Attached files

| file | filename |

|---|---|

| 8-K - OKE-OKS TO INVEST UP TO $160 MILLION FOR ADDITIONAL GROWTH PROJECTS IN THE BAKKEN SHALE - ONEOK INC /NEW/ | form_8-k.htm |

Exhibit 99.1

| April 4, 2012 | Analyst Contact: | Andrew Ziola | |

| 918-588-7163 | |||

| Media Contact: | Megan Lewis | ||

| 918-561-5325 |

ONEOK Partners to Invest $140 Million to $160 Million for

Additional Growth Projects in the Bakken Shale

Partnership’s Total Investment in Bakken Shale

Increases to $1.6 Billion to $2 Billion

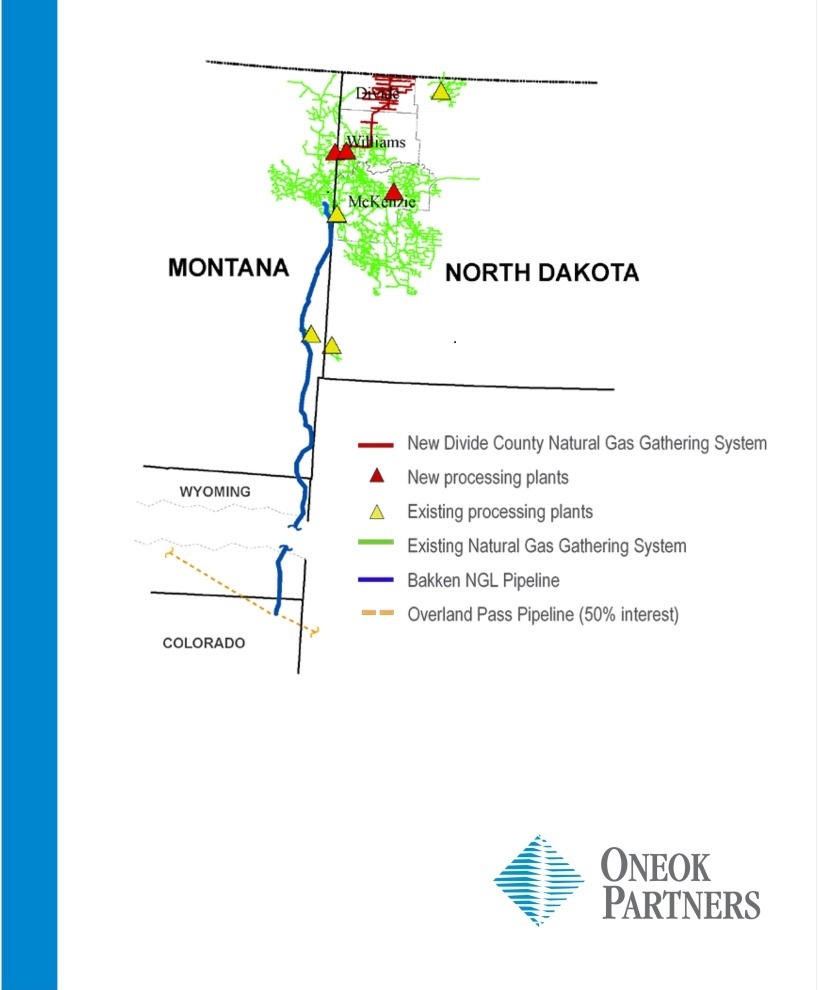

TULSA, Okla. – April 4, 2012 – ONEOK Partners, L.P. (NYSE: OKS) today announced plans to invest another $140 million to $160 million to construct a 270-mile natural gas gathering system and related infrastructure in Divide County, N.D.

The new system, which is expected to be completed in the second half of 2013, will gather and deliver natural gas from producers in the Bakken Shale in the Williston Basin to the partnership’s previously announced 100 million cubic feet per day (MMcf/d) Stateline II natural gas processing facility in western Williams County, N.D. The Stateline II plant is expected to be in service in the first half of 2013. The partnership has secured long-term supply commitments from producers structured with percent-of-proceeds and fee-based components.

“Expanding our natural gas gathering system into Divide County will open up new development potential for the partnership and will give producers developing the Bakken Shale and Three Forks plays the infrastructure they need to process and deliver natural gas to the marketplace,” said Terry K. Spencer, ONEOK Partners president. “This project is the latest example of our ongoing commitment to provide value-added services to producers and reduce the amount of natural gas being flared in the Bakken Shale.”

In aggregate, the new gathering system and related infrastructure are expected to generate EBITDA (earnings before interest, taxes, depreciation and amortization) multiples of five to seven times. The incremental earnings from these projects are expected to increase distributable cash flow and value to unitholders in the form of higher distributions.

In addition to the Divide County natural gas gathering system, ONEOK Partners previously announced it will invest approximately $1.5 billion to $1.8 billion for growth projects in the Bakken Shale between 2011 and 2014 in its natural gas gathering and processing and natural gas liquids (NGL) businesses. These investments include the construction of an

-more-

ONEOK Partners to Invest $140 Million to $160 million for

Additional Growth Projects in the Bakken Shale

Page 2

approximately 500-mile NGL pipeline – the Bakken Pipeline – and three 100 MMcf/d natural gas processing facilities including the Garden Creek plant, Stateline I plant and Stateline II plant. The Garden Creek plant went into service in December 2011.

With the completion of the Divide County natural gas gathering system, the partnership will have installed the necessary natural gas gathering infrastructure sufficient to fill all four of the partnership’s natural gas processing plants in the Bakken Shale and Three Forks regions.

ONEOK Partners is the largest independent operator of natural gas gathering and processing facilities in the Williston Basin, with a natural gas gathering system of more than 3,500 miles and acreage dedications of more than 2.2 million acres.

EDITOR’S NOTE:

View a map of the proposed natural gas pipeline gathering system.

NON-GAAP (GENERALLY ACCEPTED ACCOUNTING PRINCIPLES) FINANCIAL MEASURES

ONEOK Partners has disclosed in this news release anticipated EBITDA and Distributable Cash Flow levels that are non-GAAP financial measures. EBITDA and DCF are used as a measure of the partnership’s financial performance. EBITDA is defined as net income adjusted for interest expense, depreciation and amortization, income taxes and allowance equity funds used during construction. DCF is defined as EBITDA, computed as described above, less interest expense, maintenance capital expenditures and equity earnings from investments, adjusted for cash and certain other items.

The partnership believes the non-GAAP financial measures described above are useful to investors because these measurements are used by many companies in its industry as a measurement of financial performance and are commonly employed by financial analysts and others to evaluate the financial performance of the partnership and to compare the financial performance of the partnership with the performance of other publicly traded partnerships within its industry.

EBITDA and DCF should not be considered an alternative to net income, earnings per unit or any other measure of financial performance presented in accordance with GAAP.

These non-GAAP financial measures exclude some, but not all, items that affect net income. Additionally, these calculations may not be comparable with similarly titled measures of other companies. Furthermore, these non-GAAP measures should not be viewed as indicative of the actual amount of cash that is available for distributions or that is planned to be distributed for a given period nor do they equate to available cash as defined in the partnership agreement.

-more-

ONEOK Partners to Invest $140 Million to $160 million for

Additional Growth Projects in the Bakken Shale

Page 3

ONEOK Partners, L.P. (NYSE: OKS) is one of the largest publicly traded master limited partnerships, and is a leader in the gathering, processing, storage and transportation of natural gas in the U.S. and owns one of the nation’s premier natural gas liquids (NGL) systems, connecting NGL supply in the Mid-Continent and Rocky Mountain regions with key market centers. Its general partner is a wholly owned subsidiary of ONEOK, Inc. (NYSE: OKE), a diversified energy company, which owns 43.4 percent of the overall partnership interest. ONEOK is one of the largest natural gas distributors in the United States, and its energy services operation focuses primarily on marketing natural gas and related services throughout the U.S.

For more information, visit the website at www.oneokpartners.com.

For the latest news about ONEOK Partners, follow us on Twitter @ONEOKPartners.

Some of the statements contained and incorporated in this news release are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act, as amended. The forward-looking statements relate to our anticipated financial performance, management’s plans and objectives for our future operations, our business prospects, the outcome of regulatory and legal proceedings, market conditions and other matters. We make these forward-looking statements in reliance on the safe harbor protections provided under the Private Securities Litigation Reform Act of 1995. The following discussion is intended to identify important factors that could cause future outcomes to differ materially from those set forth in the forward-looking statements.

Forward-looking statements include the items identified in the preceding paragraph, the information concerning possible or assumed future results of our operations and other statements contained or incorporated in this news release identified by words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “should,” “goal,” “forecast,” “guidance,” “could,” “may,” “continue,” “might,” “potential,” “scheduled” and other words and terms of similar meaning.

The forward looking statements in this news release relating to the estimated costs and completion schedules as well as anticipated EBITDA levels with respect to the referenced growth construction projects are subject to known and unknown risks, uncertainties and other factors that may cause actual project costs and completion schedules and associated EBITDA levels to be materially different from those included in the forward looking statements. These risks and uncertainties include, but are not limited to, timely receipt of necessary governmental approvals and permits, our ability to control the costs of construction, including costs of materials, labor and right-of-way and other factors that may impact our ability to complete these projects within budget and on schedule.

###