Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - MOSAIC CO | d329439d8k.htm |

| EX-99.1 - TRANSCRIPT OF CONFERENCE CALL OF THE MOSAIC COMPANY - MOSAIC CO | d329439dex991.htm |

The Mosaic Company

Earnings

Conference

Call

–

3

rd

Quarter

Fiscal

2012

Thursday,

March

29,

2012

Exhibit 99.2

Jim Prokopanko, President and Chief Executive Officer

Larry

Stranghoener,

Executive

Vice

President

and

Chief

Financial

Officer

Laura Gagnon, Vice President Investor Relations |

This presentation contains forward-looking statements within the meaning of

the Private Securities Litigation Reform Act of 1995. Such statements

include, but are not limited to, statements about future financial and operating results. Such statements are based upon the

current beliefs and expectations of The Mosaic Company’s management and are

subject to significant risks and uncertainties. These risks and

uncertainties include but are not limited to the predictability and volatility of, and customer expectations about, agriculture,

fertilizer,

raw

material,

energy

and

transportation

markets

that

are

subject

to

competitive

and

other

pressures

and

economic

and

credit

market conditions; the level of inventories in the distribution channels for crop

nutrients; changes in foreign currency and exchange rates; international

trade risks; changes in government policy; changes in environmental and other governmental regulation, including

greenhouse gas regulation, implementation of the U.S. Environmental Protection

Agency’s numeric water quality standards for the discharge of

nutrients into Florida lakes and streams or possible efforts to reduce the flow of excess nutrients into the Gulf of Mexico;

further developments in judicial or administrative proceedings; difficulties or

delays in receiving, increased costs of or challenges to necessary

governmental permits or approvals; the effectiveness of the Company’s processes for managing its strategic priorities;

adverse weather conditions affecting operations in Central Florida or the Gulf

Coast of the United States, including potential hurricanes or excess

rainfall; actual costs of various items differing from management’s

current estimates, including, among others, asset retirement, environmental

remediation, reclamation or other environmental regulation, or Canadian resources taxes and royalties;

accidents and other disruptions involving Mosaic’s operations, including

brine inflows at its Esterhazy, Saskatchewan potash mine and other

potential mine fires, floods, explosions, seismic events or releases of hazardous or volatile chemicals, as well as other risks and

uncertainties reported from time to time in The Mosaic Company’s reports

filed with the Securities and Exchange Commission. Actual results may

differ from those set forth in the forward-looking statements. Safe

Harbor Statement 2 |

Ongoing business strength

despite near-term market challenges

Strong execution

Market impacts

South Fort Meade litigation

resolved [pending court approval]

Lower potash volumes

Potash expansion on track

Higher raw materials costs

MicroEssentials

®

expansion on

track for 4Q12 completion

Operational excellence delivering

benefits

Increased dividend 150%*

*The declaration and payment of future dividends is subject to approval by

Mosaic’s Board of Directors. These can be no assurance that the

Company and Board of Directors will declare future dividends. |

Resolving Near-term

Market Challenges

•

Indian subsidy known

•

China-Canpotex contract signed

•

Phosphate raw material spot prices down

Long-term market conditions remain

attractive |

Expecting a strong spring

season in North America

•

Farm economics remain compelling

•

Farmers have incentive to plant more

acres and maximize yields

•

Expect early start due to warm weather

Mosaic is well positioned for the spring

season |

Fourth quarter outlook

The issue is timing, not tonnes

6

Price

risk

aversion

remains

high,

impacting

timing

of

fertilizer

purchases

and willingness to hold inventories

Potash Fourth Quarter 2012 Guidance

Sales volume 1.7

–

2.2 million tonnes

MOP

selling

price

$420

–

$450

per

tonne

Up

from

1.1

million

tonnes

in

3Q

Reflecting mix change from 3Q

Phosphates Fourth Quarter 2012 Guidance

Sales

volume

2.3

–

2.7

million

tonnes

DAP

selling

price

$460

-

$490

per

tonne

~Flat with 2.6 million tonnes in 3Q

Down from $536

per tonne in 3Q |

Financial Results Review

7 |

Net Sales reflect delayed purchasing

8

Q3 FY12

Q3 FY12 vs.

Q3 FY11

Revenue

$2.2 billion

(1)%

Phosphates

$1.7 billion

13%

Potash

$553 million

(27) %

•

Phosphates sales volume:

–

2.6 million tonnes, up 9%

•

DAP price (FOB Central FL):

–

$536 / tonne, down 1%

•

Potash sales volume:

–

1.1 million tonnes, down 41%

•

MOP price (FOB Mine):

–

$453 / tonne, up 27% |

Earnings reflect higher Phosphates raw

material costs and lower Potash volumes

9

Q3 FY12

Gross margin

Q3 FY12 vs.

Q3 FY11

Consolidated

24%

$522 million

(39)%

Phosphates

16%

$259 million

(43)%

Potash

49%

$270 million

(34)% |

Net Earnings and EPS

Reported Earnings

($ in million except per share)

Q3 FY12

Earnings Before Taxes

$355

Net Earnings

$273

EPS

$0.64

Impact of Notable Items

$(0.08)

10 |

Potash Segment Highlights

11

In millions, except MOP price

Q3 FY12

Q2 FY12

Q3 FY11

Net sales

$553

$839

$758

Gross Margin

$270

$394

$412

Percent of net sales

49%

47%

54%

Operating earnings

$234

$358

$414

Sales volumes

1.1

1.8

1.9

Production volume

1.8

1.8

2.0

Production operating rate

79%

78%

90%

Avg MOP selling price

$453

$440

$358

Third quarter year over year highlights:

•

Operating earnings reflect lower sales volumes; expected to resume in 4Q

•

Operating rates reflect announced curtailments of up to 20% in January through

March 2012 •

Average selling price driven by industrial and export average price increases

Q/Q 0

100

200

300

400

500

600

Q3 FY11 OE

Sales Sales volumes

price

Resource

taxes

Other

Q3 FY12 OE

OPERATING EARNINGS BRIDGE

$ IN MILLIONS |

Phosphates Segment Highlights

12

In millions, except DAP price

Q3 FY12

Q2 FY12

Q3 FY11

Net sales

$1,652

$2,179

$1,458

Gross Margin

$259

$476

$454

percent of net sales

16%

22%

31%

Operating earnings

$190

$432

$372

Sales volumes

2.6

3.2

2.4

NA production volume

(a)

2.0

2.1

2.0

Finished product

operating rate

81%

86%

83%

Avg DAP selling price

$536

$611

$543

(a)

Includes crop nutrient dry concentrates and animal feed ingredients

Third quarter year over year highlights:

•

Operating

earnings

are

down

49

percent,

primarily

as

a

result

of

higher

raw

material

costs

reflected

in

the

income statement

•

Full

benefits

from

the

Faustina

ammonia

plant

are

expected

to

be

realized

in

Q4

FY12

•

Finished product operating rate of 81 percent includes the impact of the

previously announced curtailment of 250,000 tonnes in January through March

2012 0

50

100

150

200

250

300

350

400

450

500

Q3 FY11

OE

Sales

price

Sales

volumes

Raw

materials

Other

Q3 FY12

OE

OPERATING EARNINGS BRIDGE

$ IN MILLIONS |

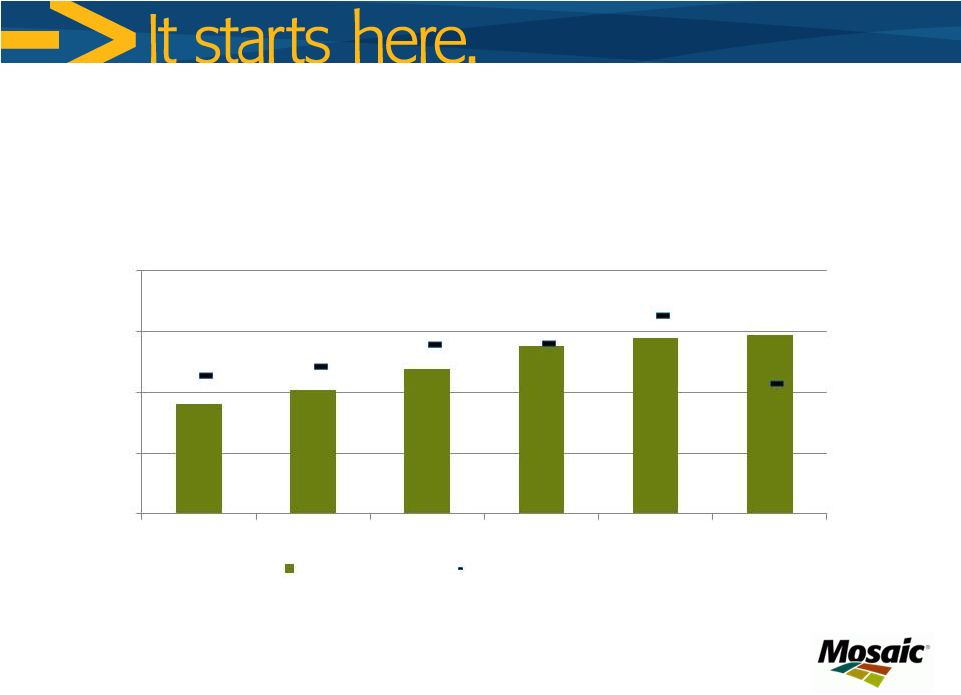

Phosphate Raw Material Costs

13

Ammonia

$/tonne

Realized costs of raw materials in COGS lag spot prices by approximately 3 months.

Realized ammonia costs, in most periods shown, include a benefit of our

manufacture of ammonia at Faustina. $431

$589

$0

$200

$400

$600

$800

Q2 FY11

Q3 FY11

Q4 FY11

Q1 FY12

Q2 FY12

Q3 FY12

Realized in COGS

Average Purchase Price |

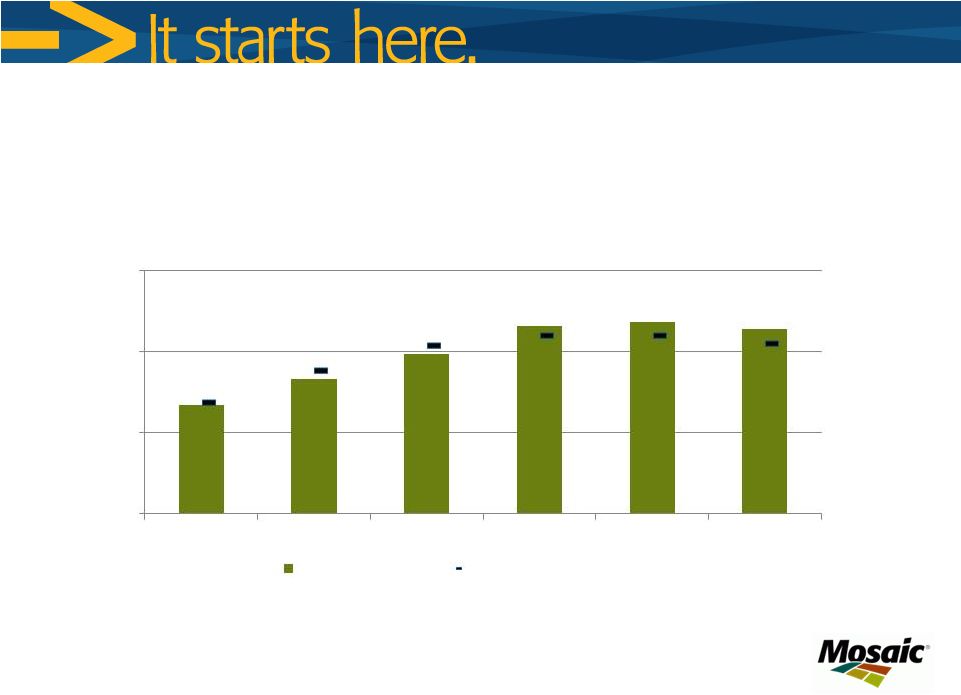

Phosphate Raw Material Costs

14

Sulfur Costs

$/long ton

Realized costs of raw materials in COGS lag spot prices by approximately 3 months.

Sulfur realized prices include storage, conversion and transformation costs

of $10 - $15 / ton.

$228

$211

$0

$100

$200

$300

Q2 FY11

Q3 FY11

Q4 FY11

Q1 FY12

Q2 FY12

Q3 FY12

Realized in COGS

Average Purchase Price |

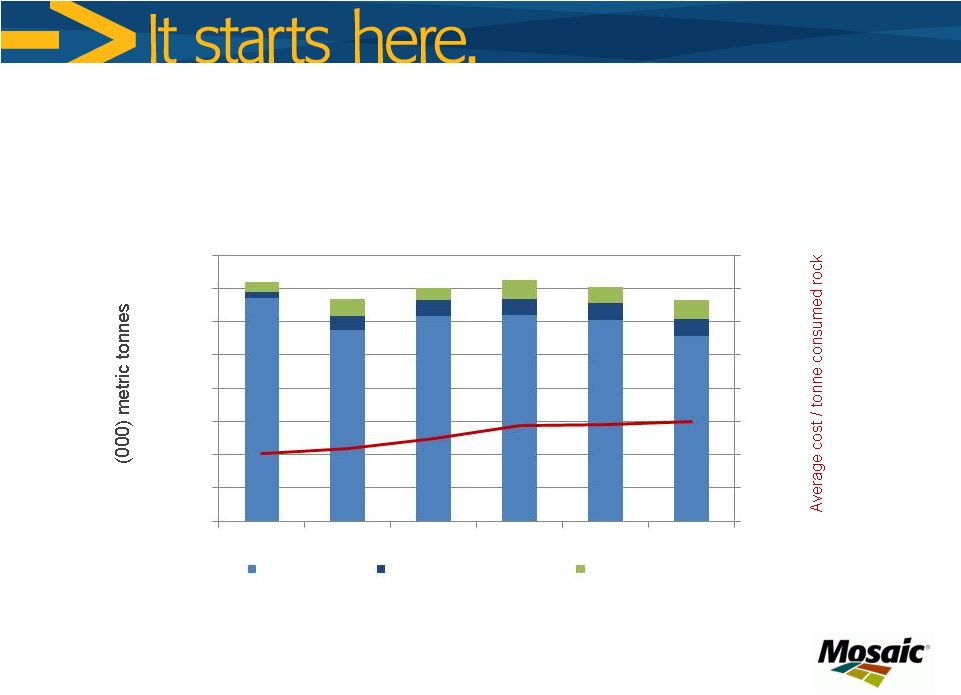

Phosphate Rock Sourcing

15

Rock Mix used in U.S. Operations

$-

$25

$50

$75

$100

-

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

Q2 FY11

Q3 FY11

Q4 FY11

Q1 FY12

Q2 FY12

Q3 FY12

US mined rock

Purchased Miski Mayo rock

Other purchased rock |

Category

Guidance –

Fiscal 2012

Potash

Q4 Sales volume 1.7 –

2.2 million tonnes

Q4 MOP selling price $420 –

$450 per tonne

Q4 Operating rate above 70 percent

Phosphates

Q4 Sales volume

2.3

–

2.7

million tonnes

Q4 DAP selling price $460 -

$490 per tonne

Q4 Operating rate above 80 percent

Capital Expenditures

$1.6 -

$1.7 billion

Canadian Resource Taxes and Royalties

$310

–

$360

million

SG&A

$400

–

$430

million

Effective Tax Rate

Upper 20 percent range

Financial Guidance Summary

16 |

The Mosaic Company

Thank you |

Earnings

Sensitivity

to

Key

Drivers

(a)

18

Change

Estimated Change in

Pre-Tax Earnings

($ in millions)

Estimated

Change in Annual

EPS

MOP Price ($/tonne)

$50

$313

$0.51

Potash Volume (000 tonnes)

500

$159

$0.26

DAP Price ($/tonne)

$50

$407

$0.66

Phosphates Volume (000 tonnes)

500

$99

$0.16

Sulfur ($/lt)

$25

$86

$0.14

Ammonia ($/tonne)

$25

$37

$0.06

Natural Gas ($/mmbtu)

$1.00

$31

$0.05

(a)

These factors do not change in isolation; actual results could vary from the above

estimates |