Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - CYBRA CORP | Financial_Report.xls |

| EX-31.1 - CERTIFICATION - CYBRA CORP | exhibit31-1.htm |

| EX-32.2 - CERTIFICATION - CYBRA CORP | exhibit32-2.htm |

| EX-10.8 - FORBEARANCE AGREEMENT - CYBRA CORP | exhibit10-8.htm |

| EX-32.1 - CERTIFICATION - CYBRA CORP | exhibit32-1.htm |

| EX-31.2 - CERTIFICATION - CYBRA CORP | exhibit31-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 10-K

(Mark One)

[ x ]ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2011

[ ]TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _______ to _______

Commission File Number 000-52624

CYBRA CORPORATION

(Exact

Name of Registrant as Specified in Its Charter)

| New York | 13-3303290 |

| (State or Other Jurisdiction of | (I.R.S. Employer |

| Incorporation or Organization) | Identification No.) |

| One Executive Blvd., Yonkers, NY | 10701 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s Telephone Number, Including Area Code (914)963-6600

Securities registered pursuant to Section 12(b) of the Act: None

Securities registered pursuant section 12(g) of the Act:

Common Stock, $0.001 par value

Title of Class

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [ x ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes [ ] No [ x ]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [ x ] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K . [ x ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check One):

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | Smaller reporting company [ x ] |

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [ x ]

As of June 30, 2011, which was the last business day of the registrant’s most recent second fiscal quarter, the aggregate market value of the registrant’s Common Stock held by non-affiliates of the registrant was $1,831,104

As of March 15, 2012, there were 15,529,667 shares of Common Stock outstanding.

Documents Incorporated by Reference: None

TABLE OF CONTENTS

FORWARD LOOKING STATEMENTS

This report on Form 10-K contains forward-looking statements within the meaning of Rule 175 of the Securities Act of 1933, as amended, and Rule 3b-6 of the Securities Exchange Act of 1934, as amended, that involve substantial risks and uncertainties. These forward-looking statements are not historical facts, but rather are based on current expectations, estimates and projections about our industry, our beliefs and our assumptions. Words such as “anticipates”, “expects”, “intends”, “plans”, “believes”, “seeks” and “estimates” and variations of these words and similar expressions are intended to identify forward-looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control and difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements. You should not place undue reliance on these forward-looking statements, which apply only as of the date of this Form 10-K. Investors should carefully consider all of such risks before making an investment decision with respect to the Company’s stock.

PART I

ITEM 1. DESCRIPTION OF BUSINESS

THE COMPANY

CYBRA Corporation (“CYBRA” or the “Company”) was founded as a New York corporation in 1985 by Harold Brand, an Information Technology (“IT”) professional with extensive experience in computer systems design, and Dr. Shlomo Kalish, an authority in marketing for start up ventures. Initially, CYBRA was a consulting organization for mid-range computing systems. Utilizing Mr. Brand’s expertise in the IT industry, CYBRA resold and integrated Israeli software products for the IBM System 34, 36, and 38 platforms in the North American marketplace. In the early 1990’s, one of the Company’s main clients asked CYBRA (in collaboration with Pitney Bowes) to develop a bar code label software component. In order to accommodate its client’s needs, CYBRA agreed to develop the new technology. The results had a profound effect on the Company’s future. CYBRA became much more heavily involved in software application development, and wrote the code for a new proprietary software product known as MarkMagicTM. CYBRA owns the trademark for MarkMagic. The MarkMagic software is not patented. It is protected by use of standard secure software keys that are locked to specific computer serial numbers. Computer source code is not distributed with the product.

In August 1997, Monarch Marking Systems, a supplier of labels and printers to retail customers, acquired a minority ownership position in CYBRA with the intention of establishing a strategic partnership. Since that time, CYBRA’s fundamental strategy has been to establish OEM partnerships that embed MarkMagic in leading business software products. Vendors of these business software products resell MarkMagic to their customers. In addition, CYBRA sells MarkMagic directly to businesses needing radio frequency identification (RFID) and bar code labels, as well as electronic forms. Today, the Company is well known for its computerized bar code document design and printing. CYBRA’s R&D department has core competencies in auto id/bar code and RFID expertise, object oriented programming and design, and information technology — especially in connection with the IBM System i.

IBM System i and its predecessors (IBM iSeries and IBM AS/400) have been deployed into midsize companies since the late 1980s. System i, however, has been transformed since that time, meeting a new set of price points and performance results that far outstrip the price/performance ratio offered in the 1990s, or even a few years ago. The System i is a midrange computer platform aimed at meeting the business information and technology needs of midsize businesses, and it is designed to support the growth of a business over time.

CYBRA’s key distributors and resellers are Manhattan Associates, Apparel Business Systems, Vormittag Associates (“VAI”) and Solzon Corporation. CYBRA’s primary suppliers are: Motorola Solutions (RFID readers), Alien Technology (RFID readers and tags), Avery Dennison (bar code and RFID printers and printing supplies), Impinj (RFID readers), Zebra (bar code and RFID printers), Sato (bar code and RFID printers and supplies), Psion Teklogix (bar scanners and wireless equipment), ScanSource (wholesale distributors), Blue Star (wholesale distributors), and Nimax (wholesale distributors).

| Percentage of | ||||||

| Sales | ||||||

| Attributable to | Percentage of | |||||

| Software | Sales | |||||

| Manufacturers | to End Users | |||||

| 2011 | 65% | 35% | ||||

| 2010 | 78% | 22% |

CYBRA’s annual revenues are derived from hundreds of customers. Sales to the largest customers are as follows::

| Percentage | ||||||||||||

| Sales to the | of | |||||||||||

| largest | Total | |||||||||||

| Total Sales | customer | Sales | ||||||||||

| 2011 | $ | 1,800,654 | Maidenform Inc. | $ | 163,086 | 9.0% | ||||||

| 2010 | $ | 1,605,744 | Manhattan Assoc. | $ | 133,205 | 8.1% | ||||||

1

PRODUCTS AND SERVICES

CYBRA’s two proprietary product family offerings are MarkMagic and EdgeMagic.

Thousands of customers worldwide use CYBRA’s MarkMagic™ to design virtually any type of bar coded document — labels, forms, RFID tags, tickets, fabric care labels, magnetic stripe plastic cards — and print them on hundreds of types of general and specialized printers from laser to thermal to automated applicators.

CYBRA’s EdgeMagic® is a platform for developing RFID solutions that seamlessly integrate the massive potential of object sensing technology with the core business applications that run all types of enterprises such as manufacturing, distribution and warehousing. Features include server based encoding, sensing, managing and business intelligence of RFID tags.

CYBRA owns the trademark for MarkMagic and the registered trademark for EdgeMagic. Both products are protected by use of standard secure software keys that are locked to specific computer serial numbers. Computer source code is not distributed with the products. Both MarkMagic and EdgeMagic run on IBM Power Systems (AIX, System i), UNIX, Linux and Windows servers. MarkMagic and EdgeMagic support popular industry standard databases and are easily integrated with application packages such as SAP, JD Edwards, BPCS and JDA.

MarkMagicTM

CYBRA’s MarkMagic is used worldwide by thousands of companies, including hundreds of apparel manufacturers and retailers, for their special in-house printing and encoding needs. MarkMagic supports over 450 different printer models. The range of printer types supported by MarkMagic includes:

2

| MarkMagic - Printer Types Supported | |

| Thermal transfer | Laser/Page |

| Ticket/Tag | Automatic Applicators |

| Adobe PDF | RFID |

| Fabric Care Label | Portable Thermal |

| Plastic Card | Dot Matrix/Ink Jet |

Classic printing tasks supported by MarkMagic include the production of shipping labels, garment tickets, price tags, pallet labels, packing slips, checks with MICR support, invoices and statements.

MarkMagic’s key features include:

- Ultra-fast print performance

- Ease of integration with customer applications – no programming skills required

- One product for all printing needs – labels, forms, RFID tags, PDF, report writing, faxing

- One product for all computing platforms

- One product for any printer type – supports over 450 types of printers

MarkMagic add-on options:

- FormComposer – full featured report writer

- Print Transformer – printed fields and attributes change on the fly based on user-defined rules

- PDF/email/Fax – email and fax documents, cutting down on paper, postage, labor and errors

- PrintMonitor – application activity triggers printing events based on user-defined rules

- 2D Bar Codes – prints complex bar code types on laser forms, including the popular QR code

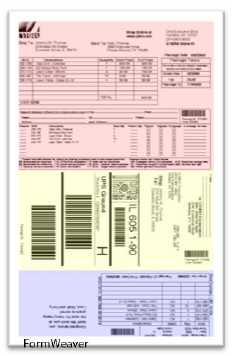

- FormWeaver – merges multiple documents into one form – perfect for shipping direct to consumer

- RFID Encoding – formulates user data to produce smart labels meeting RFID standards

- On Demand Printing –moves user intiated label and form retrieval and printing to a web portal

3

Until recently, MarkMagic addressed the IBM System i market exclusively. In 2010, CYBRA completed a version of MarkMagic called MarkMagic Platform Independent (PI) that is designed to run on all major computing platforms, such as Windows, UNIX and Linux. MarkMagic PI sales to end-user customers began in 2010. A major OEM software partner is planning to roll it out to its customer base in mid-2012.

MarkMagic Version 7, a major new release, was launched in May 2009. It contains the MarkMagic FormsComposer feature that adds full report writing functions to MarkMagic with a simple user interface. The other significant feature introduced in Version 7 is the Print Transformer, which provides MarkMagic users with powerful conditional printing capabilities. Since its initial launch, MarkMagic Version 7 has undergone two upgrade releases, providing improvements in performance, usability and functionality.

The upcoming major new release of MarkMagic, Version 8, is scheduled to launch in May 2012. It will contain an Instant Compliance enhancement which effortlessly upgrades any application to EPC RIFD compliance, including serialization management, in a matter of minutes.

Other significant features to be introduced in Version 8 are:

- QR barcode support

- Field Groups: Headers, Footers, Detail and Calculation groups, including floating footers.

- Live Conditional print preview

EdgeMagic®

With its RFID Encoding add-on option, MarkMagic can print and encode all types of RFID tags – item level, pallet, carton, asset, etc. However, where the real benefits accrue is when MarkMagic is paired with EdgeMagic to allow a manufacturer to improve efficiency in shipping and receiving, and in tracking inventory. Picking orders and puting them away can be done quickly and with a minimum of error. Taking inventory of items on shelves or in warehouses with RFID can be conducted in minutes as opposed to hours using bar code technology.

EdgeMagic is a fully integrated RFID platform that combines the critical functions of managing serialized goods, sensing and storing data, and analyzing the data to provide meaningful management information. EdgeMagic runs on all major computing platforms, but it is the only fully integrated RFID control software that runs on the IBM Power System i. This IBM server is extremely popular with a high percentage of apparel companies. EdgeMagic is just as adept at RFID applications that involve sharing information with a trading partner (“Open Loop”) as it is at applications used for internal benefit (“Closed Loop”). It has built-in interfaces to popular application systems –Manhattan Associates’ Warehouse Management System, JD Edwards, BPCS, etc. With EdgeMagic, a company can start with an RFID pilot representing a relatively small investment in time and money and build up to a full scale, enterprise-wide system. EdgeMagic Dashboards provide business intelligence to easily visualize RFID tag data performance and spot business trends.

Key EdgeMagic features:

- Ultra-fast performance

- Ease of integration with customer applications – weeks not months – rapid ROI

- One product for all RFID needs – EPC and asset tracking

- One product for all computing platforms – and only solution for IBM Power System i

4

- One product for any RFID device type – supports all major RFID device manufacturers

- Scalable from simple pilot to full enterprise solution

Throughout 2007 and 2008 management focused substantially all of the Company’s resources on development and release of EdgeMagic with revenue potential that management believes will be far in excess of the current product mix. EdgeMagic product development remains a high priority for the Company. During 2011, EdgeMagic was enhanced to provide industry specific functionality. Key among those were enhancements for tracking item level apparel and other commodities.

Auto-ID MagicTM Sales Strategy

Together, MarkMagic and EdgeMagic constitute CYBRA’s Auto-ID Magic family of products. CYBRA’s primary sales strategy is to sell through original equipment manufacturers (OEM’s) that bundle MarkMagic and EdgeMagic with their package offerings.

Auto-ID (Automatic Identification) is a term that encompasses a wide range of technologies that allow items to be automatically identified, including Bar Code, RFID Tagging, Magnetic Stripe, Biometrics, etc.

The main benefits of Auto-ID are:

- Reduced human error by eliminating manual look-up and entry;

- Increased speed, reducing labor costs;

- Improved security, as it can be difficult to forge or fool;

- Increased revenue by insuring that products are always available; and

- Significant reductions in personnel training.

The key benefits to the OEM of integrating CYBRA’s Auto-ID Magic family of products are:

- Increased Revenues – OEM’s can generate an additional source of

revenue through sales of CYBRA’s Auto-ID Magic family of products to future

customers as well as to their installed base. With MarkMagic integrated into

their application, their customers can quickly create new labels and change

existing labels with ease, including RFID “smart” labels. With CYBRA’s forms

component, they can eliminate many, or all, of the preprinted forms required

by their application. These net savings give OEM customers a compelling reason

to upgrade their OEM product. Utilizing EdgeMagic, OEM’s can help their

customers with the essential need to comply with trading partner mandates, as

well as developing tracking of their own assets, with ease and at a

competitive price compared to other alternatives.

- Cost Avoidance – OEM’s can greatly reduce, or eliminate, their

staff costs for ongoing source code maintenance and customer support for all

Auto-ID customer requirements. Their staff no longer needs to learn and

maintain competence on complex RFID printer or reader command languages. As

Auto-ID Magic provides a full range of RFID and bar code solutions that run on

all major computing platforms, the burden for the OEM to support multiple

computing environments is dramatically reduced.

- Competitive Advantage – OEM’s can improve their competitive advantage by offering compliance labeling solutions – including the printing of RFID smart labels, and the commissioning, validating and management of RFID tags – to their customers on a wide range of RFID and bar code equipment from numerous manufacturers. OEM’s can avail themselves of a source for all RFID needs – middleware, training, services, equipment, supplies, maintenance and support – without having to develop their own expertise.

In 2012, we are expanding our channel strategy beyond OEM’s to include System Integrators that specialize in Auto-ID solutions. Auto-ID Magic provides the integrator with out-of-the-box solutions that permit work on virtually any computing platform and implement a full scale system in days, rather than weeks or months.

5

THE MARKET

Wal-Mart, along with the U.S. Department of Defense and the FDA, kick-started the entire RFID industry in 2003 when they announced plans for revolutionizing the supply chain with RFID technology. RFID would enable a more visible and effective supply chain and better tracking of corporate assets. Other benefits included lower labor cost, reduced product theft, elimination of counterfeiting and reduced stock outages. According to figures released by the National Retail Foundation, out of stock alone was a $92 billion annual across all retail establishments in 2010.

From the outset, proponents insisted that RFID would dramatically change the way companies track goods in the supply chain. For the next seven years it remained a niche technology, held back by the difficulties its pioneers had pulling in a critical mass of partners. A relatively small number of Wal-Mart’s suppliers had started using RFID since the retailer announced its famous supply chain “mandate”.

All that changed in the middle of 2010.

Retailers at all points on the price spectrum are now embracing RFID and are positioning themselves to gain market share from rivals and operate more intelligently. Wal-Mart has thrown its considerable weight behind item-level RFID in the apparel category as have JCPenney, Macy’s and Dillard’s. The world’s leading specialty apparel retailers — GAP Inc. and Inditex (operator of multiple retail banners, including Zara) — are both devoting energy to RFID, as is Banana Republic. Wal-Mart’s decision to initiate tagging of all men’s jeans, socks, underwear and t-shirts is significant, especially considering that some of the items being tagged sell for less than $5. The significance of the fact that disposable RFID tags are now being applied to millions of items with retail price points of $5 or less shatters the myth that RFID tags are too expensive to provide ROI.

An October 2011 survey of 58 suppliers and 56 retailers in North America, conducted by Accenture – Item-Level RFID Initiative – confirmed that many executives across the entire retail supply chain are convinced that item-level RFID can improve efficiencies and boost sales. More specifically, the results of this survey by Accenture suggest:

- Item-level RFID may be creating a competitive advantage for early adopters by giving them better inventory accuracy, visibility, and insight, enabling them to improve in-stock positions and increase sales.

- For some processes, the technology can now drive improvements several orders of magnitude better than current standard methods. For example, taking a store inventory, once a project of days or weeks, can now be tallied with lightning-fast near-perfect accuracy.

- Costs of RFID tags are falling and will continue to fall as the rate of adoption increases.

- Most major apparel and footwear retailers will adopt RFID technology in some of the business within the next 3-5 years if recent momentum continues.

Stores that utilize RFID become more attractive shopping destinations. Better on-shelf availability, faster checkout and amenities such as “smart” fitting rooms are a powerful draw.

CYBRA anticipated this trend in planning the architecture of its EdgeMagic product. After a number of difficult years in which we waited for the RFID curve to take off, we believe that we are now well positioned to leverage our IP to gain market share with respect to this fast emerging trend.

RFID Business Forecasts

A selection of quotes from recent analyst reports predicts that 2012 will be a growth year for RFID and that apparel will be the principal industry affected.

|

|

Jan 2012 | “58 percent of respondents [in the apparel market] indicated plans to increase RFID budgets in 2012.” |

6

|

|

Oct 2011 | “Apparel RFID will grow at double the rate of the overall RFID market through the next ten years.” |

|

|

Nov 2011 | “…we appear to have reached an inflection point - a level of RFID critical mass never seen before.” |

|

Nov 2010 | “[RFID is]…biggest retail supply chain transformation since the bar code …” |

|

July 2011 |

“…fastest-growing application between now and 2016 will be item-level tracking… will exceed a 37% growth rate. “ “RFID software revenue should approach $500 million in 2016… compound annual growth rate of more than 20%.” “…growth in retail item-level tagging is huge … The average growth rate is close to 60% for the next three years.” |

|

Jan 2011 | “Inventory accuracy of more than 95%, up from an average of 62%. …time savings of 96% out-of-stock reductions of up to 50% ” |

|

|

Jan 2011 |

“40% of 125 survey respondents denote that a pilot store is part of their RFID roll-out strategy” “… consumer goods, apparel, and consumer electronics are top three product categories that retailers are currently tagging or plan to tag.” |

COMPETITION — MarkMagic

CYBRA Corporation’s MarkMagic product family faces competition for each of its feature sets, but it is our belief that no single product, on any platform, offers the wide range of output device and document support that MarkMagic brings to the marketplace.

MarkMagic’s advantage is that besides addressing the key requirements of thermal bar code label and RFID printing, it alone provides virtually all other printing needs that customers may demand. Only MarkMagic supports all the following printer devices and document types:

-

Thermal bar code tags

-

Thermal care labels

-

RFID smart labels

-

Laser printed bar code documents

-

Ink jet printed documents

7

-

Plastic ID cards with magnetic stripe encoding

-

Fabric care labels

-

Double sided direct thermal shipping/packing list labels

In our legacy direct market, which can be defined as IBM Power System i users of bar code and RFID labeling, CYBRA faces one major competitor, T.L. Ashford of Covington, Kentucky, a private company of similar size to CYBRA. The competitor entered the bar code labeling software arena a few years before we did. To the best of our knowledge, the competitor has a larger base of System i bar code labeling customers than we have. We estimate their customer base at around more than 4,000. The competitor’s base price is lower than ours, but we believe that additional features can level out the price difference. To the best of our knowledge, the competitor sells software only, and does not offer bar code and RFID equipment, supplies or services.

We began to expand the MarkMagic product beyond the IBM Power System i platform in 2010 and we anticipate a number of competitors on those other platforms – Windows, UNIX, Aix, Linux. We believe that many of these competitors are well financed and have large customer installed bases. We expect CYBRA’s appeal to end user customers will be based on our feature set, multiple platform support, multiple document type support, and experience and track record in integrating with business software packages and the upgrade path we provide to those requiring or anticipating a full RFID control solution. Our prime target customers – software OEM companies and system integrators – tend to be attracted to CYBRA for ease of integration into their software packages, multiple platforms supported, the wide range of capabilities available (thus lowering their R&D burden) and competitive discount structure.

Enterprise barcode labeling software vendors in the non-IBM Power System i space include:

- Loftware

- Teklynx

- Seagull Scientific

- Niceware

- Unibar

COMPETITION — EdgeMagic

In the RFID market, we anticipate that we will face many competitors as the market grows. Many of these will be large companies, both public and private. There are, to our knowledge, currently no clearly dominant companies in the RFID space. We anticipate that CYBRA’s appeal will be based on our multiple platform support and our experience and track record in providing solutions for developers of business software packages.

Currently, Tyco Retail Solutions, Checkpoint Systems and Xterprise are the leaders in RFID production and implementation. Other manufacturers and providers of RFID to the retail industry include companies such as Impinj, Intermec and Avery Dennison.

CYBRA’s EdgeMagic product faces well financed competition for each of its feature sets, but we believe that no single product offers the integrated solution that EdgeMagic brings to the IBM Power System i platform.

EdgeMagic’s competitive advantage is that the functions of RFID tag reading and device control it provides are native to the System i platform. No PC’s or additional servers are required. The EdgeMagic solution significantly reduces the systems’ integration effort required to install competing solutions.

Competing Windows, Linux, or Unix-based solutions may have more functions, but each installation in a System i environment requires custom programming to match up System i files and programs with RFID data.

8

We believe that EdgeMagic alone provides a tightly integrated solution that has the functions System i customers require, yet offers the flexibility for System i customers to implement advanced RFID applications without costly custom programming.

On platforms other than System i, EdgeMagic’s advantages are ease and speed of integration, superior performance, ease of use and scalability.

Included certified EPC-compliant label templates, pre-configured interfaces to leading ERP and WMS packages, and modular device control allow customers to roll out both open loop and closed loop industrial strength RFID solutions in far less time than with competing solutions.

High-end competitors (selling a suite of products to a specific industry) include:

- BEA Weblogic RFID Platform Edge Server

- Fluensee

- Globeranger

- IBM

- InSync

- OAT Systems (Owned by Checkpoint)

- Odin Technologies

- Omnitrol Networks

- RFID GlobalSolution

- S3Edge

- Stratum Global

- TAGSYS

- Vue Technology (Owned by Tyco)

- Xterprise

Low end (selling stand-alone tools that are not industry-specific) includes EPCSolutions Tag Manager.

PARTNERSHIPS

CYBRA has established partnerships with key bar code and RFID companies. CYBRA partners fall into one or more of the following categories:

- OEM partners who have integrated MarkMagic into their application software products that also sell through VARs and Systems Integrators.

- Technology Partners with whom CYBRA works closely to support their printing technologies or computing platforms. CYBRA has relationships with their VAR channels.

- Channel Partners whose products CYBRA resells to provide a single source for a customer’s entire bar code label and RFID needs. The table below contains a list of our key partners, the type of relationship(s) and the product(s) involved:

| Company | OEM | Technology | Channel | Product |

| Apparel Business Systems | [ x ] | MarkMagic Labels Development | ||

| Infor | [ x ] | MarkMagic Labels Runtime | ||

| Manhattan Assoc. | [ x ] | MarkMagic Labels Runtime | ||

| Network Systems | [ x ] | MarkMagic Labels Development |

9

| Company | OEM | Technology | Channel | Product |

| Vormittag Assoc. | [ x ] | MarkMagic Enterprise Development | ||

| Wynne Systems | [ x ] | MarkMagic Labels Development | ||

| Avery Dennison |

[ x ] |

[ x ] |

Printers,

Supplies, and RFID Encoders and Care Label Printers and Supplies | |

| Datamax |

[ x ] |

[ x ] |

Printers, Supplies, and RFID

Encoders | |

| HP | [ x ] | [ x ] | HP PCL laser printers | |

| IBM |

[ x ] |

[ x ] |

Printers, Supplies, and RFID

Encoders, System servers | |

| Intermec |

[ x ] |

[ x ] |

Printers,

Supplies, and RFID Encoders | |

| Impinj | [ x ] | [ x ] | RFID Readers and antennas | |

| Motorola |

[ x ] |

[ x ] |

RFID Readers,

Mobile Computers, Wireless Networks, Bar Code Scanners | |

| Printronix |

[ x ] |

[ x ] |

Printers, Supplies, and RFID

Encoders | |

| Psion Teklogix |

[ x ] |

[ x ] |

RFID Readers,

Mobile Computers, Wireless Networks | |

| SATO |

[ x ] |

[ x ] |

Printers, Supplies, and RFID

Encoders | |

| Zebra |

[ x ] |

[ x ] |

Label and Plastic

Card Printers, Supplies, and RFID Encoders | |

| Alien Technologies | [ x ] | RFID UHF readers and tags | ||

| Microscan | [ x ] | Fixed bar code scanners | ||

| Tagsys | [ x ] | RFID HF and UHF readers and tags |

CYBRA’s key distributors and resellers are Manhattan Associates, Inc., Vormittag Associates, Inc., Apparel Business Systems, LLC and Solzon Corporation.

On October 20, 1998, the Company signed a five-year Software License, Sublicensing and Distribution Commitment Agreement (the “License Agreement”) with Manhattan Associates, Inc. (“MAI”). The License Agreement automatically renews on a year-to-year basis unless cancelled by either party 30 days prior to each renewal date. Pursuant to the License Agreement, the Company granted to MAI a worldwide non-exclusive license to market and sell its MarkMagic software and related products. MAI pays to the Company a per copy license fee for copies of MarkMagic licensed by MAI or its distributors to end user customers. MAI has agreed to provide support to its customers, and CYBRA has agreed to provide back-up support to MAI. The License Agreement

10

contains other standard provisions such as a source code escrow, copyright indemnification and limitation of warranties.

Effective April 20, 2007, the Company entered into a two year OEM Software Licensing Agreement with Vormittag Associates, Inc. (“VAI”) (the “VAI Agreement”). Pursuant to the VAI Agreement the reseller is granted marketing rights to the MarkMagic and EdgeMagic suite of software products and ancillary products in the United States and Canada. Thus VAI became the first OEM reseller for EdgeMagic. The VAI Agreement provides for set commissions on the sale of products based upon the then current list price. The VAI Agreement contains confidentiality provisions, warranty and support obligations of CYBRA and the reseller’s provisions governing selling methods, and related standard provisions. The VAI Agreement automatically renews for additional one-year periods unless either party notifies the other of its intention to terminate at least 30 days prior to any termination or renewal date. Each party may terminate the VAI Agreement by notifying the other party of its intent to do so three months in advance without cause.

Effective October 23, 2006, the Company entered into a two-year Domestic Reseller Agreement with Apparel Business Systems, Inc. (“ABS”) (the “Reseller Agreement”). Pursuant to this Reseller Agreement the Company granted ABS marketing rights to the MarkMagic suite of software products and ancillary products in the United States and Canada. The Reseller Agreement provides for set commissions on the sale of products based upon the then current list price. The Reseller Agreement contains confidentiality provisions, warranty and support obligations of CYBRA and the reseller’s provisions governing selling methods, and related standard provisions. The Reseller Agreement automatically renews for additional one-year periods unless either party notifies the other of its intention to terminate at least 30 days prior to any termination or renewal date. Each party may terminate the Reseller Agreement by notifying the other party of its intent to do so three months in advance without cause.

Effective August 27, 2007, CYBRA entered into three agreements with Solzon Corporation, Nashua, New Hampshire: (1) a Technology License Agreement; (2) a Contractor Agreement for System Integration and Consulting Services; and (3) a Reseller Agreement (the “Solzon Agreements”). Pursuant to the Solzon Agreements, Solzon has assigned to CYBRA a perpetual world-wide license to utilize Solzon’s RFID for iSeries Product and Solzon has agreed to provide support of the installation and configuration of CYBRA’s EdgeMagic Application Software at certain of CYBRA’s customer facilities. Pursuant to these Agreements, Solzon will abandon future development of Solzon’s products and for so long as Solzon is a reseller of CYBRA’s products, and for a period of two years thereafter, Solzon will cease all sales and marketing of its products to any third party. Solzon will be available to answer customers’ RFID and associated questions regarding application and customer needs. In addition, the parties entered in a two-year “Premier Reseller Software Licensing Agreement” (the “PRSLA”), pursuant to which Solzon will market and sell CYBRA’s suite of software products anywhere in the world. The PRSLA provides for set commissions on the sale of products based upon the then current list price. The PRSLA contains confidentiality provisions, warranty and support obligations of CYBRA and the reseller’s provisions governing selling methods, and related standard provisions. The PRSLA automatically renews for additional one-year periods unless either party notifies the other of its intention to terminate at least 30 days prior to any termination or renewal date. Each party may terminate the PRSLA by notifying the other party of its intent to do so three months in advance without cause. For so long as Solzon acts as a reseller of CYBRA’s products, and for a period of two years thereafter, Solzon has agreed not to compete with CYBRA’s business.

Research and Development

In fiscal year 2011, the Company spent $242,675 on Research and Development activities and in fiscal year 2010, the Company spent $215,772 on Research and Development activities. For the years ended December 31, 2011 and 2010, all costs were borne directly by CYBRA. No customers paid for these activities in any direct manner.

Employees

As of March 15, 2012, the Company employed 12 full time employees. In addition, the Company retains the services of consultants and other third-parties on an as-needed basis.

11

Stock Option Plan

The Company adopted an Incentive Stock Plan on April 30, 2006 and has reserved 5,000,000 shares of its Common Stock for issuance thereunder.

ITEM 1A. Risk Factors

There are numerous and varied risks, known and unknown, that may prevent us from achieving our goals, including those described below. The risks described below are not the only ones we will face. Additional risks not presently known to us or that we currently believe are immaterial may also impair our financial performance and business operations. If any of these risks actually occurs, our business, financial condition or results of operations may be materially adversely affected.

We may not be able to pay, refinance or otherwise satisfy our obligations under certain of the 8% Convertible Debentures (the “Debentures”).

We did not pay the Debentures when they became due on April 10, 2011. Holders of Debentures having an aggregate principal amount of $1,195,000 have agreed to extend the term of their Debentures until December 31, 2012. We can provide no assurance that we will be able to generate adequate revenue from our operations to pay such Debentures when they mature or to refinance or further extend the term of the Debentures at that time.

We may not be able to generate sufficient cash flow or raise sufficient capital to successfully operate or expand our business.

Our continued operations will depend upon the availability of cash flow from operations and our ability to raise additional funds through various financing methods. If sales or revenues do not meet expectations, or cost estimates for development and expansion of our business prove to be inadequate, we will require additional funding. If additional capital cannot be obtained, we may have to delay or postpone acquisitions, development or other expenditures, which can be expected to harm our competitive position, business operations and growth potential. There can be no assurance that cash flow from operations will be sufficient to fund our financial needs, or if such cash flow is not sufficient, that additional financing will be available on satisfactory terms, if at all. Changes in capital markets and the cost of capital are unpredictable. Any failure to obtain such financing, or obtaining financing on unfavorable terms, can be expected to have a material adverse effect on our business, financial condition, results of operations and future business prospects.

We have had limited revenues and experienced significant net losses thus far.

To date, we have had limited revenues. We had revenues of $1,800,654 and $1,605,744 in fiscal years 2011 and 2010, respectively. In fiscal year 2011, we had a net loss of $208,202 and in fiscal year 2010, we had a net loss of $2,491,966. Because we are subject to all risks inherent in a business venture it is not possible to predict whether or not our current and proposed activities will be sufficiently profitable. Prospective purchasers of our securities should bear in mind that, in light of the risks and contingencies involved, no assurance can be given that we will ever generate enough revenue to offset expenses or to generate a return on invested capital. There is no guarantee of our successful, profitable operation. Our failure to achieve or maintain profitability can be expected to have a material adverse effect on our business, financial condition, results of operations and future business prospects.

We may experience significant fluctuations in our operating results and rate of growth and may not be profitable in the future.

Our results of operations may fluctuate significantly due to a variety of factors, many of which are outside of our control and difficult to predict. The following are some of the factors that may affect us from period to period and may affect our long-term financial performance:

- our ability to retain and increase revenues associated with customers and satisfy customers’ demands;

12

-

our ability to be profitable in the future;

-

our investments in longer-term growth opportunities;

-

our ability to expand our marketing network, and to enter into, maintain, renew and amend strategic alliance arrangements on favorable terms;

-

changes to offerings and pricing by us or our competitors;

-

fluctuations in the size of our customer base, including fluctuations caused by marketing efforts and competitors’ marketing and pricing strategies;

-

the effects of commercial agreements and strategic alliances and our ability to successfully integrate them into our business;

-

technical difficulties, system downtime or interruptions;

-

the effects of litigation and the timing of resolutions of disputes;

-

the amount and timing of operating costs and capital expenditures;

-

changes in governmental regulation and taxation policies;

-

events, such as a sustained decline in our stock price, that cause us to conclude that goodwill or other long-term assets are impaired and for which a significant charge to earnings is required; and

-

changes in, or the effect of, accounting rules on our operating results.

The market for RFID services may not develop as anticipated, which would adversely affect our ability to execute our business strategy.

The success of our RFID offerings depends on growth in the number of RFID users, which in turn depends on wider public acceptance of RFID software solutions. The RFID market is in its early stages and may not develop as rapidly as is expected. Potential new users may view RFID as unattractive relative to traditional bar code products for a number of reasons, including implementation, procurement, integration and supply costs, greater technical complexity, immature technology, consumer privacy concerns, or the perception that the performance advantage for RFID is insufficient to justify the increased costs. There is no assurance that RFID will ever achieve broad user acceptance.

We may not successfully enhance existing products and services or develop new products and services in a cost-effective manner to meet customer demand in the evolving market for bar code and RFID software services.

The market for bar code and RFID software solutions is characterized by evolving technology and industry standards, changes in customer needs and frequent new product introductions. We are currently focused on enhancing our RFID capabilities through wider device coverage, additional application coverage and supporting other computing platforms beyond the System i. Our future success will depend, in part, on our ability to use leading technologies effectively, to continue to develop our technical expertise, to enhance our existing services and to develop new services that meet changing customer needs on a timely and cost-effective basis. We may not be able to adapt quickly enough to changing technology, customer requirements and industry standards. If we fail to use new technologies effectively, to develop our technical expertise and new services, or to enhance existing services on a timely basis, either internally or through arrangements with third parties, our product and service offerings may fail to meet customer needs, which would adversely affect our revenues and prospects for growth.

13

RFID solutions may have technological problems or may not be accepted by customers. To the extent we pursue commercial agreements, acquisitions and/or strategic alliances to facilitate new product activities, the agreements, acquisitions and/or alliances may not be successful. If any of this were to occur, it could damage our reputation, limit our growth, negatively affect our operating results and harm our business.

Intense competition could reduce market share and harm financial performance.

The market for bar code and RFID encoding software is emerging, intensely competitive and characterized by rapid technological change.

Bar code and RFID software companies compete for customers based on industry experience, know-how, technology and price, with the dominant providers conducting extensive advertising campaigns to capture market share. Many of our competitors have (i) greater financial, technical, engineering, personnel and marketing resources; and (ii) better name recognition. These advantages afford our competitors the ability to (a) offer greater pricing flexibility, (b) offer more attractive incentive packages to encourage resellers to carry competitive products, (c) negotiate more favorable distribution contracts with resellers and (d) negotiate more favorable contracts with suppliers. We believe additional competitors may be attracted to the market, including IBM, Oracle, Microsoft, and HP. We also believe existing competitors are likely to continue to expand their offerings.

Current and prospective competitors include many large companies that have substantially greater market presence and greater financial, technical, marketing and other resources than we have. We compete directly or indirectly with the following categories of companies:

-

System i Label Software

-

System i Forms Software

-

UNIX/Linux/Windows Label Software

-

UNIX/Linux/Windows Forms Software

-

UNIX/Linux/Windows RFID Edge Software

As competition in the bar code and RFID market continues to intensify, competitors may continue to merge or form strategic alliances that would increase their ability to compete with us for customers. These relationships may negatively impact our ability to form or maintain our own strategic relationships and could adversely affect our ability to expand our customer base. Because we operate in a highly competitive environment, the number of customers we are able to add may decline, and the cost of acquiring new customers through our own sales and marketing efforts may increase.

Our ability to compete effectively in the bar code and RFID services industry will depend upon our ability to (i) continue to provide high quality products and services at prices competitive with, or lower than, those charged by our competitors and (ii) develop new and innovative products and services. There can be no assurance that competition from existing or new competitors or a decrease in prices by competitors will not have a material adverse effect on our business, financial condition and results of operations, or that we will be able to compete successfully in the future.

We may not be able to keep up with rapid technological and other changes.

The industry in which we compete is characterized, in part, by rapid growth, evolving industry standards, significant technological changes and frequent product enhancements. These characteristics could render our existing systems and strategies obsolete, and require us to continue to develop and implement new products and services, anticipate changing customer demands and respond to emerging industry standards and technological changes. We intend to evaluate these developments and others that may allow us to improve service to our customers. However, no

14

assurance can be given that we will be able to keep pace with rapidly changing customer demands, technological trends and evolving industry standards. The failure to keep up with such changes is likely to have a material adverse effect on our business, long-term growth prospects and results of operations.

We are dependent on strategic relationships.

Our business is dependent, in part, upon current relationships and those we intend to develop with suppliers, distributors and resellers in various markets and other third parties. The failure to develop or maintain these relationships could result in a material adverse effect on our financial condition and results of operations.

Reliance upon third-party suppliers for components may place us at risk of interruption of supply or increase in costs.

We rely on third-party suppliers for certain hardware and software necessary for our services and we do not have any long-term supply agreements. Although we believe we can secure other suppliers, we expect that the deterioration or cessation of any relationship would have a material adverse effect, at least temporarily, until the new relationships are satisfactorily in place. Adverse affects could limit our ability to fill customer orders for bar code and RFID hardware and supplies, resulting in potential loss of revenues and loss of goodwill. Replacing any one supplier could take weeks.

Ongoing success and our ability to compete depend upon hiring and retention of key personnel.

Success will be dependent to a significant degree upon the involvement of current management, especially Harold Brand, our CEO. These individuals have critical industry experience and relationships upon which we rely. The loss of services of any of our key personnel could divert time and resources, delay the development of our business and negatively affect our ability to sell our products and services or execute our business plan. In addition, we will need to attract and retain additional talented individuals in order to carry out our business objectives. The competition for such persons is intense and there are no assurances that these individuals will be available. Such problems might be expected to have a material adverse impact on our financial condition, results of operations and future business prospects.

We are subject to control by officers and management and there could be conflicts of interest with management that may be adverse to your interests.

Management of CYBRA currently beneficially owns approximately 57.6% of the outstanding shares of our Common Stock. As a result, management possesses meaningful influence and control over the Company, and may be able to control and direct the Company’s affairs, including the election of directors and approval of significant corporate transactions for the foreseeable future.

A conflict of interest may arise between our management’s personal pecuniary interest and its fiduciary duty to our shareholders. Conflicts of interest create the risk that management may have an incentive to act adversely to the interests of other investors. Such influence may not necessarily be consistent with the interests of our other shareholders.

Director and officer liability is limited.

As permitted by New York law, our certificate of incorporation limits the personal liability of directors to the fullest extent permitted by the provisions of New York Business Corporation Law. As a result of our charter provision and New York law, shareholders may have limited rights to recover against directors for breach of fiduciary duty.

If we raise additional funds through the issuance of equity securities, or determine in the future to register additional Common Stock, your percentage ownership will be reduced, you will experience dilution which could substantially diminish the value of your stock and such issuance may convey rights, preferences or privileges senior to your rights, which could substantially diminish your rights and the value of your stock.

15

We may issue additional shares of Common Stock for various reasons and may grant additional stock options to employees, officers, directors and third parties. If we determine to register for sale to the public additional shares of Common Stock or other debt or equity securities in any future financing or business combination, a material amount of dilution can be expected to cause the market price of the Common Stock to decline. One of the factors that generally affects the market price of publicly traded equity securities is the number of shares outstanding in relationship to assets, net worth, earnings or anticipated earnings. Furthermore, the public perception of future dilution can have the same effect even if actual dilution does not occur.

In order for us to obtain additional capital, complete a business combination, or refinance the Debentures, we may find it necessary to issue securities, including but not limited to debentures, options, warrants or shares of preferred stock, conveying rights senior to those of the holders of Common Stock. Those rights may include voting rights, liquidation preferences and conversion rights. To the extent senior rights are conveyed, the value of the Common Stock can be expected to decline.

The existence of outstanding warrants, debentures, preferred stock and shares available under our Incentive Stock Plan may harm our ability to obtain additional financing and their exercise will result in dilution to your interests.

We have 1,023,669 outstanding Class A Warrants exercisable at $0.75 per share, which expire in March 2013 and 7,876,735 outstanding Class B Warrants exercisable at prices ranging from $1.00 to $1.75 per share, which expire in March and April, 2013. Holders of certain Class B Warrants may not exercise the warrant if, after giving effect to the issuance of shares after exercise, such holder would beneficially own more than 4.99% of our outstanding shares.

We also have 2,840,000 shares of Common Stock issuable upon exercise of the outstanding Debentures, and an additional 2,090,000 shares of Common Stock issuable upon exercise of an equal number of shares of Series A Preferred Stock. The Debentures and the Series A Preferred Stock are generally convertible into shares of Common Stock at any time at the option of the holders thereof.

Further, we have 5 million shares of Common Stock available for the grant of stock options and other grants of equity-based compensation under our 2006 Incentive Stock Plan.

The warrants contain standard anti-dilution provisions in the event of stock dividend, splits or other dilutive transactions. While these various securities are outstanding or otherwise available for grant, our ability to obtain future financing may be harmed. Upon exercise of these warrants, conversion of debentures or preferred stock or exercise of options or grants of other equity-based awards, substantial dilution to your ownership interests will occur as the number of shares of Common Stock outstanding increases.

We have identified material weaknesses in our internal controls over financial reporting.

In response to the material weaknesses that management identified in connection with its assessment of internal control over financial reporting for the year ended December 31, 2010, management has taken certain remedial measures that we believe will correct the design and operational effectiveness of such internal controls; however, we cannot guarantee that such remedial measures will actually correct the design and operational effectiveness of internal controls and that in the future we will not discover additional material weaknesses in internal control over financial reporting.

Penny stock regulations may impose certain restrictions on marketability of the Company’s securities.

We are subject to rules pertaining to “penny stocks”. The SEC has adopted regulations which generally define a “penny stock” to be any equity security that has a market price (as defined) of less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our shares have not had a market price of or greater than $5.00 per share since they began trading, nor is it likely that they will attain such price in the foreseeable future. As a result, our Common Stock will be subject to rules that impose additional sales practice requirements on broker-dealers who sell such securities to persons other than established clients and “accredited

16

investors”. For transactions covered by these rules, the broker-dealer must make a special suitability determination for the purchase of such securities and have received the purchaser’s written consent to the transaction prior to the purchase. Additionally, for any transaction involving a penny stock, unless exempt, the rules require the delivery, prior to the transaction, of a risk disclosure document mandated by the SEC relating to the penny stock market. The broker-dealer must also disclose the commission payable to both the broker-dealer and the registered representative, current quotations for the securities and, if the broker-dealer is the sole market maker, the broker-dealer must disclose this fact and the broker-dealer’s presumed control over the market. Finally, monthly statements must be sent disclosing recent price information for the penny stock held in the account and information on the limited market in penny stocks. Consequently, the “penny stock” rules may restrict the ability of broker-dealers to sell shares of our Common Stock and may affect the ability of investors to sell such shares of Common Stock in the secondary market and the price at which such investors can sell any of such shares.

Investors should be aware that, according to the SEC, the market for penny stocks has suffered in recent years from patterns of fraud and abuse. Such patterns include:

-

control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer;

-

manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases;

-

“boiler room” practices involving high pressure sales tactics and unrealistic price projections by inexperienced sales persons;

-

excessive and undisclosed bid-ask differentials and markups by selling broker-dealers; and

-

the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the inevitable collapse of those prices with consequent investor losses.

Our management is aware of the abuses that have occurred historically in the penny stock market.

Our Common Stock is thinly traded, and as a result, the market price for our Common Stock may be particularly volatile, which could lead to wide fluctuation in our share price, as the sale of substantial amounts of our Common Stock in the public market could depress the price of our Common Stock.

The trading volume of our Common Stock on the OTC Bulletin Board has been relatively low when compared with larger companies listed on the OTC Bulletin Board or other stock exchanges. Thinly traded stocks, such as ours, can be more volatile than stocks trading in an active public market. Because of this, our shareholders may not be able to sell their shares at the volumes, prices, or times that they desire.

We cannot predict the effect, if any, that future sales of our Common Stock in the market, or availability of shares of our Common Stock for sale in the market, will have on the market prices of our Common Stock. Therefore, we can give no assurance that sales of substantial amounts of our Common Stock in the market, or the potential for large amounts of sale in the market, would not cause the price of our Common Stock to decline or impair our ability to raise capital through sales of our Common Stock.

The market price of our Common Stock may fluctuate in the future, and these fluctuations may be unrelated to our performance. General market price declines or overall market volatility in the future could adversely affect the price of our Common Stock, and the current market price may not be indicative of future market prices.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not applicable.

17

ITEM 2. DESCRIPTION OF PROPERTY

The Company maintains its administrative and R&D offices in approximately 3,400 square feet of space located at One Executive Blvd., Yonkers, New York 10701 under a lease that expires January 31, 2014. Monthly rent for the remainder of the term of the lease will be $6,689, which includes electricity.

CYBRA also leases approximately 1,100 square feet in West Seneca (Buffalo), New York for sales and customer support. The Company is leasing this space for a period of two years, beginning June 1, 2010. Monthly rent is currently $945. On June 1, 2012 it will be increased to $964. Electricity is billed directly from the utility company.

ITEM 3. LEGAL PROCEEDINGS

None.

ITEM 4. Mine Safety Disclosures.

N/A

18

PART II

ITEM 5. MARKET FOR COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES.

Trading in our Common Stock began in the third quarter of 2008. Our Common Stock is currently quoted on the OTC Bulletin Board under the symbol “CYRP”. The following table sets forth the range of high and low bid prices per share of our Common Stock for each of the calendar quarters identified below as reported by the OTC Bulletin Board. These quotations represent inter-dealer prices, without retail mark-up, markdown or commission, and may not represent actual transactions. It should be noted that although there may have been sales of the Common Stock during the periods set forth below, there may not have been quotes reported by the OTC Bulletin Board. This is reflected in the columns below with dashes. The zeroes in the table below indicate when there were two market makers posting a zero quote.

| 2011: | High | Low | ||||

| Quarter ended March 31, 2011 | $ | 0.00 | $ | 0.00 | ||

| Quarter ended June 30, 2011 | $ | 0.00 | $ | 0.00 | ||

| Quarter ended September 30, 2011 | $ | - | $ | - | ||

| Quarter ended December 31, 2011 | $ | 0.10 | $ | 0.05 |

| 2010: | High | Low | ||||

| Quarter ended March 31, 2010 | $ | 0.51 | $ | 0.10 | ||

| Quarter ended June 30, 2010 | $ | 0.59 | $ | 0.50 | ||

| Quarter ended September 30, 2010 | $ | 0.60 | $ | 0.25 | ||

| Quarter ended December 31, 2010 | $ | 0.55 | $ | 0.15 |

Holders

As of March 15, 2012, there were 98 record owners of our Common Stock.

Dividends

Holders of Common Stock are entitled to receive dividends as may be declared by our Board of Directors and, in the event of liquidation, to share pro rata in any distribution of assets after payment of liabilities and payment of the liquidation preference to holders of our preferred stock. The Board of Directors is not obligated to declare a dividend. In addition, the terms of the Debentures and preferred stock restrict our ability to pay dividends. We have not paid any dividends and do not have any current plans to pay any dividends.

Recent Sales of Unregistered Securities

None.

19

Securities Authorized For Issuance under Equity Compensation Plan

| Number of securities | |||

| remaining available for | |||

| Number of securities | Weighted-average | future issuance under | |

| to be issued upon exercise | exercise price of | equity compensation plan | |

| of outstanding options, | outstanding options, | (excluding securities | |

| Plan Category | warrants and rights | warrants and rights | reflected in column (a) |

| (a) | (b) | (c) | |

| Equity compensation plans approved by security holders |

— |

— |

4,921,046 |

| Equity compensation plans not approved by security holders |

— |

— |

— |

| Total | — | 4,921,046 |

ITEM 6. SELECTED FINANCIAL DATA

Not applicable

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS AND PLAN OF OPERATIONS

This report on Form 10-K contains forward-looking statements. Forward-looking statements are statements not based on historical information and that relate to future operations, strategies, financial results or other developments. Forward-looking statements are necessarily based upon estimates and assumptions that are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond our control and many of which, with respect to future business decisions, are subject to change. These uncertainties and contingencies can affect actual results and could cause actual results to differ materially from those expressed in any forward-looking statements made by us or on our behalf. We disclaim any obligation to update forward-looking statements.

Comparison of the years ended December 31, 2011 and 2010

The following table summarizes certain aspects of our results of operations for the years ended December 31, 2011 and 2010

| Years Ended | ||||||||||||

| December 31, | ||||||||||||

| 2011 | 2010 | Change $ | Change % | |||||||||

| Revenues | ||||||||||||

| Products | 884,739 | $ | 806,980 | $ | 77,759 | 10% | ||||||

| Services | 915,915 | 798,764 | 117,151 | 15% | ||||||||

| Total Revenues | 1,800,654 | 1,605,744 | 194,910 | 12% | ||||||||

| Direct Costs | ||||||||||||

| Equipment Purchases | 345,909 | $ | 143,272 | $ | 202,637 | 141% | ||||||

| Royalties & Consulting | 48,561 | 50,243 | (1,682 | ) | -3% | |||||||

| Total Direct Costs | 394,470 | $ | 193,515 | $ | 200,955 | 104% | ||||||

| % of total revenues | 22% | 12% | ||||||||||

| Gross margin | 1,406,184 | $ | 1,412,229 | $ | (6,045 | ) | 0% | |||||

| % of total revenues | 78% | 88% | ||||||||||

20

| Years Ended | ||||||||||||

| December 31, | ||||||||||||

| 2011 | 2010 | Change $ | Change % | |||||||||

| Research and development costs | 242,675 | $ | 215,772 | $ | 26,903 | 12% | ||||||

| % of total revenues | 13% | 13% | ||||||||||

| Sales and marketing expenses | 138,737 | $ | 173,550 | $ | (34,813 | ) | -20% | |||||

| % of total revenues | 8% | 11% | ||||||||||

| General and administrative expenses | 1,167,645 | $ | 1,594,243 | $ | (426,598 | ) | -27% | |||||

| % of total revenues | 65% | 99% | ||||||||||

| Interest expense | 114,459 | $ | 173,616 | $ | (59,157 | ) | -34% | |||||

| % of total revenues | 6% | 11% | ||||||||||

| Other Income (Expenses) | 49,130 | $ | (1,747,014 | ) | $ | 1,796,144 | -103% | |||||

| % of total revenues | 3% | -109% | ||||||||||

| Income (Loss) Before Taxes | (208,202 | ) | $ | (2,491,966 | ) | $ | 2,283,764 | -92% | ||||

| % of total revenues | -12% | -155% | ||||||||||

| Cash and cash equivalents | 54,535 | 24,335 | 30,200 | 55% | ||||||||

| Working capital deficit | (2,517,483 | ) | (2,410,668 | ) | (106,815 | ) | 4% | |||||

| Net cash used in operating activities | 38,175 | 64,847 | (26,672 | ) | -70% | |||||||

| Net cash used in investing activities | (18,447 | ) | (16,357 | ) | (2,090 | ) | 11% | |||||

| Net cash provided by financing activities | 86,822 | 47,500 | 39,322 | -100% | ||||||||

Revenues

Revenues were $1,800,654 and $1,605,744 for the years ended December 31, 2011 and 2010. This is an increase of $194,910 or 12% for the year ended December 31, 2011 as compared to 2010. Sales for our most recent RFID product, EdgeMagic, increased 63% during 2011, mirroring the general trend of increased market acceptance of RFID technology, particularly in the apparel sector. Demand for services showed an increase as RFID projects are more service intensive than our traditional mix. We expect these trends to continue contributing to positive growth in revenues in 2012.

Direct Costs

The costs for equipment that was resold to customers increased 141% from $143,372 to $345,909 for the year ended December 31, 2011 as compared to 2010. As EdgeMagic sales tend to be more of an “end-to-end” solution than MarkMagic sales, the increase in EdgeMagic sales resulted in an increase in sales of hardware, supplies and services.

21

Gross Margin

Gross Margin as a percentage of sales for the year ended December 31, 2011 was 78% as compared to 88% in the year ended December 31, 2010. This was due to an increase in EdgeMagic projects that include a higher concentration of lower margin hardware and supplies than our traditional mix of MarkMagic sales.

Research and Development Costs

Research and development costs for the year ended December 31, 2011 as compared to December 31, 2010 increased 12% from $215,772 to $242,675. These costs consisted primarily of compensation of development personnel, related overhead incurred to develop EdgeMagic and upgrades and to enhance our current products, and fees paid to outside consultants. Substantially all of these expenses have been incurred by us in the United States. Software development costs are accounted for in accordance with ASC 985-20-25, Research and Development Costs of Computer Software, under which we are required to capitalize software development costs between the time technological feasibility is established and the product is ready for general release. Costs that do not qualify for capitalization are charged to research and development expense when incurred. Our EdgeMagic software product was available for general release on September 1, 2010, and all costs after that date have been expensed in accordance with ASC 985-20-25. During the years ended December 31, 2011 and 2010, the software development costs that were expensed were $102,104 and $226,605, respectively.

Sales and Marketing Expenses

Sales and marketing expenses consisted primarily of commissions, trade shows, advertising and promotional expenses. There was a decrease of 20% from $173,550 in 2010 to $138,737 in 2011. This is due to lower sales commissions paid out in 2011 and a reduced reliance on sales consultants.

General and Administrative Expense

General and administrative expenses consisted primarily of costs associated with our executive, financial, human resources and information services functions. General and administrative expenses decreased 27% from $1,594,243 to $1,167,645 for the years ended December 31, 2011 and 2010, respectively. This reflects managements’ ongoing commitment to control costs as well as a substantial drop in amortization. Specific categories of cost reduction in 2011 included payroll, insurance, legal fees and stock based compensation.

Interest Expense

Interest expense for the years ended December 31, 2011 as compared to the same period in 2010 decreased by 34% from $173,616 to $114,459. Interest expense in 2010 represented interest accrued on, and amortization of deferred financing costs related to, the 8% Convertible Debentures originally due April 10, 2009 (the “Debentures’). Amortization of these deferred financing costs ceased in April 2009 and standard interest continued to accrue on the Debentures. On June 8, 2010, holders of our Debentures having an aggregate principal amount of $1,445,000 converted outstanding interest due through April 2010 into shares of common stock. On the same date, 16 holders of Debentures having an aggregate principal amount of $1,045,000 agreed to exchange their Debentures for a new class of preferred stock of the Company having terms similar to those in the Debentures. This reduction in principal on which interest was calculated resulted in decreased interest expense for year ended December 31, 2011.

Other Income (Expense)

Other income and expenses decreased for the year ended December 31, 2011 compared to 2010 because in 2010 we recorded net charges of $1,763,303 related to restructuring the 8% debentures. Other Income (expense) decreased from ($1,920,630) in 2010 to ($65,329) in 2011. Large expenses in 2010 were recorded in connection with the renegotiation and restructuring of the Debentures in 2010, whereas no such expenses were recorded in 2011. In addition, interest expense was partially offset in 2011by income from a refundable state tax credit and interest.

22

Provision for Income Taxes

The provision for income taxes consists of provisions for state franchise taxes.

We recorded no income tax expense or benefit for the years ended December 31, 2011 and 2010. The effective tax rate of 0% differs from the statutory U.S. federal income tax rate of 35% primarily due to increases in valuation allowance for deferred tax asset that we believe we are unlikely to be able to realize.

Liquidity and Capital Resources

The following table summarizes our cash and cash equivalents, working capital, long-term debt and cash flows for the years ended December 31, 2011 and 2010.

| Years Ended | ||||||||||||

| December 31, | ||||||||||||

| 2011 | 2010 | Change $ | Change % | |||||||||

| Cash and cash equivalents | 54,535 | 24,335 | 30,200 | 55% | ||||||||

| Working capital deficit | (2,517,483 | ) | (2,410,668 | ) | (106,815 | ) | 4% | |||||

| Net cash used in operating activities | (38,175 | ) | (64,847 | ) | 26,672 | -70% | ||||||

| Net cash used in investing activities | (18,447 | ) | (16,357 | ) | (2,090 | ) | 11% | |||||

| Net cash provided by financing activities | 86,822 | 47,500 | 39,322 | -100% | ||||||||

As of December 31, 2011, our principal source of liquidity was cash of approximately $54,500. Our operations used $38,175 in cash during the years ended December 31, 2011 as compared to $64,847 for the same period in 2010.

To sustain operations under our current structure, we need cash of approximately $120,000 per month to fund research and administrative expenses. Management is confident that we will be able to meet that continuing obligation at our current sales level.

Our working capital deficit was approximately $2,517,000 at December 31, 2011. The deficit in working capital included approximately $1,420,000 in liabilities related to the Debentures. It also included $424,966 in deferred revenues that require settlement in future services rather than cash.

During the year ended December 31, 2011 we issued 10,000 shares of common stock for services rendered as directors for total compensation of $7,500. During the year ended December 31, 2010, we issued 285,000 shares of common stock for services rendered as consultants and directors for total compensation of $147,750.

As of the first quarter of 2012, we are operating above break-even on a cash flow basis. Although there has been an upturn in business, full collection of receivables during much of 2011 took longer than previous periods. As we moved into 2012, this is now less of a problem as management instituted changes to billing methods to shorten collection times. We see a recent positive trend in customer interest in RFID in general and in our EdgeMagic product in particular. Wal-Mart’s implementation of RFID tracking throughout its stores for selected apparel goods sparked a game-changing trend towards industry-wide acceptance of item level RFID tagging. Apparel suppliers represent a large segment of our customer base. Wal-Mart is often a pioneer in new technology, with other retailers following suit. JC Penney, Dillard’s and, most recently, Macy’s and Bloomingdale’s have already joined Wal-Mart in mandating that their suppliers - among them many CYBRA customers - to tag their apparel goods at the item level. We therefore expect increased interest in EdgeMagic to meet anticipated retailer compliance requirements over the course of 2012. In addition to apparel retail mandates, EdgeMagic is also being employed by companies in various industries for track and trace initiatives. Furthermore, we believe that the hiring of a Vice President Sales and Marketing with extensive industry experience and success, particularly in RFID, will continue to contribute significantly to revenue improvement.

23

The amended 8% Convertible Debentures with a principal balance of $1,420,000 became due on April 11, 2011. In March 2012, holders of Amended Debentures having a total principal balance of $1,195,000 signed a Forbearance Agreement in which such holders agreed to forebear from taking any action to enforce collection of their Amended Debentures until the earlier of (i) December 31, 2012 or (ii) the occurrence of a Material Adverse Event (as defined in the Securities Purchase Agreement with respect to the Debentures). Management has continued negotiations with the holders of these Amended Debentures to extend their term, exchange them for equity, or to otherwise provide for their payment. No assurance can be given that these negotiations will be successful and the effects of unsuccessful negotiations cannot be determined.

Critical Accounting Policies

Revenue

recognition

The Company recognizes revenues in accordance with FASB ASC

985-605, Software Revenue Recognition.

Revenue from software license agreements is recognized when persuasive evidence of an agreement exists, delivery of the software has occurred, the fee is fixed or determinable, and collectability is probable. In software arrangements that include more than one element, the Company allocates the total arrangement fee among the elements based on the relative fair value of each of the elements.