Attached files

| file | filename |

|---|---|

| 8-K - EARNINGS Q3 FY12 SLIDES - PROCTER & GAMBLE Co | earningsq3fy12slides.htm |

The Procter & Gamble Company: Reg G Reconciliation of Non-GAAP measures

In accordance with the SEC’s Regulation G, the following provides definitions of the non-GAAP measures used in the earnings call and slides with the reconciliation to the most closely related GAAP measure. The measures provided are as follows:

|

1.

|

Organic Sales Growth – pages 1 and 2

|

|

2.

|

Core EPS – pages 2 through 4

|

|

3.

|

Core Operating Margin – page 4

|

|

4.

|

Core Gross Margin – page 5

|

|

5.

|

Core Selling, General & Administrative Expenses (SG&A) as a % of Net Sales – page 5

|

|

6.

|

Core Operating Profit Growth – page 5

|

|

7.

|

Core Effective Tax Rate – page 6

|

|

8.

|

Free Cash Flow – page 6

|

|

9.

|

Free Cash Flow Productivity – page 6

|

1. Organic Sales Growth:

Organic sales growth is a non-GAAP measure of sales growth excluding the impacts of acquisitions, divestitures and foreign exchange from year-over-year comparisons. We believe this provides investors with a more complete understanding of underlying sales trends by providing sales growth on a consistent basis. Organic sales is also one of the measures used to evaluate senior management and is a factor in determining their at-risk compensation. The reconciliation of reported sales growth to organic sales is as follows:

| Total P&G |

Net Sales Growth

|

Foreign Exchange Impact

|

Acquisition/ Divestiture Impact*

|

Organic Sales Growth

|

||||

|

OND 09

|

6%

|

-2%

|

1%

|

5%

|

||||

|

JFM 10

|

7%

|

-3%

|

0%

|

4%

|

||||

|

AMJ 10

|

5%

|

-1%

|

0%

|

4%

|

||||

|

JAS 10

|

2%

|

3%

|

-1%

|

4%

|

||||

|

OND 10

|

2%

|

2%

|

-1%

|

3%

|

||||

|

JFM 11

|

5%

|

-1%

|

0%

|

4%

|

||||

|

AMJ 11

|

10%

|

-5%

|

0%

|

5%

|

||||

|

JAS 11

|

9%

|

-5%

|

0%

|

4%

|

||||

|

OND 11

|

4%

|

0%

|

0%

|

4%

|

||||

|

JFM 12

|

2%

|

1%

|

0%

|

3%

|

||||

|

Average–OND 09-JFM 12

|

5%

|

-1%

|

0%

|

4%

|

||||

|

AMJ 12 (Estimate)

|

1% to 2%

|

3%

|

0%

|

4% to 5%

|

||||

|

2H FY 2012 (Estimate)

|

0% to 2%

|

4% to 3%

|

0%

|

4% to 5%

|

||||

|

FY 2009

|

-3%

|

4%

|

1%

|

2%

|

||||

|

FY 2010

|

3%

|

1%

|

-1%

|

3%

|

||||

|

FY 2011

|

5%

|

0%

|

-1%

|

4% | ||||

|

FY 2012 (Estimate)

|

4%

|

0%

|

0%

|

4%

|

||||

| Total Developing | ||||||||

|

Average–AMJ 11-JFM 12

|

14% |

-2%

|

0% | 12% | ||||

|

JFM 2012

|

Net Sales Growth

|

Foreign Exchange Impact

|

Acquisition/ Divestiture Impact*

|

Organic Sales Growth

|

|||

|

Beauty

|

1%

|

1%

|

0%

|

2%

|

|||

|

Grooming

|

0%

|

2%

|

0%

|

2%

|

|||

|

Health Care

|

2%

|

1%

|

-1%

|

2%

|

|||

|

Fabric Care and Home Care

|

1%

|

1%

|

0%

|

2%

|

|||

|

Baby Care and Family Care

|

5%

|

1%

|

0%

|

6%

|

|||

|

Total P&G

|

2%

|

1%

|

0%

|

3%

|

*Acquisition/Divestiture Impact includes rounding impacts necessary to reconcile net sales to organic sales.

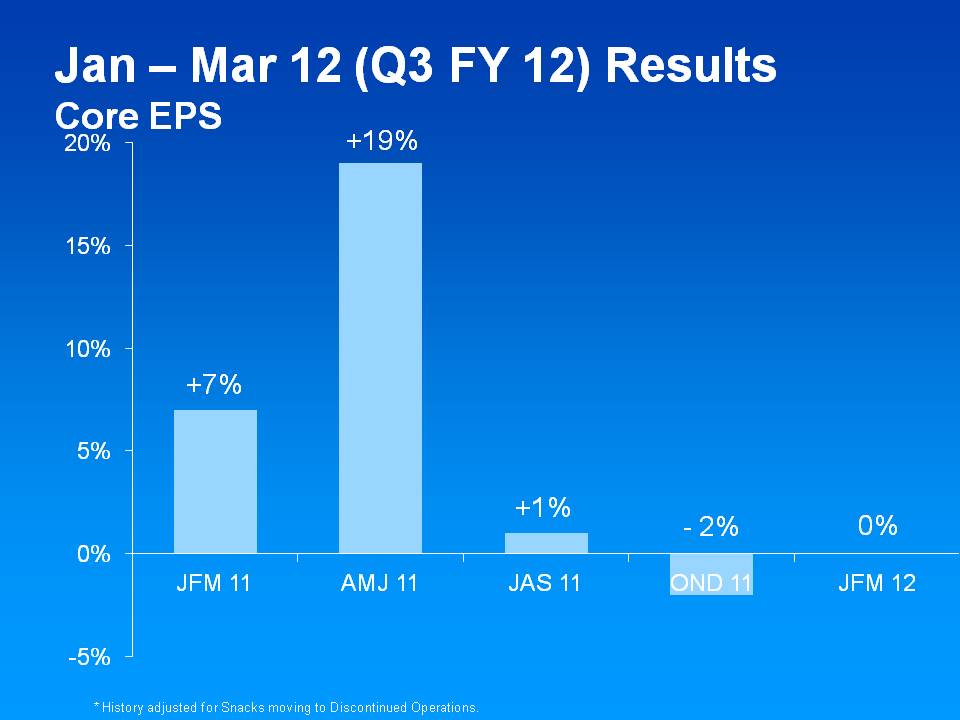

2. Core EPS: This is a measure of the Company’s diluted net earnings per share from continuing operations excluding certain items that are not judged to be part of the Company’s sustainable results or trends. This includes current year impairment charges for goodwill and indefinite lived intangible assets, current year charges related to incremental restructuring charges due to increased focus on productivity and cost savings, a significant benefit in FY 2011 from the settlement of U.S. tax litigation primarily related to the valuation of technology donations, charges in FY’s 2012, 2011 and 2010 related to European legal matters, a FY 2010 charge related to a tax provision for retiree healthcare subsidy payments in the U.S. healthcare reform legislation, incremental restructuring charges in FY 2009 to offset the dilutive impact of the Folgers divestiture, and significant adjustments to tax reserves in FY 2008. We believe the Core EPS measure provides an important perspective of underlying business trends and results and provides a more comparable measure of year-on-year earnings per share growth. Core EPS is also one of the measures used to evaluate senior management and is a factor in determining their at-risk compensation. The tables below provide a reconciliation of diluted net earnings per share to Core EPS:

|

Fiscal Year Data:

|

|

FY 2011

|

FY 2010

|

FY 2009

|

FY 2008

|

||||||

|

Diluted Net Earnings Per Share - Continuing Operations

|

$3.85

|

$3.47

|

$3.35

|

$3.36

|

|||||||

|

Settlement from U.S. Tax Litigation

|

($0.08)

|

-

|

-

|

-

|

|||||||

|

Charges for European Legal Matters

|

$0.10

|

$0.09

|

-

|

-

|

|||||||

|

Charge for Taxation of Retiree Healthcare Subsidy

|

-

|

$0.05

|

-

|

-

|

|||||||

|

Incremental Folgers-related Restructuring Charges

|

-

|

-

|

$0.09

|

-

|

|||||||

|

Significant Adjustments to Tax Reserves

|

-

|

-

|

-

|

($0.14)

|

|||||||

|

Rounding Impacts

|

($0.01)

|

-

|

|||||||||

|

Core EPS

|

$3.87

|

$3.61

|

$3.43

|

$3.22

|

|||||||

|

Core EPS Growth

|

7%

|

5%

|

7%

|

||||||||

|

Quarter / Period Data:

|

JFM 12

|

JFM 11

|

||

|

Diluted Net Earnings Per Share

|

$0.82 |

$0.96

|

||

|

Snacks Results of Operations – Discontinued Operations

|

($0.01)

|

($0.02)

|

||

|

Diluted Net Earnings Per Share – Continuing Operations

|

$0.81

|

$0.94

|

||

|

Incremental restructuring

|

$0.12

|

-

|

||

|

Non-cash Impairment charges

|

$0.01

|

-

|

||

|

Core EPS

|

$0.94

|

$0.94

|

||

|

Core EPS Growth

|

0%

|

|||

|

AMJ 12 (Est.)

|

AMJ 11

|

|||

|

Diluted Net Earnings Per Share

|

$1.21 to $1.32

|

$0.84

|

||

|

Gain from snacks divestiture

|

($0.47) to ($0.50)

|

|||

|

Snacks results of operations – Discontinued Operations

|

($0.02)

|

($0.02)

|

||

|

Diluted Net Earnings Per Share–Continuing Operations

|

$0.72 to $0.80

|

$0.82

|

||

|

Incremental Restructuring

|

$0.07 to $0.05

|

-

|

||

|

Core EPS

|

$0.79 to $0.85

|

$0.82

|

||

|

Core EPS Growth

|

-4% to 4%

|

|||

|

OND 11

|

OND 10

|

||||||||||

|

Diluted Net Earnings Per Share-Continuing Operations

|

|||||||||||

|

$0.56

|

$1.09

|

||||||||||

|

Impairment charges

|

$0.50

|

-

|

|||||||||

|

Charges for European legal matters

|

$0.02

|

$0.10

|

|||||||||

|

Settlement from U.S. tax litigation

|

-

|

($0.08)

|

|||||||||

|

Incremental restructuring

|

$0.01

|

-

|

|||||||||

|

Core EPS

|

$1.09

|

$1.11

|

|||||||||

|

Core EPS Growth

|

-2%

|

||||||||||

|

JFM

11

|

JFM

10

|

||||||||||

| Diluted Net Earnings Per Share – Continuing Operations |

$0.94

|

$0.82

|

|||||||||

| Charge for Taxation of Retiree Healthcare Subsidy |

-

|

$0.05

|

|||||||||

| Rounding Impacts |

-

|

$0.01

|

|||||||||

| Core EPS |

$0.94

|

$0.88

|

|||||||||

| Core EPS Growth |

7%

|

||||||||||

|

AMJ 12 (Est.)

|

AMJ 11

|

||

|

Diluted Net Earnings Per Share

|

$1.21 to $1.32

|

$0.84

|

|

|

Gain from snacks divestiture

|

($0.47) to ($0.50)

|

||

|

Snacks results of operations

|

($0.02)

|

($0.02)

|

|

|

Diluted Net Earnings Per Share–Continuing Operations

|

$0.72 to $0.80

|

$0.82

|

|

|

Incremental Restructuring

|

$0.07 to $0.05

|

-

|

|

|

Core EPS

|

$0.79 to $0.85

|

$0.82

|

|

|

Core EPS Growth

|

-4% to 4%

|

|

FY 2012 (Est.)

|

FY 2011

|

||

|

Diluted Net Earnings Per Share

|

$3.63 to $3.74

|

$3.93

|

|

|

Gain from snacks divestiture

|

($0.47) to ($0.50)

|

||

|

Snacks results of operations

|

($0.07)

|

($0.08)

|

|

|

Diluted Net Earnings Per Share–Continuing Operations

|

$3.09 to $3.17

|

$3.85

|

|

|

Impairment charges

|

$0.51

|

||

|

Incremental restructuring

|

$0.20 to $0.18

|

||

|

Charges for European legal matters

|

$0.02

|

$0.10

|

|

|

Settlement from U.S. tax litigation

|

-

|

($0.08)

|

|

|

Core EPS

|

$3.82 to $3.88

|

$3.87

|

|

|

Core EPS Growth

|

-1% to 0%

|

Note – All reconciling items are presented net of tax. Tax effects are calculated consistent with the nature of the underlying transaction. The charge for the significant settlement from U.S. tax litigation is tax expense.

3. Core Operating Margin:

This is a measure of the Company’s operating margin adjusted for current year charges related to incremental restructuring charges due to increased focus on productivity and cost savings:

|

JFM 12

|

JFM 11

|

||

|

Operating Profit Margin

|

16.3%

|

18.6%

|

|

|

Incremental restructuring

|

2.4%

|

-

|

|

|

Core Operating Profit Margin

|

18.7%

|

18.6%

|

|

|

Bps change

|

10

|

4. Core Gross Margin:

This is a measure of the Company’s Gross Margin adjusted for the current year charges related to incremental restructuring charges due to increased focus on productivity and cost savings:

|

JFM 12

|

JFM 11

|

||

|

Gross Margin

|

49.3%

|

50.8%

|

|

|

Incremental restructuring

|

0.5%

|

||

|

Core Gross Margin

|

49.8%

|

50.8%

|

|

|

Basis point change

|

-100

|

5. Core SG&A as a % of Net Sales:

This is a measure of the Company’s SG&A as a % of Net Sales adjusted for the current year charges related to incremental restructuring charges due to increased focus on productivity and cost savings:

|

JFM 12

|

JFM 11

|

||

|

Selling, General & Administrative Expenses (SG&A) as a % Net Sales

|

32.9%

|

32.2%

|

|

|

Incremental restructuring

|

-1.7%

|

-

|

|

|

Rounding

|

-0.1%

|

-

|

|

|

Core SGA % Net Sales

|

31.1%

|

32.2%

|

|

|

Basis point change

|

-110

|

6. Core Operating Profit Growth:

This is a measure of the Company’s operating profit growth adjusted for the current year impairment charges for goodwill and indefinite lived intangible assets, current year charges related to incremental restructuring charges due to increased focus on productivity and cost savings, and charges in current and prior year related to the European legal matters:

|

JFM 12

|

OND 11

|

JAS 11

|

AMJ 11

|

JFM 11

|

|||||

|

Operating Profit Growth

|

-11%

|

-36%

|

-4%

|

11%

|

-5%

|

||||

|

Impairment charges

|

1%

|

37%

|

0%

|

0%

|

0%

|

||||

|

Charges for European legal matters

|

0%

|

-6%

|

0%

|

0%

|

-1%

|

||||

|

Incremental restructuring

|

12%

|

1%

|

0%

|

0%

|

0%

|

||||

|

Core Operating Profit Growth

|

2%

|

-4%

|

-4%

|

11%

|

-6%

|

|

AMJ 12 (Est.)

|

|

|

Operating Profit Growth

|

-3%-6%

|

|

Incremental restructuring

|

8%-6%

|

|

Core Operating Profit Growth

|

5%-12%

|

7. Core Effective Tax Rate:

This is a measure of the Company’s effective tax rate adjusted for current year impairment charges for goodwill and indefinite lived intangible assets and charges in current and prior year related to the European legal matters. The table below provides a reconciliation of the effective tax rate to the Core tax rate:

|

JFM 2012

|

JFM 2011

|

||

|

Effective Tax Rate

|

23.7%

|

20.7%

|

|

|

Tax impact of impairment charges

|

-0.2%

|

||

|

Tax impact of European legal matters

|

-0.1%

|

0.1%

|

|

|

Core Effective Tax Rate

|

23.4%

|

20.8%

|

8. Free Cash Flow:

Free cash flow is defined as operating cash flow less capital spending. We view free cash flow as an important measure because it is one factor in determining the amount of cash available for dividends and discretionary investment. Free cash flow is also one of the measures used to evaluate senior management and is a factor in determining their at-risk compensation. The reconciliation of free cash flow is provided below (amounts in millions):

|

Operating Cash Flow

|

Capital Spending

|

Free Cash Flow

|

|

|

Jan-Mar ‘12

|

$3,816

|

($883)

|

$2,933

|

9. Free Cash Flow Productivity:

Free cash flow productivity is defined as the ratio of free cash flow to net earnings. The Company’s long-term target is to generate free cash flow at or above 90 percent of net earnings. Free cash flow productivity is also one of the measures used to evaluate senior management and is a factor in determining their at-risk compensation. The reconciliation of free cash flow productivity is provided below (amounts in millions):

|

Free Cash Flow

|

Net Earnings

|

Free Cash Flow Productivity

|

|

|

Jan-Mar ‘12

|

$2,933

|

$2,467

|

119%

|