Attached files

| file | filename |

|---|---|

| EX-32.1 - EX-32.1 - STATE BANK FINANCIAL CORP | a2208779zex-32_1.htm |

| EX-31.1 - EX-31.1 - STATE BANK FINANCIAL CORP | a2208779zex-31_1.htm |

| EX-31.2 - EX-31.2 - STATE BANK FINANCIAL CORP | a2208779zex-31_2.htm |

QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K/A

(Amendment No. 1)

| ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | |

For the fiscal year ended December 31, 2011 |

||

or |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to |

||

Commission file number: 000-54056

STATE BANK FINANCIAL CORPORATION

(Exact name of registrant as specified in its charter)

| Georgia (State or other jurisdiction of incorporation or organization) |

27-1744232 (I.R.S. Employer Identification No.) |

|

3399 Peachtree Road, NE, Suite 1900, Atlanta, Georgia (Address of principal executive offices) |

30326 (Zip Code) |

404-475-6599

(Registrant's telephone number, including area code)

Securities registered under Section 12(b) of the Exchange Act: None

Securities registered under Section 12(g) of the Act:

Common

Stock, $0.01 par value per share

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ý

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No ý

As of the last business day of the registrant's most recently completed second fiscal quarter, the aggregate market value of the registrant's common stock held by nonaffiliates of the registrant was approximately $517.5 million.

The number of shares outstanding of the registrant's common stock, as of March 15, 2012 was 31,721,236.

DOCUMENTS INCORPORATED BY REFERENCE

None in this Amendment No. 1.

This Form 10-K/A amends the Annual Report on Form 10-K of State Bank Financial Corporation for the fiscal year ended December 31, 2011 (the "Form 10-K"), as filed with the Securities and Exchange Commission on March 15, 2012, for the sole purpose of providing certain information required by Part II, Item 5 of the Form 10-K. The complete text of Item 5, as amended, is included in this Form 10-K/A. Capitalized terms used but not otherwise defined in this Form 10-K/A have the meanings given in the Form 10-K.

Except as described above, no other changes have been made to the Form 10-K. This Form 10-K/A speaks as of the original filing date of the Form 10-K, does not reflect events that may have occurred subsequent to the original filing date and does not modify or update in any way disclosures made in the Form 10-K.

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

On April 14, 2011, our common stock became listed on The NASDAQ Capital Market under the symbol "STBZ." Prior to April 14, 2011, our common stock was quoted on the OTCQB. OTCQB securities are quoted on OTC Market Group's quotation and trading system. In 2010, our common stock was considered a "grey market" security. Trades in grey market stocks are reported by broker-dealers to their Self Regulatory Organization (SRO) and the SRO distributes the trade data to market data vendors and financial websites so investors can track price and volume information. Because grey market securities are not traded or quoted on an exchange or interdealer quotation system, investors' bids and offers are not collected in a single location and market transparency is diminished.

The following table shows the high and low sales prices for shares of our common stock reported by the OTC Markets for 2010 and the first quarter of 2011, and the high and low sales prices for our shares as quoted on The NASDAQ Capital Market for the second, third and fourth quarters of 2011.

| |

High | Low | |||||

|---|---|---|---|---|---|---|---|

2011 |

|||||||

Fourth Quarter |

$ | 15.50 | $ | 12.50 | |||

Third Quarter |

$ | 16.58 | $ | 12.59 | |||

Second Quarter |

$ | 17.90 | $ | 16.37 | |||

First Quarter |

$ | 18.00 | $ | 16.00 | |||

2010 |

|||||||

Fourth Quarter |

$ | 16.00 | $ | 14.00 | |||

Third Quarter |

$ | 16.00 | $ | 15.25 | |||

Second Quarter(1) |

$ | 16.00 | $ | 16.00 | |||

First Quarter(1) |

$ | 14.00 | $ | 14.00 | |||

- (1)

- Trades reported before the holding company reorganization on July 23, 2010.

As of March 15, 2012, we had 31,721,236 shares of common stock issued and outstanding and approximately 232 shareholders of record.

The following performance graph and related information shall not be deemed "soliciting material" or to be "filed" with the SEC, nor shall such information be incorporated by reference into any future filings under the Securities Act of 1933 or the Securities Act of 1934, each as amended, except to the extent the Company specifically incorporates it by reference into such filing.

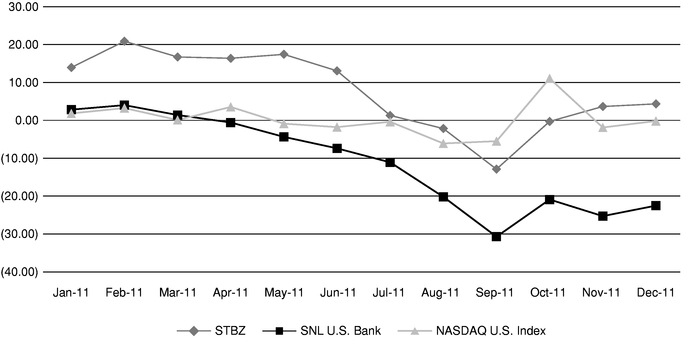

2

The performance graph compares the total return percentage on the Company's common stock, to that of the common stocks reported in the SNL U.S. Bank Index and the common stocks reported in the NASDAQ U.S. Index. The SNL U.S. Bank Index is made up of 338 U.S. bank stocks and the NASDAQ U.S. Index comprises of all domestic shares traded on the NASDAQ Global Select, NASDAQ Global Market and The NASDAQ Capital Market, excluding preferred, rights and warrants. The following graph shows the total return percentage for shares of our common stock beginning with the second quarter of 2011. For the prior periods indicated, the table shows the reported price change percentage for our common stock based on information gathered from OTC markets. Prior to our listing on NASDAQ, our common stock was considered a "grey market" security. Trades in grey market stocks are reported by broker-dealers to their Self Regulatory Organization (SRO) and the SRO distributes the trade data to market data vendors and financial websites so investors can track price and volume information. Because grey market securities are not traded or quoted on an exchange or interdealer quotation system, investors' bids and offers are not collected in a single location and market transparency is diminished.

Stock Performance Graph

Total Return (%)

We have not declared or paid any cash dividends on our common stock. For the foreseeable future we do not intend to declare cash dividends and instead we plan to retain earnings to grow our business. Our ability to pay dividends depends on the ability of the Bank to pay dividends to us. Under Georgia law, the prior approval of the Georgia Department of Banking and Finance is required before the Bank may pay any cash dividends if:

(a) total classified assets at the Bank's most recent examination exceed 80% of equity capital (which includes the reserve for loan losses);

(b) the aggregate amount of dividends declared or anticipated to be declared in the calendar year exceeds 50% of the net profits for the previous calendar year; or

(c) the Bank's ratio of equity capital to adjusted total assets is less than 6%.

For a period of three years after consummation of the July 24, 2009 offering, the Bank must also obtain approval from the Georgia Department of Banking and Finance before paying any dividends, including dividend payments to the Company. On November 28, 2011, the Georgia Department of Banking and Finance approved the Bank's application to dividend $15.0 million to the Company, which was effected on December 1, 2011.

3

Item 15. Exhibits, Financial Statement Schedules.

Exhibit No. |

Document | ||

|---|---|---|---|

| 31.1 | Rule 13a-14(a) Certification of the Chief Executive Officer | ||

31.2 |

Rule 13a-14(a) Certification of the Chief Financial Officer |

||

32.1 |

Section 1350 Certifications |

||

4

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| STATE BANK FINANCIAL CORPORATION | ||||

Date: April 10, 2012 |

By: |

/s/ JOSEPH W. EVANS Joseph W. Evans Chief Executive Officer |

||

5

EXPLANATORY NOTE

Part II

Stock Performance Graph Total Return (%)

Part IV

SIGNATURES