Attached files

| file | filename |

|---|---|

| EX-23.2 - CONSENT OF GRANT THORNTON LLP - CHESAPEAKE OILFIELD SERVICES INC | d330734dex232.htm |

| EX-23.1 - CONSENT OF PRICEWATERHOUSECOOPERS LLP - CHESAPEAKE OILFIELD SERVICES INC | d330734dex231.htm |

Table of Contents

Index to Financial Statements

As filed with the Securities and Exchange Commission on April 16, 2012

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Chesapeake Oilfield Services, Inc.

(Exact name of registrant as specified in its charter)

| Oklahoma | 1389 | 45-5011340 | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification No.) |

6100 North Western Avenue

Oklahoma City, Oklahoma 73118

(405) 848-8000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Jerry L. Winchester

Chief Executive Officer

6100 North Western Avenue

Oklahoma City, Oklahoma 73118

(405) 848-8000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Michael S. Telle Bracewell & Giuliani LLP 711 Louisiana Street, Suite 2300 Houston, Texas 77002 (713) 221-1327 |

William S. Moss III Mayer Brown LLP 700 Louisiana Street, Suite 3400 Houston, Texas 77002 (713) 238-2649 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | þ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

CALCULATION OF REGISTRATION FEE

|

| ||||

| Title of Each Class of Securities to Be Registered |

Proposed Maximum Aggregate Offering Price(1)(2) |

Amount of Registration Fee | ||

| Class A Common Stock, par value $0.001 per share |

$862,500,000 | $98,843 | ||

|

| ||||

|

| ||||

| (1) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

| (2) | Includes approximately $112,500,000 attributable to shares of Class A common stock that may be offered upon exercise of a 30-day option to purchase additional shares granted to the underwriters. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission acting pursuant to said Section 8(a), may determine.

Table of Contents

Index to Financial Statements

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to Completion

Preliminary Prospectus dated April 16, 2012

Shares

Chesapeake Oilfield Services, Inc.

Class A Common Stock

This is an initial public offering of the Class A common stock of Chesapeake Oilfield Services, Inc. We are offering shares of our Class A common stock.

Prior to this offering, there has been no public market for our Class A common stock. We anticipate that the initial public offering price of our Class A common stock will be between $ and $ per share. We intend to apply to list our Class A common stock on the New York Stock Exchange under the symbol “COS.”

Concurrently with the consummation of this offering, we will issue shares of our Class B common stock, each share of which initially entitles the holder to votes per share, to Chesapeake Energy Corporation. Through its ownership of our Class B common stock, Chesapeake will hold % of the combined voting power of our outstanding common stock immediately after this offering.

See “Risk Factors” on page 25 to read about factors you should consider before buying shares of our Class A common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| Per Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discount |

$ | $ | ||||||

| Proceeds, before expenses, to Chesapeake Oilfield Services, Inc. |

$ | $ | ||||||

The underwriters have the option, exercisable for 30 days from the date of this prospectus, to purchase up to additional shares of our Class A common stock at the initial public offering price less the underwriting discount.

The underwriters expect to deliver the shares against payment in New York, New York on , 2012.

| Goldman, Sachs & Co. | BofA Merrill Lynch |

Prospectus dated , 2012.

Table of Contents

Index to Financial Statements

| Page | ||||

| 1 | ||||

| 25 | ||||

| 47 | ||||

| 48 | ||||

| 51 | ||||

| 53 | ||||

| 54 | ||||

| 55 | ||||

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

57 | |||

| 79 | ||||

| 102 | ||||

| 106 | ||||

| 114 | ||||

| 116 | ||||

| 121 | ||||

| 123 | ||||

| 125 | ||||

| MATERIAL U.S. FEDERAL INCOME TAX CONSIDERATIONS TO NON-U.S. HOLDERS |

134 | |||

| 138 | ||||

| 144 | ||||

| 144 | ||||

| 145 | ||||

| F-1 | ||||

Through and including , 2012 (the 25th day after the date of this prospectus), all dealers effecting transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to an unsold allotment or subscription.

We have not authorized anyone to provide any information or to make any representations other than those contained in this prospectus or in any free writing prospectuses we have prepared. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus is an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus is current only as of its date.

Industry and Market Data

The market data and certain other statistical information used throughout this prospectus, including statements as to our ranking, market position and market estimates, are based on independent industry publications, government publications or other published independent sources. Some data is also based on our good faith estimates. Prospective investors are cautioned not to place undue reliance on such data and information due to the fact that it may be based on our estimates or, if derived from a third party, we have not verified it.

i

Table of Contents

Index to Financial Statements

This summary provides a brief overview of information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider before investing in our Class A common stock. You should read the entire prospectus carefully before making an investment decision, including the information presented under the headings “Risk Factors,” “Cautionary Note Regarding Forward-Looking Statements,” “Organizational Structure” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the historical consolidated financial statements and related notes thereto included elsewhere in this prospectus.

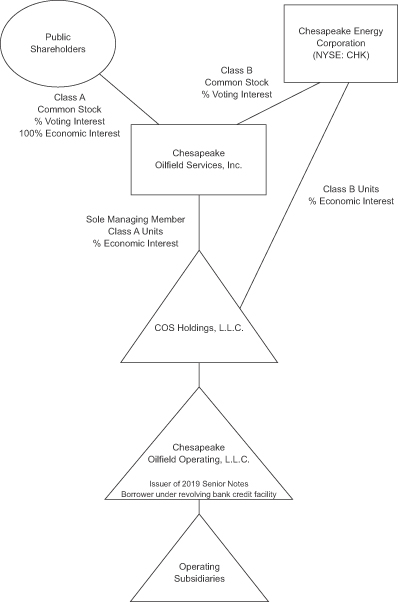

On October 25, 2011, Chesapeake completed the process of reorganizing its oilfield services subsidiaries and operations as subsidiaries of COS Holdings, L.L.C. (“COS LLC”) and commenced providing all of its oilfield services through COS LLC, as more fully described under “Organizational Structure.” As a result, the historical financial information presented in this prospectus for periods and as of dates prior to that October 25, 2011 reorganization is the historical consolidated financial information of our “predecessor” or “Chesapeake Oilfield Services Predecessor.” The historical financial information presented in this prospectus for periods and as of dates on or after that October 25, 2011 reorganization is the historical consolidated financial information of COS LLC.

In this prospectus, unless the context otherwise requires, the terms “we,” “us,” “our” or “ours” refer to COS LLC and its subsidiaries and predecessor entities prior to this offering and to Chesapeake Oilfield Services, Inc. (“COS Inc.”) and its subsidiaries, including COS LLC, from and after this offering. See “—Organizational Structure.” References to “Chesapeake Oilfield Operating” or “COO” mean Chesapeake Oilfield Operating, L.L.C., a wholly owned subsidiary of COS LLC, which is the borrower under our revolving bank credit facility and the co-issuer of our 6.625% Senior Notes due 2019 (the “2019 Senior Notes”). References to “Chesapeake” mean Chesapeake Energy Corporation and its subsidiaries (excluding us), unless the context indicates otherwise.

Our Company

We are a diversified oilfield services company that provides a wide range of well site services primarily to Chesapeake, our founder and principal customer, and its partners. Chesapeake is the most active driller of new oil and natural gas wells in the U.S. based on rig count. We focus on providing services to Chesapeake that are strategic to its oil and gas operations, represent historical bottlenecks to those operations or provide relatively high margins to the service provider, including drilling, hydraulic fracturing, oilfield rentals, oilfield trucking and manufacturing of natural gas compressor packages. Our operations are geographically diversified across most major basins in the U.S. Specifically, we provide Chesapeake and its partners with services in the Eagle Ford, Utica, Granite Wash, Cleveland, Tonkawa, Mississippi Lime, Bone Spring, Avalon, Wolfcamp, Wolfberry and Niobrara unconventional liquids plays and the Barnett, Haynesville, Bossier, Marcellus and Pearsall natural gas shale plays.

Our objective is to provide up to two-thirds of Chesapeake’s overall expected needs for our current and future services. This objective, combined with our unique relationship with Chesapeake, makes us fundamentally different than our competitors because it provides us with substantial growth opportunities while at the same time positioning us to maintain our industry-leading asset utilization rates. We believe that our high-growth, high-utilization business model will allow us to continue creating significant shareholder value over time.

1

Table of Contents

Index to Financial Statements

Our business has grown rapidly since our first subsidiary was founded in 2001, both organically and through acquisitions, and we are now one of the larger U.S. onshore oilfield service companies. We currently operate 111 land drilling rigs, the fourth largest active rig fleet in the U.S., which represents our largest revenue generating service line today. We also operate (a) four hydraulic fracturing fleets with an aggregate of 140,000 horsepower; (b) one of the largest oilfield rental businesses in the U.S.; (c) one of the largest oilfield trucking fleets in the U.S., currently consisting of 227 rig relocation trucks, 57 cranes and forklifts used in the movement of drilling rigs and other heavy equipment and 157 fluid hauling trucks; and (d) manufacturing capacity for up to 150 compressor units per quarter, or approximately 85,000 horsepower in the aggregate per quarter. We continue to grow our assets rapidly and have ordered 12 drilling rigs that will utilize advanced electronic drilling technology, including 10 of our proprietary, fit-for-purpose PeakeRigs™, which are scheduled to be delivered at a rate of approximately one rig per month through May 2013. We have also ordered additional new hydraulic fracturing equipment with an aggregate of 175,000 horsepower, and we expect to have eight hydraulic fracturing fleets with an aggregate of 315,000 horsepower operating by the end of 2012 and 12 such fleets with an aggregate of 450,000 horsepower operating by the end of 2013. We believe our growth plans will place us among the largest hydraulic fracturing companies in the U.S. by year-end 2014 based on horsepower.

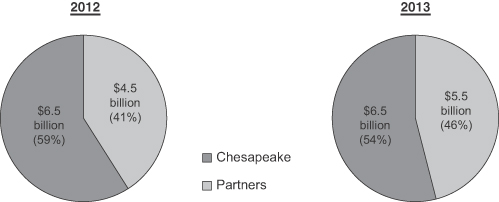

The services that we provide to Chesapeake are fundamental to establishing and maintaining the production of oil and natural gas from its wells. As of December 31, 2011, Chesapeake had total estimated net proved reserves of approximately 18.8 trillion cubic feet of natural gas equivalent (tcfe), which includes approximately 545 million barrels (mmbbls) of oil and natural gas liquids, which we refer to collectively as “liquids,” and was operating 162 drilling rigs to develop its inventory of approximately 39,000 risked net drill sites. During 2011, Chesapeake utilized hydraulic fracturing fleets with an average of approximately 1.0 million horsepower per day. For 2012 and 2013, Chesapeake’s gross operated drilling and completion capital expenditure budgets are approximately $11.0 billion and $12.0 billion, respectively.

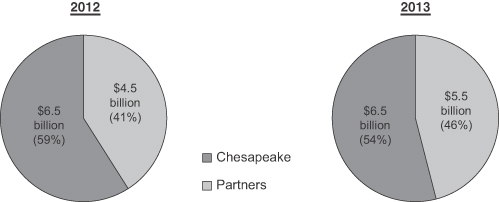

Chesapeake’s operated drilling program includes expenditures by both Chesapeake and its partners. The charts below show the percentage of budgeted capital expenditures expected to be funded by Chesapeake and its partners in 2012 and 2013.

Chesapeake’s Gross Operated Drilling and Completion

Capital Expenditure Budget

2

Table of Contents

Index to Financial Statements

We currently supply Chesapeake with small percentages of its overall requirements for most of our services, which presents us with significant organic growth opportunities. For example, during the year ended December 31, 2011, our revenues from hydraulic fracturing represented less than 1% of Chesapeake’s gross operated expenditures for hydraulic fracturing services and our revenues from oilfield equipment rentals would have represented approximately 19% of its gross operated expenditures for oilfield equipment rentals. Additionally, although we already supply approximately two-thirds of Chesapeake’s current drilling rig needs, we provide low percentages of the drilling-related services it uses, such as directional drilling, mud logging and geosteering services, providing us with significant organic growth opportunities for those services as well. Likewise, while our trucking segment provides Chesapeake with a significant percentage of its rig relocation services, we provide only a small percentage of its fluid hauling requirements.

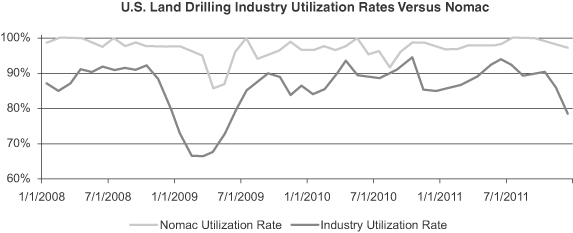

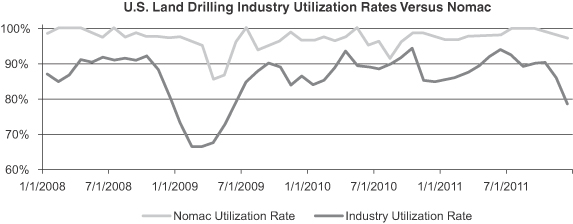

By seeking to match our productive capacity to meet up to two-thirds of Chesapeake’s expected need for our services, we anticipate that we will continue to have industry-leading asset utilization levels through industry cycles, as we believe that Chesapeake will have a number of incentives to use our services given our relationship and the operational efficiencies we provide. Moreover, Chesapeake’s drilling activity levels over time have been more stable than those of its peers. For example, in the twelve-month period ended September 30, 2009, one of the most challenging periods in the recent history of our industry, the U.S. onshore industry rig count decreased by 1,308 rigs, or 50%, while Chesapeake’s operated rig count, which includes third-party rigs, decreased by only 53 rigs, or 34%. During that same period, Chesapeake’s utilization of our rigs increased by six rigs, from 71 to 77, or 8%. Our rig utilization rates for 2009, 2010 and 2011 were 95%, 97% and 98%, respectively, compared to industry averages for the same periods of 79%, 89% and 88%, respectively. The utilization rates of our other assets are correlated with our rig utilization rates because the well drilling performed by our rigs creates demand for most of the other services we provide.

Significantly, we also have contractual arrangements with Chesapeake that provide additional revenue stability in the event of an industry downturn. Under our services agreement with Chesapeake, Chesapeake has guaranteed the utilization of the lesser of 75 of our drilling rigs or 80% of our operational drilling rig fleet at market-based rates. In addition, Chesapeake has guaranteed that each month it will ensure utilization of our operational hydraulic fracturing fleets, up to a maximum of 13 fleets, to complete a minimum aggregate number of fracturing stages equal to 25 stages per month for each fleet at market-based rates.

We currently conduct our business through five operating segments:

Drilling. Nomac Drilling, L.L.C., our drilling subsidiary, provides premium land drilling and drilling-related services, including directional drilling, geosteering and mudlogging, for oil and natural gas exploration and development activities. As of March 31, 2012, we operated a fleet of 111 land drilling rigs, making us the fourth largest land driller operating in the U.S. according to RigData, an independent source of drilling activity information. To address Chesapeake’s needs for horizontal drilling in shale formations and other unconventional resource plays, we have expanded our areas of operation and improved the capability of our drilling rig fleet. We are in the process of building 12 new rigs that will utilize advanced electronic drilling technology, including 10 of our proprietary, fit-for-purpose PeakeRigs™, which are scheduled to be delivered at a rate of approximately one rig per month through May 2013. We are also in the process of refurbishing three rigs in order to modernize and increase the capability of those rigs. For the year ended December 31, 2011, Chesapeake’s gross operated expenditures for drilling and drilling-related services were approximately $1.7 billion, and our revenues from this segment represented approximately 50% of such expenditures.

3

Table of Contents

Index to Financial Statements

Hydraulic Fracturing. Performance Technologies, L.L.C., our hydraulic fracturing subsidiary, provides hydraulic fracturing and other well stimulation services. We began hydraulic fracturing operations in the fourth quarter of 2011 with one hydraulic fracturing fleet and currently have four operational fleets with an aggregate of approximately 140,000 horsepower. We plan to have eight such fleets with approximately 315,000 horsepower in the aggregate operating by the end of 2012 and 12 such fleets with approximately 450,000 horsepower in the aggregate operating by the end of 2013. For the year ended December 31, 2011, Chesapeake’s gross operated expenditures for hydraulic fracturing services were approximately $3.5 billion, and our revenues from this segment represented less than 1% of such expenditures.

Oilfield Rentals. Great Plains Oilfield Rental, L.L.C., our oilfield rentals subsidiary, provides a wide range of premium rental tools and services for land-based oil and natural gas drilling, completion and workover activities. We offer a full line of rental tools, including drill pipe, drill collars, tubing, blowout preventers, frac and mud tanks and also provide air drilling services and services associated with the transfer of fresh water to the well site. As our oilfield rentals segment generates our highest margins and we currently supply Chesapeake with a low percentage of its overall oilfield rentals requirements, this segment offers attractive expansion opportunities, including the purchase and subsequent rental of equipment used in pressure control, flowback and hydraulic fracturing services. For the year ended December 31, 2011, Chesapeake’s gross operated expenditures for oilfield rentals were approximately $1.3 billion, and our revenues from this segment represented approximately 19% of such expenditures.

Oilfield Trucking. Hodges Trucking Company, L.L.C. and Oilfield Trucking Solutions, L.L.C., our oilfield trucking subsidiaries, provide rig relocation and logistics services and fluid hauling services. Our trucks move drilling rigs, crude oil, fluids and construction materials to and from the well site and also transport produced water from the well site. As of March 31, 2012, we owned a fleet of 227 rig relocation trucks, 57 cranes and forklifts used in the movement of drilling rigs and other heavy equipment and 157 fluid hauling trucks. Expansion opportunities for our oilfield trucking segment include expanding our assets, such as our crude hauling capabilities, and deploying our assets in new areas. For the year ended December 31, 2011, Chesapeake’s gross operated expenditures for rig relocation and logistics services were approximately $167.0 million, and our revenues from this segment represented approximately 77% of such expenditures. These amounts do not include Chesapeake’s expenditures for fluid hauling services, of which we currently provide only a small percentage.

Other Operations. Compass Manufacturing, L.L.C., our manufacturing subsidiary, designs, engineers, fabricates, sells and installs natural gas compression units, accessories and equipment used in the production, treatment and processing of oil and natural gas. As of March 31, 2012, we had the capacity to manufacture up to up to 150 compressor units per quarter, or approximately 85,000 horsepower in the aggregate per quarter. Expansion opportunities for Compass include the manufacture of other types of oilfield equipment that are used in our oilfield rentals business. For the year ended December 31, 2011, Chesapeake’s gross operated expenditures for compressor purchases were approximately $87.5 million, and we provided Chesapeake with approximately 66% of its compressor manufacturing needs.

4

Table of Contents

Index to Financial Statements

Our Competitive Strengths

We believe that we have the following competitive strengths:

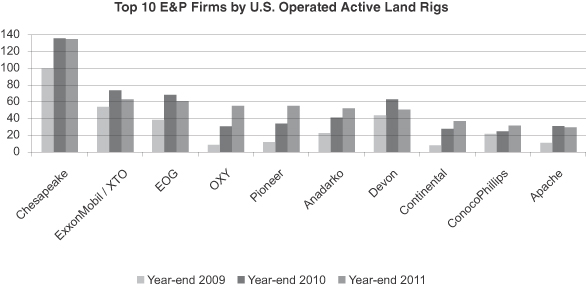

Our relationship with Chesapeake. For nearly eight years, Chesapeake, our founder and principal customer, has maintained the nation’s most active drilling program, based on rig count. For the years ended December 31, 2009, 2010 and 2011, Chesapeake drilled 1,212, 1,445 and 1,662 gross operated oil and natural gas wells, respectively, and made $5.2 billion, $7.9 billion and $13.3 billion, respectively, of gross operated drilling and completion expenditures. As of December 31, 2011, Chesapeake had total estimated net proved reserves of 18.8 tcfe, which includes approximately 545 mmbbls of liquids, and was operating 162 drilling rigs to develop its inventory of approximately 39,000 risked net drill sites. We anticipate that a significant portion of the demand for our services in future years will come from Chesapeake’s exploitation of this large backlog of drilling locations, approximately 20 years’ worth at current drilling levels.

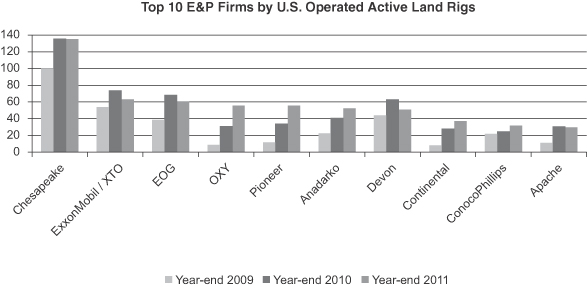

The chart below shows the average number of rigs drilling for Chesapeake during 2009, 2010 and 2011 compared to its most active competitors.

Source: RigData–The Land Rig Newsletter Biweekly Report (excludes operating rigs that are in the process of rigging up or mobilization).

Looking forward, Chesapeake’s gross operated drilling and completion expenditure budgets for 2012 and 2013 are expected to be approximately $11.0 billion and $12.0 billion, respectively. Chesapeake’s industry-leading acreage position and active drilling program provide us with significant growth opportunities. Our relationship with Chesapeake, which gives us unique insights into our principal customer’s current and future oilfield services needs, positions us to operate efficiently, maintain industry-leading asset utilization and continue to improve our margins and creates incentives for Chesapeake to use our services.

5

Table of Contents

Index to Financial Statements

Significant revenue growth opportunities. Chesapeake’s current and future oilfield services needs provide us with significant growth opportunities. As shown in the table below, revenues from our hydraulic fracturing and oilfield rentals segments in 2011 represented less than 1% and approximately 19%, respectively, of Chesapeake’s gross operated expenditures for these services, which is well below our objective of providing up to two-thirds of Chesapeake’s overall expected need for these services.

| Segment(1) |

2011 Revenues (in millions)(2) |

Chesapeake’s 2011 Gross Operated Expenditures (in millions) |

As a Percentage of Chesapeake’s Gross Operated Expenditures |

|||||||||

| Drilling |

$ | 855 | $ | 1,725 | 50 | % | ||||||

| Hydraulic Fracturing |

$ | 13 | $ | 3,486 | 0 | % | ||||||

| Oilfield Rentals |

$ | 246 | $ | 1,266 | 19 | % | ||||||

| (1) | See Note 14 to our audited consolidated financial statements included elsewhere in this prospectus for additional information about our reportable segments. |

| (2) | Drilling and oilfield rentals segment revenues include third-party revenues. Hydraulic fracturing includes ancillary support services. |

In addition, within our drilling and oilfield trucking segments, we currently provide Chesapeake with a small percentage of its needs for drilling-related services and fluid hauling services, providing us with additional growth opportunities. We will also have the opportunity to increase the scope of our service offerings to Chesapeake and its partners and to grow with Chesapeake, whose drilling and completion expenditures have increased by an average of 27% year over year since 2006. We believe that Chesapeake’s oilfield services demand and its incentives to use our services will provide us with the opportunity to grow our business significantly with relatively low risk of over-expansion.

6

Table of Contents

Index to Financial Statements

Industry-leading asset utilization. Chesapeake’s 20-year backlog of drilling locations, many of which are in unconventional liquids plays, provides us with a unique opportunity to keep our assets highly utilized for years to come. We believe that Chesapeake’s incentives to use our services, combined with our objective of matching our productive capacity to meet up to two-thirds of Chesapeake’s expected overall needs for our services, will allow us to maintain industry-leading asset utilization levels through industry cycles. Additionally, Chesapeake’s drilling activity levels over time have been more stable than those of its peers. For example, in the twelve-month period ended September 30, 2009, one of the most challenging periods in the recent history of our industry, the U.S. onshore industry rig count decreased by 1,308 rigs, or 50%, while Chesapeake’s operated rig count, which includes third-party rigs, decreased by only 53 rigs, or 34%. During that same period, Chesapeake’s utilization of our rigs increased by six rigs, from 71 to 77, or 8%. The utilization rates of our other assets are correlated with our rig utilization rates because the well drilling performed by our rigs creates demand for most of the other services we provide. The chart below shows our drilling rig utilization over the last four years as compared with the U.S. industry onshore average.

Source: RigData and Nomac active rig counts.

Additionally, our services agreement with Chesapeake guarantees the utilization of a portion of our drilling rig and hydraulic fracturing fleets through October 2016, with an annual evergreen thereafter. While we believe the utilization of our assets will remain at a level significantly higher than the minimum utilization rates provided for in the services agreement, the guaranteed utilization provides us with downside protection in our traditionally cyclical industry.

7

Table of Contents

Index to Financial Statements

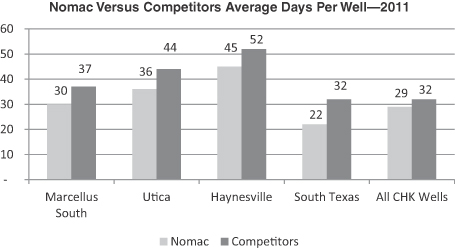

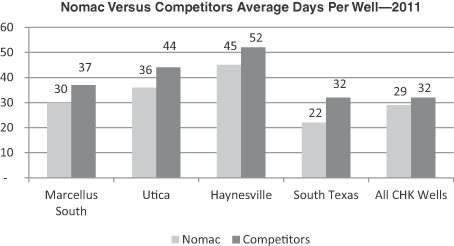

Enhanced operational efficiencies. Our unique relationship with Chesapeake creates operational efficiencies that our competitors cannot replicate. We have access to the activity forecasts prepared by Chesapeake and we maintain close communications with Chesapeake regarding its service needs, allowing us to efficiently provide timely, tailored, “just-in-time” service to Chesapeake. As the graph below indicates, we drill wells for Chesapeake and its partners on average approximately 10% faster than our competitors do.

Source: Chesapeake internal reports based on wells spudded in 2011.

Our ability to align our operations and forecasts with Chesapeake incentivizes it to use our services, provides us with cost savings and efficient deployment of capital and allows us to provide services at an overall cost that is attractive to Chesapeake and its partners. Our relationship with Chesapeake also provides us with the support of a large, well-known parent-sponsor which we believe benefits us in dealing with suppliers, lenders, capital providers and others that a similarly sized standalone service company could not replicate. Finally, we believe that Chesapeake’s workplace reputation, which was recently recognized on FORTUNE’s 100 Best Companies to Work For® list as the best among energy production companies, and our stable asset utilization levels have allowed us to build a well-trained, safe and efficient workforce of over 5,000 employees and to maintain a lower employee turnover rate compared to industry averages.

Diversified, high quality asset base. Our modern and well maintained assets are capable of providing unique operational advantages to Chesapeake. A substantial majority of our drilling rig fleet has been newly fabricated or refurbished since 2001, and substantially all of our rigs have been updated with the equipment necessary for horizontal drilling in today’s unconventional resource plays. We expect to have an additional 30 of our proprietary, fit-for-purpose PeakeRigs™ operating in the next six years, which will utilize state-of-the-art technology to improve drilling efficiency and will be rated 1,000 horsepower or greater. We also have an initiative underway to repower our drilling rigs with dual fuel, diesel/natural gas (DNG) systems, which will reduce our customers’ costs through the utilization of natural gas during our rig operations. Our hydraulic fracturing assets are among the newest in the industry, with 100% of our fleet built in 2011 or later by manufacturers with strong reputations for producing durable equipment capable of withstanding the demanding conditions typically presented by unconventional reservoirs. Our oilfield rentals, oilfield trucking and natural gas compressor manufacturing assets are modern and well maintained. The quality of our asset base

8

Table of Contents

Index to Financial Statements

and our comprehensive maintenance program results in less downtime, lower operating costs and increased utilization of our assets, which is critical for drilling and hydraulic fracturing operations where assets are commonly utilized on a 24-hour per day, seven day per week basis.

Experienced management team. We have an experienced and skilled management team which is led by our Chief Executive Officer, Jerry L. Winchester, who has over 30 years of industry experience, including 13 years of experience as the president and chief executive officer of Boots & Coots International Well Control, Inc. (“Boots & Coots”). Our management team, including Mr. Winchester, Cary D. Baetz, our Chief Financial Officer, James G. Minmier, President of Nomac Drilling, L.L.C., Zachary M. Graves, President of Thunder Oilfield Services, L.L.C., William R. Stanger, President of Performance Technologies, L.L.C., and Alan D. Lavenue, President of Compass Manufacturing, L.L.C., collectively has over a century of oilfield services experience with prominent oilfield service companies such as Halliburton Company, Boots & Coots, Helmerich & Payne, Inc., Schlumberger Limited, Precision Drilling Corporation, Bronco Drilling Company, Inc. and Exterran Holdings, Inc. The remainder of our management team is comprised of seasoned operating, financial and administrative executives with extensive experience in and knowledge of the oilfield services industry. Our management team has operated through numerous oilfield services cycles and provides us with valuable experience and a detailed understanding of customer requirements.

Our Business Strategy

Our goal is to maximize shareholder value by profitably building a leading oilfield services company through leveraging our relationship with Chesapeake, the most active driller of new oil and natural gas wells in the U.S., to achieve our objective of providing up to two-thirds of Chesapeake’s overall expected needs for our current and future services and maintain industry-leading utilization rates. We plan to pursue the following strategic objectives to achieve this goal.

Grow our asset base. We intend to aggressively grow our asset base, particularly our hydraulic fracturing fleets, oilfield rental inventory and drilling-related services, in order to achieve our objective of increasing our productive capacity to meet up to two-thirds of Chesapeake’s expected need for our services. We have placed substantial orders for additional new hydraulic fracturing units and expect to have eight fleets with approximately 315,000 horsepower in the aggregate operating by the end of 2012 and 12 fleets with approximately 450,000 horsepower in the aggregate operating by the end of 2013. Our drilling, hydraulic fracturing and oilfield rentals segments provide our highest margins and highest returns on invested capital relative to the other segments in which we operate. We are focused on increasing the revenues of these segments by growing our assets and expanding into the markets necessary to meet higher percentages of Chesapeake’s needs for these services, particularly the liquids-rich plays in which Chesapeake is now most active. During 2012 and 2013, we plan to make $1.1 billion to $1.2 billion of growth capital expenditures, in addition to amounts budgeted for the acquisition of presently leased rigs, and these expenditures will allow us to meet a greater percentage of Chesapeake’s needs and solidify our position as one of the largest U.S. onshore oilfield services companies.

Focus on full utilization of our assets. Our oilfield service assets have traditionally maintained high utilization rates. For example, the utilization of our drilling rigs has averaged between approximately 95% and 99% since 2008. The utilization rates of our other assets are directly correlated with our rig utilization rates because the well drilling performed by our rigs creates demand for most of the other services we provide. Our industry-leading asset utilization rates result from our strategy of growing in tandem with Chesapeake and serving as a substantial provider of oilfield services to Chesapeake and its partners. We plan to maintain our industry-leading utilization rates as we continue

9

Table of Contents

Index to Financial Statements

to grow by growing our productive capacity to meet up to two-thirds of Chesapeake’s overall expected need for our services. We believe this strategy, combined with Chesapeake’s incentives to use our services, will continue to result in high utilization rates for our assets throughout industry cycles.

Focus on improving margins. We plan to continue to improve our margins by leveraging our relationship with Chesapeake to decrease costs and make our business more efficient. Our relationship with Chesapeake enables us to operate more efficiently than our competitors by providing us with exclusive access to data that allows us to align our operations and projections with those of Chesapeake, to efficiently provide Chesapeake with timely, tailored, “just-in-time” services and to anticipate and quickly react to industry trends. As a result, our management team can focus its efforts on delivering efficient, high-quality services to Chesapeake and its partners rather than on marketing our services and managing through the cyclicality of oilfield activity and commodity prices. Additionally, we plan to continue to evolve our product and service offerings to include a larger percentage of higher margin offerings. We also believe that our new management team, which is exclusively dedicated to our operations and collectively has over a century of experience in the oilfield services industry, will enable us to better capitalize on existing efficiencies and identify further opportunities to maximize our margins. For example, since July 2011, our new management team has increased the gross margins in our drilling segment through various cost saving initiatives by approximately 20%, while at the same time improving our safety and productivity metrics.

Capitalize on opportunities to provide additional services. As the driller of a substantial majority of Chesapeake’s wells, we play a central role in the planning and execution of Chesapeake’s drilling program. As a result of this role, we are uniquely positioned to cross-sell our other service offerings to Chesapeake, observe the service offerings of other third-party service providers that are present at the well site and evaluate expansion opportunities. We plan to use this role to focus our growth on high margin product and services offerings. While we already provide Chesapeake with approximately two-thirds of its drilling rig needs, we plan to increase the percentage of drilling-related services that we provide, such as directional drilling, mud logging and geosteering. In our hydraulic fracturing segment, we believe that expansion opportunities exist not only through expanding our fleets but also by vertically integrating our operations through the integration of sand reserves, sand processing operations and railcar, truck and other logistics assets. We also plan to continue to grow our oilfield rentals segment, where our inventory of tools and equipment can be expanded to include additional drilling and completion rental tools. We have a significant growth capital expenditure budget of between $1.1 billion and $1.2 billion over the next two years with which to develop such business lines. These amounts are in addition to amounts budgeted for the acquisition of presently leased rigs. We believe that targeting the development of these high margin product and services offerings through geographic expansion, vertical integration and asset additions will provide us with a greater return on our investment in our assets and cash flows for future growth.

Continued focus on safety. Our relationship with Chesapeake provides us with enhanced utilization across industry cycles, which in turn reduces employee turnover, increases safety and drives superior results. In addition, the continuity of working relationships between our employees and Chesapeake provides for greater communication and data sharing at our drill sites, which we believe results in safer working conditions for employees. We are focused on hiring, training and retaining high-quality employees. As a result of our strong emphasis on training and safety protocols for our employees, we believe we have a superior safety record and reputation. We have a strong and improving Total Recordable Incidence Rate (TRIR) safety record even as our employee base has more than doubled over the past two years. From 2009 to 2011, our TRIR dropped by approximately 36%. In addition, all of our field-based employees are eligible to receive incentive pay based on satisfying safety standards, which we believe motivates them to continually maintain quality and safety.

10

Table of Contents

Index to Financial Statements

Industry Overview

Oilfield service companies provide services that are used by exploration and production companies, or E&P companies, in connection with the exploration for and the development and production of hydrocarbons. E&P companies operating in the U.S. include independent E&P companies, such as Chesapeake, U.S.-based major integrated oil and gas companies, such as ExxonMobil, ChevronTexaco and ConocoPhillips, and international major integrated oil and gas companies, such as Shell, Total S.A., BP America, CNOOC Limited and Statoil. Demand for domestic onshore oilfield services is a function of the willingness of E&P companies to make operating and capital expenditures to explore for, develop and produce hydrocarbons in the U.S. When oil or natural gas prices increase, E&P companies generally increase their capital expenditures, resulting in greater revenues and profits for oilfield service companies. Likewise, significant decreases in the prices of those commodities typically lead E&P companies to reduce their capital expenditures, which lowers the demand for oilfield services.

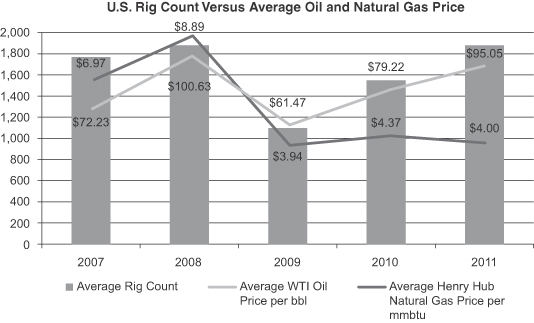

Oil and natural gas prices rose to record levels in 2008 and then began to decline in late 2008 in conjunction with the widespread economic recession. While the price of oil rebounded somewhat in 2009 and continued to rise throughout 2010 and 2011, the price of natural gas has continued to fall since 2009 largely due to discoveries of vast new natural gas resources in the U.S. The WTI Cushing spot price of a barrel of crude oil reached an all-time high of $145.29 per barrel in July 2008 and then dropped sharply by the end of the year, falling to as low as $31.41 per barrel on December 22, 2008 before trending upward again by late 2009 and reaching $92.19 in January 2011. During 2011, oil prices generally remained high, averaging $95.05 per barrel through December 31, 2011, due to increased demand, generally flattening international supply and geopolitical tensions. This trend has continued in 2012 with current oil prices above $100 per barrel. On the other hand, from the beginning of 2009 through March 31, 2012, U.S. Henry Hub natural gas prices generally declined from a starting price of $5.40 per mmbtu to an ending price of $2.00 per mmbtu.

11

Table of Contents

Index to Financial Statements

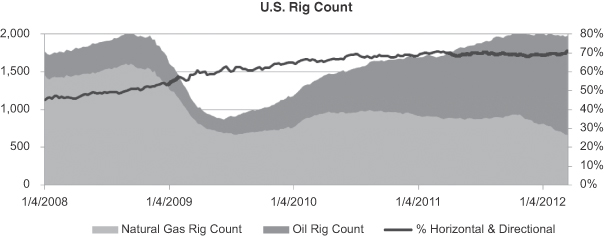

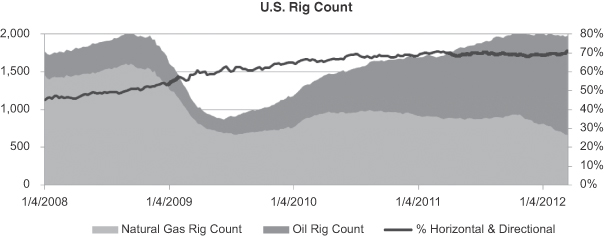

The number of drilling rigs under contract in the U.S. decreased in 2009 but rebounded in 2010 and has remained high since then relative to historical levels, according to data compiled by Baker Hughes Incorporated. This has remained the case despite a dramatic decrease in the price of natural gas over the same period, suggesting a weakening in the traditional correlation between natural gas prices and U.S. onshore drilling rig counts. We believe this decrease in correlation is attributable to several factors, including the discovery of potentially large oil and liquids-rich unconventional plays onshore in the U.S., the increasing presence in U.S. onshore plays of major U.S. and international integrated E&P companies that are typically less reactive to short-term price fluctuations than independent E&P companies, the presence of term contracts for certain types of oilfield services, the need by operators to commence drilling activities in order to establish production and avoid the expiration of oil and natural gas leases, and the more regimented approach to developing unconventional plays characterized by continuous hydrocarbon accumulations. Additionally, we believe that the weakening correlation between natural gas prices and U.S. onshore rig counts is partially attributable to the prevalence of joint ventures for the development of U.S. unconventional plays, many of which include a drilling “carry” that is paid by the joint venture partner and used by the operator to pay for a portion of the cost of drilling and completing the well. Chesapeake, for example, has entered into several such joint ventures since 2008 with companies such as Total S.A., CNOOC Limited, Statoil, BP America and Plains Exploration & Production Company that have provided more than $9.0 billion of drilling carries to Chesapeake.

Source: Baker Hughes Incorporated and Bloomberg.

12

Table of Contents

Index to Financial Statements

In response to historically low natural gas prices, a number of E&P companies, including Chesapeake, have announced that they are reducing dry natural gas drilling and production and redirecting their activities and capital toward currently more economic liquids-rich plays. Liquids-rich plays are those that are characterized by production of predominantly oil and natural gas liquids such as ethane, propane, butane and iso-butane, which are used as energy sources and manufacturing feedstocks, and the prices of which have historically been highly correlated with oil prices rather than natural gas prices. As a result, we expect the trend toward liquids-focused drilling to continue. The proportion of rigs in the U.S. drilling for liquids versus natural gas has also increased steadily over the past few years and, in April 2011, for the first time since 1993, the number of rigs drilling for liquids surpassed the number of rigs drilling for natural gas.

Source: Baker Hughes Incorporated

Trends that we believe are affecting, and will continue to affect, our industry include:

Drilling and developing unconventional U.S. hydrocarbon resources. Due to the maturity of conventional U.S. oil and natural gas reservoirs, the relative abundance of undeveloped unconventional resources and the cost advantage of developing unconventional resources, an increasing proportion of U.S. oil and natural gas production is coming from unconventional resources, which include shale formations. Since the beginning of 2008, producers have spent substantial amounts acquiring properties in unconventional resource plays in the U.S., including approximately $20.0 billion spent by Chesapeake, as advances in horizontal drilling and completion technologies have made the development of many unconventional resources economically attractive.

Horizontal wells are typically drilled in these unconventional formations and tend to involve a higher degree of service intensity associated with their initial drilling and completion, and we believe that these wells will also ultimately require a high degree of service intensity over their lifetime. The U.S. horizontal and directional rig count has risen from 705 (or 42% of the total) at the beginning of 2007 to 1,413 (or 71% of the total) for the week ending March 30, 2012, according to Baker Hughes Incorporated. In addition to an increase in the number of horizontal wells drilled in the U.S., the length of well laterals has increased and the intervals between fracturing stages have decreased over the past several years. The longer laterals and increasing number of fracturing stages have enhanced recoveries and lowered field development costs while causing the number of fracturing stages to grow at a faster rate than the horizontal rig count, creating an increased demand for completion related services.

13

Table of Contents

Index to Financial Statements

Increased drilling in liquids-rich formations. There is increasing horizontal drilling- and completion-related activity in liquids-rich formations such as the Eagle Ford, Utica, Bakken and Niobrara Shales and various other unconventional liquids-rich plays in Texas and Oklahoma, including the Wolfcamp, Bone Spring, Granite Wash, Cleveland and Tonkawa sands and the Mississippi Lime. In January 2012, Chesapeake announced its plan to curtail its dry gas drilling and production activities and redirect capital to its liquids-rich plays. We believe that the oil and natural gas liquids content in these plays significantly enhances the returns for Chesapeake and its partners relative to opportunities in dry gas basins due to the significant disparity between oil and natural gas prices on a British thermal unit (btu) basis. Furthermore, we believe that oil and natural gas liquids prices tend to exhibit less volatility than natural gas prices due to the global nature of the crude oil market and the more localized market for natural gas. We believe that the higher price of liquids relative to natural gas, as well as liquids’ reduced pricing volatility will continue over the near- to medium-term, resulting in increasing demand for services in liquids-rich basins and a reduction in the variability of demand for oilfield services generally.

High asset utilization and tight labor and equipment market. Many of the unconventional reservoirs in the U.S. are deep, high-pressure and challenging environments, factors that increase the demand for skilled workers and high-quality oilfield services. Equipment manufacturers have had difficulty meeting the demand for services equipment, resulting in high asset utilization levels across the industry. In addition, demand for skilled workers is high and the supply is limited. We believe these trends will continue to keep supply tight in our industry for the foreseeable future.

Complex technologies, techniques and equipment. The development of unconventional oil and natural gas resources is driving the need for complex new technologies, completion techniques and equipment designed to increase recovery rates, lower production costs and accelerate field development. These needs have spurred the development of more technologically advanced, higher-margin oilfield services that are required to economically produce oil and natural gas from unconventional resources. In addition to rigs with adequate horsepower and top drives, in many cases directional drilling systems are necessary to enable the operator to steer the drill bit into the appropriate section of the reservoir, and advanced technologies, such as the latest hydraulic fracturing, proppant and fluids technologies, are needed for completion of the wells.

Constrained supply of hydraulic fracturing sand. The sand used as a proppant in hydraulic fracturing operations must meet certain size and other specifications in order to be suitable for hydraulic fracturing purposes. Securing access to hydraulic fracturing sand that conforms to the specifications established by the American Petroleum Institute is increasingly important to suppliers and customers of hydraulic fracturing services. Rising unconventional production in the U.S. will continue to support demand for hydraulic fracturing sand, which is used extensively in domestic unconventional basins. The hydraulic fracturing sand market is driven by the overall demand for oil and natural gas production and, in particular, horizontal drilling of oil and natural gas wells. Accordingly, the demand for hydraulic fracturing sand has grown significantly, paralleling the heightened development activity in unconventional reservoirs. We believe the industry is currently experiencing both high demand and limited supply of hydraulic fracturing sand. As we continue to grow our hydraulic fracturing business, we plan to mitigate this risk by vertically integrating our operations through the integration of sand reserves, sand processing operations and logistics assets such as storage and transload, railcar, trucking and other assets.

14

Table of Contents

Index to Financial Statements

Organizational Structure

Formation Transactions

On October 25, 2011, Chesapeake completed the process of reorganizing its oilfield services subsidiaries and operations as subsidiaries of COS LLC and commenced providing all of its oilfield services through COS LLC.

We were incorporated in Oklahoma on April 10, 2012 and have not engaged in any business or other activities except in connection with our formation and the offering transactions described in this prospectus.

Offering Transactions

Concurrently with the closing of this offering, we will issue shares of our Class A common stock to the purchasers in this offering in exchange for net proceeds of approximately $ . We will use the net proceeds from this offering to acquire newly issued Class A units from COS LLC, representing % of COS LLC’s outstanding membership units. COS LLC will use the following approximate amounts of such net proceeds for the following purposes:

| Ÿ | $ million will be used by COS LLC to make a capital contribution to COO, which will use such cash to repay outstanding borrowings under its revolving bank credit facility and for general corporate purposes; |

| Ÿ | $ million will be used by COS LLC to repay the balance outstanding under an intercompany promissory note with Chesapeake; and |

| Ÿ | $ million will be used to make a distribution to Chesapeake Operating, Inc., a wholly owned subsidiary of Chesapeake. |

If the underwriters exercise their option to purchase additional shares of Class A common stock in full in connection with this offering, we will use the additional net proceeds to acquire additional Class A units from COS LLC, and COS LLC will distribute any such proceeds to Chesapeake. For more information regarding the transactions occurring in connection with the offering, see “Organizational Structure—Offering Transactions.”

Chesapeake’s existing membership units in COS LLC will be reclassified as “Class B units” and will represent % of COS LLC’s outstanding membership units immediately following this offering. In addition, we will issue to Chesapeake a number of shares of our Class B common stock equal to the number of Class B units of COS LLC held by Chesapeake immediately following this offering in exchange for the payment by Chesapeake of the aggregate par value of such shares. Each share of Class B common stock will entitle Chesapeake to votes on matters to be voted on by our shareholders generally until the first time that the number of shares of our Class B common stock outstanding constitutes less than % of the number of all shares of our common stock outstanding. For more information regarding the terms of our common stock, see “Description of Capital Stock.”

Immediately following this offering:

| Ÿ | We will be appointed as the sole managing member of COS LLC; |

| Ÿ | We will hold Class A units of COS LLC representing approximately % of COS LLC’s total outstanding membership units (or and %, respectively, if the underwriters exercise their option to purchase additional shares of Class A common stock in full); |

15

Table of Contents

Index to Financial Statements

| Ÿ | Chesapeake will own Class B units of COS LLC representing approximately % of COS LLC’s total outstanding membership units (or and %, respectively, if the underwriters exercise their option to purchase additional shares of Class A common stock in full); |

| Ÿ | Chesapeake, through its ownership of our Class B common stock, will have % of the combined voting power of all of our common stock and, through its ownership of Class B units of COS LLC, will hold approximately % of the economic interest in our business (or % voting power in us and a % economic interest if the underwriters exercise their option to purchase additional shares of Class A common stock in full); and |

| Ÿ | the purchasers in this offering will own shares of our Class A common stock, representing % of the combined voting power of all of our common stock and, through our ownership of Class A units of COS LLC, approximately % of the economic interest in our business (or % voting power in us and a % economic interest if the underwriters exercise their option to purchase additional shares of Class A common stock in full). |

Following this offering, Chesapeake may exchange its Class B units in COS LLC for shares of our Class A common stock on a one-for-one basis. When Chesapeake exchanges a Class B unit of COS LLC for a share of our Class A common stock, we will automatically redeem and cancel a corresponding share of our Class B common stock. See “Certain Relationships and Related Party Transactions—Amended and Restated Operating Agreement of COS LLC—Exchange Rights.”

16

Table of Contents

Index to Financial Statements

The following chart summarizes our holding company structure and anticipated ownership immediately following this offering and the transactions described above (assuming no exercise by the underwriters of their option to purchase additional shares of Class A common stock). For more information, please see “Organizational Structure.”

Our Relationship with Chesapeake

Following this offering, we will be a holding company and our sole material asset will be the Class A units of COS LLC that we own. As the sole managing member of COS LLC, we will control all of the business and affairs of COS LLC and its subsidiaries. Initially, Chesapeake, as the holder of all

17

Table of Contents

Index to Financial Statements

of the shares of our Class B common stock, will have % of the combined voting power of all of our outstanding common stock (or % if the underwriters exercise their option to purchase additional shares of Class A common stock in full). Therefore, upon the closing of this offering and for the foreseeable future thereafter, Chesapeake will continue to control our business and will be able to control all matters requiring the approval of our shareholders, including the election of directors and the approval of significant corporate transactions. See “Organizational Structure.”

Additionally, we are a party to several agreements with Chesapeake, including a master services agreement and services agreement pursuant to which we provide services and supply materials and equipment to Chesapeake and under which Chesapeake has agreed to operate a minimum number of our drilling rigs and to utilize our hydraulic fracturing equipment for a minimum number of fracturing stages per month.

In addition, we and Chesapeake are parties to an administrative services agreement and a facilities lease agreement. These agreements were entered into in the context of an affiliated relationship and, consequently, may not be as favorable to us as they might have been if we had negotiated them with unaffiliated third parties. For a more comprehensive discussion of the agreements that we have entered into with Chesapeake and certain of its affiliates, please see “Certain Relationships and Related Party Transactions.” For a discussion of the risks related to our relationship with Chesapeake, please read “Risk Factors—Risks Relating to Our Relationship with Chesapeake.”

Tax Receivable Agreement

In connection with the consummation of this offering, we will enter into a tax receivable agreement with Chesapeake pursuant to which we will agree to pay to Chesapeake 85% of the amount of cash savings, if any, in federal, state and local income taxes that we actually realize (or in certain circumstances are deemed to realize) as a result of (a) the tax basis increases in the assets of COS LLC that arose from certain recent acquisitions by us; (b) any tax basis increase resulting from COS LLC’s distribution of offering proceeds to Chesapeake; (c) the tax basis increases resulting from exchanges by Chesapeake of its Class B units of COS LLC for shares of our Class A common stock; (d) additional deductions allocated to us pursuant to Section 704(c) of the Internal Revenue Code of 1986, as amended (the “Code”) to reflect the difference between the fair market value and the adjusted tax basis of COS LLC’s assets as of the date of this offering and (e) imputed interest deemed to be paid by us as a result of, and additional tax basis arising from, payments under the tax receivable agreement. We will retain the benefit of the remaining 15% of these cash savings. See “Certain Relationships and Related Party Transactions—Tax Receivable Agreement.”

Corporate Information

Our principal executive offices are located at 6100 North Western Avenue, Oklahoma City, Oklahoma 73118, and our telephone number is (405) 848-8000. Our website is located at www.cosok.com. Information on our website or any other website is not incorporated by reference herein and does not constitute a part of this prospectus.

18

Table of Contents

Index to Financial Statements

The Offering

| Class A common stock offered by us |

shares of our Class A common stock. |

| Class A common stock outstanding after the offering |

shares of our Class A common stock (or shares of Class A common stock if the underwriters exercise their option to purchase additional shares of Class A common stock in full). |

| Class B common stock outstanding after the offering |

shares of our Class B common stock (or shares of Class B common stock if the underwriters exercise their option to purchase additional shares of Class A common stock in full). |

| Underwriters’ option to purchase additional shares of Class A common stock in this offering |

We have granted the underwriters an option, exercisable for 30 days from the date of this prospectus, to purchase up to additional shares of our Class A common stock. |

| Use of proceeds |

We are offering the Class A common stock to be sold in this offering. Assuming no exercise of the underwriters’ option to purchase additional shares of Class A common stock, we expect to receive approximately $ million of net proceeds from the sale of the Class A common stock offered based upon the assumed initial public offering price of $ per share (the midpoint of the price range set forth on the cover page of this prospectus), after deducting underwriting discounts and estimated offering expenses. Each $1.00 increase (decrease) in the public offering price would increase (decrease) our net proceeds by approximately $ million. |

| We intend to use the net proceeds from this offering to acquire newly issued Class A units from COS LLC, representing % of COS LLC’s outstanding membership units. COS LLC will use approximately $ million of such net proceeds to make a capital contribution to COO, which will use such cash to repay outstanding borrowings under its revolving bank credit facility and for general corporate purposes, approximately $ million of such net proceeds to repay the balance outstanding under an intercompany promissory note with Chesapeake and approximately $ million of such net proceeds to make a distribution to Chesapeake Operating, Inc., a wholly owned subsidiary of Chesapeake. |

19

Table of Contents

Index to Financial Statements

| We intend to use any additional proceeds we receive if the underwriters exercise their option to purchase additional shares of Class A common stock to acquire additional Class A units from COS LLC, and COS LLC will distribute any such proceeds to Chesapeake. |

| Chesapeake has advised us that it intends to use the net proceeds distributed to it by COS LLC to repay borrowings under its corporate revolving bank credit facility, under which it may re-borrow from time to time and does so for general corporate purposes, including land, drilling and other costs. See “Use of Proceeds.” |

| Voting rights |

Each share of our Class A common stock will entitle its holder to one vote on all matters to be voted on by shareholders generally. |

| Each share of our Class B common stock will entitle its holder to votes on all matters to be voted on by shareholders generally until the first time that the number of shares of our Class B common stock outstanding constitutes less than % of the number of all shares of our common stock outstanding. From and after that time, each share of our Class B common stock will entitle its holder to one vote. Through its ownership of our Class B common stock, Chesapeake will hold shares of our common stock having % of the combined voting power of all of our common stock outstanding (or % if the underwriters exercise their option to purchase additional shares of Class A common stock in full). As a result, for the foreseeable future following this offering, Chesapeake will be able to exercise control over matters requiring the approval of our shareholders, including the election of our directors and the approval of significant corporate transactions. |

| Holders of our Class A common stock and Class B common stock will vote together as a single class on all matters presented to shareholders for their vote or approval, except as otherwise required by law. See “Description of Capital Stock.” |

| Economic interest |

Immediately following this offering, the purchasers in this offering will own in the aggregate a % economic interest in our business through our ownership of Class A units of COS LLC and Chesapeake will own a % economic interest in our business through its ownership of Class B units of COS LLC (or a % economic interest and a % economic interest, respectively, if the underwriters exercise their option to purchase additional shares of our Class A common stock in full). |

20

Table of Contents

Index to Financial Statements

| Lock-up |

We, all of our directors and officers and Chesapeake will enter into a lock-up agreement with the underwriters pursuant to which we and it may not, without the prior written approval of Goldman, Sachs & Co., offer, sell, contract to sell or otherwise dispose of or hedge our Class A common stock or securities convertible into or exchangeable for our Class A common stock, subject to certain exceptions, for a period of 180 days after the date of this prospectus, subject to extension in certain circumstances. See “Underwriting” for a discussion of the circumstances in which this 180-day period may be extended. |

| Exchange and registration rights |

Each Class B unit of COS LLC will be exchangeable for a share of our Class A common stock as described under “Certain Relationships and Related Party Transactions—Amended and Restated Operating Agreement of COS LLC—Exchange Rights.” |

| Pursuant to a registration rights agreement that we will enter into with Chesapeake, we will agree to file a registration statement for the sale of the shares of our Class A common stock that are issuable upon exchange of Class B units of COS LLC upon request and cause that registration statement to be declared effective by the U.S. Securities and Exchange Commission (“SEC”) as soon as practicable thereafter. See “Certain Relationships and Related Party Transactions—Registration Rights Agreement” for a description of the timing and manner limitations on resales of these shares of our Class A common stock. |

| Dividend policy |

After this offering, we do not anticipate paying cash dividends on our Class A common stock in the immediate future. Holders of our Class B common stock will not have the right to receive regular dividends. See “Dividend Policy.” |

| Proposed New York Stock Exchange symbol |

“COS” |

Unless otherwise indicated, the number of shares of Class A common stock outstanding after this offering and other information based thereon in this prospectus excludes:

| Ÿ | shares of our Class A common stock which may be issued upon the exercise of the underwriters’ option to purchase additional shares of Class A common stock and the corresponding number of Class A units of COS LLC that we would acquire with the net proceeds therefrom; and |

| Ÿ | shares of our Class A common stock reserved for issuance upon exchange of Chesapeake’s Class B units of COS LLC that will be outstanding immediately after this offering. |

21

Table of Contents

Index to Financial Statements

Risk Factors

An investment in our Class A common stock involves significant risks. Before investing in our Class A common stock, you should carefully consider all the information contained in this prospectus, including the information under the headings “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements.” Our business, financial condition and results of operations could be materially and adversely affected by many factors, including the following factors and the factors discussed in “Risk Factors” and elsewhere in this prospectus:

| Ÿ | We are dependent on Chesapeake for a substantial majority of our revenues. Therefore, we are indirectly subject to the business risks of Chesapeake. We have no control over Chesapeake’s business decisions and operations, and Chesapeake is under no obligation to adopt a business strategy that favors us; |

| Ÿ | Demand for services in our industry is cyclical and depends on drilling and completion spending by Chesapeake and other E&P companies in the U.S., and the level of such activity is volatile; |

| Ÿ | Competition in our industry or increases in the supply of drilling rigs or hydraulic fracturing units could decrease the prices for our products and services and our revenues; |

| Ÿ | Shortages or increases in the costs of the equipment we use in our operations could adversely affect our growth plans and our operations in the future; |

| Ÿ | Shortages or increases in the costs of the products we use in our operations could adversely affect our results of operations; |

| Ÿ | The loss of key executives could adversely affect our ability to effectively operate and manage our business; |

| Ÿ | Increased labor costs or the unavailability of skilled workers could hurt our operations; |

| Ÿ | We participate in a capital intensive industry. We may not be able to finance future growth of our operations or future acquisitions; |

| Ÿ | Delays in obtaining permits by our customers for their operations could impair our business; |

| Ÿ | Any future decreases in the rate at which oil or natural gas reserves are discovered or developed could decrease the demand for our services; |

| Ÿ | Our business involves many hazards and operational risks, some of which may not be fully covered by insurance. If a significant accident or event occurs for which we are not adequately insured, our operations and financial results could be adversely affected; |

| Ÿ | Federal and state legislative and regulatory initiatives relating to hydraulic fracturing could restrict or make more difficult our hydraulic fracturing operations or could increase our or Chesapeake’s operating costs; |

| Ÿ | We are subject to federal, state and local laws and regulations regarding issues of health, safety, climate change and protection of the environment. Under these laws and regulations, we may become liable for penalties, damages or costs of remediation or other corrective measures. Any changes in laws or government regulations could increase our costs of doing business; and |

| Ÿ | Chesapeake has the option to terminate our services agreement if Chesapeake no longer controls us. |

22

Table of Contents

Index to Financial Statements

Summary Historical and Pro Forma Financial Data

The following tables set forth summary historical and unaudited pro forma financial data of COS LLC and its predecessors. The summary historical financial data as of December 31, 2011 and for each of the years ended December 31, 2009, 2010 and 2011 is derived from the audited consolidated financial statements included elsewhere in this prospectus. Our historical consolidated financial statements for periods and as of dates prior to our October 25, 2011 reorganization were prepared on a “carve-out” basis from Chesapeake and are intended to represent the financial results of Chesapeake’s oilfield service operations for those periods. The summary historical financial data is not necessarily indicative of results to be expected in future periods. Our summary historical financial data should be read together with the historical consolidated financial statements and related notes thereto and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” each included elsewhere in this prospectus.

The summary unaudited pro forma financial data as of December 31, 2011 and for the year ended December 31, 2011 is derived from the audited consolidated financial statements included elsewhere in this prospectus and includes pro forma adjustments to give effect to certain transactions that occurred during the year ended December 31, 2011, and the transactions associated with our formation and this offering. Our summary unaudited pro forma financial data should be read together with the unaudited pro forma consolidated financial statements and related notes thereto included elsewhere in this prospectus.

The financial statements of COS Inc. have not been presented in this prospectus as it is a newly incorporated entity, has had no business transactions or activities to date and has no (or nominal) assets or liabilities.

| Years Ended December 31, | ||||||||||||||||

| COS LLC Historical | Pro Forma Combined (3) |

|||||||||||||||

| 2009 | 2010 | 2011 | 2011 | |||||||||||||

| (Unaudited) | ||||||||||||||||

| (In thousands) |

||||||||||||||||

| Income Statement Data: |

||||||||||||||||

| Revenues, including revenues from affiliates |

$ | 650,279 | $ | 815,756 | $ | 1,303,496 | $ | 1,366,066 | ||||||||

| Operating costs |

556,008 | 666,924 | 987,032 | 1,036,399 | ||||||||||||

| Depreciation and amortization |

70,429 | 106,425 | 171,908 | 180,236 | ||||||||||||

| General and administrative costs, including expenses from affiliates |

17,735 | 25,312 | 37,074 | 45,902 | ||||||||||||

| Losses (gains) on sales of property and equipment |

(1,551 | ) | (854 | ) | (3,571 | ) | (3,546 | ) | ||||||||

| Impairments |

26,797 | (1) | 9 | 2,729 | 3,408 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Operating income (loss) |

(19,139 | ) | 17,940 | 108,324 | 103,667 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Interest expense, including expenses from affiliates |

(23,453 | ) | (38,511 | ) | (65,072 | ) | ||||||||||

| Losses from equity investee |

(164 | ) | (2,243 | ) | — | — | ||||||||||

| Other income (expense) |

(283 | ) | 211 | (2,464 | ) | (1,979 | ) | |||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Total other expense |

(23,900 | ) | (40,543 | ) | (67,536 | ) | ||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Income (loss) before income taxes |

(43,039 | ) | (22,603 | ) | 40,788 | |||||||||||

| Income tax expense (benefit) |

(2,656 | ) | (3,751 | ) | 21,030 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net income (loss) |

(40,383 | ) | (18,852 | ) | 19,758 | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Less: Net Loss Attributable to Noncontrolling Interest |

— | (639 | ) | (154 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Net Income (Loss) Attributable to COS Holdings, L.L.C. |

$ | (40,383 | ) | $ | (18,213 | ) | $ | 19,912 | $ | |||||||

|

|

|

|

|

|

|

|

|

|||||||||

| Other Financial Data: |

||||||||||||||||

| Adjusted EBITDA(2)(unaudited) |

$ | 76,089 | $ | 121,488 | $ | 276,926 | $ | |||||||||

| Capital expenditures (including acquisitions) |

$ | 325,895 | $ | 269,769 | $ | 738,354 | $ | |||||||||

23

Table of Contents

Index to Financial Statements

| As of December 31, 2011 | ||||||||

| Actual | Pro Forma(4) | |||||||

| (Unaudited) | ||||||||

| (In thousands) | ||||||||

| Balance Sheet Data: |

||||||||

| Cash |

$ | 2,360 | $ | |||||

| Total property and equipment, net |

$ | 1,225,580 | $ | 1,225,580 | ||||

| Total assets |

$ | 1,598,582 | $ | |||||

| Total long-term debt |

$ | 1,050,674 | $ | |||||

| Total equity |

$ | 181,782 | $ | |||||

| (1) | We recorded an impairment to goodwill in the amount of $19.8 million and an impairment of long-lived assets in the amount of $7.0 million for the year ended December 31, 2009. |

| (2) | “Adjusted EBITDA” is a non-GAAP financial measure that we define as net income before interest, taxes, depreciation and amortization, as further adjusted to add back gain or loss on sale of property and equipment and impairments. “Adjusted EBITDA,” as used and defined by us, may not be comparable to similarly titled measures employed by other companies and is not a measure of performance calculated in accordance with GAAP. Adjusted EBITDA should not be considered in isolation or as a substitute for operating income, net income or loss, cash flows provided by operating, investing and financing activities, or other income or cash flow statement data prepared in accordance with GAAP. However, our management believes Adjusted EBITDA may be useful to an investor in evaluating our operating performance because this measure: |