Attached files

| file | filename |

|---|---|

| 8-K - LIVE FILING - NORTHRIM BANCORP INC | htm_44836.htm |

EXHIBIT 99.1

|

||

Contact:

|

Joe Schierhorn, Chief Financial Officer (907) 261-3308 |

|

NEWS RELEASE

Northrim BanCorp First Quarter 2012 Profits Increase 5% to $2.6 Million, or $0.39 per

Diluted Share

ANCHORAGE, AK—April 24, 2012—Northrim BanCorp, Inc. (NASDAQ: NRIM) today reported net profits increased 5% to $2.6 million, or $0.39 per diluted share, in the first quarter of 2012, compared to $2.5 million, or $0.37 per diluted share in the first quarter a year ago. Loan growth, increasing contributions from other operating income, and continued improvements in loan quality generated an increase in profitability in the first quarter of 2012 compared to a year ago.

“We believe the steady growth in shareholders’ equity combined with regular dividend payments delivers solid value to our shareholders over the long-term,” said Marc Langland, Chairman, President and CEO of Northrim BanCorp, Inc. “These two components of our franchise value are derived from the solid balance sheet we maintain and the deep relationships we are building with Alaska businesses and consumers.”

Financial Highlights (at or for the period ended March 31, 2012, compared to December 31, 2011, and March 31, 2011)

| • | Diluted earnings per share in the first quarter of 2012 were $0.39, compared to $0.50 per diluted share in the quarter ended December 31, 2011, and $0.37 per diluted share in the quarter ended March 31, 2011. |

| • | Northrim paid a quarterly cash dividend of $0.13 per share in the first quarter of 2012, compared to a quarterly cash dividend of $0.12 per share in the first quarter of 2011, which provides a yield of approximately 2.4% at current market share prices. |

| • | At quarter end, tangible book value was $18.51 per share, an increase through retained earnings of 8% from $17.13 per share at March 31, 2011. |

| • | Other operating income, which includes revenues from financial services affiliates, service charges, and electronic banking, contributed 23.6% to first quarter 2012 total revenues, compared to contributions of 26.5% to total revenues at the end of the prior quarter and 20.6% to first quarter 2011 total revenues. |

| • | Northrim remains well-capitalized with Tier 1 Capital to Risk Adjusted Assets at March 31, 2012, of 15.04%, compared to 15.20% at the end of the prior quarter and 14.97% a year ago. Tangible common equity to tangible assets was 11.21% at March 31, 2012, up from 10.86% in the preceding quarter and 10.13% a year ago. |

| • | Asset quality remains solid with nonperforming assets at $13.5 million, or 1.25% of total assets at March 31, 2012, compared to $12.5 million, or 1.16% of total assets at the end of December 2011 and $20.7 million, or 1.89% of total assets a year ago. |

| • | The allowance for loan losses totaled 2.45% of gross loans at March 31, 2012, compared to 2.56% in the fourth quarter of 2011 and 2.31% a year ago. The allowance for loan losses to nonperforming loans also increased to 238.8% at March 31, 2012, from 224.2% in the preceding quarter and 146.7% a year ago. |

| • | First quarter 2012 net interest margin (NIM) was 4.53%, down 2 basis points from the fourth quarter of 2011 and down 19 basis points from the year ago quarter. |

“This month we are launching our “100% 907” campaign (based on the Alaska area code 907) to broaden and deepen our relationship with our local communities,” said Joe Beedle, President and CEO of Northrim Bank. “We are reaching out to Alaskans to make Northrim their value added bank of choice.”

Alaska Economic Update

The Anchorage Daily News reported on April 6 that “Alaska’s Revenue Department projects the state will collect $1.2 billion more in unrestricted revenue this year and next than it projected last fall, thanks to high oil prices. The department projects the state will collect $9.9 billion in unrestricted revenue this fiscal year and $8.4 billion next. That compares to the earlier forecast of $8.9 billion this year and $8.2 billion next.” “Higher-than-expected oil prices have given the state a strong revenue outlook,” said Bryan Butcher, Alaska Department of Revenue Commissioner. “But the long-term health of the state’s economy and finances depends on stemming the decline of North Slope oil production.”

“Two major milestones have been met in the state’s effort to bring Alaska’s natural gas to Alaskans and markets beyond,” said Sean Parnell, Alaska’s Governor. “First, the State of Alaska resolved its long-running litigation with ExxonMobil and other leaseholders regarding the Point Thomson field, which holds a quarter of the North Slope’s known natural gas. And, second, the three major producers – ExxonMobil, ConocoPhillips and BP – delivered a letter (to the State) announcing that they are now aligned with the Alaska Pipeline Project (APP) parties, and working on a gasline project focusing on bringing North Slope gas to tidewater in Alaska.” Point Thomson, located 60 miles east of Prudhoe Bay, is Alaska’s largest undeveloped oil and gas field, holding an estimated 8 trillion cubic feet of natural gas and hundreds of millions of barrels of oil and gas liquids.”

“We believe the progress for significant new infrastructure investments in oil and gas production is extremely important to Alaska’s economy,” said Langland. “In addition to the benefits for employment, they provide solid support for long-term sustainable revenues for the state.”

Northrim Bank sponsors the Alaskanomics blog to provide news, analysis and commentary on Alaska’s economy. With contributions from economists, business leaders, policy makers and everyday Alaskans, Alaskanomics aims to engage readers in an ongoing conversation about our economy, now and in the future. Join the conversation at Alaskanomics.com or for more information on the Alaska economy, visit www.northrim.com and click on the “About Alaska” tab.

Balance Sheet Review

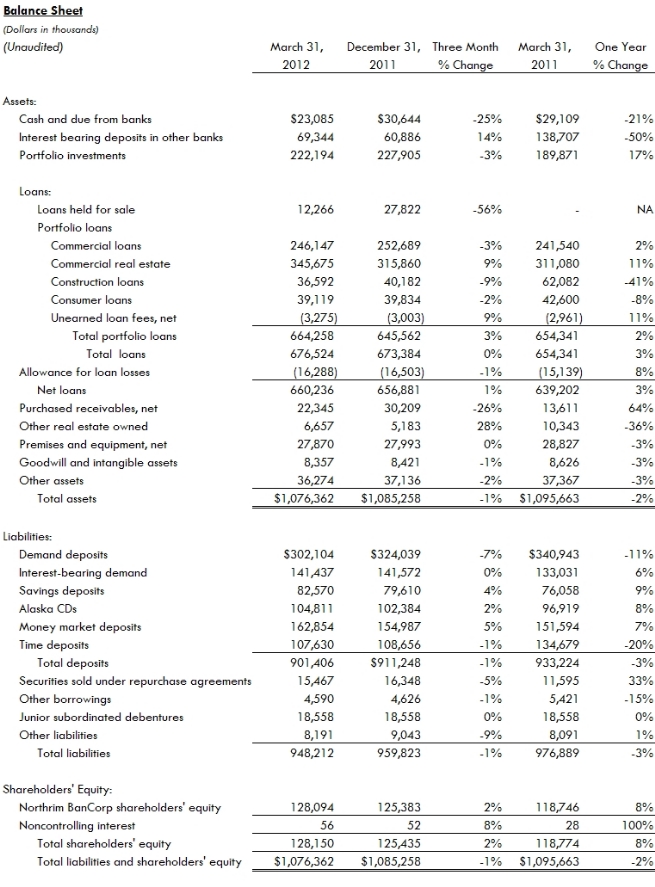

Northrim’s assets totaled $1.08 billion at March 31, 2012, compared to $1.09 billion at December 31, 2011, and $1.10 billion a year ago.

Investment securities totaled $222.2 million at the end of March 2012, compared to $227.9 million at December 31, 2011, and $189.9 million a year ago. At March 31, 2012, the investment portfolio was comprised of 62% U.S. Agency securities (primarily Federal Home Loan Bank and Federal Farm Credit Bank debt), 10% Alaskan municipality, utility, or state agency securities, 23% corporate securities, 4% U.S. Treasury Notes, and 1% stock in the Federal Home Loan Bank of Seattle. The average estimated duration of the investment portfolio is less than two years.

Portfolio loans totaled $664.3 million at March 31, 2012, as compared to $645.6 million at December 31, 2011 and $654.3 million at March 31, 2011. In the first quarter ended March 31, 2012, the growth in commercial real estate loans offset declines in construction loans and commercial loans. At March 31, 2012, commercial loans totaled $246.1 million and accounted for 37% of portfolio loans, as compared to a total of $252.7 million at December 31, 2011, and $241.5 million at March 31, 2011. Commercial real estate loans totaled $345.7 million at March 31, 2012 and accounted for 52% of portfolio loans, compared to a total of $315.9 million at December 31, 2011, and $311.1 million at March 31, 2011. Construction and land development loans totaled $39.1 million at March 31, 2012 and accounted for 5% of portfolio loans, compared to a total of $39.8 million at December 31, 2011 and $42.6 million at March 31, 2011.

“As our new “100% 907” marketing campaign emphasizes, our deposits come from local customers living and working in greater Anchorage and Fairbanks,” said Beedle. At the end of March 2012, total deposits were $901.4 million, compared to $911.2 million at December 31, 2011, and $933.2 million a year ago. “Because we bank a number of large commercial accounts, demand deposits can fluctuate at any given point in time. Our noninterest bearing deposits dropped about $22 million in the quarter. On an average basis, these deposits actually increased $1.0 million in the first quarter of 2012 over the same quarter last year.”

Noninterest-bearing demand deposits at March 31, 2012, were down 11% from a year ago. Interest-bearing demand deposits at the end of the first quarter of 2012 grew 6% year-over-year. Money market balances at the end of March 2012 were up 7% from year ago levels and savings account balances increased 9% from a year ago. The Alaska CD (a flexible certificate of deposit program) was up 8% at the end of March 2012 while time deposit balances fell 20% compared to the first quarter a year ago. At the end of the first quarter of 2011, noninterest-bearing demand deposits accounted for 33% of total deposits, interest-bearing demand accounts were 16%, savings deposits were 9%, money market balances accounted for 18%, the Alaska CD accounted for 12% and time certificates were 12% of total deposits.

Shareholders’ equity totaled $128.2 million, or $19.80 per share, at March 31, 2012, compared to $125.4 million, or $19.39 per share, at December 31, 2011, and $118.8 million, or $18.47 per share, a year ago. Tangible book value per share was $18.51 at March 31, 2012, compared to $18.09 per share at December 31, 2011and $17.13 per share a year ago. Northrim remains well-capitalized with Tier 1 Capital to Risk Adjusted Assets of 15.04% at March 31, 2012.

Asset Quality

Nonperforming assets (NPAs) were $13.5 million at March 31, 2012 compared to $12.5 million in the

preceding quarter and $20.7 million a year ago. The NPA to total assets ratio stood at 1.25% at

March 31, 2012, up slightly from 1.16% three months earlier but down from 1.89% a year ago. “The

increase in NPAs was primarily the result of transferring a $2.3 million loan for a duplex

townhouse development in Fairbanks into non-accrual. There have been 54 townhomes constructed in

this project with 13 remaining for sale. We anticipate continued sales activity for the townhomes

during the summer selling season,” said Chris Knudson, Chief Operating Officer.

Nonperforming (nonaccrual) loans declined to $6.8 million at March 31, 2012, as compared to $7.4 million at December 31, 2011, and $10.3 million a year ago. “During the first quarter of this year, we foreclosed and transferred to other real estate owned a $1.3 million property in Fairbanks, related to the townhouse project, which includes 37 lots that are ready for building and some unrestricted acreage,” said Knudson. Other reductions in nonperforming loans resulted from upgrades, charge-offs and pay-offs.

Loans measured for impairment totaled $12.3 million at March 31, 2012, as compared to $9.5 million at the end of 2011, and $14.1 million in the first quarter a year ago.

At March 31, 2012, there were $4.3 million of restructured loans included in nonaccrual loans, as compared to $2.2 million at December 31, 2011, and $1.4 million at March 31, 2011. At March 31, 2012, there were $4.9 million in performing restructured loans that were not included in nonaccrual loans, as compared to $2.3 million at December 31, 2011, and $1.5 million at March 31, 2011. “Restructured loans involve situations where the borrowers were granted concessions on the terms of their loans due to their financial difficulties,” said Joe Schierhorn, Chief Financial Officer. “We present restructured loans that are performing separately from those that are in nonaccrual to provide more information on this category of loans and to differentiate between accruing performing and nonperforming restructured loans.”

The coverage ratio of the allowance for loan losses to nonperforming loans increased to 238.8% at March 31, 2012, compared to 224.2% at December 31, 2011, and to 146.7% a year ago. The allowance for loan losses was $16.3 million, or 2.45% of total loans at the end of the first quarter, compared to $16.5 million, or 2.56% of total loans at December 31, 2011, and $15.1 million, or 2.31% of total loans a year ago.

Review of Operations

Net Interest Income

In the first quarter of 2012 net interest income was down 3% year-over-year to $10.4 million from $10.7 million in the first quarter of 2011 and down 4% from $10.8 million in the immediate prior quarter.

“In the current flat interest rate environment, we are seeing some margin compression,” Schierhorn noted. In the first quarter of 2012, Northrim’s net interest margin was 4.53%, down 2 basis points from 4.55% in the fourth quarter of 2011 and down 19 basis points from 4.72% in the first quarter a year ago.

Provision for Loan Losses

The loan loss provision in the first quarter of 2012 totaled $89,000, down from $350,000 recorded in the preceding quarter and down from $549,000 in the first quarter a year ago. “Due to the continued decline of our nonperforming loans, we decreased our provision this quarter,” said Beedle.

Other Operating Income

In addition to traditional loans and savings accounts, Northrim offers purchased receivables financing in its Alaska markets and the Pacific Northwest through a division of Northrim Bank and health insurance plans, mortgages, and wealth management including business and employee retirement services through several affiliates in which it shares an ownership position. Total other operating income increased 15% to $3.2 million in the first quarter of 2012, compared to $2.8 million for the first quarter of 2011and declined 17% compared to $3.9 million for the fourth quarter of 2011.

“Our Seattle based purchased receivable financing division continues to contribute to other operating income,” said Beedle. Purchased receivables income contributed $712,000 to first quarter 2012 revenues, compared to $817,000 in the preceding quarter and $626,000 in the first quarter a year ago. “Our purchased receivable income declined in the first quarter of this year as compared to the last quarter as several customers paid their balances down during the quarter,” said Beedle.

Income from Northrim’s mortgage affiliate contributed $301,000 to first quarter revenues, compared to $626,000 in the preceding quarter and a loss of $52,000 in the first quarter of 2011. “Income from our mortgage affiliate varies according to its level of mortgage origination activity. In the first quarter of this year, refinance activity declined as compared to the fourth quarter of last year, which also caused the income from our mortgage affiliate to decline,” said Beedle.

Northrim’s employee benefit plan affiliate, contributed $540,000 to first quarter 2012 revenues, compared to $538,000 in the preceding quarter and $500,000 in the first quarter of 2011. “As part of our full service deposit and lending products, we also offer a wide choice of employee health benefit plans for our business customers and several wealth management programs,” noted Knudson.

In the first quarter of 2012, both service charges on deposit accounts and electronic banking income increased 8% from the first quarter a year ago. “We are continuing to see higher volumes of electronic banking transactions and have seen an increase in service charges during the first quarter,” said Knudson.

Other Operating Expenses

First quarter 2012 overhead costs increased 4% during the quarter and 5% year-over-year, reflecting increases in compensation costs, occupancy expense, and professional and outside services, offset in part by reduced FDIC insurance costs. Expenses from other real estate owned “OREO”, net of rental income and gains on sale, also increased due primarily to a lower level of OREO rental income. “As we have continued to sell our bank-owned properties, we are no longer generating the same levels of rental income from our OREO assets as we did last year,” said Beedle.

About Northrim BanCorp

Northrim BanCorp, Inc. is the parent company of Northrim Bank, a commercial bank that provides personal and business banking services through locations in Anchorage, Eagle River, Wasilla, and Fairbanks, Alaska, and a factoring/asset based lending division in Washington. The Bank differentiates itself with a “Customer First Service” philosophy. Affiliated companies include Elliott Cove Insurance Agency, LLC; Elliott Cove Capital Management, LLC; Residential Mortgage, LLC; Northrim Benefits Group, LLC; and Pacific Wealth Advisors, LLC.

www.northrim.com

This release may contain “forward-looking statements” that are subject to risks and uncertainties. Readers should not place undue reliance on forward-looking statements, which reflect management’s views only as of the date hereof. All statements, other than statements of historical fact, regarding our financial position, business strategy and management’s plans and objectives for future operations are forward-looking statements. When used in this report, the words “anticipate,” “believe,” “estimate,” “expect,” and “intend” and words or phrases of similar meaning, as they relate to Northrim or management, are intended to help identify forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Although we believe that management’s expectations as reflected in forward-looking statements are reasonable, we cannot assure readers that those expectations will prove to be correct. Forward-looking statements are subject to various risks and uncertainties that may cause our actual results to differ materially and adversely from our expectations as indicated in the forward-looking statements. These risks and uncertainties include our ability to maintain or expand our market share or net interest margins, and to implement our marketing and growth strategies. Further, actual results may be affected by our ability to compete on price and other factors with other financial institutions; customer acceptance of new products and services; the regulatory environment in which we operate; and general trends in the local, regional and national banking industry and economy as those factors relate to our cost of funds and return on assets. In addition, there are risks inherent in the banking industry relating to collectibility of loans and changes in interest rates. Many of these risks, as well as other risks that may have a material adverse impact on our operations and business, are identified in our other filings with the SEC. However, you should be aware that these factors are not an exhaustive list, and you should not assume these are the only factors that may cause our actual results to differ from our expectations.

Sources: http://www.adn.com/2012/04/06/2411075/department-releases-new-revenue.html#storylink=cpy and

http://gov.alaska.gov/parnell/press-room/full-press-release.html?pr=6071