Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - Matador Resources Co | d335347d8k.htm |

Investor

Presentation Exhibit 99.1

April 2012 |

1

Forward-Looking Statements

This presentation and statements made by representatives of Matador Resources Company

(“Matador” or the “Company”) during the course of this presentation include

“forward-looking statements” within the meaning of Section 27A of the Securities Act of

1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended.

“Forward-looking statements” are statements related to future, not past,

events. Forward-looking statements are based on current expectations and include any

statement that does not directly relate to a current or historical fact. In this context,

forward-looking statements often address expected future business and financial

performance, and often contain words such as “could,” “believe,” “would,” “anticipate,”

“intend,” “estimate,” “expect,” “may,” “should,”

“continue,” “plan,” “predict,” “potential,” “project” and similar expressions that are

intended to identify forward-looking statements, although not all forward-looking statements

contain such identifying words. Actual results and future events could differ materially from

those anticipated in such statements. These forward-looking statements involve certain

risks and uncertainties and ultimately may not prove to be accurate, including, but not limited to, the following risks

related to our financial and operational performance: general economic conditions; our ability

to execute our business plan, including the success of our drilling program; changes in oil,

natural gas and natural gas liquids prices and the demand for oil, natural gas and natural gas

liquids; our ability to replace reserves and efficiently develop our current reserves; our costs of

operations, delays and other difficulties related to producing oil, natural gas and natural gas

liquids; our ability to make acquisitions on economically acceptable terms; availability of

sufficient capital to execute our business plan, including from our future cash flows,

increases in our borrowing base and otherwise; weather and environmental conditions; and other important factors which

could cause actual results to differ materially from those anticipated or implied in the

forward-looking statements. For further discussions of risks and uncertainties, you

should refer to Matador’s SEC filings, including the “Risk Factors” section of Matador’s

Annual Report on Form 10-K for the year ended December 31, 2011. Matador undertakes no

obligation and does not intend to update these forward-looking statements to reflect events

or circumstances occurring after the date of this presentation, except as required by

law. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the

date of this presentation. All forward-looking statements are qualified in their entirety by

this cautionary statement. |

2

Company Overview

Completed IPO of 14,883,334 shares (12,209,167 primary) including overallotment at

$12.00/share in March 2012 Exchange: Ticker

NYSE: MTDR

Shares Outstanding

55.27 million common shares

Share Price as of April 10, 2012

$11.10/share

Market Capitalization as of April 10, 2012

$613.5 million

2012 Guidance Summary

2012 Estimated Capital Spending

$313 million

2012 Estimated Total Oil Production

1.4 to 1.5 million barrels

2012 Estimated Exit Rate for Oil Production

5,000 to 5,500 barrels per day

2012 Estimated Total Natural Gas Production

12.5 to 13.5 billion cubic feet |

Founded by Joe Foran in 1983

Foran Oil funded with $270,000 in contributed

capital from 17 friends and family members

Rolled into Matador Petroleum Corporation in

1988

Grown primarily through acquire and exploit

strategy

Delivered 21% average annual rate of return

over 15 years

Sold

to

Tom

Brown,

Inc.

(1)

in

June

2003

for an

enterprise value of $388 million in an all-cash

transaction

Foran Oil & Matador Petroleum

3

Matador History

Matador Resources Company

Founded by Joe Foran in 2003

Attracted start-up capital from long-time

shareholders; diverse and unique shareholder

group including over 400 friends and neighbors

Proven management, technical team and Board of

Directors

Grown entirely through drill bit, with focus on

unconventional reservoir plays

Chesapeake transaction and strong science and

technical teams enabled the strategic transition to

the Eagle Ford play

Strong growth since 2008 and 2009

Daily

production

has

increased

over

4x

(2)

Proved

reserves

have

increased

9x

(3)

Adjusted

EBITDA

(4)

has

more

than

tripled

(5)

Predecessor Entities

Matador Today

(1) Tom Brown purchased by Encana in 2004

(2) Year ended December 31, 2011 compared to year

ended December 31, 2008 (3)

At December 31, 2011 as compared to

at December 31, 2008 (4)

Adjusted EBITDA is a non-GAAP

financial measure. For a definition of Adjusted EBITDA and a reconciliation of Adjusted EBITDA to our net income (loss) and net cash provided by operating

activities, see slide 25

(5) Year ended December 31, 2011 compared to year

ended December 31, 2009 |

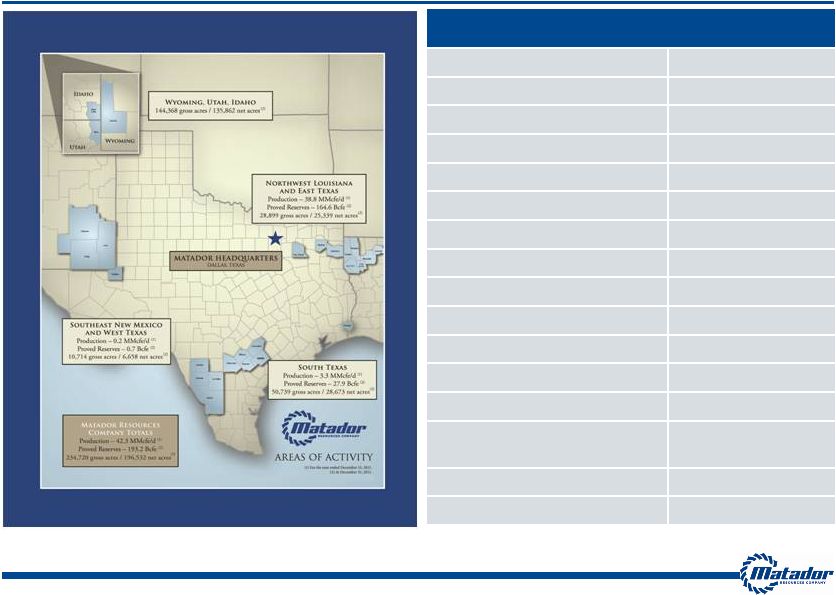

4

Daily Production

(1)

54 MMcfe/d

Oil Production (% total)

3,400 Bbl/d (38%)

Proved Reserves @ 12/31/11

193.2 Bcfe

% Proved Developed

33.7%

% Oil

12% (and growing)

2012E CapEx

$313 million

% Eagle Ford

84%

% Oil and Liquids

94%

2012E Anticipated Drilling

29.5 net wells

Eagle Ford / Austin Chalk

27.6 net wells

Haynesville

1.5 net wells

Gross Acreage

(2)

234,720 acres

Net Acreage

(2)

196,532 acres

Identified Drilling

Locations

(2)

793 gross / 308 net

Eagle Ford / Austin Chalk

(2)

209 gross / 169 net

Haynesville / Cotton Valley

(2)

584 gross / 139 net

(1)

Estimated average daily production for the month of March 2012

(2)

As of December 31, 2011

Matador Resources Snapshot |

5

Investment Highlights

Strong Growth Profile with Increasing Focus on Oil / Liquids

Oil production up almost five-fold in 2011 and projected to increase nearly 10x

in 2012 94%

(1)

of 2012E capital expenditure program focused on oil / liquids exploration and

development High Quality Asset Base in Attractive Areas

Eagle Ford provides immediate oil-weighted value and upside

Other key assets provide long-term option value on natural gas, with

Haynesville, Bossier and Cotton Valley assets all essentially HBP

Significant Multi-year Drilling Inventory

169

net

drilling

locations

identified

in

Eagle

Ford

(153)

and

Austin

Chalk

(16)

(2)

139

net

drilling

locations

identified

in

Haynesville

(103)

and

Cotton

Valley

(36)

(2)

Strong Financial Position and Long-Term Institutional, Industry and Individual

Shareholders Proven Management, Technical Team and Active Board of

Directors Management averaging over 25 years of industry experience

Board with extensive industry experience and expertise as well as significant

company ownership Strong record of stewardship for over 28 years

Low Cost Operations

LOE for year ended December 31, 2011 was $0.47 per Mcfe, a 23% reduction since year

end 2010 Active Exploration Effort Using Science and Technology

Ongoing pipeline of new oil and natural gas opportunities, with strong emphasis on

science and technology to create value

(2)

As of December 31, 2011

(1)

Calculated as percent of anticipated CapEx focused on oil weighted Eagle Ford and Austin Chalk drilling

and acreage and includes $20 million to acquire oil prospective acreage in New Mexico and West Texas

|

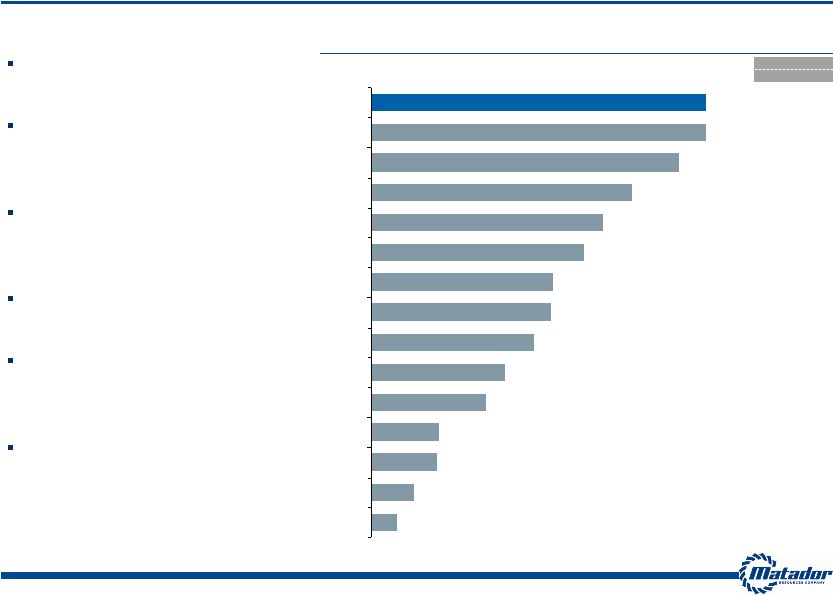

Leverage to Eagle Ford (Net Eagle Ford Acres / EV)

(Net Acres / $mm)

6

Leading Eagle Ford Exposure

Matador offers significant leverage

and focus to the Eagle Ford

Approximately 85% of Eagle Ford

acreage is in the prospective oil and

liquids window

All 2012E Eagle Ford drilling

focused in the prospective oil and

liquids window

84% of 2012 estimated CapEx

allocated to Eagle Ford

One rig running in the eastern and

one in the western portions of the

Eagle Ford play

Eagle Ford acreage well-positioned

throughout the play

2012E Capex

% Eagle Ford

48.8

48.8

44.8

37.9

33.8

31.0

26.5

26.2

23.6

19.5

16.7

9.9

9.6

6.3

3.8

MTDR

SFY

NFX

SM

FST

GDP

PVA

CRZO

ROSE

MHR

CHK

APA

PXD

PXP

APC

84%

48%

34%

N/A

N/A

N/A

78%

92%

N/A

N/A

62%

25%

73%

85%

5.2%

Reflects companies with greater than 50 Bcfe of proved reserves. Data sourced from public filings;

stock price data as of 04/10/2012 Note: |

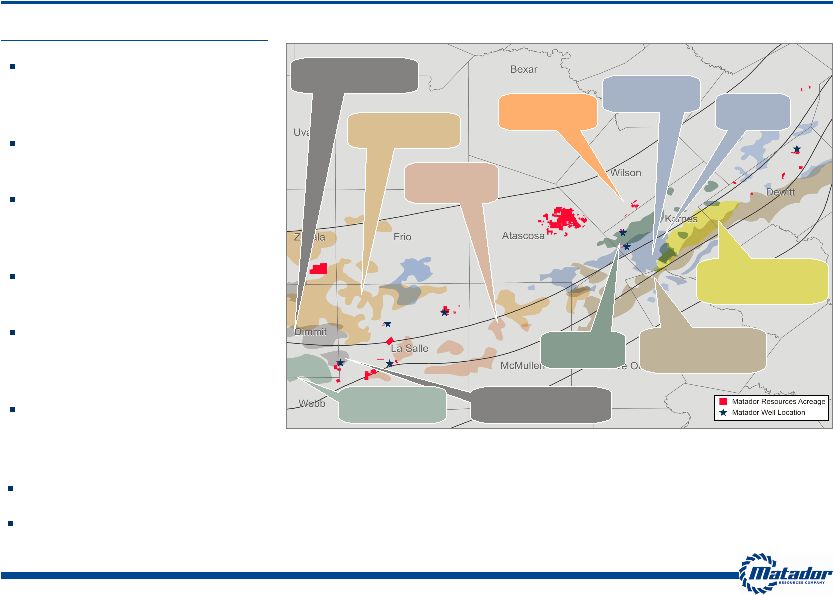

Highlights

7

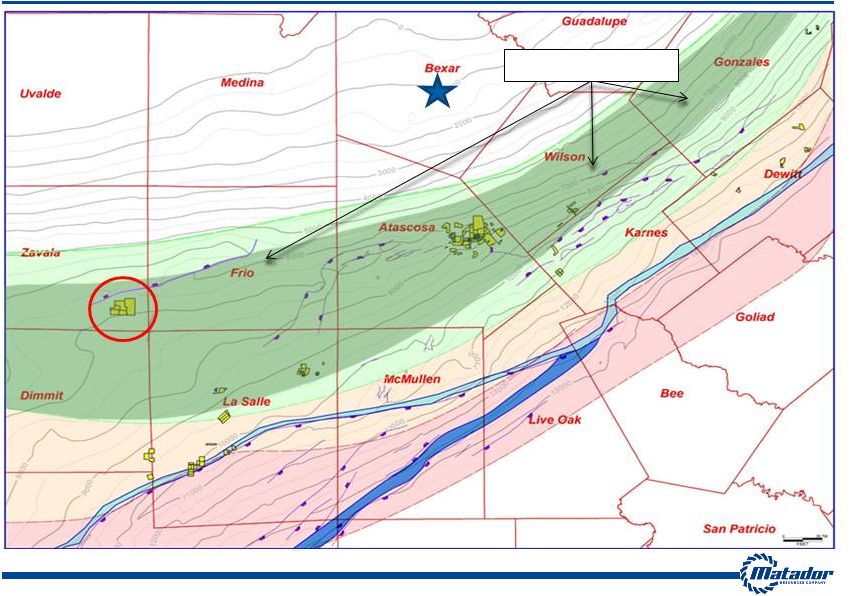

Eagle Ford Properties are Well Positioned

MTDR acreage in counties with

robust transaction activity –

“good neighborhoods”

Transaction values ranging

from $10,000 to $25,000 / acre

Our Eagle Ford position has

grown to almost 30,000 net

acres

Acreage in both the eastern

and western areas of the play

Approximately 85% of acreage

in prospective oil and liquids

windows

Acreage offers potential for

Austin Chalk, Buda, Olmos,

Pearsall and other formations

Note: Information for precedent transactions based on public filings

Good reputation with land and mineral owners

80% of Eagle Ford acreage HBP or not burdened with lease expirations before

2013 COMBO LIQUIDS /

GAS FAIRWAY

DRY GAS

FAIRWAY

OIL FAIRWAY

TALISMAN-STATOIL / SM ENERGY

June 2011

$14,610 / acre

SHELL / HARRISON RANCH

March 2010

$10,000 / acre

CNOOC / CHESAPEAKE

October 2010

$11,011 / acre

MARATHON / HILCORP

June 2011

$24,823 / acre

KKR / HILCORP

June 2010

$10,000 / acre

TALISMAN-STATOIL / ENDURING

October 2010

$13,660 / acre

RELIANT / PIONEER NEWPEK

June 2010

$11,070 / acre

PLAINS / HUGHES

October 2010

$9,633 / acre

TALISMAN / COMMON

March 2010

$9,730 / acre

HUNT / MARUBENI

January 2012

+$20,000 / acre

MITSUI / SM ENERGY

June 2011

$18,846 / acre

COMBO LIQUIDS /

GAS FAIRWAY

DRY GAS

FAIRWAY

OIL FAIRWAY

TALISMAN-STATOIL / SM ENERGY

June 2011

$14,610 / acre

SHELL / HARRISON RANCH

March 2010

$10,000 / acre

CNOOC / CHESAPEAKE

October 2010

$11,011 / acre

MARATHON / HILCORP

June 2011

$24,823 / acre

KKR / HILCORP

June 2010

$10,000 / acre

TALISMAN-STATOIL / ENDURING

October 2010

$13,660 / acre

RELIANT / PIONEER NEWPEK

June 2010

$11,070 / acre

PLAINS / HUGHES

October 2010

$9,633 / acre

TALISMAN / COMMON

March 2010

$9,730 / acre

HUNT / MARUBENI

January 2012

+$20,000 / acre

MITSUI / SM ENERGY

June 2011

$18,846 / acre |

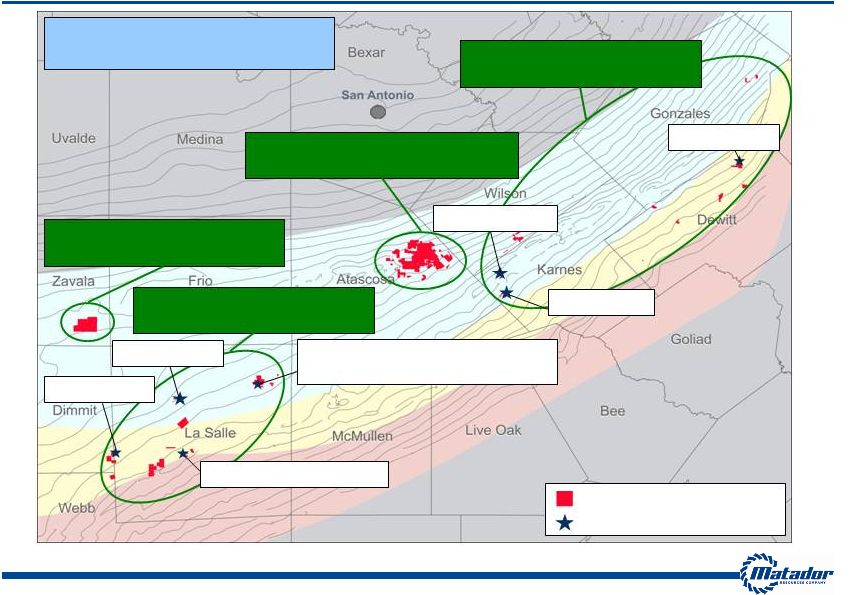

8

Eagle Ford and Austin Chalk Properties

Note: All acreage values are as of December 31, 2011

COMBO LIQUIDS /

GAS FAIRWAY

OIL FAIRWAY

EOG OPERATED, MTDR WI = 21%

GLASSCOCK (WINN) RANCH

8,891 gross / 8,891 net acres

EAGLE FORD WEST

13,329 gross / 10,465 net acres

EAGLE FORD EAST

EAGLE FORD ACREAGE TOTALS

Affleck #1H

JCM Jr. Minerals #1H

COMBO LIQUIDS /

GAS FAIRWAY

DRY GAS FAIRWAY

OIL FAIRWAY

Lewton #1H

Northcut #1H

Danysh #1H

Sickenius #1H

Matador Resources Acreage

Matador Producing Well

50,739 gross / 28,673 net acres

22,179 gross / 4,372 net acres

6,340 gross / 4,945 net acres

Martin Ranch #1H, #2H, #3H, #4H

#5H, #6H, #7H, #8H |

9

Eagle Ford and Austin Chalk Overview

Acreage positioned in some of the most

active counties for Eagle Ford and Austin

Chalk (including “Chalkleford”)

Two rigs running, primarily focused on oil

and liquids

94%

(5)

of 2012E capital expenditure

program focused on oil / liquids exploration

and development

Drilling locations are based on 120 acre

spacing

Anticipate oil production to constitute

approx. 35-40% of total production volume

and oil revenues to constitute approx. 75-

80% of total oil and natural gas revenues in

2012

Proved Reserves

@

12/31/11

4.7 MMBoe

% Proved Developed

37.9%

% Oil / Liquids

78.1%

Daily Oil Production

(1)

3,300+ Bbls/d

Gross Acres

(2)

50,739 acres

Net Acres

(2)

28,673 acres

Eagle Ford

(2)(3)

28,673 acres

Austin Chalk

(2)(3)

14,849 acres

Identified Drilling Locations

(2)

169.1 net

2012E Anticipated Drilling

27.6 net wells

2012E CapEx Budget

$268.5 million

% HBP or no short term expirations

(4)

80%

(1)

Estimated average production for the month of March 2012

(2)

As of December 31, 2011

(3)

Some of the same leases cover the net acres shown for Eagle Ford & Austin Chalk. Therefore, the sum

for both formations is not equal to the total net acreage

(4)

80% of Eagle Ford acreage HBP or not burdened with lease expirations before 2013

(5)

Calculated as percent of anticipated CapEx focused on oil weighted Eagle Ford and Austin Chalk drilling

and acreage and includes $20 million to acquire oil prospective acreage in New Mexico and West

Texas |

10

Emerging Multi-Pay Area in Eagle Ford Oil Fairway and MTDR

Acreage

OIL FAIRWAY

OIL FAIRWAY

DRY GAS FAIRWAY

DRY GAS FAIRWAY

San Antonio

Multi-Pay Fairway |

11

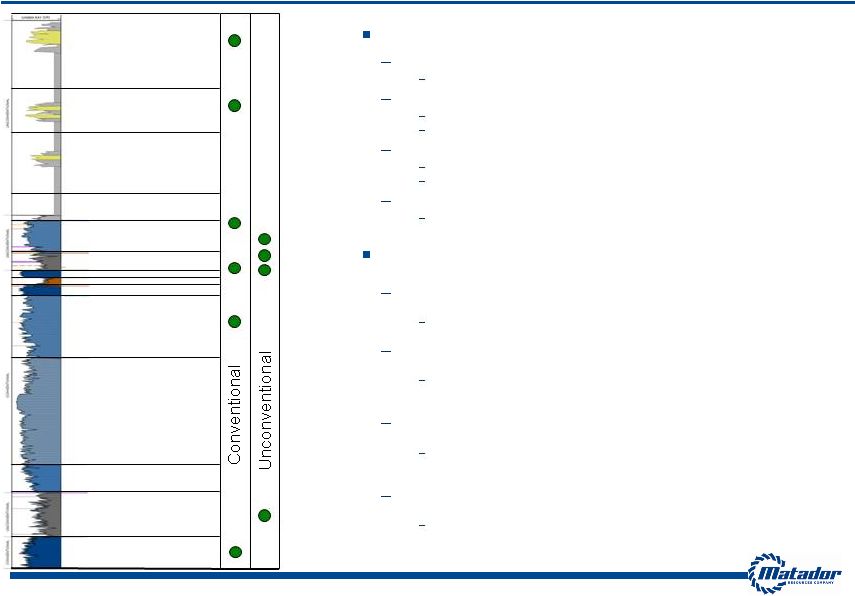

Multi-Pay Fairway: Productive and Prospective Pay Zones

Historic Conventional Zones

Olmos-Navarro

Gas and oil fields in shallow section

Austin

Upper Austin horizontal drilling

Fractured reservoir

Buda

Primarily productive on structure

Fractured reservoir

Edwards

Productive on structure

“New”

Unconventional Zones

“Chalkleford”

(Eagle Ford / Austin Chalk transition zone)

Recent results in Pearsall Field from other operators are positive

Eagle Ford

Lower costs combined with better completion techniques have improved initial

results in northern oil window

Horizontal Buda Drilling

Exploratory play developing to exploit fracturing within the Buda both on and

off structure

Pearsall Shale

Exploratory play, initial test wells now being drilled

Austin Chalk

Eagle Ford

Del Rio

Edwards

Glen Rose

Rodessa

Pearsall

Sligo

Olmos

Navarro

ANCC

Georgetown

Buda |

12

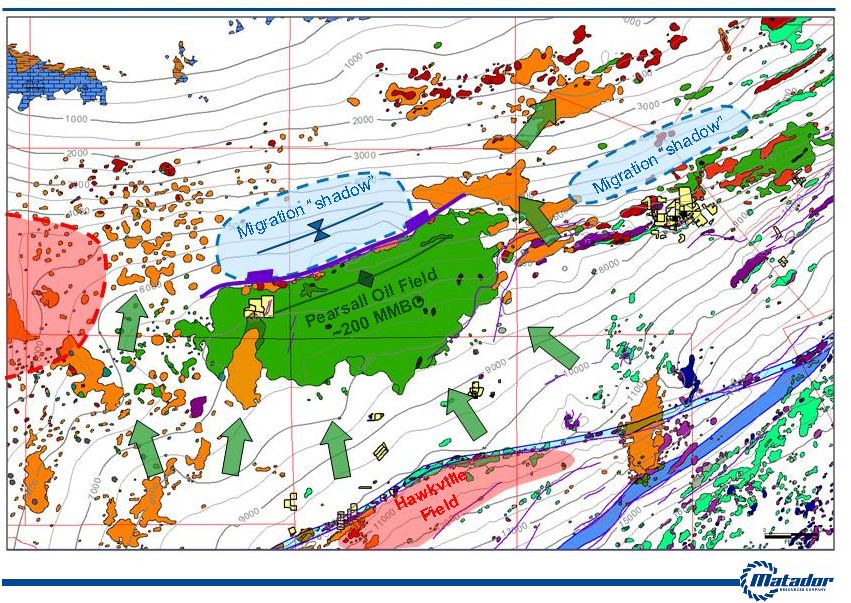

South Texas Multi-Pay Petroleum Systems:

Petroleum Charge focus towards Glasscock Ranch

Note: Information for Pearsall Oil Field sourced from public information

Redhawk

Area |

13

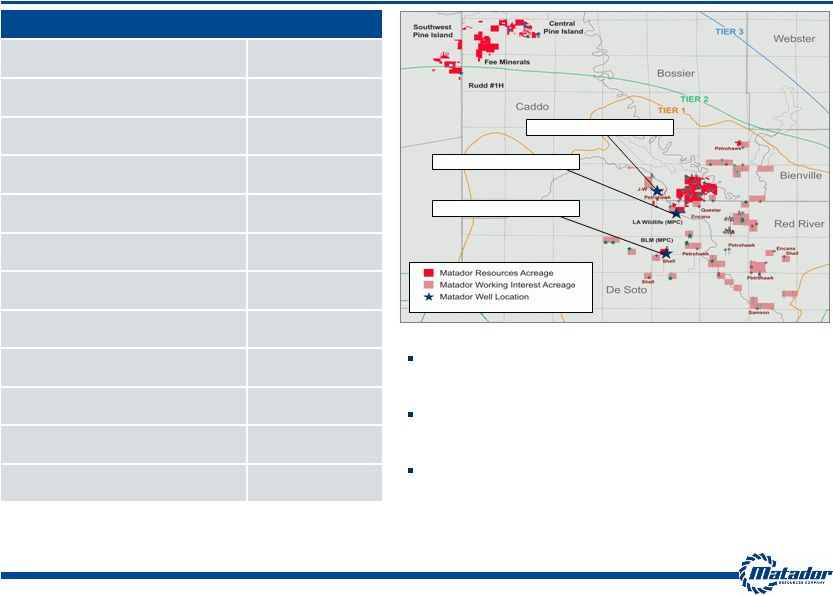

Northwest Louisiana / East Texas Properties Overview

Proved Reserves @ 12/31/11

164.6 Bcfe

% Proved Developed

32.7%

% Natural Gas

99.8%

Daily Production

(1)

30.8 MMcfe/d

Gross Acres

(2)

28,899 acres

Net Acres

(2)

25,339 acres

Haynesville

(2)(3)

14,527 acres

Cotton Valley

(2)(3)

23,054 acres

Identified

Drilling

Locations

(2)

138.9 net wells

2012E Anticipated Drilling

1.5 net wells

2012E CapEx Budget

$13.5 million

% HBP

Over 90%

(1)

Estimated average daily production for the month of March 2012

(2)

As of December 31, 2011

(3) Some of the same leases cover the net acres shown for

Haynesville and Cotton Valley. Therefore, the sum for both formations is not

equal to the total net acreage Participated in 106 operated and

non-operated Haynesville wells at December 31, 2011

Haynesville proved reserves grew from zero at year

end 2008 to 164.6 Bcfe at December 31, 2011

LA Wildlife H#1 and Williams 17 H#1 operated wells

produced approximately 3.4 Bcfe (9.3 MMcfe/d) and

1.83 Bcfe (6.7 MMcfe/d) in their first 12 and 9

months, respectively

Note: Matador operates two sections, including the LA Wildlife and the BLM

sections, in Tier 1; all other acreage in Tier 1 is non-operated LA

Wildlife

H#1

Alt.

(HV)

Williams

17

H#1

(HV)

Tigner

Walker

H#1

Alt

(CV) |

Highlights

14

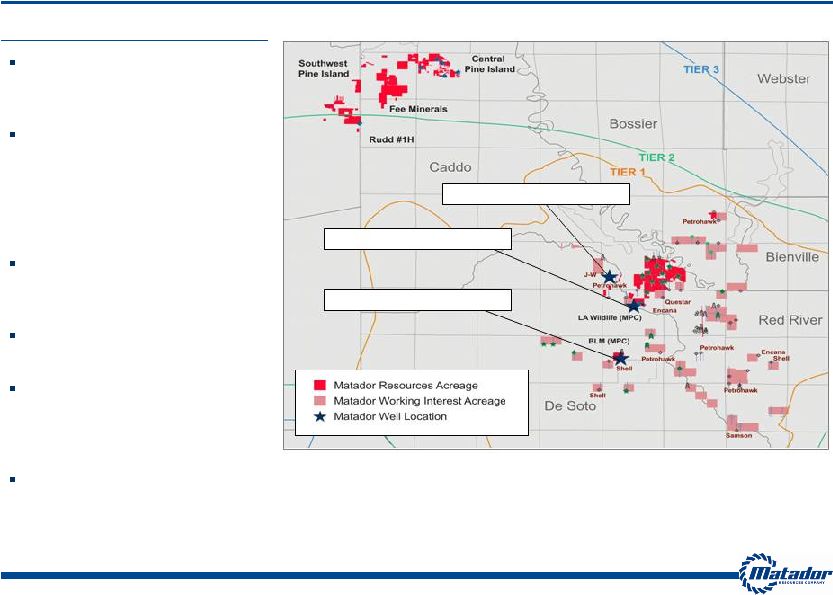

Haynesville Positioning

Approximately 12,000 gross

and 5,500 net acres in

Haynesville Tier 1 core area

Almost all Tier 1 core acreage

is HBP, as is over 90% of all

prospective Haynesville

acreage –

provides “natural

gas bank”

for future

development

MTDR active as both operator

and non-operator in

Haynesville play

Approximately 1,700 net acres

with Bossier potential

Haynesville acreage also

prospective for shallower

targets –

Cotton Valley,

Hosston –

in many areas

Approximately 10,000 net

HBP acres prospective for

Cotton Valley Horizontal play

at Elm Grove / Caspiana

Note: Matador operates two sections, including the LA Wildlife and the BLM

sections, in Tier 1; all other acreage in Tier 1 is non-operated. Tigner Walker H#1

Alt (CV) LA Wildlife H#1 Alt. (HV)

Williams 17 H#1 (HV) |

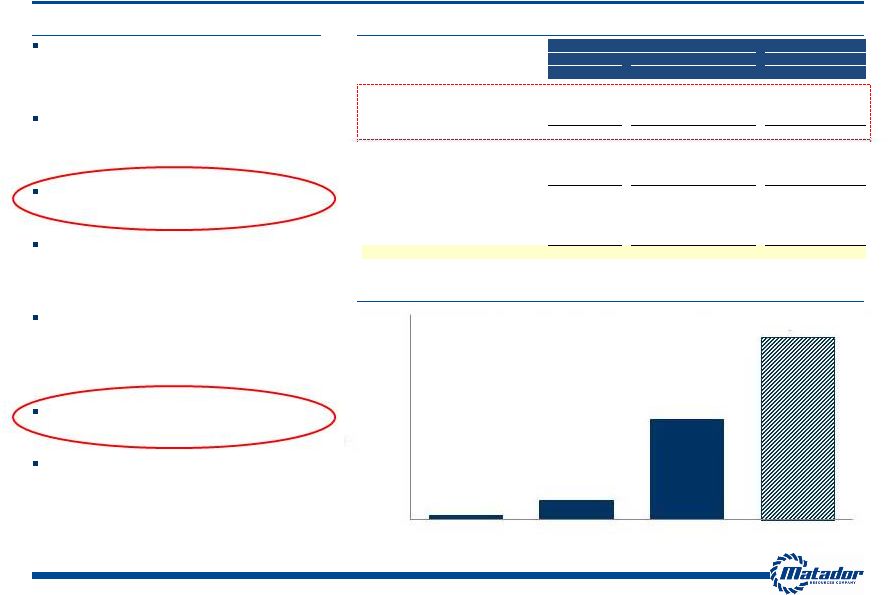

Liquids Focused CapEx in 2012E

Commentary

Oil Production Growth Over Time (Bbls/d)

15

Approximately 88% of 2012E capital

budget focused on Eagle Ford (84%)

and

Austin Chalk (4%)

Oil production up about five-fold

year-over-year at December 31,

2011

Oil production expected to increase

nearly 10x in 2012

All 2012 Eagle Ford and Austin

Chalk drilling locations targeting oil

and liquids

Only 14% of our identified Eagle

Ford and 5% of our identified

Haynesville locations expected to be

drilled in 2012

Q1 2012 oil production

approximately 200,000 barrels

From April 1, 2012 through April 10,

2012, oil production in excess of

4,000 bbls per day

Strong Growth Profile Focused on Liquids

(1) First quarter 2012, estimated oil production was approximately 2,200 bbls per

day (2) From April 1, 2012 through April 10, 2012, estimated oil production in

excess of 4,000 bbls per day +

2012 Anticipated Drilling

2012E CapEx

Gross Wells

Net Wells

(in millions)

Total

Total

%

Total

%

South Texas

Eagle Ford

28.0

25.6

86.8%

$257.2

82.2%

Austin Chalk

2.0

2.0

6.8%

$11.3

3.6%

Area Total

30.0

27.6

93.6%

$268.5

85.8%

NW LA / E Texas

Haynesville

25.0

1.5

5.1%

$13.5

4.3%

Cotton Valley

-

-

-

-

-

Area Total

25.0

1.5

5.1%

$13.5

4.3%

SW WY, NE UT, SE ID

1.0

0.4

1.3%

$2.5

0.8%

Other

-

-

-

$28.5

9.1%

Total

56.0

29.5

100.0%

$313.0

100.0%

0

500

1000

1500

2000

2500

3000

3500

4000

4500

2010

2011

Q1 2012

April 2012

91

422

2,200

4,000

(2)

(1) |

Diversified Investor Composition

16

Given management’s significant equity position, interests are well aligned with

public shareholders Unique and diverse investor base includes institutional

and industry shareholders with significant experience investing in the oil

and gas sector Most initial capital was provided by investor base of

predecessor company, Matador Petroleum Corporation

99.2% of shares outside the public float locked-up for 180 days following

February 1, 2012 Management

13%

of shares

(1)

Public Float

27%

of shares

(2)

Legacy Shareholders

60%

of shares

(1)

(1) Approximate ownership at the time of the IPO

(2) Public Float percentage also includes shares purchased by Management and Legacy

Shareholders on or after the IPO |

Exploration and Development

Dedicating

approximately

94%

of

2012E

CapEx

to

oil

and

liquids

opportunities

Approximately 80% of Eagle Ford and approximately 90% of Haynesville acreage either

HBP or not burdened by near-term lease expirations

Balanced Portfolio

Growing Eagle Ford contributes to a diversified portfolio mix between oil and

natural gas Active,

ongoing

exploration

effort

continues

to

identify

new

oil

prospects

and

opportunities

Pursue Opportunistic Acquisitions

Ability to identify high return, operated opportunities at attractive prices

History of significant acquisitions and joint ventures

Maintain Financial Discipline

Keep balance sheet strong and control expenses

Work with industry participants to control costs for non-operated

properties Leverage Industry Relationships

Leverage expertise of our industry partners, exchange data and information and

build upon existing relationships

Continue active participation in industry consortia and professional

societies Build Upon Director and Management Team Experience and Success in

Unconventional Plays Business Strategy to Deliver Growth and Value

17

(1)

Calculated as percent of anticipated capital expenditure focused on oil weighted Eagle Ford and Austin

Chalk and includes $20 million to acquire acreage for oil opportunities in New Mexico and West Texas

|

18

Matador Today

Gross

Acres

(1)(2)

144,368 acres

Net

Acres

(1)(2)

135,862 acres

2012E CapEx Budget

$2.5 million

Matador Today

Gross Acres

(1)(3)

10,714 acres

Net Acres

(1)(3)

6,658 acres

Wyoming, Utah and Idaho (Meade Peak Shale)

Option Value in Large Unevaluated Acreage Positions

Initial test well drilled and cored through the Meade Peak

shale

Detailed petrophysical and rock properties testing in

progress

Carried participation interest provided by an affiliate of

Alliance Bernstein

Foothold of existing production and reserves

Budgeted $20 million in 2012 to acquire acreage in oil-

focused opportunities

Southeast New Mexico / West Texas

(1)

As of December 31, 2011

(2)

While we and our partners continue to evaluate the results from the initial test

well and plan for its completion and further testing, we expect a significant portion of our acreage will be allowed to expire during 2012

(3)

We believe approximately 8,000 gross and 4,000 net acres are no longer prospective,

and we plan to let them expire without drilling during 2012 |

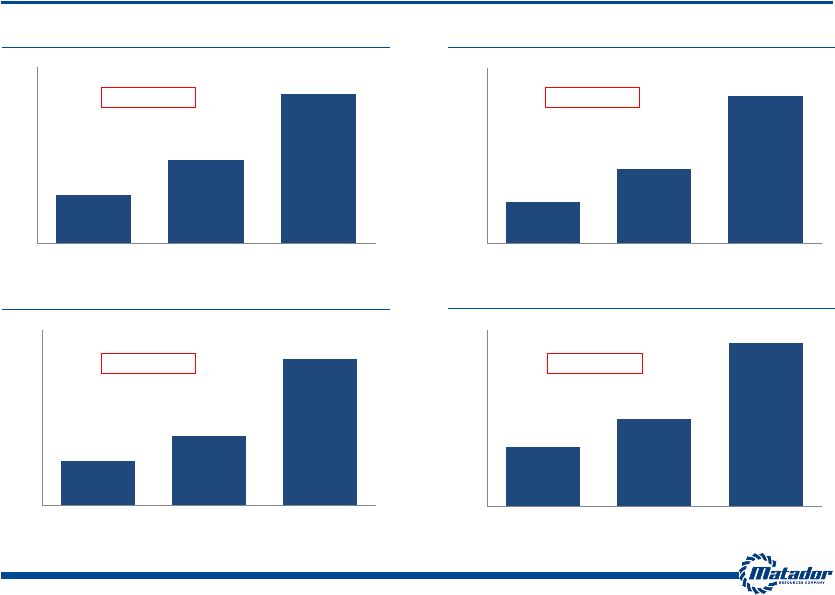

19

Financial Performance: Proven Management Team

Note: CAGR stands for compounded annual growth rate

(2) Includes realized gain on derivatives

Oil and Natural Gas Revenues

($ in mm)

Total

Realized

Revenues

(2)

($ in mm)

Adjusted

EBITDA

(1)

($ in mm)

Average Daily Production

(MMcfe/d)

CAGR: 75.7%

CAGR: 87.8%

CAGR: 66.6%

CAGR: 81.2%

(1) Adjusted EBITDA is a non-GAAP financial measure. For a

definition of Adjusted EBITDA and a reconciliation of Adjusted EBITDA to our net income (loss) and net cash provided by operating activities, see slide 25

13.7

23.6

42.3

0.0

10.0

20.0

30.0

40.0

50.0

2009

2010

2011

$19.0

$34.0

$67.0

$0.0

$40.0

$80.0

2009

2010

2011

$15.2

$23.6

$49.9

$0.0

$10.0

$20.0

$30.0

$40.0

$50.0

$60.0

2009

2010

2011

$26.7

$39.3

$74.1

$0.0

$20.0

$40.0

$60.0

$80.0

2009

2010

2011 |

20

Selected Historical Financials

(Revenues and Adjusted EBITDA in millions)

Year Ended December 31,

2009

2010

2011

Production Summary

Oil Production (MBbls)

30.0

33.0

154.0

Gas Production (Bcf)

4.8

8.4

14.5

Total Annual Production (Bcfe)

5.0

8.6

15.4

Realized Prices (Including hedges)

Oil ($/ Bbl)

$57.72

$76.39

$93.80

Natural Gas ($/ Mcf)

$5.17

$4.38

$4.11

Revenues

Oil and Gas Production Revenues

$19.0

$34.0

$67.0

Realized Oil & Gas Hedging Gain / (Loss)

7.6

5.3

7.1

Unrealized Oil & Gas Hedging Gain / (Loss)

(2.4)

3.1

5.1

Total Revenues

$24.3

$42.5

$79.2

Operating Expenses ($/ Mcfe)

Lease Operating

$0.94

$0.61

$0.47

Production Taxes and Marketing

0.22

0.23

0.41

General and Administrative

1.42

1.13

0.87

Total Expenses

$2.58

$1.97

$1.75

Adjusted EBITDA

(1)

$15.2

$23.6

$49.9

(1)

Adjusted EBITDA is a non-GAAP financial measure. For a definition of Adjusted EBITDA and

a reconciliation of Adjusted EBITDA to our net income (loss) and net cash provided by operating activities, see slide 25 |

21

Hedging Profile

Oil Hedges

2012

2013

Total Volume Hedged by Ceiling (Bbl)

1,180,000

1,260,000

Weighted Average Price ($ / Bbl)

$109.84

$110.26

Total Volume Hedged by Floor (Bbl)

1,180,000

1,260,000

Weighted Average Price ($ / Bbl)

$90.51

$87.14

Natural Gas Hedges

2012

2013

Total Volume Hedged by Ceiling (Bcf)

7.20

1.05

Weighted Average Price ($ / MMBtu)

$5.78

$5.75

Total Volume Hedged by Floor (Bcf)

7.20

1.05

Weighted Average Price ($ / MMBtu)

$4.44

$4.50 |

22

Financial Flexibility

Plan to fund 2012 capital budget with a portion of IPO net proceeds, anticipated

cash flows from operations and available borrowings under credit

facility Intend

to

seek

redeterminations of borrowing base as a result of any increases in oil and natural

gas proved reserves during the year

May, November and one additional redetermination available in 2012

Have met with banks to discuss expanding the bank group and to confirm expectations

on future borrowing base increases

Borrowing base of $125 million, based on February 2012 redetermination

20% of current market capitalization

Oil production base expected to increase 10x in 2012

$30 million in debt outstanding as of April 12, 2012

(1) As of April 10, 2012 close

(1) |

23

Investment Highlights

Strong Growth Profile with Increasing Focus on Oil / Liquids

High Quality Asset Base in Attractive Areas

Significant Multi-year Drilling Inventory

Strong Financial Position and Long-Term Institutional, Industry and Individual

Shareholders

Proven Management and Technical Team and Active Board of Directors

Low Cost Operations

Active Exploration Effort Using Science and Technology

|

Appendix |

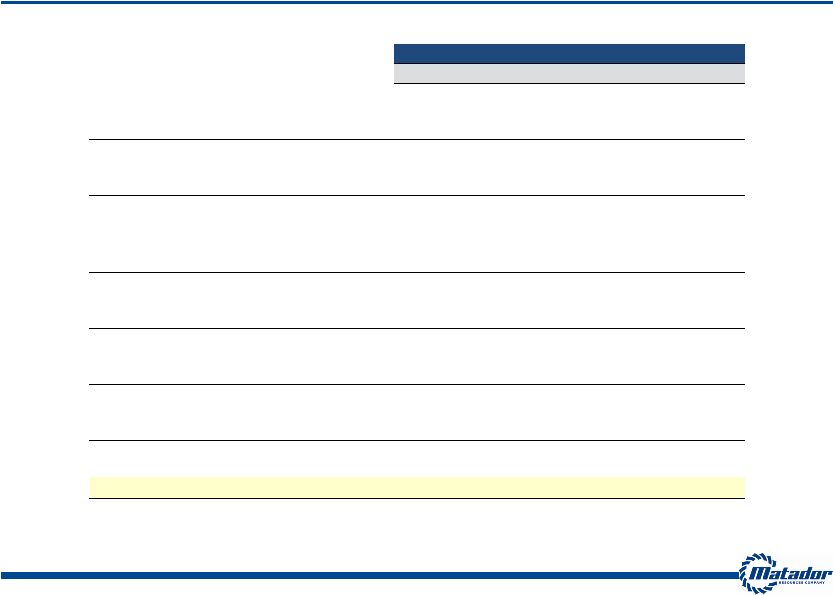

25

Adjusted EBITDA Reconciliation

The following table presents our calculation of Adjusted EBITDA and reconciliation

of Adjusted EBITDA to the GAAP financial measures of net income (loss) and

net cash provided by operating activities, respectively. We believe Adjusted

EBITDA helps us evaluate our operating performance and compare our results of operation from period to period without regard to our financing

methods or capital structure. We define Adjusted EBITDA as earnings before interest

expense, income taxes, depletion, depreciation and amortization, accretion of asset

retirement obligations, property impairments, unrealized derivative gains and

losses, non-recurring income and expenses and non-cash stock-based compensation expense,

including stock option and grant expense and restricted stock grants. Adjusted

EBITDA is not a measure of net income (loss) or cash flows as determined by GAAP.

Adjusted EBITDA should not be considered an alternative to, or more meaningful

than, net income or cash flows from operating activities as determined in accordance with

GAAP or as an indicator of our operating performance or liquidity.

Year Ended December 31,

(In thousands)

2008

2009

2010

2011

Unaudited Adjusted EBITDA reconciliation to Net Income (Loss):

Net income (loss)

$103,878

($14,425)

$6,377

($10,309)

Interest expense

-

-

3

683

Total income tax provision (benefit)

20,023

(9,925)

3,521

(5,521)

Depletion, depreciation and amortization

12,127

10,743

15,596

31,754

Accretion of asset retirement obligations

92

137

155

209

Full-cost ceiling impairment

22,195

25,244

-

35,673

Unrealized (gain) loss on derivatives

(3,592)

2,375

(3,139)

(5,138)

Stock option and grant expense

605

622

824

2,362

Restricted stock grants

60

34

74

44

Net (gain)/loss on asset sales and inventory impairment

(136,977)

379

224

154

Adjusted EBITDA

$18,411

$15,184

$23,635

$49,911

Year Ended December 31,

(In thousands)

2008

2009

2010

2011

Unaudited Adjusted EBITDA reconciliation to Net Cash Provided

by Operating Activities:

Net cash provided by operating activities

$25,851

$1,791

$27,273

$61,868

Net change in operating assets and liabilities

(17,888)

15,717

(2,230)

(12,594)

Interest expense

-

-

3

683

Current income tax provision (benefit)

10,448

(2,324)

(1,411)

(46)

Adjusted EBITDA

$18,411

$15,184

$23,635

$49,911 |

Board

of

Directors

and

Special

Board

Advisors

–

Expertise

and

Stewardship

26

Board Members

and Advisors

Professional Experience

Business Expertise

Charles L. Gummer

Director

-

Former

Chairman,

President

and

CEO,

Comerica

Bank

–

Texas

Banking

Dr. Stephen A. Holditch

Director

-

Professor and Former Head of the Department of Petroleum

Engineering, Texas A&M University

-

Founder / President S.A. Holditch & Associates

-

Past President of Society of Petroleum Engineers

Oil & Gas Operations

David M. Laney

Director

-

Past Chairman, Amtrak Board of Directors

-

Former Partner, Jackson Walker LLP

Law

Gregory E. Mitchell

Director

-

President / CEO, Toot’n Totum Food Stores

Petroleum Retailing

Dr. Steven W. Ohnimus

Director

-

Retired VP and General Manager, Unocal Indonesia

Oil & Gas Operations

Michael C. Ryan

Director

-

Partner, Berens Capital Management

International Business and

Finance

Margaret B. Shannon

Director

-

Retired VP and General Counsel, BJ Services Co.

-

Former Partner, Andrews Kurth LLP

Law and

Corporate Governance

Marlan W. Downey

Special Board Advisor

-

Retired President, ARCO International

-

Former President, Shell Pecten International

-

Past President of American Association of Petroleum Geologists

Oil & Gas Exploration

Edward R. Scott, Jr.

Special Board Advisor

-

Former Chairman, Amarillo Economic Development Corporation

-

Law Firm of Gibson, Ochsner & Adkins

Law, Accounting and Real

Estate Development

W.J. “Jack”

Sleeper

Special Board Advisor

-

Retired President, DeGolyer and MacNaughton (Worldwide

Petroleum Consultants)

Oil & Gas Executive

Management |

Proven

Management Team – Experienced Leadership

27

Management Team

Background and Prior Affiliations

Industry

Experience

Matador

Experience

Joseph Wm. Foran

Founder, Chairman and CEO

-

Matador Petroleum Corporation, Foran Oil Company,

J Cleo Thompson Jr. and Thompson Petroleum Corp.

31 years

Since Inception

David E. Lancaster

EVP, COO and CFO

-

Schlumberger, S.A. Holditch & Associates, Inc., Diamond

Shamrock

32 years

Since 2003

Matthew V. Hairford

EVP, Operations

-

Samson, Sonat, Conoco

27 years

Since 2004

Wade I. Massad

EVP, Capital Markets

-

Cleveland Capital Management, LLC, KeyBanc Capital

Markets, RBC Capital Markets

22 years

Since 2010

David F. Nicklin

Executive Director, Exploration

-

ARCO, Senior Geological Assignments in UK, Angola,

Norway and the Middle East

40 years

Since 2007

Scott E. King

Co-Founder, VP, Geophysics

and New Ventures

-

Matador Petroleum Corporation, Enserch, BP, Sohio

28 years

Since Inception

Bradley M. Robinson

VP, Reservoir Engineering

-

Schlumberger, S.A. Holditch & Associates, Inc.,

Marathon

34 years

Since Inception

Kathryn L. Wayne

Controller and Treasurer

-

Matador Petroleum Corporation, Mobil

27 years

Since Inception |