Attached files

| file | filename |

|---|---|

| EX-10.1 - EXHIBIT 10.1 - Opera Jet International Ltd | v310290_ex10-1.htm |

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

February 6, 2012

Date of Report

(Date of Earliest Event Reported)

OPERA JET INTERNATIONAL LTD.

(Exact Name of Registrant as Specified in its Charter)

| Delaware | 000-53255 | 20-5572714 | ||

| (State or other jurisdiction | (Commission File Number) | (IRS Employer | ||

| of incorporation) | Identification No.) |

Ivanska cesta 30/B

Aircraft Building

821 04 Bratislava, Slovakia

(Address of Principal Executive Offices)

(011) 421 2 2090 2741

(Registrant’s Telephone Number)

| ITEM 2.01 | Completion of Acquisition or Disposition of Assets |

On February 6, 2012, Opera Jet International Ltd. ("Opera Jet Delaware") effected an acquisition of all the outstanding stock of Opera Jet a.s., an aircraft charter operator corporation formed under the laws of the Slovak Republic (“Opera Jet Slovakia”) in a stock-for-stock transaction. Opera Jet Slovakia was formed in the Slovak Republic in 2006 (originally organized as Air Carpatia Services s.r.o.) and has ongoing business operations. As used herein the term "Company" means the existing entity after the acquisition of its now wholly-owned and operating subsidiary, Opera Jet Slovakia, its operations, assets and business.

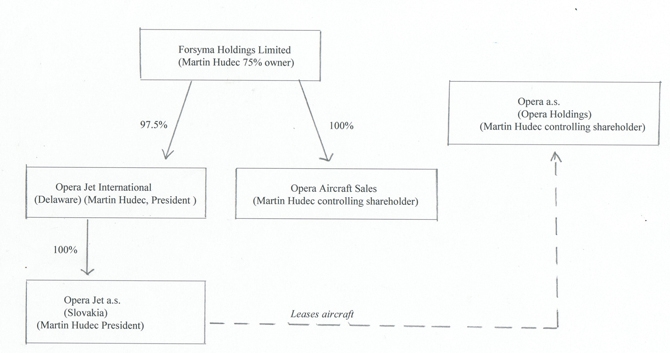

Opera Jet Delaware issued an aggregate of 500,000 shares of its common stock in exchange for all the 100 outstanding shares of Opera Jet Slovakia. All the outstanding shares of Opera Jet Slovakia were wholly owned by Forsyma Holdings Limited (“Forsyma”) which is the majority shareholder of Opera Jet Delaware. Forsyma is 75% owned by the Company's sole officer and director, Martin Hudec.

Opera Jet Slovakia has become a wholly owned subsidiary of Opera Jet Delaware.

Opera Jet Slovakia was formerly known as Opera Jet s.r.o., and a formal change of the name of company to Opera Jet a.s. from Opera Jet s.r.o. was completed on January 1, 2011. At such time, Opera Jet Slovakia also changed its legal form from a private limited liability company to a joint-stock company under the law of the Slovak Republic.

Forsyma purchased its interest in Opera Jet Slovakia from Opera a.s., a holding company formed under the laws of the Slovak Republic (“Opera Holdings”), and majority-owned and controlled by the sole officer and director of Opera Jet Delaware.

Accounting Treatment

The merger is being accounted for as a reverse-merger and recapitalization. Opera Jet Slovakia is the acquirer for financial reporting purposes and Opera Jet Delaware is the acquired company. Consequently, the assets and liabilities and the operations that will be reflected in the historical financial statements prior the merger will be those of Opera Jet Slovakia and will be recorded at the historical cost basis of Opera Jet Slovakia, and the consolidated financial statements after completion of the merger will include the assets and liabilities of the Company and Opera Jet Slovakia, historical operations of Opera Jet Slovakia and operations of the Company from the closing date of the merger.

Corporate History

The Company, incorporated in Delaware on September 13, 2006 under the name Canistel Acquisition Corporation, was originally formed to serve as a vehicle to effect a merger, exchange of capital stock asset acquisition or other business combination. The Company filed a registration statement on Form 10 on May 23, 2008 registering its class of common stock pursuant to the Securities Exchange Act of 1934.

In December 2010, the Company changed its name to Opera Jet International Ltd. and effected a change in control whereby the Company: (i) redeemed 500,000 of its then outstanding 1,000,000 shares of common stock from two shareholders (ii) issued 21,000,000 shares of its common stock to three shareholders of which 20,000,000 shares were issued to Forsyma Holdings Limited and 500,000 shares to each of two other shareholders and (iii) new directors were elected and new officers appointed. Forsyma Holdings Limited became the majority owner of the Company.

On February 6, 2012, the Company acquired all the outstanding stock of Opera Jet a.s., an operating aircraft charter operator corporation formed under the laws of the Slovak Republic (“Opera Jet Slovakia”) for Forsyma Holdings Limited in a stock-for-stock transaction. Consequently Opera Jet Slovakia became a wholly owned subsidiary of the Company which is a majority owned subsidiary of Forsyma Holdings Limited.

Forsyma Holdings Limited is majority-owned and controlled by Martin Hudec, the sole officer and director of the Company.

Opera Jet International

Corporate Chart

April 2012

Business

The Company operates private jets and provides air transportation services. The Company charters and operates business jets within Europe, Russia, North Africa and the Middle East, and possesses the requisite licenses to provide these services across the world. The core business is to provide personal jet services at reasonable prices to high net worth customers. The Company also has developed a charter business by managing private jets for individuals and selling flights to outside customers on these jets with the consent of the owner.

The Company officially became a Slovak aircraft operator (AOC) in the first half of 2008, then expanding in the executive jets business in the region of Central and Eastern Europe. The Company’s core business is chartering business jets, through a fleet of private jets which are leased from Opera Holdings and other third parties.

The Company receives a large portion of its business through brokers who arrange private air travel for their clients. Currently, the Company works with over 500 brokers across Europe and the Middle East. Brokers are provided online access to all flights and current aircraft locations.

Clients from Russia and Ukraine account for approximately 50% of the Company’s total current business. The remainder of the Company’s business is primarily concentrated in Europe. The Company intends to build its business in the Middle East, Asia and across the rest of Central Europe, in the near future.

The Company's business plan anticipates that the Company will develop additional revenues as its name and reputation grows and through the offering of its securities either privately or publicly. The Company plans to initially utilize available funds, after operational expenses, to expand its operations in Europe, Russia, Ukraine, the Middle East and Northern Africa. The Company will purchase additional aircraft and expand its communication/advertising to its broker network. At some time in the future, the Company anticipates that it will have expanded its operational jet fleet sufficiently to meet the market demand in its target areas. At such time, the Company anticipates that it will further expand its business into the purchasing and trading of options to buy aircraft and to offer financing and services to other purchasers of aircraft. The Company does not have a timetable for such additional expansion nor any cost projections but anticipates that it may be several years in the future.

Operations

The Company leases three private jets (Cessna Citation Jets 1, 2 and 3) from Opera Holdings and one private jet from LBG Style, an independent third party. These aircraft are smaller light jet transport aircraft.

In 2011, Opera Jet Slovakia leased a Falcon 2000 from Opera Aircraft Sales s.r.o. In mid-2011, the Company subleased the Falcon 2000 to an Italian company until the time of the termination of its lease in January 2012 and continued to manage the jet for that company. In January, 2012, the Falcon 2000 jet was leased directly from its owner by the Italian company. The Company continues to manage the Falcon 2000 for the new lessee.

Although the Company manages the Falcon 2000, a heavy jet, and the Company still perceives a demand for such a longer range jet, it anticipates that the smaller aircraft to be in greater demand by its clients because such aircraft are more fuel efficient and less costly to charter. The Company believes that the focus on light jet transport and the trip range provided by such aircraft will still allow it to cover all the flight ranges within Europe, Russia and the Middle East.

In 2011 the Company managed three aircraft (one of which was the Falcon 2000 which it also leased at that time). Currently, as of the date of filing of this report, the Company manages four aircraft (one of which is the Falcon 2000). The Company receives a fixed monthly management fee from the owners. These jets are primarily used for owner flights. However with the owner's permission, the Company will from time to time arrange charter flights on these aircraft. The Company earns between 5 to 10% of the revenues derived from selling such charter flights. All direct and indirect costs are reimbursed by the owners.

The Company rents premises related to flight activities, such as aviation simulators and airport hangar premises.

Customers generally contact the Company through their travel brokers or on occasion directly (because the Company has a large direct client base) and specify their air travel demands, including usually the date and time of their intended departure and arrival. The Company’s internal personnel then calculate and determine an official flight offer that includes available aircraft types, the price and any additional conditions or information, if applicable. After acceptance of the travel offer by the client, the jet charter contract is signed and the payment is made to the Company. The Company’s dispatch department typically then prepares the flight plan and asks for all needed flight permissions so that the flight can occur. On a small number of flights (less than 5% of all flights), the Company pays the broker a commission approximately 7.5% of the price; but typically no commission is paid because the broker is the Company's client and the ultimate client is confidential to the broker. As such, the Company has no access to the information about the final price or commission to the ultimate flying client.

The Company conducts most of its operations through its own employees from the Company’s locations at headquarters and the aircraft operations at the Bratislava airport and other airports (depending on current location of the aircrafts). The Company does not generally utilize the services of other entities (i.e. sub-contractors or other outsourced providers) services, except in the instances of travel brokers who organize travel arrangements with the Company for their clients.

The Company had 2,565 flights (including empty flights with no passengers) in 2011 with an average length of 1 hour and 25 minutes per flight. A flight is defined as time from takeoff to landing and one "trip" may contain several flights (legs).

The Company often operates flights between international destinations. The Company files its flight plan with the Central Flow Management Unit (CFMU) in Brussels and the flight plan is either directly confirmed by the CFMU as submitted or it is edited and then confirmed by the CFMU. Filing flight plans with the CFMU allows the Company to fly to (and over) all EU countries and also some other non-EU countries such as Switzerland. If the Company intends to fly to a non CFMU participating country, then it will usually use a local handling agent who will file the flight plan with the local flight control authority and obtain the flight permits.

Revenues

Aircraft charter of its aircraft is the Company's primary source of revenue. The revenue potential of flights depends on each flight and the agreed price for such flight. The Company negotiates the prices charged for each chartered trip.

In 2010, approximately 94% of the revenues of the Company were generated primarily from the chartering of aircraft with approximately 5.5% attributable to managed aircraft. In 2011, the Company increased the number of its managed aircraft and its revenues attributed to managed jets rose to 23.8% of its total revenue.

From time to time, the Company will arrange, with the owner's permission, charter flights utilizing the aircraft that it manages. The Company earns between 5 to 10% of the revenues derived from selling such charter flights.

The private jet charter business is seasonal in nature. The strongest season is typically in the summer period (April to September), which is caused mostly by the summer holiday season. In addition, the months of December and January, when winter holidays occur, are generally strong. The remainder of the year is usually slower in terms of private jet charter business.

The Business: Charter Air Travel

The Company has noticed that seemingly in response to the economic crisis of recent years, that when distances allow many of its clients have requested the use of smaller aircraft rather than the use of a larger, more spacious and more expensive jet. A heavy or larger jet is characterized with a longer, higher and more spacious cabin space ("stand-up" space) with a flight range over 2500 nautical miles whereas a small aircraft has a smaller cabin with a flight range typically of approximately 1500 nautical miles. The smaller and lighter aircraft are more fuel efficient and less costly to charter.

The Company manages a heavy jet but no longer leases a heavy jet. Although the Company still perceives a demand for the longer range and more spacious jet by certain clients to whom space is a priority, it anticipates that the smaller aircraft to be in greater demand by its clients because of the economic benefits. The Company believes that the light jet transport will still allow it to cover all flight ranges within Europe, Russia and the Middle East with this type of aircraft. Because the Company is not leasing larger aircraft, the Company can keep its fixed costs at low levels compared to competitors in the industry which operate larger aircraft. If at such time a client may demand a larger jet, the Company can attempt to arrange a charter on the larger jet that it manages.

The Company is aware of rising fuel prices and the potential for even greater increases in aircraft fuel prices. The Company pegs its pricing to average market prices. The Company anticipates that as its competitors raise charter prices in response to the increasing fuel prices, the Company will do so likewise and the increased prices will be passed through to customers industry and marketwide. However, the Company believes that demand for the charter air travel business does not seem to be so price dependent that the percentage increase in prices based on increased fuel prices will diminish the demand for the jet charters. The Company's clients that need charter flights typically need the timing, flexibility and/or privacy offered by charter flights and do not necessarily have viable alternatives.

The Market: Slovakia

The Company believes that it is well positioned by its location in Bratislava in the Slovak Republic. Slovakia has been a member of the European Union since 2004. Accordingly, Slovakia has since benefitted from all advantages associated with the Schengen Agreement among various European nations. Additionally, Slovakia is located across many flight routes and provides easy access and connections among numerous European important locations, and is also the most eastern European way point from Europe to Russia. Moreover, Slovakia utilizes the Euro as a currency and the Slovak aviation industry conforms to all of the air safety, maintenance and quality rules and regulations of the European Aviation Safety Agency (EASA).

The hub city of Bratislava is only 40 kilometers from the airport located in Vienna, Austria. The Company can offer the convenience of travel proximate to Vienna (a major European hub) at a fraction of the cost, as Bratislava offers substantially lower operational costs than Vienna.

Over-flight and other fees in the European Union for aircraft operations can be substantial. Typically, these fees are calculated based on the country of the aircraft’s registration. The Company believes that its location in Slovakia offers an attractive opportunity for lower costs and fees as compared to other European nations.

The Market: China

The Company believes that China will offer a good market for the use of private jet services such as those offered by the Company as China's economy grows and its private general aviation becomes available. The Company hopes that at some time in the future it will develop a Chinese market. At such time, the Company will study the Chinese market and the need for private jet charter service and the corresponding demand for aircraft and aircraft sales and the potential at that time offered to the Company. Presently, the Company has determined to develop its European market activities and at such time, if ever, that the Company feels that it has met its expansion in the European market, it will investigate the markets offered in China and elsewhere.

Services

The Company believes that flights services offered by the Company are competitive with other leading private airline services. The Company offers global charter flights with pilots and crew ready to assist customers. In addition, the Company arranges ground handling services and coordinates catering, hotel reservations and transportation for customers. Also, customers have access to computerized flight plans, weather information and other useful charts.

Competition

The Company believes that its two major competitors are Vista Jet and Netjets, both of which are well-established in the world private jet charter business. The Company believes that it can actively compete with these two larger companies as the Company's history shows that it was able to begin operations against the competition presented by these companies. The Company began operation in the second half of 2008, the start of the global financial crisis. Despite those hard times on markets globally, the Company was able to begin operations and achieve gradual greater success. The Company believes that such increasing flight hours on its aircraft and its returning customers is testament to its ability to compete with the then existing air charter companies.

Competition in the sector typically revolves around several factors, including price which is a significant component of differentiation between companies. Other factors that are important to consumers include flights and options offered, customer service, and convenience.

Customers

During 2011, there were two customers representing 10% or more of the Company's sales. The Company manages the aircraft for one of such customers.

Suppliers

The Company has no regular major suppliers. Practically the only suppliers are various fuel companies, handler companies, hangar owners, etc. The Company leases three of its aircraft from Opera Holdings, a company controlled by the Company's sole officer and director and indirect controlling shareholder which by virtue of such aircraft leasing can be considered a large supplier to the Company. The Company leases aircraft from two other suppliers.

Marketing Strategy

To date, the Company has not invested a lot of time or capital into traditional marketing activities, as brokers have been a large source of the Company’s customers. However, the Company has devoted substantial attention to constructing the marketing strategy and plans that it will use to continue building its business. The Company eventually anticipates additional marketing activities designed to help the Company find new customers and to increase awareness of the Company’s ability to offer consumer flight services. The Company's business targets a specific and limited charter jet customer and as such the Company has advertised in several international private jet aviation magazines. The Company is currently promoting its services in high-class print magazines and also through online publications and the Company’s own website. The Company's website is www.operajet.eu.

There are limited possibilities for the Company to approach the final flight customer as most charter jet fliers utilize flight brokers to book aircraft. Therefore the Company targets flight brokers to develop its market. The Company works on maintaining relationships with primary brokers through email, telephone and personal visits. The Company sends representatives to the important private aviation fairs and conferences. The Company also maintains a direct presence of salesmen who are located directly in the Company’s headquarters on Bratislava, Slovakia airport. The salesmen conduct in-person marketing and communicate with potential clients. Finally, the Company also promotes its brand and services at business aviation conventions and trade shows, and plans to increase such activities as its business continues to grow.

Over time, the Company may also build a loyalty and rewards program for its database of customers, thereby increasing brand loyalty and consumer awareness. The Company has been attempting to begin such a customer loyalty rewards program and is currently testing a program of membership cards by which a customer (including a broker) would prepay a certain amount of services and based upon the amount of prepayment they would receive a percentage pricing discount. To date, no customer has prepaid such a membership card.

Business Plan

The Company plans to build its business by establishing new branches and sales points across the world. The Company believes that additional geographic expansion provides significant opportunities for growth. These expansion opportunities will be pursued primarily through entering into additional or new leases for aircrafts.

The Company’s current aircraft focus is on the Cessna Citation Jet, which is the core of its current fleet as well. All four models: CJ1, CJ2, CJ3 and CJ4 require the same pilot type rating which means that all of the Company’s pilots may operate all of the fleet. Hence, the fixed wage costs can be kept at a minimum level, as the Company is not forced to employ various pilots for each aircraft separately. The Company owns a certified CJ2 flight simulator, thus it can make type rating for new pilots and recurrent training for old pilots, all in-house.

The Company also plans to lease additional aircraft in the future, subject to obtaining additional capital and finding suitable opportunities to do so. The Company believes that it can strategically lease aircraft assets at opportunistic valuations, with a view toward reselling the same when market conditions improve and demand for rapid delivery of aircraft is high.

Dr. Hudec, the sole officer and director of the Company, has a controlling interest in Opera a.s, a holding company formed under the laws of the Slovak Republic ("Opera Holdings"). Opera Jet Slovakia has borrowed monies from Opera Holdings.

Opera Jet Slovakia currently leases four jets (three from Opera Holdings and one from LBG Style s.r.o). The lease for the Falcon 2000 (a heavy jet) leased from Opera Aircraft Sales s.r.o. expired in mid-January 2012 and although the Company manages that aircraft for the new lessee but no longer leases it nor any other heavy jet.

The Company intends to raise capital (through private and public offerings) to fund fleet expansion, acquiring sufficient funding for lending services, financing aircraft options trading, opening its own maintenance center and extending the existing private jet charter business.

The Company's business plan anticipates that the Company will develop additional revenues as its name and reputation grows and through the offering of its securities either privately or publicly. The Company plans to initially utilize available funds, after operational expenses, to expand its operations in Europe, Russia, Ukraine, the Middle East and Northern Africa. The Company will purchase additional aircraft and expand its communication/advertising to its broker network. At some time in the future, the Company anticipates that it will have expanded its operational jet fleet sufficiently to meet the market demand in its target areas. At such time, the Company anticipates that it will further expand its business into the purchasing and trading of options to buy aircraft and to offer financing and services to other purchasers of aircraft. The Company does not have a timetable for such additional expansion but anticipates that it may be several years in the future.

The Company

Intellectual Property

The Company intends to protect its intellectual property, trade secrets and proprietary methods and processes (to the extent applicable) in the United States and abroad.

Presently, the Company possesses a trademark registered with the Office for Harmonization in the International Market and the World Intellectual Property Organization. The trademark is registered and valid in all 27 countries of the European Union, and additionally, in Switzerland, Russia and Ukraine.

Employees

The Company presently has one person who serves as its officer and director, Dr. Martin Hudec, who is employed by the Company's subsidiary, Opera Jet Slovakia, who is also it sole executive officer and director. The Company has no other employees but expects that it will hire additional personnel upon raising additional capital and as the Company expands.

The Company's subsidiary, Opera Jet Slovakia has certain employees and a developed management and employee organization structure. Opera Jet Slovakia has approximately 8 key executives and managers and 43 additional supporting personnel. Certain managers are permitted the use of corporate vehicles. All employees may use the services of a sports club providing fitness and wellness services. No other employee benefits or benefit plans are made available by the Company.

The principal key executives and managers of Opera Jet Slovakia are the following:

| Martin Sykora | Managing Director |

| Lubos Hajek | Head of Accident Prevention and Flight Safety Programme and Crew Training |

| Milos Daniel | Head Quality Manager |

| Dusan Vavro | Head of Flight Operations |

| Peter Jurak | Head of Maintenance |

| Michal Polakovic | Head of Ground Operations |

| Dusan Blascak | Head of Sales |

| Stanislava Valova | Head of Dispatch |

Opera Jet Slovakia is organized as follows:

Sales (4 personnel who handle customer sales, flight and price negotiations, etc.);

Dispatch (7 personnel who are responsible for complete planning and management of flights);

Technical (3 personnel who provide light maintenance on aircrafts and perform technical checks on flights);

Ground Operations (6 personnel who are responsible for all non-technical activities in connection with flights). Flight Operations (16 personnel, consisting of pilots and others related directly to the airborne flight and management);

Flight Operations (15 personnel includes mostly pilots but head of flight operations prepares planned flights, monitors pilot duties and training;

Finance and IT (5 personnel who manage finances and provide information technology support).

Property

The Company primarily operates from the Opera Jet Slovakia offices.

Opera Jet Slovakia is located in the Slovak Republic and maintains a monthly lease for office space and parking facilities at its headquarters. The Company can withdraw from these lease agreements upon three (3) months’ termination notice. The total lease expense on the office and parking facilities for the years ended December 31, 2011 and December 31, 2010 were $68,979 and $44,687, respectively.

Opera Jet Slovakia also rents premises related to flight activities, such as aviation simulators and airport hangar premises. In addition, Opera Jet Slovakia leases vehicles, a private jet from LBG Style s.r.o and three private jets from Opera Holdings. Opera Jet Slovakia also rents a vehicle for use by its managing director. The cost of such vehicle lease is approximately $5,000 per quarter.

Equipment Financing

Currently, Opera Jet Slovakia leases three of jets (Cessna Citation Jets 1, 2 and 3) from Opera Holdings and one jet (a Cessna Citation Jet 3) from LBG Style s.r.o .

During 2011, Opera Jet Slovakia leased a Falcon 2000 from Opera Aircraft Sales s.r.o., with lease payments of approximately $120,000 per quarter. This lease expired in early 2012 and the aircraft is being leased by a new lessee from Italy but continues to be managed by the Company.

The leases are classified as operating leases and the total lease expense of the jets for the years ended December 31, 2011 and December 31, 2010 were $1,174,839 and $914,897, respectively.

The Company leases two flight simulators. The smaller simulator is under a lease purchase financed by VB Leasing Company commenced in 2008 with a total price of 194,662 Eur with a 15% down payment. Installments are due each month with the last installment planned for December 2012.

The larger simulator is financed by UniCredit Leasing with the total price of 840,000 Eur with a 30% down payment. Installments are due quarterly commencing in January, 2009. The final installment was initially scheduled for December, 2012, but in September 2011 the Company restructured the financing and no principal payments are due in 2012 and consequently the final installment payment will be made in December 2014. The Company determined to restructure the financing as the Company was not utilizing the simulator for flight training and wanted to postpone payment until it commenced usage of the equipment.

The Company purchased three automobiles in 2011 financed though loans with monthly installment payments ending in 2014 for two of the automobiles and 2015 for the third.

Subsidiaries

Opera Jet Slovakia is a wholly owned subsidiary of the Company. The Company currently has no other subsidiaries.

Permits

The Company holds several important permits/licenses and may continue to obtain additional permits/licenses as its business expands. The Company currently possesses the following permits:

(1) an air operator certificate, with authorized worldwide operation, issued by the Civil Aviation Authority of the Slovak Republic;

(2) a license for performance of air transportation services issued by the Ministry of Transport, Post and Telecommunications, of Slovakia;

(3) an FNPT II flight simulator certificate issued by the Civil Aviation Authority of the Czech Republic; and

(4) an FNPF II MCC flight simulator certificate issued by the Finish Civil Aviation Authority.

Management

The following table sets forth information regarding the members of the Company’s board of directors and its executive officers:

Name |

Age |

Position |

Year Commenced |

| Martin Hudec | 31 | President, Chief Executive and Director | 2011 |

Martin Hudec serves as the Company's sole one director and its sole officer, holding the titles of President, Chief Executive Officer, Chief Financial Officer and Director. Dr. Hudec is also a director and manager of Opera Jet Slovakia, which is the Company's wholly-owned subsidiary. In 2006, Dr. Hudec co-founded Opera a.s., a real estate development company and Opera Reform International, a real estate investment fund in order to finance and construct real estate projects in Central and Eastern Europe. Since 2009, Dr. Hudec has served as “accountable manager” of Opera Jet Slovakia, where he is responsible for all of its operations (to be approved as “accountable manager” by the Civil Aviation Authority of Slovakia, Dr. Hudec had to fulfill various experiential, qualification and professional requirements.)

Dr. Hudec earned his pilot’s license in 1998 and has since been continuously involved in the aviation business. Dr. Hudec also served as a director of several aviation companies, including East Air Company, s.r.o., Air Carpatia s.r.o., and Opera Jet s.r.o., providing a wide range of services, such as flight training, military pilot training, aircraft maintenance, and private charters. Dr. Hudec received both his Master’s Degree in Financial Management in 2002 and his Ph.D in Management in 2009 from the Comenius University in Bratislava, Slovakia.

Director Independence

Pursuant to Rule 4200 of The NASDAQ Stock Market one of the definitions of an independent director is a person other than an executive officer or employee of a company. The Company's Board of Directors has reviewed the materiality of any relationship that each of the directors has with the Company, either directly or indirectly. Based on this review, the Board has determined that there are no independent directors.

Committees and Terms

The Board of Directors has not established any committees of the Board. Specifically, the Company does not currently have an audit committee, compensation committee or nominating committee serving, and as a result, the Board performs the duties of such committees.

Employment Agreements

The Company's subsidiary, Opera Jet Slovakia, has entered into an employment agreement with Dr. Hudec pursuant to which he receives a nominal salary of 300 Euros per month. The Company anticipates that this salary will increase after the Company is successful in raising additional capital through a public or private offering of its securities.

Anticipated Officer and Director Remuneration

The Company intends to pay annual salaries to all of its employees and an annual stipend to its directors when, and if, it completes a primary public offering for the sale of securities (i.e. a public offering raising capital for the Company). At such time, the Company anticipates offering cash and non-cash compensation to other employees and directors. Officers are expected to receive such compensation amounts as are stated in their respective employment agreements.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth information as of the date of this prospectus regarding the beneficial ownership of the Company’s common stock by each of its executive officers and directors, individually and as a group and by each person who beneficially owns in excess of five percent of the common stock after giving effect to any exercise of warrants or options held by that person.

| Number of Shares of | Percentage | |||||||

| Name/Position | Common Stock | of Class (1) | ||||||

| Forsyma Holdings Limited | 21,000,000 | 95.5 | % | |||||

| Diagorou 4 | ||||||||

| Kermia Building, 6th floor | ||||||||

| Flat/Office 601 P.C. 1097 | ||||||||

| Nicosia, Cyprus | ||||||||

| Martin Hudec | 21,000,000 | (2) | 95.5 | % | ||||

| President, Chief Executive | ||||||||

| and Director | ||||||||

| Total owned by officers, directors (1 person) | 21,000,000 | 95.5 | % | |||||

| (1) | Based upon 22,000,000 shares outstanding as of February 6, 2012. |

| (2) | Dr. Hudec owns a majority interest (75%) of Forsyma Holdings Limited and may be considered the beneficial owner of the shares owned by it. |

Certain Relationships and Related Transactions

The Company leases three of its jets from Opera Holdings for a total lease expense for the years ended December 31, 2011 and 2010 of $100,303 and $95,090, respectively.

James Cassidy, a partner in the law firm which acts as counsel to the Company, is the sole owner and director of Tiber Creek Corporation which owns 250,000 shares of the Company's common stock.

Dr. Hudec, who serves as the Company's sole director and officer. Forsyma Holdings Limited is the majority shareholder of the Company. Dr. Hudec owns a controlling interest (75%) of Forsyma Holdings. Before the exchange of shares effecting the acquisition of the Company's subsidiary Opera Jet Slovakia, Opera Jet Slovakia was wholly owned by Forsyma Holdings. Dr. Hudec serves as a director of and is employed as manager by Opera Jet Slovakia.

Dr. Hudec has a controlling interest in Opera a.s., a holding company formed under the laws of the Slovak Republic ("Opera Holdings") which has several wholly owned subsidiaries. Opera Aircraft Sales is a subsidiary of Forsyma Holdings Limited.

Opera Jet Slovakia has borrowed monies from its former parent company, Opera Holdings with the total outstanding principal as of December 31, 2011, of 55,416 Euros with an interest rate of 2% and unpaid interest of 8,217 Euros with a maturity date at the end of 2012. Opera Holdings can call the loan at any time with a 15 day notice.

Opera Jet Slovakia leases three of its jets from Opera Holdings.

Opera Holdings leased a jet with an initial cash deposit of $550,000. Opera Jet Slovakia entered into an agreement with Deutsche leasing company in September, 2011, to guarantee the leasing fees, up to $550,000 if Opera Holdings defaulted. In October, 2011, the Export-Import Bank of Slovakia guaranteed the lease payments in the event that both Opera Holdings and Opera Jet Slovakia defaulted. Opera Jet Slovakia provided collateral of $110,000 to effect this guarantee issued by the Export-Import Bank of Slovakia on behalf of Opera Holdings.

Opera Jet Slovakia leased the Falcon 2000 from Opera Aircraft Sales s.r.o., with lease payments of approximately $120,000 per quarter. The lease expired at the beginning of 2012 and the aircraft is being leased by a new lessee from Italy but is managed by Opera Jet Slovakia.

Opera Aircraft Sales is a subsidiary of Forsyma Holdings, of which Dr. Hudec is the controlling shareholder, and a sister company to the Company,. Opera Aircraft Sales s.r.o. is an official sales agent of the Gulfstream Aerospace Corporation for business aircraft in the region of Central and Southeast Europe.

Summary Financial Information

The statements of operations data for the annual periods ending December 31, 2011, December 31, 2010 and December 31, 2009, respectively, and the balance sheet data at December 31, 2011, are derived from Opera Jet Slovakia’s audited financial statements and related notes thereto included elsewhere in this report. As the Company had no operations or specific business plan until the acquisition of Opera Jet Slovakia, the information presented below is with respect to Opera Jet Slovakia.

| Year ended | Year ended | Year ended | ||||||||||

| December 31, 2011 | December 31, 2010 | December 31, 2009 | ||||||||||

| Statement of operations data | ||||||||||||

| Net sales | $ | 17,318,240 | $ | 10,529,484 | $ | 5,376,080 | ||||||

| Operating income (loss) | $ | 529,717 | $ | 721,844 | $ | (1,126,640 | ) | |||||

| Net income (loss) | $ | 313,473 | $ | 369,305 | $ | (945,377 | ) | |||||

| Foreign current translation adjustment | $ | (41,115 | ) | $ | 108,121 | $ | (44,384 | ) | ||||

| Net comprehensive income (loss) | $ | 272,358 | $ | 477,427 | $ | (989,761 | ) | |||||

| At December 31, | At December 31, | At December 31, | ||||||||||

| 2011 | 2010 | 2009 | ||||||||||

| Balance sheet data | ||||||||||||

| Cash | $ | 135,930 | $ | 292,467 | $ | 245,048 | ||||||

| Other assets | $ | 2,873,595 | $ | 2,670,224 | $ | 2,359,487 | ||||||

| Total assets | $ | 3,009,525 | $ | 2,962,691 | $ | 2,604,535 | ||||||

| Total liabilities | $ | 3,081,988 | $ | 3,599,330 | $ | 3,770,796 | ||||||

| Total stockholders’ equity (deficit) | $ | (72,463 | ) | $ | (636,639 | ) | $ | (1,166,261 | ) | |||

UniCredit Bank Slovakia has issued four bank guarantees for Opera Jet Slovakia in order to secure the receivables of fuel providers. This allows Opera Jet Slovakia to utilize a credit line for fuel for its aircrafts.

Management's Discussion and Analysis of Financial Condition And Results of Operations

The Company was incorporated in the State of Delaware on September 13, 2006. The Company acquired Opera Jet Slovakia in February 2012. As prior to that acquisition, the Company had no operations or specific business plan, the information presented below is with respect to Opera Jet Slovakia. References to the financial condition and performance of the Company below in this section “Management’s Discussions and Analysis of Financial Condition and Results of Operation” are to Opera Jet Slovakia.

Revenues

Total revenue for the Company in 2010 was $10,529,484 and rose in 2011 to $17,318,240. In 2010, approximately 94% of the revenues of the Company were generated from the chartering of aircraft with approximately $587,911 (5.5%) attributable to managed aircraft. In 2011, the Company increased the number of its managed aircraft and the revenues attributable to managed jets rose to $4,178,420 (23.8%) of its total revenue.

Revenues of the Company are generated primarily from the chartering of its four leased aircrafts. The revenue potential of flights depends on each flight and the agreed price for such flight. The Company negotiates the prices charged for each chartered trip.

The Company also manages four aircraft (one of which is the Falcon 2000 which until mid-January 2012 the Company leased from Opera Aircraft Sales but now manages for the new lessee). The Company receives a fixed monthly management fee from the owners.

The managed jets are primarily used for owner flights but, with the owner's permission, the Company will from time to time arrange charter flights on these aircraft. The Company earns between 5 to 10% of the revenues derived from selling such charter flights. All direct and indirect costs are reimbursed by the owners.

From time to time, the Company will act as an agent to sell brokered flights to customers when it cannot provide the needed travel service to a client. Typically the flight is provided by a third party air charter operator and the Company receives a commission for brokering such flights. For the year ended 2011, the Company received total net revenue from brokered flights of $175,340. In 2010 the Company did not earn any revenues from brokered flights.

Equipment Financing, Leasing Arrangements

Opera Jet Slovakia leases three of jets (Cessna Citation Jets 1, 2 and 3) from Opera Holdings and one jet (a Cessna Citation Jet 3) from LBG Style s.r.o. Opera Holdings is a company controlled by the Company's president. During 2011, Opera Jet Slovakia leased a Falcon 2000 from Opera Aircraft Sales s.r.o. This lease expired in early 2012 and the aircraft is being leased by a new lessee from Italy but continues to be managed by the Company. Opera Holdings is a company controlled by the Company's president.

The lease terms for each of the aircraft lease from Opera Holdings are varied.

The total lease expense for the three jets leased from Opera Holdings (a company controlled by the president of the Company) for the years ended December 31, 2011 and 2010 were 100,303 Eur and 95,090 Eur, respectively.

The Citation Jet 1 has a monthly lease of 800 Eur in 2009 and 1,600 Eur in 2010. The lease term runs from March 17, 2009 to March 16, 2016.The Citation Jet 2 has a monthly lease of 1,000 Eur in 2009 and 2,000 Eur in 2010. The lease term runs from March 17, 2009 to March 16, 2016. The Citation Jet 3 has a monthly lease of 1,200 Eur in 2009 and 2,400 Eur in 2010. The lease term runs from March 17, 2009 to March 16, 2016.

Opera Holdings has indicated that it does not intend to increase the lease amounts of the aircrafts to the Company. The goal of Opera Holdings is to eventually sell the aircrafts on the market because the core business of Opera Holdings is not providing aircraft lease. Opera Holdings intends to continue to lease these jets to the Company as it develops its chart aircraft business and until the Company has sufficient funds to enter into other aircraft leases.

The jet leased from LBG Style s.r.o is a variable interest rate lease and the Company was able to negotiate for a lower lease payment amount because of the significant decrease in interest rates in 2009 and 2010. Overpayment from 2009 and 2010 was used as an offset against the principal payments due in 2011.

The Falcon 2000 was leased from Opera Aircraft Sales s.r.o. with lease payments of approximately $120,000 per quarter.

The leases for leased aircraft are classified as operating leases and the aggregate lease expense of the leased jets for the years ended December 31, 2011 and December 31, 2010 was $1,174,839 and $914,897, respectively.

The Company leases two flight simulators. The smaller simulator is under a lease purchase financed by VB Leasing Company commenced in 2008 with a total price of 194,662 Eur with a 15% down payment. Installments are due each month with the last installment planned for December 2012.

The larger simulator is financed by UniCredit Leasing with the total price of 840,000 Eur with a 30% down payment. Installments are due quarterly which commenced in January, 2009. The final installment was initially scheduled for December 2012, but in September 2011 the Company restructured the financing and no principal payments are due in 2012. Consequently the final installment payment will be made in December 2014. The Company determined to restructure the financing as the Company was not utilizing the simulator for flight training and wanted to postpone payment until it commenced usage of the equipment.

The Company purchased three automobiles in 2011 financed though loans with monthly installments aggregating$199,254 for the year ended December 31, 2011, with the leases ending in 2014 for two of the automobiles and 2015 for the third.

Potential Revenue

Sources of potential revenue include the flight revenues achieved in the normal course of the Company’s charter aircraft business, and to a lesser extent, fees from management of aircraft.

Alternative Financial Planning

The Company currently has no alternative financial plans. If the Company is not able to organically generate profits and/or successfully receive monies as needed through a private placement or public securities offering, the Company’s ability to survive as a going concern and implement any part of its business plan or strategy may be severely jeopardized.

Summary of Significant Accounting Policies

Those material policies that the Company believes are the most critical to understanding the Company’s financial results and condition are discussed below.

Use of estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires our management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period.

Foreign currencies

Assets and liabilities recorded in foreign currencies are translated at the exchange rate on the balance sheet date. Revenue and expenses are translated at average rates of exchange prevailing during the year. Translation adjustments resulting from this process are recorded to other comprehensive income.

Revenue recognition

The Company recognizes revenue from services rendered when the following four revenue recognition criteria are met: persuasive evidence of an arrangement exists, delivery has occurred or services have been rendered, the selling price is fixed or determinable, and collectability is reasonably assured. Cancellations of flights, refunds, or credit notes require approval from senior management and are on a case-by-case basis. Historically, refunds and credit notes have been insignificant.

All revenues recognized in 2009 were from flights provided with jets leased and operated by the Company. The risks of profit or loss were based on the number of flights sold in the year. In late 2010 and 2011, the Company also began managing jets for individual owners. The Company receives a fixed monthly management fee from the owners and earns 5 to 10% of the revenues derived from selling flights to customers with the consent of the owner. In one case the Company earns 30% of the net profit from the managed aircraft’s operation. All direct and indirect costs incurred are reimbursed by the owners. The revenues earned from managed jet sales are reported as gross revenue because the Company is the primary obligor, sets the sales price and bears the risk of collection from the customer.

The Company also acts as an agent to sell brokered flights to customers when the Company cannot provide the services as demanded by the customers. Usually, the flight is provided by a third party (another air operator) and the Company earns a net commission for providing the broker services. All such flights are reported in net revenue basis, because the Company is not the primary obligor to these flights. The total net revenue from brokered flights was $175,340 and zero for the years ended December 31, 2011 and 2010, respectively.

The Company is required to charge certain taxes and fees to our passengers when travelling within the Slovak Republic. Because we are not entitled to retain these taxes and fees, we do not include such amounts in passenger revenue. We record a liability when the amounts are collected and reduce the liability when payments are made to the applicable government agency or operating carrier.

Leases

Capital lease:

The Company leases two aviation simulators under capital leases expiring in various years through 2014. The assets and liabilities under capital leases are recorded at the lower of the present value of the minimum lease payments or the fair value of the asset. The assets are depreciated over the lower of their related lease terms or their estimated productive lives. Depreciation of assets under capital leases is included in depreciation expense in 2011 and 2010.

Operating lease:

The company leases three private jets from Opera a.s., one private jet from Opera Aircraft Sales s.r.o., and one private jet from a third party under operating lease expiring in 2015. Rental expense for operating lease, which is recorded on a straight-line basis over the life of the lease term, totaled $1,698,699 and $1,208,304 for the years ended December 31, 2011 and 2010, respectively.

Cost of sales

Cost of sales consists primarily of fuels, landing fees, repair and maintenance on jets, lease costs on jets, direct wages of pilots, and related costs in operations, which are directly attributable to the charter flight services and managed jet operations.

Advertising costs

The Company expenses advertising costs as other selling expenses in the year incurred. Advertising expense was $73,719 and $37,475 for the years ended December 31, 2011 and 2010, respectively.

Off-balance sheet arrangements

The Company does not have any off-balance sheet arrangements.

Recently Issued Accounting Pronouncements

Accounting standards promulgated by the FASB change periodically. Changes in such standards may have an impact on the Company’s future financial statements. For the Company’s analysis and impact of these accounting standards, please see Note 2, Summary of Significant Accounting Policies, in the Company’s December 31, 2011 and 2010 financial statements.

Discussion of Period Ended December 31, 2011 and December 31, 2010

Until the Company acquired Opera Jet Slovakia in February 2012, it had no revenues and only small operating expenses. The following discussion refers to the financial statement and operations of Opera Jet Slovakia.

The Company generated net revenues of $17,318,240 for the year ended December 31, 2011, as compared to net revenues of $10,529,484 for the year ended December 31, 2010. This significant increase in revenues arises from the growth of the Company during that period. The year 2009 was an economically tough year and the demand for the Company's services was weak. In 2010, the demand started to increase and grew increasingly strong during 2011 coupled with the stabilization of the market and the expansion of the Company's fleet. At the same time during 2011, the Company added managed aircrafts to the fleet for which all costs are reimbursed by the aircraft owners.

In 2011 the Company earned commissions for selling brokered flights to customers when it was not able to provide the needed service. The flight was provided by a third party operator. The total net revenue for brokered flights was $175,340 for the year ended December 31, 2011. The Company does not anticipate that brokering flights to be a major component to its business plan.

Net income of $313,473 was reduced for the year ended December 31, 2011 compared to the net income of $369,305 for the year ended December 31, 2010. Although net revenues of $17,318,240 were greater for the year ended December 31, 2011 than the $10,529,484 for the year ended December 31, 2010 and cost of sales were relatively proportionately similar, general and administrative expenses for the year ended December 31, 2011 significantly increased to $1,987,643 from $1,255,669 for the year ended December 31, 2010. This increase in administrative expenses in 2011 was caused mainly by employing new administrative back office personnel and by restructuring certain cost groups from other accounts to administrative expenses. This increase in general and administrative expenses resulted in an increase in the total operating expenses for the year ended December 31, 2011 of $2,441,404 compared to $1,667,154 for the year ended December 31, 2010.

Liquidity. The Company is able to continuously generate cash from its operations. During the year ended December 31, 2011, the Company generated $1,101,425 of cash flow from its operating activities compared to $356,109 for the year ended December 31, 2010. The primary reason for such increase in cash flow was a significant increase in net profit and accounts payable as the economy started to gain strength and the Company grew. The Company has also received cash deposits for the new managed jets which resulted in an increase in operating cash flow.

The Company had a significant decrease in the cash flows used in financial activities of $(1,133,564) for the year ended December 31, 2011 compared to $(175,837) for the year ended December 31, 2010 arising from the increase in the amount of repayment of loans to Opera Holdings for the year ended December 31, 2011 of $(954,830) compared to $(250,389) for the year ended December 31, 2010.

As of December 31, 2011, the Company had an accumulated deficit of $(460,239) for the year ended December 31, 2011 compared to $(773,712) for the year ended December 31, 2010. This decrease in accumulated deficit is primarily due to the increase in net profit achieved for the year ended December 31, 2011. The total stockholders' deficit has decreased due to additional paid in capital through forgiveness of a debt by the shareholder.

Risk Factors

The Company has limited profits to date.

The Company has generated limited profits to date. While the Company has posted revenues on a recurring basis, the Company has shown low profit margins, thus exposing the risk that the Company’s overall profitability is subject to the high expenses associated with its business. The Company primarily operates smaller aircraft which allows it to maintain relatively low costs compared to competitors in the industry which operate more larger aircraft. Nevertheless, aviation is a very regulated business and the options for cost cutting are limited (e.g. a company cannot scrimp on maintenance). The industry is also very capital intensive and profit margins may not be as high as in other businesses and thus, although the Company's fixed costs are at low levels there are still high costs associated with the industry.

The Company is controlled by one person who also controls companies with which the Company does business which can result in non arm's-length transactions that may not be beneficial to the Company and may put the Company at risk for default.

Dr. Hudec, serves as the Company's sole director and officer and is the controlling shareholder of Forsyma Holdings Limited, the Company's majority shareholder. Dr. Hudec also serves as a director of and is employed as manager by the Company's wholly-owned subsidiary Opera Jet Slovakia. As such Dr. Hudec is in a position to control most matters coming before management of the Company, the board of directors of the Company and the shareholders of the Company.

In addition, Dr. Hudec has a controlling interest in Opera a.s., a holding company formed under the laws of the Slovak Republic ("Opera Holdings") which has several wholly owned subsidiaries. The Company leases three of its jets from Opera Holdings. Because Dr. Hudec controls both the lessee and the lessor such lease arrangements are not effected in arms length transactions and the leasing costs paid by the Company are directly controlled by Dr. Hudec.

In addition, the Company has acted as a guarantor of lease payments to be made by Opera Holdings for a jet leased by Opera Holdings. If Opera Holdings defaults on such lease payments, the Company would be required to make such payments on behalf of Opera Holdings. The Company also provided collateral of $110,000 to a third party guarantor for payments up to$550,000 in the event that Opera Holdings and the Company itself defaults on such lease payments. Thus if Opera Holdings defaults on the lease payments, the Company would be required to pay the lease payments of up to $550,000 and if the Company could not make such payments, it would lose its collateral of $110,000.

The Company’s largest stockholder owns a majority of the Company’s common stock and, as a result, can exercise control over stockholder and corporate actions.

Forsyma Holding Limited, largest stockholder of the Company, is currently owner of approximately 95% of the Company’s outstanding common stock. As such, Forsyma will be able to control most matters requiring approval by stockholders, including the election of directors and approval of significant corporate transactions. This concentration of ownership may also have the effect of delaying or preventing a change in control, which in turn could have a material adverse effect on the market price of the Company’s common stock or prevent stockholders from realizing a premium over the market price for their shares of common stock.

The impact of higher fuel prices could be severe and significantly increase the expenses of the Company and thereby reduce any profits .

Fuel prices are rising and such an increase in the price of aircraft jet fuel would naturally increase the expenses of the Company. This would result in requiring the Company to possibly increase the prices of its charter jet services. However, such fuel increases would be felt industry-wide and the Company's competitors would likewise be increasing their charter jet services. Therefore although the Company does not believe such increases would reduce the demand for charter jet services, it could reduce the profit margin experienced by the Company. A reduction in the profit margin obtained by the Company from its charter jet activities could significantly impact the results of operations of the Company as a whole.

The Company has no diversification of management and directors.

The Company only has one executive officer and director, who is the same individual. Accordingly, the Company has no management breadth or depth of its directors, and may suffer adverse consequences from relying on only one individual to serve as its sole officer and director.

No assurance of continued commercial feasibility or success.

Even if the Company can successfully continue to operate its business and offers its flights for sale to the marketplace, there can be no assurance that such flight services will have any commercial advantages. Also, there is no assurance that the services will continue to remain in demand as intended in the marketplace or that the Company’s sales and marketing strategy will continue to be successful.

The Company expects to incur additional expenses and may ultimately never be significantly profitable.

The Company has posted limited profits since its inception, and has accumulated losses in the aggregate since inception. In addition, the Company will need to improve its profit margins and improve its overall expense structure in order to maintain profitability. To become consistently profitable in a significant manner, the Company must successfully market and sell its services, a process that involves many factors that are beyond the Company’s control, including the type of competition that the Company may encounter. Ultimately, in spite of the Company’s best or reasonable efforts, the Company may never actually generate significant profits or remain competitive in the marketplace.

If the Company is unable to generate sufficient cash from operations, it may find it necessary to curtail operational activities.

The Company has an extensive business plan hinged on its ability to market and commercialize its service offerings. If the Company is unable to market and/or commercialize its services, then it would not be able to proceed with its business plan or possibly to successfully develop its planned operations at all.

The private aircraft leasing business is seasonal and as such the Company may suffer inconsistent revenue which may make it difficult to make certain payments timely.

The private jet charter business is seasonal in nature. The strongest season is typically in the summer period (April to September), which is caused mostly by the summer holiday season. In addition, the months of December and January, when winter holidays occur, are generally strong. The remainder of the year is usually slower in terms of private jet charter business. Such slow periods may reduce the revenue received by the Company and may impact on its ability to make payment on outstanding financial commitments such as lease or loan payments.

Government regulation could negatively impact the business.

The Company’s services may be subject to various government regulations in the jurisdictions in which they will operate. Due to the potential wide geographic scope of the Company’s operations, the Company could be subject to regulation by political and regulatory entities throughout the world, including various local and municipal agencies and government sub-divisions, and various foreign governments and political subdivisions thereof. The Company may incur increased costs necessary to comply with existing and newly adopted laws and regulations or penalties for any failure to comply. The Company’s operations could be adversely affected, directly or indirectly, by existing or future laws and regulations relating to its business or industry.

The Company is subject to foreign currency exchange rate and is at risk for any unfavorable change in such rates.

The Company is subject to foreign currency exchange rate risk because the Company has revenue and expense denominated in foreign currencies, From January 1, 2009, the Euro became the official local currency of the Slovak Republic. Due to the Company providing chartered flight services to many different countries, the Company is using both Euro and US Dollar to facilitate the daily operations from customers around the world. From time to time, the Company will incur currency exchange rate gain or loss because of the difference in exchange rate. The depreciation of the U.S. dollar against the Euro was approximately 7.30%, 5.73%, and 7.40% during 2008, 2010, and for the nine months period ended September 30, 2011 respectively and the appreciation of U.S. dollar against the Euro was approximately 10.22% in 2009. The foreign currency exchange risk fluctuations depend on the overall economic environment in European countries.

The regulations imposed by the government of the Slovak Republic may impact on the Company's licensing to operate aircraft.

The Ministry of Transport, Construction and Regional Development of the Slovak Republic established the Slovak Civil Aviation Authority which issued the Air Operator Certificate (AOC) to the Company. Any lack of compliance or deficiencies with regulations may prohibit the Company to provide chartered flight service to customers. The governments in the Slovak Republic may restrict or revoke the Company’s authority to operate flights to or over countries. The Company has the authority to operate flights with no geographical restrictions. However, either the Slovak Republic or foreign governments could limit or restrict the authority to operate flights to or over specified countries due to security concerns, armed conflict, international disputes, or for other reasons. For example, certain foreign governments currently restrict the number of charter flights that can operate to these countries. In light of such restrictions, the Company may not be able to serve customers seeking charter services to or that would require flying over such countries, and the business, financial condition and results of operations of the Company could be adversely affected.

The Company is dependent on technology and on the steady availability of communication and technological systems and any disruption by hacking or equipment failure could severely impact the Company's operations.

The Company is heavily and increasingly dependent, particularly at its operations centers, on technology to operate its business. The computer and communications systems on which the Company relies could be disrupted due to various events, some of which are beyond its control, including natural disasters, power failures, terrorist attacks, equipment failures, software failures and computer viruses and hackers. The Company has taken certain steps to help reduce the risk of some of these potential disruptions. There can be no assurance, however, that the measures the Company has taken are adequate to prevent or remedy disruptions or failures of these systems. Any substantial or repeated failure of these systems could adversely affect the Company’s operations, result in the loss of important data, loss of revenues, and increased costs, and generally harm its business. Moreover, a failure of certain of its vital systems could limit its ability to operate its flights for an extended period of time, which would have a material adverse effect on its business, financial condition and results of operations.

Legal Proceedings

The Company is currently pursuing an action against an individual in the amount of less than $20,000 for repayment of funds.

The Company joined with Opera Holdings in action against Air Carpatia (a former co-owner of the Opera Jet Slovakia) to enforce an agreement between Air Carpatia and Opera Holdings. In 2009, pursuant to a transfer agreement, Opera Holdings purchased the shares of Opera Jet Slovakia owned by Air Carpatia becoming the sole shareholder of Opera Jet Slovakia. Air Carpatia s.r.o. determined to withdraw from the agreement stating that Opera Holdings failed on obligations arising from the agreement. Opera Holdings sued Air Carpatia requesting the court to determine that there was no failure on the part of Opera Holdings and that the withdrawal of Air Carpatia was invalid. Hearings on the action began in March, 2012, with the next court proceeding scheduled for June 7, 2012. Opera Holdings anticipates that it will prevail in this action.

Market Price of and Dividends on the Registrant's Common Equity

There is no public market for the Company's stock.

ITEM 3.02 Unregistered Sales of Equity Securities

Recent Sales of Unregistered Securities

The Company has issued the following securities in the last three (3) years. Such securities were issued pursuant to exemptions from registration under Section 4(2) of the Securities Act of 1933, as amended, as transactions by an issuer not involving any public offering, as noted below. Each of these transactions was issued as part of a private placement of securities by the Company in which (i) no general advertising or solicitation was used, and (ii) the investors purchasing securities were acquiring the same for investment purposes only, without a view to resale.

On February 6, 2012, the Company issued 500,000 shares to Forsyma Holdings Limited in exchange for all 100 shares of Opera Jet a.s. ("Opera Jet Slovakia").

On December 3, 2010, the Company issued 21,000,000 shares of common stock for an aggregate purchase price of $2,050, as set forth below:

| Forsyma Holdings Limited | 20,000,000 | |

| Otto Clark | 500,000 | |

| Vladimir Ulman | 500,000 |

The shares owned by Valdimir Ulman were transferred to Forsyma Holdings Limited on January 27,2012.

On December 3, 2010, the Company also redeemed an aggregate of 500,000 of its then outstanding shares of common stock at a redemption price of $.0001 per share for an aggregate redemption price of $50. The shares redeemed, and the number of shares still owned by such shareholder, are set forth below,

| Name | Shares Redeemed | Shares Still Owned | ||

| Tiber Creek Corporation | 250,000 | 250,000 | ||

| IRAA Fin Serv | 250,000 | 250,000 |

ITEM 5.06 Change in Shell Company Status

The Company has acquired Opera Jet Slovakia which has a defined business plan, continuous operations and revenues which the Company believes removes it from the status of a shell company.

ITEM 9.01 Financial Statements and Exhibits

The audited financial statements for the years ended December 31, 2011 and 2010 are attached.

Exhibits

| 2.1 | Stock exchange agreement |

| 10.1 | IS-BAO certificate (International Standards for Business Aviation Operation) |

OPERA JET a.s.

FINANCIAL STATEMENTS

December 31, 2011

index to THE financial statements

| Report of Independent Registered Public Accounting Firm | 3 |

| Balance Sheets as of December 31, 2011 and December 31, 2010 | 4 |

| Statements of Comprehensive Income for the Years Ended December 31, 2011 and 2010 | 5 |

| Statements of Changes in Stockholders’ Deficit for the Years Ended December 31, 2011 and 2010 | 6 |

| Statements of Cash Flows for the Years Ended December 31, 2011 and 2010 | 7 |

| Notes to Financial Statements | 8 - 23 |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Stockholders of Opera Jet a.s.

We have audited the accompanying balance sheets of Opera Jet a.s. (the “Company”) as of December 31, 2011 and 2010, and the related statements of comprehensive income, changes in stockholders’ deficit, and cash flows for the years then ended. These financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States of America). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the financial position of Opera Jet a.s. as of December 31, 2011 and 2010, and the results of its comprehensive income and cash flows for the years then ended in conformity with accounting principles generally accepted in the United States of America.

/s/ Anton & Chia, LLP

Newport Beach, California

April 13, 2012

| 3 |

| OPERA JET a.s. |

| BALANCE SHEETS |

| December 31, | December 31, | |||||||

| 2011 | 2010 | |||||||

| ASSETS | ||||||||

| Current Assets | ||||||||

| Cash | $ | 135,930 | $ | 292,467 | ||||

| Restricted cash | 110,000 | - | ||||||

| Trade accounts receivable, net of allowance for doubtful | ||||||||

| accounts of $163,277 and $155,156, respectively | 1,042,744 | 648,824 | ||||||

| Related party receivable | 29,060 | - | ||||||

| Other receivables | 189,700 | 324,296 | ||||||

| Prepaid expense | 388,090 | 295,439 | ||||||

| Total current assets | 1,895,524 | 1,561,026 | ||||||

| Equipment, net | 1,083,438 | 1,265,287 | ||||||

| Deferred taxes | 30,563 | 136,378 | ||||||

| Total assets | $ | 3,009,525 | $ | 2,962,691 | ||||

| LIABILITIES | ||||||||

| Current Liabilities | ||||||||

| Accounts payable | $ | 1,748,672 | $ | 1,196,136 | ||||

| Deferred revenue | 498,804 | $ | 124,765 | |||||

| Accrued liabilities | 98,904 | 245,016 | ||||||

| Current portion of loan payable | 20,220 | - | ||||||

| Current portion of obligations under capital lease | 94,028 | 216,073 | ||||||

| Related party payable | 71,891 | 1,249,733 | ||||||

| Total current liabilities | 2,532,519 | 3,031,723 | ||||||

| Obligations under capital lease, net of current portion | 340,168 | 407,044 | ||||||

| Long term portion of loan payable | 50,365 | - | ||||||

| Other long term liabilities | 158,936 | 160,563 | ||||||

| Total liabilities | 3,081,988 | 3,599,330 | ||||||

| STOCKHOLDERS' DEFICIT | ||||||||

| Registered capital | $ | - | $ | 61,940 | ||||

| Common stock, $619.40 par value, 100 shares authorized, issued and outstanding | 61,940 | - | ||||||

| Restricted retained earnings | 11,899 | 11,899 | ||||||

| Accumulated other comprehensive income | 22,119 | 63,234 | ||||||

| Additional paid in capital | 291,818 | - | ||||||

| Accumulated deficit | (460,239 | ) | (773,712 | ) | ||||

| Total stockholders' deficit | (72,463 | ) | (636,639 | ) | ||||

| TOTAL LIABILITIES AND STOCKHOLDERS' DEFICIT | $ | 3,009,525 | $ | 2,962,691 | ||||

The accompanying notes are an integral part of these financial statements.

| 4 |

| OPERA JET a.s. |

| STATEMENTS OF COMPREHENSIVE INCOME |

| For the years ended | ||||||||

| December 31, | ||||||||

| 2011 | 2010 | |||||||

| Revenues, net | $ | 17,318,240 | $ | 10,529,484 | ||||

| Brokered flight commissions, net | 175,340 | - | ||||||

| Cost of sales | 14,522,459 | 8,140,486 | ||||||

| Gross profit | 2,971,121 | 2,388,998 | ||||||

| Operating expenses: | ||||||||

| Salaries and benefits | 453,761 | 411,485 | ||||||

| General and administrative expenses | 1,987,643 | 1,255,669 | ||||||

| Total operating expenses | 2,441,404 | 1,667,154 | ||||||

| Operating income | 529,717 | 721,844 | ||||||

| Currency exchange loss, net | 3,909 | 115,796 | ||||||

| (Gain) loss on disposal of equipment | (75 | ) | 231 | |||||

| Interest expense, net | 116,169 | 113,905 | ||||||

| Total other expenses | 120,003 | 229,932 | ||||||

| Income before taxes | 409,714 | 491,912 | ||||||

| Income taxes expense | 96,241 | 122,607 | ||||||

| Net income | $ | 313,473 | $ | 369,305 | ||||

| Other comprehensive income (loss) | ||||||||

| Foreign currency translation adjustment | (41,115 | ) | 108,121 | |||||

| Net comprehensive income | $ | 272,358 | $ | 477,426 | ||||

The accompanying notes are an integral part of these financial statements.

| 5 |

| OPERA JET a.s. |

| STATEMENTS OF CHANGES IN STOCKHOLDERS’ DEFICIT |

| Accumulated | ||||||||||||||||||||||||||||

| Restricted | Other | Additional | ||||||||||||||||||||||||||

| Registered | Common | Retained | Comprehensive | Paid In | Accumulated | |||||||||||||||||||||||

| Capital | Stock | Earnings | Income (Loss) | Capital | Deficit | Total | ||||||||||||||||||||||

| Balance at December 31, 2009 | 9,744 | - | 256 | (44,887 | ) | - | (1,131,374 | ) | (1,166,261 | ) | ||||||||||||||||||

| Foreign currency translation | - | - | - | 108,121 | - | - | 108,121 | |||||||||||||||||||||

| Net income | - | - | - | - | - | 369,305 | 369,305 | |||||||||||||||||||||

| Surplus allocation | - | - | 11,643 | - | - | (11,643 | ) | - | ||||||||||||||||||||

| Paid in capital | 52,196 | - | - | - | - | - | 52,196 | |||||||||||||||||||||

| Balance at December 31, 2010 | 61,940 | - | 11,899 | 63,234 | - | (773,712 | ) | (636,639 | ) | |||||||||||||||||||

| Foreign currency translation | - | - | - | (41,115 | ) | - | - | (41,115 | ) | |||||||||||||||||||

| Shares registered | (61,940 | ) | 61,940 | - | - | - | - | - | ||||||||||||||||||||

| Net income | - | - | - | - | - | 313,473 | 313,473 | |||||||||||||||||||||

| Capital contribution | - | - | - | - | 291,818 | - | 291,818 | |||||||||||||||||||||

| Balance at December 31, 2011 | $ | - | $ | 61,940 | $ | 11,899 | $ | 22,119 | $ | 291,818 | $ | (460,239 | ) | $ | (72,463 | ) | ||||||||||||

The accompanying notes are an integral part of these financial statements.

| 6 |

| OPERA JET a.s. |

| STATEMENTS OF CASH FLOWS |

| For the years ended | ||||||||

| December 31, | ||||||||

| 2011 | 2010 | |||||||

| USD | USD | |||||||

| Operating Activities | ||||||||

| Net income | $ | 313,473 | $ | 369,305 | ||||

| Adjustments to reconcile net income to cash flows from operating activities: | ||||||||

| Depreciation and amortization | 360,290 | 319,744 | ||||||

| Gain (loss) on sale of equipment | (75 | ) | 231 | |||||

| Provision for bad debts | 13,572 | 86,148 | ||||||