UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 5, 2012

KB HOME

(Exact name of registrant as specified in its charter)

| Delaware | 1-9195 | 95-3666267 | ||

| (State or other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 10990 Wilshire Boulevard, Los Angeles, California | 90024 | |||

| (Address of Principal Executive Offices) | (Zip Code) | |||

Registrant’s telephone number, including area code: (310) 231-4000

Not Applicable

(Former name or former address if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 8.01 Other Events.

Adoption of 2012 Fiscal Year Annual Incentive Program Guidelines

The Management Development and Compensation Committee (the “Compensation Committee”) of the Board of Directors of KB Home (the “Company”) has adopted guidelines for its use of negative discretion in determining actual payouts of 2012 fiscal year annual incentives to the Company’s executive officers, as described below.

Overview of 2012 Fiscal Year Annual Incentive Program. In accordance with the terms of the Company’s stockholder-approved Annual Incentive Plan for Executive Officers, the Compensation Committee has determined that each executive officer of the Company is eligible for an annual incentive for the Company’s 2012 fiscal year if at least one of three independent objective performance goals is achieved in the year, subject to the Compensation Committee’s discretion to reduce, but not increase (“negative discretion”) the actual payout of any annual incentive based on its subjective evaluation of the Company’s overall performance and each executive officer’s individual performance.

The applicable independent objective performance goals are (a) a specified pretax result, excluding inventory impairments and other non-recurring extraordinary items; (b) a specified level of homes delivered; and (c) a specified ratio of selling, general and administrative expenses to housing revenues. Each of these performance goals is to be determined in accordance with generally accepted accounting principles (as applicable), and is considered to be substantially uncertain to be met.

Negative Discretion Guidelines. The Compensation Committee has decided that it will follow the guidelines below in its use of negative discretion in determining actual payouts of 2012 fiscal year annual incentives to the Company’s executive officers.

| 1. | Performance Goal Weighting. All three of the applicable objective performance goals must be met for each executive officer to receive the officer’s full respective eligible 2012 fiscal year annual incentive payout amount (the “eligible amount”). For each applicable objective performance goal that is not met, each executive officer’s respective eligible amount will be reduced by one-third. In other words, each objective performance goal will determine an executive officer’s respective eligible amount as indicated in the bullets and the table below. |

| • | The “pretax result” performance goal will determine one-third of each executive officer’s respective eligible amount; |

| • | The “homes delivered” performance goal will determine one-third of each executive officer’s respective eligible amount; and |

| • | The “selling, general and administrative ratio” performance goal will determine one-third of each executive officer’s respective eligible amount. |

| Example: If an executive officer’s eligible amount is $300,000 and the Company achieves only one of the three applicable objective performance goals, the executive officer’s eligible amount would be reduced to $100,000. |

| 2. | Relative Total Stockholder Return Performance. Additionally, the Company’s 2012 fiscal year total stockholder return (“TSR”) performance relative to its peer group* will potentially reduce (or further reduce) each executive officer’s respective eligible amount as outlined below. |

| • | If the Company’s 2012 fiscal year TSR is in the top quartile of its peer group, there will be no reduction to an executive officer’s respective eligible amount as determined under 1 above (subject to the Compensation Committee’s discretion to reduce an executive officer’s actual 2012 annual incentive payout for other reasons, including the Company’s relative operating margin improvement as described below). |

| • | If the Company’s 2012 fiscal year TSR is in the second quartile of its peer group, each executive officer’s respective eligible amount will be reduced by 5% from the eligible amount determined under 1 above. |

| • | If the Company’s 2012 fiscal year TSR is in the third quartile of its peer group, each executive officer’s respective eligible amount will be reduced by 10% from the eligible amount determined under 1 above. |

| • | If the Company’s 2012 fiscal year TSR is in the bottom quartile of its peer group, each executive officer’s respective eligible amount will be reduced by 15% from the eligible amount determined under 1 above. |

| 3. | Relative Operating Margin Improvement. Further, the degree to which the Company’s fiscal year operating margin improves from the prior fiscal year in percentage points relative to its peer group will potentially reduce (or further reduce) each executive officer’s respective eligible amount as outlined below. |

| • | If the Company’s 2012 fiscal year operating margin improvement is in the top quartile of its peer group, there will be no reduction to an executive officer’s respective eligible amount as determined under 1 above (subject to the Compensation Committee’s discretion to reduce an executive officer’s actual 2012 annual incentive payout for other reasons, including the Company’s relative TSR performance as described above). |

| • | If the Company’s 2012 fiscal year operating margin improvement is in the second quartile of its peer group, each executive officer’s respective eligible amount will be reduced by 5% from the eligible amount determined under 1 above. |

| • | If the Company’s 2012 fiscal year operating margin improvement is in the third quartile of its peer group, each executive officer’s respective eligible amount will be reduced by 10% from the eligible amount determined under 1 above. |

| • | If the Company’s 2012 fiscal year operating margin improvement is in the bottom quartile of its peer group, each executive officer’s respective eligible amount will be reduced by 15% from the eligible amount determined under 1 above. |

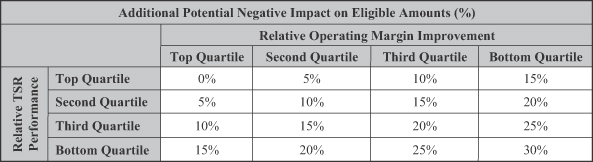

The additional potential negative impact on the Company’s executive officers’ respective eligible amounts from the above-described relative TSR performance and operating margin improvement items will be added together in the manner shown below.

Example: If an executive officer’s eligible amount is $300,000 and the Company achieves only one of the three applicable objective performance goals, the executive officer’s eligible amount would be reduced to $100,000. In addition, if the relative TSR performance and operating margin improvement items are each in the third quartile, the executive officer’s eligible amount would be further reduced to $80,000.

| * | As disclosed in the Company’s proxy statement for its 2012 Annual Meeting of Stockholders, the Company’s peer group consists of the following 12 homebuilding companies: |

| • Beazer Homes |

• DR Horton |

• Hovnanian Enterprises | ||

| • Lennar Corporation |

• MDC Holdings |

• M/I Homes | ||

| • Meritage Homes Corp. |

• NVR Incorporated |

• PulteGroup Inc. | ||

| • Ryland Group |

• Standard Pacific |

• Toll Brothers |

In addition, the Compensation Committee will, to the extent it deems appropriate, based on its subjective evaluation of the Company’s overall performance and each executive officer’s individual performance, apply negative discretion to further reduce actual payouts of 2012 annual incentives to the Company’s executive officers below the respective eligible amounts resulting from the Compensation Committee’s application of the above guidelines.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: April 5, 2012

| KB Home | ||

| By: | /s/ THOMAS F. NORTON | |

| Thomas F. Norton | ||