Attached files

| file | filename |

|---|---|

| EX-31 - EX. 32 - Oraco Resources, Inc. | ex32.htm |

| EX-32 - EX. 31 - Oraco Resources, Inc. | ex31.htm |

| EXCEL - IDEA: XBRL DOCUMENT - Oraco Resources, Inc. | Financial_Report.xls |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2011

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number: 000-54472

ORACO RESOURCES, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

27-2300414

|

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

|

189 Brookview Drive, Rochester NY

|

14617

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant's telephone number: (212) 279-6260

Copies of Communications to:

Stoecklein Law Group, LLP.

401 West A Street

Suite 1150

San Diego, CA 92101

(619) 704-1310

Fax (619) 704-1325

Securities registered under Section 12(b) of the Act: None

Securities registered under Section 12(g) of the Act: Common Stock, $0.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "small reporting company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ¨

|

Accelerated filer ¨

|

|

Non-accelerated filer ¨ (Do not check if a smaller reporting company)

|

Smaller reporting company x

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes ¨ No x

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity, as of June 30, 2011 (the last business day of the registrant's most recently completed second fiscal quarter) was $7,225,360 based on a share value of $1.00.

The number of shares of Common Stock, $0.001 par value, outstanding on April 11, 2012 was 23,725,360 shares.

DOCUMENTS INCORPORATED BY REFERENCE: None.

ORACO RESOURCES, INC.

FOR THE FISCAL YEAR ENDED

DECEMBER 31, 2011

Index to Report

on Form 10-K

|

PART I

|

Page

|

|

|

Item 1.

|

Business

|

2 |

|

Item 1A.

|

Risk Factors

|

18 |

|

Item 1B.

|

Unresolved Staff Comments

|

26 |

|

Item 2.

|

Properties

|

26 |

|

Item 3.

|

Legal Proceedings

|

34 |

|

PART II

|

||

|

Item 5.

|

Market for Registrant's Common Equity and Related Stockholder Matters and Issuer Purchases of Equity Securities

|

35 |

|

Item 6.

|

Selected Financial Data

|

37 |

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

37 |

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

41 |

|

Item 8.

|

Financial Statements and Supplementary Data

|

41 |

|

Item 9.

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

41 |

|

Item 9A (T)

|

Control and Procedures

|

41 |

|

Item 9B.

|

Other Information

|

42 |

|

PART III

|

||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

43 |

|

Item 11.

|

Executive Compensation

|

46 |

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

47 |

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

48 |

|

Item 14

|

Principal Accounting Fees and Services

|

49 |

|

PART IV

|

||

|

Item 15.

|

Exhibits, Financial Statement Schedules

|

51 |

i

FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements and involves risks and uncertainties that could materially affect expected results of operations, liquidity, cash flows, and business prospects. These statements include, among other things, statements regarding:

|

o

|

our ability to diversify our operations;

|

|

o

|

our ability to implement our business plan of providing;

|

|

o

|

our ability to attract key personnel;

|

|

o

|

our ability to operate profitably;

|

|

o

|

our ability to efficiently and effectively finance our operations, and/or purchase orders;

|

|

o

|

inability to achieve future sales levels or other operating results;

|

|

o

|

inability to raise additional financing for working capital;

|

|

o

|

inability to efficiently manage our operations;

|

|

o

|

the inability of management to effectively implement our strategies and business plans;

|

|

o

|

the unavailability of funds for capital expenditures and/or general working capital;

|

|

o

|

the fact that our accounting policies and methods are fundamental to how we report our financial condition and results of operations, and they may require management to make estimates about matters that are inherently uncertain;

|

|

o

|

deterioration in general or regional economic conditions;

|

|

o

|

changes in U.S. GAAP or in the legal, regulatory and legislative environments in the markets in which we operate;

|

|

o

|

adverse state or federal legislation or regulation that increases the costs of compliance, or adverse findings by a regulator with respect to existing operations;

|

as well as other statements regarding our future operations, financial condition and prospects, and business strategies. Forward-looking statements may appear throughout this report, including without limitation, the following sections: Item 1 “Business,” Item 1A “Risk Factors,” and Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Forward-looking statements generally can be identified by words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “projects,” “will be,” “will continue,” “will likely result,” and similar expressions. These forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties, which could cause our actual results to differ materially from those reflected in the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in this Annual Report on Form 10-K, and in particular, the risks discussed under the caption “Risk Factors” in Item 1A and those discussed in other documents we file with the Securities and Exchange Commission (SEC). We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements, except as required by law. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements.

1

Throughout this Annual Report references to “we”, “our”, “us”, “Oraco”, “the Company”, and similar terms refer to Oraco Resources, Inc. and its subsidiaries, unless the context indicates otherwise.

PART I

ITEM 1. BUSINESS

Business Development

Oraco Resources, Inc. ("Oraco") was incorporated on April 6, 2010 in the State of Nevada originally under the name Sterilite Solutions Corp. On February 23, 2011, the Company changed its name from Sterilite Solutions Corp. to Oraco Resources, Inc.

On May 16, 2011, Oraco completed the acquisition of all the issued and outstanding shares of Oraco Resources, a Canadian corporation, ("ORI") and JYORK Industries, Inc. Ltd ("JYORK") (collectively, the "Acquired Businesses") pursuant to a Share Purchase Agreement (the "SPA"). Under the SPA, Oraco issued 15,001,500 shares of the its common stock to various individuals and entities in exchange for a 100% interest in ORI and 3,000,000 shares of Oraco's common stock to an individual for a 100% interest in JYORK. Additionally under the SPA, the former officers and directors of Oraco agreed to cancel 10,000,000 shares of its common stock. For accounting purposes, the acquisition of the Acquired Businesses by Oraco has been accounted for as a recapitalization, similar to a reverse acquisition except no goodwill is recorded, whereby the private companies, ORI and JYORK, in substance acquired a non-operational public company (Oraco) with nominal assets and liabilities for the purpose of becoming a public company. Accordingly, ORI and JYORK are considered the acquirer for accounting purposes and thus, the historical financials are primarily that of ORI. As a result of this transaction, Oraco changed its business direction and is now a mineral and natural resource exploration business. ORI was incorporated on August 4, 2010 (Date of Inception) and accordingly, the accompanying financial statements are from the Date of Inception of ORI through ending reporting periods reflected.

Effective May 16, 2011, Oraco completed the acquisition of contractual rights for the disposition and exportation of diamonds and gold, and any other minerals recovered both in Zimmi Town, Pujehun District of Sierra Leone as well as the Gbense Tailings No. 5 reserve located in Koidu Town, Kono District – Sierra Leone, through the acquisition of 100% of the ownership of what are now the wholly owned subsidiaries, JYORK and ORI.

Through our acquisitions, we obtained control of the recovery and disposition of all diamonds, gold and other natural resources of any kind at the following sites via the agreements described below:

|

§

|

Gbense Tailings Number 5 – Memorandum of Understanding which provides that JYORK and the Gbense Chiefdom will work jointly to recovery any precious minerals and all other natural resources found above or below the ground at Tailings Number 5, with JYORK providing any necessary expertise and/or machinery. The net profits realized from these efforts will be divided 70% to JYORK and 30% to the Gbense Chiefdom. (“Net Profits” being defined as the gross value of the recovery, as determined by governmental agencies, less any and all costs incurred in connection with the recovery and evaluation of the product).

|

2

|

§

|

Zimmi Mining Area – Memorandum of Understanding which provides that JYORK and the Baysuagung-Gbeya Cooperative Mining Society will work jointly to recovery any precious minerals and all other natural resources found above or below the ground at the Zimmi mining site, with JYORK providing any necessary expertise and/or machinery. The net profits realized from these efforts will be divided 70% to JYORK and 30% to the Baysuagung-Gbeya Cooperative Mining Society. (“Net Profits” being defined as the gross value of the recovery, as determined by governmental agencies, less any and all costs incurred in connection with the recovery and evaluation of the product).

|

|

§

|

Boroma Mining Area –Memorandum of Understanding which provides that JYORK and the Boroma Gbense Chiefdom will work jointly to recovery any precious minerals and all other natural resources found above or below the ground at the Boroma mining site, with JYORK providing any necessary expertise and/or machinery. The net profits realized from these efforts will be divided 50% to JYORK and 50% to the Boroma Gbense Chiefdom. (“Net Profits” being defined as the gross value of the recovery, as determined by governmental agencies, less any and all costs incurred in connection with the recovery and evaluation of the product). In addition, JYORK has the first right of refusal to purchase for itself any diamonds or other minerals

|

|

§

|

Nimini Hills – Memorandum of Understanding which provides that JYORK and the Nimikoro Chiefdom will work jointly to recovery any precious minerals and all other natural resources found above or below the ground, with JYORK providing any necessary expertise and/or machinery. The net profits realized from these efforts will be divided 69% to JYORK and 31% to the Nimikoro Chiefdom, with 1% of the Nimikoro Chiefdom’s portion to be used for developmental purposes. (“Net Profits” being defined as the gross value of the recovery, as determined by governmental agencies, less any and all costs incurred in connection with the recovery and evaluation of the product).

|

Prior to our acquisition of JYORK and ORI, ORI purchased a one-half interest in JYORK’s rights in the concessions JYORK holds in the Tailings Number 5 reserve and the Zimmi location. We acquired 100% of the ownership of ORI and JYORK to obtain the control of all rights and interests in and to the Tailings Number 5 and Zimmi concessions.

As a result of the closing of the Share Exchange Agreements, Oraco is now involved in the mining industry in the African country of Sierra Leone through mining concessions held primarily by JYORK. The objectives of the Company are to seek additional mining concession rights, privileges, and to own mines in Sierra Leone, as well as other West African Countries. In addition, we intend to process minerals and to sell such processed minerals around the world, and explore new areas in Sierra Leone and elsewhere in West Africa as opportunities may arise.

Recent Developments

In October 2011 we strengthened our holdings by reviving contractual rights for the disposition of diamonds, gold, and any other minerals recovered in an approximately 10 acre area of mineral rich Boroma, Sierra Leone. These rights had been acquired by JYORK in 2008 before becoming our wholly-owned subsidiary. The holding is located northwest of the city of Koidu in the Kono District, Sierra Leone.

3

Under the revived form of the agreement, net revenues generated from the activities at the Boroma site will be divided evenly between JYORK and the Boroma Gbense Chiefdom. (“Net Revenue” is defined as the gross value of the recovery, as determined by governmental agencies, less any and all costs incurred in connection with the recovery and evaluation of the product).

Subject to adequate financing, we plan to begin operations in Boroma in the fourth quarter of 2012. Findings will be released as soon as possible thereafter.

Also in October 2011, we further increased our holdings by fulfilling a condition precedent to the effectuation of an agreement that had been entered into on or about April 20, 2011 between JYORK and the authorities representing the Nimikoro Chiefdom in Sierra Leone, which granted to JYORK the rights to recover all precious minerals and natural resources located above and below ground in the area located in the Nimikoro Chiefdom known as Nimini Hills. The contract called for JYORK to provide all funding necessary to mine the area known as Nimini Hills, and all net profits earned from the recovery and sale of any precious minerals or other natural resources are to be divided 69% to JYORK and 31% to the Chiefdom (1% of the Chiefdom’s portion of the net profits is to apply to local development). The agreement applied to an area that is approximately 50 square kilometers (or approximately 12,355 acres) in size. However, since the specific metes and bounds of the area were indeterminate, the effectuation of the agreement was subject to JYORK having a complete survey done to establish these boundaries. On October 12, 2011, a surveyor was retained, and it is believed that a thorough survey of the metes and bounds of the Nimini Hills concession should be completed shortly, after which a geophysical review of the area will be conducted to determine the locations that hold the highest probability of return, in which operations should be commenced.

OUR BUSINESS

Mineral Exploration and Mining

We are a mineral exploration and mining company engaged in the discovery, acquisition, development, production, and marketing of gold, diamonds, and other natural resources. We plan to engage SRK Worldwide, or a similar consultant, to provide geological and geophysical analysis of our assets in Sierra Leone so as to prepare a feasibility and technical report with respect to the proposed mining operations on certain of our mining concessions.

In connection with our additional geophysical investigations, we also plan to complete a drilling program on additional areas of interest at Tailings Number 5 and Zimmi. This will allow us to determine the full potential of the projects, as well as better estimates of resource estimates and production targets. We are also involved in additional discussions aimed at the potential acquisition of other production based diamond and precious mineral projects. If these negotiations are successful, we could have the potential to achieve an additional diamond production within 24-36 months.

4

Management believes that with at least $7 million USD, the Company should be able to commence the recovery of diamonds, gold and other precious minerals. If we are able to acquire additional concessions, and the capital necessary to operate such concessions, we should be able to expand annual production from the initial levels, with the rate of expansion being dependent upon the amount of diamonds, gold and other natural minerals recovered, the number of additional concessions we are able to obtain and the level of additional capital that can be raised.

We intend to focus on the identification, acquisition and operations of diamond and gold projects that have the potential to generate sustained production and cash flow. Recent transactions, such as Tailings Number 5 and Zimmi, are aimed at giving the Company the potential to deliver significant annual diamond production yields on a consistent basis. We are also targeting further growth through the identification of additional resources throughout Sierra Leone and neighboring countries.

There has been no drilling to test the depth potential of commercial ore on these properties, and proposed programs on such properties are exploratory in nature only. Development of these mineral properties is contingent upon obtaining satisfactory exploration results. Mineral exploration and development involve substantial expenses and a high degree of risk, which even a combination of experience, knowledge and careful evaluation may not be able to adequately mitigate. There is no assurance that additional commercial quantities of ore will be discovered on the Company’s exploration properties. There is also no assurance that, even if commercial quantities of ore are discovered, a mineral property will be brought into commercial production, or if brought into production, that it will be profitable.

Exporting of Diamonds and Gold

In addition to being a mineral exploration and mining company, we also intend to become a wholesale purchaser and exporting company of diamonds and gold while the geophysical reports are being undertaken on our assets. Our products consist of: metal concentrates, which we intend to sell to custom smelters; unrefined bullion bars (doré), which may be sold as doré or further refined before sale to precious metals traders; unfinished diamonds; and some gem quality diamonds which we cut and polish before selling on the open market.

Our current business plan is to continue our current gold and diamond buy/sell transactions, which are presently being conducted on a small scale basis. With the additional capital, it is our intention to expand the level of the buy/sell transactions, which should provide current revenues for the Company.

We have previously entered into an agreement for the disposition of diamonds and gold and any other minerals recovered in: Koidu Town, Kono District - Sierra Leone Gbense Tailings Number 5 at the property known as “Tailings Number 5” ; Zimmi Town, Pujehun District of Sierra Leone at the property known as “Zimmi”; Boroma northwest of the city of Koidu in the Kono District, Sierra Leone at the property known as “Boroma”; and the Nimikoro Chiefdom, Kono District, Sierra Leone at the property known as “Nimini Hills”.

5

While the geophysical reports are being undertaken on our assets, we will intend to expand our gold and diamond buy/sell program which should deliver sufficient cash-flow to fund the costs, at least in part, associated with exploration and related geophysical examinations of our mining concessions.

We plan on initially processing placer gravel which is easily accessible. We will also stockpile quantities of potentially gold bearing and diamond bearing placer gravel during the rainy season (May/June through October). All such gravel will be identified appropriately and later brought to the plant for processing and mineral extraction.

On June 3, 2011, we entered into an Acquisition, Distribution and Marketing Agreement with Ozuro Jewelry, a New York corporation (“Ozuro”), wherein we agreed to offer to Ozuro the right to purchase our diamonds and gold (the “Product”) before offering to sell the Product to any other third party, and Ozuro agreed to consider purchasing our Product, in accordance with the terms and conditions set forth in the agreement. The term of the agreement began on June 3, 2011 and will terminate on June 3, 2014. The price of the gold shall initially be set at 90% of the London PM fix as reported as of the date of the sale and diamonds pricing shall be initially set at 95% of the Rapaport Diamond Price Index as reported as of the date of sale.

Diamonds

Diamonds are made of carbon, the fourth most abundant element. They are crystals which grow by adding layer after layer of carbon atoms under extreme pressure. Diamonds originate some 200 miles below the Earth’s surface in the “mantle” layer. At that depth, enormous pressure is exerted on the carbon molecules, forging them into diamonds, and creating one of the strongest molecular bonds known to chemistry.

Diamonds are moved from deep in the earth to the surface in volcanic eruptions. They typically come to the surface in thin magma streams known as ‘Kimberlite pipes’. Even though diamonds are relatively abundant, they are hard to find in quantities sufficient to support economic mining. The best place to look for diamonds is where diamonds have been found before.

Africa is widely believed to be the richest continent for diamond mining. The major sources of diamonds are in the south with lesser concentrations in the west-central part of the continent. The major producing countries are Congo Republic (Zaire), Botswana, South Africa, Angola, Namibia, Ghana, Central African Republic, Guinea, Sierra Leone, and Zimbabwe. Political turmoil in some countries has led to highly variable production and severe degradation of the environment stemming from uncontrolled or unregulated mining.

Diamonds are the hardest and most brilliant mineral and around the world diamonds are recognized as an eternal stone of value. Industrial diamonds play a key role in cutting and high wear applications. The vast difference between the hardness of diamonds, as opposed to every other mineral, means that there is no effective substitute for use in demanding industrial applications, including, and in particular, oil and gas drilling.

6

While diamonds are virtually indestructible, they can, like any crystal, shatter along a plane, particularly if flawed. These characteristics make it possible to craft a gem into the most brilliant and desirable shape. Cutters face a trade-off between maximizing the size of the finished jewel and optimizing its reflectiveness.

Extractable diamonds are very rare: only about 130 tons of rough diamonds have been found over the last 120 years. Even in rich ore, the grade is only about one carat per 3 tons of kimberlite, (1 Carat = .2 of a gram = 1/150 of an ounce) or 1 part in 14 million. Gold explorers think in parts per million (grams of gold per ton of ore). Diamond explorers commonly think in parts per billion (carats per tens of tons). This is why diamond explorers use ‘diamond indicators’, rather than the actual diamonds, when seeking potential excavation sites. While the presence of a kimberlite pipe is an indicator of the presence of diamonds, the best diamond indicator, of course, is a diamond in the kimberlite pipe. Only 1 in 22 kimberlite pipes are diamond-bearing, and only 1 in 50 are economic to exploit.

The rarity and value of large stones means that the statistical distortion of the “nugget effect” (the statistical effect upon the conclusions drawn from a sample that contains a large stone versus one that has a small stone) is more pronounced for diamonds than any other mineral. This makes exploration an art as much as a science. Successful primitive miners and experienced geologists display an intuitive sense for finding diamonds.

Diamond Pricing Trends Index

The Diamond Prices Index (“DPI”) is a representation of the current market pricing trend for diamonds. The DPI takes into account the average retail price per carat of loose diamonds from jewelers around the web. Prices are calculated for groups of weight ranges as well as by color and clarity.

Diamond Prices Index™ - 129.90

Source: www.idexonline.comSierra Leone – Diamonds

7

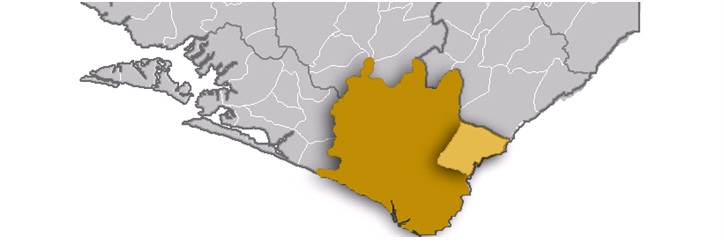

The Sierra Leone’s established diamond fields cover an area of about 7,700 square miles (about one quarter of the country) in the south-eastern and eastern parts of Sierra Leone. The diamond producing areas are concentrated in Kono, Kenema and Bo Districts. They are mainly situated in the drainage areas of the Sewa, Bafi, Woa, Mano and Moa Rivers. Alluvial diamond concentrations occur in river channel gravels, flood-plain gravels, terrace gravels and gravel residues in soils and swamps. Kimberlites, the primary host rocks for diamonds, have been discovered in the Koidu and Tongo areas. Reserves are estimated to potentially be at 6.3 million carats down to a depth of 600m at Koidu and 3.2 million carats to a depth of 600m at Tongo. Artisanal and small-scale diamond mining activities are widespread in the Kono District as well as Kenema, Bo and Pujehun Districts.

Sierra Leone is renowned for the quality of its diamonds and for the recovery of some of the most spectacularly large stones of very high value. The largest diamond, discovered in February 1972, was the 969.8 ct “Star of Sierra Leone”. More recently, in 1996, two stones weighing 188 ct and 283 ct were recovered and sold. Annual diamond output reached a peak of around 2 million carats in the late 1960s, with output declining thereafter. By 1997, output was seriously disrupted by RUF rebel activity, with most of the diamondiferous areas becoming off-limits.

Market Analysis

Over the past twenty-five years, the demand for diamonds has grown annually at double-digit rates. More than 115 million carats (5 carats =1 gram), worth $60 billion at retail level, were sold in 2002. While price competition at the lower quality industrial end is severe, gemstone quality diamonds have held their prices and are expected to maintain at no less than the present level as new markets open in China and other Asian countries.

We believe that the demand for diamonds will, at the very least, sustain at no less than present levels. Many industry experts actually predict the market will expand. De Beers suggests that the demand for diamonds should rise by 50% from $9.5 billion in 2003 to $14.5 billion over the next decade - a rise of almost $5 billion. That is equivalent to the combined production of Botswana, Russia and Angola. A 50% cumulative increase in demand over ten years is possible. This is in accord with the recent history of increases in demand: 11% per annum 1983-1993; and 6% per annum from 1993 to 2002. Average diamond prices are expected to rise by some 30% in real terms over the next 5 years.

The predicted future demand for diamonds simply cannot be met from existing mines. Even though new diamond mines are opening up in Canada and Russia, they cannot keep pace with the diminishing output of the older mines worldwide. This trend is most noticeable among gemstone quality mines. In 2003, the demand for diamonds totaled $9.5 billion, while only $8.2 billion in diamonds were produced, leaving a $1.3 billion shortfall in supply.

We have existing strategic relationships with dealers who export the purchased diamonds to New York where they are sorted, polished and cut for eventual sale to retailers. The dealers purchase the rough gem quality stones and export the rough diamonds, in full compliance with the Kimberley Certification Process, to New York, where the stones are sorted, polished and cut for eventual sale to retailers. As operations expand, we intend to polish and cut more of our product ourselves in New York, and potentially sell it directly to the consumer.

8

Charles Huggins, Founder of JYORK, has been legally exporting diamonds and gold through the Kimberley Process, UPS (Red Coat Shipping) and customs brokers such as Malca-Amit in the United States for more than the last twelve years. Mr. Huggins became a consultant for the Company, on a long term basis, on August 8, 2011, Through these relationships, we will be able to provide product into New York.

The Market for Diamonds

The greatest value in the diamond market is found in “gemstones”: larger, clearer, relatively flawless rocks amenable to cutting. Fifty percent of the gemstone market is controlled and largely underwritten by the De Beers’ cartel, usually referred to as the “Central Selling Organization”. Gemstones represent most of the sector’s value, account for approximately $10 billion yearly in sales of rough, or uncut stones. This translates into $25 billion of cut, but unset stones. The retail value of these gemstones is about $60 billion annually, with over one-third of the retail sales being made in the USA.

The worth of an individual diamond varies according to its classification, of which there are nearly 500. Valuation is labor-intensive and highly subjective. Valuers must gamble on their estimate of the ultimate shape and qualities of the cut and polished jewel. The average price as of the date of this filing per rough carat (0.2gm) is approximately $65, but varies widely by brightness, gem size, color and shape. For example, Australian diamonds are generally small and tinted, averaging $15, while Namibian stones are clearer and bigger, averaging $260 per carat. In extreme cases, large, brilliant gems may retail for nearly $1 million per carat. Though valuing individual stones is an art form, gemstone diamonds generally are not subject to wide price swings because the market is largely controlled by the Central Selling Organization.

Gold

Gold was discovered in Sierra Leone in several localities in the years from 1926 onwards, in the Sula Mountains and Kangari Hills, and in the Koinadugu, Tonkolili and Bo Districts. All greenstone belts in Sierra Leone (with the possible exception of the Marampa Group and perhaps the Kambui Hills) are known to contain gold. Rivers and streams draining these areas also carry gold. The most important known lode gold deposits occur around the Lake Sonfon area, Kalmaro, Makong, Baomahun and Komahun. At present, the only gold production in Sierra Leone comes from alluvial deposits. Notwithstanding the limited gold exports in recent years, Sierra Leone is thought to be well-endowed with gold deposits.

Of all the precious metals, gold is the most popular as an investment. Investors generally buy gold as a hedge or safe haven against any economic, political, social, or fiat currency crises (including investment market declines, burgeoning national debt, currency failure, inflation, war and social unrest). Since the year 2000, gold has gone from $300 USD per troy ounce to over $1,400 during 2011. With regards to gold, the Company is very excited with its in-ground assets, as well as its current relationships to sell this product. The Company intends to export the product directly to a U.S.-based refinery and receive then current market price minus a small refiner’s discount.

9

Gold Pricing Trends

On average, gold prices increased by 1.4% to US$1,386.27/oz in Q1 2011 from US$1,366.78/oz in Q4 2010, on the London PM fix (the gold price referenced will refer to the London PM fix). While gold experienced a price consolidation in the early part of the quarter, falling as low as US$1,319.00/oz on 29 January of 2011, it climbed to new record highs throughout March of 2011 and continued to achieve new highs in April 2011. More importantly, January’s 2011 price fall of 5.6% corresponded to not much over a one standard deviation move for a given month. The average monthly volatility has been 4.9% over the past ten years.

Gold’s long-term supply and demand dynamics and a number of macro-economic factors ensured gold remained a sought-after asset. First, the US dollar weakened against major currencies, which in turn supported gold prices given gold’s negative correlation to the dollar. Second, comments by the Federal Reserve that signaled an extended period of low rates have kept anxieties about rising inflation entrenched in the US. Third, while inflation rates in countries such as India and China appear to have moderated, they remain uncomfortably high, promoting activity in the gold market as exemplified by higher delivery volumes in the Shanghai Gold Exchange. Fourth, unrest in Africa and the Middle East and the natural disaster in Japan, have drawn attention to gold’s quality as a vehicle to preserve capital and provide liquidity. While gold prices did not react as much as oil for example, this was in part due to gold’s ability to absorb economic and geopolitical shocks and remain less volatile. Finally, central bank activity indicates a continuation of the trend of limited supply and potential net purchases.

The gold price continued its upward trend, rising during the first quarter of 2011 by 2.4% to finish the quarter at US$1,439/oz, on the London PM fix. While gold’s performance seemed more modest relative to average gains of 6.2% per quarter over the past two years, its consistency and robust growth trend has contributed significantly to its ability to provide diversification, risk management and wealth preservation to an investor’s portfolio.

Gold Prices From 2000 to 2011

Source: www.kitco.com

10

|

Current Gold Prices

|

|

|

|

Source: www.kitco.com

Demand

Gold demand in 2010 reached a 10-year high of 3,812.2 tonnes. Demand was up 9% year-on-year, and marginally above the previous peak of 2008 despite a 40% increase in the annual average price level between 2008 and 2010.

|

Gold Demand

|

2009

|

2010*

|

YoY(%)

|

|

Jewelry

|

1,760

|

2,060

|

17%

|

|

Technology

|

373

|

420

|

12%

|

|

Investment

|

1,360

|

1,333

|

-2%

|

|

Demand

|

3,493

|

3,812

|

9%

|

|

OTC and stock flows

|

541

|

296

|

-45%

|

|

London PM Fix, $/oz

|

972

|

1,225

|

26%

|

* Provisional.

Source: GFMS, LBMA, WGC

In value terms, annual gold demand surged 38% to a record of US$150bn. The fourth quarter also set a new quarterly record of US$42bn.

Jewelry demand was remarkably robust in the face of record prices in the majority of currencies. Annual demand for gold jewelry rose 17% from 1760.3 tonnes in 2009 to 2059.6 tonnes. The rise in annual average prices over the same period was 26%. In value terms, this resulted in record annual jewelry demand of US$81 bn.

Investment demand, comprising bar and coin demand and demand for ETFs and similar products, remained more or less stable in 2010, down just 2% versus 2009. However, this annual comparison masks some more interesting movements within the various components of investment. Physical bar investment was particularly strong during the year, recording an annual gain of 56%. Conversely, demand for ETFs and similar products (as measured by GFMS) was unable to sustain the previous year’s remarkable levels and consequently was down 45% on an annual comparison. At 338.0 tonnes however, this was still the second highest year on record for ETF demand.

11

In 2010, ‘OTC Investment and stock flows’ (previously referred to as ‘Inferred investment’) almost halved from 2009 levels to 296 tonnes. This was largely a result of strong 2009 demand in this category. However, it jumped to 238 tonnes in the fourth quarter, partly reflecting a shift from the ETF market into the OTC market, as investor interest was stimulated by debt problems in Europe and the second round of quantitative easing in the US.

Supply

|

Gold Supply

|

2009

|

2010*

|

YoY(%)

|

|

Total mine supply

|

2,332

|

2,543

|

9%

|

|

Official sector sales

|

30

|

-87

|

n/a

|

|

Recycled gold

|

1,672

|

1,653

|

-1%

|

|

Total supply

|

4,034

|

4,108

|

2%

|

* Provisional.

Source: GFMS, LBMA, WGC

2010 mine production is estimated to have increased slightly, 3% higher year-on-year, as a number of new projects across a range of countries contributed to higher levels of supply. Net producer de-hedging imposed a modest restraint on total mine supply, although de-hedging activity was relatively limited compared with 2009 as the global hedge book continued to wind down.

The supply of recycled gold dipped slightly in 2010 year-on-year (-1%), although this comparison was largely influenced by the very strong first quarter of 2009. 2010 recycling activity remained elevated relative to historical averages as higher prices continued to attract profit-taking and consumers in the west became increasingly aware of opportunities and channels by which they might sell their unwanted gold items. Notably, the supply of gold from the official sector turned negative as central banks became modest net purchases of gold in 2010.

Products and Marketing Channels

Gold produced by the Company’s mining operations is intended to be processed to a saleable form at various precious metals refineries. Once refined to a saleable product – generally large bars weighing approximately 12.5 kilograms and containing 99.5% gold, or smaller bars weighing 1.0 kilograms or less with a gold content of 99.5% and above –is sold either through the refineries’ channels or directly to bullion banks with the proceeds paid to the Company.

Bullion banks are registered commercial banks that deal in gold. They participate in the gold market by buying and selling gold and distribute physical gold bullion bought from mining companies and refineries to physical off take markets worldwide. Bullion banks hold consignment stocks in all major physical markets and finance these consignment stocks from the margins charged by them to physical buyers, over and above the amounts paid by such banks to mining companies for the gold.

12

Gold Market Characteristics

Gold price movements are largely driven by macro-economic factors such as expectations of inflation, currency fluctuations, interest rate changes or global or regional political events that are anticipated to impact on the world economy. Gold has played a role historically as a store of value in times of price inflation and economic uncertainty. This factor, together with the presence of significant gold holdings above ground, tends to dampen the impact of supply/demand fundamentals on the market. Trade in physical gold is, however, still important in determining a price floor, and physical gold, either in the form of bars or high-caratage jewelry, is still a major investment vehicle in the emerging markets of India, China and the Middle East.

Gold is relatively liquid compared to other commodity markets and significant depth exists in futures and forward gold sales on the various exchanges, as well as in the over-the-counter market.

Top Gold Markets in 2010

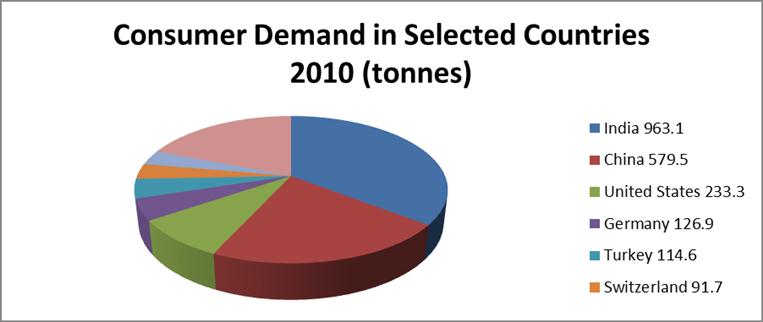

Consumer Demand in Selected Countries 2010 (tonnes)

Data Source: WGC

Individually, India represents the strongest demand for gold in 2010 where demand gained 66% relative to 2009. India accounts for more than 40% of global gold jewelry demand and is by far the largest market for gold in jewelry. It also accounted for more than 236% of identifiable investment demand in the sector in 2010. Total bullion imports to India, though they may fluctuate significantly according to price movements during the year, have risen steadily over the last decade.

The characteristics of the gold market in the Middle East are similar, although an important difference is the exceptionally high per capita ownership of gold in some of the countries of that region. In the United Arab Emirates, for example, consumption per capita is some 30 times that in the US or the UK and some 50 times higher than in India. The Middle Eastern market accounted for over 238 tons of gold demand in 2010 or approximately 113% of the global total. Turkey, Saudi Arabia, Egypt, and the United Arab Emirates are the largest consumers within this market.

13

In terms of investment demand growth, China represented the most robust market in 2010. Compared to 2009 demand of gold for investment in 2010 grew nearly 70% from approximately 106 tonnes to a record level of 180 tonnes. In China, approximately 69% of gold is sold in the form of high caratage jewelry which is easily traded, similarly to the Indian and Middle Eastern markets. The balance of gold in China is sold in the form of 18 carat jewelry. Although introduced to the market only in 2002, sales in this category of jewelry have grown quickly due to its appeal to a rapidly-growing market segment of young, independent urban women. An important feature of the Chinese market in recent years has been the relatively stable nature of gold demand, particularly in comparison to the Indian and Middle Eastern markets, where volatility typically causes price-sensitive consumers to hold back on jewelry purchases.

The US market accounted for approximately 230 tons of jewelry demand in 2010, just over 8% of the global total. High prices Gold in the USA is purchased largely as an adornment product and purchase decisions are dictated by fashion rather than the desire to buy gold as an investment. The intrinsic value of gold as a store of value does still, however, play a role in the purchase decision process. Consumers in the US purchased aproximately129 tons of gold for jewelry, compared to 105 tons for investment purposes, such as ETF’s, bullion, and coins.

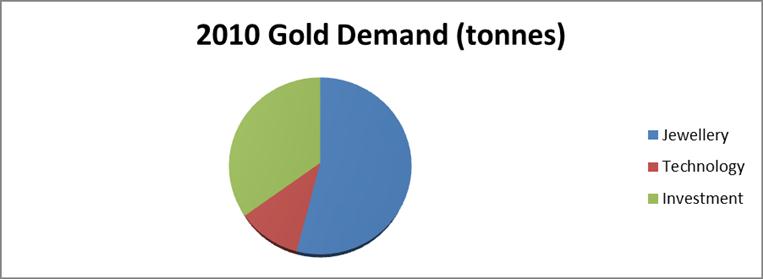

Gold Demand by Sector

Jewelry demand

Gold Demand 2010 (tonnes)

Gold demand excluding central banks.

Source: GFMS, LBMA, WGC

Geographically, just less than 80% of gold jewelry demand now originates in emerging markets, in comparison to 64% a decade ago. The major markets for gold jewelry are India, China, the Middle East and the United States. The Middle East market has also seen recent strong growth, and was one of the largest markets for gold jewelry in 2010. Turkey, Saudi Arabia, Egypt, and United Emirates (UAE) are the largest consumers in this region with an aggregate demand at 238 tons.

14

In the economies of India and the sub-continent, gold jewelry is purchased as a quasi-investment product. High-caratage jewelry is sold at a relatively small margin to the spot gold price, which is generally transparent to the consumer, and is therefore easily re-sold to jewelers or bullion traders when cash is required or when the jewelry is out of date and needs to be refashioned.

Investment demand

As well as holdings in ETFs, which have become a well-recognized investment vehicle for gold, primarily in the US and European markets, physical gold investment takes the form of physical bar demand and official coins.

Physical investment demand has grown significantly since 2003, when it stood at just less than 300 tons, to levels of approximately 908 tons in 2010. Over the course of 2010, total demand remained stable in investment categories, decreasing slightly at 2% compared to 2009.

Total Physical bar demand rose from approximately 743 tonnes in 2009 to 995 tonnes in 2010, an increase of 56% but witnessed significant decline particularly in ETFs.

2010 demand for ETFs declined from 1,359 tonnes to 1,331 tonnes, a decrease of 2%. Holdings in the ETF’s decreased from 617.1 tonnes to 338 tonnes, a decrease of nearly 45% in a single year. However, investment in bar hoarding and coin demand rose from 743 tonnes to 995 tonne, an increase of nearly 25%.

Industrial and other sectors

The largest industrial use of gold is in electronics, as plating or bonding wire. In line with the growth in the use of personal computers and other electronic instruments globally, the use of gold in this sector has also increased, averaging a growth rate of over 9% in the five-year period from 2002-2007. However, in 2008 consumption of gold in the electronics industry was approximately 439 tonnes, compared to 2009 where it fell to nearly 373 tonnes, a decline of nearly 15%. Total demand for 2010 rose back to 420 tonnes, an increase of nearly 10%. The overall quantity of gold used in this sector, however, remains small, at only 11% of total demand.

Demand for gold for dentistry purposes continues to decline, however this constitutes only a small portion of total demand, less than 2% of the global total.

Central bank holdings, sales and purchases

Gold held by the official sector, essentially central banks and the IMF, stood at approximately 64,135 tonnes in 2010. Periodically, central banks buy and sell gold as market participants. Most central bank sales take place under the Central Bank Gold Agreements (CBGA) and therefore without any significant impact on the market. The third Central Bank Gold Agreement (CBGA3) currently in effect encompasses the gold sales of the Euro system central banks, specifically Sweden and Switzerland. Similar to the previous agreements, CBGA3 remains in effect for a five-year period, which began on the expiration date of its predecessor (September 27, 2009 to September 26, 2014).

15

This agreement includes two important features which differ from the two previous agreements. First, the parties reduced the ceiling so that “annual sales will not exceed 400 tonnes and total sales over this period will not exceed 2,000 tonnes,” which is 500 tonnes less than CGBA2.

The second major difference in the CBGA3 is that the agreement took into account the fact that the IMF intended to sell 403 tonnes of gold, and stated that these sales “can be accommodated within the above ceiling”.

Competition

The diamond and gold mining and exporting industry is intensely competitive. We will compete with numerous other mining companies in connection with the acquisition, exploration, financing and development of diamond and gold properties. Many of the other competing companies are significantly larger than the Company and have far greater resources both monetary and work-force to rely upon. There is competition for the limited number of gold acquisition and exploration opportunities, some of which are with other companies having substantially greater financial resources than we have. We also will compete with other mining companies for mining engineers, geologists and other skilled personnel in the mining industry and for exploration and development equipment. There can be no assurance that we will be sufficiently capitalized to compete with such companies in Africa; particularly those that have both greater resources and longer operating histories than the Company’s.

Personnel

As of the date of this 10-K, and as a result of our recent organizational establishment, we have 3 employees. As mining and exportation activities commence, increase or decrease, we may have to adjust our technical, operational and administrative personnel as appropriate. We are using and will continue to use independent consultants and contractors to perform various professional services. We believe that this use of third-party service providers may enhance our ability to contain operating and general expenses, and capital costs.

New Consultant

On August 8, 2011, we entered into a Consultant Agreement with Mr. Charles Huggins, wherein he agreed to assist the Company in locating working interest partner, mining concessions, mining operations, and similar financing and business agreements to further the Company’s business in West Africa on a “best efforts” basis. This agreement provides the Company with Mr. Huggins’ services on a long term basis. Mr. Huggins has, over the past 20 years been involved in numerous business ventures throughout West Africa, all of which have involved natural resources, including such activities as the purchase of such resources in country and sale of the same on the international market, the acquisition of recovery rights and other like activities. Mr. Huggins was also the founder of JYORK Industries, Inc. He has also developed strong relationships with West African business leaders and become well acquainted with the governmental processes and regulations that are involved in the various types of dealings.

16

Mr. Huggins’ services shall include, but not limited to:

|

§

|

Identifying, negotiating and/or obtain contracts, rights and/or other agreements for the mining or acquisition of diamonds, gold and/or other natural resources with rights holders throughout the world, on behalf of the Company.

|

|

§

|

Obtaining governmental approvals and/or authorizations to use, implement or otherwise exploit any contracts or agreements obtained by Mr. Huggins and entered into by the Company.

|

|

§

|

Locate, negotiate the purchase of and/or obtain diamonds, gold or other precious minerals on behalf of the Consultant throughout the world.

|

|

§

|

Facilitate the transportation of such minerals obtained to the United States and further assist in the sale of such minerals obtained and transported.

|

The term of the agreement is for five (5) years beginning on August 8, 2011. The agreement may be extended by and between the parties.

The Company agreed to pay Mr. Huggins 5% all the gross income (the “Commission”) of the Company. Gross income shall mean all income received by the Company, less any payment that the Company must make for: the acquisition and sale of any gold, diamonds or other minerals (including, but not limited to, the costs of the purchase of any gold, diamonds or precious minerals; taxes, insurance and transportation costs payable on same; the cost of finishing and polishing any diamonds; and any other like inherent costs of such transaction); and all costs incurred in connecting with the recovery and subsequent sale of any gold, diamonds or other minerals recovered from any operations being conducted pursuant to any contract, license or other agreement the Company may have for the performance of such activities. Mr. Huggins’ Commission shall be paid to him in perpetuity, and shall be considered as an asset of his estate and shall be deemed a descendible right that shall be passed to his heirs as he so designates by his will, or if he dies intestate, then in accordance with the laws of the State of New York.

Additionally, the Company agreed to pay all of Mr. Huggins’ expenses for travel and accommodations in connection with the fulfillment of his duties. The Company will also provide Mr. Huggins with an automobile and driver who also will act in place of a security guard.

Available Information

We are subject to the informational requirements of the Securities Exchange Act of 1934, as amended. All of our reports are able to be reviewed through the SEC’s Electronic Data Gathering Analysis and Retrieval System (EDGAR) which is publicly available through the SEC’s website (http://www.sec.gov).

We intend to furnish to our stockholders annual reports containing financial statements audited by our independent certified public accountants and quarterly reports containing reviewed unaudited interim financial statements for the first three-quarters of each fiscal year. You may contact the Securities and Exchange Commission at (800) SEC-0330 or you may read and copy any reports, statements or other information that we file with the Securities and Exchange Commission at the Securities and Exchange Commission’s public reference room at the following location:

17

Public Reference Room

100 F. Street N.W.

Washington, D.C. 2054900405

Telephone: (800) SEC-0330

ITEM 1A. RISK FACTORS

Diamond and gold prices are volatile and there can be no assurance that a profitable market for diamonds, gold and gems will exist.

The diamonds and metals mining industry is intensely competitive, and there is no assurance that, even if the Company discovers commercial quantities of diamonds, gold and other mineral resources, a profitable market will exist for the sale of those resources. There can be no assurance that diamond and gold prices will remain at such levels or be such that the Company can mine at a profit. Factors beyond the Company’s control may affect the marketability of any minerals discovered. Diamond and gold prices are subject to volatile changes resulting from a variety of factors including international, economic and political trends, expectations of inflation, global and regional supply and demand and consumption patterns, metal stock levels maintained by producers and others, the availability and cost of metal substitutes, currency exchange fluctuations, inflation rates, interest rates, speculative activities and increased production due to improved mining and production methods.

The Company is subject to substantial environmental and other regulatory requirements and such regulations are becoming more stringent. Non-compliance with such regulations, either through current or future operations or a pre-existing condition could materially adversely affect the Company.

All phases of the Company’s operations are subject to environmental regulations in the jurisdiction in which it operates. Environmental legislation is evolving in a manner that will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors, and employees. There can be no assurance that future changes in environmental regulation, if any, will not be materially adverse to the Company’s operations.

The Company’s properties may contain environmental hazards, which are presently unknown to the Company and which have been caused by previous or existing owners or operators of the properties. If these properties do contain such hazards, this could lead to the Company being unable to use the properties or may cause the Company to incur costs to clean up such hazards. In addition, the Company could find itself subject to litigation should such hazards result in injury to any persons.

18

Government approvals and permits are sometimes required in connection with mining operations. Although the Company believes it will obtain all of the material approvals and permits to carry on its operations, the Company may require additional approvals or permits or may be required to renew existing approvals or permits from time to time. Obtaining or renewing approvals or permits can be a complex and time-consuming process. There can be no assurance that the Company will be able to obtain or renew the necessary approvals and permits on acceptable terms, in a timely manner, or at all. To the extent such approvals are required and not obtained; the Company may be delayed or prohibited from proceeding with planned exploration, development or mining of mineral properties.

Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities, that may require operations to cease or be curtailed, or corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. Parties engaged in mining operations may be required to compensate those suffering loss or damage by reason of the mining activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations.

Amendments to current laws, regulations and permits governing operations and activities of mining companies, or more stringent implementation of such requirements could have a material adverse impact on the Company and cause increases in capital expenditures or production costs or reductions in levels of production at producing properties or require abandonment or delays in development of new mining properties.

Our auditor’s “Going Concern” qualification in our financial statements might create additional doubt about our ability to stay in business, which could result in a total loss on investment by our stockholders.

Our financial statements have been prepared assuming that we will continue as a “going concern.” We are in the development stage and, accordingly, have generated minimal revenues from operations. Since our inception, we have been engaged substantially in financing activities and developing our business plan and incurring start up costs and expenses. As a result, we have incurred accumulated net losses from inception. In addition, our development activities since inception have been financially sustained through equity financing. These issues raise substantial doubt about our ability to continue as a going concern. Our auditor’s report reflects the fact that the ability of Oraco to continue as a going concern is dependent upon our ability to raise additional capital from the sale of stock and, ultimately, the achievement of significant operating revenues.

Decrease in value of diamonds and gold could result in decreased revenues.

While we intend to mine for other precious stones and metals, our business is currently focused on mining for diamonds and gold. Thus, in the event the price of diamonds and/or gold decreases, our revenues and/or profit margins could likewise decrease.

19

We will be competing with better established companies.

We will not be the first company to attempt to mine for diamonds and other precious stones and metals in Sierra Leone. There are other companies whose equipment may be more advanced than ours, and whose methods may be more cost-effective. Further, we will be facing competition from better established companies, which may have better local, regional and national connections in Sierra Leone, and whose efforts produce larger quantities or higher quality diamonds.

There has been political instability in Sierra Leone which, if reignited, could adversely affect our business.

Between 1991 and 2002, Sierra Leone was engaged in a civil war, in which tens of thousands of people were killed and more than two million people were displaced. Control of Sierra Leone’s diamond industry was the primary cause of this war. Since 2002, the government has been stable. However, given the history of that country, and the previous focus on the disparity between Sierra Leone’s diamonds and the poverty of many of its citizens, there is the risk that other conflicts will arise. Such political strife could adversely affect our ability to mine diamonds and other precious stones and metals in Sierra Leone.

Diamond and gold prices, and natural resources in general, are volatile and there can be no assurance that a profitable market for diamonds, gold and gems will exist.

The diamonds and metals mining industry is intensely competitive, and there is no assurance that, even if the Company discovers commercial quantities of diamonds, gold and other mineral resources, a profitable market will exist for the sale of those resources. There can be no assurance that diamond and gold prices will remain at such levels or be such that the Company can mine at a profit. Factors beyond the Company’s control may affect the marketability of any minerals discovered. Diamond and gold prices are subject to volatile changes resulting from a variety of factors including international, economic and political trends, expectations of inflation, global and regional supply and demand and consumption patterns, metal stock levels maintained by producers and others, the availability and cost of metal substitutes, currency exchange fluctuations, inflation rates, interest rates, speculative activities and increased production due to improved mining and production methods.

Uncertainty involved in mining.

Mining involves various types of risks and hazards, including environmental hazards, unusual or unexpected geological operating conditions such as rock bursts, structural cave-ins or slides, flooding, earthquakes and fires, labor disruptions, industrial accidents, metallurgical and other processing problems, metal losses, and periodic interruptions due to inclement or hazardous weather conditions. These risks could result in damage to, or destruction of, mineral properties, production facilities or other properties, personal injury, environmental damage, delays in mining, increased production costs, monetary losses, and possible legal liability.

20

The Company may not be able to obtain insurance to cover these risks at economically feasible premiums. Insurance against certain environmental risks, including potential liability for pollution or other hazards as a result of the disposal of waste products occurring from production, is not generally available to the Company or to other companies within the mining industry. The Company may suffer a material adverse effect on its business if it incurs losses related to any significant events that are not covered by its insurance policies.

Calculation of mineral resources and metal recovery is only an estimate, and there can be no assurance about the quantity and grade of minerals until resources are actually mined.

The calculation of reserves, resources and corresponding grades being mined or dedicated to future production are imprecise and depend on geological interpretation and statistical inferences or assumptions drawn from drilling and sampling analysis, which might prove to be unpredictable. Mineral resources that are not mineral reserves do not have demonstrated economic viability. Until reserves or resources are actually mined and processed, the quantity of reserves or resources and grades must be considered as estimates only. Any material change in the quantity of reserves, resources, grade or stripping ratio may affect the economic viability of the Company’s properties. In addition, there can be no assurance that metal recoveries in small-scale field or laboratory tests will be duplicated in larger scale tests under on-site conditions or during actual mining production.

The Company’s operations involve exploration and development and there is no guarantee that any such activity will result in commercial production of mineral deposits.

There has been no drilling to test the depth potential of commercial ore on these properties, and proposed programs on such properties are exploratory in nature only. Development of these mineral properties is contingent upon obtaining satisfactory exploration results. Mineral exploration and development involve substantial expenses and a high degree of risk, which even a combination of experience, knowledge and careful evaluation may not be able to adequately mitigate. There is no assurance that additional commercial quantities of ore will be discovered on the Company’s exploration properties. There is also no assurance that, even if commercial quantities of ore are discovered, a mineral property will be brought into commercial production, or if brought into production, that it will be profitable. The discovery of mineral deposits is dependent upon a number of factors including the technical skill of the exploration personnel involved. The commercial viability of a mineral deposit is also dependent upon, among a number of other factors, its size, grade and proximity to infrastructure, current metal prices, and government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals, and environmental protection. Most of the above factors are beyond the Company’s control.

Competition for new mining properties may prevent the Company from acquiring interests in additional properties or mining operations.

Significant and increasing competition exists for mineral acquisition opportunities throughout the world. Some of the competitors are large, more established mining companies with substantial capabilities and greater financial resources, operational experience and technical capabilities than the Company. As a result of the competition, the Company may be unable to acquire rights to exploit additional attractive mining properties on terms it considers acceptable. Increased competition could adversely affect the Company’s ability to attract necessary capital funding or acquire any interest in additional operations that would yield reserves or result in commercial mining operations.

Recent high diamond and metal prices have encouraged increased mining exploration, development and construction activity, which has increased demand for, and cost of, exploration, development and construction services and equipment.

21

Actual capital costs, operating costs, production and economic returns may differ significantly from those the Company has anticipated and there can be no assurance that any future development activities will result in profitable mining operations.

Capital and operating costs, production and economic returns, and other company estimates for the Company's projects may differ significantly from those anticipated by the Company’s current studies and estimates, and there can be no assurance that the Company’s actual capital and operating costs will not be higher than currently anticipated. In addition, delays to construction schedules may negatively impact the net present value and internal rates of return of the Company’s mineral properties as set forth in the applicable feasibility studies.

There can be no assurance that the interests held by the Company in its properties is free from defects.

The Company has investigated the rights to explore and exploit its properties, and, to the best of its knowledge, those rights are in good standing. No guarantee can be given that such rights will not be revoked or significantly altered to the detriment of the Company. There can also be no guarantee that the Company’s rights will not be challenged or impugned by third parties. The properties may be subject to prior recorded and unrecorded agreements, transfers or claims, and title may be affected by, among other things, undetected defects. A successful challenge to the precise area and location of these claims could result in the Company being unable to operate on these properties as permitted or being unable to enforce any rights with respect to its properties.

The Company is exposed to risks of changing political stability and government regulation in the country in which it intends to operate.

The Company’s mining rights in Sierra Leone or elsewhere in West Africa that may be affected in varying degrees by political instability, government regulations relating to the mining industry and foreign investment therein, and the policies of other nations in respect of companies operating in Sierra Leone or other countries in West Africa. Any changes in regulations or shifts in political conditions are beyond the control of the Company and may adversely affect its business. The Company’s operations may be affected in varying degrees by government regulations, including those with respect to restrictions on production, price controls, export controls, income taxes, expropriation of property, employment, land use, water use, environmental legislation and mine safety. The regulatory environment is in a state of continuing change, and new laws, regulations and requirements may be retroactive in their effect and implementation. The Company’s operations may also be affected in varying degrees by political and economic instability, economic or other sanctions imposed by other nations, terrorism, military repression, crime, extreme fluctuations in currency exchange rates and high inflation.

The Company is subject to substantial environmental and other regulatory requirements of the various countries in which the Company will conduct business and operations, and such regulations are becoming more stringent. Non-compliance with such regulations, either through current or future operations or a pre-existing condition could materially adversely affect the Company.

22

All phases of the Company’s operations are subject to environmental regulations in the jurisdiction in which it operates. Environmental legislation is evolving in a manner that will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors, and employees. There can be no assurance that future changes in environmental regulation, if any, will not be materially adverse to the Company’s operations.

The Company’s properties may contain environmental hazards, which are presently unknown to the Company and which have been caused by previous or existing owners or operators of the properties. If these properties do contain such hazards, this could lead to the Company being unable to use the properties or may cause the Company to incur costs to clean up such hazards. In addition, the Company could find itself subject to litigation should such hazards result in injury to any persons.

Government approvals and permits are sometimes required in connection with mining operations. Although the Company believes it will obtain all of the material approvals and permits to carry on its operations, the Company may require additional approvals or permits or may be required to renew existing approvals or permits from time to time. Obtaining or renewing approvals or permits can be a complex and time-consuming process. There can be no assurance that the Company will be able to obtain or renew the necessary approvals and permits on acceptable terms, in a timely manner, or at all. To the extent such approvals are required and not obtained; the Company may be delayed or prohibited from proceeding with planned exploration, development or mining of mineral properties.

Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities, that may require operations to cease or be curtailed, or corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions. Parties engaged in mining operations may be required to compensate those suffering loss or damage by reason of the mining activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations.

Amendments to current laws, regulations and permits governing operations and activities of mining companies, or more stringent implementation of such requirements could have a material adverse impact on the Company and cause increases in capital expenditures or production costs or reductions in levels of production at producing properties or require abandonment or delays in development of new mining properties.

Because the Company’s success is dependent upon a limited number of people, our business may fail if those individuals leave the Company.

The ability to identify, negotiate and consummate transactions that will benefit the Company is dependent upon the efforts of the Company’s management team. While the Company has no assurance that its current management will produce successful operations, the loss of such personnel could have an adverse effect on meeting its production and financial performance objectives. The Company’s planned drilling activities may require significant investment in additional personnel and capital equipment.

23

While our current management has field experience in West Africa related to the acquisition and sale of gold and diamonds it lacks technical training and experience with exploring for, starting, and operating a mine; and with no direct training or experience in requirements related to working within the industry, our management may be unable to manage the Company’s operations.

Our current management lacks the technical training and experience with exploring for, starting, and operating a mine. Because of that, we may face additional risks and challenges, for which we have no ability to forecast. There can be no assurance that our current management will produce successful operations and we are significantly dependent upon our ability to locate, attract and hire experienced personnel. In the event we are unable to do so, we may be unable to manage the planned operations of the Company.

Our present limited operations have not yet proven profitable.

To date we have not shown a profit in our operations. We cannot assure that we will achieve or attain profitability in 2012 or at any other time. If we cannot achieve operating profitability, we may not be able to meet our working capital requirements, which will have a material adverse effect on our business operating results and financial condition.

We have no proven or probable reserves or feasibility studies. Accordingly, our property may not contain any reserves, and any funds spent by us on exploration or development could be lost.

We have not established the presence of any proven or probable mineral reserves, as defined by the SEC, at our property. The SEC has defined a “reserve” as that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. Any mineralized material discovered by us should not be considered proven or probable reserves.

In order to demonstrate the existence of proven or probable reserves, it would be necessary for us to continue exploration to demonstrate the existence of sufficient mineralized material with satisfactory continuity and then obtain a positive feasibility study. Exploration is inherently risky, with few properties ultimately proving economically successful. We intend to pursue additional exploration for the purpose of establishing proven or probable reserves.

Establishing reserves requires a feasibility study demonstrating with reasonable certainty that the deposit can be economically extracted and produced. We have not completed a feasibility study with regard to our property.

We are a start-up company with limited operating history.

We have conducted only very limited exploration and mining activities. Accordingly, we have a limited operating history and our business strategy may not be successful. Our failure to implement a successful business strategy will materially adversely affect our business, financial condition and results of operations.

24

Planned acquisitions come with various risks, along with dilution to our stockholders, both of which can be adverse.