Attached files

| file | filename |

|---|---|

| EX-32.1 - CERTIFICATION - GSP-2, INC. | f10k2011a1ex32i_gsp2.htm |

| EX-31.1 - CERTIFICATION - GSP-2, INC. | f10k2011a1ex31i_gsp2.htm |

| EX-31.2 - CERTIFICATION - GSP-2, INC. | f10k2011a1ex31ii_gsp2.htm |

| EXCEL - IDEA: XBRL DOCUMENT - GSP-2, INC. | Financial_Report.xls |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K /A

(Mark One)

x ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2011

o TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________to ___________

Commission File No. 000-27195

GSP-2, INC.

(Name of small business issuer in its charter)

|

Nevada

|

27-3120288

|

|

|

(State or other jurisdiction of

|

(IRS Employer Identification No.)

|

|

|

incorporation or organization)

|

||

|

Gongzhuling State Agriculture Science and Technology Park, location of 998 kilometers, Line 102,

Gongzhuling city, Jilin province, China

|

||

|

(Address of principal executive offices)

|

(Zip Code)

|

+86-434-627-8415

(Registrant’s telephone number, including area code)

Securities registered under Section 12(b) of the Exchange Act:

|

Title of each class registered:

|

Name of each exchange on which registered:

|

|

|

None

|

None

|

Securities registered under Section 12(g) of the Exchange Act:

Common Stock, $0.001 par value

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yeso Nox

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yeso Nox

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yeso Noo

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yesx Noo

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference Part III of this Form 10-K or any amendment to this Form 10-K. [x]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

o

|

Accelerated filer

|

o

|

|

Non-accelerated filer

|

o

|

Smaller reporting company

|

x

|

|

(Do not check if a smaller reporting company)

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes o No x

As of March 30, 2012, the registrant had 14,208,880 shares of its common stock outstanding.

Documents Incorporated by Reference: None.

TABLE OF CONTENTS

|

PAGE

|

|||||

|

PART I

|

|||||

|

ITEM 1.

|

2 | ||||

|

ITEM 1A.

|

12 | ||||

|

ITEM 2.

|

20 | ||||

|

ITEM 3.

|

20 | ||||

|

ITEM 4.

|

20 | ||||

|

PART II

|

|||||

|

ITEM 5.

|

21 | ||||

|

ITEM 6.

|

21 | ||||

|

ITEM 7.

|

21 | ||||

|

ITEM 7A.

|

32 | ||||

|

ITEM 8.

|

F- | ||||

|

PART III

|

|||||

|

ITEM 9.

|

33 | ||||

|

ITEM 9A.

|

33 | ||||

|

ITEM 10.

|

34 | ||||

|

ITEM 11.

|

36 | ||||

|

ITEM 12.

|

39 | ||||

|

ITEM 13.

|

40 | ||||

|

ITEM 14.

|

41 | ||||

|

PART IV

|

|||||

|

ITEM 15.

|

41 | ||||

|

SIGNATURES

|

43 | ||||

Unless specifically noted otherwise, this Annual Report on Form 10-K (this “Report”) reflects the business and operations of GSP-2, Inc., a Nevada corporation, after the reverse acquisition of Shiny Gold Limited, a British Virgin Islands company (“Shiny Gold”), which was completed on February 11, 2011 (the “Share Exchange”). For a more complete discussion of the Share Exchange and the business and operations of Shiny Gold, please see our Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on February 11, 2011.

USE OF CERTAIN DEFINED TERMS

Except as otherwise indicated by references in this Report to “we,” “us,” “our,” “our Company,” or “the Company” are to the combined businesses of GSP-2, Inc. and its consolidated subsidiaries. In addition, unless the context otherwise requires and for the purposes of this Report only:

|

●

|

“GSP-2” refers to GSP-2, Inc., a Nevada company;

|

|

●

|

“Exchange Act” refers to the Securities Exchange Act of 1934, as amended;

|

|

●

|

“Heng Chang HK” refers to Heng Chang HK Produce (HK) Investments, Ltd., a Hong Kong company;

|

|

●

|

“Hengchang Agriculture” refers to Jilin Hengchang Agriculture Development Co., Ltd., a PRC company;

|

|

●

|

“Hengchang Business Consultants” refers to Siping Hengchang Business Consultants Co., Ltd., a PRC company;

|

|

●

|

“Hengjiu” refers to Jilin Hengjiu Grain Purchase and Storage Co., Ltd., a PRC company;

|

|

●

|

“Operating Companies” refers to Hengchang Agriculture and Hengjiu;

|

|

●

|

“PRC” refers to the People’s Republic of China; and

|

|

●

|

“Securities Act” refers to the Securities Act of 1933, as amended; and

|

|

●

|

“Shiny Gold” refers to Shiny Gold Holdings Limited, a British Virgin Islands company.

|

FORWARD-LOOKING STATEMENTS

Certain information included in this Report or in other materials we have filed or will file with the SEC (as well as information included in oral statements or other written statements made or to be made by us) contains or may contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934. You can identify these statements by the fact that they do not relate to matters of strictly historical or factual nature and generally discuss or relate to estimates or other expectations regarding future events. They contain words such as “anticipate,” “estimate,” “expect,” “project,” “intend,” “plan,” “believe,” “may,” “can,” “could,” “might,” “should” and other words or phrases of similar meaning in connection with any discussion of future operating or financial performance. Such statements may include, but are not limited to, information related to: anticipated operating results; consumer demand; financial resources and condition; changes in revenues; changes in profitability; changes in margins; changes in accounting treatment; cost of revenues; selling, general and administrative expenses; interest expense; growth and expansion; anticipated income or benefits to be realized from our investments in unconsolidated entities; the ability to produce the liquidity and capital necessary to expand and take advantage of opportunities; legal proceedings and claims.

From time to time, forward-looking statements also are included in other periodic reports on Forms 10-Q and 8-K, in press releases, in presentations, on our website and in other materials released to the public. Any or all of the forward-looking statements included in this Report and in any other reports or public statements made by us are not guarantees of future performance and may turn out to be inaccurate. This can occur as a result of incorrect assumptions or as a consequence of known or unknown risks and uncertainties. Many factors mentioned in this Report or in other reports or public statements made by us, such as government regulation and the competitive environment, will be important in determining our future performance. Consequently, actual results may differ materially from those that might be anticipated from our forward-looking statements.

Forward-looking statements speak only as of the date they are made. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise.

1

PART I

|

ITEM 1.

|

BUSINESS.

|

We were incorporated in the State of Nevada on December 31, 2009 as a blank check development stage company formed for the purpose of acquiring an operating business, through a merger, stock exchange, asset acquisition or similar business combination. Prior to the reverse acquisition of Shiny Gold on February 11, 2011, we made no efforts to identify a possible business combination and had not previously conducted negotiations or entered into a letter of intent concerning any target business.

Acquisition of Shiny Gold Limited

On February 11, 2011, we completed the reverse acquisition of Shiny Gold through the Share Exchange whereby we acquired all of the issued and outstanding ordinary shares of Shiny Gold in exchange for 12,800,000 shares of our common stock, par value $0.001 per share, which shares constituted approximately 92.8% of our issued and outstanding shares, as of and immediately after the consummation of the Share Exchange. As a result of the Share Exchange, Shiny Gold became our wholly owned subsidiary and the former shareholders of Shiny Gold became our controlling stockholders. The share exchange transaction with Shiny Gold was treated as a reverse acquisition, with Shiny Gold as the acquirer and the Company as the acquired party.

Upon the closing of the Share Exchange, Peter Goldstein, our then sole officer, resigned from all offices that he held. In addition, Mr. Goldstein resigned from his position as our sole director. Upon the closing of the reverse acquisition, our Board of Directors appointed Yushan Wei to fill the vacancy created by the resignation of Mr. Goldstein. In addition, our Board of Directors appointed Yushan Wei to serve as our President and Chief Executive Officer and Yufeng Wei as our Chief Operating Officer.

Current Operations

As a result of the Share Exchange, the Company is now a China-based agriculture company which engages in research and genetic development of corn seed, cultivation, production, purchasing, storage, and distribution of corn and other agriculture products. The Company sells high quality agricultural products as raw materials for commercial livestock feed and other renewable energy uses. We plan to change our name to more accurately reflect our new business operations at some point in the future.

We believe that we have developed a unique model for the Chinese agricultural industry. As Chinese governmental policies place more restrictions on the people of China to reduce the size of their families, there are less people to farm the agricultural crops. The Company’s business model is designed to vertically integrate and manage integral aspects of the agricultural process as a producer, processor, marketer and distributor of agricultural products. The Company engages in research, and genetic development of the seed used for growing corn. The Company sells corn seed to local seed distributors that in turn sell to the local provincial farmers, and provides a full service facility for the farmer when the corn is fully grown and harvested. The Company’s state of the art facilities purchase, separate, store and distribute corn products for the farmers. The Company also intends to plant and harvest our own land through land use rights that we intend to acquire with the proceeds from a future financing. The Company serves our well established customer base in Jilin province with its 180 employees. With additional funding, the Company anticipates the acquisition of additional land rights, farming equipment, storage facilities and additional distribution facilities.

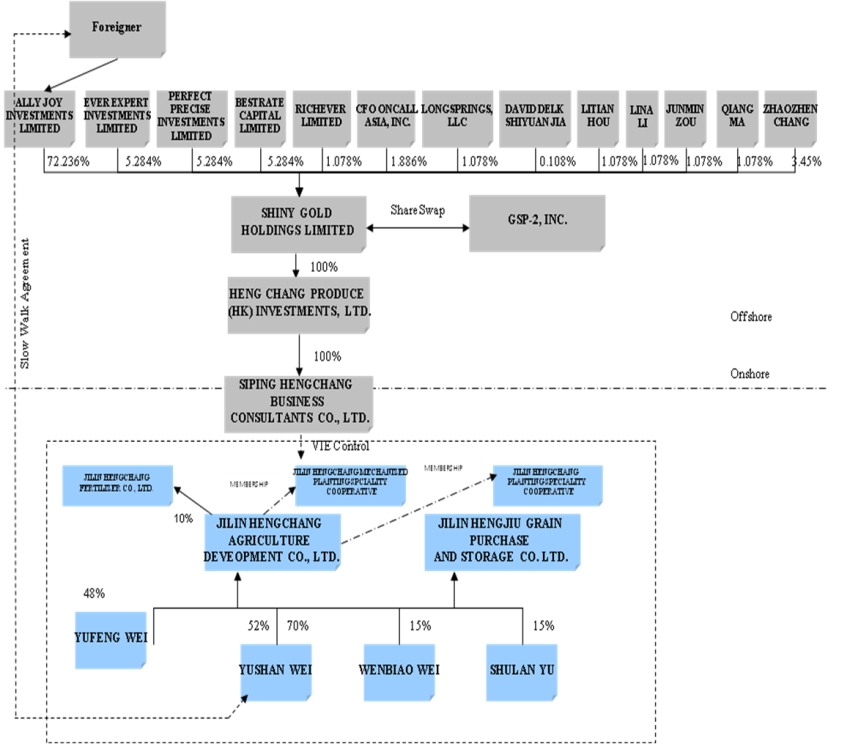

Corporate Structure

We own all of the ordinary shares of Shiny Gold. Shiny Gold was formed under the laws of the British Virgin Islands on May 20, 2010. Shiny Gold owns all of the share capital of Heng Chang HK. Heng Chang HK owns all of the share capital of Hengchang Business Consultants, a wholly foreign owned enterprise located in the PRC. On February 10, 2011, Hengchang Business Consultants entered into a series of agreements (the “Contractual Arrangements”) with each of Hengchang Agriculture and Hengjiu (together, the “Operating Companies”) and their respective shareholders. Other than the parties thereto, the material terms and conditions of the Contractual Arrangements entered into with Hengchang Agriculture and the terms and conditions of the Contractual Arrangements with Hengjiu are the same. The following is a summary of each of the Contractual Arrangements:

|

●

|

Exclusive Business Cooperation Agreement. Pursuant to the exclusive business cooperation agreement between Hengchang Business Consultants and the Operating Companies (the “Business Cooperation Agreement”), Hengchang Business Consultants has the exclusive right to provide to the Operating Companies general business operation services, including advice and strategic planning, as well as consulting services related to technology, research and development, human resources, marketing and other services deemed necessary (collectively, the “Services”). Under the Business Cooperation Agreement, Hengchang Business Consultants has exclusive and proprietary rights and interests in all rights, ownership, interests and intellectual properties arising out of or created during the performance of the Business Cooperation Agreement, including but not limited to copyrights, patents, patent applications, software and trade secrets. The Operating Companies shall pay to Hengchang Business Consultants a monthly consulting service fee (the “Service Fee”) in Renminbi that is equal to 100% of the monthly net income to the Operating Companies. Upon the prior written consent by Hengchang Business Consultants, the rate of Service Fee may be adjusted pursuant to the operational needs of the Operating Companies. Within ninety (90) days after the end of each fiscal year, the Operating Companies shall (a) deliver to Hengchang Business Consultants financial statements of the Operating Companies for such fiscal year, which shall be audited and certified by an independent certified public accountant approved by Hengchang Business Consultants, and (b) pay an amount to Hengchang Business Consultants equal to the shortfall, if any, of the aggregate net income of the Operating Companies for such fiscal year, as shown in such audited financial statements, as compared to the aggregate amount of the Monthly Payments paid by the Operating Companies to Hengchang Business Consultants in such fiscal year. Unless earlier terminated in accordance with the provisions of the Business Cooperation Agreement or other agreements separately executed between Hengchang Business Consultants and the Operating Companies, the Business Cooperation Agreement expires on February 10, 2021; however, the term of the Business Cooperation Agreement may be extended if confirmed in writing by Hengchang Business Consultants prior to the expiration of the term thereof. The period of the extended term shall be determined exclusively by Hengchang Business Consultants and the Operating Companies shall accept such extended term unconditionally. Unless Hengchang Business Consultants commits gross negligence, or a fraudulent act, against the Operating Companies, the Operating Companies shall not terminate the Business Cooperation Agreement prior to the expiration of the term, including any extended term. Notwithstanding the foregoing, Hengchang Business Consultants shall have the right to terminate the Business Cooperation Agreement at any time upon giving 30 days' prior written notice to the Operating Companies. Shareholders’ Equity Interest Pledge Agreement. In order to guarantee the Operating Companies’ performance of its respective obligations under the Exclusive Business Cooperation Agreement, the Operating Companies’ Shareholders and Hengchang Business Consultants entered into an equity interest pledge agreement (the “Pledge Agreement”), pursuant to which the Operating Companies’ shareholders pledged all of their equity interest in the Operating Companies to Hengchang Business Consultants. If the Operating Companies or the Operating Companies’ shareholders breach their respective contractual obligations, Hengchang Business Consultants, as pledgee, will be entitled to exercise certain rights, including the right to sell the pledged equity interests. Upon the full payment of the Service Fee under the Business Cooperation Agreement and upon the termination of the Operating Companies’ obligations thereunder, the Pledge Agreement shall be terminated.

|

2

|

●

|

Exclusive Option Agreement. Under the exclusive option agreement between the Operating Companies, the Operating Companies’ Shareholders and Hengchang Business Consultants (the “Option Agreement”), the Operating Companies’ Shareholders have irrevocably granted Hengchang Business Consultants or its designee the irrevocable and exclusive right to purchase, to the extent permitted under PRC law, all or any part of the equity interests in the Operating Companies (the "Equity Interest Purchase Option") for RMB 10. If an appraisal is required by PRC laws at the time when and if Hengchang Business Consultants exercises the Equity Interest Purchase Option, the parties shall negotiate in good faith and, based upon the appraisal, make a necessary adjustment to the purchase price so that it complies with any and all then applicable PRC laws. Pursuant to the Exclusive Option Agreement, the Operating Companies and the Operating Companies’ shareholders agree that, without the prior consent of Hengchang Business Consultants, they shall not in any manner supplement, change or amend the articles of association and bylaws of the Operating Companies, increase or decrease its registered capital, or change the structure of its registered capital in any other manner, shall not engage in any transactions that could materially affect the Operating Companies’ assets, liabilities, rights or operations, including, without limitation, the incurrence or assumption of any indebtedness except incurred in the ordinary course of business, execute any major contract over RMB 100,000, shall not sell or purchase any assets or rights, incur of any encumbrance on any of its assets or intellectual property rights in favor of a third party or transfer of any agreements relating to its business operation to any third party. The term of the Exclusive Option Agreement is ten years commencing on February 10, 2021 and may be extended at the sole election of JSJ.

|

Shiny Gold controls and receives the economic benefits of the Operating Companies’ business operations through the Contractual Arrangements, but does not own any equity interests in the Operating Companies. In addition, as a result of the Contractual Arrangements, the Operating Companies are deemed to be Shiny Gold’s variable interest entities and, accordingly, Shiny Gold consolidates the Operating Companies’ results, assets and liabilities into its financial statements.

3

DESCRIPTION OF BUSINESS

Overview

The Company is a China based agriculture company which engages in research and genetic development of corn seed, cultivation, production, purchasing, storage, and distribution of corn and other agriculture products. The Company sells high quality agricultural products as raw materials for commercial livestock feeding and other renewable energy uses.

The Company has developed a unique model for the Chinese agricultural industry. As Chinese governmental policies place more restrictions on the people of china to reduce the size of their families, there are less people to farm the agricultural crops. The Company’s business model is designed to vertically integrate and manage integral aspects of the agricultural process as a producer, processor, marketer and distributor of agricultural products. The Company engages in research, and genetic development of the seed used for growing corn. The Company sells the corn seed to a major local distributor that, in turn, sells to the local provincial farmers, and provides a full service facility for the farmers when the corn is fully grown and harvested. Their state of the art facilities purchase, separate, store and distribute the corn products for the farmers. The Company will also be planting and harvesting its own land through land use rights that they acquire with the proceeds from future financing. The Company serves its well established customer base in the Jilin province with its 180 employees. With additional funding, the Company anticipates the acquisition of additional land rights, farming equipment, storage facilities, and additional distribution facilities.

Our Corporate History and Background

We were incorporated in the State of Nevada on December 31, 2009 as a blank check development stage company formed for the purpose of acquiring an operating business, through a merger, stock exchange, asset acquisition or similar business combination. Prior to our reverse acquisition of Shiny Gold on February 11, 2011, we made no efforts to identify a possible business combination and had not previously conducted negotiations or entered into a letter of intent concerning any target business.

On February 11, 2011, we completed a reverse acquisition transaction through a share exchange with Shiny Gold whereby we acquired all of the issued and outstanding ordinary shares of Shiny Gold in exchange for 12,800,000 shares of our common stock, par value $0.001 per share, which shares constituted approximately 92.8% of our issued and outstanding shares, as of and immediately after the consummation of the reverse acquisition. As a result of the reverse acquisition, Shiny Gold became our wholly owned subsidiary and the former shareholders of Shiny Gold became our controlling stockholders. The share exchange transaction with Shiny Gold was treated as a reverse acquisition, with Shiny Gold as the acquirer and the Company as the acquired party. Unless the context suggests otherwise, when we refer in this report to business and financial information for periods prior to the consummation of the reverse acquisition, we are referring to the business and financial information of Shiny Gold and its respective consolidated subsidiaries.

Upon the closing of the reverse acquisition, Peter Goldstein, our then sole officer, resigned from all offices that he held. In addition, Mr. Goldstein resigned from his position as our sole director, effective immediately at the closing of the reverse acquisition.

Also upon the closing of the reverse acquisition, our board of directors appointed Yushan Wei to fill the vacancy created by the resignation of Mr. Goldstein, effective immediately at the closing of the reverse acquisition. In addition, our board of directors appointed Yushan Wei to serve as our President and Chief Executive Officer and Yufeng Wei as our Chief Operating Officer, effective immediately at the closing of the reverse acquisition.

As a result of our acquisition of Shiny Gold, Shiny Gold became our wholly owned subsidiary and we have assumed the business and operations of Shiny Gold and its subsidiaries. We plan to change our name in the future to more accurately reflect our new business operations.

Historical Sales & Income Summary

|

Fiscal Year Ended

December 31,

|

||||||||

|

($ in USD)

|

2011

|

2010

|

||||||

|

Revenue

|

$

|

86,870

|

$

|

59,321

|

||||

|

Gross Profit

|

20,184

|

15,975

|

||||||

|

Net Income

|

16,647

|

12,340

|

||||||

Corporate Structure

GSP-2, Inc. owns all of the Ordinary Shares of Shiny Gold. Shiny Gold was formed under the laws of the British Virgin Islands on May 20, 2010. Shiny Gold owns all of the share capital of Heng Chang HK. Heng Chang HK owns all of the share capital of Hengchang Business Consultants, a wholly foreign owned enterprise located in the PRC. On February 10, 2011, Hengchang Business Consultants entered into a series of agreements (the “Contractual Arrangements”)with each of the Operating Companies and their respective shareholders. Other than the parties thereto, the material terms and conditions of the Contractual Arrangements entered into with Hengchang Agriculture and the terms and conditions of the Contractual Arrangements with Hengjiu are the same. The following is a summary of each of the Contractual Arrangements:

4

|

●

|

Exclusive Business Cooperation Agreement. Pursuant to the exclusive business cooperation agreement between Hengchang Business Consultants and the Operating Companies (the “Business Cooperation Agreement”), Hengchang Business Consultants has the exclusive right to provide to the Operating Companies general business operation services, including advice and strategic planning, as well as consulting services related to technology, research and development, human resources, marketing and other services deemed necessary (collectively, the “Services”). Under the Business Cooperation Agreement, Hengchang Business Consultants has exclusive and proprietary rights and interests in all rights, ownership, interests and intellectual properties arising out of or created during the performance of the Business Cooperation Agreement, including but not limited to copyrights, patents, patent applications, software and trade secrets. The Operating Companies shall pay to Hengchang Business Consultants a monthly consulting service fee (the “Service Fee”) in Renminbi that is equal to 100% of the monthly net income to the Operating Companies. Upon the prior written consent by Hengchang Business Consultants, the rate of Service Fee may be adjusted pursuant to the operational needs of the Operating Companies. Within ninety (90) days after the end of each fiscal year, the Operating Companies shall (a) deliver to Hengchang Business Consultants financial statements of the Operating Companies for such fiscal year, which shall be audited and certified by an independent certified public accountant approved by Hengchang Business Consultants, and (b) pay an amount to Hengchang Business Consultants equal to the shortfall, if any, of the aggregate net income of the Operating Companies for such fiscal year, as shown in such audited financial statements, as compared to the aggregate amount of the Monthly Payments paid by the Operating Companies to Hengchang Business Consultants in such fiscal year. Unless earlier terminated in accordance with the provisions of the Business Cooperation Agreement or other agreements separately executed between Hengchang Business Consultants and the Operating Companies, the Business Cooperation Agreement expires on February 10, 2021; however, the term of the Business Cooperation Agreement may be extended if confirmed in writing by Hengchang Business Consultants prior to the expiration of the term thereof. The period of the extended term shall be determined exclusively by Hengchang Business Consultants and the Operating Companies shall accept such extended term unconditionally. Unless Hengchang Business Consultants commits gross negligence, or a fraudulent act, against the Operating Companies, the Operating Companies shall not terminate the Business Cooperation Agreement prior to the expiration of the term, including any extended term. Notwithstanding the foregoing, Hengchang Business Consultants shall have the right to terminate the Business Cooperation Agreement at any time upon giving 30 days' prior written notice to the Operating Companies. Shareholders’ Equity Interest Pledge Agreement. In order to guarantee the Operating Companies’ performance of its respective obligations under the Exclusive Business Cooperation Agreement, the Operating Companies’ Shareholders and Hengchang Business Consultants entered into an equity interest pledge agreement (the “Pledge Agreement”), pursuant to which the Operating Companies’ shareholders pledged all of their equity interest in the Operating Companies to Hengchang Business Consultants. If the Operating Companies or the Operating Companies’ shareholders breach their respective contractual obligations, Hengchang Business Consultants, as pledgee, will be entitled to exercise certain rights, including the right to sell the pledged equity interests. Upon the full payment of the Service Fee under the Business Cooperation Agreement and upon the termination of the Operating Companies’ obligations thereunder, the Pledge Agreement shall be terminated.

|

|

●

|

Exclusive Option Agreement. Under the exclusive option agreement between the Operating Companies, the Operating Companies’ Shareholders and Hengchang Business Consultants (the “Option Agreement”), the Operating Companies’ Shareholders have irrevocably granted Hengchang Business Consultants or its designee the irrevocable and exclusive right to purchase, to the extent permitted under PRC law, all or any part of the equity interests in the Operating Companies (the "Equity Interest Purchase Option") for RMB 10. If an appraisal is required by PRC laws at the time when and if Hengchang Business Consultants exercises the Equity Interest Purchase Option, the parties shall negotiate in good faith and, based upon the appraisal, make a necessary adjustment to the purchase price so that it complies with any and all then applicable PRC laws. Pursuant to the Exclusive Option Agreement, the Operating Companies and the Operating Companies’ shareholders agree that, without the prior consent of Hengchang Business Consultants, they shall not in any manner supplement, change or amend the articles of association and bylaws of the Operating Companies, increase or decrease its registered capital, or change the structure of its registered capital in any other manner, shall not engage in any transactions that could materially affect the Operating Companies’ assets, liabilities, rights or operations, including, without limitation, the incurrence or assumption of any indebtedness except incurred in the ordinary course of business, execute any major contract over RMB 100,000, shall not sell or purchase any assets or rights, incur of any encumbrance on any of its assets or intellectual property rights in favor of a third party or transfer of any agreements relating to its business operation to any third party. The term of the Exclusive Option Agreement is ten years commencing on February 10, 2021 and may be extended at the sole election of JSJ.

|

|

●

|

Power of Attorney. Under the power of attorney between the Operating Companies’ shareholders and Hengchang Business Consultants (the “Power of Attorney”), Hengchang Business Consultants has been granted an exclusive, irrevocable power of attorney to take actions in the place and stead of the Operating Companies’ shareholders, to act on behalf of the Operating Companies’ shareholders as their exclusive agent and attorney with respect to all matters concerning the Operating Companies’ shareholders’ equity interests in the Operating Companies, including without limitation, the right to: 1) attend shareholders' meetings of the Operating Companies; 2) exercise all the Operating Companies’ shareholders’ rights, including voting rights under PRC laws and the Operating Companies’ Articles of Association, including but not limited to the sale or transfer or pledge or disposition of the Operating Companies’ shareholders’ equity interests in the Operating Companies in whole or in part; and 3) designate and appoint on behalf of the Operating Companies’ shareholders the legal representative, executive director, supervisor, manager and other senior management of the Operating Companies.

|

Shiny Gold controls and receives the economic benefits of their business operations through the Contractual Arrangements, but does not own any equity interests in the Operating Companies. In addition, as a result of the Contractual Arrangements, the Operating Companies are deemed to be Shiny Gold’s variable interest entities and, accordingly, Shiny Gold consolidates the Operating Companies’ results, assets and liabilities into its financial statements.

Shiny Gold’s organizational structure was developed to permit the infusion of foreign capital under the laws of the PRC and to maintain an efficient tax structure, as well as to foster internal organizational efficiencies. The corporate structure of the Company as a result of the Share Exchange is as follows:

5

The corporate structure of the Company as a result of the Share Exchange is as follows:

Our Industry

China’s economy has grown rapidly in recent years making China one of the fastest growing economies in the world in 2011 (source: www.tradingeconomics.com). China’s agricultural industry has also grown significantly (source: China Economic Net), driven by the growth of the overall economy. According to the China Statistical Abstract, the increase in China’s agricultural production is the result of an increase in the consumption of food products such as crops and meat proteins for human and animal nutrition, as well as food products for industrial uses such as fuels and materials. However, while domestic productions have grown, it has not kept pace with consumption resulting in imports of many agricultural products such as corn.

Despite its recent rapid growth, the agricultural industry in China remains at an early stage of modernization, with significant manual labor and less usage of advanced machinery and irrigation than that of developed economies. The Chinese agricultural sector is primarily made up of small, family-oriented farms. In an effort to modernize and promote development of the agricultural industry in China, the Chinese government has provided substantial financial support to agricultural and related business through low interest loans, preferential tax treatments, financial subsidies and other measures (source: Ministry of Agriculture of the P.R.C.). In the mean time, Chinese farmers are increasingly using improved production techniques and products, including hybrid seeds.

Corn

Increasingly, corn is becoming an important crop in China because it has a number of uses, including the use as livestock feed, source of industrial products and a source of fuel in the form of ethanol.

6

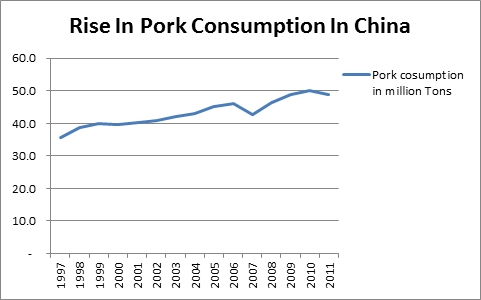

China is the world’s second largest corn producer after the United States (source: U.S. Department of Agriculture). Coincident with the growth of its economy and the agricultural industry, corn production in China has grown at a rate more than twice the growth rate of the United States. Corn is used primarily as animal feed particularly for chickens and pigs as well as food for human consumption. According to the China National Grain and Oil Information Center, almost three quarters of China’s total corn production was used to produce animal feed and 20% was used to produce ethanol, and the other 5% was used for human consumption.

The increasing demand for corn in China has been partially driven by the increasing demand for animal feed, which in turn has been driven by the significant growth in meat consumption as a result of the recent rapid growth in per capita disposable income in China (source:USA Today). For more than two decades, China was one of the world’s largest net corn exporting countries (source: AgDM newsletter article “ Is China about to Drop out of the Corn Export Market?”) . However, due to the rapid increase on domestic demand for corn in China, China now exports significantly less corn than it used to and its imports of corn have increased considerably.

We believe production and demand for corn are likely to continue to rise as Chinas economy further develops, driven by increasing demands across all major uses of corn. Given limitations on land available for corn production, we believe use of hybrid corn seeds that can produce corn with characteristics such as high yielding drought or pest resistant or high oil content is also likely to continue to increase. As competition for suitable land in China for other crops continues while demand for corn increases, Chinese farmers may be inclined to utilize better production methods to increase yields and improve the quality and attributes of their corn products. However, there is no guarantee that the production and demand for corn or hybrid corn will grow or increase as we anticipate. We believe that the relatively low corn consumption per capita in China coupled with the rapid increase in domestic demand for corn demonstrates significant potential for China’s corn market to further grow.

Corn Seed

The Chinese agricultural seed industry is fragmented, with the corn seed market in particular being served by approximately 5,000 small, local seed suppliers. Most of these seed companies were established in the 1960s and 1970s by local county governments to address Chinese central government agricultural initiatives. They were designed at the time to provide service and support to local farmers. These local seed providers usually sell varieties of agricultural seeds that have been grown in their respective locales for years. Improved seed products have been generally available in China through large multinational suppliers, the largest being Pioneer Hi-Bred International, Inc., or Pioneer, Monsanto Company, or Monsanto, and Syngenta AG, or Syngenta, each of which established operations in China more than a decade ago.

The average lifespan of a typical product in our industry is five to seven years. After this period, the product begins to lose potency and develops material genetic weaknesses that make the product significantly less attractive in the marketplace. New hybrids are approved every year and the speed at which technology changes is driven by the amount of high quality hybrids produced in the local region for the local seed type. One product may dominate a particular region for a three to five year time period, and then dominance may shift depending on the available seeds for the local soil types.

Participation in the crop seed business is a highly regulated activity in the PRC. In July 2000, China enacted its Seed Law, which became effective on December 1, 2000. The Seed Law was revised in August 2004. The Seed Law sets forth provisions concerning the development, government approval, production, and distribution of crop seeds. Various provinces have enacted regulations to implement the Seed Law.

Under the Seed Law, for a company to engage in the seed business, it must obtain two licenses. One is the production license, which is issued at the provincial level, entitling the holder to engage in seed production in that province. The production license specifies the types of seeds that may be produced, the location of the production of the seeds, and the term of the production license. The second is a license to distribute seeds. Generally, a distribution license is issued by the government at the county level or above. A seed company must obtain a provincial-level license to distribute major crop seeds in that province. In addition, a national level license is necessary for a seed company to distribute seeds nationwide. Among other standards, the amount of the licensee’s registered capital determines if the distribution license is issued at the national or local level, along the following lines:

|

●

|

to obtain a national distribution license, the licensee must have a registered capital of at least RMB30 million (approximately US$4,418,327);

|

|

|

●

|

to obtain a provincial license to distribute hybrid seed varieties, the licensee must have a registered capital of at least RMB5 million (approximately US$736,388); and

|

|

|

●

|

to obtain a provincial license to distribute non-hybrid seed varieties, the licensee must have a registered capital of at least RMB1 million (approximately US$147,278).

|

We have a provincial hybrid seed distribution license, which entitles us to sell major crop seeds in Jilin province in the PRC. Our general business license includes provincial hybrid seed distribution as a part of our permissible operating items. As such, we are not required to obtain a separate license for our seed distribution business.

7

Our Products

We purchase, store and sell corn and corn seed in China. We currently have the capacity to purchase and store up to 350,000 tons of corn and corn seeds on an annual basis. With respect to our corn business, we purchase fresh corn from farmers during early November of each calendar year. We dry the corn purchased, since such corn contains high moisture level, and turn the corn into easy-to-store dry corn. After the drying process, the corn contains a safe moisture level and we are able to store the dry corn in our warehouse. The purchasing and drying process generally continues through August. The majority of the dry corn is sold to provincial granaries as food reserve in the Guangxi autonomous area, with the rest being sold to companies in the animal feed industry.

We also breed hybrid corn seeds through seed breeders. We provide the parent seed combinations to the seed breeder and the seed breeder is responsible for breeding the seeds in accordance with a set of hybrid corn seed production process. Harvested seeds are shipped to us from the seed breeder at harvest. We sell the corn seeds to our customers. A significant portion of our corn seeds is sold to Defeng Seed Co., Ltd. with the rest being sold to local distributors who in turn sell to local farmers.

Corn

We purchase, store and sell corn. We purchase almost all of our corn in Jiling province from local farmers and sell approximately 89% of our corn product to Nanning Granary Reserve and Liuzhou Granary Reserve in Guangxi province. Our corn product is primarily used for commercial livestock feed, and a small portion of our corn products are used for renewable energy uses and raw materials for corn starch.

Corn Seed

Our corn seed products are not genetically modified. The chart below provides selected summary information about our primary corn seed products:

|

Name

|

Resistance

|

Lodging resistance

|

Resistance in corn inbred lines

|

Density

|

Accumulated temperature

|

Crop quality

|

Plant height

|

Yield

|

Axial color

|

|

Defeng 359

|

Strong

|

Strong

|

Highly resistance

|

60-65 thousand plants/ha.

|

2550-2650℃

|

Fine

|

2.78m

|

11.5 thousand kilos/ha.

|

Red

|

|

Hongyu

29

|

Strong

|

Strong

|

Highly resistance

|

60-65 thousand plants/ha.

|

2700℃

|

Fine

|

2.85m

|

12.5 thousand/ha.

|

Red

|

|

Defeng 10

|

Medium

|

Medium

|

Mid resistance

|

60 thousand plants/ha.

|

2700℃

|

General

|

2.79 m

|

11 thousand kilos/ha.

|

Red

|

|

Defeng 77

|

Medium

|

Medium

|

Mid resistance

|

60 thousand plants/ha.

|

2700℃

|

General

|

2.85 m

|

11 thousand kilos/ha.

|

Red

|

Defeng Seed Co., Ltd. (“Defeng”) has the production and planting rights of all four of our products. The four seeds have passed the examination and obtained approval from the Jilin Crop Variety Examination and Approval Committee. The four seeds have been widely planted in three northeastern provinces and in certain areas in Inner Mongolia. Through contractual arrangements, we have joint use rights to Defeng 359 and Hongyu 29 with Defeng. Under the joint use right agreements, we paid Defeng a total of 3.0 million RMB (approximately $463,000) and Defeng provides us with parent seeds and the technical support to enable us to breed the seeds for commercial resale. Defeng also granted us the breeding rights to Defeng 10 and Defeng 77 through non contractual agreements. We are allowed to breed, operate and sell the four seed varieties. In 2011, we contracted a seed producer in Xinjiang provinces to cultivate seeds for us and we purchase seeds from them at harvest. Each of our seed products has an average selling price of RMB18.6 ($2.9) per kilogram. We sell our seed products to local seed distributors in Jilin province. Besides Defeng, we believe we are the primary grower and distributor of the four seed varieties in Jilin province. Defeng 359, Hongyu 29, Defeng 10 and Defeng 77 accounted for approximately 32%, 21%, 16% and 30%, respectively, of our current annual seed sales volume.

8

Source: China Food Web, www.foodchina.com

Percentage of total China corn production by area:

1: Northern spring planting corn area: 40%

2: Yellow River Plain spring and summer planting corn area: 34%

3: Southwestern mountain and hill corn area: 18%

4: Southern mountain hill corn area: 4%

5. Northwestern inland corn area: 3%

6. Qinghai-Tibet plateau corn area: less than 1%

Percentage of total planting acreage by area:

1: Northern spring planting corn area: 36%

2: Yellow River Plain spring and summer planting corn area: 32%

3: Southwestern mountain and hill corn area: 22%

4: Southern mountain hill corn area: 6%

5. Northwestern inland corn area: 3.5%

6. Qinghai-Tibet plateau corn area: less than 1%

Our general business license includes the permission to distribute crop seeds through whole sale and/or retail channels in Jilin province. We also have a provincial seed license, which entitles us to sell major crop seeds as a crop seed broker to distribute in Jilin province in the PRC. Our seed license is valid through December 31, 2012. To renew our seed license, we are required to maintain a registered capital of at least RMB 5 million (approximately US$736,388) and the renewal fee and miscellaneous costs are less than US$100. We are currently applying for the national seed production and distribution license. The national seed production and distribution license will allow us to develop and breed new crop seeds, produce and distribute crop seeds through the P.R.C. We are required to have a registered capital of at least RMB 30 million (approximately US$4,418,328) and minimal of RMB 10 million (US$1,472,776) in fixed assets. We are also required to have a sales store no less than 500 square meters and at least five seed laboratory technicians, storage and production technicians. The related application and miscellaneous costs are less than US$1,000. We expect to meet all the requirements for the national seed production and distribution license and obtain the license by December 31, 2012.

The corn seeding process generally starts in April and lasts through late September each year. The corn seeds are harvested in October and the seed breeders start reaping corn seeds at that time. Corn seeds are then transported to our headquarters in Jilin province and we start to sell them to seed distributors in Jilin in late November every year. After the distributors purchase corn seeds from us, they typically package the seeds into small bags and sell to local farmers for the coming corn growing season which starts in May. Seed distributors need to have corn seeds packaged and in stock before local farmers start buying seeds after the Chinese New Year (generally in early February). As such, a majority of our corn seed revenue is concentrated in November and December of each calendar year.

Customers

Three customers accounted for approximately 87% and 94%, respectively, of our revenue during the years ended December 31, 2011 and 2010 respectively, All of our customers are located in the PRC. Our major customers are granary reserves in the Guangxi province and a seed company in Jinlin province. Below is a list of our largest customers:

9

|

●

|

Guangxi Nanning Granary Reserve;

|

|

|

●

|

Guangxi Liuzhou Granary Reserve; and

|

|

|

●

|

Jilin Defeng Seed Co. Ltd.

|

Guangxi Nanning Granary Reserve and Guangxi Liuzhou Granary Reserve accounted for approximately 89% of our total corn sales. Our contracts with Guangxi Nanning Granary Reserve provides for us to receive a payment when the products are delivered. Our contracts with Guangxi Liuzhou Granary Reserve generally require Guangxi Liuzhou Granary Reserve to make 50% of prepayments prior to the products are delivered. Jilin Defeng Seed Co. Ltd. (“Defeng”) accounted for approximately 83% of our total seed sales and Defeng is required to make payments when Defeng sells the seeds. No other customer accounted for more than 10% of our sales.

Suppliers

Two suppliers accounted for approximately 31% of our purchases during the year ended December 31, 2011. We did not have any supplier who accounted for more than 10% of our total purchase during the year ended December 31, 2010. Prior to December 31, 2010, we primarily purchased our corn directly from local farmers and small local brokers. In 2011, as the demand for our corn product continues to grow, we secured purchase agreements with large companies and brokers in Jilin province to ensure we can meet our customers’ demand. We also purchased our corn seed products from a seed producer we contracted to produce seeds for us in Xinjiang. Below is a list of our largest suppliers:

|

●

|

Gongzhuling Jinyu Grain Purchase and Storage Co., Ltd.;

|

|

|

●

|

Niu Miao (seed producer)

|

Our purchase agreements generally require us to make a certain amount of prepayments prior to the products being delivered to us. No other suppliers accounted for more than 10% of our purchases in 2011.

Research & Development

We believe that our future success depends on our ability to provide high quality and advanced products to our customers. We currently do not have a dedicated research team in-house. We conduct research and development in cooperation with the Corn Research Institute at Jilin Academy of Agricultural Sciences (“Jilin Academy”). On March 1, 2011, we entered into an agreement with Jilin Academy regarding seed research and development. Under the agreement with Jilin Academy, we agree to utilize Academy’s nationally recognized corn and sorghum seed experts and senior technicians to conduct research and development activities on various seed varieties. We will provide financial incentives to Jilin Academy when new crop seeds are approved by national or provincial governmental authorities. For every new crop variety approved at the national level, we will provide 300,000 RMB (approximately $47,000) to Jilin Academy, and for every new crop variety approved at the provincial level, we will provide 200,000 RMB (approximately $31,000) to Jilin Academy as incentives. We will have the primary commercial rights to the crop seeds developed by Jilin Academy under the agreement and Jilin Academy will receive royalty payments when we start to sell the crop seeds. We will pay Jilin Academy 0.2 RMB for every 500 gram crop seeds (approximately $31 for every 500 kilograms) we sell that are developed by Jilin Academy as the royalty payment. If the sales for the crop seeds reaches three million kilograms, we shall pay Jilin Academy additional 500,000 RMB (approximately $78,000). If the accumulated sale for the crop seeds reaches 5.5 million kilograms, we shall pay Jilin Academy another 500,000 RMB (approximately $78,000). When the accumulated sale for the crop seeds reaches 7.5 million kilograms, we shall pay Jilin Academy an additional 500,000 RMB (approximately $78,000).

We are currently developing a new corn seed variety, under the tentative name Hengyu 218. The research and development process includes four stages: nurturing and selection, review and test approval, area test, and final approval. The entire process takes approximately three-four years and the estimated cost for the project is approximately 8 million RMB (approximately $1.2 million). The primary researcher is an independent individual who resides in Jilin; we have not signed a formal research and development agreement with him and the project arrangements are made through oral agreements. The project is currently at the initial nurturing and selection stage. The researcher will be in charge of making progress and we will provide capital to the project in according to the project progress. Our capital investment on this project currently is insignificant. We estimate the selling price for Hengyu 218 will be 16 RMB (approximately $2.5) per kilogram once it is approved.

Intellectual Property

Many elements of our proprietary information, such as production processes, technologies, know-how and data are not patentable in China. We rely primarily on a combination of trade secrets, trademarks, and confidentiality agreements with employees and third parties to protect our intellectual property.

10

Growth Strategy

We anticipate growing our business through the acquisition of additional land use rights, cultivation of that land, and modernization of farming techniques. We have recently obtained approximately 7,400 acres of farming land use right and expect to begin cultivating and farming the land in the summer of 2012. This will produce approximately 30, 000 tons of corn. Our state of the art facilities are set up to separate, store and distribute the corn products for us and the local farmers. This unique operating process facilitates the sales of the seeds all the way through to the distribution and sales of the harvested corn. Additional growth strategy for us is in our acquisition of land use rights. We anticipate acquiring 17,000 additional land use acreage rights by end of 2013 but have not yet entered into any agreements to acquire this land. With us reaching our ultimate goal to cultivate and harvest more than 50,000 acres of corn by 2015, we will more than double our current volume, and with the increase in efficiency we expect we will continue to increase our profits. However, there is no guarantee that we will be able to achieve such land acquisitions as well as no guarantee that we will achieve the volume, efficiency or profit growth goals that we anticipate above.

We formed two agricultural cooperative associations with several other individuals in 2011. Being a founding member of the cooperative associations will enable us to have direct access to farmer members’ crop products, and obtain the crop products at a better price which in turn will allow us to enjoy higher profit margin. We will also be able to distribute our seed products directly to farmer members. Through the agricultural cooperative associations, our farmer members will be able to purchase seeds from us at a lower than market price while we are able to sell our seeds to the members at a price higher than we sell to distributors.

In addition, our growth strategy also includes plans for the acquisition of land use rights. We anticipate leasing up to 17,000 land use acreage rights by end of 2013, with us reaching our ultimate goal to control the cultivation and harvesting of more than 50,000 acres by 2015. We have recently signed two 16 years land lease agreements to lease 3000 hectare (approximately 7,413 acres) of corn paddy field and 200 hectare (approximately 494 acres) of rice paddy field. We plan to grow corn and rice on our own on the land we lease using the mechanized growing technology. We will engage qualified and experienced farming professionals to manage the cultivation process for us. We believe the strategy will streamline the corn and rice growing process and help to reduce the growing costs and better control quality of the crops that we grow as we will be able to enjoy the economy of scale and utilize the in house technicians and experts we have to provide crop quality monitoring and control. We believe once we reach our goal of controlling more than 50,000 acres by 2015, we will be able to substantially increase our current sales volume. However, there is no assurance that we will able to secure land use rights for the acreage we plan to obtain, and no guarantee that we will be able to substantially increase our current sales volume.

Marketing and Customer Support

Our product marketing and our customer support are closely linked. The company supplies its seed products to local distributors in Jilin. Distributors then sell the seed products purchased from us to over 100,000 farmers in the Jilin, Liaoning and Heilongjiang provinces. The three provinces are in proximity to each other. We assign 120 agents to the Jilin province, 42 in Liaoning province and 86 in Heilongjiang province to provide technical and customer supports.

Competition

The agricultural industry in China is highly fragmented, largely regional and competitive. We do expect future competition; however, there is no immediate or direct competitor with us in our corn business, as we are the largest seller in the Gongzhulin province. Additionally, starting in 2010, there has been a shortage of corn supply globally and the supply in the PRC is limited. We do not believe we will have difficulties in selling all of our corn crop inventories. We estimate that we have approximately 0.8% of the corn seed market share in China.

In our seed business, we face competition at three primary levels, including other private Chinese companies, smaller local seed companies, and large multinational hybrid and genetic modified seed producers. Currently, we believe that we can compete effectively with each of these competitors and that we can continue to do so in the future.

We may potentially face future competition from multinational seed companies. These multinational seed companies possess competitive advantages including (a) greater financial resources; (b) high quality seed products; and (c) increased biotechnological capabilities. To date, multinational seed companies have not yet begun operating in China on an independent basis, but rather through joint ventures formed with existing Chinese seed companies. While these multinational seed companies do possess some competitive advantages, the seed market in China favors our business plan. This is due to the fact that in China, the seed market is focused on low volume sales made to numerous local farmers. In contrast, Western seed markets are characterized by high volume sales to few customers. As such, we believe that our business plan will enable us to continue to grow in the Chinese market.

Multinational companies rely heavily on genetically modified seed products. Genetically modified seed products have only begun to be accepted in China, and the extent of this acceptance is not yet determinable. Should genetically modified seed products become approved by the government on a larger scale and begin to gain broader acceptance in the market, as we expect will occur in the future, the large biotech companies would become more serious competitors. However, they will also continue to face numerous obstacles in competing with us, including the significant lead time associated with obtaining approval of a new seed (usually at least six years) and the need to establish effective sales, marketing and distribution networks to manage the large volume of small purchases that is characteristic of the Chinese market.

11

We believe our seed products have better brand recognition amongst local farmers and they are more suitable for the soil in the region, as such, we believe we can effectively compete with other larger domestic seed companies and smaller local seed companies. While there are six seed companies that control roughly 25% of the corn seed market of China and most of the largest crop seed companies have been in existence for much longer periods of time than we have. Some of these larger entities were previously owned by the state. We compete within these large domestic seed companies with our consistent product quality, customer and technical support, competitive pricing and widely established network amongst local farmers. The local seed companies in China are the legacy of the centrally planned agricultural economy that was predominant in China until recently. We believe the majority of these local companies lack the scale and the resources to compete with us as they do not have effective capital resources, marketing, advertising, technical support or customer service operations.

Competitive Advantages

We believe that the following strengths have contributed to our current market position in the corn seed business:

|

●

|

We have expanded the production capacity in the corn seed segment by obtaining access to additional farmland across major geographic regions in China. We currently have access to approximately 3,800 acres of farmland in Jilin and Xinjiang provinces for corn seed production.

|

|

●

|

Our seed products have one or more of the following special characteristics: high yield, disease resistance; drought resistance; high starch content; and stress tolerance. We are developing more varieties of corn seeds with these characteristics, as well as seeds for corn with high oil content and pest resistant corn.

|

|

●

|

Our core production base is strategically located in the Jilin province in the northern region of China, which is one of the largest corn seed production areas in China and is highly suited to growing corn and corn seeds due to its geographical and climate conditions.

|

|

●

|

We are members of two agricultural cooperative associations. We have direct access to cooperative association farmer members’ crop products. We will be able to obtain the crop products at a better price which in turn will allow us to enjoy higher profit margin. We will also be able to distribute our seed products directly to farmer members without distributors’ markup. Through the agricultural cooperative associations, our farmer members will be able to purchase seeds from us at a lower than market price while we are able to sell our seeds to the members at a price higher than we sell to distributors.

|

|

●

|

Our state of the art facilities separate, store and distribute the corn products for the farmers. This unique operating process facilitates the sales of the seed all the way through to the distribution and sales of the harvested corn. We have negotiated contracts with the government for sales of the harvested corn products. We own our own railroad tracks that allow it to load up to 29 carts of corn at one time. Each cart holds approximately 65 tons of corn. As our main customers are grain reserves in Guangxi province, the railroad tracks ensure that we are able to get the rail time needed to ship the products to Guangxi on time.

|

|

●

|

Our quality management for the production of our corn seed involves rigorous quality control and inspection procedures. For corn seed production, we carefully select parent seeds before growing seeds on a mass scale. During the entire production process, we continually provide technical guidance to the village collectives and seed production companies that are contracted to grow our seeds, and we supervise the production and harvest process.

|

Facilities

Our principal executive offices are located in the Gongzhuling State Agricultural Technology Park. We operate the separation, storage and distribution processes along with the business offices on approximately 42 acres of land. We have 9 storage warehouses that can have a total capacity of 350,000 tons of product. All storage facilities are covered with cooling and air circulating systems, and are equipped with electronic grain temperature inspection systems. We also have approximately ¼ mile of rail tracks for distribution purposes that can hold 29 train cars, each which holds approximately 65 tons of corn.

In addition, we signed an asset transfer agreement to purchase Jilin National Agriculture Technology Demonstration Park (“Demonstration Park”) for RMB 87 million (approximately $13.6 million) in March 2011 from Jilin Nongke Hi-Tech Industry Development Co., Ltd. (the “Seller”). We paid the sell price in full in October 2011. The land certificate and property ownership certificate of the Demonstration Park were originally issued in the name of the Seller when the Demonstration Park was first established. Currently, we do not directly own the land use rights, but lease the rights from the Seller. We are in the process of working with the Seller to have the land use rights formally transferred to us and we expect the process will take several months to a year to complete. The Demonstration Park is not currently in operation due to the winter season; however we plan to begin trial planting of a new corn seed in the summer of 2012.

|

ITEM 1A.

|

RISK FACTORS.

|

An investment in our common stock involves a high degree of risk. You should carefully consider the risks described below, together with all of the other information included in this Annual Report, before making an investment decision. If any of the following risks actually occurs, our business, financial condition or results of operations could suffer. In that case, the trading price of our shares of common stock could decline, and you may lose all or part of your investment. You should read the section entitled “Special Note Regarding Forward Looking Statements” above for a discussion of what types of statements are forward-looking statements, as well as the significance of such statements in the context of this Annual Report.

12

Risks Relating to our Business and Industry

We are subject to the risks that are inherent in farming.

Our results of operations may be adversely affected by numerous factors over which we have little or no control and that are inherent in farming, including reductions in the market prices for our products, adverse weather and growing conditions, pest and disease problems, and new PRC regulations regarding farming and the marketing of agricultural products.

Our earnings are sensitive to fluctuations in market prices and demand for our products.

Excess supplies often cause severe price competition in our industry. Growing conditions in various parts of the PRC, particularly weather conditions such as windstorms, floods, droughts and freezes, as well as diseases and pests, are primary factors affecting market prices because of their influence on the supply and quality of product.

Fresh produce is highly perishable and generally must be brought to market and sold soon after harvest. The selling price received for each type of produce depends on all of these factors, including the availability and quality of the produce item in the market, and the availability and quality of competing types of produce.

In addition, general public perceptions regarding the quality, safety or health risks associated with particular food products could reduce demand and prices for some of our products. To the extent that consumer preferences evolve away from products that we produce for health or other reasons, and we are unable to modify our products or to develop products that satisfy new consumer preferences, there will be a decreased demand for our products.

Adverse weather conditions could reduce supply and/or demand for our products.

The supply of and demand for our products fluctuate significantly with weather conditions, which could have either a positive or negative effect on production. If any natural disasters, such as flood, drought, hail, tornadoes or earthquakes, occur, supply for our products would likely be reduced.

We may not be able to obtain regulatory or governmental approvals for our products.

The manufacture and sale of our agricultural products in the PRC is regulated by the PRC and the local Provincial Government. The legal and regulatory regime governing our industry is evolving, and we may become subject to different, including more stringent, requirements than those currently applicable to us. We may be vulnerable to local and national government agencies or other parties who wish to renegotiate the terms and conditions of, or terminate their agreements or other understandings with us, or implement new or more stringent requirements, which may require us to suspend or delay production of their products. Our many permits and licenses related to the agricultural and food industries may expire and there is not guarantee the government or certifying agency will renew our licenses and/or certifications.

Potential environmental liability could have a material adverse effect on our operations and financial condition.

To the knowledge of our management team, neither the production nor the sale of our products constitutes activities, or generates materials that create any environmental hazards or violates PRC environmental laws. Although it has not been alleged by PRC government officials that we have violated any current environmental regulations, we cannot assure you that the PRC government will not amend the current PRC environmental protection laws and regulations. Our business and operating results may be materially and adversely affected if we were to be held liable for violating existing environmental regulations or if we were to increase expenditures to comply with environmental regulations affecting our operations.

Any significant fluctuation in price of our raw materials may have a material adverse effect on the manufacturing cost of our products.

The prices for the raw materials that we use in the manufacture of our fertilizer products are subject to market forces largely beyond our control, including the price of coal, our energy costs, organic chemical feedstock costs, market demand, and freight costs. The prices for these raw materials may fluctuate significantly based upon changes in these forces. If we are unable to pass any raw material price increases through to our customers, we could incur significant losses and a diminution of the market price of our common stock.

13

We require short-term financing to fund our working capital, especially due to the seasonal nature of our business.

The nature of the agricultural corn distribution and seed production industry involves expenses and revenue cycles that are seasonal in nature. From period to period, we may face costs that are in excess of our cash flow sources. The advance payments made to our corn and seed producing farmers may exceed the amount of deposits received from our customers, the distributors and end users. As a result, we sometimes rely upon short term loans to cover our expenses pending receipt of cash payment from our customers at the time of corn and seed purchases. Although historically we have had access to sufficient financing to manage our cash flow cycles, we cannot be certain that we will be able to obtain sufficient debt financing on terms that are satisfactory to us to maintain consistent operating results given changing credit conditions worldwide and internal PRC policies. Downgrades in our credit rating, tightening of related credit facilities or financial markets or other limitations on our ability to access short-term financing would increase our interest costs and adversely affect our operating results and operations.

Because of the nature of our business, which has seasonal variation, it is likely that our future financial performance will fluctuate from period to period.

Our operating results likely will fluctuate due to a number of factors, many of which are beyond our control. Our quarterly and annual revenues and costs and expenses as a percentage of our revenues may be significantly different from our historical rates. Our operating results in future quarters may fall below expectations. The industry in which we operate is seasonal in nature. As several of our major corn customers are governmental entities, the timing of their purchases may vary based on the fluctuations in the granary reserve level. The historical sales season of our corn seeds concentrated from October December. As a result, if we are unable to generate sufficient working capital from cash flow from operations and working capital facilities, we may encounter liquidity difficulties from the period to period, which may harm our operations. The seasonal nature of our business causes our operating results to fluctuate from quarter to quarter. Any unexpected seasonal or other fluctuations could cause the price of our common shares to fall. As a result, you may not rely on comparisons of our quarterly operating results as an indication of our future performance.

We may experience major accidents in the course of our operations, which may cause significant property damage and personal injuries.

We may experience major accidents in the course of our operations, which may cause significant property damage and personal injuries. Significant industry-related accidents and natural disasters may cause interruptions to various parts of our operations, or could result in property or environmental damage, increase in operating expenses or loss of revenue. The occurrence of such accidents and the resulting consequences may not be covered adequately, or at all, by the insurance policies we carry. In accordance with customary practice in China, we do not carry any business interruption insurance or third party liability insurance for personal injury or environmental damage arising from accidents on our property or relating to our operations other than our automobiles. Losses or payments incurred may have a material adverse effect on our operating performance if such losses or payments are not fully insured.

We could face increased competition.

We believe that competitors will try to expand their sales and build up their distribution networks in our principal market. We believe this trend will continue and probably accelerate. Increased competition may have a material adverse effect on our financial condition and results of operations.

Our failure to comply with increasingly stringent environmental regulations and related litigation could result in significant penalties, damages and adverse publicity for our business.

In recent years, the government of China has become increasingly concerned with the degradation of China’s environment that has accompanied the country’s rapid economic growth. In the future, we expect that our operations and properties will be subject to extensive and increasingly stringent laws and regulations pertaining to, among other things, the discharge of materials into the environment or otherwise relating to protection of the environment. Failure to comply with any laws and regulations and future changes to them may result in significant consequences to us, including civil and criminal penalties, liability for damages and negative publicity. Additional environmental issues may require currently unanticipated investigations, assessments or expenditures, or that requirements applicable to us will not be altered in ways that will require us to incur significant additional costs.

Consumer concerns regarding the safety and quality of food products or health concerns could adversely affect sales of our products.

Our sales performance could be adversely affected if consumers lose confidence in the safety and quality of our products. Consumers in the PRC are increasingly conscious of food safety and nutrition. Consumer concerns could discourage them from buying certain of our products and cause our results of operations to suffer.

We may be subject to substantial liability should the consumption of any of our products cause personal injury or illness, and we do not maintain product liability insurance to cover our potential liabilities.

The sale of food products for human consumption involves an inherent risk of injury to consumers, and we do not have product liability or any other insurance covering such risks. Even if a product liability claim is unsuccessful or is not fully pursued, the negative publicity surrounding any assertions that our products caused personal injury or illness could adversely affect our reputation with customers and our corporate and brand image. We do not maintain product liability insurance. Product liability claims may be asserted against us, which could have a material adverse effect on our revenues, profitability and business reputation.

14

The government of the PRC has broad powers to set price controls, which, if adopted, could impair our profitability.