Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - BOSTON PRIVATE FINANCIAL HOLDINGS INC | d329481d8k.htm |

Exhibit 99.1

ANNUAL REPORT OF FINANCIAL CONDITION AS OF DECEMBER 31, 2011 BOSTON PRIVATE BANK & TRUST COMPANY New England Southern California San Francisco Bay Area Pacific Northwest

Dear Friend, Boston Private Bank & Trust Company achieved a significant milestone during 2011 with the integration of our three affiliate banks into one unified bank charter. As a result of this integration, we are now operating as Boston Private Bank & Trust Company in New England, the Pacific Northwest and Southern California, and as Borel Private Bank & Trust Company, a division of Boston Private Bank & Trust Company, in the San Francisco Bay Area. We are a larger, financially stronger bank with consolidated total assets of $5.8 billion, more than $500 million of capital strength, and nearly $3.6 billion of client assets under management. As we close the books on 2011, we are pleased to report that our financial performance exceeded our targets for the year. Net income ended 2011 at $40 million for the year, and total loans were up 4% compared to the same time last year. We attribute our success in 2011 to our continued improvements in credit quality and our overall risk profile, enabling us to generate organic business growth, even as we dealt with the added complexity and workload of the consolidation. Although we continue to operate in an uncertain economic environment, I’m confident in our ability to manage effectively through those challenges as we complete our integration. My confidence stems not only from the steady growth we have achieved despite the economic tribulations of recent years, but also from a number of 2011 accomplishments (see highlights, right). Not the least of those was our “Outstanding” Community Reinvestment Act (CRA) rating from the Massachusetts Division of Banks and the FDIC. We are committed to the communities we serve. We are an active provider of financing for affordable housing, first-time homebuyers, economic development, social services, community revitalization and small business. Meanwhile, during 2011, our parent company, Boston Private Financial Holdings, Inc. (BPFH), delivered three consecutive quarters of profitability, with growth in its private banking and wealth management subsidiaries. BPFH improved its balance sheet and achieved a stable and balanced revenue stream and strong capital ratios. For Boston Private Bank & Trust, perhaps our most valued accomplishments of 2011 are the personal relationships we continued to cultivate during a period of significant change and growth. We thank you for your unwavering loyalty to Boston Private Bank & Trust, for the continuing opportunity to serve you, and for your suggestions as to how we might improve. As your trusted partner, we pledge a commitment to providing you with exceptional service and customized advice to address the unique financial needs of you, your family and your business. “Our most valued accomplishments of 2011 are the personal relationships we continued to cultivate during a period of significant change and growth.” Sincerely, Mark D. Thompson CEO & President

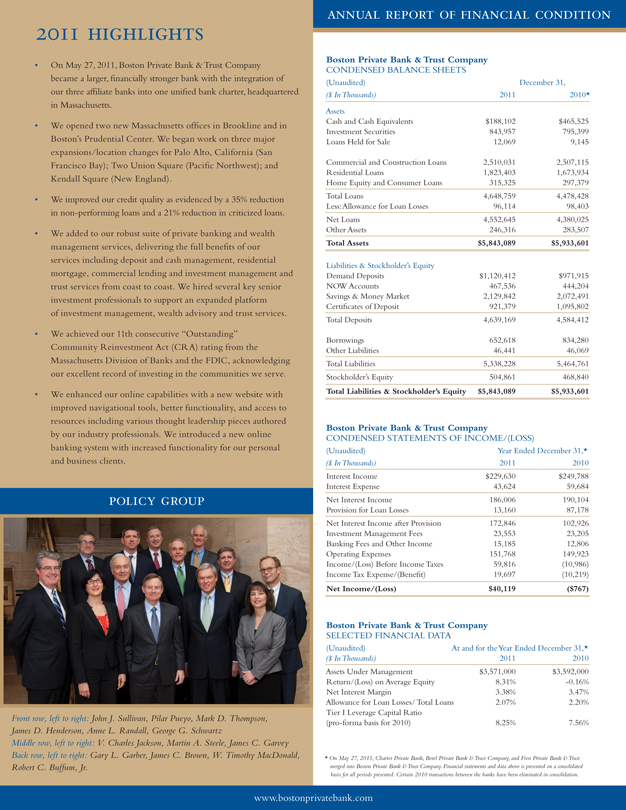

2011 HIGHLIGHTS On May 27, 2011, Boston Private Bank & Trust Company became a larger, financially stronger bank with the integration of our three affiliate banks into one unified bank charter, headquartered in Massachusetts. We opened two new Massachusetts offices in Brookline and in Boston’s Prudential Center. We began work on three major expansions/location changes for Palo Alto, California (San Francisco Bay); Two Union Square (Pacific Northwest); and Kendall Square (New England). We improved our credit quality as evidenced by a 35% reduction in non-performing loans and a 21% reduction in criticized loans. We added to our robust suite of private banking and wealth management services, delivering the full benefits of our services including deposit and cash management, residential mortgage, commercial lending and investment management and trust services from coast to coast. We hired several key senior investment professionals to support an expanded platform of investment management, wealth advisory and trust services. We achieved our 11th consecutive “Outstanding” Community Reinvestment Act (CRA) rating from the Massachusetts Division of Banks and the FDIC, acknowledging our excellent record of investing in the communities we serve. We enhanced our online capabilities with a new website with improved navigational tools, better functionality, and access to resources including various thought leadership pieces authored by our industry professionals. We introduced a new online banking system with increased functionality for our personal and business clients. POLICY GROUP Front row, left to right: John J. Sullivan, Pilar Pueyo, Mark D. Thompson, James D. Henderson, Anne L. Randall, George G. Schwartz Middle row, left to right: V. Charles Jackson, Martin A. Steele, James C. Garvey Back row, left to right: Gary L. Garber, James C. Brown, W. Timothy MacDonald, Robert C. Buffum, Jr. ANNUAL REPORT OF FINANCIAL CONDITION Boston Private Bank & Trust Company CONDENSED BALANCE SHEETS (Unaudited) December 31, ($ In Thousands) 2011 2010* Assets Cash and Cash Equivalents $188,102 $465,525 Investment Securities 843,957 795,399 Loans Held for Sale 12,069 9,145 Commercial and Construction Loans 2,510,031 2,507,115 Residential Loans 1,823,403 1,673,934 Home Equity and Consumer Loans 315,325 297,379 Total Loans 4,648,759 4,478,428 Less: Allowance for Loan Losses 96,114 98,403 Net Loans 4,552,645 4,380,025 Other Assets 246,316 283,507 Total Assets $5,843,089 $5,933,601 Liabilities & Stockholder’s Equity Demand Deposits $1,120,412 $971,915 NOW Accounts 467,536 444,204 Savings & Money Market 2,129,842 2,072,491 Certificates of Deposit 921,379 1,095,802 Total Deposits 4,639,169 4,584,412 Borrowings 652,618 834,280 Other Liabilities 46,441 46,069 Total Liabilities 5,338,228 5,464,761 Stockholder’s Equity 504,861 468,840 Total Liabilities & Stockholder’s Equity $5,843,089 $5,933,601 Boston Private Bank & Trust Company CONDENSED STATEMENTS OF INCOME/(LOSS) (Unaudited) Year Ended December 31,* ($ In Thousands) 2011 2010 Interest Income $229,630 $249,788 Interest Expense 43,624 59,684 Net Interest Income 186,006 190,104 Provision for Loan Losses 13,160 87,178 Net Interest Income after Provision 172,846 102,926 Investment Management Fees 23,553 23,205 Banking Fees and Other Income 15,185 12,806 Operating Expenses 151,768 149,923 Income/(Loss) Before Income Taxes 59,816 (10,986) Income Tax Expense/(Benefit) 19,697 (10,219) Net Income/(Loss) $40,119 ($767) Boston Private Bank & Trust Company SELECTED FINANCIAL DATA (Unaudited) At and for the Year Ended December 31,* ($ In Thousands) 2011 2010 Assets Under Management $3,571,000 $3,592,000 Return/(Loss) on Average Equity 8.31% -0.16% Net Interest Margin 3.38% 3.47% Allowance for Loan Losses/ Total Loans 2.07% 2.20% Tier I Leverage Capital Ratio (pro-forma basis for 2010) 8.25% 7.56% * On May 27, 2011, Charter Private Bank, Borel Private Bank & Trust Company, and First Private Bank & Trust merged into Boston Private Bank & Trust Company. Financial statements and data above is presented on a consolidated basis for all periods presented. Certain 2010 transactions between the banks have been eliminated in consolidation. www.bostonprivatebank.com

BOARD OF DIRECTORS Susan P. Haney POLICY GROUP Pilar Pueyo Private Investor Senior Vice President Herbert S. Alexander Mark D. Thompson Managing Partner CEO & President Director of Human Resources V. Charles Jackson Alexander, Aronson, Finning & CEO, Southern California Anne L. Randall Company James C. Brown Boston Private Bank & Trust Company Executive Vice President Executive Vice President John H. Clymer Chief Lending Officer Chief Financial & Administrative Officer E. Christopher Palmer Senior Counsel President & Managing Shareholder George G. Schwartz Nixon Peabody LLP Robert C. Buffum, Jr. Palmer and Corbett, PC Executive Vice President Senior Vice President Eugene S. Colangelo Chief Credit Officer Chief Operating Officer & Treasurer W. Thomas Porter Chairman of the Board Chairman Martin A. Steele Julio Enterprises Gary L. Garber Porter Investments CEO, Pacific Northwest Chairman of the Board Senior Vice President Boston Private Bank & Trust Company James K. Schmidt Chief Information Officer John J. Sullivan Private Investor Executive Vice President Clayton G. Deutsch James C. Garvey CEO & President Brian G. Shapiro CEO, San Francisco Bay Area Boston Private Financial Holdings, Inc. Managing Partner Borel Private Bank & Trust Company, The Shapiro Group A Division of Boston Private Bank & Harold Fick Trust Company Private Investor William J. Shea Executive Chairman James D. Henderson Kathleen M. Graveline Lucid Inc. Executive Vice President Private Investor Chairman of the Board DeMoulas Markets V. Charles Jackson Charles T. Grigsby CEO, Southern California President Mark D. Thompson Mass. Growth Capital Corp. W. Timothy MacDonald CEO & President Senior Vice President Boston Private Bank & Trust Company Chief Risk Officer NEW ENGLAND OFFICES Lexington Office Redmond Office Westlake Village Office Boston Office 1666 Massachusetts Avenue 7536 164th Avenue NE 2835 Townsgate Road Ten Post Office Square Lexington, MA 02420 Redmond, WA 98052 Westlake Village, CA 91361 Boston, MA 02109 Phone: (617) 912-3600 Phone: (425) 882-3535 Phone: (805) 230-2778 Phone: (617) 912-1900 Newton Centre Office Seattle Office SAN FRANCISCO BAY AREA Back Bay Office 1223 Centre Street 601 Union Street, Suite 3030 OFFICES – BOREL PRIVATE 500 Boylston Street Newton, MA 02459 Seattle, WA 98101 BANK & TRUST COMPANY, Boston, MA 02116 Phone: (617) 646-4850 Phone: (206) 774-5400 A Division of Boston Private Phone: (617) 912-4500 Bank & Trust Company Prudential Center Office SOUTHERN CALIFORNIA Burlingame Office Beverly Office 800 Boylston Street OFFICES 1440 Chapin Avenue 57 Enon Street, Route 1A Boston, MA 02199 Burbank Office Burlingame, CA 94010 Beverly, MA 01915 Phone: (617) 912-7300 333 N. Glenoaks Boulevard Phone: (650) 375-6000 Phone: (978) 922-8000 Burbank, CA 91502 Seaport Office Phone: (818) 842-9191 Los Altos Office Brookline Office 157 Seaport Boulevard 345 S. San Antonio Road 1295A Beacon Street Boston, MA 02210 Encino Office Los Altos, CA 94022 Brookline, MA 02446 Phone: (617) 646-4880 16000 Ventura Boulevard Phone: (650) 917-4600 Phone: (617) 739-0002 Encino, CA 91436 Wellesley Office Phone: (818) 501-1700 Palo Alto Office Hingham Office 336 Washington Street 245 Lytton Avenue 7 Central Street Wellesley, MA 02481 Granada Hills Office Palo Alto, CA 94301 Hingham, MA 02043 Phone: (781) 707-7700 10820 Zelzah Avenue Phone: (650) 463-8700 Phone: (781) 740-2405 Granada Hills, CA 91344 PACIFIC NORTHWEST Phone: (818) 832-3800 San Francisco Office Jamaica Plain Loan Center OFFICES 433 California Street 401c Centre Street Bellevue Office Santa Monica Office San Francisco, CA 94104 Jamaica Plain, MA 02130 10885 N.E. 4th Street, Suite 100 520 Broadway Phone: (415) 402-5900 Phone: (617) 524-6050 Bellevue, WA 98004 Santa Monica, CA 90401 Phone: (425) 586-5000 Phone: (310) 899-2620 San Mateo Office Kendall Square Office 160 Bovet Road One Cambridge Center San Mateo, CA 94402 Cambridge, MA 02142 Phone: (650) 378-3700 Phone: (617) 646-4800 BOSTON PRIVATE BANK & TRUST COMPANY www.bostonprivatebank.com Member FDIC