Attached files

| file | filename |

|---|---|

| EX-32 - EX-32 - GTSI CORP | d331603dex32.htm |

| EX-31.2 - EX-31.2 - GTSI CORP | d331603dex312.htm |

| EX-31.1 - EX-31.1 - GTSI CORP | d331603dex311.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2011

Commission File Number: 001-34871

GTSI CORP.

(Exact name of registrant as specified in its charter)

| Delaware | 54-1248422 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) | |

| 2553 Dulles View Drive, Suite 100, Herndon, VA | 20171-5219 | |

| (Address of principal executive offices) | (Zip Code) | |

703-502-2000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock, $0.005 par value | NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act. YES ¨ NO x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ¨ NO x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES x NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive DataFile required to be submitted and posted pursuant to Rule 405 of Regulations S-T (232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES x NO ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definition of “accelerated filer”, “large accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES ¨ NO x

The aggregate market value of the voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, as of June 30, 2011 was $42, 361,175.

The number of shares outstanding of the registrant’s common stock on March 20, 2012 was 9,672,177.

DOCUMENTS INCORPORATED BY REFERENCE

Items 10, 11, 12, 13 and 14 of Part III of this Form 10-K are incorporated by reference to GTSI’s proxy statement to be filed with the Securities and Exchange Commission in connection with the Annual Meeting of GTSI’s Stockholders scheduled to be held on May 25, 2012.

EXPLANATORY NOTE

This Amendment No. 1 to the Annual Report on Form 10-K of GTSI Corp. (“GTSI” or the “Company”) amends the Company’s Annual Report on Form 10-K for the 12 months ended December 31, 2011, which was filed with the Securities and Exchange Commission on March 29, 2012 (“Original 10-K”). This Amendment No. 1 does not reflect a change in our results of operations or financial position as reported in the Original 10-K. The Company is filing this Amendment No. 1 because the number of holders of record of the Company’s common stock was inadvertently omitted from Part 2-Item 5 of the Original 10-K. Except as described above, this Amendment No. 1 does not amend any other information set forth in the Original 10-K and the Company has not updated disclosures included therein to reflect any events that occurred subsequent to March 29, 2012. Pursuant to Rule 12b-15 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the complete text of Item 5, as amended, is repeated in this Amendment No. 1.

This Amendment No. 1 consists solely of the preceding cover page, this explanatory note, amended Item 5, the signature page and restated exhibits 31.1, 31.2 and 32.1.

PART II

| ITEM 5. | MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES |

The annual meeting of GTSI’s stockholders is scheduled to be held at 11:00 a.m. on May 25, 2012, at the Company’s headquarters located at 2553 Dulles View Drive, Suite 100, Herndon, VA.

Price Range of Common Stock

GTSI’s common stock is traded on the NASDAQ Global Market under the symbol GTSI. As of March 20, 2012, there were 281 holders of record of the Company’s common stock. The following stock prices are the high and low sales prices of GTSI’s common stock during the calendar quarters indicated.

| Quarter |

2011 | 2010 | ||||||||||||||

| High | Low | High | Low | |||||||||||||

| First |

$ | 4.84 | $ | 4.42 | $ | 6.28 | $ | 5.05 | ||||||||

| Second |

$ | 5.52 | $ | 4.17 | $ | 6.67 | $ | 5.46 | ||||||||

| Third |

$ | 5.41 | $ | 4.23 | $ | 7.05 | $ | 5.04 | ||||||||

| Fourth |

$ | 4.53 | $ | 3.99 | $ | 7.25 | $ | 3.55 | ||||||||

GTSI’s transfer agent is American Stock Transfer & Trust Company, 59 Maiden Lane Plaza Level, New York, NY 10038; telephone 1-800-937-5449.

Dividends

The Company has never paid any cash dividends and currently has no plans to pay cash dividends on its common stock. Also, as discussed in Note 10 to GTSI’s consolidated financial statements, included in Part II, Item 8 of this Form 10-K, the Second Amended Credit Agreement prohibits GTSI from paying any cash dividends without the consent of the lenders.

Issuer Purchases of Equity Securities

On June 8, 2009, GTSI’s Board of Directors authorized a program for periodic purchases of GTSI common stock through May 27, 2011 for an aggregate purchase price not to exceed $5 million, replacing GTSI’s stock repurchase program announced in December 2008. In October, 2010 GTSI Corp. entered into the Amended Credit Agreement which among other things, prohibits GTSI from purchasing any of its common stock.

On August 30, 2011, GTSI entered into a Second Amendment to Second Amended Credit Agreement which permits GTSI to purchase its common stock subject to certain terms and conditions, including that such purchases cannot exceed an aggregate purchase price of $5 million. On August 31, 2011, the Board of Directors authorized a share repurchase program pursuant to Rules 10b5-1 and 10b-18 of the Exchange Act permitting the Company to repurchase its common stock up to an aggregate purchase price of $5 million.

1

The following table sets forth the purchases of our common stock we made each month during the quarter ended December 31, 2011.

| Total Number of Shares | Maximum Dollar Value | |||||||||||||||

| (a) | Average | Purchased as Part of | of Shares that May Yet | |||||||||||||

| Total Number of | Price Paid | Publicly Announced | Be Purchased Under the | |||||||||||||

| Month |

Shares Purchased | per Share | Plans or Programs | Plans or Programs | ||||||||||||

| October |

4,155 | $ | 4.62 | 3,807 | $ | 1,740,234 | ||||||||||

| November |

671 | $ | 4.53 | — | $ | 1,740,234 | ||||||||||

| December |

— | $ | — | — | $ | 1,740,234 | ||||||||||

|

|

|

|

|

|

|

|||||||||||

| 4,826 | $ | 4.61 | 3,807 | |||||||||||||

|

|

|

|

|

|

|

|||||||||||

| (a) | 1,019 shares purchased in the fourth quarter of 2011 were surrendered to cover the tax withholdings obligation with respect to the vesting of $3,162 restricted stock awards. |

Equity Compensation Plans

The following table summarizes information regarding GTSI’s equity compensation plans as of December 31, 2011 (GTSI does not have any equity compensation plans that have not been approved by its stockholders).

| (a) | Weighted | Number of Shares Available | ||||||||||

| Number of Shares to be | Average Exercise | for Future Issuance Under | ||||||||||

| Issued upon Exercise / Lapse | Price of | Equity Compensation Plans | ||||||||||

| of Outstanding Options / | Outstanding | (excluding shares reflected in | ||||||||||

| Plan Category |

Restricted Stock Awards | Options | column (a)) | |||||||||

| Equity compensation plans approved by stockholders |

925,226 | $ | 7.39 | 1,608,423 | ||||||||

2

PERFORMANCE GRAPH—UPDATE

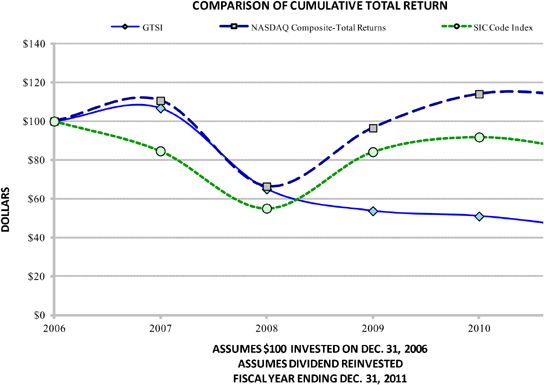

The following graph is furnished pursuant to SEC Exchange Act regulations. It compares the annual percentage change in the cumulative total return on GTSI’s common stock with the cumulative total return of the NASDAQ Composite Index and a Peer Index of companies with the same four-digit standard industrial classification (SIC) code as the Company (SIC Code 5045 — Computers and Peripheral Equipment and Software) for the period commencing December 31, 2006 and ending December 31, 2011. The stock price performance shown on the graph below is not necessarily indicative of future price performance.

| 12/31/2006 | 12/31/2007 | 12/31/2008 | 12/31/2009 | 12/31/2010 | 12/31/2011 | |||||||||||||||||||

| GTSI |

100.00 | 106.81 | 64.98 | 53.71 | 51.00 | 45.02 | ||||||||||||||||||

| NASDAQ Composite-Total Returns |

100.00 | 110.66 | 66.41 | 96.54 | 114.06 | 113.16 | ||||||||||||||||||

| SIC Code Index |

100.00 | 84.67 | 55.08 | 84.24 | 91.82 | 85.11 | ||||||||||||||||||

The 13 companies listed in SIC Code 5045 are: APPLIED VISUAL; DIGITAL RIVER, INC.; GTSI; INGRAM MICRO, INC.; INFONOW CORP.; NAVARRE CORPORATION; EPLUS INC.; SCANSOURCE INC.; SMART CARD MKTG;TECH DATA CORP.;TRANSET CORP.;WAYSIDE TECH GP

3

SIGNATURES

Pursuant to the requirements of Section 13 or 15 (d) of the Securities Exchange Act of 1934, the registrant has duly caused this Amendment No. 1 to be signed on its behalf by the undersigned thereunto duly authorized.

| GTSI CORP. | ||

| By: | /s/ STERLING E. PHILLIPS, JR. | |

| Sterling E. Phillips, Jr. | ||

| Chief Executive Officer | ||

April 12, 2012

4