Attached files

| file | filename |

|---|---|

| EX-31.1 - EXHIBIT 31.1 - QKL Stores Inc. | v245211_ex31-1.htm |

| EX-32.1 - EXHIBIT 32.1 - QKL Stores Inc. | v245211_ex32-1.htm |

| EX-23.1 - EXHIBIT 23.1 - QKL Stores Inc. | v245211_ex23-1.htm |

| EX-31.2 - EXHIBIT 31.2 - QKL Stores Inc. | v245211_ex31-2.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K/A

(Amendment No. 1)

(Mark One)

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

For the fiscal year ended December 31, 2010

Or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

For the transition period from ________ to __________

Commission file number 001-34498

QKL STORES INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 75-2180652 | |

| (State or Other Jurisdiction | (I.R.S. Employer | |

| of Incorporation or Organization) | Identification No.) |

4 Nanreyuan Street

Dongfeng Road

Sartu District

163300 Daqing, P.R. China

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (011) 86-459-460-7987

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| Common Stock, par value $0.001 per share | NASDAQ Capital Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company þ |

Indicate by check mark whether the registrant is a shell company (as defined in Exchange Act Rule 12b-2). Yes ¨ No þ

The aggregate market value of the registrant’s common stock, $0.001 par value per share, held by non-affiliates of the registrant on June 30, 2010 was approximately $44,520,596 (based on the closing sales price of the registrant’s common stock on that date ($4.20). Shares of the registrant’s common stock held by each officer and director and each person known to the registrant to own 10% or more of the outstanding voting power of the registrant have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not a determination for other purposes.

APPLICABLE ONLY TO REGISTRANTS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PRECEDING FIVE YEARS:

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15 of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes ¨ No ¨

(APPLICABLE ONLY TO CORPORATE REGISTRANTS)

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. As of March 28, 2011 there were 29,769,590 shares of common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE: Portions of the Registrant’s Proxy Statement relating to the Registrant’s 2011 Annual Meeting of Shareholders are incorporated by reference into Part III of this Annual Report on Form 10-K/A.

Explanatory Note

We are filing this Amendment No. 1 (this “Amendment No. 1”) on Form 10-K/A to our Annual Report on Form 10-K for the fiscal year ended December 31, 2010, which was filed with the Securities and Exchange Commission (“SEC”) on March 31, 2011 (the “Original 2010 Form 10-K”). This Amendment No. 1 amends the Original 2010 Form 10-K, as follows:

(i) to amend Item 8 – Financial Statements and Supplementary Data and certain related areas to reflect the correction of a misstatement related to accounting for basic and dilutive earnings per share, as discussed under “Restatement of Financial Statements” below:

(ii) to amend Item 9A – Controls and Procedures to reflect a reassessment of our disclosure controls and procedures and internal control over financial reporting, as of December 31, 2010, in light of the restatement of our audited financial statements for the year ended December 31, 2010; and

(iii) to amend the Items listed below to provide updated disclosure in response to certain other comments we received from the SEC in connection with the SEC’s periodic review of our SEC filings:

Item 7 –Management’s Discussion and Analysis of Financial Condition and Results of Operations

Under “Our Operations in China”, we have added disclosure about the nature of assets held by, and the operations of, entities apart from the consolidated VIE.

Under “Our Corporate Structure”, we have added disclosure about the risks and uncertainties that may result in deconsolidation of the VIE.

Under “Critical Accounting Policies and Estimates - Goodwill”, we have added disclosure for the probability of future goodwill impairment charges..

Under “About Non-GAAP Financial Measures”, we have added disclosure about reconciliation of net Income (loss) to adjusted net income.

Under “Liquidity and Capital Resources”, we have added disclosure as follows:

(i) how cash is transferred to our PRC subsidiary and variable interest entity, and conversely, how earnings and cash are transferred from our PRC subsidiary and variable interest entity to offshore companies;

(ii) restrictions that impact the ability to transfer cash within the corporate structure and the nature of restrictions on the subsidiary and variable interest entity’s net assets, the amount of those net assets and the potential impact on the company’s liquidity; and

(iii) the amount of cash held by your PRC subsidiary and variable interest entity, and our intention to transfer the funds to your non-PRC entities and the need to accrue and pay withholding and other taxes if funds were transferred to our non-PRC entities.

Under “Notes to Consolidated Financial Statements”, we have added disclosure as follows:

(i) disclose, within our accounting policy footnote, the method and the inputs used in estimating the fair value the warrant liabilities as of 12/31/2009;

(ii) disclose accounting policies regarding the accrual and disclosure of loss contingencies and the procedures undertook to assess the probability of loss related to asserted and unasserted claims or assessments;

(iii) disclose the fact that our control and economic benefits agreements are enforceable under PRC and local law;

(iv) disclose (a) the significant judgments and assumptions made in determining that the Company is the primary beneficiary of QKL-China, (b) whether the Company has provided financial or other support to QKL-China during the years presented that the Company was not previously contractually required to provide including the type and amount of support and the primary reasons for providing the support, (c) how QKL-China is financed, (d) the nature of any restrictions on the assets of QKL-China, (e) whether the creditors of QKL-China have recourse to the general credit of QKL Stores, Inc., Speedy Brilliant (BVI) or Speedy Brilliant (Daqing), (f) the terms of arrangements that could require the Company to provide financial support to QKL-China, (g) the Company's policy regarding how net income is attributed to any noncontrolling interest and (h) quantitative information about the size of QKL-China;

(v) describe the potential impact of risks associated with the Company's involvement with QKL-China, including potential for deconsolidation, if the legal structure and contractual arrangements were found to be in violation of any existing or future PRC laws and regulations; and

(vi) disclose the pertinent rights and privileges of the Company's Series A convertible preferred shares.

We refer to the Original 2010 Form 10-K and this Amendment No. 1 as this “Annual Report on Form 10-K”. Except as discussed above, the Company has not modified or updated disclosures presented in the Original 2010 Form 10-K. Accordingly, except as discussed above, this Amendment No. 1 does not reflect events occurring after the filing of the Original 2010 Form 10-K, nor does it modify or update those disclosures affected by subsequent events or discoveries. Events occurring after the filing of the 2010 Original Form 10-K or other disclosures necessary to reflect subsequent events have been or will be addressed in the Company's reports filed subsequent to the Original 2010 Form 10-K.

Restatement of Financial Statements

In connection with a review of the Company's Annual Report among the Audit Committee and the Company's management, with the assistance of BDO China Shu Lun Pan Certified Public Accountants LLP and Albert Wong & Co LLP, the Company's former and current independent registered public accounting firms, the Company has reassessed the computation of basic and diluted earnings per share . The review was conducted to respond to certain comments raised by the staff of the SEC in connection with its periodic review of the Company's SEC filings.

The Company calculates earnings per share in accordance with ASC 260, Earnings Per Share, which requires a dual presentation of basic and diluted earnings per share. Basic earnings per share are computed using the weighted average number of shares outstanding during the fiscal year. Potentially dilutive common shares consist of convertible preferred stock (using the if-converted method) and exercisable warrants and stock options outstanding (using the treasury method).

The errors in our computations of basic and diluted (loss) earnings per share were caused by errors in the numerator of these computations relating to our convertible preferred stock and outstanding warrants.

For basic EPS, ASC 260-10-45-60A states that “all securities that meet the definition of a participating security, irrespective of whether the securities are convertible, nonconvertible, or potential common stock securities, shall be included in the computation of basic EPS using the two-class method.” The company has determined that holders of its Class A convertible preferred stock participate in dividends of the Company on the same basis as holders of the Company’s common stock. Accordingly, the Class A preferred must be included in the calculation of basic earnings per share using the two class method to allocate earnings. Since we did not use the two class method to calculate basic earnings per share in our originally filed financial statements, we have restated basic earnings per share using the two class method.

For diluted earnings per share, the warrants, which were recorded as a derivative liability on our balance sheet, were presumed to be settled in our common shares. The resulting potential common shares are included in the denominator of our diluted earnings per share in accordance with ASC 260-10-45-45 and calculated using the treasury stock method. Our denominator for the potential common shares outstanding remains unchanged as a result of the restatement. However, the numerator in our prior computations did not include an adjustment for the change in fair value of the derivative liability relating to our dilutive warrants. ASC 260-10-45-46 states that “a contract that is reported as an asset or liability for accounting purposes may require an adjustment to the numerator for any changes in income or loss that would result if the contract had been reported as an equity instrument for accounting purposes during the period.”

In order to correct the error in our diluted earnings per share computation, we adjusted the numerator to effectively reverse the derivative for the gains (losses) that were recorded in our statement of operations relating to the change in the fair value of the warrants (derivative liability) to the extent such adjustments had a dilutive effect on the computations.

Except as specifically referenced herein, this 10-K/A does not reflect any event occurring subsequent to March 31, 2011, the filing date of the original annual report, and no other changes have been made to the annual report

CAUTIONARY STATEMENT

This 10-K/A contains forward-looking statements. Forward-looking statements give our current expectations or forecasts of future events. You can identify these statements by the fact that they do not relate strictly to historical or current facts. Forward-looking statements involve risks and uncertainties. Forward-looking statements include statements regarding, among other things, (a) our projected sales, profitability and cash flows, (b) our growth strategies, (c) anticipated trends in our industries, (d) our future financing plans and (e) our anticipated needs for working capital. They are generally identifiable by use of the words “may,” “will,” “should,” “anticipate,” “estimate,” “plan,” “potential,” “projects,” “continuing,” “ongoing,” “expects,” “management believes,” “we believe,” “we intend” or the negative of these words or other variations on these words or comparable terminology. In particular, these include statements relating to future actions, future performance, sales efforts, expenses, the outcome of contingencies such as legal proceedings, and financial results.

Any or all of our forward-looking statements in this annual report may turn out to be inaccurate. They can be affected by inaccurate assumptions we might make or by known or unknown risks or uncertainties. Consequently, no forward-looking statement can be guaranteed. Actual future results may vary materially as a result of various factors, including, without limitation, the risks outlined under “Risk Factors” and matters described in this annual report generally. In light of these risks and uncertainties, there can be no assurance that the forward-looking statements contained in this filing will in fact occur and you should not place undue reliance on these forward-looking statements.

Part II

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Throughout this section, our fiscal years ended December 31, 2010 and December 31, 2009 are referred to as fiscal 2010 and 2009, respectively. The following management’s discussion and analysis should be read in conjunction with our financial statements and the notes thereto and the other financial information appearing elsewhere in this report. In addition to historical information, the following discussion contains certain forward-looking information. See “Special Note Regarding Forward Looking Statements” above for certain information concerning those forward looking statements.

Overview

We are a regional supermarket chain that currently operates 29 supermarkets, 11 hypermarkets and 3 department stores in northeastern China and Inner Mongolia. Our supermarkets sell a broad selection of merchandise including groceries, fresh food and non-food items. We have 2 distribution centers servicing our supermarkets, one for fresh food and one for grocery and non-food merchandise.

We believe that we are the first supermarket chain in northeastern China and Inner Mongolia that is a licensee of the Independent Grocers Alliance, or IGA, a United States-based global grocery network with aggregate retail sales of more than $21.0 billion per year. As a licensee of IGA, we are able to engage in group bargaining with suppliers and have access to more than 2,000 private IGA brands, including many that are exclusive IGA brands.

Our expansion strategy emphasizes growth through geographic expansion in northeastern China and Inner Mongolia, where we believe local populations can support profitable supermarket operations, and where we believe competition from large foreign and national supermarket chains, which generally have resources far greater than ours, is limited. Our strategies for profitable operations include buy-side initiatives to reduce supply costs; focusing on merchandise with higher margins, such as foods we prepare ourselves and private label merchandise; and increasing reliance on the benefits of membership in the international trade group IGA.

We completed the initial steps in the execution of our expansion plan in March 2008, when we raised financing through the combination of our reverse merger and private placement and also raised additional financing in our public offering in the fourth quarter of 2009. Under our expansion plan, we opened:

| · | ten new stores in 2008 that have in the aggregate approximately 42,000 square meters of space, |

| · | seven new stores in 2009 that have, in the aggregate, approximately 32,000 square meters of space |

| · | nine new stores in 2010 that have in the aggregate approximately 74,189 square meters of space |

In 2011, we plan to open 12 hypermarkets, supermarkets and department stores having, in the aggregate, approximately 70,000 square meters of space. We are also making improvements to our logistics and information systems to support our supermarkets. We expect to finance our expansion plan from funds generated from operations, bank loans and proceeds from our public offering in the fourth quarter of 2009, and our long-term target is to increase our total number of stores to 200 over the next five years, including hypermarkets, supermarkets and department stores.

Our Operations in China

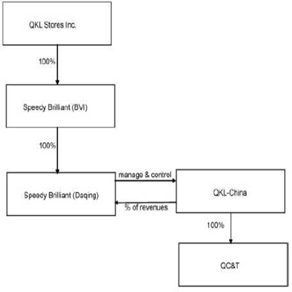

We operate our business in the PRC through our variable interest entity (“VIE”), QKL-China. QKL, Speedy Brilliant (BVI) and Speedy Brilliant (Daqing) did not have significant operations and their major assets are cash and pledge deposits. Total cash held by entities apart from the consolidated VIE was $7,300,794 and $8,842,494 as at December 31, 2010 and December 31, 2009, respectively. Total pledge deposits held by entities apart from the consolidated VIE was $77,205 and $181,836 as at December 31, 2010 and December 31, 2009, respectively. QKL-China holds the licenses, approvals and assets necessary to operate our business in the PRC.

Our headquarters and all of our stores are located in the provinces of northeastern China and Inner Mongolia. The economy of this area has grown rapidly over the last four to five years and we believe that the national government is committed to enhancing economic growth in the region. In December 2003, a major economic-development plan for northeastern China, the “Plan for Revitalizing Northeast China,” was announced by an office of the national government’s State Council.

Based on our own research, we believe there are approximately 200 to 300 small and medium-sized cities in northeast China without modern supermarket chains. We believe the number of supermarket customers and the demand for supermarkets in these cities are likely to grow significantly over the next several years as the region continues to experience urbanization.

Our Corporate Structure

We have no equity ownership interest in QKL-China and rely on contractual arrangements with QKL-China and its shareholders that allow us to substantially control and operate QKL-China. These contractual arrangements may not be as effective as direct ownership in providing control over QKL-China because QKL-China or its shareholders could breach the arrangements. For example, the VIE may be unwilling or unable to perform their obligations under our contractual arrangements with it, including payments under the consigned management and technology service agreements as they become due. The legal environment in the PRC is not as developed as in the United States and uncertainties in the Chinese legal system could limit our ability to enforce these contractual arrangements. In the event that we are unable to enforce these contractual arrangements, our business, financial condition and results of operations could be materially and adversely affected.

Our contractual arrangements with QKL-China are governed by PRC law and provide for the resolution of disputes through arbitration in the PRC. Accordingly, these contracts would be interpreted in accordance with PRC law and any disputes would be resolved in accordance with PRC legal procedures. Although we believe our current business operations are in compliance with the current laws in China, we cannot be sure that the PRC government would view our contractual arrangements to be in compliance with PRC regulations that may be adopted in the future. If we are determined not to be in compliance, the PRC government could levy fines, revoke our business and operating licenses, require us to discontinue or restrict our operations, restrict our right to collect revenues, require us to restructure our business, corporate structure or operations, impose additional conditions or requirements with which we may not be able to comply, impose restrictions on our business operations or on our customers, or take other regulatory or enforcement actions against us that could be harmful to our business. As a result, our business in the PRC could be materially adversely affected, which in turn may result in the deconsolidation of the VIE.

Our Strategy for Growth and Profitability

Our strategic plan includes the following principal components: expanding by opening stores in new strategic locations, improving profitability by decreasing the cost through origin sourcing, setting up distribution centers and increasing the percentage of our sales attributable to private label merchandise, membership sales and gift card sales.

Expanded Operations

As of December 31, 2010, we operated 29 supermarkets, 11 hypermarkets, 3 department stores, and 2 distribution centers, one in Daqing and one in Harbin. Under our expansion plan, we opened nine new stores in 2010 that have, in the aggregate, approximately 74,189 square meters of space. In 2011, we plan to open additional hypermarkets, supermarkets and department stores having, in the aggregate, approximately 70,000 square meters of retail space. Most of the stores will be opened by us and others will be acquired by us. We are also making improvements to our logistics and information systems to support our supermarkets. We expect to finance our expansion plan from funds generated from operations and bank loans. Based on our previous experience, we believe it takes six to nine months for a new store to achieve profitability.

Private Label Merchandise

Some of the merchandise we sell is made to our specifications by manufacturers using the QKL brand name. We refer to such merchandise as “private label” merchandise. With private label merchandise, we entrust the manufacturer to make the product and to select the name and design. Under our agreements with the private label manufacturer, the private label manufacturers can not sell the private label merchandise to any other party. Sales of private label merchandise accounted for approximately 5.8% and 5.5% of our total revenues in 2010 and 2009, respectively. In June 2008, we established a specialized department for designing and purchasing private label merchandise, in which 7 full-time employees currently work. Our goal is to increase private label sales to 20% of our total revenues.

Principal Factors Affecting Our Results

The following factors have had, and we expect they will continue to have, a significant effect on our business, financial condition and results of operations.

Seasonality – Our business is subject to seasonality, with increased sales in the first quarter and fourth quarter, due to increases in shopping and consumer activity as a result of the holidays such as New Year (January 1), Chinese Lunar New Year (January or February), the Dragon Festival (February 2), Women’s Day (March 8), the Back to School Day (March 1), National Day (October 1), Mid-Autumn Festival (September or October) and Christmas (December 25).

Timing of New Store Openings – Growth through new store openings is a fundamental part of our strategy. Our new stores typically operate at a loss for approximately three months due to start-up inventory and other costs, promotional discounts and other marketing costs and strategies associated with new store openings, rental expenses and costs related to hiring and training new employees. Our operating results, and in particular our gross margin, have and will continue to vary based in part on the pace of our new store openings.

Locations for New Stores – Good commercial space that meets our standards, in locations that meet our needs, may be scarce in some of the cities we wish to enter. One option for entering certain target markets within our intended timeframe may be to begin operations in a location that is not optimal and wait for an opportunity to move to a better location. Alternatively, we may seek to enter into a target market through acquisitions. As such, the timing and costs associated with entry into new markets can be difficult to predict. Identifying and pursuing opportunities will be a resource-intensive challenge, and if we do not perform or if actual costs of entering new markets exceed our expectations, our total revenues, cash flows, and liquidity could suffer.

Logistics of Geographic Expansion – Opening additional stores in cities further from our distribution centers in Daqing and Harbin will mean that the transportation of our supplies and personnel among our stores will become more difficult and subject to disruption. To alleviate this, we expanded our distribution capabilities by opening a new distribution center in Harbin in the 2 nd quarter of 2010. We have been using our regional purchasing systems since 2008. All fresh food is ordered by individual stores based on their needs from local vendors designated by our headquarters or regional purchasing department and is delivered directly by the local vendors to individual stores. A portion of our non-perishable food and non-food items are distributed from our distribution center to our different stores, and the remaining portion is purchased by our regional purchasing department or headquarters and delivered directly to individual stores. Long-distance transportation for both food and non-food items from our distribution center to our stores can be challenging in the winter as the roads can be covered with snow. As we expand in territories further from our existing or planned distribution facilities, the costs of delivering food and merchandise may become less /predictable and more volatile.

Hiring – In our experience, it takes approximately three months to train new employees to operate a new store. Training and supervision is organized by experienced teachers in our training school. The management team for a new store is hired first and is trained in our training school, where they learn our culture and operations. Employees are hired afterwards, and are trained by both our teachers and the management team. In addition, the management team and the employees are sent to existing stores to get practical training from the employees and management team members in those stores. Eventually, local employees must learn to perform the training and supervisory roles themselves. If we do not perform well in response to these challenges, our operating costs will rise and our margins will fall.

Shortages of Trained Staff in Our New Locations – Opening stores in locations with little or no competition from other large supermarkets is a major part of our strategy. However, there are disadvantages to this approach, which relate to hiring. Where competitors operate supermarkets nearby, their trained staff is a potential source for our own hiring needs, especially if we offer a superior compensation package. Cities that have no large supermarkets also have no sources of trained employees. Although we believe we have a good training school, from time to time we have to send experienced management team members from our headquarters or other stores to new stores to provide assistance. This increases our cost of operating and decreases our gross margin.

Critical Accounting Policies and Estimates

Our critical accounting estimates are included in our significant accounting policies as described in Note 2 of the consolidated financial statements included in Item 8, Financial Statements, of this Annual Report on Form 10-K. Those consolidated financial statements were prepared in accordance with GAAP. Critical accounting estimates are those that we believe are most important to the portrayal of our financial condition and results of operations. The preparation of our consolidated financial statements requires us to make estimates and judgments that affect the reported amounts of assets, liabilities, revenue and expense. Our estimates are evaluated on an ongoing basis and drawn from historical experience, current trends and other factors that management believes to be relevant at the time our consolidated financial statements are prepared. Actual results may differ from our estimates. Management believes that the following accounting estimates reflect the more significant judgments and estimates we use in preparing our consolidated financial statements.

Revenue Recognition

We earn revenue by selling merchandise primarily through our retail stores. Revenue is recognized when merchandise is purchased by and delivered to the customer and is shown net of estimated returns during the relevant period. The allowance for sales returns is estimated based upon historical experience.

Cash received from the sale of cash card (aka “gift card”) is recorded as a liability, and revenue is recognized upon the redemption of the cash card or when it is determined that the likelihood of redemption is remote (“cash card breakage”) and no liability to relevant jurisdictions exists. We determine the cash card breakage rate based upon historical redemption patterns and recognizes cash card breakage on a straight-line basis over the estimated cash card redemption period. We recognized approximately nil in cash card breakage revenue for fiscal 2010 and 2009, respectively.

We record sales tax collected from our customers on a net basis, and therefore excludes it from revenue as defined in ASC 605, Revenue Recognition.

Included in revenue are sales of returned merchandise to vendors specializing in the resale of defective or used products, which accounted for less than 0.5% of net sales in each of the periods reported.

Inventories

Inventories primarily consist of merchandise inventories and are stated at lower of cost or market and net realizable value. Cost of inventories is calculated on the weighted average basis which approximates cost.

Management regularly reviews inventories and records valuation reserves for damaged and defective returns, inventories with slow-moving or obsolescence exposure and inventories with carrying value that exceeds market value. Because of its product mix, we have not historically experienced significant occurrences of obsolescence.

Inventory shrinkage is accrued as a percentage of revenues based on historical inventory shrinkage trends. The Company performs physical inventory counts of its stores once per quarter and cycle counts inventories at its distribution center once per quarter. The reserve for inventory shrinkage represents an estimate for inventory shrinkage for each store since the last physical inventory date through the reporting date.

These reserves are estimates, which could vary significantly, either favorably or unfavorably, from actual results if future economic conditions, consumer demand and competitive environments differ from expectations.

Long-lived Assets

We review long-lived assets for impairment annually or whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable.

Long-lived assets are reviewed for recoverability at the lowest level in which there are identifiable cash flows, usually at the store level. The carrying amount of a long-lived asset is not considered recoverable if it exceeds the sum of the undiscounted cash flows expected to result from the use of the asset. If the asset is determined not to be recoverable, it is considered to be impaired and the impairment to be recognized is the amount by which the carrying amount of the asset exceeds the fair value of the asset, determined using discounted cash flow valuation techniques, as defined in ASC 360, Property, Plant, and Equipment.

We determined the sum of the undiscounted cash flows expected to result from the use of the asset by projecting future revenue and operating expense for each store under consideration for impairment. The estimates of future cash flows involve management judgment and are based upon assumptions about expected future operating performance. The actual cash flows could differ from management’s estimates due to changes in business conditions, operating performance and economic conditions.

Our evaluation resulted in no long-lived asset impairment charges during fiscal 2010 and 2009.

Goodwill

We perform an annual goodwill impairment test as of December 31 each year in accordance with ASC subtopic 350-20, Goodwill (formerly SFAS No. 142), and update the test between annual tests if events or circumstances occur that indicate an impairment might exist. We perform the annual review for goodwill impairments.

Reporting units are determined based on the organizational structure at the date of the impairment test. A separate goodwill impairment test is performed for each reporting unit on the goodwill that has been allocated to it.

Reporting units are the component business units from our operating segment where discrete financial information exists for them. Management regularly reviews their operating results. Also, for each reporting unit, their economic characteristics are dissimilar from each other. Currently, we have 12 reporting units under goodwill impairment testing.

The annual test of the potential impairment of goodwill requires a two-step process. Step one of the impairment test involves comparing the estimated fair values of reporting units with their aggregate carrying values, including goodwill. If the carrying amount of a reporting unit exceeds the reporting unit’s fair value, step two must be performed to determine the amount, if any, of the goodwill impairment loss. If the carrying amount is less than fair value, further testing of goodwill impairment is not performed.

Step two of the goodwill impairment test involves comparing the implied fair value of the reporting unit’s goodwill against the carrying value of the goodwill. Under step two, determining the implied fair value of goodwill requires the valuation of a reporting unit’s identifiable tangible and intangible assets and liabilities as if the reporting unit had been acquired in a business combination on the testing date. The difference between the fair value of the entire reporting unit as determined in step one and the net fair value of all identifiable assets and liabilities represents the implied fair value of goodwill. The goodwill impairment charge, if any, would be the difference between the carrying amount of goodwill and the implied fair value of goodwill upon the completion of step two.

For purposes of the step one analyses, determination of reporting units’ fair value is based on the income approach, which estimates the fair value of our reporting units based on discounted future cash flows.

We recorded $43,863,929 in goodwill in connection with our acquisitions (see Note 6) of businesses in the years of 2010 and 2008. As of December 31, 2010, we performed step one of the impairment test. The result is that the fair values of our reporting units are substantially in excess of their carry values and step two is not required. Therefore, we believed no goodwill was subject to the risk of impairment.

We believe the difference between the market capitalization and the carrying value of our net assets is to due (a) a control premium that should be applied to the market capitalization in determining the fair value of the entire Company and (b) a temporary decline in the stock price suffered by Chinese companies that are public in the U.S. as a result of negative press surrounding accounting practices and reverse mergers of certain Chinese companies.

Recently Issued Accounting Guidance

See Note 2 to consolidated financial statements included in Item 8, Financial Statements, of this Annual Report on Form 10-K.

Results of Operations

The following table sets forth selected items from our consolidated statements of operations by dollar and as a percentage of our net sales for the periods indicated:

| Year Ended December 31, 2010 | Year Ended December 31, 2009 | |||||||||||||||

| Amount | % of Net Sales | Amount | % of Net Sales | |||||||||||||

| Net sales | $ | 298,399,394 | 100.0 | % | $ | 247,594,272 | 100.0 | % | ||||||||

| Cost of sales | 245,548,576 | 82.3 | 203,994,809 | 82.4 | ||||||||||||

| Gross profit | 52,850,818 | 17.7 | 43,599,463 | 17.6 | ||||||||||||

| Selling expenses | 32,348,721 | 10.8 | 24,324,848 | 9.8 | ||||||||||||

| General and administrative expenses | 8,151,742 | 2.7 | 4,802,262 | 1.9 | ||||||||||||

| Operating income | 12,350,355 | 4.2 | 14,472,353 | 5.8 | ||||||||||||

| Other income(expenses) | - | - | (14,253 | ) | - | |||||||||||

| Decrease(Increase) in fair value of warrants | 7,801,649 | 2.6 | (35,492,017 | ) | (14.3 | ) | ||||||||||

| Interest income | 670,245 | 0.2 | 222,007 | 0.1 | ||||||||||||

| Interest expenses | (10,469 | ) | - | (23,734 | ) | - | ||||||||||

| Income (loss) before income taxes | 20,811,780 | 7.0 | (20,835,644 | ) | 8.5 | |||||||||||

| Income taxes | 3,381,216 | 1.1 | 3,807,794 | 1.5 | ||||||||||||

| Net income (loss) | $ | 17,430,564 | 5.9 | % | $ | (24,643,438 | ) | (10.0 | )% | |||||||

Net Sales – Net sales increased by $50.8 million, or 20.5%, to $298.4 million for fiscal 2010 from $247.6 million for fiscal 2009. The change in net sales was primarily attributable to the following:

| · | Comparable stores are stores that were opened for at least one year before the beginning of the comparison period, or by January 1, 2009. Those 27 stores generated approximately $227.5 million sales in fiscal 2010, an increase of $20.1 million, or 9.7% compared with $207.4 million sales in fiscal 2009. |

| · | New store sales increased, reflecting the opening of 16 new stores since January 1, 2009. Nine stores opened in fiscal 2010 generated approximately $14.7 million for fiscal 2010, and seven stores opened in 2009 generated $51.3 million for fiscal 2010 and $23.7 million for fiscal 2009, respectively. |

Cost of Sales – Our cost of sales for fiscal 2010 was approximately $245.5 million, representing an increase of $41.5 million, or 20.4%, from approximately $204.0 million for fiscal 2009. The increase was due to increase volume of sales. Our cost of sales primarily of the cost for our merchandises, it also includes related costs of packaging and shipping costs and the distribution center cost.

We anticipate that our cost of sales will continue to increase along with our expansion in the coming quarters.

Gross Profit – Gross profit, or total revenue minus cost of sales, was increased by $9.3 million, or 21.2%, to $52.9 million, or 17.7% of net sales, in fiscal 2010 from $43.6 million, or 17.6% of net sales, in fiscal 2009. The change in gross profit was primarily attributable to the following:

| · | Net sales increased by $50.8 million in 2010 compared to 2009. |

| · | We reclassified $2.6 million of vendor rebates received from vendors from selling expenses to offset cost of sales. We believe that such reclassification represents better presentation to its retail industry standard. |

All of the reasons above attributed to the gross margin changes. We believe that our gross margin is likely to be between 17.5% and 18.5%, over the next few business quarters. New stores tend to be less profitable during their early months of operation. In addition, China’s retail industry in general, and its supermarket industry in particular, are becoming more competitive every year. In this competitive marketplace, it is likely that we will focus on providing our customers with low prices in order to increase our market share and long-term sales volume.

Selling Expenses – Selling expenses increased by $8.0 million, or 33.0%, to $32.3 million, or 10.8% of net sales, in fiscal 2010 from $24.3 million, or 9.8% of net sales, in fiscal 2009. The change in selling expense was mainly due to increase in labor costs, depreciation, rent expense, and utilities and other operating costs for fiscal 2010 compared with fiscal 2009 primarily due to support of an increase in store count. In particular, labor costs increased by $2.8 million or 35.5%, to $10.8 million in fiscal 2010 from $8.0 million in fiscal 2009. Depreciation increased by $0.9 million, or 35.8% in fiscal 2010, to $3.4 million from $2.5 million in fiscal 2009. Rent expenses increased by $2.9 million, or 255.3%, to $4.0 million in fiscal 2010 from $1.1 million in fiscal 2009. Utilities increased by $1.0 million, or 30.3%, to $4.4 million in fiscal 2010 from $3.4 million in fiscal 2009.

General and Administrative Expense – General and administrative expenses increased by $3.4 million to $8.2 million, or 2.7% of net sales, in fiscal 2010 from $4.8 million, or 1.9% of net sales, in fiscal 2009. The increase was mainly due to the fact that we continued to strengthen our work force by hiring new employees, training and providing higher compensation to managerial staff. Moreover, after we upgraded to Nasdaq in October 2009, professional fee expenses increased due to additional compliance standards. In specific, staff costs increased by $0.6 million or 21.6%, to $3.0 million in fiscal 2010 from $2.4 million in fiscal 2009. Depreciation increased by $1.1 million to $1.2 million in fiscal 2010 from $0.1 million in fiscal 2009. Professional fee expenses increased by $0.4 million, or 41.9%, to $1.2 million in fiscal 2010 from $0.8 in fiscal 2009. Besides that, in fiscal 2010, we recognized a non-cash expense of $1,014,755 relating to (i) the warrant agreement we entered into on January 22, 2010, (ii) the option agreements we entered into with our independent directors on September 14, 2009, and our Chief Operating Officer, Alan Stewart and 20 employees on June 26, 2010, and (iii) the option agreement we entered into with our Chief Financial Officer, Tsz-Kit Chan on December 2, 2010.

Changes in fair value of warrants – We recognized a non-cash income of $7.8 million and a non-cash charge of $35.5 million unrelated to the company’s operations in fiscal 2010 and 2009 respectively, which resulted from the change in fair value of warrants issued to investors in conjunction with the Company’s issuance of warrants in March 2008 pursuant to provisions of FAB ASC Topic 815, “Derivative and Hedging” (“ASC 815”). The accounting treatment of the warrants resulted from a provision providing anti-dilution protection to the warrant holders. The warrant holders have permanently waived the “down-round” protection from the warrants as of March 30, 2010. Therefore, we believe that the non-cash incomes or charges affecting net income will not be applied after December 31, 2010.

Income Taxes – The provision for income taxes was $3.4 million in fiscal 2010 compared with $3.8 million in fiscal 2009. Excluding the effect of changes in fair value of warrants, our effective tax rate was 26.0% for fiscal 2010 and 2009. There was no significant change in our effective tax rate.

Net Income

We had a net income of $17.4 million in fiscal 2010 compared to a net loss of $24.6 million in fiscal 2009. Excluding changes in the fair value of warrants, adjusted net income for fiscal 2010 decreased 11.3% to $9.6 million, or $0.24 per diluted share, from $10.8 million, or $0.34 per diluted share for fiscal 2009. The number of shares used in the computation of diluted EPS (excluding changes in the fair value of the warrants) increased 23.5% to 40.2 million shares from 31.9 million shares for the year of 2009.

About Non-GAAP Financial Measures

The Company uses “adjusted net income” to provide information about its operating trends. Investors are cautioned that adjusted net income and the decrease in adjusted net income are not a measure of liquidity or of financial performance under Generally Accepted Accounting Principles (“GAAP”).

The Company defines adjusted net income as net income excluding non-recurring items as well as special non-cash charges. The adjusted net income numbers presented may not be comparable to similarly titled measures reported by other companies. Adjusted net income, while providing useful information, should not be considered in isolation or as an alternative to net income or cash flows as determined under GAAP. The non-GAAP measures in this annual report have been reconciled to the nearest GAAP measure, and this reconciliation is located under the heading “Non-GAAP Net Income Calculation” below. Non-GAAP Net Income Calculation

Reconciliation of Net Income (Loss) to Adjusted Net Income

(Unaudited)

| Years Ended December 31 | 2010 | 2009 | ||||||

| Net income (loss) | $ | 17,430,564 | $ | (24,643,438 | ) | |||

| Add back (deduct): | ||||||||

| Change in fair value of warrants | (7,801,649 | ) | 35,492,017 | |||||

| Adjusted net income | $ | 9,628,915 | $ | 10,848,579 | ||||

Liquidity and Capital Resources

We are a holding company and conduct our operations through our PRC subsidiary (Speedy Brilliant (Daqing)) and variable interest entity (QKL-China) in China. We may transfer funds to Speedy Brilliant (Daqing) by means of shareholder's loans or capital contributions. We may also transfer funds to QKL-China by means of Loan Agreement among Speedy Brilliant (Daqing) and all of the shareholders of QKL-China. Earnings of QKL-China may be transferred to Speedy Brilliant (Daqing) in the form of payments under the consigned management and technology service agreements, which in turn gives Speedy Brilliant (Daqing) the ability to pay dividends to our offshore company (Speedy Brilliant (BVI)).

Our principal liquidity requirements are for working capital, capital expenditures and cash dividends. We fund our liquidity requirements primarily through cash on hand, cash flow from operations and borrowings from our revolving credit facility. We believe our cash on hand, future funds from operations and borrowings from our revolving credit facility will be sufficient to fund our cash requirements for at least the next twelve months. There is no assurance, however, that we will be able to generate sufficient cash flow or that we will be able to maintain our ability to borrow under our revolving credit facility.

Our ability to pay dividends is primarily dependent on our receiving distributions of funds from Speedy Brilliant (Daqing), our operating subsidiary, which is restricted by certain regulatory requirements. Relevant PRC statutory laws and regulations permit payments of dividends by QKL-China and Speedy Brilliant (Daqing) only out of their retained earnings, if any, as determined in accordance with PRC accounting standards and regulations. In addition, QKL-China and its subsidiary are required to set aside at least 10% of their after-tax profit, after deducting any accumulated deficit, each year to its general reserves until the cumulative amount of such reserves reach 50% of its registered capital. These reserves are not distributable as cash dividends. As investment holding companies, our off-shore subsidiaries, including QKL Stores Inc. and Speedy Brilliant (BVI), do not have material cash obligations to third parties. Therefore, the dividend restriction does not impact the liquidity of these companies. As of December 31, 2010 and December 31, 2009, restricted retained earnings were $ 6.0 million and $4.9 million, respectively. Unrestricted retained earnings as of December 31, 2010 and December 31, 2009 were $39.4 million and $29.4 million, respectively, which were the amounts ultimately available for distribution if we were to pay dividends.

In accordance with relevant PRC laws and regulations, Speedy Brilliant (Daqing), QKL-China and its subsidiary are restricted from transferring funds to our off-shore companies in the form of cash dividends, loans or advances, except for the unrestricted retained earnings described above. Therefore, as of December 31, 2010 and December 31, 2009, restricted net assets comprising statutory reserve funds of our PRC operating subsidiary and variable interest entity were $6.0 million and $4.9 million, respectively.

As of December 31, 2010 and 2009, our PRC subsidiary, variable interests entity and its subsidiary had cash and cash equivalents of approximately $10.2 million and $38.4 million, respectively and did not have any restricted cash. Dividend distribution from our PRC subsidiaries and variable interest entity to our non-PRC entities would be subject to a 10% PRC withholding taxes under current PRC tax laws. Currently, we do not have the intention to transfer funds from our PRC entities to our non-PRC entities.

At December 31, 2010, we had $17.5 million of cash on hand compared to $45.9 million at December 31, 2009. The following table sets forth a summary of our cash flows for the periods indicated:

| Years Ended December 31 | 2010 | 2009 | ||||||

| Net cash provided by operating activities | $ | (9,073,830 | ) | $ | 10,866,330 | |||

| Net cash used in investing activities | (21,143,179 | ) | (19,455,014 | ) | ||||

| Net cash provided by financing activities | - | 35,210,517 | ||||||

| Effect of foreign currency translation | 1,764,245 | 5,944 | ||||||

| Net change in cash | $ | (28,452,764 | ) | $ | 26,627,777 | |||

The seasonality of our business historically provides greater cash flow from operations during the holiday and winter selling season, with the fourth fiscal quarter net sales traditionally generating the strongest profits of our fiscal year. Typically, we use operating cash flow and borrowings under our revolving credit facility to fund inventory increases in anticipation of the holidays and our inventory levels are at their highest in the months leading up to Chinese Spring Festival. As holiday sales significantly reduce inventory levels, this reduction, combined with net income, historically provides us with strong cash flow from operations at the end of our fiscal year.

Cash Flows from Operating Activities

Net cash used in operating activities was $9.1 million for fiscal 2010 and net cash provided by operating activities was $10.9 million for fiscal 2009, respectively. The decrease in cash provided by operating activities for fiscal 2010 compared to fiscal 2009 primarily reflects the increase of other receivables and inventories, the decrease of customer deposits received and the increase in prepaid expenses. The increase in other receivables resulted from increasing loans to vendors to insure adequate levels of merchandise during the peak Chinese New Year season. The increase in inventory was due to the fact that we have more stores and we reserved inventories for our new store openings in January 2011.

Cash Flows from Investing Activities

Net cash used in investing activities for fiscal 2010 and 2009 was $21.1 million and $19.5 million, respectively. Capital expenditures represented substantially all of the net cash used in investing activities for each period. Our capital spending is primarily for new store openings, store-related remodeling and corporate headquarters. Capital expenditures were higher for fiscal 2010 mostly due to the acquisitions of business operations for seven new stores. Moreover, we terminated a property buying/selling agreement for our headquarters, and approximately $11.3 million was refunded to us. The building, which we have determined to lease instead, is intended to accommodate future growth of the Company’s administrative and operations personnel as we implement our supermarket expansion plan.

The following table sets forth net cash used in investing activities

| Years Ended December 31 | 2010 | 2009 | ||||||

| New stores | $ | 6,394,870 | $ | 8,553,096 | ||||

| Renovation of old stores | 1,532,590 | - | ||||||

| New distribution center | 690,828 | 11,647 | ||||||

| Acquisition of businesses | 23,984,428 | - | ||||||

| New headquarters | (11,343,373 | ) | 11,001,584 | |||||

| Sale proceeds from disposal of fixed assets | (11,533 | ) | - | |||||

| Pledged deposits | (104,631 | ) | (111,313 | ) | ||||

| Total | $ | 21,143,179 | $ | 19,455,014 | ||||

Cash flows From Financing Activities

Net cash used for financing activities for fiscal 2010 and 2009 was nil and $35.2 million, respectively. Cash provided by financing activities was used to acquire and open new stores, and a distribution center, store renovations and relocations.

Financing Agreement

On June 18, 2009, we entered into a financing agreement with Longjiang Commercial Bank. Under this agreement, the Company had a credit line up to approximately $4.2 million (RMB27.6 million) expiring June 18, 2011. The loan under this financing agreement is secured by buildings with net worth book value of approximately $7.4 million (RMB 48.7 million). As of December 31, 2010, we did not have any outstanding revolving line of credit.

Future Capital Requirements – We had cash on hand of $17.5 million at December 31, 2010. We expect capital expenditures for fiscal 2011 primarily to fund the opening of new stores, store-related remodeling and relocation. We anticipate an opening of 70,000 square meters of new stores in fiscal 2011 compared to 74,189 square meters of new stores in fiscal 2010.

We believe we will be able to fund our cash requirements, for at least the next twelve months, from cash on hand, operating cash flows and borrowings from our revolving credit facility. However, our ability to satisfy our cash requirements depends upon our future performance, which in turn is subject to general economic conditions and regional risks, and to financial, business and other factors affecting our operations, including factors beyond our control. There is no assurance that we will be able to generate sufficient cash flow or that we will be able to maintain our ability to borrow under our revolving credit facility.

If we are unable to generate sufficient cash flow from operations to meet our obligations and commitments, or if we are unable to maintain our ability to borrow sufficient amounts under our existing revolving credit facility, or successfully negotiate and enter into a new revolving credit facility to replace our current facility, which has an initial termination date of June 18, 2011, we will be required to refinance or restructure our indebtedness or raise additional debt or equity capital. Additionally, we may be required to sell material assets or operations, suspend or further reduce dividend payments or delay or forego expansion opportunities. We might not be able to implement successful alternative strategies on satisfactory terms, if at all.

Off-Balance Sheet Arrangements and Contractual Obligations – Our material off-balance sheet arrangements are operating lease obligations. We excluded these items from the balance sheet in accordance with generally accepted accounting principles in the United States of America (“GAAP”). Information regarding our operating leases is available in Item 2, Properties and Note 14, Operating Leases , of the notes to consolidated financial statements included in Item 8, Financial Statements and Supplementary Data , of this Annual Report on Form 10-K.

Operating lease commitments consist principally of leases for our retail store facilities and distribution center. These leases frequently include options which permit us to extend the terms beyond the initial fixed lease term. With respect to most of those leases, we intend to renegotiate those leases as they expire.

In the ordinary course of business, we enter into arrangements with vendors to purchase merchandise in advance of expected delivery. Because most of these purchase orders do not contain any termination payments or other penalties if cancelled, they are not included as outstanding contractual obligations.

Item 9A. Controls and Procedures

Disclosure Controls and Procedures

Management conducted an evaluation, under the supervision and with the participation of our Chief Executive Officer ( “ CEO ” ) and Chief Financial Officer ( “ CFO ” ), of the effectiveness of the design and operation of our disclosure controls and procedures (as such term is defined in Rules 13a15 (e) and 15d15(e) under the Securities Exchange Act of 1934, as amended (the “ Exchange Act ” ) as of the end of the period covered by this report. Disclosure controls and procedures are those controls and procedures designed to provide reasonable assurance that the information required to be disclosed in our Exchange Act filings is (i) recorded, processed, summarized and reported within the time periods specified in the SEC’s rules and forms, and (ii) accumulated and communicated to management, including our chief executive officer and chief financial officer, as appropriate, to allow timely decisions regarding required disclosure. Our CEO and CFO have determined that as of December 31, 2010, our disclosure controls and procedures were not effective. This conclusion was based on the fact that Company has not timely filed certain current reports on Form 8-K.

In connection with the preparation of this Amendment No. 1, our Chief Executive Officer and our Chief Financial Officer re-evaluated the effectiveness of the design and operation of our disclosure controls and procedures as of December 31, 2010. In making this evaluation, they considered the material weakness related to the misstatement related to accounting for basic and dilutive earnings per share discussed in Item 7. (Management's Discussion and Analysis of Financial Condition and Results of Operations). As a result of this material weakness and the late filing of current reports on form 8-K discussed above, our Chief Executive Officer and Chief Financial Officer have concluded that our disclosure controls and procedures were not effective as of December 31, 2010.

Management’s Report on Internal Control over Financial Reporting

Our management is responsible for establishing and maintaining adequate internal control over financial reporting, as such term is defined in Exchange Act Rules 13a-15(f) and 15d-15(f). Internal control over financial reporting refers to the process designed by, or under the supervision of, our principal executive officer and principal financial officer, and effected by our Board of Directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles, and includes those policies and procedures that:

(1) Pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of our assets;

(2) Provide reasonable assurance that transactions are recorded as necessary to permit preparation of financial statements in accordance with generally accepted accounting principles, and that our receipts and expenditures are being made only in accordance with authorization of our management and directors; and

(3) Provide reasonable assurance regarding prevention or timely detection of unauthorized acquisitions, use or disposition of our assets that could have a material effect on the financial statements.

Internal control over financial reporting cannot provide absolute assurance of achieving financial reporting objectives because of its inherent limitations. Internal control over financial reporting is a process that involves human diligence and compliance and is subject to lapses in judgment and breakdowns resulting from human failures. Internal control over financial reporting also can be circumvented by collusion or improper management override. Because of such limitations, there is a risk that material misstatements may not be prevented or detected on a timely basis by internal control over financial reporting. However, these inherent limitations are known features of the financial reporting process. Therefore, it is possible to design into the process safeguards to reduce, though not eliminate, this risk. Management is responsible for establishing and maintaining adequate internal control over financial reporting for the company.

Management has used the framework set forth in the report entitled Internal Control—Integrated Framework published by the Committee of Sponsoring Organizations of the Treadway Commission, known as COSO, to evaluate the effectiveness of our internal control over financial reporting. Based on such evaluation, our CEO and CFO have concluded that, as of the end of such period, our internal controls over financial reporting were not effective due to the material weaknesses described below.

Material Weaknesses

A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the company’s annual or interim financial statements will not be prevented or detected on a timely basis.

The conclusion that our internal control over financial reporting was not effective was based on material weaknesses we identified in relation to our financial closing process and the conclusion regarding our disclosure controls and procedures above. Management believes that it had inadequate accounting personnel, and that it did not supply adequate training to new staff in a timely manner, which led to the delay of processing some transactions or events.

In connection with this Amendment No. 1, management, including our Chief Executive Officer and Chief Financial Officer, reassessed the effectiveness of our internal control over financial reporting as of December 31, 2010. In making this assessment, our management used the criteria set forth by the COSO in Internal Control-Integrated Framework. This evaluation identified a material weakness in our internal control regarding our process and procedures related to the accounting for basic and dilutive earnings per share. This material weakness in our internal controls resulted in the restatement of our 2010 financial statements.

Remediation Measures for Material Weaknesses

Management intends to continue to implement procedures to remedy such material weaknesses. We plan to utilize appropriate training programs on accounting principles and procedures to better ensure the adequacy of our accounting and finance personnel. We plan to continue to provide additional training to the Company’s internal auditor on appropriate controls and procedures necessary to document and evaluate our internal control procedures. In the fourth quarter of 2010, we appointed PricewaterhouseCoopers as our accounting advisor to ensure that our staff has adequate professional knowledge and to monitor the need for additional or better qualified staff. The advisor also provided training programs on develop our corporate culture toward emphasizing the importance of internal controls so as to ensure that all personnel involved in maintaining proper internal controls recognize the importance of strictly adhering to accounting principles accepted in the United States of America.

This annual report does not include an attestation report of our registered public accounting firm regarding internal control over financial reporting. Our management’s report was not subject to attestation by our registered public accounting firm pursuant to temporary rules of the Securities and Exchange Commission that permit us to provide only our management’s report in this annual report.

QKL STORES INC.

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS

| CONTENTS | PAGES | |

| REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | F-1 | |

| CONSOLIDATED BALANCE SHEETS | F-2 | |

| CONSOLIDATED STATEMENTS OF OPERATIONS | F-3 | |

| CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY | F-4 | |

| CONSOLIDATED STATEMENTS OF CASH FLOWS | F-5 | |

| NOTES TO CONSOLIDATED FINANCIAL STATEMENTS | F6 – F40 | |

| CONSOLIDATED FINANCIAL STATEMENT SCHEDULE: | SCHEDULE | |

| VALUATION AND QUALIFYING ACCOUNTS | II |

| ALBERT WONG & CO. LLP | |

| CERTIFIED PUBLIC ACCOUNTANTS | |

| 139 Fulton Street, Suite 818B | |

| New York, NY 10038-2532 | |

| Tel : 1-212-226-9088 | |

| Fax: 1-212-437-2193 | |

Report of Independent Registered Public Accounting Firm

| To: | The Board of Directors and Shareholders of |

QKL Stores Inc. and Subsidiaries:

We have audited the accompanying consolidated balance sheets of QKL Stores Inc. and Subsidiaries (the “Company”) as of December 31, 2010 and 2009, and the related consolidated statements of operations, shareholders' equity and cash flows for the year then ended. These consolidated financial statements and schedule are the responsibility of the Company's management. Our responsibility is to express an opinion on these consolidated financial statements based on our audit.

We conducted our audits in accordance with standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the consolidated financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of the Company’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company’s internal control over financial reporting. Accordingly, we express no such opinion. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall consolidated financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the consolidated financial position of the Company as of December 31, 2010 and 2009, and the results of its operations and its cash flows for the year then ended in conformity with accounting principles generally accepted in the United States of America.

| /s/ Albert Wong & Co. LLP | |

| New York, United States of America | Albert Wong & Co. LLP |

| April 9, 2012 | Certified Public Accountants |

| F-1 |

QKL STORES INC. AND SUBSIDIARIES

Consolidated Balance Sheets

| December 31, 2010 | December 31, 2009 | |||||||

| ASSETS | ||||||||

| Cash | $ | 17,460,034 | $ | 45,912,798 | ||||

| Restricted cash | 77,205 | 181,836 | ||||||

| Accounts receivable | 167,509 | 283,929 | ||||||

| Inventories | 44,467,265 | 24,691,156 | ||||||

| Other receivables | 28,236,397 | 13,980,572 | ||||||

| Prepaid expenses | 5,088,825 | 2,993,191 | ||||||

| Advances to suppliers | 3,740,327 | 2,965,139 | ||||||

| Deferred income tax assets | 508,617 | 417,788 | ||||||

| Total current assets | 99,746,179 | 91,426,409 | ||||||

| Property, plant equipment, net | 24,792,149 | 29,402,630 | ||||||

| Land use rights, net | 748,533 | 753,226 | ||||||

| Goodwill | 43,863,929 | 19,280,509 | ||||||

| Other assets | 467,927 | 408,391 | ||||||

| Total assets | $ | 169,618,717 | $ | 141,271,165 | ||||

| LIABILITIES AND STOCKHOLDERS’ EQUITY | ||||||||

| Accounts payable | 38,944,917 | 29,244,923 | ||||||

| Cash card and coupon liabilities | 10,814,546 | 7,721,630 | ||||||

| Customer deposits received | 1,495,059 | 3,862,890 | ||||||

| Accrued expenses and other payables | 9,883,282 | 6,656,089 | ||||||

| Income taxes payable | 2,365,931 | 1,154,229 | ||||||

| Total current liabilities | 63,503,735 | 48,639,761 | ||||||

| Warrant liabilities | - | 44,304,034 | ||||||

| Total liabilities | 63,503,735 | 92,943,795 | ||||||

| Commitments and contingencies | - | - | ||||||

| Shareholders’ equity | ||||||||

| Common stock, $.001 par value per share, authorized 100,000,000, shares, issued and outstanding 29,743,811 and 29,475,983 at December 31, 2010 and December 31, 2009, respectively | 29,744 | 29,476 | ||||||

| Series A convertible preferred stock, par value $0.01, 10,000,000 shares authorized, 7,295,328 and 7,548,346 shares outstanding at December 31, 2010 and December 31, 2009, respectively | 72,953 | 75,483 | ||||||

| Additional paid-in capital | 90,710,619 | 53,191,217 | ||||||

| Retained earnings – appropriated | 6,012,675 | 4,913,072 | ||||||

| Retained earnings (accumulated deficit) | 2,094,850 | (14,236,111 | ) | |||||

| Accumulated other comprehensive income | 7,194,141 | 4,354,233 | ||||||

| Total shareholders’ equity | 106,114,982 | 48,327,370 | ||||||

| Total liabilities and shareholders’ equity | $ | 169,618,717 | $ | 141,271,165 | ||||

See notes to audited consolidated financial statements.

| F-2 |

QKL STORES INC. AND SUBSIDIARIES

Consolidated Statements of Operations

| Years Ended December 31, | ||||||||

| 2010 | 2009 | |||||||

| (Restated) | ||||||||

| Net sales | $ | 298,399,394 | $ | 247,594,272 | ||||

| Cost of sales | 245,548,576 | 203,994,809 | ||||||

| Gross profit | 52,850,818 | 43,599,463 | ||||||

| Operating expenses: | ||||||||

| Selling expenses | 32,348,721 | 24,324,848 | ||||||

| General and administrative expenses | 8,151,742 | 4,802,262 | ||||||

| Total operating expenses | 40,500,463 | 29,127,110 | ||||||

| Income from operations | 12,350,355 | 14,472,353 | ||||||

| Non-operating income(expense): | ||||||||

| Other income (expenses) | - | (14,253 | ) | |||||

| (Increase) decrease in fair value of warrants | 7,801,649 | (35,492,017 | ) | |||||

| Interest income | 670,245 | 222,007 | ||||||

| Interest expense | (10,469 | ) | (23,734 | ) | ||||

| Total non-operating income (loss) | 8,461,425 | (35,307,997 | ) | |||||

| Income (loss) before income tax | 20,811,780 | (20,835,644 | ) | |||||

| Income taxes | 3,381,216 | 3,807,794 | ||||||

| Net income (loss) | $ | 17,430,564 | $ | (24,643,438 | ) | |||

| Basic earnings (loss) per share of common stock | $ | 0.47 | $ | (1.13 | ) | |||

| Diluted earnings per share | $ | 0.24 | $ | (1.13 | ) | |||

| Weighted average shares used in calculating net income per ordinary share – basic | 29,670,468 | 21,885,423 | ||||||

| Weighted average shares used in calculating net income per ordinary share – diluted | 40,170,511 | 21,885,423 | ||||||

See notes to audited consolidated financial statements.

| F-3 |

QKL STORES INC. AND SUBSIDIARIES

Consolidated Statements of Shareholders’ Equity

| Common stock | Series A convertible

preferred stock | Additional paid-in | Retained Earnings - | Retained earnings (accumulated | Accumulated other comprehensive | |||||||||||||||||||||||||||||||

| Share | Amount | Share | Amount | capital | appropriated | deficit) | income | Total | ||||||||||||||||||||||||||||

| January 1, 2009 | 20,882,353 | $ | 20,882 | 9,117,647 | $ | 91,176 | $ | 21,783,477 | $ | 3,908,247 | $ | 14,204,169 | $ | 3,859,136 | $ | 43,867,087 | ||||||||||||||||||||

| Net income | - | - | - | - | - | - | (24,643,438 | ) | - | (24,643,438 | ) | |||||||||||||||||||||||||

| Reclassification of warrants from equity to derivative liabilities | (6,020,000 | ) | (2,792,017 | ) | (8,812,017 | ) | ||||||||||||||||||||||||||||||

| Compensation expense for stock option granted | - | - | - | - | 14,252 | - | - | - | 14,252 | |||||||||||||||||||||||||||

| Warrants exercised (cashless) | 124,329 | 124 | (124 | ) | - | - | ||||||||||||||||||||||||||||||

| Preferred stock convert to common stock | 1,569,301 | 1,570 | (1,569,301 | ) | (15,693 | ) | 14,123 | |||||||||||||||||||||||||||||

| common shares offering | 6,900,000 | 6,900 | 37,399,489 | 37,406,389 | ||||||||||||||||||||||||||||||||

| Appropriation to statutory reserves | - | - | - | - | - | 1,004,825 | (1,004,825 | ) | - | - | ||||||||||||||||||||||||||

| Foreign currency translation adjustment | - | - | - | - | - | - | - | 495,097 | 495,097 | |||||||||||||||||||||||||||

| December 31, 2009 | 29,475,983 | $ | 29,476 | 7,548,346 | $ | 75,483 | $ | 53,191,217 | $ | 4,913,072 | $ | (14,236,111 | ) | $ | 4,354,233 | $ | 48,327,370 | |||||||||||||||||||

| Net income | - | - | - | - | - | - | 17,430,564 | 17,430,564 | ||||||||||||||||||||||||||||

| Reclassification of warrants from derivative liabilities to equity | 36,502,385 | 36,502,385 | ||||||||||||||||||||||||||||||||||

| Compensation expense for stock option granted | - | - | - | - | 1,014,755 | - | - | - | 1,014,755 | |||||||||||||||||||||||||||

| Warrants exercised (cashless) | 14,810 | 15 | (15 | ) | - | - | ||||||||||||||||||||||||||||||

| Preferred stock convert to common stock | 253,018 | 253 | (253,018 | ) | (2,530 | ) | 2,277 | - | - | - | - | |||||||||||||||||||||||||

| common shares offering | - | |||||||||||||||||||||||||||||||||||

| Appropriation to statutory reserves | - | - | - | - | - | 1,099,603 | (1,099,603 | ) | - | |||||||||||||||||||||||||||

| Foreign currency translation adjustment | - | - | - | - | - | - | - | 2,839,908 | 2,839,908 | |||||||||||||||||||||||||||

| December 31, 2010 | 29,743,811 | $ | 29,744 | 7,295,328 | $ | 72,953 | $ | 90,710,619 | $ | 6,012,675 | $ | 2,094,850 | $ | 7,194,141 | $ | 106,114,982 | ||||||||||||||||||||

See notes to audited consolidated financial statements .

| F-4 |

QKL STORES INC. AND SUBSIDIARIES

Consolidated Statements of Cash Flows

| Years Ended December 31, | ||||||||

| 2010 | 2009 | |||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||

| Net income (loss) | $ | 17,430,564 | $ | (24,643,438 | ) | |||

| Depreciation-property, plant and equipment | 4,858,011 | 2,721,636 | ||||||

| Amortization | 28,294 | 27,967 | ||||||

| Deferred income tax | (77,850 | ) | (416,944 | ) | ||||

| Loss on disposal of property, plant and equipment | 180,304 | 36,938 | ||||||

| Share-based compensation | 1,014,755 | - | ||||||

| Change in fair value of warrants | (7,801,649 | ) | 35,492,017 | |||||

| Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||

| Accounts receivable | 125,240 | 512,692 | ||||||

| Inventories | (19,009,023 | ) | (10,047,537 | ) | ||||

| Other receivables | (13,821,470 | ) | (9,749,527 | ) | ||||

| Prepaid expenses | (2,038,694 | ) | (327,811 | ) | ||||

| Advances to suppliers | (2,043,610 | ) | 1,686,988 | |||||

| Accounts payable | 8,791,436 | 7,829,738 | ||||||

| Cash card and coupon liabilities | 2,853,026 | 3,834,412 | ||||||

| Customer deposits received | (2,487,840 | ) | 944,028 | |||||

| Accrued expenses and other payables | 1,748,832 | 3,069,863 | ||||||

| Income taxes payable | 1,175,844 | (104,692 | ) | |||||

| Net cash (used in) provided by operating activities | (9,073,830 | ) | 10,866,330 | |||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||

| Purchases of property, plant and equipment | (8,618,288 | ) | (19,566,327 | ) | ||||

| Acquisition of business, net | (23,984,428 | ) | - | |||||

| Refund of office building purchase | 11,343,373 | - | ||||||

| Sales proceeds of fixed assets disposal | 11,533 | - | ||||||

| Decrease of restricted cash | 104,631 | 111,313 | ||||||

| Net cash used in investing activities | (21,143,179 | ) | (19,455,014 | ) | ||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||

| Proceeds from issuance of Common stock | - | 37,406,389 | ||||||

| Repayment of bank loan | - | (2,195,872 | ) | |||||

| Net cash provided by financing activities | - | 35,210,517 | ||||||

| Net increase in cash | (30,217,009 | ) | 26,621,833 | |||||

| Effect of foreign currency translation | 1,764,245 | 5,944 | ||||||

| Cash at beginning of period | 45,912,798 | 19,285,021 | ||||||

| Cash at end of period | $ | 17,460,034 | $ | 45,912,798 | ||||

| Supplemental disclosures of cash flow information: | ||||||||

| Interest paid | 10,469 | 23,734 | ||||||

| Income taxes paid | $ | 2,260,343 | $ | 4,120,045 | ||||

See notes to audited consolidated financial statements .

| F-5 |

QKL STORES INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

NOTE 1 – ORGANIZATION AND BUSINESS OPERATIONS