Attached files

| file | filename |

|---|---|

| EX-1.1 - FORM OF UNDERWRITING AGREEMENT - EXTEND HEALTH INC | d211158dex11.htm |

| EX-4.1 - SPECIMEN COMMON STOCK CERTIFICATE OF THE REGISTRANT - EXTEND HEALTH INC | d211158dex41.htm |

| EX-10.2 - 2004 EQUITY INCENTIVE PLAN AND FORM OF STOCK OPTION AGREEMENT - EXTEND HEALTH INC | d211158dex102.htm |

| EX-10.1 - FORM OF INDEMNIFICATION AGREEMENT - EXTEND HEALTH INC | d211158dex101.htm |

| EX-10.3 - 2007 EQUITY INCENTIVE PLAN AND FORM OF STOCK OPTION AGREEMENT - EXTEND HEALTH INC | d211158dex103.htm |

| EX-21.1 - LIST OF SUBSIDIARIES OF THE REGISTRANT - EXTEND HEALTH INC | d211158dex211.htm |

| EX-23.1 - CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - EXTEND HEALTH INC | d211158dex231.htm |

| EX-10.16 - EXECUTIVE INCENTIVE COMPENSATION PLAN - EXTEND HEALTH INC | d211158dex1016.htm |

| EX-10.4 - 2012 EQUITY INCENTIVE PLAN AND FORM OF AWARD AGREEMENT - EXTEND HEALTH INC | d211158dex104.htm |

Table of Contents

As filed with the Securities and Exchange Commission on April 30, 2012

Registration No. 333-178910

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 3

TO

FORM S-1

REGISTRATION STATEMENT

Under

The Securities Act of 1933

EXTEND HEALTH, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 6411 | 26-0775680 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

2929 Campus Drive, Suite 400

San Mateo, California 94403

(650) 288-4800

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Bryce A. Williams

President and Chief Executive Officer

2929 Campus Drive, Suite 400

San Mateo, California 94403

(650) 288-4800

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Steven E. Bochner Jon C. Avina Wilson Sonsini Goodrich & Rosati, P.C. 650 Page Mill Road Palo Alto, California 94304 (650) 493-9300 |

Thomas J. Smith General Counsel 2929 Campus Drive, Suite 400 San Mateo, California 94403 (650) 288-4800 |

Richard A. Kline Anthony J. McCusker Goodwin Procter LLP 135 Commonwealth Drive Menlo Park, California 94025 (650) 752-3100 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ | |||

| Non-accelerated filer x | (do not check if a smaller reporting company) | Smaller reporting company ¨ | ||

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

PROSPECTUS (Subject to Completion)

Issued April 30, 2012

Shares

COMMON STOCK

Extend Health, Inc. is offering shares of its common stock. This is our initial public offering and no public market currently exists for our shares. We anticipate that the initial public offering price of our common stock will be between $ and $ per share.

We have applied to list our common stock on The NASDAQ Global Market under the symbol “XH.”

We are an “emerging growth company” under applicable federal securities laws and will be subject to reduced public company reporting requirements.

Investing in our common stock involves risks. See “Risk Factors” beginning on page 11.

PRICE $ A SHARE

| Price to Public |

Underwriting Discounts and Commissions |

Proceeds to Extend Health | ||||

| Per Share |

$ | $ | $ | |||

| Total |

$ | $ | $ |

We have granted the underwriters the right to purchase up to an additional shares of common stock to cover over-allotments, exercisable at any time until 30 days after the date of this prospectus.

The Securities and Exchange Commission and state securities regulators have not approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of common stock to purchasers on , 2012.

| MORGAN STANLEY | BARCLAYS |

WELLS FARGO SECURITIES

, 2012

Table of Contents

Table of Contents

You should rely only on the information contained in this prospectus or contained in any free writing prospectus prepared by or on behalf of us. Neither we nor the underwriters have authorized anyone to provide you with information different from, or in addition to, that contained in this prospectus or any related free writing prospectus. This prospectus is an offer to sell only the shares offered hereby but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date, regardless of its delivery. Our business, financial condition, results of operations and prospects may have changed since that date.

Through and including , 2012 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

For investors outside the United States: neither we nor any of the underwriters have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

-i-

Table of Contents

This summary highlights selected information appearing elsewhere in this prospectus and is qualified in its entirety by the more detailed information and financial statements included elsewhere in this prospectus. This summary may not contain all the information you should consider before investing in our common stock. You should carefully read this prospectus in its entirety before investing in our common stock, including “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes included elsewhere in this prospectus.

EXTEND HEALTH, INC.

Overview

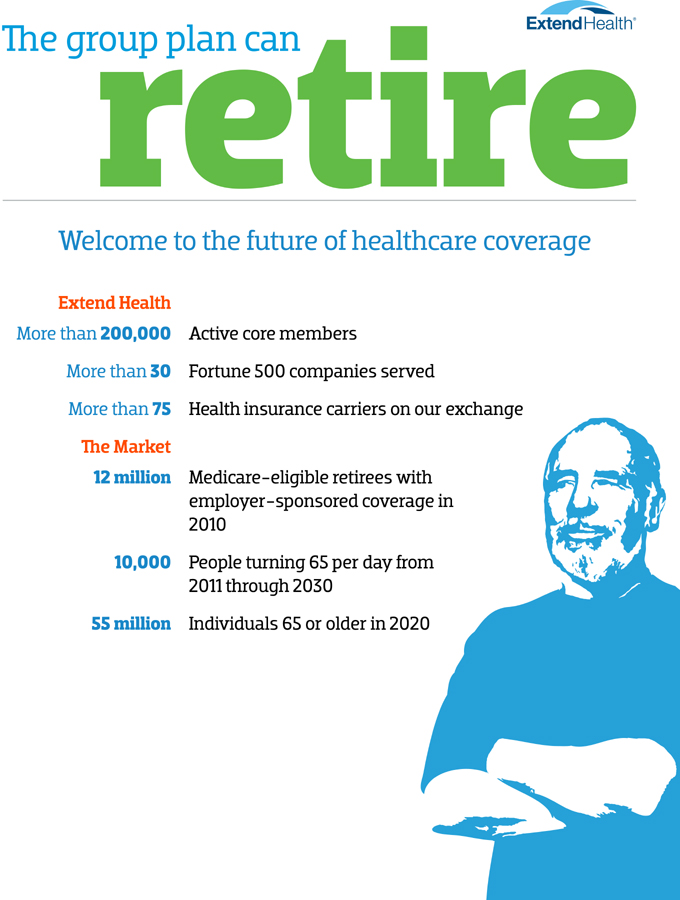

Extend Health is a leading provider of health benefit management services and operates the largest private Medicare exchange in the United States. As a technology leader in the health insurance industry, we are redefining the manner in which health benefits are offered and delivered. Our solutions create cost savings for our employer clients and provide our individual customers with improved choice and control over their health benefits. Our core solution, ExtendRetiree, enables our employer clients to transition their retirees to individual, defined contribution health plans that provide individuals with a tax-free allowance or “contribution” to spend on their healthcare at an annual cost that the employer controls versus group-based, defined benefit health plans that provide groups of individuals with defined healthcare benefits such as doctor visits, hospitalization and prescription drugs at an uncertain annual cost. ExtendRetiree allows our clients to provide their post-65 retirees with the same or better healthcare benefits at a lower cost to our clients. To date, we have provided an effective alternative to traditional group Medicare health plans for over 150 private and public sector clients, including over 30 Fortune 500 companies such as Caterpillar, General Motors, Honeywell and Whirlpool, and we have helped hundreds of thousands of retirees and their dependents navigate to, evaluate and choose a health plan using our proprietary exchange platform and decision support tools. In addition, we are developing and expanding our solutions to address the pre-65 retiree, or early retiree, and active employee exchange opportunities for our existing and prospective clients.

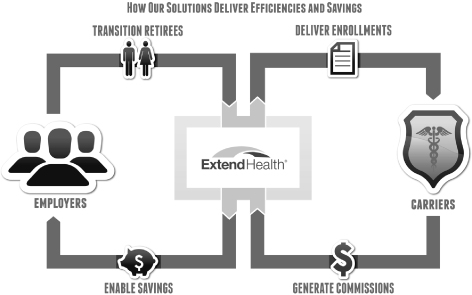

We provide our solutions through our proprietary technology platform, which integrates our patented call-routing technology, efficient Medicare quoting and enrollment engine, custom-developed CRM system and comprehensive insurance carrier connectivity. We deliver our solutions by:

| • | analyzing and optimizing employer healthcare benefit subsidies and developing healthcare coverage strategies so that our clients can predict their future healthcare liabilities and realize immediate and significant cost savings by transitioning their retirees to defined contribution plans; |

| • | managing an exchange of over 75 national and regional insurance carriers offering thousands of health plans that compete on price, coverage and quality; |

| • | simplifying the complexities of Medicare by helping individuals navigate through a meaningful choice of health plans using our proprietary software to analyze employer subsidies, health plan details and individuals’ doctor, hospital and prescription drug needs; |

| • | offering retirees and employees unbiased guidance about their expanded healthcare options and our enrollment services that match their individual health status and financial resources to a specific plan; and |

| • | providing lifelong advocacy and support services for each individual as they engage with insurance carriers beginning with their initial enrollment and continuing as their healthcare needs evolve. |

-1-

Table of Contents

While we have provided health benefit management services to hundreds of thousands of retirees and their dependents, our core market opportunity remains largely unaddressed, with an estimated 12 million Medicare-eligible retirees currently receiving some form of employer-sponsored group Medicare coverage. Moreover, we believe that this market will grow significantly as the number of Americans over age 65 continues to grow.

We believe there are significant opportunities to further penetrate our core market and expand into new target markets. For instance, we are broadening our presence among public sector employers, such as through our engagement with the State of Nevada to transition its 10,000 retirees to individual Medicare plans. In addition, we are developing and expanding our solutions to address the early retiree and active employee markets.

We generate most of our revenue from the commissions that we receive from insurance carriers for enrolling individuals into their health plans. These commissions result in increasing recurring revenue as our number of active members grows. The vast majority of our revenue is currently derived from Medicare-related plans, including Medicare supplement, Medicare Advantage and Medicare Part D prescription drug plans. As of March 31, 2012, we had 213,900 active core members enrolled in a Medicare supplement or Medicare Advantage plan. Our revenue has grown from $12.4 million in the fiscal year ended June 30, 2008 to $51.1 million in the fiscal year ended June 30, 2011.

Healthcare Trends Driving Demand for our Health Benefit Management Solutions

We expect that several trends will continue to expand our market opportunities, including:

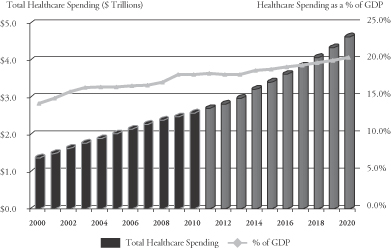

| • | Increasing healthcare costs. Healthcare-related costs have become one of the largest benefit-related expenses for employers. The Centers for Medicare and Medicaid Services, or CMS, estimates that in 2009 private and public sector employers spent $548 billion on healthcare coverage, nearly doubling over the previous 10 years. According to a 2011 Towers Watson report, the cost of insuring employees is projected to have increased by 38% from 2006 to 2011. |

| • | Increasing individual responsibility for healthcare costs. In response to rising healthcare costs, many group-based health plans have reduced benefits, shifted costs to retirees and employees, or both. CMS estimates that private health insurance expenditures increased by 91% from 1999 to 2009. According to a 2011 Towers Watson report, the average individual’s share of their total healthcare premium was estimated to have reached 24% in 2011. Furthermore, while healthcare costs have become a top household expense, there has not been a corresponding increase in control and choice over individual healthcare options. |

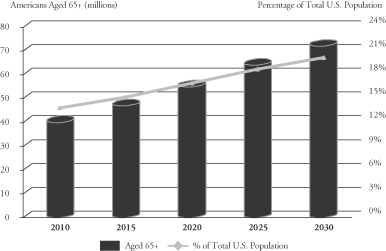

| • | Aging population. According to the U.S. Census, from 2011 through 2030 an estimated 10,000 individuals per day will reach the age of 65 and become eligible for Medicare. The number of individuals who are over the age of 65 is expected to increase from approximately 40.2 million individuals in 2010, or 13% of the U.S. population, to approximately 54.8 million individuals by 2020, or 16% of the U.S. population. Moreover, post-65 individuals are becoming increasingly comfortable using technology to research personal healthcare information. |

| • | Increasing incentives for employers to eliminate group retiree drug benefits. In 2013, employers’ tax deduction for the Retiree Drug Subsidy, or the RDS, will be eliminated, thereby increasing employers’ cost of providing prescription drug coverage to retirees using group-based health plans. In addition, while there has historically been a gap in Medicare’s prescription drug coverage, upcoming changes to Medicare Part D will gradually eliminate this gap by 2020. We believe that the elimination of the tax-deductibility of the RDS together with the closing of the gap in Medicare Part D prescription drug coverage will make individual Medicare plans more attractive to employers and retirees. |

| • | Healthcare reform. Over the past decade, certain Federal legislation in the United States, such as the Medicare Modernization Act and the Medicare Improvement for Patients and Providers Act, has |

-2-

Table of Contents

| strengthened the foundation on which we have built our business model. More recent healthcare reform legislation requires that states establish health insurance exchanges where individuals can select and purchase health plans. In addition, just as private Medicare plans are required to do today, healthcare reform will require insurance carriers to offer standardized plan designs and accept all pre-65 individuals, regardless of their age or health status, which is referred to as “guaranteed issue.” While healthcare reform involves uncertainty and may be modified or repealed, we believe that these healthcare reform measures will accelerate the adoption of exchanges, further enabling the transition of healthcare in the United States from group-based coverage to individual plans. |

Our Solutions

We believe our solutions offer employers and retirees a new experience with managing healthcare benefits. Our proprietary technology platform delivers our integrated solutions to our clients, customers and carrier partners through a multi-step process that starts with an actuarial assessment for a prospective employer client to determine the financial benefits of transitioning their retirees to ExtendRetiree. This analysis determines the optimal subsidy levels needed from the employer to support the transition of its retirees from their existing group-based health plan to individual health plans and enables employers to accurately quantify the expected reduction in their long-term healthcare financial obligations.

Once our employer clients have determined optimal subsidy levels, our proprietary software securely gathers and assimilates personal healthcare data from our clients and their retirees, as well as health plan information from our insurance carrier partners to ensure a smooth enrollment process. Concurrently, we work with our employer clients to design a communication campaign to educate their retirees about the transition from their current group health plan to individual health plans.

With the client and customer data integrated into our system, our patented call-routing technology provides our licensed benefit advisors with immediate access to a retiree’s profile that includes personalized information about the retiree’s healthcare needs and available subsidy. Our proprietary decision support tools then present the benefit advisor with a selection of health plans that has been optimized for the retiree’s unique healthcare needs. The benefit advisor then helps the retiree select and enroll in a plan by guiding the retiree through our streamlined application process.

The retiree’s application is then transmitted through our efficient and secure electronic exchange to the selected insurance carrier, allowing our customers to monitor the status of their application throughout the enrollment process. Our comprehensive platform also provides our clients with regular reports with which they can track their retiree enrollment metrics.

Our solutions enable our employer clients to:

| • | move to a more sustainable economic model by capping and controlling the costs associated with offering healthcare benefits to their retirees while continuing to honor their healthcare commitments; |

| • | eliminate the burden of procuring and administering inefficient group health plans for geographically dispersed retirees; and |

| • | ensure a smooth transition for their retirees from group-based to individual health plans by providing access to a health insurance exchange and a dedicated implementation team that delivers a complete suite of services, communication materials and education. |

Our solutions enable our individual customers to:

| • | compare a broad selection of insurance carriers, health plans and related provider networks unavailable from any single group plan; |

-3-

Table of Contents

| • | optimize their employer subsidy and choose a health plan that best meets their needs, using our plan comparison and selection tools to obtain quotes by plan type; and |

| • | receive ongoing unbiased guidance, enrollment services, advocacy and support from our trained and licensed benefit advisors. |

Our Strengths

We believe that we have the following key competitive strengths:

| • | Proprietary exchange platform. Our proprietary exchange platform integrates our patented call-routing technology, proprietary Medicare quoting and enrollment engine, custom-developed CRM system and comprehensive insurance carrier connectivity. We believe that our technology platform has enabled us to become the largest private Medicare exchange in the United States. |

| • | Attractive, proven business model and trusted brand name. Our high customer retention rate and commission-based revenue model produces a stable and recurring revenue stream. We have extensive experience having transitioned hundreds of thousands of retirees from more than 150 private and public sector employers and unions, including large employers such as General Motors and the State of Nevada. Our historical client retention rate exceeds 95% with our core solution, ExtendRetiree, which is a testament to our trusted brand name and exceptional service and support. |

| • | Strong relationships with a large number of insurance carriers. We offer our customers access to a broad selection of health plans from insurance carriers with which we have developed relationships over the past seven years. Our solutions are integrated with the information systems of our insurance carrier partners, which we believe results in a better customer experience, reduced customer turnover and greater efficiency for the insurance carriers. |

| • | Experienced management team. Our management team has significant experience in the health insurance and healthcare technology industries, and with using new business models to deliver healthcare benefits more efficiently. Our leadership efforts have resulted in a reputation for the development of innovative solutions that meet the future needs of the dynamic, evolving U.S. healthcare system. |

Our Growth Strategies

Our objective is to become the health benefit manager of choice for private and public sector employers, post-65 and early retirees and active employees. Our principal strategies to meet our objective are:

| • | Expand market share within the private sector in our core market. With an estimated 6.2 million retirees who have a health plan sponsored by their private sector employer, we believe there is a large opportunity to expand our market share in the private sector employer market. We intend to aggressively pursue opportunities to help private sector employers transition their retirees to individual health plans using our proprietary exchange platform. |

| • | Increase our presence in the public sector. With an estimated 5.8 million retirees who have a health plan sponsored by their public sector employer, we believe there is a significant opportunity to expand our market share in the public sector employer market. We are leveraging our private sector experience and initial public sector engagements to capture the growing demand by public sector employers for solutions to their state budget shortfalls and growing unfunded retiree liabilities. |

| • | Extend our technology leadership position. Our proprietary technology platform is a key competitive advantage that allows us to address our clients’ and customers’ healthcare benefit needs. We continue to innovate and invest in our software platform, call-routing technology, Medicare quoting and |

-4-

Table of Contents

| enrollment engine, CRM system and insurance carrier connectivity, as we believe these investments will allow us to extend our technology leadership position. |

| • | Maximize our existing channel partner strategy and add new channel partners. We have established partnerships with leading health and welfare benefit consultants and brokers, including Gallagher, Lockton, Mercer, Towers Watson, Wells Fargo Insurance Services and Willis. We intend to leverage our existing channel partners and add additional channel partners to gain deeper and broader access to potential clients in both the private and public sectors. |

| • | Cultivate a retail sales channel. There are approximately 32 million retirees participating in the Medicare program with no employer subsidy. We have begun to adapt our sales and marketing strategy to target these retail customers directly through a variety of consumer-centric media. We believe that this retail sales channel will continue to grow as more Americans turn age 65, affording us direct access to a broader base of potential customers. |

| • | Expand into new markets. We expect the demand for individual, defined contribution plans to grow beyond the Medicare market and are targeting these new opportunities. Initially, we are expanding our solution to help control employers’ early retiree healthcare costs. By building on our solutions for retirees, we also intend to offer solutions for our clients’ active employees. Finally, we are actively pursuing opportunities to work with various states to help them implement the state exchanges mandated by healthcare reform. |

Risks Affecting Us

Our business is subject to numerous risks and uncertainties. Please see “Risk Factors” immediately following this prospectus summary, which describes all of the significant risks of which we are aware. These risks include, but are not limited to, the following:

| • | We have a limited operating history in a new and rapidly evolving industry, which makes it difficult to evaluate our current business and future prospects and may increase the risk of your investment. |

| • | The marketing and sale of Medicare plans are subject to numerous, complex and frequently changing laws and regulations, and the impact of changes in laws related to Medicare or any failure to comply with them could harm our business, results of operations and financial condition. |

| • | If we are unable to retain our members, our business and results of operations would be harmed. |

| • | Our business may be harmed if we lose our relationships with insurance carriers, fail to maintain good relationships with insurance carriers, become dependent upon a limited number of insurance carriers or fail to develop new insurance carrier relationships. |

| • | Insurance carriers could reduce the commissions paid to us or change their plan pricing practices in ways that reduce the commissions paid to us, which could harm our revenue and results of operations. |

| • | Changes and developments in the health insurance system in the United States could harm our business. |

| • | Our results of operations fluctuate depending upon insurance carrier payment and reporting practices and the timing of our receipt of commission payments from insurance carriers. |

| • | Our two largest stockholders, Psilos Group and Revolution Extend Holdings, LLC, collectively will own % of our outstanding capital stock and will continue to have effective control over our management and affairs and other matters requiring stockholder approval after the completion of this offering. |

-5-

Table of Contents

If we are unable to adequately address these and other risks we face, our business, financial condition, results of operations and prospects may be harmed. In addition, there are numerous risks related to an investment in our common stock. You should carefully consider the risks described in “Risk Factors” and elsewhere in this prospectus.

Corporate History and Information

We were incorporated in April 2002 as a Delaware limited liability company. In July 2007, we became Extend Health, Inc., a Delaware corporation. Our principal executive offices are located at 2929 Campus Drive, Suite 400, San Mateo, California 94403, and our telephone number is (650) 288-4800. Our website address is www.extendhealth.com. Information contained on our website is not incorporated by reference into this prospectus, and you should not consider any information contained on, or that can be accessed through, our website as part of this prospectus or in deciding whether to purchase shares of our common stock.

“ExtendRetiree,” “ExtendAccess,” “ExtendExchange” and “Extend University” are registered or common law trademarks or service marks of Extend Health, Inc. This prospectus also contains additional trade names, trademarks, and service marks of ours and of other companies. We do not intend our use or display of other companies’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, these other companies. We have omitted the ® and ™ designations, as applicable, for the trademarks we name in this prospectus.

-6-

Table of Contents

| Common stock offered by us |

shares | |

| Common stock to be outstanding after this offering |

shares | |

| Over-allotment option to be offered by us |

shares | |

| Use of proceeds |

We intend to use the net proceeds from this offering for working capital and general corporate purposes, including expansion of our sales and marketing activities and capital expenditures. We also intend to use a portion of the net proceeds to repay some or all of our debt obligations. In addition, we may use a portion of the net proceeds to acquire complementary businesses, products, services or technologies. See “Use of Proceeds.” | |

| Risk factors |

See “Risk Factors” and the other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our common stock. | |

| Proposed NASDAQ symbol |

“XH” | |

The number of shares of our common stock to be outstanding after this offering is based on 16,296,745 shares of our common stock outstanding as of March 31, 2012, and excludes:

| • | 3,050,438 shares of common stock issuable upon the exercise of options outstanding as of March 31, 2012, with a weighted-average exercise price of $1.43 per share; |

| • | 948,011 shares of common stock that may be issuable upon the exercise of an outstanding warrant to purchase common stock, with an exercise price of $10.00 per share; |

| • | 13,750 shares of common stock issuable upon the exercise of options granted subsequent to March 31, 2012, with an exercise price of $9.15 per share; and |

| • | 1,939,059 unallocated shares of common stock reserved for future issuance under our stock-based compensation plans, consisting of (i) 139,059 shares of common stock reserved for future issuance under our 2007 Equity Incentive Plan (not including the options to purchase 13,750 shares of common stock granted subsequent to March 31, 2012) and (ii) 1,800,000 shares of common stock reserved for future issuance under our 2012 Equity Incentive Plan, which will become effective in connection with this offering, and shares that become available under our 2012 Equity Incentive Plan, pursuant to provisions thereof that automatically increase the share reserves under this plan each year, as more fully described in “Executive Compensation—Employee Benefit and Stock Plans.” |

Unless otherwise noted, the information in this prospectus reflects and assumes the following:

| • | the conversion of all outstanding shares of our convertible preferred stock into an aggregate of 14,749,992 shares of common stock immediately prior to the completion of this offering; |

| • | the filing of our amended and restated certificate of incorporation in connection with the completion of this offering; |

| • | the adjustment of outstanding stock options as described in “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Dividend-Related Option Adjustments”; and |

| • | no exercise of the underwriters’ over-allotment option. |

-7-

Table of Contents

SUMMARY CONSOLIDATED FINANCIAL DATA

The following tables summarize our consolidated financial data for the periods presented. We derived the consolidated statements of operations data for the years ended June 30, 2009, 2010 and 2011 from our audited consolidated financial statements included elsewhere in this prospectus. The unaudited consolidated statements of operations data for the nine months ended March 31, 2011 and 2012, and the unaudited consolidated balance sheet data as of March 31, 2012, are derived from our unaudited consolidated financial statements included elsewhere in this prospectus. We have prepared the unaudited financial information on the same basis as the audited consolidated financial statements and have included, in our opinion, all adjustments, consisting only of normal recurring adjustments that we consider necessary for a fair presentation of the financial information set forth in those statements. You should read this summary consolidated financial data in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes, all included elsewhere in this prospectus. Our historical results are not necessarily indicative of the results that may be expected in the future.

| Year Ended June 30, | Nine Months Ended March 31, |

|||||||||||||||||||

| 2009 | 2010 | 2011 | 2011 | 2012 | ||||||||||||||||

| (in thousands, except share and per share amounts) | ||||||||||||||||||||

| Consolidated Statements of Operations Data: |

||||||||||||||||||||

| Revenue: |

||||||||||||||||||||

| Commissions |

$ | 16,933 | $ | 43,646 | $ | 50,451 | $ | 35,716 | $ | 48,411 | ||||||||||

| Other |

779 | 370 | 676 | 442 | 468 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total revenue |

17,712 | 44,016 | 51,127 | 36,158 | 48,879 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating expenses: |

||||||||||||||||||||

| Service center |

18,117 | 14,994 | 18,551 | 15,050 | 19,955 | |||||||||||||||

| Sales and marketing |

6,768 | 7,290 | 10,134 | 6,346 | 10,856 | |||||||||||||||

| Technology |

2,096 | 3,060 | 3,195 | 2,242 | 3,264 | |||||||||||||||

| General and administrative |

5,072 | 5,464 | 6,728 | 5,043 | 5,974 | |||||||||||||||

| Restructuring expense |

— | 314 | — | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total operating expenses |

32,053 | 31,122 | 38,608 | 28,681 | 40,049 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) from operations |

(14,341 | ) | 12,894 | 12,519 | 7,477 | 8,830 | ||||||||||||||

| Interest income |

58 | 28 | 53 | 35 | 30 | |||||||||||||||

| Interest expense |

(80 | ) | (69 | ) | (110 | ) | (81 | ) | (323 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (loss) before income taxes |

(14,363 | ) | 12,853 | 12,462 | 7,431 | 8,537 | ||||||||||||||

| Provision for income taxes |

2 | 346 | 2,505 | 575 | 3,313 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) |

$ | (14,365 | ) | $ | 12,507 | $ | 9,957 | $ | 6,856 | $ | 5,224 | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) attributable to common stockholders(1)(2): |

||||||||||||||||||||

| Basic |

$ | (14,365 | ) | $ | 280 | $ | 676 | $ | 395 | $ | (30,345 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Diluted |

$ | (14,365 | ) | $ | 821 | $ | 1,139 | $ | 635 | $ | (30,345 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net income (loss) per share attributable to common stockholders(1): |

||||||||||||||||||||

| Basic |

$ | (72.01 | ) | $ | 0.67 | $ | 0.47 | $ | 0.28 | $ | (19.95 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Diluted |

$ | (72.01 | ) | $ | 0.64 | $ | 0.44 | $ | 0.27 | $ | (19.95 | ) | ||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

-8-

Table of Contents

| Year Ended June 30, | Nine Months Ended March 31, |

|||||||||||||||||||

| 2009 | 2010 | 2011 | 2011 | 2012 | ||||||||||||||||

| (in thousands, except share and per share amounts) | ||||||||||||||||||||

| Weighted-average shares used to compute net income (loss) per share attributable to common stockholders(1): |

||||||||||||||||||||

| Basic |

199,495 | 414,615 | 1,424,511 | 1,394,005 | 1,521,353 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Diluted |

199,495 | 1,288,140 | 2,569,722 | 2,378,444 | 1,521,353 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Cash dividend declared per common share |

$ | — | $ | — | $ | — | $ | — | $ | 2.25 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Pro forma net income per share attributable to common stockholders (unaudited)(1): |

||||||||||||||||||||

| Basic |

$ | $ | ||||||||||||||||||

|

|

|

|

|

|||||||||||||||||

| Diluted |

$ | $ | ||||||||||||||||||

|

|

|

|

|

|||||||||||||||||

| Pro forma weighted-average shares used to compute pro forma net income per share attributable to common stockholders (unaudited)(1): |

||||||||||||||||||||

| Basic |

||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||

| Diluted |

||||||||||||||||||||

|

|

|

|

|

|||||||||||||||||

| Other Financial and Operational Data: |

||||||||||||||||||||

| Active core members (end of period)(3) |

97,600 | 126,000 | 161,700 | 163,000 | 213,900 | |||||||||||||||

| Pending core members (end of period)(3) |

800 | 2,000 | 10,500 | 1,500 | 7,900 | |||||||||||||||

| Core applications submitted(3) |

73,600 | 50,000 | 60,700 | 49,800 | 61,800 | |||||||||||||||

| Adjusted EBITDA(4) |

$ | (13,259 | ) | $ | 14,819 | $ | 14,913 | $ | 9,270 | $ | 11,206 | |||||||||

| (1) | See Note 13 to our consolidated financial statements for further details on the calculation of basic and diluted net income (loss) per share attributable to common stockholders and for a discussion and reconciliation of pro forma net income per share attributable to common stockholders. |

| (2) | The net income (loss) attributable to common stockholders for the nine months ended March 31, 2012 includes a $35.6 million adjustment for dividends distributed to preferred stockholders during the period. See Note 13 to our consolidated financial statements for further details regarding the adjustments applied in the calculation of basic and diluted net income (loss) per share attributable to common stockholders. |

| (3) | See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Key Business Metrics” for a discussion of active and pending core members and core applications submitted. |

| (4) | See “Adjusted EBITDA” below for a discussion regarding the use of adjusted EBITDA as a financial measure and for a reconciliation to net income (loss), the most directly comparable GAAP financial measure. |

| As of March 31, 2012 | ||||||||||||

| Actual | Pro Forma(1) | Pro Forma As Adjusted(2)(3) |

||||||||||

| Consolidated Balance Sheet Data: |

||||||||||||

| Cash and cash equivalents and short-term investments |

$ | 13,261 | $ | 13,261 | $ | |||||||

| Working capital (deficit) |

(8,994 | ) | (8,994 | ) | ||||||||

| Total assets |

21,492 | 21,492 | ||||||||||

| Total indebtedness(4) |

10,168 | 10,168 | ||||||||||

| Convertible preferred stock |

22,539 | — | ||||||||||

| Total stockholders’ deficit |

(35,322 | ) | (12,783 | ) | ||||||||

| (1) | The pro forma balance sheet data in the table above reflects the automatic conversion of all outstanding shares of convertible preferred stock into common stock prior to the completion of this offering. |

| (2) | The pro forma as adjusted balance sheet data in the table above reflects (i) the automatic conversion of convertible preferred stock described immediately above plus (ii) the sale of shares of our common stock in this offering at an assumed initial public offering |

-9-

Table of Contents

| price of $ per share, the midpoint of the range set forth on the front cover of this prospectus, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. |

| (3) | A $1.00 increase (decrease) in the assumed initial public offering price of $ per share would increase (decrease) cash and cash equivalents, and working capital, total assets and total stockholders’ equity (deficit) by $ million, assuming that the number of shares offered by us, as set forth on the front cover of this prospectus, remains the same, and after deducting estimated underwriting discounts and commissions payable by us. The pro forma as adjusted information discussed above is only illustrative and will be adjusted based on the actual public offering price and other terms of this offering determined at pricing. |

| (4) | Total indebtedness includes $9.8 million in term loans, $0.3 million in an equipment loan and $47,000 in capital lease obligations. |

Adjusted EBITDA

To provide investors with additional information regarding our financial results, we have disclosed in the table above and within this prospectus adjusted EBITDA, a non-U.S. generally accepted accounting principle, or GAAP, financial measure. We have provided a reconciliation below of adjusted EBITDA to net income (loss), the most directly comparable GAAP financial measure.

We have included adjusted EBITDA in this prospectus because it is a key measure used by our management and board of directors to understand and evaluate our core operating performance and trends, to prepare and approve our annual budget and to develop short- and long-term operational plans. In particular, the exclusion of certain expenses in calculating adjusted EBITDA can provide a useful measure for period-to-period comparisons of our core business. Accordingly, we believe that adjusted EBITDA provides useful information to investors and others in understanding and evaluating our results of operations in the same manner as our management and board of directors.

Our use of adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are:

| • | although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and adjusted EBITDA does not reflect capital expenditure requirements for such replacements or for new capital expenditures; |

| • | adjusted EBITDA does not reflect changes in, or cash requirements for, our working capital needs; |

| • | adjusted EBITDA does not consider the potentially dilutive impact of equity-based compensation; |

| • | adjusted EBITDA does not reflect tax payments that may represent a reduction in cash available to us; and |

| • | other companies, including companies in our industry, may calculate adjusted EBITDA differently, which reduces its usefulness as a comparative measure. |

Because of these limitations, you should consider adjusted EBITDA alongside other financial performance measures, including various cash flow metrics, net income (loss) and our other GAAP results. The following table presents a reconciliation of adjusted EBITDA to net income (loss) for each of the periods indicated:

| Year Ended June 30, | Nine Months Ended March 31, |

|||||||||||||||||||

| 2009 | 2010 | 2011 | 2011 | 2012 | ||||||||||||||||

| (in thousands) |

||||||||||||||||||||

| Reconciliation of Adjusted EBITDA: |

||||||||||||||||||||

| Net income (loss) |

$ | (14,365 | ) | $ | 12,507 | $ | 9,957 | $ | 6,856 | $ | 5,224 | |||||||||

| Adjustments: |

||||||||||||||||||||

| Depreciation and amortization |

1,013 | 1,831 | 2,144 | 1,636 | 1,384 | |||||||||||||||

| Provision for income taxes |

2 | 346 | 2,505 | 575 | 3,313 | |||||||||||||||

| Stock-based compensation |

69 | 94 | 250 | 157 | 992 | |||||||||||||||

| Interest income |

(58 | ) | (28 | ) | (53 | ) | (35 | ) | (30 | ) | ||||||||||

| Interest expense |

80 | 69 | 110 | 81 | 323 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA |

$ | (13,259 | ) | $ | 14,819 | $ | 14,913 | $ | 9,270 | $ | 11,206 | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

-10-

Table of Contents

Investing in our common stock is highly speculative and involves a significant degree of risk. You should consider carefully all the risks and uncertainties described below, together with all of the other information contained in this prospectus and the other documents attached or summarized herein, including, but not limited to, our consolidated financial statements and related notes, before deciding whether to purchase shares of our common stock. Many of the following risks and uncertainties relate to factors that are not within our control. If any of the following risks is realized, our business, financial condition, results of operations and prospects could be harmed. In that event, the price of our common stock could decline and you could lose part or all of your investment. Actual results could differ materially from those anticipated in the forward-looking statements as a result of any number of factors, including the risks and uncertainties described below and elsewhere in this prospectus. You should consult with your own counsel, financial advisors and accountants for advice concerning the various legal, regulatory, accounting, tax and economic considerations relating to a potential investment in our common stock.

Risks Related to Our Business

We have a limited operating history, which makes it difficult to evaluate our current business and future prospects and may increase the risk of your investment.

We have a limited operating history. Because of our limited operating history and because the health insurance industry is rapidly evolving, we have limited insight into trends that may emerge and affect our business. We may make errors in predicting and reacting to relevant business trends, which could harm our business. In addition, since we have only been offering our products and services since 2004, we have limited historical financial data. As a result of these factors, the revenue and income potential of our business is unproven, and we have only a limited operating history upon which to base an evaluation of our current business and future prospects. You should consider our business and prospects in light of the risks and difficulties we encounter in this rapidly evolving market. These risks and difficulties include our ability to, among other things:

| • | establish new or maintain existing relationships with employer clients, individual customers and insurance carriers; |

| • | increase sales of health insurance plans; |

| • | maintain compliance with applicable laws and regulations; |

| • | successfully compete with other companies that are currently in, or may in the future enter, the Medicare exchange space; |

| • | hire, integrate and retain qualified personnel; and |

| • | successfully expand our business. |

If the market for individual Medicare plans does not develop as we expect, or if we fail to address the needs of this market, our business will be harmed. Any potential opportunities that we may have to expand our business beyond post-65 retirees or into other markets may not develop. If these opportunities do not materialize or if we are not able to capture such opportunities, our business could be harmed. We may not be able to successfully address these risks and difficulties or others, including those described elsewhere in these risk factors. Failure to adequately address these risks and difficulties could materially harm our business and cause our financial condition, results of operations and prospects to suffer.

The market for insurance exchanges in the United States is relatively undeveloped and rapidly evolving, which makes it difficult to forecast adoption rates and demand for our solutions.

The market for insurance exchanges in the United States is relatively undeveloped and rapidly evolving. Accordingly, our future financial performance will depend in part on growth in this market and on our ability to

-11-

Table of Contents

adapt to emerging demands in this market. Demand for our solutions has been driven in large part by employer cost-saving efforts, recent regulatory changes, broader use of the Internet and advances in technology. It is difficult to predict with any precision employer and individual adoption rates or the future growth rate and size of our target market. The rapidly evolving nature of the market in which we operate, as well as other factors that are beyond our control, reduces our ability to accurately evaluate our long-term outlook and forecast annual performance. A reduction in demand for insurance exchanges caused by lack of employer and individual acceptance, technological challenges, competing offerings or otherwise would result in a lower revenue growth rate or decreased revenue, either of which could negatively impact our business and results of operations.

The marketing and sale of Medicare plans are subject to numerous, complex and frequently changing laws and regulations, and the impact of changes in laws related to Medicare or any failure to comply with them could harm our business, results of operations and financial condition.

The marketing and sale of Medicare plans are subject to numerous laws, regulations and guidelines at both the Federal and state level. The marketing and sale of Medicare Advantage and Medicare Part D prescription drug plans are principally regulated by the Centers for Medicare and Medicaid Services, or CMS, which is a division of the U.S. Department of Health and Human Services, and the marketing and sale of Medicare supplement plans is principally regulated on a state-by-state basis by state departments of insurance. The laws and regulations applicable to the marketing and sale of Medicare plans lack clarity, are numerous and complex, were not drafted to contemplate health insurance exchanges, and change frequently, particularly with respect to regulations and guidance issued by CMS for Medicare Advantage and Medicare Part D prescription drug plans and by the various state departments of insurance for Medicare supplement plans.

As a result of these laws, regulations and guidelines, we have altered, and will need to continue to alter, our business operations and procedures, including without limitation, our call center operations, website and sales process to comply with these changing requirements. For instance, many aspects of, and changes to, our website content and marketing materials and processes, including call center scripts, must be approved by CMS and by insurance carriers in light of CMS requirements. Changes to the laws, regulations and guidelines relating to Medicare plans, the scope of their application to our business, their interpretation or the manner in which they are enforced could be incompatible with our business model. Due to changes in CMS guidance or enforcement of existing guidance, or as a result of new regulations and guidelines, CMS, state departments of insurance or insurance carriers may determine not to approve aspects of our website content or marketing materials and processes and may determine that certain existing aspects of our business are not compliant. As a result, our business could be slowed or we could be prevented from operating portions of our business altogether, either of which would materially harm our results of operations and financial condition, particularly if this occurred during the Medicare annual enrollment period, which is when the vast majority of Medicare plans are sold.

In March 2010, the Federal government enacted significant reforms to healthcare legislation through the Patient Protection and Affordable Care Act, or PPACA, and the Healthcare and Education Reconciliation Act of 2010, or HCERA, which we refer to collectively as Healthcare Reform. In addition, one of the elements of the recently passed Budget Control Act of 2011 is the creation of a joint select committee on deficit reduction to develop recommendations, including changes to entitlement programs such as Medicare, to reduce the national debt by at least $1.2 trillion over 10 years. In connection with the U.S. Congress’s failure to agree on a proposal to lower the national deficit, the Budget Control Act mandates automatic cuts to domestic and defense spending, including a significant reduction in Medicare spending. The impact that Healthcare Reform and the Budget Control Act will have on the market for Medicare plans could change the demand for Medicare plans, the way these plans are delivered, or the commissions that insurance carriers pay to us in connection with their sale or otherwise adversely impact us.

In the event that these laws and regulations or changes in these laws and regulations, or other laws and regulations that impact the marketing and sale of Medicare plans, adversely impact our ability to market any type of Medicare plan on our exchange platform or the commissions that we receive for selling these plans, our business, results of operations and financial condition would be harmed.

-12-

Table of Contents

If we are unable to retain our members, our business and results of operations would be harmed.

Our revenue is primarily derived from commissions that insurance carriers pay to us for the health insurance plans that we market. When one of these plans is cancelled, or if we otherwise do not remain the agent of record on the policy, we no longer receive the related commission revenue. Individuals may choose to discontinue their insurance policies for a number of reasons. For example, members may determine that they cannot afford supplemental Medicare coverage or may receive increases in premiums from insurance carriers that force them to cancel their coverage. In addition, our members may choose to purchase new plans using a different agent if, for example, they are not satisfied with our customer service or the health insurance plans that we offer. Insurance carriers may also terminate health insurance plans purchased by our members for a variety of reasons. Our cost in acquiring a new member is substantially greater than the cost involved in maintaining our relationship with an existing member. If we are not able to successfully retain existing members and limit member turnover, our revenue and operating margins could be adversely impacted.

Our business may be harmed if we lose our relationships with insurance carriers, fail to maintain good relationships with insurance carriers, become dependent upon a limited number of insurance carriers or fail to develop new carrier relationships.

We typically enter into contractual agency relationships with insurance carriers that are non-exclusive and terminable on short notice by either party for any reason. In many cases, insurance carriers also have the ability to amend the terms of our agreements unilaterally on short notice. Insurance carriers may be unwilling to allow us to sell their existing or new health insurance plans or may amend our agreements with them, for a variety of reasons, including for competitive or regulatory reasons or because of a reluctance to distribute their products through our exchange platform. Insurance carriers may decide to rely on their own internal distribution channels, including traditional in-house agents, carrier websites or other sales channels, or to market their own plans, and, in turn, could limit or prohibit us from marketing their plans. For example, in August 2011, one of our largest insurance carrier partners discontinued the indirect distribution of Medicare supplement policies through all of their distribution vendors. As a result, our new Medicare supplement enrollments have shifted to other insurance carriers that pay us lower commission rates on average. Insurance carriers may also choose to exclude us from their most profitable or popular plans or may determine not to distribute insurance plans in individual markets in certain geographies or altogether. Additionally, if one of the insurance carriers with which we are associated violates the law or comes under scrutiny by CMS, CMS may impose sanctions on such carriers, resulting in a loss of supply of insurance plans that we are able to sell. The termination or amendment of our relationship with an insurance carrier could reduce the variety of health insurance plans we offer. We also could lose a source of, or be paid reduced commissions for, future sales and could lose renewal commissions for past sales. Our business could also be harmed if we fail to develop new carrier relationships or are unable to offer customers a wide variety of health insurance plans.

The private health insurance industry in the United States has experienced a substantial amount of consolidation over the past several years, resulting in a decrease in the number of insurance carriers. In the future, it may become necessary for us to offer insurance plans from a reduced number of insurance carriers or to derive a greater portion of our revenue from a more concentrated number of carriers as our business and the health insurance industry evolve. For example, in fiscal 2011, our top two carriers, Mutual of Omaha and UnitedHealthcare, accounted for an aggregate of 58% of our commission revenue. Each of these insurance carriers may terminate our agreements with them, and, in some cases, as a result of the termination we may lose our right to receive future commissions for policies we have sold. Should our dependence on a smaller number of insurance carriers increase, whether as a result of the termination of carrier relationships, further insurance carrier consolidation or otherwise, we may become more vulnerable to adverse changes in our relationships with our carriers, particularly in states where we offer health insurance plans from a relatively small number of carriers or where a small number of insurance carriers dominate the market. The termination, amendment or consolidation of our relationship with our insurance carriers could harm our business, results of operations and financial condition.

-13-

Table of Contents

Insurance carriers could reduce the commissions paid to us or change their plan pricing practices in ways that reduce the commissions paid to us, which could harm our revenue and results of operations.

Our commission rates are either set by each carrier or negotiated between us and each carrier. Insurance carriers have altered, and may in the future alter, the contractual relationships we have with them, either by renegotiation or unilateral action. Also, insurance carriers may adjust their commission rates to comply with regulatory guidelines, such as those published by CMS with respect to the marketing of Medicare Advantage and Medicare Part D prescription drug plans. If these contractual changes result in reduced commissions, our revenue may decline.

In addition, insurance carriers periodically adjust the premiums they charge to individuals for their insurance policies. These premium changes may cause members to cancel their existing policies and purchase a replacement policy from a different insurance carrier, either through our exchange or through another agent. In many cases, we receive a reduced commission when a member purchases a replacement policy. Also, because insurance rates may vary between insurance carriers, plans and enrollment dates, changes in enrollment mix may impact our commission revenue. Future changes in carrier pricing practices could harm our business, results of operations and financial condition.

Changes and developments in the health insurance system in the United States could harm our business.

Our business depends upon the private sector of the United States insurance system, its role in financing health care delivery, and insurance carriers’ use of, and payment of commissions to, agents, brokers and other organizations to market and sell individual and family health insurance plans. Healthcare Reform contains provisions that have changed and will continue to change the industry in which we operate in substantial ways.

Many aspects of Healthcare Reform do not go into effect until 2014, although certain provisions currently are effective, such as medical loss ratio requirements for individual, family and small business health insurance and a prohibition against using pre-existing health conditions as a reason to deny health coverage for children. In addition, state governments have adopted, and will continue to adopt, changes to their existing laws and regulations in light of Healthcare Reform and related regulations. Future changes may not be beneficial to us.

Legal challenges to the constitutionality of Healthcare Reform have been initiated. Notably, litigation regarding the constitutionality of Healthcare Reform is pending before the United States Supreme Court. Many of the challenges center upon the constitutionality of the mandate requiring individuals to maintain health coverage. Decisions on the issue have been inconsistent. These decisions will be appealed and it is impossible to predict their outcome. More challenges could also be initiated under various other legal theories. If the final outcome of one or more of these legal challenges is adverse to our business interests, our results of operations and financial condition could be harmed.

Certain key members of Congress have also expressed a desire to withhold the funding necessary to implement Healthcare Reform as well as the desire to replace or amend all or a portion of Healthcare Reform. Any partial or complete repeal or amendment or implementation difficulties, or uncertainty regarding such events, could increase our costs of compliance, prevent or delay future adoption of our exchange platform, and adversely impact our results of operations and financial condition. The implementation of Healthcare Reform could have negative effects on us, including:

| • | increase our competition; |

| • | reduce or eliminate the need for health insurance agents and brokers or demand for the health insurance that we sell; |

| • | decrease the number of types of health insurance plans that we sell, as well as the number of insurance carriers offering such plans; |

-14-

Table of Contents

| • | cause insurance carriers to change the benefits and/or premiums for the plans they sell; or |

| • | cause insurance carriers to reduce the amount they pay for our services or change our relationship with them in other ways. |

Any of these effects could materially harm our business, results of operations and financial condition. For example, the manner in which the Federal government and the states implement health insurance exchanges and the process for receiving subsidies and cost-sharing credits could substantially increase our competition and member turnover and substantially reduce the number of individuals who purchase insurance through us. Various aspects of Healthcare Reform could cause insurance carriers to limit the type of health insurance plans we are able to sell and the geographies in which we are able to sell them. In addition, the U.S. Congress has been charged with finding spending cuts, and such cuts are expected to include Medicare. If cuts are made to Medicare, there may be substantial changes in the types of health insurance plans we are able to sell. Changes in the law could also cause insurance carriers to exit the business of selling insurance plans in a particular jurisdiction, to eliminate certain categories of products or to attempt to move members into new plans for which we receive lower commissions. If insurance carriers decide to limit our ability to sell their plans or determine not to sell individual health insurance plans altogether, our business, results of operations and financial condition would be materially harmed.

Our results of operations fluctuate depending upon the timing of our receipt of commission payments from insurance carriers.

The timing of our revenue recognition is dependent upon the receipt of commission payments from insurance carriers. There have been instances where commission payments from insurance carriers have been delayed. Any delay could impact our financial results for a given quarter as we would not be able to recognize the related commission revenue in that quarter if payments are pushed beyond the quarter. In addition, receipt of past due payments at a later date could result in a large amount of commission revenue from a carrier being recorded in a given quarter that is not indicative of the amount of revenue we may receive from that carrier in subsequent quarters, causing fluctuations in our quarterly or annual results of operations. We could report revenue below the expectations in any particular period if a large payment from an insurance carrier is delayed or not received within the time frame required for revenue recognition.

We rely on insurance carriers to provide membership and commission reporting to us, and if these reports are inaccurate or not delivered to us in a timely manner, they could impact our ability to report our operating metrics accurately or on a timely basis.

We are dependent on insurance carriers for providing data to us related to membership and commission payments. For example, some insurance carriers do not directly report member cancellations to us or report cancellations in a delayed manner, resulting in the need for us to determine cancellations using the commission payment data. We infer cancellations from this payment data by analyzing whether payments from members have ceased for a period of time, and we may not learn of a cancellation for several months, given that some of our members pay on a schedule less frequently than monthly. After we have estimated membership for a period, we may receive information from insurance carriers that would have impacted the estimate if we had received the information prior to the date of estimation, which would cause our member data to be inaccurate. Our estimate regarding the average amount of time our members maintain their health insurance plans also could be inaccurate as it is dependent upon the accuracy of our membership estimates.

Our revenue growth rate may decline, and, as our costs increase, we may not be able to generate sufficient revenue to sustain our profitability.

Our revenue has grown from $12.4 million in fiscal year 2008 to $51.1 million in fiscal year 2011. We expect that, in the future, as our revenue increases to higher levels our revenue growth rate will decline over time.

-15-

Table of Contents

Our future revenue growth will depend in large part upon our ability to continue to attract new individuals to purchase health insurance through our exchange platform. To the extent that the rate of growth of our new customers slows or our customer retention rates decrease, our revenue growth will also slow, and we may not be able to generate sufficient revenue to sustain our profitability. We also expect our costs to increase in future periods, which could negatively affect our future results of operations. We expect to continue to expend substantial financial and other resources on:

| • | sales and marketing, including a significant expansion of our direct and partner channel sales organizations; |

| • | technology development, including investments in the scalability of our exchange platform and the development of new features; and |

| • | general administration, including legal and accounting expenses related to being a public company. |

These investments may not result in increased revenue or growth in our business. If we fail to continue to grow our revenue and increase our profitability, our results of operations would be harmed and our stock price would decline.

If we do not continue to attract new employer clients or individual customers, we may not achieve our revenue projections, and our results of operations would be harmed.

In order to grow our business, we must continually attract new employer clients and individual customers. Our ability to do so depends in large part on the success of our sales and marketing efforts. Potential employer clients may not see the value in our solution and potential individual customers may seek out other options for purchasing Medicare insurance. Therefore, we must demonstrate that our Medicare exchange provides a viable solution for our employer clients to reduce healthcare costs and for individual customers to obtain high quality coverage at an attractive price. If we fail to provide high quality solutions and convince employer clients and individual customers of our value proposition, we may not be able to retain existing customers or attract new individual customers. Moreover, employer clients may decide not to transition their retirees and employees to our platform or these retirees and employees may choose not to enroll with us after we have already incurred operating overhead. Additionally, there is no guarantee that the market for our services will grow as we expect. If the market for our services declines or develops more slowly than we expect, or the number of potential employer clients or individual customers that use our solutions declines or fails to increase as we expect, our revenue, results of operations, financial condition, business and prospects could be harmed.

We expect our results of operations to fluctuate on a quarterly and annual basis.

Our revenue and results of operations could vary significantly from quarter to quarter and year to year and may fail to match our past performance due to a variety of factors, some of which are outside of our control. Any of these events could cause the market price of our common stock to fluctuate. Factors that may contribute to the variability of our results of operations include:

| • | seasonality of our business related to the timing of enrollment in employer-sponsored health plans; |

| • | the extent to which we retain existing members; |

| • | the size of new employer clients that we engage in any particular period; |

| • | the timing of commission payments from insurance carriers; |

| • | changes in the commission rates we receive from insurance carriers; |

| • | the utilization and mix of channel partners; |

| • | the timing of retail marketing campaigns; |

| • | our ability to increase the number of health insurance plans we are able to sell; |

-16-

Table of Contents

| • | the entrance of new competitors to our market; |

| • | our ability to establish and maintain relationships with insurance carriers; and |

| • | general industry and macroeconomic conditions. |

Given these factors, our short operating history, and the current changes and developments in the health insurance industry, our historical results of operations may not be useful to you in predicting our future results of operations. If we fail to meet or exceed expectations for our business for these or any other reasons, the market price of our shares could fall substantially, and we could face costly lawsuits, including securities class action suits. Furthermore, fluctuations in our results of operations related to these factors and industry developments could adversely impact our ability to meet our earnings forecasts or the expectations of market analysts, which could cause declines in our stock price.

Seasonality has caused and will continue to cause fluctuations in our financial results and operational challenges.

Our business of marketing Medicare plans is subject to seasonal fluctuations. The benefits enrollment period for a majority of private employers occurs during October through December of each year for a January 1 effective date, and this period also coincides with the timing of the annual enrollment period when Medicare-eligible individuals can make changes to their Medicare Advantage or Medicare Part D prescription drug coverage for the following year. As a result, the majority of our Medicare enrollments have historically occurred in the fourth calendar quarter during the Medicare annual enrollment period. During this period, we need to hire, train and certify a substantial number of seasonal personnel to supplement our employee base. If we are unable to hire, train and certify this seasonal workforce, we could not accommodate the heightened enrollment demand. Failure to meet this demand could negatively impact our business. Additionally, due to the heavy influx of healthcare benefit enrollments we experience at the end of each calendar year, we incur a significant portion of our marketing and enrollment expenses during the fourth calendar quarter, but we typically do not begin to recognize the associated commission revenue until the first calendar quarter of the following year. As our business matures, other seasonality trends may develop and the existing seasonality and consumer behavior that we experience may change. In particular, public sector employers are generally more inclined to opt for transition periods outside of the annual enrollment period, as their benefits effective date typically coincides with the beginning of their fiscal year, which is often not January 1. Any seasonality that we experience may cause fluctuations in our financial results, which could lead to declines in our stock price, and operational challenges such as demand for an increased or decreased short-term workforce.

Our estimates of Projected Annual Recurring Revenue, or PARR, may prove inaccurate.

As an indication of our estimated future recurring revenue, we report Projected Annual Recurring Revenue, or PARR, which reflects our expected total commission revenue for the subsequent 12 months from all members that are active or pending as of the reporting date. We report PARR as a range as it represents an estimate of our future recurring revenue based on certain member retention assumptions. The PARR metric includes expected commission revenue on all Medicare-related and ancillary policies and is based upon actual contractual commission rates in effect during the forecasted period as well as assumptions regarding future member retention. Our estimates for future member retention are based on our historical experience regarding the extent and timing of policy attrition, along with any known future trends that may be expected to occur during the forecasted period.

PARR is a forward-looking metric that is based on our management’s beliefs and assumptions and on information available to our management as of the reporting date. As a result, our ability to recognize the forecasted revenue indicated by the PARR metric over the subsequent 12 months is subject to a number of risks, uncertainties and assumptions, including:

| • | higher cancellation rates of Medicare-related and ancillary policies by our members than expected; |

-17-

Table of Contents

| • | the inability of our carriers to fulfill their obligations under our members’ Medicare-related and ancillary policies, which could cause a decrease in future member retention rates; and |

| • | delayed payment, non-payment and/or inaccurate payment of commissions by our carriers. |

We cannot guarantee that we will be able to recognize the revenue associated with the PARR metric due to these risks and uncertainties or if our assumptions turn out to be incorrect. These risks and assumptions are inherently subject to significant business and economic uncertainties and contingencies, many of which are beyond our control. As a result, the PARR that we disclose at any particular time may prove to be an inaccurate indicator of the revenue we actually derive over the subsequent 12 months from active and pending members.

If we fail to effectively manage our growth, our business and results of operations could be harmed.