Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BANCORPSOUTH INC | d339277d8k.htm |

| EX-99.1 - PRESS RELEASE ISSUED ON APRIL 23, 2012 BY BANCORPSOUTH, INC - BANCORPSOUTH INC | d339277dex991.htm |

BancorpSouth, Inc.

Financial Information

As of March 31, 2012

Exhibit 99.2 |

Forward Looking Information

2

Certain statements contained in this presentation and the accompanying slides may not be based on

historical facts and are “forward-looking

statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of

1934, as amended. These forward-looking statements may be identified by reference to a

future period or by the use of forward-looking terminology, such as “anticipate,” “believe,” “estimate,” “expect,” “foresee,” “may,” “might,” “will,” “intend,” “could,” “would” or “plan,” or future

or conditional verb tenses, and variations or negatives of such terms. These forward-looking

statements include, without limitation, statements about long-term prospects for

shareholder value, the impact of the prevailing economy, the use of non-GAAP financial measures, disposition of

ORE, internal initiatives, results of operations and financial condition. We caution you not to place

undue reliance on the forward-looking statements contained in this presentation, in that

actual results could differ materially from those indicated in such forward-looking statements as a

result of a variety of factors. These factors may include, but are not limited to, conditions in the

financial markets and economic conditions generally, the ongoing debt crisis and the downgrade

of the sovereign credit ratings for various nations, the adequacy of the Company’s provision

and allowance for credit losses to cover actual credit losses, the credit risk associated with real

estate construction, acquisition and development loans, losses resulting from the significant

amount of the Company’s other real estate owned, limitations on the Company’s ability to declare and

pay dividends, the impact of legal or administrative proceedings, the availability of capital

on favorable terms if and when needed, liquidity risk, governmental regulation, including the

Dodd Frank Act, and supervision of the Company’s operations, the impact of regulations on service

charges on the Company’s core

deposit accounts, the susceptibility of the Company’s business to local economic conditions, the soundness of

other financial institutions, changes in interest rates, the impact of monetary policies and economic

factors on the Company’s ability to attract

deposits or make loans, volatility in capital and credit markets, reputational risk, the impact of

hurricanes or other adverse weather events, any requirement that the Company write down

goodwill or other intangible assets, diversification in the types of financial services the Company offers,

competition with other financial services companies, risks in connection with completed or potential

acquisitions, the Company’s growth strategy,

interruptions or breaches in the

Company’s information system security, the failure of certain third party vendors to perform, dilution caused by the

Company

’

s issuance of any additional shares of its common stock to raise capital or acquire other banks, bank

holding companies, financial holding companies and insurance agencies, the effectiveness of the

Company’s internal controls, other factors generally understood to affect the

financial results of financial services companies and other factors detailed from time to time in the

Company’s press releases and filings with the

Securities and Exchange Commission. Forward-looking statements speak only as of the date

they were made, and, except as required by law, we do not undertake any obligation to update or

revise forward-looking statements to reflect events or circumstances after the date of this

presentation. Certain tabular presentations may not reconcile because of rounding. Unless otherwise

noted, any quotes in this presentation can be attributed to company management.

|

This presentation contains financial information determined by methods other than

those prescribed by accounting principles generally accepted in the United

States ("GAAP”). Management uses these "non-GAAP" financial measures in its analysis of the Company's capital and

performance. Management believes that the ratio of tangible common equity to

tangible assets is important to investors who are interested in evaluating

the adequacy of the Company’s capital levels. You should not view these

disclosures as a substitute for results determined in accordance with GAAP, and they are not necessarily

comparable to non-GAAP measures used by other companies. The limitations

associated with these measures are the risks that persons might disagree as

to the appropriateness of items comprising these measures and that different companies might calculate these measures

differently. Information provided in the Appendix of this presentation reconciles

these non-GAAP measures with comparable measures calculated in

accordance with GAAP. Non-GAAP Financial Disclaimer

3 |

Financial Highlights

At and for the three months ended March 31, 2012

Net income of $22.9 million, or $0.25 per diluted share

Continued improvement in many credit quality indicators including the

provision for credit losses, total NPLs and NPAs, net charge-offs, and

near-term past dues

Net interest margin remained relatively stable at 3.66%

Mortgage production increased to $395 million, and mortgage lending

contributed $15.1 million of non-interest revenue including a positive

MSR valuation adjustment of $3.7 million

Capital levels improved:

3/31/12

12/31/11

3/31/11

Equity/Assets

10.46%

9.72%

8.94%

TIER I Leverage Capital

9.85%

8.85%

8.01%

Total Capital

14.39% 13.03%

11.92%

4 |

Provision for credit losses declined $9.3 million, or 48.1%, from the

previous quarter

NPLs decreased $37.0 million, or 11.5%, and NPAs declined $43.0 million,

or 8.7%, from the previous quarter

Nonaccrual loan formation remained relatively flat at $40.4 million,

compared to $39.5 million for the fourth quarter of 2011

54% of non-accrual loans were paying as agreed

Loans 30-89 days past due, still accruing, declined from $37.5 million as

of

12/31/11 to $29.0 million as of 3/31/12

OREO decreased $6.0 million, or 3.5%, from the previous quarter

Credit Quality Highlights

At and for the three months ended March 31, 2012

“Paying as Agreed”

includes loans < 30 days past due with payments occurring at least

quarterly 5 |

6

Recent Operating Results

Dollars in millions, except per share data

NM –

Not meaningful

3/31/12

12/31/11

3/31/11

Net interest revenue

$105.6

$107.5

$109.4

(3.5)

%

Provision for credit losses

10.0

19.3

53.5

(81.3)

Noninterest revenue

72.4

65.3

68.3

5.9

Noninterest expense

135.7

135.9

130.0

4.4

Income (loss) before income taxes

32.3

17.7

(5.7)

NM

Income tax provision (benefit)

9.4

4.4

(5.2)

NM

Net income (loss)

$22.9

$13.3

($0.5)

NM

Net income (loss) per share: diluted

$0.25

$0.16

($0.01)

NM

Three Months Ended

Q1'12 vs.

Q1'11 |

Noninterest Revenue

Dollars in thousands

NM –

Not meaningful

7

Q1 '12 vs.

3/31/12

12/31/11

3/31/11

Q1 '11

Mortgage origination and servicing

11,445

$

9,919

$

5,041

$

127.0

%

MSR valuation adjustment

3,697

(991)

2,540

45.6

Credit card, debit card and merchant fees

7,523

7,783

10,346

(27.3)

Service charges

15,116

17,412

15,368

(1.6)

Trust income

2,282

3,348

3,134

(27.2)

Security gains, net

74

18

17

NM

Insurance commissions

23,153

19,416

22,549

2.7

Other

9,070

8,430

9,316

(2.6)

Total noninterest revenue

72,360

$

65,335

$

68,311

$

5.9

%

Three Months Ended |

NPLs

Dollars in millions

Net loans and leases as of March 31, 2012

8

NPLs as a Percent

Outstanding

NPLs

of Outstanding

Commercial and industrial

$1,441.7

$12.5

0.9

%

Real estate:

Consumer mortgages

1,938.0

52.2

2.7

Home equity

501.3

2.7

0.5

Agricultural

256.7

4.3

1.7

Commercial and industrial-owner occupied

1,287.5

37.1

2.9

Construction, acquisition and development

858.1

121.4

14.1

Commercial

1,742.0

46.8

2.7

Credit cards

100.5

3.1

3.0

All other

612.0

5.2

0.9

Total loans

$8,737.9

$285.2

3.3

% |

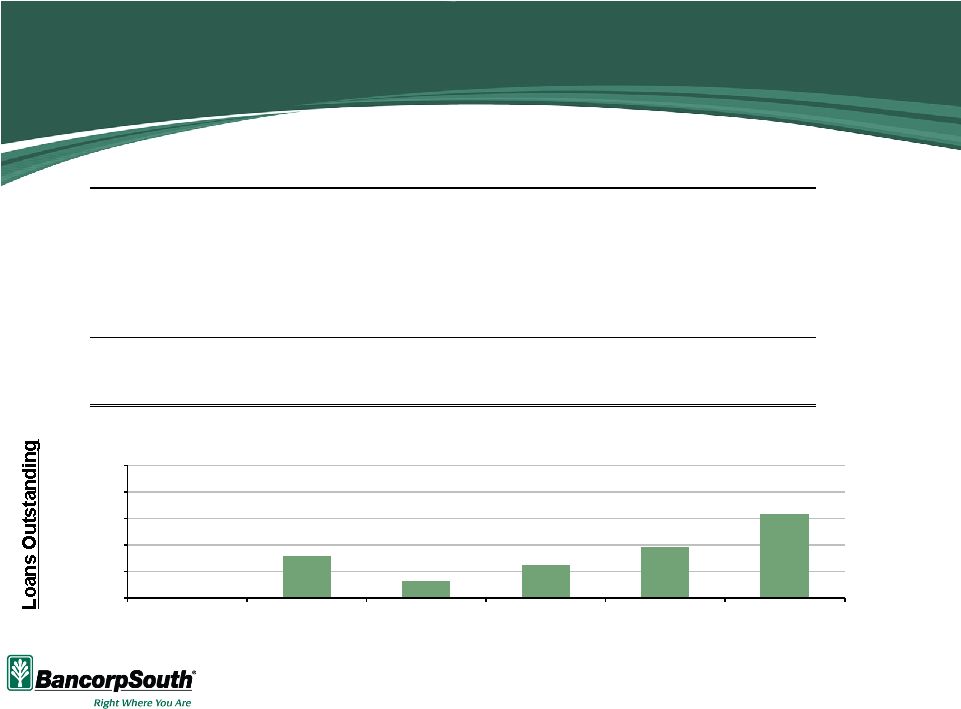

Real

Estate Construction, Acquisition and Development Dollars in millions

Net loans and leases as of March 31, 2012

9

$0

$100

$200

$300

$400

$500

Multi

-Family

Construction

1-4 Family

Construction

Recreation & All

Other Loans

Commercial

Construction

Commercial A & D

Residential A & D

NPLs

NPLs as a Percent of

Outstanding

Multi-Family Construction

4.7

$

-

$

1-4 Family Construction

159.3

12.8

Recreation and All Other Loans

63.4

1.2

Commercial Construction

122.2

4.7

Commercial Acquisition and Development

191.8

26.4

Residential Acquisition and Development

316.8

76.3

Real Estate Construction, Acquisition

and Development

858.1

$

121.4

$

Outstanding

13.8

24.1

14.1%

0.0%

8.0

1.9

3.8 |

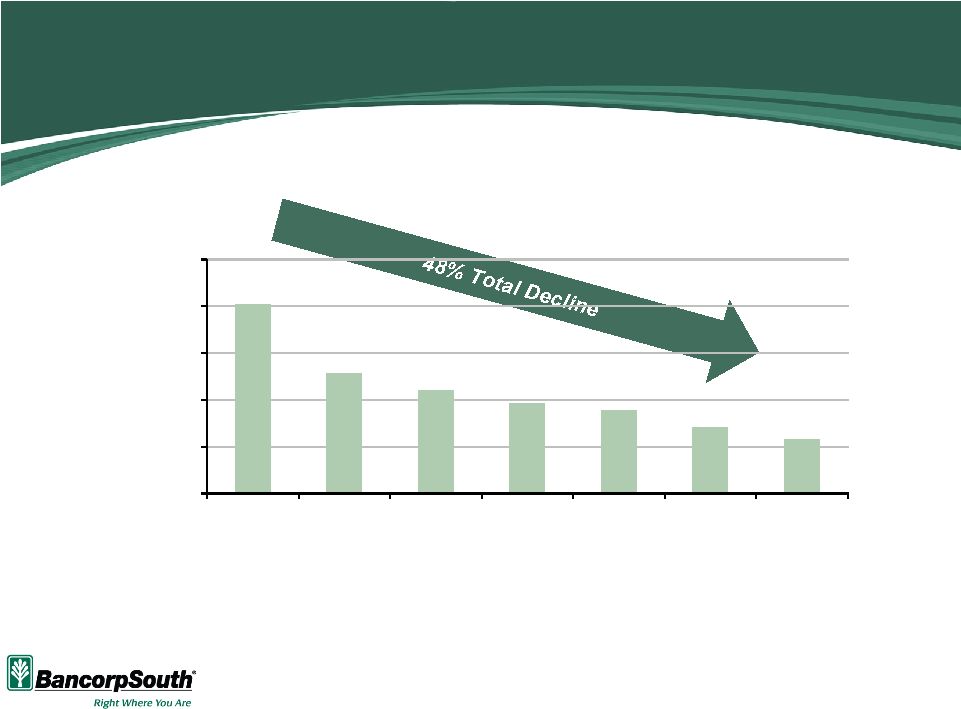

Residential Acquisition and Development

10

Dollars in millions

$606

$456

$420

$393

$377

$342

$317

$200

$300

$400

$500

$600

$700

12/31/09

12/31/10

3/31/11

6/30/11

9/30/11

12/31/11

3/31/12 |

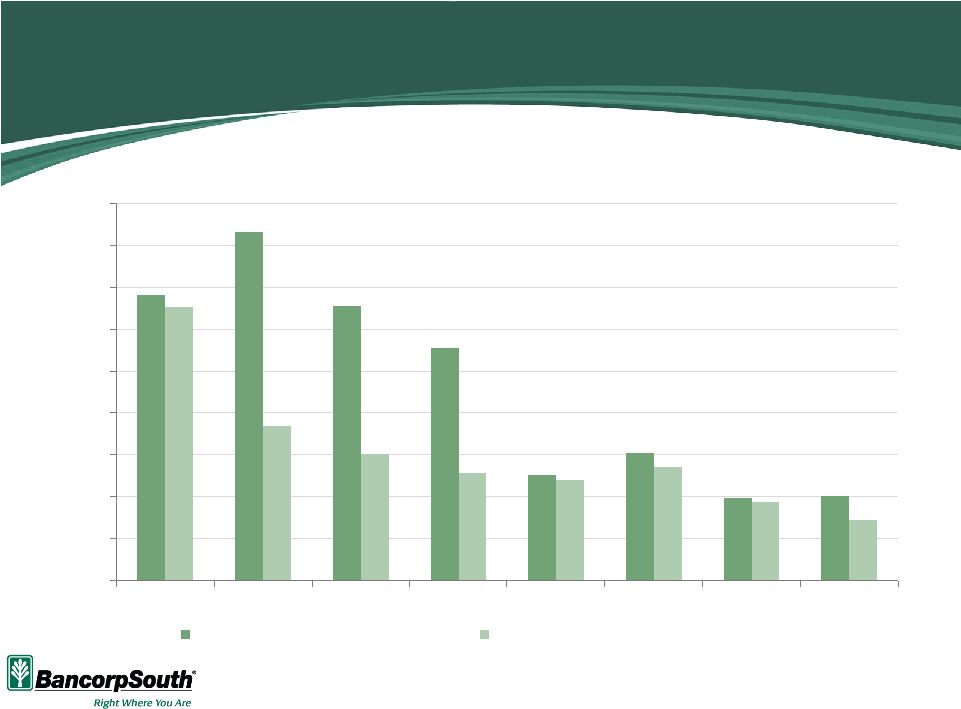

Newly

Identified Non-Accrual Loans Dollars in millions

Newly identified non-accrual loans based on the quarters ended for the dates

shown 11

$136

$166

$131

$111

$50

$61

$39

$40

$131

$74

$60

$52

$48

$54

$38

$29

$0

$20

$40

$60

$80

$100

$120

$140

$160

$180

6/30/10

9/30/10

12/31/10

3/31/11

6/30/11

9/30/11

12/31/11

3/31/12

Newly Identified Non-Accrual Loans

Loans 30-89 Days Past Due, Still Accruing |

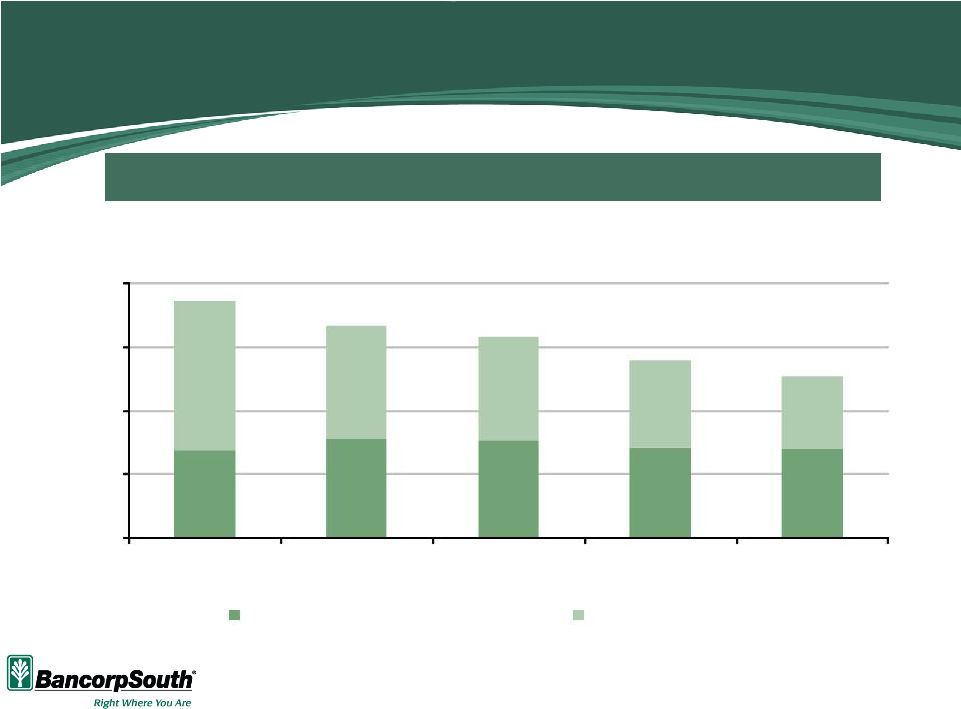

Non-Accrual Loans

Dollars in millions

“Paying as Agreed”

includes loans < 30 days past due with payments occurring at least

quarterly 54% of non-accrual loans were paying as agreed as of March 31,

2012 12

$0

$100

$200

$300

$400

3/31/11

6/30/11

9/30/11

12/31/11

3/31/12

Non-Accrual Lns Paying as Agreed

All Other Non-Accrual Lns |

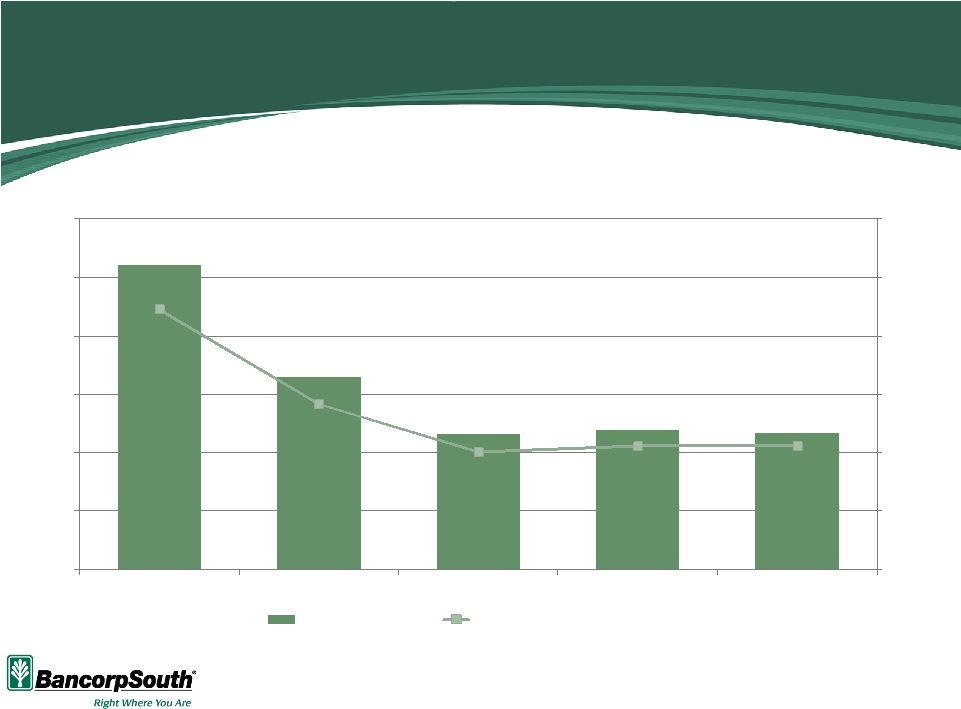

Dollars in millions

Net charge-offs based on the quarters ended for the dates shown

Net Charge-offs are Improving

% Avg. Loans

13

$52

$33

$23

$24

$23

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

3.0%

$0

$10

$20

$30

$40

$50

$60

3/31/11

6/30/11

9/30/11

12/31/11

3/31/12

Net Charge-Offs

Net Charge-offs / Average loans |

14

Internal Initiatives

Integration of specialty lending lines of business into the general banking

organization structure

Corporate Banking

Small Business Lending

Equipment Leasing

Home Equity Lines of Credit

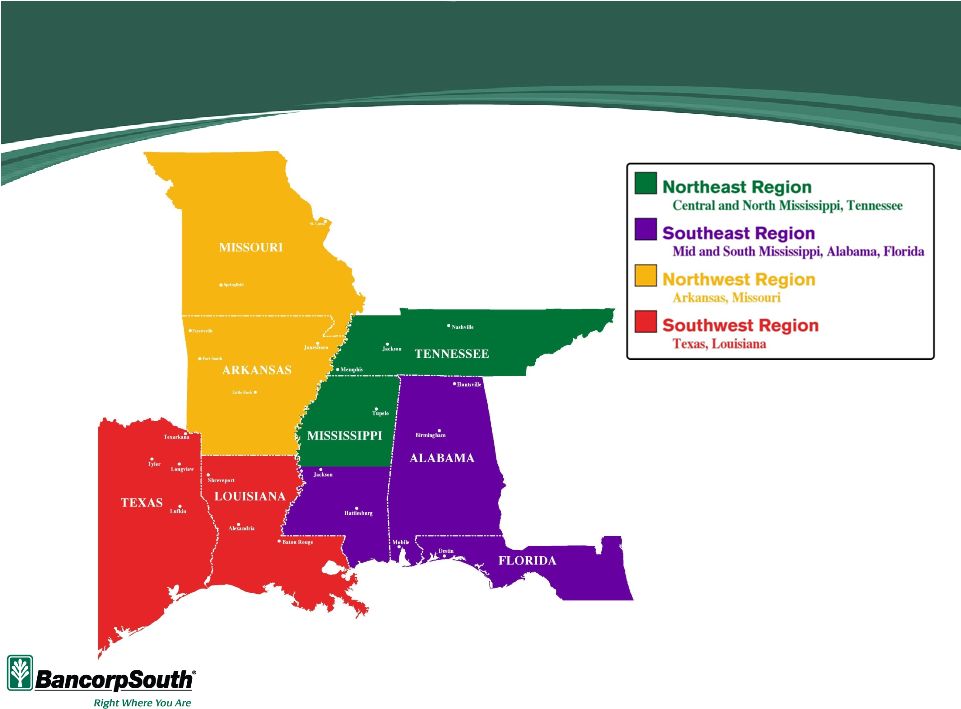

Geographic reorganization from 10 regions to 4 regions

Northeast –

Central and North MS, Tennessee

Southeast –

Mid and South MS, Alabama, Florida

Northwest –

Arkansas, Missouri

Southwest –

Texas, Louisiana |

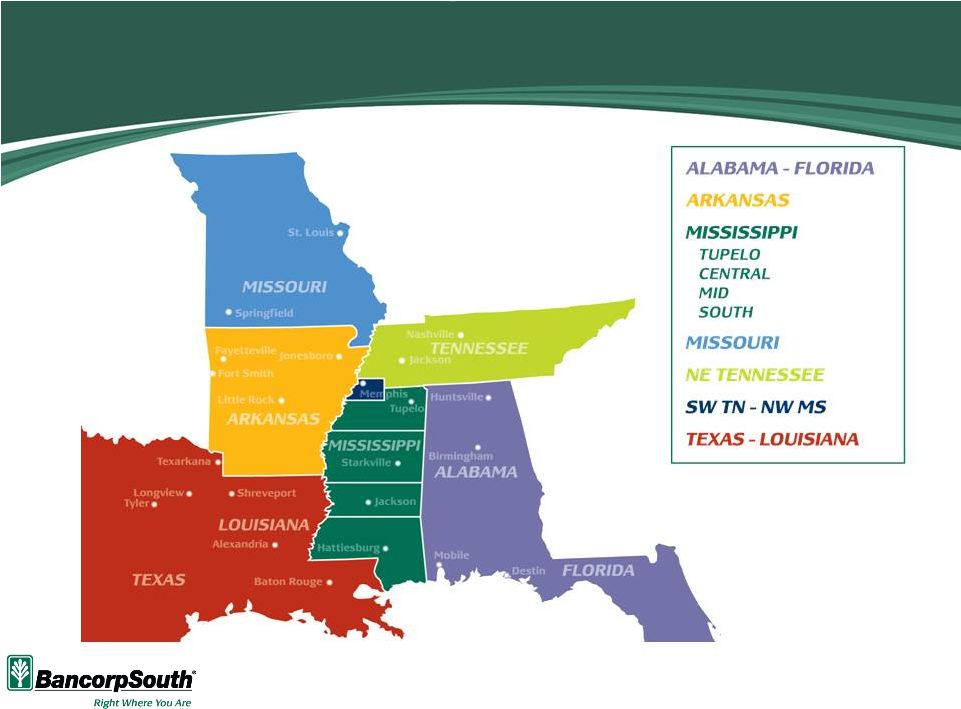

15

Previous Regional Structure |

New

Regional Structure 16 |

Appendix |

18

Non-GAAP Financial Reconciliation

Tangible Common Equity / Tangible Assets (TCE/TA)

As of

As of

As of

3/31/2012

12/31/2011

3/31/2011

(Dollars In Thousands)

Common Equity --> A

$1,392,199

$1,262,912

$1,211,061

Assets --> B

13,307,572

12,995,851

13,547,238

Intangibles --> C

287,147

287,910

290,141

Tangible Common Equity --> D=A-C

1,105,052

975,002

920,920

Tangible Assets --> E=B-C

13,020,425

12,707,941

13,257,097

TCE/TA --> D/E

8.49%

7.67%

6.95% |