Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - SolarWindow Technologies, Inc. | Financial_Report.xls |

| 10-Q - QUARTERLY REPORT - SolarWindow Technologies, Inc. | v308621_10q.htm |

| EX-31.1 - CERTIFICATION - SolarWindow Technologies, Inc. | v308621_ex31-1.htm |

| EX-32.1 - CERTIFICATION - SolarWindow Technologies, Inc. | v308621_ex32-1.htm |

STOCK PURCHASE AGREEMENT

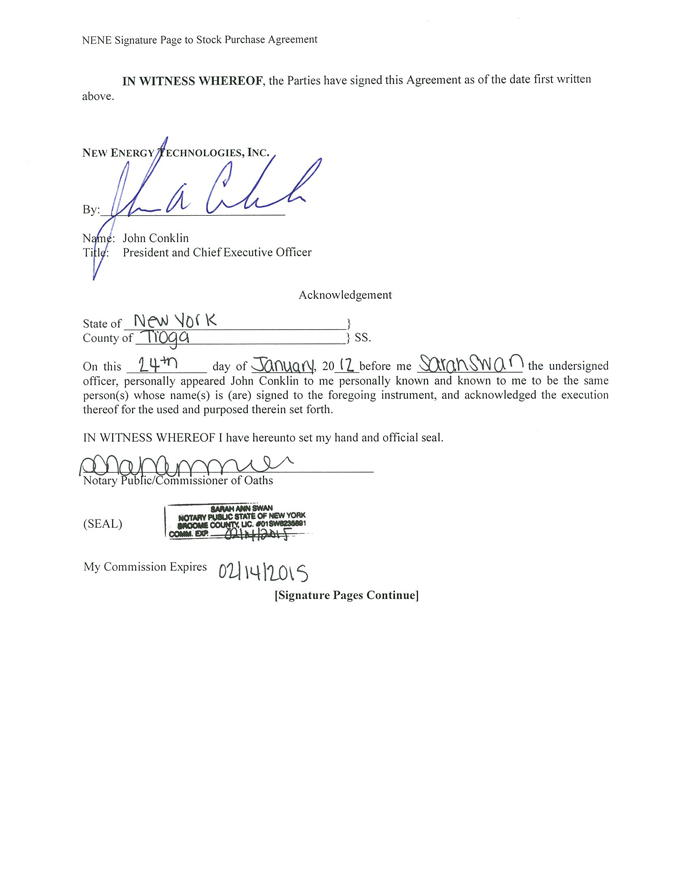

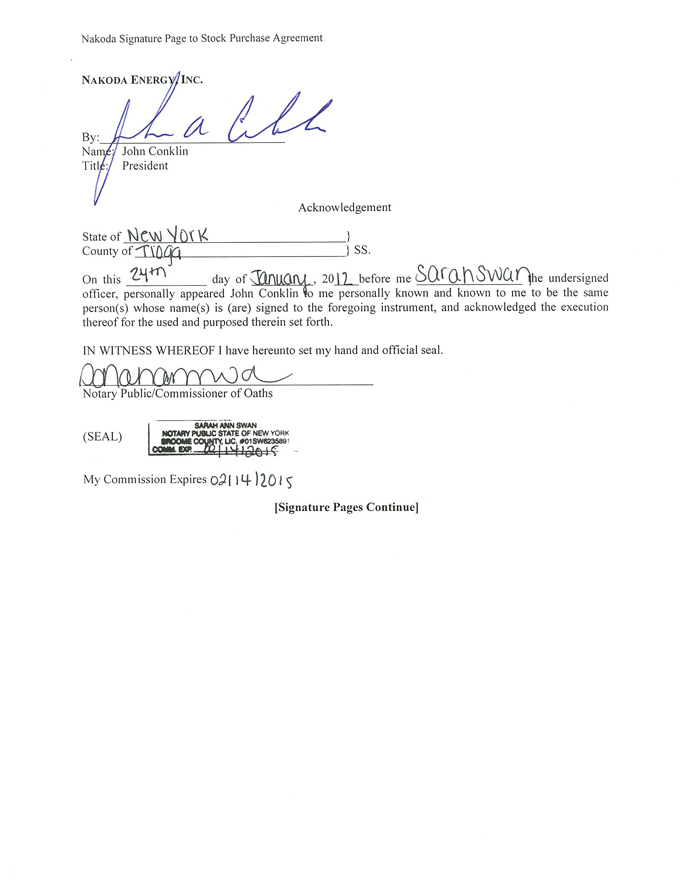

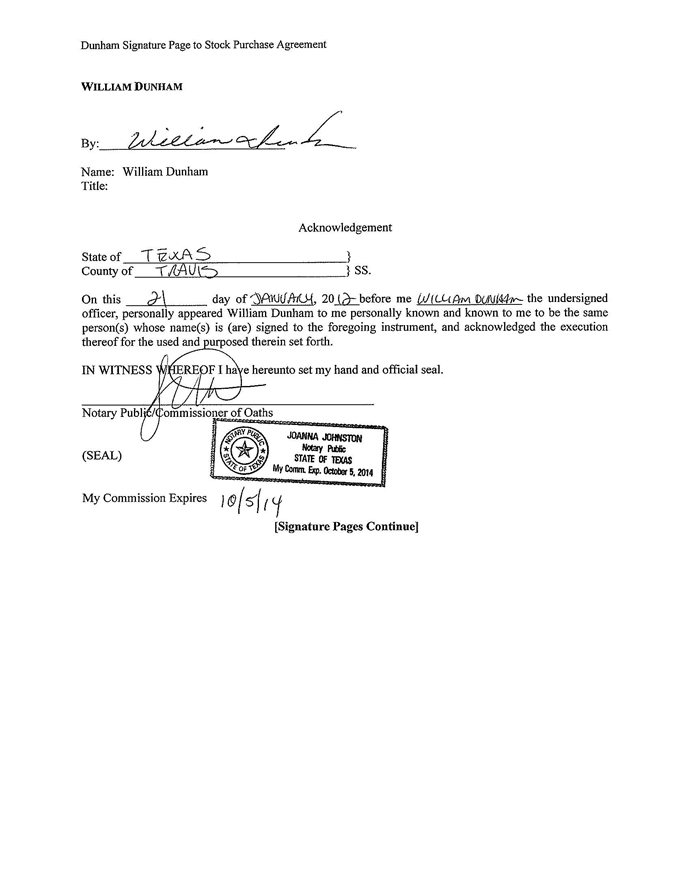

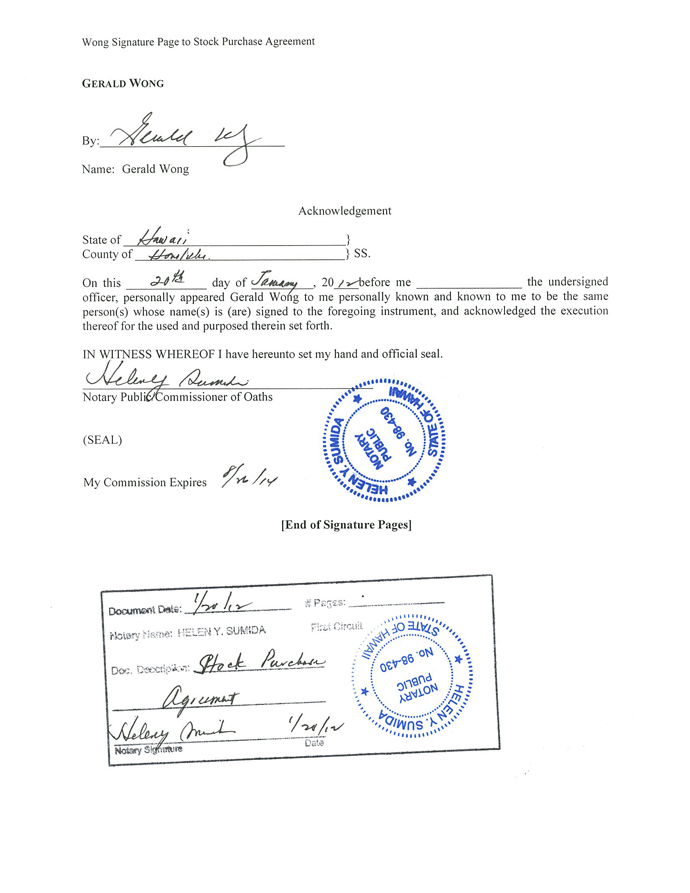

THIS STOCK PURCHASE AGREEMENT (the “Agreement”), dated as of January 20, 2012, is entered into by and among New Energy Technologies, Inc., a corporation organized under the laws of the State of Nevada (“NENE”), Nakoda Energy, Inc., a corporation organized under the laws of the State of California (“Nakoda”), National Energy Integration LLC, a limited liability corporation organized under the laws of the State of Hawaii (the “NEI”), William Dunham, an individual residing in the State of Texas (“Dunham”), Gerald Wong, an individual residing in the State of Hawaii (“Wong”). NENE, Nakoda, NEI, Dunham and Wong may hereinafter be referred to individually as a “Party” and collectively as the “Parties.”

RECITALS

WHEREAS, NENE owns ten (10) shares (the “Nakoda Shares”) of Nakoda’s common stock, par value $0.01, constituting all of the issued and outstanding capital stock of Nakoda;

WHEREAS, Nakoda was engaged in the business of providing technical and management services associated with identifying and assessing energy efficiency and implementing specific energy management systems to assist with controlling energy consumption and expenses and has suspended its business activities;

WHEREAS, Dunham is currently employed by Nakoda as Vice President of Sales – Energy Services;

WHEREAS, Wong is currently employed by Nakoda as Vice President of Business Development – Energy Services;

WHEREAS, Dunham and Wong are the controlling members of NEI;

WHEREAS, NEI desires to purchase from NENE, and NENE desires to sell and convey to NEI, all of the Nakoda Shares, upon and subject to the terms and conditions more fully set forth in this Agreement;

NOW, THEREFORE, for and in consideration of the promises and of the mutual representations, warranties, covenants, assumption of liabilities and agreements contained herein and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, and upon the terms and subject to the conditions hereinafter set forth, the Parties do hereby agree as follows:

SECTION 1

DEFINITIONS AND USAGE

Section 1.1 Defined Terms in Agreement. For the purposes of this Agreement, capitalized terms used but not otherwise defined in this Agreement shall have the meanings set forth below:

“Actions” means any actions, suits, arbitrations, inquiries, proceedings or investigations by or before any Governmental Authority.

“Affiliate” means, with respect to any Person, any other Person directly or indirectly controlling, controlled by, or under common control with such Person. For purposes of this definition, a Person is deemed to “control” an Entity if such Person, directly or indirectly: (i) has the power to direct the management or policies of such Entity; or (ii) owns, beneficially or of record (a) an amount of voting securities or other interests in such Entity that is sufficient to enable such Person to elect at least a majority of the members of such Entity’s Board of Directors or other governing body, or (b) at least fifty percent (50%) of the outstanding equity or financial interests of such Entity.

“Business Day” means any day other than a Saturday, Sunday or any day on which banks in the State of New York are authorized or required by federal law to be closed.

“Claim” means claims, demands, charges, complaints, actions, causes of action, suits, proceedings, hearings or administrative proceedings.

“Governmental Authority” shall mean (a) the United States of America, (b) any state, county, municipality, or other governmental subdivision within the U.S., (c) any court or any governmental department, commission, board, bureau, agency, or other instrumentality of the U.S. or of any state, county, municipality, water rights, taxing, or zoning authority, or other governmental subdivision within the U.S. and (d) any foreign government or agency having jurisdiction over any party to this Agreement.

“Entity” shall mean any corporation (including any non-profit corporation), general partnership, limited partnership, limited liability partnership, limited liability company, joint venture, estate, trust, company (including any limited liability company or joint stock company), firm or other enterprise, association, organization or entity.

“Material Adverse Effect” when used in connection with a Party means any change, event, circumstance or effect whether or not such change, event, circumstance or effect is caused by or arises in connection with a breach of a representation, warranty, covenant or agreement of such Party in this Agreement that is or is reasonably likely to be materially adverse to the business, assets (including intangible assets), capitalization, financial condition, operations or results of operations of such Party taken as a whole with its subsidiaries, except to the extent that any such change, event, circumstance or effect results from (i) changes in general economic conditions, (ii) changes affecting the industry generally in which such Party operates, or (iii) changes in the trading prices for such Party’s capital stock.

“Person” means any natural person, or Entity.

“Tax” or “Taxes” means (a) any federal, foreign, state or local tax, including any income, gross income, gross receipts, ad valorem, excise, sales, use, value added, admissions, business, occupation, license, franchise, margin, capital, net worth, customs, premium, real property, personal property, intangibles, capital stock, transfer, profits, windfall profits, environmental, severance, fuel, utility, payroll, social security, employment, withholding, disability, stamp, rent, recording, registration, alternative minimum, add-on minimum, or other tax, assessment, duty, fee, levy or other governmental charge of any kind whatsoever imposed by a Governmental Authority, together with and including, without limitation, any and all interest, fines, penalties, assessments and additions to tax resulting from, relating to, or incurred in connection with any such tax or any contest or dispute thereof, (b) any liability for the payment of any amount of the type described in the immediately preceding clause (a) as a result of being a member of a consolidated, affiliated, unitary or combined group with any other corporation or entity at any time prior to and through the Closing Date, and (c) any liability for the payment of any amount of the type described in the preceding clauses (a) or (b) as a result of a contractual obligation to any other Person or of transferee, successor or secondary liability.

| 2 |

SECTION 2

SALE AND PURCHASE

Section 2.1 Sale and Transfer of Nakoda Shares. At the Closing (as defined in Section 2.3) NENE shall sell, transfer and convey the Nakoda Shares to NEI, and NEI shall acquire the Nakoda Shares from NENE, free and clear of any liens.

Section 2.2 Purchase Price. The purchase price for the Nakoda Shares to be paid by NEI to NENE shall be $1.00 (ONE DOLLAR) (the “Purchase Price”), along with the representations, warranties, obligations and releases further set forth in Sections 5, 6, and 7 of this Agreement.

Section 2.3 Closing. The closing of the sale and purchase of the Nakoda Shares contemplated by this Agreement (the “Closing”) shall be held on the Closing Date at 10:00 am, Eastern Standard Time (EST), at the offices of NENE’s counsel, Sierchio & Company, LLP, at 430 Park Avenue, Suite 702, New York, NY 10022, no later than January 27, 2012, or at such other time or place as the Parties may otherwise agree in writing (the “Closing Date”).

Section 2.4 Closing Deliverables.

(a) NENE Deliverables. At the Closing NENE shall deliver to NEI:

(i) certificate(s) representing the Nakoda Shares, duly endorsed in blank or accompanied by stock powers duly executed in blank, in proper form for transfer to NEI;

(ii) assets of Nakoda, to the extent in the possession of NENE, including, but not limited to, the stock book, stock ledger, minute book and corporate seal of Nakoda, marketing materials, website domain, copies of the legal agreements to which Nakoda is a party all as more fully set forth on Schedule 2.4(a)(ii) hereto, accounting data, year-end financial reports, and bank accounts;

(iii) a bank account statement, or other such documentation, evidencing that, as of the Closing Date, Nakoda has in its bank accounts gross cash of no less than $102,250.00 (ONE HUNDRED TWO THOUSAND, TWO-HUNDRED AND FIFTY DOLLARS);

(iv) such documentation as necessary to evidence that, as of the Closing Date, Nakoda has paid in full the verified vendor accounts;

(v) such documentation as necessary to evidence that, as of the Closing Date, Nakoda has paid in full all its requisite taxes (other than taxes not yet due), withholdings, payroll obligations and other such related payables through such date;

(vi) Mr. John Conklin shall resign as the sole director and executive officer of Nakoda effective as of the Closing Date; and

(vii) such other documents, instruments and certificates as shall be reasonably requested by NEI for the purpose of effecting the transactions provided for and contemplated by this Agreement.

| 3 |

(b) NEI, Wong and Dunham Deliverables. At the Closing NEI shall deliver to NENE:

(i) the Purchase Price;

(ii) each of the Nakoda/Wong Termination and Release Agreement and the NENE/Wong Termination and Release Agreement, each as defined in Section 7 hereof;

(iii) each of the Nakoda/Dunham Termination and Release Agreement and the NENE/Dunham Termination and Release Agreement, each as defined in Section 7 hereof;

(iv) each of the Nakoda/NEI Termination and Release Agreement and the NENE/NEI Termination and Release Agreement, each as defined in Section 7 hereof; and

(v) such other documents, instruments and certificates as shall be reasonably requested by NENE for the purpose of effecting the transactions provided for and contemplated by this Agreement.

Section 2.5 Concurrent Requirements. At Closing each of the Parties hereto will deliver to the other such documents and make such payments of money as are required by the terms of this Agreement to be delivered or paid at the time of Closing and all matters of delivery of documents and payment of money by the parties hereto pursuant to this Agreement and the registration of all appropriate documents in all appropriate public offices of registration will be deemed to be concurrent requirements such that nothing is deemed to be completed until everything has been paid, delivered and registered with respect to the transactions contemplated herein.

Section 2.6 Conditions to Obligations of NENE and Nakoda. The obligation of NENE and Nakoda to consummate the transactions contemplated by this Agreement is subject to the satisfaction of the following conditions, any one or more of which may be waived in writing by all of NENE and Nakoda:

(i) each of the representations and warranties of NEI, Dunham and Wong made in this Agreement will be true and correct in all respects as of the Closing Date;

(ii) NEI, Dunham and Wong shall have performed or complied in all material respects with all of the covenants and agreements required by this Agreement to be performed or complied with by each of NEI, Dunham and Wong on or before the Closing Date;

(iii) the consummation of the transactions contemplated hereby by each of NEI, Dunham and Wong:

(iv) all closing deliveries required by Section 2.4(b) shall have been made; and

(v) no order or provision of any applicable law will be in effect that prohibits or restricts the consummation of the Closing.

Section 2.7 Conditions to Obligations of NEI, Dunham and Wong. The obligation of NEI, Dunham and Wong to consummate the transactions contemplated by this Agreement is subject to the satisfaction of the following conditions, any one or more of which may be waived in writing by NEI, Dunham and Wong:

| 4 |

(i) each of the representations and warranties of NENE and Nakoda made in this Agreement will be true and correct in all respects as of the Closing Date;

(ii) NENE and Nakoda shall have performed or complied in all material respects with all of the covenants and agreements required by this Agreement to be performed or complied with by NENE and Nakoda on or before the Closing Date;

(iii) all closing deliveries required by Section 2.4(a) shall have been made; and

(iv) no order or provision of any applicable law will be in effect that prohibits or restricts the consummation of the Closing.

SECTION 3

REPRESENTATIONS AND WARRANTIES OF NAKODA AND NENE

Section 3.1 Representations and Warranties of Nakoda. Nakoda and NENE hereby jointly represent and warrant to NEI as follows:

(a) Organization and Qualification. Nakoda is a corporation duly organized, validly existing and in good standing under the laws of the State of California and has the requisite corporate power and authority to carry on its business as it is now being conducted. Nakoda has no subsidiaries, nor does it have any equity interest in any corporation, partnership, joint venture, limited liability company or other entity.

(b) Capitalization. The authorized capital stock of Nakoda consists of 50,000,000 (FIFTY MILLION) shares of common stock par value $0.01 per share and 10,000,000 (TEN MILLION) shares of preferred stock, par value $0.01 per share. Except for the Nakoda Shares, there are no outstanding shares of capital stock or other securities of Nakoda. NENE is the record and beneficial owner of all right, title and interest in and to the Nakoda Shares. The Nakoda Shares are duly authorized, validly issued and outstanding, fully paid and non-assessable and with no personal liability attaching thereto.

(c) No Further Issuances. There is no existing contract, agreement or other instrument requiring the issuance or sale of any additional shares of capital stock or other securities of Nakoda and no shares of Nakoda are reserved for issuance for any purpose.

(d) Authority. Nakoda has all requisite corporate power and authority to execute and deliver this Agreement and to perform each of its respective obligations under this Agreement (and under all documents required to be executed and delivered and actions to be performed by Nakoda pursuant hereto). The execution, delivery and performance of this Agreement and the agreement contemplated hereby and the transactions contemplated hereby and thereby have been duly and validly authorized by corporate action on the part of Nakoda.

(e) Enforceability. This Agreement constitutes a valid and binding agreement of Nakoda enforceable against Nakoda in accordance with its terms, subject to (i) applicable bankruptcy, insolvency, reorganization, moratorium and other similar laws of general application with respect to creditors; (ii) general principles of equity; and (iii) the power of a court to deny enforcement of remedies generally based upon public policy.

| 5 |

(f) Actions. (i) there is no Action pending (with service of process therein having been made on Nakoda) or, to the knowledge of Nakoda and NENE, threatened (or pending without service of process therein having been made on Nakoda) to which Nakoda is (or is threatened to be made) a party and (ii) without limiting the foregoing, to the knowledge of Nakoda or NENE, no written or electronic notice from any third Person has been received by Nakoda claiming or calling attention to any violation of Law which relates to Nakoda’s business, or, in the case of a Governmental Authority, claiming or calling attention to any possible violation of law which relates to Nakoda’s business, other than any such violation or possible violation which is not reasonably expected to have a Material Adverse Effect.

(g) Compliance with Laws. (i) Nakoda and NENE have no knowledge of any violation by Nakoda of any law with respect Nakoda’s business and (ii) to the knowledge of Nakoda and NENE, all necessary permits, licenses, approvals, consents, certificates, and other authorizations with respect to the performance of Nakoda’s business are in full force and effect, and no violations exist in respect thereof.

(h) Insolvency. There are no bankruptcy, receivership or arrangement proceedings pending against, being contemplated by, or, to the knowledge of Nakoda or NENE, threatened against Nakoda.

(i) Tax Matters.

(i) Except for Taxes not yet due and payable, Nakoda has not received written notice of any Claim from any applicable Governmental Authority for the assessment of any Taxes with respect to Nakoda’s business. There is not currently in effect any extension or waiver of any statute of limitation of any jurisdiction regarding the assessment or collection of Taxes with respect to Nakoda’s business. There are no administrative proceedings or lawsuits pending against Nakoda by any applicable Governmental Authority with respect to Taxes.

(ii) No lien or encumbrance (other than Tax liens contested in good faith and for which adequate reserves are maintained in accordance with the Accounting Principles) exists (whether or not filed in the real property records of any applicable Governmental Authority) on or with respect to Nakoda as a result of a failure to pay Taxes; provided , however , that, to the extent notice of any such Tax lien or encumbrance is not filed in the real property records of an applicable Governmental Authority, this representation shall be deemed to be qualified by the knowledge of Nakoda.

(iii) Nakoda is not subject to any Tax partnership agreement requiring a partnership income Tax Return to be filed under Subchapter K of Chapter 1 of Subtitle A of the Code.

(j) Outstanding Capital Commitments. As of the date of this Agreement, there are no outstanding authorities for expenditure or other commitments, whether oral or written, to conduct any operations or expend any amount of money on or with respect to Nakoda which are binding on Nakoda.

(k) No Conflict; Consents. The execution and delivery by Nakoda of this Agreement and consummation of the transactions contemplated hereby, and the compliance by Nakoda with any of the provisions hereof or thereof, do not and shall not violate any law applicable to Nakoda in any material respect.

(l) Suspension of Activities. On or about December 5, 2011, Nakoda has suspended all of its business activities.

| 6 |

(m) Lahaina Shores Contract. Notwithstanding anything in this Agreement to the contrary, and without limiting any of the representations, warranties, or covenants contained herein, Nakoda makes no representations or warranties regarding the status of the Lease Purchase and Services Agreement dated as of October __, 2011, entered into between AOAO of Lahaina Shores and Nakoda (the “Lahaina Shores Contract”).

(n) Agreements. Based upon representations made to Nakoda by the former executive officers of Nakoda, the Agreements listed on Schedule 2.4(a)(iv) represent all of the outstanding agreements entered into by Nakoda and, to the best knowledge of Nakoda and NENE, there are no additional agreements to which Nakoda is a party. Anything herein to the contrary notwithstanding, Nakoda and NENE make no representations or warranties as to whether any such agreements are currently in effect.

(o) No Other Representations or Warranties. Except as set forth in this Section 3 (and as to NENE Section 4) each of Nakoda and NENE has not, and does not, make any additional representations or warranties and hereby disclaims any other representations or warranties whether made by any of its officers, directors, employees, agents or representatives, with respect to the execution and delivery of this Agreement or any document entered into pursuant to the terms and conditions of this Agreement, or the transactions contemplated hereby.

SECTION 4

ADDITIONAL REPRESENTATIONS AND WARRANTIES OF NENE

Section 4.1 Representations and Warranties of NENE. NENE hereby represents and warrants to NEI as follows:

(a) Organization and Qualification. NENE is a corporation duly organized, validly existing and in good standing under the laws of the State of Nevada.

(b) Authority. NENE has all requisite corporate power and authority to execute and deliver this Agreement and to perform each of its respective obligations under this Agreement (and under all documents required to be executed and delivered and actions to be performed by NENE pursuant hereto). The execution, delivery and performance of this Agreement and the agreement contemplated hereby and the transactions contemplated hereby and thereby have been duly and validly authorized by corporate action on the part of NENE.

(c) Enforceability. This Agreement constitutes a valid and binding agreement of NENE enforceable against it in accordance with its terms, subject to (i) applicable bankruptcy, insolvency, reorganization, moratorium and other similar laws of general application with respect to creditors; (ii) general principles of equity; and (iii) the power of a court to deny enforcement of remedies generally based upon public policy.

(d) Ownership of Nakoda Shares. NENE is the record and beneficial owner of all right, title interest in and to the Nakoda Shares. The Nakoda Shares are duly authorized, validly issued and outstanding, fully paid and non-assessable and with no personal liability attaching thereto. Other than this Agreement, NENE is not a party to any contract relating to the transfer, sale, assignment, purchase pledge or other disposition of any of the Nakoda Shares by NENE. There are no contracts relating to ownership or voting of any shares of capital stock or other securities of Nakoda.

(e) No Conflict or Violation. Neither the execution and delivery of this Agreement nor the consummation of the transactions and performance of the terms and conditions contemplated hereby by NENE will (i) conflict with or result in a violation or breach of or default under any provision of the articles of incorporation, by-laws, or other similar governing documents of NENE or any material agreement, indenture or other instrument under which NENE is bound, or (ii) violate or conflict with any Law applicable to NENE.

| 7 |

(f) Consents. No consent, approval, authorization or permit of, or filing with or notification to, any Person is required for or in connection with the execution and delivery of this Agreement by NENE or for or in connection with the consummation of the transactions and performance of the terms and conditions contemplated hereby by NENE.

(g) Actions. There is no Action pending (with service of process therein having been made on NENE) regarding the Nakoda Shares or, to the knowledge of NENE, threatened (or pending without service of process therein having been made on NENE) regarding the Nakoda Shares to which NENE is (or is threatened to be made) a party, other than Actions which are not reasonably expected by NENE to have a material adverse effect on the Nakoda Shares.

(h) Insolvency. There are no bankruptcy, reorganization, receivership or arrangement proceedings pending against, being contemplated by, or, to the knowledge of NENE, threatened against NENE or any Affiliate of NENE.

(i) No Other Representations or Warranties. Except as set forth in Section 3 and this Section 4 NENE has not, and does not, make any additional representations or warranties and hereby disclaims any other representations or warranties whether made by any of its officers, directors, employees, agents or representatives, with respect to the execution and delivery of this Agreement or any document entered into pursuant to the terms and conditions of this Agreement, or the transactions contemplated hereby.

SECTION 5

REPRESENTATIONS AND WARRANTIES OF NEI

Section 5.1 Representations and Warranties of NEI. NEI hereby represents and warrants to NENE and Nakoda as follows:

(a) Organization and Qualification. NEI is a limited liability corporation duly organized, validly existing and in good standing under the laws of the State of Hawaii and has the requisite corporate power and authority to carry on its business as it is now being conducted.

(b) Authority. NEI has all requisite corporate power and authority to execute and deliver this Agreement and to perform each of its respective obligations under this Agreement (and under all documents required to be executed and delivered and actions to be performed by NEI pursuant hereto). The execution, delivery and performance of this Agreement and the agreement contemplated hereby and the transactions contemplated hereby and thereby have been duly and validly authorized by corporate action on the part of NEI.

(c) Enforceability. This Agreement constitutes a valid and binding agreement of NEI enforceable against it in accordance with its terms, subject to (i) applicable bankruptcy, insolvency, reorganization, moratorium and other similar laws of general application with respect to creditors; (ii) general principles of equity; and (iii) the power of a court to deny enforcement of remedies generally based upon public policy.

| 8 |

(d) No Conflict or Violation. Neither the execution and delivery of this Agreement nor the consummation of the transactions and performance of the terms and conditions contemplated hereby by NEI will (i) conflict with or result in a violation or breach of or default under any provision of the articles of incorporation, by-laws, or other similar governing documents of NEI or any material agreement, indenture or other instrument under which NEI is bound, or (ii) violate or conflict with any Law applicable to NEI.

(e) Consents. No consent, approval, authorization or permit of, or filing with or notification to, any Person is required for or in connection with the execution and delivery of this Agreement by NEI or for or in connection with the consummation of the transactions and performance of the terms and conditions contemplated hereby by NEI.

(f) Actions. There is no Action pending (with service of process therein having been made on NEI) or, to the knowledge of NEI, threatened (or pending without service of process therein having been made on NEI) to which NEI is (or is threatened to be made) a party, other than Actions which are not reasonably expected by NEI to have a material adverse effect on NEI.

(g) Taxes. NEI agrees that, subject to the consummation of the transactions contemplated by this Agreement, it shall be responsible for the filing and payment of any and all Taxes due by Nakoda, if any, including, but not limited to, any withholding taxes, beginning on the Closing Date.

(h) Insolvency. There are no bankruptcy, reorganization, receivership or arrangement proceedings pending against, being contemplated by, or, to the knowledge of NEI, threatened against NEI or any Affiliate of NEI.

(i) Lahaina Shores Contract. NEI agrees for and on behalf of itself and its respective Affiliates that it hereby assumes all the rights and obligations contained in the Lahaina Shores Contract and shall hold NENE, its employees, executives, director and Affiliates harmless for any current or contingent liabilities arising from the Lahaina Shores Contract.

(j) No Other Agreements. Other than this Agreement and the mutual termination and release agreements entered into pursuant to Section 7, there are no other agreements, whether written, oral or otherwise, that have been entered into by and between or among NEI and Nakoda or NENE.

(k) No Other Representations or Warranties. Except as set forth in this Section 5 NEI has not, and does not, make any additional representations or warranties and hereby disclaims any other representations or warranties whether made by any of its officers, directors, employees, agents or representatives, with respect to the execution and delivery of this Agreement or any document entered into pursuant to the terms and conditions of this Agreement, or the transactions contemplated hereby.

SECTION 6

REPRESENTATIONS AND WARRANTIES OF DUNHAM AND WONG

Section 6.1 Representations and Warranties of Dunham and Wong. Dunham and Wong, jointly and severally, hereby represent and warrant to NENE and Nakoda as follows:

(a) Knowledge of Nakoda Business. Each of Dunham and Wong has previously been employed by and served as executives of Nakoda, through the Closing Date, and are familiar with the business in which Nakoda is currently engaged in.

| 9 |

(b) Authority. Each of Dunham and Wong has the requisite power and authority to execute and deliver this Agreement and to perform each of their respective obligations under this Agreement (and under all documents required to be executed and delivered and actions to be performed by each of Dunham and Wong pursuant hereto). The execution, delivery and performance of this Agreement and the agreement contemplated hereby and the transactions contemplated hereby and thereby have been duly and validly authorized by each of Dunham and Wong.

(c) Control of NEI. Dunham and Wong are the controlling members of NEI.

(d) Employment by Nakoda. Dunham is currently employed by Nakoda as Vice President of Sales – Energy Services and Wong is currently employed by Nakoda as Vice President of Business Development – Energy Services.

(e) Enforceability. This Agreement constitutes a valid and binding agreement of each of Dunham and Wong enforceable against each of them in accordance with its terms, subject to (i) applicable bankruptcy, insolvency, reorganization, moratorium and other similar laws of general application with respect to creditors; (ii) general principles of equity; and (iii) the power of a court to deny enforcement of remedies generally based upon public policy.

(f) No Conflict or Violation. Neither the execution and delivery of this Agreement nor the consummation of the transactions and performance of the terms and conditions contemplated hereby by each of Dunham and Wong will violate or conflict with any federal, state, local or municipal law applicable to each of Dunham and Wong.

(g) Consents. No consent, approval, authorization or permit of, or filing with or notification to, any Person is required for or in connection with the execution and delivery of this Agreement by NEI or for or in connection with the consummation of the transactions and performance of the terms and conditions contemplated hereby by NEI.

(h) Actions. There is no Action pending (with service of process therein having been made on either Dunham or Wong) or, to the knowledge of Dunham or Wong, threatened (or pending without service of process therein having been made on either Dunham or Wong) to which either Dunham or Wong is (or is threatened to be made) a party.

(i) Insolvency. There are no bankruptcy, reorganization, or other such proceedings pending against, being contemplated by, or, to the knowledge of either Dunham or Wong, threatened against either Dunham or Wong.

(h) Taxes. Each of Dunham and Wong agree that, subject to the consummation of the transactions contemplated by this Agreement, NEI shall be liable for the filing and payment of any and all Taxes, if any, due by Nakoda, including, but not limited to, withholding taxes, beginning on January 1, 2012.

(i) Suspension of Activities. Each of Dunham and Wong is aware that on or about December 5, 2011, Nakoda has suspended all of its business activities and that the agreements listed on Schedule 2.4(a)(iii) hereto may no longer be in effect.

(j) Lahaina Shores Contract. Each of Dunham and Wong agree that NEI shall assume all the rights and obligations contained in the Lahaina Shores Contract and shall hold Nakoda, NENE, its employees, executives, directors and Affiliates harmless for any current or contingent liabilities arising from the Lahaina Shores Contract.

| 10 |

(k) No Other Agreements. Other than this Agreement, the agreements set forth on Schedule 7.1(a), Schedule 7.1(b) Schedule 7.1(d) and Schedule 7.1(e) hereto and the mutual termination and release agreements entered into pursuant to Section 7, there are no other agreements, whether written, oral or otherwise, between Dunham, Wong, Nakoda or NENE.

(l) No Other Representations or Warranties. Except as set forth in this Section 6 neither Dunham nor Wong has made, and does not make, any additional representations or warranties and hereby disclaims any other representations or warranties whether made by any of their agents or representatives, with respect to the execution and delivery of this Agreement or any document entered into pursuant to the terms and conditions of this Agreement, or the transactions contemplated hereby.

SECTION 7

MUTUAL TERMINATION AND RELEASE OF OUTSTANDING AGREEMENTS

Section 7.1 Termination and Release of Agreements. As of the Closing Date:

(a) Agreements Between Nakoda and Dunham. Except for the Nakoda/Dunham Termination and Release Agreement, as defined below, any and all outstanding agreements, whether written, oral or otherwise, entered into by and between Nakoda and Dunham prior to the Closing Date, including, but not limited to, the agreements set forth on Schedule 7.1(a) hereto, and any rights or obligations thereunder, are hereby terminated as of the Closing Date. At or prior to the Closing Date Nakoda and Dunham shall have executed and delivered the Mutual Termination and Release Agreement in the form of Exhibit 7.1(a) hereto (the “Nakoda/Dunham Termination and Release Agreement”).

(b) Agreements Between Nakoda and Wong. Except for the Nakoda/Wong Termination and Release Agreement, as defined below, any and all outstanding agreements, whether written, oral or otherwise, entered into by and between Nakoda and Wong prior to the Closing Date, including, but not limited to, the agreements set forth on Schedule 7.1(b) hereto, and any rights or obligations thereunder, are hereby terminated as of the Closing Date. At the Closing Nakoda and Wong shall have executed and delivered the Mutual Termination and Release Agreement in the form of Exhibit 7.1(b) hereto(the “Nakoda/Wong Termination and Release Agreement”).

(c) Agreements Between Nakoda and NEI. Except for the Nakoda/NEI Termination and Release Agreement, as defined below, any and all outstanding agreements, whether written, oral or otherwise, entered into by and between Nakoda and NEI prior to the Closing Date, including, but not limited to, the agreements set forth on Schedule 7.1(c) hereto, and any rights or obligations thereunder, are hereby terminated as of the Closing Date. At the Closing Nakoda and NEI shall have executed and delivered the Mutual Termination and Release Agreement in the form of Exhibit 7.1(c) hereto(the “Nakoda/NEI Termination and Release Agreement”).

(d) Agreements Between NENE and Dunham. Except for the NENE/Dunham Termination and Release Agreement, as defined below, any and all outstanding agreements, whether written, oral or otherwise, entered into by and between NENE and Dunham prior to the Closing Date, including, but not limited to, the agreements set forth on Schedule 7.1(d) hereto, and any rights or obligations thereunder, are hereby terminated as of the Closing Date. At the Closing NENE and Dunham shall have executed and delivered the Mutual Termination and Release Agreement in the form of Exhibit 7.1(d) hereto (the “NENE/Dunham Termination and Release Agreement”).

(e) Agreements Between NENE and Wong. Except for the NENE/Wong Termination and Release Agreement, as defined below, any and all outstanding agreements, whether written, oral or otherwise, entered into by and between NENE and Wong prior to the Closing Date, including, but not limited to, the agreements set forth on Schedule 7.1(e) hereto, and any rights or obligations thereunder, are hereby terminated as of the Closing Date. At the Closing NENE and Wong shall have executed and delivered the Mutual Termination and Release Agreement in the form of Exhibit 7.1(e) hereto (the “NENE/Wong Termination and Release Agreement”).

| 11 |

(f) Agreements Between NENE and NEI. Except for the NENE/NEI Termination and Release Agreement, as defined below, any and all outstanding agreements, whether written, oral or otherwise, entered into by and between NENE and NEI prior to the Closing Date, including, but not limited to, the agreements set forth on Schedule 7.1(f) hereto, and any rights or obligations thereunder, are hereby terminated as of the Closing Date. At the Closing NENE and NEI shall have executed and delivered the Mutual Termination and Release Agreement in the form of Exhibit 7.1(f) hereto (the “NENE/NEI Termination and Release Agreement”).

Section 7.2 Termination and Release to be Deemed as Mutual. The termination and release of all rights and obligations of the agreements listed on Schedules 7.1(a)-(f) is to be treated as a mutual termination and release and that none of the parties to the respective agreements is currently in breach of the terms and conditions set forth in the respective agreement.

SECTION 8

SURVIVAL OF REPRESENTATIONS, WARRANTIES, COVENANTS AND RELEASES

Section 8.1 Survival of Representations and Warranties. All representations, warranties, covenants and releases made by NENE, Nakoda, NEI, Dunham and Wong under or pursuant to this Agreement will survive the Closing.

SECTION 9

MISCELLANEOUS

Section 9.1 Counterparts. This Agreement may be executed in one or more counterparts, all of which shall be considered one and the same agreement, and shall become effective when one or more counterparts have been signed by each of the Parties and delivered to the other Party.

Section 9.2 Governing Law; Jurisdiction; Venue. THIS AGREEMENT AND THE TRANSACTIONS CONTEMPLATED HEREBY SHALL BE GOVERNED BY AND INTERPRETED IN ACCORDANCE WITH THE LAWS OF THE STATE OF NEW YORK WITHOUT GIVING EFFECT TO PRINCIPLES THEREOF RELATING TO CONFLICTS OF LAW RULES THAT WOULD DIRECT THE APPLICATION OF THE LAWS OF ANOTHER JURISDICTION. EXCLUSIVE JURISDICTION AND VENUE SHALL LIE IN NEW YORK, NY.

Section 9.3 Arbitration; Waiver of Trial. In the event of any dispute arising out of or relating to this Agreement such dispute shall be resolved exclusively by confidential binding arbitration. The Parties agree that dispute resolution shall be conducted, at any mutually agreed upon neutral JAMS Resolution Center, pursuant to JAMS’ commercial rules of arbitration, subject nevertheless to Section 9.2 hereof and heard before one arbitrator. If the Parties cannot mutually agree on the selection of the JAMS resolution center within 5 days of the notice for arbitration by any Party, then the arbitration shall be conducted at the JAM’s resolution center located in the City of Chicago, Illinois. Each Party shall bear its own attorneys’ fees, expert witness fees, and costs incurred in connection with any arbitration.

Section 9.4 Entire Agreement. This Agreement and any Appendices, Schedules and Exhibits hereto contain the entire agreement between the Parties with respect to the subject matter hereof and there are no agreements, understandings, representations or warranties, either written or oral, between the Parties other than those set forth or referred to herein.

| 12 |

Section 9.5 Notices. Unless otherwise expressly provided in this Agreement, all notices required or permitted hereunder shall be in writing and deemed sufficiently given for all purposes hereof if (a) delivered in person, by courier or by registered or certified United States Mail to the Person to be notified, with receipt obtained, or (ii) sent by telecopy, telefax or other facsimile or electronic transmission, with “answer back” or other “advice of receipt” obtained, in each case to the appropriate address or number as set forth below. Each notice shall be deemed effective on receipt by the addressee as aforesaid; provided that, notice received by telex, telecopy, telefax or other facsimile or electronic transmission after 5:00 p.m. at the location of the addressee of such notice shall be deemed received on the first Business Day following the date of such electronic receipt.

Notices to NEI shall be addressed as follows:

National Energy Integration LLC

1330 Bertania

No. 305

Honolulu, Hawaii 96814

Attention: William Dunham

Notices to Dunham shall be addressed as follows:

Mr. William P. Dunham

5013 Greenshore Circle

Lago Vista, TX 78645

Notices to Wong shall be addressed as follows:

Mr. Gerald K. Wong

1330 Bertania

No. 305

Honolulu, Hawaii 96814

or at such other address or to such other telecopy, telefax or other facsimile or electronic transmission number and to the attention of such other Person as NEI, Dunham or Wong may designate by written notice to Nakoda or NENE.

Notices to NENE shall be addressed as follows:

New Energy Technologies, Inc.

9192 Red Branch Road

Suite 110

Columbia, MD 21045

Attention: John Conklin, President & CEO

Notices to Nakoda shall be addressed as follows:

Nakoda Energy, Inc.

9192 Red Branch Road

Suite 110

Columbia, MD 21045

Attention: John Conklin, President

| 13 |

and a copy, which shall not constitute notice, to:

Sierchio & Company, LLP

430 Park Avenue, Suite 702

New York, NY 10022

Attention: Joseph Sierchio, Esq.

Telephone: (212) 246-3030

Facsimile: (212) 246-3039

or at such other address or to such other telecopy, telefax or other facsimile or electronic transmission number and to the attention of such other Person as NENE or Nakoda may designate by written notice to NEI, Dunham and Wong.

Section 9.6 Successors and Assigns. This Agreement shall be binding upon and inure to the benefit of the Parties and their respective successors and assigns; provided, however, that the respective rights and obligations of the Parties shall not be assignable or delegable (whether by assignment, conveyance, merger, consolidation, Change of Control, entity purchase, or otherwise) by any Party without the express written consent of the non-assigning or non-delegating Party, such consent shall not unreasonably be withheld.

Section 9.7 Amendments and Waivers. This Agreement may not be modified or amended except by an instrument or instruments in writing signed by the Party against whom enforcement of any such modification or amendment is sought which instrument and expressly identified as a modification or amendment. Any Party may, only by an instrument in writing and expressly identified as a waiver, waive compliance by another Party with any term or provision of this Agreement on the part of such other Party to be performed or complied with. The waiver by any Party hereto of a breach of any term or provision of this Agreement shall not be construed as a waiver of any subsequent breach.

Section 9.8 Appendices, Schedules and Exhibits. All Appendices, Schedules and Exhibits hereto which are referred to herein are hereby made a part of this Agreement and incorporated herein by such reference.

Section 9.9 Interpretation. It is expressly agreed that this Agreement shall not be construed against any Party, and no consideration shall be given or presumption made, on the basis of who drafted this Agreement or any particular provision hereof or who supplied the form of Agreement. Each Party agrees that this Agreement has been purposefully drawn and correctly reflects its understanding of the transactions that this Agreement contemplates. In construing this Agreement:

(a) examples shall not be construed to limit, expressly or by implication, the matter they illustrate;

(b) the word “includes” and its derivatives means “includes, but is not limited to” and corresponding derivative expressions;

(c) a defined term has its defined meaning throughout this Agreement and each Appendix, Exhibit and Schedule to this Agreement, regardless of whether it appears before or after the place where it is defined;

(d) each Exhibit and Schedule to this Agreement is a part of this Agreement, but if there is any conflict or inconsistency between the main body of this Agreement (including Schedule A which shall be considered part of the main body of this Agreement) and any Exhibit or Schedule, the provisions of the main body of this Agreement shall prevail;

| 14 |

(e) the term “cost” includes expense and the term “expense” includes cost;

(f) the headings and titles herein are for convenience only and shall have no significance in the interpretation hereof;

(g) “include” and “including” shall mean include or including without limiting the generality of the description of the preceding term; and

(h) the word “knowledge” or “best knowledge” means the actual knowledge of the person making the statement.

Section 9.10 Agreement for the Parties’ Benefit Only. This Agreement is for the sole benefit of NENE, Nakoda, NEI, Dunham and Wong and their respective successors and assigns as permitted herein and no other Person shall be entitled to enforce this Agreement, rely on any representation, warranty, covenant or agreement contained herein, receive any rights hereunder or be a third party beneficiary of this Agreement.

Section 9.11 Attorneys’ Fees. Each Party shall be responsible for its own attorneys’ fees associated with the Closing and execution of this Agreement. In the event that a dispute or controversy arises as a result of the subject matter set forth in this Agreement, the prevailing party shall be entitled to costs and fees, including attorney’s fees, associated with the enforcement of the terms of this Agreement.

Section 9.12 Severability. If any term, provision or condition of this Agreement, or any application thereof, is held invalid, illegal or unenforceable in any respect under any Law, this Agreement shall be reformed to the extent necessary to conform, in each case consistent with the intention of the Parties, to such Law, and to the extent such term, provision or condition cannot be so reformed, then such term, provision or condition (or such invalid, illegal or unenforceable application thereof) shall be deemed deleted from (or prohibited under) this Agreement, as the case may be, and the validity, legality and enforceability of the remaining terms, provisions and conditions contained herein (and any other application such term, provision or condition) shall not in any way be affected or impaired thereby. Upon such determination that any term or other provision is invalid, illegal or incapable of being enforced, the Parties shall negotiate in good faith to modify this Agreement so as to effect the original intent of the Parties as closely as possible in an acceptable manner to the end that the transactions contemplated hereby are fulfilled to the extent possible.

Section 9.13 Time of the Essence. Time is of the essence in this Agreement. If the date specified in this Agreement for giving any notice or taking any action is not a Business Day (or if the period during which any notice is required to be given or any action taken expires on a date which is not a Business Day), then the date for giving such notice or taking such action (and the expiration date of such period during which notice is required to be given or action taken) shall be the next day which is a Business Day.

[SIGNATURE PAGES FOLLOW]

| 15 |

Schedule 2.4(a)(ii) to the Stock Purchase Agreement

Schedule 2.4(a)(ii)

Employment Agreement dated as of August 22, 2011, entered into by and between Nakoda Energy, Inc. and William Dunham.

Employment Agreement dated as of August 22, 2011, entered into by and between Nakoda Energy, Inc. and Gerald Wong.

Consulting Agreement dated as of September 21, 2011, entered into by and between Nakoda Energy, Inc. and Alan Tucker

Lease Purchase and Services Agreement dated as of October __, 2011, entered into by and between Nakoda Energy, Inc. and AOAO of Lahaina Shores.

Teamin Agreement dated as of November 8, 2011, entered into by and between Nakoda Energy, Inc. and Winn Energy.

Investment Grade Audit & Project Proposal Contract dated as of November 27, 2011, entered into by and between Nakoda Energy, Inc. and Equinox Fitness Clubs.

Schedule 7.1(a) to the Stock Purchase Agreement

Schedule 7.1(a)

This Stock Purchase Agreement and the Employment Agreement dated as of August 22, 2011, entered into by and between Nakoda Energy, Inc. and William Dunham.

Schedule 7.1(b) to the Stock Purchase Agreement

Schedule 7.1(b)

This Stock Purchase Agreement and the Employment Agreement dated as of August 22, 2011, entered into by and between Nakoda Energy, Inc. and Gerald Wong.

Schedule 7.1(c) to the Stock Purchase Agreement

Schedule 7.1(c)

Other than this Stock Purchase Agreement, there are no known outstanding agreements entered into between National Energy Integration LLC and Nakoda Energy, Inc.

Schedule 7.1(d) to the Stock Purchase Agreement

Schedule 7.1(d)

This Stock Purchase Agreement and the Restricted Stock Purchase Agreement dated as of August 22, 2011, between New Energy Technologies, Inc. and William Dunham.

Schedule 7.1(e) to the Stock Purchase Agreement

Schedule 7.1(e)

This Stock Purchase Agreement and the Restricted Stock Purchase Agreement dated as of August 22, 2011, between New Energy Technologies, Inc. and Gerald Wong.

Schedule 7.1(f) to the Stock Purchase Agreement

Schedule 7.1(f)

Other than this Stock Purchase Agreement, there are no known outstanding agreements entered into between National Energy Integration LLC and New Energy Technologies, Inc.