Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K/A

(AMENDMENT NO. 2 )

|

[X]

|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the year ended December 31, 2011

Commission file number: 000-31380

|

APPLIED MINERALS, INC.

|

||

|

(Exact name of registrant as specified in its charter)

|

||

|

Delaware

|

82-0096527

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

110 Greene Street – Suite 1101, New York, NY

|

10012

|

||||

|

(Address of principal executive offices)

|

(Zip Code)

|

||||

|

(800) 356-6463

|

|||||

|

Issuer's telephone number, including area code

|

|||||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

|

YES

|

o |

NO

|

x

|

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act:

|

YES

|

o |

NO

|

x

|

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

YES

|

x

|

NO

|

o |

Indicate by check mark whether the registrant submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

|

YES

|

x

|

NO

|

o |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulations S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K/A (AMENDMENT NO. 2 ) or any amendment to this Form 10-K/A (AMENDMENT NO. 2 ).

|

x

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller-reporting company” in Rule 12b-2 of the Exchange Act.

|

Large Accelerated Filer

|

o |

Accelerated Filer

|

x

|

Non-accelerated Filer

|

o |

Smaller Reporting Company

|

o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

|

YES

|

o |

NO

|

x

|

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant on June 30, 2011, based on the last sales price on the OTC Bulletin Board on that date, was approximately $89,144,127.

APPLIED MINERALS, INC. AND SUBSIDIARY

YEAR 2011 ANNUAL REPORT ON FORM 10-K/A (AMENDMENT NO. 2 )

TABLE OF CONTENTS

|

PART I

|

Page(s)

|

|

|

Item 1.

|

Business

|

3

|

|

Item 1A.

|

Risk Factors

|

10

|

|

Item 1B.

|

Unresolved Staff Comments

|

11

|

|

Item 2.

|

Properties

|

11

|

|

Item 3.

|

Legal Proceedings

|

12

|

|

Item 4.

|

Mine Safety Disclosures

|

12

|

|

PART II

|

||

|

Item 5.

|

Market Price for the Registrant’s Common Equity, Related Stockholders Matters and Issuer Purchases of Equity Securities

|

12

|

|

Item 6.

|

Selected Financial Data

|

15

|

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operation

|

15

|

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

19

|

|

Item 8.

|

Financial Statements and Supplementary Data

|

19

|

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

19

|

|

Item 9A.

|

Controls and Procedures

|

19

|

|

Item 9B.

|

Other Information

|

21

|

|

PART III

|

||

|

Item 10.

|

Directors and Executive Officers and Corporate Governance

|

21

|

|

Item 11.

|

Executive Compensation

|

24

|

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

28

|

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

29

|

|

Item 14.

|

Principal Accounting Fees and Services

|

30

|

|

Item 15.

|

Exhibits

|

31

|

|

PART IV

|

||

|

Item 16.

|

Exhibits, Financial Statement Schedules and Reports on Form 8-K

|

F-1 – F-31

|

2

PREFERATORY NOTE

The purpose of this Amendment No. 2 to our Annual Report on Form 10-K for the fiscal year ended December 31, 2011 ("Form 10-K"), as filed with the Securities and Exchange Commission ("SEC") on March 19, 2012, is to furnish information for Items 10 through 14. . In prior years, such information has been included in definitive proxy materials filed prior to 120 days after the end of the fiscal year and incorporated into the 10-K. The 10-K is deemed to be timely filed if such information is incorporated by reference within the 120 day period. After the filing of the 10-K in March, the Company determined to hold its annual meeting in September 2012 and, as a result, it is impractical to file definitive proxy materials within the 120-day period. Accordingly, the 10-K is amended to include the information for Items 10 to 14 within 120 days and as amended the 10-K is deemed to be timely filed.

No other changes have been made to the Form 10-K other than the furnishing of the information described above. This Amendment No. 2 to the Form 10-K speaks as of the original filing date of the Form 10-K, and does not reflect subsequent events occurring after the original filing date of the Form 10-K or modify or update in any way disclosures made in the Form 10-K.

Pursuant to Rule 406T of Regulation S-T, the XBRL Exhibit attached hereto are deemed not filed or part of a registration statement or prospectus for purposes of Sections 11 or 12 of the Securities Act of 1933, as amended, are deemed not filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and otherwise are not subject to liability under those sections.

NOTE REGARDING FORWARD LOOKING STATEMENTS

This Annual Report on Form 10-K contains "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based on our current expectations, assumptions, estimates and projections about our business and our industry. Words such as "believe," "anticipate," "expect," "intend," "plan," "will," "may," and other similar expressions identify forward-looking statements. In addition, any statements that refer to expectations, projections or other characterizations of future events or circumstances are forward-looking statements. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those reflected in the forward-looking statements. Factors that might cause such a difference include, but are not limited to, those discussed in the section of this Annual Report entitled “1A. RISK FACTORS.”

PART I

ITEM 1. BUSINESS

|

|

HISTORY AND DEVELOPMENT OF THE COMPANY

|

Applied Minerals, Inc. (“the Company”) was originally formed for the purpose of exploring and developing the Atlas Mine, a silver mine located in the Coeur d’Alene Mining District near Mullan, Idaho. During 1980 the Company suspended operations at the mine as a result of a decline in silver prices until mining operations would be profitable again. In September 1997, the Company entered the contract mining business, which was the Company’s sole source of revenue until the contract mining business was discontinued in December 2008 due to adverse economic changes in the mining industry.

In 2001 we entered a lease/purchase agreement for the Dragon Mine, located in Juab County, Utah (Tintic mining District). In 2005 we acquired a 100% ownership interest in the Dragon Mine for $500,000 in cash. The Dragon Mine is a halloysite clay property located in Juab County, Utah (Tintic Mining Distric t ). The Company purchased the Dragon Mine for the purpose of mining and marketing the unique chemical and morphological characteristics of the clay to a number of advanced application markets.

Beginning in January 2008 with the appointment of two new directors and ending in December 2008 with the resignation of a director, the membership of board of directors completely turned over. On January 1, 2008, new management was appointed. Generally speaking current management believes that the corporate strategies employed by the Company’s former management were ineffective in successfully commercializing the Dragon Mine.

THE DRAGON MINE

The Dragon Mine, to our knowledge, is the only source of halloysite clay in the Western Hemisphere large enough, and of high enough purity, to supply commercial-sized application demand.

The property is located in the Tintic District of Utah, covering approximately 230 acres with a large mining permit covering 40 acres allowing for the extraction of minerals. The property consists of 38 patented and six unpatented mining claims located in the following sections: T10S, R2W, sections 29, 30, 31, and T10S, R3W, Section 36, all relative to the Salt Lake Base Meridian. The Company pays approximately $800 in annual maintenance fees to the U.S. Department of Interior Bureau of Land Management to maintain rights to its unpatented claims. The BLM Claim Numbers are: UMC385543, UMC 385544, UMC394659, UMC394660, UMC408539, and UMC408540. The Company has no underlying royalty agreements with any third-party with respect to the Dragon Mine.

Formation of the Dragon Mine property is attributed to the alteration of fine clay sediments that accumulated on what was then a shallow sea floor over 600 million years ago. From 1949 through 1976, Filtrol Corporation operated the Dragon Mine on a contracted basis for the property’s owner at the time, a subsidiary of Anaconda Mining Company.

3

According to certain mining-related records, Filtrol mined approximately 1.35 million tons of clay from the Dragon Mine for use as an input of a petroleum-cracking catalyst product. The mine was idle from 1977 until it was leased by the Company beginning in 2001. The Company eventually purchased a 100% interest in the property in 2005 for $500,000 in cash. Currently, the Company has no underlying royalty agreements with any third-party with respect to the Dragon Mine. The current management of the Company hired geologist Dr. Ian Wilson who has supervised an extensive drilling program and continues to explore underground areas of the Dragon property including, but not limited to, two mines developed by prior operators as well as one area that had previously remained unexplored. Dr. Wilson has supervised our drilling program and has played a critical role in classifying the mineralization of the Dragon Mine property, which is essential to the successful commercialization of the mine’s deposit. Dr. Wilson is a member of iom 3 (Institute of Materials, Minerals and Mining of the UK). As of the date of this report, an above-ground area covering approximately 11.5 of the Dragon Mine’s 230 acres have been explored. The extraction of material from certain targeted areas of this resource is in progress.

The Company applied for and was granted a large mining permit in early 2011 for which it posted the required surety bond in May 2011. To date the Company has completed underground work to the 300’ level of the eastern portion of its property from where it is currently extracting halloysite clay. The Company explores underground and mines its clay mineral utilizing traditional methods and equipment and expends the necessary resources to maintain Mining Heath and Safety Act (MSHA) compliance. From our drilling activity we have sampled certain cores by engaging a leading UK-based geological consulting organization to identify the chemical composition of our mineral and classify its purity levels, the results of which are used, in part, to map our property. All quality control and quality assurance protocols utilized as part of our exploration program have been developed by this third-party organization. Analytical equipment used to classify the mineral mined at the mine includes, but is not limited to, a Scanning Electron Microscope (SEM), and XRD and XRF machines.

The Dragon Mine property also contains five waste piles comprised of material, which can, in our opinion, be processed to create a saleable product. The piles are the result of prior mining operations that took place between 1949 and 1976. The clay mined during that period was used in a petroleum-cracking catalyst application. For that application the clay mined had to contain no more than 2% of an iron oxide impurity. Any clay, which exceeded such limit, was discarded into the piles. To date, Applied Minerals has characterized the chemistry and mineralogy of the surface piles and has developed a processing system to convert them into purified halloysite products. The Company has identified a number of application areas to which it is marketing its waste pile material.

In addition to the presence of halloysite, the Dragon Mine also possesses quantities of other clays as well as iron oxide ores in the form of hematite, goethite, and ferrihydrite, some of which we are in the process of commercializing. The Dragon Mine is present at the contact between the Silver City quartz monzonite stock and limestone and dolomite of the Paleozoic formation. Gold and silver is found in veinlets in pervasively altered rocks of the Silver City stock immediately south of the Dragon mine and were one of the first discoveries made in the Tintic district in 1869. The Dragon Mine was mined as a copper-gold deposit not long after these initial findings. The mine’s fissure fault system forms the southern extremity of the Iron Blossom ore run.

It is known that within five kilometers of the Dragon Mine, exploration is being carried out by at least one major mining company to determine the possibility of the existence a large copper-gold porphyry. Whether such a porphyry exists, the location of such a porphyry, whether any deposits related to any such porphyry are located on our property and whether any such deposits would be of commercial grade or could be economically extracted is not known. If there is a porphyry, it is likely to be located at least 1000 feet under the surface and could be accessed only through a large open pit mine (so that we could not access it on our property by means of an open pit mine confined to our property). It is estimated that if there is a commercial grade mineralization that could be economically extracted, a large mining company would have to acquire sufficient land for a large open pit mine, expend billions in preparation for mining and it is estimated that it would be at least 15 or 20 years before mining could begin.

Testing of surface rock samples in the vicinity of the Dragon Mine carried out in the past show anomalous copper values with gold values exceeding one ounce per ton and silver values of approximately five ounces per ton. Records indicate that, during the 1870’s, mining activity at the Dragon Mine had been focused on the iron ore presence at the mine. According to certain records kept by the former U.S. Bureau of Mines, the 305,000 tons of iron ore mined during the 1870’s produced 18,000 ounces of gold and 928,000 ounces of silver. . In connection with our mining of iron ore at the Dragon Mine and in connection with drilling in connection with a resource statement concerning the iron ore, we have tested for the presence of commercial amounts of copper, gold and silver and we have not found any. We will continue testing and if commercial amounts are located, we will consider the appropriate alternatives.

The Company has spent significant resources on the exploration of its Dragon Mine property. The results of an extensive drilling program supervised by the Company’s consulting geologist has identified what is believed to be a sufficient amount of clay material, both underground and on the surface of the property, to support a commercial operation. The clay mineral identified at the Dragon Mine has been classified by level of purity. The Company will not be able to refer to the mineral found in its Dragon Mine property as a “reserve” until it can demonstrate the deposit is economically viable. As the Company continues to sell its halloysite clay products into existing and developing markets, it will revisit the possibility of classifying its deposit as a reserve.

Currently, the property is without known reserves and our drilling program has been exploratory in nature. During the last twelve months, the Company produced approximately 650 tons of halloysite clay and 7,500 tons of iron ore. The halloysite clay produced during this period has been used to supply certain customers and provide samples to potential customers at different stages of product development utilizing our material. We are in the process of mining and storing iron ore present on our property while we determine the best way to monetize the mineral.

4

We have completed our initial exploration program. A description of the program is as follows:

|

·

|

Cores from 80 boreholes drilled in 2003, 2005, 2006, 2009 and 2010, totaling 15,362 ft, were tested. The average depth of the 80 boreholes drilled was 192 ft with a range of depths drilled from 50ft to 360 ft;

|

|

·

|

The Western area of the property, drilled from 2003 to 2006, includes 44 boreholes totaling 9,448 ft covering an area of 6.33 acres. These boreholes were drilled in mainly altered quartz monzonite, which is an intrusive igneous rock with approximately equal parts of orthoclase and plagioclase feldspar. Quartz monzonite porphyry is often associated with copper mineralization in porphyry copper deposits;

|

|

·

|

The Dragon Pit area of the property, drilled in 2009 and 2010, includes 36 boreholes totaling 5,914 ft and covering an area of 4.95 acres. The area is mainly iron ore and some altered monzanite on the periphery. High levels of halloysite (up to 100% in some cases) are adjacent to the iron ore;

|

|

·

|

To date over 500 samples of borehole material has been tested to determine mineralogy, particularly for halloysite, kaolinite, illite, smectite levels and other properties;

|

|

·

|

Five waste piles, the product of previous clay mining activity, were drilled. The waste piles cover 34.2 acres and have volume of 1.99 million cubic yards. Following a detailed trenching campaign on the waste piles, fifty-two boreholes were drilled totaling 1,986 ft. The whole rock evaluation included chemical testing by XRF of 216 samples with 69 of these samples tested for their mineralogy by XRD. To determine clay content, samples were processed to <45 μm and <5μm fractions and 185 samples were tested for their mineralogy by XRD and 133 samples for their chemistry by XRF;

|

|

·

|

An evaluation of the iron ore present in the Pit Area (4.95 acres) and elsewhere was carried out. Testing of approximately 100 samples was carried out to determine the quality of the iron ore; and

|

|

·

|

A detailed evaluation of surface samples, from which some halloysite is now being mined from the open pit, was carried out.

|

From the above program, we believe we have identified the presence of enough halloysite and iron ore at the Dragon Mine to move forward with a commercialization of each mineral. We are contemplating further exploration of the Dragon Mine property.

Our exploration expenses for the twelve months ending December 31, 2011, 2010 and 2009 were $2,971,3626 , $2,307,202, and $1,299,753, respectively, on the halloysite clay project. Since January 1, 2009, the date on which the Company’s current exploration program of the Dragon Mine began, approximately $6.6 million has been expended on exploration-related activities. We expect our exploration costs for both the fiscal years ended December 31, 2012 and December 31, 2013 to approximate the exploration costs incurred during the fiscal year ended December 31, 2011. At this moment we are unable to identify the total costs that will be incurred to complete the exploration of the 230-acre Dragon Mine property.

We believe the physical plant and equipment utilized at the Dragon Mine are satisfactory condition to continue our current mining activity. The Company continually reviews the adequacy of its physical plant and equipment inventory and expects to invest accordingly to ensure that the size and quality of its physical plant and equipment can meet its needs. Currently, our physical plant includes, but is not limited to, a processing mill, a dry house, a site office, a general storage facility, an equipment repair facility, and a structure housing three IR compressors, which are used to power the mill and certain drilling equipment used underground. Our mining equipment includes, but is not limited to, a road header, an underground drill, a Scooptrams, a skid steer, a front-end loader and a number of other pieces traditionally used to mine underground. There are some pieces of equipment we choose to rent on a daily basis rather than own or lease to own. The Company uses diesel fuel as it primary source of power and has water transported to the property from an external source. The property has sufficient access roads to enable the transportation of materials and products

ATLAS MINE

The Company owns a 100% interest in the Atlas Mine, which consists of approximately 900 acres of fee simple property and patented mining claims, and 260 acres of mineral rights and unpatented claims, located in the Coeur d'Alene mining district in Shoshone County, Idaho, commonly referred to as the Silver Valley of North Idaho. The property is divided in to the following five tracts: Atlas Mine, Sierra Trapper Creek, Aulbach – Section 6 & 7, Sierra Silver, Woodland Park and 9 Mi., Sierra Hardscrabble, and L&M Claims. We pay approximately $1,300 to keep certain claims related to these properties active. The Company was originally incorporated to pursue silver mining activities on the Atlas mine property. The property has been idle since the early 1980’s. At the present moment, we do not consider this property material and have classified it as an asset held-for-sale. We are exploring ways in which to monetize this property. Currently, the property is without known reserves.

SAMPLING

From our drilling activity at the Dragon Mine, we have sampled certain cores by engaging a leading UK-based geological consulting organization to identify the chemical composition of our mineral and classify its purity levels, the results of which are used, in part, to map our property. All quality control and quality assurance protocols utilized as part of our exploration program have been developed by this third-party organization. Analytical equipment used to classify the mineral mined at the mine includes, but is not limited to, a Scanning Electron Microscope (SEM), and XRD and XRF machines. Our consulting geologist, Dr. Ian Wilson, oversees our relationship with the firm that provides us these services.

5

PROCESSING

The Company has a dry-process facility at its Dragon Mine property with which it is able to process the material from the underground areas of the Dragon Mine. Additionally, the Company has a tolling agreement with KaMin Performance Minerals, LLC, utilizing a wet process technology, to process both underground material and the material from the waste piles. The dry-process facility at the Dragon Mine includes, but is not limited to, a KDS Micronex, an air-powered jet mill, a dust capture system and a bagging system. The Company is exploring the possibility of building an expanded, advanced production facility in proximity to the Dragon Mine property that will be equipped to process both clay material and iron ore.

PRODUCTS AND SALES

There are three types of clay that can be extracted from the Dragon Mine, halloysite, kaolinite, and illite-smectite. Halloysite is a high value clay whose uses are discussed below. Kaolinite and illite-smectite are lower value clays, which the Company will use in products not requiring high concentrations of halloysite. The concentrations of the minerals vary at the Dragon Mine, with some areas containing relatively high concentrations of halloysite. The Dragon Mine also contains an iron our resource from which the Company has developed a product.

Halloysite-based products:

|

·

|

Dragonite–XR: An advanced reinforcing filler for polymers used at loadings of 20%-50% by weight and offering improved modulus, yield strength and HDT. This product grade offers advantages compared to other reinforcing fillers for polymers such as glass fiber, mica, wollastonite or talc. These include rentention of impact resistance, elongation to break, control over CTE and warpage, and lack of abrasiveness. Flame retardance up to V0 level is also possible when Dragonite-XR is used alone or as a synergist.

|

|

·

|

Dragonite–HP: A high performance additive for engineered thermoplastics, used at loadings of just 1-3 weight %, offering improvements in mechanical performance and cycle time reduction. This product grade offers a drop-in solution for polymer applications needing mechanical improvements without the density penalty associated with traditional fillers. By using Dragonite-HP, customers can reduce their overall manufacturing and materials costs through cycle time improvements and thin-walling.

|

|

·

|

Dragonite–Pure White: Highest purity Dragonite™ product - meeting the strict specifications of the cosmetics industry.

|

Iron-based Product:

|

·

|

Dragonite–IO: High grade iron oxide product line from the Dragon Mine. Products include Goethite and Hematite grades for use in pigments and technical applications such as smoke suppression and remediation of arsenic and metal contamination.

|

COMMERCIAL APPLICATIONS OF HALLOYSITE

Halloysite is an aluminosilicate clay exhibiting a rare, naturally occurring hollow tubular structure. Halloysite tubes have a length in the range of 0.5 - 3.0 microns, an exterior diameter in the range of 50 - 70 nanometers and an internal diameter (lumen) in the range of 15 - 30 nanometers. The clay is non-toxic and natural, demonstrating high biocompatibility without posing any risk to the environment. It is chemically identical to commonly used kaolin clay (Al2Si2O5(OH)4 x nH2O) with one layer of water molecules existing between layers of alumina and silica. Formation of halloysite occurs when kaolin sheets roll into tubes due to the strain caused by a lattice mismatch between the adjacent silicone dioxide and aluminum oxide layers. This is a process that occurs over millions of years under extremely rare geological conditions.

The results of research carried out by the Company, academic institutions, and other third parties have determined that the unique morphological and chemical characteristics of the Dragon Mine’s halloysite resource add functionality to applications such as, but not limited to, the controlled release of biological and chemical agents, polymer-related additives, fillers and fire retardants, paints and coatings, agricultural products, sorbents for environmental remediation, oil field drilling minerals, catalysts, filtration technologies, hydrogen storage for fuel cells and cosmetics.

To our knowledge, the only other large-scale commercial source of halloysite clay is located in New Zealand. The New Zealand property, which is owned by Imerys, (Euronext: NK), has been historically focused on supplying its halloysite clay to the porcelain, fine china and other commodity-like markets. Our primary focus, however, is centered on marketing the Dragon Mine’s halloysite clay to certain advanced application markets to which the material’s unique morphological and chemical characteristics provides enhanced functionality, contributing to the development of a number of high-performance products within an range of industries. At the time of this report, we have sold our Dragon Mine clay to two customers who plan to utilize it in plastic applications. Additionally, we are at different stages of the halloysite commercialization process with at least one hundred potential customers.

The Company currently markets its line of halloysite-based products under the Dragonite™ name. A description of certain application markets for which products have been developed, or will be developed, utilizing the Company’s Dragonite are provided below.

FUNCTIONAL FILLERS AND ADDITIVES FOR POLYMER COMPOSITES

High-performance functional fillers and additives are generally defined as particulates, whether spherical, platy, fibrous or tubular, which are introduced into a polymer matrix to enhance or create specific properties in an end product. Traditionally, fillers, such as talc, kaolin, silica and glass fibers have been loaded into polymer matrices to reduce costs by partially replacing more expensive resin. Functional fillers and additives are now used to improve mechanical properties such as impact strength, tensile strength, modulus, elongation at break and toughness, improve electrical properties such as conductivity and insulation, create flame retardancy (smoke suppression and char formation), improve polymer processing characteristics such as rheology, melt flow and viscosity, reduce weight and decrease permeability within plastics.

6

The factors driving the increased utilization of functional fillers and additives in plastics include, but are not limited to, the need for greater mechanical properties in high performance applications, the adoption of increasingly stringent environmental and safety legislation, the demand for lighter engineered plastic components, and the development of surface modifiers, allowing for the utilization of a wider array of materials as fillers and additives. According to Frost & Sullivan, the market for functional fillers and additives in 2008 was approximately $11.6 billion (approximately 15.7 million tons by volume), with mechanical property modifiers, electrical property modifiers and processing aids representing approximately 79.2%, 10.0% and 5.6% of the market, respectively. According to Frost & Sullivan, the market for functional fillers and additives in plastics is expected to grow to approximately $18.4 billion (20.1 million tons by volume) by 2015.

We currently produce and market Dragonite-XR ™ as our high performance, halloysite-based functional filler and Dragonite-HP ™ as our high performance, halloysite-based functional additive. Dragonite-XR is used at loading rates of 5.0% - 40.0% by weight while Dragonite-HP, in many applications, is utilized at loading rates of just 1.0% - 5.0% by weight. The unique tubular morphology, naturally exfoliated state and uniform surface charge of the Dragonite clay results in an even dispersion throughout the polymer matrix without the need for a costly surface modification required by other silicate fillers and additives. The complete dispersion of the Dragonite clay throughout the polymer matrix results in a significant enhancement in a number of mechanical properties of the polymer such as, but not limited to, increased stiffness, strength, and impact resistance (ability to resist fracturing under certain stresses), a reduction in uneven shrinkage and warpage, and improvement in fire retardant properties.

Plastic manufacturers are continuously looking to either (i) improve the mechanical properties of an engineered plastic component without sacrificing impact resistance or (ii) reduce the manufacturing costs and weight of an engineered plastic component by replacing a portion of the resin with a lower cost filler without sacrificing mechanical properties. Traditionally, when a manufacturer desires to increase the mechanical properties of a plastic component it must either use a higher cost resin or utilize a filler to obtain the desired mechanical improvements.

The utilization of a higher cost resin will reduce the profitability of the component and the use of a filler often degrades the impact resistance of the component. We have found that the utilization of Dragonite-HP at loadings of 1.0% - 2.0% by weight allows a manufacturer to both avoid the use of a more expensive resin while increasing mechanical properties, such as strength and modulus (a measure of elasticity), of an engineered plastic component without sacrificing impact resistance. When looking to reduce the cost and weight of a component through the partial replacement of resin with traditional fillers, a manufacturer must frequently accept a certain level of degradation of the mechanical properties of the component to achieve such cost savings and weight reduction. We have found the utilization of Dragonite-HP at loadings of 1.0% - 2.0% by weight enables a manufacturer to reduce both the resin-related cost and weight of a plastic component without have to accept a decline in mechanical properties. We have also found that Dragonite-XR, at relatively high loading rates by weight, not only improves certain mechanical properties without impairing impact resistance but also adds fire retardant characteristics to the polymer.

In addition to providing mechanical property improvements, we have also found that the utilization of Dragonite-HP contributes to the reduction of the manufacturing cycle time of a number of resin-based components by 20.0% - 27.0%. Cycle time represents the amount of time it takes to manufacture a single engineered plastic component. A reduction in cycle time, depending on the degree, can produce significant cost savings for a manufacturer. Dragonite produces a nucleating effect within a polymer matrix, which shortens the time it takes for a part to solidify within a mold, resulting in a shorter manufacturing cycle time. To our knowledge, Dragonite-HP is only one of two additives on the market that can nucleate high-density polyethylene. We have filed a provisional patent with respect to this technology.

We are currently marketing the benefits of Dragonite-XR and Dragonite-HP to the mechanical property modifier and processability modifier segments of the high performance filler market. According to Frost & Sullivan, in 2008 the market for mechanical property modifiers was approximately $9.2 billion (13.7 million tons by volume) with carbon black representing approximately 80% of the market by value (approximately 68.0% by volume), precipitated silica, silica fume, and fumed silica representing approximately 14.3% of the market by value (approximately 13.0% by volume) and calcium carbonate representing 1.8% of the market by value (approximately 4.0% by volume).

According to Frost & Sullivan, carbon black dominates the tire reinforcement market, precipitated silica is increasingly being used as a “green” reinforcement filler in tires, silica fume is used as a reinforcement for cement and certain plastics, fumed silica is used to reinforce rubber and calcium carbonate is used primarily to strengthen PVC. Except for carbon black as a tire filler, our research shows that Dragonite outperforms these other fillers under a number of scenarios and, as such, is presented with sizeable market opportunities both in terms of values and volumes. For example, at the time of this report, two customers of ours are utilizing our Dragonite-HP additive in high-density polyethylene applications to obtain mechanical property improvements. The annual global demand for high-density polyethylene is approximately 100 million pounds, which presents an attractive market opportunity for us even if we penetrate a relatively small portion of the market.

FIRE RETARDANTS FILLERS

According to Industrial Minerals Magazine, the world market for flame retardant additives for polymers is approximately 1.65 million tons, with a value of over $2.8 billion. Mineral-based flame retardants, such as Dragonite-XR, represent 50% of the market by volume and 35% by value. UL 94 is a plastics flammability standard released by Underwriters Laboratories of the USA. The standard classifies plastics according to how they burn in various orientations and thicknesses. For plastic composites the highest rating that can be achieved, with respect to the applications into which Dragonite-XR is being marketed, is V0.

The results of research and development activities carried out by the Company and certain potential commercial customers has demonstrated that the introduction of Dragonite-XR into polymer matrices at loadings between 30% and 50% by weight produces a V0 flame retardant rating for the composite. Additionally, unlike other mineral-based flame retardants, the Dragonite-XR increases the mechanical properties and retains the impact resistance of the plastic into which it is loaded. We have found that the structural water bound to Dragonite-XR, when liberated at 400° C, most likely contributes to the flame retardant capability of the filler. Dragonite-HP has been shown to act as an effective char forming additive that can be used in conjunction with other mineral-based flame retardant to improve both mechanical properties and the flame retardancy of a plastic composite. As the demand for mineral-based flame retardants, such as aluminum trihydrate, magnesium hydroxide and hydromagnesite, continue to grow due to the effects of the ban of the use of halogenated flame retardants, we expect Dragonite-XR to be attractively positioned to compete with these alternative flame retardant fillers.

7

CONTROLLED RELEASE CARRIER

The results of research and development activities carried out by the Company, certain potential commercial customers, and a number of academic institutions have demonstrated that the tubular nature of the Dragonite clay can act as an effective carrier of active ingredients, enabling an agent to be released from the carrier over an extended time frame. This controlled release capability can be utilized in a wide array of applications including, but not limited to, anti-corrosive and anti-mold paint applications, agricultural applications, cosmetics, and certain pharmaceutical products, which would require the prevention of overdosing.

The release rates of the agent from the Dragonite can be controlled through the selection of tube diameter and length and the type of encapsulation method utilized. The controlled-release capability provided by the Dragonite reduces the amount of active agent needed to achieve desired results, translating into significant cost savings and environmental protection. The Company is a co-exclusive licensee of the Naval Research Lab’s patented halloysite-based, controlled-release technology for certain applications. We are currently working with a number of partners to commercialize certain applications utilizing the patented controlled-release technology.

According to BCC Research, the market for materials used as carriers for controlled release applications is expected to grow to approximately $1.0 billion by 2015.

ENVIRONMENTAL REMEDIATION

Dragonite, due to its high selectivity of toxic compounds, high porosity, high surface area, fine particle size, fast adsorption rate and high absorption capacity, acts as an effective sorbent in environmental remediation and emissions capture. According to the results of research and development activities carried out by the Company and certain academic institutions, Dragonite can be utilized to facilitate the remediation of environments polluted with oil, PCB’s, toluene, phenols, methylene blue, chromium-6, ammonium, heavy and alkali metals, and uranium.

In a deepwater environment, Dragonite performs as an effective sieve to sequester pollutants released from a variety of sources such as oil spills, power plant and mine site run-off. Once captured in the clay, the pollutant is immobilized in a solid form, which can be collected and disposed of in an environmentally friendly manner. Dragonite works as a hydrocarbon remediation material through its ability to adsorb, de-emulsify and disperse micro-droplets of oil, which then float in the upper water column of the deep-sea environment. The outer silica surface of Dragonite rapidly enhances the growth of bacteria necessary, which is necessary for hydrocarbon degradation.

According to research conducted by the Company and certain academic institutions, Dragonite is able to adsorb between 85% and 245% of its weight in oil. Data indicates that upon colonization of bacteria within the Dragonite clay, 98% of the adsorbed hydrocarbon naturally degrades within 7 days, eliminating the need to retrieve the sequestered oil. In a marshland environment, Dragonite adsorbs the oil via capillary “wicking” and prevents penetration to the subsurface. Because Dragonite does not need to be recovered once the oil is adsorbed, disruption of the marsh wildlife is avoided.

In June 2011 the Company announced that it had entered into a Cooperative Research and Development Agreement with the U.S. Environmental Protection Agency’s National Risk Management Research Laboratory to pursue the development of its Dragonite Halloysite Clay sorbent technology used for the bio-remediation of oil from contaminated salt marsh and wetland environments.

AGRICULTURE

Dragonite provides a natural, environmentally friendly solution for a more direct and efficient delivery method of often-toxic agricultural agents. Utilizing the inner lumen of the clay as a natural reservoir, Dragonite is able to load, store, and control the release of a range of agents in a uniform manner, which, in turn, allows a lower loading of a substance, such as pesticide or herbicide, to be as effective as a higher loading delivered in a more traditional manner. Dragonite release rates can be controlled to match the duration of a growth or reproductive cycle, resulting in a reduction of the frequency of applications of an agent. The ability to both utilize lower loadings of toxic agents and reduce the frequency of their application will lead to an improvement in the safety of applying such agricultural agents and prevent of harmful run-off which results from traditional agricultural spraying.

CATALYSTS & MOLECULAR SIEVES

Dragonite works as an excellent binder to zeolite crystals to enhance a molecular sieve’s productivity in critical functions such as drying of natural gas and air, separation of liquid from product streams, and separation of impurities from a gas stream. Dragonite possesses a superb dispersion ability that allows it to combine with the zeolite crystals without attracting to them or reducing the rate of diffusion of liquids and gases. Dragonite’s fine particle size, porosity, and thermal stability also ensure that adsorbates diffuse rapidly through the sieve without affecting the adsorbent blend’s physical properties.

Dragonite is proven to be an effective catalyst and catalyst support for the hydrotreatment and hydrodemetalation of hydrocarbonaceous feedstocks. The clay’s unique tubular morphology, pore size, thermal stability, and high surface area create a perfect recipe for removing impurities such as metals, sulfur, nitrogen, and asphaltenes. Halloysite from the Dragon Mine was previously dedicated strictly to this application, successfully supplying the market over 1.1 million tons of material. Certain results of our drilling program demonstrate that we can produce commercial quantities of clay from the Dragon Mine that meet the purity requirements of catalyst applications. According to the U.S. Geological Service’s 2008 Minerals Yearbook, approximately 337,000 tons of various clays were used in catalyst applications.

8

COSMETICS

Dragonite’s tubular morphology is uniquely suited for an array of cosmetic applications. Dragonite has been shown to be capable of functioning as a non-irritating carrier and release mechanism of cosmetic ingredients for a long lasting application. Additionally, the adsorptive nature of the Dragonite clay serves as an effective hypoallergenic skin cleanser capable of removing unwanted toxins and oils from the skin without the need for harsh chemicals. Dragonite is also capable of exfoliating the skin. We are currently assessing commercial opportunities for the unique cosmetic-related characteristics of Dragonite within the skincare segment of the cosmetic industry.

RESEARCH & DEVELOPMENT

The Company’s research and developments efforts, accounted for as exploration expense, are focused on the continued creation of commercial applications based on the unique morphological and chemical characteristics of the Dragon Mine’s halloysite resource. We have engaged a number of highly regarded consultants who have expertise in controlled release technologies, advanced material development, and polymer engineering.

In 2008, we engaged Ian Wilson, Ph.D. as our consulting geologist. Dr. Wilson has supervised our drilling program and has played a critical role in classifying the mineralization of the Dragon Mine property, which is essential to the successful commercialization of the mine’s deposit. Dr. Wilson is a member of iom3 (Institute of Materials, Minerals and Mining of the UK). His Ph.D. was carried out on wall rock alteration and trace element dispersion patterns around gold and tin ore bodies in Ashanti Gold Mine, Ghana and Geevor Tin Mine, Cornwall, respectively. From 1974 to 2001 he worked with English China Clays/Imerys mainly as a geologist and with management roles in Brazil, Spain, Sweden and China. Since his retirement in 2001, he has worked as an independent consultant dealing with many industrial minerals including halloysite.

Since 2008, we have utilized the services of Steve Hillier, Ph.D. of the James Hutton Institute (Scotland, UK) (formerly known as Macaulay Institute) to analyze the mineralogical characteristics of the Dragon Mine deposit. Dr. Hillier works closely with Dr. Wilson to characterize our property. Dr. Hillier has a Ph.D. from Southampton University (UK) and his research interests revolve around a mixture of clay, soil and environmental mineralogy. Dr. Hillier is considered a leading expert in his field of research.

In 2009, we entered into a development agreement with Yuri M. Lvov, Ph.D., a professor of chemistry at Louisiana Tech University and the T.C. Pipes Eminent Endowed Chair on Micro and Nanosystems at the Institute for Micromanufacturing (Louisiana Tech University). The scope of the agreement includes, among other things, the development of the Dragon Mine halloysite as part of an anti-corrosion paint application in addition to the development of other emerging applications.

In 2009, we entered into an agreement with Transmit Technology Group, LLC (“TTG”) of Austin, TX to act as our research and development facility focused primarily on polymer composite applications. TTG provides contract research and development, testing, technical marketing and consulting services to domestics and international plastic resin producers, compounders, and converters. Amit Dharia, Ph.D., is President of TTG. Dr. Dharia has over 23 years of experience in the plastics industry focused primarily on R&D and new product development. Dr. Dharia is advising us with regard to its pursuit of opportunities within the polymer composite market. Dr. Dharia is also acting as an agent with respect to the sale of Dragonite into customer applications, which he plays a role in developing.

In May 2010, we entered into a consulting agreement with Yash Khanna of Innoplast Solutions. Dr. Khanna has over 34 years of highly diversified experience within the plastics industry focused primarily on new product development and marketing. Dr. Khanna is consulting us on the development, commercialization and marketing of polymer-based applications that utilize our halloysite clay to enhance performance. Dr. Khanna is also acting as an agent with respect to the sale of Dragonite into customer applications, which he plays a role in developing.

In October 2010, we entered into an agreement with KibbeChem, Inc. in which KibbeChem agreed to act as the Company’s partner to toll pelletize a new range of high performance Dragonite™ branded halloysite clay products developed specifically for the polyolefin and elastomer markets. These solution-driven products contain a grade of our Dragonite to be used as a multi-functional additive designed to provide a meaningful improvement in properties at loadings of just 1 to 3%.

In February 2011, we hired Chris DeArmitt, Ph.D. as our Chief Technology Officer. Dr. DeArmitt is a globally recognized expert in plastics, functional fillers and additives. His experience spans all facets of the value chain, having served in senior level positions in areas including R&D, product development, and marketing during his tenures at Electrolux (OEM), BASF (plastics & additives manufacturer) and Hybrid Plastics (specialty additives producer). Dr. DeArmitt worked with the Company as a technical advisor for seven months before being named Chief Technology Officer.

GOVERNMENTAL REGULATION

DRAGON MINE

The Utah Department of Natural Resources sets the guidelines for exploration and other mineral related activities based on provisions of the Mined Land Reclamation Act, Title 40-8, Utah Code Annotated 1953, as amended, and the General Rules and Rules of Practice and Procedures, R647-1 through R647-5. We have received a large mine permit from the department.

We carry a Mine Safety and Health Administration (MSHA) license (#4202383) for this property and report as required to this agency.

The Company is subject to extensive regulation by the Mine Safety and Health Administration, which was created by the Mine Safety and Health Act of 1977. The regulations generally are designed to assure the health and safety of miners and our mine is periodically inspected by MSHA inspectors .

9

The clays that the Company mines, including halloysite, contains crystalline silica when mined. Crystalline silica is considered a hazardous substance under regulations promulgated by the U.S. Occupational Health and Safety Administration (OSHA) and U.S. Mine Health and Safety Administration (MSHA) and as a result is subject to permissible exposure limits (PELs), both in the mine and at the workplaces of our customers. The Company is required to provide Material Saftey Data Sheets (MSDS) at the mine and accompanying sales of products to customers. The Company must also apply hazard warning to labels of containers of the product sold to customers. Kaolin and halloysite are also subject to PELs.

EPA has stated that it is developing a test rule under the Toxic Substances Control Act (TSCA) to require manufacturers (which would include the Company) of certain nanoscale materials including kaolin, halloysite, and alumina (which is present in the clays mined by the company) to conduct testing for health effects, ecological effects, and environmental fate, as well as provide material characterization data. The impact of such a rule on the Company cannot be determined at this time. It seems clear, however, that if the results of the testing of particular nanomaterials indicate adverse health, ecological, or environmental effects, the EPA may seek to regulate those nanomaterials more extensively. Such regulation could include, among other things, limiting the uses of the nanoscale materials; requiring the use of personal protective equipment, such as impervious gloves and NIOSH approved respirators, and limiting environmental releases. The EPA is developing a SNUR for nanoscale materials under TSCA.

EMPLOYEES

As of December 31, 2011, Applied Minerals, Inc. and its subsidiary had 17 employees. None of our employees were covered by a collective bargaining agreement, we have never experienced a work stoppage, and we considered our labor relations to be excellent.

ITEM 1A. RISK FACTORS

RISK FACTORS

AN INVESTMENT IN OUR SECURITIES IS VERY SPECULATIVE AND INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD CAREFULLY CONSIDER THE FOLLOWING RISK FACTORS, ALONG WITH THE OTHER MATTERS REFERRED TO IN THIS ANNUAL REPORT, BEFORE YOU DECIDE TO BUY OUR SECURITIES. IF YOU DECIDE TO BUY OUR SECURITIES, YOU SHOULD BE ABLE TO AFFORD A COMPLETE LOSS OF YOUR INVESTMENT.

At December 31, 2011 and 2010, the Company had accumulated deficits of $39,183,632 and $31,543,411, respectively, in addition to limited cash and unprofitable operations. For the year ended December 31, 2011 and 2010, the Company sustained net losses before discontinued operations of $7,476,864 and $4,891,525, respectively. As of the date of filing this report, the Company has not commercialized the Dragon Mine and has had to rely on cash flow generated from the sale of stock and convertibe debt to fund its operations. If the Company is unable to fund its operations through the commercialization of the Dragon Mine, the sale of equity and/or debt or a combination of both, it may have to file bankruptcy. There is no assurance that we will be able to commercialize the Dragon Mine or if necessary raise money through the sale of debt or equity

NO SIGNIFICANT REVENUE HAS BEEN GENERATED FROM THE SALE OF HALLOYSITE CLAY

The Company has yet to generate any significant revenue from the sale of its Dragonite halloysite clay products. One cannot assume that any significant revenue will be generated from the sale of halloysite clay in 2012 or beyond.

WE HAVE EXPERIENCED CONTINUED, ANNUAL OPERATING LOSSES SINCE SEPTEMBER 1997.

We have experienced annual operating losses since our reactivation in September 1997. As of December 31, 2011, we had an accumulated deficit of $39,026,047. We cannot assure that products can be successfully marketed to an extent that we will ever achieve significant revenues or profit margins.

WE CAN PROVIDE NO ASSURANCE THAT OUR PRODUCTS WILL BE SUCCESSFULLY COMMERCIALIZED

The development or modification of a product that utilizes our Dragonite halloysite frequently requires a manufacturer to expend resources to modify certain aspects of its manufacturing processes. We can provide no assurance that potential customers will be willing to expend the resources necessary to commercialize products utilizing Dragonite.

THE COMPANY’S SUCCESS DEPENDS LARGELY ON THE COMMITTED SERVICE AND AVAILABILITY OF KEY PERSONNEL

In January 2009, Material Advisors, LLC was engaged to assume the managerial responsibilities of Applied Minerals, Inc. Also in January 2009, Andre Zeitoun, the majority partner of Material Advisors, LLC, assumed the role of President and CEO of Applied Minerals, Inc. Mr. Zeitoun has played a critical role in leading the effort to commercialize the Company’s Dragon Mine property. If the Company loses the service of Mr. Zeitoun, there is no assurance that the Company would be able to attract and retain a qualified replacement.

THERE ARE NO ASSURANCES THAT OUR HALLOYSITE PRODUCTS WILL GAIN ADEQUATE COMMERCIAL ACCEPTANCE

We have spent, and will continue to spend, considerable resources on the development of halloysite-based products for a number of applications, which, we believe, would benefit from the utilization of our halloysite clay. Despite the advantages we believe our products provide, there are no assurances that the manufacturers of the applications, to which we are marketing our products, will move to incorporate our halloysite clay into their respective applications. If this does not happen, our ability to achieve significant revenue and profit margins may be impaired.

10

THE COMPANY’S SUCCESS DEPENDS, IN PART, ON ITS ABILITY TO MAINTAIN RELATIONSHIPS WITH CONSULTANTS WHO ASSIST US WITH THE RESEARCH AND DEVELOPMENT OF OUR PRODUCTS.

We currently engage a number of consultants who have assisted us with the research and development of our products. We engage one consultant, in particular, who provides us with access to laboratory facilities through which we much of our product testing is conducted. If we are unable to continue to identify and maintain relationship with consultants who are familiar with halloysite and have expertise in the application areas for which we plan to develop products, our ability to successfully commercialize the Dragon Mine property will be impaired.

MATERIAL WEAKNESS OF INTERNAL CONTROL

As of December 31, 2011 the following material weaknesses in our internal controls over financial reporting were identified: (i) certain controls over equity were not effective to ensure that all transactions involving equity were recorded in an accurate and timely fashion; (ii) certain controls were not effective to ensure that all expenses were accurately categorized; (iii) the Company did not have adequate control over the recording and monitoring of purchase orders and accounts receivables; and (iv) the Company, given its relatively small size, did not have sufficient segregation of duties over a variety of financial processes. If these weaknesses are not remedied, our ability to avoid a material loss may be impaired.

THERE IS COMPREHENSIVE FEDERAL, STATE AND LOCAL REGULATION OF THE EXPLORATION INDUSTRY THAT COULD HAVE A NEGATIVE IMPACT OUR MINING OPERATIONS.

Exploration and mining operations are subject to federal, state and local laws relating to the protection of the environment, including laws regulating removal of natural resources from the ground and the discharge of materials into the environment. Exploration and mining operations and some of the products we sell are also subject to federal, state and local laws and regulations which seek to maintain health and safety standards by regulating the design and use of exploration methods and equipment. We cannot assure you that such permits will be received. No assurance can be given that environmental standards imposed by federal, state or local authorities will not be changed or that any such changes would not have material adverse effects on our activities. Moreover, compliance with such laws may cause substantial delays or require capital outlays in excess of those anticipated, thus causing an adverse effect on our financial position. Additionally, we may be subject to liability for pollution or other environmental damages that we may elect not to insure against due to prohibitive premium costs and other reasons. Management is aware of the necessity of obtaining proper permits prior to conducting any exploration activity.

FAIR MARKET VALUE

We have recorded our properties and equipment held for sale at what we believe to be fair market value. We are actively seeking to sell such properties and equipment. There can be no assurance we can sell such properties and equipment at the value recorded, if at all.

ITEM 1B. UNRESOLVED STAFF COMMENTS

None.

ITEM 2. PROPERTIES

PRINCIPAL OFFICE

As of the date of this filing, the primary corporate office was located at 110 Greene Street, Suite 1101, New York, N.Y., 10012. We also rent office space at 630 East Mullan Avenue #D, Osburn, Idaho 83849.

MINING PROPERTIES

We have assets of real property, mineral leases and options. The following section describes our right, title, or claim to our properties and each property's location. This section also discusses our present plans for exploration of the properties.

JUAB COUNTY, UTAH

Dragon Mine

The Dragon Mine property, located in Juab County, Utah near the City of Eureka (Tintic Mining District), has been principally exploited for halloysite clay. It is located approximately 2 miles southwest of Eureka, Utah and can be accessed via state highway and county road. The Union Pacific Railroad has a spur approximately 2 miles from the property. Electrical power is located approximately 1.5 miles from the site and there was no evidence of a water source on the property except in the mine shaft.

The property consists of 38 patented mining claims, approximately 230 acres, located in the following sections: T10S, R2W, sections 29, 30, 31, and T10S, R3W, Section 36, all relative to the Salt Lake Meridian. We leased the property in 2001 and on August 18, 2005, we purchased the property for approximately $500,000 in cash.

11

It is known that within five kilometers of the Dragon Mine, exploration is being carried out by at least one major mining company to determine the possibility of the existence of a large copper-gold porphyry. We offer the following cautionary statements. Whether such a porphyry exists, the location of such a porphyry, whether any deposits related to any such porphyry are located on our property and whether any such deposits would be of commercial grade or could be economically extracted is not known. If there is a porphyry, it is likely to be located at least 1000 feet under the surface and could be accessed only through a large open pit mine (so that we could not access it on our property by means of an open pit mine confined to our property). It is estimated that if there is a commercial grade mineralization that could be economically extracted, a large mining company would have to acquire sufficient land for a large open pit mine, expend billions in preparation for mining and it is estimated that it would be at least 15 or 20 years before mining could begin.

Testing of surface rock samples in the vicinity of the Dragon Mine carried out in the past show anomalous copper values with gold values exceeding one ounce per ton and silver values of approximately five ounces per ton. Records indicate that, during the 1870’s, mining activity at the Dragon Mine had been focused on the iron ore presence at the mine. According to certain records kept by the U.S. Bureau of Mines, the 305,000 tons of iron ore mined during the 1870’s produced 18,000 ounces of gold and 928,000 ounces of silver. In connection with our mining of iron ore at the Dragon Mine and in connection with drilling in connection with a resource statement concerning the iron ore, we have tested for the presence of commercial amounts of copper, gold and silver and we have not found any. We will continue testing and if commercial amounts are located, we will consider the appropriate alternatives.

Certain geological research indicates that the existence of certain clays, such as the ones found at the Dragon Mine, is one of a number of possible indicators of the possible presence of an underground, copper-gold porphyry. We are currently evaluating the feasibility of exploring for a potential copper-gold deposit at the Dragon Mine. If we decide to pursue such exploration activities, we can provide no assurance that our exploration activities will be successful.

PROPERTIES HELD FOR SALE

Shoshone County, ID

We own approximately 900 acres of fee simple property and patented mining claims, and 260 acres of mineral rights and unpatented claims, including the Atlas Mine, located in the Coeur d'Alene mining district in Shoshone County, Idaho, commonly referred to as the Silver Valley of North Idaho. At December 31, 2011, this property was classified as held for sale. We are actively seeking to sell our properties in Idaho, however, we cannot provide any assurances that we will be able to do so.

ITEM 3. LEGAL PROCEEDINGS

In accordance with SFAS No. 5, Accounting for Contingencies, when applicable, we record accruals for contingencies when it is probable that a liability will be incurred and the amount of loss can be reasonably estimated. In addition to the matters described herein, we are involved in or subject to, or may become involved in or subject to, routine litigation, claims, disputes, proceedings and investigations in the ordinary course of business, which in our opinion will not have a material adverse effect on our financial condition, cash flows or results of operations. Currently, we have no lawsuits, claims, proceedings and investigations pending involving us.

ITEM 4. MINE SAFETY DISCLOSURES

The information concerning mine safety violations or other regulatory matters required by Section 1503(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act and this Item is included in exhibit 95 to this 10-K.

PART II

|

ITEM 5.

|

MARKET PRICE FOR THE REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDERS MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

Market Prices for Our Common Stock

Our common stock is quoted on the OTCBB under the symbol “AMNL.” The following quotations reflect inter-dealer prices, without retail mark-up, mark-down, or commission, and may not represent actual transactions.

|

Year 2011

|

Year 2010

|

|||||||

|

High

|

Low

|

High

|

Low

|

|||||

|

First Quarter

|

$ 0.83

|

$ 0.71

|

$ 0.93

|

$ 0.59

|

||||

|

Second Quarter

|

$ 1.78

|

$ 0.82

|

$ 1.08

|

$ 0.71

|

||||

|

Third Quarter

|

$ 2.10

|

$ 1.30

|

$ 1.06

|

$ 0.75

|

||||

|

Fourth Quarter

|

$ 1.70

|

$ 1.07

|

$ 0.87

|

$ 0.62

|

||||

Record Holders

As of December 31, 2011, there were approximately 1,535 holders of record of our common stock. This number does not include an indeterminate number of shareholders whose shares are held by brokers in street name.

12

Dividends

Since we became a reporting company in 1999, we have never declared or paid any cash dividend on our common stock. We are not subject to any restrictions or limitations relating to the declaration or payment of dividends other than those imposed by state corporate laws applicable to corporations generally.

Equity Compensation Plans

In June 2008, as compensation for his work as Chief Executive Officer, Michael Lyon was granted 50,000 options to purchase common stock with an exercise price of $0.65 per share and a term of 5 years. The options vest monthly over a 12-month period beginning June 2008.

In August 2008, as compensation for his work as Chief Executive Officer, Michael Lyon was granted 25,000 options to purchase common stock with an exercise price of $0.71 per share and a term of 5 years. The options vest monthly over a 12-month period beginning August 2008.

In October 2008, Mr. Morris D. Weiss, a former director, was named the Company’s Chief Restructuring Officer for a period of six months and, as part of his agreement with us, was granted 550,000 options to purchase common stock with an exercise price of $0.70 per share and a term of 10 years. 250,000 of these options vested upon the appointment of Mr. Weiss as Chief Restructuring Officer and the remaining 300,000 options vested at the conclusion of his term as Chief Restructuring Officer. In May 2009, Mr. Weiss was granted an additional 100,000 options an exercise price of $0.70 per share and a term of 10 years for work related to a class action settlement. As of the date of this report, the 100,000 have fully vested.

In December 2008, the Company entered into a Management Agreement with Material Advisors LLC, a management services company. The agreement granted Material Advisors, LLC 6,583,277 options to purchase common stock at $0.70 per share with a ten-year term. The options vest equally over 36 months starting on the effective date of the Management Agreement. A copy of the Management Agreement was filed as an 8-K on January 7, 2009.

In April 2009, as compensation per the terms of a consulting agreement, Rubenstein Investor Relations was granted 100,000 options to purchase common stock that have an exercise price of $0.35 and a term of five years. The options have vested.

In October 2009, as compensation related to his election as Chairman of the Board of Directors, John Levy was granted 125,000 options to purchase common stock that have an exercise price of $0.70 per share and a term of five years. The options have vested.

In October 2009, as compensation for acting as agent related to a financing, Rodman & Renshaw, LLC was granted 160,000 warrants to purchase common stock with an exercise price of $1.00 per share and a term of five years. The warrants have vested.

In February 2010, as compensation related to his position as Chief Technical Officer, Chris DeArmitt was granted 213,402 warrants to purchase common stock that have an exercise price of $0.78 per share and a term of five years. The warrants have vested.

In March 2010, as compensation related to his position as Chairman of the Board of Directors, John Levy was granted 60,000 options to purchase common stock that have an exercise price of $1.00 per share and a term of five years. The options have vested.

In October 2010, as compensation fro acting as agent related to a financing, Tejas Securities, Inc. was granted 180,000 warrants to purchase common stock that have an exercise price of $1.00 per share and a term of five years. The warrants have vested.

In October 2010, as part of work provided per the terms of consulting agreement related to the marketing of certain non-core assets, the Company granted Victor Lazarovici 139,340 warrants to purchase common stock that have an exercise price of $0.75. The warrants have vested.

In February 2011, as part of the extension of its Management Agreement with the Company, Material Advisors, LLC was granted 2,904,653 options to purchase common stock that have an exercise price of $0.83 per share and a term of 10 years. The options have vested.

In January 2011, as part of work provided per the terms of consulting agreement related to the marketing of certain non-core assets, the Company granted Victor Lazarovici 124,481 warrants to purchase common stock that have an exercise price of $0.80. The warrants have vested.

In February 2011, as compensation related to his position as Chairman of the Board of Directors, John Levy was granted 100,000 options to purchase common stock that have an exercise price of $0.83 per share and a term of five years. The options have vested.

In February 2011, as compensation related to his position as work performed as Chairman of the Executive Committee, Evan Stone was granted 200,481 options that have an exercise price of $0.83 per share and a term of five years. The options have vested.

In April 2011, as part of an engagement of Dahlman Rose & Co. as its financial advisors, granted it 461,340 options to purchase common stock with an exercise price of $1.15 per share and a term of ten years. The options have vested.

In August 2011, the Company issued to Chris DeArmitt, it Chief Technology Officer, 54,367 warrants to purchase common stock that have an exercise price of $2.00 per share and a term of five years. The options were granted in lieu of a portion of cash salary Mr. DeArmitt was due per the terms of his employment agreement. The options have vested.

In August 2011, as compensation related to his position as General Counsel of the Company, William Gleeson was granted 900,000 options to purchase common stock that have an exercise price of $1.90 per share and a term of ten years. The options vest equally over a thirty-sixth month period beginning August 2011.

13

|

Equity Compensation Information

|

||||

|

As of December 31, 2011

|

||||

|

Number of securities to be issued upon exercise of outstanding options, warrants, and rights

|

Weighted-average exercise price of outstanding options, warrants and rights

|

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))

|

||

|

(a)

|

(b)

|

(c)

|

||

|

Equity compensation plans approved by security holders

|

- 0 -

|

- 0 -

|

-0-

|

|

|

Equity compensation plans

|

||||

|

not approved by security holders

|

13,021,341

|

$0.85

|

-0-

|

|

|

Total

|

13,021,341

|

$0.85

|

||

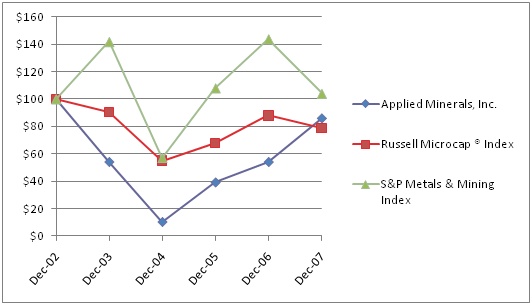

COMPARISON OF 5-YEAR CUMULATIVE TOTAL RETURN*

AMONG APPLIED MINERALS, INC.

|

Dec-06

|

Dec-07

|

Dec-08

|

Dec-09

|

Dec-10

|

Dec-11

|

|

|

Applied Minerals, Inc.

|

$100

|

$54

|

$10

|

$39

|

$54

|

$86

|

|

Russell Microcap ® Index

|

$100

|

$91

|

$55

|

$68

|

$88

|

$79

|

|

S&P Metals & Mining Index

|

$100

|

$142

|

$57

|

$108

|

$144

|

$104

|

* Cumulative return assumes a $100 investment of each respective security at December 31, 2006

14

|

ITEM 6.

|

SELECTED FINANCIAL DATA

|

|

Year Ended December 31 (in 000’s except per share data)

|

2011

|

2010

|

2009

|

2008

|

2007

|

|

Revenue

|

$92.0

|

$0

|

$0

|

$0

|

$0

|

|

Income (loss) from continuing operations

|

$(7,529.2)

|

$(4,891.5)

|

$(6,701.5)

|

$(6,215.7)

|

$(4,700.1)

|

|

Net income (loss)

|

$(7,534.9)

|

$(4,767,7)

|

$(6,766.2)

|

$(5,420.4)

|

$(1,681.7)

|

|

Income (loss) from continuing operations - basic

|

$(0.10)

|

$(0.07)

|

$(0.11)

|

$(0.11)

|

$(0.09)

|

|

Net income (loss) - basic

|

$(0.10)

|

$(0.07)

|

$(0.11)

|

$(0.10)

|

$(0.03)

|

|

Income (loss) from continuing operations - diluted

|

$(0.10)

|

$(0.07)

|

$(0.11)

|

$(0.11)

|

$(0.09)

|

|

Net income (loss) - diluted

|

$(0.10)

|

$(0.07)

|

$(0.11)

|

$(0.10)

|

$(0.03)

|

|

Cash and equivalents

|

$10,170.5

|

$1,642.3

|

$1,584.9

|

$903.0

|

$1,210.6

|

|

Total assets

|

$12,874.8

|

$4,215.1

|

$4,005.3

|

$4,506.1

|

$6,271.6

|

|

Long-term liabilities

|

$97.8

|

$5,055.0

|

$2,257.3

|

$1,357.9

|

$705.9

|

|

Shareholders’ equity (deficit)

|

$8,828.4

|

$(1,561.3)

|

$310.6

|

$2,197.0

|

$4,517.0

|

|

ITEM 7.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL

|

CONDITION AND RESULTS OF OPERATIONS

OVERVIEW

Applied Minerals, Inc. is a leading global producer of halloysite clay used in the development of advanced polymer, catalytic, environmental remediation, and controlled release applications. The Company operates the Dragon Mine located in Juab County, Utah, the only commercial source of halloysite clay in the western hemisphere. We believe that the only source of halloysite clay in the Western Hemisphere large enough, and of high enough purity, to supply commercial-sized application demand.

Since January 1, 2011 we have sold approximately $93,000 of halloysite clay to two companies that are using it in the production of a number polymer-based applications. We have three grades of halloysite products, the difference among them being the percentage of halloysite contained in each. We also differntiate our halloysite products based on color. At times we surface treat our product to achieve certain performance characteristics required by customers products. There are approximately 300 companies in various stages of testing halloysite clay products.

There have been no sales of iron ore. We intend to market the goethite and the hematite as iron ore pigments.

GCRITICAL ACCOUNTING POLICIES

The following accounting policies have been identified by management as policies critical to the Company’s financial reporting:

Use of Estimates