Attached files

| file | filename |

|---|---|

| 8-K/A - 8-K/A - FIFTH THIRD BANCORP | d339773d8ka.htm |

1Q12

Earnings Conference Call April 19, 2012

Please refer to earnings release dated April 19, 2012 for further information.

Exhibit 99.1

©

Fifth Third Bank | All Rights Reserved |

2

Cautionary statement

©

Fifth Third Bank | All Rights Reserved

This report contains statements that we believe are “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as amended, and Rule 175 promulgated

thereunder, and Section 21E of the Securities Exchange Act of 1934, as amended, and Rule

3b-6 promulgated thereunder. These statements relate to our financial condition, results of

operations, plans, objectives, future performance or business. They usually can be identified by

the use of forward-looking language such as “will likely result,” “may,” “are expected to,” “is

anticipated,” “estimate,” “forecast,” “projected,” “intends

to,” or may include other similar words or phrases such as “believes,” “plans,” “trend,”

“objective,” “continue,” “remain,” or similar expressions, or future or

conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,” or

similar verbs. You should not place undue reliance on these statements, as they are subject to risks

and uncertainties, including but not limited to the risk factors set forth in our most recent

Annual Report on Form 10-K. When considering these forward-looking statements, you should

keep in mind these risks and uncertainties, as well as any cautionary statements we may make.

Moreover, you should treat these statements as speaking only as of the date they are made and

based only on information then actually known to us.

There are a number of important factors that could cause future results to differ materially from

historical performance and these forward- looking statements. Factors that might cause such

a difference include, but are not limited to: (1) general economic conditions and weakening in

the economy, specifically the real estate market, either nationally or in the states in which Fifth Third, one or more acquired entities and/or

the combined company do business, are less favorable than expected; (2) deteriorating credit quality;

(3) political developments, wars or other hostilities may disrupt or increase volatility in

securities markets or other economic conditions; (4) changes in the interest rate environment

reduce interest margins; (5) prepayment speeds, loan origination and sale volumes, charge-offs and

loan loss provisions; (6) Fifth Third’s ability to maintain required capital levels and

adequate sources of funding and liquidity; (7) maintaining capital requirements may limit Fifth

Third’s operations and potential growth; (8) changes and trends in capital markets; (9) problems

encountered by larger or similar financial institutions may adversely affect the banking

industry and/or Fifth Third; (10) competitive pressures among depository institutions increase

significantly; (11) effects of critical accounting policies and judgments; (12) changes in accounting

policies or procedures as may be required by the Financial Accounting Standards Board (FASB) or

other regulatory agencies; (13) legislative or regulatory changes or actions, or significant

litigation, adversely affect Fifth Third, one or more acquired entities and/or the combined company or the businesses in which Fifth

Third, one or more acquired entities and/or the combined company are engaged, including the

Dodd-Frank Wall Street Reform and Consumer Protection Act; (14) ability to maintain

favorable ratings from rating agencies; (15) fluctuation of Fifth Third’s stock price; (16) ability to attract

and retain key personnel; (17) ability to receive dividends from its subsidiaries; (18) potentially

dilutive effect of future acquisitions on current shareholders’ ownership of Fifth Third;

(19) effects of accounting or financial results of one or more acquired entities; (20) difficulties from the

separation of Vantiv, LLC, formerly Fifth Third Processing Solutions from Fifth Third; (21) loss of

income from any sale or potential sale of businesses that could have an adverse effect on Fifth

Third’s earnings and future growth; (22) ability to secure confidential information through

the use of computer systems and telecommunications networks; and (23) the impact of reputational risk

created by these developments on such matters as business generation and retention, funding and

liquidity. You should refer to our periodic and current reports filed with the Securities and Exchange

Commission, or “SEC,” for further information on other factors, which could cause

actual results to be significantly different from those expressed or implied by these forward-looking

statements. |

3

©

Fifth Third Bank | All Rights Reserved

Net income available to common shareholders of $421mm ($0.45 per

diluted common share), vs. $305mm ($0.33 per

share) in 4Q11 and $88mm ($0.10 per share) in 1Q11

—

1Q12 return on assets (ROA) of 1.49%; 1.20% excluding items below

—

Pre-provision net revenue (PPNR)* of $694mm, or $569mm excluding items

below Credit trends remain favorable

—

Net charge-offs (NCOs) of $220mm (1.08% of loans and leases) down $19mm (8 bps)

vs. 4Q11; lowest since 4Q07 —

Total NPAs of $1.8bn including loans HFS down $164mm or 8% sequentially; lowest since

1Q08 —

NPA ratio of 2.03% down 20 bps from 4Q11, NPL ratio of 1.64% down 12 bps from 4Q11;

gross NPL inflows of $351mm down 11% sequentially

—

Provision expense `of $91mm, up $36mm vs. 4Q11; loan loss allowance down $129mm

sequentially; allowance to loan ratio of 2.59%, 127% of NPAs, 157% of

nonperforming loans and leases, and 2.4x 1Q12 annualized NCOs —

Total delinquencies (loans 30-89 days past due and >90 days past due) down

11% sequentially, lowest since 3Q05 —

No direct European sovereign exposure; total exposure to European peripheral

borrowers <$0.2bn; total exposure to European banks <$0.1bn**

Strong capital ratios; exceed fully phased-in Basel III proposed standards

—

Tier 1 common ratio 9.64%*, up 29 bps sequentially (pro forma***

~10.0% on a fully-phased in Basel III-adjusted

basis, estimated among highest of large cap U.S. banks)

—

Tier 1 capital ratio 12.19%, Total capital ratio 16.06%, Leverage ratio 11.31%

—

Tangible common equity ratio* of 9.02% excluding unrealized gains/losses; 9.37%

including them —

Book value per share of $14.30, tangible book value per share* of $11.64 (up 3% from

4Q11) Significant items in 1Q12 results related to Vantiv

$ in mm, except per share data

Net income impact

After tax EPS

impact

Pre-tax

After tax

Gains associated with Vantiv IPO

$115

~$75

~$0.08

Vantiv debt termination-related charges (estimated)

~($36)

~($23)

~($0.02)

Gains on higher valuation of Vantiv puts and warrants

$46

~$30

~$0.03

1Q12 in review

* Non-GAAP measure; See Reg. G reconciliation in appendix

** “European” includes non-Eurozone countries; “European peripheral” includes

Greece, Ireland, Italy, Portugal, Spain *** Current estimate (non-GAAP), subject to final

rule-making and clarification by U.S. banking regulators; currently assumes unrealized securities gains are included

in common equity for purposes of this calculation

|

4

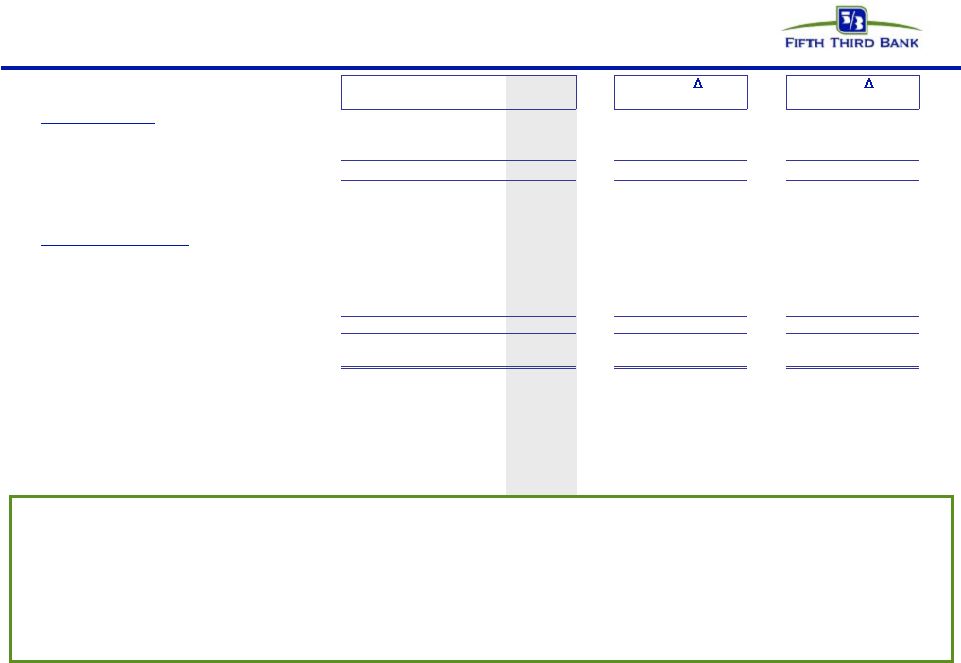

Financial summary

•

1Q12 earnings of $0.45 per diluted share driven by strong core performance and gains

associated with Vantiv’s IPO –

Included $115mm pre-tax gains associated with Vantiv’s IPO and $46mm in

positive valuation adjustments on the Vantiv warrant and put option, as well

as estimated $36mm pre-tax charges related to Vantiv’s bank debt

refinancing and termination

•

13% return on average common equity; 16% return on average tangible common

equity^ •

Average transaction deposits up 2%; core deposits up 1% sequentially

•

Average loans* up 5% from 1Q11, reflecting strength in C&I, commercial lease,

residential mortgage, and auto loans Actual

Seq.

YOY

($ in millions)

1Q11

4Q11

1Q12

$

%

$

%

Average Balances

Commercial loans*

$43,410

$44,636

$45,913

$1,277

3%

$2,503

6%

Consumer loans*

34,226

35,278

35,587

309

1%

1,361

4%

Total loans & leases*

$77,636

$79,914

$81,500

$1,586

2%

$3,864

5%

Core deposits

$77,524

$80,587

$81,686

$1,099

1%

$4,162

5%

Income Statement Data

Net interest income (taxable equivalent)

$884

$920

$903

($17)

(2%)

$19

2%

Provision for loan and lease losses

168

55

91

36

64%

(77)

(46%)

Noninterest income

584

550

769

219

40%

185

32%

Noninterest expense

918

993

973

(20)

(2%)

55

6%

Net Income

$265

$314

$430

$116

37%

$165

62%

Net income available to common shareholders

$88

$305

$421

$116

38%

$333

377%

Pre-provision net revenue^

$545

$473

$694

$221

47%

$149

27%

Earnings per share, diluted

$0.10

$0.33

$0.45

$0.12

36%

$0.35

350%

Net interest margin

3.71%

3.67%

3.61%

(6bps)

(2%)

(10bps)

(3%)

Return on average assets

0.97%

1.08%

1.49%

41bps

38%

52bps

54%

Return on average common equity

3.1%

9.5%

13.1%

360bps

38%

1000bps

323%

Return on average tangible common equity^

4.2%

11.9%

16.2%

430bps

36%

1200bps

286%

^

Non-GAAP measure; See Reg. G reconciliation in appendix

Note: Numbers may not sum due to rounding and percentages are calculated on actual

dollar amounts not the rounded dollar amounts ©

Fifth Third Bank | All Rights Reserved |

5

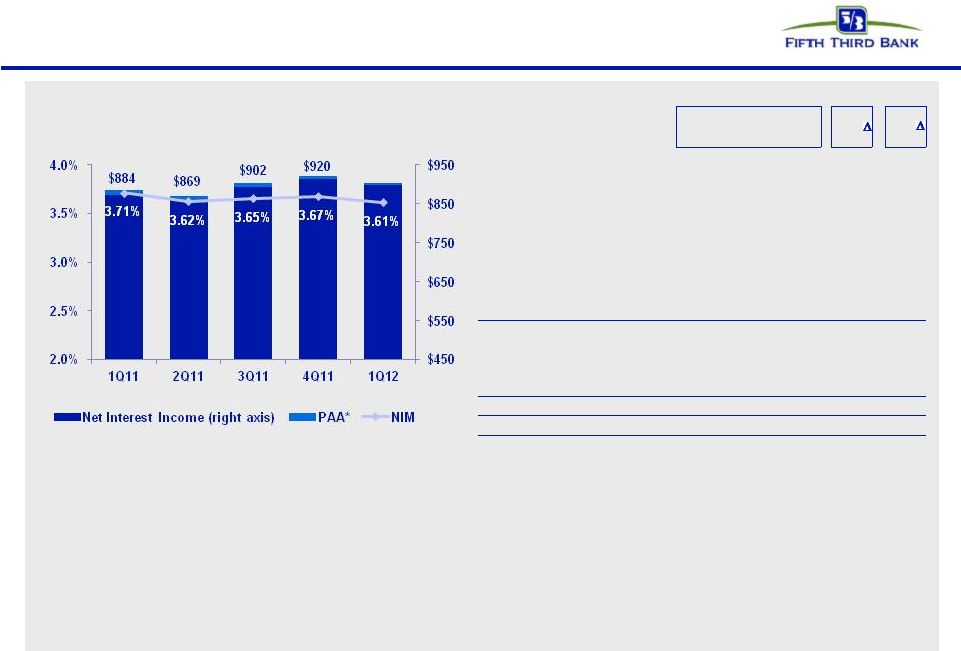

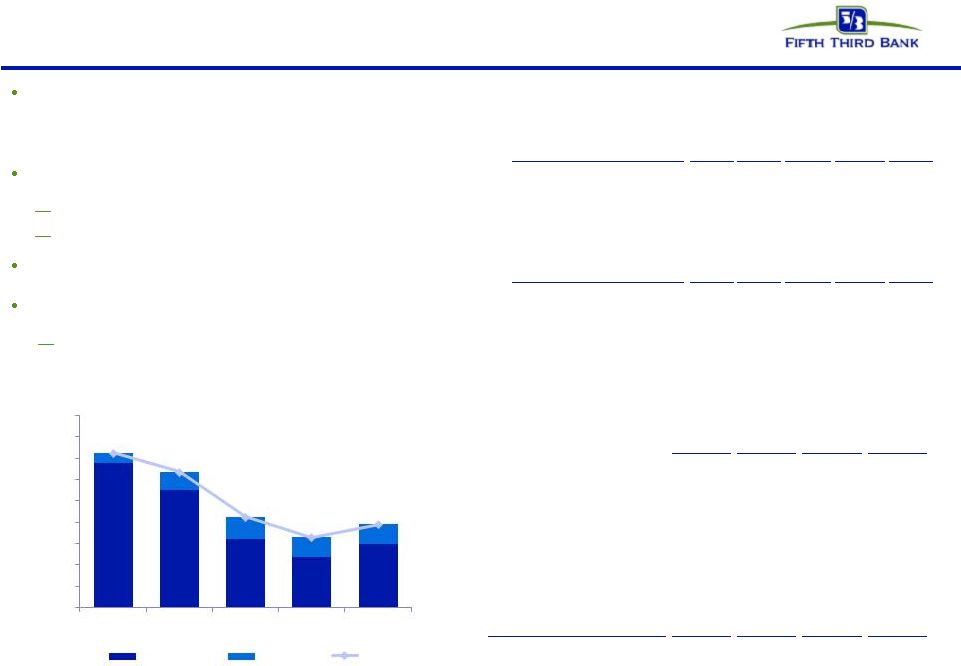

Net interest income

NII and NIM (FTE)

•

Sequential net interest income trends reflected lower yields on loans and lower

reinvestment rates on securities given the current interest rate environment

partially offset by growth in C&I, commercial lease, residential mortgage,

and auto loan balances –

NII down $17mm, or 2%, sequentially and up $19mm, or 2% year-over-year

–

NIM down 6 bps sequentially and 10 bps year-over-year

•

Yield on interest-earning assets declined 5 bps sequentially and 29 bps

year-over-year * Represents purchase accounting adjustments included

in net interest income. Yield Analysis

1Q11

4Q11

1Q12

(bps)

YoY

(bps)

Commercial and industrial loans

4.45%

4.28%

4.20%

(8)

(25)

Commercial mortgage loans

4.11%

3.89%

3.95%

6

(16)

Commercial construction loans

3.15%

3.04%

3.04%

-

(11)

Commercial leases

4.17%

3.87%

3.79%

(8)

(38)

Residential mortgage loans

4.67%

4.16%

4.17%

1

(50)

Home equity

3.96%

3.87%

3.85%

(2)

(11)

Automobile loans

5.10%

4.27%

3.99%

(28)

(111)

Credit card

10.43%

9.66%

9.43%

(23)

(100)

Other consumer loans and leases

18.54%

36.95%

40.13%

318

2,159

Total loans and leases

4.67%

4.41%

4.34%

(7)

(33)

Taxable securities

3.96%

3.75%

3.68%

(7)

(28)

Tax exempt securities

4.77%

5.42%

5.60%

18

83

Other short-term investments

0.25%

0.24%

0.26%

2

1

Total interest-earning assets

4.47%

4.23%

4.18%

(5)

(29)

Total interest-bearing liabilities

1.02%

0.79%

0.79%

-

(23)

Net interest spread

3.45%

3.44%

3.39%

(5)

(6)

©

Fifth Third Bank | All Rights Reserved

($mm)

$903

Seq. |

6

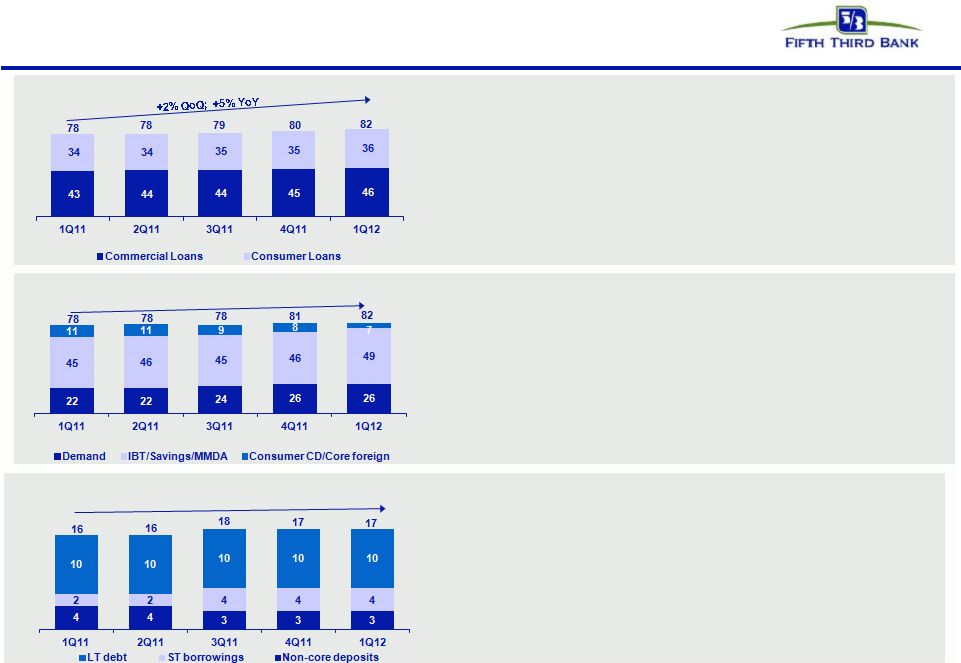

Balance sheet

•

C&I loans up 5% sequentially and 15% from 1Q11

•

CRE loans down 3% sequentially and 13% from 1Q11

•

Consumer loans up 1% sequentially and 4% from 1Q11

•

Average warehoused residential mortgage loans held-for-sale were

$2.1B in 1Q12 versus $2.2B in 4Q11

+1% QoQ; +5% YoY

•

Core deposit to loan ratio of 100%, flat versus 1Q11

•

DDAs flat sequentially and up 21% year-over-year

•

Consumer average transaction deposits up 1% sequentially and 7%

from the previous year

•

Commercial average transaction deposits up 3% sequentially and

14% from the previous year

Average loan growth ($B)^

Average core deposit growth ($B)

(2%) QoQ; +1%YoY

Average wholesale funding ($B)

•

Wholesale funding relatively flat year-over-year

–

Non-core deposits up 3% sequentially

–

Short term borrowings down 12% sequentially

–

Long-term debt up 1% sequentially

^ Excludes loans held-for-sale

Note: Numbers may not sum due to rounding

©

Fifth Third Bank | All Rights Reserved |

7

Noninterest income

•

Noninterest income of $769mm increased $219mm, or 40%, from prior quarter; driven by

the net benefit of Vantiv’s IPO, related debt refinancing, and warrant

gains; lower charges on the Visa total return swap; and higher mortgage

banking and corporate banking revenue •

1Q12 debit interchange revenue of $29mm, versus $29mm in 4Q11 and $54mm in 1Q11

•

Credit costs recorded in noninterest income:

Noninterest income

Note: Numbers may not sum due to rounding

Actual

($ in millions)

1Q11

4Q11

1Q12

Gain / (loss) on sale of loans

$17

$9

$5

Commercial loans HFS FV adjustment

(16)

(18)

(1)

Gain / (loss) on sale of OREO properties

(2)

(22)

(17)

Mortgage repurchase costs

(2)

(1)

(2)

Total credit-related revenue impact

($3)

($33)

($14)

Actual

Seq.

YOY

1Q11

4Q11

1Q12

$

%

$

%

($ in millions)

Service charges on deposits

$124

$136

$129

($7)

(5%)

$5

4%

Corporate banking revenue

86

82

97

15

18%

11

13%

Mortgage banking net revenue

102

156

204

48

31%

102

100%

Investment advisory revenue

98

90

96

6

7%

(2)

(1%)

Card and processing revenue

80

60

59

(1)

(2%)

(21)

(27%)

Other noninterest income

81

24

175

151

629%

94

116%

Securities gains, net

8

5

9

4

80%

1

13%

Securities gains, net -

5

(3)

-

3

NM

(5)

NM

non-qualifying hedges on MSRs

Noninterest income

$584

$550

$769

$219

40%

$185

32%

©

Fifth Third Bank | All Rights Reserved |

8

Noninterest expense

Noninterest expense

•

Noninterest expense of $973mm decreased $20mm, or 2%, compared with 4Q11, driven by a

$23mm benefit from resolution of certain outstanding disputes for

non-income tax related assessments, partially offset by seasonally high

FICA and unemployment costs; additions to litigation reserves; debt termination charges; and severance

expense

•

Credit costs recorded in noninterest expense:

Note: Numbers may not sum due to rounding

©

Fifth Third Bank | All Rights Reserved

Actual

Seq.

YOY

1Q11

4Q11

1Q12

$

%

$

%

($ in millions)

Salaries, wages and incentives

$351

$393

$399

$6

2%

$48

14%

Employee benefits

97

84

112

28

32%

15

15%

Net occupancy expense

77

79

77

(2)

(2%)

-

-

Technology and communications

45

48

47

(1)

(2%)

2

4%

Equipment expense

29

27

27

-

(1%)

(2)

(6%)

Card and processing expense

29

28

30

2

5%

1

3%

Other noninterest expense

290

334

281

(53)

(16%)

(9)

(3%)

Noninterest expense

$918

$993

$973

($20)

(2%)

$55

6%

Actual

($ in millions)

1Q11

4Q11

1Q12

Mortgage repurchase expense

$8

$18

$15

Provision for unfunded commitments

(16)

(6)

(2)

Derivative valuation adjustments

(0)

(5)

(4)

OREO expense

13

8

5

Other problem asset related expenses

27

28

19

Total credit-related operating expenses

$31

$44

$34 |

9

Pre-tax pre-provision earnings*

PPNR trend

*Non-GAAP measure. See Reg. G reconciliation in appendix.

^ Prior quarters include similar adjustments.

^^ See Slide 7 and Slide 8 for detailed breakout of credit-related items.

•

PPNR of $694mm up 47% from 4Q11 levels and up 27% over prior year

reflecting increased noninterest income and decreased

noninterest expense, partially offset by lower net interest income

•

Adjusted PPNR

of

$584mm,

including

negative

adjustments

totaling

$110mm,

up

10%

sequentially and 7% year-over-year

PPNR reconciliation

©

Fifth Third Bank | All Rights Reserved

($ in millions)

1Q11

2Q11

3Q11

4Q11

1Q12

Income before income taxes (U.S. GAAP) (a)

$377

$506

$530

$418

$603

Add: Provision expense (U.S. GAAP) (b)

168

113

87

55

91

PPNR (a) + (b)

$545

$619

$617

$473

$694

Adjustments to remove (benefit) / detriment^:

Vantiv IPO gain

-

-

-

-

(115)

Vantiv debt refinancing

-

-

-

-

36

Valuation of 2009 Visa total return swap

9

4

17

54

19

Securities (gains) / losses

(8)

(6)

(26)

(5)

(9)

Non-income tax related assessment resolution

-

-

-

-

(23)

Vantiv warrants & puts

2

(29)

(3)

(10)

(46)

Extinguishment (gains) / losses

(3)

(6)

-

-

9

Termination of certain borrowings and hedging

transactions

-

-

28

-

-

Severance expense

-

-

-

-

6

Litigation reserve additions

1

-

4

19

13

Adjusted PPNR

$546

$582

$637

$531

$584

Credit-related items^^:

In noninterest income

3

28

25

33

14

In noninterest expense

31

36

45

44

34

Credit-adjusted PPNR**

$580

$646

$707

$608

$632

** There are limitations on the usefulness of credit-adjusted PPNR, including the significant

degree to which changes in credit and fair value are integral, recurring components of the

Bancorp’s core operations as a financial institution. This measure has been included herein to facilitate a greater understanding of the Bancorp’s financial condition. |

10

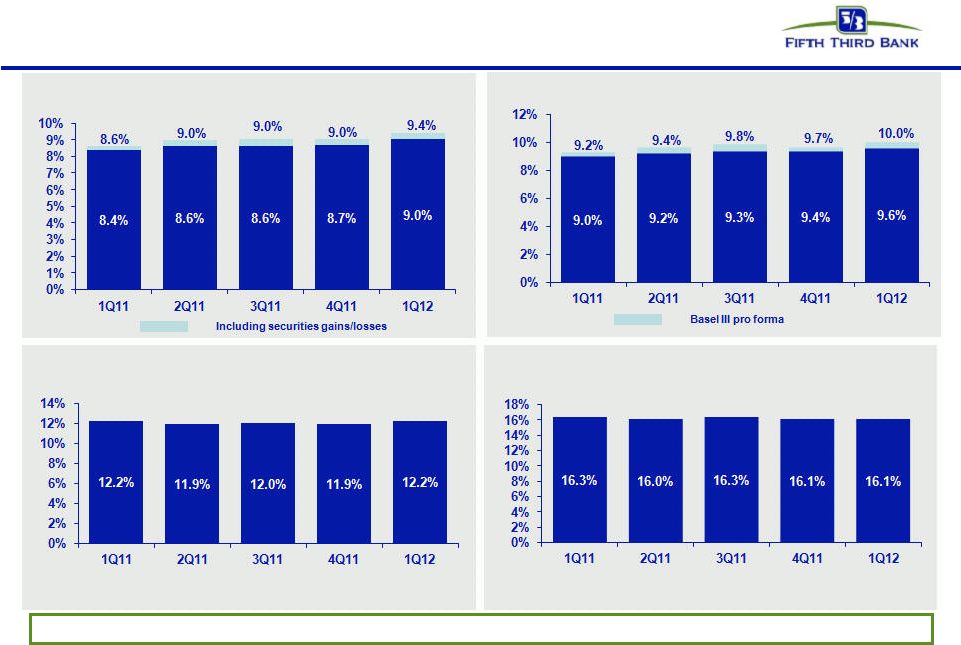

Strong capital position

Strong capital ratios under Basel I; estimated Basel III Tier 1 common ratio of

10.0%* Tangible common equity ratio^**

Tier I capital ratio

Total risk-based capital ratio

Tier 1 common equity**

©

Fifth Third Bank | All Rights Reserved

C

urrent period regulatory capital data ratios are estimated.

^ Tangible common equity ratio excluding (dark blue) and including (light blue) unrealized securities

gains / losses after-tax * Estimate, subject to final rule-making and clarification by

U.S. banking regulators; currently assumes unrealized securities gains are included in common equity for purposes of this calculation

**Non-GAAP measure. See Reg. G reconciliation in appendix. |

11

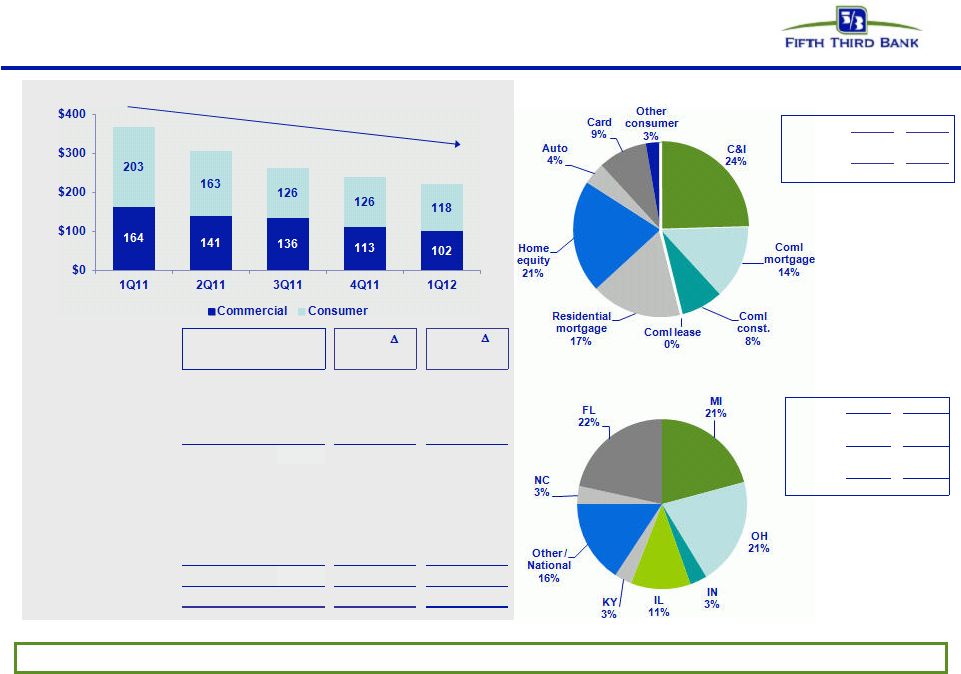

Net charge-offs

Net charge-offs by loan type

Net charge-offs by geography

Net charge-offs ($mm)

$mm

%

Commercial

$102

46%

Consumer

$118

54%

Total

$220

100%

Actual

Seq.

YOY

($ in millions)

1Q11

4Q11

1Q12

$

%

$

%

C&I

$83

$62

$54

($8)

(13%)

($29)

(35%)

Commercial mortgage

54

47

30

(17)

(36%)

(24)

(44%)

Commercial construction

26

4

18

14

350%

(8)

(31%)

Commercial lease

1

-

-

-

NM

(1)

(100%)

Commercial

$164

$113

$102

($11)

(10%)

($62)

(38%)

Residential mortgage loans

65

36

37

1

3%

(28)

(43%)

Home equity

63

50

46

(4)

(8%)

(17)

(27%)

Automobile

20

13

9

(4)

(31%)

(11)

(55%)

Credit card

31

21

20

(1)

(5%)

(11)

(35%)

Other consumer

24

6

6

-

-

(18)

(75%)

Consumer

$203

$126

$118

($8)

(6%)

($85)

(42%)

Total net charge-offs

$367

$239

$220

($19)

(8%)

($147)

(40%)

Year-over-year charge-offs down significantly due to improving credit

trends $mm

%

Florida

$47

22%

Michigan

46

21%

Subtotal

$93

43%

Other

127

57%

Total

$220

100%

©

Fifth Third Bank | All Rights Reserved

$239

$220

$367

$304

$262 |

©

Fifth Third Bank | All Rights Reserved

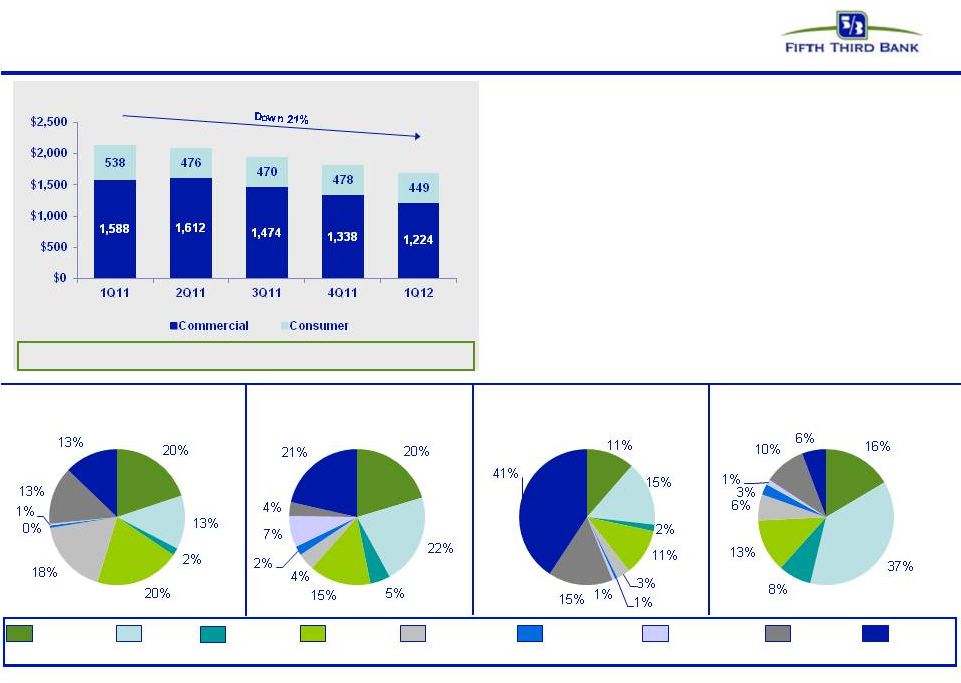

Nonperforming assets

•

NPAs of $1.7B excluding held-for-sale down

21% year-over-year

•

Commercial NPAs of $1.2B, down 23% from

the previous year

–

Homebuilder / developer NPAs of

$123mm; represent 10% of total

commercial NPAs

•

Consumer NPAs of $449mm, down 17% from

the previous year

•

NPAs in held-for-sale of $117mm

C&I / Lease

$485mm, 29%

CRE

$739mm, 44%

Residential

$393mm, 24%

Other Consumer

$56mm, 3%

ILLINOIS

INDIANA

FLORIDA

TENNESSEE

KENTUCKY

OHIO

MICHIGAN

NORTH

CAROLINA

OTHER /

NATIONAL

NPAs exclude loans held-for-sale.

Nonperforming assets ($mm)

$1,944

$1,816

Nonperforming assets continue to improve

$1,673

$2,126

$2,088

12 |

13

NPL Rollforward

Significant improvement in NPL inflows over past year

Note: Numbers may not sum due to rounding

©

Fifth Third Bank | All Rights Reserved

NPL HFI Rollforward

Commercial

1Q11

2Q11

3Q11

4Q11

1Q12

Beginning NPL Amount

1,214

1,211

1,253

1,155

1,058

Transfers to nonperforming

329

340

217

189

168

Transfers to performing

(2)

(10)

(11)

-

(1)

Transfers to performing (restructured)

-

-

(1)

-

(2)

Transfers from held for sale

-

-

-

4

-

Transfers to held for sale

(16)

(15)

(58)

(3)

(3)

Loans sold from portfolio

(12)

(7)

(17)

(21)

(8)

Loan paydowns/payoffs

(108)

(91)

(77)

(149)

(94)

Transfer to other real estate owned

(37)

(39)

(20)

(14)

(36)

Charge-offs

(164)

(141)

(136)

(113)

(101)

Draws/other extensions of credit

7

5

5

10

7

Ending Commercial NPL

1,211

1,253

1,155

1,058

988

Consumer

1Q11

2Q11

3Q11

4Q11

1Q12

Beginning NPL Amount

466

434

386

383

380

Transfers to nonperforming

232

214

201

205

184

Transfers to performing

(35)

(34)

(33)

(28)

(36)

Transfers to performing (restructured)

(50)

(41)

(39)

(39)

(36)

Transfers to held for sale

-

-

-

-

-

Loans sold from portfolio

(1)

(21)

-

-

(4)

Loan paydowns/payoffs

(18)

(27)

(27)

(26)

(28)

Transfer to other real estate owned

(18)

(15)

(16)

(30)

(18)

Charge-offs

(144)

(126)

(91)

(87)

(80)

Draws/other extensions of credit

2

2

2

2

2

Ending Consumer NPL

434

386

383

380

364

Total NPL

1,645

1,639

1,538

1,438

1,352

Total new nonaccrual loans -

HFI

561

554

418

394

352 |

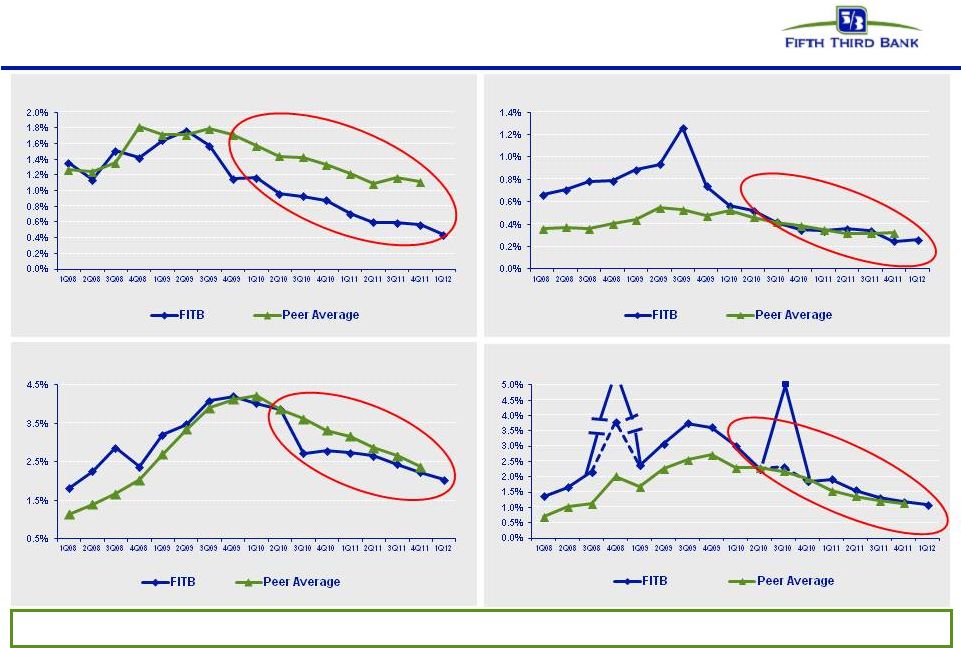

14

Continued improvement in credit trends

FITB credit metrics are in line with or better than peers

NPA ratio vs. peers

Net charge-off ratio vs. peers

Loans 90+ days delinquent % vs. peers

Loans 30-89 days delinquent % vs. peers

(7.5%)*

(HFS transfer)

3.8%

Before credit

actions

5.0%*

2.3%

Before credit

actions

©

Fifth Third Bank | All Rights Reserved

Peer average includes: BBT, CMA, HBAN, KEY, MTB, PNC, RF, STI, USB, WFC, and ZION

Source: SNL Financial and company filings. All ratios exclude loans held-for-sale and covered

assets for peers where appropriate. * 4Q08 NCOs included $800mm in NCOs related to commercial

loans moved to held-for-sale; 3Q10 NCOs included $510mm in NCOs related to loans sold or moved to held-for-sale

|

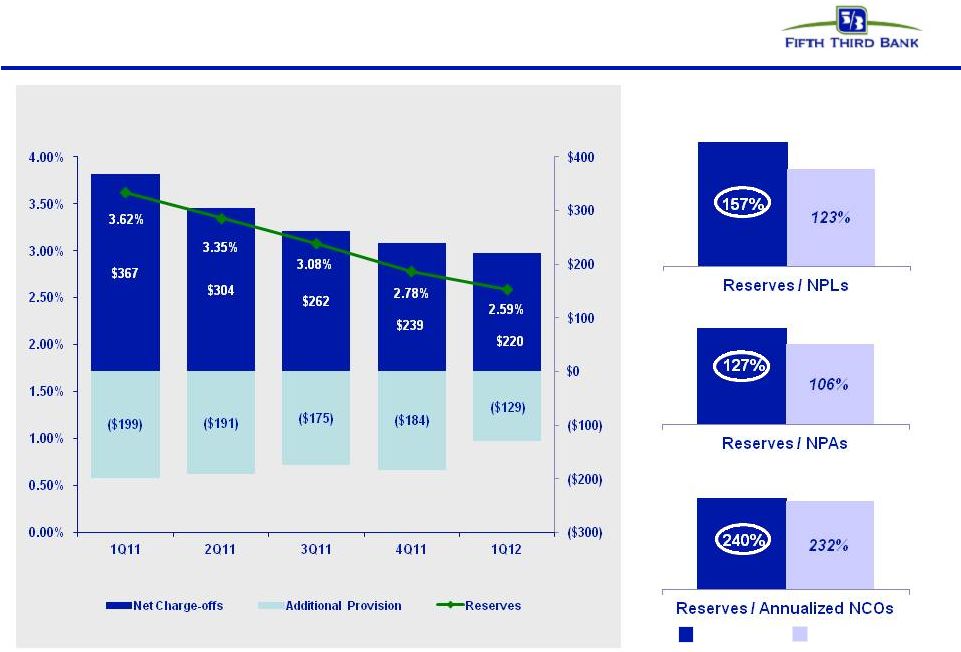

15

Strong reserve position

Peer average includes: BBT, CMA, HBAN, KEY, MTB, PNC, RF,STI, USB, WFC, and

ZION Source: SNL and company reports. NPAs / NPLs exclude

held-for-sale portion for all banks as well as covered assets for BBT, USB, and ZION

1Q12 coverage ratios strong

relative to peers (4Q11)

Industry leading reserve levels

Fifth Third

(1Q12)

Peer Average

(4Q11)

©

Fifth Third Bank | All Rights Reserved |

16

Mortgage repurchase overview

18% rise in 1Q12 outstanding claims balance from prior

quarter

—

Within recent norms of quarterly increases and

decreases

Virtually all sold loans and the majority of new claims relate

to agencies

Majority of outstanding balances of the serviced for others

portfolio relates to origination activity in 2009 and later

Private claims and exposure relate to whole loan sales (no

outstanding first mortgage securitizations)

Repurchase Reserves* ($ in millions)

Outstanding Counterparty Claims ($ in millions)

Outstanding Balance of Sold Loans ($ in millions)

1Q11

2Q11

3Q11

4Q11

1Q12

Beginning balance

101

87

80

69

72

Net reserve additions

10

15

20

20

17

Repurchase losses

(23)

(23)

(31)

(17)

(17)

Ending balance

87

80

69

72

71

2005 and prior

GSE

GNMA

Private

Total

$6,680

$273

$492

$7,445

2006

1,550

55

250

1,855

2007

2,509

80

215

2,804

2008

2,406

633

0.3

3,039

2009

9,462

3,563

0.7

13,026

2010 and later

26,338

5,884

0.3

32,222

Total

$48,945

$10,488

$958

$60,391

*Includes

reps

and

warranty

reserve

($55mm)

and

reserve

for

loans

sold

with

recourse

($17mm)

% Current

40% 42% 49% 41%

37%

©

Fifth Third Bank | All Rights Reserved

135

110

64

47

60

17

21

19

18

$145

$127

$85

$66

$78

$-

$20

$40

$60

$80

$100

$120

$140

$160

$180

1Q11

2Q11

3Q11

4Q11

1Q12

Agencies

Private

Total Claims

10

98% of outstanding balance of loans sold

77% of current quarter outstanding claims

Preponderance of private sales prior to 2006

Note: Numbers may not sum due to rounding |

17

*“European”

includes

non-Eurozone

countries;

“European

peripheral”

includes

Greece,

Ireland,

Italy,

Portugal,

Spain

Traditional banking focus

consistent with direction of financial reform

Business

profile

positions

Fifth

Third

well

–

today

and

in

the

future

•

Do not require substantial changes to Fifth Third’s business model or asset mix

with attendant execution risk

•

Fifth Third’s business model is driven by traditional banking activities,

consistent with direction of financial reform

Dodd-Frank /

Basel III

•

International activity primarily related to trade finance and lending to U.S.

subsidiaries of foreign companies (e.g. Fifth Third loss in Lehman bankruptcy

expected to be less than $2mm)

Financial system

interconnectedness

•

Little to no impact (de minimis market maker in derivatives, proprietary

trading) –

Low trading business activity; daily VaR ~$1mm or less

–

Small private equity portfolio <$200mm

Volcker rule

•

Other large firms facing significant litigation related to mortgage securitizations,

GSE repurchases, and private label mortgage repurchases

•

Fifth Third’s mortgage risks are manageable

–

Quarterly mortgage repurchase costs ~$20mm

–

Total

mortgage securitizations outstanding $19mm (2003 HELOC performing well)

Mortgage Putback /

Litigation risk

•

No significant business at Fifth Third impaired during crisis

Effect of crisis on

core business

•

No direct European sovereign exposure

European banks and

sovereign debt

exposure

©

Fifth Third Bank | All Rights Reserved

No originations of CDOs, securitizations on behalf of others

–

Didn’t originate or sell subprime mortgages or Option ARMs

Total exposure to European peripheral borrowers less than $0.2 billion*

Total exposure to European banks less than $0.1B |

18

Appendix

©

Fifth Third Bank | All Rights Reserved |

19

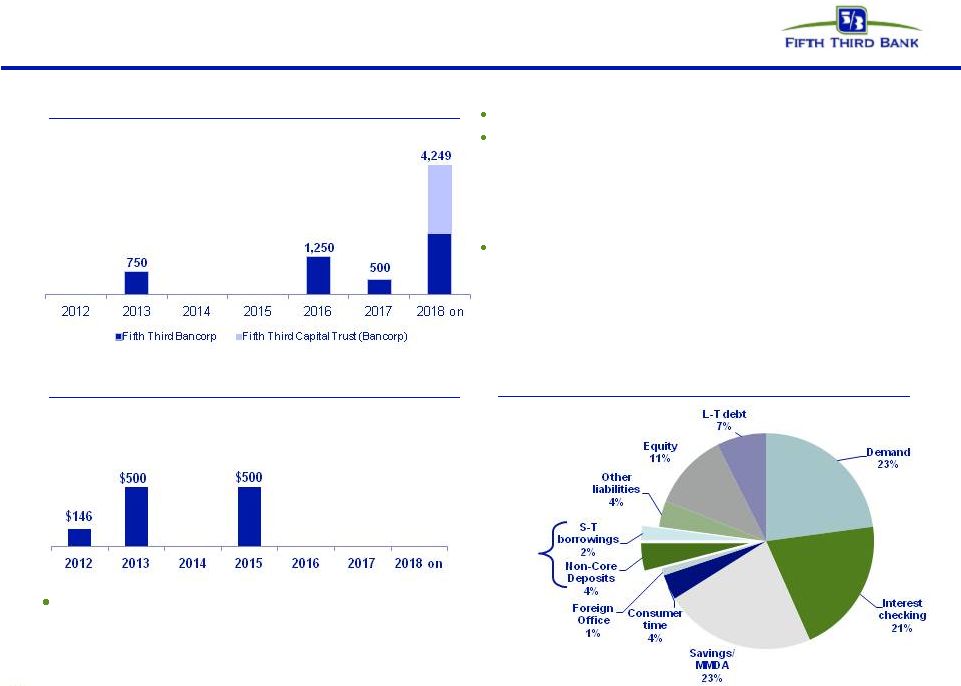

Well-positioned for the future

•

Holding company cash currently sufficient for more than 3 years of obligations; no

holding company and minimal Bank unsecured debt maturities until 2013

•

Fifth Third has completely exited all crisis-era government support

programs Superior capital and liquidity position

•

NCOs of 1.1%; 2.4x reserves / annualized NCOs

•

Substantial reduction in exposure to CRE since 1Q09; relatively low CRE exposure

versus peers •

Very low relative exposure to areas of concern, e.g. European financials, mortgage

repurchase risk Proactive approach to risk management

•

Traditional commercial banking franchise built on customer-oriented localized

operating model •

Strong market share in key markets with focus on further improving density

•

Fee income ~46% of total revenues

Diversified traditional banking platform

•

PPNR has remained strong throughout the credit cycle

•

PPNR substantially exceeds annual net charge-offs (315% PPNR / NCOs^ in

1Q12) •

1.5% ROAA; 16% return on average tangible common equity^

Industry leader in earnings power

^ Non-GAAP measure. See Reg. G reconciliation on slides 34-35.

©

Fifth Third Bank | All Rights Reserved

Fifth Third is one of the few large banks that have no TLGP-guaranteed debt to

refinance in 2012 |

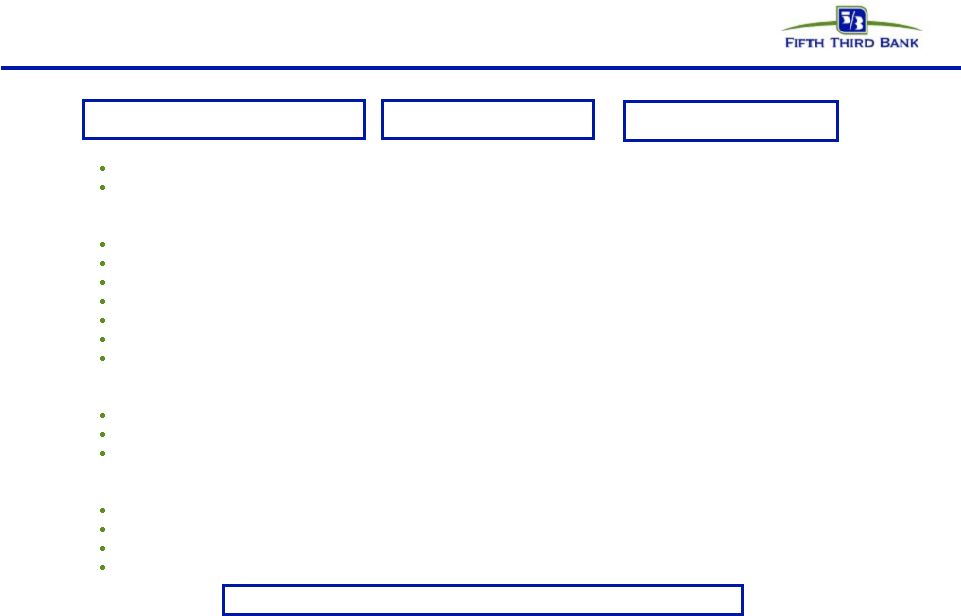

20

Balance Sheet:

Average loans & leases (excl. HFS)

Average transaction deposits

Income Statement:

Net interest income*

Net interest margin*

Noninterest income

Noninterest expense

Pre-provision net revenue**

ROA

Effective tax rate

Asset Quality:

Net charge-offs

Loan loss allowance

Nonperforming assets^

Capital

Ratios

#

:

Tier I common equity** (Basel III)

Tier I leverage

Tier I capital

Total risk-based capital

Category

Fifth Third: Outlook

2Q12 Outlook

$81.5bn

$77.1bn

~$895mm +/-

Down ~5-6 bps +/-

vs.1Q12

~$625mm +/-

Down ~$15mm vs. 1Q12

~1Q12 levels (ex-Vantiv) +/-

~1.1 -1.2%

~32-33% for 2Q12 (29% FY2012)

*Presented on a fully-taxable equivalent basis.

** Non-GAAP measure. See Reg. G reconciliation on slides 34-35.

^ Ratio as a percent of loans excluding held-for-sale; allowance

expectation assumes current expectation for credit and economic trends and is subject to review at quarter-end.

^^ Annualized net charge-offs as a percentage of average loans and leases

# Current period regulatory capital data ratios are estimated; see slide 35 for

estimation of Basel III phased-in Tier 1 common 1Q12 Actual

Outlook as of April 19, 2012

Solid growth vs. 1Q12

Stable vs. 1Q12

Down ~$25mm vs. 1Q12 (<1.00%^^)

Lower vs. 1Q12

Down ~$75-100mm vs. 1Q12

$903mm

3.61%

$769mm ($644mm ex-Vantiv)

$973mm

$694mm ($569mm ex-Vantiv)

1.5% (1.2% ex-Vantiv)

29%

9.6% (~10.0%)

11.3%

12.2%

16.1%

$220mm(1.08%^^)

$2.1bn (2.59%)

$1.7bn (2.03%)

Please see cautionary statement on slide 2 for risk factors related to

forward-looking statements ©

Fifth Third Bank | All Rights Reserved |

21

Total

Exposure

Funded

Exposure

Total

Exposure

Funded

Exposure

Total

Exposure

Funded

Exposure

Total

Exposure

Funded

Exposure

(amounts in $mm)

Peripheral Europe

-

-

11

-

168

124

179

124

Other Eurozone

-

-

44

34

1,275

742

1,319

776

Total Eurozone

-

-

55

34

1,443

866

1,498

900

Other Europe

-

-

23

18

820

496

843

514

Total Europe

-

-

77

52

2,263

1,362

2,340

1,414

Sovereigns

Financial Institutions

Non-Financial Entities

Total

European Exposure

Total exposure includes funded and unfunded commitments, net of collateral; funded

exposure excludes unfunded exposure Peripheral Europe includes Greece,

Ireland, Italy, Portugal and Spain Eurozone

includes

countries

participating

in

the

European

common

currency

(Euro)

Other Europe includes European countries not part of the Euro (primarily the United

Kingdom and Switzerland) Data above includes exposure to U.S. subsidiaries of

Europe-domiciled companies Note: Numbers may not sum due to

rounding z

•

International exposure primarily related to trade finance and financing activities of

U.S. companies with foreign parent or overseas activities of U.S.

customers •

No European sovereign exposure (total international sovereign exposure $3mm)

•

Total exposure to European financial institutions <$80mm

•

Total exposure to five peripheral Europe countries <$200mm

•

$900mm in funded exposure to Eurozone-related companies (~1% of total loan

portfolio) z

z

©

Fifth Third Bank | All Rights Reserved |

22

Available and contingent borrowing capacity (1Q12):

–

FHLB ~$11B

–

Federal Reserve ~$24B

Holding Company cash at 3/31/12: $3.2B

Cash currently sufficient to satisfy all fixed obligations

in a stressed environment for more than 3 years

(debt maturities, common and preferred dividends,

interest and other expenses) without accessing capital

markets; relying on dividends from subsidiaries;

proceeds from asset sales

Expected cash obligations over the next 24 months

—

~$591mm common dividends

—

~$70mm Series G preferred dividends

—

~$889mm interest and other expenses

Holding company unsecured debt maturities ($mm)

Bank

unsecured

debt

maturities

($mm

–

excl.

Brokered

CDs)

Heavily core funded

Strong liquidity profile

S-T

wholesale

6%

©

Fifth Third Bank | All Rights Reserved |

23

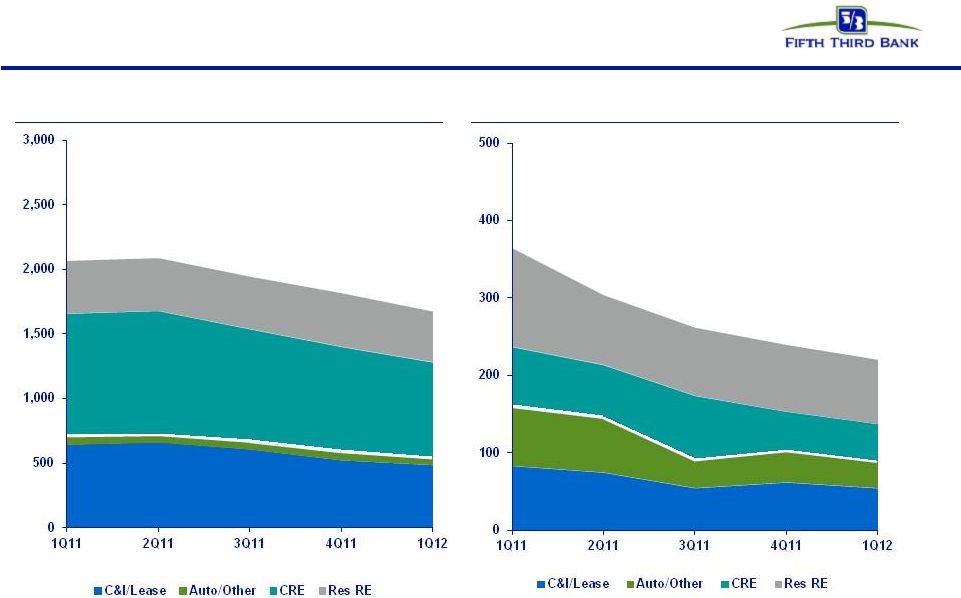

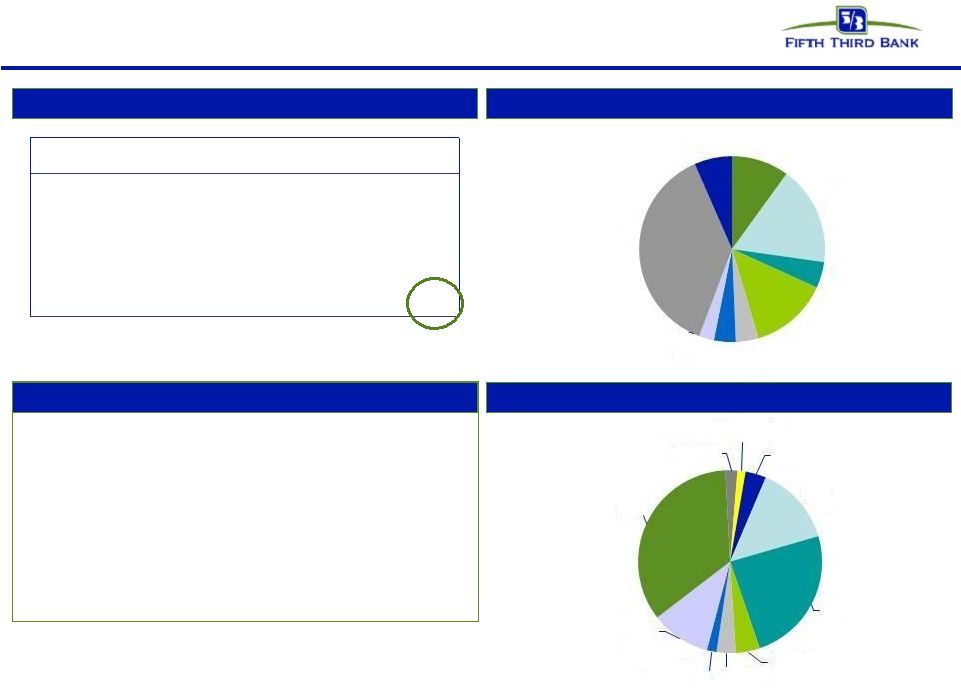

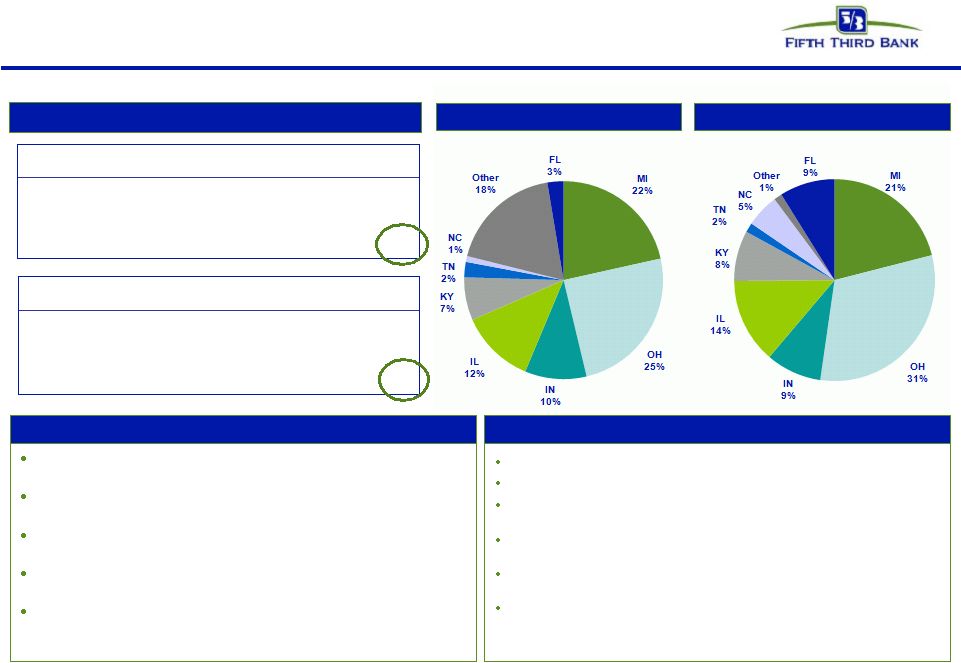

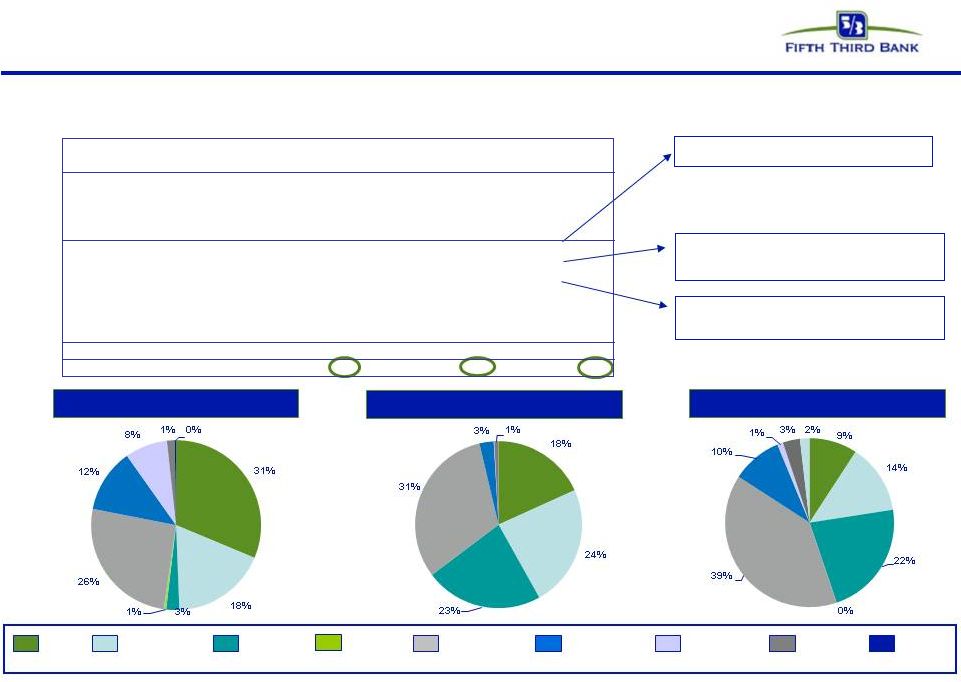

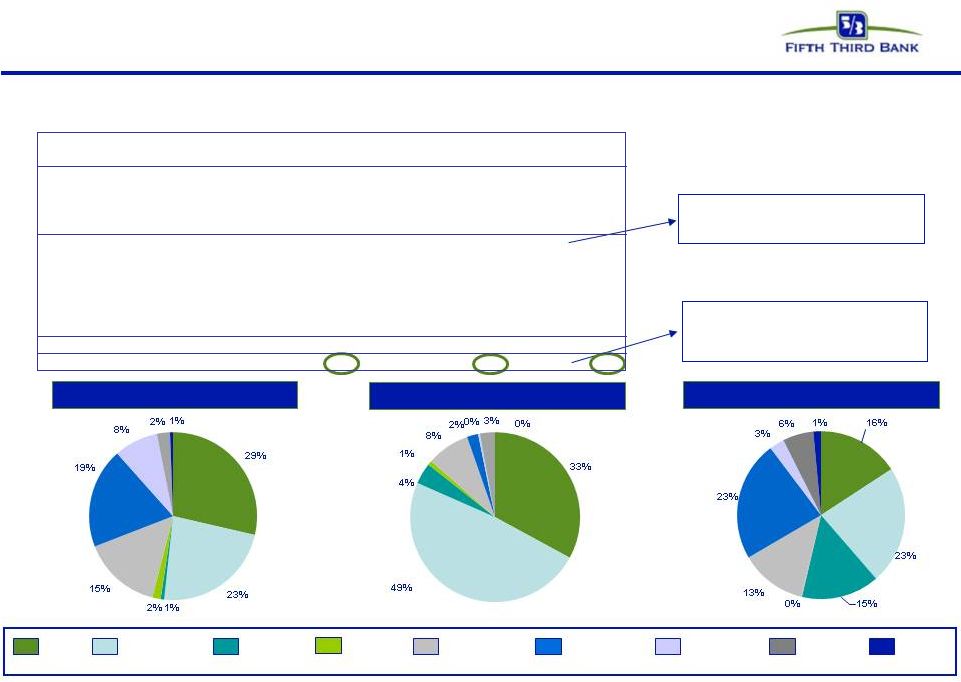

Non-performing assets and net charge-offs:

Product view*

Total NPAs

Total NCOs

*NPAs exclude loans held-for-sale.

©

Fifth Third Bank | All Rights Reserved |

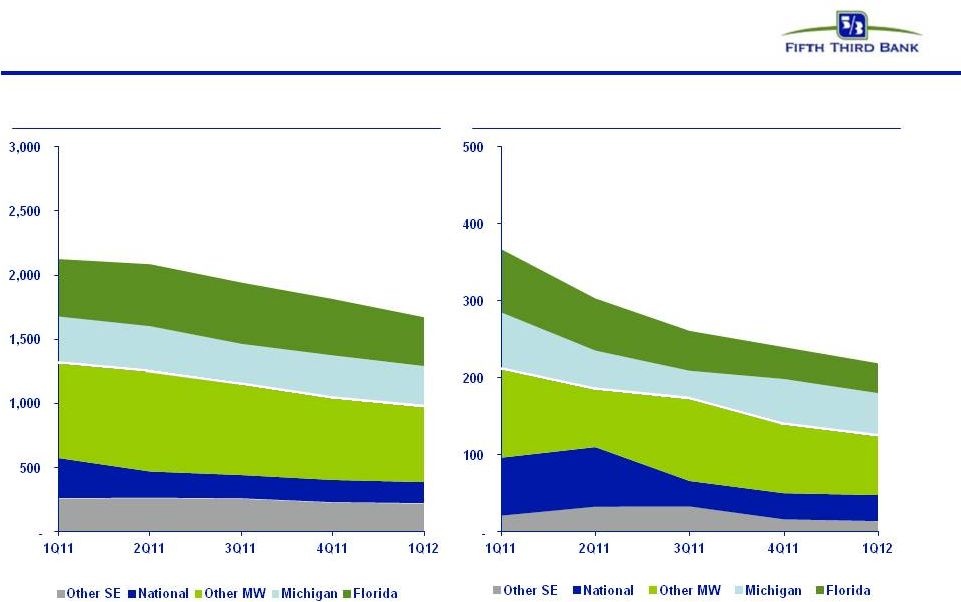

Total NPAs

Total NCOs

Non-performing assets and net charge-offs:

Geographic view*

*NPAs exclude loans held-for-sale.

24

©

Fifth Third Bank | All Rights Reserved |

25

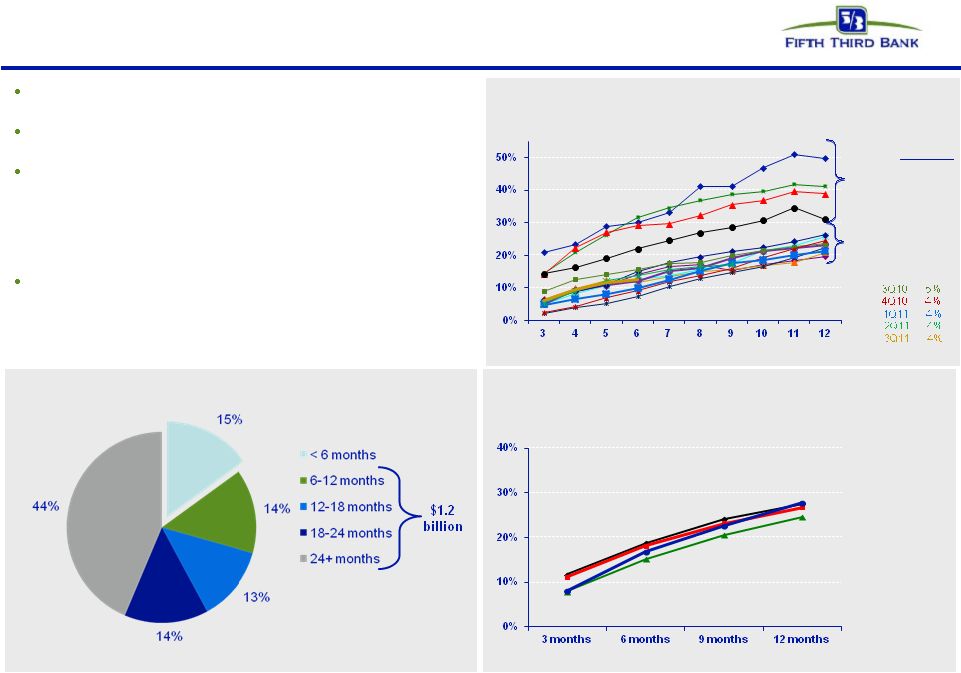

Troubled debt restructurings overview

Successive improvement in vintage performance during

2008 and 2009 as volume of modification increased

Fifth Third’s mortgage portfolio TDRs have redefaulted

at a lower rate than GSE composites

Of $1.8B in consumer TDRs, $1.6B were on accrual

status and $201mm were nonaccruals

—

$1.2B of TDRs are current and have been on the

books 6 or more months; within that, ~$1B of

TDRs are current and have been on the books for

more than a year

As current TDRs season, their default propensity

declines significantly

—

We see much lower defaults on current loans after

a vintage approaches 12 months since

modification

TDR performance has improved in newer vintages

Redefault benchmarks

Source: Fifth Third and OCC/OTS data through 3Q11

Mortgage TDR 60+ redefault trend by vintage*

1Q08 3%

2Q08 7%

3Q08 7%

4Q08 8%

1Q09 11%

2Q09 12%

Months since modification

Mortgage TDR 60+ redefault rate: Fifth Third comparison

(January 1, 2008 through December 2011)*

Fannie Mae

Industry

portfolio loans

Fifth Third

Volume by

vintage

Freddie Mac

3Q09 12%

$1.3B current consumer TDRs (%)

4Q09 7%

2008

2009-

2011

1Q10 7%

2Q10 5%

* Fifth Third data includes changes made to align with OCC/OTS methodology (i.e.

excludes government loans, closed loans and OREO from calculations)

©

Fifth Third Bank | All Rights Reserved |

26

Commercial & industrial*

Loans by geography

Credit trends

Loans by industry

Comments

•

Commercial & Industrial loans represented 39% of total loans

and 24% of net charge-offs

•

25% of 1Q12 losses on loans to companies in real estate

related industries

–

Loans to real estate related industries of $2.5B (8%);

1Q12 NCO ratio of 0.53%

•

FL represented 8% of 1Q12 losses, 6% of loans; MI

represented 14% of losses, 10% of loans

*NPAs exclude loans held-for-sale.

©

Fifth Third Bank | All Rights Reserved

($ in millions)

1Q11

2Q11

3Q11

4Q11

1Q12

EOP Balance

$27,344

$28,099

$29,258

$30,783

$32,155

Avg Loans

$27,331

$27,909

$28,777

$29,891

$31,371

90+ days delinquent

$8

$7

$9

$4

$2

as % of loans

0.03%

0.02%

0.03%

0.01%

0.01%

NPAs

$620

$638

$588

$509

$474

as % of loans

2.27%

2.27%

2.01%

1.65%

1.47%

Net charge-offs

$83

$76

$55

$62

$54

as % of loans

1.22%

1.10%

0.76%

0.82%

0.69%

C&I

Accommodation

2%

Construction

4%

Finance

&

Insurance

13%

Manufacturing

24%

Real Estate

4%

Retail Trade

4%

Auto Retailers

2%

Other

35%

MI

10%

OH

17%

IN

4%

IL

14%

KY

4%

TN

4%

NC

3%

Other /

National

38%

FL

6%

Auto

Manufacturing

1%

Wholesale

Trade

11% |

27

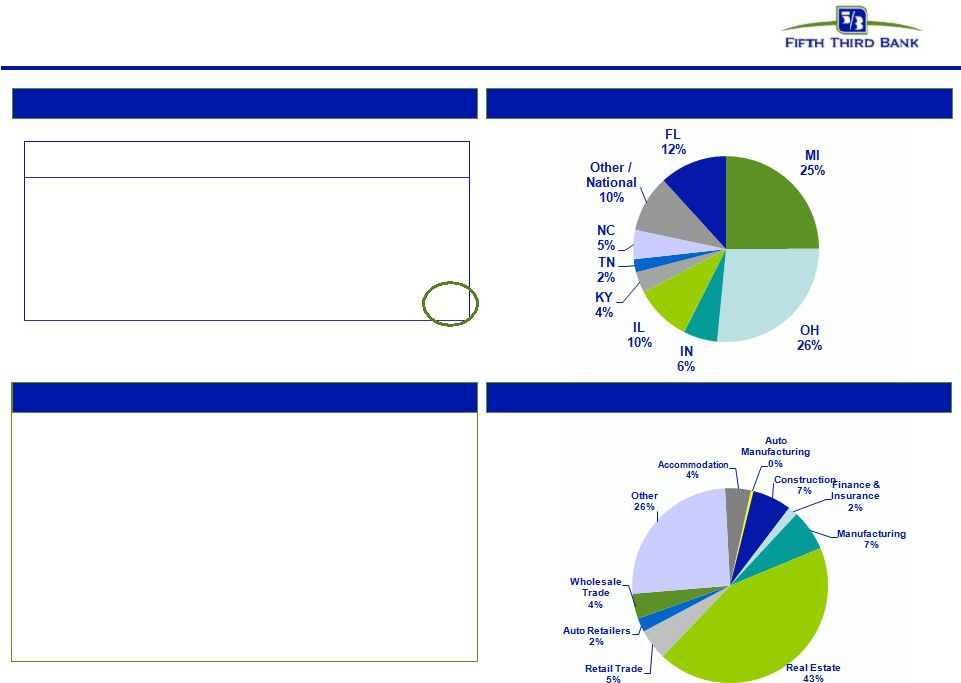

Commercial mortgage*

Loans by geography

Credit trends

Loans by industry

Comments

*NPAs exclude loans held-for-sale.

•

Commercial mortgage loans represented 12% of total loans

and 13% of net charge-offs

•

Owner occupied 1Q12 NCO ratio of 0.9%, non-owner occupied

1Q12 NCO ratio of 1.5%

•

Loans from FL/MI represented 38% of portfolio loans, 57% of

portfolio losses in 1Q12

($ in millions)

1Q11

2Q11

3Q11

4Q11

1Q12

EOP Balance

$10,510

$10,233

$10,330

$10,138

$9,909

Avg Loans

$10,685

$10,394

$10,050

$10,262

$10,007

90+ days delinquent

$8

$12

$9

$3

$30

as % of loans

0.08%

0.11%

0.09%

0.03%

0.30%

NPAs

$696

$710

$630

$637

$568

as % of loans

6.63%

6.94%

6.10%

6.28%

5.73%

Net charge-offs

$54

$47

$47

$47

$30

as % of loans

2.04%

1.83%

1.86%

1.82%

1.18%

Commercial mortgage

©

Fifth Third Bank | All Rights Reserved |

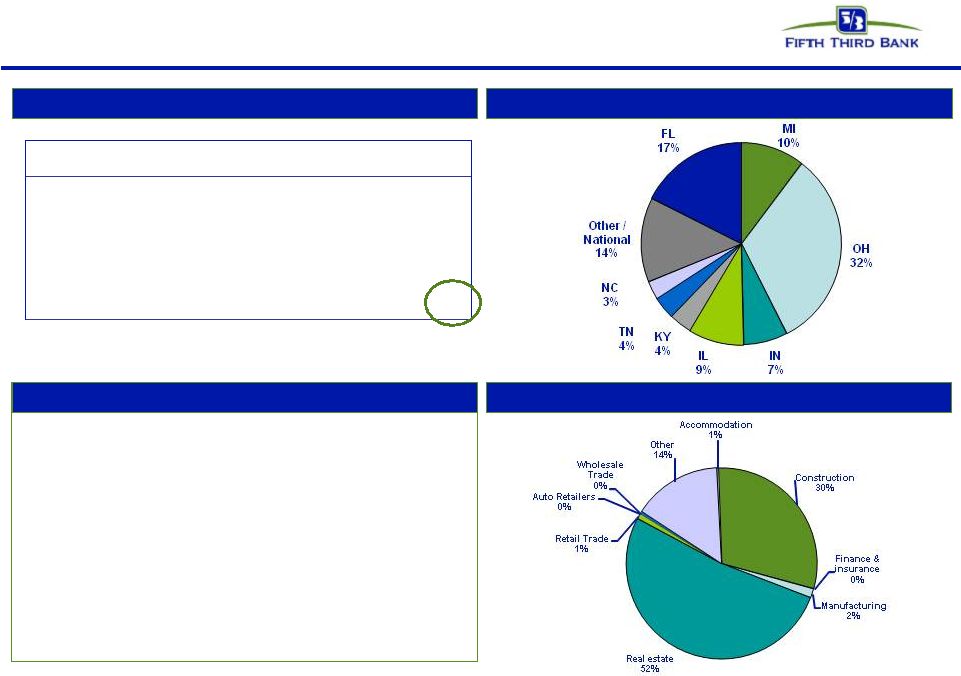

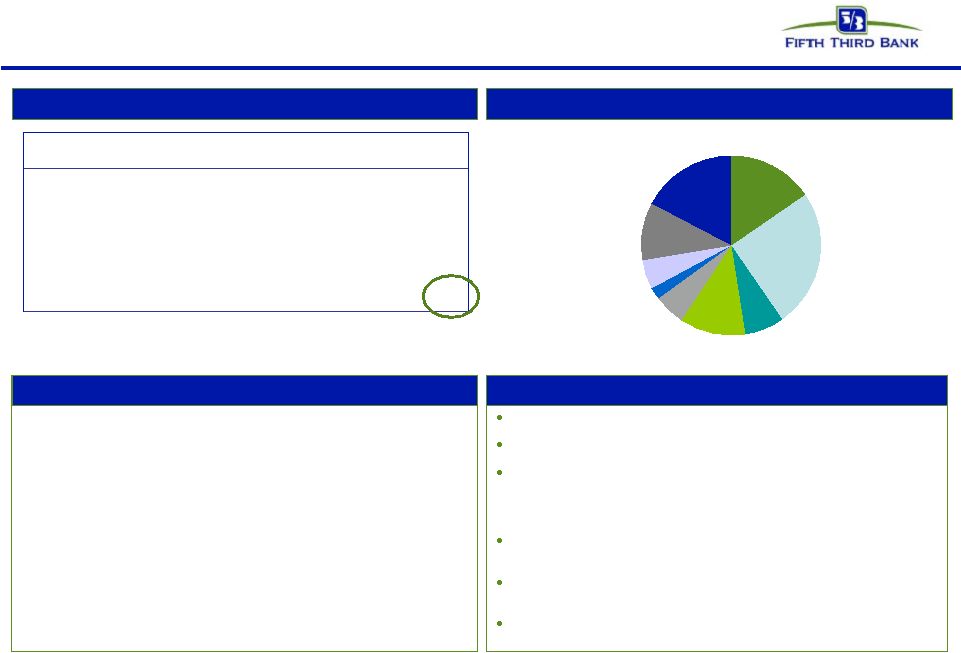

28

($ in millions)

1Q11

2Q11

3Q11

4Q11

1Q12

EOP Balance

$1,980

$1,778

$1,213

$1,020

$901

Avg Loans

$2,030

$1,918

$1,752

$1,132

$992

90+ days delinquent

$23

$48

$43

$1

$0

as % of loans

1.16%

2.71%

3.65%

0.09%

0.05%

NPAs

$248

$240

$238

$179

$171

as % of loans

12.53%

13.52%

19.60%

17.60%

19.02%

Net charge-offs

$26

$20

$35

$4

$18

as % of loans

5.24%

4.09%

7.90%

1.37%

7.30%

Commercial construction

Commercial construction*

Loans by geography

Credit trends

Loans by industry

Comments

*NPAs exclude loans held-for-sale.

•

Commercial construction loans represented 1% of total loans

and 8% of net charge-offs

•

Loans from FL/MI represented 27% of portfolio loans, 97% of

portfolio losses in 1Q12

©

Fifth Third Bank | All Rights Reserved |

29

($ in millions)

1Q11

2Q11

3Q11

4Q11

1Q12

EOP Balance

$651

$597

$578

$512

$423

90+ days delinquent

$1

$1

$3

$0

$1

as % of loans

0.16%

0.19%

0.59%

0.03%

0.15%

NPAs

$249

$243

$207

$155

$123

as % of loans

38.30%

40.67%

35.87%

30.34%

29.06%

Net charge-offs

$22

$14

$18

$2

$14

as % of loans

13.04%

8.91%

11.50%

1.28%

11.95%

Homebuilders/developers

Homebuilders/developers*

(included in previous slides)

Loans by geography

Credit trends

Loans by industry

Comments

•

Originations of builder/developer loans suspended in 2007

•

Remaining portfolio balance of $423mm, down 87% from

peak of $3.3B in 2Q08; represents approximately 0.5% of

total loans and 0.9% of commercial loans

•

$14mm of NCOs (17% commercial mortgage, 81%

commercial construction, 2% C&I)

•

$123mm of NPAs (53% commercial mortgage, 38%

commercial construction, 9% C&I)

*NPAs exclude loans held-for-sale.

©

Fifth Third Bank | All Rights Reserved |

30

©

Fifth Third Bank | All Rights Reserved

Residential mortgage

1

liens:

100%;

weighted

average

LTV:

73.6%

Weighted average origination FICO: 749

Origination FICO distribution: <660 7%; 660-689 6%; 690-719

10%; 720-749 13%; 750+ 52%; Other^ 12%

(note: loans <660 includes CRA loans and FHA/VA loans)

Origination LTV distribution: <=70 36%; 70.1-80 38%; 80.1-90 7%;

90.1-95 4%; >95 15%

Vintage distribution: 2012 8%; 2011 28%; 2010 17%; 2009 5%;

2008 6%; 2007 7%; 2006 7%; 2005 11%; 2004 and prior 11%

% through broker: 14%; performance similar to direct

Loans by geography

Credit trends

Portfolio details

Comments

^ Includes acquired loans where FICO at origination is not available

•

Residential

mortgage

loans

represented

14%

of

total

loans

and

17% of net charge-offs

•

FL portfolio 16% of residential mortgage loans and 50% of

portfolio losses

($ in millions)

1Q11

2Q11

3Q11

4Q11

1Q12

EOP Balance

$9,530

$9,849

$10,249

$10,672

$11,094

Avg Loans

$9,282

$9,654

$10,006

$10,464

$10,828

90+ days delinquent

$98

$87

$91

$79

$73

as % of loans

1.03%

0.88%

0.89%

0.74%

0.66%

NPAs

$338

$338

$337

$350

$331

as % of loans

3.55%

3.43%

3.29%

3.28%

2.98%

Net charge-offs

$65

$36

$36

$36

$37

as % of loans

2.82%

1.50%

1.41%

1.38%

1.39%

Residential mortgage

MI

15%

OH

25%

IN

7%

IL

12%

KY

6%

TN

2%

NC

5%

Other /

National

12%

FL

16%

st |

31

Home equity loans represented 13% of total loans and 21% of net

charge-offs

Approximately 14% of portfolio in broker product generated 33% total

loss

Approximately one third of Fifth Third 2

liens are behind Fifth

Third 1

liens

2005/2006 vintages represent approximately 28% of portfolio; account

for 50% of losses

Aggressive home equity line management strategies in place

($ in millions)

1Q11

2Q11

3Q11

4Q11

1Q12

EOP Balance

$9,585

$9,462

$9,380

$9,038

$8,986

90+ days delinquent

$59

$61

$62

$56

$55

as % of loans

0.62%

0.64%

0.66%

0.62%

0.62%

Net charge-offs

$39

$34

$35

$30

$31

as % of loans

1.64%

1.46%

1.50%

1.33%

1.39%

Home equity - direct

($ in millions)

1Q11

2Q11

3Q11

4Q11

1Q12

EOP Balance

$1,637

$1,586

$1,540

$1,455

$1,507

90+ days delinquent

$25

$23

$21

$18

$19

as % of loans

1.51%

1.46%

1.37%

1.24%

1.23%

Net charge-offs

$24

$20

$18

$16

$15

as % of loans

5.88%

4.95%

4.53%

4.27%

4.01%

Home equity - brokered

Home equity

1 liens: 32%; 2

liens: 68%

Weighted average origination FICO: 750

Origination FICO distribution^: <660 4%; 660-689 7%; 690-719 13%;

720-749 17%; 750+ 51%; Other 8%

Average CLTV: 74%; Origination CLTV distribution: <=70 40%; 70.1-80 22%;

80.1-90 18%; 90.1-95 7%; >95 13%

Vintage distribution: 2012 1%; 2011 5%; 2010 4%; 2009 4%; 2008 11%; 2007

11%; 2006 14%; 2005 13%; 2004 and prior 37%

% through broker channels: 14% WA FICO: 735 brokered, 753 direct; WA

CLTV: 88% brokered; 71% direct

Portfolio details

Comments

Brokered loans by geography

Direct loans by geography

Credit trends

Note: Brokered and direct home equity net charge-off ratios are calculated

based on end of period loan balances ^ Includes acquired loans where FICO at

origination is not available ©

Fifth Third Bank | All Rights Reserved

st

st

nd

nd |

Florida market*

Deterioration in real estate values having effect on credit trends as evidenced by

elevated NPA/NCOs in real estate related products COML

MORTGAGE

C&I

RESI

MORTGAGE

OTHER

CONS

COML

CONST

COML

LEASE

HOME

EQUITY

AUTO

CREDIT

CARD

Total Loans

NPAs

NCOs

*NPAs exclude loans held-for-sale.

Weak commercial real estate market

Losses due to significant declines in

valuations

Valuations; relatively small home

equity portfolio

32

©

Fifth Third Bank | All Rights Reserved

Loans ($B)

% of

FITB

NPAs ($M)

% of

FITB

NCOs

($M)

% of

FITB

Commercial loans

2.1

7%

62

13%

4

8%

Commercial mortgage

1.2

12%

80

14%

6

21%

Commercial construction

0.2

19%

78

46%

11

59%

Commercial lease

0.0

1%

-

0%

-

0%

Commercial

3.5

8%

221

18%

21

21%

Mortgage

1.7

16%

150

46%

19

50%

Home equity

0.8

8%

9

15%

5

10%

Auto

0.5

5%

0

4%

1

5%

Credit card

0.1

5%

3

6%

2

8%

Other consumer

0.0

6%

-

0%

1

18%

Consumer

3.2

9%

163

36%

26

22%

Total

6.7

8%

384

23%

47

21% |

Michigan market*

Deterioration in home price values coupled with weak economy impacted credit results

due to frequency of defaults and severity COML

MORTGAGE

C&I

RESI

MORTGAGE

OTHER

CONS

COML

CONST

COML

LEASE

HOME

EQUITY

AUTO

CREDIT

CARD

Total Loans

NPAs

NCOs

*NPAs exclude loans held-for-sale.

Negative impact from housing

valuations, economy,

unemployment

Economic weakness impact on

commercial real estate market

33

©

Fifth Third Bank | All Rights Reserved

Loans ($B)

% of

FITB

NPAs ($M)

% of

FITB

NCOs

($M)

% of

FITB

Commercial loans

3.2

10%

94

20%

7

14%

Commercial mortgage

2.6

26%

139

24%

10

36%

Commercial construction

0.1

9%

11

7%

7

38%

Commercial lease

0.2

5%

2

21%

(0)

0%

Commercial

6.0

13%

247

20%

25

24%

Mortgage

1.7

15%

39

12%

6

16%

Home equity

2.2

21%

6

10%

11

23%

Auto

0.9

8%

1

9%

1

13%

Credit card

0.3

15%

9

20%

3

14%

Other consumer

0.1

21%

-

0%

1

14%

Consumer

5.1

14%

55

12%

21

18%

Total

11.2

301

46

14%

18%

21% |

34

Regulation G Non-GAAP reconciliation

©

Fifth Third Bank | All Rights Reserved

$ and shares in millions

(unaudited)

March

December

September

June

March

2012

2011

2011

2011

2011

Income before income taxes (U.S. GAAP)

$603

$418

$530

$506

$377

Add:

Provision expense (U.S. GAAP)

91

55

87

113

168

Pre-provision net revenue (a)

694

473

617

619

545

Net income available to common shareholders (U.S. GAAP)

421

305

373

328

88

Add:

Intangible amortization, net of tax

3

3

3

4

5

Tangible net income available to common shareholders

424

308

376

332

93

Tangible net income available to common shareholders (annualized) (b)

1,705

1,222

1,492

1,332

377

Average Bancorp shareholders' equity (U.S. GAAP)

13,366

13,147

12,841

12,365

13,052

Less:

Average preferred stock

398

398

398

398

1,557

Average goodwill

2,417

2,417

2,417

2,417

2,417

Average intangible assets

38

42

47

52

59

Average tangible common equity (c)

10,513

10,290

9,979

9,498

9,019

Total Bancorp shareholders' equity (U.S. GAAP)

13,560

13,201

13,029

12,572

12,163

Less:

Preferred stock

(398)

(398)

(398)

(398)

(398)

Goodwill

(2,417)

(2,417)

(2,417)

(2,417)

(2,417)

Intangible assets

(36)

(40)

(45)

(49)

(55)

Tangible common equity, including unrealized gains / losses (d)

10,709

10,346

10,169

9,708

9,293

Less: Accumulated other comprehensive income / loss

(468)

(470)

(542)

(396)

(263)

Tangible common equity, excluding unrealized gains / losses (e)

10,241

9,876

9,627

9,312

9,030

Total assets (U.S. GAAP)

116,747

116,967

114,905

110,805

110,485

Less:

Goodwill

(2,417)

(2,417)

(2,417)

(2,417)

(2,417)

Intangible assets

(36)

(40)

(45)

(49)

(55)

Tangible assets, including unrealized gains / losses (f)

114,294

114,510

112,443

108,339

108,013

Less: Accumulated other comprehensive income / loss, before tax

(720)

(723)

(834)

(609)

(405)

Tangible assets, excluding unrealized gains / losses (g)

113,574

113,787

111,609

107,730

107,608

Common shares outstanding (h)

920

920

920

920

919

Net charge-offs (i)

220

239

262

304

367

Ratios:

Return on average tangible common equity (b) / (c)

16.2%

11.9%

15.0%

14.0%

4.2%

Tangible common equity (excluding unrealized gains/losses) (e) /

(g)

9.02%

8.68%

8.63%

8.64%

8.39%

Tangible common equity (including unrealized gains/losses) (d) /

(f)

9.37%

9.04%

9.04%

8.96%

8.60%

Tangible book value per share (d) / (h)

11.64

11.25

11.05

10.55

10.11

Pre-provision net revenue / net charge-offs (a) / (i)

315%

198%

235%

204%

149%

For the Three Months Ended |

35

Regulation G Non-GAAP reconciliation

©

Fifth Third Bank | All Rights Reserved

$ and shares in millions

(unaudited)

March

December

September

June

March

2012

2011

2011

2011

2011

Total Bancorp shareholders' equity (U.S. GAAP)

$13,560

$13,201

$13,029

$12,572

$12,163

Goodwill and certain other intangibles

(2,518)

(2,514)

(2,514)

(2,536)

(2,546)

Unrealized gains

(468)

(470)

(542)

(396)

(263)

Qualifying trust preferred securities

2,248

2,248

2,273

2,312

2,763

Other

38

38

20

20

12

Tier I capital

12,860

12,503

12,266

11,972

12,129

Less:

Preferred stock

(398)

(398)

(398)

(398)

(398)

Qualifying trust preferred securities

(2,248)

(2,248)

(2,273)

(2,312)

(2,763)

Qualifying noncontrolling interest in consolidated subsidiaries

(50)

(50)

(30)

(30)

(30)

Tier I common equity (a)

10,164

9,807

9,565

9,232

8,938

Unrealized gains

468

Disallowed deferred tax assets

-

Disallowed MSRs

78

Other

11

Less:

10% of individual deferred tax assets, MSRs, investment in financial entities

-

15% of aggregate deferred tax assets, MSRs, investment in financial entities

-

Tier 1 common equity, Basel III proforma (b)

10,721

Risk-weighted assets, determined in accordance with

prescribed regulatory requirements (c)

105,451

104,945

102,562

100,320

99,392

Regulatory deductions not deducted from Tier 1 common equity,

risk-weighted at 250%

1,582

Risk-weighted assets, Basel III proforma (d)

107,033

Ratios:

Tier I common equity (a) / (c)

9.64%

9.35%

9.33%

9.20%

8.99%

Tier I common equity, Basel III proforma (b) / (d)

10.02%

Add:

For the Three Months Ended

9.74%

9.80%

1,453

1,377

106,398

103,939

470

542

-

-

70

64

12

10

-

-

-

-

10,359

10,181

9.43%

9.16%

101,794

100,964

1,474

1,572

-

-

-

-

9

396

263

(113)

(41)

70

90

(7)

9,594

9,243 |