Attached files

| file | filename |

|---|---|

| EX-32.2 - ALL GRADE MINING, INC. | ex32-2.htm |

| EX-32.1 - ALL GRADE MINING, INC. | ex32-1.htm |

| EX-31.2 - ALL GRADE MINING, INC. | ex31-2.htm |

| EX-31.1 - ALL GRADE MINING, INC. | ex31-1.htm |

ALL GRADE MINING, INC.

(A Developmental Stage Company)

U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

Annual Report for 2011

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE

ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2011.

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES

EXCHANGE ACT OF 1934.

For the transition period from________ to ________

Commission File Number 033-17774-NY

All Grade Mining, Inc.

(Name of Small Business Issuer in Its Charter)

|

COLORADO

|

93-0955290

|

|

|

(State or Other Jurisdiction of

|

(I.R.S. Employer Identification No.)

|

|

|

In Company)

|

||

|

330 W. Pleasantview Avenue, Suite 163

140 58th Street, Suite 8E

|

(201) 788-3785

|

|

|

Hackensack, NJ 07601

|

(Issuer’s Telephone Number,

|

|

|

(Address of Principal Executive Offices)

|

Including Area Code)

|

Securities registered under Section 12(b) of the Exchange Act: NONE

-1-

Securities registered under Section 12(g) of the Act: Common Stock, $.001 Par Value Per Share

Indicate by check mark if Registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No þ

Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act. Yes o No þ

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No

o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (check one):

|

Large accelerated filer o

|

Accelerated filer o

|

|

Non-accelerated filer o

|

Smaller reporting company þ

|

|

(do not check if a smaller reporting company)

|

|

Indicate by check mark if there is no disclosure of delinquent filers in response to Item 405 of Regulation S-B contained in this form and no disclosure will be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. Yes oNo þ

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold (June 30, 2011): $169,366.

Indicate the number of shares outstanding of each of the Registrant’s classes of common stock, as of the latest practicable date: On March 31, 2012, the Registrant had 85,059,759 shares of common stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to Rule 424(b) or (e) under the Securities Act of 1933.

None

-2-

ALL GRADE MINING, INC.

A Developmental Stage Company

INDEX TO FORM 10-K

|

Part & Item

|

Section

|

Page

|

|

PART I

|

||

|

ITEM 1.

|

DESCRIPTION OF BUSINESS

|

4 |

|

ITEM 1A.

|

RISK FACTORS

|

5 |

|

ITEM 1B.

|

UNRESOLVED STAFF COMMENTS

|

5 |

|

ITEM 2.

|

DESCRIPTION OF PROPERTY

|

5 |

|

ITEM 3.

|

LEGAL PROCEEDINGS

|

6 |

|

ITEM 4.

|

SUBMISSION OF MATTERS TO A VOTE OF THE SECURITY HOLDERS

|

6 |

|

PART II

|

||

|

ITEM 5.

|

MARKET FOR COMMON EQUITY, RELATED STOCKHOLDER MATTERS

|

7 |

|

ITEM 6.

|

SELECTED FINANCIAL DATA

|

8 |

|

ITEM 7.

|

MANAGEMENT’S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION

|

8 |

|

ITEM 7A.

|

QUANTITATIVE AND QUALITATIVE DISCLOSURE ABOUT MARKET RISK

|

10 |

|

ITEM 8.

|

FINANCIAL STATEMENTS

|

10 |

|

ITEM 9.

|

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

|

10 |

|

ITEM 9A.

|

CONTROLS AND PROCEDURES

|

10 |

|

ITEM 9B

|

OTHER INFORMATION

|

12 |

|

PART III

|

||

|

ITEM 10.

|

DIRECTORS, EXECUTIVE OFFICERS, AND CORPORATE GOVERNANCE

|

12 |

|

ITEM 11.

|

EXECUTIVE COMPENSATION

|

13 |

|

ITEM 12.

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

|

14 |

|

ITEM 13.

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

|

14 |

|

ITEM 14.

|

PRINCIPAL ACCOUNTANT FEES AND SERVICES

|

14 |

|

PART IV

|

||

|

ITEM 15.

|

EXHIBITS AND FINANCIAL STATEMENT SCHEDULES

|

14 |

|

SIGNATURES

|

14 | |

References in this Annual Report to, the terms “Company”, “All Grade Mining, Inc.”, “Hybred”, “we”, “us” and “our” refer to All Grade Mining, Inc., unless otherwise stated or the context clearly indicates otherwise.

Forward Looking Statements

This report contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the “1934 Act”) and Section 27A of the Securities Act of 1933 (the “1933 Act”). Any statements contained in this report that are not statements of historical fact may be forward-looking statements. When we use the words “anticipates,” “plans,” “expects,” “believes,” “should,” “could,” “may,” “will” and

similar expressions, we are identifying forward-looking statements. Further, all statements that express expectations, estimates, forecasts or projections are forward-looking statements within the meaning of the 1933 Act and 1934 Act, respectively. Forward-looking statements involve risks and uncertainties, which may cause our actual results, performance or achievements to be materially different from those expressed or implied by forward-looking statements. These factors include our limited experience with our business plan; pricing pressures on our product caused by competition; the risk that our products will not gain market acceptance; our ability to obtain additional financing; our ability to protect intellectual property; and our ability to attract and retain key employees.

-3-

Except as may be required by applicable law, we do not undertake or intend to update or revise our forward-looking statements, and we assume no obligation to update any forward-looking statements contained in this report as a result of new information or future events or developments. Thus, you should not assume that our silence over time means that actual events are bearing out as expressed or implied in such forward-looking statements. You should carefully review and consider the various disclosures we make in this report and our other reports filed with the Securities and Exchange Commission (“SEC”) that attempt to advise interested parties of the risks, uncertainties and other

factors that may affect our business.

Item 1. Description of Business

Temporary Time Capital Corp., Inc., a corporation organized under the laws of the State of Colorado, was not a shell company with no or nominal business operations. On January 31, 2008, the Company entered into a merger agreement with Hybred International, Inc., a corporation organized under the laws of the State of New Jersey. No prior relationship between the companies, or any natural person, is known to have existed.

The merger agreement was filed and was effective within the State of Colorado on February 7, 2008, and was effective within the State of New Jersey on February 27, 2008.

The merger agreement (the “Agreement”) stipulated that the companies would merge and the surviving entity would be Temporary Time Capital Corp., Inc.. Temporary Time Capital Corp., Inc. would then change its name to Hybred International, Inc. (the name of the New Jersey entity that merged into the Colorado entity, with the result that one entity with the name of Hybred International, Inc. with the business operations of the original New Jersey entity would be registered to do business in the States of New Jersey and Colorado).

The shareholders of the former Hybred International, Inc. had their shares exchanged 1:1 into the new entity. The shareholders of the former Temporary Time Capital Corp., Inc. retained their holdings 1:1. The authorized number of shares in the new Hybred International, Inc. was increased to 120,000,000 (from 50,000,000) to allow for the distribution to the shareholders of the former Hybred International, Inc.

As part of the Agreement, the Directors and officers of Temporary Time Capital Corp., Inc. resigned and the officers and Directors of the former Hybred International, Inc. are now the officers and Directors of the new Hybred International, Inc.

The former (prior to merger) Hybred International, Inc. has developed and intends to produce and market a revolutionary therapeutic horseshoe, which contains an injection molded urethane composition into the shoe designed to reduce the concussive effect of horses’ hooves on surfaces such as concrete, asphalt and rock hard race tracks, thus reducing the chances of a horse developing a hoof injury, which comprise approximately 90% of all equine injuries.

The new (post merger) Hybred International, Inc. has acquired the business operations of the former Hybred International, Inc. which consists mainly of research and development and resultant intellectual property necessary to manufacture (or cause to be manufactured) the therapeutic horseshoe and the knowledge of the equine industry of the pre-merger Hybred’s officers and directors.

In November 2009, the Board of Directors voted to increase the number of authorized shares to 200,000,000. In June 2010, the Board of Directors voted to further increase the number of common shares authorized to 500,000,000 shares.

-4-

In June 2011 the Board of Directors and shareholders affirmatively voted to reverse the common voting stock 500:1 in a reverse stock split, voted affirmatively to create an offering of securities to explore a mining opportunity in Chile, and create three preferred classes of stock. The preferred classes of stock have the following characteristics: the preferred class A class is convertible into common voting shares at a ratio of one share of Class A converts into 1,000 shares of common stock (1:1,000) and there were 100,000 shares of the preferred class A authorized. The preferred class B was authorized at 400,000 shares which are convertible into 40 shares of common voting stock (1:40).

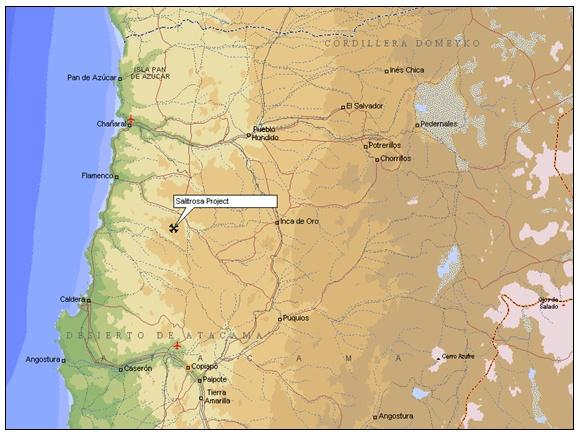

The preferred class C was authorized at 50,000 shares and has super-voting characteristics of one share of the class C possess 1,000 votes and is NOT convertible. The Company further authorized an offering, and due registration thereof, of a capital raise to explore an opportunity of the Saltirosa mine in Chile (located 28 kilometers from Chanaral and 60 kilometers from the Caldera port). The Board and Shareholders also voted to make the necessary corresponding adjustments to the articles of incorporation and bylaws to reflect the new classes of securities.

The overview of the process and the insight behind the corporate activity was the corporate sales of horseshoes had bottomed out after the recession and the decline in consumer spending on luxury goods. Particularly, several opportunities to sell the rubberized horseshoe to mounted police turned out to be a non-starter because the police wanted the noise a regular horseshoe made. Simultaneously, a mining opportunity presented itself. The company decided that the opportunity, while not in the core line of business, was lucrative enough to resuscitate the company if the Company could raise capital to pursue the project; while keeping the horseshoe business in its back pocket for future

exploration. The above changes reflect the process of preparation to pursue the mining opportunity. It should be mentioned that the preferred C class was created particularly for the management of the Company so they could maintain positive leverage if the capital raise becomes overly onerous or invasive, or there is a buyout on the horizon.

The Regulation D filing was filed roughly two months later, in August 2011.

In October 2011, the Board and shareholders affirmatively voted to acquire the Saltirosa mine in Chile, change the name of the Company to “All Grade Mining, Inc.” and modify the core line of business to reflect the positive feedback and traction from the offering of securities earmarked for the mining project.

In November 2011, the name change and reverse split went effective. In December 2011 the Company created a wholly owned subsidiary in Chile, “All Grade Mining Chile, SA” to take possession of the Saltirosa mine.

Item 1A. Risk Factors

The Company is a “smaller reporting company” as defined by Regulation S-K and as such, are not required to provide the information contained in this item pursuant to Regulation S-K.

Item 1B. Unresolved Staff Comments

The Company is a “smaller reporting company” as defined by Regulation S-K and as such, are not required to provide the information contained in this item pursuant to Regulation S-K.

Item 2. Description of Property

The Company enters into month to month leases for their office space. Rent expense incurred under this arrangement for the years ended December 31, 2011 and December 31, 2010 was $5,551 and $4,600, respectively.

-5-

The Saltirosa mine is located in the country of Chile approximately 28 kilometers from Chanaral and 60 kilometers from the Caldera port). Please see the feasibility study for greater detail, description, and maps of the area filed in the 14C dated 11 October 2011.

Item 3. Legal Proceedings

The Company is not a party to, or the subject of any material pending legal proceedings.

Item 4. Mine Safety Disclosures

The Saltirosa mine is located in Chile. As such, none of the disclosures in this section are applicable as they make specific reference to United States law. In the interest of fair disclosure and substantial compliance, management is not aware of any flagrant violations or imminent danger orders, or their Chilean equivalent, that have been issued regarding the Saltirosa mine within 2011.

-6-

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities.

The common stock of the Company (the “common stock”) is traded in the Over-The-Counter Market and is quoted on the National Association of Securities Dealers Automated Quotation (“NASDAQ”)System Bulletin Board and the Electronic Bulletin Board (OTCBB) under the symbol “HYII”.

Market Information

The range of high and low bid prices for the Company’s common stock, for the periods indicated, are set forth below.

|

Period

|

High Bid

|

Low Bid

|

|

Year Ended 31 December 2011 (*)

|

||

|

1st Quarter

|

$0.9000

|

$0.1500

|

|

2nd Quarter

|

$1.4000

|

$0.3000

|

|

3rd Quarter

|

$0.7500

|

$0.0500

|

|

4th Quarter

|

$2.7500

|

$0.1000

|

|

Year ended December 31, 2010 (*)

|

|

|

|

1st Quarter

|

$11.5000

|

$0.5000

|

|

2nd Quarter

|

$2.2000

|

$0.2500

|

|

3rd Quarter

|

$0.5000

|

$0.1000

|

|

4th Quarter

|

$0.8000

|

$0.1500

|

(*) As reported by the OTCBB.

The above quotations, as reported, represent prices between dealers and do not include retail mark-ups, mark-downs or commissions. Such quotations do not necessarily represent actual transactions.

|

Date

|

Amount of Securities and class

|

Consideration

|

Principals

|

Exemption

|

Terms of Conversion or Exercise

|

Use of Proceeds

|

|

Preferred C, Preferred A

|

$100,000

Stock Based

Compensation

|

Gary Kouletas, CEO

|

144 Issuance

|

Taken in 70,000 class A and 20,000 class

|

N/A

|

|

|

November 2011

|

CS, not yet converted †

|

$50,000

|

Cova Holdings, Inc.

|

Convertible Note

|

Operating Capital

|

|

|

November 30, 2011, original notes date from 2008

|

34,732,000

|

Exercise of prior notes dating back to 2008

|

Various 3

|

144

|

At par

|

Operating capital

|

|

August 2011

|

CS, not yet converted

|

$75,000

|

Sunrise Capital

|

Regulation D filing

|

@ $0.25

|

Purchase of mine

|

|

August 2011

|

CS, not yet converted 1

|

$75,000

|

PMT Capital

|

Regulation D filing

|

@ $0.25

|

Purchase of mine

|

|

September 2011

|

CS, not yet converted 1

|

$50,000

|

Adler

|

Regulation D filing

|

@ $0.25

|

FCCSI/permitting process for mine 2

|

|

October 2011

|

CS, not yet converted 1

|

$75,000

|

Cornell Funding

|

Regulation D filing

|

@ $0.25

|

Retire outstanding debt

|

|

October 2011

|

CS, not yet converted 1

|

$75,000

|

Ygar Capital

|

Regulation D filing

|

@ $0.25

|

FCCSI/permitting process and operations 2

|

1 Estimates are 300,000 share conversion of principal, plus interest conversion.

2 Foreign Commerce Consultative Services, Inc. is All Grade Mining’s general contractor in Chile

3 Toney Alvarez 4.1m; Theodore Collas 3.3m; Angelo Kouletas 3.3m; James Hamburger 3.9m; Marshal Shichtman 1m; Optimus Holdings 1.9m; Madison Consulting, Majorie Group, NVNY, IVD internet 3.4m each. Christine Mulijono 3.764 M

No Issuer repurchases of any class were made during 2011.

-7-

Item 6. Selected Financial Data.

The Company is a “smaller reporting company” as defined by Regulation S-K and as such, are not required to provide the information contained in this item pursuant to Regulation S-K.

Item 7. Management’s Discussion and Analysis of Financial Condition, Developmental Plan of Operations and Results of Operation.

Statements contained in this report, which are not historical facts, may be considered forward looking information with respect to plans, projections, or future performance of the Company as defined under the Private Securities Litigation Act of 1995. These forward-looking statements are subject to risks and uncertainties, which could cause actual results to differ materially from those projected. The words “anticipate”, “believe”, “estimate”, “expect”, “objective”, and “think” or similar expressions used herein are intended to identify forward-looking statements. The forward-looking statements are based upon the

Company’s current views and assumptions and involve risks and uncertainties that include, among other things, the effects of the Company’s business, actions of competitors, changes in laws and regulations, including accounting standards, employee relations, customer demand, prices of purchased material and parts, domestic economic conditions, including housing starts and changes in consumer disposable income, and foreign economic conditions, including currency rate fluctuations. Some or all of the facts are beyond the Company’s control.

The following discussion and analysis should be read in conjunction with our audited financial statements and related footnotes included elsewhere in this report, which provide additional information concerning the Company’s financial activities and condition.

Comparative Analysis Year Ended December 31, 2011 and December 31, 2010

The Company’s operating expenses were $560,157 for the year ended December 31, 2011, an increase of $471,605 or 533% compared to the operating expenses of $88,552 for the year ended December 31, 2010. The increase was primarily due to officer’s compensation being recorded in the year ended December 31, 2011 as well as expenses incurred in the Company’s change of focus to mining, including other operating expenses associated with the mine.

Other expenses also increased in 2011 from $1,746 to $1,222,900 primarily due to the Company recording a change in the fair value of its derivative liabilities.

-8-

During the first half of 2011, the Company realized its business model regarding the manufacture and sale of the Hybred Horseshoe was not meeting expectations, and that the cost of operating the Company could not be sustained. The Company was introduced to Foreign Commerce Consultative Services, Inc.(“FCC”), who was in the process of securing the rights to an existing iron mine located in the Republic of Chile known as the Saltirosa Mine. The Company decided to utilize its public securities to raise the necessary capital to acquire the Saltirosa Mine and commence production.

In June 2011, the Company prepared a Regulation D Offering as a capital raising vehicle and authorized both a 500 to 1 reverse stock split and a name change to All Grade Mining, Inc. Upon receiving a favorable response from potential investors, the CEO undertook a personal inspection of the Mine and familiarized himself with the local mining authorities and principals of the company that owned the Saltirosa Mine. During his trip to Chile, the CEO retained local counsel, Carlos Eva, Esq., who assisted him with the verification of the documentation concerning the Saltirosa Mine, including the RSE Global , Chile, SA’s feasibility study and environmental impact study. A wholly owned

Chilean subsidiary was created with the intent to take title to the Mine. As of December 31, 2011, the subsidiary had no assets and was inactive.

Following the CEO’s due diligence efforts, the Company entered into an assignment agreement with FCC, whereby the Company received FCC’s rights to the Mine and agreed to make payments totaling $3,250,000 to the Mine owner and pay the owner 15% of the profits from the Mine’s production. The Company agreed to retain FCC as its general contractor. FCC was to receive $2.00 per ton out of production and 20% of the Company’s profit from the Mine’s production plus an initial payment of $250,000 on account of prior expenses.

Liquidity and Capital Resources

The Company to date has had no operating revenue and has relied primarily on funding from financial activities.

The Company is seeking financing from various third party sources for the purpose of acquiring the necessary machinery and for working capital. To date the Company has not entered into any definitive agreement with any third party, although it has commenced discussions with a potential financing source.

In the interim the Company has raised a total of $588,000 during 2011 under its Regulation D Offering, and separate financing outside the Offering.

Currently there are no off-balance sheet agreements.

Going Concern

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. The Company has incurred operating losses of $1,783,057 and $90,298 for the years ended December 31, 2011 and 2010, respectively. The Company has a working capital deficiency of $1,819,986 and $164,716 as of December 31, 2011 and 2010, respectively and a stockholders’ deficiency of $1,825,236 and $176,911 at December 31, 2011 and 2010, respectively. The Company continues to

incur recurring losses from operations and has an accumulated deficit since inception of approximately $2,129,334. These conditions raise substantial doubt about the Company’s ability to continue as a going concern. The accompanying consolidated financial statements have been prepared assuming the Company will continue as a going concern and do not include any adjustments that might be necessary should the Company be unable to continue as a going concern.

-9-

The Company’s plan of operations, even if successful, may not result in cash flow sufficient to finance and expand its business. Realization of assets is dependent upon continued operations of the Company, which in turn is dependent upon management’s plans to meet its financing requirements and the success of its future operations. The ability of the Company to continue as a going concern is dependent on the Company’s profitability, cash flows and securing additional financing.

While the Company believes in the viability of its strategy to generate revenues and profitability and in its ability to raise additional funds, and believes that the actions presently being taken by the Company provide the opportunity for it to continue as a going concern. However the Company provides no assurance that such financing will be available on terms advantageous to the Company, or at all and should the Company not be successful in obtaining the necessary financing to fund its operations, the Company would need to curtail certain or all of its operational activities detailed above.

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

The Company is a “smaller reporting company” as defined by Regulation S-K and as such, are not required to provide the information contained in this item pursuant to Regulation S-K.

Item 8. Financial Statements and Supplementary Data

The Company is a “smaller reporting company” as defined by Regulation S-K and as such, are not required to provide the information contained in this item pursuant to Regulation S-K.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Reporting.

The Company does not have any disagreements with any accountants or financial officers at this time.

Item 9A. Controls and Procedures.

Evaluation of Disclosure Controls and Procedures

The Company’s Chief Executive Officer has evaluated the effectiveness of our disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)). In designing and evaluating the disclosure controls and procedures, the principal executive officer recognized that any controls and procedures, no matter how well designed and operated, can provide only reasonable assurance of achieving the desired control objectives, and management is required to apply its judgment in evaluating the cost-benefit relationship of possible controls and procedures.

Based upon that evaluation, our Chief Executive Officer has concluded that as of the end of the period covered by this report the disclosure controls and procedures were not effective to provide reasonable assurance that information required to be disclosed in the reports that we file and submit under the Exchange Act is (i) recorded, processed, summarized and reported as and when required and (ii) accumulated and communicated to our principal executive officer, as appropriate to allow timely discussions regarding disclosure.

The delay in completion and submission of this document was due to the fact that the Company had hired a Chief Financial Officer who did not begin work until January 2012 and had engaged and retained a new independent registered public accounting firm to audit the books and records of the Company for the period covered by this report.

-10-

Under the supervision of the principal executive officer, we conducted an assessment of the effectiveness of our internal control over financial reporting based upon the framework in Internal Control – Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based upon this assessment, the principal executive officer has concluded that our internal control over financial reporting is not effective as of December 31, 2011.

The Principal Executive Officer and the Chief Financial Officer are devising controls to correct this situation.

Management’s report on Internal Controls over Financial Reporting

Our management, under the supervision of our Chief Executive Officer, is responsible for establishing and maintaining adequate internal control over financial reporting (as defined in Rules 13a-15(f) and 15d-15(f) under the Exchange Act). Our internal control over financial reporting is a process designed by, or under the supervision of our principal executive officer, or persons performing similar functions, and effected by our Board of Directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statement for external purposes in accordance with generally accepted accounting principles. The

Company’s internal control over financial reporting includes those policies and procedures that:

|

|

i)

|

pertain to the maintenance of records that, in reasonable detail, accurately and fairly reflect the transactions and dispositions of the assets of the Company;

|

|

|

ii)

|

provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that receipts and expenditures of the company are being made only in accordance with authorizations of management and directors of the Company; and

|

|

|

iii)

|

provide reasonable assurance regarding prevention or timely detection of unauthorized acquisition, use or disposition of the Company’s assets that could have a material effect on the financial statements.

|

Our Chief Executive Officer, conducted an evaluation of the effectiveness of our internal control over financial reporting as of December 31, 2011. In making this evaluation, management used the framework in Internal Control – Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (COSO). Based on our evaluation under the framework in Internal Control – Integrated Framework, our management has concluded that our internal control over financial reporting was not effective as of December 31, 2011

This annual report on Form 10-K does not include an attestation report of our independent register public accounting firm regarding our internal control over financial reporting. Management’s report was not subject to attestation by our registered public accounting firm pursuant to temporary rules of the SEC that permit us to provide only management’s report in this Annual Report.

Because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Changes in Internal Control over Financial Reporting

There was no change in our system of internal control over financial reporting (as defined in Rule 13a-15(f) under the Exchange Act) during our fiscal year ended December 31, 2011 that has materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

-11-

Inherent Limitations on Effectiveness of Controls

We do not expect that internal controls over financial reporting will prevent all errors or all instances of fraud. A control system, no matter how well designed and operated, can provide only reasonable, not absolute, assurance that the control system’s objectives will be met. Further, the design of a control system must reflect the fact that there are resource constraints, and the benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within its company have been detected. These inherent limitations include the

realities that judgments in decision-making can be faulty, and that breakdowns can occur because of simple error or mistake. Controls can also be circumvented by the individual acts of some persons, by collusion of two or more people, or by management override of the controls.

The design of any system of controls is based in part upon certain assumptions about the likelihood of future events, and any design may not succeed in achieving its stated goals under all potential future conditions. Over time, controls may become inadequate because of changes in conditions or deterioration in the degree of compliance with policies or procedures. Because of the inherent limitation of a cost-effective control system, misstatements due to error or fraud may occur and not be detected.

Other Information Related to Internal Controls

Historically, the Company has relied upon the entire Board of Directors in appointing the Company’s independent auditors and reviewing the financial condition and statements of the Company. Given the relatively small size of the Company’s operations and revenues, the Board has not believed that appointing an independent committee was a necessity.

Item 9B. Other Information

The Company has no further information to disclose at this time. Please feel free to see our website at www.allgrademining.com

Part III

Item 10. Directors, Executive Officers, and Corporate Governance.

The Company’s Board of Directors consists of Gary Kouletas and an independent director, Paul Stitzer.

Mr. Kouletas, 36 years old, was the founder of Hybred International, Inc., now All Grade Mining, Inc. He has over ten years of entrepreneurial startup business owner experience. Mr. Kouletas attended William Paterson University and Montclair University, both in New Jersey. After College, Mr. Kouletas became operating partner of Kouletas Real Estate, a commercial property management company. He then went on to develop Kouletas Construction, a town home development company in southern New Jersey. Mr. Kouletas has been involved in the horseshoe manufacturing business for the past seven years. From 2002-2005 Mr. Kouletas served as a consultant to International Surfacing, Inc., a research and

development company, concentrating on the development of a rubberized horseshoe and rubber metal bonding. He has designed numerous therapeutic and innovative horseshoes and corroborated with top industry professionals to create and bring to market the Hybred Horseshoe.

Mr. Stitzer, age 70, spent the majority of his career in the electronics industry. Mr. Stitzer initially acquired A & M Instruments, Inc. from Local Corporation. As the chief executive officer and chairman of the Board of Directors, he built A & M into a leading supplier to the U.S. Government of analog meters for the military. A & M was acquired by Hawker Sidley, a British conglomerate, in 1986. Mr. Stitzer thereafter became an officer and director of Voltampere Corporation, a cutting edge power supply company which was sold to Dynarad Corporation in 1991. Mr. Stitzer is presently residing in Boca Raton,

Florida and continues to consult with various companies in the area of corporate finance.

-12-

All directors serve for a term of one year or until their successors are duly elected. All officers serve at the discretion of the Board of Directors.

Since the Board of Directors has historically and will in the immediate future consist of only a small number of members, we have not formed any Board Committees. All matters relating to audit, compensation, nominations and corporate governance are considered and acted upon by the entire Board of Directors.

No Board member, or executive officer, is known to have been convicted of any crime, excluding any traffic violations and other minor offenses, if any, or have had an adverse adjudication by a Self Regulated organization having jurisdiction or an inhibitive order inhibiting any Director or Executive Officer from any financial activity, or have had a discharge in bankruptcy, all within the previous ten years from the date of this filing.

Promoters

(None)

Certain Reports

Section 16(a) of the Securities Exchange Act of 1934 requires the Company’s directors and officers and persons who own, directly or indirectly, more than 10% of a registered class of the Company’s equity securities, to file with the SEC reports of ownership and reports of changes in ownership of common stock of the Company.

Officers, directors and greater than 10% shareholders are required to furnish the Company with copies of all Section 16(a) reports that they file. Based solely on review of the copies of such reports received

by the Company, the Company believes that filing requirements applicable to officers, directors and 10% shareholders were complied with during the year ended December 31, 2011.

Item 11. Executive Compensation

Summary Compensation Table

|

Name and Principal Position

|

Year

|

Salary

|

Bonus

|

Stock Awards

|

Option Awards

|

Non-Equity Incentive Plan compen-

sation

|

Non-qualified deferred compensation earnings

|

All other Compensation

|

Total

|

|

Kouletas, Gary, CEO and Director

|

2011

|

$-0-

|

-0-

|

$100,000

|

-0-

|

-0-

|

-0-

|

-0-

|

$100,000

|

|

Stitzer, Paul, Director

|

2011

|

-0-

|

-0-

|

-0-

|

-0-

|

-0-

|

-0-

|

-0-

|

$0.00

|

-13-

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters

Equity Compensation Plan Information

|

Plan Category

|

Number of securities to be issued upon exercise of outstanding options, warrants and rights

|

Weighted average exercise price of outstanding options, warrants, and rights

|

Number of Securities Remaining available for future issuance under equity compensation plans (excluding securities reflected in column a)

|

|

(a)

|

(b)

|

(c)

|

|

|

Equity compensation plans approved by security holders

|

None

|

||

|

Equity compensation plans NOT approved by security holders

|

|||

|

Total

|

-0-

|

-0-

|

-0-

|

Item 13. Certain Relationships and Related Transactions, and Director Independence.

No related party had any transaction with the Company in an amount exceeding $120,000. Gary Kouletas, the CEO, received $100,000 in stock compensation by the issuance to him of 70,000 shares of Class A preferred stock and 20,000 shares of Class C preferred stock.

Item 14. Principal Accounting Fees and Services.

|

Audit Fees

|

Audit Related Fees

|

Tax Fees

|

All Other Fees

|

|||||

|

Marcum, LLP

|

2010

|

2011

|

2010

|

2011

|

2010

|

2011

|

2010

|

2011

|

|

-0-

|

$22,500

|

-0-

|

-0-

|

-0-

|

||||

|

Jerome Rosenberg

|

$3,000

|

-0-

|

-0-

|

-0-

|

||||

Part IV

Item 15. Exhibits, Financial Statements Schedules

Exhibit

31.1 Rule 13a-14(a) Certification of CEO

31.2 Rule 13a-14(a) Certification of CFO

32.1 Rule 13a-14(b) Certification of CEO

32.2 Rule 13a-14(b) Certification of CFO

Signatures

| All Grade Mining, Inc. | |||

|

Date: April 25, 2012

|

By:

|

/s/ Gary Kouletas | |

| Name: Gary Kouletas | |||

| Title: President (Principal Executive Officer) | |||

-14-

ALL GRADE MINING, INC.

(A Developmental Stage Company)

AUDITED CONSOLIDATED FINANCIAL STATEMENTS

CONTENTS

|

Page

|

|

|

Report of Independent Registered Public Accounting Firms

|

16 |

|

Consolidated Balance Sheets as of December 31, 2011 and 2010

|

18 |

|

Consolidated Statements of Operations for the Years Ended December 31, 2011

|

|

|

and 2010 and for the period January 3, 2006

|

|

|

(Date of commencement as a development stage company) to

|

|

|

December 31, 2011

|

20 |

|

Consolidated Statements of Changes in Stockholders’ Deficiency

|

|

|

for the period January 3, 2006 (Date of commencement as a development

|

|

|

stage company) to December 31, 2011

|

21 |

|

Consolidated Statements of Cash Flows for the Years Ended December 31, 2011

|

|

|

and 2010 and for the period January 3, 2006

|

|

|

(Date of commencement as a development stage company) to

|

|

|

December 31, 2011

|

24 |

|

Notes to consolidated financial statements

|

26 |

-15-

Report of Independent Registered Public Accounting Firm

Board of Directors

All Grade Mining, Inc. and Subsidiary

We have audited the accompanying consolidated balance sheet of All Grade Mining, Inc. (a development stage company) (formerly known as Hybred International, Inc.) and its Subsidiary as of December 31, 2011 and the related consolidated statements of operations, stockholders’ deficiency, and cash flows for the year then ended, and for the period January 3, 2006 (date of commencement as a development stage company) to December 31, 2011. These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated

financial statements based upon our audit. The accompanying consolidated financial statements of the Company for the period from January 3, 2006 (date of commencement as a development stage company) to December 31, 2010 were not audited by us. Those statements were audited by other auditors whose report, dated September 22, 2011, expressed an unqualified opinion on those statements and included an explanatory paragraph regarding the Company's ability to continue as a going concern. Our opinion, insofar as it relates to the amounts included for such prior periods as indicated in the accompanying financial statements for such periods from January 3, 2006 (date of commencement as a development stage company) through December 31, 2010, is based solely on the report of such other auditors.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test

basis, evidence supporting the amounts and disclosures in the consolidated financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of All Grade Mining, Inc., (a development stage company) (formerly known as Hybred International, Inc.) and its Subsidiaries, of December 31, 2011 and the results of its operations and its cash flows for the year then ended, and for the period January 3, 2006 (date of commencement as a development stage company) to December 31, 2011 in conformity with U.S. generally accepted accounting principles.

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 2 to the consolidated financial statements, The Company’s recurring losses, working capital deficiency, cumulative losses during the development period, and the need to obtain substantial additional funding to complete its development, raises substantial doubt about its ability to continue as a going concern. Management’s plans in regard to these matters are also described in Note 2. The consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ Marcum LLP

Marcum LLP

New York, New York

April 25, 2012

-16-

Report of Independent Registered Public Accounting Firm

Board of Directors

Hybred International, Inc.

We have audited the accompanying balance sheets of Hybred International, Inc. (A Developmental Stage Company) as of December 31, 2010 and the related statements of operations, holders’ equity, and cash flows for the year then ended and for the period from January 3, 2006 (Commencement as A Developmental Stage Company) to December 31, 2010. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based upon our audit.

We conducted our audit in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit

also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audit provides a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects the financial position of Hybred International, Inc (A Developmental Stage Company) as of December 31, 2010 and the results of its operations and its cash flows for the year then ended and for the period from January 3, 2006 (Commencement as A Developmental Stage Company) to December 31, 2010 in conformity with U.S. generally accepted accounting principles.

The accompanying financial statements have been prepared assuming that Hybred International, Inc. (A Developmental Stage Company) will continue as a going concern. As discussed in Note 2 to the financialstatements, The Company’s cumulative losses during the development period, and the need to obtain substantial additional funding to complete its development, raises substantial doubt about its ability to continue as a going concern. Management’s plans in regard to these matters are also described in Note 2. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

|

/s/Jerome Rosenberg CPA, P.C.

Jerome Rosenberg CPA, P.C.

Melville, New York

September 22, 2011

|

-17-

ALL GRADE MINING, INC.

( A Developmental Stage Company Commencing January 3, 2006)

CONSOLIDATED BALANCE SHEETS

As of December 31, 2011 and 2010

ASSETS

|

December 31,

|

December 31,

|

|||||||

|

2011

|

2010

|

|||||||

|

CURRENT ASSETS:

|

||||||||

|

Cash

|

$ | 1,040 | $ | - | ||||

|

Total current assets

|

1,040 | - | ||||||

|

FIXED ASSETS, Net of accumulated depreciation of $87 and $7,731 as of December 31, 2011 and 2010, respectively.

|

350 | 5,305 | ||||||

|

OTHER ASSETS:

|

||||||||

|

Depository payment towards acquisition of iron ore mine

|

250,000 | - | ||||||

|

TOTAL ASSETS

|

$ | 251,390 | $ | 5,305 | ||||

LIABILITIES AND STOCKHOLDERS’ DEFICIENCY

|

CURRENT LIABILITIES:

|

||||||||

|

Accounts payable

|

$ | 164,215 | $ | 120,363 | ||||

|

Cash overdraft

|

- | 317 | ||||||

|

Accrued interest payable

|

15,193 | 6,990 | ||||||

|

Payroll taxes payable

|

8,716 | - | ||||||

|

Advances payable, stockholders

|

7,302 | 9,146 | ||||||

|

Loans payable

|

205,000 | 17,900 | ||||||

|

Convertible debentures

|

48,000 | 10,000 | ||||||

|

Derivative liability

|

1,372,600 | - | ||||||

|

Total current liabilities

|

1,821,026 | 164,716 | ||||||

|

Convertible debentures, net of debt discount of $144,400 and $0 as of December 31, 2011 and 2010, net of current portion

|

255,600 | - | ||||||

|

Deferred income

|

- | 17,500 | ||||||

|

TOTAL LIABILITIES

|

2,076,626 | 182,216 | ||||||

The accompanying notes are an integral part of these consolidated financial statements.

-18-

ALL GRADE MINING, INC.

( A Developmental Stage Company Commencing January 3, 2006)

CONSOLIDATED BALANCE SHEETS (Continued)

As of December 31, 2011 and 2010

|

December 31,

|

December 31,

|

|||||||

|

2011

|

2010

|

|||||||

|

COMMITMENTS AND CONTINGENCIES:

|

- | - | ||||||

|

STOCKHOLDERS’ DEFICIENCY:

|

||||||||

|

Convertible Preferred Stock Class A, no par value, 100,000 shares authorized at December 31, 2011 and none authorized at December 31, 2010. Issued and outstanding 20,000 shares at December 31, 2011, none issued and outstanding at December 31, 2010

|

46,000 | - | ||||||

|

Convertible Preferred Stock Class B, no par value, 400,000 shares authorized at December 31, 2011 and none authorized at December 31, 2010. None issued and outstanding at December 31, 2011 and December 31, 2010

|

- | - | ||||||

|

Preferred Stock Class C, no par value, 50,000 shares authorized at December 31, 2011 and none authorized at December 31, 2010. Issued and outstanding 20,000 shares at December 31, 2011, none issued and outstanding at December 31, 2010

|

9,000 | - | ||||||

|

Common stock, par value $.001 per share; authorized 500,000,000 shares at December 31, 2011 and 2010. Issued and outstanding, 85,058,759 shares at December 31, 2011 and 338,731 at December 31, 2010

|

85,059 | 339 | ||||||

|

Additional paid in capital

|

164,039 | 169,027 | ||||||

|

Deficit accumulated during the development stage

|

(2,129,334 | ) | (346,277 | ) | ||||

|

Total stockholders’ deficiency

|

(1,825,236 | ) | (176,911 | ) | ||||

|

Total liabilities and stockholders’ deficiency

|

$ | 251,390 | $ | 5,305 | ||||

The accompanying notes are an integral part of these consolidated financial statements.

-19-

ALL GRADE MINING, INC.

(A Developmental Stage Company Commencing January 3, 2006)

CONSOLIDATED STATEMENTS OF OPERATIONS

|

January 3, 2006

|

||||||||||||

|

Year Ended

December 31,

|

Year Ended

December 31,

|

(date of commencement

as a development

stage company) through

|

||||||||||

|

2011

|

2010

|

December 31, 2011

|

||||||||||

|

REVENUES

|

$ | - | $ | - | $ | 7,500 | ||||||

|

COST OF REVENUES

|

- | - | 3,135 | |||||||||

|

Gross profit

|

- | - | 4,365 | |||||||||

|

OPERATING EXPENSES:

|

||||||||||||

|

Officer’s compensation

|

100,000 | - | 100,000 | |||||||||

|

Mine related expenses

|

232,500 | - | 232,500 | |||||||||

|

Consulting fees

|

60,000 | 60,000 | 120,000 | |||||||||

|

General and administrative

|

167,657 | 28,552 | 422,505 | |||||||||

|

Total Operating Expenses

|

560,157 | 88,552 | 875,005 | |||||||||

|

Operating Loss

|

(560,157 | ) | (88,552 | ) | (870,640 | ) | ||||||

|

OTHER INCOME AND (EXPENSES):

|

||||||||||||

|

Interest income

|

12 | - | 12 | |||||||||

|

Other income

|

17,500 | - | 17,500 | |||||||||

|

Change in fair value of derivative liability

|

(645,600 | ) | - | (645,600 | ) | |||||||

|

Interest expense

|

(594,812 | ) | (1,746 | ) | (604,506 | ) | ||||||

|

Loss on negotiated debt settlement

|

- | - | (26,100 | ) | ||||||||

|

Total other expenses

|

(1,222,900 | ) | (1,746 | ) | (1,258,694 | ) | ||||||

|

Net Loss

|

$ | (1,783,057 | ) | $ | (90,298 | ) | $ | (2,129,334 | ) | |||

|

Earnings per share – basic and diluted

|

$ | (0.23 | ) | $ | (0.27 | ) | ||||||

|

Weighted average number of common shares outstanding

|

7,661,977 | 338,731 | ||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

-20-

ALL GRADE MINING, INC. AND SUBSIDIARY

(A Developmental Stage Company Commencing January 3, 2006)

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

For the Period January 3, 2006 (Date of Commencement as a Developmental Stage Company) through December 31, 2011

|

Deficit

Accumulated

|

||||||||||||||||||||||||||||||||||||||||||||

|

Class A

Preferred Stock

|

Class B

Preferred Stock

|

Class C

Preferred Stock

|

Common Stock

|

Additional

Paid in

|

During

Development

|

|||||||||||||||||||||||||||||||||||||||

|

Shares

|

Amount

|

Shares

|

Amount

|

Shares

|

Amount

|

Shares

|

Amount

|

Capital

|

Stage

|

Total

|

||||||||||||||||||||||||||||||||||

|

January 3, 2006 (Date of commencement as a developmental stage company)

|

- | $ | - | - | $ | - | - | $ | - | - | $ | - | $ | - | $ | - | $ | - | ||||||||||||||||||||||||||

|

781 shares issued at $0.50 per share

|

- | - | - | - | - | - | 781 | 1 | 390 | - | 391 | |||||||||||||||||||||||||||||||||

|

Net loss

|

- | - | - | - | - | - | - | - | - | (18,016 | ) | (18,016 | ) | |||||||||||||||||||||||||||||||

|

Balances at December 31, 2006

|

- | - | - | - | - | - | 781 | 1 | 390 | (18,016 | ) | (17,625 | ) | |||||||||||||||||||||||||||||||

|

November 6, 2007- Compensatory stock issuance

|

- | - | - | - | - | - | 40,000 | 40 | 19,960 | - | 20,000 | |||||||||||||||||||||||||||||||||

|

Net loss

|

- | - | - | - | - | - | - | - | - | (24,500 | ) | (24,500 | ) | |||||||||||||||||||||||||||||||

|

Balances at December 31, 2007

|

- | - | - | - | - | - | 40,781 | 41 | 20,350 | (42,516 | ) | (22,125 | ) | |||||||||||||||||||||||||||||||

|

January 28, 2008- Issuance 600 shares of common stock at $150 per share

|

- | - | - | - | - | - | 600 | 1 | 89,999 | - | 90,000 | |||||||||||||||||||||||||||||||||

|

February 1, 2008- Conversion of existing note payable of $15,000 plus accrued interest of $4,125 into common stock

|

- | - | - | - | - | - | 38,250 | 38 | 19,087 | - | 19,125 | |||||||||||||||||||||||||||||||||

|

February 1, 2008- Cancellation of 39,400 shares of common stock issued

|

- | - | - | - | - | - | (39,400 | ) | (39 | ) | (19,661 | ) | - | (19,700 | ) | |||||||||||||||||||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

-21-

ALL GRADE MINING, INC. AND SUBSIDIARY

(A Developmental Stage Company Commencing January 3, 2006)

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

For the Period January 3, 2006 (Date of Commencement as a Developmental Stage Company) through December 31, 2011

|

Deficit

Accumulated

|

||||||||||||||||||||||||||||||||||||||||||||

|

Class A

Preferred Stock

|

Class B

Preferred Stock

|

Class C

Preferred Stock

|

Common Stock

|

Additional

Paid in

|

During

Development

|

|||||||||||||||||||||||||||||||||||||||

|

Shares

|

Amount

|

Shares

|

Amount

|

Shares

|

Amount

|

Shares

|

Amount

|

Capital

|

Stage

|

Total

|

||||||||||||||||||||||||||||||||||

|

February 1, 2008- Merger with Hybred International pursuant to the plan of merger; shares issued on a 1:1 basis to Hybred shareholders

|

- | - | - | - | - | - | 160,000 | 160 | 8,290 | (47,080 | ) | (38,630 | ) | |||||||||||||||||||||||||||||||

|

February 1, 2008- Issuance 39,400 shares to cancel debt

|

- | - | - | - | - | - | 39,400 | 39 | 19,961 | - | 20,000 | |||||||||||||||||||||||||||||||||

|

Net loss

|

- | - | - | - | - | - | - | - | - | (104,276 | ) | (104,276 | ) | |||||||||||||||||||||||||||||||

|

Balances at December 31, 2008

|

- | - | - | - | - | - | 239,631 | 240 | 138,026 | (193,872 | ) | (55,606 | ) | |||||||||||||||||||||||||||||||

|

Conversion of existing loan payable of $5,000 into common stock by issuing 99,100 shares

|

- | - | - | - | - | - | 99,100 | 99 | 31,001 | - | 31,100 | |||||||||||||||||||||||||||||||||

|

Net loss

|

- | - | - | - | - | - | - | - | - | (62,107 | ) | (62,107 | ) | |||||||||||||||||||||||||||||||

|

Balances at December 31, 2009

|

- | - | - | - | - | - | 338,731 | 339 | 169,027 | (255,979 | ) | (86,613 | ) | |||||||||||||||||||||||||||||||

|

Net loss

|

- | - | - | - | - | - | - | - | - | (90,298 | ) | (90,298 | ) | |||||||||||||||||||||||||||||||

|

Balances at December 31, 2010

|

- | - | - | - | - | - | 338,731 | 339 | 169,027 | (346,277 | ) | (176,911 | ) | |||||||||||||||||||||||||||||||

|

February 25, 2011- Court ordered disgorgement of 12,000 (6,000,000 pre-reverse split) shares of common stock

|

- | - | - | - | - | - | (12,000 | ) | (12 | ) | 12 | - | - | |||||||||||||||||||||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

-22-

ALL GRADE MINING, INC. AND SUBSIDIARY

(A Developmental Stage Company Commencing January 3, 2006)

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

For the Period January 3, 2006 (Date of Commencement as a Developmental Stage Company) through December 31, 2011

|

Deficit

Accumulated

|

||||||||||||||||||||||||||||||||||||||||||||

|

Class A

Preferred Stock

|

Class B

Preferred Stock

|

Class C

Preferred Stock

|

Common Stock

|

Additional

Paid in

|

During

Development

|

|||||||||||||||||||||||||||||||||||||||

|

Shares

|

Amount

|

Shares

|

Amount

|

Shares

|

Amount

|

Shares

|

Amount

|

Capital

|

Stage

|

Total

|

||||||||||||||||||||||||||||||||||

|

November 23, 2011- Issuance of 70,000 shares of Class A preferred stock and 20,000 shares of Class C preferred stock to the president representing compensation

|

70,000 | 91,000 | - | - | 20,000 | 9,000 | - | - | - | - | 100,000 | |||||||||||||||||||||||||||||||||

|

November 30, 2011- Issuance of shares for the settlement of debt

|

- | - | - | - | - | - | 34,732,028 | 34,732 | - | - | 34,732 | |||||||||||||||||||||||||||||||||

|

November 29, 2011- Conversion of 50,0000 shares of Class A preferred stock into 50,000,000 shares of common stock by the president

|

(50,000 | ) | (45,000 | ) | - | - | - | - | 50,000,000 | 50,000 | (5,000 | ) | - | - | ||||||||||||||||||||||||||||||

|

Net loss

|

- | - | - | - | - | - | - | - | - | (1,783,057 | ) | (1,783,057 | ) | |||||||||||||||||||||||||||||||

|

Balance at December 31, 2011

|

20,000 | $ | 46,000 | - | $ | - | 20,000 | $ | 9,000 | 85,058,759 | $ | 85,059 | $ | 164,039 | $ | (2,129,334 | ) | $ | (1,825,236 | ) | ||||||||||||||||||||||||

The accompanying notes are an integral part of these consolidated financial statements.

-23-

ALL GRADE MINING, INC. AND SUBSIDIARY

(A Developmental Stage Company Commencing January 3, 2006)

STATEMENTS OF CASH FLOWS

|

January 3, 2006

|

||||||||||||

|

For the

|

For the

|

(date of commencement

|

||||||||||

|

Year Ended

|

Year ended

|

as a development

|

||||||||||

|

December 31,

|

December 31,

|

stage company) though

|

||||||||||

|

2011

|

2010

|

December 31, 2011

|

||||||||||

|

CASH FLOWS FROM OPERATING ACTIVITIES:

|

||||||||||||

|

Net Loss

|

$ | (1,783,057 | ) | $ | (90,298 | ) | $ | (2,129,334 | ) | |||

|

Adjustments to reconcile net loss to

|

||||||||||||

|

net cash used by operating activities:

|

||||||||||||

|

Depreciation expense

|

1,485 | 1,864 | 9,216 | |||||||||

|

Impairment of equipment

|

3,907 | - | 3,907 | |||||||||

|

Stock based compensation

|

100,000 | - | 120,000 | |||||||||

|

Amortization of debt discount

|

43,600 | - | 43,600 | |||||||||

|

Deferred income

|

(17,500 | ) | - | - | ||||||||

|

Change in fair value of derivative liability

|

645,600 | - | 645,600 | |||||||||

|

Interest Expense

|

539,000 | - | 539,000 | |||||||||

|

Changes in assets and liabilities:

|

||||||||||||

|

Accounts payable

|

43,852 | 68,500 | 223,190 | |||||||||

|

Accrued interest payable

|

30,035 | 1,746 | 37,025 | |||||||||

|

Payroll taxes payable

|

8,716 | - | 8,716 | |||||||||

|

NET CASH USED BY OPERATING ACTIVITIES

|

(384,362 | ) | (18,188 | ) | (499,080 | ) | ||||||

|

CASH FLOWS FROM INVESTING ACTIVITIES:

|

||||||||||||

|

Purchase of property and equipment

|

(437 | ) | - | (13,473 | ) | |||||||

|

Depository payment towards acquisition of iron ore mine

|

(250,000 | ) | - | (250,000 | ) | |||||||

|

NET CASH USED BY INVESTING ACTIVITIES

|

(250,437 | ) | - | (263,473 | ) | |||||||

|

CASH FLOWS FROM FINANCING ACTIVITIES:

|

||||||||||||

|

Cash overdraft

|

(317 | ) | 317 | - | ||||||||

|

Repayment of advances

|

(1,844 | ) | - | (1,844 | ) | |||||||

|

Cash proceeds from advances

|

- | 3,146 | 9,146 | |||||||||

|

Cash proceeds from loans

|

200,000 | - | 217,900 | |||||||||

|

Cash proceeds from convertible debentures

|

438,000 | 10,000 | 448,000 | |||||||||

|

Issuance of common stock for cash

|

- | - | 90,391 | |||||||||

|

NET CASH PROVIDED BY FINANCING ACTIVITIES

|

635,839 | 13,463 | 763,593 | |||||||||

The accompanying notes are an integral part of these consolidated financial statements.

-24-

ALL GRADE MINING, INC. AND SUBSIDIARY

(A Developmental Stage Company Commencing January 3, 2006)

STATEMENTS OF CASH FLOWS (Continued)

|

January 3, 2006

|

||||||||||||

|

For the

|

For the

|

(date of commencement

|

||||||||||

|

Year Ended

|

Year ended

|

as a development

|

||||||||||

|

December 31,

|

December 31,

|

stage company) through

|

||||||||||

|

2011

|

2010

|

December 31, 2011

|

||||||||||

|

Increase (decrease) in cash

|

1,040 | (4,725 | ) | 1,040 | ||||||||

|

Cash, beginning of period

|

- | 4,725 | - | |||||||||

|

Cash, end of period

|

1,040 | - | 1,040 | |||||||||

|

Supplemental Disclosure of Cash Flow Information:

|

||||||||||||

|

Cash paid for interest

|

$ | - | $ | - | $ | - | ||||||

|

Cash paid for income taxes

|

$ | - | $ | - | $ | - | ||||||

|

Non-cash investing and financing activities:

|

||||||||||||

|

Debt discount related to convertible debentures

|

$ | 188,000 | $ | - | $ | 188,000 | ||||||

|

Issuance of shares for the settlement of debt

|

$ | 34,732 | $ | - | $ | 77,857 | ||||||

The accompanying notes are an integral part of these consolidated financial statements.

-25-

ALL GRADE MINING, INC.

(A Developmental Stage Company Commencing January 3, 2006)

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

|

Note 1-

|

NATURE OF BUSINESS:

|

Organization:

All Grade Mining, Inc. and Subsidiary (formerly known as Hybred International, Inc.) (“the Company”) is a corporation organized under the laws of the State of Colorado. The Company's corporate headquarters is in Hackensack, New Jersey.

The Company former principal business was the development and production of therapeutic horseshoes.

The Company has generated nominal revenues to date; accordingly, the Company is considered a development stage enterprise as defined in the Accounting Standards Codification 915 “Development Stage Entities.” The Company is subject to a number of risks similar to those of other companies in an early stage of development.

In June 2010, the Board of Directors voted to increase the number of authorized common shares to 500,000,000.

The Company discontinued its focus in the therapeutic horseshoe industry in November 2011. The Company has refocused its efforts on raising capital and developing markets for the mining industry and on November 22, 2011 the Company changed its name to All Grade Mining, Inc. to reflect the change in its core business. Concurrent with the change in name, the Company’s Board of Directors voted to complete a reverse split of its authorized common voting shares in the ratio of 500:1. All share and per share amounts have been restated for all periods presented to reflect this reverse stock split. The Company is currently engaged in the acquisition and exploration of mining

properties.

-26-

|

Note 2-

|

GOING CONCERN:

|

The accompanying consolidated financial statements have been prepared assuming that the Company will continue as a going concern which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. The Company has incurred operating losses of $1,783,057 and $90,298 for the years ended December 31, 2011 and 2010, respectively. The Company has a working capital deficiency of $1,819,986 and $164,716 as of December 31, 2011 and 2010, respectively and a stockholders’ deficiency of $1,825,236 and $176,911 at December 31, 2011 and 2010, respectively. The Company

continues to incur recurring losses from operations and has an accumulated deficit since inception of approximately $2,129,334. In addition as disclosed in Note 5, the Company has minimum commitment requirements with respect to the purchase of a mine in the Country of Chile. These conditions raise substantial doubt about the Company’s ability to continue as a going concern. The accompanying consolidated financial statements have been prepared assuming the Company will continue as a going concern and do not include any adjustments that might be necessary should the Company be unable to continue as a going concern.

The Company’s plan of operations, even if successful, may not result in cash flow sufficient to finance and expand its business. Realization of assets is dependent upon continued operations of the Company, which in turn is dependent upon management’s plans to meet its financing requirements and the success of its future operations. The ability of the Company to continue as a going concern is dependent on the Company’s profitability, cash flows and securing additional financing.

While the Company believes in the viability of its strategy to generate revenues and profitability and in its ability to raise additional funds, and believes that the actions presently being taken by the Company provide the opportunity for it to continue as a going concern. However the Company provides no assurance that such financing will be available on terms advantageous to the Company, or at all and should the Company not be successful in obtaining the necessary financing to fund its operations, the Company would need to curtail certain or all of its operational activities detailed above.

-27-

|

Note 3-

|

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES:

|

Use of Estimates

The preparation of the consolidated financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities and disclosures of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting period.

Management bases its estimates on historical experience and on various assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying value of assets and liabilities that are not readily apparent from other sources. The most significant estimates, among other things, are used in accounting for allowances are for deferred income taxes, expected realizable values for long-lived assets (primarily property and equipment), derivative liability and contingencies, as well as the recording and presentation of its common stock issuances. Estimates and assumptions are periodically reviewed and the

effects of any material revisions are reflected in the consolidated financial statements in the period that they are determined to be necessary. Actual results could differ from those estimates and assumptions.

Principle of Consolidation

The consolidated financial statements of All Grade Mining, Inc. and Subsidiary include accounts of the Company and its wholly-owned foreign subsidiary, All Grade Mining Chile, SA. Intercompany transactions and balances are eliminated in consolidation. All Grade Mining Chile, S.A. was formed in November 2011, has yet to commence operations and has minimal assets.

Cash and Cash Equivalents

For purpose of the statement of cash flows, the Company considers all highly liquid debt with a maturity of three months or less, when purchased, to be cash equivalents. As of December 31, 2011 and 2010 the Company did not have any cash equivalents.

Property and Equipment

Property and equipment consists primarily of furniture and fixtures and is stated at cost. Depreciation and amortization are provided using the straight-line method over the estimated useful lives (seven years) of the related assets. Expenditures for maintenance and repairs, which do not extend the economic useful life of the related assets, are charged to operations as incurred. Gains or losses on disposal of property and equipment are reflected in the statement of operations in the period of disposal.

-28-

|

Note 3-

|

SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES: (continued)

|

Impairment of Long-Lived Assets:

The Company assesses the recoverability of its long lived assets, including property and equipment when there are indications that the assets might be impaired. When evaluating assets for potential impairment, the Company first compares the carrying amount of the asset to the asset’s estimated future cash flows (undiscounted and without interest charges). If the estimated future cash flows used in this analysis are less than the carrying amount of the asset, an impairment loss calculation is prepared.

The Company recorded an impairment charge of $3,907 for the year ended December 31, 2011 due to the Company’s discontinued focus in the therapeutic horseshoe industry refocusing its efforts on raising capital and developing markets for the mining industry

Stock-based compensation:

The Company reports stock-based compensation under ASC 718 “Compensation – Stock Compensation”. ASC 718 requires all share-based payments to employees, including grants of employee stock options, warrants to be recognized in the consolidated financial statements based on their fair values.

The Company accounts for equity instruments issued to non-employees as compensation in accordance with the provisions of ASC 718, which require that each such equity instrument be recorded at its fair value on the measurement date, which is typically the date the services are performed.

The Black-Scholes option valuation model is used to estimate the fair value of the warrants or options granted. The model includes subjective input assumptions that can materially affect the fair value estimates. The model was developed for use in estimating the fair value of traded options or warrants. The expected volatility is estimated based on the most recent historical period of time equal to the weighted average life of the warrants or options granted. During the year ended December 31, 2011 and 2010, the Company did not grant any options or warrants.

During the year ended December 31, 2011 the Company recorded a stock based compensation charge of $100,000 for the issuance of 70,000 shares of its Class A Convertible Preferred Stock and 20,000 shares of its Class C Preferred Stock. The Company had no share based awards for the year ended December 31, 2010.

-29-

|

Note 3-

|