Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - GRANITE CITY FOOD & BREWERY LTD. | a2208967zex-32_2.htm |

| EX-31.1 - EX-31.1 - GRANITE CITY FOOD & BREWERY LTD. | a2208967zex-31_1.htm |

| EX-31.2 - EX-31.2 - GRANITE CITY FOOD & BREWERY LTD. | a2208967zex-31_2.htm |

| EX-32.1 - EX-32.1 - GRANITE CITY FOOD & BREWERY LTD. | a2208967zex-32_1.htm |

Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 27, 2011. |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to . |

||

Commission file number 000-29643

GRANITE CITY FOOD & BREWERY LTD.

(Exact Name of Registrant as Specified in Its Charter)

| Minnesota (State or Other Jurisdiction of Incorporation or Organization) |

41-1883639 (I.R.S. Employer Identification No.) |

701 Xenia Avenue South, Suite 120

Minneapolis, Minnesota 55416

(Address of Principal Executive Offices, Including Zip Code)

(952) 215-0660

(Registrant's Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Name of Each Exchange on Which Registered | |

|---|---|---|

| Common Stock, $0.01 par value | NASDAQ Capital Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months, and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large Accelerated Filer o | Accelerated Filer o | Non-Accelerated Filer o (Do not check if a smaller reporting company) |

Smaller reporting company ý |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

As of June 28, 2011, the aggregate market value of the registrant's common stock held by non-affiliates (assuming for the sole purpose of this calculation, that all directors and officers of the registrant are "affiliates") was $8,922,639 (based on the closing sale price of the registrant's common stock as reported on the NASDAQ Capital Market). The number of shares of common stock outstanding at that date was 4,650,804 shares.

The number of shares of common stock outstanding as of March 15, 2012 was 4,785,472.

DOCUMENTS INCORPORATED BY REFERENCE

None.

We filed our Annual Report on Form 10-K for the year ended December 27, 2011 (the "Form 10-K") on March 23, 2012, pursuant to which we incorporated by reference into Part III thereof portions of our definitive proxy statement for our 2012 Annual Meeting of Shareholders (the "Proxy Statement") to be subsequently filed with the Securities and Exchange Commission ("SEC"). We hereby amend the Form 10-K to file Part III information in this Form 10-K/A (the "Form 10-K/A") rather than incorporating it into the Form 10-K by reference to the Proxy Statement. Accordingly, Part III of the Form 10-K is hereby amended and restated in its entirety as set forth below. In addition, in connection with the filing of this Form 10-K/A and pursuant to the rules of the SEC, we are including in this amendment currently dated certifications. Accordingly, Item 15 of Part IV has also been amended to reflect the filing of these currently dated certifications.

This Form 10-K/A makes reference to the date of the Form 10-K, and we have not updated or amended the disclosures contained herein to reflect events that have occurred since the filing of the Form 10-K, or modified or updated the disclosures contained in the Form 10-K in any way other than as specifically set forth in this Form 10-K/A. Accordingly, this Form 10-K/A should be read in conjunction with the Form 10-K and other filings made by our company with the SEC subsequent thereto.

Item 10. Directors, Executive Officers and Corporate Governance.

Our Directors

Our directors are elected annually, by a plurality of the votes cast, to serve until the next annual meeting of shareholders and until their respective successors are elected and duly qualified. There are no familial relationships between any director or officer.

DHW Leasing, L.L.C. ("DHW") and Concept Development Partners, LLC ("CDP") are parties to a shareholder and voting agreement and irrevocable proxy pursuant to which CDP has the right to nominate five members of our board, DHW has the right to nominate two members of our board, and CDP has voting power over DHW's shares. CDP and DHW have also agreed to vote for each others' nominees. CDP beneficially owns a majority of our common stock and DHW also is one of our significant shareholders. See "Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters—Security Ownership." Pursuant to these rights, DHW nominated Messrs. Hey and Longtin and CDP nominated Messrs. Doran, Bashour, Mucci, Rawlings, and Staenberg to our board.

1

The following table and related narrative set forth certain information concerning the members of our board of directors as of April 13, 2012.

Name

|

Age | Principal Occupation | Position with Granite City |

Director Since |

Independent Director |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

Robert J. Doran(1) |

65 | Chief Executive Officer and Director of Granite City and Managing Partner of CDP Management | Chief Executive Officer and Director | 2011 | ||||||||

Fouad Z. Bashour(1)(2)(3) |

36 | Founding Partner of CIC Partners | Chairman of the Board | 2011 | X | |||||||

Charles J. Hey |

76 | Chairman of the Board of School Bus, Inc. | Director | 2011 | ||||||||

Joel C. Longtin(1)(2)(4) |

52 | President and Chief Executive Officer of JKL Enterprises, Inc. and Longtin Leasing, LLC | Director | 2009 | X | |||||||

Louis M. Mucci(3)(4) |

70 | Business Consultant | Director | 2011 | X | |||||||

Michael S. Rawlings(1) |

57 | Mayor of Dallas and Founding Partner of CIC Partners | Director | 2011 | X | |||||||

Michael H. Staenberg(2)(4) |

58 | President of THF Realty | Director | 2011 | X | |||||||

Steven J. Wagenheim(1) |

58 | President, Founder and Director of Granite City | President, Founder and Director | 1997 | ||||||||

- (1)

- Member

of the executive committee.

- (2)

- Member

of the compensation committee.

- (3)

- Member

of the corporate governance and nominating committee.

- (4)

- Member of the audit committee.

Business Experience

Robert J. Doran has been the Chief Executive Officer of Granite City since May 2011. Mr. Doran has been a Managing Partner of CDP Management Partners, LLC ("CDP Management"), a merchant banking firm focusing on principal investments and consulting in the restaurant, food processing, and retail industries, since April 2010. He is the founder of Doran Consulting, a niche consulting group specializing in executive coaching since 1999, providing services to McDonald's Corporation, Bell South, Boston Markets, and Delphi Auto Parts. Mr. Doran was employed with McDonald's Corporation from January 1967 to March 1999 serving in a variety of regional director and vice president positions, most recently as Executive Vice President of McDonald's USA. Mr. Doran currently serves on the board of directors of Hawaii Development Company and McDonald's of Hawaii. Mr. Doran brings business consulting, executive leadership and extensive multi-location restaurant experience to our board.

Fouad Z. Bashour, who became Chairman of the Board of Granite City in May 2011, is a founding partner of CIC Partners Firm LP ("CIC Partners") and its current Chief Financial Officer, and has been with CIC Partners and its predecessor since 1999. Prior to joining CIC Partners, he worked at The Boston Consulting Group, a leading strategy consulting firm. Mr. Bashour currently serves as a director

2

of Red Mango, Inc. and Schuepbach Energy LLC. He is a former director of Bagby Energy Holdings, LP, Triumph Pacific Oil and Gas Company, Buffet Partners, L.P. (doing business as Furr's) and GreenLeaf Auto Recyclers LLC, where he served as co-chairman. Mr. Bashour brings business strategy consulting, capital markets and private equity experience to our board.

Charles J. Hey, who rejoined our board in October 2011, previously served as one of our directors from June 2010 to May 2011. Mr. Hey, who has been in the business of operating school bus contracts since 1962, currently serves as Chairman of the Board of School Bus, Inc., a transportation company. For a five-year period in the 1990's, Mr. Hey was a co-owner of Jasper State Bank. Mr. Hey co-owns DHW and, therefore, has interests in certain of our restaurant leases and our company's other transactions with DHW. See "Certain Relationships and Related Transactions—Relationship and Transactions with DHW." Mr. Hey brings business and banking experience to our board.

Joel C. Longtin became one of our directors in October 2009. He served as Chairman of the Board of Granite City from March 2010 through May 2011. Since January 2004, Mr. Longtin has been the President and Chief Executive Officer of JKL Enterprises, Inc. and Longtin Leasing, LLC, both of which are office equipment distribution and leasing companies. Mr. Longtin served as president of First American Bank in Sioux City, Iowa from November 2001 to January 2004. From 1990 to 2001, Mr. Longtin was the President of Mr. Gatti's, L.P. and Pizza Ranch, Inc. At that time, both of these entities were franchisors operating approximately 350 and 90 restaurants, respectively. Since 2007, Mr. Longtin has been a partner in the private equity firms of Harmony Equity Income Fund, L.L.C. and Harmony Equity Income Fund II, L.L.C. Mr. Longtin brings executive management experience in banking, restaurant and franchising industries to our board.

Louis M. Mucci joined our board in May 2011. Mr. Mucci has served as an advisor to the board of directors of Ruby's Tequilas, a restaurant company, since June 2007. From February 2007 until June 2009, Mr. Mucci was a senior advisor to SMH Capital Corp., an investment banking group, a company with shares registered pursuant to Section 12 of the Securities Exchange Act of 1934. Mr. Mucci has served on the board of directors of Build-A-Bear Workshop, Inc. since November 2004. Mr. Mucci is also the "audit committee financial expert" at Build-A-Bear and serves as Audit Committee Chairman and a member of the Nomination and Governance Committee. He held the position of Chief Financial Officer at BJ's Restaurants, Inc., a public company, and served on that company's board of directors from May 2002 until September 2005. Mr. Mucci also served as an advisor to the board of directors of BJ's Restaurants through December 2008. He retired from PricewaterhouseCoopers, LLP in 2001 after 25 years as a partner with the firm. Mr. Mucci's most recent position at PricewaterhouseCoopers was Chairman of the West Coast Retail Group. In this role, he served on the firm's National Retail Executive Committee. Mr. Mucci had also served as the West Coast Personnel and Business Development partner. He led several quality control reviews of various offices within PricewaterhouseCoopers and has extensive securities experience, including initial public offerings, registration statements and other filings, and correspondence and dialog with the Securities and Exchange Commission. He also has significant litigation support experience in acting as an accounting expert witness for his clients. Mr. Mucci is a member of the American Institute of Certified Public Accountants, the California State Society of Certified Public Accountants and the Retail Executive Forum. Mr. Mucci obtained extensive financial and accounting expertise while serving as a partner of an independent accounting firm. During his tenure as Chief Financial Officer of BJ's Restaurants, he gained additional financial and accounting expertise in addition to store operations, human resources, workers compensation, insurance, corporate administration, and strategic planning experience. Mr. Mucci brings extensive financial expertise to our board and qualifies as an "audit committee financial expert" as such term is defined under applicable SEC rules. In addition, given his experience with other consumer-focused businesses, Mr. Mucci provides valuable insights and perspectives regarding financing and operations to our board.

3

Michael S. Rawlings, who joined our board in May 2011, is a founding partner of CIC Partners and its current Vice-Chairman, and has been with the firm since 2004. In June 2011, Mr. Rawlings was elected mayor of Dallas, Texas. From 1997 to 2003, Mr. Rawlings was President of Pizza Hut, Inc. Before joining Pizza Hut, he was Chief Executive Officer of DDB Needham Dallas Group (formerly Tracy-Locke), the largest marketing communications agency in the Southwest, whose clients have included Frito-Lay, Pepsi, GTE and American Airlines. Mr. Rawlings currently serves as Chairman of Legends Hospitality Management, LLC, and as a director of Adina for Life, Inc. and River Point Farms. He is a former director of Buffet Partners, Main Street Restaurant Group, Inc., Quiznos, and Signstorey, Inc. Mr. Rawlings formerly served as the City of Dallas Park and Recreation Board President and as Dallas' Homeless Czar and Chairman for the Dallas Convention & Visitors Bureau. In addition, he is on the Board of Trustees at Jesuit College Preparatory and has been an active lecturer at many universities, as well as an adjunct professor at Southern Methodist University. Mr. Rawlings brings restaurant operations and leadership, marketing and communications and private equity experience to our board.

Michael H. Staenberg, who joined our board in May 2011, has been the President of THF Realty, a leasing, development, and real estate management company, since he founded the company in September 1991. THF Realty currently has over 22 million square feet of property and retail shopping centers under management. Mr. Staenberg has served as the developer of more than 100 shopping centers in over 25 states. Prior to founding THF Realty, Mr. Staenberg was employed as a real estate broker and served as Senior Vice President and Director of Real Estate for Leo Eisenberg Company, a national real estate development company, from 1981 to 1990. Mr. Staenberg has served on the Advisory Board of Directors of US Bank, N.A. since March 2011. Mr. Staenberg is involved with a variety of organizations, including The Sheldon Concert Hall, Center for Contemporary Arts, Variety Club, St. Louis Zoo Foundation, Regional Business Council-Executives for Regional Growth and Civic Change, Judy Ride, Jewish Community Center Association, American Society for Technion-Israel Institute of Technology, St. Louis Effort for Aids and Holocaust Museum. In addition, he has been a member of the International Council of Shopping Centers since 1976 and the Metropolitan St. Louis Board of Realtors since 1984. Mr. Staenberg brings extensive real estate leasing, development and management experience to our board.

Steven J. Wagenheim, who served as our Chief Executive Officer from June 1997 through May 2011, currently serves as our President, Founder and one of our directors. He has been a board member since 1997 and served as Chairman of the Board of Granite City from July 2006 to February 2009. Mr. Wagenheim has over 30 years of hospitality industry experience as a corporate executive, owner/operator, manager and consultant for hotels, resorts, and individual and multi-unit restaurant operations. Mr. Wagenheim previously served as Chief Executive Officer and principal shareholder of New Brighton Ventures, Inc., an investment holding company that formerly operated a Champps Americana restaurant in New Brighton, Minnesota. Between 1989 and 1997, Mr. Wagenheim was involved in the expansion and operations of Champps restaurants, holding positions with Champps Entertainment, Inc., Champps Development Group, Inc. and Americana Dining Corporation. Mr. Wagenheim brings three decades of hospitality industry experience to our board.

Our Executive Officers

Pursuant to General Instruction G(3) to Form 10-K and Instruction 3 to Item 401(b) of Regulation S-K, information regarding our executive officers was provided in Part I of our Form 10-K under separate caption.

4

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our officers, directors and persons who own more than 10% of a registered class of our equity securities to file reports of ownership and changes in ownership with the SEC. Such officers, directors and shareholders are required by the SEC to furnish us with copies of all such reports. To our knowledge, based solely on a review of copies of reports filed with the SEC during the last fiscal year, all applicable Section 16(a) filing requirements were met, except that (a) one report on Form 4 for Joel C. Longtin setting forth his direct acquisition of 400 shares on May 16, 2011, (b) one report on Form 4 for Joel C. Longtin setting forth his stock option grant in the amount of 5,000 shares on October 5, 2011, and (c) one report on Form 3 for Charles J. Hey setting forth his initial beneficial ownership on October 18, 2011, were not filed on a timely basis.

Code of Ethics

We have adopted a Code of Business Conduct and Ethics that applies to our employees, officers (including our principal executive officer, principal financial officer, principal accounting officer or controller, and persons performing similar functions) and directors. Our Code of Business Conduct and Ethics satisfies the requirements of Item 406(b) of Regulation S-K and applicable NASDAQ Marketplace Rules. Our Code of Business Conduct and Ethics is posted on our internet website at www.gcfb.net and is available, free of charge, upon written request to our Corporate Secretary at 701 Xenia Avenue South, Suite 120, Minneapolis, MN 55416. We intend to disclose any amendment to or waiver from a provision of our Code of Business Conduct and Ethics that requires disclosure on our website at www.gcfb.net.

Audit Committee Matters

Our audit committee was established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). Each member of our audit committee is independent as defined in Rule 5605(a)(2) of the Marketplace Rules of the NASDAQ Stock Market and Exchange Act Rule 10A-3. Further, no member of our audit committee participated in the preparation of the financial statements of our company or any current subsidiary of our company at any time during the past three years. The membership of our audit committee is set forth above under the caption "Our Directors."

Pursuant to our listing agreement with the NASDAQ Stock Market, each member of our audit committee is able to read and understand fundamental financial statements, including an issuer's balance sheet, income statement, and cash flow statement and at least one member of the committee has past employment experience in finance or accounting, requisite professional certification in accounting, or other comparable experience or background which results in the individual's financial sophistication. In addition, our board of directors has determined that Mr. Mucci is an audit committee financial expert as such term is defined by Item 407(d)(5) of Regulation S-K.

5

Item 11. Executive Compensation.

Summary Compensation Table

The following table sets forth information concerning the compensation of our named executive officers for fiscal years 2011 and 2010. Messrs. Doran and Wagenheim, who also serve as directors, receive no additional compensation for their board service.

Name and Principal Position(a)

|

Year | Salary ($)(b) |

Bonus ($)(c) |

Stock Award ($)(d) |

Option Awards ($)(e) |

Non-Equity Incentive Plan Compensation ($)(f) |

All Other Compensation ($)(g) |

Total ($) |

|||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Robert J. Doran |

2011 | 225,289 | 0 | 2,917,500 | 0 | 0 | 103,257 | 3,246,046 | |||||||||||||||||

Chief Executive Officer |

|||||||||||||||||||||||||

Dean S. Oakey |

2011 | 190,385 | 0 | 2,917,500 | 0 | 0 | 90,251 | 3,198,136 | |||||||||||||||||

Vice President—Chief Concept Officer |

|||||||||||||||||||||||||

Steven J. Wagenheim |

2011 | 300,000 | 0 | 0 | 34,228 | 86,100 | 14,150 | 434,478 | |||||||||||||||||

President and Founder |

2010 | 300,000 | 0 | 0 | 267,103 | 78,960 | 39,164 | 685,227 | |||||||||||||||||

James G. Gilbertson |

2011 | 225,000 | 0 | 0 | 12,115 | 65,543 | 4,200 | 306,858 | |||||||||||||||||

Chief Financial Officer |

2010 | 225,000 | 0 | 0 | 207,310 | 55,979 | 4,200 | 492,489 | |||||||||||||||||

Darius H. Gilanfar |

2011 | 187,255 | 31,172 | 0 | 9,852 | 18,703 | 232,307 | 479,289 | |||||||||||||||||

Former Chief |

2010 | 202,806 | 0 | 0 | 207,310 | 44,775 | 6,000 | 460,891 | |||||||||||||||||

Operating Officer |

|||||||||||||||||||||||||

- (a)

- In

connection with the May 2011 closing of the CDP transaction, Robert J. Doran became our Chief Executive Officer and a member of our board of directors

and Dean S. Oakey became our Vice President—Chief Concept Officer. Messrs. Doran and Oakey are control persons of CDP, which now beneficially owns a majority of our common stock,

and their appointments were in conjunction with that change in control. Steven J. Wagenheim, our former Chief Executive Officer and a founder of our company, was elected President and Founder and

remains a director of our company. James G. Gilbertson continues as our Chief Financial Officer. Darius H. Gilanfar served as our Chief Operating Officer until his resignation in November 2011.

- (b)

- As

of January 1, 2012, our named executive officers had the following annual base salaries: Mr. Doran, $355,000; Mr. Oakey, $300,000;

Mr. Wagenheim, $300,000; and Mr. Gilbertson, $225,000.

- (c)

- Represents

a bonus paid in connection with Mr. Gilanfar's resignation. See "Potential Payments upon Termination or Change in Control" below for

further information.

- (d)

- Represents

the aggregate grant date fair value computed in accordance with FASB ASC Topic 718 of interests granted by CDP in a profits interest plan. In

particular, these entries represent the product of (a) the number of Granite City shares held by CDP in which our executive officers will become vested over time pursuant to CDP's profits

interest plan and (b) the per share closing price of our common stock on the date of grant. See the subsection captioned "Equity-Based Compensatory Arrangement of Concept Development Partners"

below for further information regarding this third party compensatory arrangement.

- (e)

- The 2011 entries represent the incremental fair value received by our executive officers based upon the Black-Scholes valuation of our option exchange at the date of grant, computed in accordance with FASB ASC Topic 718. See the subsection captioned "Option Exchange Program" below for further information.

6

The 2010 entries represent aggregate grant date fair value computed in accordance with FASB ASC Topic 718. The assumptions made in the valuation are those set forth in Note 1 to the consolidated financial statements in our Form 10-K for the fiscal year ended December 27, 2011. Details regarding the terms of such awards appear below under the caption "Outstanding Equity Awards at Fiscal Year-End."

- (f)

- Further

information regarding our non-equity incentive plan appears below in the subsection captioned "Components of Executive Officer

Compensation."

- (g)

- All other compensation for fiscal year 2011 was as follows:

Name

|

Housing Allowance |

Car Allowance |

Guaranty Fees |

Consulting Fees(1) |

Insurance | COBRA Continuation Payments(2) |

Severance Payments(2) |

Total | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Robert J. Doran |

$ | 9,251 | 0 | 0 | 81,000 | 13,006 | 0 | 0 | $ | 103,257 | |||||||||||||||

Dean S. Oakey |

9,251 | 0 | 0 | 81,000 | 0 | 0 | 0 | 90,251 | |||||||||||||||||

Steven J. Wagenheim |

0 | 7,655 | 6,495 | 0 | 0 | 0 | 0 | 14,150 | |||||||||||||||||

James G. Gilbertson |

0 | 4,200 | 0 | 0 | 0 | 0 | 0 | 4,200 | |||||||||||||||||

Darius H. Gilanfar |

$ | 0 | 5,308 | 0 | 0 | 0 | 8,535 | 218,464 | $ | 232,307 | |||||||||||||||

- (1)

- Represents

consulting fees paid pursuant to the consulting agreement described below in the subsection captioned "Consulting Agreement."

- (2)

- Represents payment made in connection with Mr. Gilanfar's resignation. See "Potential Payments upon Termination or Change in Control" below for further information.

Components of Executive Officer Compensation

Base Salary. Named executive officers receive a base salary to compensate them for services rendered throughout the year. Base salary is intended to recognize each officer's responsibilities, role in the organization, experience level, and contributions to the success of our company. The compensation committee sets base salaries for the named executive officers at or above market level for the industry based on our benchmarking data.

Pursuant to the terms of our employment agreements with our named executive officers, the compensation committee reviews individual performance and base salary level each year. In general, the compensation committee has the sole discretion to increase (but not decrease) the base salaries of our named executive officers.

Stock Option Awards. The compensation committee grants stock options to our named executive officers to provide additional incentives to maximize our company's share value, and to make equity ownership an important component of executive compensation. Stock option award levels are determined based on market data, and vary based on an individual's position within our company, time at our company, and contributions to our company's performance. Stock options are granted at the closing market price of our common stock on the date of grant and vest over time.

Annual Incentive Compensation. Our named executive officers receive annual incentive compensation to reward achievement of our key financial performance goals in accordance with our non-equity incentive plan. These annual key financial performance goals are sales, restaurant-level EBITDA, general and administrative cost control, and earnings per share. They are based on annual operating budgets established by management and submitted to our board of directors for review. Annual incentive compensation is paid quarterly in cash. We weigh financial metrics differently for our named executive officers, depending on the different outcomes we are seeking to incentivize. Our compensation committee can, at its discretion, recommend to the board that awards be adjusted based on the executive's individual performance. Fifty percent of the quarterly bonuses are held in reserve, subject to verification of our company's performance after audited financial results become available. The targeted amounts for annual incentive compensation are set at or above market level for the industry based on our benchmarking data.

7

Employment Agreements with Current Executive Officers

In May 2011, we entered into employment agreements with Messrs. Doran and Oakey. Each agreement provides for employment with the company through December 31, 2012, to be extended for additional one-year terms upon the mutual agreement of our company and the executive. Each executive is entitled to severance benefits including one year of base salary if his employment is terminated without cause or for good reason, including upon a change in control, in addition to his base salary for the remainder of the term. The agreements provide for an annual base salary, which may be increased by our board of directors, eligibility for an annual bonus of up to 50% of base salary based on achieving performance targets determined by our compensation committee, participation in our company's other employee benefit plans and expense reimbursement. Each executive has also agreed to certain nondisclosure provisions during the term of his employment and any time thereafter, and certain non-competition and non-recruitment provisions during the term of his employment and for a certain period thereafter.

We also have employment agreements with Messrs. Wagenheim and Gilbertson. Each agreement, as amended in June 2010, provides for employment with the company through October 6, 2012, to be extended for additional one-year terms unless either our company or the executive gives notice at least 60 days before the termination date of an intent not to extend. Each executive is entitled to severance benefits including one year of base salary if his employment is terminated without cause or for good reason, including upon a change in control, in addition to his base salary for the remainder of the term. If we elect not to extend the executive's employment beyond October 6, 2012, or beyond the end of any applicable extension, and terminate executive's employment, such termination will be deemed to be a termination without cause for purposes of severance benefits and the payment of his base salary through the end of the applicable term. The agreements also provide for an annual base salary, which may be increased by our board of directors, eligibility for incentive compensation as determined by our compensation committee from time to time, and participation in our company's other employee benefit plans. Each executive has also agreed to certain nondisclosure provisions during the term of his employment and any time thereafter, and certain non-competition, non-recruitment and/or non-interference provisions during the term of his employment and for a certain period thereafter.

In May 2011, we entered into an amended and restated employment agreement with Mr. Wagenheim to address his new position as President and Founder of our company and to provide that the May 2011 closing of the CDP transaction did not constitute a "change in control" under Mr. Wagenheim's employment agreement.

Consulting Agreement

Prior to their employment by our company, Messrs. Doran and Oakey served in a consulting capacity to our company under our engagement agreement with CDP Management Partners, LLC ("CDP Management"), a merchant banking firm focusing on principal investments and consulting in the restaurant, food processing, and retail industries. Messrs. Doran and Oakey are managing partners of CDP Management, which is a co-owner of CDP. Under this agreement, CDP Management acted as an operating consultant to our company in connection with planning and executing a management strategy to ensure the growth stability of our company prior to closing of the CDP transaction. The engagement provided for the management services of Messrs. Doran and Oakey for the period of time commencing January 10, 2011 through May 10, 2011. In connection with its engagement, CDP Management consulted and advised our company management in operating our company, analyzing operating practices, analyzing operating costs, analyzing existing restaurant facilities for upgrades to drive revenue growth, and analyzing and establishing a go-forward development plan for new restaurant growth. For CDP Management's services during 2011, we paid total fees of $162,000. In addition, we agreed to reimburse CDP Management for its reasonable third-party out-of-pocket expenses, not to exceed $6,000 per month. Messrs. Doran and Oakey each own 50% of CDP Management. As a result, half of the consulting fees paid to CDP Management appears in the "All Other Compensation" entry for each of Messrs. Doran and Oakey in the Summary Compensation Table above.

8

Equity-Based Compensatory Arrangement of Concept Development Partners

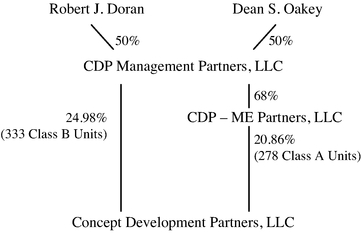

Prior to the May 2011 closing of the CDP transaction, the members of CDP entered into an amended and restated limited liability company agreement. Under the agreement, Messrs. Doran and Oakey, as employee members, agreed to devote substantially all of their business time and efforts to CDP and our company for as long as they are employees of CDP or our company. As consideration for the services to be rendered under such agreement, Messrs. Doran and Oakey became participants in a CDP profits interest plan pursuant to which they become vested over time in a portion of their equity interest in CDP. Messrs. Doran and Oakey became vested in 33.1 percent of CDP Management's Class B units in CDP on the May 2011 closing of the CDP transaction. Subject to continued employment, they become vested in an additional 22.3 percent of such units on each of the first, second and third anniversaries of such closing. They would become 100 percent vested in such profits interest in the event of a change in control of CDP or our company. As a result, this profits interest, which can be depicted as set forth below, constitutes equity-based compensation paid by a third party for services rendered by Messrs. Doran and Oakey to our company.

As a consequence of these ownership interests and the related vesting schedule, the indirect increasing pecuniary interests of Messrs. Doran and Oakey in the shares of Granite City common stock issuable upon conversion of the shares of Granite City Series A Preferred held by CDP is as follows:

Date

|

Class B Interest in CDP (#) |

Class A Interest in CDP (#) |

Total Units in CDP (#) |

Total Percentage Interest in CDP (%) |

Indirect Pecuniary Interest in Granite City Common Stock Issuable to CDP upon Conversion of Series A Preferred ($) |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

May 10, 2011 |

110.223 | 189.040 | 299.263 | 22.45 | 1,347,020 | |||||||||||

May 10, 2012 |

184.482 | 189.040 | 373.522 | 28.02 | 1,681,269 | |||||||||||

May 10, 2013 |

258.741 | 189.040 | 447.781 | 33.59 | 2,015,518 | |||||||||||

May 10, 2014 |

333.000 | 189.040 | 522.04 | 39.16 | 2,349,767 | |||||||||||

Each of Messrs. Doran and Oakey have a 50 percent interest in such securities since they are each 50 percent owners of CDP Management.

9

Option Exchange Program

On December 28, 2010, our compensation committee approved an option exchange program, subject to shareholder approval. Following receipt of shareholder approval on May 10, 2011, we commenced an offer on May 25, 2011 pursuant to which we provided eligible employees, including executive officers, the opportunity to exchange outstanding options with an exercise price in excess of $6.00 per share for the same number of new options granted under our Amended and Restated Equity Incentive Plan with an exercise price of $2.00 per share. The exercise price of the new options was greater than the closing price of one share of our common stock on the grant date of the new options. Eligible employees had the opportunity to exchange these options for new options regardless of whether the options were vested or unvested; however, all of the new options vested in full one year after the date of grant, namely December 28, 2011, subject to continued employment through such date and subject to the terms of the new option agreement. The offer expired on June 23, 2011. A total of 32 eligible employees participated in the offer. We accepted for cancellation options to purchase an aggregate of 188,696 shares of our common stock, which were cancelled as of June 23, 2011, and, in exchange, delivered new options to purchase an aggregate of 188,696 shares of our common stock with an exercise price of $2.00 per share.

At the time of the offer to exchange, three of our five named executive officers held eligible options for the purchase of 129,995 shares of common stock out of the total 189,529 shares of common stock that were subject to existing options which were eligible for surrender in the option exchange program. Messrs. Doran and Oakey did not hold eligible options at the time of the offer to exchange. The following chart sets forth details regarding the exchanged options held by our executive officers. The options values set forth in the table below were based upon price per share of our common stock of $1.905, the closing price of one share of our common stock on the NASDAQ Capital Market on December 28, 2010, the date of grant. The aggregate incremental fair value received by our executive officers based upon the Black-Scholes valuation of our option exchange at the date of grant was $56,195, allocated as follows: Mr. Wagenheim, $34,228; Mr. Gilbertson, $12,115; and Mr. Gilanfar, $9,852.

Name

|

Number of Securities Underlying Exchanged Options |

Former Option Exercise Price |

Former Option Value(a) |

New Option Exercise Price |

New Option Value(a) |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Steven J. Wagenheim |

4,166 | $ | 9.90 | $ | 0 | $ | 2.00 | $ | 0 | |||||||

|

5,000 | $ | 14.70 | $ | 0 | $ | 2.00 | $ | 0 | |||||||

|

8,333 | $ | 21.72 | $ | 0 | $ | 2.00 | $ | 0 | |||||||

|

25,000 | $ | 25.86 | $ | 0 | $ | 2.00 | $ | 0 | |||||||

|

16,666 | $ | 25.38 | $ | 0 | $ | 2.00 | $ | 0 | |||||||

|

16,666 | $ | 37.20 | $ | 0 | $ | 2.00 | $ | 0 | |||||||

Totals: |

75,831 | $ | 0 | $ | 0 | |||||||||||

James G. Gilbertson |

29,166 | $ | 21.48 | $ | 0 | $ | 2.00 | $ | 0 | |||||||

Totals: |

29,166 | $ | 0 | $ | 0 | |||||||||||

Darius H. Gilanfar(b) |

16,666 | $ | 25.32 | $ | 0 | $ | 2.00 | $ | 0 | |||||||

|

4,166 | $ | 11.94 | $ | 0 | $ | 2.00 | $ | 0 | |||||||

|

4,166 | $ | 10.50 | $ | 0 | $ | 2.00 | $ | 0 | |||||||

Totals: |

24,998 | $ | 0 | $ | 0 | |||||||||||

- (a)

- As of December 28, 2010, both the exercise price of the former options and the exercise price of the new options were in excess of market value.

10

- (b)

- Please see narrative following "Potential Payments upon Termination or Change in Control" regarding the amendment of Mr. Gilanfar's options in connection with his separation from our company.

Outstanding Equity Awards at Fiscal Year-End

The following table sets forth certain information concerning outstanding stock options held by our named executive officers as of December 27, 2011:

| |

Option Awards(a) | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Name

|

Number of Securities Underlying Unexercised Options (#) Exercisable |

Number of Securities Underlying Unexercised Options (#) Unexercisable |

Option Exercise Price ($) |

Option Expiration Date |

|||||||||

Robert J. Doran |

0 | 0 | N/A | N/A | |||||||||

Dean S. Oakey |

0 |

0 |

N/A |

N/A |

|||||||||

Steven J. Wagenheim |

0 |

5,000 |

(b) |

2.00 |

02/11/2013 |

||||||||

|

0 | 8,333 | (b) | 2.00 | 10/24/2013 | ||||||||

|

0 | 25,000 | (b) | 2.00 | 03/15/2015 | ||||||||

|

0 | 16,666 | (b) | 2.00 | 02/22/2016 | ||||||||

|

0 | 16,666 | (b) | 2.00 | 04/13/2017 | ||||||||

|

8,333 | (c) | 4,167 | (c) | 1.0752 | 04/02/2019 | |||||||

|

37,500 | (d) | 37,500 | (d) | 2.25 | 05/26/2020 | |||||||

|

0 | (c) | 69,958 | (c) | 2.00 | 12/28/2020 | |||||||

James G. Gilbertson |

0 |

29,166 |

(b) |

2.00 |

11/29/2017 |

||||||||

|

8,333 | (c) | 4,167 | (c) | 1.0752 | 04/02/2019 | |||||||

|

37,500 | (d) | 37,500 | (d) | 2.25 | 05/26/2020 | |||||||

|

0 | (c) | 34,244 | (c) | 2.00 | 12/28/2020 | |||||||

Darius H. Gilanfar |

16,666 |

(e) |

0 |

2.00 |

02/29/2012 |

||||||||

|

4,166 | (e) | 0 | 2.00 | 02/29/2012 | ||||||||

|

4,166 | (e) | 0 | 2.00 | 02/29/2012 | ||||||||

|

8,332 | (f) | 0 | 1.0752 | 11/29/2016 | ||||||||

|

37,500 | (g) | 0 | 2.25 | 11/29/2016 | ||||||||

|

11,414 | (h) | 0 | 2.00 | 12/28/2020 | ||||||||

- (a)

- Unless

otherwise indicated, represents shares issuable upon the exercise of stock options granted under our Amended and Restated Equity Incentive Plan.

- (b)

- This

option became exercisable in full on December 28, 2011, one day after fiscal year-end 2011.

- (c)

- This

option is exercisable for one-third of the shares purchasable thereunder on the first anniversary of the date of grant,

two-thirds of the shares purchasable thereunder on the second anniversary of the date of grant and in full on the third anniversary of the date of grant.

- (d)

- This option is exercisable for one-fourth of the shares purchasable thereunder on August 25, 2010, one-half of the shares purchasable thereunder on the first anniversary of the date of grant, three-fourths of the shares purchasable thereunder on the second anniversary of the date of grant and in full on the third anniversary of the date of grant.

11

- (e)

- This

option became exercisable in full on November 29, 2011 in connection with Mr. Gilanfar's separation from our company.

- (f)

- This

option, which was originally for the purchase of 12,500 shares, became exercisable for one-third of the shares purchasable thereunder on

the first anniversary of the date of grant and two-thirds of the shares purchasable thereunder on the second anniversary of the date of grant. The unvested portion of this option was

cancelled upon Mr. Gilanfar's separation from our company.

- (g)

- This

option, which was originally for the purchase of 75,000 shares, became exercisable for one-fourth of the shares purchasable thereunder on the first

anniversary of the date of grant and one-half of the shares purchasable thereunder on the second anniversary of the date of grant. The unvested portion of this option was cancelled upon

Mr. Gilanfar's separation from our company.

- (h)

- One-third of this option, which was originally for the purchase of 34,244 shares, became exercisable on November 29, 2011 in connection with Mr. Gilanfar's separation from our company. The remainder of this option was cancelled upon Mr. Gilanfar's separation from our company.

Potential Payments upon Termination or Change in Control

Upon the termination of a named executive officer or change in control of the company, a named executive officer may be entitled to payments or the provision of other benefits, depending on the triggering event.

The potential payments for each named executive officer who is currently employed with our company were determined as part of the negotiation of each of their employment agreements, and the compensation committee believes that the potential payments for the triggering events are in line with current compensation trends. The events that would trigger a current named executive officer's entitlement to payments or other benefits upon termination or a change in control, and the value of the estimated payments and benefits, based on annual base salaries in effect as of January 1, 2012, are described in the following table, assuming a termination date and, where applicable, a change in control

12

date of December 27, 2011, and a stock price of $2.21 per share, which was the closing price of one share of our common stock on such date.

Name and Benefits

|

Involuntary Termination without Cause, or Voluntary Termination for Good Reason, not upon a Change in Control |

Change in Control | Involuntary Termination without Cause, or Voluntary Termination for Good Reason, within 12 months of Change in Control(a) |

Voluntary Resignation following Change in Control(a) |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Robert J. Doran |

|||||||||||||

Severance |

$ | 355,000 | $ | 0 | $ | 355,000 | $ | 0 | |||||

Acceleration of equity awards |

0 | 1,108,035 | (b) | 1,108,035 | (b) | 1,108,035 | (b) | ||||||

COBRA continuation payments |

1,033 | 0 | 1,033 | 0 | |||||||||

Total |

$ | 356,033 | $ | 1,108,035 | $ | 1,464,068 | $ | 1,108,035 | |||||

Dean S. Oakey |

|||||||||||||

Severance |

$ | 300,000 | $ | 0 | $ | 300,000 | $ | 0 | |||||

Acceleration of equity awards |

0 | 1,108,035 | (b) | 1,108,035 | (b) | 1,108,035 | (b) | ||||||

COBRA continuation payments |

1,033 | 0 | 1,033 | 0 | |||||||||

Total: |

$ | 301,033 | $ | 1,108,035 | $ | 1,409,068 | $ | 1,108,035 | |||||

Steven J. Wagenheim |

|||||||||||||

Severance |

$ | 300,000 | $ | 0 | $ | 300,000 | $ | 0 | |||||

Acceleration of equity awards |

35,344 | 0 | 35,344 | 0 | |||||||||

COBRA continuation payments |

9,858 | 0 | 9,858 | 0 | |||||||||

Total: |

$ | 345,202 | $ | 0 | $ | 345,202 | $ | 0 | |||||

James G. Gilbertson |

|||||||||||||

Severance |

$ | 225,000 | $ | 0 | $ | 225,000 | $ | 0 | |||||

Acceleration of equity awards |

0 | 0 | 18,045 | 0 | |||||||||

COBRA continuation payments |

9,858 | 0 | 9,858 | 0 | |||||||||

Total: |

234,858 | $ | 0 | $ | 252,903 | $ | 0 | ||||||

- (a)

- Our

Amended and Restated Equity Incentive Plan and our Long-Term Incentive Plan provide that, unless otherwise provided by our compensation

committee in an award agreement, involuntary termination of any optionee in connection with a change in control will cause the immediate vesting of any unvested stock options then held by the

optionee.

- (b)

- Under CDP's amended and restated limited liability company agreement, Messrs. Doran and Oakey would receive acceleration of their Class B Units in CDP upon a change in control of Granite City, as defined in such agreement. Each of Messrs. Doran and Oakey have a 50 percent interest in such securities. Upon a change in control, the unvested indirect interest of each of Messrs. Doran and Oakey in approximately 501,374 shares of our common stock underlying our Series A Preferred would accelerate.

Upon an involuntary termination without cause or a voluntary termination for good reason, the affected executive also would be entitled to receive base compensation through the end of the applicable employment agreement term. Because the amount of such base compensation is indeterminable, it is not included in the amounts set forth above. Furthermore, as to Messrs. Wagenheim and Gilbertson, if we elect not to extend the executive's employment beyond October 6, 2012, or beyond the end of any applicable extension, and terminate executive's employment, such termination will be deemed to be a termination without cause for purposes of the severance benefits set forth above and the continuation of base compensation through the end of the applicable term.

Separation Agreement with Former Executive Officer

Until his resignation from our company on November 29, 2011, we had an employment agreement with Mr. Gilanfar that was substantially similar to our employment agreements with Messrs. Wagenheim and Gilbertson. On December 1, 2011, we entered into a separation agreement with Mr. Gilanfar. In consideration of a release, Mr. Gilanfar received payments aggregating $218,464, a separate bonus payment of $31,172, and payment of the company portion of medical (COBRA)

13

premiums through December 1, 2012. Pursuant to the separation agreement, Mr. Gilanfar's outstanding options were amended as follows:

Options Amended to Extend Exercisability for Five Years from November 29, 2011:

Original Option Grant Amount |

Date Granted |

Vested Portion Upon Termination* |

Original Expiration Date |

New Expiration Date |

Exercise Price |

|||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

12,500 |

04/02/2009 | 8,332 | 04/02/2019 | 11/29/2016 | $ | 1.0752 | ||||||||||

75,000 |

08/25/2010 | 37,500 | 05/26/2020 | 11/29/2016 | $ | 2.25 | ||||||||||

- *

- Remainder cancelled as of November 29, 2011.

Options Amended to Accelerate Vesting from December 28, 2011 to November 29, 2011:

Original Option Grant Amount |

Date Granted |

Vested Portion Upon Termination |

Original Vesting Date |

New Vesting Date |

Original Expiration Date |

New Expiration Date |

Exercise Price |

|||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

34,244 |

12/28/2010 | 11,414 | 12/28/2011 | 11/29/2011 | 12/28/2020 | 2/29/2012 | $ | 2.00 | ||||||||||||||

16,666 |

12/28/2010 | 16,666 | 12/28/2011 | 11/29/2011 | 09/24/2017 | 2/29/2012 | $ | 2.00 | ||||||||||||||

4,166 |

12/28/2010 | 4,166 | 12/28/2011 | 11/29/2011 | 06/17/2018 | 2/29/2012 | $ | 2.00 | ||||||||||||||

4,166 |

12/28/2010 | 4,166 | 12/28/2011 | 11/29/2011 | 07/24/2018 | 2/29/2012 | $ | 2.00 | ||||||||||||||

All other options held by Mr. Gilanfar were forfeited as of his termination date.

Shareholder Approval of Executive Compensation Proposals

Although our company is a smaller reporting company, we voluntarily presented both "say-on-pay" and "say-on-frequency" proposals to our shareholders at our 2011 special meeting of shareholders held in May 2011. The non-binding advisory say-on-pay proposal, pursuant to which we sought shareholder approval of the compensation of our named executive officers, was approved by 96.7 percent of those voting on the proposal. Of those voting on the non-binding advisory say-on-frequency proposal, 93.1 percent recommended that we hold a non-binding advisory vote on executive compensation every three years. In light of this result, our board of directors has determined that we will hold a non-binding advisory vote on executive compensation every three years, until the next required shareholder non-binding advisory vote on the frequency of shareholder voting on executive compensation, which, in accordance with applicable law, will occur no later than our annual meeting of shareholders to be held in 2014, unless our board otherwise determines that a different frequency of non-binding advisory votes on executive compensation is in the best interests of our shareholders.

Non-Employee Director Compensation

Standard Compensation Arrangements

Our compensation committee periodically reviews and makes recommendations to our board of directors regarding the components and amount of non-employee director compensation. Directors who are employees of our company receive no fees for their service as director.

In June 2011, our board of directors, based upon the recommendation of the compensation committee, approved the following standard compensation arrangements for our non-employee directors, our Chairman of the Board and our committee chairpersons:

- •

- Each non-employee director receives an annual retainer in the amount of $15,000, payable in equal quarterly installments.

Annual Retainer for Non-Employee Directors and Chairman of the Board

14

- •

- Upon initially joining the board, each non-employee director receives a stock option to purchase common stock

valued at $10,000 at an exercise price equal to the per share fair market value on the date of grant, which award is reduced and pro-rated on the basis of a 360-day year if

such director is elected to the board at a time other than May 10th, and, on May 10th of each year, each non-employee director then serving

on the board receives a stock option to purchase common stock valued at $10,000 at an exercise price equal to the per share fair market value on the date of grant. Initial and annual awards are

subject to the following additional terms: (a) the option vests on the first anniversary of the date of grant, provided that the award recipient is then serving as a director, and

(b) the option has a term of ten years. Pursuant to this policy, each non-employee director was awarded a stock option for the purchase of 3,000 shares of common stock for their

service in 2011.

- •

- In addition to the foregoing annual retainer and stock option, the Chairman of the Board, if he or she is a non-employee director, receives a $15,000 annual retainer for service as chairperson, payable in quarterly installments.

- •

- The chairperson of the audit committee receives a $10,000 annual retainer, payable in quarterly installments.

- •

- The chairperson of the corporate governance and nominating committee receives a $5,000 annual retainer, payable in

quarterly installments.

- •

- The chairperson of the compensation committee receives a $10,000 annual retainer, payable in quarterly installments.

Compensation of Committee Members

Prior to these June 2011 modifications, our non-employee directors received an annual retainer of $10,000, paid in quarterly installments, and $500 per meeting for attending board meetings, committee meetings and the annual meeting of shareholders. The chairpersons of our audit committee and compensation committee each received an additional annual retainer of $5,000. The chairperson of our corporate governance and nominating committee received an additional annual retainer of $2,500. In addition, each non-employee director also received automatic awards of stock options for the purchase of 5,000 shares of common stock per year on the anniversary of his election to the board. Such awards, which became exercisable in full on the first anniversary of the date of grant, had a ten-year term. Although such practice has been discontinued pursuant to the board actions taken in June 2011, the board further determined that the stock options that would have been awarded to Milton D. Avery, one of our former directors, and Joel C. Longtin, one of our current directors, in 2011 pursuant to this particular compensation arrangement should still be made and such awards were made in June 2011 and October 2011, respectively.

Equity For Departing Directors

In March 2011, our board of directors resolved to provide certain cash and non-cash, stock-based compensation to its members who remained on the board following the closing of the CDP transaction, and those who resigned from the board concurrent with such closing. These awards were in consideration of their service to the company in connection with the CDP and related transactions.

Mr. Longtin, then chairman of our board, received $40,000 for his role as lead director in negotiating the transactions, and each of our other then independent directors (Messrs. Avery, Gramm and Timpe) received $7,500 for his service in reviewing and approving the transactions.

In addition, our board of directors determined to provide non-cash, stock-based compensation to resigning members to compensate them for the forfeitures of stock options or ordinary course awards they would otherwise experience due to their resignations in connection with the transactions, and to continuing members for their service in connection with negotiating, reviewing and approving the transactions.

15

The following summarizes actions taken by our board:

- •

- modified certain outstanding options to purchase 5,000 shares of our common stock held by each of Messrs. Dunham

and Timpe, two then non-employee directors whose annual option awards would not otherwise vest, to provide that such options vested upon their departure from our board, and that such

options may be exercised for five years after departure from our board;

- •

- granted ten-year options to purchase 5,000 shares of our common stock to certain of our then resigning

non-employee directors (Messrs. Dunham, Gramm and Hey), in place of the non-employee director options that would have otherwise been awarded to them during 2011 in the

ordinary course, which options immediately vested and are exercisable for five years after departure from our board;

- •

- granted a ten-year option to purchase 25,000 shares of our common stock to Mr. Longtin, our chairman of

the board, for his service as lead director in negotiating the transactions, vested immediately and exercisable through the earlier to occur of five years after his departure from the board or the

tenth anniversary of the date of grant; and

- •

- granted a ten-year option to purchase 12,500 shares of our common stock to each of our then other independent directors (Messrs. Avery, Gramm and Timpe) for his service in reviewing and approving the transactions, vested immediately and exercisable through the earlier to occur of five years after his departure from the board or the tenth anniversary of the date of grant.

Director Compensation Table

Compensation of our non-employee directors during fiscal year 2011 appears in the following table. Because Messrs. Doran and Wagenheim also served as executive officers in fiscal year 2011, their compensation, including information regarding their unexercised stock options, is instead presented in the Summary Compensation Table.

Name

|

Fees Earned or Paid in Cash ($) |

Option Awards ($)(a) |

All Other Compensation ($) |

Total ($) |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Milton D. Avery(b) |

$ | 23,878 | $ | 62,286 | $ | 0 | $ | 86,164 | |||||

Fouad Z. Bashour |

$ | 19,121 | $ | 9,379 | $ | 0 | $ | 28,500 | |||||

Donald A. Dunham, Jr.(c) |

$ | 5,654 | $ | 12,048 | $ | 0 | $ | 17,702 | |||||

Brian K. Gramm(c) |

$ | 19,981 | $ | 50,665 | $ | 0 | $ | 70,646 | |||||

Charles J. Hey(d) |

$ | 9,404 | $ | 12,048 | $ | 0 | $ | 21,452 | |||||

Joel C. Longtin |

$ | 64,588 | $ | 95,773 | $ | 0 | $ | 160,361 | |||||

Louis M. Mucci |

$ | 19,121 | $ | 9,379 | $ | 0 | $ | 28,500 | |||||

Michael S. Rawlings |

$ | 9,560 | $ | 9,379 | $ | 0 | $ | 18,939 | |||||

Michael H. Staenberg |

$ | 9,560 | $ | 9,379 | $ | 0 | $ | 18,939 | |||||

David A. Timpe(c) |

$ | 19,981 | $ | 56,032 | $ | 0 | $ | 76,013 | |||||

- (a)

- Represents

the aggregate grant date fair value computed in accordance with FASB ASC Topic 718. The assumptions made in the valuation are those set forth in

Note 1 to the consolidated financial statements in our Form 10-K for the fiscal year ended December 27, 2011. The company used a 0 percent forfeiture rate

assumption in fiscal year 2011.

- (b)

- Mr. Avery

ceased serving as a director in October 2011.

- (c)

- Messrs. Dunham,

Gramm and Timpe ceased serving as directors in May 2011.

- (d)

- Mr. Hey, who ceased serving as a director in May 2011, was re-elected to our board in October 2011.

16

Those who served as non-employee directors during fiscal year 2011 held the following unexercised options at fiscal year-end 2011. Unless otherwise noted below, each such option is exercisable in full on the first anniversary of the date of grant.

| |

Option Awards | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Name

|

Number of Securities Underlying Unexercised Options (#) Exercisable |

Number of Securities Underlying Unexercised Options (#) Unexercisable |

Option Exercise Price ($) |

Option Expiration Date |

|||||||||

Milton D. Avery |

12,500 | 0 | 3.49 | 10/18/2012 | (a) | ||||||||

Fouad Z. Bashour |

0 | 3,000 | 3.55 | 06/14/2021 | |||||||||

Donald A. Dunham, Jr. |

5,000 | (b) | 0 | 1.82 | 05/10/2016 | (c) | |||||||

|

5,000 | (b) | 0 | 3.3501 | 05/10/2016 | (c) | |||||||

Brian K. Gramm |

12,500 | 0 | 3.49 | 05/10/2016 | (c) | ||||||||

|

5,000 | (b) | 0 | 3.3501 | 05/10/2016 | (c) | |||||||

Charles J. Hey |

5,000 | (d) | 0 | 3.3501 | 05/10/2016 | (e) | |||||||

Joel C. Longtin |

5,000 | 0 | 1.82 | 10/05/2020 | |||||||||

|

25,000 | 0 | 3.49 | 03/17/2021 | |||||||||

|

0 | 3,000 | 3.55 | 06/14/2021 | |||||||||

|

0 | 5,000 | 2.10 | 10/05/2021 | |||||||||

Louis M. Mucci |

0 | 5,000 | 3.55 | 06/14/2021 | |||||||||

Michael S. Rawlings |

0 | 5,000 | 3.55 | 06/14/2021 | |||||||||

Michael H. Staenberg |

0 | 5,000 | 3.55 | 06/14/2021 | |||||||||

David A. Timpe |

12,500 | 0 | 3.49 | 05/10/2012 | (a) | ||||||||

- (a)

- This

option expires 12 months after such former director's departure from our board.

- (b)

- This

option became exercisable in full upon such former director's departure from our board.

- (c)

- This

option expires five years after such former director's departure from our board.

- (d)

- This

option became exercisable in full upon Mr. Hey's May 2011 departure from our board. Mr. Hey rejoined our board in October 2011.

- (e)

- This option expires five years after Mr. Hey's May 2011 departure from our board. As noted above, Mr. Hey rejoined our board in October 2011.

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters.

Security Ownership

The following table sets forth certain information known to us regarding beneficial ownership of our voting securities as of April 13, 2012, by (1) each person who is known to us to own beneficially more than five percent of any class of our voting securities, (2) each director, (3) each executive officer named in the summary compensation table above, and (4) all current directors and executive officers as a group. The percentage of beneficial ownership is based on 4,831,662 shares of common stock and 3,000,000 shares of Series A Preferred outstanding as of April 13, 2012. As indicated in the footnotes, shares issuable pursuant to derivative securities are deemed outstanding for computing the percentage of the person holding such derivative securities but are not deemed outstanding for computing the percentage of any other person. Except as otherwise noted below or pursuant to applicable community property laws, each person identified below has sole voting and investment power with respect to the

17

listed shares and none of the listed shares has been pledged as security. Except as otherwise noted below, we know of no agreements among our shareholders that relate to voting or investment power with respect to our voting securities. Unless otherwise indicated, the address for each listed shareholder is c/o Granite City Food & Brewery Ltd., 701 Xenia Avenue South, Suite 120, Minneapolis, Minnesota 55416.

Name and Address of Beneficial Owner(a)

|

Amount and Nature of Beneficial Ownership(a) |

Percentage of Class(a) |

|||||

|---|---|---|---|---|---|---|---|

Common Stock |

|||||||

Concept Development Partners LLC |

7,805,964 | (b) | 72.1 | % | |||

Fouad Z. Bashour |

0 | (c) | 0 | % | |||

Robert J. Doran |

0 | (c) | 0 | % | |||

Michael S. Rawlings |

0 | (c) | 0 | % | |||

Charles J. Hey |

1,692,687 | (d) | 34.8 | % | |||

DHW Leasing, L.L.C. |

1,666,666 | (e) | 34.5 | % | |||

Steven J. Wagenheim |

262,433 | (f) | 5.3 | % | |||

James G. Gilbertson |

116,830 | (g) | 2.4 | % | |||

Joel C. Longtin |

52,899 | (h) | 1.1 | % | |||

Darius H. Gilanfar(i) |

37,580 | (j) | * | ||||

Louis M. Mucci |

0 | 0 | % | ||||

Dean S. Oakey |

0 | (c) | 0 | % | |||

Michael H. Staenberg |

0 | 0 | % | ||||

All current directors and executive officers as a group (11 persons) |

2,141,787 | (k) | 41.3 | % | |||

Series A Convertible Preferred Stock |

|||||||

Concept Development Partners LLC |

3,000,000 | (l) | 100 | % | |||

Fouad Z. Bashour |

0 | (m) | 0 | % | |||

Robert J. Doran |

0 | (m) | 0 | % | |||

Michael S. Rawlings |

0 | (m) | 0 | % | |||

Charles J. Hey |

0 | 0 | % | ||||

Steven J. Wagenheim |

0 | 0 | % | ||||

James G. Gilbertson |

0 | 0 | % | ||||

Darius H. Gilanfar(i) |

0 | 0 | % | ||||

Joel C. Longtin |

0 | 0 | % | ||||

Louis M. Mucci |

0 | 0 | % | ||||

Dean S. Oakey |

0 | (m) | 0 | % | |||

Michael H. Staenberg |

0 | 0 | % | ||||

All current directors and executive officers as a group (11 persons) |

0 | (n) | 0 | % | |||

- *

- Represents

less than one percent.

- (a)

- Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to securities. Securities "beneficially owned" by a person may include securities owned by or for, among others, the spouse, children, or certain other relatives of such person as well as other securities as to which the person has or shares voting or investment power or has the option or right to acquire within 60 days of April 13, 2012.

18

- (b)

- As

set forth in the Schedule 13D filed on April 13, 2012 by Concept Development Partners LLC, a Delaware limited liability company

("CDP"), CIC Partners Firm LP, a Delaware limited partnership ("CIC Partners"), CIC II LP, a Delaware limited partnership ("CIC Fund II"), CIC II GP LLC, a Delaware limited

liability company ("CIC II GP"), CDP-ME Holdings, LLC, a Delaware limited liability company ("CDP-ME"), and CDP Management Partners, LLC, a Delaware

limited liability company ("CDP Management") (collectively, the "Reporting Persons"). CDP is a limited liability company organized under the laws of the State of Delaware and is primarily in the

business of investing in the restaurant industry. CDP's board of directors consists of Fouad Z. Bashour, Michael S. Rawlings, Dean S. Oakey and Robert J. Doran. CDP is minority owned by

CDP-ME and CDP Management. Both CDP-ME and CDP Management are investment companies jointly owned and managed by Messrs. Oakey and Doran. The present principal occupation

of Mr. Oakey is Chief Concept Officer of Granite City, and the present principal occupation of Mr. Doran is Chief Executive Officer of Granite City. Each of CDP, CDP-ME and

CDP Management has a principal place of business at 5724 Calpine Drive, Malibu, California 90265. CDP is majority owned by CIC CDP LLC, a Delaware limited liability company ("CIC

CDP LLC"), which is itself a wholly-owned subsidiary of CIC Fund II. CIC Fund II is an investment fund managed by its general partner, CIC II GP, and ultimately owned and controlled by

CIC Partners, a mid-market private equity firm headquartered in Dallas, Texas. The principal business of CIC CDP LLC is the investment in Granite City's Series A Preferred.

The principal business of CIC Fund II is to be an investment fund in CIC Partners, and the principal business of CIC II GP is to act as the general partner of CIC Fund II. CIC Partners is

jointly owned and managed by Marshall Payne, Drew Johnson, Michael S. Rawlings, Fouad Z. Bashour and James C. Smith. The present principal occupation of Messrs. Payne, Johnson, Rawlings,

Bashour and Smith is serving as a director of CIC Partners, and together with CIC Partners, CIC Fund II and CIC II GP, each have a principal place of business at 500 Crescent Court,

Suite 250, Dallas, Texas 75201. Messrs. Payne, Johnson, Rawlings, Bashour, Oakey and Doran, as well as CIC Partners, CIC Fund II, CIC II GP, CDP-ME and CDP

Management disclaim beneficial ownership of such securities. Represents beneficial ownership of 7,805,964 shares of common stock, including 6,000,000 shares of common stock issuable upon conversion of

3,000,000 shares of Series A Preferred owned by CDP, 139,298 shares of common stock issued as dividends on the Series A Preferred, and 1,666,666 shares of common stock over which CDP has

voting power pursuant to a shareholder and voting agreement and irrevocable proxy between CDP and DHW Leasing, L.L.C. ("DHW"), dated May 10, 2011. The Reporting Persons have shared voting power

over all of the reported shares and shared dispositive power over 6,139,298 shares of common stock. Prior to conversion, the holder of our Series A Preferred has 0.77922 votes per preferred

share and votes with the holders of our common stock as a single class, except on matters adversely affecting the holder of our Series A Preferred as a class.

- (c)

- The

number of shares of common stock reported herein as beneficially owned by Messrs. Bashour, Doran, Oakey and Rawlings excludes the 7,805,964

shares of common stock beneficially owned by CDP. Messrs. Bashour, Doran, Oakey and Rawlings disclaim beneficial ownership of such securities. Messrs. Bashour, Doran, Oakey and Rawlings,

together with another individual, are managers of CDP. Since a majority of managers of CDP is required to vote or dispose of any shares of our stock, none of such individuals is deemed a beneficial

owner of the common stock beneficially owned by CDP.

- (d)

- Includes 5,000 shares of common stock purchasable by Mr. Hey upon the exercise of an option and 21,021 shares of common stock purchasable by Mr. Hey upon the exercise of

19

a warrant. Because Mr. Hey may be deemed to be an indirect beneficial owner of the shares of common stock held by DHW, the number of shares of common stock reported herein as beneficially owned by Mr. Hey also includes the 1,666,666 shares of common stock beneficially owned by DHW.

- (e)

- DHW

retains the right to dispose of such shares of common stock; however, it has granted an irrevocable proxy to vote such shares of common stock to CDP.

DHW's address is 230 S. Phillips Avenue, Suite 202, Sioux Falls, SD 57104.

- (f)

- Includes

163,734 shares of common stock purchasable by Mr. Wagenheim upon the exercise of options. Because Mr. Wagenheim may be deemed to be

an indirect beneficial owner of the securities held by Brewing Ventures LLC, the number of shares of common stock reported herein as beneficially owned by Mr. Wagenheim also includes

83,125 shares of common stock beneficially owned by Brewing Ventures LLC.

- (g)

- Includes

109,330 shares of common stock purchasable by Mr. Gilbertson upon the exercise of options.

- (h)

- Includes

30,000 shares of common stock purchasable by Mr. Longtin upon the exercise of options, 838 shares of common stock purchasable by

Mr. Longtin upon the exercise of a warrant, and 2,436 shares of common stock held by Mr. Longtin's spouse's IRA. Because Mr. Longtin may be deemed to be an indirect beneficial

owner of the securities held by JNB Ventures LP, the number of shares of common stock reported herein as beneficially owned by Mr. Longtin also includes 2,092 shares of common stock

purchasable by JNB Ventures LP upon the exercise of a warrant.

- (i)

- Mr. Gilanfar

resigned from his position as Chief Operating Officer of our company in November 2011.

- (j)

- Includes

37,500 shares of common stock purchasable by Mr. Gilanfar upon the exercise of options.

- (k)

- Includes

324,586 shares of common stock purchasable upon the exercise of options and 23,951 shares of common stock purchasable upon the exercise of warrants

(including 2,092 shares of common stock purchasable by JNB Ventures LP). Also includes shares of common stock beneficially owned by Brewing Ventures LLC and Mr. Longtin's spouse's

IRA. Excludes shares of common stock beneficially owned by CDP.

- (l)

- CDP's

address is 5724 Calpine Drive, Malibu, CA 90265.

- (m)

- The

number of shares of Series A Preferred reported herein as beneficially owned by Messrs. Bashour, Doran, Oakey and Rawlings excludes the

3,000,000 shares of Series A Preferred held by CDP. Messrs. Bashour, Doran, Oakey and Rawlings disclaim beneficial ownership of such securities. Messrs. Bashour, Doran, Oakey and

Rawlings, together with another individual, are managers of CDP. Since a majority of managers of CDP is required to vote or dispose of any shares of our stock, none of such individuals is deemed a

beneficial owner of the Series A Preferred held by CDP.

- (n)

- Excludes shares of Series A Preferred held by CDP.

20

Equity Compensation Plan Information

The following table provides information as of the end of fiscal year 2011 with respect to compensation plans under which our equity securities are authorized for issuance.

| |

Number of securities to be issued upon exercise of outstanding options, warrants and rights (a) |

Weighted-average exercise price of outstanding options, warrants and rights (b) |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

Equity compensation plans approved by security holders |

1,113,445 | $ | 2.28 | 534,705 | (1) | |||||

Equity compensation plans not approved by security holders |

260,481 | (2) | $ | 2.01 | 0 | |||||

Total |

1,373,926 | $ | 2.23 | 534,705 | ||||||

- (1)

- Represents

134,705 shares remaining available for future issuance under our Amended and Restated Equity Incentive Plan and 400,000 shares remaining

available for future issuance under our Long-Term Incentive Plan as of December 27, 2011. On January 1st of each year, the aggregate number of shares of stock that may

be awarded under the Amended and Restated Equity Incentive Plan automatically increases by 150,000 shares of stock. As a result, an additional 150,000 shares (not shown above) became available for

future issuance under our Amended and Restated Equity Incentive Plan as of January 1, 2012. However, on February 27, 2012, our Equity Incentive Plan expired and no further awards may be

issued thereunder.

- (2)

- Represents (a) an aggregate of 3,333 shares of common stock underlying ten-year options exercisable at $14.70 per share issued on February 11, 2003 to a former executive officer who also served as a director; (b) an aggregate of 203,816 shares of common stock underlying five-year warrants exercisable at a weighted average per-share price of $1.94 issued between February 7, 2009 and May 11, 2011 to certain of our landlords; and (c) an aggregate of 53,332 shares of common stock underlying five-year warrants exercisable at $1.52 per share issued to a bridge lender of which a former director is a member and in which such former director has a beneficial interest on March 30, 2009.

Item 13. Certain Relationships and Related Transactions, and Director Independence.

Review and Approval of Transactions with Related Persons

Our audit committee is responsible for reviewing any proposed transaction with a related person. In April 2007, our board of directors adopted a written policy for the review and approval of related person transactions requiring disclosure under Rule 404(a) of Regulation S-K. This policy states that the audit committee is responsible for reviewing and approving or disapproving all interested transactions, which are defined as any transaction, arrangement or relationship in which (a) the amount involved may be expected to exceed $120,000 in any fiscal year, (b) our company will be a participant, and (c) a related person has a direct or indirect material interest. A related person is defined as an executive officer, director or nominee for director, or a greater than five percent beneficial owner of any class of our voting securities, or an immediate family member of the foregoing. The policy deems certain interested transactions to be pre-approved, including the employment and compensation of executive officers, and the compensation paid to directors.

21