Attached files

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2011

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 000-52642

Westway Group, Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 20-4755936 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 365 Canal Street, Suite 2900, New Orleans, LA |

70130 | |

| (Address of principal executive offices) | (Zip Code) | |

(504) 525-9741

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of exchange on which registered | |

| Class A Common Stock, $0.0001 par value | The NASDAQ Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes ¨ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes x No

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant computed by reference to the price at which the registrant’s Class A Common Stock, par value $0.0001 per share, was last sold as of June 30, 2011, the last business day of the registrant’s most recently completed second fiscal quarter, was $30.0 million.

As of March 16, 2012, 14,205,995 shares of our Class A common stock, par value $0.0001 per share, and 13,144,677 shares of our Class B common stock, par value $0.0001 per share, were outstanding. The number of shares of our Class A common stock outstanding stated above includes 1,000,000 shares issued to Shermen WSC Holding LLC and held in escrow.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement for its 2012 annual meeting of stockholders, which is anticipated to be filed with the Securities and Exchange Commission by April 30, 2012, are incorporated by reference into Part III of this Form 10-K.

Table of Contents

Westway Group, Inc. Index to Form 10-K

1

Table of Contents

Unless the context otherwise requires, when used in this annual report on Form 10-K:

| • | the “Company” or “we” or “us” or “our” or “Westway Group, Inc.” means the public company now named Westway Group, Inc. together with its wholly-owned subsidiaries; |

| • | the “acquired business” or “predecessor” means the bulk liquid storage and liquid feed supplements businesses, prior to acquisition, that were acquired by the Company from the ED&F Man group in the 2009 business combination; |

| • | the “2009 business combination” means the set of transactions consummated on May 28, 2009, by which the Company (which was then a “special purpose acquisition” corporation) acquired the acquired business; |

| • | “ED&F Man” means ED&F Man Holdings Limited, on an unconsolidated basis; |

| • | “ED&F Man group” means ED&F Man and its direct and indirect subsidiaries; and |

| • | “Agman” means Agman Louisiana, Inc, a subsidiary of ED&F Man and member of the ED&F Man group which was named Westway Holdings Corporation before June 17, 2010; |

| • | “Class A common stock” means our Class A Common Stock, par value $0.0001 per share (this class is listed on NASDAQ; generally, shares of this class automatically convert into shares of Class B common stock at any time they become owned by a member of the ED&F Man group); |

| • | “Class B common stock” means our Class B Common Stock, par value $0.0001 per share (this class is not listed on NASDAQ; generally, shares of this class automatically convert into shares of Class A common stock at any time they cease to be owned by a member of the ED&F Man group); and |

| • | “Series A Convertible Preferred Stock” means our Series A Perpetual Convertible Preferred Stock, par value $.0001 per share (this class is not listed on NASDAQ). |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K includes statements regarding our future performance, liquidity, and capital resources, our plans and objectives for future operations, and assumptions relating to the foregoing. Such statements are “forward-looking” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 21E of the Securities Exchange Act of 1934, and Section 27A of the Securities Act of 1933. Our use of words such as “believe,” “expect,” “anticipate,” “intend,” “aim,” “will,” “shall,” “may,” “should,” “could,” “would,” “plan,” “estimate,” “continue,” “foresee,” or the negative of such terms, or other similar expressions, often further identify a statement as a forward-looking statement.

We have based our forward-looking statements on our current expectations and projections about future events, trends, and uncertainties. Our forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and assumptions. There are a number of important factors that could cause our actual results and financial position to differ materially from those contemplated by our forward-looking statements, including, among other things, the risk factors discussed in the “Risk Factors” section of this Form 10-K.

Our business is highly complex and competitive, with many different factors affecting results. Any or all of our forward-looking statements may turn out to be wrong, and actual results may differ materially from those expressed or implied by our forward-looking statements. They can be affected by inaccurate assumptions or by known or unknown risks, uncertainties and other factors, many of which are beyond our control. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

1

Table of Contents

PART I

| ITEM 1. | BUSINESS |

Background

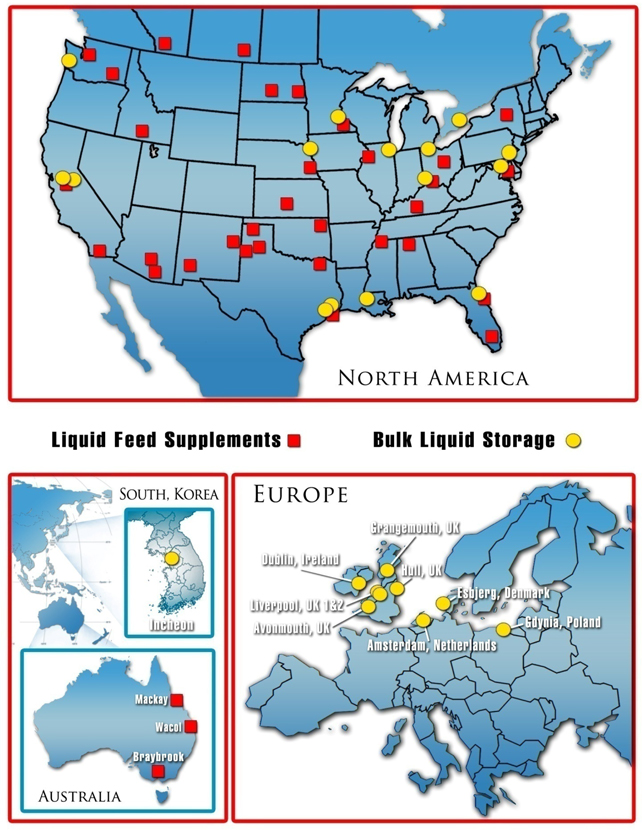

We are a leading provider of bulk liquid storage and related value-added services. Our bulk liquid storage business is a global business with locations at key port and terminal sites throughout North America and in Western Europe and Asia. Our infrastructure includes a network of 25 terminals offering approximately 363 million gallons of bulk liquid storage capacity to manufacturers and consumers of agricultural and industrial liquids. Our bulk liquid storage business has maintained a long-term presence in a number of highly strategic, deep water ports around the world. This locational advantage provides our international customer base with access to these strategic storage locations, as well as the highest level of our service for these important markets.

We are also a leading manufacturer and distributor of liquid animal feed supplements. Through our 35 facilities in North America, western Canada, and eastern Australia, we produce approximately 1.8 million tons of liquid feed supplements annually. By using formulation processes that are tailored specifically to the needs of our customers, we blend molasses and essential nutrients to form feed rations that help to maximize the genetic potential of livestock. We sell our liquid animal feed supplements to distributors, dealers, and directly to end users, such as “ranchers,” and feed manufacturers, primarily supplying the beef and dairy livestock industries. Our liquid feed supplements business is the leading North American manufacturer of liquid feed products and the only supplier with a true national U.S. footprint.

Our Management Team

We have an experienced senior management team comprised of James B. Jenkins as Chief Executive Officer, Thomas A. Masilla Jr. as Chief Financial Officer, Gene McClain as President of our bulk liquid storage business, and Steve Boehmer as President of our liquid feed supplements business. Mr. Jenkins has worked in the commodities industry for 29 years, and Messrs. McClain and Boehmer have 31 and 35 years of relevant industry experience, respectively. Mr. Masilla possesses over 35 years of extensive executive and financial management experience in publicly-traded commercial banking and real estate entities.

We benefit from the skill, experience, and commitment of a talented and experienced staff of middle managers across our various functions and geographies. In particular, our Company has a highly skilled health, safety, environmental, and quality team, which provides continual reviews of policy and regulatory compliance. By this means, our staff contribute to minimizing our exposure to injury and loss, ensuring the highest quality of service to our customers, and overseeing the physical integrity of our facilities. Our management team also has years of experience in successfully designing and executing numerous acquisitions, new site openings, facility expansions, and new product introductions.

2

Table of Contents

Global Footprint Locations

3

Table of Contents

Recent Developments

In 2011, we have focused on the expansion of our bulk liquid storage capacity, improving liquidity for our stockholders, and simplifying our capital structure.

First Quarter 2011 Highlights

| • | Gene McClain was appointed President of Westway Terminal Company. Mr. McClain has 31 years of extensive experience in the terminal industry. |

| • | Construction began on four new tanks at our Houston 1, TX terminal, totaling approximately 4.0 million gallons of capacity in the aggregate, as well as on two new dock lines. |

| • | Westway Terminal Company LLC, a wholly owned subsidiary of the Company, received the Responsible Care Partner of the Year Award. This award is the American Chemistry Council’s top partner award, presented to three partner companies for their record of performance and dedication to safety. |

Second Quarter 2011 Highlights

| • | 11.1 million of our publicly traded warrants expired in accordance with their terms. The combination of this expiration and the successful warrant tender offer completed in 2010 has significantly simplified our capital structure. |

| • | Westway Terminal Company LLC received the Safety Improvement Award from the International Liquid Terminals Association (ILTA). This award reflects the commitment, dedication, and collaborative effort of our employees aimed at the continual improvement of our health, safety, environmental and security performance. |

| • | We created a new Corporate Business Development team which will focus on the identification, evaluation and execution of strategic growth opportunities for our liquid feed supplement and liquid storage subsidiaries as well as growth in other strategic areas. |

| • | Mr. Anthony J. Andrukaitis was elected to the Board of Directors of the Company. He brings extensive knowledge and experience, including skills in finance, marketing, and operations as well as experience in both domestic and international terminal operations. |

Third Quarter 2011 Highlights

| • | The Company and its bank syndicate amended certain key terms of the Company’s existing $200 million credit facility. The modifications included, among other items, extension of the maturity date to July 6, 2015, reduction of the interest rate and commitment fee payable, relaxation of certain key financial covenants, permission to pay dividends, and addition of a $50 million accordion feature to the current facility. |

| • | The Board of Directors declared our first quarterly dividend of $0.04 per share of common stock, payable in cash or common stock, to holders of our common stock and participating preferred stock. This dividend, which has since continued through the first quarter of 2012, is consistent with our goal of building shareholder value, both in terms of our stock price as well as liquidity in the trading volume of our stock. |

| • | In our bulk liquid storage business, 2.5 million gallons of new tank capacity was added and leased at our Houston 2, TX terminal. |

| • | Also in our bulk liquid storage business, three tanks (totaling 1.4 million gallons) of nine tanks scheduled to be finalized in the second half of 2011 at our Amsterdam, Netherlands terminal were completed and leased. |

| • | Mr. Paul Chatterton was elected to the Board of Directors of the Company. Mr. Chatterton previously served in a senior management role for Westway Terminals from 1997 through 2007. His addition to the Board brings extensive knowledge and experience in both domestic and international terminal operations. |

Fourth Quarter 2011 Highlights

| • | In our bulk liquid storage business, 8.0 million gallons of new tank capacity were completed and leased at our Houston 1, TX terminal. We also began constructing six new 1 million gallon tanks and three new dock lines as well as the associated inbound and outbound marine and land traffic infrastructure at our Houston 1, TX terminal. We are in Phase 7 of the Houston 1 expansion program, and this phase will maximize utilization of our existing land bank, as well as improve economic efficiencies at this site. The Houston 1 facility has continued at near 100% utilization, with demand for storage exceeding the phased nature of our expansion program at this site. |

4

Table of Contents

| • | Also in our bulk liquid storage business, we began constructing four new 630,000 gallon tanks at the Houston 2 facility— which is Phase 6 in this expansion program. The Houston 2 facility has continued at near 100% utilization due to strong demand for non-fuel product storage in this market. |

| • | Also in our bulk liquid storage business, two new tanks (totaling 900,000 gallons) at our Amsterdam, Netherlands terminal were completed and leased. |

| • | Our liquid feed supplements business began production of low moisture tubs at our Catoosa, OK facility. This new product will expand our sales and serves to complement our existing chemical tub product line. |

| • | Our liquid feed supplements business also completed research and commenced sales of an environmentally friendly “Eco Tub” container. The “Eco Tub” container has been very well received by the industry and improved our sales during the period. |

| • | The National Safety Council recognized eleven of our facilities with their prestigious Safety Leadership Award. This award is presented to a facility that has achieved five consecutive years without a fatality or occupational injury. |

Since January 1, 2012

| • | In our bulk liquid storage business, the remaining four new tanks, totaling 1.9 million gallons, at our Amsterdam, Netherlands terminal were completed as part of a nine- tank project. |

Risks

Our statements about our corporate plans, including our expansion plans, their expected completion dates, and their effect on our terminal capabilities, storage capacity, and liquid animal feed production are forward-looking. Important factors that could cause our actual results to differ materially from these statements include changes in demand for bulk liquid storage or for liquid animal feed supplements, delays in construction or increased construction costs due to weather, disputes with contractors, or opposition by environmental groups, and unanticipated changes in our results of operations or general market conditions in the future. For a more detailed description of risks that we face, please see the “Risk Factors” section, Item 1A of this Form 10-K.

Bulk Liquid Storage Business

Overview

Our bulk liquid storage business owns and/or operates a network of facilities located in North America, Western Europe, and Asia, providing storage and related services to manufacturers and purchasers of bulk liquid products. Our customers represent a diverse group of multi-national, national, and regional corporations. Our value-added services are customer specific and include transloading and blending of bulk liquids as well as acting as regional distribution centers for our customers on an entirely outsourced basis. Underpinning all of our services is our foremost objective, which is to differentiate our service quality by achieving the highest level of customer satisfaction. We often coordinate closely with our customers’ technical services and product handling experts in designing and adapting the customized product handling systems required for each customer’s specific product. By this means, our facilities often become critical links in the distribution chains of our customers. Our proprietary systems, rapid execution, and superior commodity management expertise has led to many long-term customer relationships.

Services—by Product Stored

We provide bulk liquid storage services for a wide range of products. This diverse product servicing portfolio helps to minimize our exposure to significant customer and product risk.

The eight product groups stored by our bulk liquid storage business worldwide are:

| • | Molasses and Liquid Animal Feed Products. Historically, storage of molasses for the liquid feed supplements and yeast production industries has comprised a major single component of our and our predecessor’s bulk liquid storage business. We are well positioned in this product category, given our and our predecessor’s significant experience handling highly viscous liquids and our specialized infrastructure that includes large, positive displacement pumps and custom tank design. |

| • | Vegetable Oils, Tallows, and Greases. For decades, we or our predecessor have handled customer requirements for storage and transportation of vegetable oils, tallows and greases. These products are utilized in the food, biofuels, industrial soaps, detergent, and biochemical industries and require specialized services such as heated tankage and kosher certification. |

5

Table of Contents

| • | Lignin Sulphonate, Calcium Chloride, and Liquid Fertilizers. Our experience with non-hazardous bulk solutions such as calcium chloride, urea ammonium nitrate, and lignin sulphonate is extensive. These products are tied to basic industries such as agriculture and paper production. Because many of these products are corrosive, specialized tank linings are required to maintain quality control and safe handling. |

| • | Petroleum, Petro-Chemicals, Waxes, and Petroleum Oil. Our position in this category is primarily concentrated in storing niche products, such as paraffin waxes and lubrication oils, derived from the petroleum refining process for candle, coatings and automotive markets, in addition to certain other heavy industries. The heat and viscosity requirements of these products lend themselves to our high value-added service model. Generally, we do not handle petroleum fuels, gasoline, or traditional petro-chemicals (e.g. benzene or toluene). |

| • | Chemicals. Since the mid 1990s, we or our predecessor have expanded our storage services into a more diverse range of chemical products, for producers and distributors serving manufacturing and industrial markets. Subsequent improvements in industry-specific expertise have provided us with the experience necessary to handle these products. We conduct a thorough risk analysis when evaluating all new chemical opportunities to ensure minimal safety and environmental risk. |

| • | Caustics. Chloralkali products, including sodium and potassium hydroxide, are stored on behalf of industrial use producers and distributors and were the first product category that our predecessor commenced to store for external customers in the 1970s. Specialized heated tanks, linings and piping systems are utilized to protect product quality and ensure efficient handling of products for municipalities and the sanitation and paper production industries, as well as for others. |

| • | Methyl Esters (Bio-diesel). We or our predecessor have been handling methyl esters since 2002 on behalf of producers and distributors. Our employees are familiar with the unique properties of methyl esters, and we have systems to ensure that our quality control and safe handling standards are maintained. These systems include standardized handling procedures and the use of specialized equipment to prevent moisture intrusion. |

| • | Asphalts. We handle asphalt products which are used in roadways and in roofing applications. Our Baltimore, MD and St. Paul, MN facilities have special systems constructed to handle asphalts. We employ hot oil systems, tank heating coils, insulated tanks and pipelines needed to keep these products flowing properly through our facilities. |

Services—by Activity Performed

We provide our customers with a broad range of value-added services across all stages of the bulk liquid storage chain:

| Storage |

Handling |

Receipt/ Distribution |

Transloading |

Other | ||||

| Carbon tanks |

Additive injection | Marine | Rail to truck | Audit Documentation | ||||

| Stainless tanks |

Custom blending | Rail | Truck to rail | FEMAS certification | ||||

| Dry air treatment |

Direct transfer | Truck | Lightering | Food grading | ||||

| Foam systems |

Filtration | GMP certification | ||||||

| Radar gauging |

Heating | ISO certification | ||||||

| Hot oil systems |

Piggable lines | Marketing | ||||||

| Nitrogen blanketing |

Recirculation | Responsible Care - | ||||||

| Lined tanks |

Dilutions | Partner | ||||||

| Stainless piping |

ISO containers | |||||||

| Custom build |

Flexi bags |

We work closely with our customers to design service packages and contracts that meet their specific storage and handling requirements. This process involves varying degrees of complexity across our customer base and generates many long-term collaborative relationships. For example, some customers require only basic storage services, such as tank storage, product receipt and delivery services, and occasional transloading. Others have more complex requirements, including the provision of temperature regulation, blending, or sampling services. Our breadth of services and flexibility differentiates us in the marketplace and provides a distinct advantage when competing for new business.

6

Table of Contents

Customers

Our customer-focused approach has resulted in a number of long-standing relationships with major customers. In 2011, the ED&F Man group, a related party, accounted for 17% of the revenues of our bulk liquid storage business. The loss of the ED&F Man group or any of our next three top customers would have a material adverse effect on our bulk liquid storage business. As discussed in more detail below in the subsection entitled “Our Commercial Relationship with the ED&F Man Group,” we have a long-term contractual relationship as a supplier of bulk liquid storage to the ED&F Man group. Our bulk liquid storage business is not dependent on any other single or small number of customers whose loss would have a material adverse effect on the business.

A large proportion of our bulk liquid storage business’ revenues are derived from services for highly-regarded multi-national corporations. Our relationships with these customers have resulted in longer term contracts. Approximately 68% of our bulk liquid storage contracts had initial terms of two years or more in duration and approximately 56% had initial terms of three years or longer as of December 31, 2011. The initial duration of our storage contracts is set out below in more detail:

Initial Duration of Storage Contracts—Terminals Worldwide as of December 31, 2011

| > 5 Years |

10 | % | ||

| 3 to 5 Years |

46 | % | ||

| 2 to < 3 Years |

12 | % | ||

| 1 to < 2 Years |

28 | % | ||

| < 1 Year |

4 | % |

Competition

Competitive Conditions

Our bulk liquid storage business competes in international, national, regional, and local markets, throughout the United States, Eastern Canada, portions of Western Europe, and Korea. The competitive environment in which we operate, the number of competitors, and our market position vary across different markets.

In the international market, competitors include multi-national providers such as Oil Tanking, Stolt Nielsen S.A., LBC Holdings LLC and Royal Vopak N.V. At locations in Europe, such as Denmark and Poland, competition also derives from smaller independent storage businesses and former state-owned installations. In the United States, at a national level, major competitors include Nu Star Energy L.P., Kinder Morgan Energy Partners, International-Matex Tank Terminals (50% owned by Macquarie Infrastructure Company LLC), and TransMontaigne.

The principal competition for each of our facilities comes from other third-party bulk liquid storage facilities located in the same regional or local market. In regional and local markets, we face competition from independent storage businesses operating in a number of markets served by us, such as Simon Storage Ltd. (owned by Interpipeline Fund) in the United Kingdom. In some regional and local markets, such as St. Paul, MN, Jacksonville, FL, and Toledo, OH, our facilities represent a significant proportion of available bulk liquid storage capacity. In other markets, such as Houston, TX, our facilities represent only a small proportion of available bulk liquid storage capacity and have numerous competitors with facilities of similar or larger size and with similar capabilities.

Across product groups, our bulk liquid storage business competes with companies having a primary focus in the storage of specific products, such as hydrocarbons and derivatives, as well as with businesses providing a broader range of services.

We also compete for acquisition and expansion opportunities with other companies involved in the bulk liquid storage business.

Principal Methods of Competition

Independent terminal owners principally compete on the basis of the location and versatility of terminals, service, and price. A favorably located terminal will have access to various cost-effective transportation modes both to and from the terminal. Transportation modes typically include waterways, railroads, and roadways.

An important competitive element is the operator’s ability to offer complex handling requirements for diverse products. A terminal operator that can handle many types of products and provide a broad range of high quality services has a distinct advantage over a less versatile terminal operator. Our terminals handle a broad spectrum of specialty products through a number of features, including rail capacity, dedicated pipelines, on-scale top-loading of trucks, heating capacity, and multiple tank sizes, including small and medium capacity tanks.

7

Table of Contents

A terminal operator’s ability to provide attractive pricing is often dependent on the quality, versatility, and reputation of the facilities owned by the operator. Although many products require modest terminal modification, our versatile storage capabilities typically require less modification prior to usage, ultimately making the storage cost to our customer more attractive.

Factors Affecting Competitive Position

Positive factors pertaining to our competitive position are discussed at length below in the subsection entitled “Competitive Strengths.” Negative factors pertaining to our competitive position include the fact that some of our competitors are larger than we are, have greater financial resources, have lower costs of capital, control more storage capacity, and accordingly sometimes are able to offer a better price or greater storage capacity. There are also occasions where a competitor has a facility in a location that enables it to serve a particular customer’s need more economically than our nearest facility. These negative factors are further described in the “Risk Factors” section of this Form 10-K.

Competitive Strengths

Broad Geographic Footprint and Strategic Location of Facilities

Our bulk liquid storage business is one of the few service providers capable of providing truly international service across a broad range of agricultural and industrial liquids. We own and/or operate 25 terminal locations globally, with a presence in the U.S., eastern Canada, Western Europe and South Korea. Together these facilities provide approximately 363 million gallons of total bulk liquid storage capacity. Many of our storage facilities are located in important strategic deep water ports, such as Houston, TX; Philadelphia, PA; Jacksonville, FL; Baltimore, MD; and Grays Harbor, WA in the U.S., as well as Amsterdam, Netherlands; Gydnia, Poland; and Liverpool, U.K. in Europe. Moreover, we have numerous in-fill growth opportunities on available land at our existing sites.

We benefit from a broad geographic footprint and the extensive experience of our management team. We operate in a variety of regional, national and international markets. Our bulk liquid storage business offers our customers a truly global storage solution with a high level of expertise across multiple markets. Our strategic locations of bulk liquid storage terminals and the barriers to entry at these locations constitute advantages for our bulk liquid storage business. Our good relationships with regulators and port authorities and our extensive experience with permitting processes bolster these advantages.

Differentiated Service Offering

We provide a differentiated service to manufacturers, bulk liquid traders, and those corporations looking to minimize cost and maximize flexibility of service in the bulk liquid storage market.

We offer numerous tailored services such as heating, blending, sampling and transloading (the transfer of products from one transportation vehicle, such as a rail car or a ship, to a truck) and have customized our service contracts to meet specific customer requirements.

The range of our service offerings and our attention to customer service enables us to differentiate ourselves in the marketplace and to maintain our leading positions in many of the bulk liquid storage markets where we compete.

Strong Relationships with Blue-Chip Customers

Our business approach, which focuses on being a long-term partner rather than merely an industrial supplier, reinforces the strategic nature of our relationships with our customers. We have developed long-standing relationships with numerous well-established global customers, many of whom have been doing business with us (or our predecessor) for more than 10 years. Our ability to attract and retain blue-chip customers is the direct result of our unparalleled customer service. Maintenance of important customer relationships with long-term contracts provides us with stable revenue and income streams.

Storage Relationship with the ED&F Man Group

We have an important global relationship with the ED&F Man group as their principal supplier of storage requirements. This relationship is discussed in more detail below in the subsection entitled “Our Commercial Relationship with the ED&F Man Group.”

8

Table of Contents

Growth Strategies

Increase Volumes of Existing Services

We expect that global demand for our bulk liquid storage service should continue to increase over the long-term, although such demand may vary in particular years depending on global economic conditions. Despite uncertainty that may affect the overall economy, our growth is expected to be driven by the underlying expansion of long-term demand for a wide variety of agricultural and industrial raw materials that will need bulk liquid storage.

Given the high levels of utilization of our storage facilities, we believe one key to increasing the volume of our storage services is to increase our storage capacity in appropriate locations. In structuring our capacity to accommodate higher levels of demand, we expect to utilize the capital resources provided by our internally generated cash flow and our bank credit facility to finance increased total bulk liquid storage capacity.

When evaluating new development opportunities, we analyze a series of objective criteria including the potential benefits of additional infrastructure, logistics capability, overall environmental conditions, political stability, and payback period. Through this process, we assess the acceptability of projected financial returns, as well as the level of potential execution risk. In addition, prior to construction or expansion of any facilities, we will typically secure an indication of appropriate interest from potential customers in order to ensure that our investments will be supported by contracted base revenues.

Pursue Acquisitions

Our management maintains an active dialogue with potential acquisition targets and frequently explores opportunities in the context of our strategic goals and financial return expectations. Additionally, our staff has experience in acquiring and integrating new businesses into our operations, which has increased the size and scope of our business, and we expect to continue to pursue this strategy as appropriate opportunities surface in the future. When evaluating potential acquisitions, we expect to focus our resources on increasing our storage capacity in key markets that will enhance our scope of service offerings, as well as gaining entrance to new strategically attractive markets where we are not currently represented.

Develop New Services

We are committed to developing a range of services that will contribute long-term profitable growth to the Company. We will strive to offer new or expanded customer services through our high-quality infrastructure and state-of-the-art technical competencies. For example, in Houston we developed a custom designed base oil blending system which was built to provide optimal market flexibility to one of our customers. This base oil blending system provides a customer with a long-term technical solution to meet the demands of their market and provides Westway with a solid long-term contractual source of revenue and earnings.

Expand into Complementary Businesses

We believe that our international network of facilities, extensive management experience, and core operating capabilities in the storage of liquid products creates numerous opportunities for us to expand profitably into businesses that are vertically and/or horizontally complementary to our existing business mix.

Pursue International Joint Venture and Royalty Agreements

We intend to actively explore joint ventures and strategic alliances with business partners that will enable us to expand our interests and geographic network. We are exploring alliance agreements with companies that would utilize our tank capacity for both raw materials and finished product storage. By this means, we want to position ourselves as a critical component of a new partner’s supply chain with the goal of creating new multi-site commercial relationships.

Liquid Feed Supplements Business

Overview

Through our 35 facilities in North America, western Canada, and eastern Australia, we provide liquid feed supplements to the lower 48 U.S. states, five Canadian provinces, northern Mexico, and eastern Australia. We compete in these markets by using formulation processes that are tailored specifically to the needs of customers. We blend molasses and other essential nutrients to form feed rations that help to maximize the genetic potential of livestock. Typically, these supplements contain concentrated forms of protein, energy, minerals, and vitamins, which normally comprise 5-10% of an animal’s daily diet. Beef cattle, dairy cattle, and horses consume the majority of our liquid feed supplements. We continue to invest in research to develop new products and manufacturing processes, which allows us to maintain our competitive position.

9

Table of Contents

Our manufacturing and distribution locations allow us to provide nutritional liquid feed supplements to the majority of the U.S. livestock markets. In addition, eight of our facilities and joint venture facilities are positioned at deep water port locations, facilitating the cost-effective receipt of off-shore ingredients such as molasses and condensed molasses solubles. These deep water port terminals provide a barrier to new entry into the North American liquid feed supplements business. The balance of our manufacturing locations are either strategically located on navigable inland river systems or have direct railroad access.

Products

Our finished products provide supplemental nutrients that allow livestock to achieve their genetic potential. We use specialized manufacturing of complex formulations of several basic raw ingredients, including proteins, minerals, and vitamins, to produce complex liquid and block supplements for sale to livestock feed operators, dry feed mills, and distributors. We also produce less complex products that are utilized as ingredients in livestock feeds specifically to enhance the appearance, preserve the product, improve the palatability, or act as a binding agent for other dry feed ingredients. Specialized least-cost formulation programs allow us to maximize margins while providing the best performing product for the customer.

Our product classes and their more specific subcategories are as follows:

Complex Liquid Feed Protein Supplements, Suspensions, and Mill Products

| • | Liquid Protein Supplements. Liquid lick tanks supplements are typically fed “free choice” in pastures. Free choice consumption is normally considered to average 2 lbs. per animal, per day, and is controlled through the formulation of the liquid supplement. These pastures are normally low in nutrients such as protein, energy, phosphorus, and other minerals. Accordingly, the nutrient-dense liquid feed supplements provide a way to balance the nutritional requirements of livestock, allowing them to reproduce or gain weight at an optimum rate. In applications where liquid protein supplements are part of a complete ration, the inclusion rate of the supplement depends on the nutrient profile of the other dry feed ingredients. Nutrient profiles of the supplement can be adjusted to balance the nutrients of the dry feed ingredients. Livestock that consume the complete ration form of liquid feed supplements are normally held in confinement rather than in open pasture. Liquid protein supplements are utilized in virtually all regions of the United States and western Canada. They are marketed through both distributor and dealer networks as well as sold directly from us to the end users. |

| • | Liquid Suspension Products. Liquid suspension products are the most complex liquid feed supplements that we manufacture. Thixotropic technology allows insoluble ingredients such as calcium carbonate, potassium chloride, feathermeal, and salt to be suspended in a liquid supplement that can “flow.” These supplements provide a wide range of minerals, proteins, and medications, and are mainly utilized in confined beef feeding operations and large dairies. The largest concentrations of customers of our liquid suspension products are in the Texas panhandle and northern California. In Texas, such supplements are sold directly to the end user, whereas in northern California they are marketed through large distributors. |

| • | Mill Products. Mill products are specialized molasses-based products sold to dry feed milling companies and mixed by them with other dry feed ingredients. These specialized products are used in two primary types of applications in the dry feed milling industry: texturized horse feed and pelleted products fed to different classes of livestock. Our “E-Z Glo” product is a mill product fortified with high-quality vegetable oil, minerals, and preservatives that is included in texturized horse feed as 5-15% of overall product content. Our “Pellet Partner” product is a mill product containing liquid lignin, a by-product from the timber industry, that is used to bind dry feed ingredients to form pellets or cubes. Mill products are utilized in dry feed mills throughout the United States. They are mainly sold directly to the feed mills. |

Molasses and Molasses Blends

| • | Molasses. Molasses is a standardized 79.5 brix product that is sold predominantly to the commercial dry feed industry. Standardized molasses is typically used for a coating on textured feeds and dry feed products. |

| • | Blends. Blends are the simplest form of value-added products. Typically blends include molasses blended with one or more of the following ingredients: corn steep liquor, condensed molasses solubles, whey permeate, distillers’ solubles, lignin sulphonate, and/or glycerine. Blends are normally utilized in complete feed rations to reduce the dust and improve the palatability of the ration. Virtually all blends are incorporated into livestock rations that do not use a protein supplement or a suspension and are consumed in confined feeding operations. We use distribution and direct supply formats for the sale of blends. |

10

Table of Contents

Other

| • | Blocks/Tubs. Blocks, or tubs as they are sometimes referred to, are a solid feed supplement that is fed, unmixed with any other food, as a free choice protein supplement to cattle on pasture or improved pastures. The primary package size is 200 lbs. and is marketed through a series of distributors and local farm stores. The majority of our blocks are toll manufactured for other feed companies, sold through their respective labels, and fed primarily to beef cattle, dairy cattle, and horses, with some products sold for sheep, goats, and wild game. |

| • | Dried Products. Dried products result from mixing ground soybean hulls and sunflower hulls with cane molasses and drying the mix through a rotating drum drier. Dried products are typically used either as sweeteners for dry feed rations, or as binding agents for other dry feed ingredients in the manufacture of solid feed supplements known as “blocks.” Target customers include small confined feeding operators that use dried products as sweeteners, and specialty small block manufacturers that use dried products as a binder and sweetener. All dried product marketing to confined feeding operators is done through a series of distributors. The majority of our dried products are consumed by beef and dairy cattle, with little consumed by horses, sheep, goats, swine, or poultry. |

| • | Other Ingredients. This category is comprised of liquid whey permeate, renewable fuel by-products, and other liquid ingredients sold typically directly to customers. |

Champion Liquid Feeds Pty Ltd

In addition to serving markets in North America, we also have a presence in the Australian feed market through our 50% interest in Champion. Champion was formed in 2001 for the purpose of manufacturing and distributing liquid feed supplements in eastern Australia. During 2010, Gardner Smith (Holdings) Pty Ltd acquired our prior joint venture partner’s 50% ownership in Champion. Gardner Smith has a significant presence in the agricultural liquid storage business in Australia and New Zealand. Champion is able to supply a complete range of liquid feed supplements to Victoria, New South Wales, and Queensland.

Customers

Our liquid feed supplements business is not dependent on any single or few customers whose loss would have a material adverse effect on the business.

Sources and Availability of Raw Materials

Molasses is one of our primary inputs. We have a long term supply agreement through May 2019 with the ED&F Man group to provide us with heavy brix cane molasses based on formula pricing determined in part by prices charged by the ED&F Man group to third parties. Under the agreement, the ED&F Man group must maintain books and records sufficient to be audited in accordance with generally accepted auditing standards. The ED&F Man group must also arrange for independent verification on a quarterly basis of the prices charged to their customers by a reputable independent certified public accounting firm and provide the reports of such information to us. This agreement is expected to provide us with the majority of our molasses needs in 2012. We expect that we will be able to obtain a sufficient supply of molasses for the foreseeable future. In addition we purchase significant volumes of other food and agricultural raw materials through fixed or indexed pricing mechanisms. We expect that we will be able to obtain sufficient supplies of needed ingredients in 2012 and the foreseeable future.

Intellectual Property

The collective body of our intellectual property, including patents and trademarks, affords us the opportunity to profitably utilize a wide range of human-food industry by-products and other co-products to help meet the needs of the livestock industry as well as certain other industries. However, our overall success is not dependent upon any single portion of our intellectual property.

Seasonality

The liquid feed supplement business, which is predominately driven by cattle feeding, is typically stronger in the fall and winter months (feed season) because many cattle are fed on natural grasses during the spring and summer months. Range cattle are typically fed liquid supplements during late fall and winter as grass nourishment diminishes and/or is dormant due to weather conditions. This seasonality is also impacted by the “calving season”. Range cattle “typically” calve in the January through March time frame, requiring heavier supplementation during the late gestation/lactation period. This seasonality is also driven in part by the colder weather which requires more feed for body maintenance purposes.

11

Table of Contents

Competition

Competitive Conditions

We are the largest producer of liquid feed supplements in North America. Our business operates in a highly competitive environment, and our competition in North America falls into three categories: the commercial liquid feed industry, the commercial dry feed industry, and the commodity brokerage industry. Regionally, we compete against a number of smaller liquid animal feed companies.

Principal Methods of Competition

We operate in markets with competition based on price, quality, and service. We focus on managing our input costs, utilizing the best of available co-product streams, improving efficiencies via technological advancements, pursing research and development, and making productivity enhancements.

Factors Affecting Our Competitive Position

Positive factors pertaining to our competitive position are discussed at length below in the subsection entitled “Competitive Strengths.” Negative factors pertaining to our competitive position include competitors who are larger, vertically integrated, and have greater financial resources and lower costs of capital than us. Accordingly, these competitors are sometimes able to offer a better price. There are also occasions where a competitor has a facility in a location that enables it to serve a particular customer’s need more economically than our nearest facility. These negative factors are further described in the “Risk Factors” section of this Form 10-K.

Competitive Strengths

Broad Geographic Footprint and Strategic Location of Facilities

Through our liquid feed supplements business, we own and/or operate 35 facilities—32 located throughout the U.S. and western Canada, and three joint venture facilities in eastern Australia. Together the facilities provide on an annual basis approximately 1.8 million tons of liquid feed supplements production.

Our liquid feed supplements business has the broadest geographic coverage of any North American liquid feed supplements manufacturer, and we are the only producer capable of servicing all lower 48 U.S. states, as well as five provinces in Canada and parts of northern Mexico. Moreover, our seven deep-water port locations together with a key alliance at the Melbourne, Australia port gives us a competitive advantage over other liquid feed supplements companies in markets we serve. We expect to continue leveraging our network and extensive market knowledge to explore expansion opportunities on a global scale in the years to come.

Differentiated Product Offering

We offer a broad range of liquid feed supplements, ranging from simple molasses-based blends and mill products to highly complex suspension products. Further, our research and development skill and proprietary manufacturing processes allow us to customize our feed products to meet specific customer nutritional requirements and to respond to the changing availability and cost of ingredients. The range of our product offerings and our attention to customer service enable us to differentiate ourselves in the marketplace and to maintain our leading market position in the liquid feed supplements industry.

Strong Relationships with Blue-Chip Customers

Our business approach, which focuses on being a long-term partner rather than merely an industrial supplier, reinforces the strategic nature of our relationships with our customers. We have developed long-standing relationships with numerous well-established global customers, many of whom have been doing business with us (or our predecessor) for more than 10 years. Our ability to attract and retain blue-chip customers is the direct result of our unparalleled customer service.

Feed Relationship with the ED&F Man Group

We have an important global relationship with the ED&F Man group as an important supplier of cane molasses for our liquid feed supplements business. This relationship is described in more detail below in the subsection entitled “Our Commercial Relationship with the ED&F Man Group.”

12

Table of Contents

Growth Strategies

Increase Volumes of Existing Products

We expect that global demand for our liquid feed supplements products will continue to increase over the long-term, although such demand may vary in particular years depending on global economic conditions. In the long-term, we expect the liquid feed supplements business to continue to benefit from increasing global demand for animal feed containing higher protein content. In the near term of 2012, however, we expect the low U.S. beef cattle numbers and declining dairy profits will continue, which in turn could negatively affect the demand for animal feed, including liquid feed supplements. However, in anticipation of a growing long-term demand, we expect to utilize the capital resources provided by our internally generated cash flow and our bank credit facility to finance increased production.

When evaluating new development opportunities, we analyze a series of objective criteria including the potential benefits of complementary products and services, additional infrastructure, logistics capability, overall environmental conditions, political stability, and payback period. Through this process, we assess acceptability of projected financial returns and the potential level of execution risk of possible transactions.

Pursue Acquisitions

The liquid feed supplement industry is highly fragmented in nature with numerous small and mid-sized companies operating in North America. We believe this market fragmentation provides us with significant expansion opportunities. Our management team maintains an active dialogue with potential acquisition targets and frequently explores opportunities in the context of our strategic goals and financial return expectations. Additionally we have experience in acquiring and integrating new businesses which have increased the size and scope of our operations, and expect to continue to pursue this strategy as new opportunities become available in the market. When evaluating potential acquisitions, we focus on those opportunities which will increase production capacity in key markets that enhance our product offerings, and those which will provide new entry into strategically attractive markets where we are not currently represented.

Develop New Products

We expect to dedicate appropriate resources to developing a range of products that will contribute long-term profitable growth to the Company. We will continue to leverage our strong research and development capabilities to design products that incorporate and/or expand on new technologies, as well as source raw materials that have not been previously utilized. We will focus on products that provide the most significant potential for profit and have the most potential to differentiate us in the marketplace. For example, we are currently exploring opportunities related to emerging liquid byproducts from the biofuel industry, edible packaging alternatives, and new applications for low-cost suspension products for the beef industry. Additionally, we have expanded our product offering to include low moisture tubs. We believe this product line is complementary to our existing poured tub product line.

Expand into Complementary Businesses

We believe our international network of facilities, extensive management experience, and core operating capabilities in the manufacturing and distribution of liquid products create numerous opportunities for us to profitably expand into businesses that are vertically and/or horizontally complementary to our existing business mix.

Pursue International Joint Venture and Royalty Agreements

We intend to actively explore joint ventures and strategic alliances with global business partners to expand our interests and geographic network. Currently, we are expanding our geographic footprint in Mexico. Mexico, which has approximately 1/3 the beef cattle/dairy cattle numbers as the U.S., is a largely untapped liquid supplement market. We believe our existing US infrastructure, technologies, and staff can be utilized to expand into this country. By combining our expertise with those of our joint venture partners, we will continue to create successful liquid feed manufacturing capabilities that are poised for future growth in the international marketplace. We are also actively seeking opportunities to leverage our technological leadership in liquid feed supplements by establishing royalty agreements with complementary organizations for the manufacturing and distribution of our products on a worldwide basis.

Our Commercial Relationship with the ED&F Man Group

Our commercial relationship with the ED&F Man group provides a number of benefits to both our bulk liquid storage and liquid feed supplements businesses. In particular, the benefits of being a supplier of bulk liquid storage to the ED&F Man group, combined with the quality and quantity of molasses supplied to our liquid feed supplements business by the ED&F Man group, provides us with a degree of certainty in the operation of our businesses and our ability to service our many customers in the future.

13

Table of Contents

Bulk Liquid Storage Arrangements

Our long-term relationship as a supplier of bulk liquid storage to the ED&F Man group’s various trading divisions has been a contributor to our performance. The long-term contract setting forth our supplier status is the storage alliance agreement, the initial term of which runs until May 28, 2029, after which the agreement provides for automatic renewals for successive ten year periods, unless either party gives at least three years notice of non-renewal. The storage alliance agreement is described in “Certain Relationships and Related Transactions—Related Transactions—Storage Strategic Alliance Agreement and Terminal Service Agreement” in the prospectus we filed with the SEC on August 7, 2009. The ED&F Man group has global expansion opportunities, and as their storage supplier, we expect to capitalize on these opportunities which will provide additional business for both our existing and new locations.

Molasses Supply Arrangements

Molasses is an important ingredient utilized in our liquid feed supplement formulations. We and the ED&F Man group have a long-term molasses supply agreement, pursuant to which the ED&F Man group is our primary supplier of cane molasses. The initial term of the agreement runs until May 28, 2019, after which the agreement provides for automatic renewals for successive one-year periods unless either party gives notice of non-renewal. The long-term molassess supply agreement is described in “Certain Relationships and Related Transactions—Related Transactions—Molasses Supply Agreement” in the prospectus we filed with the SEC on August 7, 2009. Effective October 2011, an addendum to this molasses supply agreement was renewed, with a one-year term that slightly modifies the pricing mechanism.

Insurance Participation Agreement

We have a participation agreement with a captive insurance company owned by the ED&F Man group. The captive underwrites the self-insured portion of certain risks insured by us through the captive and charges a premium for the first layer of claims exposure. Under this agreement all of our transactions are partitioned into a separate operational cell from the ED&F Man group’s business.

Employees

As of March 16, 2012, we had 496 employees, of which 495 are full-time employees.

Regulation and Safety

We are required to comply with the health and safety regulations and requirements of each of the jurisdictions in each of the countries in which we operate. In order to comply with their requirements, management focuses on the issue of health and safety from the top down, identifying key operational risks and seeking to ensure that our policy, process and practice are in conformity with legal and normal business practices. The risks relating to the safe handling, storage and regulation of each of our bulk liquid storage and liquid feed supplements operations are managed on a centralized basis for both of our businesses. The regulatory and legal environments within which liquid products are handled by our businesses differ with the geography, markets, product offerings, and sophistication within which we operate.

We are required to comply with Federal Food and Drug Administration requirements as well as local State feed control requirements in the U.S. To meet and exceed these requirements, we have developed and implemented an extensive Standard Operating Procedures Manual, which comprises all aspects of quality, FDA regulation, training, manufacturing, administrative, and security compliance.

In addition, we comply with applicable health and safety requirements in Europe and elsewhere by following our European Health, Safety, Environmental, and Quality (“HSEQ”) policy, including local legal requirements that govern the care and safeguarding of the health and safety of our employees and the environment.

Our compliance with Federal, State, foreign, and local regulations relating to the protection of the environment is not expected to have a material effect upon our capital expenditures, earnings, or competitive position.

Forward-Looking Statements

This Item 1 of our Form 10-K contains numerous forward-looking statements, including our statements about future growth in demand for various products and services and about our plans, intentions, or hopes to increase storage and production volumes, open new facilities, expand terminal capacity through site development, market products in other nations, expand our liquid supplement business, pursue acquisitions, invest in the development of and develop new products and services, and explore joint venture and strategic alliance opportunities. There are a number of important factors that could cause actual results to differ materially from our forward-looking statements, including the factors discussed at length in the “Risk Factors” section, Item 1A of this Form 10-K.

14

Table of Contents

Information Available on Our Website

We make available free of charge on or through our website, as soon as reasonably practicable after we electronically file with or furnish to the SEC, our annual report on Form 10-K and our quarterly reports on Form 10-K and any amendments thereof, and (via a link to EDGAR) our current reports on Form 8-K and any amendments thereof. Our internet address is www.westway.com. Additionally, we have adopted a Code of Conduct and Ethics, applicable to all employees, officers and directors, which is available on our website, along with our corporate governance principles, audit committee charter, nominating committee charter, compensation committee charter, and whistle blower policy.

| ITEM 1A. | RISK FACTORS |

You should carefully consider each of the following risks. These risks constitute important factors that could cause our actual results to differ materially from those indicated by our forward-looking statements in this Form 10-K.

The realization of any of the following risks may significantly and adversely affect our business, prospects, financial condition, or operating results, as well as the trading price of our common stock. Moreover, some of the risks described below may to some degree already have occurred or be occurring. For further information regarding our actual recent experience, please see Items 7 and 7A of this Form 10-K.

The risks and uncertainties described below are not the only ones that we face. We are also subject to risks that affect many other companies, such as general economic conditions and geopolitical events. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial also may adversely affect our business. In describing these risk factors, we are not undertaking to address or update each factor in future filings or communications regarding our business or results.

Risks Related to Our Business and Operations Generally

The proposals received by our Board of Directors, and the related Special Committee process, could materially and adversely affect our business and financial results. In addition, there can be no assurance that any definitive offers will be made, or, if made, that any transactions will be consummated.

As described in “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” our Board of Directors has received (1) an unsolicited preliminary offer from ED&F Man, our largest stockholder, to acquire our animal feed supplements business and certain non-core bulk liquid storage terminals and (2) an unsolicited proposal from an infrastructure investment fund to acquire us for $6.00 per common share, $6.00 for each outstanding Series A Convertible Preferred share and $1.00 for each outstanding Founder Warrant, contingent upon the consummation of the proposed transaction to sell our animal feed supplements business and certain non-core bulk liquid storage terminals to ED&F Man. Our Board of Directors has initiated a process to explore strategic alternatives for the company as a whole and formed a Special Committee of independent directors to direct the strategic review process. The Special Committee has retained Evercore Partners as financial advisor to assist it during this process.

No definitive timetable has been set for evaluation of ED&F Man’s proposal. The Special Committee reviewed the infrastructure investment fund proposal with Evercore Partners and determined that it substantially undervalued the bulk liquid storage business and did not provide any basis to begin discussions or negotiations.

The process undertaken by the Special Committee could cause distractions and disruptions in our business. We may encounter difficulty retaining officers and other key employees who may be concerned about their future roles with us if a transaction were completed. Further, the costs associated with the evaluation of proposals and any related process is expected to be considerable, regardless of whether any transaction is consummated. All of the foregoing could materially and adversely affect our business and financial results. In addition, there is no assurance that any definitive offer for a change of control transaction will be made, or, if made, that any change of control transaction will be consummated. If a change of control transaction does not occur, the share price of our Class A common stock may decline to the extent that the current market price of our Class A common stock reflects an expectation that a transaction will be completed.

15

Table of Contents

Divestitures of any of our businesses could have a material adverse effect on our business, results of operations and financial condition.

We continually evaluate the performance of our businesses and may determine to sell a business. Divestitures may result in significant write-offs or impairment of assets, including goodwill or other intangible assets. Divestitures may involve additional risks, including separation of operations and personnel, diversion of management attention, disruption of our businesses or loss of key employees. We may not successfully manage those or other risks we may confront in divesting a business, which could have a material adverse effect on our business, results of operations and financial condition.

Our business has an important business relationship and dependence on the ED&F Man group.

Our liquid feed supplements business relies to a significant extent on the ED&F Man group as a supplier of raw cane molasses, which is used as a component of our liquid feed supplements products. We intend to continue sourcing a substantial portion of this raw material from the ED&F Man group in the future. We have a long-term supply agreement with the ED&F Man group whereby they supply us with heavy brix cane molasses. In the event that we are unable to purchase this raw material on reasonable terms from the ED&F Man group, we may be unable to find suitable alternatives to meet our needs, which could adversely affect our financial condition and results of operations.

The ED&F Man group is also an important customer of our bulk liquid storage business. We expect to derive a significant portion of our revenue from this relationship for the foreseeable future. Events that adversely affect the business operations of the ED&F Man group at times can adversely affect our financial condition and results of operations. We are indirectly subject to the business risks of the ED&F Man group, which are not always similar to the business risks we face directly. In addition, if the ED&F Man group is unable to meet its contractual commitments to us for any reason, then our revenue and cash flow could be negatively affected.

We may not be successful in identifying sufficient suitable development or acquisition opportunities, or purchasing or financing such opportunities on an acceptable basis.

Part of our business strategy includes developing or acquiring additional assets that complement our existing asset base, including developing or acquiring additional terminal, transportation, and storage facilities and the expansion of our existing liquid storage capacity. We may not be able to identify sufficient suitable development or acquisition opportunities. We may not be able to purchase or finance some potential developments or acquisitions on terms that we find acceptable. Additionally, we compete against other companies for development locations and acquisitions, and sometimes we are outbid by competitors. We can provide no assurance that we will be successful in the acquisition or development of assets and businesses appropriate for our growth strategy.

Cost overruns and delays in our expansion activities could adversely affect our business.

We currently have several significant expansion projects underway or planned. A variety of factors outside of our control, including weather or natural disasters, shortages of materials, construction equipment, or skilled labor; unforeseen engineering, geological, or environmental problems; poor performance by or disputes with contractors; opposition by environmental groups; or difficulties in obtaining permits or other regulatory approvals, at times may result in delays in construction or increased construction costs that may have an adverse effect on our return on investment, results of operations, or cash flows.

We may enter into agreements for or consummate acquisitions with little or no notice to our stockholders.

We regularly consider and enter into discussions regarding potential acquisitions. Any such transaction would be subject to negotiation of mutually agreeable terms and conditions and approval of the parties’ respective boards of directors. The acquisition of a business or assets can be effected quickly, may occur at any time, and may be significant in size relative to our existing assets or operations. Our capitalization and results of operations may change significantly as a result of these activities, and you generally will not have the opportunity to evaluate the economic, financial, and other relevant information that we will consider in connection with any future acquisitions or development opportunities, even though you may have the opportunity to evaluate material information in certain circumstances, such as when the approval of our common stockholders is required.

Our future developments or acquisitions may substantially increase the levels of our indebtedness and contingent liabilities, may impose substantial costs and delays, and may cause other unanticipated adverse impacts. We may not be able to integrate effectively and efficiently any future operations that we may develop or acquire.

Unexpected costs or challenges may arise whenever businesses with different operations and management are combined. For example, the incurrence of substantial unforeseen environmental and other liabilities, including liabilities arising from a newly-developed site or the operation of an acquired business or asset prior to our acquisition for which we are

16

Table of Contents

not indemnified, or for which indemnity is inadequate, may adversely affect our ability to realize the anticipated benefit from the development or acquisition. Inefficiencies and difficulties at times arise because of our unfamiliarity with new assets and new geographic areas of acquired locations or businesses. With acquisitions in particular, successful business combinations typically require our management and other personnel to devote significant amounts of time to integrating the acquired business or assets with our existing operations. These efforts at times temporarily distract our attention from day-to-day business, the development or acquisition of new properties, and other business opportunities. To the extent we do not successfully integrate any past or future acquisitions, or there is any significant delay in achieving such integration, our business and financial condition may be adversely affected. As previously mentioned our Amsterdam, Netherlands terminal tank expansion was delayed from its original schedule due to the extensive permitting process in the Netherlands.

We are the borrower under a credit facility with a syndicate of banks as the lenders. The amount we borrow under this facility or its terms may restrict our operating flexibility, could adversely affect our financial health, and could prevent us from fulfilling certain financial obligations.

We are the borrower under a credit agreement dated as of November 12, 2009, with JPMorgan Chase Bank, N.A., as administrative agent, Regions Bank, as syndication agent, Capital One, N.A., Rabobank Nederland, SunTrust Bank, and Compass Bank (doing business as BBVA Compass), as documentation agents, and the lenders from time to time party thereto (currently, JPMorgan Chase Bank, N.A., Regions Bank, Capital One, N.A., Rabobank Nederland, Suntrust Bank, Compass Bank, Whitney National Bank, and CoBank ACB) (the “Credit Agreement”). The Credit Agreement was delivered and became effective on November 16, 2009 and has been amended several times.

This revolving credit facility, which now totals $200 million, is scheduled to mature on July 6, 2015. The facility provides for loans at variable rates of interest, and is secured by most of our assets, various pledges of equity, and various guarantees by subsidiaries in our group. For a discussion of the terms of the credit agreement and its security, see the “Liquidity and Capital Resources” section of the “Management’s Discussion and Analysis of Financial Condition and Results of Operations” part of this Form 10-K.

Our borrowings under this credit facility are being used primarily for working capital and to assist us in funding capital expenditures, including acquisitions. As of December 31, 2011, our total indebtedness under this facility was $93.5 million, leaving $106.5 million available for additional borrowing, along with a $50 million accordion. The amount we borrow under this facility could significantly affect our operating flexibility, our financial health, and our ability to fulfill certain financial obligations. For example, the more we borrow under the facility:

| • | the more difficult it may be for us to satisfy our current and future debt obligations; |

| • | the more dependent we may be on the credit facility and the more any default under or termination of the credit facility may adversely affect us; |

| • | the greater the portion of cash flows from operating activities we must dedicate to the payment of principal and interest on the indebtedness, thereby reducing the funds available for other purposes; |

| • | the more we may be at a competitive disadvantage to competitors who are not as leveraged; and |

| • | the more vulnerable we are to interest rate fluctuations, as the indebtedness under the facility bears interest at variable rates. |

Likewise, the terms of the credit agreement may restrict our operating flexibility, financial health, or ability to fulfill certain financial obligations. For example, the terms of the credit agreement since the last amendment in July 2011:

| • | include not only first priority liens and security interests on the majority of our assets, but also a negative pledge on substantially all our non-mortgaged assets that restricts the encumbrance of such assets, subject to narrow exceptions; |

| • | require us to maintain certain financial covenants, including (a) a maximum consolidated total leverage ratio (as defined in the amended credit agreement) of no more than 3.75 to 1 at the end of each quarter; and (b) a minimum consolidated interest coverage ratio (as defined in the credit agreement) of not less than 3.0 to 1 at the end of each quarter; |

| • | put restrictions on our ability to make capital expenditures, dispose of assets, incur indebtedness, encumber assets, pay dividends, redeem securities, make investments, change the nature of our business, acquire or dispose of a subsidiary, enter into transactions with affiliates, enter into hedging agreements, or merge, consolidate, liquidate, or dissolve; |

| • | provide for the possibility of acceleration of our debt and the termination of all loan commitments under the facility upon the occurrence of an event of default; and |

17

Table of Contents

| • | require the consent of each lender directly affected with respect to most time extensions or forgiveness of any amounts owed. |

Our acquisition strategy and expansion programs require access to new capital. Volatility in the credit markets or more expensive capital could impair our ability to grow.

Our business strategies include acquiring additional terminal, transportation and storage facilities and the expansion of our existing liquid storage capacity. Although the bank syndicate credit facility into which we entered in November 2009 provides significant financing for corporate purposes, including future acquisitions and expansion, additional funds may be required to grow our business further and fully implement these strategies. Any equity or additional debt financing to raise such additional funds is subject to availability and may not be available on favorable terms. An inability to access the equity capital markets may result in a substantial increase in leverage and have a detrimental impact on our creditworthiness. If adequate additional financing cannot be obtained, our business strategies may not be able to be fully implemented or implemented in the expected time frame and our financial condition and results of operations could be adversely affected.