Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - TrueBlue, Inc. | tbiq18k2012.htm |

| EX-99.1 - PRESS RELEASE OF THE COMPANY DATED APRIL 25, 2012 - TrueBlue, Inc. | tbiq18k2012ex991.htm |

TrueBlue™ (NYSE:TBI) 2011 Q2 Results 1 Q-1 2012 Results WORKING TOGETHER

TrueBlue™ (NYSE:TBI) Q1 2012 Results Cautionary Note About Forward-Looking Statements: This document contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “may,” “will,” “should,” “expects,” “intends,” “projects,” “plans,” “believes,” “estimates,” “targets,” “anticipates,” and similar expressions are used to identify these forward-looking statements. Examples of forward-looking statements include statements relating to our future financial condition and operating results, as well as any other statement that does not directly relate to any historical or current fact. Forward-looking statements are based on our current expectations and assumptions, which may not prove to be accurate. These statements are not guarantees and are subject to risks, uncertainties, and changes in circumstances that are difficult to predict. Many factors could cause actual results to differ materially and adversely from these forward-looking statements. Examples of such factors can be found in our reports filed with the SEC, including the information under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended Dec. 30, 2011. Any forward-looking statement speaks only as of the date on which it is made, and we assume no obligation to update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise, except as required by law.

TrueBlue™ (NYSE:TBI) Q1 2012 Results 3 Q-1 2012 Highlights 13% revenue growth Solid execution across the business Continued success with vertical market sales strategy Strong results serving the energy industry Continued positive gross margin trends Operating margin expansion

TrueBlue™ (NYSE:TBI) Q1 2012 Results 4 Vertical Market Strategy Dedicated sales leaders with expertise in the specific industries we serve Specialized national sales and service teams deliver tailored solutions to our national customers Local sales and service staff use industry best practices to serve local customers better Strong focus on customer relationships and loyalty on both the local and national level

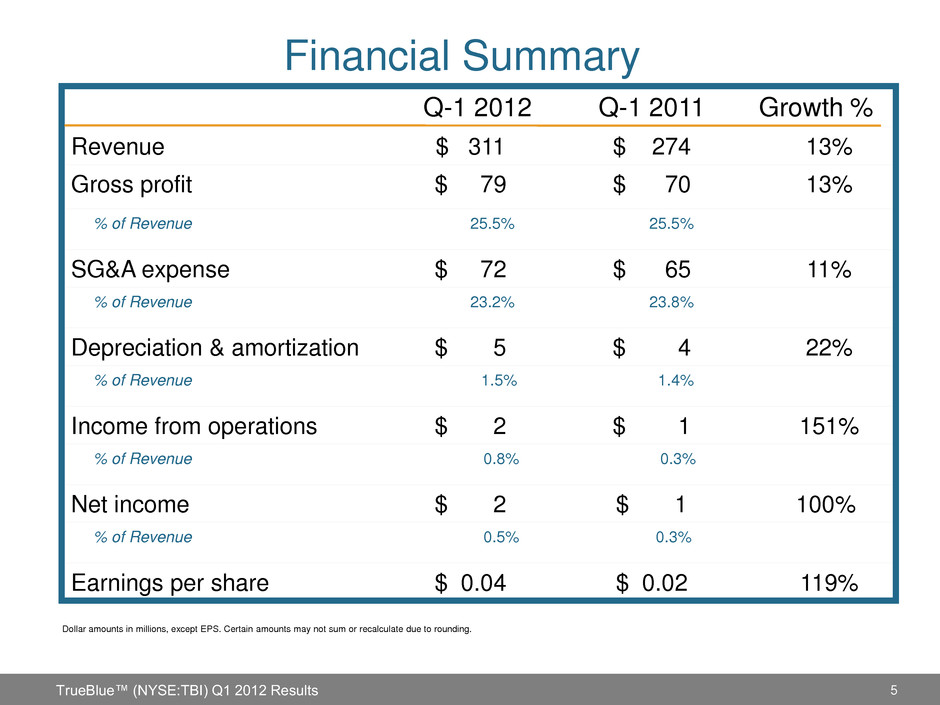

5 Financial Summary Q-1 2012 Q-1 2011 Growth % Revenue $ 311 $ 274 13% Gross profit $ 79 $ 70 13% % of Revenue 25.5% 25.5% SG&A expense $ 72 $ 65 11% % of Revenue 23.2% 23.8% Depreciation & amortization $ 5 $ 4 22% % of Revenue 1.5% 1.4% Income from operations $ 2 $ 1 151% % of Revenue 0.8% 0.3% Net income $ 2 $ 1 100% % of Revenue 0.5% 0.3% Earnings per share $ 0.04 $ 0.02 119% Dollar amounts in millions, except EPS. Certain amounts may not sum or recalculate due to rounding. TrueBlue™ (NYSE:TBI) Q1 2012 Results

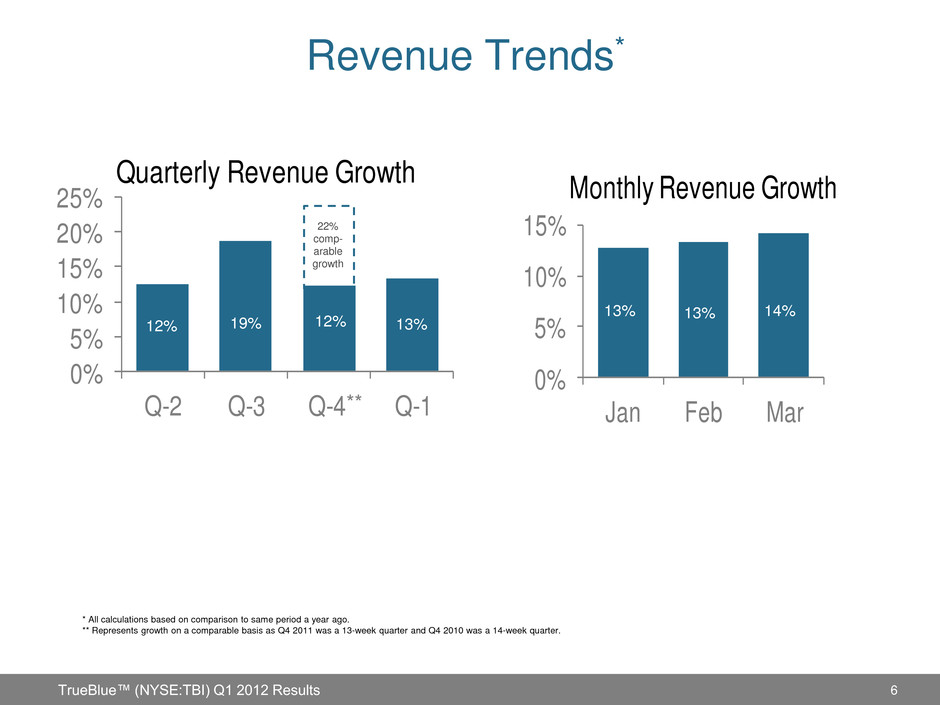

Revenue Trends* 0% 5% 10% 15% Jan Feb Mar Monthly Revenue Growth 0% 5% 10% 15% 20% 25% Q-2 Q-3 Q-4 Q-1 Quarterly Revenue Growth 12% 14% 13% 6 13% 19% 12% 22% comp- arable growth 13% TrueBlue™ (NYSE:TBI) Q1 2012 Results * All calculations based on comparison to same period a year ago. ** Represents growth on a comparable basis as Q4 2011 was a 13-week quarter and Q4 2010 was a 14-week quarter. **

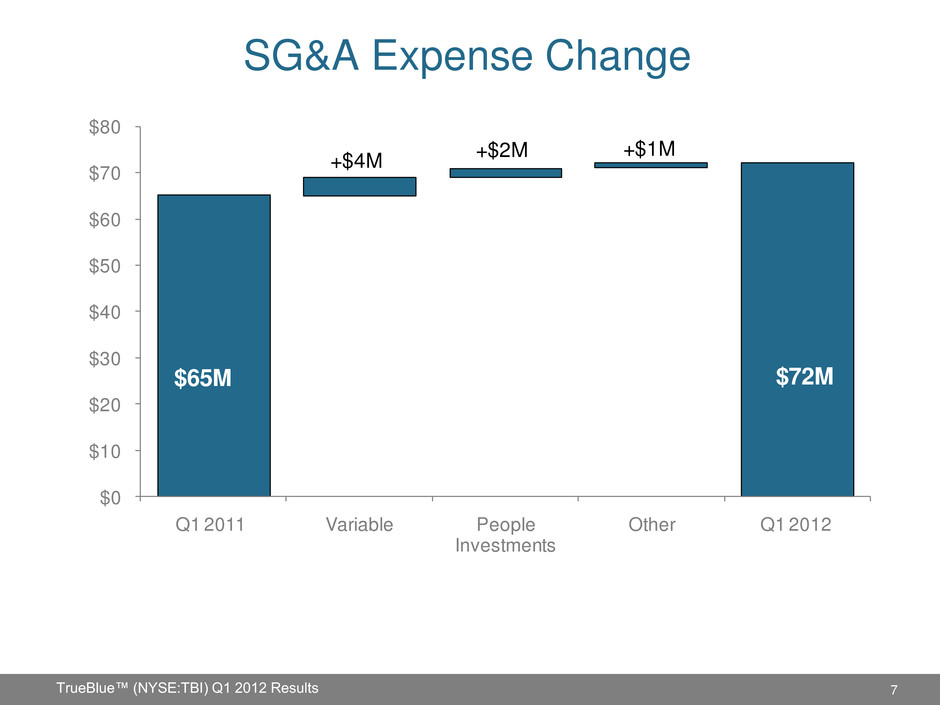

TrueBlue™ (NYSE:TBI) Q1 2012 Results 7 SG&A Expense Change $0 $10 $20 $30 $40 $50 $60 $70 $80 Q1 2011 Variable People Investments Other Q1 2012 +$4M $65M +$2M +$1M $72M

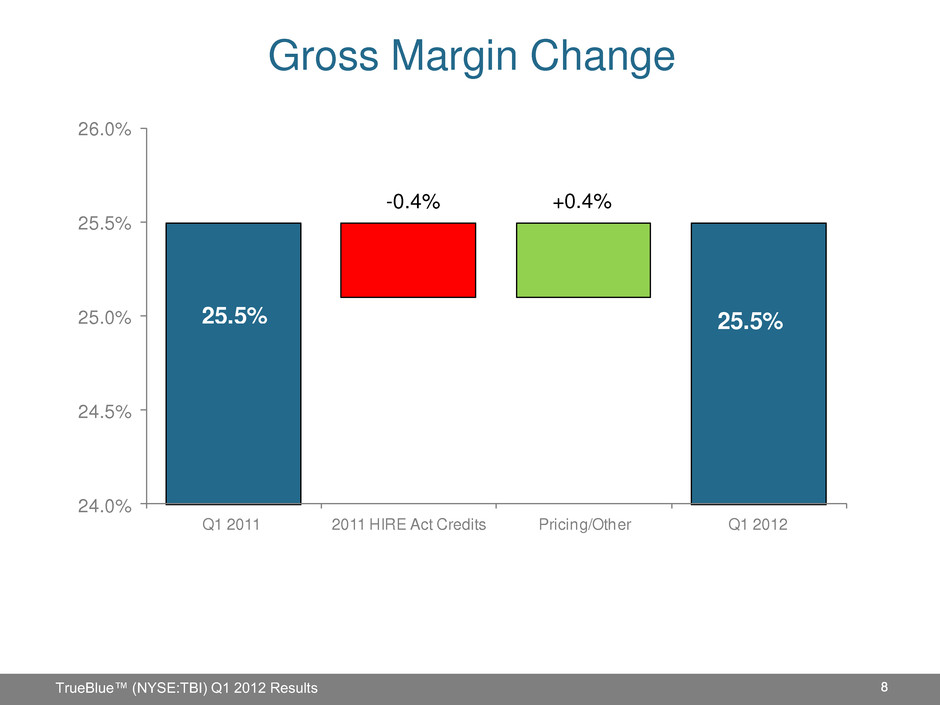

TrueBlue™ (NYSE:TBI) Q1 2012 Results Gross Margin Change 24.0% 24.5% 25.0% 25.5% 26.0% Q1 2011 2011 HIRE Act Credits Pricing/Other Q1 2012 25.5% 25.5% -0.4% +0.4% TrueBlue™ (NYSE:TBI) Q1 2012 Results

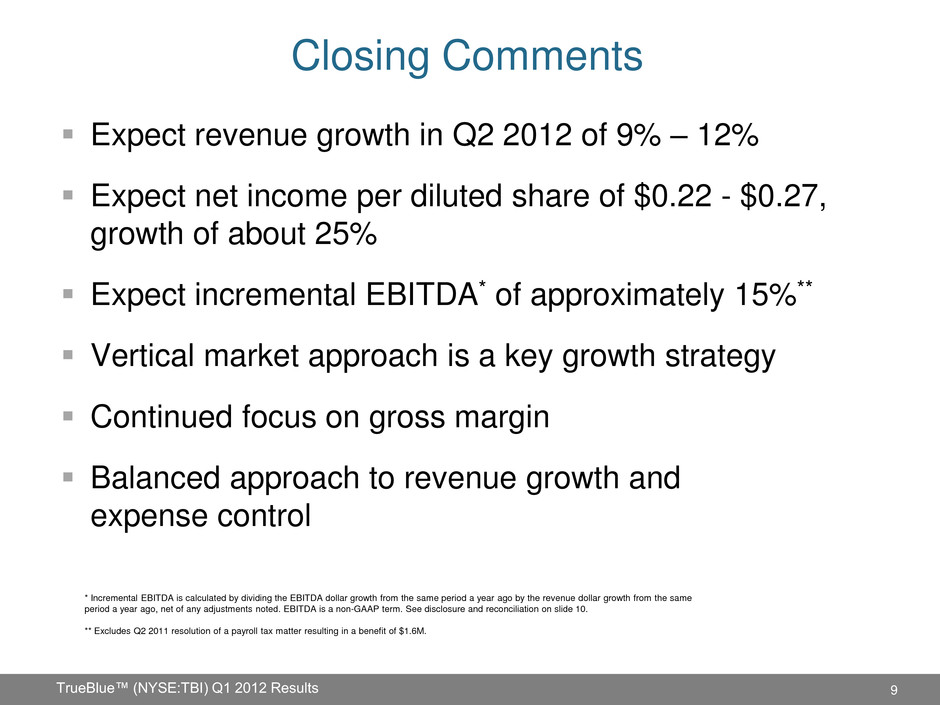

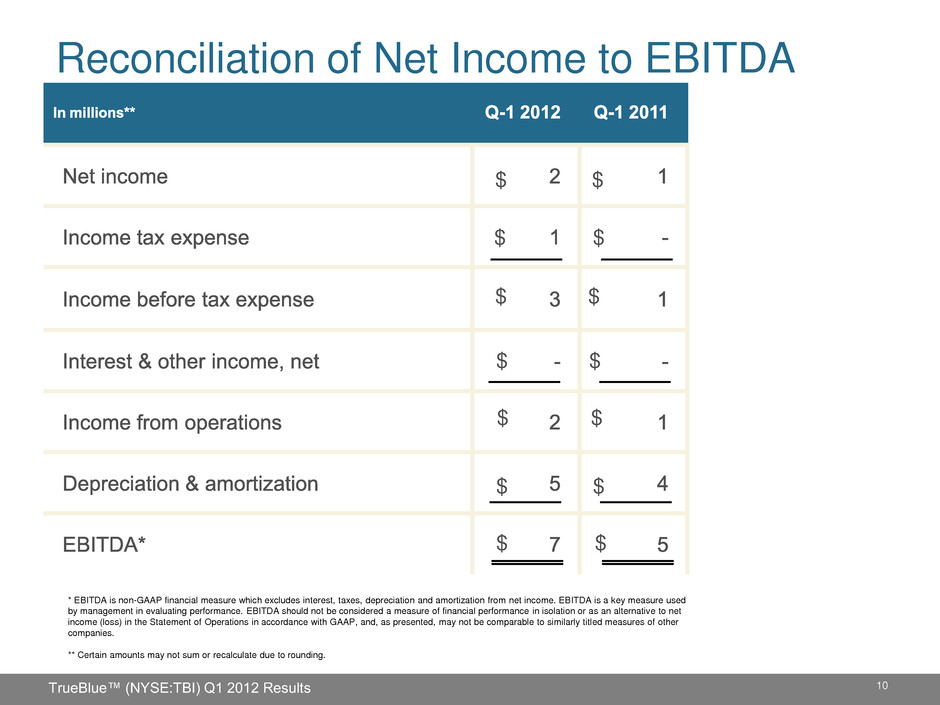

TrueBlue™ (NYSE:TBI) Q1 2012 Results 9 Closing Comments Expect revenue growth in Q2 2012 of 9% – 12% Expect net income per diluted share of $0.22 - $0.27, growth of about 25% Expect incremental EBITDA* of approximately 15%** Vertical market approach is a key growth strategy Continued focus on gross margin Balanced approach to revenue growth and expense control * Incremental EBITDA is calculated by dividing the EBITDA dollar growth from the same period a year ago by the revenue dollar growth from the same period a year ago, net of any adjustments noted. EBITDA is a non-GAAP term. See disclosure and reconciliation on slide 10. ** Excludes Q2 2011 resolution of a payroll tax matter resulting in a benefit of $1.6M.

TrueBlue™ (NYSE:TBI) Q1 2012 Results 10 Reconciliation of Net Income to EBITDA $ $ $ $ $ $ $ $ $ $ $ $ $ $ * EBITDA is non-GAAP financial measure which excludes interest, taxes, depreciation and amortization from net income. EBITDA is a key measure used by management in evaluating performance. EBITDA should not be considered a measure of financial performance in isolation or as an alternative to net income (loss) in the Statement of Operations in accordance with GAAP, and, as presented, may not be comparable to similarly titled measures of other companies. ** Certain amounts may not sum or recalculate due to rounding.