Attached files

| file | filename |

|---|---|

| EX-31.1 - EX-31.1 - NiMin Energy Corp. | d344260dex311.htm |

| EX-31.2 - EX-31.2 - NiMin Energy Corp. | d344260dex312.htm |

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2011

Commission file number: 000-54162

(Exact name of registrant as specified in its charter)

| Canada | 61-1606563 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 1160 Eugenia Place, Suite 100, Carpinteria, California USA 93013 |

Tel: 805.566.2900 Fax: 805.566.2917 | |

| (Address of principal executive offices) | (Registrant’s telephone number, including area code) | |

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| Title of each class |

Name of each exchange on which registered | |

| N/A | N/A |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

Title of each class

Common Shares, no par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ¨ Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference on Part III of this Form 10-K or any amendment to this Form10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer x | Non-accelerated filer ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes x No

The aggregate market value of the voting and non-voting common equity held by non-affiliates as of June 30, 2011 based on the closing sales price of the Common Shares on the Toronto Stock Exchange was $116,879,107.

The number of Common Shares, without par value, outstanding on March 14, 2012, was 69,834,396.

Documents Incorporated by Reference:

None

Table of Contents

EXPLANATORY NOTE

This Amendment No. 1 on Form 10-K/A (this “Amendment”) amends NiMin Energy Corp.’s (the “Corporation,” “NiMin,” “we,” “us” or “our”) Annual Report on Form 10-K for the year ended December 31, 2011, originally filed with the Securities and Exchange Commission (the “SEC”) on March 15, 2012 (the “Original Filing”).

This Amendment is being filed to amend the Original Filing to include the information required by Items 10 through 14 of Part III of Form 10-K, which information was previously omitted from the Original Filing in reliance on General Instruction G(3) to Form 10-K. General Instruction G(3) to Form 10-K permits the information in the above referenced items to be included in the Form 10-K filing by incorporation by reference from our definitive proxy statement if such statement is filed no later than 120 days after our fiscal year-end. We will file our definitive proxy statement outside such 120-day period and therefore, we are filing this Amendment to include Part III information in our Form 10-K. The reference on the cover of the Original Filing to the incorporation by reference to portions of our definitive proxy statement into Part III of the Original Filing is hereby deleted. In addition, the reference on the cover of the Original filing regarding disclosure of delinquent filers pursuant to Item 405 of Regulation S-K has been amended based upon the Corporation’s knowledge at the time of filing of this Amendment. Defined terms in this Amendment not otherwise ascribed herein are as defined in the Original Filing. The Original Filing, as amended by this Amendment, is referred to herein as the Annual Report.

In accordance with Rule 12b-15 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), Part III, Items 10 through 14 of the Original Filing are hereby amended and restated in their entirety, and Part IV, Item 15 of the Original Filing is hereby amended and restated in its entirety. This Amendment No. 1 does not amend or otherwise update any other information in the Original Filing. Accordingly, this Amendment should be read in conjunction with the Original Filing and with our filings with the SEC subsequent to the Original Filing. This Amendment does not reflect events occurring after the filing of the Original Filing or modify or update disclosures affected by subsequent events.

Unless otherwise indicated or the context otherwise requires, all dollar amounts in this Amendment are in United States dollars. Cdn $ means Canadian dollars.

i

Table of Contents

NIMIN ENERGY CORP.

FORM 10-K/A ANNUAL REPORT

ii

Table of Contents

Note Regarding Forward-Looking Statements

This Annual Report on Form 10-K contains certain forward-looking statements or information (“forward-looking statements”), which is based upon the current internal expectations, estimates, projections, assumptions and beliefs of NiMin, as of the date of such statements or information. Words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate”, “may”, “will”, “potential”, “proposed” and other similar words, or statements that certain events or conditions “may” or “will” occur, are intended to identify forward-looking statements. These statements are not guarantees of future performance and involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in the forward-looking statement. By its nature, a forward-looking statement involves numerous assumptions, known and unknown risks and uncertainties, both general and specific, that contribute to the possibility that the predictions, forecasts, projections and other forward-looking statement will not occur. Such forward- looking statements in this Annual Report speak only as of the date of this Annual Report.

Although NiMin believes that the expectations reflected in the forward-looking statements are reasonable, there can be no assurance that such expectations will prove to be correct. NiMin cannot guarantee future results, levels of activity, performance or achievements. Some of the risks and other factors, some of which are beyond the control of NiMin which could cause results to differ materially from those expressed in the forward-looking statements contained in this Annual Report, include, but are not limited to:

| • | general economic conditions in the United States, Canada and globally; |

| • | industry conditions, including fluctuations in the price of oil and natural gas; |

| • | liabilities inherent in oil and natural gas operations; |

| • | governmental regulation of the oil and gas industry, including environmental regulation; |

| • | geological, technical, drilling and processing problems and other difficulties in producing reserves; |

| • | fluctuations in foreign exchange or interest rates; |

| • | failure to realize anticipated benefits of acquisitions; |

| • | unanticipated operating events which can reduce production or cause production to be shut-in or delayed; |

| • | failure to obtain industry partner and other third-party consents and approvals, when required; |

| • | competition for, among other things, capital, acquisitions of reserves, undeveloped land and skilled personnel; |

| • | competition for and/or inability to retain drilling rigs and other services; |

| • | the availability of capital on acceptable terms; |

| • | the need to obtain required approvals from regulatory authorities; and |

| • | the other factors disclosed under the heading Item 1.A – Risk Factors in this Annual Report. |

The above summary of assumptions and risks related to forward-looking statements has been provided in this Annual Report in order to provide readers with a more complete perspective on the future operations of the Corporation. Readers are cautioned that this information may not be appropriate for other purposes. The forward-looking statements contained in this Annual Report are expressly qualified by the cautionary statements provided for herein. NiMin is not under any duty to update any of the forward-looking statements after the date of this Annual Report or to conform such statements or information to actual results or to changes in the expectations of NiMin except as otherwise required by applicable laws.

1

Table of Contents

ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

Directors and Executive Officers

Set forth below is information regarding each of the executive officers of NiMin and each member of the Board of Directors of NiMin (the “Board”):

| Name |

Positions |

Age | Date First Elected or Appointed a Director or Officer | |||||

| Clarence Cottman III (1) |

Chief Executive Officer and Director | 56 | September 2009 | |||||

| E. Sven Hagen |

President and Director (5) | 54 | September 2009 | |||||

| Jonathan S. Wimbish |

Chief Financial Officer | 41 | September 2009 | |||||

| D. Scott Dobson |

Chief Operating Officer(6) | 38 | January 2011 | |||||

| Brian E. Bayley (1) (3)(4) |

Director | 59 | September 2009 | |||||

| William Gumma(2)(3) |

Director | 64 | June 2011 | |||||

| W.A. (Alf) Peneycad(1)(2)(3)(4) |

Director | 65 | September 2009 | |||||

| Robert L. Redfearn(2)(3) (4) |

Director | 77 | September 2009 | |||||

Notes:

| (1) | Member of the corporate governance committee. |

| (2) | Member of the reserves committee. |

| (3) | Member of the compensation committee. |

| (4) | Member of the audit committee. |

| (5) | Resigned as President and Director on January 24, 2012. |

| (6) | D. Scott Dobson was initially appointed Vice President Operations in January 2011 and subsequently was promoted to Chief Operating Officer in September 2011. |

Clarence Cottman III

Chairman, CEO and Director

Clarence Cottman III is Chairman, CEO, and Director of NiMin. Mr. Cottman has over 30 years of experience in the oil and gas industry with a focus on joint ventures, acquisitions and project development. He was on the Advisory Board to Nanes Balkany Partners, a hedge fund investor in small publicly traded energy companies. Mr. Cottman has held various senior management positions at Etrion Corporation (formerly PetroFalcon Corporation), Benton Oil & Gas and Sun E&P. He has negotiated numerous oil and gas contracts and arranged multiple energy financings in both North America and overseas. He holds a BA from Rochester Institute of Technology and an MBA from the University of Rhode Island. Mr. Cottman is a Certified Professional Landman. The board believes that Mr. Cottman’s expertise and experience in the oil and gas industry is valuable to the Board.

Jonathan S. Wimbish, CFA

Chief Financial Officer

Jonathan Wimbish, CFA is Chief Financial Officer for NiMin. Prior to joining Legacy in 2007, which became a wholly-owned subsidiary of NiMin in 2009, Mr. Wimbish was a Portfolio Manager, Managing Director and Co-Founder of Marketus, LLC, an equity-based hedge fund management company. He managed all energy investments

2

Table of Contents

from its founding in 2002. Mr. Wimbish was also a Managing Director and Portfolio Manager at ING Furman Selz Asset Management and Analyst with Husic Capital. He began his career at MasterCard International and held roles of increasing responsibility including; Internal Auditor and Manager of Strategic Planning. Mr. Wimbish holds a BA in Economics from UCLA, an MBA from Columbia Business School and is a CFA Charterholder.

D. Scott Dobson

Chief Operating Officer

Scott Dobson was named Chief Operating Officer on September 1, 2011. Previously, Mr. Dobson served as Vice President of Operations. Mr. Dobson was named Vice President of Operations in January, 2011 . Mr. Dobson has over 15 years experience in the oil and gas industry and began his career as a production and reservoir engineer with Burlington Resources in Farmington, New Mexico where he was responsible for drilling, completion and project improvement of large development programs. From 2008 to 2011, Mr. Dobson was the Operations Manager of Legacy, the wholly-owned subsidiary of NiMin, and was instrumental in the execution of the Corporation’s business model and success. From 2001 until 2008, Mr. Dobson worked for Merit Energy Company in Dallas, Texas where his primary role was Region Manager. As Region Manager, he directed the operation and development of oil and gas properties in 9 of the 13 states in which Merit had assets, including Wyoming. Mr. Dobson graduated from Montana Tech with a Bachelor of Science degree in Mining Engineering.

Brian E. Bayley

Director

Brian E. Bayley holds an MBA from Queen’s University. Mr. Bayley is currently a director and Resource Lending Advisor for Sprott Resource Lending Corp. (formerly Quest Capital Corp.), a TSX and NYSE Amex listed resource lending corporation. Prior thereto, Mr. Bayley also held the following positions with Quest Capital Corp.: President and Chief Executive Officer from May 2009 to September 2010; Co-Chairman from January 2008 to May 2009; President from July 2003 to January 2008; and Chief Executive Officer from July 2003 to March 2008. Mr. Bayley has been the President and a director of Ionic Management Corp., a private management company, since December 1996. He has also served as a director and/or officer of numerous other public companies. The Board believes that Mr. Bayley’s experience and his independence from management make him a valuable member of the Board.

E. Sven Hagen

Former President and Director

Dr. Sven Hagen is a former Director and former President NiMin. He has over 26 years of experience in the oil and gas industry with a focus on domestic and international field development, new venture acquisitions, and exploration. In 1985, Dr. Hagen worked with Standard Oil Production Company and later Shell Oil Company as an Exploration Geologist. From 1990 to 2001, he served in a variety of positions with Benton Oil and Gas Company including Senior VP of Exploration and Production for worldwide operations. During this time, he presided over an international team that developed major oil and gas fields in Russia and Venezuela. Dr. Hagen has led or managed new venture projects in over 40 countries resulting in the acquisition of six significant oil and gas development projects. From 2001 to 2005, Dr. Hagen worked in a senior management position for PetroFalcon Corporation, now Etrion Corporation, a natural resource company formerly focused on oil and gas operations in Venezuela. Dr. Hagen graduated from the University of California at Santa Barbara in 1979 with Bachelors in Geology, and in 1985 he earned a Doctorate in Geology from the University of Wyoming.

William Gumma

Director

Bill Gumma has over 30 years of oil and gas experience, and has been responsible for worldwide exploration and production activities, including pioneering projects in the United States, Russia, and Venezuela. Since 2010, Mr. Gumma has been the Managing Director at Chisholm Partners, LLC, an independent energy resource development company. From June 2003 until September 2009, Mr. Gumma served as President and CEO of PetroFalcon Corporation, now Etrion Corporation, a natural resource company formerly focused on oil and gas operations in Venezuela. He also worked in both engineering and exploration capacities at Shell USA and Amoco Oil Co.

3

Table of Contents

Additionally, Mr. Gumma served as Chief Geophysicist-International for Maxus Energy Corp. and as an executive officer and Director for Benton Oil and Gas Co., now Harvest Natural Resources. Mr. Gumma holds a Bachelor of Science degree in engineering from the Colorado School of Mines and a Master of Science degree in geophysics from Oregon State University. The Board believes that Mr. Gumma’s expertise and experience in the oil and gas industry is valuable to the Board.

W.A. (Alf) Peneycad

Director

Alfred Peneycad is a graduate of Queen’s University Law School and is currently Of Counsel to Norton Rose Canada LLP. He also serves as a director of several public companies, including Parex Resources Inc., a Calgary-based oil and gas company with operations in Colombia and Trinidad & Tobago. Mr. Peneycad recently retired from Petro-Canada where he served as Vice-President, General Counsel and Chief Compliance Officer. Mr. Peneycad spent 28 years at Petro-Canada and while there, played a lead role in the acquisition of several major companies in Canada, the US and internationally. The Board believes that Mr. Peneycad’s experience and his independence from management make him a valuable member of the Board.

Robert L. Redfearn

Director

Robert L. Redfearn is a graduate of Tulane University (B.B.A., J.D.), specializing in oil and gas related law. In 1979, Mr. Redfearn became a founding partner of Simon, Peragine, Smith & Redfearn, L.L.P., where he represents clients in mergers of business and acquisitions of oil and gas properties, financing, complex litigation and arbitrations related to oil and gas, environmental concerns and banking and securities. Prior to founding Simon, Peragine, Smith & Redfearn, L.L.P., Mr. Redfearn was an attorney at Deutsch, Kerrigan and Stiles, a New Orleans based law firm, where his practice centered around the oil and gas industry. Mr. Redfearn was employed in the legal department of Humble Oil & Refining Company (now Exxon Corporation). The Board believes that Mr. Redfearn’s experience and his independence from management make him a valuable member of the Board.

The following table sets forth the directors of the Corporation who are presently directors of other reporting issuers (or equivalent).

| Name of Director |

Name of Other Issuers | |

| Brian E. Bayley | Kramer Capital Corp. Cypress Hills Resource Corp. Esperanza Silver Corporation Eurasian Minerals Inc. Kirkland Lake Gold Inc. Sprott Resources Lending Corp.(formerly Quest Capital Corp.) American Vanadium Corp. (formerly Rocky Mountain Resources Corp.) Bearing Resources Ltd. TransAtlantic Petroleum Corp. | |

| W.A. (Alf) Peneycad | Parex Resources Inc. Canadian Wireless Trust R Split III Corp. | |

Corporate Cease Trade Order or Bankruptcies

To the best of the Corporation’s knowledge, none of those persons who are proposed directors of the Corporation is, or has been within the past ten years, a director, chief executive officer or chief financial officer of any company, including the Corporation, that while such person was acting in that capacity, was the subject of a cease trade or similar order or an order that denied the company access to any exemption under securities legislation, for a period of more than 30 consecutive days, or after such persons ceased to be a director, chief executive officer or chief financial officer of the company, was the subject

4

Table of Contents

of a cease trade or similar order or an order that denied the company access to any exemption under securities legislation, for a period of more than 30 consecutive days, which resulted from an event that occurred while acting in such capacity, except as noted below.

Brian E. Bayley was a director of American Natural Energy Corp. (“American”) from June 2001 until November 2010. In June 2003, each of the l’Autorité des marchés financiers (the “AMF”), the British Columbia Securities Commission (“BCSC”) and the Manitoba Securities Commission (the “MSC”) issued cease trade orders against American for its failure to file financial statements within the prescribed times. The cease trade orders were rescinded in August and September 2003. Subsequently, during the period between May 2007 and March 2008, each of the BCSC, the OSC, the ASC and AMF issued cease trade orders against American for failure to file its financial statements within the prescribed times. The cease trade orders were rescinded in October 2008.

Brian E. Bayley has been a director of Esperanza Silver Corporation (“Esperanza”) since December 1999. In early 2003, the directors and officers of Esperanza became aware that Esperanza was subject to outstanding cease trade orders by the ASC (issued on September 17, 1998) and the AMF (issued on August 12, 1997) for failure to file its financial statements within the prescribed times. The cease trade orders were rescinded on or prior to August 1, 2003.

In addition, to the best of the Corporation’s knowledge, none of those persons who are proposed directors of the Corporation is, or has been within the past ten years, a director or executive officer of any company, including the Corporation, that, while such person was acting in that capacity, or within a year of that person ceasing to act in that capacity became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets.

To the best of the Corporation’s knowledge, none of the persons who are proposed directors of the Corporation have, within the past ten years made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold his assets.

Penalties or Sanctions

Except as set forth below and to the best of the Corporation’s knowledge, none of those persons who are proposed directors of the Corporation have been subject to any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement with a securities regulatory authority or been subject to any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable shareholder in deciding whether to vote for a proposed director.

Brian E. Bayley was a director of PetroFalcon Corporation (now Etrion Corporation) (“PetroFalcon”) from November 2001 to June 2008. On February 27, 2002, the BCSC issued an order regarding a private placement (the “PetroFalcon Private Placement”) of PetroFalcon to Quest Ventures Ltd. (“Quest Ventures”), a private company in which Brian E. Bayley was a director. The BCSC considered it to be in the public interest to remove the applicability of certain exemptions from the prospectus and registration requirements of the Securities Act (British Columbia) for PetroFalcon until the matter could be placed before the shareholders of PetroFalcon. In addition, the BCSC removed the applicability of the same exemptions for Quest Ventures in respect of the PetroFalcon common shares received pursuant to the PetroFalcon Private Placement. Approval of the shareholders of PetroFalcon was received on May 23, 2002 and the BCSC reinstated the applicability of the exemptions from the prospectus and registration requirements for both PetroFalcon and Quest Ventures shortly thereafter.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires our directors and executive officers, persons who beneficially own more than ten percent of a registered class of our equity securities, and certain other persons to file reports of ownership and changes in ownership on Forms 3, 4 and 5 with the Securities and Exchange Commission (“SEC”), and to furnish the Corporation with copies of the forms. Our directors, executive officers and greater than ten percent beneficial owners were not required to comply with such filing requirements during 2011, but became subject to such filing requirements in 2012.

5

Table of Contents

Code of Ethics

The Board has adopted a Code of Business Conduct and Ethics (“Code of Conduct”) applicable to directors, officers, employees and consultants of the Corporation. A copy of the Code of Conduct is provided to each of the above persons. A copy of the Code of Conduct can be found on www.sedar.com and on the Corporation’s website at www.niminenergy.com.

Nomination of Directors

The Board, acting as a whole, is responsible for proposing new nominees to the Board and for assessing the performance of directors on an ongoing basis. Factors considered for nominees include an appropriate mix of skills, knowledge and experience in business and a history of achievement. Directors are required to have available time to devote to the duties of the Board. The majority of directors comprising the Board must qualify as independent directors. The Board has not appointed a nominating committee to assess the effectiveness of the Board as a whole, the Committees and the contribution of individual directors, provided however, from time to time the Chairman of the Board surveys the Board to provide feedback on the effectiveness of the Board, following which the Chairman recommends changes to enhance the performance of the Board based on the survey feedback. The Board also reviews the composition and size of the Board and tenure of directors in advance of annual general meetings when directors are most commonly elected by the Corporation’s shareholders, as well as when individual directors indicate that their terms may end or that their status may change. The Board takes into account the number of directors required to carry out the duties of the Board effectively, and to maintain a diversity of view and experience. The Board will evaluate candidates recommended by the shareholders in the same manner as candidates recommended by other sources, using criteria, if any, developed and approved by the Board, from time to time.

Audit Committee

The Audit Committee is a committee of the Board established for the purpose of overseeing the accounting and financial reporting process of the Corporation and annual external audits of the consolidated financial statements.

Audit Committee Charter

The Audit Committee has set out, in a written policy, its responsibilities and composition requirements in fulfilling its oversight in relation to the Corporation’s internal accounting standards and practices, financial information, accounting systems and procedures. The Audit Committee charter is provided in Appendix A attached hereto.

Composition of the Audit Committee

The Audit Committee consists of Brian E. Bayley (Chair), W. A. (Alf) Peneycad, and Robert L. Redfearn. All members of the Audit Committee have been determined to be independent and all members are considered to be financially literate. A member of an Audit Committee is independent if the member has no direct or indirect material relationship with the Corporation which could, in the view of the Board, reasonably interfere with the exercise of a member’s independent judgment. An individual is financially literate if he/she has the ability to read and understand a set of financial statements that present a breadth of complexity of accounting issues that are generally comparable to the breadth and complexity of the issues that can reasonably be expected to be raised by the Corporation’s financial statements. Mr. Bayley is considered to be the Audit Committee Financial Expert within the meaning of the SEC rules and regulations.

Relevant Education and Experience of Audit Committee Members

Brian E. Bayley

Brian E. Bayley holds an MBA from Queen’s University. Mr. Bayley is currently a director and Resource Lending Advisor for Sprott Resource Lending Corp. (formerly Quest Capital Corp.), a TSX and NYSE Amex listed resource lending corporation. Prior thereto, Mr. Bayley also held the following positions with Quest Capital Corp.: President and CEO from May 2009 to September 2010; Co-Chairman from January 2008 to May 2009; President from July 2003 to January 2008; and CEO from July 2003 to March 2008. Mr. Bayley has been the President and a director of Ionic Management Corp., a private management company, since December 1996. He has also served as a director and/or officer of numerous other public companies.

6

Table of Contents

W. A. (Alf) Peneycad

Alfred Peneycad is a graduate of Queen’s University Law School and is currently Of Counsel to Macleod Dixon LLP. He also serves as a director of several public companies, including Parex Resources Inc., a Calgary-based oil and gas company with operations in Colombia and Trinidad & Tobago. Mr. Peneycad recently retired from Petro-Canada where he served as Vice-President, General Counsel and Chief Compliance Officer. Mr. Peneycad spent twenty-eight (28) years at Petro-Canada and while there, played a lead role in the acquisition of several major companies in Canada, the US and internationally.

Robert L. Redfearn

Robert L. Redfearn is a graduate of Tulane University (B.B.A., J.D.), specializing in oil and gas related law. Prior to joining Deutsch, Kerrigan and Stiles, a New Orleans based law firm, where his practice centered around the oil and gas industry and included representation of clients in mergers of businesses and acquisitions of oil and gas properties, financings, complex litigation and arbitrations related to oil and gas, environmental concerns, and banking and securities, Mr. Redfearn was employed in the legal department of Humble Oil & Refining Company (now Exxon Corporation). In 1979, Mr. Redfearn became a founding partner of Simon, Peragine, Smith & Redfearn, L.L.P., where he continues his representation of clients as reflected above.

Audit Committee Oversight

At no time since the commencement of the Corporation’s most recently completed financial year was a recommendation of the Audit Committee to nominate or compensate an external auditor not adopted by the Board.

7

Table of Contents

ITEM 11. EXECUTIVE COMPENSATION

STATEMENT OF EXECUTIVE COMPENSATION

COMPENSATION DISCUSSION AND ANALYSIS

Compensation Committee Report

The Compensation Committee has reviewed and discussed the Compensation Discussion and Analysis section of the Amendment with management. Based on such review and discussions, the Compensation Committee recommended to the Board that the Compensation Discussion and Analysis be included in this Amendment.

COMPENSATION COMMITTEE

Brian E. Bayley

William Gumma

W. A. Peneycad

Robert L. Redfearn

Overview

The Compensation Committee is responsible for determining the overall compensation strategy of the Corporation, administering the Corporation’s executive compensation program, making recommendations to the Board regarding compensation including incentive and equity-based compensation, reviewing and approving corporate goals and objectives relevant to the Chief Executive Officer, for proposals for the compensation of the executive officers, management and directors, for evaluations of performance to determine compensation, for employee benefit and retirement plans and all other matters related to compensation. The Compensation Committee is also responsible for reviewing the Corporation’s compensation policies and guidelines generally.

Objectives of Compensation Program

It is the objective of the executive compensation program to attract and retain highly qualified and experienced individuals to serve as executive officers and to align incentive compensation to performance and shareholder value. It is the goal of the Compensation Committee to endeavor to ensure that the compensation of executive officers is sufficiently competitive to achieve the objectives of the executive compensation program. The Compensation Committee gives consideration to the Corporation’s long-term interests and quantitative financial objectives, as well to the qualitative aspects of the individual’s performance and achievements.

Risks of Compensation Policies and Practices

The Corporation’s compensation program is designed to provide executive officers incentives for the achievement of near-term and long-term objectives, without motivating them to take unnecessary risk. As part of its review and discussion of executive compensation, the Compensation Committee noted the following facts that discourage the Corporation’s executives from taking unnecessary or excessive risk: (i) the Corporation’s operating strategy and related compensation philosophy; (ii) the effective balance, in each case, between cash and equity mix, near-term, and long-term focus, corporate and individual performance, and financial and non-financial performance; and (iii) the Corporation’s approach to performance evaluation and compensation provides greater rewards to an executive officer achieving both short-term and long-term agreed upon objectives. Based on this review, the Compensation Committee believes that the Corporation’s total executive compensation program does not encourage executive officers to take unnecessary or excessive risk.

8

Table of Contents

Role of Executive Officers in Compensation Decisions

The Compensation Committee receives and reviews recommendations of the Chief Executive Officer (and President, as applicable) relating to the general compensation structure and policies and programs for the Corporation and the salary and benefit levels for the executive officers.

Elements of Compensation

The executive compensation program is comprised of three (3) principal components: base salaries, cash bonuses and stock options which are, collectively, designed to provide a combination of cash and equity–based compensation to effectively retain and motivate the executive officers to achieve the corporate goals and objectives. These elements contain both short-term incentives comprised of cash payments by way of base salaries and bonuses and long-term incentives by way of equity-based compensation. Other components of the executive compensation program include perquisites and other personal benefits. Each component of the executive compensation program is addressed separately below.

The amount for each element of the Corporation’s executive compensation program is determined based upon compensation levels provided by the Corporation’s competitors as well as upon the discretion of the Board, as described below. Each element of the Corporation’s executive compensation program contributes to an overall compensation package, which is designed to provide both short-term and long-term financial incentives to the executive officers and to thereby assist the Corporation to successfully implement its strategic plans. The Compensation Committee annually assesses how each element fits into the overall compensation package.

Compensation Committee Interlocks and Insider Participation

The Compensation Committee is comprised of Messrs. Redfearn (Chair), Bayley, Gumma, and Peneycad, none of whom are employees or current or former officers of the Corporation, or had any relationship with the Corporation required to be otherwise disclosed herein.

Compensation Governance

The policies and practices adopted by the Board to determine compensation of the Corporation’s executive officers and directors is described under “Statement of Executive Compensation – Compensation Discussion and Analysis” and “Director Compensation” respectively.

The Compensation Committee is comprised of four independent directors (being Messrs. Redfearn (Chair), Bayley, Gumma and Peneycad). The skills and experience of each Committee member in executive compensation that is relevant to his responsibilities and the making of decisions on the suitability of the Corporation’s compensation policies and practices is as follows:

| Robert L. Redfearn, Chair | Mr. Redfearn has a breadth of experience as a director and officer and has addressed compensation matters for companies’ executive officers. | |

| Brian E. Bayley | Mr. Bayley has served as a director of numerous public companies and is currently a director of three (3) other TSX listed companies, serving on the Compensation Committee of the board of directors of two (2) of those companies. Mr. Bayley has worked with compensation consultants and advisors in designing and implementing compensation programs for executive officers of public companies. | |

9

Table of Contents

| William Gumma | Mr. Gumma has a breadth of experience as a director and officer and has experience setting compensation at one other public company. | |

| W. A. (Alf) Peneycad | Mr. Peneycad has been an independent businessman since 2006, which includes consulting to Norton Rose Canada LLP. Previously, Mr. Peneycad was Vice President, General Counsel and Chief Compliance Officer for Petro-Canada from 2003 to 2006, and Vice President, General Counsel and Corporate Secretary of Petro-Canada prior to 2003. Mr. Peneycad attended the Institute of Corporate Directors receiving an ICD.D designation. Mr. Peneycad is a director for several other Canadian public companies including Parex Resources Inc., Canadian Wireless Trust, and R Split III Corp. where he holds positions on the Audit, Finance, Corporate Governance and Human Resource Committees. Mr. Peneycad currently serves as the Chairman of the Corporate Governance and Compensation Committee for Parex Resources Inc. | |

The Compensation Committee is responsible for determining the overall compensation strategy of the Corporation and administering the Corporation’s executive compensation program. As part of its mandate, the Compensation Committee approves the appointment and remuneration of the Corporation’s executive officers, including the Corporation’s Named Executive Officers identified in the Summary Compensation Table. The Compensation Committee is also responsible for reviewing the Corporation’s compensation policies and guidelines generally.

Base Salaries

Salaries for executive officers are reviewed annually based on corporate and personal performance and on individual levels of responsibility and are set to be competitive with industry levels. Salaries of the executive officers are not determined based on benchmarks or a specific formula. Consideration is given to compensation packages that may be available to such executive officers from other employment opportunities and commercially available data on salaries disclosed by competitors and peers. The Compensation Committee submits its recommendation to the Board as to salary of the Chief Executive Officer and as applicable, the President. The Compensation Committee considers, and, if thought appropriate, also submits to the Board recommendations for salaries for the other executive officers based on those salaries recommended by the Chief Executive Officer and as applicable, the President. As stated above, base salaries are established to be competitive in order to attract and retain highly qualified and experienced individuals.

Bonus and Bonus Goals

In 2010, the Corporation adopted a bonus program including annual bonus goals which are to be reviewed annually by the Board and the Compensation Committee. There are two (2) categories of bonus goals each having its own weighted value: (i) operational goals, which focus on safety, production, proved reserved growth and cost control and (ii) financial goals, which focus on controls, public reporting and market recognition. The operational goals were applied to Mr. Dobson and the financial goals were applied to Mr. Wimbish. Operational and financial goals were applied to Mr. Cottman. Bonus payments, along with base salary, are considered to be an integral component of an executive officer’s compensation package. Provided that bonus goals are met, executive officers will be entitled to a cash bonus of up to twenty-five percent (25%) of the individual’s base salary. In the event that bonus goals are exceeded, the Compensation Committee may at its discretion award an amount up to an additional twenty-five percent (25%) of an individual’s base salary to an executive officer. Additional bonus payments above fifty percent (50%) of base salary may be awarded at the discretion of the Compensation Committee for extraordinary effort and achievement. The Board exercises its discretion, upon recommendations received from the Compensation Committee, regarding the payment of bonuses based upon employee merit and the payment thereof, if any, is determined by the Board. In making these decisions and in exercising this discretion, the Board recognizes extraordinary efforts made to enhance the value of the Corporation’s asset base and any extraordinary success that has been achieved in implementing the Corporation’s business plans as a result of such efforts, including significant production and reserve additions.

10

Table of Contents

For 2011 performance, Mr. Dobson received a cash bonus of $50,000, or 25% of his base salary, for accomplishing the operational goals. During 2011, none of the financial goals were achieved and Messrs. Cottman, Hagen and Wimbish did not receive bonuses.

Stock Option Plan

The Compensation Committee also administers the incentive stock option plan that is designed to provide a long-term incentive that is aligned with shareholder value. The Compensation Committee makes recommendations to the Board regarding the number of options to be granted to each executive officer based on the level of responsibility and experience of the individual, the performance of the individual and the number of stock options previously granted to the individual. The Compensation Committee regularly reviews and where appropriate adjusts the number of options granted to executive officers. The Compensation Committee sets the number of options as appropriate designed to attract and retain qualified and talented executive officers. Other than set forth above, recommendations with respect to the payment of bonuses are not based on a specific formula or benchmarks.

Perquisites and Other Components

Other components of compensation include perquisites and personal benefits as determined by the Compensation Committee and recommended to the Board that are consistent with the overall compensation strategy. There is no specific formula or benchmarks for assessing how perquisites or personal benefits are utilized in the total compensation package. The Corporation does not provide any pension or retirement benefits to its executive officers.

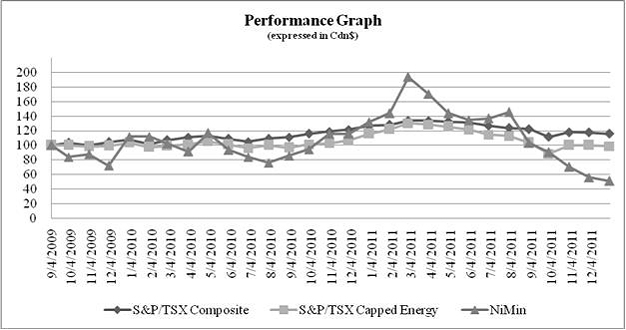

Performance Graph

The following graph compares the percentage change in the cumulative shareholder return over the last three (3) years of the (post-consolidated) Common Shares of the Corporation (assuming a Cdn$100 investment was made on September 4, 2009, the date on which the Corporation’s Common Shares were listed on the TSX) and the cumulative total return of the S&P/TSX Composite Index.

11

Table of Contents

ASSUMES $100 INVESTED ON SEPTEMBER 4, 2009

ASSUMES DIVIDEND REINVESTED

FISCAL YEAR END DEC. 31, 2011

(Expressed in Canadian dollars)

| 12/31/2009 | 12/31/2010 | 12/31/2011 | ||||||||||

| NiMin Energy Corp. |

112 | 132 | 51 | |||||||||

| S&P/TSX Composite |

108 | 127 | 99 | |||||||||

| S&P/TSX Capped Energy |

104 | 116 | 116 | |||||||||

Prior to the completion of the acquisition of Legacy (the “Legacy Acquisition”) that was completed on September 4, 2009, the Corporation was a Capital Pool Company listed on the TSX Venture Exchange (“TSXV”) in 2007, did not carry on active commercial business and did not have any tangible assets other than a minimal amount of cash. As a result of the Legacy Acquisition, Legacy is a wholly-owned subsidiary of the Corporation. In connection with the completion of the Legacy Acquisition, the Common Shares were listed on the TSX and delisted from the TSXV on September 4, 2009. As a result, the Corporation has only commenced carrying on active business since September 4, 2009.

As described above under the “Compensation Discussion and Analysis – Elements of Compensation”, the Corporation’s executive compensation program consists of a combination of cash and equity based compensation. When determining compensation, the Compensation Committee and the Board consider a number of factors, one of which is corporate performance. As a result there is no direct correlation between the trend shown in the performance graph and the trend in compensation to executive officers reported over the same period.

Option Based Awards

For a description of the process that the Corporation uses to grant option-based awards to executive officers including the role of the Compensation Committee, see the description under “Statement of Executive Compensation – Compensation Discussion and Analysis – Elements of Compensation”.

Summary Compensation

Securities legislation requires the disclosure of compensation received by each “Named Executive Officer” of the Corporation for the most recently completed financial year. “Named Executive Officer” is defined by the legislation to mean (i) each of Chief Executive Officer and Chief Financial Officer of the Corporation (ii) each of the Corporation’s three (3) most highly compensated executive officers, or the three (3) most highly compensated individuals acting in a similar capacity, other than the Chief Executive Officer and Chief Financial Officer, at the end of the most recently completed financial year and whose total compensation exceeds Cdn $150,000, and (iii) any additional individual for whom disclosure would have been provided under (ii) but for the fact that the individual was not serving as an executive officer of the Corporation at the end of the most recently completed financial year end of the Corporation.

“Executive Officer” is defined by the legislation to mean (i) the chair, vice-chair or president of the Corporation, (ii) a vice-president of the Corporation in charge of a principal business unit, division or function including sales, finance or production, or (iii) an individual performing a policy-making function in respect of the Corporation.

The following table sets forth a summary of all compensation for services paid during the financial years ended December 31, 2011, 2010 and 2009 for Clarence Cottman III, Chief Executive Officer (“CEO”) (appointed in September 2009), Dr. E. Sven Hagen, former President (appointed in September 2009 and resigned January 24, 2012), Jonathan S. Wimbish, Chief Financial Officer (“CFO”) (appointed in September 2009), D. Scott Dobson, Chief Operating Officer (“COO”) (appointed Vice President of Operations in January 2011 and promoted to COO in September 2011) and Rick McGee, former Chief Operating Officer (appointed in September 2009 and resigned effective February 1, 2011) (collectively, the “Named Executive Officers” for the years set out therein).

12

Table of Contents

SUMMARY COMPENSATION TABLE

| Option-based

awards ($) |

Non-equity incentive plan compensation ($) |

|||||||||||||||||||||||||||||||||||||||

| Name and principal position |

Year | Salary ($) |

Share- based awards ($) |

Options Granted(1)(2) ($) |

Replacement Options(4)(5) ($) |

Annual incentive plans(9) |

Long term incentive plans |

Pension value ($) |

All

other compensation ($)(10) |

Total compensation ($) |

||||||||||||||||||||||||||||||

| Clarence Cottman III(3)(7) CEO |

|

2011 2010 2009 |

|

|

250,154 230,000 230,000 |

(6) |

|

Nil Nil Nil |

|

|

Nil Nil 343,692 |

|

|

Nil Nil 230,353 |

|

|

Nil 130,000 |

|

|

Nil Nil Nil |

|

|

Nil Nil Nil |

|

|

16,648 13,874 Nil |

|

|

266,802 373,874 884,554 |

| ||||||||||

| Dr. E. Sven Hagen(3) (7) President |

|

2011 2010 2009 |

|

|

240,155 230,000 230,000 |

(6) |

|

Nil Nil Nil |

|

|

Nil Nil 343,692 |

|

|

Nil Nil 230,353 |

|

|

Nil 95,000 |

|

|

Nil Nil Nil |

|

|

Nil Nil Nil |

|

|

14,868 13,314 Nil |

|

|

255,023 338,314 873,045 |

| ||||||||||

| Rick McGee(3) COO |

|

2010 2009 |

|

|

230,000 230,000 |

|

|

Nil Nil |

|

|

Nil 343,692 |

|

|

Nil 230,353 |

|

|

Nil Nil |

|

|

Nil Nil |

|

|

Nil Nil |

|

|

12,064 Nil |

|

|

242,064 804,045 |

| ||||||||||

| Jonathan S. Wimbish(3) CFO |

|

2011 2010 2009 |

|

|

220,035 200,000 214,000 |

(6) |

|

Nil Nil Nil |

|

|

Nil Nil 343,692 |

|

|

Nil Nil 288,594 |

|

|

Nil 100,000 |

|

|

Nil Nil Nil |

|

|

Nil Nil Nil |

|

|

11,227 11,079 Nil |

|

|

231,262 311,079 906,286 |

| ||||||||||

| D. Scott Dobson(8) COO |

2011 | 204,605 | Nil | 275,658 | Nil | 50,000 | Nil | Nil | 8,187 | 538,450 | ||||||||||||||||||||||||||||||

Notes:

| (1) | The value of the option-based awards represents the fair value, on the date of grant, of awards under the Stock Option Plan of the Corporation. The grant date fair value has been calculated using the Black Scholes Merton model and reflects assumptions for risk-free interest rate, expected life, expected stock price volatility and expected dividend yield. (See Consolidated Financial Statements – Note 10.) |

| (2) | The 2009 stock options were awarded in Canadian dollars and exercise prices are also in Canadian dollars. The $ figures are based on the exchange rate as at September 4, 2009 of Cdn $1.00 = $0.9068. The 2011 stock option were awarded in Canadian dollars and exercise prices are also in Canadian dollars. The $ figures are based on an exchange rate as at January 10, 2011 of Cdn $1.00 = $1.006, January 25, 2011 of Cdn $1.00 = $1.0053 and November 23, 2011 of Cdn $1.00 = $0.959. |

| (3) | Appointed as a Named Executive Officer of the Corporation on September 4, 2009 in connection with completion of the Legacy Acquisition. Mr. McGee resigned as COO effective February 1, 2011. Dr. Hagen resigned as an officer and director of the Corporation on January 24, 2012. |

| (4) | Options were granted in connection with completion of the Legacy Acquisition to replace cancelled options previously granted during 2008 to buy common shares in the capital of Legacy for new options to buy common shares in the capital of the Corporation (the “Replacement Options”). The Replacement Options have an exercise price of Cdn $1.25 and expire on September 4, 2019. The $ figures are based on the exchange rate as at September 4, 2009 of Cdn $1.00 = $0.9068. |

| (5) | The value of the Replacement Options has been calculated based on the difference between the historic fair value, on the date of grant, of the old options to buy shares in the capital of Legacy and the new options to buy shares in the capital of the Corporation. The grant date fair value has been calculated using the Black Scholes Merton model and reflects assumptions for risk-free interest rate, expected life, expected stock price volatility and expected dividend yield. The Corporation chose this methodology because it is recognized as the most common methodology used for valuing options and doing value comparisons. |

| (6) | Represents annual salary paid by Legacy to the Named Executive Officer for the financial year ended December, 31, 2009. Pursuant to the Legacy Acquisition, Legacy became a wholly-owned subsidiary of the Corporation on September 4, 2009. |

| (7) | Mr. Cottman and Dr. Hagen also served as directors of the Corporation for the years listed. All of the compensation paid to Mr. Cottman and Dr. Hagen relate to their positions as Named Executive Officers and none of their compensation relates to their roles as directors. |

| (8) | Mr. Dobson was named COO on September 1, 2011. Previously, Mr. Dobson served as Vice President of Operations. Mr. Dobson was named Vice President of Operations in January, 2011. He previously served as Operations Manager. |

| (9) | In 2012, Mr. Dobson was paid a cash bonus of $50,000 for achievement of the performance goals established under the 2011 bonus plan. In 2011, Messrs. Cottman, Hagen and Wimbish were each paid a cash bonus of $130,000, $95,000 and $100,000, respectively, for their extraordinary services in 2010. In 2010, Messrs. Cottman, Hagen and Wimbish were each paid a cash bonus of $80,500, $69,000 and $60,000, respectively, for their extraordinary services in 2009. |

| (10) | Includes perquisites and benefits including Corporation paid premiums for health, dental and life insurance. |

13

Table of Contents

Incentive Plan Awards

The table below supplements the Summary Compensation Table by providing additional information about plan-based compensation for the financial year ended December 31, 2011.

| Name |

Grant Date |

Estimated Future Payouts Under Non-Equity Incentive Plan Awards |

Estimated Future Payouts Under Equity Incentive Plan Awards |

All Other Stock Awards: Number of Shares of Stock |

All Other Option Awards: Number of Securities Underlying Options |

Exercise or Base Price of Option Awards Cdn $ |

Grant Date Fair Value of Stock and Option Awards $ |

|||||||||||||||||||||||||||||||||||||

| Threshold $ |

Target $ |

Maximum $ |

Threshold | Target | Maximum | |||||||||||||||||||||||||||||||||||||||

| Clarence Cottman, III |

0 | 62,500 | 250,000 | — | — | — | — | |||||||||||||||||||||||||||||||||||||

| E. Sven Hagen |

0 | 62,500 | 250,000 | — | — | — | — | |||||||||||||||||||||||||||||||||||||

| Jonathan S. Wimbish |

0 | 55,000 | 220,000 | — | — | — | — | |||||||||||||||||||||||||||||||||||||

| D. Scott Dobson |

|

1/11/11 1/26/11 11/23/11 |

|

0 | 50,000 | 200,000 | — | — | — | — |

|

150,000 60,000 250,000 |

|

|

1.65 1.64 1.00 |

|

|

143,941 57,086 74,631 |

| |||||||||||||||||||||||||

Outstanding Share-Based Awards and Option-Based Awards

The following table sets forth information in respect of all share-based awards and option-based awards outstanding at the end of the financial year ended December 31, 2011 to the Named Executive Officers of the Corporation.

Outstanding Share-Based Awards and Option-Based Awards

| Option-based Awards | Share-based Awards | |||||||||||||||||||||||

| Name |

Number of securities underlying unexercised options(6) (#) |

Option exercise price Cdn ($) |

Option expiration date |

Value of unexercised in-the-money options(1) ($) |

Number of shares or units of shares that have not vested (#) |

Market or payout value of share-based awards that have not vested ($) |

||||||||||||||||||

| Clarence Cottman III(2)(5) CEO |

1,200,000 | 1.25 | September 4, 2019 | — | Nil | Nil | ||||||||||||||||||

| Dr. E. Sven Hagen(2)(3)(5) President |

1,200,000 | 1.25 | December 31, 2012 | (7) | — | Nil | Nil | |||||||||||||||||

| Jonathan S. Wimbish(2) CFO |

1,350,000 | 1.25 | September 4, 2019 | — | Nil | Nil | ||||||||||||||||||

| D. Scott Dobson(4) COO |

|

350,000 150,000 60,000 250,000 |

|

|

1.25 1.65 1.64 1.00 |

|

|

September 4, 2019 January 10, 2016 January 25, 2016 November 23, 2016 |

|

— | Nil | Nil | ||||||||||||

Notes:

| (1) | The closing market price of the Common Shares on December 30, 2011, being the last trading day in the 2011 calendar year, was Cdn $0.64. |

| (2) | Appointed as a Named Executive Officer of the Corporation on September 4, 2009 in connection with completion of the Legacy Acquisition. |

| (3) | Dr. Hagen resigned as President and a director on January 24, 2012. |

14

Table of Contents

| (4) | Mr. Dobson was named COO on September 1, 2011. Previously, Mr. Dobson served as Vice President of Operations. Mr. Dobson was named Vice President of Operations in January, 2011. He previously served as Operations Manager. |

| (5) | Mr. Cottman and Dr. Hagen also served as directors of the Corporation during the financial year ended December 31, 2011. All of the compensation paid to Mr. Cottman and Dr. Hagen relate to their positions as Named Executive Officers and none of their compensation relates to their roles as directors. |

| (6) | The aggregate number of securities underlying unexercised options includes an aggregate number of exercisable and unexercisable options for the Named Executive Officers as follows: Cottman: 799,999 exercisable and 400,001 unexercisable; Hagen: 799,999 exercisable and 400,001 unexercisable; Wimbish: 899,999 exercisable and 450,001 unexercisable; and Dobson: 316,666 exercisable and 493,334 unexercisable. |

| (7) | The expiration date of these options was changed from September 4, 2019 to December 31, 2012 in connection with Dr. Hagen’s departure from the Corporation. |

Incentive Plan Awards – Value Vested or Earned During the Year

The following table sets forth information in respect of the value vested or earned during the Corporation’s financial year ended December 31, 2011 of option-based awards, share-based awards and non-equity incentive plan compensation for Named Executive Officers of the Corporation.

Value Vested or Earned of Incentive Plan Awards

during the Financial Year Ended December 31, 2011

| Name |

Option-based awards

– Value vested during the year ($)(1) |

Share-based awards

– Value vested during the year ($) |

Non-equity incentive

plan compensation – Value earned during the year ($) |

|||||||||

| Clarence Cottman III(2)(4) |

274,953 | Nil | Nil | |||||||||

| Dr. E. Sven Hagen(2)(4) |

274,953 | Nil | Nil | |||||||||

| Jonathan S. Wimbish(2) |

309,322 | Nil | Nil | |||||||||

| D. Scott Dobson(3) |

24,877 | Nil | Nil | |||||||||

Notes:

| (1) | The value of the option-based awards represents the fair value, on the date of grant, of awards under the Stock Option Plan of the Corporation. The grant date fair value has been calculated using the Black Scholes Merton model and reflects assumptions for risk-free interest rate, expected life, expected stock price volatility and expected dividend yield. The Corporation chose this methodology because it is recognized as the most common methodology used for valuing options and doing value comparisons. (See Consolidated Financial Statements – Note 10.) |

| (2) | Appointed as a Named Executive Officer of the Corporation on September 4, 2009 in connection with completion of the Legacy Acquisition. |

| (3) | Mr. Dobson was named COO on September 1, 2011. Previously, Mr. Dobson served as Vice President of Operations. Mr. Dobson was named Vice President of Operations in January, 2011. He previously served as Operations Manager. |

| (4) | Mr. Cottman and Dr. Hagen also served as directors of the Corporation during the financial year ended December 31, 2011. All of the compensation paid to Mr. Cottman and Dr. Hagen relate to their positions as Named Executive Officers and none of their compensation relates to their roles as directors. |

None of the Named Executive Officers exercised any vested option-based awards during 2011.

Pension Plan Benefits

Defined Benefit Plans Table

The Corporation does not have a pension or retirement plan.

Deferred Compensation Plans

The Corporation does not have a deferred compensation plan.

Termination and Change of Control Benefit and Management Contracts

Other than as described herein, the Corporation does not have any contract, agreement, plan or arrangement that provides for payments to the Named Executive Officers at, following or in connection with any termination (whether voluntary, involuntary or constructive), resignation, a change in control of the Corporation or a change in the Named Executive Officer’s responsibilities.

15

Table of Contents

Messrs. Cottman and Wimbish are employed by Legacy under employment agreements dated April 29, 2008, amended January 1, 2009 and December 12, 2011. Mr. Dobson is employed by Legacy under an employment contract dated January 1, 2012. These agreements specify base salaries of at least $200,000 per annum. Included in these employment agreements are change of control provisions which automatically extend the term of the agreements for a period of at least 24 months beyond the month in which the change of control occurred. If a change of control occurs and the executive’s employment is terminated by Legacy without cause or by the executive for good reason, the executive shall be entitled to the following benefits: (i) full base salary through the date of termination at the rate in effect immediately prior to the time a notice of termination is given plus any benefits or awards that have been earned or become payable, but which have not been paid; (ii) as severance, three (3) times the executive’s base salary in the case of Messrs. Cottman and Wimbish and two (2) times the executive’s base salary in the case of Mr. Dobson at the rate in effect immediately prior to the time a notice of termination is given; and (iii) continued coverage, for a period of not more than two (2) years in all employer life, accidental death, medical and dental insurance plans in which executive was entitled to participate immediately prior to the date of termination. Good reasons is defined in the employment agreements to mean (a) a change in executive’s status, position or responsibilities which does not represent a promotion; (b) a reduction in executive’s base salary; (c) the failure of the Corporation to continue in effect any existing equity plan or other employee benefit plan (other than as a result of the normal expiration of such plan); (d) requiring the executive to be based anywhere other than the current location; (e) any purported termination of the employment agreement by the Corporation that is not in compliance with the terms of the employment agreement.

The following table sets forth estimates of the amounts payable to each of the Named Executive Officers an involuntary termination or termination without cause in the event of a change of control, if such Named Executive Officer was terminated effective December 31, 2011.

| Name |

Severance (1) ($) |

Other(2) ($) |

Total ($) |

|||||||||

| Clarence Cottman III |

750,000 | 140,885 | 890,885 | |||||||||

| Jonathan S. Wimbish |

660,000 | 119,932 | 779,932 | |||||||||

| D. Scott Dobson |

440,000 | 51,923 | 491,923 | |||||||||

Notes:

| (1) | The base salary for Messrs. Cottman, Wimbish and Dobson is $250,000, $220,000 and $220,000 respectively. The severance amount listed in the table above, represents three (3) times such base salary for Messrs. Cottman and Wimbish and two (2) times such base salary for Mr. Dobson. |

| (2) | The “Other” amount listed above represents the payment of tax-adjusted health, dental and life insurance benefits for Messrs. Cottman, Wimbish and Dobson for a period of two (2) years unused vacation and sick days. |

| (3) | The Named Executive Officers have thirty (30) days following the termination event to exercise their vested options. |

On January 24, 2012, the Board of Directors decided not to renew the employment contract of Dr. Sven Hagen, President, as a means to streamline management. Effective January 24, 2012, Dr. Hagen is no longer a director or officer of the Corporation and its subsidiaries. In connection therewith, the Corporation and Dr. Hagen entered into a Separation Agreement dated January 24, 2012 pursuant to which the Corporation has agreed to provide Dr. Hagen with the following severance benefits:

| • | Aggregate severance of $120,000, payable in equal monthly installments during 2012; |

| • | Monthly reimbursement of health and dental insurance premiums in the amount of $1,414.26 through September 15, 2012; |

| • | Accelerated vesting of 400,001 options, with an exercise price of Cdn $1.25 that would have otherwise vested on September 4, 2012, and all vested options may be exercised on or before December 31, 2012. |

On July 16, 2009, management of the Corporation obtained shareholder approval for the adoption of a Stock Option Plan of the Corporation in compliance with the rules and regulations of the TSX. A “Change of Control” is defined in the Stock Option Plan to mean the occurrence of any one (1) or more of the following:

| (a) | a consolidation, merger, amalgamation, arrangement or other reorganization or acquisition involving the Corporation or any of its affiliates and another corporation or other entity, as a result of which the holders of Common Shares prior to the completion of the transaction hold less than fifty percent (50%) of the outstanding shares of the successor corporation after completion of the transaction; |

16

Table of Contents

| (b) | the sale, lease, exchange or other disposition, in a single transaction or a series of related transactions, of assets, rights or properties of the Corporation and/or any of its subsidiaries which have an aggregate book value greater than thirty percent (30%) of the book value of the assets, rights and properties of the Corporation and its subsidiaries on a consolidated basis to any other person or entity, other than a disposition to a wholly-owned subsidiary of the Corporation in the course of a reorganization of the assets of the Corporation and its subsidiaries; |

| (c) | a resolution is adopted to wind up, dissolve or liquidate the Corporation; |

| (d) | any person, entity or group of persons or entities acting jointly or in concert (an “Acquiror”) acquires or acquires control (including, without limitation, the right to vote or direct the voting) of Voting Securities of the Corporation which, when added to the Voting Securities owned of record or beneficially by the Acquiror or which the Acquiror has the right to vote or in respect of which the Acquiror has the right to direct the voting, would entitle the Acquiror and/or associates and/or affiliates of the Acquiror to cast or to direct the casting of twenty percent (20%) or more of the votes attached to all of the Corporation’s outstanding Voting Securities which may be cast to elect directors of the Corporation or the successor corporation (regardless of whether a meeting has been called to elect directors); |

| (e) | as a result of or in connection with: (i) a contested election of directors; or (ii) a consolidation, merger, amalgamation, arrangement or other reorganization or acquisition involving the Corporation or any of its affiliates and another corporation or other entity, the nominees named in the most recent management information circular of the Corporation for election to the Board shall not constitute a majority of the Board; or |

| (f) | the Board adopts a resolution to the effect that a Change of Control as defined herein has occurred or is imminent. |

For the purposes of the foregoing, “Voting Securities” means Common Shares and any other shares entitled to vote for the election of directors of the Corporation and shall include any security, whether or not issued by the Corporation, which are not shares entitled to vote for the election of directors of the Corporation but are convertible into or exchangeable for shares which are entitled to vote for the election of directors of the Corporation including any options or rights to purchase such shares or securities.

In the event of a Change of Control as defined under the Stock Option Plan, all stock options granted pursuant to the terms of the Stock Option Plan (includes, Incentive Stock Options and Non-Qualified Stock Options, collectively, as defined herein), shall be immediately exercisable, and the expiry date of such options shall remain the same. Thus, any unvested options granted pursuant to the terms of the Stock Option Plan would immediately vest in the event of a Change of Control. If a Change of Control, as defined under the Stock Option Plan, had occurred and any unvested options held by Named Executive Officers or directors vested effective December 31, 2011, no value would be realized as the closing price per Common Share on December 30, 2011 (the last trading day of the 2011 calendar year), of Cdn $0.64, is less than the exercise price of unvested options held.

Director Compensation

The Compensation Committee reviews and makes recommendations to the Board with respect to compensation of the Board and committee members. Directors who are employees of the Corporation receive no compensation for service as members of the Board. Directors who are not also employees (“Non-Employee Directors”) are entitled to receive an annual retainer of $60,000. Beginning in February 2012, each Non-Employee Director is also entitled to receive additional cash compensation in the amount of $5,000 per month in recognition of the time and effort required with respect to the Corporation’s strategic review.

17

Table of Contents

From time to time Non-Employee Directors are also granted options. Pursuant to our policies, we also reimburse our directors for reasonable expenses incurred in the performance of their duties, including reimbursement for air travel and hotel expenses.

Director Compensation Table

The following table sets forth information in respect of all amounts of compensation provided to the directors during the Corporation’s financial year ended December 31, 2011.

| Name(1) |

Fees

earned ($) |

Share- based awards ($) |

Option- based awards(2)(3) ($) |

Non-equity incentive plan compensation ($) |

Pension value ($) |

All

other compensation ($) |

Total ($) |

|||||||||||||||||||||

| Brian E. Bayley(4) |

60,000 | — | 42,815 | Nil | Nil | Nil | 102,815 | |||||||||||||||||||||

| W. A. (Alf) Peneycad(4) |

60,000 | — | 42,815 | Nil | Nil | Nil | 102,815 | |||||||||||||||||||||

| Robert L. Redfearn(4) |

60,000 | — | 42,815 | Nil | Nil | Nil | 102,815 | |||||||||||||||||||||

| William Gumma(5) |

30,461 | — | 94,383 | Nil | Nil | Nil | 128,844 | |||||||||||||||||||||

Notes:

| (1) | Compensation for Mr. Cottman, CEO and a director of the Corporation and Dr. Hagen, President and a director of the Corporation during the Corporation’s financial year ended December 31, 2011, has been previously provided under “Summary Compensation”. |

| (2) | The value of the option-based awards represents the fair value, on the date of grant, of awards under the Stock Option Plan of the Corporation. The grant date fair value has been calculated using the Black Scholes Merton model and reflects assumptions for risk-free interest rate, expected life, expected stock price volatility and expected dividend yield. The Corporation chose this methodology because it is recognized as the most common methodology used for valuing options and doing value comparisons. (See “Consolidated Financial Statements” – Note 10.) |

| (3) | The 2011 stock options awarded in Canadian dollars and exercise prices are also in Canadian dollars. The dollar amounts for the stock options awarded to Messrs. Bayley, Peneycad and Redfearn are based on the exchange rate as at January 25, 2011 of Cdn $1.00 = $1.0053. The dollar amounts for the stock options awarded to Mr. Gumma are based on the exchange rate as at June 24, 2011 of Cdn $1.00 = $1.02444. |

| (4) | Appointed as a director of the Corporation on September 4, 2009 in connection with the completion of the Legacy Acquisition. |

| (5) | Elected as a director of the Corporation on June 24, 2011. |

Outstanding Share-Based Awards and Option-Based Awards

The following table sets forth information in respect of all share-based awards and option-based awards outstanding at the end of the financial year ended December 31, 2011 to the directors of the Corporation.

Outstanding Share-Based Awards and Option-Based Awards

at the end of the Financial Year Ended December 31, 2011

| Option-based Awards | Share-based Awards | |||||||||||||||||||||

| Name(4) |

Number

of securities underlying unexercised options (#) |

Option exercise price (Cdn$) |

Option expiration date |

Value of

unexercised in-the-money options (Cdn $)(1) |

Number of shares or units of shares that have not vested (#) |

Market or payout value of share-based awards that have not vested ($) |

||||||||||||||||

| Brian E. Bayley(2) |

|

100,000 45,000 |

|

|

1.25 1.64 |

|

September 4, 2019 January 25, 2016 |

|

— — |

|

Nil | Nil | ||||||||||

| W. A. (Alf) Peneycad(2) |

|

100,000 45,000 |

|

|

1.25 1.64 |

|

September 4, 2019 January 25, 2016 |

|

— — |

|

Nil | Nil | ||||||||||

| Robert L. Redfearn(2) |

|

100,000 45,000 |

|

|

1.25 1.64 |

|

September 4, 2019 January 25, 2016 |

|

— — |

|

Nil | Nil | ||||||||||

| William Gumma(3) |

|

30,000 100,000 |

|

|

1.25 1.61 |

|

December 1, 2019 June 24, 2016 |

|

— — |

|

Nil | Nil | ||||||||||

18

Table of Contents

Notes:

| (1) | The closing market price of the Common Shares on December 30, 2011, being the last trading day of the 2011 calendar year, was Cdn $0.64. |

| (2) | Appointed as a director of the Corporation on September 4, 2009 in connection with the completion of the Legacy Acquisition. |

| (3) | Elected as a director of the Corporation on June 24, 2011. |

| (4) | Compensation for Mr. Cottman, CEO and a director of the Corporation and Dr. Hagen, President and a director of the Corporation during the Corporation’s financial year ended December 31, 2011, has been previously provided under “Summary Compensation”. |

Incentive Plan Awards – Value Vested or Earned During the Year

The following table sets forth information in respect of the value vested or earned during the Corporation’s financial year ended December 31, 2011 of option-based awards, share-based awards and non-equity incentive plan compensation for directors of the Corporation.

Value Vested or Earned of Incentive Plan Awards

during the Financial Year Ended December 31, 2011

| Name(4) | Option-based awards – Value vested during the year (1) ($) |

Share-based awards – Value vested during the year ($) |

Non-equity incentive plan compensation – Value earned during the year ($) |

|||||||||

| Brian E. Bayley(2) |

22,913 | Nil | Nil | |||||||||

| W. A. (Alf) Peneycad(2) |

22,913 | Nil | Nil | |||||||||

| Robert L. Redfearn(2) |

22,913 | Nil | Nil | |||||||||

| William Gumma(3) |

7,319 | Nil | Nil | |||||||||

Notes:

| (1) | The value of the option-based awards represents the fair value, on the date of grant, of awards under the Stock Option Plan of the Corporation. The grant date fair value has been calculated using the Black Scholes Merton model and reflects assumptions for risk-free interest rate, expected life, expected stock price volatility and expected dividend yield. The Corporation chose this methodology because it is recognized as the most common methodology used for valuing options and doing value comparisons. (See Consolidated Financial Statements – Note 10.) |

| (2) | Appointed director of the Corporation on September 4, 2009 in connection with the completion of the Legacy Acquisition. |

| (3) | Elected as a director of the Corporation on June 24, 2011. |

| (4) | Compensation for Mr. Cottman, CEO and a director of the Corporation and Dr. Hagen, formerly a President and a director of the Corporation during the Corporation’s financial year ended December 31, 2011, has been previously provided under “Summary Compensation”. |

Stock Option Plan

On July 16, 2009, management of the Corporation obtained shareholder approval for the adoption of the Stock Option Plan in compliance with the rules and regulations of the TSX. A copy of the Stock Option Plan is attached to the Management Information Circular of the Corporation, dated June 17, 2009, available on the internet under the Corporation’s SEDAR profile at www.sedar.com.