Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Titan Energy Worldwide, Inc. | Financial_Report.xls |

| EX-21 - EXHIBIT 21 - Titan Energy Worldwide, Inc. | v308136_ex21.htm |

| EX-32.2 - EXHIBIT 32.2 - Titan Energy Worldwide, Inc. | v308136_ex32-2.htm |

| EX-31.1 - EXHIBIT 31.1 - Titan Energy Worldwide, Inc. | v308136_ex31-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Titan Energy Worldwide, Inc. | v308136_ex31-2.htm |

| EX-32.1 - EXHIBIT 32.1 - Titan Energy Worldwide, Inc. | v308136_ex32-1.htm |

U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| R | ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 31, 2011 |

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from ________ to ________ |

Commission File No. 000-26139

Titan Energy Worldwide, Inc.

| Nevada | 26-0063012 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

6130 Blue Circle Drive, Suite 600, Minnetonka, MN 55343

(Address of principal executive offices) (Zip Code)

Company’s telephone number, including area code: (952) 960-2371

Securities registered under Section 12(b) of the Exchange Act: None.

Securities registered under Section 12(g) of the Exchange Act:

Common stock, par value $0.0001 per share.

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act Yes ¨ No R

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No R

Indicate by check mark whether the Company (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding twelve months (or such shorter period that the Company was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes R No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ¨ No R

Check if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained in this form, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. R

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” ““accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer £ | Accelerated filer£ | Non-accelerated filer £ | Smaller reporting company R |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No R

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of June 30, 2011 (the last business day of the registrant’s most recently completed second fiscal quarter): $5,596,504

Indicate the number of shares outstanding of the Company’s classes of common stock as of April 16, 2012 36,084,315 shares.

Documents incorporated by reference: None.

TABLE OF CONTENTS

| PART I | 3 | ||

| ITEM 1. | DESCRIPTION OF BUSINESS | 3 | |

| ITEM 2. | DESCRIPTION OF PROPERTY | 23 | |

| ITEM 3. | LEGAL PROCEEDINGS | 23 | |

| ITEM 4. | (REMOVED AND RESERVED) | 23 | |

| PART II | 24 | ||

| ITEM 5. | MARKET FOR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS | 24 | |

| ITEM 7. | MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION | 26 | |

| ITEM 8. | FINANCIAL STATEMENTS | 35 | |

| ITEM 9. | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | 36 | |

| ITEM 9A. | CONTROLS AND PROCEDURES | 36 | |

| ITEM 9B. | OTHER INFORMATION | 37 | |

| PART III | 37 | ||

| ITEM 10. | DIRECTORS AND EXECUTIVE OFFICERS OF THE COMPANY | 37 | |

| ITEM 11. | EXECUTIVE COMPENSATION | 39 | |

| ITEM 12. | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 42 | |

| ITEM 13. | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 43 | |

| ITEM 14. | PRINCIPAL ACCOUNTANT FEES AND SERVICES | 43 | |

| ITEM 15. | EXHIBITS | 44 |

PART I

ITEM 1. Description of Business

Statements in this Form 10-K Annual Report may be “forward-looking statements.” Forward-looking statements include, but are not limited to, statements that express our intentions, beliefs, expectations, strategies, predictions or any other statements relating to our future activities or other future events or conditions. These statements are based on current expectations, estimates and projections about our business based, in part, on assumptions made by our management. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may, and probably will, differ materially from what is expressed or forecasted in the forward-looking statements due to numerous factors, including those described above and those risks discussed from time to time in this Form 10-K Annual Report, including the risks described under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and in other documents which we file with the Securities and Exchange Commission (“SEC”).

In addition, such statements could be affected by risks and uncertainties related to our financial condition, factors that affect our industry, market and customer acceptance, competition, government regulations and requirements, pricing, general industry and market conditions, growth rates, and general economic conditions. Any forward-looking statements speak only as of the date on which they are made, and we do not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date of this Form 10-K Annual Report.

Overview

We specialize in the sales and management of onsite power generation for industrial and commercial customers. By utilizing advanced communication technologies, automated data collection, reporting systems and remote monitoring capabilities, we believe we are creating a new standard for power asset management and are leading the way for critical energy management programs such as demand response and distributed generation. In fact, we believe we are one of the first companies to combine expertise in power generation asset management with real time information processing to create a more reliable and effective Smart Grid approach to onsite power management.

We provide our products and services to customers nationwide. These customers include utilities, major national retailers, telecommunications companies, banks, data centers, grocery stores, hospitals and other health care facilities, schools and colleges, property management companies, government and military facilities, manufacturers, retail stores among others. We offer a range of state-of-the-art generators supplied by some of the leading generator manufacturers such as MTU Onsite and Generac Power Systems. We also provide and service transfer switches and UPS systems so as to completely meet the energy management needs of our customers.

We have dedicated considerable resources to developing a technologically superior program that benefits our customer from a cost and quality standpoint. Our professionally trained team services more than 5,000 generators owned by more than a thousand customers with facilities located throughout the United States. We are always striving to advance our capabilities and improve our customers’ experiences. For example, to meet a critical need in our industry, we developed our own proprietary remote monitoring and automated control system for onsite power generation. At the request of our major retail customers, we have developed a national network of professionally trained service technicians so that we can effectively service equipment in any city of the United States and maintain the same high level of quality at each site.

Since our inception in 2006, we have grown substantially. We began with one office providing emergency and back-up power and have expanded to five regional offices providing services nationwide. We reported gross sales revenues of $14 million in 2011, which is basically equal to revenues in 2010; however we continue to see a strong, steady increase in higher margin service revenue, offsetting the lower equipment growth. We have significantly grown our service business which for the most part consists of recurring revenue service contracts to maintain and manage our customers’ power generation assets. As discussed in more detail below, 64% of our sales revenues were from power generation equipment and 36% from our service programs. That said we are currently seeing a significant surge in equipment sales, perhaps the result of mild winter weather and a recovering economy

Currently, we are reporting a net loss of $3,435,009 for 2011. The Company believes the “Adjusted EBITDA” (a non-GAAP financial measure) is a better indicator of our liquidity position which is calculated by adjusting our cash outflow by the changes in operating assets and liabilities and reducing it by interest expense. Our 2011 adjusted EBITDA was a negative $1,577,130. Our adjusted EBITDA improved steadily month by month throughout 2011. We posted our lowest losses in the 4th quarter of 2011 since June 2010, and for the month of December 2011 we achieved a positive adjusted EBITDA. Based on a number of positive economic factors that are carrying forward into 2012, including increased sales revenues, sales backlog and higher margin service sales, Management believes that the Company can achieve a positive adjusted EBITDA in 2012.

| 3 |

Significant Recent Developments

The following developments were critical to building our business in 2011:

| 1. | Establishment of our National Accounts Business. Our national accounts business services customers that have multiple locations in several states and regions of the United States. In less than a year we have successfully grown our national accounts business from a few locations to more than 2000 locations nationwide. Many of our customers are Fortune 100 companies and we believe we will continue to see significant growth and expansion in this business in 2012. |

| 2. | Development of our remote monitoring and automated control platform for power generation asset management. In 2011 we completed the development and testing of our remote monitoring platform and are now ready to begin commercial deployment. The need for remote monitoring is growing throughout the onsite power industry as customers seek improved operating and maintenance information on their power investments. New EPA regulations will require regular monitoring of emissions. Programs such as demand response and distributed generation will require our monitoring to operate more effectively and reliably in these critical energy management efforts. We expect our remote monitoring system to be a market differentiator for Titan and our service programs, as well as support our penetration into the demand response and distributed generation markets. |

| 3. | Launch of national service and maintenance program for onsite power generation. To best serve our national clients, we developed a national network of professional service technicians who can respond promptly and effectively to a service need anywhere in the United States. This service is provided on a 24/7 basis and managed from our Minneapolis office. Now fully in place, this program allows us to begin expansion of our national accounts and demand response businesses. |

| 4. | Automated audit and asset management program. Responding to the needs of one of our national account customers, we have developed an automated equipment audit and asset management program utilizing state of the art equipment and specialized software solutions for the collection, transmission and reporting of audit data. Once fully developed, we plan to offer this service to all of our customers as well as use it as a tool to garner more national account business. |

| 5. | Launch of our SMART POWER program for servicing generators in demand response programs. The Midwest has thousands of industrial customers on Interruptible Rate demand response programs and the number in the Midwest and the nation is expected to grow as utilities seek to expand their demand response resources. (See Section “Our Products and Services” below). To better serve these customers and provide a more comprehensive and effective service programs, we have developed out SMARTPOWER program which combines onsite monitoring with advanced service and asset management capabilities to create a program that improves generator performance, helps support utilities’ demand response programs and provides all required reporting. |

| 6. | Board of Advisors. To better support Management and staff in making operational, sales and development decisions, as well as provide the Company with industry information and marketing support, we established a board of advisors comprised of some of the top professional in the energy and utility infrastructure industries. Some members of the Board of Advisors have strong relationships with government and regulatory institutions this will allow Management to stay better abreast of changes affecting our industry and supporting our efforts to expand the acceptance and utilization of our technologies and services. |

| 4 |

Background

To appreciate how our business operates within the electrical utility industry requires some background of the electrical power industry, the Smart Grid, Demand Response, Distributed Generation and the Regulatory Organizations that influence our industry.

The Electric Power Industry

When the National Academy of Engineering convened a jury in 2003 to recognize the most important technological developments of the twentieth century, they chose national electrification as the preeminent engineering achievement. Across the country, an integrated system of nearly ten thousand power plants and six million miles of power lines had been constructed, connecting an inconceivable array of electric devices. This massive, complicated network with its millions upon millions of circuits, switches, breakers and other elements, operated with 99.97% reliability. Impressive as that may sound, it is simply not good enough. According to the DOE, the 0.03% unreliability resulting from grid failures is responsible for $150 billion in annual losses in the U.S (Source: U.S. Department of Energy (DOE), The Smart Grid: An Introduction, 2009).

Traditionally, the utility system can be thought of in terms of three interconnected segments: energy production, transmission and distribution. Utilities have been constrained in their ability to invest in new power production plants needed to meet projected growth in demand by a restrictive regulatory process, the increased burden of environmental constraints and a lack of government and public support for long-term, major capital infrastructure projects. This has increased the strain on the existing electric power grid , in particular in capacity constrained areas and, combined with higher costs to produce electricity, has caused the price of electricity to increase in nearly all areas of the country, especially during peak demand periods.

Challenges at the level of production are mirrored on the transmission side of the electrical power grid. Under-investment in the transmission infrastructure required to deliver power from centralized power plants to end-use customers has resulted in an overburdened electric power grid. This periodically prevents the transport of the lowest cost power to constrained areas, which can affect reliability and cause significant economic impact. For example, although a base load power plant might have sufficient capacity, if the grid is underdeveloped for delivery, it will result in congestion on the grid. When there is congestion on the grid, the grid operator might call upon a generating plant to operate based on its ability to alleviate the congestion (its location). If the called-upon generator is a peaking plant the cost of energy will be higher. Not only does this increase the cost of energy during non-peak times, when a peaking event occurs the capacity intended for peaking is already being used.

This under-investment in generation and transmission, coupled with a growth in electricity consumption, has led to an increased frequency of brownouts (when power delivery is severely reduced) and blackouts (when power delivery is completely disrupted), which results in lost productivity, loss of perishable goods, and other major problems. This environment of increasing demand coupled with inadequate resources has generated a growing need in the marketplace for products and services in our strategic growth areas of Emergency and Back-up Power, Power Generation Maintenance Programs, Demand Response and Distributed Generation. Titan has created programs that will allow onsite power generation to participate more effectively and reliably in these programs as they become more popular across the United States.

While grid failures impact all of us to some extent, there are many industries which simply cannot afford to lose power for any length of time for economic reasons. The table below illustrates the economic damages across several industries:

| Cost of One-Hour Power Service Interruption in Various Industries | Average Cost of 1-Hour of Interruption | |||

| Cellular communications | $ | 41,000 | ||

| Telephone ticket sales | $ | 72,000 | ||

| Airline reservation system | $ | 90,000 | ||

| Semiconductor manufacturer | $ | 2,000,000 | ||

| Credit card operation | $ | 2,580,000 | ||

| Brokerage operation | $ | 6,480,000 | ||

| Source: U.S. Department of Energy |

| 5 |

Its impressive engineering accomplishments notwithstanding, the electrical utility industry has not kept up with the growth in demand for power during the last decades, potentially increasing rates of failure especially in densely populated cities and rapidly growing industrial zones. While energy consumption has actually declined in the United States the last few years, partially due to the response to the recent economic downturn, according to the North American Electric Reliability Council, demand for electricity is expected to increase over the next 10 years by approximately 18%, while generation capacity is expected to increase by only 6%. Another way of looking at this is that since 1982, growth in peak demand for electricity – driven by population growth, bigger houses, bigger TVs, more air conditioners and computers – has exceeded growth by almost 25% every year. As a result, in North America, margin between electric supply and demand is projected to drop below minimum target levels (below what is needed for regulatory requirements) over the next few years.

Population growth has the most straightforward effect on energy consumption. According to the U.S. census estimate, the United States will grow by over 100 million people by 2050. Even if we could keep per capita electricity use constant, as California has done for a decade, we would increase total power sales by nearly 33%. Distribution companies will also need to install about forty million more electric meters in new housing units and expand their systems accordingly. Economic activity and power use are, of course, related. The stronger the U.S. economy grows, that more power is used by industrial and commercial firms and more residential customers buy and more use electrical equipment.

In addition, electricity is gradually stealing market share from other fuels for the overall mix of applications we use in the United States. In the residential sector, for example, electricity use is projected to grow six times faster than natural gas use through 2030. During the next century this trend will take a giant leap forward. In the United States the largest use of energy outside the power sector is gasoline use for personal vehicles. As plug-in hybrid-electric vehicles (PHEVs) are introduced, electricity will gradually displace gasoline, boosting power sales at the expense of oil-based fuels. Over the long run, PHEVs represent a large new use of electricity. The timing depends on how quickly these vehicles will become affordable and how well public policies encourage their adoption. A 2007 study by the Electric Power Research Institute (EPRI) forecasts that we will need 282 million megawatt hours - the output of thirty-eight large power plants - to "fuel" all these cars.

In any case, many experts have argued that our ability to manage consumption and maintain reasonable pricing for electricity as the EIA has set forth will ultimately depend on the availability, strength and efficacy of our energy efficiency, demand response and distributed generation programs. (For example, Peter Fox-Penner. Smart Power: Climate Change, the Smart Grid, and the Future of Electric Utilities, 2010; and Amory Lovins, Reinventing Fire, 2011). Advanced technologies, improved service and better management are the keys, and this is where the expertise of Titan Energy can play a significant role in our nation’s energy management programs.

The Smart Grid

Technological advances are beginning to have a profound impact on how the electrical grid operates and how it is envisioned to function in the future. Indeed, the success of energy efficiency programs and demand response will in many ways be measured in how it is able to meet the challenges presented by electrical utility systems that are not technologically efficient or controlled. In particular, key developments have come in the way of metering, web-based tools and applications and communication protocols.

While definitions of what constitutes a Smart Grid vary, nearly all attempts to describe the Smart Grid include one key element: the need to provide accurate and reliable communication of information. What this really means is the intersection of modern information technology and the electric system. Combining time-based prices with the technologies that can be set by users to automatically control their use and self-production, can lower power costs and offering other benefits such as increased reliability to the system as a whole.

For the most part, the electrical utility grid that we have been referring to is not exceedingly “smart.” The foundation of the transmission system consists of decade’s old technology that oftentimes requires customers to notify the utility of power outages, costly truck rolls to read electrical meters, and inefficient load profiles of electrical consumption. Too often utilities learn of a power outage only when a customer calls, and utilities and electric consumers still lack the information intelligence to prevent many problems and disasters even when we see them coming. However, billions of dollars, dozens of utilities and hundreds of companies are dedicated to finding a way to bring a new level of intelligence, communication and efficiency to the electrical utility grid. In fact, many believe the utility grid holds the same if not greater promise as the Internet in our future.

Electric utilities are under increasing economic, regulatory, environmental and societal pressure to deploy open standard based smart grid technologies to more efficiently serve their customers and the public at large. Likewise, FERC, Federal Energy Regulatory Commission (the Federal agency that regulates electricity infrastructure and transmission among other mandates) has been directed by Congress to adopt standards and protocols over Smart Grid technologies and FERC has committed to implement rate treatment policies that support investments in Smart Grid technologies. On July 16, 2009, FERC issued a Policy Statement for development of key standards for Smart Grid devices and systems and an interim rate. (FERC, Smart Grid Policy, 128, ¶ 61,060 (2009))

| 6 |

The economic advantages of having a more intelligent electrical grid are numerous. Smart Grid technologies could reduce power disturbance costs to the U.S. economy by $49 billion per year. (Source: Electric Power Research Institute (EPRI), “Electricity Sector Framework for the Future”). EPRI estimates $1.8 trillion in annual additive revenue by 2020 with a substantially more efficient and reliable grid. Delivering the electrical power generated today by more efficient means can greatly reduce the need to build out new power plants by between $46 billion and $117 billion over the next 20 years. Additional benefits include the avoided costs of additional in GHG emissions that would result from fewer new power plants. Widespread deployment of technology that allows businesses to more easily control their power consumption could add $5 billion to $7 billion per year back into the U.S. economy by 2015, and $15 billion to $20 billion per year by 2020. According to the EPRI’s same report, distributed generation technologies and smart, interactive storage capacity could add another $10 billion per year to the U.S. economy by 2020.

Titan Energy, through its development of remote monitoring and asset management platforms, considers itself to be a key participant in Smart Grid development and implementation, Titan also consider itself to be a company that can contribute solutions, new technologies and results that will benefit the utilities and customers alike.

Demand Response Programs

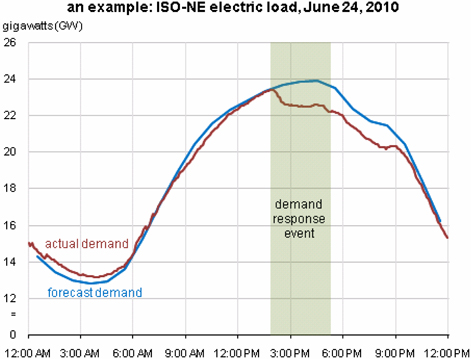

Demand response is a program that changes the consumer’s usage of electrical energy either through behavioral or load shifting methods (i.e. method of reducing electric demand at critical times for the grid)... Demand response is a resource that is often utilized to mitigate the effects of peak demand, those times when the load on the grid outstrips either production or transmission capacity or creates detrimental pricing effects. According to the DOE, the majority of operational problems on the electrical grid occur during times of peak demand. While these periods of peak load occur relatively infrequently, less than 1% of the time, they are often responsible for the economic impacts of power failures as well as the utility’s need to build additional infrastructure or buy expensive energy to meet the need during these relatively rare periods. Utilities are mandated to have this additional capacity and performance standards in place and it is very expensive to do so

Demand response is recognized as an important solution to help address the imbalance in electric supply and demand. The role of demand response as an electrical utility recourse has increased as the feasibility of building new production facilities or transmission lines has lessened. As a result, greater and more specific support has been forthcoming from government and regulatory agencies for demand response. For example, the Energy Policy Act of 2005 declared it the official policy of the United States to encourage demand response and the adoption of devices that enable it.

More than 500 utilities and utility service entities are currently offering demand response programs in the U.S. and the potential demand response resource contribution from all programs in 2011 was estimated to be more than 58,000 MW or about 7.6% of U.S. peak demand. (FERC 2011). This is an increase of about 17,000 MW from 2008. The regions with the largest demand response resources are the Midwest, Mid-Atlantic, and the Southeast regions.

| 7 |

Over the past 10 years, demand response has become such an important resource in helping to maintain the electrical utility grid, that some have gone so far as to proclaim that demand response will evolve beyond its current role in load curtailment to fundamentally change how electricity is produced, transported and consumer. (ACEEE Report). Already demand response program have had an impact on price stability, reliability and operations in many of the bid-based organized markets.

Demand response can have an economic effect beyond price savings for customer and utilities. Depending on its effectiveness in managing peak demand, demand response programs can also influence money spent on new power plants and infrastructure. It is estimated by the International Energy Agency that over 10% of the $2.65 trillion in electrical power infrastructure to be built between 2007 and 2030 will be constructed specifically to meet peaks in electricity demand which occur less than 88 hours per year. Based on these estimates, the market in North America for reducing demand during these critical peak hours, in place of building supply infrastructure, is $11.5 billion per year, if the need to build-out infrastructure occurs on an equal annual basis. Using these same assumptions, the market for eliminating the top 1% of peak demand for electricity worldwide during this same period could be over $59.2 billion per year. Based on its June 2009 Congressionally-mandated National Assessment of Demand Response Potential, FERC estimates the potential for peak electricity demand reductions across the country to be between 38 gigawatts (GW) and 188 GW. Another industry analyst, the Brattle Group, estimates that reducing peak demand in America by a mere 5% would yield savings of about $66 billion over 20 years. This avoided capacity cost is often the largest benefit from demand response, even larger than the energy savings to all customers. In fact, demand response from both traditional and Smart Grid sources is expected to eliminate 80% of all peak power growth through 2016.

New uses of demand response are beginning to be accepted as the U.S. moves towards greater use of wind and solar power generation. Demand response has the potential to reduce transmission capacity by reducing peak demand, run the amount of ancillary service needed by reducing the peak and to directly provide ancillary services such as short term reserves and frequency support.

Interruptible Rate Demand Response

One of the most available sources of Demand Reduction is the on-site power generator. The DOE estimates that there are more than 192 GW of potential demand reduction capability in onsite power generation currently installed in the United States (Backup Generators (BUGS): The Next Smart Grid Resource, April 10, 2010). Diesel and natural gas generators offer the largest and most available source of immediate power. It is likely that generators will remain the on-site generation system of choice for many years to come. Developments in the design of diesel and other generators have produced a new echelon of engine powered generators that are cleaner, quieter and more environmentally friendly. Power generators as a demand response resource have environmental benefits as well. The DOE also provides data to support the conclusion that the use of onsite diesel power generators in a demand response program would produce fewer pollutants than gas powered peaking plants

Demand response programs aimed at reducing peak load by having onsite generators (called “peak shaving generators”) provide a facility’s electrical power can have economic benefits for both the utility and the consumer. In many cases, peaking generators only need to run a few hours a year when the load on the grid is at its highest, when energy costs are as high as $1000 per megawatt hour (MWh) to generate (Source: Electricity Advisory Committee's report, “Keeping the Lights On in the New World”). In the longer term, the use of demand response / load management programs as a power generation resource avoids the expense of building peak generation infrastructure. The same BUGS report by the DOE referenced above also presents data suggesting that the use of diesel generators during peak demand periods can produce fewer emissions than gas-fired peaking plants.

The Impact of Regulation and the Opportunity It Creates

Regulation by State and Federal Government. The state and federal governments’ regulation of the energy industry continue to advance our market opportunities. The states regulate the retail sales and transmission of energy to consumers, whereas the Federal Energy Regulatory Commission (FERC) protects consumers by ensuring the wholesale electric market is just and reasonable.

FERC’s regulation of the wholesale electric market includes sales and transmission of electricity in interstate commerce, and promoting safe, reliable and efficient energy infrastructure. In The Strategic Plan FY 2009-2014 (September, 14, 2009) FERC identifies key strategies which include the Smart Grid, Demand Response, and Renewable Resources.

The states regulatory oversight of retail energy rates for consumers also encompasses renewable energy and energy conservation mandates and programs. Interruptible rate programs, offered by utilities and regulated by each state’s Public Utility Commission, or other state regulatory agency, have increased the payback for customers who choose on-site generation. These rate programs and our ability to work with the utility on behalf of a customer provide us with a substantial strength in marketing our on-site generation products.

| 8 |

Regulation of Power Engines and Emission. In 1996, the Environmental Protection Agency (EPA) introduced new emission standards aimed at non-road mobile diesel engines including onsite stationary power generators. To be phased in over a four-year period beginning January 2007, these regulations require the new diesel engines that power these generators to comply with a tiered timing structure of emission allowances. Based on the system’s engine horsepower rating, generators are rated from Tier 1 to 4, with most non-emergency diesel engine generators required to arrive at Tier 4 by 2012. Tier 4 requirements are the most stringent.

Beginning January 1, 2011, the EPA will introduce the next phase of its Tier 4 emissions control regulations. The regulations limit emissions of oxides of nitrogen, particulate matter, hydrocarbons and carbon monoxide. Non-emergency diesel engines less than 10 liters per cylinder and greater than 175 hp will be required to meet Tier 4 regulations. The term “non-emergency” is very important in this context. Essentially, if an installation is classified as emergency, the power generator must not run unless the primary electrical power source is not available. However, owner/operators are allowed to run their emergency-classified power generators up to 100 hours per year for maintenance and testing. There is no current limit for run time during an emergency or power outage. The challenges facing the electric power industry are unique in a number of areas, particularly with the larger power generators, where regulations focus on reducing nitrogen oxide emissions from generator sets by 90 percent, compared to a 45 percent reduction for other equipment types

.

Since the Tier 4 emissions levels are so low, the EPA decided that emergency standby generator sets, which by their nature run very few hours per year, would be exempt from Tier 4 regulations, including any associated after-treatment. Furthermore, the EPA states that emergency standby applications can utilize current Tier products such as today’s Tier 2 and Tier 3 offerings. The list of applications that will require Tier 4 certified generator sets are as follows: non-emergency standby units, prime power applications, load management/peak shaving and electric power rental units. These include nearly all generators that would be deployed in a demand reduction or load management type of program.

In addition to these federal standards, there are state and local regulations that may force the use of Tier 4 generator sets in 2012 and beyond. The State of California will most likely have emissions regulations requiring the use of after-treatment on all standby generator sets including emergency units. As a result it is believed that the vast majority of standby generator sets sold into the State of California in 2012 will be Tier 4. Along with California, some regions and localities have stationary emission limits far more stringent than EPA diesel engine tier levels including: the New England states; Atlanta, Georgia; and Houston, Texas. The result is that diesel-fueled generator sets deployed in these areas, even if certified to the appropriate EPA tier level, may not meet local requirements.

While good maintenance has always been among end-user best practices, the new emissions regulations now imply that maintenance will be larger part of compliance. Although the regulations are not explicit, the EPA requires a diesel power generator to remain in compliance throughout its defined useful life, and that normal maintenance is the only way to accomplish this. This may also include record keeping, validation and other compliance measures that could be audited.

Diesel engine manufacturers will bear the burden of testing their diesel engines and certifying them according to EPA guidelines. However, owner/operators have a great deal of responsibility to understand how the regulations affect power generator availability, how installations are classified, as well as the record-keeping and maintenance requirements. Many companies in the standby and demand reduction industry are rightfully concerned about the impact these new standards will have on their respective businesses. In effect, Tier 4 will likely increase the expense, lower profitability, and lengthen returns on investment for both back-up power and demand reduction providers and consumers. However, these new requirement have long been anticipated and the major generator engine manufacturers have been announcing their technological answers to Tier 4 standards and more solutions are becoming available both for new engines as well as for after treatment options. Management believes that engine design and engineering will solve many of these problems and that suitable solutions to its business applications will be available and affordable.

At the same time, we believe that this change in emission policy brings significant opportunity for Titan Energy. The need for emergency power and demand reduction is not going to lessen. The costs of not having power or the ability to support our ailing grid are too high. We feel that we have alternative equipment technologies that will satisfy Tier 4 standards, superior solutions such as natural gas engines and smaller diesel units arranged in parallel configurations. There will also be a greater need for our maintenance and service programs as this will be a requirement of the owners/operators. And Titan Energy will benefit from the monitoring and validations technologies what will allow for improved operations and compliance with the new regulations.

Our Market

We have developed the expertise, strategic relationships and technological solutions that we believe will help customer avoid potentially devastating electrical grid failures, save customers money, improve the operation of the electrical utility system, and help our nation build a stronger and more effective Smart Grid. We operate our business in the industrial and commercial sectors of the US economy. According to a study by McKinsey & Company (“Unlocking Energy Efficiency in the US Economy”), the industrial sector accounts for 51 percent of the end use consumption and 40 percent of the end use potential for energy efficiency. The commercial sector consumes 20 percent of the end use energy and offers 25% of the efficiency potential. Electricity represents the major share of consumption in this sector. Therefore, the industrial and commercial sectors combined represent more than 75% of the energy market as well as the greatest potential for creating energy efficiency results for every dollar invested in energy efficiency.

| 9 |

Business Segments

We operate under two business segments: Power Distribution Segment and Energy Services Segment. Within these business segments we provide our products and services across five strategic business areas: Emergency and Back-up Power Solutions, Renewable Energy Technologies, Power Maintenance Programs, Remote Monitoring and Control Technologies, Demand Response Solutions, and Energy Efficiency.

POWER DISTRIBUTION SEGMENT

Emergency and Back-up Power Solutions. Our Emergency and Back-up Power business provides customers with sophisticated electrical power generation equipment to be used during a power outage or emergency or for load shedding in demand response programs. Titan Energy offers a complete turn-key solution to help companies avoid costly power outages as well as ensure smooth, uninterrupted operations during times of emergency. We help design, engineer and install the power equipment needed by each customer.

In 2011, sales of power generation equipment accounted for more than $ 9 million or 65% of our business. We provide what we consider to be the most advanced and reliable power generation systems on the market and operate as an exclusive dealer (10KW and above) for Generac Power Systems in five Midwestern states, and a Power Partner dealer (10KW to 600 KW) for MTU Onsite Energy in Florida. We also sell switchgear, UPS and related equipment used to support our customers’ power generation systems.

There are an estimated 330,000 industrial enterprises and 4.9 million commercial buildings in the United States (Source: McKinsey, “Unlocking Energy Efficiency in the U.S. Economy”). In terms of population, based on geographic territories that we service, Titan Energy covers approximately 25% of the total US population. Assuming a roughly equal distribution of facilities across the population, this translates into about 80,000 existing industrial facilities and 1,250,000 commercial buildings within our service territories. Many of these buildings will already have back power generation systems installed, while many will have older or inadequate systems that need to be replaced, and still others will need to upgrade their system in order to meet new federal and regional regulations and mandates.

Our market potential is further influenced by regional factors. All areas of the United States are subject to failures of the electrical utility grid and the resultant interruption in power, unstable power and greatly increased energy prices during peak periods. Some areas, however, are more susceptible to power problems. Our opportunity in some areas of the country is increased due to the occurrence and frequency of storms and other natural disasters. Florida is a key example of a state that frequently needs to respond to power outages due to hurricanes and high winds. Other areas of the country experience brown outs and black outs due to heavy snow and ice storms, floods and other natural catastrophes. Customers in these regions of the U.S. include grocery stores who must maintain power to keep produce chilled or frozen, gas stations and toll booths that must remain operational during time of emergency, bank and financial institution that require constant online capabilities, health care institutions, public buildings, government buildings and many other businesses.

Federal, state and regional regulations also impact our opportunities. Some industries are nationally mandated to have adequate emergency and back power due to the nature of their services; hospitals and critical care facilities, and financial institutions are a few such examples. Some states have placed mandates across additional industries due to the frequency of natural disasters and other factors. In Florida for example, gas stations must have power back-up systems, as well as apartments, schools and many other public buildings.

ENERGY SERVICES SEGMENT

Power Maintenance Programs. Power generation systems represent considerable investments that require proper maintenance and service in order to operate when required during a time of emergency or during a demand reduction request. Titan Energy’s Power Maintenance Programs offer maintenance, repair and support service for our customers’ power generation systems. In 2011 these annualized contracts contributed $5 million (36%) of our gross sales revenues. To support our customers, we maintain warehouses of inventory and parts, a fleet of service trucks and a staff of 16 trained service technicians in the Midwest, New Jersey and Florida.

We expect our service business to grow considerably in the coming years. With every new generator we sell, we expect to sign a service contract for one to five years in term-length. Our market potential however is not solely defined by the generators we sell but also by our service of any manufacturers’ generator. Titan continues to service an increasing number of customers who have acquired generators from our competitors but sign up with Titan Energy for their service needs.

| 10 |

With regards to the size of our potential service market, we estimates that approximately 30,000 industrial and commercial generators are sold each year in the US by the four major manufacturers. Assuming that sales have been somewhat consistent over the last twenty years, the average lifetime of a generator has remained constant; suggest that there are at least 600,000 working, serviceable generators installed in the US. If Titan’s territory covers 25% of the US population thne this creates a market of 150,000 working generators that we could potentially service.

Because we are able to service facilities far outside our sales territories, we estimate that these potential numbers are probably only half of what our true total market potential is at this time. In addition, this does not take into account that we also service numerous cellular transmission towers, highway toll-booths, direction signs, government and institutional facilities that may not be included in these estimates. New regulations are expected increase the demand, sophistication and cost of energy back-up systems that will in turn require managed preventive maintenance and improved performance records. Customers are expected, as a result of both cost and economic opportunity, to be more likely to adopt preventive maintenance programs to protect their investment, ensure economic benefit and comply with continuingly more complex regulations.

Our ability to achieve such sale numbers would require dramatic changes and expansion in our service program and company infrastructure, but more accurately indicates that our potential market is large enough to support significant growth for many years.

Our Products and Services

Emergency and Back-Up Power Generation Systems.

We provide a variety of customers with power generation equipment, depending on their needs and application that can range from 5kW to several Megawatts. We also provide the transfer switches, UPS systems and other necessary equipment to create a reliable and dependable power generation systems. We currently represent several brands of generator manufacturers. In some areas of the country, we have exclusive distribution and service territories for certain manufactures. For switch gear, we utilize ASCO Power Technologies and others. For UPS systems, we are an authorized dealer for GE.

Generac Power Systems Generators. In the Midwest, through our Titan Energy Services, Inc. (TESI) subsidiary, we are an authorized dealer for Generac Power Systems, Inc. (“Generac”) generators and other products in four Midwestern states. TESI provides products to protect a company’s critical equipment from over/under voltage or outages, transient surges and harmonic distortion. TESI provides a full line of power generation equipment for all kinds of applications, in both diesel and natural gas fuel options. The Generac brand features fully integrated power generation systems that include industrial, commercial, and residential generator sets, as well as automatic transfer switches, controls, fuel tanks, enclosures and remote monitoring software. For higher kilowatt requirements, Generac’s Modular Power System (“MPS”) utilizes multiple diesel or natural gas generators in various side-by-side arrangements that match the power output of large single engine units. The MPS system is based upon diesel fueled units of 400, 500 or 600 kW working in concert to offer outputs ranging from 800 to 6000 kW, and natural gas units of 100 to 300 kW with combined outputs of 200 to 3000 kW. In addition to the above models, the entire MPS product offering uses Generac’s PowerManager® Digital Control Platform, which brings reliability and flexibility to the control of these systems.

Generac Natural Gas Generators. Many of our customers are seeking “greener” solutions for stand by and emergency power generation, considering how their overall environmental footprint affects the world. Regulatory issues are also impacting these decisions and the cost of diesel generators. Diesel engines have been subject to intense emission level regulations and have seen aggressive Environmental Protection Agency (EPA) regulatory changes. This additional oversight has increased the total cost of both diesel engines and fuel. Future governmental cap and trade regulations for emissions trading may cause diesel engines to be taxed at a higher rate due to higher CO2 emissions. Fuel containment and the environmental concerns surrounding large quantities of fuel stored on site are considerable issues, as well.

Combining fuel cost with environmental impact provides companies with a broader view to the true bottom line, and overall environmental impact, of their generator choice. Natural gas generators have historically cost less per installed kilowatt than their diesel counterparts in the smaller sizes. The most noticeable advantage of natural gas-fueled generators over diesel is the extended run time provided by a continuous supply of natural gas. According to the Edison Electric Institute, severe weather events account for 62% of unexpected power outages in the United States. These events can close roads and cripple municipal infrastructures, making it difficult or impossible to refuel the diesel generators used in so many standby applications. The natural gas infrastructure has shown itself to be extremely reliable in situations that cause power outages; through four Florida hurricanes in 2004 and Northeast grid failure of 2003, the natural gas supply was unaffected.

The Generac Bi-Fuel™ configuration provides a number of alternative energy options. This technology uses a combination of diesel and natural gas to take advantage of the best qualities of each fuel (more power from diesel, lower emissions from natural gas). Bi-Fuel configurations are available for both stand-alone and MPS applications. Single-engine units are available at 300 and 375 kW output, while Gemini Twin Pack modules are rated at 600 and 750 kW. MPS versions can be combined as needed to achieve numerous power outputs up to 3750 kW. While operating under load, Bi-Fuel units can operate on up to 90% natural gas. If conditions dictate, the unit can revert to 100% diesel fuel with a no-break, automatic fuel changeover. The on-site diesel fuel tank required for Bi-Fuel units can also be smaller, if desired, to save space and cost.

| 11 |

MTU On-Site Energy Generators. Our Grove Power subsidiary is a factory authorized Power Partner dealership for Florida. In the Northeast, we are a sub-dealer and offer a complete line of MTU Onsite Energy diesel, natural gas, and propane generator sets, including digital engine and generator controls which provide superior performance and response time, proven reliability and durability reducing maintenance costs, state-of-the-art emissions technology and UL2200 listing for both standby and prime power applications. The MTU (Detroit Diesel) engine line-up is a world premier class of products recognized and accepted throughout North America and the international market place. MTU offers diesel generator set ratings range from 20 kW to 3250 kW, using John Deere and MTU (Detroit Diesel) engines, and natural gas generator set ratings range from 20 kW to 400 kW, using GM and Doosan engines.

Lister Petter Products. The Lister Petter series of generators provide clean stable power with very steady voltage and frequency output. The Alpha SeriesTM engines are extensively used in generator sets with tens of thousands of installations for a proven track record in power generation demonstrating high reliability, longer maintenance intervals and lower cost of ownership. Lister Petter’s strength is manufacturing small 6-30kw long run diesel engine generator systems. Where a region such as the Caribbean has a lack of natural gas and unstable utility power this product is in high demand.

Transfer Switches and Switchgear. ASCO Power Technologies and General Electric-Zenith offer automatic transfer switches and paralleling switchgear built for dependability and ease of operation, ranging from 40amp to 4000amp, in 2, 3, and 4 pole configurations.

Uninterruptible Power Supply (UPS) Systems – The Digital Energy General Electric (GE) UPS Series was developed using GE’s Design for Six Sigma methodology to ensure that the product fully meets customer requirements and expectations. GE has one of the most extensive and accepted UPS products available in the market today. They manufacture systems from 10 -750 KVA. The UPS system is designed to provide seamless power during any utility fluctuations or loss of power. The UPS system provides battery backup power until an emergency backup engine generator comes online. Once the engine generator is producing proper voltage and frequency the UPS switches the building load onto the engine generator. This provides the highest degree of protection typically used by Data Centers, Banks and Credit Card companies.

Maintenance and Service Programs.

Titan Energy recognizes additional revenues from service contracts, installation and maintenance services for its customers and owners of power generation equipment. We offer service contracts and support to all generator owners. The service contracts yield higher margins as compared to equipment sales and help support our effort to achieve profitability. These service contracts may also include remote monitoring services that allow owners to be informed of the condition and operations of their equipment at any time and from any place. With terms ranging from one to five years, service and remote monitoring contracts are providing the Company with strong recurring revenues.

We provide factory-trained technicians equipped with the necessary tools, parts and manuals in their trucks. We support our technicians with our specialized service experts and our warehouse, andwe manage our service activities to provide the most responsive and proficient service available. Our services have these specific advantages:

| · | Factory trained technicians. No other organization has Generac, MTU Online Energy, Lister-Petter, ASCO Power Technologies and GE-Zenith factory trained technicians. All Titan Energy technicians attend factory training on regular intervals. |

| · | Warranty. As the authorized distributor, only Titan can perform warrant work on the manufacturer’s products. |

| · | Service Manuals and technical documents. As the exclusive Industrial Distributor in certain territories, we are the

only company that has these technical documents to provide the necessary service. Any other organization must get these from us. |

| · | Parts. To meet the needs of our customers quickly and efficiently, we inventory the common service items in our warehouses and in our trucks, so as to avoid the need and expense to special order from another source. |

Remote Monitoring and Control Technology for Onsite Power Generation.

The ability of onsite power generation to respond quickly and sufficiently to either a grid failure or a utility demand response event is critical to the operations of the facility that it supports as well as to the utility that depends on its load shift for peaking shaving purposes. Titan has developed a monitoring and control systems that performs 24 hours/7 days a week, monitoring of dozens of critical functions on these onsite generators. In this way, we can see in advance if there is a problem that needs to be addressed, if servicing programs are being administered appropriately and if trends are occurring that suggest and can prevent future problems. This information can be incorporated into a comprehensive service and management program to insure that these power generators are ready to perform when called upon. The result is a system that is as reliable as any other demand response program in the marketplace.

| 12 |

This level of efficiency has not been historically available from onsite power generation. In fact, for decades, generators were often referred to as the “blunt instrument” of demand response. This was due to inefficient communications, monitoring and control programs. Titan has developed a fully integrate program that not only monitors and provides alarm for generators, but offers a complete asset management program that can offer multiple levels of reliability, efficiency that customers require and all utilities need to effectively manage their load control programs.

Our program will be designed to offer the following features and capabilities:

| · | Reliable asset management the ability to engineer, install, service and manage all forms of onsite power generation |

| · | State of the art communications between distributed sources of power generation, the Titan NOC, and utilities |

| · | New levels of intelligence creating unprecedented efficiencies, reliability and functionality |

| · | Real time monitoring and control of multiple disparate power sources now available for the first time |

| · | New forms of data collection, reporting and validation |

| · | Immediate value. Built to take on current needs in IR, DR, real time pricing and maintenance of power generation assets |

| · | Versatile. Created to work with all forms of power generation – from diesel generators to renewable. |

| · | Future applications. Designed for all future energy programs. |

Current monitoring systems are primarily defined by the system architecture chosen and the technology used to build it Supervisory Control and Data Acquisition (SCADA) systems are built on a point-to-multipoint architecture, based on central processing, low latency communications, and master/slave protocols. Decisions are made by a central “master station” or by the operator. These systems were first designed for central control operations of pipelines, substations and large central power plants. The disadvantages for onsite power generation application are: Expensive hardware, high monthly operations cost, scalability is an issue and, difficulty in sharing data

Machine-to-Machine (M2M) are web based systems that work off a multipoint-to-multipoint architecture, shared and hosted applications, low to high latency communications, internet protocols (connection and connectionless). M2M is designed to monitor remote sites where SCADA is too expensive and not time sensitive and is often utilized to provide owners of equipment a means to obtain remote data. Advantages are lower hardware costs, reasonable monthly cost, easier to scale. Disadvantages are that user interfaces typically is less sophisticated than SCADA, problems with variable latency, can be difficult to manage and secure, user interfaces typically rudimentary

Titan has recognized that the industry needed much more: and in fact what was required was a hybrid system of SCADA and M2M. Titan’s program is an Asset Management System for Generators, not just an alarm or monitoring system. Titan’s system will incorporate a variety of new data communication technologies: wireless, secure, efficient and cost effective, in order to provide 24/7 information on all aspects of generation assets. This is a new control system that allows real time management of equipment and, immediate response to events: dynamic systems to manage larger networks of power generation assets – networks with automated decisions making and controls to solve problems and optimize operations. New validation measures and reporting: immediate real time information on activities, results and impact and trending, improvement factors, etc.

Our system will be capable of collecting data from all types of Distributed Energy Resources (DERs) or “micro-generators” — diesel and natural gas generators, solar, UPS’s, battery storage, and wind. It is a fully featured and highly engineered system that will be capable of:

| · | Being scaled and utilized for thousands of DER’s managed from a central site or distributed locations, and by field technicians nationwide |

| · | Interfacing and integrating with current and future operations applications |

| · | An extensible, easily changed User Interface and reporting system |

| · | An Energy Management System for controlling and scheduling IR generation independently or through utility interaction |

| · | Aggregating available generation for sale to utilities |

| · | Capable of integration into future Smart Grid Distributed Generation Programs |

| · | A “ Utility Grade” Managed Service |

A unique feature of Titan’s technology is that it is an architecture that utilizes distributed intelligence. End-Devices act as SCADA Masters and poll in real-time and so can make decisions and report events on an exception basis, perform scheduled tasks utilizing connectionless “over-the-air” protocol. This system is designed to work efficiently and reliably over packet switched networks (e.g.3G and 4G) networks with the following features:

| • | End-Devices log data and use store-and-forward data transfer method |

| 13 |

| • | A data collection engine and database designed for interfacing to any type of equipment |

| • | Designed to interface to outside or 3rd party systems |

| • | Designed as a managed service with metadata collected and network management tools used to guarantee and optimize system performance |

We have created tools that allow us to ensure reliable data collection and control. We monitor the end-devices, communications paths, data usage, network components, etc.

Future Uses of Titan’s Monitoring and Control Technology. While Titan’s technology was designed and developed to allow us to move quickly and effectively into the IR and DR markets, this versatile system offers many other opportunities for titan to expand its sales and services:

| • | Generator (DER) Monitoring: Private Label Monitoring for Manufacturers and Distributors |

| • | Distributed Generations: Generators, Combined Heating and Power, Solar, Wind |

| • | Energy Industry: Large industrial and commercial facility energy management; Gas pipeline and compressor stations |

| • | Water and Wastewater utilities: Water Quality monitoring , water inlets; Wastewater pumping stations |

| • | Large Industrial Equipment: Rentals (Geofencing and usage monitoring), Chillers, Pumps |

SMART POWER: Our Demand Response Service Offering

Our services provide assistance to reduce electric demand during periods of peak demand using onsite generation to shift load off the electrical grids and thereby preventing grid failures. By improving grid reliability and efficiency, we delay the need for construction of new electrical generating plants. In effect, all consumers of electricity benefit from our demand response activities. We enter into management contracts with commercial, institutional and industrial customers to help them negotiate and comply with utility sponsored programs for demand reduction.

Our SMARTPOWER business is responsible for managing the power generation assets of our customers in utility-sponsored programs that lessen demand during peak periods and lower utility rates for participating customers. When used at specific times, onsite generators can significantly reduce peak loads and reduce energy expenses for industrial and commercial customers in areas where utilities offer reduced rates for participation in peak load reduction programs.

We believe that the market opportunity is significant and will remain so as demand response programs, operational efficiency and energy savings are given increased priority by commercial, institutional and industrial end-users of electricity, and as energy market prices remain volatile. Titan Energy generates revenues in various ways from this program: the sale of power generation equipment, service and maintenance contracts for the equipment after installation, and separate monitoring and management fees for helping the customer comply with the utilities and the regulatory agencies. We are also looking at contracts in 2012 that will allow us to share in the rate savings in return for providing these various services. Our experience with industrial generators, our established relationships with utilities and ability to integrate new communications technology to support demand response programs uniquely position Titan Energy in this business segment.

.

Automated Audit and Inventory Services

We have developed a state of the art auditing and asset management application that can be used to quickly and efficiently record and categorize the power generation assets of a facility. These applications utilize handheld computer tablets and specialized software that downloads wirelessly to Titan’s servers. The process was designed so as to minimize input errors, mistakes in categorizations, or missed data points by the recording technicians. Reports are available immediately to Company personnel and the customer and can be updated anytime.

The advantage of these electronic audit systems is that when combined with Titan’s remote monitoring and service programs, the customer now has a comprehensive asset management program that better protects its equipment, ensures that systems will operate properly and when needed and will save costs on service and repairs through preventative maintenance.

| 14 |

Strategy

Currently, Titan Energy specializes in providing industrial, commercial and institutional customers with the power generation equipment and energy management solutions that enable our customers to maintain critical operations during a grid failure and to better manage their energy usage and save money. We consider ourselves the experts when it comes to integrating onsite power generation equipment with the needs of the local electrical grid and utility based programs. Our knowledge of key technologies, our network of offices and service centers in more than 12 key states, our expanding base of more than 1,000 customers including several Fortune 500 companies, and our established working relationships with utilities across the country are all key factors that position Titan Energy to capitalize strongly in the energy management and Smart Grid arena.

Our strategy is to capitalize on our growing national footprint of sales and service centers, our scalable technology platform and our market position to continue providing intelligent energy solutions to commercial, institutional and industrial customers and utilities. Ultimately, our aim is to become one of the leading energy management solutions providers for commercial, institutional and industrial customers throughout the United States.

We plan to grow significantly as a company over the next several years through the development and successful implementation of the following business initiatives:

Expansion of Our Power Generation Sales in Existing Territories.

Sales of power generation and associated equipment will provide the company with significant revenues and create opportunities for Titan Energy to develop long term customer contracts for service and in some cases demand reduction programs. These sales also create opportunities for us to deploy our monitoring and communication technologies, services that generate recurring revenues and stronger profit margins. We will grow our Equipment sales in the following ways:

Increase Equipment Sales in Existing Territories. We now cover rich market territories in the Midwestern, Southeastern and Northeast United States. Our goal is to now begin to exploit these territories by bringing in qualified, professional sales people from the power generation industry that can help us build our brand, our sales and our revenues.

Expand Equipment Sales through Sub Dealer program. Titan Energy has made a commitment to expand its Sub-dealer program in all Titan Energy’s existing territories where it has an exclusive relationship with a manufacturer. Sub-dealers are independent sales and service companies that are authorized by Titan to market, sell and service our line of power generation equipment. Sub-dealers are generally paid a commission on sales. There are several potential sub-dealers in our current territories, representing the ability of Titan Energy to double its equipment and service sales through this program alone.

Expand Our Equipment offerings. UPS, emissions retrofits, others.

Web based Sales. We will seek to expand our ability to offer web based sales of equipment and parts through the development of a sophisticated online ordering system.

Expansion of Our Power Maintenance Programs

Our Maintenance and Service programs usually involve recurring revenues and offer the Company higher margins than equipment sales. Therefore, the Company is focused on aggressively increasing the number of these contracts throughout our territories and expanding the number of national accounts that allow us to service multiple facilities for a customer throughout the United States. We will seek to accomplish this expansion in the following ways:

Improve our Service Management Systems. We are in the process of improving the capability and efficiencies of our software systems that support our Service programs. These improvements will allow us to process, monitor, and validate orders more accurately and efficiently, thereby allowing our company to take on getter numbers of customers.

Increase the number of national accounts. We have been very successful in 2010 and 2011 in acquiring national accounts for our service program. We have developed a nationwide network of service providers that can assist us in providing Titan level of service to our customer anywhere in the United States.

Expand Our Service Sales Force. We believe we have the internal capacity to aggressively expand our service sales in the Midwest and Florida, where we have established operations, without adding significantly to our administrative or overhead expenses. We also plan to open service sales operations in additional territories such as New York, New Jersey and parts of the Midwest where we do not current have service operations.

| 15 |

Sub Dealer Program. Through our sub-dealer program in the Midwest, we expect to acquire relationships with a number of established companies that will also offer Titan Energy additional service opportunities. As with equipment sales, the cost of new service contracts through our sub-dealer program is minimal and as an exclusive dealer in these territories, we are the only authorized service provider for the industrial line of products.

Expansion of Our Demand Response Programs

Management believes that onsite distributed power generation systems offer an under-utilized resource for solving problems related to congestion and failure on our electrical power grids. These programs are also of potential economic benefit to the customers who participate. According to the DOE, less than 5% of the potential power available from distributed generators is being utilized to support our electrical power grid and that utilizing only 5% of this potential would save the U.S. economy more than $40 billion per year.

As more Demand Response programs are developed and offered, Titan is well suited to help customers participate. Customers with very small generators will be able to participate through an Aggregator. Savvy customers will want to take-advantage of the potentially more lucrative programs the wholesale market. Titan Energy will seek to expand its role in the demand response industry providing a full range of load management services to our industrial and commercial customers. Our services will allow our customers to utilize incentives to reduce electric demand during periods of peak demand using onsite generation to shift load off the electrical grids and thereby preventing grid failures. By improving grid reliability and efficiency, we delay the need for construction of new generation plants. In effect, all consumers of electricity would benefit from our demand response activities. We will enter into contracts with commercial, institutional and industrial customers to help them negotiate and comply with utility sponsored programs for demand reduction. We will support these programs with the ability to install new equipment, maintain existing power generation systems and advanced communications and control technologies. We believe we can attain good growth within our current customer base as well as through establishing these programs with new customers in our service territories.

Utilizing our current customer base of more than 1,000 companies with more than 5,000 generators creates a base of potential customers for Demand Response Programs. Management estimates that if we can attain 5% penetration of our current customer base per year, the result would generate as much as $6 million in new recurring revenues contracts per year. In other words, over five years we could expect to generate as much as $60 million in annual revenues from these kinds of programs. However, we will not limit our demand response programs to our current customers, and will seek contracts with any eligible customer within our service territories, thereby increasing our potential market opportunity several fold.

In addition, we are committed to the development, implementation and broader adoption of technology-enabled demand response solutions. This technology enables us to continuously monitor remotely, deliver and receive alerts, send control signals to, and receive bi-directional communications from an Internet-enabled network of dispersed end-use customer sites. With this technology we can better coordinate requests from utilities as well as manage, monitor and remotely maintain our customers’ generators. We believe that improved communications and network technologies will increase our opportunities in the demand reduction industry by giving us the ability to offer a more efficient and responsive service to a broader range of potential customers.

Sales of Technology-Enabled Energy Management Solutions

At Titan Energy, we believe literally in the maxim: “You can’t manage what you can’t measure.” One of our goals is to develop and expand the use of more effective monitoring and communication technologies that will allow us to better measure and so manage our customers’ energy assets. We feel that as the industry experts in power generation systems and maintenance, we should offer the most sophisticated and effective monitoring and reporting systems on the market. We plan to develop these programs through internal development and acquisition of key companies and/or technologies. The result of utilizing these technologies will be greater efficiencies in managing customer assets, greater revenues through the deployment of recurring revenue service programs, and lowered costs due to less need for technicians to manually monitor and service equipment. Key systems we plan to offer include:

Remote, Automated, On-line Monitoring Systems. Titan Energy offers one of the most effective and reliable online metering systems for power generation systems. We plan to expand the capabilities of this technology and make it available to a greater number of our customers as part of our services and maintenance program.

Metering Systems. We have identified a number of metering systems that provide onsite monitoring and information to consumers. We are currently working with a number of end users to determine the validity, efficacy and pricing for these newer series and hope to move into commercial implementation in 2012.

| 16 |

Online, Automated Reporting Services. As the need increases for detailed, real-time information about generator operations and efficiencies due to regulatory and other factors, we intend to provide the reporting and management programs that will allow our customers to more easily and cost effectively comply with regulators.

Sales and Service Support for EPA Requirements on Diesel Engines

Changes in the EPA’s regulatory requirements for diesel engines could have a number of significant impacts on owners of diesel engine generators. We believe that these changes in emissions policy, while posing challenges to everyone in the industry, also bring significant opportunity for Titan Energy. The EPA estimates that there are more than 900,000 back up diesel generators in the U.S. EPRI estimated more than 50,000 of these onsite power generators were enrolled in utility sponsored DR programs back in 2003. The need for emergency power and demand reduction is not going to lessen. The costs of not having power or the ability to support our ailing grid are too high. It is safe to assume that this number could well have doubled by 2012. All of these generators face modification, replacement or additional service requirements in light of the new regulatory requirements as the EPA rolls out its changes in emission policies in 2013 and beyond. This creates a significant market where the expertise of Titan Energy can be uniquely valuable.