Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

| (Mark One) | FORM 10-K |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2011

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ___________to __________

Commission file number: 001-34386

CHINA EDUCATION ALLIANCE, INC.

(Exact name of registrant as specified in its charter)

| North Carolina | 56-2012361 | |

|

State or other jurisdiction of Incorporation or organization |

(I.R.S. Employer Identification No.) |

| 58 Heng Shan Road, Kun Lun Shopping Mall, Harbin, People’s Republic of China | 150090 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: +86-451-8233-5794

Securities registered pursuant to Section 12(b) of the Act: None.

| Title of each class | Name of each exchange on which registered |

Securities registered pursuant to section 12(g) of the Act:

Common Stock, $0.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Note – Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Exchange Act from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ | |

|

Non-accelerated filer ¨ (Do not check if a smaller reporting company) |

Smaller reporting company x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

¨ Yes x No

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter.

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter was $ 16,377,768 (6,347,972 shares of common stock held by non-affiliates, closing price on June 30, 2011 was $2.58).

Note.—If a determination as to whether a particular person or entity is an affiliate cannot be made without involving unreasonable effort and expense, the aggregate market value of the common stock held by non-affiliates may be calculated on the basis of assumptions reasonable under the circumstances, provided that the assumptions are set forth in this Form.

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. ¨ Yes ¨ No

(APPLICABLE ONLY TO CORPORATE REGISTRANTS)

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

The number of shares of common stock, par value $0.001 (the “Common Stock”), outstanding as of April 13, 2012 is 10,582,503.

DOCUMENTS INCORPORATED BY REFERENCE

List hereunder the following documents if incorporated by reference and the Part of the Form 10-K (e.g., Part I, Part II, etc.) into which the document is incorporated: (1) Any annual report to security holders; (2) Any proxy or information statement; and (3) Any prospectus filed pursuant to Rule 424(b) or (c) under the Securities Act of 1933. The listed documents should be clearly described for identification purposes (e.g., annual report to security holders for fiscal year ended December 24, 1980).

Table of Contents

| Page | ||

| PART I | ||

| Item 1. | Business. | 1 |

| Item 1A. | Risk Factors. | 13 |

| Item 1B. | Unresolved Staff Comments. | 13 |

| Item 2. | Properties. | 13 |

| Item 3. | Legal Proceedings. | 14 |

| Item 4. | Mine Safety Disclosures. | 14 |

| PART II | ||

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. | 15 |

| Item 6. | Selected Financial Data. | 16 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. | 17 |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk. | 29 |

| Item 8. | Financial Statements and Supplementary Data. | 29 |

| Item 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure. | 30 |

| Item 9A. | Controls and Procedures. | 30 |

| Item 9B. | Other Information. | 31 |

| PART III | ||

| Item 10. | Directors, Executive Officers, and Corporate Governance. | 32 |

| Item 11. | Executive Compensation. | 38 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters. | 42 |

| Item 13. | Certain Relationships and Related Transactions, and Director Independence. | 44 |

| Item 14. | Principal Accountant Fees and Services. | 44 |

| Item 15. | Exhibits, Financial Statement Schedules. | 45 |

Cautionary Statement Regarding Forward Looking Statements

The discussion contained in this Annual Report on Form 10-K (“Annual Report”) contains “forward-looking statements” within the meaning of Section 27A of the United States Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the United States Securities Exchange Act of 1934, as amended, or the Exchange Act. Any statements about our expectations, beliefs, plans, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. These statements are often, but not always, made through the use of words or phrases like “anticipate,” “estimate,” “plans,” “projects,” “continuing,” “ongoing,” “target,” “expects,” “management believes,” “we believe,” “we intend,” “we may,” “we will,” “we should,” “we seek,” “we plan,” the negative of those terms, and similar words or phrases. We base these forward-looking statements on our expectations, assumptions, estimates and projections about our business and the industry in which we operate as of the date of this Annual Report. These forward-looking statements are subject to a number of risks and uncertainties that cannot be predicted, quantified or controlled and that could cause actual results to differ materially from those set forth in, contemplated by, or underlying the forward-looking statements. Statements in this Annual Report describe factors, among others, that could contribute to or cause these differences. Actual results may vary materially from those anticipated, estimated, projected or expected should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect. Because the factors discussed in this Annual Report could cause actual results or outcomes to differ materially from those expressed in any forward-looking statement made by us or on our behalf, you should not place undue reliance on any such forward-looking statement. New factors emerge from time to time, and it is not possible for us to predict which will arise. In addition, we cannot assess the impact of each factor on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statement. Except as required by law, we undertake no obligation to publicly revise our forward-looking statements to reflect events or circumstances that arise after the date of this Annual Report or the date of documents incorporated by reference herein that include forward-looking statements.

PART I

| Item 1. | Business. |

History of our Organization

We were incorporated in North Carolina on December 2, 1996 under the name of ABC Realty Co. to engage in residential real estate transactions as a broker or agent. Following the September 2004 reverse acquisition described below, our corporate name was changed to China Education Alliance, Inc. At the time of the reverse acquisition, we were not engaged in any business activity and we were considered to be a blank-check shell.

On September 15, 2004, we entered into an agreement pursuant to which:

| · | the stockholders of Harbin Zhong He Li Da, a PRC corporation, transferred all of the stock of Harbin Zhong He Li Da to us and we issued to those stockholders a total of 18,333,333 shares of Common Stock, representing 95% of our outstanding Common Stock after giving effect to the transaction. |

| · | Duane Bennett, who was then our chairman of the board and controlling shareholder, caused 3,666,667 shares of Common Stock that were controlled by him to be transferred to us for cancellation, for which Harbin Zhong He Li Da or its stockholders paid $400,000, of which $300,000 was paid in cash and the balance was paid by a promissory note, which has been paid. |

We changed our corporate name to China Education Alliance, Inc. on November 17, 2004.

General

We are an education service company that provides on-line education and on-site training in the People’s Republic of China (“PRC”). We were organized to meet what our founders believe is an unmet need for educational resources throughout the PRC. Based on the Chinese Finance Ministry’s 2011 draft report, the appropriation for education spending in 2011 was RMB1.612 trillion.(source: http://gks.mof.gov.cn/zhengfuxinxi/tongjishuju/201201/t20120120_624316.html) According to Chinese tradition, spending on education resources is one of the family’s major expenditures. However, just as economic development is not even throughout the PRC, there is an uneven allocation of educational resources in the PRC. In general, only students who pass the numerous examinations which are given at various stages of the educational process, can obtain better educational opportunities at a higher level. We believe that the examination-oriented education has created a market for products from companies that address this need.

Our principal business is the distribution of educational resources through the internet. Our website, www.edu-chn.com, is a comprehensive education network platform which is based on network video technology and large data sources of elementary education resources. We have a database comprised of such resources as test papers that were used for secondary education and university level courses as well as video on demand. Our data base includes more than 400,000 exams and test papers and courseware for college, secondary and elementary schools. While some of these exams were given in previous years, we engage instructors to develop new exams and a methodology for taking the exams. We market this data base under the name “Famous Instructor Test Paper Store.” We also offer, through our website, video on demand, which includes tutoring of exam papers and exam techniques. We compliment the past exams and test papers by providing an interactive platform for students to understand the key points from the papers and exams. Although a number of the resources are available through our website without charge, we charge our subscribers for such services as the Famous Instructor Test Paper Store and the video on demand. Subscribers can purchase debit cards which can be used to download material from our website.

We also provide on-site teaching services in Harbin, which we market under the name “Classroom of Famed Instructors.” We have 20 training facilities in Heilongjiang, Jilin, Liaoning, and Beijing, which can accommodate approximately 10,000 students at the same time. These training facilities, which complement our on-line education services, provide classroom and tutoring to our students. The courses cover primarily the compulsory education curriculum of junior, middle and high school. We charge tuition for these classes.

| 1 |

We have also introduced a program of on-line vocational training services. We collaborated with the China Vocation Education Society to set up a website, www.360ve.com , which is an internet platform for training agencies and schools to offer their services. We launched www.360ve.com in September 2007 and we called this program the “Millions of College Students Employment Crossroad” program. Through this program we offer job search capability and career planning courses for university students via our website. We developed this program in response to the high unemployment rate for PRC college graduates. Many college graduates pursue vocational training after their college education in order to find employment. Our program is designed to establish a long-term training program for college students to build connections with corporations and participate in educational programs prescribed by hiring corporations. We anticipate that we will constantly revise our materials to meet changes in the market as well as the demands of university students and graduates who enroll in our courses in order to meet their changing needs.

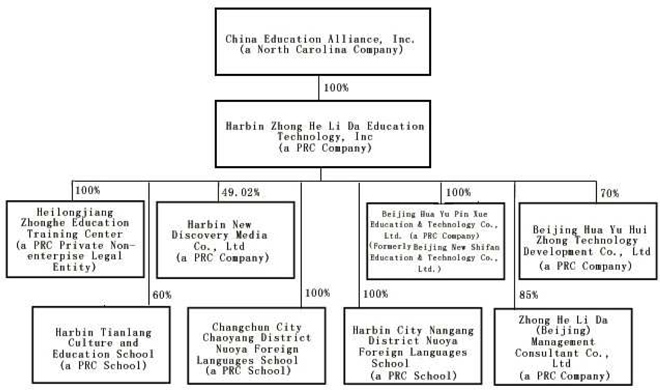

On April 18, 2008, our wholly owned subsidiary, Harbin Zhong He Li Da Education Technology, Inc. (“ZHLD”) entered into an agreement and supplementary agreement with Harbin Daily Newspaper Group to invest in a joint venture company, Harbin New Discovery Media Co. ZHLD contributed RMB 3,000 000 (approximately $430,000) and Harbin Daily Newspaper Group contributed RMB 3,120,000 (approximately $445,000) towards the registered capital of Harbin New Discovery Media Co. In return for their respective contributions, ZHLD will own 49.02% equity interest and Harbin Daily Newspaper Group will own 50.98% equity interest in Harbin New Discovery Media Co., Ltd. This joint venture will create new educational material distribution channels in readable newspaper format in the future. Pursuant to the terms of the supplementary agreement, Harbin Daily Newspaper Group assigned all its rights in the “Scientific Discovery” newspaper exclusively to the joint venture company. The transaction closed on July 7, 2008 and as a result, Harbin New Discovery Media Co. Ltd. is now a 49.02% owned subsidiary of ZHLD and we are now in the publication and distribution of a scientific newspaper business.

On January 4, 2009, our subsidiary, ZHLD entered into an agreement with Mr. Guang Li to jointly incorporate and invest in a joint venture company, Zhong He Li Da (Beijing) Management Consultant Co., Ltd. (“ZHLDBJ”). ZHLD contributed RMB 425,000 (approximately $62,107), and Mr. Guang Li contributed RMB 75,000 (approximately $10,960) towards the registered capital of ZHLDBJ, amounting to a total registered capital of RMB 500,000 (approximately $73,067). ZHLD will own a 85% equity interest in ZHLDBJ and Mr. Guang Li will own a 15% equity interest in ZHLDBJ. ZHLD has authorized Mr. Xiqun Yu to hold 20% of its equity interest of ZHLDBJ on its behalf.

ZHLDBJ was incorporated on January 4, 2009 with a business term of 20 years. The registered capital of ZHLDBJ has been paid by the parties concerned. Mr. Xiqun Yu, our CEO, is the legal representative and the managing director of ZHLDBJ. ZHLDBJ planned to run the ‘Million Managers Training Program” with The National Association of Vocational Education of China. This program is still in the planning stage. Towards the end of 2011, we have successfully developed a new project called the “Zhong He Win-Win Program”, which is designed to fit the needs of Chinese entrepreneurs to improve their leadership, management and marketing skills. Our comprehensive business training initiatives integrate research-based, proprietary content with processes that are specifically connected to the critical business issues that most private Chinese companies are facing.

In February 2010, the Company, through its wholly owned subsidiary, ZHLD, incorporated a new company in the PRC, Beijing New Shifan Education & Technology Co., Ltd. (“New Shifan”) with a registered capital of RMB 1.95 million (approximately $291,132). ZHLD owned a 65% equity interest in New Shifan and the other equity holders together owned a 35% equity interest in New Shifan. In September 2011, New Shifan changed its name to Beijing Hua Yu Ping Xue Education Technology Co., Ltd (“HYPX”). In October 2011, ZHLD took over the 35% equity interest from the other equity holders of NYPX with no consideration, and authorized Mr. Xiqun Yu to hold the 35% equity interest on its behalf. In November 2011, HYPX increased its share capital to RMB 2 million (approximately $298,597). HYPX is focusing on expansion of our training centers in Beijing, and developing extensive marketing strategy to establish new markets in other main cities.

| 2 |

In October 2010, the Company founded a “Hundred Celebrity Teachers Club” in the PRC. The goal of the club is to “assemble famous teachers, train students, and promote basic education in China”. The “Hundred Celebrity Teachers Club” (the “Club”) is the first dynamic educational platform aimed at promoting math, physics, and chemistry in middle and high schools in the PRC. So far, 100 teachers from 15 provinces of the PRC have joined the Club, making us one of the largest bases of well-known teachers in the PRC. As members of the Club, these famous teachers will promote high teaching standards in all three major disciplines – math, physics and chemistry – and provide consultation services to select middle and high schools in the PRC. The Club's activities include teacher training, lectures given by celebrity teachers, education evaluation, teaching cases analysis, subjects study, and international exchanges. It provides an excellent stage for teachers to explore resources, discuss hot education topics, and promote academic growth. The “Hundred Celebrity Teachers Club” is endorsed by the PRC Ministry of Education.

On March 4, 2011, the Company entered into a management agreement (the “Management Agreement”) with Nanchang Institute of Technology (“NIT”), a vocational training institution based in Nanchang, the PRC. Pursuant to the Agreement, the Company will manage the daily operations of NIT for ten years for an annual management fee of RMB 10 million (approximately $1,461,347). The management fee is payable on a quarterly basis and in the event of late payment, a late fee is imposed. Additionally, a liquidated damage of RMB 50 million (approximately $7,869,678) will be paid by the party that defaults on the agreement.

In connection with the Management Agreement, the Company entered in to a loan agreement (the “Loan Agreement”), pursuant to which the Company will loan NIT RMB 50 million (approximately $7,869,678) to build training facilities and NIT will repay the RMB 50 million (approximately $7,869,678) in ten years from the date NIT receives the principal. The loan has an annual interest rate of 20% and the interests will be waived by the Company if NIT makes all payments under the Management Agreement in a timely manner. In the event it prepays the principal and interests that are not due, NIT is subject to a prepayment penalty in the amount of 25% of the loan principal. The loan is secured by the assets of certain guarantors.

As of December 31, 2011, we loaned NIT RMB 50 million (approximately $7,869,678) and NIT paid us RMB 7.5 million (approximately $1,161,998) in interest and $0 in principal, and we accrued RMB 2.5 million (approximately $387,333) as interest receivable in the 4th quarter, 2011. Currently, we receive 20% annual interest income due quarterly; therefore, the management fee is waived.

On March 14, 2011, the Company entered into a Share Transfer Agreement with the shareholder of Harbin Tianlang Culture and Education School (“Tianlang”), a tutoring school with 5,000 then enrolled students, based in Harbin, the PRC.

Pursuant to the Share Transfer Agreement, the Company agreed to purchase 60% of the equity interests of Tianlang for RMB 35 million (approximately $5.3 million). The shareholder and the Company also provided RMB 2 million (approximately $0.3 million) and RMB 3 million (approximately $0.5 million) as working capital for Tianlang, respectively. After the execution of the Share Transfer Agreement, Tianlang established a new board of directors with five directors, of which three directors were appointed by the Company and two directors were appointed by the shareholder. The acquisition of Tianlang was officially completed in April 2011. We are currently co-managing Tianlang with the previous majority owner.

On March 21, 2011, the Company entered into an additional agreement with NIT. Pursuant to the agreement, the Company and NIT jointly established Nanchang Institute of Technology College of Vocational Training and Certification (the “College”). NIT provides facilities for free and the Company provides teachers, curriculums and certificates of trainings and pays all the expenses incurred in the teaching process. In return, NIT and the Company receive 20% and 80% of the total revenue of the College, respectively. The College is currently in the planning stage which is managed by the Company.

On May 31, 2011, we entered into share transfer agreements with the shareholders of Changchun City Chaoyang District Nuoya Foreign Languages School (“Changchun Nuoya”) and Harbin City Nangang District Nuoya Foreign Languages School (“Harbin Nuoya”), two foreign language schools with a total of approximately 1,000 then enrolled students based in the PRC. Pursuant to the share transfer agreements, we purchased 100% ownership of each of the two schools for RMB 8 million (approximately $1.23 million). As a result of the acquisition, we are capable of offering courses of English, Japanese, Korean, Russian, German, French, Spanish, Italian, Arabic, etc.

| 3 |

On September 26, 2011, we effected a one-for-three reverse stock split of our issued and outstanding common stock. As a result, the number of our issued and outstanding common stock was reduced from 31,747,249 shares to 10,582,503 shares.

Corporate Structure

Education Systems in the PRC

Since 1949 when the PRC was founded, the government in the PRC has considered education an important component of its economic and social development. Recently, with the emergence of its market economy, education has become a priority in the PRC.

According to the Ministry of Finance Report, the gross domestic education expenditure of the PRC in 2011 was approximately RMB 1.612 trillion, increased by RMB356.6 billion, or 28.4% as compared to 2010 (source: http://gks.mof.gov.cn/zhengfuxinxi/tongjishuju/201201/t20120120_624316.html). The average PRC family sets aside 10% of its savings for education according to the United Nations Educational, Scientific, and Cultural Organization. We believe that many parents are willing to invest in their children for better and higher education because it is critical for their future opportunities and advancement. The educational system in the PRC is under pressure to reform and develop. On March 14, 2004, the second session of the 10th National People’s Congress concluded that the PRC advocates “putting people first” as its development model. The PRC government sets education as a strategic priority in the China Agenda for Education.

| 4 |

The central government in the PRC, through the Ministry of Education, manages education in the PRC at a macro level, responsible for carrying out related laws, regulations, guidelines and policies of the central government; planning development of the education sector; integrating and coordinating educational initiatives and programs nationwide; maneuvering and guiding education reform countrywide. To a large degree, the provincial governments are left to implement basic education through development of teaching plans to supplement the required coursework from the central Ministry of Education and the funding of basic education in poorer areas. Provincial level governments have the main responsibilities for implementing basic education on a day to day basis.

Education is funded by a variety of sources: schools directly controlled by the central government are generally funded from the central financial pool; schools controlled by local governments are supported by local governments, the central government, and fund raising projects initiated by these schools themselves; schools sponsored by township and village governments and by public institutions are mainly financed by the sponsor institutions and subsidized by local governments; private schools are funded by sponsors (including collecting tuition from students and soliciting contributions).

In the PRC, primary and secondary education takes 12 years to complete. Primary education generally is six years, junior middle school is three years, and senior middle school is three years. Children generally begin primary school at the age of six. In 1986, the PRC passed the Compulsory Education Law, which dictates that nine years of compulsory education (grades 1 through 9) is to become mandatory and requires that provincial and local governments take the necessary steps to ensure that all students receive at least the required nine years of education. The goal of the Compulsory Education Law, as well as the subsequent guidelines, was to universalize compulsory education and to eliminate illiteracy among the PRC people. According to the Bulletin of Statistics on National Educational Development in 1999 issued by the Ministry of Education, the nine-year compulsory education has covered 80% of the PRC’s population since its inception. In 2002, the PRC began to aggressively incorporate English into its elementary school curriculum.

On March 3, 2004, the State Council approved and disseminated the 2003-2007 Action Plan for Invigorating Education in the 21st Century, which was formulated by the Ministry of Education. The plan recognizes the need to make the PRC competitive in the world economy and provides a blueprint to speed up educational reform and development in the PRC. The plan is based on two fundamental concepts to “Rejuvenating China through Science and Education” and “Reinvigorating China through Human Resource Development.” The objectives of the plan are to establish a well-to-do society and perfect the socialistic market economy in the PRC. The plan has goals to consolidate and universalize the nine-year compulsory education program and eradicate illiteracy, to continue educational reforms, to improve the quality of education and to provide a system designed to enable the public to have access to quality education. The plan emphasizes the use of information technology in education and training.

Since 2000, the PRC government has been implementing reform in educational policy to change the orientation of the education system from one based on memory learning to a more individualized creative approach.

On-line Education

Our core business is the exam-oriented education in junior, middle, and high school. We believe that our on-line education programs are in line with the government policy of using information technology to make educational resources available throughout the country. The reforms in education policy has created a demand for new curriculum, updated educational materials and educational resources. Our portal enables our customers to access the new curriculum created by various levels of government and leading academic experts, which are endorsed by the Ministry of Education. Our courses have the necessary certification or registration with the Ministry of Education.

Our website makes use of its internet network resources beyond the traditional teaching methods and face-to-face constraints by providing students with access to multi-media resources such as college, middle school and elementary school test papers, courseware designed to prepare students for taking the exams, and video on demand courseware. We market our website as a platform to offer services like “Famed Instructors Test Paper Store” by offering prepaid learning debit cards that can be used to purchase our products. The learners can have materials downloaded for off-line education or study the material on-line.

| 5 |

We believe that through our website, we can help to change the uneven distribution of education resources since our material is designed for nationwide exams and, though the Internet, students can have access to our material nationwide. We sell our exam papers, test papers, and video on demand through our website www.edu-chn.com. We offer both exams that were previously given as well as copyrighted exams that were developed by teachers who we hire for that purpose. These examinations cover PRC primary, middle and high school exams which are used by students who are primarily in age range of six to eighteen.

We have developed some educational software and we own a database covering all levels of basic education from primary school through high school. Our plans for expansion of our business operations include the following:

| · | Build up the infrastructure to ensure fast access and to satisfy the volume that would develop with increasing demand; |

| · | Develop a nation-wide advertising campaign to increase market awareness of our products; |

| · | Open branch offices in key cities. Even though our website is accessible from anywhere in the PRC, course materials are not standardized throughout the PRC, and there are many differences in both the course materials and the resources among the different regions in the PRC. As a result, we believe that we can best serve the students in a region by using our branch offices to employ local teachers who understand the local educational system. In this manner, we can customize our course materials to meet the local educational requirements and develop face-to-face tutorial centers to further expand our revenue. |

Training Center

We provide on-site teaching services under the “Big Classroom of the Famed Instructors,” our state-of-the-art training center in Harbin. At this center, we offer both classroom training and one-on-one tutoring. We have 20 training facilities in Heilongjiang, Jilin, Liaoning, and Beijing, which can accommodate approximately 10,000 students at the same time. The courses cover each phase of compulsory education, of which junior, middle and high schools are the key parts. Our courses are designed to complement our students' daily school curriculum, and will vary depending on the age of the students as well as the progress of the class. Class subjects include Math, Physics, Chemistry, English, Chinese, etc. We charge students for each class taken. Thus, we determine our enrollment by the number of classes that were taken during a given period of time, and not by the number of individual students. Since the term of the classes vary, we do not schedule classes on a semester basis.

Vocational Training

We have introduced a program of on-line vocational training services. We have collaborated with the National Association of Vocation Education of China to set up a website, www.360ve.com, which is an internet platform for training agencies and schools to offer their services. We launched www.360ve.com in September 2007, and we named this program our “Millions of College Students Employment Crossroad” program. Through this program we offer job search capability and career planning courses for university students by our website. We developed this program in response to the high unemployment rate for PRC college graduates. Our program is designed to establish a long-term training program for college students to build connections with corporations and obtain educational programs prescribed by the recruiting corporations. We anticipate that we will constantly revise our materials to meet changes in the market as well as the demands of university students and graduates who enroll in our courses in order to meet their career needs.

Through our “Millions of College Students Employment Crossroad” program, we seek to address two problems - one is the need for university students to find jobs and the other is to satisfy the need of businesses to hire qualified candidates. We cooperate with businesses and other entities to enable us to communicate the requirements of potential employers, including the necessary skill sets needed, to the students who enroll in the program. In this manner, the students can learn the needs of different businesses while they are at school, and can develop educational programs in their university to enable them to meet the educational requirements of their desired field of business. This will help students seek employment after college and improve their job seeking strategy.

| 6 |

The National Association of Vocation Education of China has a large number of institutional members, including provincial education bureaus and more than 1,000 vocational training schools across the PRC. We intend to expand our strategic cooperation with training agencies, especially in the aspects of joint enrollment, the exchange of resources and on-site training agencies facilities.

During December 2006, we acquired all of the fixed assets and franchise rights of Harbin Nangang Compass Computer Training School for approximately $1 million. The Nangang Compass Computer Training School provided classroom education resources to computer vocational school students. As a result of this acquisition, we became the exclusive partner of Beida Qingniao APTEC Software Engineering within Heilongjiang Province in the PRC for vocational training. The acquisition included materials and resources to provide on-site education classes and patented course materials. The Nangang Compass Computer Training School currently has two principal education programs focused on network engineering and ACCP software engineering with 9 on-site classrooms and 9 multimedia/computer classrooms at two centers.

Pursuant to the Management Agreement between the Company and NIT, the Company and NIT jointly established Nanchang Institute of Technology College of Vocational Training and Certification (the “College”). NIT provides facilities for free and the Company provides teachers, curriculums and certificates of trainings and pays all the expenses incurred in the teaching process. In return, NIT and the Company receive 20% and 80% of the total revenue of the College, respectively. The College is currently in the planning stage which is managed by the Company.

Harbin New Discovery Media Co.

On April 18, 2008, ZHLD entered into an agreement and supplementary agreement with Harbin Daily Newspaper Group to invest in a joint venture company, Harbin New Discovery Media Co., ZHLD contributed RMB 3,000 000 (approximately $430,000) and Harbin Daily Newspaper Group contributed RMB 3,120,000 (approximately $445,000) towards the registered capital of Harbin New Discovery Media Co. In return for their respective contributions, ZHLD will own 49.02% equity interest and Harbin Daily Newspaper Group will own 50.98% equity interest in Harbin New Discovery Media Co., Ltd. Pursuant to the terms of the supplementary agreement, Harbin Daily Newspaper Group shall assign all its rights in the “Scientific Discovery” newspaper exclusively to the joint venture company, Harbin New Discovery Media Co. “Scientific Discovery” was established in October 2001 to popularize scientific information and knowledge with PRC citizens, and it has won strong brand recognition and a loyal readership in Heilongjiang province. In 2010, the “Scientific Discovery” circulation generated total revenues of $1.1 million during the year. Harbin New Discovery Media Co., Ltd. publishes this newspaper twice per week. The first publication targets primary and middle school students by providing pertinent and authoritative after-school tutorship materials, which are synchronized with students’ syllabi. Top-ranked educational experts and professors prepare the educational materials. The second publication targets the general population by providing scientific information and guidance in daily life.

“Million Managers Training Program”

We, along with The National Association of Vocational Education of China and Beijing Hua Yu Education Foundation are dedicated to building the PRC’s first management training program, Million Managers Training Program, with the goal of improving management skills and designing a complete solution for management, clients and suppliers. The topics are aimed at improving management skills, increasing corporate profitability and sustaining development. The program comprises 9 education modules:

| · | Ongoing enterprise and operation strategies; |

| · | Marketing; |

| · | General management; |

| 7 |

| · | Enterprise management tactics; |

| · | Human resources management; |

| · | Enterprise culture; |

| · | Financial management and capital management; |

| · | Purchasing and production management; and |

| · | Enterprise self-management and improvement. |

Currently this program is on hold because we are redesigning the training program with potential opportunities with other schools, as well as adjusting our own business model to cooperate with all subsidiaries. However, we have successfully developed a new project called the “Zhong He Win-Win Program”, which is designed to satisfy the needs of Chinese entrepreneurs to improve their leadership, management and marketing skills. Our comprehensive business training initiatives integrate research-based, proprietary content with processes that are specifically connected to the critical business issues that most private Chinese companies are facing.

Schools

Tianlang

Established in 1999, Tianlang is a tutoring school based in Harbin, the PRC. Tianlang has a number of campuses, including the provincial government campus, Aijian campus, Yanchang campus, Harbin Institute of Technology – Science Park campus, and Hujunjie campus, etc., with the main school campus located at 40 Jiaohua Road, Harbin. Tianlang is mainly engaged in examination orientated training classes for primary school, middle school, and high school students, also provides one-on-one counseling lessons with experts. Tianlang has more than 10,000 students currently enrolled for different classes or training lessons, and over 200 qualified teachers (including part-time teachers).

Harbin Nuoya and Changchun Nuoya

Harbin Nuoya was established in 2006, and is one of the largest language learning schools in the Heilongjiang Province, PRC, especially for non-English foreign lanuage leanings. It provides various language learning classes: English, Korean, Japanese, Russian, French, German, Spanish, etc. Harbin Nuoya has over 500 currently enrolled students and more than 50 qualified teachers (including part-time teachers).

Changchun Nuoya was established in 2007, and is one of the largest language learning schools in the Jilin Province, PRC, especially for non-English foreign lanuage leanings. It provides various language learning classes: English, Korean, Japanese, Russian, French, German, etc. Chuangchun Nuoya currently has over 400 students enrolled and more than 30 qualified teachers (including part-time teachers).

Marketing

We employ sales persons who market our products to the Ministry of Education and the provincial education commissions. Although the government agencies do not purchase our products, we need to obtain their approval for the use of our programs in connection with the curriculums in schools under their jurisdiction. We also use these marketing calls to generate information to assist us in developing new educational products and opportunities. Our sales force is also actively involved with educators in developing curriculums based on our products.

| 8 |

We intend to use our web-based educational portal to assist us in marketing our educational products. This portal provides data and other materials for free but charges users for downloads of our products.

We also market our schools, Training Center and vocational training products by way of the following methods: (A) directly at conferences and events where we invite teachers, students and their families to learn about our education materials; (B) through various internet links and search engines; (C) by traditional media advertising, such as TV and newspaper advertisements; and (D) through fliers or coupons handed out to students in front of high schools and other major education institutions. We are also able to attract users by reputation and referrals from current students or users.

“Scientific Discovery,” a scientific information newspaper focusing on introducing scientific knowledge to elementary and secondary school students exclusively, is marketed by the joint venture company, New Discovery. This joint venture creates new educational material distribution channels in readable newspaper format and promotes our core businesses. Harbin New Discovery Media Co., Ltd. publishes this newspaper twice per week. The first publication targets primary and middle school students by providing pertinent and authoritative after-school tutorship materials, which are synchronized with students’ syllabi. The educational materials are prepared by top-ranked educational experts and professors. The second publication targets the general population by providing scientific information and guidance in daily life.

Our Million Managers Training Program is supported by the China Industry-University-Research Institute Collaboration Association and the Asian Brand China Committee, which both benefit economic development and employment. China Education Alliance, along with The National Association of Vocational Education of China and Beijing Huayu Education Foundation is dedicated to building the first management training program in the PRC with the goal of improving management skills and designing a total solution for management, clients and suppliers. The topics are aimed at improving management skills, increasing corporate profitability and sustaining development. The program is advertised through newspapers, web portals, radio, and national TV programs in the PRC. Through the program, we aim to increase its revenue and gain recognition in the PRC.

We expense advertising costs for outdoor spots at the time they are aired and for all other advertising the first time the respective advertising takes place. These costs are included in selling, general and administrative expenses. The total advertising expenses incurred for the years ended December 31, 2011, 2010, and 2009 were $649,768, $1,308,290 and $1,093,535, respectively.

Major Customers

For the years ended December 31, 2011, 2010 and 2009, three customers each accounted for greater than 10% of total online education revenue during each year. A certain distribution agent in each of Heilongjing, Jilin and Liaoning Provinces accounted for 24.6%, 15.9%, and 14.9%, respectively of the total online education revenue for the year of 2011, 15.3%, 13.5%, and 14.2%, respectively of the total online education revenue for the year of 2010 and 14.8%, 11.3% and 14.0%, respectively of total online education revenue for the year of 2009. The loss of these customers would have a material adverse effect on the Company and its subsidiaries taken as a whole.

Competition

We compete with a number of PRC and international companies that sell educational materials in the PRC market. Many of our competitors are larger, more established companies, many of which have diverse businesses and are better capitalized. In some cases, these are new companies that are entering the educational market in the PRC and may offer products and services at lower costs to build up market share.

Government Regulations

The education industry in the PRC is heavily regulated at all levels - national, provincial and local. PRC practices and policies have limited contact with non-PRC entities in the education industry. In addition, our business is subject to numerous PRC rules and regulations, including restrictions on foreign ownership of Internet and education companies and regulation of Internet content. Many of the rules and regulations that we face are not explicitly communicated, but arise from the fact that education and the Internet are politically sensitive areas of the economy. We believe that the Ministry of Education and the provincial education commissions prefer to contract with PRC companies in the industry of education. As a result, all of our PRC subsidiaries are staffed with PRC nationals. All of our revenue is derived from our PRC subsidiaries, and our success is dependent on the skill and experience of the employees of our subsidiaries.

| 9 |

Ownership Restrictions on Foreign Internet Service Providers

The State Council promulgated the Administrative Rules on Foreign-Invested Telecommunications Enterprises in December 2001, as amended on September 10, 2008, or the FITE Rules. The FITE Rules set forth detailed requirements with respect to capitalization, investor qualifications and application procedures in connection with the establishment of a foreign-invested telecommunications enterprise. Pursuant to the FITE Rules, the ultimate capital contribution ratio of the foreign investor or investors in a foreign-funded telecommunications enterprise that provides value-added telecommunications services shall not exceed 50%. In addition, pursuant to the FITE Rules, permitted foreign investment ratio of value-added telecommunications services is no more than 50%.

In addition, for a foreign investor to acquire any equity interest in a value-added telecommunications business in the PRC, it must satisfy a number of stringent performance and operational experience requirements, including demonstrating a track record and experience in operating a value-added telecommunications business overseas. Moreover, foreign investors that meet these requirements must obtain approvals from the PRC Ministry of Industry and Information (“MII”) and the Ministry of Commerce or their authorized local counterparts, which retain considerable discretion in granting approvals.

On July 26, 2006, MII publicly released the Notice on Strengthening the Administration of Foreign Investment in Operating Value-added Telecommunications Business, dated July 13, 2006, or the MII Notice, which reiterates certain provisions under the FITE Rules. According to the MII Notice, if any foreign investor intends to invest in a Chinese telecommunications business, a foreign-invested telecommunications enterprise shall be established and such enterprise shall apply for the relevant telecommunications business licenses. The MII Notice prohibits domestic telecommunication services providers from leasing, transferring or selling telecommunications business operating licenses to any foreign investor in any form, or providing any resources, sites or facilities to any foreign investor for their illegal operation of a telecommunications business in the PRC. According to the MII Notice, either the holder of a value-added telecommunication service license or its shareholders must directly own the domain names and trademarks used by such license holders in their provision of value-added telecommunication services. The MII Notice also requires each license holder to have the necessary facilities, including servers, for its approved business operations and to maintain such facilities in the regions covered its license.

We completed our reverse merger and our corporate structure was established in September 2004, before the implementation of the FITE Rules and the MII Notice. Accordingly, we do not believe that the FITE Rules and the MII Notice apply to us. Further, even if they did, we do not believe that we are in the telecommunications business. We do not provide connectivity and internet services. We are primarily in the education business and only a portion of our education resources is disseminated to our paying customers as opposed to the general public via internet download. Finally, our vocational training services are provided in collaboration with and through a PRC company, China Vocation Education Society. We do not own or have any equity stake in China Vocation Education Society.

However, there are substantial uncertainties regarding the interpretation and application of PRC laws and regulations, including the laws and regulations governing the enforcement and performance of our contractual arrangements in the event of imposition of statutory liens, bankruptcy and criminal proceedings. Accordingly, we cannot assure you that the PRC regulatory authorities will not ultimately take a contrary view.

If the PRC government finds that the agreements that establish the structure of our operations in the PRC do not comply with PRC government restrictions on foreign investment in our industry, we could be subject to severe penalties.

Under our current corporate structure, ZHLD is our sole wholly foreign owned entity (“WFOE”).

| 10 |

Regulation of Online and Distance Education

Pursuant to the Administrative Regulations on Educational Websites and Online and Distance Education Schools issued by the Ministry of Education (“MOE”) in 2000, or the Online Education Regulation, educational websites and online education schools may provide education services in relation to higher education, elementary education, pre-school education, teacher education, occupational education, adult education and other educational services. Under the Online Education Regulations, “Educational websites” refers to education websites providing education or education-related information services to website visitors by means of a database or an online education platform connected via the Internet or an educational television station through an Internet service provider, or ISP. Under the Online Education Regulations, “Online education schools” refer to organizations providing academic education services or training services with the issuance of various certificates.

Under the Online Education Regulations, setting up educational websites and online education schools is subject to approval from relevant education authorities, depending on the specific types of education provided. Under the Online Education Regulations, any educational website and online education school shall, upon receipt of approval, indicate on its website such approval information as well as the approval date and file number.

According to the Administrative License Law promulgated by the National People’s Congress on August 27, 2003 and effective as of July 1, 2004, only laws promulgated by the National People’s Congress and regulations and decisions promulgated by the State Council may establish administrative license requirements. On June 29, 2004, the State Council promulgated the Decision on Cutting Down Administrative Licenses for the Administrative Examination and Approval Items Really Necessary to be Retained, in which the administrative license for “online education schools” was retained, while the administrative license for “educational websites” was not retained.

We believe we are not required to obtain a license to operate “education websites” or “online education schools” from the MOE under the current PRC laws and regulation because we do not offer through our website education services or training programs that directly offer government accredited academic degrees or other government accreditation certifications. For the same reason, we do not believe that we need to obtain a license to operate our onsite tutoring services. Finally, there appears to be no restriction against foreign ownership and it is unclear whether foreign ownership is restricted for businesses providing such “education websites” or “online education schools”.

Business Scope of our PRC Operating Entities

All our PRC operating subsidiaries, including ZHLD are in the business of providing education services. Particularly, ZHLD is a holding company of all other subsidiaries and also provides online exam preparation services; Heilongjiang Zhonghe Education Training Center provides onsite vocational training and after school tutoring services; Beijing Hua Yu Hui Zhong Technology Development Co., Ltd. provides onsite vocational training, online college graduate electronic database and pre-employment training; Zhong He Li Da (Beijing) Management Consultant Co., Ltd. provides onsite vocational training services; Harbin New Discovery Media Co., Ltd. is in the educational newspaper publishing business and Beijing Hua Yu Ping Xue Education Technology Co., Ltd. publishes a high school education magazine and organizes high school students contests. Harbin Tianlang Culture and Education School provides onsite examination-oriented training and after school tutoring services; Changchun City Chaoyang District Nuoya Foreign Languages School and Harbin City Nangang District Nuoya Foreign Languages School provides onsite program for foreign language trainings.

Intellectual Property

The exams and other materials on our websites include material that is generally available, such as exams that were previously given, and exams and other material that were developed for us. We engage authors, who are teachers, university professors or experts in their fields, to develop materials for our websites. Under the terms of our contracts, we own the copyright on all materials produced for us by these authors. We pay each author a fixed fee and certain percentage of sales as royalty. We also enter into agreements to use and publish educational materials developed by others, for which we pay for the use right.

| 11 |

Employees

As of April 13, 2012, we had approximately 509 employees, consisting of 26 executives, 44 administrative and finance employees, 166 marketing and sales personnel, 18 research and development staff, 52 information technicians, 10 designers, 154 teaching and education administrative staff, and 39 other employees engaged in security, planning, human resources and other activities. We have no collective bargaining agreements, and we believe that we have good relations with our employees.

Education and Business Licenses

Below is a list of the education and business licenses and permits of the Company and our operating subsidiaries:

Harbin Zhong He Li Da Education Technology, Inc.

1. Certificate of Approval

2. Business License

3. Tax Registration Certificate

4. Organization Code Certificate

5. State Administration of Foreign Exchange Registration Card

Heilongjiang Zhonghe Education Training Center

1. Certificate of Approval

Beijing Hua Yu Hui Zhong Technology Development Co., Ltd.

1. Business License

2. Tax Registration Certificate

3. Organization Code Certificate

Harbin New Discovery Media Co., Ltd.

1. Business License

2. Tax Registration Certificate

3. Organization Code Certificate

Zhong He Li Da (Beijing) Management Consultant Co., Ltd.

1. Business License

2. Tax Registration Certificate

3. Organization Code Certificate

Beijing Hua Yu Ping Xue Education Technology Co., Ltd.

1. Business License

2. Tax Registration Certificate

3. Organization Code Certificate

Harbin Tianlang Culture and Education School

1. Private Non-enterprise Certificate

2. Private School License

| 12 |

Harbin City Nangang District Nuoya Foreign Languages School

1. Private Non-enterprise Certificate

2. Private School License

Changchun City Chaoyang District Nuoya Foreign Languages School

1. Private Non-enterprise Certificate

2. Private School License

| Item 1A. | Risk Factors. |

Not applicable.

| Item 1B. | Unresolved Staff Comments. |

Not applicable.

| Item 2. | Properties. |

Our Beijing office is located in China Overseas Plaza, at the heart of Beijing's Central Business District (“CBD”), north to Chang'an Street and west to the third tower of the World Trade Center. The modern facility, a perfect example of the most modern international standards for a commercial building, provides a perfect environment for connecting the world’s business opportunities. The total floor area is 1,477 square meters (approximately 15,898 square feet). The CBD is the barometer of a city's commercial development. Beijing CBD is synonymous with the commercial heart of the capital with many headquarters of Fortune 500 companies. It is endowed with incomparable business advantages and resources which attract numerous world-renowned companies. China Overseas Plaza consists of two A-class office buildings and two auxiliary commercial buildings. We began using this building in December 2010. The office's lease term is 38 months from December 10, 2010 to February 9, 2014. The annual rent is RMB 243,708 (approximately $36,000).

All land in the PRC is owned by the government and cannot be sold to any individual or entity. Instead, the government grants landholders a “land use right” after a purchase price for such “land use right” is paid to the government. The “land use right” allows the holder the right to use the land for a specified long-term period of time and enjoys all the incidents of ownership of the land. The following are the details regarding our land use rights with regard to the land that we use in our business.

Our main office is located at 58 Heng Shan Road, Kun Lun Shopping Mall Harbin, Heilongjiang Province, PRC 150090, which has a total area of 388 square meters (4,177 square feet). This space is adequate for our present and our planned future operations. No other businesses operate from this office. We have no current plans to occupy other or additional office space.

Beijing Hua Yu Ping Xue Education Technology Co., Ltd. is located at 311 An Men Nei Road, Xicheng District, Beijing, PRC, which has a total area of 1,677 square meters (approximately 18,051 square feet) with an annual rent of RMB 2,203,578 (approximately $341,407).

Tianlang has several locations, the main school is located at Jiao Hua Street , Harbin, PRC, which has a total area of 1,600 square meters (approximately 17,222 square feet) with an annual rent of RMB 304,800 (approximately $47,224).

Harbin Nuoya is located at Level 6, 118 Xi Da Zhi Street, Harte Buidling, Harbin, PRC, which has a total area of 400 square meters (approximately 4,306 square feet) with an annual rent of RMB 220,000 (approximately $34,085).

| 13 |

Changchun Nuoya is located at 208 South Hutong, Xi Chao Yang Road, Chuangchun, PRC, which has a total area of 900 square meters (9,688 square feet) with an annual rent of RMB 75,000 (approximately $11,620).

| Item 3. | Legal Proceedings. |

We are presently involved in two putative class action lawsuits filed in the U.S. District Court for the Central District of California. The first action, Apicella v. China Education Alliance, Inc., et al., No. 10-cv-09239 (CAS)(JCx), was filed on December 2, 2010; the second action, Clemens v. China Education Alliance, Inc., et al., No. 10-cv-09987 (JFW) (AGRx), was filed on December 28, 2010. On March 2, 2011, both actions were consolidated in In re China Education Alliance, Inc. Securities Litigation, No. 10-cv-09239 (CAS) (JCx) (C.D. Cal.). The Consolidated Amended Complaint alleged that the Company, Xiqun Yu, Zibing Pan, Susan Liu, Chunqing Wang, James Hsu, Liansheng Zhang, and Yizhao Zhang are liable under Section 10(b) of the Securities Exchange Act of 1934 and SEC Rule 10b-5 for allegedly false and misleading statements and omissions in our public filings between 2008 and 2010 and in an investor conference call in December 2010. The Consolidated Amended Complaint also asserted claims under Section 20(a) of the Securities Exchange Act of 1934 against the individual defendants as persons who allegedly controlled the Company during the time the allegedly false and misleading statements and omissions were made. The Court denied the company's motion to dismiss the Consolidated Amended Complaint on October 11, 2011, and granted (with leave to replead) James Hsu's motion to dismiss the Consolidated Amended Complaint on November 14, 2011. On December 5, 2011, the plaintiffs in the class action filed a Consolidated Second Amended Complaint alleging claims under Section 10(b) of the Securities Exchange Act of 1934 and SEC Rule 10b-5 against the Company, Xiqun Yu, Zibing Pan, Susan Liu, and Chunqing Wang, and alleging claims under Section 20(a) of the Securities Exchange Act of 1934 against Xiqun Yu, Zibing Pan, Susan Liu, Chunqing Wang, James Hsu, Liansheng Zhang, and Yizhao Zhang. The Company answered the Consolidated Second Amended Complaint on January 5, 2012. On April 6, 2012, the court dismissed the claim against Liansheng Zhang but denied motions to dismiss the claims against James Hsu and Yizhao Zhang, the only other defendants served so far.

In addition, on October 28, 2011, a derivative lawsuit was filed on behalf of the Company in the U.S. District Court for the Central District of California against Xiqun Yu, Zibing Pan, Susan Liu, Chunqing Wang, James Hsu, Liansheng Zhang, and Yizhao Zhang for alleged breaches of fiduciary duties based on facts similar to those alleged in the class action. The derivative lawsuit is Padnos v. Yu, et al., No. 11-cv-08973 (CAS) (JCx) (C.D. Cal.). The parties have reached an agreement in principle to settle the derivative action, subject to court approval.

| Item 4. | Mine Safety Disclosures. |

Not applicable.

| 14 |

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market for Common Equity and Related Stockholder Matters

Our common stock is traded on OTCQX since January 25, 2012 under the symbol “CEAI.” From December 29, 2011 to January 24, 2012, our common stock was traded on OTCQB under the symbol “CEAI.” Our common stock was traded on the NYSE from January 27, 2010 to December 28, 2011 under the symbol CEU. From July 20, 2009 to January 26, 2010, our common stock was traded on the NYSE Amex under the symbol CEU. Prior to July 20, 2009, our common stock was traded on the OTC Bulletin Board under the trading symbol CEUA.OB. The table below presents the high and low bid for our common stock for each quarter from January 1, 2010 through December 31, 2011. These prices reflect inter-dealer prices, without retail markup, markdown, or commission, and may not represent actual transactions.

| High | Low | |||||||||

| Year ended December 31, 2010 | ||||||||||

| 1st Quarter | $ | 7.48 | $ | 5.25 | ||||||

| 2nd Quarter | $ | 5.55 | $ | 3.80 | ||||||

| 3rd Quarter | $ | 4.74 | $ | 3.65 | ||||||

| 4th Quarter | $ | 5.80 | $ | 2.18 | ||||||

| $ | 7.48 | $ | 5.25 | |||||||

| Year ended December 31, 2011 | ||||||||||

| 1st Quarter | $ | 8.01 | $ | 3.99 | ||||||

| 2nd Quarter | $ | 5.01 | $ | 2.43 | ||||||

| 3rd Quarter | $ | 3.75 | $ | 1.22 | ||||||

| 4th Quarter | $ | 1.89 | $ | 0.43 | ||||||

As of April 13, 2012, we had 10,582,503 shares of common stock outstanding and held of record by 172 stockholders. Within the holders of record of our common stock are depositories such as Cede & Co. that hold shares of stock for brokerage firms, which, in turn, hold shares of stock for beneficial owners. On April 13, 2012, the closing price of our common stock on OTCQX was $0.99 per share.

We have not declared or paid any dividends on our common stock and presently do not expect to declare or pay any such dividends in the foreseeable future.

Securities Authorized for Issuance Under Equity Compensation Plans.

On June 18, 2009, we adopted the China Education Alliance, Inc. 2009 Incentive Stock Plan (the “2009 Plan”). We registered 333,334 shares of our common stock under the 2009 Plan on a Form S-8, effective June 18, 2009. On the same date, we issued 5,445 shares of our common stock to our employees and consultants, options to purchase 100,000 shares of common stock to our Chief Executive Officer, Xiqun Yu, at an exercise price of $9.57 per share, and options to purchase 38,667 shares of common stock to other employees and consultants at an exercise price of $8.70 per share (of which an option to purchase 10,000 shares have been retired). On September 24, 2009, we issued an option to purchase 10,000 shares to our ex-Chief Financial Officer, Zibing Pan, which option has been retired after his resignation.

On January 18, 2011, we issued 155,113 shares of our common stock to our employees. As of April 13, 2012, 24,109 shares are still available under the 2009 Plan.

On June 21, 2011, we adopted the China Education Alliance Inc. 2011 Incentive Stock Plan (the “2011 Plan”), which was approved by our shareholders on September 18, 2011. We registered 333,334 shares of our common stock under the 2011 Plan on a Form S-8, effective July 1, 2011. On July 1, 2011, we issued to our employees and directors options to purchase a total of 52,667 shares of common stock under the 2011 Plan. As of April 13, 2012, 274,000 shares are still available under the 2011 Plan.

| 15 |

Set forth below is our equity compensation plan information as of December 31, 2011.

Equity Compensation Plan Information

| Plan category | Number of securities to be issued upon exercise of outstanding options, warrants and rights |

Weighted-average exercise price of outstanding options, warrants and rights |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) |

|||||||||

| (a) | (b) | (c) | ||||||||||

| Equity compensation plans | 131,780 | $9.36 | 24,109 | |||||||||

| approved by security holders | 52,667 | $2.67 | 274,000 | |||||||||

| Equity compensation plans not approved by security holders | 0 | 0 | 0 | |||||||||

| Total | 184,447 | $7.45 | 298,109 | |||||||||

Stock Transfer Agent

Our stock transfer agent is Broadridge Corporate Issuer Solutions, Inc., 1717 Arch St. Suite 1300, Philadelphia, PA 19103.

Dividends

We have not declared or paid any dividends on our common stock and presently do not expect to declare or pay any such dividends in the foreseeable future. We have not yet formulated a future dividend policy in the event restrictions on our ability to pay dividends are created. Payment of dividends to our stockholders would require payment of dividends by our PRC subsidiaries to us. This, in turn, would require a conversion of Renminbi into US dollars and repatriation of funds to the United States. Under current PRC law, the conversion of Renminbi into foreign currency generally requires government consent. Government authorities may impose restrictions that could have a negative impact in the future on the conversion process and upon our ability to meet our cash needs, and to pay dividends to our stockholders. Although, our subsidiaries’ classification as wholly-owned foreign enterprises under PRC law permits our subsidiaries to declare dividends and repatriate their funds to us in the United States, any change in this status or the regulations permitting such repatriation could prevent them from doing so. Any inability to repatriate funds to us would in turn prevent payments of dividends to our stockholders.

Repurchase of Equity Securities by China Education Alliance and Affiliated Purchasers

None.

Recent Sales of Unregistered Securities

None.

| Item 6. | Selected Financial Data. |

Not applicable.

| 16 |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

The following discussion of the results of our operations and financial condition should be read in conjunction with our consolidated financial statements and the related notes thereto, which appear elsewhere in this Annual Report.

Except for the historical information contained herein, the following discussion, as well as other information in this report, contain “forward-looking statements,” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are subject to the “safe harbor” created by those sections. Forward-looking statements include, but are not limited to, statements that express our intentions, beliefs, expectations, strategies, predictions or any other statements relating to our future activities or other future events or conditions. These statements are based on current expectations, estimates and projections about our business based, in part, on assumptions made by management. These statements are not guarantees of future performance and involve risks, uncertainties and assumptions that are difficult to predict. Therefore, actual outcomes and results may, and are likely to, differ materially from what is expressed or forecasted in the forward-looking statements due to numerous factors, including those discussed from time to time in this report, as well as and any risks described in the “risk factors” section of our filings we make with the SEC. In addition, such statements could be affected by risks and uncertainties related to the ability to conduct business in the People’s Republic of China, demand, including demand for our products resulting from change in the educational curriculum or in educational policies, our ability to raise any financing which we may require for our operations, competition, government regulations and requirements, pricing and development difficulties, our ability to make acquisitions and successfully integrate those acquisitions with our business, as well as general industry and market conditions and growth rates, and general economic conditions. Any forward-looking statements speak only as of the date on which they are made, should not be relied upon as representing our views as of any subsequent date and we do not undertake any obligation to update any forward-looking statement to reflect events or circumstances after the date of this report.

Our discussion and analysis of our financial condition and results of operations are based upon our consolidated financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States. The preparation of these financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenue and expenses. On an on-going basis, we evaluate these estimates, including those related to useful lives of real estate assets, cost reimbursement income, bad debts, impairment, net lease intangibles, contingencies and litigation. We base our estimates on historical experience and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other sources. There can be no assurance that actual results will not differ from those estimates.

Overview

Our principal business is the distribution of educational resources through the Internet. Our website, www.edu-chn.com, is a comprehensive education network platform which is based on network video technology and large data sources of education resources. We have a database comprising such resources as test papers for secondary education courses as well as video on demand. Our database includes more than 400,000 exams, test papers and courseware for secondary and elementary schools.

We also provide on-site teaching services in Heilongjiang Province, where we have 20 training facilities in Heilongjiang, Jilin, Liaoning, and Beijing, which can accommodate approximately 10,000 students at the same time. These classes complement our on-line education services. The courses cover primarily the compulsory education curriculum of junior, middle and high school. We charge tuition fees for these classes.

| 17 |

We generate revenue through our website by selling prepaid debit cards to our subscribers. These debit cards permit the subscriber to download materials from our website over a specified period, usually one year. We recognize revenue from the debit cards when the students use the debit cards to purchase our products. To the extent that the debit cards expire unused, we recognize the remaining balance of the debit card at that time. We also recognize revenue from our other online education business including the sale of advertising on our website. We recognize revenue from our training center’s classes ratably over the term of the course, and we recognize revenue from face-to-face tutorials with students who attend our training center and face-to-face information technology training courses.

The laws of the People’s Republic of China provide the government broad power to fix and adjust prices. We need to obtain government approval in setting our prices for classroom coursework and tutorials, which affects our revenue in our training center business. Although the sale of educational material over the Internet is not presently subject to price controls, we cannot give you any assurance that they will not be subject to controls in the future. To the extent that we are subject to price control, our revenue, gross profit, gross margin and net income will be affected since the revenue we derive from our services will be limited and we may face no limitation on our costs. Further, if price controls affect both our revenue and our costs, our ability to be profitable and the extent of our profitability will be effectively subject to determination by the applicable PRC regulatory authorities.

Because students who purchase our on-line programs purchase debit cards for the programs that they use and students who enroll in our training classes pay their tuition before starting classes, we do not have significant accounts receivable. As of December 31, 2011, we had $0 in accounts receivable because we collect all payment upfront.

Our prepaid expenses at $1,305,496 account for 1.73% of current assets as of December 31, 2011. Prepaid expenses are primarily comprised of advance payments made for services to teachers, online materials and video, prepaid advertising and prepaid rent. As of December 31, 2011, prepayments to teachers and online materials totaled $302,340, prepayment of rent expense totaled $387,618, prepayments for advertising totaled $53,036, prepaid services and professional fees totaled $286,281, and other prepaid expenses were $276,221. We amortize the prepayments to teachers over three months, which is the estimated life of the testing materials. The prepaid rent related to our Beijing office and dormitory rental for our training center and the prepayment to teachers decreases as the materials are delivered and the prepaid rent decreases ratably during the terms of the leases.

As a result of both the manner in which we recognize revenue and the manner that we expense the cost of our materials, there is a difference between our cash flow and our revenue and cost of revenue.

In our on-line education business segment, the principal component of cost of revenue is the cost of obtaining new material to offer students as we increase the available material as well as depreciation related to computer equipment and software and direct labor cost. Our on-line education business generates a gross margin of 65% for the year ended December 31, 2011. The gross margin is affected by the payments we have to make to the teachers for the materials. In our training center business, the principal components of cost of revenue are costs of the faculty and the amortization of intangible assets. The tuition that we charge our students at our training center is subject to government approval. As a result, we may not be able to pass on to our students any increases in costs we incur, including increased costs of running our faculty. Our gross margin in the training center is also affected by the size of our classes.

Our on-line products and our training services are dependent upon the government's education policies. Any significant changes in curriculum or testing methods could render all or a significant portion of our library of test papers and our training center obsolete and we may have to devote substantial resources in adapting to the changes.

We have recently added a platform for training agencies and schools to offer their services, and we offer job search guidance and career planning courses to college graduates through this platform. This business has become part of our online education business, since it is currently largely an Internet-based activity.