Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K APRIL 17, 2012 - ESB FINANCIAL CORP | form8k.htm |

=========================================================================================================================================================

P R E S S R E L E A S E

=========================================================================================================================================================

|

RELEASE DATE:

|

CONTACT:

|

|

April 17, 2012

|

CHARLES P. EVANOSKI

GROUP SENIOR VICE PRESIDENT

CHIEF FINANCIAL OFFICER

(724) 758-5584

|

FOR IMMEDIATE RELEASE

ESB FINANCIAL CORPORATION ANNOUNCES

INCREASED FIRST QUARTER EARNINGS

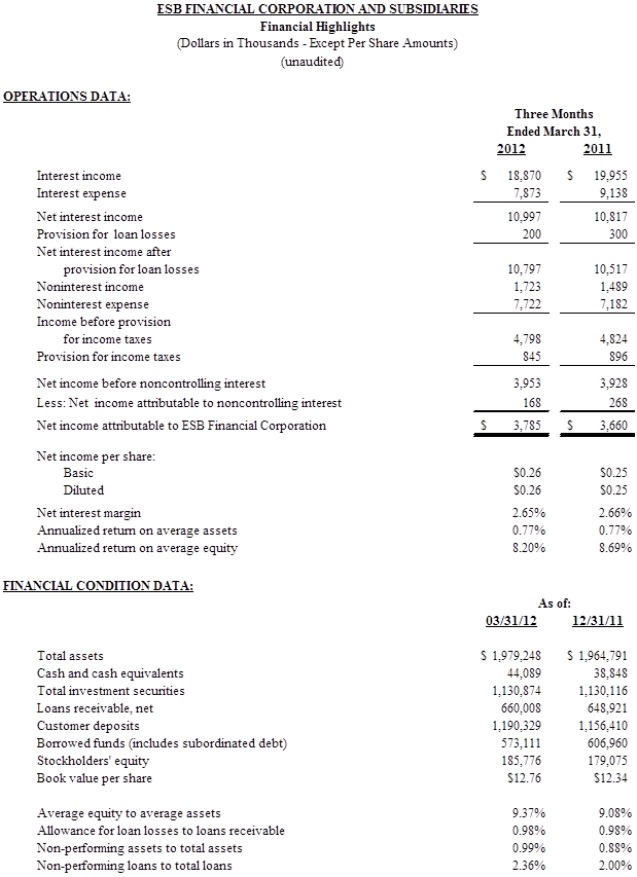

Ellwood City, Pennsylvania, April 17, 2012 – ESB Financial Corporation (Nasdaq: ESBF), the parent company of ESB Bank, today announced earnings of $0.26 per diluted share on net income of $3.8 million for the quarter ended March 31, 2012, which represents a 4.0% increase in net income per diluted share as compared to earnings of $0.25 per diluted share on net income of $3.7 million for the quarter ended March 31, 2011. The Company’s annualized return on average assets and average equity were 0.77% and 8.20%, respectively, for the quarter ended March 31, 2012, as compared to 0.77% and 8.69%, respectively at March 31, 2011.

Charlotte A. Zuschlag, President and Chief Executive Officer of the Company, stated, “The Board of Directors, senior management and I are pleased with the improvement in earnings for the quarter ended March 31, 2012. We have been successful and prudent in managing our net interest rate margin during this difficult interest rate environment while protecting our asset quality and our future earnings potential. We continue to experience growth in our core deposits which assists in reducing our cost of funds. Our deposits grew $33.9 million since December 2011 and our net income improved 3.4% over the quarter ended March 31, 2011. Ms. Zuschlag concluded by stating, “Management will continue to strive to pursue growth opportunities that will provide a sound investment return to our shareholders.”

Net income for the first quarter of 2012, as compared to the first quarter of 2011, increased by $125,000, or 3.4%, due to increases in net interest income after provision for loan losses and non-interest income of $280,000 and $234,000, respectively, as well as decreases to the noncontrolling interest and provision for income taxes of $100,000 and $51,000, respectively, partially offset by an increase in non-interest expense, of $540,000.

The $280,000 increase in net interest income after provision for loan losses for the first quarter of 2012 was due to a $1.3 million, or 13.8%, decrease in interest expense, and a $100,000, or 33.3%, decrease in provision for loan losses, partially offset by a $1.1 million, or 5.4% decrease in interest income.

The $234,000 increase in noninterest income for the quarter ended March 31, 2012 was primarily due to an increase in net realized gain on the sale of securities of approximately $267,000, partially offset by a decrease in income from real estate joint ventures of approximately $45,000. The $540,000 increase to noninterest expense was primarily related to increases in compensation and employee benefits and other expenses of $213,000 and $337,000 for the quarter ended March 31, 2012.

Press Release

Page 2 of 3

April 17, 2012

The Company’s total assets increased by $14.5 million, or 0.7%, during the quarter to $1.98 billion at March 31, 2012 from $1.96 billion at December 31, 2011. This increase resulted primarily from increases to cash and cash equivalents, securities available for sale, loans receivable, bank owned life insurance and securities receivable of $5.2 million, or 13.5%, $758,000, or 0.07%, $11.1 million, or 1.7%, $158,000, or 0.5%, and $88,000, or 7.7%, partially offset by decreases in accrued interest receivable, FHLB stock, premises and equipment, real estate acquired through foreclosure, real estate held for investment, intangible assets and prepaid expenses and other assets of $550,000, or 6.0%, $1.1 million, or 5.0%, $45,000, or 0.3%, $271,000, or 7.0%, $104,000, or 0.7%, $70,000, or 12.6% and $772,000, or 9.5%. Total non-performing assets increased to $19.8 million at March 31, 2012 compared to $17.3 million at December 31, 2011 and non-performing assets to total assets were 0.99% at March 31, 2012 compared to 0.88% at December 31, 2011. Total non-performing assets increased primarily due to an increase in the non-performing mortgage loans. The Company’s total liabilities increased $7.8 million, or 0.4%, to $1.79 billion at March 31, 2012. Total stockholders’ equity increased $6.7 million, or 3.7%, to $185.8 million at March 31, 2012, from $179.1 million at December 31, 2011. The increase to stockholders’ equity was primarily the result of increases in retained earnings of $2.2 million, or 2.8%, and accumulated other comprehensive income of $3.5 million, or 17.0%, and decreases in treasury stock of $443,000, or 2.3%, and unearned employee stock ownership plan shares of $267,000, or 6.4%. Average stockholders’ equity to average assets was 9.37%, and book value per share was $12.76 at March 31, 2012 compared to 9.08% and $12.34, respectively, at December 31, 2011.

ESB Financial Corporation is the parent holding company of ESB Bank and offers a wide variety of financial products and services through 25 offices in the contiguous counties of Allegheny, Lawrence, Beaver and Butler in Pennsylvania. The common stock of the Company is traded on The NASDAQ Stock Market under the symbol “ESBF”. We make available on our web site, which is located at http://www.esbbank.com, our annual report on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K, on the date which we electronically file these reports with the Securities and Exchange Commission. Investors are encouraged to access these reports and the other information about our business and operations on our web site.

This news release contains certain forward-looking statements with respect to the financial condition, results of operations and business of the Company. Forward-looking statements are subject to various factors which could cause actual results to differ materially from these estimates. These factors include, but are not limited to, changes in general economic conditions, interest rates, deposit flows, loan demand, competition, legislation or regulation and accounting principles, policies or guidelines, as well as other economic, competitive, governmental, regulatory and accounting and technological factors affecting the Company’s operations.

Press Release

Page 3 of 3

April 17, 2012