Attached files

| file | filename |

|---|---|

| 8-K - TRANSCONTINENTAL REALTY INVESTORS, INC. - TRANSCONTINENTAL REALTY INVESTORS INC | tri8k040312.htm |

|

NEWS RELEASE

FOR IMMEDIATE RELEASE

|

Contact:

Transcontinental Realty Investors, Inc.

Investor Relations

(800) 400-6407

investor.relations@transconrealty-invest.com

|

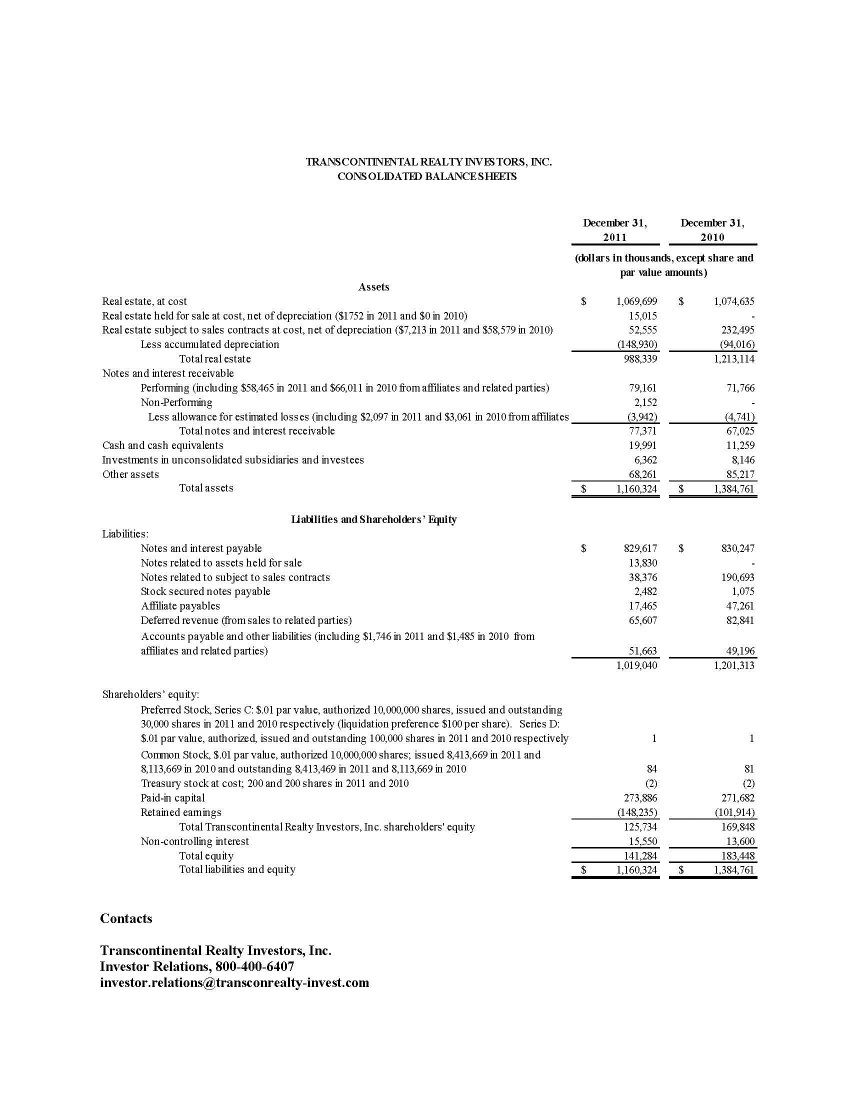

Transcontinental Realty Investors, Inc. Reports Fourth Quarter and Full Year 2011 Results

Dallas (April 2, 2012) – Transcontinental Realty Investors, Inc. (NYSE:TCI), a Dallas-based real estate investment company, today reported results of operations for the fourth quarter ended December 31, 2011. During the three months ended December 31, 2011, the Company reported net loss applicable to common shares of $21.3 million or $2.54 per diluted earnings per share, as compared to a net loss applicable to common shares of $27.9 million or $3.43 per diluted earnings per share for the same period ended 2010.

We had a net loss applicable to common shares of $47.4 million in 2011, which includes gain on land sales of $17.0 million and net income from discontinued operations of $8.4 million. The prior year net loss applicable to common shares was $68.3 million, which includes loss on land sales of $15.2 million and net gain from discontinued operations of $4.7 million.

Rental and other property revenues were $114.1 million for the twelve months ended December 31, 2011. This represents an increase of $3.8 million, as compared to the prior year revenues of $110.3 million. This change, by segment, is an increase in the apartment portfolio of $9.6 million, offset by a decrease in the commercial portfolio of $5.8 million. Within the apartment portfolio, the same property portfolio increased by $3.3 million, the acquired properties increased by $1.5 million and the developed properties increased by $4.8 million. The multifamily housing portfolio has continued to thrive, with effective rates and occupancy increasing. Within the commercial portfolio, the same property portfolio decreased by $5.8 million due to an increase in vacancy, which we attribute to the current state of the economy in the commercial market.

Property operating expenses were $63.5 million for the twelve months ended December 31, 2011. This represents an increase of $1.4 million as compared to the prior year operating expenses of $62.1 million. This change, by segment, is an increase in the apartment portfolio of $3.3 million offset by a decrease in the land and other portfolio of $1.0 million and a decrease in the commercial portfolio of $0.9 million. The decrease in the land portfolio was due to land sales. Within the apartment portfolio, the same apartment properties decreased $0.2 million due to lower overall operating costs and additional repair and maintenance. The developed apartments increased expenses by $2.4 million and the acquired properties increased expenses by $1.1 million.

Depreciation and amortization expense was $20.6 million for the twelve months ended December 31, 2011. This represents a decrease of $1.6 million, as compared to the prior year expense of $22.2 million. This change, by segment, is an increase in the apartment portfolio of $0.8 million offset by a decrease in the commercial portfolio of $2.4 million. Within the apartment portfolio, the same property portfolio decreased by $0.5 million, the acquired properties increased by $0.1 million and the developed properties in the lease-up phase increased by $1.2 million. Once the apartment complex is considered “stabilized”, we begin to depreciate the assets.

General and administrative expenses were $9.2 million for the twelve months ended December 31, 2011. This represents an increase of $1.1 million as compared to the prior year expenses of $8.1 million. This change is due to an increase in administrative expenses and professional services.

The current year provision on impairment of notes receivable, investment in real estate partnerships, and real estate assets was $41.8 million. This was an increase of $19.2 million as compared to the prior year expense of $22.6 million. In the current year, impairment was recorded as an additional loss in the investment portfolio of $5.2 in apartments we currently hold, $5.3 million in commercial properties we currently hold, $22.4 million in land we currently hold, $0.4 million in impairment on our investments in unconsolidated entities, and the remainder was land sold during the current period or subsequent to year end. The majority of the impairment losses were taken on the properties that are treated as “subject to sales contract” where, subsequent to the sale to a related party under common control, negotiations have occurred for the property ownership to transfer to the lender and estimated current property values are lower than our current basis. In the prior year, impairment was recorded as an additional loss in the investment portfolio of $18.3 million in land we sold during the current period or subsequent to year end and $4.3 million in impairment on notes receivable.

Other income was $2.1 million for the twelve months ended December 31, 2011. This represents a decrease of $6.3 million as compared to the prior year income of $8.4 million. The majority of the decrease was due to revenue received in prior year from an incentive fee.

Mortgage and loan interest expense was $53.1 million for the twelve months ended December 31, 2011. This represents a decrease of $2.1 million, as compared to the prior year expense of $55.2 million. This change, by segment, is a decrease in the commercial portfolio of $0.2 million, a decrease in the land and other portfolio of $1.5 million and a decrease in the apartment portfolio of $0.4 million. Within the apartment portfolio, the same apartment portfolio decreased $3.3 million, the acquired properties increased by $0.3 million and the developed properties increased $2.6 million due to properties in the lease-up phase. Once an apartment is completed, the interest expense is no longer capitalized. The decrease in the land and other portfolio was due to land sales.

Gain on land sales increased in the current year. In the current year, we sold 3,809.49 acres of land in 34 separate transactions for an aggregate sales price of $163.1 million and recorded a gain of $17.0 million. The average sales price was $42,801 per acre. In the prior year, we sold 1,227.53 acres of land in 13 separate transactions for an aggregate sales price of $23.1 million, receiving $8,984 in cash and recorded a loss of $15.1 million. The average sales price was $18,823 per acre.

Discontinued operations relates to properties that were either sold or held for sale as of the respective year end. Included in discontinued operations are a total of 13 and 22 income-producing properties as of 2011 and 2010, respectively and one held for sale as of 2011. Properties sold in 2011 that were held in 2010 have been reclassified to discontinued operations for 2010.

About Transcontinental Realty Investors, Inc.

Transcontinental Realty Investors, Inc., a Dallas-based real estate investment company, holds a diverse portfolio of equity real estate located across the U.S., including office buildings, apartments, hotels, shopping centers and developed and undeveloped land. The Company invests in real estate through direct equity ownership and partnerships nationwide. For more information, visit the Company’s website at www.transconrealty-invest.com