Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - DOUBLE CROWN RESOURCES INC. | Financial_Report.xls |

| EX-31.2 - CERTIFICATION - DOUBLE CROWN RESOURCES INC. | ddcc_ex312.htm |

| EX-31.1 - CERTIFICATION - DOUBLE CROWN RESOURCES INC. | ddcc_ex311.htm |

| EX-32.1 - CERTIFICATION - DOUBLE CROWN RESOURCES INC. | ddcc_ex321.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2011

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______ to _______

COMMISSION FILE NO. 000-53389

DOUBLE CROWN RESOURCES INC.

(Name of small business issuer in its charter)

| NEVADA | 98-0491567 | |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

SUITE 1026

HENDERSON, NEVADA 89014

(Address of principal executive offices)

707-961-6061

(Issuer's telephone number)

| Securities registered pursuant to Section 12(b) of the Act: | Name of each exchange on which registered: | |

| NONE |

Securities registered pursuant to Section 12(g) of the Act:

COMMON STOCK, $0.001

(Title of Class)

Check whether the issuer is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. o

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

|

Non-accelerated filer

|

o | Smaller reporting company | x |

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No þ

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked price of such common equity, as of the last business of the registrant’s most recently completed second fiscal quarter: June 30, 2011 $674,669.99

ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS

N/A

Check whether the issuer has filed all documents and reports required to be filed by Section 12, 13 and 15(d) of the Securities Exchange Act of 1934 after the distribution of securities under a plan confirmed by a court. Yes o No o

APPLICABLE ONLY TO CORPORATE REGISTRANTS

State the number of shares outstanding of each of the issuer's classes of common equity, as of the latest practicable date.

Class Outstanding as of April 10, 2012 Common Stock, $0.001 165,172,820 shares

DOCUMENTS INCORPORATED BY REFERENCE

If the following documents are incorporated by reference, briefly describe them and identify the part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (i) any annual report to security holders; (ii) any proxy or information statement; and (iii) any prospectus filed pursuant to Rule 424(b) or (c) of the Securities Act of 1933 (the "Securities Act"). The listed documents should be clearly described for identification purposes (e.g. annual reports to security holders for fiscal year ended December 24, 1990).

N/A

Transitional Small Business Disclosure Format (Check one): Yes o No x

DOUBLE CROWN RESOURCES INC.

FORM 10-K

| INDEX | Page | ||||

| Item 1. | Business | 4 | |||

| Item 1A. | Risk Factors | 15 | |||

| Item 1B. | Unresolved Staff Comments | ||||

| Item 2. | Properties | 22 | |||

| Item 3. | Legal Proceedings | 22 | |||

| Item 4. | Mine Safety Disclosures | 22 | |||

| Item 5. | Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 23 | |||

| Item 6. | Selected Financial Data | 26 | |||

| Item 7. | Management's Discussion and Analysis of Financial Condition and Results of Operation | 27 | |||

| Item 7A. | Quantity and Qualitative Disclosure About Market Risks | ||||

| Item 8. | Financial Statements and Supplemental Data | 32 | |||

| Item 9. | Changes in and Disagreements With Accountants on Accounting and Financial Disclosure | 33 | |||

| Item 9A. | Controls and Procedures | 33 | |||

| Item 9B. | Other Information | 36 | |||

| Item 10. | Directors, Executive Officers and Corporate Governance | 37 | |||

| Item 11. | Executive Compensation | 42 | |||

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 44 | |||

| Item 13. | Certain Relationships and Related Transactions and Director Independence | 45 | |||

| Item 14. | Principal Accountant Fees and Services | 45 | |||

| Item 15. | Exhibits and Financial Statement Schedules | 46 | |||

2

Statements made in this Form 10-K that are not historical or current facts are "forward-looking statements" made pursuant to the safe harbor provisions of Section 27A of the Securities Act of 1933 (the "Act") and Section 21E of the Securities Exchange Act of 1934. These statements often can be identified by the use of terms such as "may," "will," "expect," "believe," "anticipate," "estimate," "approximate" or "continue," or the negative thereof. We intend that such forward-looking statements be subject to the safe harbors for such statements. We wish to caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. Any forward-looking statements represent management's best judgment as to what may occur in the future. However, forward-looking statements are subject to risks, uncertainties and important factors beyond our control that could cause actual results and events to differ materially from historical results of operations and events and those presently anticipated or projected. We disclaim any obligation subsequently to revise any forward-looking statements to reflect events or circumstances after the date of such statement or to reflect the occurrence of anticipated or unanticipated events.

Available Information

Double Crown Resources Inc. files annual, quarterly, current reports, proxy statements, and other information with the Securities and Exchange Commission (the “Commission”). You may read and copy documents referred to in this Annual Report on Form 10-K that have been filed with the Commission at the Commission’s Public Reference Room, 450 Fifth Street, N.W., Washington, D.C. You may obtain information on the operation of the Public Reference Room by calling the Commission at 1-800-SEC-0330. You can also obtain copies of our Commission filings by going to the Commission’s website at http://www.sec.gov

3

PART I

ITEM 1. BUSINESS

BUSINESS DEVELOPMENT

Double Crown Resources Inc. was incorporated under the laws of the State of Nevada on March 23, 2006 under the name “Denarii Resources Inc’. We have been engaged in the business of exploration of mineral properties worldwide since our inception. After the effective date of our registration statement filed with the Securities and Exchange Commission on June 16, 2006, we commenced trading on the Over-the-Counter Bulletin Board under the symbol “DNRR”.

Amendment to Articles of Incorporation

On September 23, 2011, our Board of Directors, pursuant to written consent, authorized and approved the change of our name from “Denarii Resources Inc’ to “Double Crown Resources Inc” (the “Name Change”) to better reflect our current business operations and planned new programs of exploration.

Our shareholders of record as of September 23, 2011, pursuant to written consent, approved and authorized the Name Change.

On October 4, 2011, we filed an amendment to our articles of incorporation with the Nevada Secretary of State changing our name from “Denarii Resources Inc.” to “Double Crown Resources Inc.”

We also submitted documentation with FINRA to effect the Name Change in the market. FINRA received the necessary documentation and announced the Name Change to “Double Crown Resources Inc.”, which took effect at the open of business on November 10, 2011. Our new trading symbol for our shares on the OTC Bulletin Board has been changed to DDCC.OB. Our new cusip number is 25857H 103.

Amendment to Articles of Incorporation – Authorized Capital

On April 25, 2011, our Board of Directors and shareholders holding a majority of the total issued and outstanding shares of our common stock approved an increase in our authorized capital to five hundred million (500,000,000) shares of common stock, par value $0.001 (the “Increase in Authorized Capital”). Therefore, on May 23, 2011, we filed an amendment to our articles of incorporation with the Nevada Secretary of State regarding the Increase in Authorized Capital (the “Amendment”).

The Board of Directors considered certain factors regarding the Increase in Authorized Capital including, among others, the following: (i) establishing a proper market value for the Company and its shares and increasing the potential marketability of its common stock; and (ii) increasing the opportunities for the Company to engage in successful financing arrangements with a proper market cap.

The amendment will not affect the number of our issued and outstanding common shares.

4

Subsidiary

On August 24, 2011, we filed articles of incorporation with the Ministry of Government Services for the Province of Ontario, under the Business Corporations Act to incorporate Denarii Resources Inc., our wholly-owned subsidiary (“DRI”). The Ontario Corporation Number is 1857356. Paul Murphy is the sole officer and director of DRI. We formed DRI in order to obtain an access number from the Ministry of Mines to facilitate the transfer of certain mining claims located in Canada to DRI.

Please note that throughout this Annual Report, and unless otherwise noted, the words "we," "our," "us," the "Company," or "Double Crown Resources," refers to Double Crown Resources Inc and its subsidiary, DRI.

Our transfer agent is Empire Stock Transfer, Inc., 1859 Whitney Mesa Drive, Henderson, Nevada 89014.

CURRENT BUSINESS OPERATIONS

We are an exploration stage company that was organized to enter into the mineral industry. We previously located, explored, acquired and developed mineral properties. Our business operations had been limited to gold and mineral exploration/development of selected properties in North, South and Latin America. We will continue with this segment of our business plan. We will also be pursuing new programs of exploration, development and marketing of key mineral, oil, gas and other resources, which are in high demand from today's industrial market. There may also be expansion into the solar energy sector. Our Board of Directors anticipates that these new ventures will add significantly to our potential for long term revenue and profit.

MINERAL PROPERTIES

Bateman Property Option

Effective on February 9, 2011, we entered into that certain Bateman Property Option (the “Option”) between with Richard and Gloria Kwiatkowski (collectively, the “Kwiatkowski”). The Option provides for the development of 136 claim units covering a series of nickel-colbalt-gold-platinum group element prospects, which prospects are located 35 kilometers northwest of Thunder Bay, Ontario (the “Prospects”). The Prospects are owned 100% by Kwiatkowski as tenants in common. We intend to work on the Prospects, including drilling, for three types of geological conceptual targets: (i) shebandowan type high grade nickel-cobalt-gold-platinum sulphide deposits; (ii) disseminated nickel sulphides of Mount Keith type with bulk tonnage potential; and (iii) gold mineralization within an extensive conglomerate unit of potential open-pit bult tonnage configuration.

In accordance with the terms and provisions of the Option: (i) upon execution of certain documentation and transfer of title, we will pay $5,000 and issue 250,000 shares of common stock to the Kwiatkowski; (ii) at the end of year one, we will pay to Kwiatkowski a further $20,000 either in half cash and half shares or all shares at the option of the Kwiatkowski; (iii) at the end of year two, we will pay to Kwiatkowski a further $30,000 either in half cash and half shares or all shares at the option of the Kwiatkowski will; (iv) each anniversary thereafter, we shall pay to Kwiatkowski $25,000 as advance royalty payment until the sum of $200,000 has been paid; (v) we shall further make payment to Kwiatkowski of 3% NSR royalty on all production from the Prospects, which royalty may be purchased by us as to 1.5% of the 3% for the sum of $1,500,000 in increments of $500,000 per 0.5% NSR; and (vi) we shall commit to expenditures of $200,000 on the Prospects. See “Item 5

5

On July 19, 2011, we paid $4,000 and incurred an additional $1,000 payable to purchase the Option. The prepaid royalty of $124,200 has been analyzed for impairment and fully impaired on the financials.

McNab Property

We have a mineral property, known as the McNab Molybdenum Property (the “McNab Property”). The McNab Property is comprised of one mineral claim containing 1 cell claim units totaling 251.11 hectares;

| BC Tenure # | Work Due DateUnits | Total Area (Hectares) |

| 831929 | 12 | 251.11 |

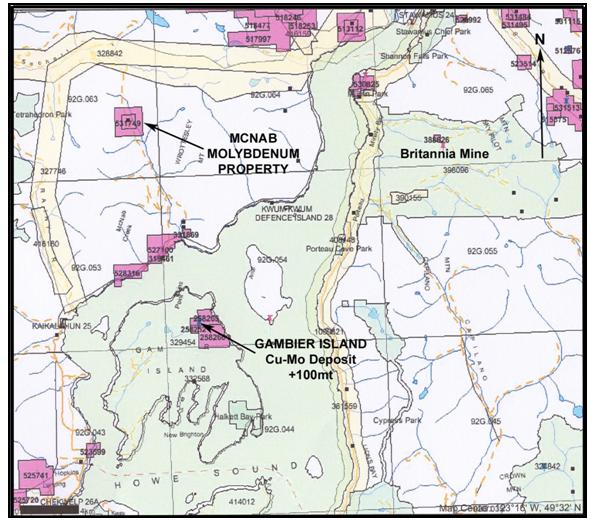

Location and Tenure

The McNab Property is located near the headwaters of McNab Creek, approximately 40 km northwest of Vancouver, BC. Access to the property is presently via water or helicopter. The McNab Property consists of 251.11 hectares of mineral title, valid until August 20, 2010. The property is held in the name of Stan Ford on behalf of the company pending completion of the company’s application for a British Columbia Miners License. The McNab Property can be reached directly from Vancouver 40 km via helicopter. Alternatively, water transportation or float plane can be used to reach the logging camp at tidewater, and then by road 10 km to the McNab Property. Arrangements can be made to rent a truck from the logging company to allow road access to the property.

Previous work consisted of geological mapping, rock sampling, and a geochemical soil survey. The McNab property has similar geological characteristics to the nearby +100 MT Gambier Island porphyry Cu-Mo deposit. The McNab Property covers a zone of porphyry-style molybdenum and copper mineralization outcropping along the main logging road. A roadcut located approximately 10 km from tidewater exposes a mineralized zone over 150 metres in width. Molybdenite, chalcopyrite, bornite and pyrite occur in quartz veins and as disseminations within quartz diorite and granodiorite porphyritic intrusives. Several copper and molybdenum soil anomalies have been delineated adjacent to the known mineralized area.

6

Geology

Molybdenum mineralization in granitic rock was discovered in 1977 during the building of a logging road up the McNab Creek Valley. There is no previous record of molybdenum discoveries in the valley, with the sole exception of Howe Copper Mine, located beyond the headwaters of McNab Creek on Mount Donaldson. The nearest similar mineral deposit of the porphyry Mo-Cu type is the +100 mt Gambier Island Cu-Mo deposit located about 15 km to the southeast.

7

The McNab Property is underlain by the various phases of the Cenozoic-Mesozoic Coast Plutonic Complex and a small pendant of Lower Cretaceous Gambier Group metavolcanic and metasedimentary rocks. The intrusive rocks vary from quartz diorite with diorite inclusions, to granodiorite. Mineralization consists of pyrite, chalcopyrite, molybdenite, and minor bornite occurring in the quartz diorite near its projected contact with granodiorite. The sulphides occur either on fracture plane surfaces or are associated with quartz veining. Minor sericite, epidote and chlorite are evident. Gambier Group rocks mask the eastward continuation of the mineralization.

The property and mineralization were described by S.S Tan, P. Eng. in a July 5, 1977 report as “Mineralization in the main showing is exposed for a north-south distance of 450 feet along the west bank of a road cut. Molybdenite with lesser chalcopyrite and pyrite occurs as streaks, patches and disseminations in closely spaced quartz veinlets and stringers within the quartz diorite porphyry host rock. A pyrite halo limits this stockwork Mo-Cu mineralization to the north and south. The McNab Property is favorable for the occurrence of the larger-tonnage low-grade Mo-Cu porphyry type deposit. The proximity to tidewater and the occurrence of Mo-Cu porphyry type showing makes this an attractive exploration target for the search of such economic mineral deposits.”

The only recorded exploration work on theMcNab Property occurred between 1977 and 1980, following discovery in 1977. Silverado Mines Ltd., a public listed company, funded this work. A geochemical soil survey done in 1979 is the most recent exploration work in the area. In a 1980 assessment report pertaining to a 370-sample geochemical soil survey of the area, J.W. Murton, P. Eng. describes two strong molybdenum and coincident copper soil anomalies, which were discovered peripheral to the showings. Additional surveys and rock trenching were recommended but no further geological work has been recorded.

Summary Report of Geologist

The McNab Property is the subject to a Summary Report dated April 2006 prepared by Greg Thomson, B.Sc., P. Geo. and James Laird, Laird Explorations Ltd. The Report was prepared in compliance with National Instrument 43-101 and Form 43-101F1.

Mr. Thomson certified that the information contained in the report was based upon a review of previous reports and geological studies related to the property area and personal experience with local geology gained while employed as a consulting geologist in Southwest British Columbia.

Proposed Work Program

A proposed work program includes construction of a control grid, geological mapping and rock sampling of surface showings, a soil and silt geochemical sampling program, IP geophysical survey, and rock trenching. Based on a compilation of these results, a diamond drill program will be designed to explore and define the potential resources.

Phase 1. Reconnaissance geological mapping, prospecting and rock sampling, helicopter transportation.

Phase 2. Detailed geological mapping and rock sampling, grid construction, soil and silt geochemical survey, IP survey, establish drill and trenching targets.

Phase 3. 1000 metres of diamond drilling including geological supervision, assays, report and other ancillary costs.

8

Our business plan is to proceed with the exploration of our molybdenum property to determine whether there is any potential for molybdenum on the property that comprises our mineral claims. We have decided to proceed with the three phases of a staged exploration program recommended by the geological report. We anticipate that these phases of the recommended geological exploration program will cost approximately $25,000.00, $100,000 and $175,000 respectively. We had $0 in cash reserves as of the period ended December 31, 2009. The lack of cash has kept us from conducting any exploration work on the property. We will commence Phase 1 of the exploration program once we receive funding. Phase 2 and 3 will commence after completion of the Phase 1 program. As such, we anticipate that we will incur the following expenses over the next twelve months:

>> $25,000.00 in connection with the completion of Phase 1 of our recommended geological work program;

>> $100,000.00 in connection with the completion of Phase 2 of our recommended geological work program;

>> $175,000 for Phase 3 of our recommended geological work program; and

>> $10,000 for operating expenses, including professional legal and accounting expenses associated with compliance with the periodic reporting requirements after we become a reporting issuer under the Securities Exchange Act of 1934.

If we determine not to proceed with further exploration of our mineral claims due to a determination that the results of our initial geological program do not warrant further exploration or due to an inability to finance further exploration, we plan to pursue the acquisition of an interest in other mineral claims. We anticipate that any future acquisition would involve the acquisition of an option to earn an interest in a mineral claim as we anticipate that we would not have sufficient cash to purchase a mineral claim of sufficient merit to warrant exploration. This means that we might offer shares of our stock to obtain an option on a property. Once we obtain an option, we would then pursue finding the funds necessary to explore the mineral claim by one or more of the following means: engaging in an offering of our stock; engaging in borrowing; or locating a joint venture partner or partners.

Guyana Prospect

Effective on February 28, 2011, we entered into that certain extension of a letter agreement to form a joint venture dated December 9, 2010 (the “Letter Agreement”) with Guyanex Minerals Corp. (“GMC”). The Letter Agreement provided for the development of the gold mining concessions owned by Guyanex Minerals Incorporation (“GMI”), which is the owner of a 100% interest in those certain gold mining concessions located in the Republic of Guyana, including three concessions along the Guyani River (collectively, known as the “Prospect”). In accordance with the terms and provisions of the Letter Agreement: (i) we were to purchase an undivided 50% equity interest in the Prospects by providing a payment of $5,000,000 prior to January 31, 2011 to be held in escrow (the “Option Purchase Price”); (ii) upon payment of the $5,000,000 by us, GMI was going to issue to us 1,000 common shares representing the 50% equity interest in GMI; and (iii) any capital requirements above the Option Purchase Price were to be paid on a 50-50 basis by us and GMC (the “Capital Requirements”).

9

In accordance with the extension of the Letter Agreement, we and GMC agreed to a payment date of May 31, 2011 for the Option Purchase Price. The payment was never made.

As of November 7, 2011, our Board of Directors determined that pursuing the purchase of the interest in GMC and incurring the Capital Requirements associated with the gold mining concessions is not in our best interests or in the nest interests of our shareholders. Therefore, we and GMC have entered into that certain rescission agreement (the “Rescission Agreement”), pursuant to which we are released from any further obligations or duties thereunder. Moreover, it was previously determined that at no time prior to May 31, 2011 was the future sacrifice of $5,000,000 associated with the Letter Agreement probable and, therefore, it is our intent to remove this liability from our financial statements and make corresponding adjustments. Therefore, our Quarterly Report on Form 10-Q for the three month period ended March 31, 2011 will be restated.

PROPOSED FUTURE BUSINESS OPERATIONS

Our current strategy is to complete further acquisition of other mineral property opportunities, which fall within the criteria of providing a geological basis for development of mining initiatives that can provide near term revenue potential and production cash flows to create expanding reserves. We anticipate that our ongoing efforts, subject to adequate funding being available, will continue to be focused on successfully concluding negotiations for additional interests in mineral properties. We plan to build a strategic base of producing mineral properties.

We also plan on becoming involved in the United States domestic oil and gas reserves on-shore development. We believe that within the continental United States, thousand of wells are being drilled and will continue to be drilled over the next thirty years. The result will be that domestic energy production may provide an estimated 70% of the nation’s energy needs. However, the oil and gas reserves are trapped in hundreds of miles of brittle shale rock thousands of feet below the surface. Engineers have recently learned that the underground shale could be hydraulically fractured (frac-dilled”) with highly compressed sand, water and specialized chemicals thereby releasing huge quantities of oil and gas from a well. In more recent years, improved equipment and horizontal drilling techniques have increased the quantity of oil and gas and the estimated life that can be expected from wells drilled in the shale formation. This frac-drilling process has created economic boom conditions in North Dakota and South Texas as these are the areas with some of the best geologic formations. We believe it has also created enormous demand for the equipment, personnel and materials required to drill economically feasible wells.

One of those vital materials for frac-drilling is a unique type of sand that can hold its shape under intense pressure and heat and is porous enough to allow thousands of gallons of oil or millions of cubic feet of gas to seep through it to the drill pipe. A typical frac-well will use 2,200 tons of this type of sand and its industry name is “frac-sand” or “proppant”. Of the on-shore domestic wells that are expected to be drilled in the coming years, over 90% are expected to need hydraulic fracturing, which will require millions of tons of frac-sand. We intend to participate in negotiations and discussions with potential joint venture parties regarding obtaining frac-sand reserves and establishing the infrastructure to deliver the sand to drilling sites.

Our ability to continue to complete planned exploration activities, expand acquisitions and explore mining opportunities and further potential operations involving the oil and gas industry and frac-drilling is dependent on adequate capital resources being available and further sources of debt and equity being obtained.

10

DEVELOPMENT OF MINERAL PROPERTIES

The requirement to raise further funding for mineral exploration and development beyond that obtained for the next six month period may be dependent on the outcome of geological and engineering testing occurring over this interval on potential properties. If future results provide the basis to continue development and geological studies indicate high probabilities of sufficient mineral production quantities, we will attempt to raise capital to further our programs, build production infrastructure, and raise additional capital for further acquisitions. This includes the following activity:

|

·

|

Target further leases for exploration potential and obtain further funding to acquire new development targets.

|

|

·

|

Review all available information and studies.

|

|

·

|

Digitize all available factual information.

|

|

·

|

Completion of a NI 43-101 Compliant Report with a qualified geologist familiar with mineralization in the respective area.

|

|

·

|

Determine feasibility and amenability of extracting the minerals.

|

|

·

|

Create investor communications materials, corporate identity.

|

|

·

|

Raise funding for mineral development.

|

COMPETITION

We operate in a highly competitive industry, competing with other mining and exploration companies, and institutional and individual investors, which are actively seeking metal and mineral based exploration properties throughout the world together with the equipment, labour and materials required to exploit such properties. Many of our competitors have financial resources, staff and facilities substantially greater than ours. The principal area of competition is encountered in the financial ability to cost effectively acquire prime metal and minerals exploration prospects and then exploit such prospects. Competition for the acquisition of metal and minerals exploration properties is intense, with many properties available in a competitive bidding process in which we may lack technological information or expertise available to other bidders. Therefore, we may not be successful in acquiring and developing profitable properties in the face of this competition. No assurance can be given that a sufficient number of suitable metal and minerals exploration properties will be available for acquisition and development.

11

MINERALS EXPLORATION REGULATION

Our minerals exploration activities are, or will be, subject to extensive foreign laws and regulations governing prospecting, development, production, exports, taxes, labor standards, occupational health, waste disposal, protection and remediation of the environment, protection of endangered and protected species, mine safety, toxic substances and other matters. Minerals exploration is also subject to risks and liabilities associated with pollution of the environment and disposal of waste products occurring as a result of mineral exploration and production. Compliance with these laws and regulations may impose substantial costs on us and will subject us to significant potential liabilities. Changes in these regulations could require us to expend significant resources to comply with new laws or regulations or changes to current requirements and could have a material adverse effect on our business operations.

Exploration and production activities are subject to certain environmental regulations, which may prevent or delay the commencement or continuance of our operations. In general, our exploration and production activities are subject to certain foreign regulations, and may be subject to foreign or federal, state and local laws and regulations, relating to environmental quality and pollution control. Such laws and regulations increase the costs of these activities and may prevent or delay the commencement or continuance of a given operation. Compliance with these laws and regulations does not appear to have a future material effect on our operations or financial condition to date. Specifically, we may be subject to legislation regarding emissions into the environment, water discharges and storage and disposition of hazardous wastes. However, such laws and regulations, whether foreign or local, are frequently changed and we are unable to predict the ultimate cost of compliance. Generally, environmental requirements do not appear to affect us any differently or to any greater or lesser extent than other companies in the industry and our current operations have not expanded to a point where either compliance or cost of compliance with environmental regulation is a significant issue for us. Costs have not been incurred to date with respect to compliance with environmental laws but such costs may be expected to increase with an increase in scale and scope of exploration.

Minerals exploration operations are subject to comprehensive regulation, which may cause substantial delays or require capital outlays in excess of those anticipated causing an adverse effect on our business operations. Minerals exploration operations are subject to foreign, federal, state, and local laws relating to the protection of the environment, including laws regulating removal of natural resources from the ground and the discharge of materials into the environment. Minerals exploration operations are also subject to federal, state, and local laws and regulations, which seek to maintain health and safety standards by regulating the design and use of drilling methods and equipment. Various permits from government bodies are required for drilling operations to be conducted; no assurance can be given that such permits will be received. Environmental standards imposed by federal, state, or local authorities may be changed and any such changes may have material adverse effects on our activities. Moreover, compliance with such laws may cause substantial delays or require capital outlays in excess of those anticipated, thus causing an adverse effect on us. Additionally, we may be subject to liability for pollution or other environmental damages, which we may elect not to insure against due to prohibitive premium costs and other reasons. As of the date of this Annual Report, we have not been required to spend any material amount on compliance with environmental regulations. However, we may be required to do so in future and this may affect our ability to expand or maintain our operations.

12

RESEARCH AND DEVELOPMENT ACTIVITIES

No research and development expenditures have been incurred, either on our account or sponsored by customers, during the past three years.

EMPLOYEES

We do not employ any persons on a full-time or on a part-time basis. David Figueiredo is our President/Chief Executive Officer and Treasurer/Chief Financial Officer. This individual is primarily responsible for all our day-to-day operations. Other services are provided by outsourcing, consultant, and special purpose contracts.

CONSULTANTS

2011 Executive Consultant Agreements

Effective on September 15, 2011 (the “Effective Date”), we entered into certain one-year agreements with certain of our executive officers and directors regarding performance of respective duties and executive compensation as follows:

|

1.

|

David Figueiredo, Chief Executive Officer/President and a member of the Board of Directors. The Board of Directors authorized in a special meeting held on September 15, 2011 an executive arrangement with Mr. Figueiredo (the “Figueiredo Agreement”). Pursuant to the Figueiredo Agreement: (i) Mr. Figueiredo shall perform certain duties including, but not limited to, interactions with the media, coordinating legal services and seeking, identifying and consummating the acquisition of properties; and (ii) we shall issue to Mr. Figueiredo an aggregate of 6,000,000 shares of our restricted common stock at a per share price of $0.005.

|

|

2.

|

Jerry Drew, member of the Board of Directors. The Board of Directors authorized in a special meeting held on September 15, 2011 an executive arrangement with Mr. Drew (the “Drew Agreement”). Pursuant to the Drew Agreement: (i) Mr. Drew shall perform certain duties including, but not limited to, assisting the Chief Executive Officer/President, identifying and interacting with investors, overseeing and monitoring our operational expenses and seeking and identifying properties for acquisition; and (ii) we shall issue to Mr. Drew an aggregate of 5,000,000 shares of our restricted common stock at a per share price of $0.005.

|

|

3.

|

Glenn Soler, member of the Board of Directors. The Board of Directors authorized in a special meeting held on September 15, 2011 an executive arrangement with Mr. Soler (the “Soler Agreement”). Pursuant to the Soler Agreement: (i) Mr. Soler shall perform certain duties including, but not limited to, providing consulting and managerial services, identifying and interacting with investors and seeking and identifying properties for acquisition; and (ii) we shall issue to Mr. Soler an aggregate of 4,000,000 shares of our restricted common stock at a per share price of $0.005.

|

|

4.

|

Tricia Oakley, Secretary. The Board of Directors authorized in a special meeting held on September 15, 2011 an executive arrangement with Ms. Oakley (the “Oakley Agreement”). Pursuant to the Oakley Agreement: (i) Ms. Oakley shall perform certain duties including, but not limited to, providing administrative support to the Chief Executive Officer/President and all members of the Board of Directors; and (ii) we shall issue to Ms. Oakley an aggregate of 3,000,000 shares of our restricted common stock at a per share price of $0.005.

|

|

5.

|

LV Media Group LLC, Consultant. The Board of Directors authorized in a special meeting held on September 15, 2011 a consultant arrangement (the “LV Media Agreement”) with LV Media Group LLC (“LV Media”). Pursuant to the LV Media Agreement: (i) LV Media shall perform certain media related duties including, but not limited to, providing media coverage and stock promoting services to us and researching stock holdings; and (ii) we shall issue to LV Media 4,000,000 shares of our restricted common stock at a per share price of $0.005.

|

13

Murphy Consultant Agreement

Effective on September 8, 2011 (the “Effective Date”), we entered into that certain consultant three-year agreement with J. Paul Murphy, one of our directors (the “Murphy Agreement”). In accordance with the terms and provisions of the Murphy Agreement: (i) Mr. Murphy shall perform certain duties including, but not limited to, assisting in financings and identifying potential investors and seeking and identifying properties for acquisition; (ii) we shall pay to Mr. Murphy a retainer fee of $10,000; and (iii) we shall issue to Mr. Murphy an aggregate of 4,000,000 shares of our restricted common stock at a per share price of $0.005.

Rescission of Murphy Agreement

As of November 7, 2011, we entered into that certain rescission agreement with Mr. Murphy (the “Murphy Rescission Agreement”), pursuant to which we are released from our required payment to Mr. Murphy of $10,000. Mr. Murphy has been included in the general executive compensation packages approved by the Board of Directors September 15, 2011 referenced above pursuant to which Mr. Murphy has been issued 4,000,000 shares of our restricted common stock. Mr. Murphy will continue to provide services to us including assistance in financings and identification of potential investors and properties for acquisition.

2012 Executive Service Agreements

Effective on February 9, 2012 (the “Effective Date”), we entered into certain written one-year agreements with certain of our consultants regarding performance of respective duties and compensation as follows:

|

1.

|

Alexis Summerfield, Consultant. The Board of Directors authorized in a special meeting held on February 9, 2012 a consultant arrangement with Ms. Alexis Summerfield (the “Summerfield Agreement”). Pursuant to the Summerfield Agreement: (i) Ms. Summerfield shall perform certain social media duties including, but not limited to, promoting us through social media exposure worldwide and providing professional social media services; and (ii) we shall issue to Ms. Summerfield an aggregate of 3,000,000 shares of our restricted common stock at a per share price of $0.01.

|

|

2.

|

Ariel Serrano, Consultant. The Board of Directors authorized in a special meeting held on February 9, 2012 a consultant arrangement with Mr. Serrano (the “Serrano Agreement”). Pursuant to the Serrano Agreement: (i) Mr. Serrano shall perform certain marketing duties including, but not limited to, providing consulting services to us, introductions to contacts regarding precious metal assets for acquisition in North America, promoting our stock and recruiting individuals who desire to provide professional services to us; and (ii) we shall issue to Mr. Serrano an aggregate of 1,000,000 shares of our restricted common stock at a per share price of $0.01.

|

|

3.

|

Interactive Business Alliance LLC, Consultant. The Board of Directors authorized in a special meeting held on February 9, 2012 a consultant arrangement (the “IBA Agreement”) with Interactive Business Alliance LLC (“IBA”). Pursuant to the IBA Agreement: (i) IBA shall perform certain public relations and communication services including, but not limited to, development, implementation and maintenance of an ongoing program to increase the investment community’s awareness of our activities and to stimulate the investment community’s interest; and (ii) we shall issue to IBA 1,500,000 shares of our restricted common stock at a per share price of $0.01.

|

Effective on March 2, 2012 (the ”Effective Date”), we entered into an agreement with a consultant regarding performance of duties and compensation as follows:

|

1.

|

LV Media LLC, Consultant. The Board of Directors authorized in a special meeting held on March2, 2011 a further consultant arrangement with LV Media (the “LV Media Agreement”). Pursuant to the LV Media Agreement: (i) LV Media shall perform certain public relations services including, but not limited to, corporate identity, news releases, corporate website and website placeholder page, corporate information circular, E-newsletter design, image contingency and coordination with industry leaders; and (ii) we shall pay to LV Media compensation in the aggregate amount of $11,500.

|

14

ITEM 1A. RISK FACTORS

An investment in our common stock involves a number of very significant risks. You should carefully consider the following risks and uncertainties in addition to other information in evaluating our company and its business before purchasing shares of our common stock. Our business, operating results and financial condition could be seriously harmed due to any of the following risks. The risks described below are all of the material risks that we are currently aware of that are facing our company. Additional risks not presently known to us may also impair our business operations. You could lose all or part of your investment due to any of these risks.

Risks Related to Our Business

We are an exploration stage company and we expect to incur operating losses for the foreseeable future.

We were incorporated on March 23, 2006 and to date have recently been involved in the organizational activities, and acquisition of our claims. We have no way to evaluate the likelihood that our business will be successful. We have not earned any revenues as of the date of this annual report. Potential investors should be aware of the difficulties normally encountered by mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration and development of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates. Prior to completion of our exploration stage, we anticipate that we will incur increased operating expenses without realizing any revenues. We expect to incur significant losses into the foreseeable future. We recognize that if production of minerals from the claims is not forthcoming, we will not be able to continue business operations. There is no history upon which to base any assumption as to the likelihood that we will prove successful, and it is doubtful that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail.

We have yet to earn revenue and our ability to sustain our operations is dependent on our ability to raise additional financing to complete the final phase of our exploration program if warranted. As a result, our accountant believes there is substantial doubt about our ability to continue as a going concern.

We have accrued net losses of $2,056,559 for the period from inception (March 23, 2006) to December 31, 2011, and have no revenues to date. Our future is dependent upon our ability to obtain financing and upon future profitable operations from the development of our mineral claims. These factors raise substantial doubt that we will be able to continue as a going concern. Seale and Beers CPAs, our independent auditor, has expressed substantial doubt about our ability to continue as a going concern. This opinion could materially limit our ability to raise additional funds by issuing new debt or equity securities or otherwise. If we fail to raise sufficient capital when needed, we will not be able to complete our business plan. As a result we may have to liquidate our business and you may lose your investment. You should consider our auditor's comments when determining if an investment in our company is suitable.

15

We may be unable to obtain additional capital that we may require to implement our business plan. This would restrict our ability to grow.

The proceeds from our private offerings completed during fiscal year ended December 31, 2011 provide us with a limited amount of working capital and is not sufficient to fund our proposed operations. We will require additional capital to continue to operate our business and our proposed operations. We may be unable to obtain additional capital as and when required. Generally during prior fiscal years, a related party paid expenses on our behalf.

Future acquisitions and future development, production and marketing activities, as well as our administrative requirements (such as salaries, insurance expenses and general overhead expenses, as well as legal compliance costs and accounting expenses) will require a substantial amount of additional capital and cash flow.

We may not be successful in locating suitable financing transactions in the time period required or at all, and we may not obtain the capital we require by other means. If we do not succeed in raising additional capital, the capital we have received to date may not be sufficient to fund our operations going forward without obtaining additional capital financing.

Any additional capital raised through the sale of equity may dilute your ownership percentage. This could also result in a decrease in the fair market value of our equity securities because our assets would be owned by a larger pool of outstanding equity. The terms of securities we issue in future capital transactions may be more favorable to our new investors, and may include preferences, superior voting rights and the issuance of warrants or other derivative securities, and issuances of incentive awards under equity employee incentive plans, which may have a further dilutive effect.

Our ability to obtain needed financing may be impaired by such factors as the capital markets (both generally and in the resource industry in particular),our status as a new enterprise without a demonstrated operating history, the location of our mineral properties and the price of minerals on the commodities markets (which will impact the amount of asset-based financing available to us) or the retention or loss of key management. Further, if mineral prices on the commodities markets decrease, then our revenues will likely decrease, and such decreased revenues may increase our requirements for capital. If the amount of capital we are able to raise from financing activities is not sufficient to satisfy our capital needs, we may be required to cease our operations.

We may incur substantial costs in pursuing future capital financing, including investment banking fees, legal fees, accounting fees, securities law compliance fees, printing and distribution expenses and other costs. We may also be required to recognize non-cash expenses in connection with certain securities we may issue, such as convertible notes and warrants, which may adversely impact our financial condition.

16

Our exploration activities on our mineral properties may not be commercially successful, which could lead us to abandon our plans to develop the property and our investments in exploration.

Our long-term success depends on our ability to establish commercially recoverable quantities of ore on our mineral properties that can then be developed into commercially viable mining operations. Mineral exploration is highly speculative in nature, involves many risks and is frequently non-productive. These risks include unusual or unexpected geologic formations, and the inability to obtain suitable or adequate machinery, equipment or labor. The success of mineral exploration is determined in part by the following factors:

· identification of potential mineralization based on superficial analysis;

· availability of government-granted exploration permits;

· the quality of management and geological and technical expertise; and

· the capital available for exploration.

Substantial expenditures are required to establish proven and probable reserves through drilling and analysis, to develop processes to extract minerals, and to develop the mining and processing facilities and infrastructure at any chosen site. Whether a mineral deposit will be commercially viable depends on a number of factors, which include, without limitation, the particular attributes of the deposit, such as size, grade and proximity to infrastructure; metal prices, which fluctuate09-8 widely; and government regulations, including, without limitation, regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. We may invest significant capital and resources in exploration activities and abandon such investments if it is unable to identify commercially exploitable mineral reserves. The decision to abandon a project may reduce the trading price of our common stock and impair our ability to raise future financing. We cannot provide any assurance to investors that we will discover or acquire any mineralized material in sufficient quantities on any of our properties to justify commercial operations. Further, we will not be able to recover the funds that we spend on exploration if we are not able to establish commercially recoverable quantities of precious metals or minerals on our properties.

Because of the unique difficulties and uncertainties inherent in mineral ventures, we face a high risk of business failure.

You should be aware of the difficulties normally encountered by mineral companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration and development of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates. If the results of our development program do not reveal viable commercial mineralization, we may decide to abandon our claim and acquire new claims. Our ability to acquire additional claims will be dependent upon our possessing adequate capital resources when needed. If no funding is available, we may be forced to abandon our operations.

Because of the inherent dangers involved in mineral extracting, there is a risk that we may incur liability or damages as we conduct our business.

The extracting of minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. At the present time we have no insurance to cover against these hazards. The payment of such liabilities may result in our inability to complete our planned program and/or obtain additional financing to fund our program.

17

Future participation in an increased number of minerals exploration prospects will require substantial capital expenditures.

The uncertainty and factors described throughout this section may impede our ability to economically discover, acquire, develop and/or exploit mineral prospects. As a result, we may not be able to achieve or sustain profitability or positive cash flows from operating activities in the future.

The financial statements for the fiscal year ended December 31, 2011 and December 31, 2010 have been prepared “assuming that we will continue as a going concern,” which contemplates that we will realize our assets and satisfy our liabilities and commitments in the ordinary course of business. Our ability to continue as a going concern is dependent on raising additional capital to fund our operations and ultimately on generating future profitable operations. There can be no assurance that we will be able to raise sufficient additional capital or eventually have positive cash flow from operations to address all of our cash flow needs. If we are not able to find alternative sources of cash or generate positive cash flow from operations, our business and shareholders will be materially and adversely affected. See “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operation – Going Concern.”

The mineral exploration and mining industry is highly competitive and there is no assurance that we will be successful in acquiring the leases.

The mineral exploration and mining industry is intensely competitive, and we compete with other companies that have greater resources. Many of these companies not only explore for and produce certain minerals, but also market certain minerals and other products on a regional, national or worldwide basis. These companies may be able to pay more for productive mineral properties and exploratory prospects or define, evaluate, bid for and purchase a greater number of properties and prospects than our financial or human resources permit. In addition, these companies may have a greater ability to continue exploration activities during periods of low mineral market prices. Our larger competitors may be able to absorb the burden of present and future foreign, federal, state, local and other laws and regulations more easily than we can, which would adversely affect our competitive position. Our ability to acquire additional properties and to discover productive prospects in the future will be dependent upon our ability to evaluate and select suitable properties and to consummate transactions in a highly competitive environment. In addition, because we have fewer financial and human resources than many companies in our industry, we may be at a disadvantage in bidding for exploratory prospects and producing mineral properties.

The marketability of natural resources will be affected by numerous factors beyond our control which may result in us not receiving an adequate return on invested capital to be profitable or viable.

The marketability of natural resources which may be acquired or discovered by us will be affected by numerous factors beyond our control. These factors include macroeconomic factors, market fluctuations in commodity pricing and demand, the proximity and capacity of natural resource markets and processing equipment, governmental regulations, land tenure, land use, regulation concerning the importing and exporting of certain minerals and environmental protection regulations. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in us not receiving an adequate return on invested capital to be profitable or viable.

18

As we undertake development of our claims, we will be subject to compliance with government regulation that may increase the anticipated cost of our program.

There are several governmental regulations that materially restrict our mineral extraction program. We will be subject to the laws of the Province of British Columbia as we carry out our program. We may be required to obtain work permits, post bonds and perform remediation work for any physical disturbance to the area in order to comply with these laws. The cost of complying with permit and regulatory environment laws will be greater because the impact on the project area is greater. Permits and regulations will control all aspects of the production program if the project continues to that stage. Examples of regulatory requirements include:

|

(a)

|

Water discharge will have to meet drinking water standards;

|

|

|

(b)

|

Dust generation will have to be minimal or otherwise re-mediated;

|

|

|

(c)

|

Dumping of material on the surface will have to be re-contoured and re-vegetated with natural vegetation;

|

|

|

(d)

|

An assessment of all material to be left on the surface will need to be environmentally benign;

|

|

|

(e)

|

Ground water will have to be monitored for any potential contaminants;

|

|

|

(f)

|

The socio-economic impact of the project will have to be evaluated and if deemed negative, will have to be remediated; and

|

|

|

(g)

|

There will have to be an impact report of the work on the local fauna and flora including a study of potentially endangered species.

|

There is a risk that new regulations could increase our costs of doing business and prevent us from carrying out our exploration program. We will also have to sustain the cost of reclamation and environmental remediation for all exploration work undertaken. Both reclamation and environmental remediation refer to putting disturbed ground back as close to its original state as possible. Other potential pollution or damage must be cleaned-up and renewed along standard guidelines outlined in the usual permits. Reclamation is the process of bringing the land back to its natural state after completion of exploration activities. Environmental remediation refers to the physical activity of taking steps to remediate, or remedy, any environmental damage caused. The amount of these costs is not known at this time as we do not know the extent of the exploration program that will be undertaken beyond completion of the recommended work program. If remediation costs exceed our cash reserves we may be unable to complete our exploration program and have to abandon our operations.

If access to our mineral properties is restricted by inclement weather, we may be delayed in any future mining efforts.

It is possible that adverse weather could cause accessibility to our properties difficult and this would delay in our timetables.

Based on consumer demand, the growth and demand for any ore we may recover from our claims may be slowed, resulting in reduced revenues to the company.

Our success will be dependent on the growth of demand for ores. If consumer demand slows our revenues may be significantly affected. This could limit our ability to generate revenues and our financial condition and operating results may be harmed.

19

We may be unable to retain key employees or consultants or recruit additional qualified personnel.

Our extremely limited personnel means that we would be required to spend significant sums of money to locate and train new employees in the event any of our employees resign or terminate their employment with us for any reason. Due to our limited operating history and financial resources, we are entirely dependent on the continued service of Dr. Stewart Jackson as our President/Chief Executive Officer/Chief Financial Officer and a director. Further, we do not have key man life insurance on any of these individuals. We may not have the financial resources to hire a replacement if any of our officers were to die. The loss of service of any of these employees could therefore significantly and adversely affect our operations.

Our officers and directors may be subject to conflicts of interest.

Our officers and directors serve only part time and are subject to conflicts of interest. Each of our executive officers and directors serves only on a part time basis. Each devotes part of his working time to other business endeavors, including consulting relationships with other corporate entities, and has responsibilities to these other entities. Such conflicts include deciding how much time to devote to our affairs, as well as what business opportunities should be presented to us. Because of these relationships, our officers and directors may be subject to conflicts of interest.

Nevada law and our articles of incorporation may protect our directors from certain types of lawsuits.

Nevada law provides that our officers and directors will not be liable to us or our stockholders for monetary damages for all but certain types of conduct as officers and directors. Our Bylaws permit us broad indemnification powers to all persons against all damages incurred in connection with our business to the fullest extent provided or allowed by law. The exculpation provisions may have the effect of preventing stockholders from recovering damages against our officers and directors caused by their negligence, poor judgment or other circumstances. The indemnification provisions may require us to use our limited assets to defend our officers and directors against claims, including claims arising out of their negligence, poor judgment, or other circumstances.

Risks Related to Our Common Stock

Sales of a substantial number of shares of our common stock into the public market by certain stockholders may result in significant downward pressure on the price of our common stock and could affect your ability to realize the current trading price of our common stock.

Sales of a substantial number of shares of our common stock in the public market by certain stockholders could cause a reduction in the market price of our common stock.

As of the date of this Annual Report, we have 165,172,820 shares of common stock issued and outstanding. As of the date of this Annual Report, there are 108,804,820 outstanding shares of our common stock that are restricted securities as that term is defined in Rule 144 under the Securities Act. Although the Securities Act and Rule 144 place certain prohibitions on the sale of restricted securities, restricted securities may be sold into the public market under certain conditions.

20

Any significant downward pressure on the price of our common stock as the selling stockholders sell their shares of our common stock could encourage short sales by the selling stockholders or others. Any such short sales could place further downward pressure on the price of our common stock.

The trading price of our common stock on the OTC Bulletin Board has been and may continue to fluctuate significantly and stockholders may have difficulty reselling their shares.

Our common stock commenced trading on approximately February 28, 2009 on the OTC Bulletin Board and the trading price has fluctuated. In addition to volatility associated with Bulletin Board securities in general, the value of your investment could decline due to the impact of any of the following factors upon the market price of our common stock: (i) disappointing results from our discovery or development efforts; (ii) failure to meet our revenue or profit goals or operating budget; (iii) decline in demand for our common stock; (iv) downward revisions in securities analysts’ estimates or changes in general market conditions; (v) technological innovations by competitors or in competing technologies; (vi) lack of funding generated for operations; (vii) investor perception of our industry or our prospects; and (viii) general economic trends.

In addition, stock markets have experienced price and volume fluctuations and the market prices of securities have been highly volatile. These fluctuations are often unrelated to operating performance and may adversely affect the market price of our common stock. As a result, investors may be unable to sell their shares at a fair price and you may lose all or part of your investment.

Additional issuances of equity securities may result in dilution to our existing stockholders.

Our Articles of Incorporation authorize the issuance of 500,000,000 shares of common stock. The Board of Directors has the authority to issue additional shares of our capital stock to provide additional financing in the future and the issuance of any such shares may result in a reduction of the book value or market price of the outstanding shares of our common stock. If we do issue any such additional shares, such issuance also will cause a reduction in the proportionate ownership and voting power of all other stockholders. As a result of such dilution, if you acquire shares of our common stock, your proportionate ownership interest and voting power could be decreased. Further, any such issuances could result in a change of control.

Our common stock is classified as a “penny stock” under SEC rules which limits the market for our common stock.

Because our stock is not traded on a stock exchange or on the NASDAQ National Market or the NASDAQ Small Cap Market, and because the market price of the common stock has fluctuated and may trade at times at less than $5 per share, the common stock may be classified as a “penny stock.” SEC Rule 15g-9 under the Exchange Act imposes additional sales practice requirements on broker-dealers that recommend the purchase or sale of penny stocks to persons other than those who qualify as an “established customer” or an “accredited investor.” This includes the requirement that a broker-dealer must make a determination that investments in penny stocks are suitable for the customer and must make special disclosures to the customers concerning the risk of penny stocks. Many broker-dealers decline to participate in penny stock transactions because of the extra requirements imposed on penny stock transactions. Application of the penny stock rules to our common stock reduces the market liquidity of our shares, which in turn affects the ability of holders of our common stock to resell the shares they purchase, and they may not be able to resell at prices at or above the prices they paid.

21

A decline in the price of our common stock could affect our ability to raise further working capital and adversely impact our operations.

A decline in the price of our common stock could result in a reduction in the liquidity of our common stock and a reduction in our ability to raise additional capital for our operations. Since our operations to date have been principally financed through the sale of equity securities, a decline in the price of our common stock could have an adverse effect upon our liquidity and our continued operations. A reduction in our ability to raise equity capital in the future would have a material adverse effect upon our business plan and operations, including our ability to continue our current operations. If our stock price declines, we may not be able to raise additional capital or generate funds from operations sufficient to meet our obligations.

ITEM 2. PROPERTIES

We currently do not own any physical property or own any real property. Our principal executive office is located at 2312 N. Green Valley Parkway, Suite 1026, Henderson, Nevada 89014.

ITEM 3. LEGAL PROCEEDINGS

On November 23, 2011, a complaint was filed in the Supreme Court of British Columbia, File No. S-115321, by Falco Investments Inc. (“Falco”) naming us as a defendant (the “Complaint”). In the Company, Falco alleges that we owe $249,000 or the issuance of 27,000,000 shares of common stock as compensation for corporate work performed by Falco through June 30, 2011. We have responded in our answer and stated that we do not owe the $249,000 or the issuance of 27,000,000 shares of common stock for such services allegedly performed by Falco since there was no written contract between us and Falco. We have counterclaimed and named the former president/chief executive officer, Dr. Stewart Jackson and Donald Rutledge and Leslie Rutledge as defendants. We believe that the Complaint is frivolous and has no merit.

Management is not aware of any other legal proceedings contemplated by any governmental authority or any other party involving us or our properties. As of the date of this Annual Report, no director, officer or affiliate is (i) a party adverse to us in any other legal proceeding, or (ii) has an adverse interest to us in any other legal proceedings. Management is not aware of any other legal proceedings pending or that have been threatened against us or our properties.

ITEM 4. MINE SAFEtY DISCLOSURES

Not applicable

22

PART II

ITEM 5. MARKET FOR COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

MARKET FOR COMMON EQUITY

Shares of our common stock commenced trading October 2008 on the OTC Bulletin Board and currently trades under the symbol “DDCC:OB”. The market for our common stock is limited, and can be volatile. The following table sets forth the high and low bid prices relating to our common stock on a quarterly basis for the periods indicated as quoted by the NASDAQ stock market. These quotations reflect inter-dealer prices without retail mark-up, mark-down, or commissions, and may not reflect actual transactions.

|

Quarter Ended

|

High Bid

|

Low Bid

|

||||||

|

December 31, 2011

|

$ | 0.019 | $ | 0.019 | ||||

|

September 30, 2011

|

0.0077 | 0.006 | ||||||

|

June 30, 2011

|

0.012 | 0.012 | ||||||

|

March 31, 2011

|

0.023 | 0.023 | ||||||

|

December 31, 2010

|

0.025 | 0.022 | ||||||

|

September 30, 2010

|

0.023 | 0.022 | ||||||

|

June 30, 2010

|

0.035 | 0.033 | ||||||

|

March 31, 2010

|

0.038 | 0.024 | ||||||

All amounts have been adjusted for stock splits.

As of March 31, 2012, we had 217 shareholders of record, which does not include shareholders whose shares are held in street or nominee names.

DIVIDEND POLICY

No dividends have ever been declared by the Board of Directors on our common stock. Our losses do not currently indicate the ability to pay any cash dividends, and we do not have the intention of paying cash dividends on our common stock in the foreseeable future.

23

SECURITIES AUTHORIZED FOR ISSUANCE UNDER COMPENSATION PLANS

We do not have an equity compensation plan. Therefore the table set forth below presents information as of the date of this Annual Report:

|

Plan Category

|

Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights

(a)

|

Weighted-Average Exercise Price of Outstanding Options, Warrants and Rights

(b)

|

Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans (excluding column (a))

|

|||||||||

|

Equity Compensation Plans Approved by Security Holders

|

n/a | $ | 0.80 | 50,000 | ||||||||

|

Equity Compensation Plans Not Approved by Security Holders

|

||||||||||||

|

Warrants

|

1,966,666 | $ | 0.04 | |||||||||

|

Total

|

1,966,666 | |||||||||||

Common Stock Purchase Warrants

As of the date of this Annual Report, there are an aggregate of 1,966,666 common stock purchase warrants issued and outstanding (the “Warrants”). The 1,966,666 Warrants to purchase shares of common stock and the shares of common stock underlying the Warrants were issued in a private placement by us during fiscal year 2011 at an exercise price of $0.02 per share exercisable for a period of two years from the date of share issuance.

As of the date of this Annual Report, no Warrants have been exercised.

RECENT SALES OF UNREGISTERED SECURITIES

As of the date of this Annual Report and during fiscal year ended December 31, 2011, to provide capital, we sold stock in private placement offerings, issued stock in exchange for our debts or pursuant to contractual agreements as set forth below.

24

2011 PRIVATE PLACEMENTS

During fiscal year ended December 31, 2011, we completed a private placement offering (the “First Private Placement Offering”) with certain United States residents. In accordance with the terms and provisions of the First Private Placement, we authorized the issuance to certain investors an aggregate of 137,266,666 shares of common stock at a per share price of $0.005. During fiscal year ended December 31, 2011, we completed a further private placement offering (the “Second Private Placement Offering”) with certain United States residents. In accordance with the terms and provisions of the Second Private Placement Offering, we authorized the issuance to certain investors an aggregate of 500,000 shares of common stock at a per share price of $0.01.

The shares under the First Private Placement Offering and the Second Private Placement Offering were sold to United States residents in reliance on Rule 506 promulgated under the United States Securities Act of 1933, as amended (the “Securities Act”). The First Private Placement Offering and the Second Private Placement Offering have not been registered under the Securities Act or under any state securities laws and may not be offered or sold without registration with the United States Securities and Exchange Commission or an applicable exemption from the registration requirements. The investors executed subscription agreements and acknowledged that the securities to be issued have not been registered under the Securities Act, that they understood the economic risk of an investment in the securities, and that they had the opportunity to ask questions of and receive answers from our management concerning any and all matters related to acquisition of the securities.

CONSULTANT SERVICES

During fiscal year ended December 31, 2011, we issued and authorized the issuance of an aggregate of 40,299,999 shares of our restricted common stock for services as follows:

|

·

|

On March 16, 2011, we issued 4,333,333 shares of common stock at $0.021772 per share for services valued at $94,334.

|

|

·

|

On March 16, 2011, we issued 5,666,666 shares of common stock at $0.02 per share for services valued at $113,333.

|

|

·

|

On September 15, 2011, we issued 28,000,000 shares of common stock to the members of our Board of Directors and affiliated key parties at $0.0079 per share for services valued at $221,200.

|

|

·

|

On September 20, 2011, we issued 2,000,000 shares of common stock at $0.0251 per share for services valued at $50,200.

|

|

·

|

On June 27, 2011, we authorized the issuance of 300,000 shares of common stock pursuant to a consulting agreement at $0.012 per share.

|

The aggregate of 40,299,999 shares of common stock were issued to either United States residents or non-United States residents in reliance on Section 4(2) or Regulation S promulgated under the Securities Act. The shares of common stock have not been registered under the Securities Act or under any state securities laws and may not be offered or sold without registration with the United States Securities and Exchange Commission or an applicable exemption from the registration requirements. The consultants acknowledged that the securities to be issued have not been registered under the Securities Act, that they understood the economic risk of an investment in the securities, and that they had the opportunity to ask questions of and receive answers from our management concerning any and all matters related to acquisition of the securities.

25

BATEMAN OPTION

On March 31, 2011, we issued an aggregate of 250,000 shares of common stock to the Kwiatkowski. In accordance with the terms and provisions of the Option, upon execution of certain documentation and transfer of title, we will pay $5,000 and issue 250,000 shares of common stock to the Kwiatkowski. The aggregate of 250,000 shares of common stock were issued to non-United States resident in reliance on Regulation S promulgated under the Securities Act. The shares of common stock have not been registered under the Securities Act or under any state securities laws and may not be offered or sold without registration with the United States Securities and Exchange Commission or an applicable exemption from the registration requirements. The consultants acknowledged that the securities to be issued have not been registered under the Securities Act, that they understood the economic risk of an investment in the securities, and that they had the opportunity to ask questions of and receive answers from our management concerning any and all matters related to acquisition of the securities.

ACCOUNTS PAYABLE