Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Abtech Holdings, Inc. | Financial_Report.xls |

| EX-23.2 - EXHIBIT 23.2 - Abtech Holdings, Inc. | v309051_ex23-2.htm |

As filed with the United States Securities and Exchange Commission on April 13, 2012

Registration No. 333-

________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________________

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

ABTECH HOLDINGS, INC.

(Name of Registrant as specified in its charter)

| Nevada | 1090 | 14-1994102 | ||

|

(State or other jurisdiction of incorporation) |

(Primary Standard Industrial Classification Code Number) |

(IRS Employer Identification No.) |

4110 N. Scottsdale Road, Suite 235

Scottsdale, Arizona 85251

(480) 874-4000

(Address and telephone number of principal executive offices and principal place of business)

________________________________

Glenn R. Rink

Chief Executive Officer, President, and Director

Abtech Holdings, Inc.

4110 N. Scottsdale Road, Suite 235

Scottsdale, Arizona 85251

(480) 874-4000

(Name address and telephone number of agent for service)

________________________________

Copies to:

Christopher D. Johnson, Esq.

Squire Sanders (US) LLP

1 East Washington Street

Suite 2700

Phoenix, AZ 85004

Tel: (602) 528-4000 Fax: (602) 253-8129

________________________________

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: T

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | Accelerated filer |

| Non-accelerated filer (Do not check if smaller reporting company) | Smaller reporting company T |

________________________________

CALCULATION OF REGISTRATION FEE

| Title of each class of securities to be registered | Amount to be registered | Proposed maximum offering price per share | Proposed maximum aggregate offering price | Amount of registration fee | |||||||

| Common Stock, par value $0.001 per share | 14,582,862(1) | $0.75(2) | $10,937,146(2) | $1,253.40 | |||||||

| (1) | This registration statement registers for resale 14,582,862 shares of common stock, par value $0.001 per share, of the registrant, of which (a) 9,428,573 are issuable upon conversion of secured convertible promissory notes sold in a private placement completed on February 15, 2012, and (b) up to 5,154,289 shares of our common stock are issuable upon exercise of warrants, of which (i) warrants to purchase 4,400,003 shares of our common stock were issued to investors in the private placement and (ii) warrants to purchase 754,286 shares of our common stock were issued to a placement agent in connection with the private placement. |

| (2) | Estimated pursuant to Rule 457(c) of the Securities Act of 1933 solely for the purpose of computing the amount of the registration fee based on the average of the high and low prices reported on the OTC Bulletin Board on April 10, 2012, which was $0.75. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the United States Securities and Exchange Commission, acting pursuant to said section 8(a), may determine.

| The information in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted. |

SUBJECT TO COMPLETION, DATED APRIL 13, 2012

ABTECH HOLDINGS, INC.

14,582,862 Shares of Common Stock

The selling shareholders identified in this prospectus may offer and sell up to 14,582,862 shares of our common stock consisting of (a) 9,428,573 shares of our common stock which are issuable to investors upon conversion of secured convertible promissory notes sold in a private placement completed on February 15, 2012, and (b) up to 5,154,289 shares of our common stock issuable upon exercise of warrants, of which (i) warrants to purchase 4,400,003 shares of our common stock were issued to investors in the private placement and (ii) warrants to purchase 754,286 shares of our common stock were issued to a placement agent in connection with the private placement.

We are not selling any shares of our common stock in this offering and will not receive any proceeds from this offering. We may receive proceeds on the exercise of outstanding warrants for shares of our common stock covered by this prospectus.

The selling shareholders may offer the shares covered by this prospectus at fixed prices, at prevailing market prices at the time of sale, at varying prices or negotiated prices, in negotiated transactions, or in trading markets for our common stock. We will bear all costs associated with the registration of the shares covered by this prospectus.

Our common stock trades on the OTC Bulletin Board under the symbol “ABHD.” The closing price of our common stock on the OTC Bulletin Board on April 10, 2012, was $0.75 per share.

Investing in our common stock involves significant risks. You should consider carefully the risk factors beginning on page 5 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is April __, 2012.

TABLE OF CONTENTS

| Page | |

| Prospectus Summary | 2 |

| Risk Factors | 5 |

| Forward-Looking Statements | 19 |

| Use of Proceeds | 20 |

| Price Range of Common Stock | 20 |

| Dividend Policy | 21 |

| Management’s Discussion and Analysis of Financial Condition | 22 |

| Our Business | 26 |

| Management | 43 |

| Executive Compensation | 47 |

| Certain Relationships and Related Party Transactions | 51 |

| Security Ownership of Certain Beneficial Owners and Management | 51 |

| Selling Shareholders | 53 |

| Plan of Distribution | 55 |

| Description of Securities | 57 |

| Experts | 57 |

| Legal Matters | 57 |

| Available Information | 58 |

| Index to Financial Statements | F-1 |

This prospectus is part of a registration statement we filed with the Securities and Exchange Commission (the “SEC”). Under this registration process, the selling shareholders may, from time to time, offer and sell up to 14,582,862 shares of our common stock, as described in this prospectus, in one or more offerings. This prospectus provides you with a general description of the common stock the selling shareholders may offer. You should read this prospectus carefully before making an investment decision.

You may only rely on the information contained in this prospectus or that we have referred you to. We have not authorized anyone to provide you with additional or different information. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities other than the shares of our common stock offered by this prospectus. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any common stock in any circumstances or any jurisdiction in which such offer or solicitation is not permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front cover of this prospectus regardless of the time of delivery of this prospectus or any sale of our common stock. The rules of the SEC may require us to update this prospectus in the future.

As used in this prospectus, the terms “Abtech Holdings,” “Abtech,” “ABHD,” the “Company,” “we,” “our” and similar terms refer to Abtech Holdings, Inc. and its subsidiaries, unless the context indicates otherwise.

| 1 |

PROSPECTUS SUMMARY

The following summary highlights selected information contained elsewhere in this prospectus and does not contain all of the information you should consider before investing in our securities. Before deciding to invest in our securities, you should read this entire prospectus, including the discussion of “Risk Factors” and our consolidated financial statements and the related notes.

Our Company

Abtech Holdings, Inc. (“Abtech Holdings,” “Abtech,” “ABHD,” the “Company,” “we” or the “registrant”) was incorporated in Nevada on February 13, 2007 under the name “Laural Resources, Inc.” and was initially engaged in the business of acquiring and developing mineral properties. Subsequent to its fiscal year ended May 31, 2010, Laural Resources, Inc. decided to change its business focus to clean technology products and services, specifically in the water clean-up sector. In furtherance of its business objectives, effective June 14, 2010, Laural Resources, Inc. merged with its wholly owned subsidiary, Abtech Holdings, Inc., for the purpose of effecting a name change to “Abtech Holdings, Inc.” On October 21, 2010, the Company’s Board of Directors (the “Board of Directors” or the “Board”) changed the Company’s fiscal year end from May 31 to December 31.

Our History

On February 10, 2011, the Company closed a merger transaction (the “Merger”) with AbTech Industries, Inc., a Delaware corporation (“AbTech Industries”), pursuant to an Agreement and Plan of Merger (the “Merger Agreement”), by and among Abtech Holdings, Abtech Merger Sub, Inc., a Nevada corporation and wholly owned subsidiary of Abtech Holdings (“Merger Sub”), and AbTech Industries.

As a result of the Merger, Abtech Holdings acquired all of the issued and outstanding common stock of AbTech Industries (through a reverse acquisition transaction) in exchange for the common stockholders of AbTech Industries acquiring an approximate 78% ownership interest in Abtech Holdings, AbTech Industries became a majority-owned subsidiary of Abtech Holdings, and Abtech Holdings acquired the business and operations of AbTech Industries.

Abtech Holdings was a “shell company” prior to the Merger and did not conduct an active trade or business. From and after the consummation of the Merger on February 10, 2011, Abtech Holdings’ primary operations consisted of the business and operations of AbTech Industries. Because Abtech Holdings was a shell company at the time of the Merger, we filed with the SEC on February 14, 2011, a “super” Form 8-K that disclosed information required by Item 2.01(f) of Form 8-K (being information that would be required if we had filed a general form for registration under Form 10 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”)).

For accounting purposes, the Merger transaction has been accounted for as a reverse acquisition, with AbTech Industries as the acquirer. The consolidated financial statements of Abtech Holdings for the fiscal year ended December 31, 2011 represent a continuation of the financial statements of AbTech Industries, with one adjustment, which is to retroactively adjust the legal capital of AbTech Industries to reflect the legal capital of Abtech Holdings. See Note 1 of Notes to Consolidated Financial Statements.

Our Industry

AbTech Industries has developed a variety of products that leverage its cornerstone filtration media technology called Smart Sponge®. This patented technology’s oil absorbing capabilities make it highly effective as a filtration media to remove hydrocarbons and other pollutants from water. AbTech Industries has introduced its products into a variety of markets resulting in over 15,000 products installed in 36 states and 8 countries to date.

| 2 |

AbTech Industries developed the Smart Sponge media, a patented polymer technology that effectively removes pollutants from water and encapsulates them so that they cannot be released back into the water, even under high pressure. AbTech Industries recently expanded the capability of the Smart Sponge technology by adding an antimicrobial agent that has proven to be effective in reducing coliform bacteria found in stormwater, industrial wastewater and municipal wastewater while maintaining its oil-absorbing capability. This expanded technology, known as Smart Sponge Plus, provides an effective solution to municipalities and other entities faced with beach closures and other hazards of bacteria-laden stormwater. This antimicrobial capability differentiates Smart Sponge Plus products from competitive stormwater treatment devices. It can be engineered to treat massive amounts of water runoff in end-of-pipe applications, such as drainage vaults or other configurations. In July 2010, AbTech Industries received notification from the United States Environmental Protection Agency (the “EPA”) that AbTech Industries’ application to register Smart Sponge Plus as a pesticide under the Federal Insecticide, Fungicide and Rodenticide Act had been conditionally approved.

Corporate Information

Our principal executive offices are located at 4110 North Scottsdale Road, Suite 235, Scottsdale, Arizona 85251. Our telephone number is (480) 874-4000 and our website address is www.abtechindustries.com. The information contained on our website is not part of this prospectus.

|

The Offering

| |

| Common stock outstanding prior to the offering | 48,482,344 shares outstanding as of April 11, 2012 |

| Common stock offered by selling shareholders | Up to 14,582,862 shares |

| Common stock to be outstanding after the offering | 63,065,206 shares, assuming full conversion of the secured convertible notes and full exercise of the warrants held by the selling shareholders |

| Use of proceeds | We will not receive any proceeds from the sale of the common stock. To the extent that the selling shareholders and the placement agent exercise all of the warrants covering the 5,154,289 shares of common stock issuable upon exercise thereof, we would receive $3,168,002 from such exercises. We intend to use such proceeds for general corporate and working capital purposes. See “Use of Proceeds” for a complete description. |

| OTC Bulletin Board Symbol | ABHD |

| Risk Factors | The purchase of our common stock involves a high degree of risk. You should carefully review and consider the “Risk Factors” beginning on page 5. |

| 3 |

Background of the Offering

From September 19 through December 31, 2011 (the “September Offering”), the Company sold $4,000,000 of Secured Convertible Promissory Notes (the “Secured Notes”). The Secured Notes bear interest at a rate of twelve percent (12%) per annum and are due and payable in full on the nine (9) month anniversary of issuance (the “Original Maturity Date”). The Company may extend the maturity date by an additional ninety (90) day period, during which period the interest rate will increase to fifteen percent (15%) per annum on the unpaid principal of the Secured Note. The Company may also extend the maturity date by a second additional 90 day period, during which period the interest rate shall increase to eighteen percent (18%) per annum on the unpaid principal of the Secured Note. All interest accrued on the Secured Notes through the Original Maturity Date will be payable by the Company on the Original Maturity Date in cash or in-kind, at the option of the payee. For all periods after the Original Maturity Date, all accrued interest will be payable quarterly in cash by the Company. The Secured Notes may be converted into shares of our common stock at any time prior to a sale for cash by the Company of debt or equity securities generating aggregate gross proceeds of at least $5,000,000 (including the proceeds from any converting Secured Notes) (a “Qualified Financing’) at the conversion rate of $0.70 per share (the “Conversion Price”). However, if the Company at any time while a Secured Note is outstanding, issues any debt or equity securities (with certain exceptions) entitling investors to subscribe for, purchase, or convert such securities into shares of our common stock at a price per share less than the Conversion Price (the “New Securities Issuance Price”), then the Conversion Price for such outstanding Secured Notes shall be reduced effective concurrently with such issuance to the New Securities Issuance Price.

In the event of a Qualified Financing by the Company, each subscriber of the Secured Notes will have the option to (i) convert their Secured Note into the securities purchased by investors in a Qualified Financing at a 20% discount to the price paid by investors in the Qualified Financing; or (ii) tender their Secured Note to the Company for immediate repayment of principal and accrued and unpaid interest. The Secured Notes may be prepaid in whole or in part without the prior written consent of the payee at any time following not less than ten (10) days prior written notice to the subscriber notifying the subscriber of the Company’s decision to prepay the Secured Notes.

The Secured Notes are secured by all of the Company’s right, title and interest in, to and under all personal property and other assets of the Company (the certain exceptions to allow for potential financing arrangements for accounts receivable and inventory) pursuant to a security agreement entered into by the Company.

From January 2012 through February 15, 2012 (the “February Offering”), the Company sold an additional $2,600,000 of the Secured Notes. The September Offering and the February Offering were undertaken by the Company in reliance on Section 4(2) and Regulation D of the Securities Act of 1933, as amended (the “Securities Act”). The Company believes each purchaser of the Secured Notes to be an accredited investor as that term is defined in Rule 501(a) of Regulation D under the Securities Act.

Each subscriber of the Secured Notes sold in the September Offering and the February Offering also received a warrant for the purchase of the number of shares of our common stock equal to forty percent (40%) of the number of shares of common stock into which the Secured Notes are convertible on the closing date of the Qualified Financing. In the event a Secured Note remains outstanding beyond the Original Maturity Date, the Secured Note holder will receive an additional warrant for 10% of the principal amount of the Secured Note outstanding at that date divided by the Conversion Price. The number of warrant shares that the payee will be entitled to under the terms of the warrant issued by the Company to subscribers in connection with their purchase of the Secured Notes shall be increased by ten percent (10%) for each extension by the Company of the Original Maturity Date. The warrants will have an initial exercise price equal to the exercise price of the warrants purchased by investors in the Qualified Financing. In the event the Secured Note holder elects to exercise the warrant prior to the consummation of a Qualified Financing, the number of shares exercisable will be based on an assumed conversion price of $0.60 per share (the “Assumed Conversion Price”) and the exercise price will be $0.60 per share (the “Base Exercise Price”). However, in the event that the Company issues shares of common stock or common stock equivalents (with certain exceptions) at any time after the issuance of the warrant and prior to a Qualified Financing at a price per share less than the Base Exercise Price (the “New Securities Exercise Price”) then the Base Exercise Price and the Assumed Conversion Price shall each be reduced effective concurrently with such issuance to the New Securities Exercise Price. Each warrant will be exercisable for a five (5) year period.

The Company engaged a placement agent in connection with the September Offering and the February Offering and paid the placement agent a cash placement fee equal to eight percent (8%) of the aggregate purchase price paid by each subscriber. This fee amounted to $320,000 for the September Offering and $208,000 for the February Offering. The placement agent will also receive a cash fee equal to four percent (4%) of all amounts received by the Company in connection with the exercise by investors of any warrants received by investors in connection with the Secured Notes. In addition to the placement agent fee, the Company issued to the placement agent warrants to purchase a number of shares of our common stock obtained by dividing eight percent (8%) of the gross proceeds from the sale of securities by the conversion price of the Secured Notes (the “PA Warrants”). The PA Warrants have an exercise price per share equal to the conversion price of the Secured Notes. The PA Warrants will expire five years from the date of issuance and will be in the same form the Secured Notes, except that the PA Warrants will include a “net issuance” cashless exercise feature. As of the close of the February Offering, PA Warrants for 754,286 shares of common stock were due to the placement agent. The value of these warrants is estimated by applying the Black Scholes model and was recorded as a deferred financing charge with its estimated fair value at each balance sheet date included in the warrant liability.

| 4 |

RISK FACTORS

Our business and an investment in our common stock is subject to a variety of risks. The following risk factors describe the most significant events, facts or circumstances that could have a material adverse effect upon our business, financial condition, results of operations, ability to implement our business plan and the market price for our common stock. Many of these events are outside of our control. If any of these risks actually occurs, our business, financial condition or results of operations may be materially adversely affected. In such case, the trading price of our common stock could decline and investors in our common stock could lose all or part of their investment.

The risk factors discussed below relate to our business and operations following the consummation of the Merger and, accordingly, relate primarily to Abtech Holdings and its subsidiary, AbTech Industries. As used in this “Risk Factors” section, the terms “Company,” “we,” our” and like words mean Abtech Holdings together with Abtech Industries, unless the context otherwise requires.

Risks Relating to Our Business

Our ability to generate revenue to support our operations is uncertain.

We are in the early stage of our business and have a limited history of generating revenues. We have a limited operating history upon which you can evaluate our potential for future success, and we are subject to the additional risks affecting early-stage businesses. Rather than relying on historical information, financial or otherwise, to evaluate our Company, you should evaluate our Company in light of your assessment of the growth potential of our business and the expenses, delays, uncertainties, and complications typically encountered by early-stage businesses, many of which will be beyond our control. Early-stage businesses in rapidly evolving markets commonly face risks, such as the following:

| • | unanticipated problems, delays, and expenses relating to the development and implementation of their business plans; |

| • | operational difficulties; |

| • | lack of sufficient capital; |

| • | competition from more advanced enterprises; and |

| • | uncertain revenue generation. |

Our limited operating history may make it difficult for us to forecast accurately our operating results.

Our planned expense levels are, and will continue to be, based in part on our expectations, which are difficult to forecast accurately based on our stage of development and factors outside of our control. We may be unable to adjust spending in a timely manner to compensate for any unexpected developments. Further, business development expenses may increase significantly as we expand operations. To the extent that any unexpected expenses precede, or are not rapidly followed by, a corresponding increase in revenue, our business, operating results, and financial condition may be materially and adversely affected.

| 5 |

We have a history of losses that may continue, which may negatively impact our ability to achieve our business objectives.

We have incurred net losses since our inception. The Company had a net loss of approximately $5.4 million during the fiscal year ended December 31, 2011. We cannot assure you that we can achieve or sustain profitability on a quarterly or annual basis in the future. There can be no assurance that future operations will be profitable. We may not achieve our business objectives and the failure to achieve such goals would have an adverse impact on us.

Our success depends on our ability to expand, operate, and manage successfully our operations.

Our success depends on our ability to expand, operate, and manage successfully our operations. Our ability to expand successfully will depend upon a number of factors, including the following:

| • | signing with strategic partners, dominant in their field |

| • | the continued development of our business; |

| • | the hiring, training, and retention of additional personnel; |

| • | the ability to enhance our operational, financial, and management systems; |

| • | the availability of adequate financing; |

| • | competitive factors; |

| • | general economic and business conditions; and |

| • | the ability to implement methods for revenue generation. |

If we are unable to obtain additional capital, our business operations could be harmed.

The development and expansion of our business may require additional funds. In the future, we may seek additional equity or debt financing to provide capital for our Company. Such financing may not be available or may not be available on satisfactory terms. If financing is not available on satisfactory terms, we may be unable to expand our operations. While debt financing will enable us to expand our business more rapidly than we otherwise would be able to do, debt financing increases expenses and we must repay the debt regardless of our operating results. Future equity financings could result in dilution to our stockholders.

The recent global financial crisis, which has included, among other things, significant reductions in available capital and liquidity from banks and other providers of credit, substantial reductions or fluctuations in equity and currency values worldwide, and concerns that the worldwide economy may enter into a prolonged recessionary period, may make it difficult for us to raise additional capital or obtain additional credit, when needed, on acceptable terms or at all.

Our inability to obtain adequate capital resources, whether in the form of equity or debt, to fund our business and growth strategies, may require us to delay, scale back, or eliminate some or all of our operations, which may adversely affect our financial results and ability to operate as a going concern.

You may suffer significant dilution if we raise additional capital.

If we raise additional capital, we expect it will be necessary for us to issue additional equity or convertible debt securities. If we issue equity or convertible debt securities, the price at which we offer such securities may not bear any relationship to our value, the net tangible book value per share may decrease, the percentage ownership of our current stockholders would be diluted, and any equity securities we may issue in such offering or upon conversion of convertible debt securities issued in such offering, may have rights, preferences, or privileges with respect to liquidation, dividends, redemption, voting, and other matters that are senior to or more advantageous than our common stock.

| 6 |

We have completed debt financings and face risks associated with financing our operations.

The Company has completed several debt financings and is subject to the normal risks associated with debt financing, including the risk that our cash flow will be insufficient to meet required payments of principal and interest and the risk that we will not be able to renew, repay, or refinance our debt when it matures or that the terms of any renewal or refinancing will not be as favorable as the existing terms of that debt.

We have debt outstanding that is secured by all of the assets of the Company.

During 2011, we issued the Secured Notes that are secured by all of the assets of the Company, including its intellectual property. If we are unable to pay our obligations to our secured lenders, they could proceed against any or all of the collateral securing our indebtedness to them which could prevent the Company from continuing its operations in whole or in part.

You may suffer dilution if the Secured Notes are converted to common stock.

As of December 31, 2011, the Company had approximately $6.8 million of convertible notes outstanding that, if converted, would require the company to issue approximately 10 million shares of common stock. Such conversion would cause the percentage ownership of our current stockholders to be diluted.

Outstanding convertible notes and warrants have price protection features.

During 2011 and 2012, we issued convertible notes and warrants that have certain price protection features that would allow the conversion prices or exercise prices of the outstanding notes and warrants to be decreased in the event of a financing by the Company at a price per share less than the stated conversion price of the notes or exercise price of the warrants. In the event the Company completes such a down-round financing within 15 months of the issuance dates of the affected notes and warrants, any subsequent conversion of the affected notes and/or exercise of the affected warrants would have a greater dilutive effect on current stockholders than would be expected if a down-round financing does not take place within the 15-month time period.

Our independent auditors have expressed substantial doubt about the Company’s ability to continue as a going concern, which may hinder our ability to obtain future financing.

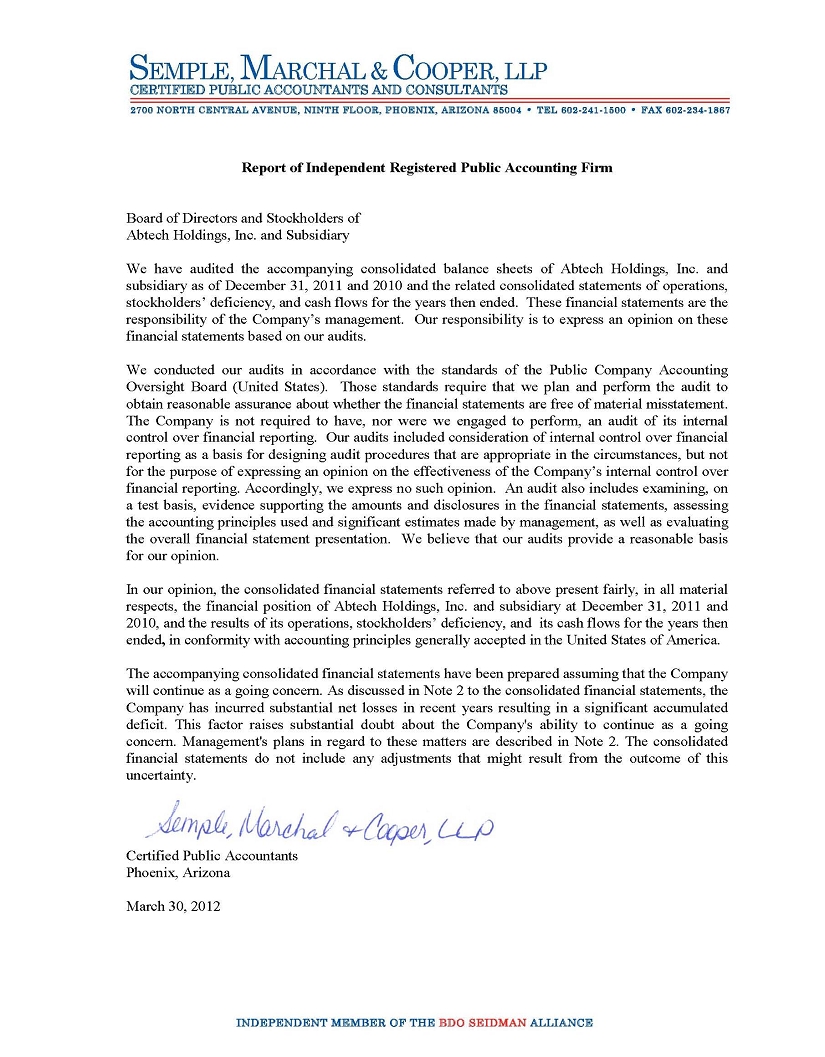

In their report dated March 30, 2012, our independent registered public accounting firm stated that our financial statements for the fiscal year ended December 31, 2011 were prepared assuming that the Company would continue as a going concern. Its ability to continue as a going concern is an issue raised as a result of recurring losses from operations. To date, each of Abtech Holdings and AbTech Industries have only incurred net operating losses resulting in a significant accumulated deficit. Our ability to continue as a going concern is subject to our ability to obtain necessary funding from outside sources, including obtaining additional funding from the sale of our securities. Our continued net operating losses increase the difficulty in meeting such goals and there can be no assurances that such methods will prove successful.

| 7 |

We depend on our officers and key employees who would be difficult to replace, and our business will likely be harmed if we lose their services or cannot hire additional qualified personnel.

Our success depends substantially on the efforts and abilities of our officers and other key employees. AbTech Industries has employment agreements with its chief executive officer, its chief financial officer, and certain key employees, but we do not think those agreements limit any employee’s ability to terminate his or her employment. We have key person life insurance on Glenn R. Rink, our president, chief executive officer and a director; we do not have key person life insurance covering any of our other officers or other key employees. The loss of services of one or more of our officers or key employees or the inability to add key personnel could have a material adverse effect on our business. Competition for experienced personnel in our industry is substantial. Our success depends in part on our ability to attract, hire, and retain qualified personnel. In addition, if any of our officers or other key employees join a competitor or form a competing company, we may lose some of our customers.

We depend on the recruitment and retention of qualified personnel, and our failure to attract and retain such personnel could seriously harm our business.

Due to the specialized nature of our business, our future performance is highly dependent upon the continued services of current and future key personnel and managers. Our future business depends upon our ability to attract and retain qualified engineering, manufacturing, marketing, sales, and management personnel for our operations. We may also have to compete with the other companies in our industry in the recruitment and retention of qualified managerial and technical employees. Competition for personnel is intense and confidentiality and non-compete agreements may restrict our ability to hire individuals employed by other companies. Therefore, we may not be successful in attracting or retaining qualified personnel. Our failure to attract and retain qualified personnel could seriously harm our business, results of operations, and financial condition. Furthermore, we may not be able to accurately forecast our needs for additional personnel, which could adversely affect our ability to grow.

The expected results from the Merger may vary significantly from our expectations.

The expected results from the Merger might vary materially from those anticipated and disclosed by us. These expectations are inherently subject to uncertainties and contingencies. These assumptions may be impacted by factors that are beyond our control, including, but not limited to, general economic factors impacting the U.S. economy.

The Merger could be difficult to integrate, disrupt business, dilute stockholder value, and harm operating results of the combined entity.

Our experience in acquiring and integrating businesses is limited. The Merger involves numerous risks, including the following:

| • | problems integrating the purchased operations, services, personnel, or technologies; |

| • | unanticipated costs associated with the acquisition; |

| • | diversion of management’s attention from the core businesses; |

| • | adverse effects on existing business relationships with suppliers and customers of purchased organizations; |

| • | potential loss of key employees and customers of purchased organizations; and |

| • | risk of impairment charges related to potential write-downs of acquired assets. |

These factors and potential unforeseeable costs may result in disruption to the business of the combined entity and any such disruption could have a significant negative impact on the combined entity’s assets, revenue, expenses, and stock price.

| 8 |

The effects of the recent global economic downturn may adversely impact our business, operating results, or financial condition.

The recent global economic downturn has caused disruptions and volatility in global financial markets and increased rates of default and bankruptcy and has impacted levels of consumer and commercial spending. We are unable to predict the duration or severity of the current global economic and financial crisis. There can be no assurance that any actions we may take in response to further deterioration in general economic and financial conditions will be sufficient. A protracted continuation or worsening of the global economic downturn or disruptions in the financial markets could have a material adverse effect on our business, financial condition, or results of operations.

If we do not achieve broad market acceptance of our products and services, we may not be successful.

Although our products and services will serve existing needs, our delivery of these products and services is unique and subject to broad market acceptance. As is typical of any new product or service, the demand for and market acceptance of these products and services are highly uncertain. We cannot assure you that any of our products and services will be commercialized on a widespread basis. The commercial acceptance of our products and services may be affected by a number of factors, including the willingness of municipalities and other commercial and industrial entities to use our products and services to control the quality of water and other fluids. If the markets for our products and services fail to develop on a meaningful basis, if they develop more slowly than we anticipate, or if our products and services fail to achieve sufficient market acceptance, our business and future results of operations could be adversely affected.

Because our products may be designed to provide a solution which competes with existing methods, we are likely to face resistance to change, which could impede our ability to commercialize this business.

Our products may be designed to provide a solution to environmental challenges created by contaminated water and other fluids. Currently, large and well capitalized companies provide services in these areas. These competitors have strong relationships with their customers’ personnel, and there is a natural reluctance for businesses to change to new technologies, particularly in such industries as the oil and gas industries where our future products may be relevant. This reluctance is increased when potential customers make significant capital investments in competing technologies. Because of these obstacles, we may face substantial barriers to commercializing our business.

If we experience rapid growth and we are not able to manage this growth successfully, this inability to manage the growth could adversely affect our business, financial condition, and results of operations.

Rapid growth places a significant strain on our financial, operational, and managerial resources. While we engage in strategic and operational planning to adequately manage anticipated growth, there can be no assurance that we will be able to implement and subsequently improve operations and financial systems successfully and in a timely manner to fully manage our growth. There can be no assurance that we will be able to manage our growth and any inability to successfully manage growth could materially adversely affect our business, financial condition, and results of operation.

| 9 |

We have no experience in manufacturing or assembling products on a large scale basis, and if we do not develop adequate manufacturing and assembly processes and capabilities to do so in a timely manner, we may be unable to achieve our growth and profitability objectives.

We have no experience manufacturing or assembling products on a large scale. We do not know whether our current or future manufacturing arrangements will be able to develop efficient, low-cost manufacturing capabilities and processes that will enable us to meet the quality, price, engineering, design and production standards, or production volumes required to successfully mass market such products. Even if we are successful in developing manufacturing capabilities and processes, we do not know whether we will do so in time to meet our product commercialization schedule or to satisfy the requirements of our target market. Our failure to develop these manufacturing processes and capabilities, if necessary, in a timely manner, could prevent us from achieving our growth and profitability objectives.

If we fail to continue to develop or acquire new products, adapt to rapid and significant technological change, and respond to introductions of new products, we will not be competitive.

Our growth strategy includes significant investment in and expenditures for product development. We intend to sell products, primarily in the water clean-up sector, which are characterized by rapid and significant technological changes, frequent new product and service introductions, and enhancements and evolving industry standards. Without the timely introduction of new products, services, and enhancements, our products and services may become technologically obsolete over time, in which case our revenue and operating results would suffer.

In addition, our competitors may adapt more quickly to new technologies and changes in customers’ requirements than we can. The products that we are currently developing or those that we will develop in the future may not be technologically feasible or accepted by the marketplace, and our products or technologies could become uncompetitive or obsolete.

The market for our products is highly competitive, and there can be no assurance that competitors will not emerge in the near to medium term with comparable products or technologies.

The markets for our products and services are expected to remain highly competitive. While we believe our products are unique and have, or will have, adequate patent protection for the underlying technologies, or unique trade secrets, there can be no assurance that competitors will not emerge in the near to medium term with comparable products or technologies. There are a number of large companies involved in the same businesses as us, but with larger more established sales and marketing organizations, technical staff, and financial resources. We may establish marketing and distribution partnerships or alliances with some of these companies, but there can be no assurance that such alliances will be formed.

Our business may become substantially dependent on contracts that are awarded through competitive bidding processes.

We may sell a significant portion of our products pursuant to contracts that are subject to competitive bidding, including contracts with municipal authorities. Competition for, and negotiation and award of, contracts present varied risks, including, but not limited to:

| • | investment of substantial time and resources by management for the preparation of bids and proposals with no assurance that a contract will be awarded to us; |

| 10 |

| • | the requirement to certify as to compliance with numerous laws (for example, socio-economic, small business, and domestic preference) for which a false or incorrect certification can lead to civil and criminal penalties; |

| • | the need to estimate accurately the resources and cost structure required to service a contract; and |

| • | the expenses and delays that we might suffer if our competitors protest a contract awarded to us, including the potential that the contract may be terminated and a new bid competition may be conducted. |

If we are unable to win contracts awarded through the competitive bidding process, we may not be able to operate in the market for products and services that are provided under those contracts for a number of years. If we are unable to consistently win new contract awards over any extended period, or if we fail to anticipate all of the costs and resources that will be required to secure and perform such contract awards, our growth strategy and our business, financial condition, and results of operations could be materially and adversely affected.

We will sell products and services to companies in industries which tend to be extremely cyclical; downturns in those industries would adversely affect our results of operations.

The growth and profitability of our business will depend on sales to industries that are subject to cyclical downturns. Slowdowns in these industries may adversely affect sales by our businesses, which in turn would adversely affect our revenues and results of operations. In particular, our products may be sold to and used by the oil and gas industry, which historically has realized significant shifts in activity and spending due to fluctuations in commodity prices. Our revenues may be dependent upon spending by oil and gas producers; therefore, a reduction in spending by producers may have a materially adverse effect on our business, financial conditions, and results of operations.

The industries in which we may sell our products are heavily regulated and costs associated with such regulation could reduce our profitability.

Federal, state, and local authorities extensively regulate the stormwater and oil and gas industries, which are primary industries in which we may sell our products and offer our services. Legislation and regulations affecting the industries are under constant review for amendment or expansion. State and local authorities regulate various aspects of stormwater and oil and gas activities that ultimately affect how customers use our products and how we develop and market our products. The overall regulatory burden on the industries increases the cost of doing business, which, in turn, decreases profitability.

International sales are also subject to rules and regulations promulgated by regulatory bodies within foreign jurisdictions, and there can be no assurance that such foreign regulatory bodies will not adopt laws or regulatory requirements that could adversely affect our Company.

If chemical companies engage in predatory pricing, we may lose customers, which could materially and adversely affect us.

Municipalities and other commercial and industrial entities traditionally have used chemicals to control the quality of water and other fluids. The chemical companies represent a significant competitive factor. The chemical companies who supply chemicals to such municipalities and other commercial and industrial entities may, in order to maintain their business relationship, drastically reduce their price and seek to undercut the pricing at which we can realistically charge for our products and services. While predatory pricing that is designed to drive us out of business may be illegal under the United States anti-trust and other laws, we may lose customers as a result of any future predatory pricing and be required to file lawsuits against any companies who engage in such improper tactics. Any such litigation may be very expensive which will further impact us and affect their financial condition. As a result, predatory pricing by chemical companies could materially and adversely affect us.

| 11 |

We are, or in the future may be, subject to substantial regulation related to quality standards applicable to our manufacturing and quality processes. Our failure to comply with applicable quality standards could have an adverse effect on our business, financial condition, or results of operations.

The Environmental Protection Agency regulates the registration, manufacturing, and sales and marketing of products in our industry, and those of our distributors and partners, in the United States. Significant government regulation also exists in overseas markets. Compliance with applicable regulatory requirements is subject to continual review and is monitored through periodic inspections and other review and reporting mechanisms.

Failure by us or our partners to comply with current or future governmental regulations and quality assurance guidelines could lead to temporary manufacturing shutdowns, product recalls or related field actions, product shortages, or delays in product manufacturing. Efficacy or safety concerns and/or manufacturing quality issues with respect to our products or those of our partners could lead to product recalls, fines, withdrawals, declining sales, and/or our failure to successfully commercialize new products or otherwise achieve revenue growth.

If a natural or man-made disaster strikes our or a third-party’s manufacturing facility that we may use, we may be unable to manufacture our products for a substantial amount of time and our sales and profitability will decline.

The manufacturing facility and manufacturing equipment we use to produce our products will be costly to replace and could require substantial lead-time to repair or replace. Our facility or a third-party’s facility that we use may be affected by natural or man-made disasters. In the event they were affected by a disaster, we would be forced to set up alternative production capacity, or rely on third-party manufacturers to whom we would have to disclose our trade secrets. Although we possess insurance for damage to our property and the disruption of our business from casualties, such insurance may not be sufficient to cover all of our potential losses, may not continue to be available to us on acceptable terms, or at all, and may not address the marketing and goodwill consequences of our inability to provide products for an extended period of time.

We may decide to outsource manufacturing in the future. Dependence on contract manufacturing and outsourcing other portions of our supply chain may adversely affect our ability to bring products to market and damage our reputation.

As part of our efforts to streamline operations and to cut costs in the future, we may decide to outsource aspects of our manufacturing processes and other functions. If our contract manufacturers or other outsourcers fail to perform their obligations in a timely manner or at satisfactory quality levels, our ability to bring products to market and our reputation could suffer. For example, during a market upturn, our contract manufacturers may be unable to meet our demand requirements, which may preclude us from fulfilling our customers’ orders on a timely basis. The ability of these manufacturers to perform is largely outside of our control. Additionally, outsourcing may take place in developing countries and, as a result, may be subject to geopolitical uncertainty.

| 12 |

The success of our businesses will depend on our ability to effectively develop and implement strategic business initiatives.

We are currently implementing various strategic business initiatives. In connection with the development and implementation of these initiatives, we will incur additional expenses and capital expenditures to implement the initiatives. The development and implementation of these initiatives also requires management to divert a portion of its time from day-to-day operations. These expenses and diversions could have a significant impact on our operations and profitability, particularly if the initiatives prove to be unsuccessful. Moreover, if we are unable to implement an initiative in a timely manner, or if those initiatives turn out to be ineffective or are executed improperly, our business and operating results would be adversely affected.

Failure to successfully reduce our current or future production costs may adversely affect our financial results.

A significant portion of our strategy will rely upon our ability to successfully rationalize and improve the efficiency of our operations. In particular, our strategy relies on our ability to reduce our production costs in order to remain competitive. If we are unable to continue to successfully implement cost reduction measures, especially in a time of a worldwide economic downturn, or if these efforts do not generate the level of cost savings that we expect going forward or result in higher than expected costs, there could be a material adverse effect on our business, financial condition, results of operations, or cash flows.

If we are unable to make necessary capital investments or respond to pricing pressures, our business may be harmed.

In order to remain competitive, we need to invest in research and development, manufacturing, customer service and support, and marketing. From time to time, we may have to adjust the prices of our products and services to remain competitive. We may not have available sufficient financial or other resources to continue to make investments necessary to maintain our competitive position.

Failure to obtain sufficient supply of component materials to conduct our business may have an adverse effect on our production and revenue targets.

Our component and materials’ suppliers may fail to meet our needs. We intend to manufacture our products using materials and components procured from a limited number of third-party suppliers. We do not currently have long-term supply contracts with our suppliers. This generally serves to reduce our commitment risk, but does expose us to supply risk and to price increases that we may have to pass on to our customers. In some cases, supply shortages and delays in delivery may result in curtailed production or delays in production, which can contribute to an increase in inventory levels and loss of profit. We expect that shortages and delays in deliveries of some components will occur from time to time. If we are unable to obtain sufficient components on a timely basis, we may experience manufacturing delays, which could harm our relationships with current or prospective customers and reduce our sales. We may also not be able to obtain competitive pricing for some of our supplies compared to our competitors. We also cannot assure that the component and materials from domestic suppliers will be of similar quality or quantity as those imported component and materials, which may lead to rejections of component and materials by our customers. In the event the domestic component and materials do not perform as well as the imported component and materials or do not perform at all, our business, financial condition, and results of operations could be adversely affected.

| 13 |

We have limited product distribution experience and we expect to rely on third parties who may not successfully sell our products.

We have limited product distribution experience and currently rely and plan to rely primarily on product distribution arrangements with third parties. We may also license our technology to certain third parties for commercialization of certain applications. We expect to enter into distribution agreements and/or licensing agreements in the future, and we may not be able to enter into these agreements on terms that are favorable to us, if at all. In addition, we may have limited or no control over the distribution activities of these third parties. These third parties could sell competing products and may devote insufficient sales efforts to our products. As a result, our future revenues from sales of our products, if any, will depend on the success of the efforts of these third parties.

We could face significant liabilities in connection with our technology, products, and business operations, which if incurred beyond any insurance limits, would adversely affect our business and financial condition.

We are subject to a variety of potential liabilities connected to our technology development and business operations, such as potential liabilities related to environmental risks. As a business which manufactures and/or markets products for use by consumers and institutions, we may become liable for any damage caused by our products, whether used in the manner intended or not. Any such claim of liability, whether meritorious or not, could be time-consuming and/or result in costly litigation. Although we have obtained insurance against certain of these risks, no assurance can be given that such insurance will be adequate to cover related liabilities or will be available in the future or, if available, that premiums will be commercially justifiable. If we were to incur any substantial liability and related damages were not covered by our insurance or exceeded policy limits, or if we were to incur such liability at a time when we are not able to obtain liability insurance, our business, financial conditions, and results of operations could be materially adversely affected.

Our failure to protect our intellectual property rights may undermine our competitive position, and litigation to protect our intellectual property rights or defend against third-party allegations of infringement may be costly.

Our success will depend in part on our ability to develop patentable products and obtain and enforce patent protection for our products in the United States and other countries. We intend to file applications, as appropriate, for patents covering our products. Patents may not be issued for any pending or future patent applications owned by or licensed to us, and the claims allowed under any issued patents may not be sufficiently broad to protect our technology. Any issued patents owned by or licensed to us may be challenged, invalidated, or circumvented, and the rights under these patents may not provide us with competitive advantages. In addition, competitors may design around our technology or develop competing technologies. Intellectual property rights may also be unavailable or limited in some foreign countries, which could make it easier for competitors to capture increased market position. We could incur substantial costs to defend suits brought against us or suits in which we may assert our patent rights against others. An unfavorable outcome of any such litigation could materially adversely affect our business and results of operations.

We may also rely on trade secrets and proprietary know-how with which we seek to protect our products, in part by confidentiality agreements with our collaborators, employees, and consultants. Nevertheless, these agreements afford only limited protection, and the actions we take to protect our intellectual property rights may not be adequate. These agreements may be breached, and we may not have adequate remedies for any breach. In addition, our trade secrets may otherwise become known or be independently developed by our competitors. As a result, third parties may infringe or misappropriate our proprietary technologies or other intellectual property rights, which could have a material adverse effect on our business, financial condition, or operating results.

| 14 |

In addition, policing unauthorized use of proprietary technology can be difficult and expensive. Litigation may be necessary to enforce our intellectual property rights, protect our trade secrets, or determine the validity and scope of the proprietary rights of others. We cannot assure you that the outcome of any litigation will be in our favor. Intellectual property litigation may be costly and may divert management attention, as well as expend our other resources away from our business. An adverse determination in any such litigation will impair our intellectual property rights and may harm our business, prospects, and reputation. In addition, we have no insurance coverage against litigation costs and would have to bear all costs arising from such litigation to the extent we are unable to recover them from other parties. The occurrence of any of the foregoing could have a material adverse effect on our business, results of operations, and financial condition.

Operational and Structural Risks

We can provide no assurances as to our future financial performance or the investment result of a purchase of our common stock.

Any projected results of operations, including the recent Merger, involve significant risks and uncertainty, should be considered speculative, and depend on various assumptions which may not be correct. The future performance of our Company and the return on our common stock depends on a complex series of events that are beyond our control and that may or may not occur. Actual results for any period may or may not approximate any assumptions that are made and may differ significantly from such assumptions. We can provide no assurance or prediction as to our future profitability or to the ultimate success of an investment in our common stock.

The compensation we pay to our executive officers and employees will likely increase, which will affect our future profitability.

We believe that the compensation we have historically paid to our executive officers is within the lower quartile of compensation paid by companies similar to our Company. Following the closing of the Merger, we increased the compensation payable to the combined entity’s executive officers and employees. An increase in compensation and bonuses payable to our executive officers and employees could decrease our net income.

As a public reporting company, we are subject to corporate governance and internal control reporting requirements, and our costs related to compliance with, or our failure to comply with existing and future requirements, could adversely affect our business.

We may face new corporate governance requirements under the Sarbanes-Oxley Act of 2002, as well as new rules and regulations subsequently adopted by the SEC and the Public Company Accounting Oversight Board. These laws, rules, and regulations continue to evolve and may become increasingly stringent in the future. We are required to evaluate our internal control over financial reporting under Section 404 of the Sarbanes-Oxley Act of 2002 (“Section 404”). We are a smaller reporting company as defined in Rule 12b-2 under the Exchange Act. Section 404 requires us to include an internal control report with our Annual Report on Form 10-K. The report must include management’s assessment of the effectiveness of our internal control over financial reporting as of the end of the fiscal year. This report must also include disclosure of any material weaknesses in internal control over financial reporting that we have identified. Failure to comply, or any adverse results from such evaluation, could result in a loss of investor confidence in our financial reports and have an adverse effect on the trading price of our securities. We strive to continuously evaluate and improve our control structure to help ensure that we comply with Section 404. The financial cost of compliance with these laws, rules, and regulations is expected to remain substantial. We cannot assure you that we will be able to fully comply with these laws, rules, and regulations that address corporate governance, internal control reporting, and similar matters. Failure to comply with these laws, rules, and regulations could materially adversely affect our reputation, financial condition, and the value of our securities.

| 15 |

As a public company, we will have significant operating costs relating to compliance requirements and our management is required to devote substantial time to compliance initiatives.

Our management has only limited experience operating AbTech Holdings as a public company. To operate effectively, we will be required to continue to implement changes in certain aspects of our business and develop, manage, and train management level and other employees to comply with on-going public company requirements. Failure to take such actions, or delay in the implementation thereof, could have a material adverse effect on our business, financial condition, and results of operations.

The Sarbanes-Oxley Act of 2002, as well as rules subsequently implemented by the SEC, impose various requirements on public companies, including requiring establishment and maintenance of effective disclosure and financial controls and changes in corporate governance practices. Our management and other personnel will need to devote a substantial amount of time to these new compliance initiatives. Moreover, these rules and regulations will increase our legal and financial compliance costs and will make some activities more time-consuming and costly.

Risks Related to our Common Stock

A limited public trading market exists for our common stock, which makes it more difficult for our stockholders to sell their common stock in the public markets.

Although our common stock is quoted on the OTCBB under the symbol “ABHD,” there is a limited public market for our common stock. No assurance can be given that an active market will develop or that a stockholder will ever be able to liquidate its shares of common stock without considerable delay, if at all. Many brokerage firms may not be willing to effect transactions in the securities. Even if a purchaser finds a broker willing to effect a transaction in these securities, the combination of brokerage commissions, state transfer taxes, if any, and any other selling costs may exceed the selling price. Furthermore, our stock price may be impacted by factors that are unrelated or disproportionate to our operating performance. These market fluctuations, as well as general economic, political, and market conditions, such as recessions, interest rates, or international currency fluctuations may adversely affect the market price and liquidity of our common stock.

Our stock price may be volatile.

The market price of our common stock is likely to be highly volatile and could fluctuate widely in price in response to various factors, many of which are beyond our control, including the following:

| • | limited “public float” in the hands of a small number of persons whose sales (or lack of sales) could result in positive or negative pricing pressure on the market price for our common stock; |

| • | actual or anticipated variations in our quarterly operating results; |

| • | changes in our earnings estimates; |

| • | our ability to obtain adequate working capital financing; |

| 16 |

| • | changes in market valuations of similar companies; |

| • | publication (or lack of publication) of research reports about us; |

| • | changes in applicable laws or regulations, court rulings, enforcement and legal actions; |

| • | loss of any strategic relationships; |

| • | additions or departures of key management personnel; |

| • | actions by our stockholders (including transactions in our shares); |

| • | speculation in the press or investment community; |

| • | increases in market interest rates, which may increase our cost of capital; |

| • | changes in our industry; |

| • | competitive pricing pressures; |

| • | our ability to execute our business plan; and |

| • | economic and other external factors. |

In addition, the securities markets have from time to time experienced significant price and volume fluctuations that are unrelated to the operating performance of particular companies. These market fluctuations may also materially and adversely affect the market price of our common stock.

Our common stock may be subject to the penny stock rules which may make it more difficult to sell our common stock.

The SEC has adopted regulations which generally define a “penny stock” to be any equity security that has a market price, as defined, less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities may be covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and accredited investors, such as institutions with assets in excess of $5,000,000 or an individual with net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with his or her spouse. For transactions covered by this rule, the broker-dealers must make a special suitability determination for the purchase and receive the purchaser’s written agreement of the transaction prior to the sale. Consequently, the rule may affect the ability of broker-dealers to sell our securities and also affect the ability of our stockholders to sell their shares in the secondary market.

FINRA sales practice requirements may also limit a shareholder’s ability to buy and sell our stock.

In addition to the “penny stock” rules described above, the Financial Industry Regulatory Authority (“FINRA”) has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative, low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives, and other information. Under interpretations of these rules, FINRA believes that there is a high probability that speculative, low priced securities will not be suitable for at least some customers. The FINRA requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock and have an adverse effect on the market for our shares.

| 17 |

Our common shares are currently traded at low volume, and you may be unable to sell at or near ask prices or at all if you need to sell or liquidate a substantial number of shares at one time.

We cannot predict the extent to which an active public market for our common stock will develop or be sustained. Our common shares are currently traded, but currently with low volume, based on quotations on the “Over-the-Counter Bulletin Board,” meaning that the number of persons interested in purchasing our common shares at or near bid prices at any given time may be relatively small or non-existent. This situation is attributable to a number of factors, including the fact that we are a small company which is still relatively unknown to stock analysts, stock brokers, institutional investors, and others in the investment community that generate or influence sales volume, and that even if we came to the attention of such persons, they tend to be risk-averse and would be reluctant to follow an unproven company such as ours or purchase or recommend the purchase of our shares until such time as we became more seasoned and viable. As a consequence, there may be periods of several days or more when trading activity in our shares is minimal or non-existent, as compared to a seasoned issuer which has a large and steady volume of trading activity that will generally support continuous sales without an adverse effect on share price. We cannot give you any assurance that a broader or more active public trading market for our common stock will develop or be sustained, or that trading levels will be sustained.

Shareholders should be aware that, according to SEC Release No. 34-29093, the market for “penny stocks” has suffered in recent years from patterns of fraud and abuse. Such patterns include: (1) control of the market for the security by one or a few broker-dealers that are often related to the promoter or issuer; (2) manipulation of prices through prearranged matching of purchases and sales and false and misleading press releases; (3) boiler room practices involving high-pressure sales tactics and unrealistic price projections by inexperienced sales persons; (4) excessive and undisclosed bid-ask differential and markups by selling broker-dealers; and (5) the wholesale dumping of the same securities by promoters and broker-dealers after prices have been manipulated to a desired level, along with the resulting inevitable collapse of those prices and with consequent investor losses. Our management is aware of the abuses that have occurred historically in the penny stock market, and we do not expect to be in a position to dictate the behavior of the market or of broker-dealers who participate in the market. The occurrence of these patterns or practices could increase the future volatility of our share price.

We have historically not paid dividends and do not intend to pay dividends for the foreseeable future.

We have historically not paid dividends to our stockholders, and management does not anticipate paying any cash dividends on our common stock to our stockholders for the foreseeable future. Any determination we make regarding dividends will be at the discretion of our Board of Directors and will depend on our results of operations, our financial condition, contractual restrictions, restrictions imposed by applicable law, and other factors our Board of Directors deem relevant. Even if the funds are legally available for distribution, we may nevertheless decide not to pay any dividends. We presently intend to retain future earnings, if any, for use in the operation and expansion of our business.

The elimination of monetary liability against our directors, officers, and employees under Nevada law and the existence of indemnification rights to our directors, officers, and employees may result in substantial expenditures by our Company and may discourage lawsuits against our directors, officers, and employees.

Our articles of incorporation contain a provision permitting us to eliminate the personal liability of our directors to our Company and shareholders for damages for breach of fiduciary duty as a director or officer to the extent provided by Nevada law. We may also have contractual indemnification obligations under our employment agreements with our officers. The foregoing indemnification obligations could result in our Company incurring substantial expenditures to cover the cost of settlement or damage awards against directors and officers, which we may be unable to recoup. These provisions and resultant costs may also discourage our Company from bringing a lawsuit against directors and officers for breaches of their fiduciary duties, and may similarly discourage the filing of derivative litigation by our shareholders against our directors and officers even though such actions, if successful, might otherwise benefit our Company and shareholders.

| 18 |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking statements within the meaning of Section 27A of the Securities Act, and Section 21E of the Exchange Act, regarding the Company. These forward-looking statements are based on our current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by us. Words such as “anticipates,” “expects,” “intends,” “plans,” “predicts,” “potential,” “believes,” “seeks,” “hopes,” “estimates,” “should,” “may,” “will,” “with a view to” and variations of these words or similar expressions are intended to identify forward-looking statements. Forward-looking statements in this prospectus may include, for example, statements about:

- any projections of earnings, revenue or other financial items;

- any statements of the plans, strategies and objectives of management for future operations;

- any statements concerning proposed new products, services or developments;

- any statements regarding future economic conditions or performance;

- any statements or belief; and

- any statements of assumptions underlying any of the foregoing.

These forward-looking statements involve various risks and uncertainties. Although we believe our expectations expressed in these forward-looking statements are reasonable, our expectations may later be found to be incorrect. Our actual results could be materially different from our expectations. Important risks and factors that could cause our actual results to be materially different from our expectations are generally set forth in “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Our Business” and other sections in this prospectus. You should read this prospectus and the documents we refer to thoroughly with the understanding that our actual future results may be materially different from and worse than what we expect. Other sections of this prospectus include additional factors which could adversely impact our business and financial performance.

The forward-looking statements made in this prospectus relate only to events or information as of the date on which the statements are made in this prospectus. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. You should read this prospectus and the documents we refer to in this prospectus and have filed as exhibits to this prospectus completely and with the understanding that our actual future results may be materially different from what we expect.

| 19 |

USE OF PROCEEDS

We will not receive any proceeds from sale of the shares of common stock covered by this prospectus by the selling shareholders. To the extent the selling shareholders exercise for cash all of the warrants covering the 5,154,289 shares of common stock issuable upon exercise of all of the warrants held by such selling shareholders, we would receive $3,168,002 from such exercises. The warrants may expire without having been exercised. Even if some or all of these warrants are exercised, we cannot predict when they will be exercised and when we would receive the proceeds. We intend to use any proceeds we receive upon exercise of the warrants for general working capital and other corporate purposes.

MARKET PRICE OF OUR COMMON STOCK