Attached files

| file | filename |

|---|---|

| 8-K - 8-K - GASCO ENERGY INC | a12-9568_18k.htm |

Exhibit 99.1

|

|

April 16, 2012 IPAA OGIS New York NYSE Amex: GSX King Grant, CEO & President Mike Decker, EVP & Chief Operating Officer |

|

|

Investor Relations Corporate Offices Forward-Looking Statements Certain statements set forth in this presentation relate to management’s future plans, objectives and expectations. Such statements are forward-looking within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical facts included in this presentation, including, without limitation, statements regarding the Company’s future financial position, business strategy, budgets, levels of production, projected costs and plans and objectives of management for future operations, are forward-looking statements. In addition, forward-looking statements generally can be identified by the use of forward-looking terminology such as “may,” “will,” “expect,” “intend,” “project,” “estimate,” “anticipate,” “believe,” or “continue” or the negative thereof or similar terminology. Although any forward-looking statements contained in this presentation are to the knowledge or in the judgment of the management of the Company, believed to be reasonable, there can be no assurances that any of these expectations will prove correct or that any of the actions that are planned will be taken. Forward-looking statements are not guarantees of performance. Known and unknown risks and uncertainties may cause the Company’s actual performance and financial results in future periods to differ materially from any projection, estimate or forecasted result. Some of the key factors that may cause actual results to vary from those the Company expects include the Company’s ability to maintain adequate cash flow and secure financing; overall demand for natural gas and oil; inherent uncertainties in interpreting engineering and reserve or production data; operating hazards; delays or cancellations of drilling operations because of weather and other natural and economic forces; fluctuations in oil and natural gas prices; competition from other companies with greater resources; environmental and other government regulations; defects in title to properties; increases in the Company’s cost of borrowing or inability or unavailability of capital resources to fund capital expenditures; and other known material risks described under “Risk Factors” in Part I, Item 1 of the Company’s latest Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 28, 2012 and the Company’s other filings with the Securities and Exchange Commissions. Existing and prospective investors are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date hereof. The Company undertakes no obligation to revise or update any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law. Gasco Energy, Inc. 8 Inverness Drive East, Suite 100 Englewood, CO 80112-5625 www.gascoenergy.com P: 303.483.0044 • F: 303.483.0011 King Grant, CEO & President P: 303.483.0044 E: kgrant@gascoenergy.com NYSE Amex: GSX |

|

|

Denver-based exploitation and production company focused on developing gas in the U.S. Rocky Mountains NYSE Amex: GSX Market Cap: ~$39.0 MM(1) Enterprise Value: $84.0 MM(1) Proved Reserve Base(2) 2011 SEC – 39.8 Bcfe; $44.7 MM PV-10 100% in Utah (Uinta Basin, Riverbend Project) 92% Natural Gas / 100% PDP Overview (1) Based on share price of $0.23 and 169.5 MM shares outstanding as of 3/28/12 and includes $45.0 MM LTD (2) As of December 31, 2011- 100% PDP - Zero PUD (3) As of December 31, 2011 and pro forma for Uinta Basin JV; does not include Nevada exploratory leasehold 2011 Production: 3.9 Bcfe 2010 Production: 4.3 Bcfe Producing Wells: 135 gross wells (81.4 net) Total Acreage(3): 154,885 gross, 56,906 net Core leasehold in Uinta Basin (UT): 116,926 gross, 42,303 net pro forma for JV Exploratory leasehold in San Joaquin Basin (CA): 37,959 gross, 14,603 net Gasco’s Asset Base Denver HQ California Projects Natural Gas Crude Oil Uinta Core Assets |

|

|

Return to Growth Funded oil and liquids-rich drilling program in Utah Carried exploratory drilling program in California Improved financial strength from 2010-2012 transactions |

|

|

Return to Growth: Utah Drilling Program Funded oil and liquids-rich drilling program in Utah New Uinta Basin JV accelerates Green River oil activity Continued Green River oil development drilling Seven gross (1.3 net) wells to commence drilling in 2H12 New-drill gas wells Six gross (2 net) gas wells targeting liquids in Wasatch and Mesaverde Fms 2012 Uinta program most active in 3+ years |

|

|

Return to Growth: California Exploration Carried exploratory drilling program in California Carried interest in up to five wells Willow Springs expected to test in Q212 SW Cymric recently sold for $750,000 prospect fee and 20% carry Looking for industry partners on newly created and existing prospects in California 2012 California program most active in 3+ years |

|

|

Return to Growth: Financial Strength Debt over Time (End of Period) |

|

|

Capital Expenditure Budget 2012 Estimated Capex: $5.0 MM 7 gross (1.3 net) Green River Oil wells 6 gross (2.0 net) new-drill natural gas wells $3.6 MM Uinta program to commence in Q312 Other: $1.4 MM (California, rentals, seismic) 2011 Actual Capex: $8.1 MM Leasehold: $2.1 MM Drilling, completion and recompletions: $5.5 MM Other: $0.5 MM (facilities and equipment costs) |

|

|

2011 Gross Natural Gas Production Utah (Bcf) Public Company Utah Production 2011 Gross Oil Production Utah (MBbl) Source: State of Utah Division of Oil, Gas and Mining |

|

|

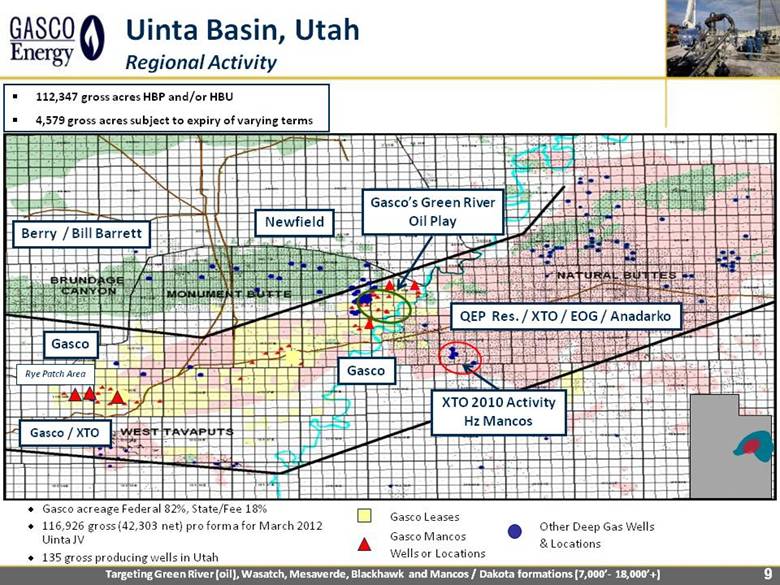

Uinta Basin, Utah Regional Activity Targeting Green River (oil), Wasatch, Mesaverde, Blackhawk and Mancos / Dakota formations (7,000’- 18,000’+) Gasco acreage Federal 82%, State/Fee 18% 116,926 gross (42,303 net) pro forma for March 2012 Uinta JV 135 gross producing wells in Utah Gasco Leases Gasco Mancos Wells or Locations Other Deep Gas Wells & Locations Gasco QEP Res. / XTO / EOG / Anadarko Newfield Gasco / XTO Berry / Bill Barrett Gasco XTO 2010 Activity Hz Mancos Rye Patch Area 112,347 gross acres HBP and/or HBU 4,579 gross acres subject to expiry of varying terms Gasco’s Green River Oil Play |

|

|

Uinta Basin Joint Venture $34 MM transaction closed March 22, 2012 Gasco sold to JV partner an undivided 50% interest in certain of its producing properties and 50% of its undeveloped leasehold Gasco received $19 MM in cash and a $15 MM drilling carry Uinta JV drilling program is $37.5 MM over a two-year period, Gasco invests $7.5 MM in program (32.5% BPO / 50.0% APO) Drilling program commences 2H12 |

|

|

Uinta Basin Green River Oil Play Green River Fm oil (GRO) historic productive horizon across the Uinta Basin First two GRO wells 7-day average IP of 67 BOPD and 50 BOPD, respectively in Q112 Shallow pay-zone (4,500’ – 6,000’) Medium gravity / low pour-point Estimated 11,000 gross GSX acres prospective for GRO South of NFX Monument Butte Field (50 MMBO / 120 Bcf Cum.) Drilled on 40-acre spacing Horizontal and waterflood potential CWC: ~$1 MM / Gross EUR: 70 MBO 2012 Capex program targets D&C of 7 gross (1.3 net) GRO wells |

|

|

Uinta Basin Green River Oil Play EUR (MBoe, gross): 70 Working Interest: 100% Net Revenue Interest : 80% Drilling Cost $400,000 Completion Cost $600,000 Completed Well Cost: $1,000,000 WTI Oil Price: $100 / Bbl Well-head Oil Price: $85.00 / Bbl API°: 34 LOE: $4,400/month Production Taxes: 5.2% Rate of Return: 45% GRO Type Well Assumptions |

|

|

Duchesne and Uintah, Counties Oil Production MBbls 32,686 Bopd 19,252 Bopd Source: State of Utah Division of Oil, Gas and Mining |

|

|

Uinta Basin Wasatch – Mesaverde Wells EUR (MMcf, gross): 1,740 Working Interest: 100% Net Revenue Interest : 80% Drilling Cost $810,000 Completion Cost $930,000 Completed Well Cost: $1,740,000 NYMEX Gas Price: $4.85 / MMbtu BTU content cryo uplift: $0.66 / MMbtu Rockies Differential 5% Gathering/Processing $0.70 LOE: $3,894/mo. Production Taxes: 5.20% Rate of Return: 35% Liquids-rich Type Well Assumptions |

|

|

California Exploration Projects 37,959 gross acres (14,603 net) in San Joaquin Basin Kern & San Luis Obispo Counties GSX has secured drilling partners for further exploration SW Cymric Sold in Q112 Projects proximate to Midway-Sunset and Belgian Anticline oil fields ( cum. ~2 billion Bbls) |

|

|

Gasco California Prospects Gross / Net Acreage Unrisked Prospect Potential Net Unrisked Prospect Potential Status Antelope Valley Trend 18,232 / 3,401 856 MMBO / 2.2 Tcf 164 MMBO / 0.4 Tcf Finalizing permitting for 3D seismic shoot over prospects; first well projected to be spud in Q212 Willow Springs 3,315 / 647 75 MMBO 11 MMBO First well down; production testing expected in Q2/Q3 12 NW McKittrick 599 / 120* 14 MMBO 3 MMBO Awaiting permitting approval SW Cymric 1,512 / 196 80 MMBO 16 MMBO Sold for $750M and 20% carry, subject to seismic evaluation Crocker Canyon 2,731 / 683 50 MMBO 13 MMBO Seeking partner New Prospects and Leads 11,571 / 8,771 TBD TBD Developing project / acquiring acreage Total California 37,959 / 14,603 1,029 MMBO / 2.2 Tcf 225 MMBO / 0.4 Tcf California Prospect Inventory * Net acreage assumes that partner fully earns Inventory as of 12/31/11 – subject to change as existing prospects are sold and new exploratory acreage is leased; SW Cymric is pro forma for Q112 prospect sale |

|

|

Green River oil program More balanced commodity exposure Low cost, solid rate of return program Helps return Gasco to a growth story once again Large upside potential from California exploration program Limited investment by Gasco provides exposure to crude oil Willow Springs well down and awaiting production testing 2012 activity includes 3-D seismic program by partners and carried interest in exploratory wells Stock price highly leveraged to natural gas prices Large, contiguous leasehold either HBP or in Federal Units Gasco retains option value on large resource when gas prices return Uinta JV accelerates activity Key Investment Considerations |

|

|

--Fin-- |