Attached files

| file | filename |

|---|---|

| 8-K - OKS Q1 2012 EARNINGS CALL, DISTRIBUTION AND PROJECTS - ONEOK Partners LP | forn_8-k.htm |

| EX-99.1 - NEWS RELEASE - EARNINGS CALL - ONEOK Partners LP | exhibit_99-1.htm |

| EX-99.2 - NEWS RELEASE - QUARTERLY DISTRIBUTION - ONEOK Partners LP | exhibit_99-2.htm |

Exhibit 99.3

| April 19, 2012 | Analyst Contact: | Andrew Ziola | |

| 918-588-7163 | |||

| Media Contact: | Brad Borror | ||

| 918-588-7582 |

ONEOK Partners to Invest $340 Million to $360 Million for

Additional Growth Projects in Cana-Woodford Shale

Projects Include New Natural Gas Processing Plant in Western Oklahoma

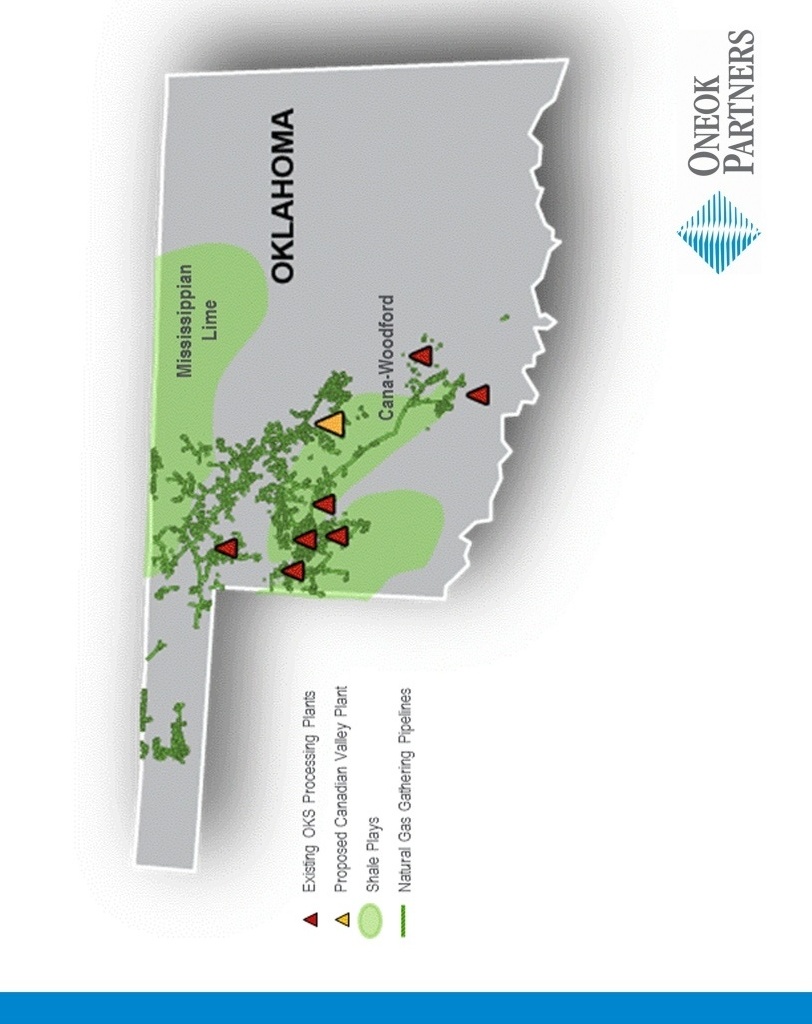

TULSA, Okla. – Apr. 19, 2012 – ONEOK Partners, L.P. (NYSE: OKS) today announced plans to invest approximately $340 million to $360 million between now and the first quarter of 2014 to construct a new natural gas gathering and processing plant and related infrastructure in the Cana-Woodford Shale in Oklahoma.

These investments include approximately $190 million for the construction of a new 200 million cubic feet per day (MMcf/d) natural gas processing facility – the Canadian Valley plant – in Canadian County, Okla. – which is expected to be in service first quarter of 2014.

In addition to the investments for the Canadian Valley plant, ONEOK Partners also expects to invest approximately $160 million for expansions and upgrades to its existing natural gas gathering and compression infrastructure, increasing the partnership’s capacity to gather and process natural gas to 390 MMcf/d in the Cana-Woodford Shale.

“Additional natural gas processing infrastructure is necessary to accommodate increased production of liquids-rich natural gas in the Cana-Woodford Shale where we have substantial acreage dedications from active producers,” said Pierce H. Norton, executive vice president and chief operating officer of ONEOK Partners. “The new Canadian Valley plant will be located in the center of the prolific Cana-Woodford Shale and in close proximity to the partnership’s existing natural gas and natural gas liquids pipelines.”

When completed, the Canadian Valley plant will be the partnership’s largest natural gas processing facility in Oklahoma and will increase the partnership’s total natural gas processing capacity in the state to 690 MMcf/d. Additionally, the natural gas liquids produced from the new plant is expected to add incremental volumes to the partnership’s extensive Oklahoma natural gas liquids system.

The partnership now has announced a total investment of $4.7 billion to $5.7 billion through 2015 for growth projects in natural gas gathering and processing, natural gas liquids and crude-oil infrastructure.

-more-

ONEOK Partners to Invest $340 Million to $360 Million for

Additional Growth Projects in Cana-Woodford Shale

April 19, 2012

Page 2

Of these projects, approximately $1.4 billion to $1.6 billion are for natural gas gathering and processing projects, which, in aggregate, are expected to generate EBITDA (earnings before interest, taxes, depreciation and amortization) multiples of five to seven times. The incremental earnings from these projects are expected to increase distributable cash flow and value to unitholders in the form of higher distributions.

The partnership has a $1 billion-plus backlog of unannounced growth projects that it continues to evaluate. Additional projects included in this backlog will be announced when sufficient supply commitments are completed.

EDITOR’S NOTE:

View map showing the location of the new processing facility.

NON-GAAP (GENERALLY ACCEPTED ACCOUNTING PRINCIPLES) FINANCIAL MEASURES

ONEOK Partners has disclosed in this news release anticipated EBITDA and Distributable Cash Flow levels that are non-GAAP financial measures. EBITDA and DCF are used as a measure of the partnership’s financial performance. EBITDA is defined as net income adjusted for interest expense, depreciation and amortization, income taxes and allowance equity funds used during construction. DCF is defined as EBITDA, computed as described above, less interest expense, maintenance capital expenditures and equity earnings from investments, adjusted for cash and certain other items.

The partnership believes the non-GAAP financial measures described above are useful to investors because these measurements are used by many companies in its industry as a measurement of financial performance and are commonly employed by financial analysts and others to evaluate the financial performance of the partnership and to compare the financial performance of the partnership with the performance of other publicly traded partnerships within its industry.

EBITDA and DCF should not be considered an alternative to net income, earnings per unit or any other measure of financial performance presented in accordance with GAAP.

These non-GAAP financial measures exclude some, but not all, items that affect net income. Additionally, these calculations may not be comparable with similarly titled measures of other companies. Furthermore, these non-GAAP measures should not be viewed as indicative of the actual amount of cash that is available for distributions or that is planned to be distributed for a given period nor do they equate to available cash as defined in the partnership agreement.

-more-

ONEOK Partners to Invest $340 Million to $360 Million for

Additional Growth Projects in Cana-Woodford Shale

April 19, 2012

Page 3

ONEOK Partners, L.P. (NYSE: OKS) is one of the largest publicly traded master limited partnerships, and is a leader in the gathering, processing, storage and transportation of natural gas in the U.S. and owns one of the nation’s premier natural gas liquids (NGL) systems, connecting NGL supply in the Mid-Continent and Rocky Mountain regions with key market centers. Its general partner is a wholly owned subsidiary of ONEOK, Inc. (NYSE: OKE), a diversified energy company, which owns 43.4 percent of the overall partnership interest. ONEOK is one of the largest natural gas distributors in the United States, and its energy services operation focuses primarily on marketing natural gas and related services throughout the U.S.

For more information, visit the website at www.oneokpartners.com.

For the latest news about ONEOK Partners, follow us on Twitter @ONEOKPartners.

Some of the statements contained and incorporated in this news release are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act, as amended. The forward-looking statements relate to the proposed construction of the new Canadian Valley natural gas processing facility and related natural gas gathering and compression infrastructure, the processing capacity of the proposed facility, the schedule and costs to complete the proposed facility and related infrastructure and expected generation of EBITDA and distributable cash flow from the proposed facility and related infrastructure. These forward-looking statements are made in reliance on the safe-harbor protections provided under the Private Securities Litigation Reform Act of 1995.

Forward-looking statements include the items identified in the preceding paragraph, the information concerning possible or assumed future results of our operations and other statements contained or incorporated in this news release identified by words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “should,” “goal,” “forecast,” “guidance,” “could,” “may,” “potential,” “scheduled,” and other words and terms of similar meaning.

###