Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MidWestOne Financial Group, Inc. | a2012annualmeetingpresenta.htm |

Exhibit 99.1

Annual Shareholder’s Meeting

April 19, 2012

Iowa City, Iowa

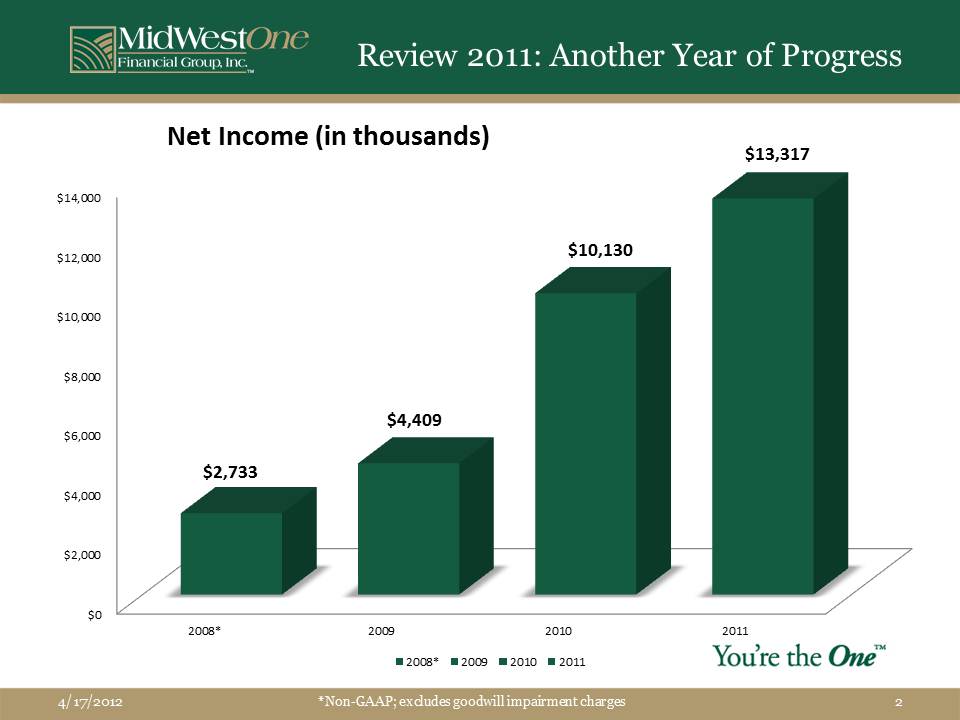

Review 2011: Another Year of Progress

Net Income (in thousands)

*Non-GAAP; excludes goodwill impairment charges

Return on Average Tangible Common Equity (MOFG)

*Non-GAAP; excludes goodwill impairment charges.

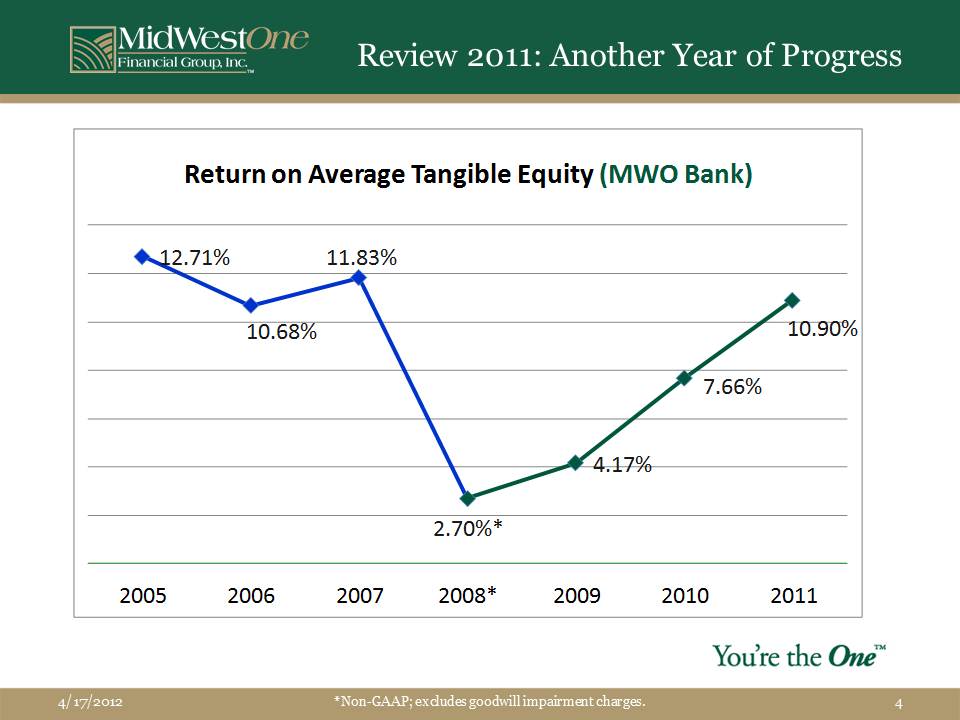

Return on Average Tangible Equity (MWO Bank)

*Non-GAAP; excludes goodwill impairment charges.

Earnings Per Share 2000-2011

* EPS excluding goodwill impairment at 12/31/2008

Total Return Performance

*2005, 2006, and 2007 prices quoted on The Pink Sheets LLC. Data provided by SNL Financial.

Publicly Traded Iowa Depository Institutions

Company City Ticker Market Cap ($M) Price Change 3 Year (%) Price Change 1 Year (%)

MidWestOne Financial Group, Inc. Iowa City MOFG 157.9 125.8 34.7

Meta Financial Group, Inc. Storm Lake CASH 65.3 94.8 23.9

West Bancorporation, Inc. West Des Moines WTBA 168.5 50.1 29.1

Iowa First Bancshares Corp. Muscatine IOFB 31.4 47.4 12.0

QCR Holdings, Inc. Moline QCRH 53.2 41.4 36.8

Ames National Corporation Ames ATLO 210.3 27.8 23.1

Heartland Financial USA, Inc. Dubuque HTLF 277.6 23.4 5.3

Hills Bancorporation Hills HBIA 304.5 20.8 0.2

Two Rivers Financial Group, Inc. Burlington TRVR 33.4 (32.1) (5.0)

National Bancshares, Inc. Bettendorf NABA 20.0 (66.7) 0.0

Iowa Average 104.4 16.6 8.5

Iowa Median 53.2 23.4 5.3

National Average 908.4 10.8 (2.5)

National Median 29.9 2.7 0.0

Balance sheet and income statement data for the quarter ended 12/31/11 where available, otherwise for quarter ended 9/30/11

Institutions sorted by asset size; Excludes M&A targets

Represents price to fully-converted tangible book value for publicly traded MHCs

Excludes renegotiated loans from nonperforming loans

Market Cap as of 03/22/2012

Source: SNL Financial

Bank Balance Sheet Trends 12/31/2011

Loan Portfolio: 2008 2009 2010 2011

Total Bank Loans, net 1,003,837 953,041 922,868 970,497

Bank Loans + Loan Pools, net 1,093,769 1,036,093 988,739 1,020,549

Deposit Portfolio: 2008 2009 2010 2011

Total Deposits 1,128,189 1,179,868 1,219,328 1,306,642

Asset Growth: 2008 2009 2010 2011

Total Assets 1,508,962 1,534,783 1,581,259 1,695,244

Bank Credit Quality Trends

Nonperforming Assets: 2007 2008 2009 2010 2011

NPA’s/ Total Assets 0.18% 1.08% 1.14% 1.49% 1.31%

Charge-offs 2007 2008 2009 2010 2011

NCO’s/ Avg. Loans 0.09% 0.48% 0.48% 0.50% 0.30%

Loan Loss Reserve 2007 2008 2009 2010 2011

LLR/Total Loans 1.36% 1.08% 1.44% 1.62% 1.59%

Bank portfolio only; excludes loan pools

Liquidity

Loan/Deposit Ratio 2007 2008 2009 2010 2011

Bank + Pools/Deposits 76.26% 98.38% 89.18% 82.51% 79.47%

Top Ten Iowa-based Bank Holding Companies by Asset Size

Institution Ticker City Assets (2011)

Heartland Financial USA, Inc. HTFL Dubuque $4,305,058

BTC Financial Corporation - Des Moines $3,090,083

Hills Bancorporation HBIA Hills $2,018,297

MidWestOne Financial Group, Inc. MOFG Iowa City $1,695,244

Stark Bank Group, LTD. - Fort Dodge $1,373,700

Northwest Financial Corp. - Arnolds Park $1,337,527

West Bancorporation WTBA West Des Moines $1,269,524

First Citizens Financial Corp. - Mason City $1,171,387

Ida Grove Bancshares, Inc. - Ida Grove $1,154,534

National Bancshares, Inc. NABA Bettendorf $1,096,123

2011 Expense Control Success

Non-Interest Expense: 2008 – 2011

2011 Expense Control Success

FDIC Premiums: 2006 to 2011

Rewarding Our Shareholders

TARP repaid

Dividend increased from $0.20 $0.34 annually

Share Repurchase Program:

102,190 Shares repurchased at $14.66 (average) in 2011

$3,388,908 returned to our shareholders via dividends and share repurchases in 2011

2012 and Beyond

Industry consolidation

Organic growth

Regulatory challenge

Where do we go from here?

Focus on internal improvement

Improve earnings

Improve efficiency

Grow within our footprint

Serving Our Communities

Our Chairman, Kevin W. Monson

Executive Management Team

Name Position Banking Experience Years with MidWestOne

Charles N. Funk President & CEO 33 Years 12 Years

Susan R. Evans Chief Operating Officer 36 Years 11 Years

Kent L. Jehle EVP, Chief Credit Officer 31 Years 26 Years

Gary J. Ortale EVP, Chief Financial Officer 34 Years 25 Years

Douglas L. Benjamin SVP, Regional President 24 Years 8 Years

James M. Cantrell SVP, Chief Risk Officer 26 Years 3 Years

Barbara A. Finney SVP, Regional President 20 Years 15 Years

Sondra J. Harney SVP, Director of Human Resources 33 Years 33 Years

John J. Henk SVP, Chief Information Officer 25 Years 6 Years

Steven P. Hicks SVP, Regional Credit Manager 24 Years 21 Years

Pamela S. Pothoven SVP, Regional President 29 Years 6 Years

Gregory W. Turner SVP, Wealth Management 15 Years 4 Years

Our Operating Principles

Take care of our customers and those who should be

Hire and retain excellent employees

Always conduct yourself with the utmost integrity

Work as one team

Learn constantly so we can continually improve

Thank you for joining us.