Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - SCIENTIFIC LEARNING CORP | Financial_Report.xls |

| EX-31.2 - EXHIBIT 31.2 - SCIENTIFIC LEARNING CORP | ex31_2.htm |

| EX-32.1 - EXHIBIT 32.1 - SCIENTIFIC LEARNING CORP | ex32_1.htm |

| EX-32.2 - EXHIBIT 32.2 - SCIENTIFIC LEARNING CORP | ex32_2.htm |

| EX-31.1 - EXHIBIT 31.1 - SCIENTIFIC LEARNING CORP | ex31_1.htm |

| EX-23.1 - EXHIBIT 23.1 - SCIENTIFIC LEARNING CORP | ex23_1.htm |

| EX-10.22 - EXHIBIT 10.22 - SCIENTIFIC LEARNING CORP | ex10_22.htm |

| EX-10.20 - EXHIBIT 10.20 - SCIENTIFIC LEARNING CORP | ex10_20.htm |

| EX-10.17 - EXHIBIT 10.17 - SCIENTIFIC LEARNING CORP | ex10_17.htm |

| EX-10.21 - EXHIBIT 10.21 - SCIENTIFIC LEARNING CORP | ex10_21.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE FISCAL YEAR ENDED DECEMBER 31, 2011

or

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 FOR THE TRANSITION PERIOD FROM TO .

COMMISSION FILE NO. 000-24547

SCIENTIFIC LEARNING CORPORATION

(Exact name of registrant as specified in its charter)

|

DELAWARE

|

94-3234458

|

|

(State or other jurisdiction of incorporation or organization)

|

(IRS Employer Identification Number)

|

300 Frank H. Ogawa Plaza, Suite 600

Oakland, CA 94612

510-444-3500

(Address of Registrant’s principal executive offices, including zip code, and telephone number, including area code)

Securities registered pursuant to Section 12 (b) of the Act:

|

Title of Each Class

|

Name of Each Exchange on which Registered

|

|

Common Stock, par value $0.001 per share

|

NASDAQ Global Market

|

Securities registered pursuant to Section 12 (g) of the Act: NONE

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes: o No: x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes: o No: x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes: x No: o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes: x No: o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant's knowledge in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer a non-accelerated filer, or a smaller reporting company. (See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act). (Check one):

Large accelerated filer o Accelerated filer o Non-accelerated filer o Smaller reporting company x

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes: o No: x

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant, based upon the closing sale price of the Common Stock on June 30, 2011 as reported on the Nasdaq Global Market was approximately $37,862,195. Shares of Common Stock held by each director and executive officer and certain persons who owned 5% or more of the registrant's outstanding Common Stock on that date have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of March 16, 2012 the Registrant had outstanding 19,032,438 shares of Common Stock.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for the Registrant's 2012 Annual Meeting of Stockholders are incorporated by reference in Part III.

TABLE OF CONTENTS

|

PART I

|

PAGE NO.

|

||

|

Item 1.

|

1

|

||

|

Item 1A.

|

8

|

||

|

Item 1B.

|

13

|

||

|

Item 2.

|

13

|

||

|

Item 3.

|

13

|

||

|

Item 4.

|

13

|

||

|

PART II

|

|||

|

Item 5.

|

15

|

||

|

Item 6.

|

17

|

||

|

Item 7.

|

18

|

||

|

Item 7A.

|

29

|

||

|

Item 8.

|

30

|

||

|

Item 9.

|

53

|

||

|

Item 9A.

|

53

|

||

|

Item 9B.

|

53

|

||

|

PART III

|

|||

|

Item 10.

|

54

|

||

|

Item 11.

|

54

|

||

|

Item 12.

|

54

|

||

|

Item 13.

|

54

|

||

|

Item 14.

|

54

|

||

|

PART IV

|

|||

|

Item 15.

|

55

|

||

|

56

|

Forward Looking Statements

Some of the statements contained in this Annual Report on Form 10-K are forward-looking statements that involve risk and uncertainties. The statements contained in this Annual Report on Form 10-K that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including, without limitation, statements regarding our expectations, beliefs, intentions or strategies regarding the future. In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “intends,” “estimates,” “predicts,” “potential,” or “continue” or the negative of these terms or other comparable terminology. These statements are subject to known and unknown risks, uncertainties and other factors, which may cause our actual results to differ materially from those implied by the forward-looking statements. Important factors that may cause actual results to differ from expectations include those discussed in this Annual Report on Form 10-K in Item 1A – “Risk Factors”. All forward-looking statements included in this Annual Report on Form 10-K are based on information available to us on the date thereof, and we assume no obligation to update any such forward-looking statements.

PART I

ITEM 1. BUSINESS

Overview

We are an education company that accelerates learning by applying proven research on how the brain learns in online and on-premise software solutions. Our results show that learners who use our products can realize achievement gains of up to 2 years in as little as 3 months and maintain an accelerated rate of learning even after product use ends. We provide our learning solutions primarily to U.S. K-12 schools in traditional brick-and-mortar, virtual or blended learning settings and also to parents and learning centers, in more than 40 countries around the world.

We are highly differentiated because of our continuous focus on the “science of learning” - combining advances in the field of brain research with standards-based learning objectives to achieve dramatic student gains. At December 31, 2011, proof that our products produce substantial academic gains was demonstrated in 263 efficacy studies, including randomized controlled trials and longitudinal studies, representing results from approximately 95,000 aggregate participants. These studies show gains for students at all K-12 grade levels, for at-risk, special education, English language, Title One (low income, under achieving), and a variety of other students. Gains have been demonstrated throughout the United States and in ten other countries. The studies show that these gains endure over time.

2011 marked the start of our transition to a software as a service (SaaS) model. Our easy-to-use and easy-to-access web-based platforms, initially introduced in mid-2011 and improved in January 2012, are able to effectively deliver individualized learning opportunities to a large number of students simultaneously. Our Fast ForWord educational software products are now available on our browser-based SciLEARN Enterprise software platform and our on-demand platform MySciLEARN On Demand. The SciLEARN Enterprise and MySciLEARN platforms meet the needs of institution and district-wide installations by providing scalability, remote access, centralized reporting, asynchronous online professional development, and ease of administration for multiple campuses.

Markets

Our products are available worldwide to educational institutions, speech and language clinics, learning centers and parents.

United States K-12 Market

Our sales are concentrated in K-12 schools in the United States, which in 2011 were estimated to total over 116,000 schools serving approximately 55 million students in almost 14,000 school districts. In each of the last three fiscal years, the U.S. K-12 sector has represented approximately 87% of our sales.

Historically, we have focused our selling efforts on district-level administrators. Under our new selling model, initial selling efforts are also directed to building level principals and lead teachers for small initial purchases. After such initial implementations, we then seek to expand throughout the school and/or district based on the demonstrated efficacy of the products.

We market our products primarily as learning acceleration solutions, to be used in a blended model with existing teaching and curriculum materials, at both the elementary and secondary school levels. Despite a national focus on reading and increased school district accountability, independent evaluations of student performance have demonstrated little improvement in reading results. According to the U.S. Department of Education (USDE), in 2011, 67% of fourth graders in the United States were not “proficient” in reading and 33% performed below the “basic” level. Between 2009 and 2011, there was no change in average 4th grade reading scores. United States K-12 public schools are funded primarily through state and local tax revenues, but also receive funding from the federal government through a variety of programs, many of which target children who are poor and/or are struggling academically. The funding for a substantial portion of our K-12 sales has historically come from federal sources, in particular IDEA (special education) and Title One funding. The amount of this funding varies from time to time, as do the rules governing the use of this funding; the temporary additional American Recovery and Reinvestment Act (ARRA) education funding expired in 2011. There has been much recent discussion about changes to the federal No Child Left Behind Act, and the administration has granted 10 states waivers from certain requirements, but there has been no legislative agreement on significant changes. State and local funding for schools continues to be significantly impacted by decreases in tax revenues due to the recent recession. While education spending remains an important priority, over half the states have reduced their funding to schools compared to 2008, resulting in teacher layoffs, program restrictions and overall expense reductions.

Other Markets

In addition to selling to K-12 schools, we also sell to and through private practice professionals and learning centers. These speech and language and other professionals recommend the use of our products to appropriate clients and then supervise the use of the software, often in connection with their other services. In 2011, over 380 non-school professionals and entities in the United States and Canada (North America) offered our products.

In 2009, we began selling web-based products and tutoring services directly to parents. These products are designed to meet the needs of learners who want to “stay ahead” or “catch up” and are delivered via a SaaS (software as a service) model.

Sales to countries other than the United States and Canada are a small but growing part of our business, which we serve through a network of value-added resellers (VARs). During 2011, products were marketed to customers in 43 countries. As of December 31, 2011, we were represented by 22 VARs.

Our strategy for international markets thus far has been conservative, so that we do not divert resources from our U.S. K-12 market. However, we believe the potential international opportunity is significant. Outside of North America, our products are used in three primary applications: (1) in tutoring and learning centers to strengthen academic skills, (2) by clinical professionals with impaired children, and (3) assisting in the acquisition of English as a second language. About one-fourth to one-third of the worldwide population now understands and speaks English to some degree, and English is the international language of business, travel, and diplomacy. While our products, in and of themselves, do not provide all the components necessary to teach English to non-native speakers, they have been demonstrated to be extremely effective in assisting in English language instruction, through building the necessary underlying cognitive, acoustic processing, fluency and other skills needed to learn and speak English. Strategic initiatives with VARs in China and Southeast Asia have included the creation of franchise-based, “business-in-a-box” learning center models where our products are augmented by direct instruction and other supplementary activities to achieve measurable results in English improvement for students age 5-14.

Transition

Historically, the majority of our sales have been large transactions from U.S. K-12 school districts. In the recent and current economic conditions, it has been more challenging to close large transactions as district leaders feel pressure to fund only basic needs. In response, we have diversified our business model to target both building and district level decision-makers. We released our new platforms, SciLEARN Enterprise in late 2010 and MySciLEARN on demand in 2011, allowing us to better address the U.S. K-12 school and district markets and the international, consumer and virtual school markets with improved access and ease-of-use. Our current technology activities are focused on expanding these robust and scalable platforms while allowing us to rapidly add new products. As our model continues to become more diversified, we expect to become increasingly less dependent on large transactions and to significantly increase our subscription base with more predictable transactions and recurring revenue.

Products

Our products unify advances in the field of brain research with standards-based learning objectives to achieve enduring student gains. Our solutions augment any curricular approach and when blended with high-quality teacher led instruction, build learning capacity by systematically and rigorously developing the academic and cognitive skills required for lifelong learning success.

Fast ForWord products

Our flagship Fast ForWord family of products was built on the foundation that the learning brain can improve through exercise - the concept of brain fitness. These products apply learning principles that have been established through neuroscience and cognitive research as critical to learning new tasks: frequency and intensity of exercises, adaptivity to the students’ individual performance, timely motivation and simultaneous development of multiple skills. The Fast ForWord products are now web-based, improving ease-of-use, access and overall effectiveness of the products.

Fast ForWord Language and Literacy products

The Fast ForWord Language products for elementary learners and the Literacy products for adolescent learners build foundational reading and language skills to help districts move below grade level learners to be successful learners in the general classroom. These products include Fast ForWord Language v2, Fast ForWord Language to Reading v2, Fast ForWord Literacy and Fast ForWord Literacy Advanced.

The exercises in the Fast ForWord Language v2 product specifically focus on oral language comprehension and listening, including phonological awareness, listening accuracy and comprehension, working memory, and familiarity with language structures. The content and exercises of the Literacy product are similar to those of Language v2, but have been adapted to maximize impact for adolescents and English language learners. The Fast ForWord Language to Reading v2 product helps students make the link between spoken and written language, using exercises that focus on listening comprehension, sound letter recognition, phonological awareness, beginning word recognition and English language conventions. The Literacy Advanced software includes content and exercises similar to those in the Fast ForWord Language to Reading with a user interface that is designed to appeal to adolescents, emphasizing phonemic awareness, decoding, word recognition, sequential and inferential comprehension and the ability to sequence multi-step instructions.

Fast ForWord Reading products

The Fast ForWord Reading products build learning capacity through developing cognitive skills using exercises focused on critical “reading to learn” abilities. The Reading product exercises focus on phonemic awareness, phonics and decoding, spelling, vocabulary, fluency and comprehension. The Fast ForWord Reading products begin with Reading Readiness, which prepares the student for reading, focusing on phonemic identification, categorization and blending, letter names, sound and letter correspondence, rapid letter/word recognition, and oral vocabulary. The products continue with levels 1 through 5, which focus on reading skills and tasks of increasing complexity. The exercises in the Reading 5 product carry a significant working memory load, as they build vocabulary, improve critical thinking and abstract reasoning, improve composition skills, and focus on accuracy, fluency and comprehension.

Reading Assistant products

Reading Assistant provides a one-on-one reading tutor for every learner. This unique software combines advanced speech verification technology with scientifically-based interventions to provide help just when a learner needs it, strengthening their reading fluency, vocabulary and comprehension. Reading fluency is the ability of a student to read quickly enough to garner meaning from a text, and is reported to have a high correlation with overall reading proficiency. However, to become a fluent reader, students must frequently read aloud and receive timely feedback and assistance with their reading. Providing effective fluency training for all students is a challenge in the classroom because teachers do not have enough resources and/or time to give the consistent and rigorous one-on-one attention a child needs to improve his or her reading fluency. Reading Assistant addresses this problem by acting as a personal tutor – saving time for teachers and engaging learners.

MySciLEARN, Progress Tracker and Reading Progress Indicator

Progress Tracker, our Internet-based data analysis and reporting tool, analyzes student learning results to provide diagnostic and prescriptive intervention information and allows educators to track and report their students’ learning progress. Progress Tracker provides detailed reports at the student, classroom, school, and district level, and can be reported by subgroup, providing a tool for educators to analyze student progress towards required goals. The MySciLEARN reporting tab also provides a subset of this information, but in a more easy-to-understand user interface. We expect that the MySciLEARN reports will eventually replace Progress Tracker because of their improved ease-of-use.

Reading Progress Indicator is a reliable and valid assessment of a student’s reading skills. It is designed to be quick and convenient to administer before and after product use, to rapidly demonstrate the effectiveness of our products and place students in the right product sequence.

BrainSpark™ products and BrainPro™ services

The BrainSpark products and BrainPro services are based on our flagship Fast ForWord family of products.

The BrainSpark products are targeted at learners ages five through thirteen who are at or above grade level and want to improve their overall learning potential. BrainSpark is cross-training for the brain; the products exercise two or more “learning muscles” within each game exercise. The BrainSpark products can be purchased directly online and accessed via a web-browser from a computer.

BrainPro services are targeted at learners who are below grade level and want to catch up. BrainPro learners access our Fast ForWord family of products from home and work with a certified tutor remotely. The BrainPro tutor is responsible for defining a customized program and goals and helping the learner achieve progress toward the learning goals with the help of the parents.

KinderSpark iPad Application Series

The KinderSpark series was launched in October 2011 with Eddy’s Number Party!, the first app within the series. The KinderSpark series is designed to be a collection of engaging iPad games for children aged 3-6 that help them build kindergarten readiness skills and excel in learning by combining proven research on how the brain learns, input from education experts, and fun.

License Terms

We license our products in a variety of configurations to meet our customers’ needs. Schools typically purchase site or per student licenses, which are available either as a perpetual or subscription license. Most customers also purchase implementation services, which we believe are important to encourage successful use of the products.

Products licensed for administration by private practice professionals and parents are generally purchased on a per student basis. Products licensed by International VARs are generally purchased on a per student, per month subscription basis.

Services and Support

We believe that training and implementation support is important to achieving appropriate product use in schools, where a limited school day and competing priorities makes it challenging for educators to devote the time and resources needed for a solid implementation. As of December 31, 2011, our service and support organization included 49 employees supplemented by 22 independent contractors who provide on-site customer training, consulting and technical support services.

Services

To facilitate effective implementation, we offer on-site product training, technical installation, implementation management, consulting, and web-based synchronous and asynchronous professional development services. We also offer a Leadership and Accountability service focused at the district level, which provides administrators a detailed overview of the implementation at each of their schools, consulting on data analysis and interpretation, intervention and motivation strategies, connecting with classroom teachers and other topics of interest to the customer.

We host user conferences and a spectrum of both live and web-based forums, workshops, and seminars for customers and prospective customers. At these gatherings, speakers provide information on advances in research on how the brain learns, and current customers offer actual case studies on how our products impact student achievement. These sessions also provide our customers with opportunities to network and develop informal support relationships.

Support

For customers who purchase our support services, we provide software technical update releases, and extensive telephone, email, and chat support. Through our new MySciLearn platform and our customer support website, we provide extensive web-based implementation and technical resources.

Warranty

We generally provide a warranty that our software products operate substantially as described in the manuals and guides that accompany the software for a period of ninety days. The warranty excludes damage from misuse, accident, and certain other circumstances. To date, we have not experienced any significant warranty expense.

Sales and Marketing

We sell to our principal market, K-12 schools and districts throughout the United States, using a diversified sales channel. Our inside sales personnel target smaller districts and building-level decision-makers while our field sales personnel target district-level decision-makers at the larger school districts. We also sell to K-12 schools in Canada using our inside sales team.

We emphasize our highly differentiated message of “accelerating learning” through web-based marketing efforts to reach more educators quickly while targeting specific audiences with research results and success stories most relevant to their areas of responsibility and expertise.

Although our focus on improved sales force productivity includes a balance of smaller sales with shorter cycles to get started in new accounts, the majority of our annual booked sales are from existing customers who have a year or more of positive experience with our programs, expanding to new sites and adding products and services to existing sites.

We sell to clinical professionals and learning centers principally through direct marketing (mail, web and telesales) and conferences (both industry conferences and an annual forum we conduct ourselves). In 2009, we began selling directly to parents online with our e-learning offering, BrainSpark™, and our remote tutoring service, BrainPro™.

We also maintain a network of independent VARs outside North America. As of December 31, 2011, we had relationships with 22 VARs. To date, booked sales outside North America have not been significant. We are building this channel in response to the growing demand for English fluency around the world. We believe that our Fast ForWord and Reading Assistant products offer unique value in quickly “rewiring” the brain for English. We also believe that the international market has significant potential growth opportunities, and we are positioning ourselves to take advantage of these in the future.

Competition

Districts and schools employ a wide variety of learning programs and methods for their students. The market for supplemental and intervention educational products is fragmented and competitive, with no single company or product with a dominant market share.

The critical factors for K-12 school districts are the perceived ability of the product to improve student performance, impact teacher productivity and fit into the traditional school day. Attributes that influence the district’s assessment of these factors include the ability to deliver measurable improvements in student achievement, cost, ease-of-use, reputation, existing relationships with customers, completeness of the product offering, ability to provide effective and efficient product implementation, and ability to work with the other components of the school curriculum. We believe that generally we compete favorably on the basis of these factors.

Our patented products are highly differentiated by their proven results and focus on the development of learning capacity. With recent improvements in ease-of-use and access, we compete vigorously for available funding against other companies offering educational products and programs, as well as with providers of traditional methods of teaching. Many of the companies providing these competitive offerings are much larger than us, are more established in the school market than we are, offer a broader range of products to schools, and have greater financial, technical, marketing and distribution resources than we do. Competitors may enter our market segment and offer actual or claimed results similar to those achieved by our products. In addition, although the traditional approaches to learning are fundamentally different from the approach we take, the traditional methods are more widely known and accepted and, therefore, represent significant competition for available funds.

Product Development; New Products

The markets in which we compete are characterized by frequent product introductions and evolving educational standards and approaches. Our future success will depend in part on our ability to continue to enhance and update our existing products and to develop and successfully introduce new products. Most of our development leadership and personnel is located at our headquarters in Oakland, CA.

In 2010, we established a wholly-owned foreign subsidiary in Shanghai, China to provide research and development services to us, initially focused on Reading Assistant. As of December 31, 2011, 61 of our employees were engaged in research and development activities, which include product development, product management, and outcomes research. We also use extensive 3rd-party resources to supplement our employees in such areas as quality assurance, design and content development. Our research and development expenses were approximately $10.3 million, $7.9 million and $6.4 million for the years ended December 31, 2011, 2010 and 2009, respectively.

Development Strategy

Over the past several years, our development efforts have focused on broadening our product solution and making our products more effective and easier to use and access. Recently, our focus has been transitioning our products to a web-based platform. The first milestone in this effort was achieved in 2010 with the release of SciLEARN Enterprise, a browser-based platform hosted by the school district or learning institution. In 2011 we released MySciLEARN (originally SciLEARN On Demand), a browser-based platform hosted by us. These two platforms achieve our plan to roll out hosted offerings that expand our per student licensing option to the broader U.S. K-12 market and that we believe will more effectively address newer markets outside U.S. K-12.

During 2011, the Company also revamped its Lab to the Learner program for development of new products. Lab to the Learner is a collaborative effort between Scientific Learning and a network of scientists and research partners to create new applications based on the latest scientific research and methodologies. Most recently launched in conjunction with this program was Eddy’s Number Party!, Scientific Learning’s first iPad app, which was made available first as an individual app and will later be combined into a more comprehensive institutional program called KinderSpark for use in pre-K and K classrooms. Eddy’s Number Party! rose to as high as the fifth most popular paid Education iPad app during its first week after release.

During 2012, major planned development milestones include the launch of the Reading Assistant product on the SciLEARN Enterprise and MySciLEARN platforms, the first KinderSpark institutional program, as well as continued expansion of MySciLEARN.

Intellectual Property

Our intellectual property strategy addresses both product technology and product concepts. Our policy is to protect our proprietary rights in our products and technology through a combination of patents, trademarks, copyrights, trade secret laws, confidentiality procedures, and contractual provisions.

At December 31, 2011, we held the rights to 81 issued patents and 12 pending applications. These include 58 issued U.S. patents and 7 pending U.S. applications that we own or co-own. We also held 5 issued patents from other countries and had 5 applications pending abroad. We were the exclusive licensee under 11 issued U.S. patents and 7 issued foreign patents.

Our U.S. patents relating to the Fast ForWord products expire between 2014 and 2026; the Reading Assistant patents expire in 2024.

The 18 patents that we license are owned by the Regents of the University of California (“the Regents”) and Rutgers, the State University of New Jersey (collectively the “University patents”), and relate to the basic speech and sound modification and adaptive technology developed at those institutions. In 2011, approximately 49% of our product booked sales was derived from selling products that use the licensed inventions. This license is exclusive and extends for the life of the University patents, which expire in 2014, subject to the right of the Regents to terminate in case of default and our right to terminate at any time upon 60 days written notice. If we were to lose our rights under this license, it would materially harm our business. This license requires payment of royalties based upon cumulative net booked sales of our products, subject to certain minimum royalty amounts. For the remainder of the license term, the minimum annual royalty payment is $150,000. In fiscal 2011, 2010 and 2009, we had approximately $0.4 million, $0.5 million and $0.8 million, respectively in royalty expense under the license.

We also have 14 U.S. trademark registrations, including registrations for marks including “Fast ForWord,” our most important trademark.

Posit Science Corporation

In September 2003, we transferred certain of our technology to Posit Science Corporation (PSC) for use in the healthcare field. PSC’s products based on our technology primarily focus on combating age-related cognitive decline and enhancing cognitive abilities as people age. The transaction included a license of the patents we own and certain software we developed, a sublicense of the patents we license from the universities, and the sale of some research-related assets. All of the rights licensed to PSC are limited to a specified healthcare field and most of the licenses are exclusive in that field. For these rights, PSC paid us a one-time initial fee, issued us shares in PSC and has an ongoing royalty obligation. PSC has also agreed to cross-license any patents issued to PSC. We retain all rights to our technology outside of the specified healthcare field.

Dr. Michael M. Merzenich, who is one of our founders and a former officer and director of ours, is also a founder, director and significant stockholder of PSC.

Seasonality

Our quarterly booked sales and revenue fluctuate seasonally, reflecting a number of factors including school purchasing practices, budget cycles and instructional periods. Historically, our booked sales have been lowest in the first and fourth quarters of the year and highest in the second or third quarter of the year.

Backlog

Our deferred revenue was approximately $17.3 million as of December 31, 2011, and $21.9 million as of December 31, 2010. These deferred revenues are primarily composed of professional development and technical services that have not yet been performed and the portion of multi-year sales, subscription and term-based sales, support and Progress Tracker sales not yet recognized as revenue. Approximately $12.6 million of our deferred revenue as of December 31, 2011 is expected to be recognized within the next 12 months.

Employees

As of December 31, 2011 we had 240 full-time equivalent employees, compared to 214 at December 31, 2010. None of our employees are represented by a union or subject to collective bargaining agreements.

General

Scientific Learning is a Delaware corporation formed in 1997 and is a successor to Scientific Learning Principles Corporation, a California corporation. Our web address is www.scilearn.com.

Item 1A. Risk Factors

RISK FACTORS

The following factors as well as other information contained in this report should be considered in making any investment decision related to our common stock. If any of the following risks actually occurs, our business, financial condition and results of operations could be materially and adversely affected and the trading price of our common stock could decline.

Sales of our products depend on the availability and extent of government funding for public school reading intervention purchases, which is variable and outside the control of both us and our direct customers. If such funding becomes less available, our public school customers may be unable to purchase our products and services on a scale or at prices that we anticipate, which would materially and adversely impact our revenue and net income.

United States public schools are funded primarily through state and local tax revenues, which are devoted primarily to school building costs, teacher salaries and general operating expenses. Public schools also receive funding from the federal government through a variety of federal programs, many of which target children who are poor and/or are struggling academically. Federal funds typically are restricted to specified uses.

The funding for a substantial portion of our K-12 sales typically comes from federal sources, in particular IDEA (special education) and Title One funding. The amount of this funding varies from time to time, as do the rules governing the use of this funding. The federal budget deficit and competing federal priorities could adversely impact the ongoing level of federal education funding. The temporary additional American Recovery and Reinvestment Act (ARRA) education funding expired in 2011. There has been much recent discussion, and the administration has granted 10 states waivers from certain requirements, but there has been no legislative agreement about changes to the No Child Left Behind Act of 2001. A cutback in federal education funding or a change in the funding rules to allow general rather than restricted uses of federal funding could have a materially adverse impact on our revenue.

State education funding continues to be significantly impacted by state budget difficulties. According to the Center on Budget and Policy Priorities, in the 2011-2012 school year, elementary and high schools in at least 37 states are receiving less state funding than in the prior school year, and in at least 30 states, school funding now stands below 2008 levels. These reductions have resulted in teacher layoffs, program restrictions and overall expense reductions. While state revenues have begun to grow since their low in 2010, as of the third quarter of 2011, state revenues remained 7 percent below pre-recession levels, again according to the Center on Budget and Policy Priorities. While education spending remains an important priority for states, it faces competition from demands for, among other things, relief for the unemployed and homeowners and rising healthcare costs. Continued pressure on state budgets and state education funding could have a materially adverse impact on our revenue.

Our sales cycle has tended to be long and somewhat unpredictable, which may result in delayed or lost sales, materially and adversely impacting our revenue and profitability.

More than 87% of our 2011 booked sales came from the K-12 market in the U.S. and Canada. In that market we have historically depended on a relatively small number of large transactions for a significant part of our sales. These types of sales require multiple levels of approval in a political environment, resulting in a time-consuming sales cycle that can be difficult to predict, particularly in a tight funding environment. Therefore, we may devote significant time and energy to a particular customer sale over the course of many months, and then not make the sale when expected or at all. In 2011, we had three transactions over $500,000, compared to five such transactions in 2010.

We may not be successful in executing our transition to a new business model.

We are completing the development of our new on-demand offerings to transition the business away from our historic sales model and to make us less dependent on large U.S. K-12 transactions. In 2011, we began selling our flagship Fast ForWord on-demand, and in January 2012, we launched Fast ForWord on our improved MySciLEARN on-demand platform. We expect our on-demand offerings to allow us to better address the international, consumer and virtual school markets, as well as the U.S. K-12 market we now principally serve and to allow us to significantly increase the number of smaller, more predictable transactions and recurring revenue. In order to successfully accomplish this transition, we need to rapidly increase our transaction volume, sell to and achieve acceptance with new types of customers, and complete our product development in a timely manner, including launching our Reading Assistant product on-demand. We may find our marketing and sales efforts in this market less effective or more expensive than we have planned. If we fail to achieve the level of market acceptance that we expect, we may be unable to achieve our planned level of sales and revenue.

It is difficult to accurately forecast our future financial results. This may cause us to fail to achieve the financial performance anticipated by investors and financial analysts, which could cause the price of our stock to decline.

Our revenue and results of operations are difficult to predict and may fluctuate substantially from quarter to quarter and from year to year. In 2011, we had a net loss of $6.5 million compared to a net loss of $9.7 million in 2010 (which included a non-cash impairment charge of $3.9 million) and net income of $4.8 million in 2009. In the past, our sales strategy has primarily emphasized district-level, multi-site transactions. The receipt or implementation of a single large order, or conversely its loss or delay, significantly impacted the level of sales booked and revenue recognized in a given quarter. In 2012, our sales focus has shifted to substantially increasing our volume of significantly smaller sales, an emphasis which began with our on-demand launch in June, 2011. We expect that this will make us less dependent on large unpredictable sales, but this is a new model for us, and the speed and extent of our transition is uncertain.

Our expense levels are based on our expectations of future revenue and are primarily fixed in the short term. We may not be able to adjust spending in a timely manner to compensate for any unexpected revenue shortfall, which could cause our net income to fluctuate unexpectedly.

Failure to achieve the financial results expected by investors and financial analysts in a given quarter could cause an immediate and significant decline in the trading price of our common stock.

Our cash flow is highly variable and may not be sufficient to meet all of our objectives.

During 2011, we used $7.2 million cash in operations, while in 2010, we used $4.2 million and in 2009 we generated $14.5 million in cash from operations. During 2012, we expect to fund our operations primarily through a combination of our current cash balances, including approximately $6.5 million in net proceeds from a private offering of our common stock completed on March 28, 2012 and cash available under our credit line.

Historically, we have used cash in our operations during the first half of the year and built cash in the second half. This pattern results largely from our seasonally low sales in the first and fourth calendar quarters, which reflects our industry pattern, and the time needed to collect on sales made towards the end of the second quarter.

On March 28, 2012, we closed our sale of 4,176,420 shares of company common stock at a price of $1.73 per share in a private transaction to several investors, which resulted in approximately $6.5 million in net proceeds to us. As a part of the transaction, we issued warrants to the investors for an aggregate of 2,505,852 additional shares of Common Stock. The warrants have an exercise price of $1.82 per share and are exercisable until 60 months after issuance.

We recently amended our credit line with Comerica Bank (Comerica), which has provided us with a line of credit since 2004. Our amended line of credit has a limit of $5 million, and expires December 31, 2013. On March 15, 2012, we borrowed $3.0 million under the line of credit and we are in compliance with all applicable covenants of the credit line.

Borrowings under the line are subject to reporting covenants requiring the provision of financial statements to Comerica and financial covenants requiring us to maintain a specified minimum adjusted quick ratio and a specified level of net worth. The required levels vary over the course of the year. If we do not comply with the covenants, we risk being unable to borrow under the credit line.

Funding our liquidity needs will require us to achieve certain levels of booked sales, collections, and expenses. If we are unable to achieve the required levels, or are unable to obtain waivers or amendments from Comerica in the event we do not comply with our covenants, we would be required to obtain additional debt or equity financing from other sources, to reduce expenses, or to sell assets. Reducing our expenses could adversely affect our operations. We cannot assure you that we will be able to secure additional debt or equity financing or sell assets on acceptable terms, if at all. In addition, raising additional equity financing could result in substantial dilution of our current equity holders and in the net tangible book value per share of such holdings.

To grow our K-12 business, we need to increase acceptance of our products among K-12 education purchasers. Failure to do so would materially and adversely impact our growth prospects.

Our Fast ForWord products use an approach that differs from the approaches that schools have traditionally used to address reading problems. In particular, our products, which are designed to develop the brain to process more efficiently, are based on neuroscience research and focus on building cognitive skills. These concepts may be unfamiliar to educators. K-12 educational practices are generally slow to change, and it can be difficult to convince educators of the value of a substantially different approach.

In order to obtain the best student results from using our product, schools must follow a recommended protocol for Fast ForWord use, which requires at least 30 minutes per day out of a limited and already crowded school day. Our recommendation that schools follow a prescribed protocol in using our products may limit the number of schools willing to purchase from us. In addition, if our products are not used in accordance with the protocol, they may not produce the expected student results, which may lead to customer dissatisfaction and decreased revenue.

Our products are generally implemented in a computer lab with a lab coach or teacher rather than in the classroom with the students’ regular classroom teachers. To reach a broader group of customers, encourage additional sales from existing customers and improve student achievement results, we need to better engage classroom teachers in the products’ implementation, in an effective and efficient manner.

If we are unable to convince our market of the value of our significantly different approach and otherwise overcome the challenges identified above, our growth prospects could be materially and adversely impacted.

If we determine that any of our intangible assets, including technology purchased in acquisitions, or goodwill are impaired, we would be required to take a charge to earnings, which could have a material adverse effect on our results of operations.

We recorded a significant amount of goodwill and other intangible assets, such as core technology, related to our acquisition of the Soliloquy product line in January 2008. We periodically evaluate goodwill and all significant intangible assets for impairment. Because of our decision to migrate the core technology associated with the Reading Assistant product acquired from Soliloquy to a web-enabled delivery platform, we determined it was necessary to assess the recoverability of the asset group associated with generating Reading Assistant cash flows. Based on our impairment analysis, we incurred non-cash charges of $3.9 million related to the write-down of the Soliloquy core technology asset group in the fourth quarter of 2010.

At December 31, 2010, after we recorded this impairment charge, we had $4.6 million of goodwill and $1.0 million of intangible assets. Significant judgments are required to evaluate goodwill and intangible assets for impairment, including estimating future cash flows, projecting future sales, forecasting industry trends and market conditions, and making other assumptions. Changes in these estimates and assumptions could materially affect our impairment determinations, which could result in non-cash charges that would adversely affect our results of operations.

Concentration of our sales in the K-12 market exposes our business to risks specific to that market.

More than 87% of our 2011 booked sales came from the K-12 market in the United States and Canada. Because of the concentration of our sales in this market, we are particularly exposed to its risks. For example, the K-12 market is characterized by its dependence on federal funding and state and local tax revenues; a political environment, particularly when large transactions are involved; and a generally conservative approach to change. All of these attributes, particularly in the current economic and political environment, can result in a time-consuming and unpredictable sales cycle for large transactions.

We rely on studies of student performance results to demonstrate the effectiveness of our products. If the validity of these studies or the conclusions that we draw from them are challenged, our reputation could be harmed and our business prospects and financial results could be materially and adversely affected.

We rely heavily on statistical studies of student results on assessments to demonstrate that our products lead to improved student achievement, which involves certain risks. For example, a school may fail to appropriately implement the products or adhere to the product protocol, resulting in a study that does not produce substantial student improvements. In addition, some studies on which we rely may be challenged because the studies use a limited sample size, lack a randomly selected control group, include assistance or participation from us or our scientists, or have other design characteristics that are not optimal. These challengers may assert that these studies are not sufficiently rigorous or free from bias, and may lead to criticism of the validity of the studies and the conclusions that we draw from them. Our sales and marketing efforts, as well as our reputation, could be adversely impacted if the studies upon which we rely to demonstrate the effectiveness of our products, or the conclusions we draw from those studies, are seen to be insufficient.

We may not be able to develop new and improved products and services as needed to address changing market trends or emerging technologies in a timely and cost effective manner.

We need to design, develop and introduce new and improved products and services on a cost effective basis and on a timeline that keeps pace with changing market trends and emerging technology developments. We had significant product introductions in 2011, and are planning additional product improvements and introductions in 2012. We may encounter unexpected difficulties developing new products and improvements that could delay our introduction of new products and services or cause their development to be more costly than planned. Additionally, our product changes may not receive the market acceptance we anticipate. If we fail to develop products and services cost effectively that respond to technology and market developments, we may lose market share and revenue, and our business could materially suffer.

If our operations are disrupted due to weaknesses in our technology infrastructure, our business could be harmed.

Providing our products and services and conducting our general business operations both substantially rely on computer and network systems. Over the past several years, our computer and network systems became outdated, and we have experienced disruptions in both our customer and internal network services due to hardware failures. We have now modernized much of our hardware infrastructure, and are completing a major upgrade to our business software platforms. In addition, our disaster recovery capability, while improved, does not permit us to recover immediately from certain sorts of disasters. We believe that our business is becoming increasingly dependent on our hardware and software infrastructure, and as a result, the reliability of our systems has become increasingly important. If our customer systems are disrupted, we may be required to issue credits, customers may elect not to renew their contracts or not to purchase additional licenses, we may lose sales to potential customers and we may be subject to liability. If our internal systems are disrupted, we may lose productivity and incur delays in product development, sales operations or other functions.

If our products contain errors or if customer access to our web-delivered products and services is disrupted, we could lose new sales and be subject to significant liability claims.

Because our software products are complex, they may contain undetected errors or defects, known as bugs. Bugs can be detected at any point in a product’s life cycle, but are more common when a new product is introduced or when new versions are released. We expect that, as we have experienced in the past, despite our testing, errors will be found in new products and product enhancements in the future. We launched important product revisions in 2011 and expect additional important launches in 2012.

Many of our products and services rely on the World Wide Web in order to function. Unanticipated problems affecting our network systems, third-party facilities, telecommunications or electricity supply could cause interruptions or delays in the delivery of these products. We have experienced problems due to power loss in the past, and we will continue to be exposed to the risk of access failure in the future.

If there are significant errors in our products or problems with customer access to our web-delivered products and services, we could be required to issue credits or we could experience delays in or loss of market acceptance of our products, diversion of our resources, decreases in expansions or renewals, injury to our reputation, increased service expenses or payment of damages.

Our product development office in China exposes us to risks specific to China, including those associated with currency exchange rates, Chinese government regulations and business practices, and intellectual property.

We established a wholly-owned subsidiary in Shanghai, China in 2010, which provides us with product development services. Previously, substantially all of our operations were located in the United States, and our sales outside the United States and Canada were made in U.S. Dollars to local distributors. Our Chinese operation conducts its operations in Chinese RMB, and therefore exposes us to the risk of unexpected and possibly sudden increases in expenses caused by shifts in currency exchange rates. In addition, Chinese government regulations and business practices are quite different from those in the U.S., and operating under those regulations and challenges may pose unexpected costs, delays or difficulties. Further, intellectual property protection is not as strong in China as in the U.S., and operating a product development group in China may increase our risk of infringement or misappropriation of our intellectual property by others.

Claims relating to data collection from our user base may subject us to liabilities and additional expense.

Schools and clinicians that use our products frequently use students’ names to register them in our products and enter into our database academic, diagnostic and/or demographic information about the students. In addition, the results of student use of our products are uploaded to our database. We have designed our system to safeguard this personally-identifiable information, but the protection of such information is an area of increasing public concern and significant government regulation, including but not limited to the Children’s Online Privacy Protection Act. If our privacy protection measures prove to be ineffective, we could be subject to liability claims for unauthorized access to or misuses of personally-identifiable information stored in our database. We may also face additional expenses to analyze and comply with increasing regulation in this area.

We may not be able to compete effectively in the education market.

The market in which we operate is very competitive. We compete vigorously for the funding available to schools, not only against other software-based reading intervention products but also against print and service-based offerings from other companies and against traditional methods of teaching language and reading. Many of the companies providing these competitive offerings are much larger than we are, are more established in the school market than we are, offer a broader range of products to schools, have already offered more web-based products, and have greater financial, technical, marketing and distribution resources than we do. In addition, although traditional approaches to language and reading are fundamentally different from our approach, the traditional methods are more widely known and accepted and, therefore, represent significant competition for available funds.

If we lose key personnel or are unable to hire additional qualified personnel as necessary, we may not be able to achieve our business goals, which could materially and adversely affect our financial results and share price.

We depend on the performance of our senior management, sales, marketing, development, research, educational, finance and other administrative personnel with extensive experience in our industry and with our Company. The loss of key personnel could harm our ability to execute our business strategy, which could adversely affect our financial results and share price. In addition, we believe that our future success will depend in large part on our continued ability to identify, hire, retain and motivate highly skilled employees who are in great demand. We cannot assure you that we will be able to do so.

If we are unable to maintain our access to the intellectual property rights that we license from third parties, our sales and net income will be materially and adversely affected.

Our most important products are based on licensed inventions owned by the University of California and Rutgers, the State University of New Jersey. These licensed patents expire in 2014. In 2011, we generated approximately 49% of our booked sales from products that use this licensed technology. The University patents are the earliest and in some ways the broadest of our patents. We have additional patents that we own with later expiration dates that we believe afford substantial continuing patent coverage for the same products. However, once the University patents expire, it may be more difficult to prevent others from marketing similar products.

We also have incorporated technology and content licensed from other third parties as part of our products and services. If we were to lose our rights under any of our in-licenses (whether through expiration of our exclusive license period, expiration of the underlying patent’s exclusivity, invalidity or unenforceability of the underlying patents, a breach by us of the terms of the license agreements or otherwise), such a loss of these licensed rights or a requirement that we must re-negotiate these licenses could materially harm our booked sales, our revenue and our net income.

If we are unable to adequately protect our intellectual property rights or if we infringe on the rights of others, we could become subject to significant liabilities, need to seek licenses or lose our rights to sell our products.

Our ability to compete effectively depends in part on whether we are able to maintain the proprietary aspects of our technology and to operate without infringing on the proprietary rights of others. It is possible that our issued patents will be found invalid or will not offer sufficient protection against competitors, that our trademarks will be challenged or infringed, or that our pending patent applications will not result in the issuance of patents. If others are able to develop similar products due to the expiration, unenforceability or invalidity of the underlying patents, the resulting competition could materially harm our sales. The Company historically has not registered its copyrights in the United States, which may make it difficult to collect damages from a third party that may be infringing a Company copyright.

In addition, we could become party to patent or trademark infringement claims, litigation or interference proceedings. These proceedings could result from claims that we are violating the rights of others or may be necessary to enforce our own rights. Any such proceedings would result in substantial expense and significant diversion of management effort, and the outcome of any such proceedings cannot be accurately predicted. An adverse determination in such proceedings could subject us to significant liabilities or require us to seek licenses from third parties, which may not be available on commercially reasonable terms or at all. In addition, competitors may design around our technology or develop competing technologies. Intellectual property rights may also be unavailable or limited in some foreign countries, which could make it easier for competitors to capture or increase their market share with respect to related technologies. Further, if unauthorized copying or misuse of our products were to occur to a substantial degree, our sales could be adversely affected.

Our common stock is thinly traded and its price is volatile.

Our common stock presently trades on the Nasdaq Global Market, and our trading volume is generally low. For example during 2011, our average daily trading volume was approximately 9,300 shares. As a result, the ability of holders of our common stock to sell such common stock and thereby monetize their investment may be limited. In addition, the market price of our common stock has been highly volatile since we became publicly traded and could continue to be subject to wide fluctuations.

The ownership of our common stock is concentrated.

At December 31, 2011, Trigran Investments owned approximately 27% of our outstanding stock, and our executive officers and directors held approximately 11% of the outstanding stock. As a result, these stockholders are able to exercise significant influence over all matters requiring stockholder approval, including the election of directors and approval of significant corporate transactions, and may have interests that diverge from those of other stockholders. This concentration of ownership may also delay, prevent or deter a change in control of the Company.

As of March 28, 2012, after our completed offering of common stock, Trigran Investments owned approximately 25% of our outstanding stock, and our executive officers and directors held approximately 9% of the outstanding stock.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not applicable

ITEM 2. PROPERTIES

We currently have the following leased properties:

|

|

1.

|

A lease for approximately 30,500 square feet of office space in Oakland, California for our headquarters that expires in December 2013. The lease includes two five-year options to extend the term of the lease.

|

|

|

2.

|

A lease for approximately 6,200 square feet of office space in Tucson, Arizona for our support center that expires in May 2013.

|

|

|

3.

|

A lease for an office in Shanghai, China for 2,500 square feet that expires in May 2012 to be used for research and development.

|

We believe our facilities are sufficient for our operations currently and should be adequate to meet our needs for at least the next year.

ITEM 3. LEGAL PROCEEDINGS

None.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

EXECUTIVE OFFICERS

The following table sets forth information concerning our executive officers:

|

Name

|

Age

|

Title

|

||

|

D. Andrew Myers

|

40

|

President and Chief Executive Officer

|

||

|

Linda L. Carloni

|

58

|

Senior Vice President, General Counsel and Corporate Secretary

|

||

|

Robert E. Feller

|

43

|

Chief Financial Officer, Senior Vice President and Treasurer

|

||

|

Dr. William M. Jenkins

|

61

|

Senior Vice President and Chief Scientific Officer

|

||

|

Jessica Lindl

|

38

|

Senior Vice President, Marketing and Inside Sales

|

||

|

Ronald Park

|

45

|

Chief Technical Officer

|

D. Andrew Myers joined us as President and Chief Operating Officer in January 2008 and became our Chief Executive Officer in January 2009. Prior to joining us, Mr. Myers worked at Pearson Education since 1996. His last position was as Senior Vice President, Digital Product Development for Pearson Curriculum, where he was responsible for integrating the technology teams from six preceding business units into a digital development group of 275 employees. From August 2004 to March 2007, Mr. Myers was the Chief Operations Officer for Pearson Digital Learning, where he was responsible for setting product, financial, technical and operational strategies for that 580-employee business unit. From 2002 to 2004, Mr. Myers served as Vice President Sales for Pearson Digital Learning. Mr. Myers started with Pearson as a sales representative in 1996. Pearson Education is the education division of Pearson PLC, an international media company. Mr. Myers holds an MBA from the Haas School of Business at the University of California Berkeley and a BS in finance from the University of Utah.

Linda L. Carloni joined us as General Counsel in October 1999, became our Secretary in March 2000, was appointed Vice President in June 2000 and Senior Vice President in January 2009. Before joining us, Ms. Carloni was a founder and Vice President of Alere Medical Incorporated, a healthcare services start-up. Earlier in her career, Ms. Carloni worked in technology transfer for the University of California, was the general counsel of Nellcor Incorporated, a medical device company, and was an associate and a partner at the Cooley Godward law firm. She received her bachelor's degree in political science from Case Western Reserve University and her law degree from Boalt Hall School of Law at the University of California, Berkeley.

Robert E. Feller joined us in December 2008 as our Chief Financial Officer. From 2006 until joining us, Mr. Feller served as Vice President, Finance and Administration at AdBrite, Inc., which operates an Internet-based advertising marketplace. Prior to AdBrite, he served in financial leadership positions of increasing responsibility at salesforce.com, a leading provider of web-based customer relationship management services, from 2003 to 2006, ending his Salesforce service as Vice President, Finance. Mr. Feller began his career as an auditor with Arthur Andersen, LLP. He holds an MBA from the Ross School of Business at the University of Michigan and a BA from the University of Michigan.

Dr. William M. Jenkins was appointed Chief Scientific Officer in June 2009. Dr. Jenkins is a founder and served as Senior Vice President, Product Development from November 2000 through 2008 and Chief Technical Officer from January 2009 to June 2009. From 1990 to 1996, Dr. Jenkins was an Adjunct Associate Professor at the University of California, San Francisco. Dr. Jenkins is the principal developer of our current learning exercises. Dr. Jenkins holds a B.S. in Psychology, an M.A. in Psychobiology and a Ph.D. in Psychobiology from Florida State University, with additional post-doctoral training from UCSF.

Jessica Lindl joined us as Vice President of Marketing in March 2007 and was promoted to Senior Vice President in January 2009. Prior to joining us, Ms. Lindl served as Vice President of Marketing and Product Management for Riverdeep, a leading developer of educational software. Ms. Lindl held marketing management positions of increasing responsibility at Riverdeep and The Learning Company, which was acquired by Riverdeep, from 2001 through 2006. Ms. Lindl began her career in sales and sales management for AT&T. Ms. Lindl holds a bachelor’s degree in economics and international studies from Miami University in Oxford, Ohio and an MBA from the Haas School of Business at the University of California, Berkeley.

Ron Park joined Scientific Learning in June 2009 as Vice President, Product Development and became a Senior Vice President in February 2011 and Chief Technical Officer in October 2011. Mr. Park has over 20 years of product development experience in the software industry. Before joining us, Mr. Park served from 2008-2009 as founder and CTO of Arkapi Corporation, a provider of web and iPhone applications. Prior to Arkapi, Mr. Park served from 2006-2007 as VP Engineering and Products for MuleSource Inc., an open source service-oriented architecture and enterprise service bus middleware software vendor. Prior to MuleSource, from 2004 to 2007, Mr. Park was Group Director, Engineering at Siebel Systems, Inc. and Oracle Corporation after its acquisition of Siebel. Earlier in his career Mr. Park held various management and engineering positions at both large and small software companies. Mr. Park holds a BS in Computer Science and Engineering from the University of California, Los Angeles, and an MBA from The Wharton School at the University of Pennsylvania.

PART II

ITEM 5. MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASE OF EQUITY SECURITIES

|

|

(a)

|

Market Information. Our common stock currently is, and since March 29, 2010 has been, traded on the Nasdaq Global Market under the symbol "SCIL”. Prior to March 29, 2010, our common stock traded on the Nasdaq Capital Market under the symbol “SCIL”.

|

The following table sets forth, for the periods indicated, the closing high and low sales prices per share of our common stock as reported on the NASDAQ Global Market and NASDAQ Capital Market, as applicable.

|

|

High

|

Low

|

||||||

|

Fiscal year ending December 31, 2011

|

||||||||

|

First quarter

|

$ | 3.54 | $ | 2.85 | ||||

|

Second quarter

|

$ | 3.27 | $ | 2.87 | ||||

|

Third quarter

|

$ | 3.25 | $ | 2.50 | ||||

|

Fourth quarter

|

$ | 3.46 | $ | 2.51 | ||||

|

Fiscal year ending December 31, 2010

|

||||||||

|

First quarter

|

$ | 5.73 | $ | 4.71 | ||||

|

Second quarter

|

$ | 5.47 | $ | 4.65 | ||||

|

Third quarter

|

$ | 5.49 | $ | 4.59 | ||||

|

Fourth quarter

|

$ | 4.52 | $ | 3.00 | ||||

Stockholders

As of March 16, 2012, the approximate number of stockholders of record of our common stock was 91.

Dividend Policy

We have never declared or paid cash dividends on our common stock, and we do not anticipate paying any cash dividends in the foreseeable future. Our current Loan and Security Agreement with Comerica Bank provides that we may not pay any dividends other than stock dividends during the term of the Agreement.

Securities Authorized for Issuance under Equity Compensation Plans

For information regarding securities authorized for issuance under equity compensation plans, see Item 12.

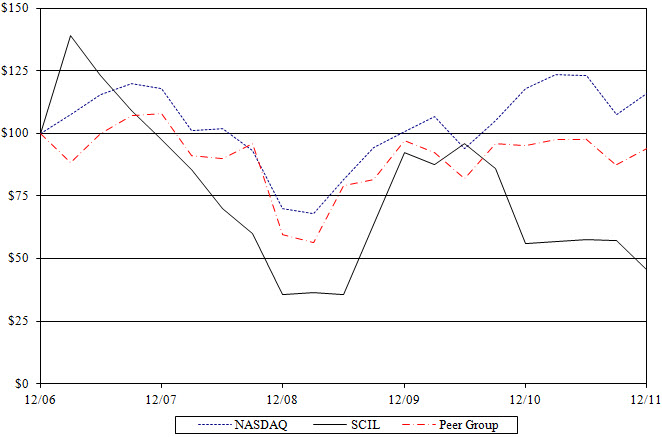

Performance Measurement Comparison

The following chart compares the cumulative total stockholder return of Scientific Learning Common Stock for the five years ended December 31, 2011 with the cumulative total return during the same period of (i) the NASDAQ Composite Market Index and (ii) a Scientific Learning constructed peer group index. The companies in the peer group index were selected on the basis of similarity in the nature of their business. At December 31, 2011, the peer group included Cambium, Scholastic Corporation, K12 Inc, Archipelago Learning and Princeton Review. Over the last five years we have changed companies in the peer group because of acquisitions, changes in business, new companies entering the market and other changes affecting peer group companies. This table shows these changes:

|

Members of Peer Group

|

Tenure in Peer Group

|

|

Cambium

|

Added to peer group in 2011 to replace Renaissance Learning, Inc.

|

|

Renaissance Learning Inc.

|

Removed from peer group in December 2011 after it was acquired.

|

|

Excelligence

|

Removed from peer group after September 30, 2006 after it stopped trading.

|

|

K12 Inc

|

Added to peer group in 2008 after going public in December 2007.

|

|

Archipelago Learning

|

Added to peer group in 2010 after going public in November 2009.

|

|

Plato Learning Inc.

|

Removed from peer group in May 2010 after it was acquired.

|

The comparison assumes $100 was invested on December 31, 2006 in Scientific Learning Common Stock and in each of the foregoing indices. It also assumes reinvestment of dividends. The performance shown in the graph below should not be considered an indication of future performance.

Recent Sales of Unregistered Securities; Use of Proceeds from Registered Securities

Not applicable

(b) Not applicable

(c) Not applicable

In thousands, except per share amounts

|

Year Ended December 31,

|

||||||||||||||||||||

|

2011

|

2010

|

2009

|

2008

|

2007

|

||||||||||||||||

|

Statement of Operations Data:

|

||||||||||||||||||||

|

Revenues:

|

||||||||||||||||||||

|

Products

|

$ | 21,758 | $ | 22,506 | $ | 35,863 | $ | 28,301 | $ | 31,023 | ||||||||||

|

Service and support

|

19,321 | 20,878 | 19,425 | 19,453 | 15,030 | |||||||||||||||

|

Total revenues

|

41,079 | 43,384 | 55,288 | 47,754 | 46,053 | |||||||||||||||

|

Cost of revenues:

|

||||||||||||||||||||

|

Cost of products

|

1,766 | 2,092 | 2,679 | 2,178 | 1,680 | |||||||||||||||

|

Cost of service and support

|

8,922 | 9,348 | 8,895 | 9,721 | 8,539 | |||||||||||||||

|

Total cost of revenues

|

10,688 | 11,440 | 11,574 | 11,899 | 10,219 | |||||||||||||||

|

Gross profit

|

30,391 | 31,944 | 43,714 | 35,855 | 35,834 | |||||||||||||||

|

Operating expenses:

|

||||||||||||||||||||

|

Sales and marketing

|

17,979 | 21,498 | 24,042 | 23,587 | 24,868 | |||||||||||||||

|

Research and development

|

10,324 | 7,933 | 6,418 | 7,016 | 4,500 | |||||||||||||||

|

General and administrative

|

8,413 | 8,129 | 8,135 | 7,883 | 7,660 | |||||||||||||||

|

Impairment charge

|

— | 3,890 | — | — | — | |||||||||||||||

|

Total operating expenses

|

36,716 | 41,450 | 38,595 | 38,486 | 37,028 | |||||||||||||||

|

Operating income (loss)

|

(6,325 | ) | (9,506 | ) | 5,119 | (2,631 | ) | (1,194 | ) | |||||||||||

|

Interest and other income (expense), net

|

13 | (41 | ) | 110 | 564 | 1,266 | ||||||||||||||

|

Income (loss) before income tax

|

(6,312 | ) | (9,547 | ) | 5,229 | (2,067 | ) | 72 | ||||||||||||

|

Provision for income taxes (income tax benefit)

|

164 | 143 | 429 | 1,248 | (1,082 | ) | ||||||||||||||

|

Net income (loss)

|

$ | (6,476 | ) | $ | (9,690 | ) | $ | 4,800 | $ | (3,315 | ) | $ | 1,154 | |||||||

|

Basic net income (loss) per share

|

$ | (0.34 | ) | $ | (0.52 | ) | $ | 0.27 | $ | (0.19 | ) | $ | 0.07 | |||||||

|

Diluted net income (loss) per share

|

$ | (0.34 | ) | $ | (0.52 | ) | $ | 0.26 | $ | (0.19 | ) | $ | 0.06 | |||||||

|

Shares used in computing basic net income (loss) per share

|

18,870 | 18,498 | 18,039 | 17,488 | 17,161 | |||||||||||||||

|

Shares used in computing diluted net income (loss) per share

|

18,870 | 18,498 | 18,690 | 17,488 | 18,297 | |||||||||||||||

|

Balance Sheet Data:

|

||||||||||||||||||||

|

Cash and cash equivalents

|

$ | 5,871 | $ | 5,415 | $ | 20,679 | $ | 7,550 | $ | 21,179 | ||||||||||

|

Short-term investments

|

— | 9,631 | — | — | — | |||||||||||||||

|

Working capital

|

(5,030 | ) | 1,176 | 5,178 | (3,551 | ) | 7,862 | |||||||||||||

|

Total assets

|

21,863 | 31,803 | 43,128 | 30,260 | 33,803 | |||||||||||||||

|

Stockholders’ equity (net capital deficiency) (1)

|