Attached files

| file | filename |

|---|---|

| EX-16 - EX-16 - ASPIRITY HOLDINGS LLC | a2207275zex-16.htm |

| EX-5.1 - EX-5.1 - ASPIRITY HOLDINGS LLC | a2207275zex-5_1.htm |

| EX-4.5 - EX-4.5 - ASPIRITY HOLDINGS LLC | a2207275zex-4_5.htm |

| EX-4.4 - EX-4.4 - ASPIRITY HOLDINGS LLC | a2207275zex-4_4.htm |

| EX-4.1 - EX-4.1 - ASPIRITY HOLDINGS LLC | a2207275zex-4_1.htm |

| EX-10.4 - EX-10.4 - ASPIRITY HOLDINGS LLC | a2207275zex-10_4.htm |

| EX-23.1 - EX-23.1 - ASPIRITY HOLDINGS LLC | a2207275zex-23_1.htm |

| EX-10.26 - EX-10.26 - ASPIRITY HOLDINGS LLC | a2207275zex-10_26.htm |

| EX-10.25 - EX-10.25 - ASPIRITY HOLDINGS LLC | a2207275zex-10_25.htm |

| EX-10.24 - EX-10.24 - ASPIRITY HOLDINGS LLC | a2207275zex-10_24.htm |

| EX-10.23 - EX-10.23 - ASPIRITY HOLDINGS LLC | a2207275zex-10_23.htm |

Use these links to rapidly review the document

Table of Contents

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS TWIN CITIES POWER HOLDINGS, LLC AND SUBSIDIARIES

As filed with the Securities and Exchange Commission on March 30, 2012

Reg. No. 333-179460

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-1

REGISTRATION STATEMENT

UNDER THE

SECURITIES ACT OF 1933

Twin Cities Power Holdings, LLC

(Exact name of registrant as specified in its charter)

| Minnesota (State or other jurisdiction of incorporation or organization) |

27-1658449 (I.R.S. Employer Identification Number) |

16233 Kenyon Ave., Suite 210

Lakeville, Minnesota 55044

(952) 241-3103

Fax (952) 898-3571

(Address, including zip code, and telephone number, including area code, of registrant's principal executive offices)

Timothy S. Krieger

Chief Executive Officer

16233 Kenyon Ave., Suite 210

Lakeville, Minnesota 55044

(952) 241-3103

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With a copy to:

Mark S. Weitz, Esq.

Leonard Street and Deinard, PA

150 South 5th Street, Suite 2300

Minneapolis, Minnesota 55402

Telephone: (612) 335-1500

Fax: (612) 335-1657

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ý

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of "large accelerated filer", "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer o | Smaller reporting company ý |

CALCULATION OF REGISTRATION FEE

|

||||||||

| Title of Each Class of Securities to Be Registered |

Amount to be Registered |

Proposed Maximum Offering Price Per Note |

Proposed Maximum Aggregate Offering Price |

Amount of Registration Fee |

||||

|---|---|---|---|---|---|---|---|---|

Renewable Unsecured Subordinated Notes |

$50,000,000 | (1) | $50,000,000 | $5,730(2) | ||||

|

||||||||

- (1)

- The

Renewable Unsecured Subordinated Notes will be issued in denominations selected by the purchasers in any amount equal to or exceeding $1,000.

- (2)

- Previously paid.

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED March 30, 2012

$50,000,000

Twin Cities Power Holdings, LLC

Three and Six Month Renewable Unsecured Subordinated Notes

One, Two, Three, Four, Five and Ten Year Renewable Unsecured Subordinated Notes

We are offering an aggregate principal amount of up to $50 million of our renewable unsecured subordinated notes. Notes with certain terms may not always be available. We intend to commence the offering promptly. The offering will be made on a continuous basis, and is expected to continue for a period in excess of 30 days. We will establish interest rates on the securities offered in this prospectus in prospectus supplements. Once you purchase a note, changes in interest rates will not affect the interest rate you receive up to maturity. The notes are unsecured obligations and your right to payment is subordinated in right of payment to all of our existing or future senior, secured, unsecured and subordinate indebtedness and other of our financial obligations. Upon maturity, the notes will be automatically renewed for the same term as your maturing note at an interest rate that we are offering at that time to other investors with similar note portfolios for notes of the same term, unless we or you elect not to have them renewed. If notes of the same term are not then being offered, the interest rate upon renewal will be the rate specified by us on or before maturity, or the rate of the existing note if no such rate is specified. The interest rate on your renewed note may be different than the interest rate on your original note.

After giving you 30 days advance notice, we may redeem all or a portion of the notes for their original principal amount plus accrued but unpaid interest. You or your representative also may request us to repurchase your notes prior to maturity; however, unless the request is due to your death or total permanent disability, we may, in our sole discretion, decline to repurchase your notes. If we do elect to repurchase your notes, we will charge you a penalty of up to three months of simple interest on notes with three month maturities and up to six months of interest on all other notes. Our obligation to repurchase notes prior to maturity for any reason in a single calendar quarter is limited to the greater of $500,000 or 1% of the aggregate principal amount of all notes outstanding at the end of the previous quarter. See "Description of the Notes—Redemption or Repurchase Prior to Stated Maturity—Repurchase at Request of Holder."

We will market and sell the notes directly to the public. The notes will not be listed on any securities exchange or quoted on Nasdaq or any over-the-counter market. We do not intend to make a market in the notes and we do not anticipate that a market in the notes will develop. There will be significant restrictions on your ability to transfer or resell the notes. We have not requested a rating for the notes; however, third parties may independently rate them. After this registration statement becomes effective, we will file periodic reports, primarily annual and quarterly reports, with the Securities and Exchange Commission.

The notes are not certificates of deposit or similar obligations of, and are not guaranteed or insured by, any depository institution, the Federal Deposit Insurance Corporation, the Securities Investor Protection Corporation or any other governmental or private fund or entity. Investing in the notes involves risks, which are described in "Risk Factors" beginning on page 10 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

||||

| |

Per Note |

Total |

||

|---|---|---|---|---|

Public offering price |

100.00% | $50,000,000 | ||

Underwriting discounts and commissions(1) |

none | none | ||

Proceeds to TCPH, before expenses |

100.00% | $50,000,000 | ||

|

||||

- (1)

- The notes are not being offered or sold pursuant to any underwriting or similar agreement, and no commissions or other remuneration will be paid in connection with their sale. The notes will be sold at face value.

See "Plan of Distribution" for a description of anticipated expenses to be incurred in connection with our offering and selling the notes. We are not required to sell any specific number or dollar amount of notes in order to accept subscriptions.

We are offering these notes to investors in the United States of America, other than in the states of Alabama, Alaska, Arizona, Arkansas, Hawaii, Kentucky, Louisiana, Maryland, Massachusetts, Montana, Nebraska, Nevada, New Hampshire, North Carolina, North Dakota, Oregon, Rhode Island, Virginia, Washington, West Virginia, and Wyoming.

We will issue the notes in book-entry or uncertificated form. Subject to certain limited exceptions, you will not receive a certificated security or a negotiable instrument that evidences your notes. We will deliver written confirmations to purchasers of the notes. BOKF, NA dba Bank of Oklahoma will act as trustee for the notes.

The date of this Prospectus is , 2012

You should rely only on the information contained in this prospectus or in any free writing prospectus we may authorize to be delivered to you. We have not authorized anyone to provide you with additional or different information. We are offering to sell, and seeking offers to buy, the notes only in jurisdictions where offers and sales are permitted. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of the notes.

This prospectus contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our control. See "Risk Factors" beginning on page 10 and "Forward-Looking Statements" on page 15.

We have established suitability standards for California investors, which require such investors to have either (i) a net worth (not including home, furnishings, and personal automobiles) of at least $70,000 and an annual gross income of at least $70,000, or (ii) a net worth (not including home, furnishings, and personal automobiles) of at least $250,000. The investor suitability requirements stated above represent minimum suitability requirements we establish for prospective note holders. However,

i

satisfaction of these requirements will not necessarily mean that the notes are a suitable investment for a prospective investor, or that we will accept the prospective investor's subscription agreement.

ii

This summary highlights selected information from this prospectus and may not contain all the information that may be important to you. You should read the entire prospectus and the other information that is incorporated by reference into this prospectus before making an investment decision.

References in this prospectus to "the Company," "we," "our," "us" or similar terms refer to Twin Cities Power Holdings, LLC and its operating subsidiaries. References to "TCPH" or "Twin Cities Power Holdings, LLC" refer to Twin Cities Power Holdings, LLC without its operating subsidiaries.

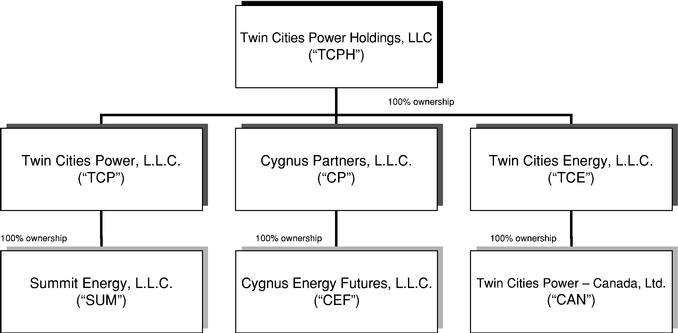

We are a holding company conducting our operations principally through our wholly-owned subsidiaries, Twin Cities Power, L.L.C. ("TCP"), Cygnus Partners, L.L.C. ("CP") and Twin Cities Energy, L.L.C. ("TCE"). Each of our subsidiaries is a Minnesota limited liability company.

Ownership and Organizational Structure

TCP had its roots in a dairy products trading company, Fairway Dairy & Ingredients, LLC ("Fairway"). As a division of Fairway, doing business originally as Twin Cities Power Generation, and then as Twin Cities Power, it was granted market-based rate authorization—the authority to buy and sell electricity—by the Federal Energy Regulatory Commission ("FERC") in January 2004. As of January 1, 2007, TCP was spun out of Fairway and commenced its existence as an independent company. TCP conducts operations directly and through its wholly-owned subsidiary, Summit Energy, L.L.C., a Minnesota limited liability company ("SUM") formed on December 4, 2009. An SUM employee currently has a profits interest in SUM. TCP trades both domestically and in Canada.

CP was formed on March 14, 2008. CP conducts business through its wholly-owned operating subsidiary Cygnus Energy Futures, L.L.C. ("CEF"), a Minnesota limited liability company formed on July 24, 2007. Two CEF employees each currently have a profits interest in CEF.

TCE, formerly known as Alberta Power, LLC, was formed on March 27, 2008. Our Canadian operations are conducted through TCE's wholly-owned subsidiary, Twin Cities Power—Canada, Ltd. ("CAN"), which was formed on January 29, 2008 as a Canadian unlimited liability corporation and converted to a regular Alberta corporation in February 2012. Following a significant downsizing of CAN's office in Calgary, Alberta Canada in February 2011, CAN currently has only two employees and limited operations.

Twin Cities Power Holdings, LLC ("TCPH") was formed as a Minnesota limited liability company on December 30, 2009. TCPH now serves as a holding company for TCP, CP, and TCE, each of which previously had common ownership. Effective December 31, 2011, the members of TCP, CP, and TCE each contributed all of their ownership interests in TCP, CP, and TCE to TCPH in exchange for

1

ownership interests in TCPH (the "Reorganization"). The result of this Reorganization is our current holding company structure, with TCPH now being the sole member of each of TCP, CP, and TCE.

We have other inactive and non-operating subsidiaries, which are identified in our audited financial statements but are not described in this prospectus because they are immaterial to our operations. It is possible that these subsidiaries could have trading operations in the future, although there are currently no plans in place to start such operations.

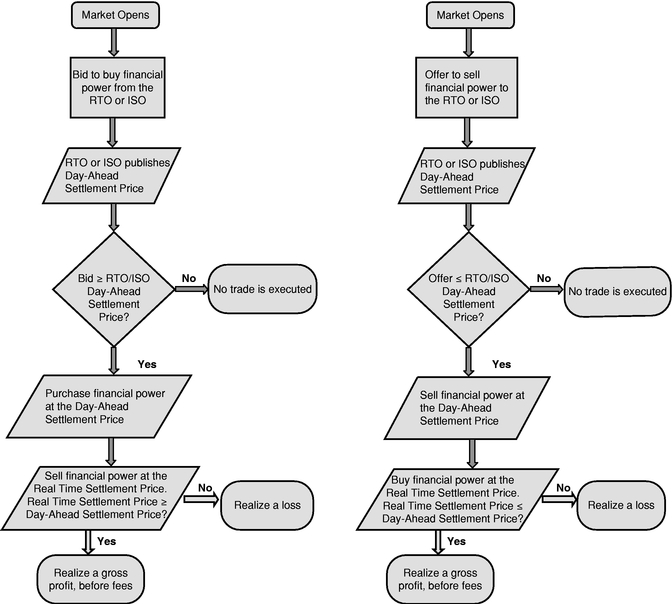

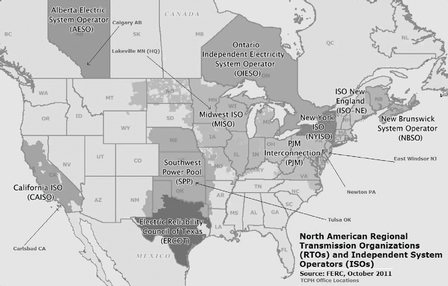

We are an energy trading firm, trading primarily in electricity. We trade financial and physical electricity contracts in seven North American wholesale markets operated by Regional Transmission Organizations ("RTOs") and Independent System Operators ("ISOs") (while, technically, ISOs are also RTOs, industry usage generally identifies them separately as ISOs) and in three exchanges: the Intercontinental Exchange® ("ICE"), the Natural Gas Exchange Inc. ("NGX"), and the CME Group ("CME").

In general, our activities in the markets administered by the various ISOs and RTOs are characterized by the acquisition of electricity at a given location and its sale at another. Our "financial" derivative transactions settle in cash in an amount equal to the difference between the purchase and sale prices, while our "physical" transactions are settled by the delivery of the electricity itself. Management estimates that approximately 90% of our revenue has historically been derived from financial transactions. Currently, we trade exclusively in financial transactions.

The financial contracts we trade in the ICE, NGX and CME markets are electricity, natural gas, and oil derivatives. We often hold an open interest in these contracts overnight or longer. These financial transactions are chiefly regulated by the Commodity Futures Trading Commission ("CFTC").

The ISO- and RTO-traded financial contracts are also known as "virtual trades." ISO and RTO markets are regulated by FERC, an independent agency within the United States Department of Energy. We have open virtual trades outstanding overnight and they settle the next day.

2

We also trade physical electricity contracts in certain North American ISO and RTO markets. These physical contracts are trades in which we buy electricity from one ISO or RTO market and sell the electricity to another.

We believe that the physical infrastructure of the North American electrical grid provides arbitrage trading opportunities, and we expect these opportunities will remain in place for the long term. We created a proprietary software system, DataLiveTM, that allows us to summarize thousands of data points into decision support tools. We believe this system assists our energy traders in achieving more profitable trading through faster and better informed decisions, increased trading volume, and reduced risk.

Our business model incorporates the following key elements:

- •

- Minimize market risk by trading principally instruments with terms of one week or less;

- •

- Minimize credit risk by trading primarily in regulated markets with a centralized counterparty, which may also be

described as cleared markets;

- •

- Maximize return on capital deployed through position and value at risk ("VaR") limits; and

- •

- Employ primarily experienced traders.

In our industry, the ability to employ and retain experienced, successful energy traders is paramount to having a successful and profitable business operation. We believe our compensation structure and flexible policy regarding working from regional locations near the traders' preferred residences enable us to attract and retain highly qualified traders. In addition, we believe our DataLiveTM proprietary software system enhances our traders' success.

Unlike many of our competitors, TCP has market based rate authority under FERC rules and regulations. Market based rate authority gives TCP the right to sell wholesale energy in the United States.

3

Summary Consolidated Financial Data

| |

Years ended December 31, |

||||||

|---|---|---|---|---|---|---|---|

Dollars in thousands

|

2011 | 2010 | |||||

Statements of Operations Data |

|||||||

Net revenue |

$ | 42,713 | $ | 44,305 | |||

Total operating expenses |

27,979 | 29,870 | |||||

Operating income (loss) |

14,734 | 14,435 | |||||

Net other income (expense) |

(3,054 | ) | (8,141 | ) | |||

Income (loss) before income taxes |

11,680 | 6,294 | |||||

Provision for taxes |

458 | 748 | |||||

Net income (loss) |

11,222 | 5,546 | |||||

Foreign currency translation adjustment |

91 | (127 | ) | ||||

Comprehensive income (loss) |

$ | 11,313 | $ | 5,419 | |||

Ratio of earnings to fixed charges(1) |

4.66 | 1.86 | |||||

Balance Sheet Data |

|||||||

Cash and trading deposits |

$ | 16,805 | $ | 40,042 | |||

Total assets |

18,839 | 55,057 | |||||

Total debt |

10,288 | 33,295 | |||||

Total liabilities |

15,777 | 54,192 | |||||

Total members' equity |

3,063 | 864 | |||||

- (1)

- Fixed charges include interest expense plus one-third of operating lease rental expense as reported in footnotes to financial statements to approximate interest expense.

Risks Related to the Offering and the Notes

Investing in our notes involves a high degree of risk. While you should carefully review and consider all of the risk factors set forth below under "Risk Factors" before deciding whether to invest in the notes, we view the following as some of the most significant risks of the offering and the notes:

- •

- The notes are unsecured and rank junior to all of our existing and future debt. The notes will be subordinated to the

prior payment in full of all of our other debt obligations.

- •

- The indenture governing the notes contains minimal restrictions on our activities and no financial covenants. In

particular, we are not restricted from incurring additional indebtedness, all of which will have priority in payment over the notes, and we are not required to maintain a positive net worth.

- •

- If we incur additional indebtedness or if our business does not provide enough cash to cover all of our liabilities, we may be unable to pay the interest or principal payments on the notes as they become due.

Certain Related Party Transactions

We have entered into transactions with certain of our officers, governors and members, and their respective affiliates. Details regarding these transactions are set forth below under "Certain Relationships and Related Party Transactions."

In particular, between 2006 and 2010, TCP borrowed a total of $30.8 million from a former member of TCP and that member's affiliates (the "HTS Parties"). These loans have been repaid and

4

we currently have a single promissory note outstanding to the HTS Parties, which is dated October 1, 2011 and has an original principal balance of $5,829,017 (the "HTS Note"). We are required to make quarterly payments of principal plus interest at 15% per annum beginning January 1, 2012 and ending on maturity on October 1, 2013. Timothy Krieger, our CEO, and Michael Tufte, the former president of TCE and the former owner of approximately 24% of our outstanding units, have each signed personal guarantees for this debt. We intend to use the initial proceeds from this offering to repay the HTS Note.

Mr. Krieger has provided personal guarantees for all of our outstanding debt (aggregating $10.3 million as of December 31, 2011), except for a $200,000 promissory note, dated April 8, 2011, and a line of credit with ABN AMRO. See "Management's Discussion and Analysis of Financial Condition and Results of Operations—Debt Financing." All such debt is senior in right of payment to the notes being offered. No one will guarantee the repayment of the notes.

Entrance into Retail Electricity Business

Management has identified a potential opportunity to diversify our operations by entering into the retail electricity market. There are several "unregulated" markets throughout the United States that allow private entities to sell electricity directly to end-users, particularly in the eastern United States. We believe this provides us with an opportunity to leverage our knowledge of wholesale energy markets to enter into a new space within the energy business.

We intend to take the initial steps necessary to launch this venture in the first half of 2012. This business will require capital investment and time to be expended by our executives and employees, and may result in one or more acquisitions of companies already involved in the retail electricity market. In that regard, we have engaged Altus Financial Group LLC, an advisory firm, to assist us in locating potential acquisition opportunities. See "Certain Relationships and Related Party Transactions—Acquisition Advisory Agreement." TCP entered into an Asset Purchase Agreement on February 20, 2012 to purchase substantially all of the assets of a retail electricity business in Connecticut for approximately $160,000. We expect to close on this initial acquisition of retail electricity assets by the end of the second quarter of 2012. We may need to hire additional personnel in order to grow the retail electricity business. We have no prior experience in the retail electricity market and can give no assurance that this new initiative will be successful.

We are headquartered at 16233 Kenyon Ave, Suite 210, Lakeville, MN 55044, telephone (952) 241-3103. In addition to our headquarters, we operate from five other locations. See "Business—Facilities."

5

Issuer |

Twin Cities Power Holdings, LLC | |

Trustee |

BOKF, NA dba Bank of Oklahoma |

|

Paying Agent |

BOKF, NA dba Bank of Oklahoma |

|

Securities Offered |

Renewable unsecured subordinated notes. The notes represent our unsecured promise to repay principal at maturity and to pay interest during the term or at maturity. By purchasing a note, you are lending money to us without any collateral security. |

|

Method of Purchase |

Prior to your purchase of notes, you will be required to complete a subscription agreement that will set forth the principal amount of your purchase, the term of the notes and certain other information regarding your ownership of the notes and your investing experience. The form of subscription agreement is filed as an exhibit to the registration statement of which this prospectus is a part. We will mail you written confirmation that your subscription has been accepted. |

|

Denomination |

You may choose the denomination of the notes you purchase in any principal amount of $1,000 or more. |

|

Offering Price |

100% of the principal amount per note. |

|

Rescission Right |

You may rescind your investment within five business days of the postmark date of your purchase confirmation without penalty. In addition, if we accept your subscription agreement at a time when we have determined that a post-effective amendment to the registration statement of which this prospectus is a part must be filed with the Securities and Exchange Commission, but such post-effective amendment has not yet been declared effective, you will be able to rescind your investment subject to the conditions set forth in this prospectus. See "Description of the Notes—Rescission Right" for additional information. |

|

Maturity |

You may generally choose maturities for your notes of 3 or 6 months or 1, 2, 3, 4, 5 or 10 years; however, depending on our capital requirements, we may not sell notes of all maturities at all times. |

|

Interest Rate |

The interest rates of the notes will be established at the time you purchase them, or at the time of renewal, based upon the rates we are offering in our latest interest rate supplement to this prospectus, and will remain fixed throughout each term. We may offer higher rates of interest to investors with larger note portfolios, as set forth in the then current interest rate supplement. |

6

Interest Payment Dates |

You may choose to receive interest payments monthly, quarterly, semiannually, annually or at maturity. If you choose to receive interest payments monthly, you may choose the day on which you will be paid. Subject to our approval, you may change the interest payment schedule or interest payment date once during each term of your notes. |

|

Principal Payment |

We will not pay principal over the term of the notes. We are obligated to pay the entire principal balance of the outstanding notes only upon maturity. |

|

Payment Method |

Principal and interest payments will be made by direct deposit to the account you designate in your subscription documents. |

|

Renewal or Redemption at Maturity |

Upon maturity, the notes will be automatically renewed for the same term at the interest rate we are offering at that time to other investors with similar note portfolios for notes of the same maturity, unless we notify you prior to the maturity date that we intend to repay the notes. You may also notify us before, or within 15 days after, the maturity date that you want your notes repaid. The 15-day post maturity period will be automatically extended if you would otherwise be required to make the repayment election at a time when we have determined that a post-effective amendment to the registration statement of which this prospectus is a part must be filed with the Securities and Exchange Commission, but such post-effective amendment has not yet been declared effective. |

|

|

If notes with similar terms are not being offered at the time of renewal, the interest rate upon renewal will be (a) the rate specified by us on or before the maturity date or (b) if no such rate is specified, the rate of your existing notes. The interest rate being offered upon renewal may, however, differ from the interest rate applicable to your notes during the prior term. See "Description of the Notes—Renewal or Redemption on Maturity." |

|

Optional Redemption or Repurchase |

After giving you 30 days' prior notice, we may redeem some or all of your notes at a price equal to their original principal amount plus accrued but unpaid interest. |

7

|

You or your representative may request us to repurchase your notes prior to maturity; however, unless the request is due to your death or total permanent disability, we may, in our sole discretion, decline to repurchase your notes, and will, if we elect to repurchase your notes, charge you a penalty of up to three months of interest for notes with a three-month maturity and up to six months of interest for all other notes. The total principal amount of notes that we will be required to repurchase prior to maturity, for any reason in any calendar quarter, will be limited to the greater of $500,000 or 1% of the total principal amount of all notes outstanding at the end of the previous quarter. See "Description of Notes—Redemption or Repurchase Prior To Stated Maturity—Repurchase At Request of Holder." |

|

Consolidation, Merger or Sale |

Upon any consolidation, merger in which TCPH is not the surviving entity, or sale of TCPH, we will either redeem all of the notes or our successor will be required to assume our obligations to pay principal and interest on the notes pursuant to the indenture for the notes. For a description of these provisions see "Description of the Notes—Consolidation, Merger or Sale." |

|

Ranking; No Security |

The notes: |

|

|

• are unsecured; and |

|

|

• rank junior to all of our existing and future debt. |

|

|

As of December 31, 2011, we had approximately $10.3 million of debt outstanding that is senior to the notes. |

|

Limited Restrictive Covenants |

The indenture governing the notes contains very limited restrictive covenants. One of these covenants prohibits us from paying distributions to our members if there is an event of default with respect to the notes or if payment of the distribution would result in an event of default. The indenture contains the following additional restriction on distributions: "The Company's Board of Governors shall not declare or pay any distributions to its Members if, in the reasonable determination of the Governors, the Company would have insufficient cash to meet anticipated redemption or repayment obligations. The foregoing restriction shall not apply to distributions in respect of taxes payable by the Members based on net income or gains of the Company that have been allocated to the Members." We are not restricted from entering into financing transactions or incurring additional indebtedness. |

|

|

The covenants set forth in the indenture are more fully described under "Description of the Notes—Restrictive Covenants." These covenants have significant exceptions. We do not plan to issue any debt that is subordinate to the notes. |

8

Use of Proceeds |

If all the notes are sold, we would expect to receive up to approximately $49.35 million of net proceeds from this offering after paying the estimated offering expenses. The exact amount of net proceeds also may vary considerably depending on how long the notes are offered and other factors. We intend to use the net proceeds to repay amounts owed under a promissory note payable to the HTS Parties, fund trading activities and facilitate growth in trading markets, pay expenses related to our possible expansion in the retail electricity market, and for the repayment of additional debt. See "Use of Proceeds" and "Business—Retail Electricity." |

|

Absence of Public Market and Restrictions on Transfers |

There is no existing market for the notes. |

|

|

We do not anticipate that a secondary market for the notes will develop. We do not intend to apply for listing of the notes on any securities exchange or for quotation of the notes in any automated dealer quotation system, including without limitation the OTC Bulletin Board or any over-the-counter market. |

|

|

You will be able to transfer or pledge the notes only with our prior written consent. See "Description of the Notes—Transfers." |

|

Book Entry |

The notes will be issued in book entry or uncertificated form only. Except under limited circumstances, the notes will not be evidenced by certificated securities or negotiable instruments. See "Description of the Notes—Book Entry Registration and Transfers." |

9

Investing in our notes involves a high degree of risk. You should carefully consider the following risk factors, as well as the other information in this prospectus, before deciding whether to invest in the notes. If any of the following risks actually occur, our business, financial condition and results of operations would suffer. In that case, we may be unable to pay the interest or repay the principal amounts owed to you under the notes and you might lose all or part of your investment in the notes. The risks described below are not the only ones we face. Additional risks that we currently do not know about or that we currently believe to be immaterial may also impair our business, financial conditions and results of operations.

Risk Factors Related to an Investment in the Notes

The characteristics of the notes, including maturity, interest rate, lack of collateral security or guarantee, and lack of liquidity, may not satisfy your investment objectives.

The notes may not be a suitable investment for you, and we advise you to consult your investment, tax and other professional financial advisors prior to purchasing notes. The characteristics of the notes, including maturity, interest rate, lack of collateral security or guarantee, and lack of liquidity, may not satisfy your investment objectives. The notes may not be a suitable investment for you based on your ability to withstand a loss of interest or principal or other aspects of your financial situation, including your income, net worth, financial needs, investment risk profile, return objectives, investment experience and other factors. Prior to purchasing any notes, you should consider your investment allocation with respect to the amount of your contemplated investment in the notes in relation to your other investment holdings and the diversity of those holdings. While we require that you fill out a subscription agreement that asks certain questions regarding suitability, we disclaim any responsibility for determining that the notes are a suitable investment for you.

Because the notes rank junior to all of our existing and future debt and all other financial obligations, your notes will lack priority in payment.

Your right to receive payments on the notes is junior to all of our existing indebtedness and future borrowings. Your notes will be subordinated to the prior payment in full of all of our other debt obligations. As of December 31, 2011, we had approximately $10.3 million of debt outstanding that is senior to your notes. We may also incur substantial additional indebtedness in the future that would also rank senior to your notes. Because of the subordination provisions of the notes, in the event of our bankruptcy, liquidation or dissolution, our assets would be available to make payments to you under the notes only after all payments had been made on all of our secured and unsecured indebtedness and other obligations that are senior to the notes. Sufficient assets may not remain after all such senior payments have been made to make any payments to you under the notes, including payments of interest when due or principal upon maturity.

Because there will be no trading market for the notes and because transfers of the notes require our consent, it may be difficult to sell your notes.

Your ability to liquidate your investment is limited because of transfer restrictions, the lack of a trading market and the limitation on repurchase requests prior to maturity. Your notes may not be transferred without our prior written consent. In addition, there will be no trading market for the notes. Due to the restrictions on transfer of the notes and the lack of a market for the sale of the notes, even if we permitted a transfer, you might be unable to sell, pledge or otherwise liquidate your investment. In any event, the total principal amount of notes that we would be required to repurchase in any calendar quarter, for any reason, will be limited to the greater of $500,000 or 1% of the aggregate principal amount of all notes outstanding at the end of the previous quarter. See "Description of the Notes."

10

Because the notes will have no sinking fund, collateral security, insurance or guarantee, you could lose all or a part of your investment in the notes if we do not have enough cash to pay the notes.

There is no sinking fund, collateral security, insurance or guarantee of our obligation to make payments on the notes. The notes are not secured by any of our assets. We will not contribute funds to a separate account, commonly known as a sinking fund, to make interest or principal payments on the notes. The notes are not certificates of deposit or similar obligations of, and are not guaranteed or insured by, any depository institution, the Federal Deposit Insurance Corporation, the Securities Investor Protection Corporation, or any other governmental or private fund or entity. Therefore, if you invest in the notes, you will have to rely only on our cash flow from operations and other sources of funds for repayment of principal at maturity or redemption and for payment of interest when due. Our cash flow from operations could be impaired under the circumstances described under "—Risks Related to Our Business." If our cash flow from operations and other sources of funds are not sufficient to pay any amounts owed under the notes, then you may lose all or part of your investment.

The notes will automatically renew unless you request repayment.

Upon maturity, the notes will be automatically renewed for the same term as your maturing note and at an interest rate that we are offering at that time to other investors with similar note portfolios for notes of the same term, unless we notify you prior to the maturity date that we intend to repay the notes or you notify us before, or within 15 days after the maturity date that you want your notes repaid. This 15-day period will be automatically extended if you would otherwise be required to make the repayment election at a time when we have determined that a post-effective amendment to the registration statement of which this prospectus is a part must be filed with the Securities and Exchange Commission, but such post-effective amendment has not yet been declared effective. If notes with the same term are not then being offered, the interest rate upon renewal will be the rate specified by us on or before the maturity date, or the rate of the existing note if no such rate is specified. The interest rate on your renewed note may be lower than the interest rate of your original note.

Because we have substantial indebtedness that is senior to the notes, our ability to pay the notes may be impaired.

We presently have a substantial amount of indebtedness. At December 31, 2011, we had approximately $10.3 million of debt outstanding, comprised of:

Note payable to HTS Parties |

$ | 5,343,265 | ||

Secured note payable, related party |

2,000,000 | |||

Notes payable |

2,945,000 | |||

Total |

$ | 10,288,265 | ||

Our substantial indebtedness could adversely affect our financial condition and prevent us from fulfilling our obligations under the notes by, among other things:

- •

- increasing our vulnerability to general adverse economic and industry conditions;

- •

- requiring us to dedicate a substantial portion of our cash flow from operations to payments on our indebtedness, thereby

reducing amounts available for working capital, capital expenditures and other general corporate purposes;

- •

- limiting our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate;

- •

- placing us at a competitive disadvantage compared to our competitors that have less debt; and

- •

- limiting our ability to borrow additional funds.

11

There is no assurance that we will be able to generate sufficient free cash flow to service this debt and our obligations under the notes. If we do not generate sufficient operating profits, our ability to make required payments on our senior debt, as well as on the debt represented by the notes described in this prospectus, may be impaired.

If we incur substantially more indebtedness that is senior to your notes, our ability to pay the notes may be further impaired.

The indenture for the notes does not prohibit us from incurring additional indebtedness. We may incur substantial additional indebtedness in the future. Any such borrowings would be senior to the notes. If we borrow more money, the risks to noteholders described in this prospectus could be increased.

Our management has broad discretion over the use of proceeds from the offering.

We intend to use the net proceeds to repay amounts owed under a promissory note payable to the HTS Parties, fund trading activities and facilitate growth in trading markets, pay expenses related to our possible expansion in the retail electricity market, repay additional debt, and for other general corporate purposes. Because no specific allocation of the proceeds is required in the indenture, our management will have broad discretion in determining how the proceeds of the offering will be used. See "Use of Proceeds."

Because we are subject to certain restrictions in a promissory note with a former member, our ability to pay the notes may be impaired.

We have issued a promissory note, dated October 1, 2011 in the principal amount of $5,829,017 payable to the HTS Parties (see "Business—Legal Proceedings"). If we are late in making a required quarterly payment on the HTS Note, on the first occasion we will have only two days to cure such a payment default, and on the second occasion, we will have no cure period. If we fail to make a payment on any due date, or within the limited cure period just described, or if we breach other provisions of the HTS Note, the HTS Parties have the right to declare the unpaid principal balance of the HTS Note, and all accrued interest thereon, to be immediately due and payable. Payment on the notes issued under this registration statement is expressly subordinated to payment of the HTS Note. If payment on the HTS Note is accelerated, our cash flow may not be sufficient to cover such payment and our other obligations, and we may need to seek additional financing. Even if any new financing is available, it may not be on terms that are acceptable to us or it may not be sufficient to refinance all of our indebtedness as it becomes due. In such an event, we may not be able to make interest or principal payments to you under the notes.

We can provide no assurance that any notes will be sold or that we will raise sufficient proceeds to carry out our business plans.

We are conducting this offering of notes ourselves without any underwriter or placement agent. We have no experience in conducting a notes offering or any other securities offering. Although we intend to sell up to $50 million in aggregate principal amount of the notes, there is no minimum amount of proceeds that must be received from the sale of the notes in order to accept proceeds from notes actually sold. Accordingly, we can provide no assurance about the total principal amount of notes that will be sold. Therefore, we cannot assure you that we will raise sufficient proceeds to carry out our business plans. Specifically, we may not be able to pay or prepay the HTS Note or fund expanded trading activities. We may also have to delay or forego our possible expansion in the retail electricity market if sufficient funds are not raised. Accordingly, our inability to raise such proceeds could have an adverse impact on our business activities, results of operations and financial condition, and may limit our ability to repay amounts owed under the notes.

12

We may be substantially reliant upon the net offering proceeds we receive from the sale of our notes to meet our liquidity needs.

Our operations alone may not produce a sufficient return on investment to pay the stated interest rates on the notes and fund our capital needs. We may be substantially reliant upon the net offering proceeds we receive from the sale of our notes in order to meet our liquidity needs. We intend to use the net proceeds to pay or prepay certain outstanding debt, including the HTS Note payable to the HTS Parties, fund our trading activities and facilitate growth in existing and new markets, pay expenses related to our possible expansion in the retail electricity market, repay additional debt, which may include the notes, and for other general corporate purposes, which may include the payment of general and administrative expenses. We may not be able to attract new investors or have sufficient borrowing capacity when we need additional funds to repay principal and interest on your notes or redeem your notes.

Because there are limited restrictions on our activities under the indenture, you will have only limited protections under the indenture.

The indenture governing the notes contains relatively minimal restrictions on our activities. In addition, the indenture contains only limited events of default other than our failure to timely pay principal and interest on the notes. Because there are only very limited restrictions and limited events of default under the indenture, we will not be restricted from issuing additional debt senior to your notes or be required to maintain any ratios of assets to debt in order to increase the likelihood of timely payments to you under the notes. Further, if we default in the payment of the notes or otherwise under the indenture, you will likely have to rely on the trustee to exercise your remedies on your behalf. You may not be able to seek remedies against us directly. See "Description of the Notes—Events of Default."

Because there are no financial covenants in the indenture, we will not be required to maintain a positive net worth.

The indenture for the notes offered hereby does not contain any financial covenants relating to our net worth. Accordingly, we will not be required to maintain a positive net worth.

Because we may redeem the notes at any time prior to their maturity, you may be subject to reinvestment risk.

We have the right to redeem any note at any time prior to its stated maturity upon 30 days written notice to you. The notes would be redeemed at 100% of the principal amount plus accrued but unpaid interest up to but not including the redemption date. Any such redemption may have the effect of reducing the income or return on investment that any investor may receive on an investment in the notes by reducing the term of the investment. If this occurs, you may not be able to reinvest the proceeds at an interest rate comparable to the rate paid on the notes. See "Description of the Notes—Redemption or Repurchase Prior To Stated Maturity."

Under certain circumstances, you may be required to pay taxes on accrued interest on the notes prior to receiving a sufficient amount of cash interest payments to cover such tax liability.

If you choose to have interest on your note paid at maturity and the term of your note exceeds one year, you may be required to pay taxes on the accrued interest prior to our making any interest payments to you. You should consult your tax advisor to determine your tax obligations.

13

Our cash flows and ability to meet our obligations are largely dependent upon the earnings of our subsidiaries and the payment of such earnings to us in the form of distributions, loans or otherwise, and repayment of loans or advances from us.

TCPH is a holding company and our obligations are structurally subordinated to existing and future liabilities of our subsidiaries. Our cash flows and ability to meet our obligations are largely dependent upon the earnings of our subsidiaries, TCP, CP, and TCE, and the payment of such earnings to us in the form of distributions, loans or otherwise, and repayment of loans or advances from us. These subsidiaries are separate and distinct legal entities and have no obligation to provide us with funds for our payment obligations, whether by distributions, loans or otherwise. Any decision by a subsidiary to provide us with funds for our payment obligations, whether by distributions, loans or otherwise, will depend on, among other things, the subsidiary's results of operations, financial condition, cash requirements, contractual restrictions and other factors. In addition, a subsidiary's ability to pay distributions may be limited by covenants in its future debt agreements or applicable law.

Because TCPH is a holding company, our obligations to our creditors are structurally subordinated to all existing and future liabilities of our subsidiaries. Therefore, our rights and the rights of our creditors to participate in the assets of any subsidiary in the event that such a subsidiary is liquidated or reorganized are subject to the prior claims of such subsidiary's creditors. To the extent that we may be a creditor with recognized claims against any such subsidiary, our claims would still be subject to the prior claims of such subsidiary's creditors to the extent that they are secured or senior to those held by us. Our subsidiaries may incur additional indebtedness and other liabilities.

If our subsidiaries are unable to provide us with funds for our payment obligations, whether by distributions, loans or otherwise, we may not be able to make interest or principal payments to you under the notes.

We are subject to ongoing complex governmental regulations and legislation that have impacted, and may in the future impact, our businesses and/or results of operations.

Our businesses operate in changing market environments influenced by various state and federal legislative and regulatory initiatives regarding the regulation of the energy industry, including competition in the generation and sale of electricity. We are required to comply with the rules and regulations of FERC, including the Federal Power Act, the U.S. Department of Energy with regard to the import and export of electricity, the CFTC with respect to energy futures and options contracts, the Federal Trade Commission, the Canadian National Energy Board, the market rules and tariffs of the ISOs and RTOs of which we are a member, and the laws of the states and provinces in which we conduct business. We will need to continually adapt to changes in these laws and regulations.

Our businesses are subject to changes in state and federal laws and changing governmental policy and regulatory actions, and also the rules, guidelines and protocols of the wholesale energy markets in which we participate. Changes in, revisions to, or reinterpretations of existing laws and regulations, for example, with respect to prices at which TCP may sell electricity, may have an adverse effect on our businesses.

Our revenues and profitability could be adversely affected if a counterparty defaults in whole or in part on its obligations to us related to our cash deposits in brokerage and collateral accounts.

We maintain cash balances in brokerage accounts that facilitate our trading activities. In addition, we have cash deposits in collateral accounts at various ISOs, RTOs and the ICE. All of these accounts are uninsured. When we place cash deposits in these accounts with a counterparty, we incur credit risk, which is the risk of loss if the counterparty fails to perform according to the terms of our contracts,

14

including safekeeping these funds and releasing the funds to us at an agreed upon time. Our revenues and profitability could be adversely affected if a counterparty were to default in whole or in part on its obligations to us. See "Business—Credit Risk Management."

TCE is currently subject to an investigation by FERC that could result in liability.

On October 12, 2011, FERC initiated a formal non-public investigation into TCE's power scheduling and trading activity in MISO for the period from January 1, 2010 through May 31, 2011. Depending on the investigation's outcome, we may be liable for legal fees, potential disgorgement of profits, and possible civil penalties. Since this investigation is in its nascent stages, we are unable to determine the likelihood of an unfavorable outcome or the amount or range of any potential loss, other than the expenditure of legal fees for defense. There is no assurance that FERC will not expand its investigation into other TCPH subsidiaries. FERC has the authority to assess fines and penalties of up to $1.0 million per day and, if FERC determined that TCE had committed serious offenses and if FERC determined to assess substantial fines and penalties, the size of such fines and penalties could have a material adverse effect on us, which could impact our ability to repay notes. See "Business—Legal Proceedings."

We are largely dependent on the success of our energy traders to generate our revenues and one or more of our successful traders may leave our business. Our revenues are concentrated in our most successful traders.

We are largely dependent on the success of our energy traders to generate our revenues. While we have employment agreements with our traders, we do not have any noncompetition agreements in place with these individuals. Accordingly, a trader may leave us and join a competitor at any time or engage in competitive activities. The loss of one or more of our most successful traders would have material and adverse affect on our results of operations, financial condition, and cash flows. If we are unable to hire replacement energy traders with comparable abilities to replace the traders who leave and our results of operations, financial condition, and cash flows suffer significantly as a result, the risks to noteholders described in this prospectus could intensify, including the risk that we may not be able to pay you interest and principal on the notes when such payments become due.

Our future success will depend on our ability to continue to attract and retain highly qualified energy traders. We compete for such energy traders with many other companies, in and outside our industry, government entities and other organizations. We may not be successful in retaining current energy traders or in hiring or retaining qualified traders in the future. Our failure to attract new or retain existing energy traders could have a material adverse effect on our businesses. Further, 75% of our revenue in 2010 was generated by our top 5 most successful traders, and in 2011 our top 5 traders generated 70% of our revenue. The loss of any of these traders would have an immediate and potentially material adverse effect on our results of operations.

We have been involved in protracted litigation with the HTS Parties and we have ongoing obligations related to the settlement of these disputes.

We have been involved in protracted litigation with the HTS Parties arising from a dispute over, among other things, repayment of certain loans made by the HTS Parties to our subsidiaries. While we have settled our disputes through binding arbitration, we have ongoing obligations to the HTS Parties under the HTS Note. Failure to fulfill our obligations under the HTS Note could materially and adversely affect our business operations. See above "Risk Factors—Because we are subject to certain restrictions in a promissory note with a former member, our ability to pay the notes may be impaired."

15

If we lose key personnel, our results of operations may be impaired.

We are dependent on the services of our senior management because of their experience and knowledge of the industry and our business. The loss of one or more of these key employees could seriously harm our business. It may be difficult to find a replacement with the same or similar level of experience or expertise. Competition for these types of personnel is high, and we may not be able to attract and retain qualified personnel on acceptable terms. Failure to recruit and retain such personnel could adversely affect our business, financial condition, results of operations and planned growth.

Our future operating results depend in significant part upon the continued service of our key energy traders, none of whom is bound by a noncompetition agreement. Our future operating results also depend in part upon our ability to attract and retain qualified management, technical, and support personnel for our operations. We cannot assure you that we will be successful in attracting or retaining such personnel. The loss of any key employee, the failure of any key employee to adequately perform in his or her current position, or our inability to attract and retain skilled employees, as needed, could materially and adversely affect our results of operations, financial condition and cash flows.

Our management has limited experience managing a public company.

Our management team has operated our business as a privately owned limited liability company. With the exception of our chief financial officer, our management team has no prior experience managing a public company. We continue to develop control systems and procedures adequate to support a public company and this transition could place a significant strain on our management systems, infrastructure, overhead and other resources.

If we are unable to successfully compete with our competitors for the best energy traders, our results of operations may be impaired.

Given the nature of our business, we do not compete with other entities for market share. Instead, we compete with other entities to attract and retain the most qualified energy traders, who are the primary source of our revenue. Our competitors may have greater liquidity, greater access to credit and other financial resources, newer or more efficient equipment, lower cost structures, more effective risk management policies and procedures and greater ability than us to withstand losses. Our competitors may also be able to respond more quickly to new laws or regulations or emerging technologies than we can. Our energy traders may leave us at any time to join a competitor or compete directly on their own, which would have an adverse effect on our results of operations and cash flow.

We may not be able to compete successfully against current and future competitors for the most qualified energy traders, and any failure to do so could have a material adverse effect on our business, financial condition, results of operations and cash flow.

We need substantial liquidity to operate our business.

We need substantial liquidity to operate our business. Our access to credit through commercial lenders is limited due to the nature of our business operations and our assets. We have historically funded our operations through borrowings under debt agreements with related and unrelated parties, and internally generated cash flows. Our results of operations, financial condition and cash flows have been and may continue to be adversely affected by the high interest rates we must pay in order to obtain private loans from related and unrelated parties. We may not be able to obtain sufficient funding for our future operations from such sources and we will be relying on sales of the notes to provide us with necessary liquidity.

16

We may be unable to protect our intellectual property and proprietary technology effectively, including DataLiveTM, which may allow competitors to duplicate our technology and may adversely affect our ability to compete with them to obtain and retain the most qualified energy traders.

In order to attract and retain the most qualified energy traders, we need to offer them access to technology resources that enable them to trade as successfully as possible. In particular, we have developed a proprietary technology known as DataLiveTM. To the extent that we are not able to protect our intellectual property effectively through patents, copyrights, contractual commitments with developers and employees, or other means, employees with knowledge of our intellectual property may leave and seek to exploit our intellectual property for their own or other's advantage.

Our auditors have identified a material weakness in our internal controls and if we fail to institute and maintain effective internal control over financial reporting, we might not be able to report our financial results accurately or prevent fraud.

To date, we have not established an effective system of internal controls and our auditors have identified a material weakness, principally due to a lack of qualified personnel. As a result, material audit adjustments were proposed and recorded in the Company's consolidated financial statements for the years ended December 31, 2010 and 2009. See "Management's Discussion and Analysis of Financial Condition, and Results of Operations—Changes in and Disagreements with Accountants on Accounting and Financial Disclosure." It we do not take the steps needed to improve our internal controls, our ability to issue accurate financial statements and to prevent fraud would be adversely impacted. The process of instituting and maintaining appropriate internal controls will be costly and time consuming and may require significant attention from management. Failure to implement required, or new or improved controls, or difficulties encountered in their implementation, could harm our results of operations or cause us to fail to meet our reporting obligations.

Our results of operations may be impaired by incorrect market price forecasts due to human or computer errors, weather events, natural disasters, malicious parties, market inequities, terrorism, illiquidity or other market factors, which impact the final published settlement price.

Our contracts are purchased at the prices determined by the market. Our traders buy in anticipation of being able to sell at a higher price. That sales price may be unexpectedly impacted by a number of factors beyond our control, resulting in a sale price lower than the purchase price we paid. Our contracts settle to quoted market prices published by the ISOs, RTOs or exchanges on which we trade. Internally prepared and externally obtained price forecasts that we rely on to execute trades may be incorrect due to human or computer errors, weather events, natural disasters, malicious parties, market inequities, terrorism, illiquidity or other market factors, which impact the final published settlement price. Incorrect price forecasts could result in trading losses, which could materially and adversely affect our results of operations, financial condition, and cash flows.

Our results of operations may be impaired as the result of regulatory risks, including changes in the rules or regulations that impair our ability to operate in the markets or to realize revenue.

We are subject to the jurisdiction of FERC, including the Federal Power Act, the U.S. Department of Energy with regard to the import and export of electricity, the CFTC with respect to energy derivative and option contracts, the Federal Trade Commission, the Canadian National Energy Board, the market rules and tariffs of the ISOs and RTOs of which we are a member (collectively "Regulators"), and the laws of the states and provinces in which we conduct business. At any time these rules and regulations could change in a manner that impairs our ability to operate in the markets, and subsequently impairs our results of operations, financial condition, and cash flows. At any time

17

these Regulators may also affect a market resettlement, which could retroactively change the quoted market prices or fees assessed, which could have a substantial impact on our results of operations, financial condition, and cash flows.

Our results of operations may be impaired as a result of a rogue trader.

A determined individual could operate as a 'rogue trader,' acting outside our delegations, controls or code of conduct in pursuit of personal objectives that could be to the detriment of us, our members, and our creditors. In so doing, one of our traders could attempt to hide or create false transactions or income/losses for personal gain. Such activities could result in results of operations, financial condition, and cash flows, lawsuits against us, and regulatory intervention, the impact of which could materially, and adversely, affect our results of operations, financial condition, and cash flows.

Shortcomings or failures in our systems, risk management methodology, internal control processes or people could lead to disruption of our business, financial loss, or regulatory intervention.

We rely on our internal control systems and risk management methodologies to protect our operations from, among other things, improper activities by individuals within our organization. Shortcomings or failures in our systems, risk management methodology, internal control processes or people could lead to disruption of our business, financial loss, or regulatory intervention.

18

This prospectus contains forward-looking statements. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based only on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, projections, anticipated events and trends, the economy and other future conditions. Forward-looking statements can be identified by words such as: "may," "will," "expect," "anticipate," "believe," "estimate," "continue," "predict," or other similar words making reference to future periods. Forward-looking statements appear in a number of places in this prospectus, including, without limitation, "Use of Proceeds," "Management's Discussion and Analysis of Financial Condition and Results of Operations" and "Business," and include statements regarding our intent, belief or current expectation about, among other things, trends affecting the markets in which we operate, our business, financial condition and growth strategies. Although we believe that the expectations reflected in these forward-looking statements are based on reasonable assumptions, forward-looking statements are not guarantees of future performance and involve risks and uncertainties. Actual results may differ materially from those predicted in the forward-looking statements as a result of various factors, including but not limited to those set forth in the "Risk Factors" section of this prospectus.

If any of the events described in "Risk Factors" occur, they could have a material adverse effect on our business, financial condition and results of operations. When considering forward-looking statements, you should keep these risk factors, as well as the other cautionary statements in this prospectus, in mind. You should not place undue reliance on any forward-looking statement. These forward-looking statements represent our estimates and assumptions only as of the date of this prospectus regardless of the time of delivery of this prospectus or any sale of our notes and, except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise after the date of this prospectus.

19

We expect to incur approximately $650,730 in initial expenses to offer the notes pursuant to this prospectus. The net proceeds we receive from this offering will be equal to the amount of the notes we sell, less our offering expenses. If all of the notes are sold, we would expect to receive approximately $49.35 million of net proceeds from this offering after payment of estimated offering expenses. Because renewals of the notes will be treated as additional sales of notes, which reduce the aggregate amount of registered securities available for sale, and we will receive no additional proceeds from such renewals, we have based our use of proceeds on the estimated maximum proceeds we will receive from the initial sale of renewable notes, or approximately $20 million.

The exact amount of net proceeds may vary considerably depending on how long the notes are offered and other factors. Also, we will not receive the net proceeds in a single closing, and will use the proceeds as we sell notes.

We intend to use the first $5.3 million of the net proceeds from this offering to repay the outstanding balance on the HTS Note. This promissory note, dated October 1, 2011, as amended, represents the total amount due to the HTS Parties resulting from an arbitration award. The Company is required to make quarterly payments of principal plus interest at 15% per annum until maturity on October 1, 2013. As of December 31, 2011, the outstanding balance on the HTS Note was approximately $5.3 million.

Following repayment of that debt, we would expect to apply the net proceeds to certain other corporate purposes. These other corporate purposes, listed in order of priority with the expected level of expenditure, include:

- •

- approximately $2 million to fund trading activities and increase our capital account balances in the markets in

which we currently trade;

- •

- approximately $3 million to pay expenses related to our expansion in the retail electricity market, including

business acquisitions, with $1 million of this spending taking priority over those other purposes listed below and $2 million being less of a priority to those other purposes;

- •

- approximately $3 million to pay off additional debt or other obligations, including specifically the promissory

note, dated July 16, 2009, outstanding to our employee, Patrick Sunseri in the principal amount of $2 million, which currently bears interest at 15% and is due on demand, and such debt

may also include the notes;

- •

- approximately $3 million to expand our trading into other markets beyond those in which we currently trade; and

- •

- approximately $3.7 million for other general corporate purposes, which may include the payment of general and administrative expenses.

The actual amount of proceeds we apply towards these various corporate purposes will depend, among other things, on how long the notes are offered, the amount of net proceeds that we receive from the sale of notes being offered, the existence and timing of certain opportunities, for example, to acquire retail electricity business assets or to expand our trading into other markets through the hiring of new traders, and the availability of other sources of cash. If we sell substantially less than the maximum amount of the offering, we will use all of the proceeds first to pay off the HTS Note, as described above, and then any remaining proceeds will be used for the other corporate purposes in the priority and approximate amounts set forth above.

20

Our subsidiaries have paid distributions on their membership units in the past. Any future determination to pay distributions will be at the discretion of our Board of Governors and will depend on various factors, including our results of operations, financial condition, capital requirements, contractual restrictions, outstanding indebtedness, investment opportunities and other factors that our Board of Governors deems relevant. The indenture governing the notes prohibits us from paying distributions to our members if there is an event of default with respect to the notes or if payment of the distribution would result in an event of default. The indenture also prohibits our Board of Governors from declaring or paying any distributions other than tax distributions if, in the reasonable determination of the Governors, the Company would have insufficient cash to meet anticipated redemption or repayment obligations.

Separate from any such discretionary operating distributions, our Member Control Agreement requires our Board of Governors to make quarterly distributions of cash to our members based upon their respective ownership interests in the amount necessary to permit each member who is in the highest income tax bracket to pay all state and federal taxes on our net income allocated to such member. We are taxed as a partnership for income tax purposes, which means that all of our income (or loss) for each fiscal year is allocated among our members, who are then personally responsible for the tax liability associated with such income. We do not pay income taxes as a partnership but we do make tax distributions to our members, as described above, to cover their income tax liability attributable to our income.

The following table sets forth historical information regarding equity distributions received by our members for the periods indicated:

| |

Years ended December 31, | ||||||

|---|---|---|---|---|---|---|---|

| |

2011 | 2010 | |||||

Timothy S. Krieger |

$ | 2,824,129 | $ | — | |||

Michael J. Tufte |

1,711,698 | — | |||||

David B. Johnson(1) |

170,000 | — | |||||

Former members as a group(2) |

2,556,320 | 544,277 | |||||

Total |

$ | 7,262,147 | $ | 544,277 | |||

- (1)

- Consists

of distributions paid to DBJ 2001 Holdings, LLC, an entity owned and controlled by Mr. Johnson.

- (2)

- Excludes distributions paid to Mr. Tufte, which are separately reflected in this table, even though as of January 1, 2012 he was no longer a member. Mr. Tufte's distributions are shown separately due to the fact that Mr. Tufte, as President of TCE, was a "named executive officer" in 2010 and, consequently, compensation information was provided for him in "Executive Compensation."

On October 1, 2011, the HTS Capital, LLC capital account of $2,117,531 was closed out and transferred to the HTS Note. See "Business—Legal Proceedings—Litigation with the HTS Parties." On January 1, 2012, all of Mr. Tufte's membership interests were redeemed for $100,000. On February 14, 2012, Mr. Krieger and DBJ 2001 Holdings, LLC received distributions of $98,362 and $11,638, respectively. On March 20, 2012, our Board of Governors declared tax distributions payable on April 1, 2012 of $223,550 to Timothy Krieger and $26,450 to DBJ 2001 Holdings, LLC.

21

MANAGEMENT'S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion should be read in conjunction with the information under our audited annual consolidated financial statements and related notes and other financial data included in this prospectus. This discussion contains forward-looking statements that involve risks and uncertainties. As a result of many factors, such as those set forth under "Risk Factors" and elsewhere in this prospectus, our actual results may differ materially from those anticipated in these forward-looking statements.

TCPH was formed as a Minnesota limited liability company on December 30, 2009. On December 31, 2011 as a result of the Reorganization, TCPH received all of the membership interests of TCP, CP, and TCE in exchange for issuing ownership interests in TCPH. Through these subsidiaries, we trade financial and physical electricity contracts in seven North American wholesale markets operated by ISOs and RTOs and in three exchanges: ICE, NGX, and CME.

Our revenues are derived primarily from trading financial and physical electricity contracts. Revenues relating to trading activities are recorded based upon changes in the fair values of the related energy trading contracts, net of costs. Trading activities use derivatives such as financial and physical swaps, forward sales contracts, futures contracts and options, to generate trading revenues. The initial recognition of fair value and subsequent changes in fair value affect reported earnings in the period the change occurs. The fair values of those instruments that remain open at the balance sheet date represent unrealized gains or losses.

In general, our activities in these markets are characterized by the acquisition of electricity at a given location and its delivery to another. Our "financial" derivative transactions settle in cash in an amount equal to the difference between the purchase and sale prices, while our "physical" transactions are settled by the delivery of the electricity itself. Currently, we are trading exclusively in financial transactions and we do not expect to trade in physical transactions in the future. The table below presents a breakdown of our trading volume between physical and financial transactions for the years indicated:

| |

Years ended December 31, |

||||||

|---|---|---|---|---|---|---|---|

| |

2011 | 2010 | |||||

Percentage of total trading volume |

|||||||

Physical |

6 | % | 10 | % | |||

Financial |

94 | % | 90 | % | |||

Total |

100 | % | 100 | % | |||