Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NORTHERN TRUST CORP | d336315d8k.htm |

Annual Meeting of Stockholders

Service

Expertise

Integrity

Service

Expertise

Integrity

P R I N C I P L E S T H A T E N D U R E

Northern Trust

Corporation

Annual Meeting of Stockholders

Frederick H. Waddell

Chairman & Chief Executive Officer

EXHIBIT 99.1

northerntrust.com

©

2012 Northern Trust Corporation |

2

Annual Meeting of Stockholders

Forward Looking Statement

This presentation may include forward-looking statements such as statements that relate to

Northern Trust’s financial goals, capital adequacy, dividend policy, expansion and business

development plans, risk management policies, anticipated expense levels and projected profit

improvements, business prospects and positioning with respect to market, demographic and

pricing trends, strategic initiatives, re-engineering and outsourcing activities, new business

results and outlook, changes in securities market prices, credit quality including reserve

levels, planned capital expenditures and technology spending, anticipated tax benefits and

expenses, and the effects of any extraordinary events and various other matters (including

developments with respect to litigation, other contingent liabilities and obligations, and

regulation involving Northern Trust and changes in accounting policies, standards and

interpretations) on Northern Trust’s business and results. These statements speak of

Northern Trust’s plans, goals, targets, strategies, beliefs, and expectations, and refer

to estimates or use similar terms. Actual results could differ materially from those indicated

by these statements because the realization of those results is subject to many risks and

uncertainties.

Our 2011 annual report and periodic reports to the SEC contain information about specific

factors that could cause actual results to differ, and you are urged to read them. Northern Trust

disclaims any continuing accuracy of the information provided in this presentation after today. |

3

Annual Meeting of Stockholders

Agenda

Northern Trust Corporation

Strategic Overview

Financial Performance

Legacy of Leadership |

Annual Meeting of Stockholders

Service

Expertise

Integrity

Strategic Overview

northerntrust.com

©

2012 Northern Trust Corporation

Service

Expertise

Integrity

P R I N C I P L E S T H A T E N D U R E

|

5

Annual Meeting of Stockholders

A Highly Focused Business Model

As of March 31, 2012

Founded in 1889, Northern Trust Corporation is a global leader in asset servicing,

asset management, wealth management and banking for personal and institutional

clients. Operations & Technology

Integrated global operating platform

Personal Financial Services

Leading advisor to affluent market

Corporate & Institutional Services

Leading global custodian

Northern Trust Global Investments

Leading asset manager for

personal & institutional clients

Corporations

Pension funds

Fund managers

Foundations

Endowments

Sovereign

wealth funds

Individuals

Families

Family offices

Family foundations

& endowments

Privately held

businesses

AUM

$179 Billion

AUC

$407 Billion

AUC

$4.2 Trillion

AUM

$537 Billion

AUM

$716 Billion

Serving personal and institutional clients

$1.6 Billion in technology spending,

2009-2011 |

6

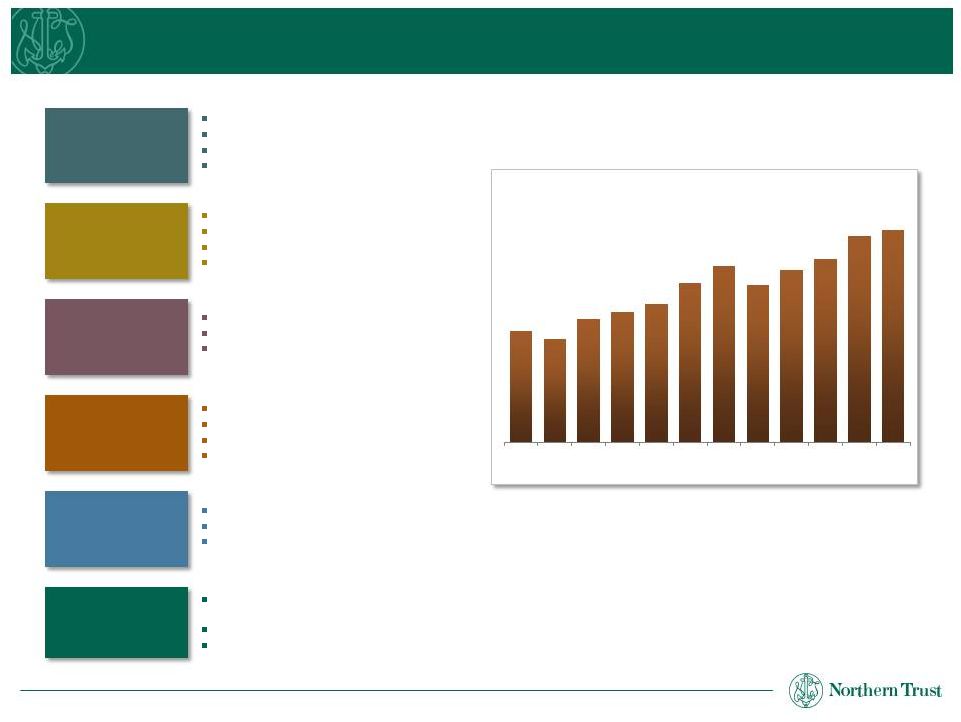

Annual Meeting of Stockholders

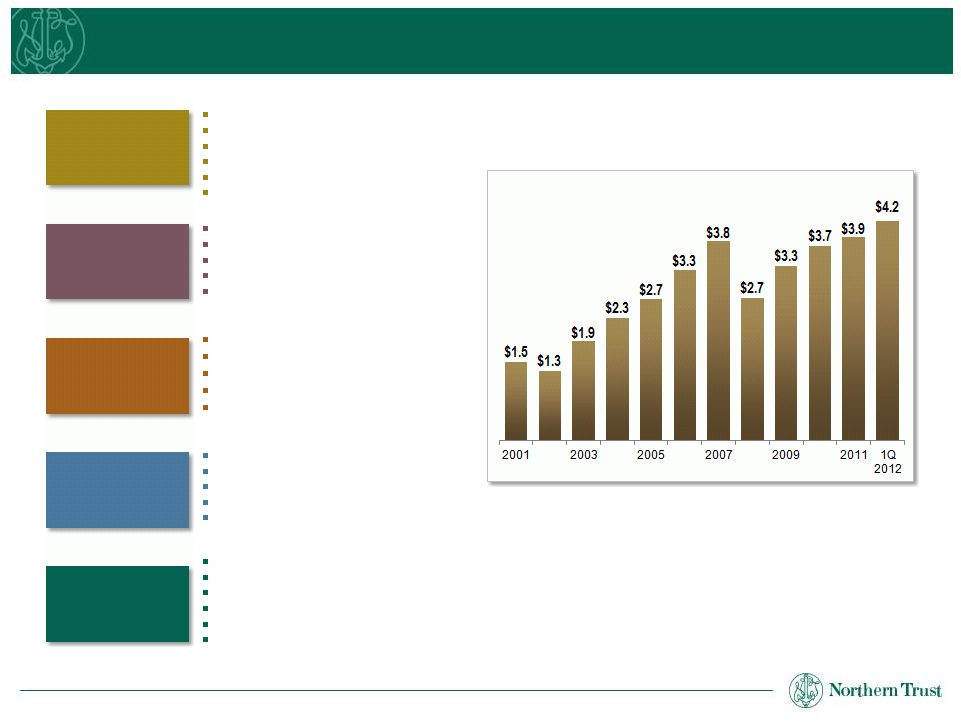

Comprehensive investment capabilities

Custom asset allocation

Broad menu of outside managers

Brokerage services

Investment

Management

Personal Financial Services

Comprehensive Approach to Serving the Affluent Market

PFS

Assets

Under

Management

($

Billions)

CAGR

+6%

S&P 500 CAGR

+2%

Private and

Business

Banking

Deposit services

Custom financing

Stock option lending

Foundation and

Institutional

Advisors

Customized investment objectives

and strategic asset allocation

Manager selection and oversight

Asset servicing and administration

Advisory

Services

Family education and governance

Family business

Non-financial asset management

Financial

Planning

Cash flow analysis

Debt management

Tax planning

Retirement planning

Trust & Estate

Services

Wealth transfer planning

Trust and estate services

Philanthropic advisory services

Securities custody

$94.0

$87.7

$104.3

$110.4

$117.2

$134.7

$148.3

$132.4

$145.2

$154.4

$173.7

$179.1

2001

2003

2005

2007

2009

2011

1Q

2012 |

7

Annual Meeting of Stockholders

C&IS

Assets

Under

Custody

($

Trillions)

Corporate & Institutional Services

Delivering a Broad Range of Solutions

CAGR

+11%

S&P 500 CAGR

+2%

US$ EAFE CAGR

+3%

Asset

Administration

Fund accounting

Transfer agency

Corporate secretarial/trustee

Valuations

Investment operations outsourcing

Asset

Management

Active

Global index

Investment outsourcing

Liability driven investing

Multi-manager

Transition management

Asset

Processing

Safekeeping

Settlement

Derivatives and collateral processing

Income collection

Corporate actions

Tax reclamation

White label reporting

Valuation analytics

Performance analytics

Risk monitoring and reporting

Trade execution analysis

Asset

Reporting

Asset

Enhancement

Cross-border pooling

Trade execution

Cash management

Securities lending

Foreign exchange |

8

Annual Meeting of Stockholders

Northern Trust Global Investments

Client Focused, Diversified Investment Manager

Assets Under Management: $716 Billion

As of March 31, 2012

* Includes Undertakings for Collective Investments in Transferable Securities

Separate Accounts

Mutual &

Commingled Funds*

Exchange Traded

Funds (ETF)

Diversified Asset Management Solutions

Delivered through Various Structures

Across Asset Classes

Across Client Segments

$537 Billion

Institutional

$179 Billion

Personal

Equities

$339 Billion

(47%)

Fixed Income

$134 Billion

(19%)

Short

Duration

$223 Billion

(32%)

Other

$20 Billion

(2%)

Across Styles

$37 Billion

(5%)

$337 Billion

(47%)

Active

$323 Billion

(45%)

Index

Multi-Manager

Other

$19 Billion

(3%) |

9

Annual Meeting of Stockholders

Northern Trust Global Investments

Representative Asset Management Client Case Studies

Institutional Client

Bond Index

45%

Short

Duration

23%

Equity Index

32%

Northern Trust Global Investments provides customized investment

solutions to

both personal and institutional clients.

Personal Client

50%

27%

23%

Fixed Income

Municipal

Inflation linked

Other

Alternatives

Real Estate

Commodities

Cash

Equities

Large cap

Small cap

International

Tax advantaged

Wealth advisory client with ~$50 million.

A goals driven solution was implemented

using a blend of proprietary and third party

investment products.

Custody client with Defined Benefit pension,

Defined Contribution, and Foundation assets

at Northern Trust.

Northern Trust manages more than $2 billion. |

10

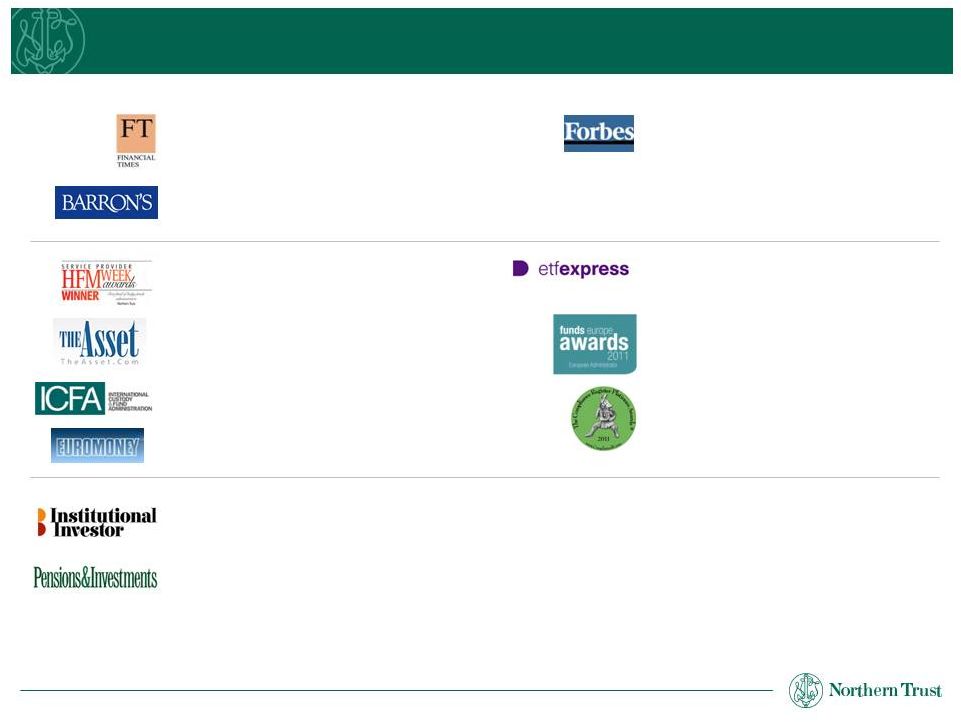

Annual Meeting of Stockholders

A Recognized Market Leader

Manager

of

the

Year

–

Equity

Indexers

(U.S.)

–

Institutional Investor (April 2011 assets)

Private Bank in North America

–

Financial Times Group

(October 2011, 3 consecutive year)

Ranked among the Top 10 Wealth Managers

–

Barron’s (September 2011)

Serving More than 20% of Forbes 400

Most Affluent Americans

–

Forbes (September 2011)

13 Largest Manager of Worldwide Institutional Assets

17 Largest Asset Manager Worldwide

3 Largest Passive International Indexed Securities

Manager Best

Client Relationship Manager of the Year

–

ICFA Americas Awards (May 2010, 2011)

Best Administrator for UCITS Funds

–

HFM Week, European Hedge Fund Awards

(May 2011 and March 2012)

Best Custody Specialist in Asia

–

The Asset Magazine Awards (4 consecutive year)

Best Outsourcing Services Company

–

The Compliance Register Platinum

Awards (November 2011)

Global Investor Services House

–

Euromoney (Sept. 2011 and July 2010)

Best European ETF Administrator

–

ETF Express Global Awards (2012)

European Administrator of the Year

–

Funds Europe Awards (December 2011)

–

Pensions & Investments (May 2011 based on December 31, 2010 assets)

th

th

th

rd

rd |

Annual Meeting of Stockholders

Financial Performance

Service

Expertise

Integrity

northerntrust.com

©

2012 Northern Trust Corporation

Service

Expertise

Integrity

P R I N C I P L E S T H A T E N D U R E

|

12

Annual Meeting of Stockholders

Solid performance despite challenging macroeconomic environment.

($MM, except EPS)

Trust, Inv. & Other Servicing Fees

Foreign Exchange Trading Income

Other Non-Interest Income

Net Interest Income

Total Revenues

Non-Interest Expenses

Provision for Credit Losses

Pre-Tax Income

Taxes

Net Income

Earnings per Share

Return on Common Equity

$2,170

325

267

1,009

3,770

2,831

55

884

280

$604

$2.47

8.6%

2011

+4%

-15%

+1%

+10%

+3%

+13%

-66%

-11%

-13%

-10%

-10%

2011 vs. 2010

Strong new business results despite

difficult macroeconomic environment

Invested approximately $609 million in

technology

Maintained

our

dividend

for

the

115

th

consecutive year

Acquisitions of Bank of Ireland

Securities Services and Omnium LLC

Results included restructuring,

acquisition and integration related

charges totaling $91.6 million ($59.8

million after tax, or $.25 per share)

2011 Financial Performance |

13

Annual Meeting of Stockholders

1Q12

1Q12 vs 1Q11

Trust, Inv. & Other Servicing Fees

Foreign Exchange Trading Income

Other Non-Interest Income

Net Interest Income

Total Revenues

Non-Interest Expenses

Provision for Credit Losses

Pre-Tax Income

Taxes

Net Income

Earnings per Share

Return on Common Equity

$575

62

72

256

965

723

5

237

76

$161

$0.66

9.0%

+12%

-27%

+13%

+9%

+8%

+11%

-67%

+3%

-4%

+7%

+8%

First Quarter 2012 Financial Performance

($MM, except EPS)

Acquisitions and new business results

delivered revenue growth against the

backdrop of a mixed macroeconomic

environment

Expense growth was impacted by

acquisitions but moderated in the first

quarter as we focused on productivity

We continue to invest in the business |

14

Annual Meeting of Stockholders

Driving Performance: Overview

Revenue enhancements

Process optimization

Technology efficiency

Corporate-wide initiatives

Maintain client focus

Improve profitability and returns

Advance high performing culture

$250 million by end of 2013

Goals

Drivers of Improvement

Estimated, Annualized

Pre-Tax Impact |

15

Annual Meeting of Stockholders

Driving Performance: Drivers of Improvement

Fully align value proposition

Unbundle pricing structures

Expand share of relationship

Streamline major business processes

Optimize operational footprint

Apply best-in-class procurement practices

Refine service delivery model

Migrate IT resourcing mix

Rationalize overlapping applications

Manage internal end-user demand

Simplify organizational structure

Align retirement plans with market

Rationalize real estate

Consolidate banking charters

30 –

35%

30 –

40%

5 –

10%

20 –

25%

Process

Optimization

Revenue

Enhancements

Technology

Efficiency

Corporate-wide

Initiatives

Percent of 2013 Impact |

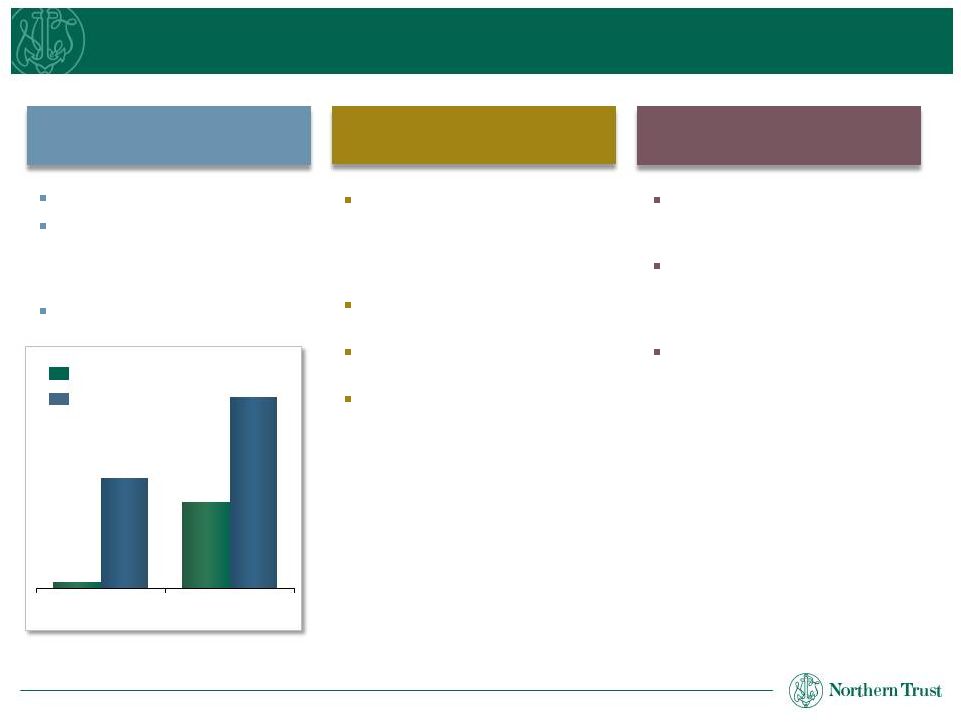

16

Annual Meeting of Stockholders

Balance Sheet: Consistently Strong and Conservative

Northern Trust data is as of March 31, 2012 and for the quarter then ended.

Peer data is as of the fourth quarter of 2011 as sourced from SNL Financial.

The peer group includes U.S. based banks with assets of more than $50 billion as of

December

31,

2011,

a

group

of

18

institutions

excluding

Northern

Trust.

Northern Trust

Peer Avg.

Relationship-based lending

Diversified by loan type, including

residential real estate (36%),

commercial & institutional (24%),

commercial real estate (10%)

Consistent and conservative

underwriting standards

Placed with banks that have

strong internal risk ratings and

external credit ratings

Includes exposure to banks in

the Eurozone of $3.0 billion,

primarily in the Netherlands

and in the Nordic region

Average duration of less than

2 months

85% of Northern Trust’s total

securities portfolio composed

of U.S. Treasury, government

sponsored agency and triple-A

rated securities

87% of Asset-Backed Securities

rated triple-A

The securities portfolio is in a

net unrealized gain position

Average maturity duration of ~2

years and a re-pricing duration

of ~11 months

Loan Portfolio

$29 billion

Securities

$32 billion

Deposits with Banks

$19 billion

0.08%

0.98%

1.25%

2.16%

NCOs to

Avg. Loans

NPAs

to Loans & REO |

17

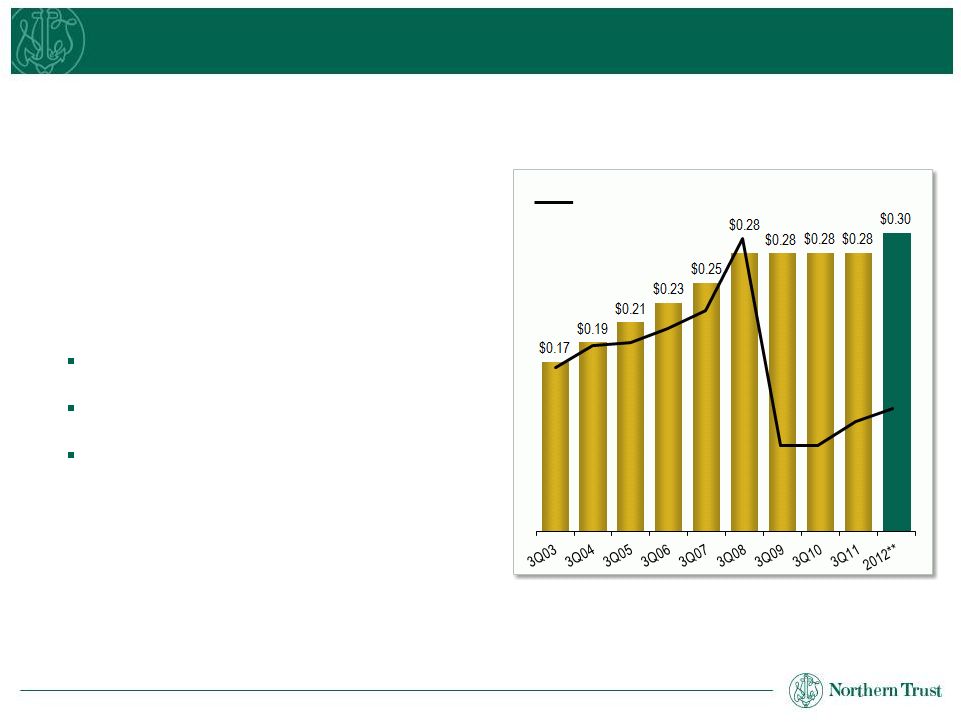

Annual Meeting of Stockholders

Balance Sheet:

Outstanding Capital Strength

Northern Trust Corporation Capital Ratios

Paid dividends totaling $273 million in 2011 for a

dividend payout ratio of 45%

Announced an increase in our dividend to $0.30

per share

The Federal Reserve did not object to Northern

Trust’s capital plan, including the repurchase of up

to $240 million of common stock through March

2013

Quarterly Dividend Paid

per Common Share

Peer Average***

rd

As of March 31, 2012. Capital ratios are considered preliminary until the 10Q has

been filed with the SEC. *

The

ratio

of

tier

1

common

equity

to

risk-weighted

assets

is

a

non-GAAP

financial

measure.

A

reconciliation

of

tier

1

common

equity

to

tier

1

capital calculated in accordance with applicable regulatory requirements and GAAP

is included in the Appendix on page 24. **2012 figures represent dividend

actions announced upon completion of the Comprehensive Capital Analysis and Review and the Capital

Plan

Review.

For

Northern

Trust,

this

represents

the

dividend

declared

on

March

14,

2012

but

payable

in

the

3

quarter.

***Peer data is indexed based on dividend data sourced from SNL Financial. See note

on slide 17 for a definition of the peer group. Tier 1 Capital Ratio

12.4%

Total Risk-Based Ratio

14.0%

Leverage Ratio

7.6%

Tier 1 Common Equity*

11.9% |

Annual Meeting of Stockholders

P R I N C I P L E S T H A T E N D U R E

Legacy of Leadership

Service

Expertise

Integrity

northerntrust.com

©

2012 Northern Trust Corporation

Service

Expertise

Integrity |

19

Annual Meeting of Stockholders

Enrique J. Sosa

Director of The Northern Trust Company and Northern Trust

Corporation for 5 years

President, BP Amoco Chemicals, 1999

Executive Vice President, Amoco, Chemicals Sector 1995

Served Dow Chemical Company for 31 years

President, Dow Chemical North America, 1992-1995

Director of other prominent companies including Amtrak, Destec

Energy, Inc., The Dow Corning Corporation, DSM N.V. of the

Netherlands, Electronic Data Systems, FMC Corporation and

MEDNAX, Inc.

Served his community as a member of the Board of Directors

and Executive Committee of the National Parkinson Foundation

and as President of The American Chamber of Commerce, Sao

Paulo, Brazil

During Enrique's tenure as Director, Northern Trust’s average

stockholders’

equity rose from $4.16 billion to $7.02 billion from

2007-2011 and revenue increased from $3.51 billion to $3.77

billion from 2007-2011 |

20

Annual Meeting of Stockholders

Robert C. McCormack

Director of The Northern Trust Company and Northern Trust

Corporation for 12 years

Co-Founder and Co-Chairman, Trident Capital, Inc. since 1993

Advisory Director, Trident Capital Inc. since 2004

Managing Director, Trident Capital Inc., 1993-2004

Assistant Secretary, U.S. Navy (Financial Management) and

Comptroller, U.S. Navy, 1990-1993

Various positions on staff of U.S. Secretary of Defense,1987-1990

Vice President, Principal and Managing Director, Morgan Stanley &

Co. Incorporated, Chicago office, 1981-1987

Director of other prominent companies including DeVry Inc., Illinois

Tool Works Inc., and MeadWestvaco Corporation

Served community by contributing his time and talent to

organizations such as the Glenwood School for Boys, The

Hotchkiss School, the Illinois Institute of Technology and the

Rehabilitation Institute of Chicago

During Bob's tenure as Director, Northern Trust’s average

stockholders’

equity rose from $2.46 billion to $7.02 billion from

2000-

2011, revenue increased from $2.2 billion to $3.77 billion

from 2000-2011 and net income grew from $485.1 million to $603.6

million from 2000-2011 |

21

Annual Meeting of Stockholders

Strategically Positioned for Growth

Market Leader in Focused Businesses

Strong History of Organic Growth

Distinctive Financial Strength

Invested & Experienced Management Team |

Annual Meeting of Stockholders

Northern Trust

Corporation

Annual Meeting of Stockholders

Questions?

Service

Expertise

Integrity

northerntrust.com

©

2012 Northern Trust Corporation

Service

Expertise

Integrity

P R I N C I P L E S T H A T E N D U R E

|

Annual Meeting of Stockholders

P R I N C I P L E S T H A T E N D U R E

Appendix

Service

Expertise

Integrity

northerntrust.com

©

2012 Northern Trust Corporation

Service

Expertise

Integrity |

24

Annual Meeting of Stockholders

Reconciliation of Non-GAAP Financial Measures

The following table provides a reconciliation of tier 1 common equity to tier 1

capital calculated in accordance with applicable regulatory requirements

and GAAP. Northern Trust is providing the ratio of tier 1 common equity to

risk-weighted assets in addition to its capital ratios prepared in

accordance with regulatory requirements and GAAP as it is a measure that Northern

Trust and investors use to assess capital adequacy.

March 31,

($ In Millions)

2011

Tier 1 Capital

$

7,157.4

Less: Floating Rate Capital Securities

268.6

Tier 1 Common Equity

$

6,888.8

Ratios

Tier 1 Capital

12.4

%

Tier 1 Common Equity

11.9

% |