Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - POPULAR, INC. | d337568d8k.htm |

Financial

Results Financial Results

First Quarter 2012

First Quarter 2012

Exhibit 99.1 |

Forward Looking

Statements 1

The information contained in this presentation includes forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of 1995. These

forward-looking statements are based on management’s current expectations and involve risks

and uncertainties that may cause the Company's actual results to differ materially from any

future results expressed or implied by such forward-looking statements. Factors

that may cause such a difference include, but are not limited to (i) the rate of growth in

the economy and employment levels, as well as general business and economic conditions; (ii)

changes in interest rates, as well as the magnitude of such changes; (iii) the fiscal

and monetary policies of the federal government and its agencies; (iv) changes in

federal bank regulatory and supervisory policies, including required levels of capital; (v)

the relative strength or weakness of the consumer and commercial credit sectors and of

the real estate markets in Puerto Rico and the other markets in which borrowers are

located; (vi) the performance of the stock and bond markets; (vii) competition in the

financial services industry; (viii) possible legislative, tax or regulatory changes;

(ix) the impact of the Dodd-Frank Act on our businesses, business practice and cost of

operations; and (x) additional Federal Deposit Insurance Corporation assessments. Other than

to the extent required by applicable law, the Company undertakes no obligation to

publicly update or revise any forward-looking statement. Please refer to our Annual

Report on Form 10-K for the year ended December 31, 2011 and other SEC reports for a

discussion of those factors that could impact our future results. The financial

information included in this presentation for the quarter ended March 31, 2012 is based on

preliminary unaudited data and is subject to change. |

Q1 2012

Highlights •

Net income for the quarter amounted to $48.4 million; our fifth consecutive profitable

quarter

•

Continued improvement in credit quality trends in non-covered portfolio

NPLs declined by $56 million

NPL inflows (commercial and construction) declined by 21%

Net charge-offs decreased by $18 million

•

Provision for non-covered loans declined by $41.4 million

•

Newly created Commercial Credit Administration Group consolidates several divisions

performing commercial credit management and administrative functions

•

Maintained strong revenue generation, robust margins and further

strengthened

capital ratios

2 |

Financial

Results 3

¹

Unaudited

$ in thousands (except per share data)

Q1 2012

1

Q4 2011

1

Variance

Net interest income

$337,582

$344,780

($7,198)

Service fees & other oper. income

129,710

113,848

15,862

Gain on sale of investments, loans & trading profits

9,453

18,064

(8,611)

Total revenues before FDIC (expense) income

476,745

476,692

53

FDIC loss-share (expense) income

(15,255)

17,447

(32,702)

Gross revenues

461,490

494,139

(32,649)

Provision

for

loan

losses

-

non

covered

loans

82,514

123,908

(41,394)

Provision

for

loan

losses

-

covered

loans

18,209

55,900

(37,691)

Total provision for loan losses

100,723

179,808

(79,085)

Net revenues

360,767

314,331

46,436

Personnel costs

121,491

124,547

(3,056)

Other operating expenses

174,676

186,546

(11,870)

Total operating expenses

296,167

311,093

(14,926)

Income before Tax

64,600

3,238

61,362

Income Tax

16,192

263

15,929

Net income

$48,408

$2,975

$45,433

Financial Ratios

EPS

$0.05

$0.00

$0.05

NIM

4.27%

4.30%

-0.03% |

4

¹

Unaudited

Significant Quarterly Variances

(1)

Net interest income

($7,198)

Service fees & other

oper. income

15,862

FDIC loss-share income

(expense)

(32,702)

Provision for loan losses

-

non covered loans

(41,394)

Provision for loan losses-

covered loans

(37,691)

Personnel costs

(3,056)

Other operating expenses

(11,870)

Due to lower provisioning requirements

Driven by lower pension costs and salaries, mostly due to the

retirement window but partially offset by payroll taxes, incentives

and other benefits

Driven

by

lower

business

promotion

($6.4

million)

and

a

benefit

from

lower provision for unfunded credit commitments ($9.5 million),

partially offset by higher OREO expenses ($4.3 million)

$25.2 million principally due to 80% mirror accounting from the

decrease in provision for loan losses of covered loans

$13.6 million from the covered portfolio related to certain pools of

mortgage loans with lower interest accretion in Q1 (extended average

life estimates) offset by lower interest expense on deposits and

repayment of FDIC note ($6.3 million)

$9.5 million higher other income mainly due to valuation in

investments accounted for under the equity method and $5.9 million

in other service fees (MSR valuation $11.5 million)

$17.9 million lower net charge offs and $25.3 million attributed to

the revision of the ALLL methodology for commercial and

construction (US $17.8 million & PR $7.5 million) |

Capital

Ratios 5

1

Peers include: CMA, HBAN, ZION, FNFG, PBCT, SNV, FHN, BOKF, ASBC & FBP

2

See the earnings press release for reconciliation of Common Stockholders Equity

(GAAP) to Tier 1 Common Equity (Non-GAAP)

3

Minimum Regulatory Requirements for Well Capitalized

4

Peer & CCAR ratios are as of December 31, 2011

•

Strong capital ratios above CCAR banks and peers

(1) (4)

5%

3

6%

3

10

3

2

Tier 1 Common

Tier 1 Capital

Total Capital

Tangible Common Equity

Popular Q1 2012

Peers Average

CCAR Average

12.53

16.51

17.79

8.83

11.18

13.76

16.24

9.15

10.65

12.98

15.70

7.01 |

6

Consolidated Credit Summary (Excluding Covered Loans)

•

Total

Loans

remained

relatively

flat

•

NPLs

decreased

for

the

second

consecutive

quarter driven primarily by lower levels in all

portfolios

•

US construction

$32 million

•

PR commercial

$10 million

•

PR mortgage

$16 million

•

NCOs declined

due to positive variances in

commercial and construction, offset in part

by increases in mortgage

•

Reduction in NCO ratio from 2.46% in

Q4 2011 to 2.13% in Q1 2012

•

Provision

for

loan

losses

in

Q1

2012

was

down

33%

compared

to

the

Q4

2011

•

Allowance

to

loans

&

allowance

coverage

ratio remained relatively

flat

$ in millions

Q1 12

Q4 11

Q1 12 vs

Q4 11

Q1 11

Q1 12 vs

Q1 11

Loans Held to Maturity (HTM)

$20,479

$20,602

-0.60%

$20,677

-0.96%

Loans Held for Sale

362

363

-0.28%

570

-36.49%

Total Non Covered Loans

20,841

20,965

0.60%

21,247

-1.91%

Non-performing loans (NPLs)

$1,682

$1,738

-3.21%

$1,614

4.21%

Commercial

$819

$830

-1.33%

$700

17.00%

Construction

$70

$96

-27.08%

$127

-44.88%

Legacy

$79

$76

3.95%

$150

-47.33%

Mortgage

$667

$687

-2.91%

$578

15.40%

Consumer

$47

$49

-4.08%

$59

-20.34%

NPLs HTM to loans HTM

8.21%

8.44%

-0.23%

7.80%

0.41%

Net charge-offs (NCOs)

108

126

-14.29%

139

-22.30%

Commercial

$54

$71

-23.94%

$56

-3.57%

Construction

$0

$5

-100.00%

$9

-100.00%

Legacy

$4

$6

-33.33%

$20

-80.00%

Mortgage

$17

$9

88.89%

$8

112.50%

Consumer

$33

$35

-5.71%

$46

-28.26%

NCOs to average loans HTM

2.13%

2.46%

-0.33%

2.74%

-0.61%

Provision for loan losses (PLL)

83

124

-33.06%

60

38.33%

PLL to total loans HTM

1.62%

2.41%

-0.79%

1.16%

0.46%

PLL to NCOs

0.76x

0.98x

-0.22x

0.43x

0.33x

Allowance for loan losses (ALL)

665

690

-3.62%

727

-8.53%

ALL to loans (excl. LHFS)

3.25%

3.35%

-0.10%

3.52%

-0.27%

ALL to NPLs HTM

39.53%

39.73%

-0.20%

45.07%

-5.54% |

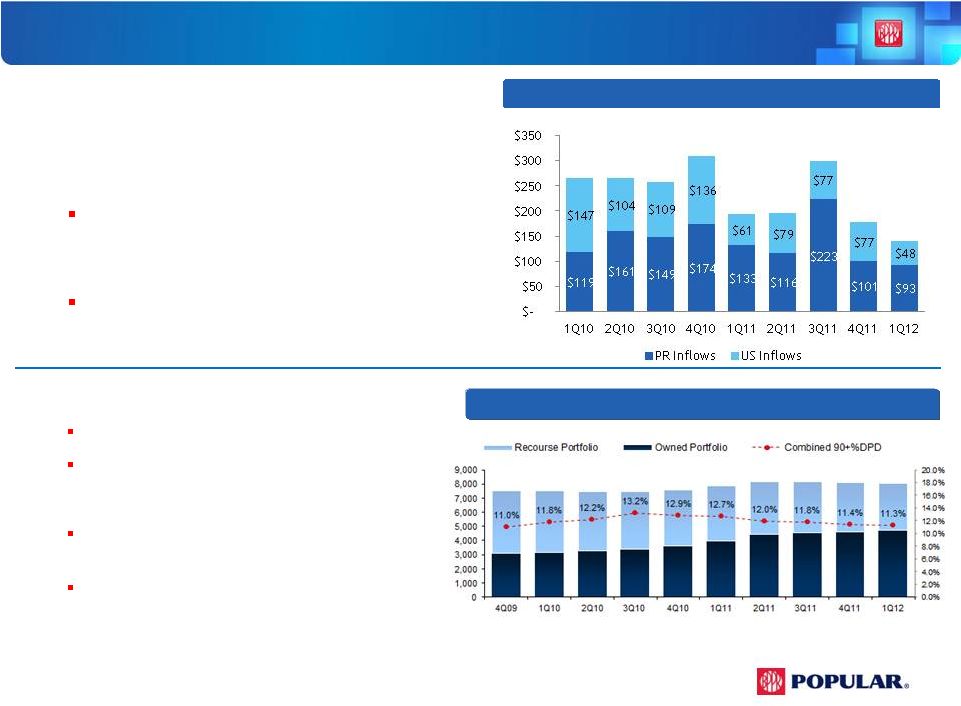

Commercial &

Construction NPL Inflows Credit Quality Overview -

•

Total commercial and construction NPL

inflows decreased

by $37 million or 21%

driven

by

decreases

in

both

PR

and

the

US

In PR, commercial and construction NPL inflows

decreased by $8 million or 8%

In the US, commercial and construction NPL

inflows decreased by $29 million or 38%

7

Selected Portfolios

Total

PR

Mortgage

Exposure

–

Owned

+

Recourse

•

Total PR mortgage exposure includes both:

On-balance sheet mortgage loans

Loans sold with recourse

•

Portfolio key statistics:

Recourse balance is

down $1.1 billion or 26%

since 4Q 2009

90+ days past due

percentage delinquency has

decreased

by

14%

from

its

peak

in

Q3

2010 |

General

Reserve-

ASC

450

(FAS

5)

+

Specific

Reserve-

ASC

310

(FAS

114)

=

Total

ALLL

•

Revised to a more granular segmentation based on credit-risk characteristics

-

Enhances homogeneity of portfolios

•

Changed trend factor to 12 months for commercial and construction portfolios

-

Improves the methodology’s ability to calibrate the impact of current loss trends

•

Implementation resulted in a net reduction of approximately $25 million in ALLL balance

(mostly in the US)

Allowance for Loan and Lease Losses (ALLL)

•

Base loss -

36-month average net charge-offs for commercial/construction portfolios and

18-month average net charge-offs for consumer/mortgage portfolios

•

Trend

factor-

Replaces base-loss period with 6-month average net charge-off when it is

higher than base loss (up to determined cap)

•

Environmental factor -

Captures certain credit / economic trends and factors not

considered in the base losses

•

General reserve -

Based on historical losses adjusted for a recent trendfactor+

8

Changes

Implemented

ASC 450

Methodology

environmental factor

•

Specific reserve -

Attributed to loans deemed impaired (mostly commercial loans

over $1mm) |

Coverage Ratio

1

Allowance to Loan Losses / Non-performing Loans

2

Allowance to Loan Losses + Lifetime Charge-offs / Non-performing

Loans 3

Includes Legacy loans

•The coverage ratio of 39.5% does not

take into account the high percentage of individually analyzed loans and

lifetime charge-offs Total NPLs

$1,682

Individually Analyzed

$849

Coverage

Ratio

(CR)

:

3%

Adjusted

Coverage

Ratio

(ACR)

:

33%

Collectively Analyzed

$833

Coverage Ratio (CR)

:

76%

Adjusted Coverage Ratio (ACR)

:

104%

$ in millions

9

3

3

1

2

Mort.

Comm.

Const.

Cons.

Mort.

Comm.

3

Const.

3

Cons.

NPLs

$239

$510

$90

$9

$428

$358

$9

$39

Lifetime NCOs

$4

$166

$80

$0

$84

$130

$18

$0

Reserve

$16

$11

$1

$1

$109

$349

$17

$161

CR

7%

2%

1%

15%

26%

97%

198%

414%

ACR

8%

35%

90%

15%

45%

133%

410%

414%

1

2 |

Summary &

Outlook 10

2012 Strategy

•

Further improve credit risk profile

•

Add low-risk assets

•

Continue efficiency efforts

•

Continue improvement at BPNA

Well positioned to deliver results in 2012

•

Reaffirming 2012 target range net income of $185 million to $200

million

•

Improvement in credit trends

•

Strong capital position

•

Favorable stress-test results in exercise similar to CCAR, with

capital ratios higher than peers and CCAR banks |

Appendix

Appendix |

P.R. &

US Business 12

1

Excludes covered loans

$ in millions (Unaudited)

Q1 12

Q4 11

Variance

Q1 12

Q4 11

Variance

Net Interest Income

$290

$299

($9)

$74

$73

$1

Non Interest Income

114

136

(22)

16

21

(5)

Gross Revenues

404

435

(31)

90

94

(4)

Provision (non-covered)

68

88

(20)

15

36

(21)

Provision (covered WB)

18

56

(38)

-

-

-

Provision for loan losses

86

144

(58)

15

36

(21)

Expenses

234

253

(19)

65

60

5

Tax Expense

17

4

13

1

1

(0)

Net Income (Loss)

$67

$34

$33

$9

($3)

$12

NPLs (HTM) ¹

$1,343

$1,371

($28)

$338

$366

($28)

NPLs (HTM + HFS) ¹

1,570

1,620

(50)

344

379

(35)

Loan loss reserve

586

578

8

217

237

(20)

Assets

$28,027

$28,423

($396)

$8,665

$8,581

$84

Loans (HTM)

19,053

19,159

(106)

5,618

5,762

(144)

Loans (HTM + HFS)

19,406

19,507

(101)

5,626

5,778

(152)

Deposits

21,040

21,850

(810)

6,247

6,168

79

NIM

4.90%

4.97%

-0.07%

3.78%

3.68%

0.10%

PR

US |

Credit Ratings

Update •

Our senior unsecured ratings have been gradually improving since

2010:

Moody’s:

Ba1

Negative Outlook

S&P:

B+

Stable Outlook

Fitch:

B+

Positive Outlook

•

April 2012: Moody’s placing most of the PR banks under review with the

possibility of downgrades, due to the state of the Puerto Rico economy

•

January 2012: Fitch raised BPOPs outlook to positive

•

December 2011: S&P raised its ratings on BPPR to BB from BB-

and changed

outlook to stable given revised bank criteria to Regional banks

•

July 2011: S&P raised our senior unsecured rating by one notch to B+

•

As the P.R. economy stabilizes and our credit metrics improve, we should see

upward pressure on the ratings

13 |

Financial

Results Financial Results

First Quarter 2012

First Quarter 2012 |