such agreements will sign, or if they do, that these agreements will not be breached, that we would have adequate remedies for any breach, or that our trade secrets or unpatentable know-how will not otherwise become known or be independently developed by competitors.

Government Regulation

Our VIE Arrangement

Under Section 433A and 433B of the Malaysian National Land Code (1965), the Malaysian State Authority must approve all transactions to purchase non-industrial property located in Malaysia if the purchaser is a company with 50% or greater foreign ownership. Obtaining the approval of the State Authority is a process requiring approximately 2 to 4 months. In addition, with respect to assets valued above RM 20,000,000, the State Authority may in its discretion require 30% local entity participation in the transaction.

To expedite the acquisition of our palm oil plantation and to avoid the uncertainty and complication of having 30% local entity participation, VSSB directly entered into the Land Purchase Agreement and the Rental Agreement with the seller to purchase its palm oil plantation. VSSB is a Malaysian corporation owned by Messrs. Wong, our Chief Executive Officer, and Chai, UHT’s director, both of who are Malaysian nationals. UHT and VSSB then entered into the MOU pursuant to which the shareholders of VSSB agreed to transfer to UHT all of their interests in VSSB upon the consummation of the Land Purchase Agreement and successful registration of the transfer of land titles in favor of VSSB. The transfer of securities is governed by the Malaysia Companies Act 1965 which does not require the consent of the state to transfer securities from VSSB shareholders to UHT.

Pursuant to the terms of the MOU, prior to the consummation of the Land Purchase Agreement Messrs. Wong and Chai are obligated, among other things, to safeguard and protect all assets of VSSB, including the oil palm plantation covered by the Land Purchase Agreement, and to continue to conduct its business in the normal course so as not to jeopardize the financial interests of UHT. The VSSB shareholders are prohibited from: (i) issuing additional securities of VSSB without UHT’s prior written consent; (ii) infringing the Land Purchase Agreement leading to a termination or threatened termination of the Land Purchase Agreement; and (i) entering into any agreement with any third party which may impede the right of the VSSB shareholders to transfer their shares to UHT. Although not specifically discussed in the MOU, all earnings derived from the palm oil plantation prior to the transfer of shares to UHT are retained by VSSB. In the event the Land Purchase Agreement is terminated, VSSB is required to refund to UHT all funds advanced by UHT which form a part of the purchase price of the palm oil plantation. Either party may terminate the MOU upon a breach of the MOU by the other party.

10

Our relationship with VSSB under Malaysian law is contractual, and we are not required to consolidate its financial results under Malaysian financial reporting standards. We believe that our agreement with VSSB is enforceable and legally compliant under Malaysian law.

Under ASC 810-10-25, VSSB is considered our variable interest entity as a result of our contractual arrangement with VSSB through the MOU. Accordingly, we have included its operating results in our financial statements.

Other Regulations

Our oilseeds business is subject to many additional laws addressing land, environmental, labor, wildlife and crop cultivation matters. By way of example, we are subject to the Land Acquisition Act of 1960, which specifies the conditions under which the Malaysian government may acquire by eminent domain private land (including our palm oil plantation) to pursue its social policies. We are also subject to various environmental laws including the Environmental Quality (Prescribed Activities) (Environmental Impact Assessment) Order 1987 which governs land clearing, air emissions, waste water discharges and other similar matters, the Workers’ Minimum Standard of Housing & Amenities Act 1990 which requires us to provide our plantation workers with reasonable housing and amenities, water, electricity and addresses other sanitation related matters, other labor laws governing minimum wages, wage increases and occupational health and safety, the Pesticides Act 1974 (Pesticides Registration) Rules 1988, Pesticides (Licensing for sale and storage) Rules 1988 and Pesticides (Labeling) Regulations 1984 which govern the registration, use, labeling and storage of pesticides and the Protection of Wildlife Act 1972 which governs the capture and destruction of certain protected wildlife.

We are also subject to taxes, tariffs, duties, subsidies and incentives and import and export restrictions on palm oil products, foreign and domestic policies regarding genetically modified organisms, renewable fuel, and low carbon fuel mandates which can influence the planting of species of crops, the location and size of crop production, and the volume and types of imports and exports. These factors all affect the viability and volume of production of the Company’s products, and industry profitability.

International trade disputes can adversely affect the trade flow of our goods by limiting or disrupting trade between countries or regions. Future government policies may adversely affect the supply of, demand for, and prices of the Company’s products, restrict the Company’s ability to do business in its existing and target markets, and can negatively impact the Company’s revenues and operating results.

All of our business segments are subject to the general laws in Malaysia governing businesses including labor, occupational safety and health, general corporations, intellectual property and other similar laws. Our software and consumer goods trading are not subject to specific laws material to our operations outside of these general laws.

Seasonality

Our software and consumer goods businesses are not subject to seasonality.

Our oilseeds business is subject to seasonality in the growing cycles, procurement, and transportation of our oilseeds. Price variations and availability of raw agricultural commodities may cause fluctuations in our working capital levels. In addition, these seasonal trends will likely cause fluctuations in our quarterly results, including fluctuations in sequential revenue growth rates.

11

Insurance

We maintain property, business interruption and casualty insurance which we believe is in accordance with customary industry practices in Malaysia, but we cannot predict whether this insurance will be adequate to fully cover all potential hazards incidental to our business.

Employees

As of January 6, 2012, we had 21 employees, all of which are full-time. Our employees are in the following principal areas:

|

Operations – 5

|

|

Administrative / Finance – 9

|

|

Management– 3

|

|

Plantation operations – 4

|

All employees of the company are located in Malaysia and are primarily focused on our oilseeds business. None of our employees are members of a trade union. We believe that we maintain good relationships with our employees, and have not experienced any strikes or shutdowns and have not been involved in any labor disputes.

We are required to contribute to the Employees Provident Fund under a defined contribution pension plan for all eligible employees in Malaysia between the ages of eighteen and fifty-five. We are required to contribute a specified percentage of the participant’s income based on their ages and wage level. The participants are entitled to all of our contributions together with accrued returns regardless of their length of service with the company. For the year ended October 31, 2011 and seven months ended October 31, 2010, we contributed $30,250 and $3,781, respectively, to the Employees Provident Fund. No contribution was made during fiscal year 2009 because the Company had no eligible employees for EPF for such period.

Corporation Information

Our principal executive offices are located at 11-2, Jalan 26/70A, Desa Sri Hartamas, 50480 Kuala Lumpur, Malaysia, telephone at +603 6201 3198, facsimile at +603 6201 3226.

ITEM 1A. RISK FACTORS.

An investment in our securities involves a high degree of risk. You should consider carefully the following information about these risks, together with the other information contained in this report before making an investment decision. Our business, prospects, financial condition, and results of operations may be materially and adversely affected as a result of any of the following risks. The value of our securities could decline as a result of any of these risks. You could lose all or part of your investment in our securities. Some of the statements in “Risk Factors” are forward looking statements.

Risks Related to Our Business

We are transitioning away from our software business which accounted for approximately 77% of our revenues in fiscal year 2011 to focus on our oilseeds business. If we are not successful in making this transition, our revenues, results of operation and financial condition will be materially and adversely affected.

Our software business segment accounted for approximately 77% and 54% of our revenues in fiscal year 2011 and the seven month period ended October 13, 2010, respectively. We are transitioning away from this business segment to focus on our oilseeds business. As of October 31, 2011, we have not consummated the acquisition of our primary oilseeds assets, a mature palm oil plantation, and have not commenced trial planting of castor plants. If our transition plan is delayed or is otherwise unsuccessful, our revenues, results of operation and financial condition may be materially adversely affected. Furthermore, it may prove difficult for us to re-enter our software business in the event of a failed transition due to the rapidly changing and converging nature of the technologies, products and services that characterize our software business industry.

12

Because we have a limited operating history and limited experience in operating a palm oil plantation, it may be difficult to evaluate an investment in our stock.

We acquired our palm oil business in August 2011 and initiated our castor contract farming program in December 2011. To date, our revenues are not substantial enough to sustain us without additional capital injection if we determine to pursue a growth strategy before significant revenues are generated. We face a number of risks encountered by early-stage companies, including our need to develop infrastructure to support growth and expansion, our need to obtain long-term sources of financing, and our need to manage expanding operations. In addition, our management team has limited experience in managing and operating palm oil and castor plantations. Our business strategy may not be successful, and we may not successfully address these risks. If we are unable to sustain profitable operations, investors may lose their entire investment in us.

We expect to grow our business through acquisitions in the near future, which may result in operating difficulties, dilution, and other harmful consequences.

We expect to achieve our business plan through organic growth as well as acquisitions and investments. We are in the process of evaluating an array of potential strategic transactions and expect to make one or more acquisitions in the near future. These transactions may span unrelated industries and could be material to our financial condition and results of operations. The process of integrating an acquired company, business, or technology may create unforeseen operating difficulties and expenditures. The areas where we face risks include:

|

·

|

Implementation or remediation of controls, procedures, and policies at the acquired company;

|

|

·

|

Diversion of management time and focus from operating our business to acquisition integration challenges;

|

|

·

|

Cultural challenges associated with integrating employees from the acquired company into our organization;

|

|

·

|

Retention of employees from the businesses we acquire;

|

|

·

|

Integration of the acquired company’s accounting, management information, human resource, and other administrative systems;

|

|

·

|

Liability for activities of the acquired company before the acquisition, including patent and trademark infringement claims, violations of laws, commercial disputes, tax liabilities, and other known and unknown liabilities;

|

|

·

|

Litigation or other claims in connection with the acquired company, including claims from terminated employees, customers, former stockholders, or other third parties;

|

|

·

|

In the case of foreign acquisitions, the need to integrate operations across different cultures and languages and to address the particular economic, currency, political, and regulatory risks associated with specific countries; and

|

|

·

|

Failure to successfully further develop the acquired product, service or technology.

|

Our failure to address these risks or other problems encountered in connection with future acquisitions and investments could cause us to fail to realize the anticipated benefits of such acquisitions or investments, incur unanticipated liabilities, and harm our business generally.

Future acquisitions may also result in dilutive issuances of our equity securities, the incurrence of debt, contingent liabilities, or amortization expenses, or write-offs of goodwill, any of which could harm our financial condition. Also, the anticipated benefit of many of our acquisitions may not materialize.

If we are unable to successfully manage growth, our business and operating results could be adversely affected.

We expect the growth of our business and operations to place significant demands on our management, operational and financial infrastructure. If we do not effectively manage our growth, the quality of our products and services could suffer, which could negatively affect our reputation and operating results. Our expansion and growth in international markets heighten these risks as a result of the particular challenges of supporting a rapidly growing business in an environment of multiple languages, cultures, customs, legal systems, alternative dispute systems, regulatory systems, and commercial infrastructures. To effectively manage this growth, we will need to develop and improve our operational, financial and management controls, and our reporting systems and procedures. These systems enhancements and improvements may require significant capital expenditures and management resources. Failure to implement these improvements could hurt our ability to manage our growth and our financial position.

13

We are subject to risks associated with doing business globally including compliance with domestic and foreign laws and regulations, economic downturns, political instability and other risks that could adversely affect our operating results.

We conduct our businesses globally and have assets located in several countries and geographic areas. Our oilseeds operations are in Malaysia and Thailand, and we intend to acquire commercial real estate in Malaysia. We are required to comply with numerous and broad reaching laws and regulations administered by United States federal, state and local, and foreign governmental authorities. We must also comply with other general business regulations such as those directed toward accounting and income taxes, anti-corruption, anti-bribery, global trade, handling of regulated substances, and other commercial activities, conducted by our employees and third party representatives globally. Any failure to comply with applicable laws and regulations could subject us to administrative penalties and injunctive relief, and civil remedies including fines, injunctions, and recalls of our products. In addition, changes to regulations or implementation of additional regulations may require us to modify existing processing facilities and/or processes, which could significantly increase operating costs and negatively impact operating results.

We operate in both developed and emerging markets which are subject to impacts of economic downturns, including decreased demand for our products, reduced availability of credit, or declining credit quality of our suppliers, customers, and other counterparties. We anticipate that emerging market areas such as Thailand could be subject to more volatile economic, political and market conditions. Economic downturns and volatile conditions may have a negative impact on our operating results and ability to execute its business strategies.

Our operating results may be affected by changes in trade, monetary, fiscal and environmental policies, laws and regulations, and other activities of governments, agencies, and similar organizations. These conditions include but are not limited to changes in a country’s or region’s economic or political conditions, trade regulations affecting production, pricing and marketing of products, local labor conditions and regulations, reduced protection of intellectual property rights, changes in the regulatory or legal environment, restrictions on currency exchange activities, currency exchange fluctuations, burdensome taxes and tariffs, enforceability of legal agreements and judgments, other trade barriers, and regulation or taxation of greenhouse gases. International risks and uncertainties, including changing social and economic conditions as well as terrorism, political hostilities, and war, may limit our ability to transact business in these markets and may adversely affect our revenues and operating results.

Risk Factors Related to Our Newly Acquired Oilseeds Business

We operate our oilseeds business through VSSB, which is beneficially owned by Weng Kung Wong, our Chief Executive Officer and director, and Kok Wai Chai, UHT’s director. If Messrs. Wong and Chai fail to transfer the VSSB to us or otherwise violate the MOU, our business could be disrupted, our reputation may be harmed and we may have to resort to litigation to enforce our rights, which may be time consuming and expensive.

VSSB is considered our variable interest entity for accounting purposes. Our relationship with VSSB is based on a Memorandum of Understanding dated August 29, 2011, pursuant to which Messrs. Wong and Chai agree, among other things, to transfer their shares in VSSB upon the consummation of the Land Purchase Agreement (relating to the acquisition of a palm oil plantation) and the registration of the transfer of title of the palm oil plantation being sold. Prior to the share transfer, Messrs. Wong and Chai are obligated under the MOU to operate the palm oil plantation in the normal course of business. If Messrs. Wong and Chai fail to transfer VSSB to us or otherwise violate the MOU, our business could be significantly disrupted and our reputation adversely affected. We may have to incur substantial costs and expend significant resources to enforce those arrangements and rely on legal remedies under Malaysian laws. Any failure in our ability to enforce the MOU, or any significant delay or other obstacles in the process of enforcing the MOU and may materially and adversely affect our results of operations and financial position.

14

The availability and prices of the agricultural commodities and agricultural commodity products we procure, transport, store, process and merchandise can be affected by weather conditions, disease, government programs, competition, and various other factors beyond our control and may adversely affect our operating results.

The availability and prices of agricultural commodities are subject to wide fluctuations due to factors such as changes in weather conditions, disease, plantings, government programs and policies, competition, changes in global demand resulting from population growth and changes in standards of living, and global production of similar and competitive crops. These factors have historically caused volatility in agricultural commodity prices which affects our operating results. Reduced supply of agricultural commodities due to weather-related factors or other reasons could adversely affect our profitability by increasing the cost of raw materials and/or limit our ability to procure, transport, store, process, and merchandise agricultural commodities in an efficient manner.

Fluctuations in energy prices could adversely affect our operating results.

Our operating costs and the selling prices are sensitive to changes in energy prices. Our farms are powered principally by electricity, natural gas, and coal. Our transportation costs are dependent upon diesel fuel and other petroleum-based products. Significant increases in the cost of these items may adversely affect our production costs and operating results.

Government policies and regulations, in general, and specifically affecting the agricultural sector and related industries, could adversely affect our operating results.

Agricultural production and trade flows are subject to government policies and regulations. Governmental policies affecting the agricultural industry, such as taxes, tariffs, duties, subsidies, incentives, and import and export restrictions on agricultural commodities and commodity products, including policies related to genetically modified organisms, renewable fuel, and low carbon fuel mandates, can influence the planting of certain crops, the location and size of crop production, whether unprocessed or processed commodity products are traded, the volume and types of imports and exports, the viability and volume of production of certain of our products, and industry profitability. In addition, international trade disputes can adversely affect agricultural commodity trade flows by limiting or disrupting trade between countries or regions. Future government policies may adversely affect the supply of, demand for, and prices of our products, restrict our ability to do business in its existing and target markets, and could negatively impact our revenues and operating results.

We are subject to industry-specific risk which could adversely affect our operating results.

We are subject to risks which include, but are not limited to, product quality or contamination; shifting consumer preferences; federal, state, and local food processing regulations; socially unacceptable farming practices; labor issues; environmental, health and safety regulations; and customer product liability claims. The liability that could result from certain of these risks may not always be covered by, or could exceed liability insurance related to product liability and food safety matters maintained by us. The occurrence of any of the matters described above could adversely affect our revenues and operating results.

We are exposed to potential business disruption, including but not limited to disruption of transportation services, supply of non-commodity raw materials used in its processing operations, and other impacts resulting from acts of terrorism or war, natural disasters, severe weather conditions, and accidents which could adversely affect our operating results.

Our operations rely on dependable and efficient transportation services. A disruption in transportation services could result in difficulties supplying materials to our facilities and impair our ability to deliver products to our customers in a timely manner. Certain factors which may impact the availability of non-agricultural commodity raw materials are out of our control including but not limited to disruptions resulting from economic conditions, manufacturing delays or disruptions at suppliers, shortage of materials, and unavailable or poor supplier credit conditions.

15

Our assets and operations could be subject to extensive property damage and business disruption from various events which include, but are not limited to, acts of terrorism or war, natural disasters and severe weather conditions, accidents, explosions, and fires. The potential effects of these conditions could impact our revenues and operating results.

Our business is capital intensive in nature and we rely on cash generated from our operations and external financing to fund our growth and ongoing capital needs. Limitations on access to external financing could adversely affect our operating results.

We require significant capital to operate our current business and fund our growth strategy. Our working capital requirements are directly affected by the price of agricultural commodities, which may fluctuate significantly and change quickly. We also require substantial capital to maintain and upgrade our facilities, transportation assets and other facilities to keep pace with competitive developments, technological advances, regulations and changing safety standards in the industry. Moreover, the expansion of our business and pursuit of acquisitions or other business opportunities may require significant amounts of capital. If we are unable to generate sufficient cash flows or raise adequate external financing, it may restrict our current operations and our growth opportunities which could adversely affect our operating results.

Our risk management strategies may not be effective.

Our business is affected by fluctuations in agricultural commodity prices, transportation costs, energy prices, interest rates, and foreign currency exchange rates. We engage in hedging strategies to manage these risks. However, these hedging strategies may not be successful in mitigating our exposure to these fluctuations.

We have limited control over and may not realize the expected benefits of our equity investments and joint ventures.

We intend to enter into many joint ventures and investments of which we have limited control as to the governance and management activities of these investments. We expect to benefit from these investments, which typically aim to expand or enhance the market for our products or offer other benefits including but not limited to geographic or product line expansion. We may encounter unanticipated operating issues or financial results related to these investments that may impact our revenues and operating results.

Risks Related to our Operations in Malaysia

We are susceptible to economic conditions in Malaysia where our principal suppliers, users, merchants and advertisers are located.

Our business and assets are primarily located in Malaysia. During the fiscal year ended October 31, 2011, 67% of our sales revenue was generated from customers located in Malaysia. Our results of operations, financial state of affairs and future growth are, to a significant degree, subject to Malaysia’s economic, political and legal development and related uncertainties. Our operations and results could be materially affected by a number of factors, including, but not limited to:

|

·

|

Changes in policies by the Malaysian government resulting in changes in laws or regulations or the interpretation of laws or regulations; changes in taxation,

|

|

·

|

changes in employment restrictions;

|

|

·

|

import duties, and

|

|

·

|

currency revaluation.

|

16

We expect our revenues to be paid in non-U.S. currencies, and if currency exchange rates become unfavorable, we may lose some of the economic value of the revenues in U.S. dollar terms.

Our oilseeds operations are conducted entirely in Malaysia and Thailand and our operating currency is the Malaysian Ringgit and the Thai Baht. Since we conduct business in currencies other than U.S. dollars but report our financial results in U.S. dollars, we face exposure to fluctuations in currency exchange rates. For instance, if currency exchange rates were to change unfavorably, the U.S. dollar equivalent of our operating income recorded in foreign currencies would be diminished.

We may implement hedging strategies, such as forward contracts, options, and foreign exchange swaps to mitigate this risk. There is no assurance that our efforts will successfully reduce or offset our exposure to foreign exchange fluctuations. Additionally, hedging programs expose us to risks that could adversely affect our financial results, including the following:

|

·

|

We have limited experience in implementing or operating hedging programs. Hedging programs are inherently risky and we could lose money as a result of poor trades;

|

|

·

|

We may be unable to hedge currency risk for some transactions or match the accounting for the hedge with the exposure because of a high level of uncertainty or the inability to reasonably estimate our foreign exchange exposures;

|

|

·

|

We may be unable to acquire foreign exchange hedging instruments in some of the geographic areas where we do business, or, where these derivatives are available, we may not be able to acquire enough of them to fully offset our exposure;

|

|

·

|

We may determine that the cost of acquiring a foreign exchange hedging instrument outweighs the benefit we expect to derive from the derivative, in which case we would not purchase the derivative and would be exposed to unfavorable changes in currency exchange rates;

|

|

·

|

To the extent we recognize a gain on a hedge transaction in one of our subsidiaries that is subject to a high statutory tax rate, and a loss on the related hedged transaction that is subject to a lower rate, our effective tax rate would be higher; and

|

|

·

|

Significant fluctuations in foreign exchange rates could greatly increase our hedging costs.

|

We anticipate increased exposure to exchange rate fluctuations as we expand the breadth and depth of our international sales.

In our financial statements, we translate our local currency financial results into U.S. dollars based on average exchange rates prevailing during a reporting period or the exchange rate at the end of that period. To the extent the U.S. dollar strengthens against foreign currencies, the translation of these foreign currency denominated transactions could result in reduced revenue, operating expenses and net income for our international operations. Similarly, to the extent the U.S. dollar weakens against foreign currencies, the translation of these foreign currency denominated transactions could result in increased revenue, operating expenses and net income for our international operations.

Because our holding company structure creates restrictions on the payment of dividends, our ability to pay dividends is limited.

We are a holding company whose primary assets are our ownership of the equity interests in our subsidiaries. We conduct no other business and, as a result, we depend entirely upon our subsidiaries’ earnings and cash flow. If we decide in the future to pay dividends, as a holding company, our ability to pay dividends and meet other obligations depends upon the receipt of dividends or other payments from our operating subsidiaries. Our subsidiaries and projects may be restricted in their ability to pay dividends, make distributions or otherwise transfer funds to us prior to the satisfaction of other obligations, including the payment of operating expenses or debt service, restrictions on the conversion of local currency into U.S. dollars or other hard currency and other regulatory restrictions. If future dividends are paid in the Malaysian Ringgit, fluctuations in the exchange rate for the conversion of the Ringgit into U.S. dollars may adversely affect the amount received by U.S. stockholders upon conversion of the dividend payment into U.S. dollars. We do not presently have any intention to declare or pay dividends in the future. You should not purchase shares of our common stock in anticipation of receiving dividends in future periods.

17

It may be difficult for stockholders to enforce any judgment obtained in the United States against us, which may limit the remedies otherwise available to our stockholders.

All of our assets are located outside of the United States. Moreover, a majority of our directors and officers are nationals or residents of Malaysia. All or a substantial portion of the assets of these persons are located outside the United States. As a result, it may be difficult for our stockholders to effect service of process within the United States upon these persons. In addition, there is uncertainty as to whether the courts of Malaysia would recognize or enforce judgments of U.S. courts obtained against us or such officers and/or directors predicated upon the civil liability provisions of the securities law of the United States or any state thereof, or be competent to hear original actions brought in Malaysia against us or such persons predicated upon the securities laws of the United States or any state thereof.

Risks Related to Management, Stockholder Control and Our Securities

Our auditors have identified a material weakness in our internal control over financial reporting which, if not corrected, may adversely affect our ability to provide reliable financial reports. Our management has limited experience serving as officers of a reporting act company listed on U.S. exchanges or the Over-the-Counter Bulletin Board which may increase the costs associated with remediating such material weakness and otherwise complying with the Sarbanes-Oxley Act.

Effective internal controls are necessary for us to provide reliable financial reports and to effectively prevent fraud. We maintain a system of internal control over financial reporting, which is defined as a process designed by, or under the supervision of, our principal executive officer and principal financial officer, or persons performing similar functions, and effected by our board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles.

A material weakness is a control deficiency, or combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of our annual or interim financial statements will not be prevented or detected on a timely basis. We have identified the following internal control weakness. We had not effectively implemented comprehensive entity-level internal controls and had not completed the documentation or testing of these controls at year end.