Attached files

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended: December 31, 2011

| ¨ | TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ________ to ________

Commission File No. 000-54191

SINO AGRO FOOD, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 33-1219070 | |

| (State or other jurisdiction of | (I.R.S. employer | |

| incorporation or formation) | identification number) |

Room 3711, China Shine Plaza

No. 9 Lin He Xi Road

Tianhe County

Guangzhou City

P.R.C. 510610

(Address of principal executive offices)

Issuer’s telephone number: (860) 20 22057860

N/A

(Former name, former address and former

fiscal year, if changed since last report)

Securities registered under Section 12(b) of the Exchange Act:

None

Securities registered under Section 12(g) of the Exchange Act:

Common Stock, $0.001 par value per share

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ¨ No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 229.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes ¨ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “non-accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | ||

| Non-accelerated filer | ¨ | Smaller reporting company | x |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ Nox

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed fiscal quarter.

As of April 9, 2012, the aggregate market value of voting common equity held by non-affiliates was approximately $49,948,068 based on approximately 59,818,046 shares outstanding held by non-affiliates and a closing price of $0.8350.

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date:

As of April 9, 2012, there were 72,718,046 shares of Common Stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

None

| 2 |

FORWARD-LOOKING STATEMENTS

Certain statements made in this Annual Report on Form 10-K are “forward-looking statements” (within the meaning of the Private Securities Litigation Reform Act of 1995) regarding the plans and objectives of management for future operations. Such statements involve known and unknown risks, uncertainties and other factors that may cause actual results, performance or achievements of the Registrant to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. The forward-looking statements included herein are based on current expectations that involve numerous risks and uncertainties. The Registrant’s plans and objectives are based, in part, on assumptions involving the continued expansion of business. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions and future business decisions, all of which are difficult or impossible to predict accurately and many of which are beyond the control of the Registrant. Although the Registrant believes its assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove inaccurate and, therefore, there can be no assurance the forward-looking statements included in this Report will prove to be accurate. In light of the significant uncertainties inherent in the forward-looking statements included herein, the inclusion of such information should not be regarded as a representation by the Registrant or any other person that the objectives and plans of the Registrant will be achieved.

Item 1. Description of Business

General:

Sino Agro Food, Inc., a Nevada corporation (hereinafter “Sino Agro,” “SIAF,” “the Company,” “we,” “us,” “our” or similar words), is an integrated developer, producer and distributor of organic food and agricultural products with its subsidiaries operating in the People’s Republic of China (the “PRC”). The Company is focused on developing, producing and distributing higher margin agricultural and aquaculture products to meet what it believes is the increasing demand from the growing middle class consumers of the PRC for gourmet and higher quality food items.

Summary Financial Information:

The table below summarizes the audited consolidated financial statements of Sino Agro Food, Inc. for the fiscal years ended December 31, 2011 and December 31, 2010:

Balance Sheet Summary:

| At December 31, 2011 | At December 31, 2010 | |||||||

| (Taken from the Audited Financial Statements*) | (Taken from the Audited Financial Statements*) | |||||||

| Balance Sheet | ||||||||

| Cash and Cash Equivalents | $ | 1,387,908 | $ | 3,890,026 | ||||

| Total Assets | $ | 151,840,878 | $ | 107,767,910 | ||||

| Total Liabilities | $ | 16,445,505 | $ | 6,716,029 | ||||

| Total Stockholders’ Equity | $ | 135,395,373 | $ | 101,051,881 | ||||

* The auditors did not audit the contents of this table.

Statement of Operations Summary:

| For the Fiscal Year Ended December 31, 2011* | For the Fiscal Year Ended December 31, 2010 | |||||||

| (Taken from the Audited Financial Statements*) | (Taken from the Audited Financial Statements*) | |||||||

| Statement of Operations: | ||||||||

| Revenue | $ | 51,879,903 | $ | 40,551,066 | ||||

| Net Income | $ | 31,266,229 | $ | 12,697,080 | ||||

| Earnings per share: | ||||||||

| Basic | $ | 0.43 | $ | 0.16 | ||||

| Diluted | $ | 0.39 | $ | 0.14 | ||||

* The auditors did not audit the contents of this table.

| 3 |

PRINCIPAL EXECUTIVE OFFICES

The address for our principal executive offices and telephone number are:

Room 3711, China Shine Plaza

No. 9 Lin He Xi Road

Tianhe County

Guangzhou City

P.R.C. 510610

(860) 20 22057860

Overview:

Business History

Our Company was initially incorporated as Volcanic Gold, Inc. (“Volcanic Gold”) on October 1, 1974 under the laws of the State of Nevada. Prior to October 14, 2005, the Company operated as a mining and exploration company. Due to the fact that the Company was unable to generate sufficient cash flows from operations, obtain funding to sustain operations or reduce or stabilize expenses to the point where it could have realized a net positive cash flow, management and the board of directors determined that it was in the best interests of the stockholders to seek a strategic alternative so that the Company could continue to operate.

On August 24, 2007, we entered into a series of agreements to effect a “reverse merger transaction” via a share exchange with Capital Award, Inc. (“Capital Award”), a Belize Corporation incorporated on November 26, 2004. These documents included a Stock Purchase Agreement, pursuant to which Volcanic Gold issued 32,000,000 shares to stockholders of Capital Award in exchange for all of the shares of Capital Award. On August 24, 2007 the Company changed its name from Volcanic Gold, Inc. to A Power Agro Agriculture Development, Inc.

On September 5, 2007 we purchased 100% equity interest in Hang Yu Tai Investment Limited (“Hang Yu Tai”) that was incorporated in Macau on September 21, 2006 from two non-affiliated shareholders of Hang Yu Tai. Hang Yu Tai had a 78% equity interest in ZhongXingNongMu Co. Ltd. (“ZhongXing”) that was incorporated in China on March 1, 2006. The purchase price was $26,910,000, satisfied by: cash payment of $10,000,000 and the issuance of 7,000,000 shares of our common stock.

On September 5, 2007 we purchased 100% equity interest in Macau Eiji Company Limited, (“Macau Eiji”),which was incorporated in Macau on September 5, 2005 from non-affiliated shareholders of Macau Eiji. Macau Eijihad a 75% equity interest in Jiang Men City Heng Sheng Tai Agriculture Development Co. Ltd., which was incorporated in China on November 27, 2007. The purchase price was $6.75 million, satisfied by cash payment of $2,000,000 and the issuance of 2 million shares of our common stock valued at $3,878,739 of $1.939 per share.

On September 5, 2007 we purchased 100% equity interest in Tri-way Industries Limited (“Triway”) that was incorporated in Hong Kong on October 28, 2005. Triway controlled a 30% equity interest in TianQuan Science and Technology, Ltd. (“TianQuan Science”) that was incorporated in China on April 4, 1999. The purchase price was $3.25 million, satisfied by: cash payment of US $1,000,000 and the issuance of one million shares of our common stock. On October 9, 2007 the Company changed its name from A Power Agro Agriculture Development, Inc. to Sino Agro Food, Inc.

By an agreement dated October 29, 2008, Triway sold its 30% equity interest in TianQuan Science to an unrelated party for consideration of $4,500,000 that was satisfied by the payment of $4,500,000 on December 18, 2008 plus our share of TianQuan Science’s profits in 2008, which amounted to $1.25 million and was paid on November 15, 2008.

By an agreement dated November 12, 2008, Triway purchased a patented “Intellectual Property” namely “Zhi Wu JeiGan Si Liao Chan Ye Hua Chan Pin Ji Qi Zhi Bei Fang Fa” registered under the Patent Number “ZL2005 10063039.9” and Certificate number “329722” of China, (Livestock feed Manufacturing Technology) for the manufacturing of Livestock feed designed and applied for the consumption of beef cattle, cows, sheep and other animals from a non-affiliated owner of the Intellectual Property. As consideration for the transaction we paid $8,000,000 that had been satisfied with $4,500,000 paid on December 18, 2008. The remaining balance $3,500,000 to be paid by cash or the issuance of our shares in three installments. The first installment of $1,000,000 was due on December 31, 2009. The second installment was due December 31, 2010 for $1,000,000 and a third and final installment is due December 31, 2012 for $1,500,000. If the payment is made in our shares, the price per share will be valued at a three months weighted average as quoted on the OTC Pink Markets prior to the date of settlement. Currently, the entire $8,000,000 has been paid as follows:

| Date | Description of settlements |

DR. US $ |

CR. US $ |

Balance Due US $ |

| 11/30/2008 | Part Payment made for the acquisition | 4,422,736.00 | 3,577,264.00 | |

| As of 12/31/2009 | Due to the seller | 3,577,264.00 | ||

| 07/30/2010 | Payments effected by issuance of 975,000 shares @ 0.75 each to a third party |

Adjustment of 1,734.00

731,250.00 |

2,844,280.00 | |

| 08/31/2010 | Payments effected by issuance of 1,625,000 shares @ 0.75 each to a third party | 1,218,750.00 | 1,625,530.00 | |

| 09/30/2010 | Payments effected by issuance of 1,380,000 shares @ 0.75 each to a third party |

1,035,000.00

|

590,530.00 | |

| 12/31/2010 | Payments effected by issuance of 790,855 shares @ 0.75 each to a third party | 590,530.00 | 0 |

| 4 |

The total settlement debt of US $3,573,530 was credited into common stock capital of US $4,771 based at par of US$0.001 each and additional capital for an amount of US $3,910,665, respectively. A loss of $73,950 has been recorded on the transaction calculated between the fair value of the shares at respective issuance date and their respective consideration received.

On December 28, 2008, the Company, through its then subsidiary Pretty Mountain Holdings Limited (“Pretty Mountain”), a company incorporated in Hong Kong, the Special Administrative Region of the PRC, entered into a Sino-foreign joint venture agreement with the following parties for the setting up of a Sino-foreign joint venture company to be named as Qinghai Sanjiang A Power Agriculture Co. Ltd. (translation in English) (“Sanjiang A Power”) in the PRC, to manufacture bio-organic fertilizer, livestock feed and to develop other agriculture projects in the County of Huangyuan, in the vicinity of the City of Xining, Qinghai Province :

| · | Qinghai Province Sanjiang Group Company Limited (English translation) (“Qinghai Sanjiang”), a PRC government owned company with major business activities in the agriculture industry; and | |

| · | Guangzhou City Garwor Company Limited (English translation) (“Garwor”), a private limited company incorporated in the PRC, specializing in sales and marketing. |

Upon completion of this exercise and the subsequent reorganization, Pretty Mountain Holdings, Inc. was dissolved on January 28, 2011.

In September, 2009, SIAF carried out an internal re-organization of its corporate structure and businesses, and on September 28, 2009, SIAF’s subsidiary A Power Agro Agriculture Development (Macau) Limited (“APWAM”) acquired the Pretty Mountain’s 45% equity interest in Sanjiang A Power by way of an assignment (“Assignment”).Application was subsequently made by the Company to the Companies Registry of Hong Kong for deregistration of Pretty Mountain under Section 291AA of the Companies Ordinance. By virtue of the Assignment, APWAM assumed all obligations and liabilities of Pretty Mountain under the SFJVA. APWAM is a 100% owned subsidiary incorporated in the Special Administrative Region of Macau, the PRC. Ten-percent (10%) of the equity interest in APWAM has been registered in the name of one Mr. HUNG Moon Cheung in compliance with the requirements of the laws of Macau on ownership of a company incorporated in Macau by non citizens of Macau, and the same is being held by Mr. HUNG in trust for and, for the benefit of, Sino Agro Food Inc. pursuant to a Deed of Trust duly executed by Mr. HUNG on December 20, 2007 in favor of Sino Agro Food, Inc.

In January 2010, Pan Shi Fang and DengJie Min (“Chinese Businessmen”) and Capital Award have entered into a Consulting Service Agreement (“the Consulting Service Agreement”), wherein Capital Award would supply the equipment and provide consulting services for the installation and construction of the fish farm and the related supporting services in Enping City, Guangdong Province of the People’s Republic of China. It was a term of the Consulting Service Agreement that the parties thereto would form a Sino-foreign joint venture company (SFJVC) to own and operate the fish farm, and that Capital Award would have the right to nominate its associate company or a company within its group of companies to substitute Capital Award as a party to the SFJVC. Upon the nomination of Capital Award, Tri-Way entered into a joint venture agreement with the Chinese Businessmen to incorporate the SFJVC to be named as Enping City Bi Tao A Power Fishery Development Co., Ltd. to own and operate the fish farm. On February 28, 2011, the Company applied to form Enping City Bi Tao A Power Fishery Development Co. Limited (EBAPFD), of which the Company would own a 25% equity interest. The approvals of the formation of EBAPFD by the relevant authorities of the PRC Government are pending.

In February 2011, we as Vendor sold our 78% interest in ZhongXing to Ximin SUN (“Purchaser”) on the following terms:

1. Total purchase price was RMB 204,600,000 (USD $31,000,000) which is equivalent to 78% of the net assets of ZhongXing plus a surplus sum of US $4,937,000 as reflected in the ZhongXing’s Management Accounts upon the terms hereinafter provided.

2. A deposit of RMB 5,011,000 (USD $759,242.50) was paid by the Purchaser upon execution of this Agreement to the Vendor by way of deposit and part payment towards the purchase price for the Vendor’s Shares.

3. Payment of the Balance of the Purchase Price:

| 3.1 | The balance of the Purchase Price amounting to RMB 199,589,000 (USD $30,240,758) only (hereinafter called “the Balance Purchase Price”) shall be paid by the Purchaser in the manner set forth hereunder:- | ||

| (a) | A sum of RMB 25,055,000 (USD $3,796,212) (hereinafter called “the Further Payment”) in cash shall be paid by the Purchaser to the Vendor by way of 5 equal instalments of RMB 5,011,000 (USD $759,242.50) each, on or before the following dates : | ||

| (1) | April 30, 2011; | ||

| (2) | June 30, 2011; | ||

| (3) | August 31, 2011; | ||

| 5 |

| (4) | October 31, 2011; and | ||

| (5) | December 31, 2011. | ||

| (b) | The remainder of the Balance Purchase Price in the amount of RMB 174,534,000 (USD $26,444,545) (hereinafter referred to as “the Final Payment”) shall be settled by the Purchaser by way of cash contribution towards part payment of the Land Price. | ||

| 3.2 | The parties hereto hereby acknowledge that despite the fact the respective relevant land authorities of the said Lands (hereinafter collectively referred to as “Land Authorities”) have verbally agreed to contribute a combined amount of RMB 36,974,996 toward the payment of the Land Price, either by way of a grant, discount or otherwise (hereinafter called “Rebate”), it shall not be deemed a discharge of the Purchaser’s obligation herein towards payment of the Purchase Price or any part thereof. | ||

| 3.3 | The Purchaser hereby further acknowledges and covenants that the Purchaser shall procure: | ||

| (a) | the said Rebate of the Land Authorities; and | ||

| (b) | the approval by the Land Authorities of the transfer of the Land Use Rights of the said Lands to the Vendor and/or the Vendor’s Associated Companies. | ||

| 4. | Completion: | ||

| 4.1 | The Completion of this Agreement shall take place upon approval of the granting of the Land Use Rights of the said Lands by the Land Authorities to the Vendor being obtained (hereinafter referred to as “Completion Date”), whereupon the Purchaser shall be entitled to all rights thereafter attaching to the Vendor’s Shares or accruing thereon including without limitation, all bonuses, rights, dividends and other distributions declared, paid or made thereof there after free from all liens, assignments, pledges, charges and other encumbrances whatsoever Provided that the Purchaser shall have paid the Purchase Price in full in accordance with the terms as prescribed herein. | ||

| 4.2 | Notwithstanding anything to the contrary herein, the Vendor shall have the right to claim against the Purchaser for the Balance Purchase Price or any part thereof remaining unpaid by the Purchaser pursuant to the terms and conditions set forth in Clause 3.1 hereof. | ||

| 5. | Debts and Liabilities. The Vendor shall not be liable for any indebtedness incurred by ZhongXing as of January 1, 2011, and the Purchaser shall indemnify the Vendor and shall keep the Vendor indemnified against any loss claim or liability resulting there from. | ||

| 6 |

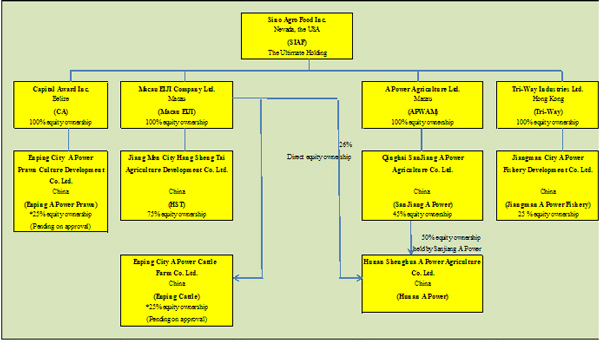

Our Current Business and Corporate Structure:

Our executive offices in the PRC is located at Room 3711, China Shine Plaza, No. 9 Lin He Xi Road, Tianhe District, Guangzhou City, the People’s Republic of China 510610, Tel: (86) 20 22057860, 22057870.,Fax:(86) 20 22057863, 22057873. We maintain a website at www.sinoagrofood.com. The contents of our website are not incorporated by reference, herein.

Note to Chart: Jiangman City A Power Fishery Development Co. Ltd, (JCAP) has been called Enping City Bi Tao Fishery Development Co. (ECBTAP) previously before the name JCAP was officially approved, such that JCAP and ECBTAP referred to in this 10K Form is the same company.

| 7 |

Revenues and Income Generating Businesses:

We conduct our operations through the following primary subsidiaries and joint ventures, as set forth below:

| 1. | Capital Award Inc., a private limited company incorporated in Belize, engaged in modern fishery project management and consultancy services; | |

| 2. | Jiang Men City Heng Sheng Tai Agriculture Development Co. Ltd., through Macau Eiji Company Limited, a 100% owned Macau subsidiary, we own 75% of Jiang Men City Heng Sheng Tai Agriculture Development Co. Ltd., a Sino-foreign joint venture company incorporated in the PRC, engaged in farming of HylocereusUndatus, commonly known as Bean Capers or Pitaya, at Juntang Town, in the vicinity of the City of Enping, Guangdong Province of the PRC; | |

| 3. | ZhongXingNongMu Co. Ltd., through Hang Yu Tai Investment Limited, a 100% owned Macau subsidiary, we own 78% of ZhongXingNongMu Co. Ltd., a private limited company incorporated in the PRC, engaged in modern dairy cows and cattle farming in the Fengning County, Province of Hebei of the PRC [Sold in February 2011]; | |

| 4. | Qinghai Sanjiang A Power Agriculture Co. Ltd., through A Power Agro Agriculture Development (Macau) Limited, a 100% owned Macau subsidiary, we own 45% of Qinghai Sanjiang A Power Agriculture Co. Limited, a Sino-foreign joint venture company incorporated in the PRC, engaged in manufacturing of bio-organic fertilizer, livestock feed, cash crops farming and beef cattle rearing and fattening in the County of Huangyuan, in the vicinity of the City of Xining, Qinghai Province of the PRC; | |

| 5. | Tri-Way Industries Ltd, which has the right initially by cash contribution to own 25% of the SFJVC, to be named Enping City Bi Tao A Power Fishery Development Co., Ltd., in Enping City, Guangdong Province of the People’s Republic of China to own and operate the fish farm in Enping City. The application to incorporate the SFJVC is pending approval of the relevant authorities of the PRC Government, having anticipated such approvals being granted on or before May 31, 2011. Capital Award is the consultant on this fish farm project. Official Approval was granted on June 2011, and the SJVC’s name is now called Jiangman City A Power Fishery Development Co. Ltd, and in turn, Tri-way obtained a 25% equity stake in the company. | |

| 6. | Hunan Shanghua A Power Agriculture Co. Ltd. (Hunan A Power) was officially approved as a Sino Joint Venture company in November 2011, and collectively we own 48.5% through Macau EIJI’s direct ownership of 26% and 22.5% through Qinghai Sanjiang A Power Agriculture Co. Ltd. Hunan A Power is in the development planning stage toward manufacturing of organic and mixed fertilizer, live stock feed and raising cattle, similar to Sanjiang A Power’s operation. | |

| 7. | Enping City A Power Prawn Culture Co. Limited (Enping Prawn) will be twenty-five percent (25%) owned by Capital Award Inc.’s nominee, pending official approval. Its operation will center on the grow-out of prawns for retail in the local market. |

| Company | % Held By SIAF |

Immediate subsidiary (I.M) |

Equity % owned by I.M. | Revenues Generating Activities |

| Sino Agro Food, Inc. (SIAF) | The Parent Company | Not Applicable | Not applicable | Service fees will be charged to its operational subsidiaries in China starting in its fiscal year 2012 |

| Capital Award Inc. | 100% Fully owned subsidiary of SIAF | Not Applicable. | Not applicable | Fishery development including consulting service fees, technology fees, supply of plant and equipment and other related services and management fees, since 2004. |

|

Macau Eiji Company Limited (MEIJI) |

100% Fully owned subsidiary of SIAF | Jiang Men City Heng Sheng Tai Agriculture Development Co. Ltd. |

75% owned by MEIJI |

Growing and processing of HU Plants including sales of fresh and dried HU flowers and value added processed HU Flowers. Revenues generated since 2008. |

|

A Power Agro Agriculture Development (Macau) Limited (APWAM) |

100% Fully owned subsidiary of SIAF |

Qinghai Sanjiang A Power Agriculture Co. Ltd (China). (Operational company) |

45% owned by APWAM | Manufacturing and beef cattle farming, including the sales of bio-organic fertilizer, livestock feed and beef cattle. Revenue generated since June 2011 |

| Qinghai Sanjiang A Power Agriculture Co. Ltd (China). | 45% owned variable interest entity of SIAF | Hunan Shanghua A Power Comapany Agriculture Co. Ltd | 50% owned by SJAP | Manufacturing and beef cattle farming including sales of mixed fertilizer, livestock feed & beef cattle. Revenue is anticipated to be generated starting Q3 2011. |

| Tri-way Industries Limited (Triway) |

100% Fully owned subsidiary of SIAF |

Jiangman City A Power Fishery Development Co. Ltd. |

25% owned by Triway | Fish Farm operation including the sale of farmed fish revenues generated starting November 2011 |

|

Macau Eiji Company Limited (MEIJI) |

100% Fully owned subsidiary of SIAF | Hunan Shanghua A Power Company Agriculture Co. Ltd. | 26% owned subsidiary of MEIJI |

Manufacturing and beef cattle farming including sales of mixed fertilizer, livestock feed & Beef cattle. Revenue is anticipated to be generated starting Q3 2012.

|

|

Macau Eiji Company Limited (MEIJI) |

100% Fully owned subsidiary of SIAF | Enping City A Power Prawn Culture Development Co Limited | 25% owned subsidiary of MEIJI | Prawn Farming, revenue anticipated to be generated starting Q3 2012 |

| 8 |

Subsidiary I.

Capital Award Inc.:

Capital Award Inc. (“Capital Award”) is currently engaged in modern fishery project management and consultancy services. We provide consulting and management services to fish farms that are adopting the “A Power Technology” and for the development of fish farms using A Power Technology systems. Capital Award commenced engaging in the marketing and sale of fish and seafood in 2011.

The A-Power Technology

A-Power Technology (“APT”) is an engineered, self-contained water treatment and re-circulating aquaculture system (“RAS”) for the growing of aquatic animals on a commercial scale. It mainly consists of the A-Power Grow Out Basin and the A-Power Treatment Stack equipment, and operating techniques and procedures, which Capital Award has established as essential or desirable for the establishment, development, and operation of the A-Power aquaculture system.

In an APT designed fish growing system; fish produced are free from diseases commonly associated withoutdoors aquaculture methods. The system is fully integrated, automated and climate-controlled, and with strict water quality management, the APT fish growing system creates a stress-free environment for the fish. These ideal growing conditions enable improved productivity, mortality rates of less than 8% and a feed-to-fish conversion ratio of 1:1 for pallet feed and 2:1 for non-pallet feed.

The system is housed on land in an enclosed environment under fully controlled conditions, and by avoiding contact with any outdoor contamination and using treated water; APT RAS produces healthy farmed fish guaranteed free of antibiotics and other pollutants.

It is an environmentally friendly system that recycles all water used in the farm. It enables the consistent year round production and supply of fish in the vicinity of urban areas. The RAS has been commercially applied in Europe and Australia for the past 30 years and APT has been commercially developed and used in Australia since 1998. However the RAS and APT are relatively new to Asian countries, including China.

APT is not a patented technology as it was developed upon the platform and principles of the RAS, but many component parts of the APT fish farms or the improved version thereof were designed and/or developed by Capital Award, such as the

| · | Solid waste filter and separator; | |

| · | Micro-bio filter for the treatment of soluble wastes; | |

| · | Oxygen injector; | |

| Steam generated heating compartment (optional, depending on the species of fish to be grown); | ||

| · | Ultra violet light disinfection chamber; | |

| · | Air blower configuration; | |

| · | Designs of the grow-out tanks; | |

| · | Designs of the quarantine station; | |

| · | Designs of the nursery station; | |

| · | Designs of the farm’s fish storage tanks; and | |

| · | Designs of stock feed processing lay-out plans. |

| 9 |

APT is a unique system as it is coupled with the farm operation’s management system and support services developed by Capital Award, which include

| · | systems for rotational stocking of fish and rotational harvesting of fish, designed to stock the growing fish tanks with certain variety of fish of certain sizes and age group at pre-determined intervals, to provide constant production of multiple varieties all year round or as and when the markets require; | |

| · | quality control systems to keep the quality of the water and production in check; | |

| · | disease control and prevention system to enhance better production cycles of the farms; | |

| · | maintenance programs to ensure the smooth running of the farms’ equipment; and | |

| · | training programs on standard operating procedures for employees. |

A standard A-Power Module has a surface area of 70 square meters and contains approximately 145 cubic meters of water.

The APT system is designed to attain economic efficiencies in the areas of reduced energy requirement, water usage, labor cost, low fish mortality rates and good feed-to-fish conversion rate, as compared to the conventional methods of fish farming.

| Items of comparison | APT farms | Conventional farms | ||

| Surface area measured for productivity | 25 tons per year per 72 m2 | 0.5 tons per year per 660mi | ||

| Water capacity measured for productivity | 25 tons per year per 100 m2 | 0.5 tons per year per 1320mі | ||

| Labor content | One worker per 50 tons per year | One worker per 6 tons per year | ||

| Water usage | Minimal | 100% Changed every year | ||

| Energy requirement | 2.5% cost of production | No specified records | ||

| Quality standard |

Can be organic or non-organic.

Guaranteed free from chemical and pollution of export standard |

No consistency

Not of export quality | ||

| Harvesting | All year round | Once or twice annually | ||

| Subjecting to seasonal variation | No | Yes | ||

| Subjecting to external predators and diseases | No | Yes | ||

| Usage of antibiotics and chemicals | No | Yes | ||

| Environmentally friendly | Yes | No | ||

| Live span of major plants & equipment | 25 years or more | Two years | ||

| Average Gross profit | Minimum 60% of sales value, depending on the species of fish grown | No accurate calculation | ||

| Averaged mortality rate for the Grow-out | 8% or less | Above 25% | ||

| Average of feed to fish conversion rate | 2 to 1 | 4.5 to 1 |

Fish Farm Development

As of February 29, 2012, Capital Award has three fishery development projects in progress; their status summarized as follows:

(1) 1st Demonstration fish farm is situated at district of Enping City, it was built and completed for operation since February 2011 and is now in production operation.

(2) 1st Demonstration prawn farm is also situated at District of Enping City. Its development was started in June 2011and expecting completion for production operation on or before July 2012.

| 10 |

(3) 2nd Fish (and Eel)Farm is situated at District of Jiangman City. Its development was started in May 2011and is expecting its Phase (1) to be completed within year 2012, and Phase (2) development starting in January 2013 with production operation beginning by year-end 2013.

(4) 2ndprawn farm is situated at District of Zhong Shan City. Its development was started in November 2011 and is expecting its Phase (1) to be completed for production operation by the end of April 2012, and Phase (2) will be completed for partial production operation on or before the end of December 2012.

(1) 1st Demonstration fish farm development

On January 15, 2010, we executed a service and consulting contract with a group of Chinese businessmen (“Chinese Businessmen”), wherein Capital Award would supply the equipment and provide consulting services for the installation and construction of the fish farm and the related supporting services in Enping City, Guangdong Province of the People’s Republic of China. It was a term of the Consulting Service Agreement that the parties thereto would form a Sino-foreign joint venture company (SFJVC) for the operation and management of the fish farm, and that Capital Award would have the right to nominate its associate company or a company within its group of companies to substitute Capital Award as a party to the SFJVC. Upon the nomination of Capital Award, Tri-Way entered into a joint venture agreement with the Chinese Businessmen to incorporate SFJVC to be named as Enping City Bi Tao A Power Fishery Development Co., Ltd. to own and operate the fish farm in accordance with the terms and conditions as prescribed therein.

The farm in Enping is being designed to have a production capacity of 500 metric tons of fish per year. We agreed to provide services amounting to about $3.5 million, which included APT sub-license fees of $400,000, part of the plant and equipment costs up to $2,500,000 including grow-out tanks and related installation, supervision and consultancy in the building of the farm structure, training of workers and other associated professional services amounting to $600,000. The Chinese Businessmen are funding this capital development. The species of fish intended to be grown in the Farm will be the “Sleepy Cod”, a Chinese species which we believe is in demand in the local market. It commands, on average, a wholesale price of US $23.00 (live fish) to US$27.00 (live fish) per kilogram, based on recorded prices as of December 31, 2011 and June 21, 2011, respectively.

The current progress report on the fish farm development as of December 31, 2011 is as follows:

| · | All land clearing, leveling and fencing at the development site have been completed. | |

| · | All soil testing, water quality testing and water in flow rate testing has been done. | |

| · | Majority of the plant equipment has been delivered. | |

| · | Construction of the farm buildings has been in progress and within schedule (subsequently the construction of the fish farm was completed on November 26, 2010). | |

| · | Construction of all 16 fish tanks were constructed, fully installed and fitted on December 5, 2010, and since the end of December 2010, the farm underwent a nurturing period to nurture and to grow filtration bacteria needed in the tanks for consumption of bio-mass. As such, we expected that the tanks would be ready for stocking fingerling to grow-out into marketable size fish on or before the mid-February 2011. We had targeted the first sales to begin by July 2011. | |

| · | Contracts on the provision of related services and consultancies needed for the operation of the farm have been organized. By December 26, 2010 a new management team for the operation of the farm had been recruited consisting of 10 personnel including the farm manager, supervisors, skilled and non-skilled workers. | |

| · | 300,000 fingerlings had been ordered for delivery from September 2010 through November 2010. At our last inspection at the supplier’s farm on August 18, 2010, the fingerlings were an average size of 60mm and growing healthily. In anticipation of a possible colder early winter, we subsequently at the end of November 2010 helped our supplier to install heating systems to cover their outdoor farms where our fingerling were being kept; ensuring that they would not suffer from any adverse effect arising from severe winter weather. The aforesaid measure was timely effective as Southern China had experienced one of its coldest winters in the early weeks of January 2011. |

As of December 31, 2010 the Chinese Businessmen had funded just under US $3.9 Million for the development of the Fishery, which covered the cost of the following:

| § | Standby diesel powered generator capable of providing electricity during outages; | |

| § | All underground and surface drainage, water works and electrical connections; | |

| § | Heating provided by boiler driven heat exchangers capable of heating each tank’s water 6°C in 30 minutes | |

| § | Dry storage of approximately 9,000 m²; | |

| § | Guard house, office and staff quarters to handle up to 15 personnel; | |

| § | Farm building measuring over 4,000 m² housing16 grow-out tanks each with the capacity to hold up to 120,000 liter of water with built-in solid waste and soluble waste filters, ultraviolet and O³ disinfectors, and aerators that will have the capacity to grow-out an average of 25 tons of fish per tank per year; |

| 11 |

| § | A nursery facility that has the capacity to grow-out 2 million fingerlings per year from 25mm per piece to 100mm per piece; | |

| § | Freezing and cool room facilities; | |

| § | Feed processing facilities and feed preparation rooms; | |

| § | Landscaping areas covering more than 15,000 m² and all boundary fences of the complex; and | |

| § | External water holding tanks with total holding capacity of more than 3 million liters of water at any given time, supplied by 4 underground bores of various depth measuring from 80m to 150m. |

At January 31, 2011, all developments mentioned above were completed and the fish farm in operation.

Subsequently the Chinese Businessmen needed to provide a further sum, estimated at up to US $1.3 million, as working capital to cover the following items within an 8 month period before incomes could be generated from the sale of fish:

| · | Up to 2 months for trials and testing of plant and equipment, and water, nurturing of bacteria, trial growing and recording of sample species of fish to be grown in the farm, etc.; (This was completed as of February 28, 2011) | |

| · | Training of staff and workers; (Completed by February 28, 2011) | |

| · | Purchase of operational feed-prep equipment, office equipment, and laboratory instruments, etc. (Completed by February 28, 2011) | |

| · | Up to 8 months of administration and operation expenses; (Completed by August 31, 2011) | |

| · | Stocking of spare parts and components and feed staff etc.; (On-going) and | |

| · | Gradual rotational stocking of fingerlings in the farm from February to March 2011 in order to achieve the targeted sales of grown fish from July 2011 onwards. (25,000 Sleepy cod fingerlings and 50,000 prawn fingerlings were stocked on February 15, 2011, and the next batch consisting of 250,000 sleepy cod fingerlings had been stocked on March 15, 2011). |

Production activities of this fish farm started from February 2011.

Between March to June, 2011, collectively the farm was stocked with over 120,000 pieces of fingerlings (measuring from 20mm up to 30mm / pieces), and in between time, the farm also was stocked with larger sized fingerlings and fish stocks of various sizes.

Commencing from June 2011, the farm has been consistently and on a monthly basis producing and selling fish that have been grown to marketable sizes (from 450g/fish and larger).

In this respect, Capital Award is the marketing and sales agent of the farm such that Capital Award supplied fish (and fingerling) stocks to the farm, and, in turn, generated fish sale revenue by buying all of the marketable sized fish produced by the farm and reselling them to wholesalers.

Supplies of Fingerling Stocks and Feed Stocks, in general;

Presently, fingerling stocks of Sleepy Cod are readily available in the PRC, but they are not disease free (DF) fingerlings. However, a nursery, quarantine station, and laboratory have been developed on the fish farm in Enping. Capital Award provides the training of and education for the farm staff for the development of DF fingerlings so that the Sleepy Cods fingerlings will be DF certified before being released into the grow-out tanks. A farm of annual capacity of 500 MT when fully developed will require over one million fingerlings within one full year of operation.

“Blue bait,” which is an ocean captured small baitfish available in the PRC, is used as the raw feed material for Sleepy Cod. Capital Award’s personnel on the preparation and formulation of the fish feed train workers at the farm.

With respect to the Supplies of Fingerling Stocks and Feed Stocks of 1st Demonstration fish farm:

From the experience gained in 2011, we discovered that this farm has the ability to grow-out larger sleepy cods (i.e. from 250g/fish and larger) to marketable sized fish efficiently and economically (i.e. better feed conversion rate, growth rate and less risk of disease, etc.). The table below reflects our recorded growth and feed conversion rates as of December 31, 2011.

| Initial size grown to marketable size | Time required | Feed required |

| From 200/250g grown to 500g | 4 months | 3 kg of blue bait |

| From 250/300g grown to 500g | 3 months | 2 Kg of blue bait |

| From 300/350g grown to 500g | 2 months | 1.5 Kg of blue bait |

| Average of mortality rate; less than 0.6% per month | ||

| 12 |

Therefore a supply contract was executed with Guangzhou Jingyang Aquaculture Co. Ltd. on November 17, 2011 to supply the farm with SPF sleepy cod stock (from 250g/fish and larger) and blue baitfish from April 2012 to March 2014.

This in turn provides the foundation to achieve targeted sales revenue of $13.5M and $21.5M based on the output of 500 MT and 800 MT in 2012 and 2013, respectively.

Sales of Fish

Sleepy Cod, especially being supplied live, have good niche markets in the local Chinese markets as well in other Asian markets. As such, Capital Award aims at mainly selling live fish, anticipating that local wholesalers and distributors will pick up their purchase orders directly at the farm, eliminating the farm’s concern with issues of delivery and logistics. All fish produced from the farm will have uniform quality standards, i.e. they will be free of any chemical and other pollutants, and will be marketed and promoted accordingly.

Currently, Capital Award has sold all of the 1st Demonstration Farm’s production to a few wholesalers in the Guangzhou Fish Market. Therefore, it is not necessary at this juncture to carry out any promotional programs, although samples of fish had been sent to a few well-known restaurants and marketing outlets in other big cities in China on a trial basis with positive reception.

As of December 31, 2011, the 1st Demonstration farm has produced and sold over 191 MT of marketable sized fish based on the rotational stocking system (i.e. stocking larger sized fish and turning them back out into the market at a faster rate).

(2) 1st Demonstration Prawn Farm Developments

Enping City A Power Prawn Culture Development Co., Ltd (Name of the SJVC, pending approval)

On February 11, 2011, Wei Da Xing and Capital Award Inc. entered into a joint venture agreement, in accordance with the laws of Sino Foreign Joint Venture Enterprises of the People’s Republic of China and other relevant regulations to incorporate a Sino-foreign joint venture company at No. 1-5, 1st Floor, JiangzhouShuiZha Office Building, No 19, Jiang Jun Road Jiangzhou, Juntang Town, Enping City, Guangdong Province of the People’s Republic of China, to be tentatively named as Enping City Bi Tao A Power Prawn Culture Development Co., Ltd (“SFJVC”).

The Parties’ purpose in establishing the SFJVC is to develop a prawn farm that produces high quality fresh prawns and products through the application of modern aquaculture technology and related management systems, developing a competitive edge toward sustained international markets while providing economic benefit to the Parties and generating socioeconomic benefits to the surrounding communities, as a whole.

The production capacity will be 2,000 MT of quality fish and prawns per year.

| · | It is estimated that the construction of the Prawn farm will be completed and operational by July 2012; targeted production for operational year (1) is 250 MT of prawn. | |

| · | From the second year of operation to the fifth year of operation, the production will be increased gradually to its final annual productivity of 2,000 MT per year, including the production of more than 3 species of fish and prawns. |

The tenure of the SFJVC shall be for a period of 50 years. The SFJVC’s Board of Directors may decide to extend the tenure of the SFJVC by applying to the China Business Registration Department (or its related authorized approving authority) within 6 months from the day of expiry, thereof.

The total investment capital of the SFJVC is US$5 million to be invested over a period of 5 years, whereas the Registered Capital of the SFJVC shall be US$100,000 for the first year and be increased gradually to US$5 million by the fifth year subject to the decision made by the Board of Directors of the SFJVC at the time.

The parties’ respective capital contribution in the 5 years is as follows:

| · | First Year: Wei Ds Xing shall contribute US$80,000 in cash and Capital Award shall contribute US$20,000 in cash. | |

| · | From the second year onward, Capital Award shall have the option to increase its share of equity interest in the SFJVC, and the parties will contribute their share of equity stake (or to increase part of the SFJVC’s registered capital by means of converting the SFJVC’s assets) in accordance with the guidelines as shown in the Table below: |

| 13 |

First Year

| Parties | Change of equity interest up to | Assets that may be converted | Maximum % that will be converted |

| Wei Ds Xing | 75% | Cash | 10% |

| Plant and equipment | 25% | ||

| Property | 25% | ||

| Land Use Right | 10% | ||

| Other | 5% | ||

| Total contribution of Wei Ds Xing | 75% | ||

| Capital Award | 25% | Cash | 25% |

Second Year Onward

| Parties | Change of equity interest up to | Assets that may be converted | Maximum % that will be converted |

| Wei Ds Xing | 25% | Cash | 2.5% |

| Plant and equipment | 6.25% | ||

| Property | 6.25% | ||

| Land Use Right | 2.5% | ||

| Other | 1.25 | ||

| Total contribution of Wei Ds Xing | 25% | ||

| Capital Award | 75% | Cash | 75% |

Schedule of Registered Capital Payments:

In the first year, the Parties hereto shall pay US$100,000 in Registered Capital to the SFJVC in accordance with their respective share of equity interest in the SFJVC within 6 months from date of issuance of the business license of the SFJVC. From the second year onward, the Parties shall pay their respective share of contribution of the Registered capital in the manner as mentioned above and in accordance with the time schedule as set forth by the Board of Directors of the SFJVC as and when it shall be necessary.

If either of the Parties hereto shall decide to sell all or part of its equity in the SFJVC to any third party, the selling party is required to obtain consent of the other party before such sale, and shall grant the first right of refusal to the other party on similar terms under the intended sale.

The responsibilities of Wei Ds Xing:

| 1. | To pay its share of the Registered Capital in a timely manner. | |

| 2. | To apply to relevant Chinese Authorities in order to obtain the official approval, registration and business license for the incorporation of the SFJVC. | |

| 3. | To apply to the Land Authorities of China to obtain official approval of the Land Use Right of the project land. | |

| 4. | To introduce and to organize all local sub-contractors and contractors to carry out construction work relating to the scopes of civil engineering, designs, building and all other related matters for the SFJVC for the purpose of developing the fish farm. | |

| 5. | To introduce to and to organize all local suppliers and manufacturers for the SFJVC such that the SFJVC will be able to obtain supplies and manufacturing of plants and equipment for the fish farm. | |

| 6. | To apply to the customs authorities and to obtain import clearance for all imported plant and equipment of the fish farm and to arrange local transportation for the delivery of the imported plant equipment to the project site. | |

| 7. | To introduce to and to organize all local contractors and sub-contractors for the SFJVC such that the SFJVC will be able to construct and to connect all basic infrastructure and utility services needed at the project site of the fish farm. | |

| 8. | To assist the SFJVC in recruiting Chinese management personnel, technical personnel, workers and other workers needed for its fish farm. | |

| 9. | To assist foreign workers and staff of the SFJVC in their applications for entry visas, work permits and other associated local traveling arrangements. | |

| 10. | To co-ordinate other general necessities requested by the SFJVC from time to time during the development period of the SFJVC. |

| 14 |

The responsibilities of Capital Award:

| 1. | To pay its share of the Registered Capital in a timely manner. | |

| 2. | To organize and to arrange supplies, purchases, delivery and related matters of all imported plant equipment needed by the Fish Farm. | |

| 3. | To organize and to arrange all transportation and related logistics needed for the importation of imported plant equipment for delivery to the appropriate sea port in China. | |

| 4. | To provide qualified technical supervisors, personnel and inspectors for the installation and commissioning of all plant equipment of the fish farm. | |

| 5. | To provide training to the personnel and workers needed for the operation of the fish Farm. | |

| 6. | To ensure that the performance of the Fish Farm (including but not limiting to the productivity and durability of the Fish Farm) will be reached within the targeted schedule. | |

| 7. | To assist the SFJVC in other matters related to the Fish Farm Development works as and when requested by the SFJVC. |

Consulting Agreement

An AP Technology Consulting Services Agreement between Capital Award and a Group of China Parties represented by Mr. Wei Da Xing (“Employer”) was executed on February 11, 2011 under which the parties agreed to build and develop a prawn farm using the AP Technology System at a site in Enping District, Guangdong Province within close proximity to the HangSingTai HU Plantation, Enping with the exact location to be determined after inflow water quality and quantity, and soil testing that will be carried out on various blocks of land in the Enping District.

The Parties agreed to apply to the China Authorities to form a Sino Foreign Joint Venture Company (hereinafter called “SFJVC”) to develop the Project. Prior to the official approval of the SFJVC the Employer shall be responsible to provide funding for the development needs of the Project, and, upon the official establishment of the SFJVC, the Parties agree to transfer this Agreement to the SFJVC wherein the SFJVC will become responsible to fund the required development of the Project. The Parties further agreed that after the official formation of the SFJVC, the SFJVC would reimburse the Employer for amounts paid by the Employer on the Project prior to its official formation. Capital Award shall provide technical service to the Employer prior to the official formation of SFJVC for the development of the Project.

Progress report of the 1st Demonstration prawn farm development (as of December 31, 2011):

| Description of work | Current status |

| Design and Engineering drawings | Mostly completed |

| Infrastructure, utilities, and land work | Mostly completed |

| Road work and drainage | Partially done |

| Farm Buildings and construction | Half way completed |

| Tank construction and fittings | Started |

| Water wells and supplied tanks | Started |

| Filtration systems construction and fittings | Starts in June 2012 |

| Heating and heat exchange systems | Starts in June 2012 |

| Plant and equipment supplies | Partially supplied |

| Supervised trial runs | Starts in July 2012 |

| Training of operators and staff | Starts in August 2012 |

| Estimated time of completion of construction | On or before August 31, 2012 |

| Estimated time of starting production operation | On or before October 31, 2012 |

| Estimated final contracted value | RMB 56.25M (US$8.989M) |

| Invoice billed as of 12/31/2011 | US $7.35M |

| 15 |

(3) 2nd Fish (and Eel) Farm Development

On May 18, 2011, a consulting and servicing contract was executed between CA and GaoQiang Aquaculture Farm of Jiangman City for the construction and development of an APT Fish and Eel farm at a 60 Mu (about 9.5 acre) block of land situated at XinHin District, Nan Zhu Village, Qi Bao County, Xinhui District, and Jiangman City, Guangdong Province. The development will be built-out in two phases.

* Phase (1) involves the development of a fish farm based on 16 APMs, staff quarters, an office, dried goods and refrigerated storage, processing facilities, etc. Current status as of March 1, 2012:

| Description of work | Current status |

| Design and Engineering drawings | Partly completed |

| Infrastructure, utilities, and land work | Partly completed |

| Road work and drainage | Partially done |

| Farm Buildings and other construction | Targeting to start building on or before June 30, 2012 |

| Ground work | In progress; estimated completion June 2012 |

| Tank construction and fittings | Depending on Ground work; targeting July 2012 |

| Water wells and supplied tanks | Scheduled to be completed August 2012 |

| Filtration systems construction and fittings | Scheduled to be completed September 2012 |

| Heating and heat exchange systems | Scheduled to be completed September 2012 |

| Plant and equipment supplies | Partially supplied |

| Supervised trial runs | Starts in November 2012 |

| Training of operators and staff | Starts in December 2012 |

| Estimated time of completion of construction | On or before the December 2012 |

| Estimated time of starting production operation | On or before the end of March 2013 |

| Estimated final contracted value | RMB65M (or US$10.38M) |

| Invoice billed as of 31.12.2011 | US$5.86M |

| Designed Production Capacity of the farm | Minimum of 500 MT/year |

Among other terms and conditions of this contract, options have been granted to Capital Award:

| • | For Capital Award to buy up to 75% of the developed farm within 3 years from the date of contract, and |

| • | For appointing Capital Award as it sole marketing and sales agent for the marketing/sale of its products. |

* Phase (2) of the development will involve the development and construction of an additional 16 APMs and other processing facilities; expected to commence after the completion of Phase (1).

(4) 2ndPrawn Farm development

On November 18th 2011, Capital Award has been awarded a two phase service and consulting contract to develop a second prawn farm valued at up to $21M in San Jiao Town, Zhong Shan City, Guangdong Province, PRC.

The servicing and consulting contract is to develop and construct a Prawn Hatchery and Nursery station on a six-acre block of land with the capacity to produce some 2.8 billion Prawn Fingerlings in its first year of operation.

The project is divided into two phases with the first phase approved. Phase one construction has already commenced with completion expected in early April 2012. Construction under phase one includes infrastructure development, utilities, staff quarters, office and Prawn hatchery and nursery construction. Phase one of the project is expected to generate approximately $8.08M in revenue for the Company.

| 16 |

Phase two of the project, which requires additional approval, includes the development and construction of a Prawn Grow-out Farm consisting of 16 APM indoor units and the conversion of twelve acres of outdoor ponds for use with the APM technology. Phase two is expected to start in mid-2012 and be completed by year-end 2012. The contract is expected to generate revenue up to $21M for 2012, which represents almost 85% of our revenue generated from Capital Award’s consulting and servicing contracts in 2011. We expect this trend to continue as more interest develops for this technology in China.

On March 1, 2012 a Form 8K (SEC) had been filed with the Servicing and Consulting Contract as attachment. Among other terms and conditions of this contract, options have been granted to Capital Award, namely:

| • | For Capital Award to buy up to 75% of the developed farm within 3 years from date of the contract, and |

| • | For appointing Capital Award as it sole marketing and sales agent for the marketing/sale of its products. |

As of March 1, 2012 the progress report on this development is reflected in the Table below:

| Description of work | Current status |

| Design and Engineering drawings | Partly completed |

| Infrastructure, utilities, and land work | Partly completed |

| Road work and drainage | Partially done |

| Farm Buildings and other construction | Just about completed |

| Laboratory and levy production construction | Partially completion |

| Tank construction and fittings | Partially done |

| Water wells and supplied tanks | Completed |

| Filtration systems construction and fittings | Partially done |

| Heating and heat exchange systems | Completed |

| Plant and equipment supplies | Partially supplied |

| Supervised trial runs | Starts month end March 2012 |

| Training of operators and staff | Started |

| Estimated time of completion of construction | On or before the end of March 31, 2012 |

| Estimated time of starting production operation | On or before the end of April 2012 |

| Estimated final contracted value of Phase (1) | RMB51M (US$8.08M) |

| Invoice billed as of 31.12.2011 | US$2.406M |

| Designed Production Capacity of the farm (Phase 1) | Minimum of 5 Billion pieces of prawn flies/year |

Supplies of Brood stocks

In recent years the prawn aquaculture industry in China has been curtailed for the following reasons:

| • | Increasing cost of land and labor |

| • | Increasing industrial water pollution |

| • | Inbreeding of brood stocks resulting in a limited number of suppliers of healthy prawn flies that can be reliably grown into larger sized prawn. |

Our AP Technology has the ability to overcome these problems, except for inbreeding. Therefore we have obtained freshly supplied brood stock from Vietnam and Cambodia to develop into second generation breeding stock, insofar that reports from our laboratory show that our second-generation breeding stocks are producing healthy flies. Management is confident that this farm will supply the local market with good healthy prawn flies for the local farmers to reliably grow into adult prawns acceptable to the local market.

Sales of Prawns and prawn flies (or fingerlings)

There is huge demand in the China local markets for both prawns (live and frozen) (tens of millions MT/year) and prawns flies (hundreds of billion pieces/year), and their wholesale price is very seasonal (i.e. small sized prawns counting from 80 to 100 pieces per kg vary from US$2/kg during heavy supply season (July to October) to US$7/kg during short-supply season (November to June). Large sized prawns counting from 10 to 15 pieces/Kg vary from US$8/kg to US$24/kg during said respective seasons.

| 17 |

However, sales of prawn flies are basically timed between April to October during the late spring to mid Autumn of every year (except the supplies to our APT farms, which would be all year round), and this year their wholesale prices are anticipated to be much higher than in 2011(estimating at least 35% more or higher). The average 2011 prices were for 80 to 100 count sizes at US$28 to US$38.3/10,000 pieces of first generation Mexican White; US$11.65 to US$21.6/10,000 pieces of 2nd generation Mexican White flies; and US$59/10,000 pieces of well known Asian species.

Management is targeting to generate upwards of US $10M in prawn flies sales revenue supplied by this farm in 2012.

Other Fish sales of Capital Award:

On March 3rd, 2011 a contract was executed between Capital Award and GaoQiang Aquaculture Co. located adjacent to the 2nd Fish Farm specified above at XinHin District, Nan Zhu Village, Qi Bao County, Xinhui District, Jiangmen City, Guangdong Province, for the growing of 600,000 pieces of sleepy cod from fingerlings (average sizes of 30mm/piece upward) to marketable sized fish (minimum of 500g/fish) within two years.

The contracted grow-out cost including cost of fingerlings or fish stocks, all feed, medication, supplementary, labor and all other associated growing costs is based on RMB40 (US$6.50) per 500g grown fish for a total contractual cost of RMB24 million (US$3.85M), payable evenly and monthly at RMB4 million (US$650K) per month commencing from March 15, 2011.

Between December 15 to 23, 2011, there were almost 60,000 fish (total weight around 30 MT) sold by Capital Award at an average of RMB150 (US$24.20)/Kg from this contract. Due to a winter spell the growth rate of the fish was negatively impacted for two months, such that, the next fish sales from this contract is anticipated to resume sometime in March 2012.

Future Sale of Fishery Plant and Equipment and Consulting Services

In 2008, management of Capital Award studied the feasibility and viability of engaging a number of the Chinese manufacturers and factories to manufacture the main parts and components of the APT Module in the PRC and then assemble the parts and component by Capital Award’s own team of workers. The finished plants and equipment were found to be comparable to most imports in terms of quality standard, but at a cost savings of up to 55% less. Based upon this experience, Capital Award committed to having up to 60% of the plant and equipment required for the farms manufactured in the PRC, and assembled by its own team of workers at the fishery project sites as required by the purchasers of the fish farms.

In 2011 we experienced having up to 90% of the APT farms’ plant and equipment supplied and sourced from local manufacturers, and, thus far, their performance has been comparable to the quality standard of similar imports.

Order Backlog

There is no backlog of orders at present in respect of any of Capital Award’s sales and services.

Competition

Many of our existing and potential competitors have substantially greater financial, marketing and distribution resources than we do. Many of these companies have greater name recognition and more established relationships with our target customers. Furthermore, these competitors may be able to adopt more aggressive pricing policies and offer customers more attractive terms than we can. If we are unable to compete successfully, our business may suffer and our sales cycles could lengthen, resulting in a loss of market share or revenues.

We believe that competition within the industry is based principally on a combination of quality, price, design, responsiveness, reputation, production capacity, and follow-up customer service. We distinguish ourselves from our competitors by being focused on RAS technology.

There are really no competitors in the PRC as far as RAS farms are concerned. We provide and support the APT fishery development with complete services from the design of a farm’s lay-out and farm building’s structure to all filtration systems; from the supplies of core plants and equipment to their maintenance services; from training of workers to full management of operation services; and from the development of SPF fingerlings to the sales and marketing of the farmed fish and fish products. There are no other RAS suppliers in the PRC providing what we have provided for our clients in the PRC. Our teams of management have significant experience in the industry that covers all aspects of the industry, including RAS technologies know-how, management of farm operation, training of operators and extensive knowledge of the markets and sales.

| 18 |

With respect to fish sales, we are competing against growers/suppliers of fish and fish products of sub-standard quality, estimated as supplied to the local markets in the tens of millions metric tons per year. There is in fact no commercial farm in the PRC producing chemical and pollution free fish. Our quality fish and fish products will be competing against high quality imports, consisting of mostly frozen items, which are being sold at premium prices. We are confident that our live or fresh chilled fish and fish products will have a competitive edge as logistic/transportation costs will be less, allowing us to pass on the cost savings.

We also believe that by building the APT farms in the PRC, it will significantly reduce the investment capital required, as it would be costlier to have them built in other countries. By reducing demand for development capital, the cost of production and sales of the fish will be reduced, wherein the competitive advantage of our fish and fish products will dramatically increase..

Patents, Trademarks & Licenses

We do not have ownership of any patented or trademarked intellectual property. The APT was designed and developed by Infinity Environmental Group, a Belize corporation. Capital Award was granted a Master License for APT for the territory of the PRC on August 1, 2006 for a term of 60 years. Pursuant to an agreement dated August 1, 2006 between Infinity Environmental Group Limited (“Infinity”) and the Company, the Company was granted an A Power Technology License with a condition that the Company was required to pay the license fee covering 500 units of APM as performance payment to Infinity on or before July 31, 2008. This license allows the Company to develop, service, manage, and supply A Power Technology Farms in the PRC using the A Power Technology. The Company has met all payment obligations to Infinity as follows:

| Date | Description of transactions |

Payments US $ |

Amounts Due US $ |

Balance US $ |

| 07/31/2007 | Due to Infinity for the contractual 500 units of APM | 2,500,000 | 2,500,000 | |

| 12/20/2007 | Payment made to Infinity under our CR#(08) Infinity 20.12.07 | 2,500,000 | ||

| 01/07/2008 | Due to Infinity for an additional 500 units of APM contracted to one of our clients in 2008 | 2,500,000 | 2,500,000 | |

| 09/18/2009 | Payments made to Infinity under our CR#001 | 2,500,000 | 0 | |

| 12/31/2010 | 0 |

We also have rights to a different RAS Technology, which we don’t intend to use in our fishery developments in China, however, it still may be useful and applicable in other countries, (i.e. Vietnam or Indonesia etc.), so we have left these rights on our balance sheet at minimal value. They are not the same as the rights we are using as described above.

Capital Award subsequently has made many improvements to the plant and equipment to suit the conditions in the PRC, and has developed operating techniques and procedures, which Capital Award has established as essential or desirable for the establishment development and operation of the APT farms.

Our APT prawn farm technology was expanded from the similar basic principle of the RAS technology. All related improvements and designs and operation procedures and techniques were uniquely developed and fine tuned by the Company with many practical applications, especially when used for the growing of prawns, eliminating many problems associated with in the prawn aquaculture industry compared to when using the old and traditional technology systems.

Environmental Matters

All new developments such as the fish farm in the PRC are required to furnish an Environmental Impact Assessment (“EIA”) Report to the local authorities. The Environmental Impact Analysis (EIA) was submitted together with the aforesaid SFJVC agreement to the relevant PRC Authorities on October 29, 2010 in application for the formation of the SFJVC. Normally, the approval process takes up to eight months from the date of submission.

As of 12/31/2011 the relevant authorities have approved our APT farm development, and we do not expect any issues rose regarding our future submissions for APT farms and projects.

| 19 |

Significant Events that may affect Fishery Operational Cash Flow:

A. Quoting from the Q2, 2011 Financial Report:

“However result from the application of the Joint Venture Company of the Enping Fish Farm, we received a notice from the tax department that only 50% of its income tax would be exempted regulated by the local Province Government. In this respect we are appealing this out-come with the local Province Government.”

Due to a contradiction in uniformly applying the tax, i.e. in Q3 authorities granted a 100% tax exemption for fish sales generated by the Open Dam Farm, the Company is intensifying its efforts seeking uniform exemption for ALL fish sales, regardless of their source. Short of obtaining the exemption, the Company will incur tax charges on 50% of its income derived from the Enping Fish Farm.

This appeal is still pending as of March 01, 2012.

B. CA does not carry a Builder or a Developer license in China, and as a result, its contracts are structured based on it providing consulting services, and subcontracting with licensed builders and developers to handle construction and payment of capital improvement taxes.

The profit CA derives from these contracts is retained in China and is recorded as payable to CA by the SJVC, by which CA may later elect to exchange for equity interest in the SJVC as provided within the terms and conditions of each contract. At such time, if and when CA decides to exercise its option to secure equity in the SJVC, certain tax implications might be triggered and have to be accounted for, accordingly.

Business Plan and Direction of Capital Award: (Please refer to the MD&A section).

Subsidiary II.

Jiang Men City Heng Sheng Tai Agriculture Development Co. Ltd.:

Macau Eiji Company Limited (“Macau Eiji”) is a 100% owned subsidiary incorporated in the Special Administrative Region of Macau, the PRC. Ten-percent (10%) of the equity interest in Macau Eiji has been registered in the name of Mr. HUNG Moon Cheung in compliance with the requirements of the laws of Macau on ownership of a company incorporated in Macau by non citizens of Macau, and the same is being held by Mr. HUNG Moon Cheung in trust for and, for the benefit of, Sino Agro Food, Inc. pursuant to a Deed of Trust duly executed by said Mr. HUNG on December 20, 2007 in favor of Sino Agro Food, Inc.

Macau Eiji entered into a Sino-foreign joint venture agreement with Enping City Juntang Town Hang Sing Tai Agriculture Co. Ltd. on September 5, 2007, for the setting up of a Sino-foreign joint venture company known as Jiang Men Shi Heng Sheng Tai Nong Ye You Xian Gong Si (English translation: Jiang Men City Heng Sheng Tai Agriculture Development Co. Ltd.) in China.

Jiang Men City Heng Sheng Tai Agriculture Development Co. Ltd. (“HST”), in which we have a 75% equity interest pursuant to the aforesaid Sino-foreign joint venture agreement, was incorporated in China on November 27, 2007.

HST is engaged in farming of HylocereusUndatus, commonly known as Bean Capers or Pitaya or Dragon Fruit(“HU Plants”), at Juntang Town, in the City of Enping, Guangdong Province of the PRC.

We currently generate revenue by:

| · | harvesting the green flowers from the HU Plants before they mature into fruits and sell them as vegetables; | |

| · | drying the green flowers harvested and selling them as dried vegetables for human consumption; and | |

| · | processing and packaging the dried and fresh flowers into salted, pickled and in-brine vegetables. |

All dried, processed and packaged green flowers are to be sold throughout the year, even after the HU Plants’ flowering season, which runs from July through October.

| 20 |

Harvesting and Sales of HU Plant Green Flowers

HST has over 1,095.58 mu (Chinese acre), equivalent to approximately 181.79 acres of land available for growing and processing HU Plants under Land Usage Rights granted for a term of 60 years having commenced in May 2007. The land is located in the City of Enping in the southwest of Guangdong Province situated in the Zhujiang Delta Region. It is 150km from the Guangzhou City and 250km from Hong Kong and Macau with good freeway access to/from these cities.

Enping is ideally suited for growing HU Plants because it has a tropical monsoon climate with short winters and long summers. It is warm in the winter and cool in the summer with abundant rainfall. It is one of the few areas, which have not been overtaken by the progress of industrialization. Before 1989, there were over 100,000 mu of HU plantation, situated among the fast growing districts in Guangdong Province, supplying HU flowers and products to the local and South East Asian markets. Now there are less than 3,000 mu of HU Plantation left of the old growing districts due to the industrialization progress of recent years.

A HU Plant normally takes three years to reach maturity, which means that:

| · | Year 1 plants yield only about 10% of green flowers, as compared to the matured plants. | |

| · | Year 2 plants yield about 50% of green flowers, as compared to the matured plants. | |

| · | Year 3 (matured) plants yield an average of 120,000 green flowers per year per mu for 25 years, the average production life span of a HU plant. |

The harvesting period of HU Plants in Enping region is between middle of June to end of October each year, divided into approximately 14 harvesting intervals during the period. During the harvesting period, HU plants naturally start to blossom with green flowers the following day after a rain, and the green flowers must be harvested right away before they bloom into colorful flowers, which are not marketable as vegetables.

Out of HST’s land holding, 187 acres were planted with HU Plants from late 2007 to current day consisting of 47 acres of 3 year-old and 88 acres of 2 year-old plants with the balance in new and 1 year-old plants.

In 2008, the Year 2007 planting showed a yield average of 7,500 flowers per mu in a year, resulting in a total yield of over 2.15 million pieces of flowers harvested and sold as fresh flowers. In 2009, Year 2007’s planting yielded over 16.5 million pieces of fresh flowers, whereas Year 2008’s planting showed a total yield of 2.5 million pieces of fresh flowers. Total harvesting for the season of 2010 was at about 31.5 million pieces of fresh flowers.

Sales of Dried Flowers Products after the Installation of the Drying and Processing Facilities

HST began in 2009 to develop the facilities for the drying and processing of the green flowers into value added products such as portion packed “Steamed and dried flowers,” “Naturally dried flowers,” and “Favorite dried flowers.”In mid June, 2009, the construction and fitting out of drying houses, for drying up to five metric tons of fresh green flowers per day, was completed on a 6,600 square meter plot. The cool room facility and the associated packaging facility were completed in March 2010. Thus, the drying and processing facilities should be fully operational for the 2011 season’s harvest.

All of our drying and processing facilities were developed using the traditional drying and processing systems and methods that have been used in the industry in the PRC for decades. The traditional drying and processing methods are simply straightforward processes as follows:

| · | All harvested green flowers will be stored and kept cool in the cool room while waiting to be processed. | |

| · | They will then be steamed in batches at boiling temperature for less than 15 minutes. The naturally dried flowers will require washing and grading. Flavored dried flowers will be aromatically cured after steaming. | |

| · | Thereafter, they will be transferred to the drier to be dried at 140°Celsius for about 3 hours, and at gradually decreasing temperatures for another 5 hours. | |

| · | Packaging procedures then follow, then | |

| · | They are stored and sold through the winter period until next harvest season. |

Although these traditional facilities are less expensive to build than facilities using more modern dryers and processors, they are more labor intensive. We’ve chosen the more traditional method because of: