Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Petron Energy II, Inc. | Financial_Report.xls |

| EX-31 - EXHIBIT 31 - Petron Energy II, Inc. | exhibit31.htm |

| EX-32 - EXHBIT 32 - Petron Energy II, Inc. | exhibit32.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2011

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to _________

Commission file number: 333-160517

(Name of registrant in its charter)

|

Nevada

|

26- 3121630

|

|

|

(State or jurisdiction of incorporation or organization)

|

(Primary Standard

Industrial Classification Code Number)

|

(IRS Employer Identification No.)

|

17950 Preston Road, Suite 960

Dallas, Texas 75252

(Address of principal executive offices)

(972) 272-8190

(Registrant's telephone number)

SECURITIES REGISTERED PURSUANT TO SECTION 12(B) OF

THE EXCHANGE ACT:

None.

SECURITIES REGISTERED PURSUANT TO SECTION 12(G) OF

THE EXCHANGE ACT:

None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [X].

Check whether the issuer is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes [ ] No [X]

Check whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the past 12 months (or for such shorter periods that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ ] No [ ]

Page - 1

Check if there is no disclosure of delinquent filers in response to Item 405 of Regulation S-K contained in this form, and no disclosure will be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer [ ]

|

Accelerated filer [ ]

|

|

Non-accelerated filer [ ]

|

Smaller reporting company [X]

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [] No [ X].

The issuer had no revenues for the most recent fiscal year ended December 31, 2011.

The aggregate market value of the Issuer's voting and non-voting common equity held by non-affiliates computed by reference to the closing price of such common equity on the Over-The-Counter Bulletin Board as of December 31, 2011, the end of the Issuer’s most recently completed second fiscal quarter, was $0 as there was no market for the Issuer’s common equity as of December 31, 2011.

At December 31, 2011, there were 83,082,071 shares of the Issuer's common stock outstanding.

Page - 2

TABLE OF CONTENTS

|

Page No.

|

|||

|

PART I

|

|||

|

Item 1.

|

Business

|

4 | |

|

Item 1A.

|

Risk Factors

|

11 | |

|

Item 1B.

|

Unresolved Staff Comments

|

21 | |

|

Item 2.

|

Properties

|

21 | |

|

Item 3.

|

Legal Proceedings

|

22 | |

|

Item 4.

|

(Removed and Reserved)

|

22 | |

|

PART II

|

|||

|

Item 5.

|

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

|

22 | |

|

Item 6.

|

Selected Financial Data

|

24 | |

|

Item 7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

24 | |

|

Item 7A.

|

Quantitative and Qualitative Disclosures About Market Risk

|

27 | |

|

Item 8.

|

Financial Statements and Supplementary Data

|

F-1 to F-22 | |

|

Item 9.

|

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

|

50 | |

|

Item 9A.

|

Controls and Procedures

|

50 | |

|

Item 9B.

|

Other Information

|

51 | |

|

Part III

|

|||

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

51 | |

|

Item 11.

|

Executive Compensation

|

54 | |

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

|

56 | |

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

57 | |

|

Item 14.

|

Principal Accounting Fees and Services

|

59 | |

|

Part IV

|

|||

|

Item 15.

|

Exhibits and Financial Statement Schedules

|

60 | |

|

Signatures

|

61 |

Page - 3

FORWARD-LOOKING STATEMENTS

All statements in this discussion that are not historical are forward-looking statements. Statements preceded by, followed by or that otherwise include the words "believes", "expects", "anticipates", "intends", "projects", "estimates", "plans", "may increase", "may fluctuate" and similar expressions or future or conditional verbs such as "should", "would", "may" and "could" are generally forward-looking in nature and not historical facts. These forward-looking statements were based on various factors and were derived utilizing numerous important assumptions and other important factors that could cause actual results to differ materially from those in the forward-looking statements.

Forward-looking statements include the information concerning our future financial performance, business strategy, projected plans and objectives. These factors include, among others, the factors set forth below under the heading "risk factors." although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Most of these factors are difficult to predict accurately and are generally beyond our control. We are under no obligation to publicly update any of the forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Readers are cautioned not to place undue reliance on these forward-looking statements. References in this form 10-k, unless another date is stated, are to august 31,

2011. As used herein, the "company," “petron energy,” "we," "us," "our" and words of similar meaning refer to petron energy ii, inc., formerly, restaurant concepts of america inc.

Corporate History

The Company was incorporated in Nevada in August 2008 as a development stage company which planned to operate as a restaurant holding company, specializing in the development and expansion of proven independent restaurant concepts into multi-unit locations through corporate-owned stores, licensing, and franchising opportunities, funding permitting. In connection with the acquisition of the Equipment and Wagoner County Leases, we changed our business focus to oil and gas exploration and production and related operations and ceased undertaking any restaurant related operations.

We have not generated any significant revenues to date, have not generated any oil and gas revenues to date and have limited operations as of the date of this filing. Our mailing address is 17950 Preston Road, Suite 960, Dallas, Texas 75252, and our telephone number is (972) 272-8190.

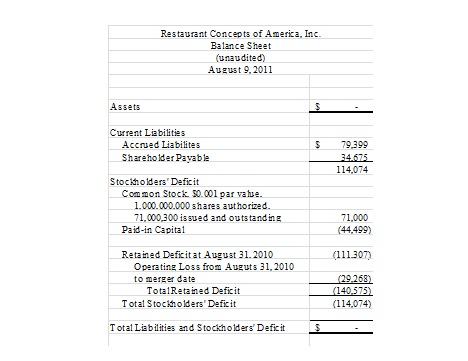

On August 9, 2011, we; David Cho, the Company’s then Chief Executive Officer and Director and then 54.4% owner of the Company’s common stock (550,000,000 shares or 5,500,000 pre-forward split shares); Pete Wainscott, the Company’s then Director and then 34.6% owner of the Company’s common stock (350,000,000 shares or 3,500,000 pre-forward split shares); and David M. Loev the then 9.9% owner of the Company’s common stock (100,000,000 shares, or 1,000,000 pre-forward split shares)(collectively the “ Selling Shareholders

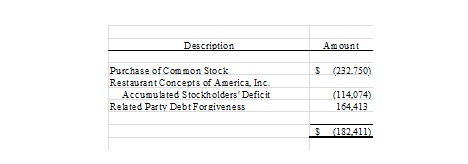

”) entered into a Stock Purchase Agreement with Petron Energy Special Corp. (formerly Petron Energy II, Inc.), a Nevada corporation (“ Petron ”), which is controlled by Floyd L. Smith. Pursuant to the Stock Purchase Agreement, the Selling Shareholders sold an aggregate of 1,000,000,000 shares (10,000,000 pre-forward split) shares of the Company’s restricted common stock to Petron in consideration for $232,750 (the “ Purchase Price ”); provided that a required term and

condition of the closing of the Stock Purchase Agreement was that the Company had no liabilities at closing, and as such, a portion of the Purchase Price was used to satisfy the Company’s outstanding liabilities. As a result of the Stock Purchase Agreement, which closed on August 10, 2011, Petron, and Mr. Smith as a result of his control of Petron, became the owner of 98.9% of the Company’s outstanding shares.

Additionally on August 9, 2011, owners of certain other of the Company’s outstanding registered shares entered into Stock Purchase Agreements and sold their shares to certain third parties in private transactions (which included ASL (defined below)). Certain of those purchasers also entered into lock-up agreements with the Company, pursuant to which those purchasers agreed not to sell any of their shares prior to the 91st day following the Company’s filing of a Form 8-K disclosing Form 10 type information (the “ Filing Date

”); 25% of such shares during the period beginning on the 91st day following the Filing Date and prior to the 181st day following the Filing Date; 25% of such shares during the period beginning on the 181st day following the Filing Date and prior to the 271st day following the Filing Date; and 25% of such shares during the period beginning on the 271st day following the Filing Date and ending on the 361st day following the Filing Date.

Page - 4

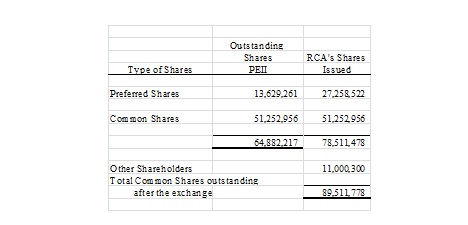

On August 12, 2011, the Company entered into an Asset Purchase Agreement with Petron, which is controlled by Floyd L. Smith, who indirectly became the majority shareholder of and President and sole Director of the Company on August 10, 2011, as described below. Pursuant to the Asset Purchase Agreement (which was subsequently amended by the parties’ entry into a First Amendment to Asset Purchase Agreement on August 15, 2011 and the Second Amendment to Asset Purchase Agreement, on August 31, 2011, the terms of which have been reflected in the discussion below unless otherwise provided), we agreed to purchase substantially all of

Petron’s assets (which consist of various oil and gas interests, leases and working interests collectively, the “ Assets ”) and none of the liabilities of Petron in consideration for 17,000,000 shares (170,000 pre-forward split shares) of the Company’s restricted common stock (the “ Petron Shares ”).

The Second Amendment modified and amended the terms of the Asset Purchase to provide for the immediate purchase, effective as of the date the Second Amendment was entered into, of all of the oil and gas equipment owned by Petron including pumping units, oil and gas separators, stock tanks, gas compressors, pumps, tubing and rods (collectively the “ Equipment ”) in consideration for 3,000,000 restricted shares of the Company’s common stock (the “

Equipment Shares ”). The issuance of the Equipment Shares decreased the total shares due to Petron in consideration for the acquisition of Petron’s assets at the closing of the Asset Purchase to 17,000,000 shares (previously 20,000,000 shares were due at closing for all of Petron’s assets including the Equipment).

The Asset Purchase Agreement contemplated the cancellation of 940,000,000 of the restricted shares of common stock purchased by Petron as described above pursuant to the Stock Purchase Agreement, which shares have been cancelled to date.

The closing of the transactions contemplated by the Asset Purchase Agreement were to occur upon the satisfaction of certain closing conditions described in the Asset Purchase Agreement, all of which have not occurred to date, but which are expected to occur shortly after the filing of this report, including: Petron providing the Company audited, interim and pro forma financial statements associated with the Assets; Petron receiving the required approval of its shareholders of the transactions contemplated by the Asset Purchase Agreement; Petron providing the Company all necessary assignments and consents relating to the transfer of the Assets; and

Petron agreeing to a lock-up agreement associated with the Petron Shares, pursuant to which it will agree not to sell or transfer any such Petron Shares for one year from the closing of the Asset Purchase Agreement and no more than 30% of such Petron shares during the period beginning on the one year anniversary of the closing and ending at the end of the 18 th month following the closing.

The Asset Purchase Agreement requires Petron to indemnify the Company from any liability associated with the Assets for actions which took place prior to the closing and for us to indemnify Petron against any liability associated with the Assets which exists due to actions which take place subsequent to the closing. The Asset Purchase Agreement also includes a non-compete provision, which prohibits Petron and Floyd L. Smith (other than through his positions with the Company) from competing against the Company for a period of twelve (12) months from the closing of the Asset Purchase Agreement. Additionally, the Asset Purchase Agreement

requires that the Company agree to commit a minimum of $5,000 and 2,000,000 shares (20,000 pre-forward split shares) of common stock per month to investor relations services following the closing; and provides for the Company to enter into employment agreements with certain employees of Petron (provided that no such employment agreements, other than the Executive Employment Agreement with Mr. Smith, as disclosed below, have been entered into or agreed to, to date).

The Second Amendment also provided for the immediate assumption by the Company and the assignment by Petron to the Company (collectively the “ Assumption ”) of the following agreements in partial consideration for the acquisition of the Equipment:

|

·

|

A Management Services Agreement with ASL Energy Corp. (“ ASL Energy ”), which has a five year term, provides for ASL Energy to provide management and consulting services to Petron (the Company following the Assumption); provides for the right for ASL Energy and Petron (the Company following the Assumption) to enter into Joint Venture Agreements regarding the purchase of oil and gas interests; provides for ASL Energy to be paid $8,000 per month during the term of the agreement and the right to receive the Series A

Preferred Stock (described below) to be issued to Mr. Smith, in connection with the Assignment Rights (defined below); and

|

|

·

|

An Asset Acquisition Agreement, pursuant to which Petron (the Company following the Assumption) agreed to acquire the assets of ONE Energy Capital Corp., ONE Energy International Corp. and their affiliated parties (“ONE Energy”), upon the mutual agreement of final closing agreements, in aggregate consideration for shares of convertible preferred stock, which convert into shares of the Company having a total value of $5,910,000, based on the trading price of the Company’s common stock on the date converted; votes one-for-one with the common shares; provides that no shares can be converted by the holders thereof if such conversion would

result in the acquisition by such holder of more than 9.99% of the Company’s outstanding stock; and provides for such converted shares to be subject to a lock-up agreement

|

Page - 5

The Company advanced $106,000 to Petron in connection with the assumption of the Asset Acquisition Agreement, which funds were subsequently paid to ONE Energy.

Effective August 31, 2011, the Company entered into an Executive Employment Agreement with Floyd L. Smith. Pursuant to the employment agreement, Mr. Smith agreed to serve as President and Chief Executive Officer of the Company for a term of five years, renewable thereafter for additional one year periods if not terminated by either party, and we agreed to provide Mr. Smith consideration of $200,000 per year; reimbursement for reasonable business expenses; the ability to earn a yearly bonus in the sole discretion of the Board of Directors of the Company; co-investment rights, providing Mr. Smith the right to participate in the amount of up to 20%

of any acquisition, transaction or funding undertaken by the Company during the term of the employment agreement; stock options to purchase 12,000,000 shares of the Company’s common stock at an exercise price of $0.0039 per share, with cashless exercise rights and a five year term, which vested immediately upon the parties’ entry into the employment agreement; and 1,000 shares of Series A Preferred Stock which provide him Super Majority Voting Rights (described in greater detail below under Item 5.03).

The employment agreement includes a non-competition provision, prohibiting Mr. Smith from competing against the Company in Texas, Louisiana, Oklahoma or New Mexico for a term of 12 months following the termination of the employment agreement.

The employment agreement can be terminated by the Company for cause (as defined in the agreement), without cause, or by Mr. Smith for good reason (as defined in the agreement) or without good reason. If the employment agreement is terminated due to Mr. Smith’s death, disability, with cause by the Company or without good reason by Mr. Smith, he is due the consideration earned by him up until the date of termination of the agreement. If the employment agreement is terminated by the Company without cause or by Mr. Smith for good reason, Mr. Smith is due the consideration earned by him up until the date of termination, plus the

lesser of six months of salary due to Mr. Smith under the employment agreement and the remaining amount of consideration due pursuant to the terms of the employment agreement in a lump sum.

Mr. Smith also agreed to assign the Company rights to any intellectual property and inventions which he creates or conceives during the term of the employment agreement relating to the Company’s business pursuant to the employment agreement.

On September 28, 2011, the Company entered into two Oil and Gas Leases and obtained rights to conduct oil and gas exploration and production activities on an aggregate of 320 acres (160 acres pursuant to each lease) located in Wagoner County, Oklahoma (the “ Wagoner County Leases ”). Pursuant to the lease agreements, we agreed to pay the lessees under each of the leases total consideration for such lease rights consisting of $10 at the time of the entry into the agreements and (a)

3/16 th of all oil produced from the leased property; (b) 3/16 th of all gas of whatever nature or kind produced or sold from the leased property; (c) 3/16 th of the gross proceeds, from the mouth of the well, of any gas produced from any oil well and used to manufacture gasoline; and (d) certain other nominal fees, during the period any well is shut-in. The leases have a term of one (1) year, provided that they continue in effect thereafter for so long as oil or gas is produced on such leases by the Company, if any.

The closing conditions required to occur pursuant to the Asset Purchase Agreement have not occurred as of the date of this filing, but are expected to occur shortly after the filing of this report.

In connection with the acquisition of the Equipment and the Wagoner County Leases the Company changed its business focus to oil and gas exploration and production and related operations and ceased undertaking any restaurant related operations as were contemplated by its previous business plan.

Change in Control

As a result of the Stock Purchase Agreement described above, Petron, and as a result of his control of Petron, Floyd L. Smith (who became our sole officer and Director on August 10, 2011, as described below) became the largest shareholder of the Company and obtained majority voting control (98.9% of the Company’s then outstanding shares) over the Company. Furthermore, in connection with the Company’s entry into the Executive Employment Agreement with Mr. Smith, Mr. Smith obtained rights to shares of Preferred Stock, which allow him to vote 51% of our outstanding common stock on any and all shareholder matters (including the

appointment of Directors), thereby providing him continuing voting control over the Company.

Page - 6

Recent Changes in Officers and Directors

On August 10, 2011, our Directors, David Cho and Pete Wainscott, increased the number of Directors of the Company to three, and appointed Floyd L. Smith as a Director of the Company, pursuant to the power provided to the Board of Directors by the Company’s Bylaws to fill the vacancy left by the increase. Immediately following such appointment, David Cho, our President, Chief Executive Officer, Chief Financial Officer, Secretary, and Director resigned as an officer and Director of the Company and Pete Wainscott, our Director, resigned as a Director of the Company and Floyd L. Smith was appointed as the Chief Executive Officer, Chief

Financial Officer, President, Secretary and Treasurer of the Company. Additionally, as a result of the resignations of Mr. Cho and Mr. Wainscott as Directors of the Company, Mr. Smith is the sole Director of the Company. On August 15, 2011, Floyd L. Smith, our then sole Director, appointed David Knepper and Kenny Fox as Directors of the Company.

On December 5, 2011, Kenny Fox resigned as a Director of the Company.

Amendment to Articles of Incorporation

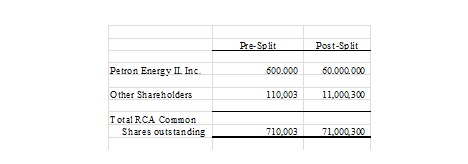

On September 7, 2011, the Company’s Board of Directors and then majority shareholder, Petron (which held approximately 98.9% of the Company’s outstanding shares of common stock), and is controlled by Mr. Smith, approved the filing of a Certificate of Amendment (the “ Amendment ”) to the Company’s Articles of Incorporation to affect (a) a name change of the Company to “ Petron

Energy II, Inc. ”; (b) a forward stock split of the Company’s outstanding common stock in a ratio of 100:1; and (c) an increase in the Company’s authorized shares of stock to 1,000,000,000 shares of common stock, $0.001 par value per share and 10,000,000 shares of preferred stock, $0.001 par value per share; each effective as of October 15, 2011.

The Amendment was filed with the Secretary of State of Nevada on September 9, 2011 and the Amendment was made effective with FINRA at the open of business on October 17, 2011. As a result of the Amendment, the Company’s trading symbol on the Over-The-Counter Bulletin Board changed to “RCNCD”, until November 29, 2011, at which time the Company’s symbol on the Over-The-Counter Bulletin Board changed to “PEII” in connection with the name change affected by the Amendment. The affects of the Forward Split have been retroactively reflected throughout this Report.

Private Placements

In August 2011, the Company sold an aggregate of 6,462,900 shares of the Company’s restricted common stock to twelve “ accredited investors ” in private transactions for aggregate consideration of $387,774 or $0.06 per share in a private placement.

In September and October 2011, the Company sold an aggregate of 4,333,300 shares of the Company’s restricted common stock to nine “ accredited investors ” in private transactions for aggregate consideration of $259,998 or $0.06 per share

Business Operations

As a result of the assumption of the Asset Acquisition Agreement, our acquisition of the Equipment and the Wagoner County Leases, our business goal has changed to the creation of an asset base consisting of oil and gas and natural gas properties which have a proven history of production. We have already made progress in connection with this goal by our acquisition of the Wagoner County Leases and our upcoming acquisition of the Assets of Petron pursuant to the Asset Purchase Agreement described above.

We hope to increase the value of the assets we acquire in the future through further acquisitions, drilling operations and the re-working of wells. We plan to concentrate our development efforts in Texas and Oklahoma. The Asset Purchase Agreement relates to our acquisition from Petron of approximately one thousand five hundred leased acres which will include 59 existing wells which will need to be reworked in an effort to attempt to re-establish commercial production (collectively the “ Leases ”). We estimate the costs of reworking these wells at $35,000 per well and estimate that it will take approximately two weeks to rework

each well, funding permitting.. We also assumed the Asset Acquisition Agreement, described above, pursuant to which we plan to acquire certain additional oil and gas producing properties located in Texas, including an additional two thousand eight hundred leased acres which include 34 existing wells.

Page - 7

Our operations are focused on the United States and Texas and Oklahoma, specifically, because we believe focusing our operations in the United States offers us the following advantages:

• Low risk opportunities;

• Growth opportunities;

• Upside profit potential in connection with oil and unconventional gas reserves; and

• Availability of technological improvements which may increase oil and gas reserves.

Our target market is the East Texas Cotton Valley, the Woodford Shale in Oklahoma and the Tannehill Sand in North Texas which we believe each offer a high success rate with respect to developing producing wells and long term cash flow. The properties we will acquire through the Asset Purchase Agreement and the rights we acquired in connection with the Wagoner County Leases are all located in the areas described in the preceding sentence.

The East Texas Cotton Valley is a shale field made up of shale, sandstone, and clay deposits which have been shown to hold natural gas deposits. The East Texas Cotton Valley field is located in east Texas in Rusk County, Panola County and Harris County. Several companies including Goodrich Petroleum, Petrohawk Energy, Devon Energy and El Paso Energy have operations in the East Texas Cotton Valley trend.

The Woodford Shale, also known as the Devonian Woodford Shale is located in south and north eastern Oklahoma. The largest gas producer in the Woodford Shale is Newfield Exploration; other operators include Devon Energy, Chesapeake Energy, Cimarex Energy and Antero Resources.

The Tannehill Sand field is located in Knox County in north central Texas.

The production life from new and existing wells in each area typically has a life expectancy of 10 - 25 years. The Cotton Valley Trend and Woodford Shale are primarily natural gas trends; however some wells provide oil production along with gas production. In addition to the Woodford Shale, there are 4 separate pay zones (the Tyner, Misner, Burgen and Dutucher) which are oil pay zones, while the Tannehill pay zone in Knox County, Texas is primarily an oil pay zone.

Moving forward, we plan to acquire additional interests, funding permitting, which have a long-term history of successful production and display characteristics of being an under developed asset. By applying new technologies we hope to exploit and produce more natural gas and oil from these assets once acquired. Additionally, the Company plans to engage primarily in the exploration and development of oil and gas leases in Oklahoma, East and North Texas and Western Louisiana over the next two years through one or more of the following activities: (i) acquisition of oil and gas leases (similar to the Wagoner County Leases); (ii) contract drilling on leases owned by the Company through investment partnerships and

banking relationships; (iii) acquisition of oil and gas producing properties; and (iv) acquisition of oil and gas companies having properties (producing and non-producing). Wells to be drilled by the Company will include both exploratory and development wells. We estimate that newly drilled wells will have a total cost range including completion of approximately $125,000 - $150,000 and reworked wells will have a total cost range of approximately $35,000 - $45,000.

We also plan to operate the natural gas pipeline which we expect to acquire as part of the Asset Purchase Agreement and undertake exploration and workover activities on oil and natural gas wells that we will acquire in the acquisition.

Our currently planned workover activities include fracing non-producing oil and natural gas wells in an effort to increase and/or restart production from such wells.

Fracing

When sandstone rocks contain oil or gas in commercial quantities, recovery can be vastly improved by a process called fracturing (“fracing”) which is used to increase permeability to its optimum level. Basically, to fracture a formation, a fracturing service company pumps a specifically blended fluid down the well and into the formation under great pressure. Pumping continues until the formation literally cracks open. Meanwhile, a special type of frac sand is mixed into the fracturing fluid. These materials are called proppants . The proppant enters the fractures in the formation and when pumping is stopped and the pressure is allowed to

dissipate, the proppant remains in the fractures. Since the fractures try to close back together after the pressure on the well is released, the proppant is needed to hold or prop the fractures open. These propped-open fractures provide passages for oil or gas to flow into the well.

Page - 8

In addition to new technology and fracing mixtures, a myriad of other technologies can be applied to produce increased production results. We plan to constantly track different well completion strategies and production results to generate an approach that will yield:

• Higher initial flow rates;

• Slower decline rates; and

• Improved recoverability.

Horizontal Wells

The first recorded true horizontal well was drilled near Texon, Texas (just west of San Angelo), and was completed in 1929; however, little practical application of horizontal wells occurred until the early 1980’s, by which time the advent of improved downhole drilling motors and the invention of other necessary supporting equipment, materials, and technologies, particularly downhole telemetry equipment, had brought some kinds of applications within the realm of commercial viability.

Horizontal drilling is the process of drilling and completing, for production, a well that begins as a vertical or inclined linear bore which extends from the surface to a subsurface location just above the target reservoir, then bears off on an arc to intersect the reservoir at the “entry point”, and, thereafter, continues at a near-horizontal angle and will substantially or entirely remain within the reservoir until the desired bottom hole location is reached.

The technical objective of horizontal drilling is to expose significantly more reservoir rock to the well bore surface than can be achieved via drilling of a conventional vertical well. The two primary benefits of horizontal drilling success are 1) increased productivity of the reservoir, as well as 2) prolongation of the reservoir’s commercial life.

An offset to the benefits provided by successful horizontal drilling is its higher cost. However, we believe that it is probable that the cost premium associated with horizontal drilling will continue to decline as horizontal drilling activity increases, provided that there is the possibility that new and improved technology could add additional costs in the future.

Horizontal wells generally have a higher productivity and pay zone contact per well than vertical wells, and allow operators to take advantage of highly heterogeneous or layered reservoirs, like the Cotton Valley Sandstone which we plan to target. Horizontal drilling is now utilized in a variety of carbonate and sandstone reservoirs across the country, including the Austin Chalk, James Lime, Woodbine and the Barnett Shale in Texas.

We plan to use horizontal wells in an effort to produce natural gas from the assets we plan to acquire through the Asset Purchase Agreement.

MARKET INFORMATION

According to the U.S. Energy Information Administration’s (the “ EIA’s ”) Annual Energy Outlook 2011, sh ale gas production in the United States grew at an average annual rate of 17 percent between 2000 and 2006 and the combination of horizontal drilling and hydraulic fracturing technologies has made it possible to produce shale gas economically, leading to an average annual growth rate of 48 percent over the 2006-2010 period.

Page - 9

The EIA projects that Shale gas production will continue to increase strongly through 2035, growing almost fourfold from 2009 to 2035. While the EIA projects that total domestic natural gas production will grow from 21.0 trillion cubic feet in 2009 to 26.3 trillion cubic feet in 2035, it projects that shale gas production (such as the Company’s planned operations following the closing of the Asset Purchase Agreement) will grow to 12.2 trillion cubic feet in 2035, when it makes up 47 percent of total U.S. production—up considerably from its 16-percent share in 2009.

Additionally, according to the EIA’s Short-Term Energy Outlook released January 11, 2011, demand for oil is expected to increase to 88.0 million barrels per day worldwide in 2011. World oil consumption was 86.6 million barrels per day in 2010. This reversed the losses of the previous two years and surpassed the 2007 level of 86.3 million barrels per day.

The EIA (as reported in the 2011 Annual Energy Outlook) also projects that total primary energy consumption, including fuels used for electricity generation, will grow by 0.7 percent per year from 2009 to 2035, to 114.2 quadrillion Btu (British thermal units) in 2035.

The Company anticipates the price of oil and natural gas increasing in the near and long-term future due to the fact that the global supply of oil and natural gas is decreasing over time while the global demand for oil and natural gas is increasing, due mainly to increases in the energy needs of developing global areas such as south-east Asia (including China) and Africa.

DEPENDENCE ON ONE OR A FEW MAJOR CUSTOMERS

The nature of the oil and natural gas industry is not based on individual customers. Crude oil and natural gas products are sold to local and international brokers as well as to refineries.

COMPETITION

The oil and gas industry is intensely competitive. This is particularly true in the competition for acquisitions of prospective oil and natural gas properties and oil and gas reserves. We believe that the location of the leasehold acreage we acquired as a result of the Wagoner County Leases and plan to acquire pursuant to the Asset Purchase Agreement and which we plan to acquire through the Asset Acquisition Agreement, our exploration, drilling, and production expertise, and the experience and knowledge of our management and industry partners will enable us to compete effectively in the oil and gas industry. Notwithstanding the above, we will still face stiff competition from a substantial number of

major and independent oil and gas companies that have larger technical staffs and greater financial and operational resources than we do. Many of these companies not only engage in the acquisition, exploration, development, and production of oil and natural gas reserves, but also have refining operations, market refined products, and own drilling rigs. We will also compete with other oil and natural gas companies in attempting to secure drilling rigs and other equipment necessary for the drilling and completion of wells.

REGULATORY MATTERS AND GOVERNMENT REGULATIONS

Regulation of Oil and Gas Production, Sales and Transportation

The oil and gas industry is subject to regulation by numerous national, state and local governmental agencies and departments. Compliance with these regulations is often difficult and costly and noncompliance could result in substantial penalties and risks. Most jurisdictions in which we operate and plan to operate also have statutes, rules, regulations or guidelines governing the conservation of natural resources, including the unitization or pooling of oil and gas properties and the establishment of maximum rates of production from oil and gas wells. Some jurisdictions also require the filing of drilling and operating permits, bonds and reports. The failure to comply with these statutes, rules and regulations

could result in the imposition of fines and penalties and the suspension or cessation of operations in affected areas.

We intend to operate various gathering systems. The United States Department of Transportation and certain governmental agencies regulate the safety and operating aspects of the transportation and storage activities of these facilities by prescribing standards. However, based on current standards concerning transportation and storage activities and any proposed or contemplated standards, we believe that the impact of such standards is not material to our operations, capital expenditures or financial position.

Various federal, state and local laws and regulations relating to the protection of the environment, including the discharge of materials into the environment, may affect our planned exploration, development and production operations and the costs of those operations. These laws and regulations, among other things, govern the amounts and types of substances that may be released into the environment, the issuance of permits to conduct exploration, drilling and production operations, the handling, discharge and disposition of waste materials, the reclamation and abandonment of wells, sites and facilities, financial assurance under the Oil Pollution Act of 1990 and the remediation of contaminated sites. These laws

and regulations may impose substantial liabilities for noncompliance and for any contamination resulting from our planned operations and may require the suspension or cessation of operations in affected areas.

Page - 10

The environmental laws and regulations applicable to us and our planned operations include, among others, the following United States federal laws and regulations:

· Clean Air Act, and its amendments, which governs air emissions;

· Clean Water Act, which governs discharges of pollutants into waters of the United States;

· Comprehensive Environmental Response, Compensation and Liability Act, which imposes strict liability where releases of hazardous substances have occurred or are threatened to occur (commonly known as “ Superfund ”);

· Resource Conservation and Recovery Act, which governs the management of solid waste;

· Oil Pollution Act of 1990, which imposes liabilities resulting from discharges of oil into navigable waters of the United States;

· Emergency Planning and Community Right-to-Know Act, which requires reporting of toxic chemical inventories;

· Safe Drinking Water Act, which governs underground injection and disposal activities; and

· U.S. Department of Interior regulations, which impose liability for pollution cleanup and damages.

We plan to routinely obtain permits for facilities and operations in accordance with these applicable laws and regulations on an ongoing basis as required by applicable laws.

EMPLOYEES

The Company currently has eight (8) employees, including its Chief Executive Officer, President and Director, Floyd L. Smith.

INTELLECTUAL PROPERTY

The Company does not currently hold any intellectual property, patent rights, trademarks or copyrights.

Our securities are highly speculative and should only be purchased by persons who can afford to lose their entire investment in our Company. If any of the following risks actually occur, our business and financial results could be negatively affected to a significant extent. The Company's business is subject to many risk factors, including the following:

General Risks Related To The Company

We May Not Be Able To Continue Our Business Plan Without Additional Financing.

We have not generated significant revenues to date and since the date of our change in business focus from restaurant related operations to an oil and gas exploration and production company. We had a total working capital surplus of $211,475 as of December 31, 2011, a deficit accumulated during the development stage of $621,047 and a net loss for the year ended December 31, 2011of $509,740. We will need to raise significant funding in the future, including approximately $500,000 to continue our operations for the next 12 months. We anticipate the need for approximately $3-5 million dollars in additional funding to expand our operations

and acquire additional properties as described above under “Plan of Operations”. In August 2011, the Company sold an aggregate of 6,462,900 shares of the Company’s restricted common stock to twelve “accredited investors” in private transactions for aggregate consideration of $387,774 or $0.06 per share in a private placement. From September through December 2011, the Company sold an aggregate of 14,250,000 shares of the Company’s restricted common stock to twenty-three “ accredited investors ” in private transactions for aggregate consideration of $855,000 or $0.06 per share. In August 2011, we assumed a Management Services Agreement with ASL Energy (described above) which requires us

to pay $8,000 per month to ASL Energy.

Page - 11

We do not believe that we have enough cash on hand to operate for the next 12 months and anticipate only being able to operate for the next six months with our current available cash. Moving forward we plan to rely on financing and additional funds from affiliates of the Company and third party investors in order to support our operations and pay our expenses in the near term. Additional funding will likely come from debt and equity financing from the sale of our common stock. If we are

successful in completing an equity financing, existing shareholders will experience dilution of their interest in our Company. We do not have any financing arranged and we cannot provide investors with any assurance that we will be able to raise sufficient funding from the sale of our common stock to fund our exploration activities. In the absence of such financing, our business will likely fail. There are no assurances that we will be able to achieve further sales of our common stock or any other form of additional financing. If we are unable to achieve the financing necessary to continue our plan of operations, then we will not be able to continue our business operations. If we are unable to raise the funds we require, your investment could become worthless.

We Have Not Generated Any Significant Revenues Since Our Inception In August 2008.

Since our inception in August 2008, we have yet to generate any significant revenues, and currently have only limited operations, as we are presently in the development stage of our business development. In August 2011, we changed our business focus to oil and gas exploration and we have not generated any revenue to date in connection with such business focus. We make no assurances that we will be able to generate any significant revenues in the future.

Shareholders May Be Diluted Significantly Through Our Efforts To Obtain Financing, Satisfy Obligations And/Or Complete Acquisitions Through The Issuance Of Additional Shares Of Our Common Stock Or Other Securities.

We have no committed source of financing. Wherever possible, our Board of Directors will attempt to use non-cash consideration to satisfy obligations. In many instances, we believe that the non-cash consideration will consist of restricted shares of our common stock or other securities (including the shares of convertible preferred stock that we have agreed to issue to shareholders of ONE Energy Capital Corp., ONE Energy International Corp. and their affiliated parties in connection with the Asset Acquisition Agreement (described above)). Additionally, moving forward, we may attempt to conduct acquisitions and/or mergers of other entities or assets using

our common stock or other securities as payment for such transactions. Our Board of Directors has authority, without action or vote of the shareholders, to issue all or part of the authorized but unissued shares of common stock and preferred stock with various preferences and other rights. If such transactions occur, this may result in substantial dilution of the ownership interests of existing shareholders, and dilute the book value of the Company’s common stock.

We Are Party to An Asset Acquisition Agreement Pursuant to Which, If Such Agreement Closes, We Will Pay Significant Consideration For The Acquisition Of Certain Oil And Gas Assets, Which Consideration Will Cause Substantial Dilution To Our Existing Shareholders.

In connection with the Second Amendment described above, we assumed rights and obligations under an Asset Acquisition Agreement, pursuant to which we agreed to acquire the assets of ONE Energy Capital Corp., ONE Energy International Corp. and their affiliated parties, upon the mutual agreement of final closing agreements, in aggregate consideration for shares of convertible preferred stock, which convert into shares of the Company having a total value of $5,910,000, based on the trading price of the Company’s common stock on the date converted; votes one-for-one with the common shares; provides that no shares can be converted by the holders thereof if

such conversion would result in the acquisition by such holder of more than 9.99% of the Company’s outstanding stock; and provides for such converted shares to be subject to a lock-up agreement. The issuance of the shares of convertible preferred stock contemplated by the Asset Acquisition Agreement and the subsequent conversion thereof will cause immediate dilution to the shareholders of the Company.

Our Majority Shareholder, Floyd L. Smith, Can Vote An Aggregate Of 87.2% Of Our Voting Shares and Holds Series A Preferred Stock Which Will Provide Him Continuing Voting Control Over the Company, And As A Result, He Will Exercise Significant Control Over Corporate Decisions.

Floyd L. Smith, our President and Director, has beneficial ownership of 48% of our outstanding shares of common stock and 67.2% of our outstanding voting shares, which includes 1,000 shares of Series A Preferred Stock, which voting together as a class have the right to vote 51% of the Company’s voting shares on any and all shareholder matters. Additionally, the Company shall not adopt any amendments to the Company's Bylaws, Articles of Incorporation, as amended, make any changes to the Certificate of Designations establishing the Series A Preferred Stock, or effect any

reclassification of the Series A Preferred Stock, without the affirmative vote of at least 66-2/3% of the outstanding shares of Series A Preferred Stock. However, the Company may, by any means authorized by law and without any vote of the holders of shares of Series A Preferred Stock, make technical, corrective, administrative or similar changes to such Certificate of Designations that do not, individually or in the aggregate, adversely affect the rights or preferences of the holders of shares of Series A Preferred Stock.

Page - 12

The Series A Preferred Stock also includes a provision which provides that in the event that Mr. Smith dies or becomes disabled within eighteen months of the issuance date of the Series A Preferred Stock to Mr. Smith, that ASL Energy Corp. and or its assigns shall have the right, with 61 days prior written notice to the Company to assume the ownership of and/or the rights associated with such shares of Series A Preferred Stock (the “ Assignment Rights ”). Other than the Super

Majority Voting Rights, the Series A Preferred Stock does not have any other dividend, liquidation, conversion, or redemption rights, whatsoever.

As a result of the above, Mr. Smith exercises control in determining the outcome of corporate transactions or other matters, including the election of directors, mergers, consolidations, the sale of all or substantially all of our assets, and also the power to prevent or cause a change in control. Any investors who purchase shares will be minority shareholders and as such will have no say in the direction of the Company and the election of Directors. Investors in the Company should keep in mind that even if you own shares of the Company's common stock and wish to vote them at annual or special shareholder meetings, your shares will have no effect on the

outcome of corporate decisions or the election of Directors. Furthermore, investors should be aware that Mr. Smith may choose to elect new Directors to the Board of Directors of the Company and/or take the Company in a new business direction altogether, and that current shareholders of the Company will have little to no say in such matters.

Finally, in the event that Mr. Smith dies or becomes disabled prior to March 1, 2013, ASL Energy has the right to take ownership of the Series A Preferred Stock, and as a result, voting control over the Company.

Shareholders Who Hold Unregistered Shares Of Our Common Stock Are Subject To Resale Restrictions Pursuant To Rule 144, Due To Our Previous Status As A “ Shell Company. ”

Pursuant to Rule 144 of the Securities Act of 1933, as amended (“ Rule 144 ”), a “ shell company ” is defined as a company that has no or nominal operations; and, either no or nominal assets; assets consisting solely of cash and cash equivalents; or assets consisting of any amount of cash and cash equivalents and nominal other

assets. As such, prior to the completion of the Asset Purchase Agreement and our related Form 8-K filing, we will be considered a “ shell company ” pursuant to Rule 144, and as such, sales of our securities pursuant to Rule 144 are not able to be made until 1) we have ceased to be a “ shell company ” (which we believe that we will after closing the Asset Purchase Agreement); 2) we are subject to Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended, and have filed all of our required periodic reports for at least the previous one

year period prior to any sale pursuant to Rule 144; and a period of at least twelve months has elapsed from the date “ Form 10 information ” has been filed with the Commission reflecting the Company’s status as a non-“ shell company ”, which information has been filed in this Report. Because none of our non-registered securities can be sold pursuant to Rule 144, until at least a year after the date of the filing of a Form 8-K Report with Form 10 information, any non-registered securities we sell in the next approximately 12 months or issue

to consultants or employees, in consideration for services rendered or for any other purpose will have no liquidity until and unless such securities are registered with the Commission and/or until a year after the date of this Report. As a result, it may be harder for us to fund our operations and pay our consultants with our securities instead of cash. Furthermore, it will be harder for us to raise funding through the sale of debt or equity securities unless we agree to register such securities with the Commission, which could cause us to expend additional resources in the future. Our status as a “ shell company ” could prevent us from raising additional funds, engaging consultants, and

using our securities to pay for any acquisitions (although none are currently planned, except as discussed above), which could cause the value of our securities, if any, to decline in value or become worthless.

Our Auditors Have Raised Substantial Doubt As To Whether We Can Continue As A Going Concern.

We have not generated any significant revenues since our incorporation, nor have we generated any revenues associated with our recent change in business focus to oil and gas exploration and production to date. Additionally, we currently have limited options. These factors among others indicate substantial doubt regarding our ability to continue as a going concern, particularly in the event that we cannot obtain additional financing and/or attain profitable operations. Our financial statements do not include any adjustments that might result from the outcome of this uncertainty and if we cannot continue as a going

concern, your investment could become devalued or even worthless.

Page - 13

We Rely Upon Key Personnel And If They Leave Us, Our Business Plan And Results Of Operations Could Be Adversely Affected.

We rely heavily on our Chief Executive Officer and Director, Floyd L. Smith. His experience and input creates the foundation for our business and he is responsible for the directorship and control over our operations. We do currently have an employment agreement with Mr. Smith (as described above), and we are putting in place a " key man " insurance policy on Mr. Smith in the amount of $1,000,000. Moving forward, should we lose the services of Mr. Smith, for any reason, we will incur costs associated

with recruiting a replacement and delays in our operations. If we are unable to replace Mr. Smith with another suitably trained individual or individuals, we may be forced to scale back or curtail our business plan. As a result of this, your investment in us could become devalued or worthless and we may be forced to abandon or change our business plan.

Our Management Lacks Experience In And With Publicly-Traded Companies.

While we rely heavily on Floyd L. Smith, our Chief Executive Officer, President, Chief Financial Officer, Secretary, Treasurer and Director and our other Director, David Knepper, they have no experience serving as an officer or Director of a publicly-traded company, or experience with the reporting requirements which public companies are subject to. Consequently, our operations, earnings and ultimate financial success could suffer irreparable harm due to their ultimate lack of experience with publicly-traded companies in general.

Our Insurance Coverage May Be Inadequate To Insure Against All Material Risks.

Moving forward, we plan to acquire insurance against some, but not all of the potential risks and losses our operations are subject to. There can be no assurance that insurance obtained by us will be adequate to and/or in sufficient amounts necessary to cover all losses or liabilities. The occurrence of a significant event not fully insured or indemnified against, could materially and adversely affect our financial condition and operations, which could lead to any investment in us becoming worthless.

We May Not Be Able To Successfully Manage Our Growth, Which Could Lead To Our Inability To Implement Our Business Plan.

Our growth is expected to place a significant strain on our managerial, operational and financial resources, especially considering that we currently only have three Directors and one executive officer. Further, as we enter into additional contracts, we will be required to manage multiple relationships with various consultants, businesses and other third parties. These requirements will be exacerbated in the event of our further growth. There can be no assurance that our systems, procedures and/or controls will be adequate to support our operations or that our management will be able to achieve the rapid execution necessary to successfully implement our

business plan. If we are unable to manage our growth effectively, our business, results of operations and financial condition will be adversely affected, which could lead to us being forced to abandon or curtail our business plan and operations.

We Have A Limited Operating History In Our Current Business Focus Of Oil And Gas Production And Because Of This It May Be Difficult To Evaluate Our Chances For Success.

We were formed in August 2008 as a company specializing in restaurant consulting and investment activities; provided that we only generated limited revenues in connection with such operations, and changed our business focus to oil and gas exploration activities in connection with our acquisition of the Equipment of Petron in August 2011 (described above). As such, we have a limited history in our current business focus of oil and gas exploration. We are a relatively new company and, as such, run a risk of not being able to compete in the marketplace because of our relatively short existence. New companies in the competitive

environment of oil and gas exploration may face significant competition, and as a result, we may be forced to abandon or curtail our business plan. Under such a circumstance, the value of any investment in us may become worthless.

We Incur Significant Increased Costs As A Result Of Operating As A Fully Reporting Company As Well As In Connection With Section 404 Of The Sarbanes Oxley Act.

We incur legal, accounting and other expenses in connection with our status as a fully reporting public company. The Sarbanes-Oxley Act of 2002 (the " Sarbanes-Oxley Act ") and rules subsequently implemented by the SEC have imposed various requirements on public companies, including requiring changes in corporate governance practices. As such, our management and other personnel need to devote a substantial amount of time to these compliance initiatives. Moreover, these rules and regulations increase our

legal and financial compliance costs and make some activities more time-consuming and costly. The Sarbanes-Oxley Act requires, among other things, that we maintain effective internal controls for financial reporting and disclosure of controls and procedures. In particular, we must perform system and process evaluation and testing of our internal controls over financial reporting to allow management to report on the effectiveness of our internal controls over financial reporting. Our testing may reveal deficiencies in our internal controls over financial reporting that are deemed to be material weaknesses. Our compliance with Section 404 and our continued status as a publicly reporting company will require that we incur substantial accounting, legal and filing expenses and expend significant management efforts. We currently do not have an internal audit group, and we may need to hire

additional accounting and financial staff with appropriate public company experience and technical accounting knowledge. Moreover, if we are not able to comply with the requirements of Section 404 in a timely manner, the market price of our stock could decline, and we could be subject to sanctions or investigations by the SEC or other regulatory authorities, which would require additional financial and management resources.

Page - 14

We May Be Unable to Close The Transactions Contemplated By The Asset Acquisition Agreement.

In August 2011, in connection with and pursuant to the Second Amendment (described above) we assume all rights and obligations under the Asset Acquisition Agreement, pursuant to which we agreed to acquire the assets of ONE Energy Capital Corp., ONE Energy International Corp. and their affiliated parties, upon the mutual agreement of final closing agreements, in aggregate consideration for shares of convertible preferred stock, which convert into shares of the Company having a total value of $5,910,000, based on the trading price of the Company’s common stock on the date converted; votes one-for-one with the common shares; provides that no shares can

be converted by the holders thereof if such conversion would result in the acquisition by such holder of more than 9.99% of the Company’s outstanding stock; and provides for such converted shares to be subject to a lock-up agreement. We and the various other counterparties to the Asset Acquisition Agreement may never consummate the acquisitions contemplated therein for reasons that may include us and such counterparties failing to agree to definitive agreements evidencing such acquisitions, such entities failing to provide us with required financial statement disclosure, and/or such counterparties failing to receive required shareholder approval for the contemplated acquisitions.

Shareholders May Be Diluted Significantly By the Conversion of the Convertible Preferred Stock and Exercise of Warrants We Have Agreed to Issue In Connection with the Asset Acquisition Agreement.

In August 2011, in connection with and pursuant to the Second Amendment (described above) we assume all rights and obligations under the Asset Acquisition Agreement, pursuant to which we agreed to acquire the assets of ONE Energy Capital Corp., ONE Energy International Corp. and their affiliated parties, upon the mutual agreement of final closing agreements, in aggregate consideration for shares of convertible preferred stock, which convert into shares of the Company having a total value of $5,910,000, based on the trading price of the Company’s common stock on the date converted; votes one-for-one with the common shares; provides that no shares can

be converted by the holders thereof if such conversion would result in the acquisition by such holder of more than 9.99% of the Company’s outstanding stock; and provides for such converted shares to be subject to a lock-up agreement. The conversion of such convertible preferred stock will result in substantial dilution of the ownership interests of existing shareholders, and dilute the book value of the Company’s common stock. Furthermore, the subsequent sale of the shares of common stock issuable upon such conversion will likely significantly decrease the trading value of the Company’s common stock.

Our Articles Of Incorporation, As Amended, And Bylaws Limit The Liability Of, And Provide Indemnification For, Our Officers And Directors.

Our Articles of Incorporation, as amended, generally limit our officers' and Directors' personal liability to the Company and its stockholders for breach of fiduciary duty as an officer or Director except for breach of the duty of loyalty or acts or omissions not made in good faith or which involve intentional misconduct or a knowing violation of law. Our Articles of Incorporation, as amended, and Bylaws provide indemnification for our officers and Directors to the fullest extent authorized by the Nevada General Corporation Law against all expense, liability, and loss, including attorney's fees, judgments, fines excise taxes or penalties and amounts to be

paid in settlement reasonably incurred or suffered by an officer or Director in connection with any action, suit or proceeding, whether civil or criminal, administrative or investigative (hereinafter a " Proceeding ") to which the officer or Director is made a party or is threatened to be made a party, or in which the officer or Director is involved by reason of the fact that he is or was an officer or Director of the Company, or is or was serving at the request of the Company as an officer or director of another corporation or of a partnership, joint venture, trust or other enterprise whether the basis of the Proceeding is an alleged action in an official capacity as an officer or Director, or in any other capacity while serving as

an officer or Director. Thus, the Company may be prevented from recovering damages for certain alleged errors or omissions by the officers and Directors for liabilities incurred in connection with their good faith acts for the Company. Such an indemnification payment might deplete the Company's assets. Stockholders who have questions regarding the fiduciary obligations of the officers and Directors of the Company should consult with independent legal counsel. It is the position of the Securities and Exchange Commission that exculpation from and indemnification for liabilities arising under the Securities Act of 1933, as amended, and the rules and regulations thereunder is against public policy and therefore unenforceable.

Page - 15

Oil, Gas And Natural Gas Liquid Prices Are Volatile.

We anticipate that our future financial results will be highly dependent on the general supply and demand for oil, gas and natural gas liquids (“ NGLs ”), which will impact the prices we ultimately realize on our future sales of these commodities. A significant downward movement of the prices for these commodities could have a material adverse effect on our future revenues, operating cash flows and profitability. Such a downward price movement could also have a material adverse effect on our

future estimated proved reserves, the carrying value of our future oil and gas properties, the level of planned drilling activities and future growth. Historically, market prices have been volatile and are likely to continue to be volatile in the future due to numerous factors beyond our control. These factors include, but are not limited to:

|

•

|

consumer demand for oil, gas and NGLs;

|

|

|

•

|

conservation efforts;

|

|

|

•

|

OPEC production levels;

|

|

|

•

|

weather;

|

|

|

•

|

regional pricing differentials;

|

|

|

•

|

differing quality of oil produced (i.e., sweet crude versus heavy or sour crude);

|

|

|

•

|

differing quality and NGL content of gas produced;

|

|

|

•

|

the level of imports and exports of oil, gas and NGLs;

|

|

|

•

|

the price and availability of alternative fuels;

|

|

|

•

|

the overall economic environment; and

|

|

|

•

|

governmental regulations and taxes.

|

Estimates Of Oil, Gas And NGL Reserves Are Uncertain.

The process of estimating oil, gas and NGL reserves is complex and requires significant judgment in the evaluation of available geological, engineering and economic data for each reservoir, particularly for new discoveries. Because of the high degree of judgment involved, different reserve engineers may develop different estimates of reserve quantities and related revenue based on the same data. In addition, the reserve estimates for a given reservoir may change substantially over time as a result of several factors including additional development activity, the viability of production under varying economic conditions and variations in production levels

and associated costs. Consequently, material revisions to our future reserve estimates may occur as a result of changes in any of these factors. Such revisions to reserves could have a material adverse effect on our future estimates of future net revenue, as well as our financial condition and profitability.

Discoveries Or Acquisitions Of Additional Reserves Will Be Needed To Avoid A Material Decline In Future Reserves And Production.

The production rates from oil and gas properties generally decline as reserves are depleted, while related per unit production costs generally increase, due to decreasing reservoir pressures and other factors. Therefore, we anticipate our future estimated proved reserves and future oil, gas and NGL production will decline materially as future reserves are produced unless we conduct successful exploration and development activities or, unless we identify additional producing zones in existing wells, secondary or tertiary recovery techniques, or acquire additional properties containing proved reserves. Consequently, our future oil, gas and NGL production and

related per unit production costs will be highly dependent upon our level of success in finding or acquiring additional reserves.

Page - 16

Future Exploration And Drilling Results Are Uncertain And Involve Substantial Costs.

Substantial costs are often required to locate and acquire properties and drill exploratory wells. Such activities are subject to numerous risks, including the risk that we will not encounter commercially productive oil or gas reservoirs. The costs of drilling and completing wells are often uncertain. In addition, oil and gas properties can become damaged or drilling operations may be curtailed, delayed or canceled as a result of a variety of factors including, but not limited to:

|

•

|

unexpected drilling conditions;

|

|

|

•

|

pressure or irregularities in reservoir formations;

|

|

|

•

|

equipment failures or accidents;

|

|

|

•

|

fires, explosions, blowouts and surface cratering;

|

|

|

•

|

adverse weather conditions;

|

|

|

•

|

lack of access to pipelines or other transportation methods;

|

|

|

•

|

environmental hazards or liabilities; and

|

|

|

•

|

shortages or delays in the availability of services or delivery of equipment.

|

A significant occurrence of one of these factors could result in a partial or total loss of our future investment in a particular property. In addition, drilling activities may not be successful in establishing proved reserves. Such a failure could have an adverse effect on our future results of operations and financial condition. While both exploratory and developmental drilling activities involve these risks, exploratory drilling involves greater risks of dry holes or failure to find commercial quantities of hydrocarbons.

Strong competition exists in all sectors of the oil and gas industry. We plan to compete with major integrated and other independent oil and gas companies for the acquisition of oil and gas leases and properties. We also plan to compete for the equipment and personnel required to explore, develop and operate properties. Competition is also prevalent in the marketing of oil, gas and NGLs. Typically, during times of high or rising commodity prices, drilling and operating costs will also increase. Higher prices will also generally increase the costs of properties available for acquisition. Our competitors have financial and other resources substantially larger

than ours. They also may have established strategic long-term positions and relationships in areas in which we may seek new entry. As a consequence, we may be at a competitive disadvantage in bidding for properties. In addition, many of our larger competitors may have a competitive advantage when responding to factors that affect demand for oil and gas production, such as changing worldwide price and production levels, the cost and availability of alternative fuels, and the application of government regulations.

Public Policy, Which Includes Laws, Rules and Regulations, Can Change.

Our planned operations are subject to federal laws, rules and regulations in the United States. In addition, we will also be subject to the laws and regulations of various states and local governments. Pursuant to public policy changes, numerous government departments and agencies have issued extensive rules and regulations binding on the oil and gas industry and its individual members, some of which carry substantial penalties for failure to comply. Changes in such public policies could affect our planned operations. Political developments can restrict production levels, enact price controls, change environmental protection requirements, and increase

taxes, royalties and other amounts payable to governments or governmental agencies. Existing laws and regulations can also require us to incur substantial costs to maintain regulatory compliance. Our future projected operating and other compliance costs could increase if existing laws and regulations are revised or reinterpreted or if new laws and regulations become applicable to our operations. Although we are unable to predict changes to existing laws and regulations, such changes could significantly impact our future profitability, financial condition and liquidity, particularly changes related to hydraulic fracturing, income taxes and climate change as discussed below.

Page - 17

Hydraulic Fracturing — The U.S. Congress is currently considering legislation to amend the federal Safe Drinking Water Act to require the disclosure of chemicals used by the oil and natural-gas industry in the hydraulic-fracturing process. Currently, regulation of hydraulic fracturing is primarily conducted at the state level through permitting and other compliance requirements. This legislation, if adopted, could establish an additional level of regulation and permitting at the federal level.

Income Taxes — The U.S. President’s recent budget proposals include provisions that would, if enacted, make significant changes to United States tax laws. The most significant change would eliminate the immediate deduction for intangible drilling and development costs.

Climate Change — Policy makers in the United States are increasingly focusing on whether the emissions of greenhouse gases, such as carbon dioxide and methane, are contributing to harmful climatic changes. Policy makers at both the United States federal and state level have introduced legislation and proposed new regulations that are designed to quantify and limit the emission of greenhouse gases through inventories and limitations on greenhouse gas emissions. Legislative initiatives to date have focused on the development of cap-and-trade programs.

These programs generally would cap overall greenhouse gas emissions on an economy-wide basis and require major sources of greenhouse gas emissions or major fuel producers to acquire and surrender emission allowances. Cap-and-trade programs would be relevant to our planned operations because the equipment we plan to use to explore for, develop, produce and process oil and natural gas emits greenhouse gases. Additionally, the combustion of carbon-based fuels, such as the oil, gas and NGLs we plan to sell, emits carbon dioxide and other greenhouse gases.

We Will Incur Certain Costs To Comply With Government Regulations, Particularly Regulations Relating To Environmental Protection And Safety, And Could Incur Even Greater Costs In The Future.

Our exploration, production and marketing operations are regulated extensively at the federal, state and local levels and are subject to interruption or termination by governmental and regulatory authorities based on environmental or other considerations. Moreover, we have incurred and will continue to incur costs in our efforts to comply with the requirements of environmental, safety and other regulations. Further, the regulatory environment in the oil and gas industry could change in ways that we cannot predict and that might substantially increase our costs of compliance and, in turn, materially and adversely affect our business, results of operations and financial condition.

Specifically, as an owner or lessee and operator of crude oil and natural gas properties, we are subject to various federal, state, local and foreign regulations relating to the discharge of materials into, and the protection of, the environment. These regulations may, among other things, impose liability on us for the cost of pollution cleanup resulting from operations, subject us to liability for pollution damages and require suspension or cessation of operations in affected areas. Moreover, we are subject to the United States (U.S.) Environmental Protection Agency's (U.S. EPA) rule requiring annual reporting of greenhouse gas (GHG) emissions. Changes in, or additions to, these

regulations could lead to increased operating and compliance costs and, in turn, materially and adversely affect our business, results of operations and financial condition.

We are aware of the increasing focus of local, state, national and international regulatory bodies on GHG emissions and climate change issues. In addition to the U.S. EPA's rule requiring annual reporting of GHG emissions, we are also aware of legislation proposed by U.S. lawmakers to reduce GHG emissions.

Additionally, there have been various proposals to regulate hydraulic fracturing at the federal level. Currently, the regulation of hydraulic fracturing is primarily conducted at the state level through permitting and other compliance requirements. Any new federal regulations that may be imposed on hydraulic fracturing could result in additional permitting and disclosure requirements (such as the reporting and public disclosure of the chemical additives used in the fracturing process) and in additional operating restrictions. In addition to the possible federal regulation of hydraulic fracturing, some states and local governments have considered imposing various conditions and